|

|

市場調査レポート

商品コード

1426525

再生水濾過の世界市場:製品タイプ (砂・マルチメディア・活性炭・メンブレンフィルター)・メンブレンタイプ (逆浸透・限外濾過・精密濾過・ナノ濾過)・最大流量・エンドユーザー・地域別- 予測(~2028年)Recycling Water Filtration Market by Product Type (Sand, Multimedia, Activated Carbon, Membrane Filters), Membrane Type (Reverse Osmosis, Ultrafiltration, Microfiltration, Nanofiltration), Maximum Flow Rate, End User and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 再生水濾過の世界市場:製品タイプ (砂・マルチメディア・活性炭・メンブレンフィルター)・メンブレンタイプ (逆浸透・限外濾過・精密濾過・ナノ濾過)・最大流量・エンドユーザー・地域別- 予測(~2028年) |

|

出版日: 2024年02月15日

発行: MarketsandMarkets

ページ情報: 英文 246 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

再生水濾過の市場規模は、2023年の27億米ドルから、予測期間中は7.5%のCAGRで推移し、2028年には38億米ドルに成長すると予測されています。

再生水濾過の市場は、持続可能な水管理の必要性、廃水処理を管理する厳しい環境規制、水処理技術の継続的な進歩から、急速な成長を経験しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額(米ドル) |

| セグメント | 製品タイプ・メンブレンタイプ・最大流量・エンドユーザー・地域 |

| 対象地域 | アジア太平洋・北米・欧州・中東&アフリカ・南米 |

製品タイプ別では、活性炭フィルターが様々な水質汚染物質への対応に顕著な効果を発揮するため、2番目に急成長すると予測されています。活性炭濾過の費用対効果と持続可能性、さまざまな産業用途における活性炭フィルターの汎用性、再生水の全体的な品質を向上させるための効率的かつ経済的なソリューションを提供する技術が、活性炭フィルターの需要を増加させています。

最大流量別では、30~50m3/hが最大の部門になると予想されています。これらのフィルターは、高収量作物栽培のための清潔な水の安定供給を保証し、外部供給源への依存を低減するため、市場で最大のシェアを得ています。

当レポートでは、世界の再生水濾過の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/ディスラプション

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 再生水濾過製品の潜在顧客リスト:国別

- 再生水濾過の資金調達情勢

- 水・衛生分野の国際開発への資金提供:OPEC諸国別

- 技術分析

- 特許分析

- 貿易分析

- 主要な会議とイベント

- 関税、基準、規制状況

- ポーターのファイブフォース分析

- ケーススタディ分析

- 主なステークホルダーと購入基準

第6章 再生水濾過市場:エンドユーザー別

- 石油・ガスプラント

- 発電所

- 食品・飲料会社

- 淡水化プラント

- 農場

第7章 再生水濾過市場:製品タイプ別

- 砂フィルター

- マルチメディアフィルター

- 活性炭フィルター

- メンブレンフィルター

第8章 再生水濾過市場:最大流量別

- 30m3/h未満

- 30~50m3/h

- 50m3/h超

第9章 再生水濾過市場:メンブレンタイプ別

- 精密濾過膜

- 限外濾過膜

- ナノ濾過膜

- 逆浸透膜

第10章 再生水濾過市場:地域別

- 北米

- アジア太平洋

- 欧州

- 中東・アフリカ

- 南米

第11章 競合情勢

- 概要

- 主要企業の採用した戦略

- 市場シェア分析

- 収益シェア分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオと動向

- 主要な再生水濾過ベンダーの評価と財務指標

- ブランド/製品の比較分析

第12章 企業プロファイル

- 主要企業

- VEOLIA

- FLUENCE CORPORATION LIMITED

- KOVALUS SEPARATION SOLUTIONS

- XYLEM

- PURE AQUA, INC.

- MANN+HUMMEL

- OSMOTECH MEMBRANES PVT. LTD.

- NEWATER

- TORAY INDUSTRIES, INC

- SYNDER FILTRATION, INC.

- PHILOS CO., LTD.

- DUPONT

- KUBOTA CORPORATION

- VIKAS PUMP

- FILSON FILTER

- GUANGZHOU CHUNKE ENVIRONMENTAL TECHNOLOGY CO. LTD.

- ARIA FILTRA

- GRUNDFOS HOLDING A/S

- NIJHUIS SAUR INDUSTRIES

- HONGTEK FILTRATION CO., LTD.

- その他の企業

- MILIPURE WATER SYSTEM

- SWATI WATER PURIFICATION

- REE & COMPANY ENGINEERING WORKS

- IMEMFLO

- MEMBRANIUM

第13章 付録

The recycling water filtration market is estimated to grow from USD 2.7 billion in 2023 to USD 3.8 billion by 2028; it is expected to record a CAGR of 7.5% during the forecast period. The recycling water filtration market is witnessing rapid growth due to the need for sustainable water management, stringent environmental regulations governing wastewater treatment, and the ongoing advancements in water treatment technologies are driving rising demand for recycling water filtration.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Billion/Million) |

| Segments | Product type, membrane type, maximum flow rate, end user, region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"Activated carbon filters are the second-fastest growing segment of the recycling water filtration market, by product type."

Based on the product, the recycling water filtration market has been split into four types: sand filters, multimedia filters, activated carbon filters, and membrane filters. The activated carbon filters segment is the second-fastest segment in the recycling water filtration market due to their remarkable effectiveness in addressing a spectrum of water contaminants. The cost-effectiveness and sustainability of activated carbon filtration, the versatility of activated carbon filters in various industrial applications and the technology that offers an efficient and economical solution for improving the overall quality of recycled water are increasing the demand for activated carbon filters. Activated carbon filters emerge as a crucial component in the recycling water filtration landscape, providing tangible benefits in terms of water purity, environmental impact, and cost efficiency.

"30-50 cubic meters/hour segment is expected to be the largest segment based on maximum flow rate."

Based on the maximum flow rate, the recycling water filtration market has been segmented into up to 30 cubic meters per hour, 30-50 cubic meters per hour and above 50 cubic meters per hour. These filters ensure a consistent supply of clean water for high-yield crop cultivation, reducing dependence on external sources account for the greatest portion of the recycling water filtration market. With this adaptable flow rate, these filters bridge the gap between smaller on-site applications and large-scale industrial needs, empowering a diverse range of industries to embrace sustainable water recycling and take significant steps toward environmental stewardship.

"Middle East & Africa is expected to emerge as the second-fastest growing region in the recycling water filtration market."

By region, the recycling water filtration market has been segmented into Asia Pacific, North America, South America, Europe, and Middle East & Africa. In the region, the recycling water filtration market is growing in the Middle East & Africa as a result of the growing importance of water recycling in addressing water scarcity, policy and regulation enforcement for the wastewater and recycled water sector, and the increased investments and new technologies are creating opportunities for advanced filtration technologies to ensure the quality of desalinated water. In South Africa, water availability and treatment methods are likely to impact the recycling water filtration market in the rest of the Middle East; increased investments, expansion and proposed projects contribute to the increased implementation of recycling water filtration technology in the Middle East & Africa region.

"Farms are expected to be the fastest growing segment based on the end user."

Farms are expected to be the fastest segment in the recycling water filtration market between 2023-2029 due to the use of untreated water having a negative impact on the crop yield and quality. As the demand for agriculture increases, coupled with consumer preferences for green and healthy food, there is a growing emphasis on stricter standards for water quality in agricultural production. The adoption of advanced filtration technologies enhances water efficiency, reduces dependency on traditional water sources, and promotes environmental sustainability in farming practices further contributing to the increasing demand.

Breakdown of primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, c-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 45%, Tier 2- 30%, and Tier 3- 25%

By Designation: C-level- 35%, Director levels- 25%, and Others- 40%

By Region: North America- 27%, Europe- 20%, Asia Pacific- 33%, The Middle East & Africa- 12%, and South America- 8%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2021. Tier 1: > USD 1 billion, Tier 2: from USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The recycling water filtration market is dominated by a few major players that have a wide regional presence. The leading players in the recycling water filtration market are Veolia (France), TORAY INDUSRIES, INC. (Japan), Xylem (US), DuPont (US), and KUBOTA Corporation (Japan).

Research coverage:

The report defines, describes, and forecasts the recycling water filtration market by component, type, services, voltage, application, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the recycling water filtration market.

Key benefits of buying the report

- The pressing need for sustainable water management and stringent environmental regulations governing wastewater treatment is likely to drive the demand. Factors such as the lack of effective pricing strategies to ensure financial viability and sustainability and high-tech complexities in water treatment hinder the growth of recycling water filtration. Ongoing advancements in water treatment technologies are creating opportunities in this market. The discrepancy between monitoring location and installation site and social and political pressure to ensure affordability and accessibility of water are major challenges faced by countries in this market.

- Product development/ innovation: Technological innovations in the field of nanotechnology, photocatalytic water purification technology, automated variable filtration technology, and digitalization are driving product development in the market.

- Market development: The global scenario of recycling water filtration has developed due to a rising focus on adopting sustainable wastewater management practices, and a growing emphasis on wastewater reuse sustainable water management solutions.

- Market diversification: Toray Industries, Inc., announced the upcoming launch of the TBW-HR series of ultralow-pressure reverse osmosis (RO) membrane elements in March 2022. These new products significantly enhance the rejection of silica, boron, and other neutral molecules from untreated water by controlling RO membrane micropore sizes and structures. The TBW-HR series surpasses existing ultralow-pressure RO membrane elements in impurity rejection, offering the potential advantage of purifying higher-quality and higher-purity water.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Veolia (France), TORAY INDUSTRIES, INC. (Japan), Xylem (US), DuPont (US), and KUBOTA Corporation (Japan), among others in the recycling water filtration market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.3.4 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RECYCLING WATER FILTRATION MARKET: RESEARCH DESIGN

- 2.2 DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.1.2 List of major secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 List of key primary interview participants

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Key industry insights

- 2.2.2.4 Breakdown of primaries

- 2.3 SCOPE

- FIGURE 3 MAIN METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR RECYCLING WATER FILTRATIONS

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4.3 DEMAND-SIDE ANALYSIS

- 2.4.3.1 Regional analysis

- 2.4.3.2 Country-level analysis

- 2.4.3.3 Assumptions for demand-side analysis

- 2.4.3.4 Calculations for demand-side analysis

- 2.4.4 SUPPLY-SIDE ANALYSIS

- FIGURE 6 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF RECYCLING WATER FILTRATION PRODUCTS

- FIGURE 7 RECYCLING WATER FILTRATION MARKET: SUPPLY-SIDE ANALYSIS

- 2.4.4.1 Assumptions for supply-side analysis

- 2.4.4.2 Calculations for supply-side analysis

- FIGURE 8 COMPANY REVENUE ANALYSIS, 2022

- 2.4.5 FORECAST

- 2.5 RISK ASSESSMENT

- 2.6 RECESSION IMPACT ANALYSIS

- 2.6.1 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON RECYCLING WATER FILTRATION MARKET

3 EXECUTIVE SUMMARY

- TABLE 1 RECYCLING WATER FILTRATION MARKET SNAPSHOT

- FIGURE 9 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN RECYCLING WATER FILTRATION MARKET DURING FORECAST PERIOD

- FIGURE 10 MEMBRANE FILTERS TO CAPTURE LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- FIGURE 11 REVERSE OSMOSIS MEMBRANES SEGMENT TO DOMINATE MARKET FROM 2023 TO 2028

- FIGURE 12 POWER GENERATION PLANTS SEGMENT TO SECURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 30-50 CUBIC METERS/HOUR SEGMENT TO DISPLAY HIGHEST CAGR FROM 2023 TO 2028

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RECYCLING WATER FILTRATION MARKET

- FIGURE 14 GROWING WATER SCARCITY CONCERNS TO DRIVE RECYCLING WATER FILTRATION MARKET

- 4.2 RECYCLING WATER FILTRATION MARKET, BY REGION

- FIGURE 15 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 RECYCLING WATER FILTRATION MARKET IN ASIA PACIFIC, BY END USER AND COUNTRY

- FIGURE 16 POWER GENERATION PLANTS SEGMENT AND CHINA DOMINATED RECYCLING WATER FILTRATION MARKET IN ASIA PACIFIC IN 2023

- 4.4 RECYCLING WATER FILTRATION MARKET, BY PRODUCT

- FIGURE 17 MEMBRANE FILTERS TO HOLD LARGEST MARKET SHARE IN 2028

- 4.5 RECYCLING WATER FILTRATION MARKET, BY MEMBRANE TYPE

- FIGURE 18 REVERSE OSMOSIS MEMBRANES SEGMENT TO SECURE LARGEST MARKET SHARE IN 2028

- 4.6 RECYCLING WATER FILTRATION MARKET, BY END USER

- FIGURE 19 POWER GENERATION PLANTS TO DOMINATE MARKET IN 2028

- 4.7 RECYCLING WATER FILTRATION MARKET, BY MAXIMUM FLOW RATE

- FIGURE 20 30-50 CUBIC METERS/HOUR SEGMENT TO HOLD LARGEST MARKET SHARE FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 RECYCLING WATER FILTRATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Pressing need for sustainable water management

- FIGURE 22 GLOBAL WATER CONSUMPTION IN ENERGY SECTOR, BY FUEL AND POWER GENERATION TYPE, 2021 AND 2030

- 5.2.1.2 Stringent environmental regulations pertaining to wastewater treatment

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of effective pricing strategies to ensure financial viability and sustainability

- FIGURE 23 DATA ON ASIA PACIFIC COUNTRIES REPORTING >80% COST RECOVERY OF O&M COSTS FROM WATER SUPPLY AND SANITATION TARIFFS, 2018

- 5.2.2.2 Complexities in water and wastewater treatment plants

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Ongoing advancements in water treatment technologies

- 5.2.3.2 Rising focus on adopting sustainable wastewater management practices

- 5.2.3.3 Adoption of circular economy approach to reuse wastewater

- 5.2.4 CHALLENGES

- 5.2.4.1 Discrepancy between monitoring location and installation site

- 5.2.4.2 Social and political pressure to ensure affordability and accessibility of water

- FIGURE 24 NUMBER OF PROJECTS WITH PRIVATE CAPITAL IN CENTRAL ASIA, BY SECTOR, 1990-2021

- FIGURE 25 TOTAL INVESTMENT WITH PRIVATE CAPITAL PARTICIPATION IN CENTRAL ASIA, BY SECTOR, 1990-2021

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESSES

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE (ASP) TREND OF RECYCLING WATER FILTRATION PRODUCTS, BY TYPE, 2021-2023

- TABLE 2 AVERAGE SELLING PRICE (ASP) TREND OF RECYCLING WATER FILTRATION PRODUCTS, BY TYPE, 2021-2023 (USD/UNIT)

- FIGURE 27 AVERAGE SELLING PRICE (ASP) TREND OF RECYCLING WATER FILTRATION PRODUCTS, BY TYPE, 2021-2023

- 5.4.2 AVERAGE SELLING PRICE (ASP) TREND OF RECYCLING FILTRATION PRODUCTS, BY MEMBRANE TYPE, 2021-2023

- TABLE 3 AVERAGE SELLING PRICE (ASP) TREND OF RECYCLING FILTRATION PRODUCTS, BY MEMBRANE TYPE, 2021-2023 (USD/UNIT)

- FIGURE 28 AVERAGE SELLING PRICE (ASP) TREND OF RECYCLING FILTRATION PRODUCTS, BY MEMBRANE TYPE, 2021-2023

- 5.4.3 AVERAGE SELLING PRICE (ASP) TREND OF RECYCLING WATER FILTRATION PRODUCTS, BY REGION, 2021-2023

- TABLE 4 AVERAGE SELLING PRICE (ASP) TREND OF RECYCLING WATER FILTRATION PRODUCTS, BY REGION, 2021-2023 (USD/UNIT)

- FIGURE 29 AVERAGE SELLING PRICE (ASP) TREND OF RECYCLING WATER FILTRATION PRODUCTS, BY REGION, 2021-2023

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 30 RECYCLING WATER FILTRATION MARKET: VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL PROVIDERS

- 5.5.2 RECYCLING WATER FILTRATION MANUFACTURERS

- 5.5.3 DISTRIBUTORS/RESELLERS

- 5.5.4 END USERS

- 5.5.5 MAINTENANCE/SERVICE PROVIDERS

- 5.6 ECOSYSTEM ANALYSIS

- TABLE 5 COMPANIES AND THEIR ROLES IN RECYCLING WATER FILTRATION ECOSYSTEM

- FIGURE 31 RECYCLING WATER FILTRATION MARKET: ECOSYSTEM ANALYSIS

- 5.7 LIST OF POTENTIAL CUSTOMERS FOR RECYCLING WATER FILTRATION PRODUCTS, BY COUNTRY

- TABLE 6 RECYCLING WATER FILTRATION MARKET: POTENTIAL CUSTOMERS

- 5.8 RECYCLING WATER FILTRATION FUNDING LANDSCAPE

- FIGURE 32 FUNDING FOR PLAYERS IN RECYCLING WATER FILTRATION MARKET

- TABLE 7 XYLEM INC.: FUNDING DETAILS

- TABLE 8 FLUENCE CORPORATION LIMITED: FUNDING DETAILS

- TABLE 9 ZWITTERCO.: FUNDING DETAILS

- 5.9 OPEC COUNTRIES FUNDING FOR INTERNATIONAL DEVELOPMENT IN WATER AND SANITATION SECTOR, 2022

- FIGURE 33 FUNDING RAISED BY OPEC COUNTRIES FUNDING FOR INTERNATIONAL DEVELOPMENT IN WATER AND SANITATION SECTOR, 2022

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 NANOTECHNOLOGY

- 5.10.2 PHOTOCATALYTIC WATER PURIFICATION

- 5.10.3 AUTOMATED VARIABLE FILTRATION

- 5.10.4 DIGITALIZATION

- 5.11 PATENT ANALYSIS

- FIGURE 34 INNOVATIONS AND PATENT REGISTRATIONS PERTAINING TO RECYCLING WATER FILTRATION PRODUCTS, 2013-2022

- 5.11.1 RECYCLING WATER FILTRATION MARKET: INNOVATIONS AND PATENT REGISTRATIONS

- 5.12 TRADE ANALYSIS

- 5.12.1 HS CODE 842121

- 5.12.1.1 Export data for machinery and apparatus used in water filtering or purifying water applications

- TABLE 10 EXPORT DATA FOR HS CODE 842121-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 35 EXPORT DATA FOR HS CODE 842121-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- 5.12.1.2 Import data for machinery and apparatus used in water filtering or purifying applications

- TABLE 11 IMPORT DATA FOR HS CODE 842121-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 36 IMPORT DATA FOR HS CODE 842121-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- 5.12.2 HS CODE 842199

- 5.12.2.1 Export scenario of machinery and apparatus for filtering or purifying liquids or gases

- TABLE 12 EXPORT DATA FOR HS CODE 842199-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 37 EXPORT DATA FOR HS CODE 842199-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- 5.12.2.2 Import data for machinery and apparatus used in liquid or gas filtering or purifying applications

- TABLE 13 IMPORT SCENARIO FOR HS CODE 842199-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 38 IMPORT DATA FOR HS CODE 842199-COMPLIANT PRODUCTS, 2020-2022 (USD THOUSAND)

- 5.12.1 HS CODE 842121

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 14 RECYCLING WATER FILTRATION MARKET: LIST OF CONFERENCES AND EVENTS, 2023-2024

- 5.14 TARIFFS, STANDARDS, AND REGULATORY LANDSCAPE

- 5.14.1 TARIFF RELATED TO RECYCLING WATER FILTRATION

- TABLE 15 IMPORT TARIFF FOR HS CODE 842121-COMPLIANT PRODUCTS, 2022

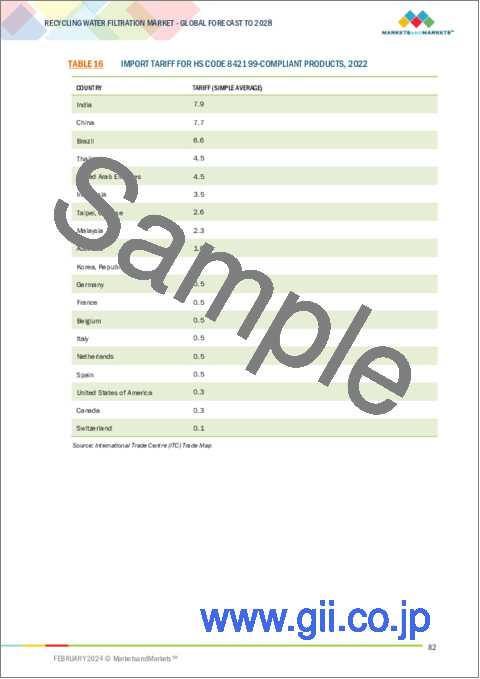

- TABLE 16 IMPORT TARIFF FOR HS CODE 842199-COMPLIANT PRODUCTS, 2022

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.3 CODES AND REGULATIONS PERTAINING TO RECYCLING WATER FILTRATION MARKET

- TABLE 23 NORTH AMERICA: CODES AND REGULATIONS

- TABLE 24 ASIA PACIFIC: CODES AND REGULATIONS

- TABLE 25 SOUTH AMERICA: CODES AND REGULATIONS

- TABLE 26 MIDDLE EAST & AFRICA: CODES AND REGULATIONS

- TABLE 27 GLOBAL: CODES AND REGULATIONS

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 39 RECYCLING WATER FILTRATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 28 RECYCLING WATER FILTRATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 THREAT OF NEW ENTRANTS

- 5.15.2 BARGAINING POWER OF SUPPLIERS

- 5.15.3 BARGAINING POWER OF BUYERS

- 5.15.4 THREAT OF SUBSTITUTES

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 FILTERSAFE ASSISTS KIBBUTZ MAAGAN MICHAEL WITH EASY FILTERS THAT HAVE HIGH RECOVERY RATES AND DURABILITY

- 5.16.2 ARIA FILTRA AND CHEMTREAT MEXICO OFFER MOBILE TEMPORARY DEPLOYMENT OF MICROFILTRATION AND HIGH-RECOVERY REVERSE OSMOSIS TO MINERA SAN XAVIER

- 5.16.3 NAWI EXPLORES LOW-SALT-REJECTION REVERSE OSMOSIS THAT TREATS HIGHLY SALINE WATER AND OFFERS DRINKABLE WATER

- 5.17 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 40 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- 5.17.2 BUYING CRITERIA

- FIGURE 41 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 30 KEY BUYING CRITERIA FOR TOP THREE END USERS

6 RECYCLING WATER FILTRATION MARKET, BY END USER

- 6.1 INTRODUCTION

- FIGURE 42 RECYCLING WATER FILTRATION MARKET SHARE, BY END USER, 2022

- TABLE 31 RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 32 RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (THOUSAND UNITS)

- 6.2 OIL & GAS PLANTS

- 6.2.1 BETTER EFFLUENT QUALITY AND LOW-SLUDGE OUTPUT OFFERED BY MEMBRANE FILTRATION SEPARATION TECHNOLOGY TO BOOST DEMAND

- TABLE 33 OIL & GAS PLANTS: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 34 OIL & GAS PLANTS: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (THOUSAND UNITS)

- 6.3 POWER GENERATION PLANTS

- 6.3.1 EXPANSION OF THERMAL POWER UNITS TO DRIVE MARKET

- TABLE 35 POWER GENERATION PLANTS: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 36 POWER GENERATION PLANTS: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (THOUSAND UNITS)

- 6.4 FOOD & BEVERAGE COMPANIES

- 6.4.1 NEED TO ADHERE TO HYGIENE STANDARDS AND PREVENT PRODUCT SPOILAGE TO ACCELERATE DEMAND

- TABLE 37 FOOD & BEVERAGE COMPANIES: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 38 FOOD & BEVERAGE COMPANIES: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (THOUSAND UNITS)

- 6.5 WATER DESALINATION PLANTS

- 6.5.1 INCREASING ENVIRONMENTAL CONCERNS ASSOCIATED WITH BRINE DISCHARGE AND CHEMICAL USAGE TO DRIVE MARKET

- TABLE 39 WATER DESALINATION PLANTS: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 40 WATER DESALINATION PLANTS: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (THOUSAND UNITS)

- 6.6 FARMS

- 6.6.1 RISING UTILIZATION OF REVERSE OSMOSIS SYSTEMS IN CROP IRRIGATION AND LIVESTOCK FARMING TO DRIVE MARKET

- TABLE 41 FARMS: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 42 FARMS: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (THOUSAND UNITS)

7 RECYCLING WATER FILTRATION MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- FIGURE 43 RECYCLING WATER FILTRATION MARKET SHARE, BY PRODUCT TYPE, 2022

- TABLE 43 RECYCLING WATER FILTRATION MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 44 RECYCLING WATER FILTRATION MARKET, BY PRODUCT TYPE, 2021-2028 (THOUSAND UNITS)

- 7.2 SAND FILTERS

- 7.2.1 HIGH AFFORDABILITY AND EXTENDED LIFESPAN TO DRIVE DEMAND

- TABLE 45 SAND FILTERS: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 46 SAND FILTERS: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (THOUSAND UNITS)

- 7.3 MULTIMEDIA FILTERS

- 7.3.1 ABILITY TO TRAP AND RETAIN LARGE QUANTITIES OF PARTICLES THROUGHOUT ENTIRE DEPTH OF FILTER BED TO DRIVE DEMAND

- TABLE 47 MULTIMEDIA FILTERS: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 48 MULTIMEDIA FILTERS: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (THOUSAND UNITS)

- 7.4 ACTIVATED CARBON FILTERS

- 7.4.1 INCREASING EMPHASIS ON ECO-FRIENDLY PRACTICES TO BOOST DEMAND

- TABLE 49 ACTIVATED CARBON FILTERS: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 50 ACTIVATED CARBON FILTERS: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (THOUSAND UNITS)

- 7.5 MEMBRANE FILTERS

- 7.5.1 ABILITY TO SEPARATE EXTRACTS AND SPECIFIC NATURAL ESSENCES AT LOW OR AMBIENT TEMPERATURES TO FOSTER SEGMENTAL GROWTH

- TABLE 51 MEMBRANE FILTERS: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 52 MEMBRANE FILTERS: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (THOUSAND UNITS)

8 RECYCLING WATER FILTRATION MARKET, BY MAXIMUM FLOW RATE

- 8.1 INTRODUCTION

- FIGURE 44 RECYCLING WATER FILTRATION MARKET SHARE, BY MAXIMUM FLOW RATE, 2022

- TABLE 53 RECYCLING WATER FILTRATION MARKET, BY MAXIMUM FLOW RATE, 2021-2028 (USD MILLION)

- 8.2 UP TO 30 CUBIC METERS/HOUR

- 8.2.1 RISING DEPLOYMENT IN FARMS TO BOOST DEMAND

- TABLE 54 UP TO 30 CUBIC METERS/HOUR: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.3 30-50 CUBIC METERS/HOUR

- 8.3.1 AQUACULTURE AND TEXTILE MILLS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES TO PLAYERS

- TABLE 55 30-50 CUBIC METERS/HOUR: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.4 ABOVE 50 CUBIC METERS/HOUR

- 8.4.1 GROWING DEPLOYMENT IN ENERGY SECTOR TO FILTER WATER IN COOLING TOWERS TO FOSTER SEGMENTAL GROWTH

- TABLE 56 ABOVE 50 CUBIC METERS/HOUR: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

9 RECYCLING WATER FILTRATION MARKET, BY MEMBRANE TYPE

- 9.1 INTRODUCTION

- FIGURE 45 RECYCLING WATER FILTRATION MARKET SHARE, BY MEMBRANE TYPE, 2022

- TABLE 57 RECYCLING WATER FILTRATION MARKET, BY MEMBRANE TYPE, 2021-2028 (USD MILLION)

- TABLE 58 RECYCLING WATER FILTRATION MARKET, BY MEMBRANE TYPE, 2021-2028 (THOUSAND UNITS)

- 9.2 MICROFILTRATION MEMBRANES

- 9.2.1 ABILITY TO REDUCE NEED FOR CHEMICAL ADDITIVES TO TREAT WATER TO DRIVE MARKET

- TABLE 59 MICROFILTRATION MEMBRANES: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 60 MICROFILTRATION MEMBRANES: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (THOUSAND UNITS)

- 9.3 ULTRAFILTRATION MEMBRANES

- 9.3.1 EFFICIENCY IN REMOVING MICROORGANISMS, PARTICULATE MATTER, AND CONTAMINANTS TO FOSTER SEGMENTAL GROWTH

- TABLE 61 ULTRAFILTRATION MEMBRANES: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 62 ULTRAFILTRATION MEMBRANES: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (THOUSAND UNITS)

- 9.4 NANOFILTRATION MEMBRANES

- 9.4.1 ABILITY TO REMOVE CYSTS AND HUMIC MATERIALS TO BOOST DEMAND

- TABLE 63 NANOFILTRATION MEMBRANES: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 64 NANOFILTRATION MEMBRANES: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (THOUSAND UNITS)

- 9.5 REVERSE OSMOSIS MEMBRANES

- 9.5.1 COMPLETE REMOVAL OF INORGANIC CONTAMINANTS FROM WATER TO ACCELERATE DEMAND

- TABLE 65 REVERSE OSMOSIS MEMBRANES: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 66 REVERSE OSMOSIS MEMBRANES: RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (THOUSAND UNITS)

10 RECYCLING WATER FILTRATION MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 46 ASIA PACIFIC TO DISPLAY HIGHEST CAGR IN GLOBAL RECYCLING WATER FILTRATION MARKET FROM 2023 TO 2028

- FIGURE 47 RECYCLING WATER FILTRATION MARKET, BY REGION, 2022

- TABLE 67 RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 68 RECYCLING WATER FILTRATION MARKET, BY REGION, 2021-2028 (THOUSAND UNITS)

- 10.2 NORTH AMERICA

- FIGURE 48 NORTH AMERICA: RECYCLING WATER FILTRATION MARKET SNAPSHOT

- 10.2.1 RECESSION IMPACT: NORTH AMERICA

- TABLE 69 NORTH AMERICA: RECYCLING WATER FILTRATION MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: RECYCLING WATER FILTRATION MARKET, BY MEMBRANE TYPE, 2021-2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: RECYCLING WATER FILTRATION MARKET, BY MAXIMUM FLOW RATE, 2021-2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: RECYCLING WATER FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Stringent environmental regulations and high-quality of water standards to boost adoption

- TABLE 74 US: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Government Investments and rising construction of water treatment plants to drive market

- TABLE 75 CANADA: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.4 MEXICO

- 10.2.4.1 Strategic Initiatives to curb wastewater spills to boost demand

- TABLE 76 MEXICO: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3 ASIA PACIFIC

- FIGURE 49 ASIA PACIFIC: RECYCLING WATER FILTRATION MARKET SNAPSHOT

- 10.3.1 RECESSION IMPACT: ASIA PACIFIC

- TABLE 77 ASIA PACIFIC: RECYCLING WATER FILTRATION MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 78 ASIA PACIFIC: RECYCLING WATER FILTRATION MARKET, BY MEMBRANE TYPE, 2021-2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: RECYCLING WATER FILTRATION MARKET, BY MAXIMUM FLOW RATE, 2021-2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: RECYCLING WATER FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.3.2 CHINA

- 10.3.2.1 Emergence of "blue water factories" to drive market

- TABLE 82 CHINA: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.3 INDIA

- 10.3.3.1 Increasing Urbanization and Population Growth to drive market

- TABLE 83 INDIA: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.4 JAPAN

- 10.3.4.1 Adoption of decentralized wastewater treatment systems to boost demand

- TABLE 84 JAPAN: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.5 SOUTH KOREA

- 10.3.5.1 International collaborations and focus on sustainable technologies to propel market

- TABLE 85 SOUTH KOREA: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.6 REST OF ASIA PACIFIC

- TABLE 86 REST OF ASIA PACIFIC: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4 EUROPE

- 10.4.1 RECESSION IMPACT: EUROPE

- TABLE 87 EUROPE: RECYCLING WATER FILTRATION MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 88 EUROPE: RECYCLING WATER FILTRATION MARKET, BY MEMBRANE TYPE, 2021-2028 (USD MILLION)

- TABLE 89 EUROPE: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 90 EUROPE: RECYCLING WATER FILTRATION MARKET, BY MAXIMUM FLOW RATE, 2021-2028 (USD MILLION)

- TABLE 91 EUROPE: RECYCLING WATER FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.4.2 UK

- 10.4.2.1 Stringent regulations and rising campaigns to address water pollution-related issues to drive market

- TABLE 92 UK: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.3 GERMANY

- 10.4.3.1 Stringent legal provisions of Federal Water Act to boost demand

- TABLE 93 GERMANY: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.4 FRANCE

- 10.4.4.1 Growing awareness of increasing water crisis to drive demand

- TABLE 94 FRANCE: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.5 ITALY

- 10.4.5.1 Increasing emphasis on improving water management practices to accelerate demand

- TABLE 95 ITALY: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.6 SPAIN

- 10.4.6.1 Rising use of treated wastewater in irrigation applications to drive market

- TABLE 96 SPAIN: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.6.2 Rest of Europe

- TABLE 97 REST OF EUROPE: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 RECESSION IMPACT: MIDDLE EAST & AFRICA

- TABLE 98 MIDDLE EAST & AFRICA: RECYCLING WATER FILTRATION MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: RECYCLING WATER FILTRATION MARKET, BY MEMBRANE TYPE, 2021-2028 (USD MILLION)

- TABLE 100 MIDDLE EAST & AFRICA: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: RECYCLING WATER FILTRATION MARKET, BY MAXIMUM FLOW RATE, 2021-2028 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: RECYCLING WATER FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 103 GCC COUNTRIES: RECYCLING WATER FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.5.2 GCC COUNTRIES

- TABLE 104 GCC COUNTRIES: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.2.1 UAE

- 10.5.2.1.1 Growing importance of water recycling to address water scarcity to boost demand

- 10.5.2.1 UAE

- TABLE 105 UAE: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.2.2 Saudi Arabia

- 10.5.2.2.1 Increasing investments in desalination and water conservation to offer lucrative growth opportunities

- 10.5.2.2 Saudi Arabia

- TABLE 106 SAUDI ARABIA: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.2.3 Rest of GCC countries

- TABLE 107 REST OF GCC COUNTRIES: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.3 SOUTH AFRICA

- 10.5.3.1 Growing importance of investing in advanced water reuse technologies to drive market

- TABLE 108 SOUTH AFRICA: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 109 REST OF MIDDLE EAST & AFRICA: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.6 SOUTH AMERICA

- 10.6.1 RECESSION IMPACT: SOUTH AMERICA

- TABLE 110 SOUTH AMERICA: RECYCLING WATER FILTRATION MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 111 SOUTH AMERICA: RECYCLING WATER FILTRATION MARKET, BY MEMBRANE TYPE, 2021-2028 (USD MILLION)

- TABLE 112 SOUTH AMERICA: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- TABLE 113 SOUTH AMERICA: RECYCLING WATER FILTRATION MARKET, BY MAXIMUM FLOW RATE, 2021-2028 (USD MILLION)

- TABLE 114 SOUTH AMERICA: RECYCLING WATER FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.6.2 BRAZIL

- 10.6.2.1 Drought conditions and low reservoirs to offer lucrative growth opportunities to players

- TABLE 115 BRAZIL: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.6.3 ARGENTINA

- 10.6.3.1 Ongoing expansions of water treatment systems to drive market

- TABLE 116 ARGENTINA: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.6.4 PERU

- 10.6.4.1 Increased construction of new water treatment plants to drive market

- TABLE 117 PERU: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.6.5 REST OF SOUTH AMERICA

- TABLE 118 REST OF SOUTH AMERICA: RECYCLING WATER FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY MAJOR PLAYERS, 2019

- TABLE 119 RECYCLING WATER FILTRATION MARKET: OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS, 2019-2022

- 11.3 MARKET SHARE ANALYSIS

- TABLE 120 RECYCLING WATER FILTRATION MARKET: DEGREE OF COMPETITION

- FIGURE 50 RECYCLING WATER FILTRATION MARKET SHARE ANALYSIS, 2022

- 11.4 REVENUE SHARE ANALYSIS, 2018-2022

- FIGURE 51 RECYCLING WATER FILTRATION MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018-2022

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2022

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 52 RECYCLING WATER FILTRATION MARKET: COMPANY EVALUATION MATRIX, (KEY PLAYERS) 2022

- 11.5.5 COMPANY FOOTPRINT

- 11.5.5.1 Product type footprint

- TABLE 121 PRODUCT TYPE FOOTPRINT

- 11.5.5.2 Membrane type footprint

- TABLE 122 MEMBRANE TYPE FOOTPRINT

- 11.5.5.3 End user footprint

- TABLE 123 END USER FOOTPRINT

- 11.5.5.4 Region Footprint

- TABLE 124 REGION FOOTPRINT

- 11.5.5.5 Overall company footprint

- TABLE 125 OVERALL COMPANY FOOTPRINT

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES), 2022

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 53 RECYCLING WATER FILTRATION MARKET: START-UP/SME EVALUATION MATRIX (KEY PLAYERS), 2022

- 11.6.5 COMPETITIVE BENCHMARKING

- 11.6.5.1 Competitive benchmarking of key startups/SMEs

- TABLE 126 RECYCLING WATER FILTRATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.6.5.2 Detailed list of key startups/SMEs

- TABLE 127 RECYCLING WATER FILTRATION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 11.7 COMPETITIVE SCENARIOS AND TRENDS

- 11.7.1 DEALS, JANUARY 2019-NOVEMBER 2023

- TABLE 128 RECYCLING WATER FILTRATION MARKET: DEALS, JANUARY 2019-NOVEMBER 2023

- 11.7.2 OTHERS, JANUARY 2019-JANUARY 2023

- TABLE 129 RECYCLING WATER FILTRATION MARKET: OTHERS, JANUARY 2019-JANUARY 2023

- 11.8 VALUATION AND FINANCIAL METRICS OF KEY RECYCLING WATER FILTRATION VENDORS

- FIGURE 54 EV/EBITDA OF KEY VENDORS

- FIGURE 55 COMPANY VALUATION OF KEY VENDORS

- 11.9 BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 56 RECYCLING WATER FILTRATION: TOP TRENDING BRAND/PRODUCTS

12 COMPANY PROFILES

- (Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 12.1 KEY PLAYERS

- 12.1.1 VEOLIA

- TABLE 130 VEOLIA: COMPANY OVERVIEW

- FIGURE 57 VEOLIA: COMPANY SNAPSHOT

- TABLE 131 VEOLIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 132 VEOLIA: DEALS

- 12.1.2 FLUENCE CORPORATION LIMITED

- TABLE 133 FLUENCE CORPORATION LIMITED: COMPANY OVERVIEW

- FIGURE 58 FLUENCE CORPORATION LIMITED: COMPANY SNAPSHOT

- TABLE 134 FLUENCE CORPORATION LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 FLUENCE CORPORATION LIMITED: DEALS

- 12.1.3 KOVALUS SEPARATION SOLUTIONS

- TABLE 136 KOVALUS SEPARATION SOLUTIONS: COMPANY OVERVIEW

- TABLE 137 KOVALUS SEPARATION SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 KOVALUS SEPARATION SOLUTIONS: PRODUCT LAUNCHES

- TABLE 139 KOVALUS SEPARATION SOLUTIONS: DEALS

- TABLE 140 KOVALUS SEPARATION SOLUTIONS: OTHERS

- 12.1.4 XYLEM

- TABLE 141 XYLEM INC.: COMPANY OVERVIEW

- FIGURE 59 XYLEM: COMPANY SNAPSHOT

- TABLE 142 XYLEM INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 XYLEM INC.: DEALS

- TABLE 144 XYLEM INC.: OTHERS

- 12.1.5 PURE AQUA, INC.

- TABLE 145 PURE AQUA, INC.: COMPANY OVERVIEW

- TABLE 146 PURE AQUA, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.6 MANN + HUMMEL

- TABLE 147 MANN+HUMMEL: COMPANY OVERVIEW

- FIGURE 60 MANN+HUMMEL: COMPANY SNAPSHOT

- TABLE 148 MANN+HUMMEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.7 OSMOTECH MEMBRANES PVT. LTD.

- TABLE 149 OSMOTECH MEMBRANES PVT. LTD.: COMPANY OVERVIEW

- TABLE 150 OSMOTECH MEMBRANES PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.8 NEWATER

- TABLE 151 NEWATER: COMPANY OVERVIEW

- TABLE 152 NEWATER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.9 TORAY INDUSTRIES, INC

- TABLE 153 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 61 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 154 TORAY INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 156 TORAY INDUSTRIES, INC.: DEALS

- TABLE 157 TORAY INDUSTRIES, INC.: OTHERS

- 12.1.10 SYNDER FILTRATION, INC.

- TABLE 158 SYNDER FILTRATION, INC.: COMPANY OVERVIEW

- TABLE 159 SYNDER FILTRATION, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 SYNDER FILTRATION, INC.: PRODUCT LAUNCHES

- TABLE 161 SYNDER FILTRATION, INC.: OTHERS

- 12.1.11 PHILOS CO., LTD.

- TABLE 162 PHILOS CO., LTD.: COMPANY OVERVIEW

- TABLE 163 PHILOS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 PHILOS CO., LTD.: PRODUCT LAUNCHES

- TABLE 165 PHILOS CO., LTD.: DEALS

- 12.1.12 DUPONT

- TABLE 166 DUPONT: COMPANY OVERVIEW

- FIGURE 62 DUPONT: COMPANY SNAPSHOT

- TABLE 167 DUPONT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 DUPONT: DEALS

- 12.1.13 KUBOTA CORPORATION

- TABLE 169 KUBOTA CORPORATION: COMPANY OVERVIEW

- FIGURE 63 KUBOTA CORPORATION: COMPANY SNAPSHOT

- TABLE 170 KUBOTA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 KUBOTA CORPORATION: DEALS

- TABLE 172 KUBOTA CORPORATION: OTHERS

- 12.1.14 VIKAS PUMP

- TABLE 173 VIKAS PUMP: COMPANY OVERVIEW

- TABLE 174 VIKAS PUMP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.15 FILSON FILTER

- TABLE 175 FILSON FILTER: COMPANY OVERVIEW

- TABLE 176 FILSON FILTER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.16 GUANGZHOU CHUNKE ENVIRONMENTAL TECHNOLOGY CO. LTD.

- TABLE 177 GUANGZHOU CHUNKE ENVIRONMENTAL TECHNOLOGY CO. LTD.: COMPANY OVERVIEW

- TABLE 178 NGZHOU CHUNKE ENVIRONMENTAL TECHNOLOGY CO. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.17 ARIA FILTRA

- TABLE 179 ARIA FILTRA: COMPANY OVERVIEW

- TABLE 180 ARIA FILTRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 ARIA FILTRA: OTHERS

- 12.1.18 GRUNDFOS HOLDING A/S

- TABLE 182 GRUNDFOS HOLDING A/S: COMPANY OVERVIEW

- FIGURE 64 GRUNDFOS HOLDING A/S: COMPANY SNAPSHOT

- TABLE 183 GRUNDFOS HOLDING A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 GRUNDFOS HOLDING A/S: OTHERS

- 12.1.19 NIJHUIS SAUR INDUSTRIES

- TABLE 185 NIJHUIS SAUR INDUSTRIES: COMPANY OVERVIEW

- TABLE 186 NIJHUIS SAUR INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 NIJHUIS SAUR INDUSTRIES: DEALS

- 12.1.20 HONGTEK FILTRATION CO., LTD.

- TABLE 188 HONGTEK FILTRATION CO., LTD: COMPANY OVERVIEW

- TABLE 189 HONGTEK FILTRATION CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 MILIPURE WATER SYSTEM

- 12.2.2 SWATI WATER PURIFICATION

- 12.2.3 REE & COMPANY ENGINEERING WORKS

- 12.2.4 IMEMFLO

- 12.2.5 MEMBRANIUM

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS