|

|

市場調査レポート

商品コード

1327332

戦闘用ドローン市場:プラットフォーム別(小型、戦術、戦略)、用途別(致死、ステルス、滞空弾、標的)、タイプ別、発射モード別(空中発射型、垂直離陸型、自動離陸型)、地域別-2028年までの予測Combat Drone Market by Platform (Small, Tactical, and Strategic) Application (Lethal, Stealth, Loitering munition and Target), Type, Launching Mode (Air Launched Effect, Vertical Take-Off, Automatic Take Off) and Region - Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 戦闘用ドローン市場:プラットフォーム別(小型、戦術、戦略)、用途別(致死、ステルス、滞空弾、標的)、タイプ別、発射モード別(空中発射型、垂直離陸型、自動離陸型)、地域別-2028年までの予測 |

|

出版日: 2023年08月01日

発行: MarketsandMarkets

ページ情報: 英文 228 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

戦闘用ドローンの市場規模は、2023年の72億米ドルから2028年には108億米ドルに成長し、2023年から2028年までのCAGRは8.6%になると予測されています。

防衛分野における無人システムに対する需要の高まりが、世界中で戦闘用ドローン市場の成長につながっています。現代の戦争における様々な破壊的技術の利用が拡大しているため、軍事用途における戦略用ドローンや特殊用途ドローンの需要が増加しています。世界のいくつかの国は、戦闘用ドローンの応用を探求し、増強するための研究開発プログラムを実施しています。さらに、戦闘用ドローンは、低高度飛行中に極めて高い効率性と可能性を示します。戦闘用ドローンは、敵地でさまざまな作業を行う軍事用途でますます活用されるようになっています。パイロットの生命へのリスクを軽減し、防衛軍の航空能力を強化するために、平時だけでなく紛争時にも使用されています。戦闘用ドローンは、有人航空機と比較して運用コストが限定的であることと、ドローンが提供する利点により、世界中の防衛分野で広く受け入れられています。

米国や新興諸国による防衛要員や装備品の採用の減少と相まって、予算上の制約が増加していることから、いくつかの軍事任務を遂行するための費用対効果の高い防衛装備品の開発が求められています。絶えず変化する現代の戦争技術では、戦闘用ドローンを使用して人口密集地域で重要なミッションを実施する必要があります。さらに、高度なナビゲーションだけでなく、衛星通信技術の利用可能性は、これらの無人機によって実施されている高度に実行可能な遠隔操作につながっています。戦闘用ドローンは、ホバリング、検索、およびターゲットを識別しながら、巻き添え被害を減らすことができ、軍事部門にとって貴重な資産となっています。また、戦闘用ドローン市場で事業を展開する企業は、これらのドローンの技術的能力の向上に注力しています。

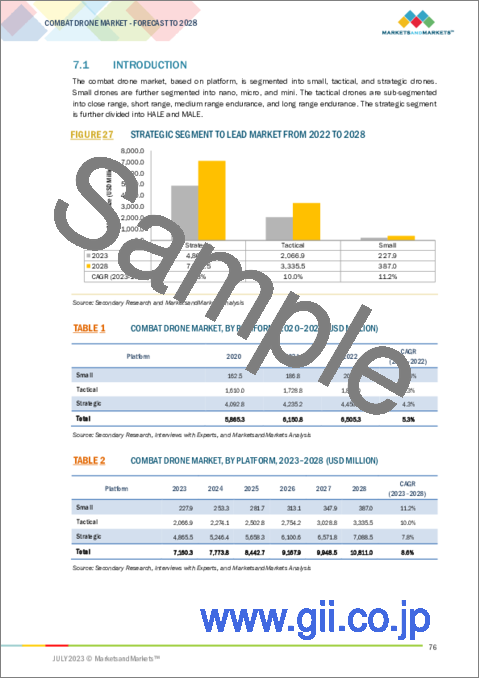

戦略ドローンセグメントは、予測期間中により高いCAGRで成長します。戦略セグメントは、2022年に市場の大半のシェアを占め、HALEおよびMALEドローンプラットフォームの高価格により、予測期間中も優位性を維持すると予測されます。

北米は2023年に戦闘用ドローン市場をリードすると予測されています。米国は北米における戦闘用ドローン市場の最大市場です。北米は政治的に安定した地域であり、これは北米諸国の政府が安定しているためです。米国とカナダは良好なビジネス関係を築いており、戦闘用ドローン市場で事業を展開する主要参入企業の本拠地でもあります。北米は世界的に起こっている技術革命の最前線にいます。カナダと米国は科学技術のパイオニアです。ドローンは長い間、世界中の防衛や商業分野で使用されてきました。当初から、この地域は技術進歩のリーダーでした。北米は他の先進地域や発展途上地域との競合に直面しながらも、技術分野での覇権を維持し続けています。

当レポートでは、世界の戦闘用ドローン市場について調査し、プラットフォーム別、用途別、タイプ別、発射モード別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 戦闘用ドローン市場のエコシステム

- 顧客のビジネスに影響を与える動向/混乱

- 戦闘用ドローン市場のバリューチェーン分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 貿易データ分析

- 関税と規制状況

- 運用データ

- 価格分析

- 2023年~2024年の主な会議とイベント

第6章 業界の動向

- イントロダクション

- 技術動向

- 技術分析

- 使用例

- メガトレンドの影響

- ドローン技術の成熟度マッピング

- イノベーションと特許登録

- 戦闘用ドローン市場ロードマップ

第7章 戦闘用ドローン市場、プラットフォーム別

- イントロダクション

- 小型

- 戦術

- 戦略

第8章 戦闘用ドローン市場、用途別

- イントロダクション

- 致死

- ステルス

- 滞空弾

- 標的

第9章 戦闘用ドローン市場、タイプ別

- イントロダクション

- 固定翼

- 回転翼

- ハイブリッド

第10章 戦闘用ドローン市場、起動モード別

- イントロダクション

- 空中発射型

- 垂直離陸型

- 自動離陸と着陸型

- カタパルトランチャー

- ハンドランチャー

第11章 地域分析

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東

- ラテンアメリカ

- アフリカ

第12章 競合情勢

- イントロダクション

- 戦闘用ドローン市場の主要企業

- 主要選手のランキング分析、2022年

- 収益分析、2022年

- 市場シェア分析、2022年

- 企業評価マトリックス

- 戦闘用ドローン市場、企業のリーダーシップマッピング(スタートアップ)

- 競合シナリオ

第13章 企業プロファイル

- イントロダクション

- 主要参入企業

- NORTHROP GRUMMAN CORPORATION

- RAYTHEON TECHNOLOGIES CORPORATION

- ISRAEL AEROSPACE INDUSTRIES LTD.

- GENERAL ATOMICS AERONAUTICAL SYSTEMS

- AEROVIRONMENT, INC.

- THE BOEING COMPANY

- AIRBUS

- ELBIT SYSTEMS LTD.

- LEONARDO SPA

- QINTEIQ GROUP PLC

- KRATOS DEFENSE & SECURITY SOLUTIONS, INC.

- LOCKHEED MARTIN CORPORATION

- GRIFFON AEROSPACE

- SCR(SISTEMAS DE CONTROL REMOTO)

- TURKISH AEROSPACE INDUSTRIES INC.

- その他の企業

- DYNETICS, INC.

- ROBOTICAN LTD.

- VOLANSI, INC.

- AEROTARGETS INTERNATIONAL, LLC

- PLATFORM AEROSPACE

- SHIELD AI

- INSTANTEYE ROBOTICS

- ATHLON AVIA

- SILVERTONE UAV

- BLUEBIRD AERO SYSTEMS LTD.

第14章 付録

The combat drone market is projected to grow from USD 7.2 billion in 2023 to USD 10.8 billion by 2028, at a CAGR of 8.6% from 2023 to 2028. Increasing demand for unmanned systems in the defense sector has led to the growth of the combat drone market across the globe. The growing use of various disruptive technologies in modern warfare has led to increased demand for strategic and special-purpose drones in military applications. Several countries worldwide are undertaking R&D programs to explore and augment the applications of combat drones. Moreover, Combat drones exhibit extreme efficiency and potential during low-altitude flights. They are increasingly being utilized in military applications to perform various tasks in hostile territories. They are used during conflicts as well as in peacetimes to mitigate the risks to the lives of pilots and to enhance the aeronautical capabilities of defense forces. Combat drones are widely accepted by the defense sector worldwide, owing to their limited operational costs in comparison to manned aircraft and the benefits offered by them.

The increasing budgetary constraints, coupled with a decline in the recruitment of defense personnel and equipment by the US and European countries, have led to the requirement for developing cost-effective defense equipment to carry out several military missions. Continuously changing modern warfare techniques require conducting critical missions in populated areas using combat drones. Moreover, the availability of advanced navigation as well as satellite communication technologies has led to highly viable remote operations being conducted by these drones. Combat drones can reduce collateral damage while hovering, searching, and identifying targets, which makes them an invaluable asset to the military sector. Besides, companies operating in the combat drone market are focusing on improving the technological capabilities of these drones.

Based on the platform, the strategic segment is to grow at a higher market share during the forecast period.

Based on the platform, the combat drone market has been classified into small, tactical, and strategic drones. The strategic drone segment is to grow at a higher CAGR during the forecast period. The strategic segment held the majority share of the market in 2022 and is estimated to hold its dominance during the forecast period owing to the high price of HALE and MALE drone platforms.

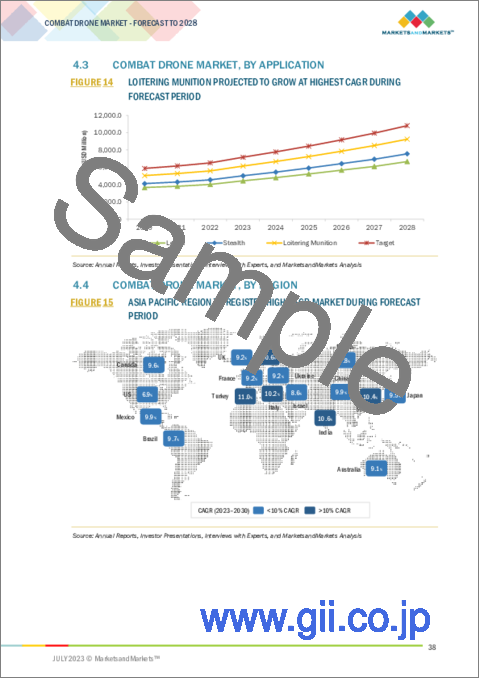

Based on application, the lethal segment is to grow at the highest market share during the forecast period.

Based on the application segment, the combat drone market has been classified into lethal, stealth, loitering munition, and target drone. The loitering segment is to grow at the highest CAGR during the forecast period. Lethal drones or lethal autonomous weapons are autonomous military systems that can individually search for targets and destroy them based on programmed limitations and descriptions. A loitering munition drone can be described as an advanced, autonomous drone equipped with explosive payloads designed to loiter or hover over a designated area for an extended period. The loitering munition segment is further sub-segmented into recoverable and expendables.

"North America is expected to hold the highest market share."

North America is projected to lead the combat drone market in 2023. The US is the largest market for combat drone market in North America. North America is a politically stable region owing to the stable governments of countries in the region. The US and Canada have good business relations and are home to some key players operating in the combat drone market. North America has been at the forefront of the technological revolution taking place globally. Canada and the US are pioneers in science and technology. Drones have been used for a long time in defense and commercial sectors worldwide. Since the beginning, the region has been a leader in technological advancements. Though North America faced competition from some other developed and developing regions, it continues to retain its supremacy in the technological field.

The break-up of the profile of primary participants in the Combat Drone market:

- By Company Type: Tier 1 - 32%, Tier 2 - 40%, and Tier 3 - 28%

- By Designation: C Level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America - 40%, Europe - 21%, Asia Pacific - 29%, Middle East & Africa -5%, Latin America-5%

The major players in the Combat Drone market mainly resorted to contracts to drive their growth. They also entered new markets by launching technologically advanced and cost-effective products. Northrop Grumman (US), General Atomics Aeronautical Systems (US), Raytheon Technologies (US), Israel Aerospace Industries Inc. (Israel), and Airbus (Netherlands) are some of the leading players in the market. An increase in the demand for advanced Public Safety Drone products and the growth of emerging markets have encouraged companies to enter new regions.

Research Coverage:

This market study covers the combat drone market across various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments based on platform, application, type, launching mode, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Combat Drone market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers and there are several factors that could contribute to an increase in the Combat Drone market.

- Market Penetration: Comprehensive information on Combat Drone systems offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Combat Drone market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the Combat Drone market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Combat Drone market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the Combat Drone market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.2 MARKETS COVERED

- FIGURE 1 COMBAT DRONE MARKET SEGMENTATION

- 1.2.3 REGIONAL SCOPE

- 1.2.4 YEARS CONSIDERED

- 1.3 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN: COMBAT DRONE MARKET

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.4 RECESSION IMPACT ANALYSIS

- 2.3 RESEARCH APPROACH AND METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation and methodology

- 2.3.1.2 Regional split of combat drone market

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 TRIANGULATION AND VALIDATION

- FIGURE 6 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- FIGURE 7 ASSUMPTIONS FOR RESEARCH STUDY

- 2.5.1 ASSUMPTIONS FOR MARKET SIZING AND FORECAST

- 2.6 RISKS

3 EXECUTIVE SUMMARY

- FIGURE 8 SMALL SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 9 STEALTH SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 HYBRID TO HAVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 LATIN AMERICA TO ACCOUNT FOR HIGHEST MARKET SHARE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN COMBAT DRONE MARKET

- FIGURE 12 INCREASED FUNDING BY GOVERNMENT TO DRIVE MARKET

- 4.2 COMBAT DRONE MARKET GROWTH, BY TYPE

- FIGURE 13 HYBRID SEGMENT ESTIMATED TO LEAD COMBAT DRONE MARKET IN 2023

- 4.3 COMBAT DRONE MARKET, BY APPLICATION

- FIGURE 14 LOITERING MUNITION PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.4 COMBAT DRONE MARKET, BY REGION

- FIGURE 15 ASIA PACIFIC REGION TO REGISTER HIGH CAGR MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 COMBAT DRONE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing adoption of combat drones

- 5.2.1.2 Deployment of combat drones

- 5.2.1.3 Surge in intensified military training

- TABLE 2 NUMBER OF ACTIVE CONFLICTS WORLDWIDE

- 5.2.1.4 Cost-effectiveness in terms of operation and maintenance

- 5.2.1.5 Counter-terrorism and homeland security applications

- 5.2.1.6 Decreasing prices of components

- FIGURE 17 DECREASING PRICES OF DRONE COMPONENTS (USD)

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited trained personnel

- 5.2.2.2 Limited bandwidth, payload capacity, and autonomy

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in AI and autonomy

- 5.2.3.2 Increased international cooperation

- 5.2.3.3 Technological advancements in drone payloads

- 5.2.3.4 Full-scale conversion for war scenario simulation

- 5.2.4 CHALLENGES

- 5.2.4.1 Safety and security of UAVs

- 5.2.4.2 Electronic jamming to limit communication and control

- 5.3 COMBAT DRONE MARKET ECOSYSTEM

- 5.3.1 PROMINENT COMPANIES

- 5.3.2 PRIVATE AND SMALL ENTERPRISES

- 5.3.3 STARTUPS

- 5.3.4 END USERS

- FIGURE 18 COMBAT DRONE MARKET ECOSYSTEM MAP

- TABLE 3 COMBAT DRONE MARKET ECOSYSTEM

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR COMBAT DRONE MARKET

- FIGURE 19 REVENUE SHIFT IN COMBAT DRONE MARKET

- 5.5 VALUE CHAIN ANALYSIS OF COMBAT DRONE MARKET

- FIGURE 20 VALUE CHAIN ANALYSIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 COMBAT DRONE MARKET: PORTER'S FIVE FORCE ANALYSIS

- FIGURE 21 COMBAT DRONE MARKET: PORTER'S FIVE FORCE ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 5.7.2 BUYING CRITERIA

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.8 TRADE DATA ANALYSIS

- TABLE 7 US, CHINA, AND ISRAEL: IMPORT AND EXPORT STATISTICS FOR COMBAT DRONES

- 5.9 TARIFF AND REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10 OPERATIONAL DATA

- FIGURE 24 ARMED DRONES ACQUIRED, USED, AND DEVELOPED BY VARIOUS COUNTRIES FROM 2000 TO 2020

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION

- TABLE 11 AVERAGE SELLING PRICE OF DRONES (USD MILLION)

- TABLE 12 AVERAGE SELLING PRICE OF UAVS AND THEIR COMPONENTS, 2020-2021 (USD)

- 5.12 KEY CONFERENCES AND EVENTS IN 2023-2024

- TABLE 13 COMBAT DRONE MARKET: KEY CONFERENCES AND EVENTS, 2023-2024

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 DRONE SWARMS

- 6.2.2 STEALTH AND LOW OBSERVABLE TECHNOLOGIES

- 6.2.3 ELECTRONIC WARFARE USING COMBAT DRONES

- 6.2.4 SYNTHETIC APERTURE RADARS

- 6.2.5 SIGINT BY DRONES

- 6.2.6 MANNED-UNMANNED TEAMING (MUM-T)

- 6.2.7 ENDURANCE

- 6.2.8 HYPERSONIC ARMED DRONES

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 AI IN COMBAT DRONES

- TABLE 14 COMPANIES DEVELOPING DRONE SOFTWARE WITH AI

- TABLE 15 COMPANIES DEVELOPING DRONE EQUIPMENT WITH AI

- 6.3.2 MID-AIR REFUELING OF DRONES

- 6.3.3 SPY DRONES

- 6.3.4 UNMANNED COMBAT AERIAL VEHICLES

- 6.3.5 ANTI-UAV DEFENSE SYSTEMS

- 6.3.6 DIPOLE DRIVE FOR COMBAT DRONES

- 6.4 USE CASES

- 6.4.1 PERSISTENT SURVEILLANCE AND INTELLIGENCE GATHERING IN HOSTILE ENVIRONMENTS

- 6.4.2 BATTLEFIELD DAMAGE ASSESSMENT AND POST-STRIKE ANALYSIS

- 6.5 IMPACT OF MEGATRENDS

- 6.6 MATURITY MAPPING OF DRONE TECHNOLOGIES

- FIGURE 25 MATURITY STAGES OF DRONE TECHNOLOGIES

- 6.7 INNOVATION AND PATENT REGISTRATIONS

- TABLE 16 INNOVATION AND PATENT REGISTRATIONS, 2020-2023

- 6.8 COMBAT DRONE MARKET ROADMAP

- FIGURE 26 EVOLUTION OF COMBAT DRONE: ROADMAP FROM 2010 TO 2030

7 COMBAT DRONE MARKET, BY PLATFORM

- 7.1 INTRODUCTION

- FIGURE 27 STRATEGIC SEGMENT TO LEAD MARKET FROM 2022 TO 2028

- 7.2 SMALL DRONES

- 7.2.1 INCREASED DEMAND FOR SURVEILLANCE AND RECONNAISSANCE TO DRIVE MARKET

- 7.2.2 NANO

- 7.2.3 MICRO

- 7.2.4 MINI

- 7.3 TACTICAL

- 7.3.1 OPTIMIZED EFFICIENCY AND SECURITY TO BOOST MARKET

- TABLE 17 TACTICAL COMBAT DRONE MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 18 TACTICAL COMBAT DRONE MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 7.3.2 CLOSE RANGE

- 7.3.3 SHORT RANGE

- 7.3.4 MEDIUM RANGE ENDURANCE

- 7.3.5 LONG RANGE ENDURANCE

- 7.4 STRATEGIC

- 7.4.1 HIGH PAYLOAD CARRYING CAPACITY TO FUEL MARKET

- TABLE 19 STRATEGIC COMBAT DRONE MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 20 STRATEGIC COMBAT DRONE MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 7.4.2 HALE

- 7.4.3 MALE

8 COMBAT DRONE MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 28 LOITERING MUNITION TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

- TABLE 21 COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 22 COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 LETHAL DRONES

- 8.2.1 EMERGENCE AS GENUINE COMBAT FORCE MULTIPLIERS TO DRIVE MARKET

- 8.3 STEALTH DRONES

- 8.3.1 NEED FOR PRECISE AND SURGICAL WARFARE APPROACH TO DRIVE DEMAND

- 8.4 LOITERING MUNITION

- 8.4.1 COST-EFFECTIVENESS AND AUTONOMOUS OPERATION TO DRIVE MARKET

- TABLE 23 LOITERING MUNITION DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 24 LOITERING MUNITION DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.4.2 RECOVERABLES

- 8.4.3 EXPENDABLES

- 8.5 TARGET

- 8.5.1 MULTI-SPECTRUM OPERATION FOR UNDETECTED OPERATIONS TO BOOST MARKET

9 COMBAT DRONE MARKET, BY TYPE

- 9.1 INTRODUCTION

- FIGURE 29 FIXED-WING SEGMENT TO DOMINATE MARKET FROM 2022 TO 2030

- TABLE 25 COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 26 COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.2 FIXED-WING

- 9.2.1 DEMAND FOR LONG RANGE AND HIGH-SPEED COMBAT DRONES TO BOOST MARKET

- 9.3 ROTARY-WING

- 9.3.1 HIGH-PERFORMANCE FOR TACTICAL COMBAT TO DRIVE MARKET

- 9.4 HYBRID

- 9.4.1 USE IN LONG-DURATION OPERATIONS AT HIGH SPEEDS TO DRIVE MARKET

10 COMBAT DRONE MARKET, BY LAUNCHING MODE

- 10.1 INTRODUCTION

- FIGURE 30 AUTOMATIC TAKE-OFF AND LANDING SEGMENT PROJECTED TO HAVE HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 27 COMBAT DRONE MARKET, BY LAUNCHING MODE, 2020-2022 (USD MILLION)

- TABLE 28 COMBAT DRONE MARKET, BY LAUNCHING MODE, 2023-2028 (USD MILLION)

- 10.2 AIR-LAUNCHED EFFECT

- 10.2.1 LOW COST AND GREATER FLEXIBILITY TO DRIVE MARKET

- 10.3 VERTICAL TAKE-OFF

- 10.3.1 GROWING USE OF ROTARY-WING DRONES TO DRIVE MARKET

- 10.4 AUTOMATIC TAKE-OFF AND LANDING

- 10.4.1 INCREASING DEMAND FOR HALE AND MALE TO FUEL MARKET

- 10.5 CATAPULT LAUNCHERS

- 10.5.1 ENHANCED COMBAT DRONE DEPLOYMENT FOR TACTICAL SUPERIORITY TO DRIVE MARKET

- 10.6 HAND LAUNCHERS

- 10.6.1 GROWING USE OF MINI AND NANO DRONES TO BOOST MARKET

11 REGIONAL ANALYSIS

- 11.1 INTRODUCTION

- FIGURE 31 ASIA PACIFIC PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 29 COMBAT DRONE MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 30 COMBAT DRONE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: PESTLE ANALYSIS

- FIGURE 32 NORTH AMERICA: COMBAT DRONE MARKET SNAPSHOT

- TABLE 31 NORTH AMERICA: COMBAT DRONE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 32 NORTH AMERICA: COMBAT DRONE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 34 NORTH AMERICA: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 36 NORTH AMERICA: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 High investment and constant innovation to drive market

- TABLE 37 US: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 38 US: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 39 US: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 40 US: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.2.3 CANADA

- 11.2.3.1 Developments in UAV space to fuel market

- TABLE 41 CANADA: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 42 CANADA: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 43 CANADA: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 44 CANADA: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 EUROPE: PESTLE ANALYSIS

- FIGURE 33 EUROPE: COMBAT DRONE MARKET SNAPSHOT

- TABLE 45 EUROPE: COMBAT DRONE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 46 EUROPE: COMBAT DRONE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.3.2 RUSSIA

- 11.3.2.1 Surge in procurement of modern combat drones to drive market

- TABLE 47 RUSSIA: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 48 RUSSIA: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 49 RUSSIA: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 50 RUSSIA: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.3 FRANCE

- 11.3.3.1 Government initiatives to fuel market

- TABLE 51 FRANCE: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 52 FRANCE: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 53 FRANCE: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 54 FRANCE COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.4 UK

- 11.3.4.1 Technological developments to boost market

- TABLE 55 UK: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 56 UK: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 57 UK: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 58 UK: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.5 GERMANY

- 11.3.5.1 Rising demand from armed forces to drive growth

- TABLE 59 GERMANY: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 60 GERMANY: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 61 GERMANY: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 62 GERMANY: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.6 UKRAINE

- 11.3.6.1 Technological developments to drive market

- TABLE 63 UKRAINE: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 64 UKRAINE: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 65 UKRAINE: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 66 UKRAINE: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.7 ITALY

- 11.3.7.1 Procurement of advanced components for technologically advanced drones to fuel market

- TABLE 67 ITALY: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 68 ITALY: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 69 ITALY: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 70 ITALY: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.8 SWEDEN

- 11.3.8.1 Increased interest in development of drones and associated solutions to drive growth

- TABLE 71 SWEDEN: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 72 SWEDEN: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 73 SWEDEN: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 74 SWEDEN: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3.9 REST OF EUROPE

- 11.3.9.1 Surge in border dispute to drive market growth

- TABLE 75 REST OF EUROPE: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 76 REST OF EUROPE: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 77 REST OF EUROPE: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 78 REST OF EUROPE: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: PESTLE ANALYSIS

- FIGURE 34 ASIA PACIFIC: COMBAT DRONE MARKET SNAPSHOT

- TABLE 79 ASIA PACIFIC: COMBAT DRONE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 80 ASIA PACIFIC: COMBAT DRONE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Focus on development of advanced weaponry to boost market

- TABLE 81 CHINA: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 82 CHINA: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 83 CHINA: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 84 CHINA: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.3 INDIA

- 11.4.3.1 Rising procurement of combat drones to drive market

- TABLE 85 INDIA: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 86 INDIA: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 87 INDIA: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 88 INDIA: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.4 JAPAN

- 11.4.4.1 Development of UAVs based on modern technologies to boost market

- TABLE 89 JAPAN: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 90 JAPAN: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 91 JAPAN: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 92 JAPAN: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.5 AUSTRALIA

- 11.4.5.1 High investment in development of military drones to fuel market

- TABLE 93 AUSTRALIA: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 94 AUSTRALIA: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 95 AUSTRALIA: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 96 AUSTRALIA: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Increased defense spending to drive market

- TABLE 97 SOUTH KOREA: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 98 SOUTH KOREA: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 99 SOUTH KOREA: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 100 SOUTH KOREA: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4.7 REST OF ASIA PACIFIC

- 11.4.7.1 Rising usage of UAVs for defense operations to drive market

- TABLE 101 REST OF ASIA PACIFIC: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 103 REST OF ASIA PACIFIC: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5 MIDDLE EAST

- 11.5.1 MIDDLE EAST: PESTLE ANALYSIS

- FIGURE 35 MIDDLE EAST: COMBAT DRONE MARKET SNAPSHOT

- TABLE 105 MIDDLE EAST: COMBAT DRONE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 106 MIDDLE EAST: COMBAT DRONE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 107 MIDDLE EAST: COMBAT DRONE MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 108 MIDDLE EAST: COMBAT DRONE MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 109 MIDDLE EAST: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 110 MIDDLE EAST: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5.2 ISRAEL

- 11.5.2.1 Presence of leading combat drone manufacturers to drive market growth

- TABLE 111 ISRAEL: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 112 ISRAEL: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 113 ISRAEL: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 114 ISRAEL: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5.3 TURKEY

- 11.5.3.1 Growing deployment of UAVs and their subsystems to fuel market

- TABLE 115 TURKEY: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 116 TURKEY: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 117 TURKEY: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 118 TURKEY: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5.4 SAUDI ARABIA

- 11.5.4.1 Increased adoption of UAVs in military applications to boost market

- TABLE 119 SAUDI ARABIA: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 120 SAUDI ARABIA: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 121 SAUDI ARABIA: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 122 SAUDI ARABIA: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5.5 UAE

- 11.5.5.1 Increased procurement of drones to drive market

- TABLE 123 UAE: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 124 UAE: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 125 UAE: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 126 UAE: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5.6 REST OF MIDDLE EAST

- 11.5.6.1 Increased focus on developing combat drones to drive market

- TABLE 127 REST OF MIDDLE EAST: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 128 REST OF MIDDLE EAST: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 129 REST OF MIDDLE EAST: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 130 REST OF MIDDLE EAST: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: PESTLE ANALYSIS

- FIGURE 36 LATIN AMERICA: COMBAT DRONE MARKET SNAPSHOT

- TABLE 131 LATIN AMERICA: COMBAT DRONE MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 132 LATIN AMERICA: COMBAT DRONE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 133 LATIN AMERICA: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 134 LATIN AMERICA: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 135 LATIN AMERICA: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 136 LATIN AMERICA: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.6.2 BRAZIL

- 11.6.2.1 Safety and security missions to gather advanced intelligence to drive market

- TABLE 137 BRAZIL: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 138 BRAZIL: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 139 BRAZIL: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 140 BRAZIL: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.6.3 MEXICO

- 11.6.3.1 Development of drones to monitor and curb illegal activities to fuel market

- TABLE 141 MEXICO: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 142 MEXICO: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 143 MEXICO: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 144 MEXICO: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.7 AFRICA

- 11.7.1 AFRICA: PESTLE ANALYSIS

- TABLE 145 AFRICA: COMBAT DRONE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 146 AFRICA: COMBAT DRONE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 147 AFRICA: COMBAT DRONE MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 148 AFRICA: COMBAT DRONE MARKET, BY TYPE, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS IN COMBAT DRONE MARKET

- TABLE 149 KEY DEVELOPMENTS OF LEADING PLAYERS IN COMBAT DRONE MARKET (2020-2023)

- 12.3 RANKING ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 37 RANKING OF KEY PLAYERS IN COMBAT DRONE MARKET, 2022

- 12.4 REVENUE ANALYSIS, 2022

- FIGURE 38 REVENUE ANALYSIS FOR KEY COMPANIES IN COMBAT DRONE MARKET

- 12.5 MARKET SHARE ANALYSIS, 2022

- FIGURE 39 MARKET SHARE ANALYSIS FOR KEY COMPANIES IN COMBAT DRONE MARKET, 2022

- TABLE 150 COMBAT DRONE MARKET: DEGREE OF COMPETITION

- 12.6 COMPANY EVALUATION MATRIX

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE COMPANIES

- 12.6.4 PARTICIPANTS

- FIGURE 40 COMBAT DRONE MARKET, COMPETITIVE LEADERSHIP MAPPING, 2022

- 12.7 COMBAT DRONE MARKET, COMPANY LEADERSHIP MAPPING (STARTUPS)

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 41 COMBAT DRONE MARKET (STARTUPS), COMPETITIVE LEADERSHIP MAPPING, 2022

- 12.7.5 COMPETITIVE BENCHMARKING

- TABLE 151 COMBAT DRONE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 12.8 COMPETITIVE SCENARIO

- TABLE 152 COMBAT DRONE MARKET: COMPETITIVE SCENARIO OF KEY PLAYERS [MAJOR PLAYERS]

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 MARKET EVALUATION FRAMEWORK

- 12.9.2 PRODUCT LAUNCHES

- TABLE 153 PRODUCT LAUNCHES, 2020-2023

- 12.9.3 DEALS

- TABLE 154 DEALS, 2020-2023

- 12.9.4 OTHERS

- TABLE 155 OTHERS, 2020-2023

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 13.2.1 NORTHROP GRUMMAN CORPORATION

- TABLE 156 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

- FIGURE 42 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- TABLE 157 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 158 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 159 NORTHROP GRUMMAN CORPORATION: DEALS

- 13.2.2 RAYTHEON TECHNOLOGIES CORPORATION

- TABLE 160 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- FIGURE 43 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- TABLE 161 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 162 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

- TABLE 163 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- 13.2.3 ISRAEL AEROSPACE INDUSTRIES LTD.

- TABLE 164 ISRAEL AEROSPACE INDUSTRIES LTD.: BUSINESS OVERVIEW

- FIGURE 44 ISRAEL AEROSPACE INDUSTRIES LTD.: COMPANY SNAPSHOT

- TABLE 165 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 166 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCT LAUNCHES

- TABLE 167 ISRAEL AEROSPACE INDUSTRIES LTD.: DEALS

- TABLE 168 ISRAEL AEROSPACE INDUSTRIES LTD.: OTHERS

- 13.2.4 GENERAL ATOMICS AERONAUTICAL SYSTEMS

- TABLE 169 GENERAL ATOMICS AERONAUTICAL SYSTEMS: BUSINESS OVERVIEW

- TABLE 170 GENERAL ATOMICS AERONAUTICAL SYSTEMS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 171 GENERAL ATOMICS AERONAUTICAL SYSTEMS: DEALS

- TABLE 172 GENERAL ATOMICS AERONAUTICAL SYSTEMS: OTHERS

- 13.2.5 AEROVIRONMENT, INC.

- TABLE 173 AEROVIRONMENT, INC.: BUSINESS OVERVIEW

- FIGURE 45 AEROVIRONMENT, INC.: COMPANY SNAPSHOT

- TABLE 174 AEROVIRONMENT, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 175 AEROVIRONMENT, INC.: PRODUCT LAUNCHES

- TABLE 176 AEROVIRONMENT, INC.: DEALS

- 13.2.6 THE BOEING COMPANY

- TABLE 177 THE BOEING COMPANY: BUSINESS OVERVIEW

- FIGURE 46 THE BOEING COMPANY: COMPANY SNAPSHOT

- TABLE 178 THE BOEING COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 179 THE BOEING COMPANY: PRODUCT LAUNCHES

- TABLE 180 THE BOEING COMPANY: DEALS

- 13.2.7 AIRBUS

- TABLE 181 AIRBUS: BUSINESS OVERVIEW

- FIGURE 47 AIRBUS: COMPANY SNAPSHOT

- TABLE 182 AIRBUS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 183 AIRBUS: PRODUCT LAUNCHES

- TABLE 184 AIRBUS: DEALS

- 13.2.8 ELBIT SYSTEMS LTD.

- TABLE 185 ELBIT SYSTEMS LTD.: BUSINESS OVERVIEW

- FIGURE 48 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- TABLE 186 ELBIT SYSTEMS LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 187 ELBIT SYSTEMS LTD.: DEALS

- 13.2.9 LEONARDO SPA

- TABLE 188 LEONARDO SPA: BUSINESS OVERVIEW

- FIGURE 49 LEONARDO SPA: COMPANY SNAPSHOT

- TABLE 189 LEONARDO SPA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 190 LEONARDO SPA: DEALS

- 13.2.10 QINTEIQ GROUP PLC

- TABLE 191 QINETIQ GROUP PLC: BUSINESS OVERVIEW

- TABLE 192 QINETIQ GROUP PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 193 QINETIQ GROUP PLC: PRODUCT LAUNCHES

- 13.2.11 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.

- TABLE 194 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: BUSINESS OVERVIEW

- FIGURE 50 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: COMPANY SNAPSHOT

- TABLE 195 KRATOS DEFENSE & SECURITY SOLUTIONS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.2.12 LOCKHEED MARTIN CORPORATION

- TABLE 196 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

- FIGURE 51 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- TABLE 197 LOCKHEED MARTIN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.2.13 GRIFFON AEROSPACE

- TABLE 198 GRIFFON AEROSPACE: BUSINESS OVERVIEW

- TABLE 199 GRIFFON AEROSPACE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 200 GRIFFON AEROSPACE: DEALS

- 13.2.14 SCR (SISTEMAS DE CONTROL REMOTO)

- TABLE 201 SCR (SISTEMAS DE CONTROL REMOTO): BUSINESS OVERVIEW

- TABLE 202 SCR (SISTEMAS DE CONTROL REMOTO): PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 203 SCR (SISTEMAS DE CONTROL REMOTO): DEALS

- 13.2.15 TURKISH AEROSPACE INDUSTRIES INC.

- TABLE 204 TURKISH AEROSPACE INDUSTRIES INC.: BUSINESS OVERVIEW

- TABLE 205 TURKISH AEROSPACE INDUSTRIES INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 13.3 OTHER PLAYERS

- 13.3.1 DYNETICS, INC.

- TABLE 206 DYNETICS, INC.: COMPANY OVERVIEW

- 13.3.2 ROBOTICAN LTD.

- TABLE 207 ROBOTICAN LTD.: COMPANY OVERVIEW

- 13.3.3 VOLANSI, INC.

- TABLE 208 VOLANSI, INC.: COMPANY OVERVIEW

- 13.3.4 AEROTARGETS INTERNATIONAL, LLC

- TABLE 209 AEROTARGETS INTERNATIONAL, LLC: COMPANY OVERVIEW

- 13.3.5 PLATFORM AEROSPACE

- TABLE 210 PLATFORM AEROSPACE: COMPANY OVERVIEW

- 13.3.6 SHIELD AI

- TABLE 211 SHIELD AI: COMPANY OVERVIEW

- 13.3.7 INSTANTEYE ROBOTICS

- TABLE 212 INSTANTEYE ROBOTICS: COMPANY OVERVIEW

- 13.3.8 ATHLON AVIA

- TABLE 213 ATHLON AVIA: COMPANY OVERVIEW

- 13.3.9 SILVERTONE UAV

- TABLE 214 SILVERTONE UAV: COMPANY OVERVIEW

- 13.3.10 BLUEBIRD AERO SYSTEMS LTD.

- TABLE 215 BLUEBIRD AERO SYSTEMS LTD.: COMPANY OVERVIEW

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 MARKET DYNAMICS

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS