|

|

市場調査レポート

商品コード

1426160

M2M衛星通信の世界市場:提供別、技術別、業界別、地域別 - 予測(~2028年)M2M Satellite Communication Market by Offering (Hardware, Software Types, Services), Technology (Satellite Constellation (LEO, MEO, GEO), Data Transmission, VSAT, AIS), Vertical (Maritime, Military & Defense) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| M2M衛星通信の世界市場:提供別、技術別、業界別、地域別 - 予測(~2028年) |

|

出版日: 2024年02月09日

発行: MarketsandMarkets

ページ情報: 英文 404 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のM2M衛星通信の市場規模は、2023年に155億米ドル、2028年に287億米ドルに達し、予測期間にCAGRで13.1%の成長が見込まれています。

コネクテッドデバイスのモニタリングと遠隔管理に対する需要の高まりが、M2M衛星通信の成長を後押しする極めて重大な市場促進要因となっています。世界がIoTを通じて相互接続を深めるにつれ、産業や企業は農業、医療、輸送、製造などの多様なセグメントで無数のコネクテッドデバイスを展開しています。このようなコネクテッドデバイスの急増により、特に従来のネットワークが信頼できなかったり利用できなかったりする遠隔地やアクセスしにくい場所での、効率的で信頼性の高い通信チャネルが必要となります。M2M衛星通信は、このような接続性ギャップを埋めるソリューションとして登場し、分散し地理的に離れたデバイスのシームレスなデータ伝送と制御を保証します。これらの機器を遠隔でモニタリング、追跡、管理する能力は、業務効率を高め、ダウンタイムを削減し、タイムリーな意思決定を可能にします。その結果、コネクテッドデバイスの接続性と制御を促進するM2M衛星通信への依存の高まりが市場の軌道を舵取りし、コネクテッドワールドの進化するニーズに対応する強固で拡大するエコシステムを生み出しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2017年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 単位 | 10億米ドル |

| セグメント | 提供別、技術別、業界別、地域別。 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

「提供別では、ハードウェアセグメントが予測期間に最大の市場規模を占める見込みです。」

急速に発展するM2M衛星通信の分野では、複数の企業が端末、モデム、アンテナを含む包括的なハードウェアソリューションの提供に積極的に取り組んでいます。これらのコンポーネントは、遠隔機器と衛星ネットワーク間のシームレスな接続とデータ転送を可能にする上で重要な役割を果たしています。M2M衛星通信市場における技術の進歩とハードウェアの提供は、性能の向上、サイズと消費電力の削減、遠隔地での展開に関連する特有の課題への対応に注力しながら、進化し続けています。この部門の企業は、ハードウェアソリューションが幅広いM2M用途の厳しい要件を満たすことを保証し、イノベーションを通じて差別化を図ることが多いです。

「ソフトウェアタイプ別では、地理空間分析/マッピングソフトウェアが予測期間にもっとも高いCAGRで成長します。」

地理空間分析とマッピングは、衛星に接続されたデバイスから収集された位置情報データを分析し、視覚化し、解釈するために設計された専門的なツールとアプリケーションを指します。このソフトウェアは、地理空間情報をM2Mデバイスによって生成されたデータと統合し、空間的関係、パターン、動向の包括的な見解を提供します。デバイスが広大な遠隔地に分散していることが多いM2Mの状況では、地理空間分析とマッピングソフトウェアは、環境モニタリング、精密農業、ロジスティクスなどの用途に価値ある知見を提供します。これにより、企業は衛星通信機能を活用してデバイスの地理的位置を追跡し、環境条件を評価し、空間データに基づいて意思決定プロセスを最適化することができます。

「アジア太平洋が予測期間にもっとも高いCAGRを示すと予測されています。」

アジア太平洋は現在、軍用衛星通信(SATCOM)産業で顕著な急成長を示しており、オーストラリア、インド、日本、韓国などの国々が国防支出や軍用SATCOMプロジェクトやプログラムの立ち上げで主導権を握っています。このセグメントの成長可能性は大きく、衛星、地上局、関連するコンポーネントやサービスなど、宇宙と地上の両方のセグメントが含まれています。特に国外企業と国内企業とのパートナーシップは、市場でのプレゼンスを拡大する上で極めて重要です。現地のサプライチェーンやバリューネットワークを支援することで、こうした提携は産業の成長を促す環境を育みます。この地域のインフラと技術力、特に5Gのような分野における全体的な進歩は、産業全体がデジタル革命を広く受け入れていることを反映しています。マレーシアやシンガポールのような国々は、5Gの速度と性能の世界ランキングで際立っており、防衛や軍事通信を含むさまざまなセグメントにおける、技術の進歩へのこの地域のコミットメントを示しています。

当レポートでは、世界のM2M衛星通信市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- M2M衛星通信市場の企業にとって魅力的な機会

- M2M衛星通信市場:提供別

- M2M衛星通信市場:提供別、主要業界別

- M2M衛星通信市場:地域別

第5章 市場の概要と産業動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 産業の動向

- M2M衛星通信市場:アーキテクチャ

- M2M衛星通信市場:進化

- サプライチェーン分析

- エコシステム/市場マップ

- ケーススタディ分析

- 関税と規制情勢

- 特許分析

- 貿易分析

- 技術分析

- 価格分析

- 投資と資金調達のシナリオ

- ポーターのファイブフォース分析

- 顧客のビジネスに影響を与える動向/混乱

- 主な会議とイベント(2024年~2025年)

- 主なステークホルダーと購入基準

- M2M衛星通信市場の技術ロードマップ

- M2M衛星通信市場のビジネスモデル

- 衛星通信サービスの種類

- 衛星通信チャネルの種類

第6章 M2M衛星通信市場:提供別

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第7章 M2M衛星通信市場:技術別

- イントロダクション

- 衛星コンステレーション

- データ送信

- VSAT

- 自動識別システム

- ネットワーキング

- 衛星通信プロトコル

- その他の技術

第8章 M2M衛星通信市場:業界別

- イントロダクション

- 鉱業

- 農業

- エネルギー・公共事業

- 政府・公共部門

- 自動車・交通機関

- 海事

- 小売

- 軍事・防衛

- 製造

- 医療

- その他の業界

第9章 M2M衛星通信市場:地域別

- イントロダクション

- 北米

- 北米のM2M衛星通信市場の促進要因

- 北米の不況の影響

- 米国

- カナダ

- 欧州

- 欧州のM2M衛星通信市場の促進要因

- 欧州の景気後退の影響

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋のM2M衛星通信市場の促進要因

- アジア太平洋の不況の影響

- 中国

- 日本

- インド

- 韓国

- オーストラリア・ニュージーランド

- ASEAN諸国

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカのM2M衛星通信市場の促進要因

- 中東・アフリカの不況の影響

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- エジプト

- トルコ

- その他の中東・アフリカ

- ラテンアメリカ

- ラテンアメリカのM2M衛星通信市場の促進要因

- ラテンアメリカの不況の影響

- ブラジル

- メキシコ

- アルゼンチン

- その他のラテンアメリカ

第10章 競合情勢

- 概要

- 主要企業の戦略

- 収益分析

- 市場シェア分析

- ブランド/製品の比較分析

- 企業の評価マトリクス(2022年)

- スタートアップ/中小企業の評価マトリクス(2022年)

- 競合シナリオと動向

- 主要ベンダーの評価と財務指標

- 主要ベンダーの年初来価格の総収益と株価ベータ

第11章 企業プロファイル

- イントロダクション

- 主要企業

- MARLINK

- VIASAT

- THALES

- ORBCOMM

- IRIDIUM COMMUNICATIONS

- GLOBALSTAR

- ORANGE

- ECHOSTAR

- INTELSAT

- ROGERS COMMUNICATIONS

- SES

- GILAT

- その他の企業

- TELIA

- KORE WIRELESS

- HONEYWELL

- QUALCOMM

- TELESAT

- WIRELESS LOGIC

- OUTERLINK GLOBAL SOLUTIONS

- NUPOINT SYSTEMS

- BUSINESSCOM NETWORKS

- SEMTECH

- YAHSAT

- スタートアップ/中小企業

- AST SPACEMOBILE

- ASTROCAST

- SKY AND SPACE GLOBAL

- SAT4M2M

- HIBER

- ALEN SPACE

- SATELIoT

第12章 隣接市場と関連市場

- 隣接市場と関連市場

- 衛星IoT市場 - 世界の予測(~2027年)

- メタデータ管理市場 - 世界の予測(~2026年)

第13章 付録

The global M2M satellite communication market is valued at USD 15.5 billion in 2023 and is estimated to reach USD 28.7 billion in 2028, registering a CAGR of 13.1% during the forecast period. The growing demand for monitoring and remote management of connected devices stands as a pivotal market driver propelling the growth of M2M satellite communication. As the world becomes increasingly interconnected through the IoT, industries and enterprises are deploying a myriad of connected devices across diverse sectors, such as agriculture, healthcare, transportation, and manufacturing. This surge in connected devices necessitates efficient and reliable communication channels, especially in remote or inaccessible locations where traditional networks may be unreliable or unavailable. M2M satellite communication emerges as a solution to bridge these connectivity gaps, ensuring seamless data transmission and control over dispersed and geographically distant devices. The ability to monitor, track, and manage these devices remotely enhances operational efficiency, reduces downtime, and enables timely decision-making. Consequently, the growing reliance on M2M satellite communication to facilitate the connectivity and control of connected devices is steering the trajectory of the market, creating a robust and expanding ecosystem that addresses the evolving needs of a connected world.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2017-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | USD (Billion) |

| Segments | By Offering, Technology, Vertical, and Region. |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

"By offering, the hardware segment is projected to hold the largest market size during the forecast period."

In the rapidly evolving field of M2M satellite communication, several companies are actively engaged in offering comprehensive hardware solutions, including terminals, modems, and antennas. These components play a crucial role in enabling seamless connectivity and data transfer between remote devices and satellite networks; technology advances and hardware offerings in the M2M satellite communication market continue to evolve, with a focus on improving performance, reducing size and power consumption, and addressing the unique challenges associated with remote deployments. Companies in this sector often differentiate themselves through innovation, ensuring that their hardware solutions meet the demanding requirements of a broad range of M2M applications.

"By software type, Geospatial Analysis and mapping software is registered to grow at the highest CAGR during the forecast period."

Geospatial analysis and mapping refer to specialized tools and applications designed to analyze, visualize, and interpret location-based data collected from satellite-connected devices. This software integrates geospatial information with data generated by M2M devices, offering a comprehensive view of spatial relationships, patterns, and trends. In the M2M context, where devices are often dispersed across vast and remote areas, geospatial analysis and mapping software provide valuable insights for applications such as environmental monitoring, precision agriculture, and logistics. It allows organizations to leverage satellite communication capabilities to track the geographical locations of devices, assess environmental conditions, and optimize decision-making processes based on spatial data.

"Asia Pacific is projected to witness the highest CAGR during the forecast period."

The Asia-Pacific region is currently experiencing a notable surge in the military satellite communications (SATCOM) industry, with countries like Australia, India, Japan, and South Korea taking the lead in defense spending and the initiation of military SATCOM projects and programs. The growth potential in this sector is substantial, encompassing both the space and ground segments, including satellites, ground stations, and associated components and services. Partnerships, particularly between foreign and domestic companies, are crucial for expanding market presence. By supporting local supply chains and value networks, these collaborations foster an environment conducive to industry growth. The region's overall progress in infrastructure and technological capabilities, particularly in areas like 5G, reflects a broader embrace of the digital revolution across industries. Countries like Malaysia and Singapore are standing out in global rankings for 5G speed and performance, showcasing the region's commitment to technological advancement in various sectors, including defense and military communications.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the M2M satellite communication market.

- By Company: Tier I: 35%, Tier II: 45%, and Tier III: 20%

- By Designation: C-Level Executives: 35%, Directors: 25%, and Others: 40%

- By Region: North America: 45%, Europe: 20%, Asia Pacific: 30%, RoW: 5%

Major vendors offering M2M satellite communication hardware, software and services across the globe are Marlink (France), Viasat (US), Thales (France), ORBCOMM (US), Iridium Communications (US), Globalstar (US), Orange (France), EchoStar (US), Intelsat (US), Rogers Communications (Canada), SES (Luxembourg), Gilat (Israel), Telia (Sweden), Kore Wireless (US), Honeywell (US), Qualcomm (US), Telesat (Canada), Wireless Logic (England), Outerlink Global Solutions (US), Nupoint Systems (Canada), Businesscom Networks (US), Semtech (US), Yahsat (UAE).

Research Coverage

The market study covers M2M satellite communication across segments. It aims at estimating the market size and the growth potential across different segments, such as offering, technology, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market for M2M satellite communication and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising need for enriched data communication, The surge in IoT proliferation drives the demand for M2M satellite communication, The escalating demand for monitoring and remote management of connected devices boosts the market), restraints (Limited bandwidth and latency issues and Cost constraints hinder the widespread adoption of M2M satellite communication), opportunities (Conjunction of satellite and terrestrial mobile technology, To enhance global connectivity in remote areas), and challenges (Growing security concerns and Interference and signal quality issues pose a challenge for M2M satellite communication) influencing the growth of the M2M satellite communication market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the M2M satellite communication market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the M2M satellite communication market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in M2M satellite communication market strategies; the report also helps stakeholders understand the pulse of the M2M satellite communication market and provides them with information on key market drivers, restraints, challenges, and opportunities.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as Viasat (US), Thales (France), Rogers Communications (Canada), EchoStar (US) and SES (Luxembourg) among others in the M2M satellite communication market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- FIGURE 1 M2M SATELLITE COMMUNICATION MARKET SEGMENTATION

- FIGURE 2 REGIONAL SEGMENTATION

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2022

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 M2M SATELLITE COMMUNICATION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- FIGURE 4 M2M SATELLITE COMMUNICATION MARKET: DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 5 M2M SATELLITE COMMUNICATION MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 6 BOTTOM-UP APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF M2M SATELLITE COMMUNICATION MARKET

- FIGURE 7 BOTTOM-UP APPROACH 2 (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF M2M SATELLITE COMMUNICATION MARKET

- FIGURE 8 BOTTOM-UP APPROACH 3 (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF M2M SATELLITE COMMUNICATION MARKET

- FIGURE 9 BOTTOM-UP APPROACH 4 (DEMAND-SIDE): SHARE OF M2M SATELLITE COMMUNICATION THROUGH OVERALL DIGITAL SOLUTIONS SPENDING

- 2.4 GROWTH FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 STUDY LIMITATIONS

- 2.7 IMPLICATIONS OF RECESSION ON M2M SATELLITE COMMUNICATION MARKET

- TABLE 3 IMPACT OF RECESSION ON GLOBAL M2M SATELLITE COMMUNICATION MARKET

3 EXECUTIVE SUMMARY

- TABLE 4 M2M SATELLITE COMMUNICATION MARKET SIZE AND GROWTH RATE, 2018-2022 (USD MILLION, Y-O-Y)

- TABLE 5 M2M SATELLITE COMMUNICATION MARKET SIZE AND GROWTH RATE, 2023-2028 (USD MILLION, Y-O-Y)

- FIGURE 10 HARDWARE ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 11 ANTENNAS DOMINATED HARDWARE SEGMENT IN 2023

- FIGURE 12 CONNECTIVITY MANAGEMENT PLATFORM WAS LARGEST SOFTWARE TYPE IN 2023

- FIGURE 13 BUSINESS SERVICES ACCOUNTED FOR LARGEST SHARE OF SERVICES SEGMENT IN 2023

- FIGURE 14 SATELLITE CONSTELLATION ACCOUNTED WAS LARGEST TECHNOLOGY SEGMENT IN 2023

- FIGURE 15 MILITARY & DEFENSE VERTICAL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN M2M SATELLITE COMMUNICATION MARKET

- FIGURE 17 THE GLOBAL DEMAND FOR M2M SATELLITE COMMUNICATION RISES AS IT ENHANCES OPERATIONAL EFFICIENCY ACROSS DIVERSE INDUSTRIES

- 4.2 M2M SATELLITE COMMUNICATION MARKET, BY OFFERING

- FIGURE 18 SERVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 M2M SATELLITE COMMUNICATION MARKET, BY OFFERING AND KEY VERTICALS

- FIGURE 19 AUTOMOTIVE & TRANSPORTATION ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN MARKET IN 2023

- 4.4 M2M SATELLITE COMMUNICATION MARKET, BY REGION

- FIGURE 20 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 MARKET DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Escalating need for enriched data communication

- 5.2.1.2 Surge in IoT proliferation

- 5.2.1.3 Growing demand for monitoring and remote management of connected devices

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited bandwidth and latency issues

- 5.2.2.2 Cost constraints hindering widespread adoption of M2M satellite communications

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Co-existence of satellite and terrestrial communications solutions

- 5.2.3.2 Global connectivity in remote areas

- 5.2.4 CHALLENGES

- 5.2.4.1 Growing security concerns

- 5.2.4.2 Interference of external factors and signal quality issues

- 5.3 INDUSTRY TRENDS

- 5.3.1 M2M SATELLITE COMMUNICATION MARKET: ARCHITECTURE

- FIGURE 22 M2M SATELLITE COMMUNICATION ARCHITECTURE

- 5.3.2 M2M SATELLITE COMMUNICATION MARKET: EVOLUTION

- FIGURE 23 M2M SATELLITE COMMUNICATION EVOLUTION

- 5.3.3 SUPPLY CHAIN ANALYSIS

- FIGURE 24 M2M SATELLITE COMMUNICATION MARKET: SUPPLY CHAIN ANALYSIS

- 5.3.4 ECOSYSTEM/MARKET MAP

- FIGURE 25 KEY PLAYERS IN M2M SATELLITE COMMUNICATION MARKET ECOSYSTEM

- TABLE 6 M2M SATELLITE COMMUNICATION MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- 5.3.4.1 Software or platform providers

- 5.3.4.2 Hardware providers

- 5.3.4.3 Service providers

- 5.3.4.4 Regulatory bodies

- 5.3.5 CASE STUDY ANALYSIS

- 5.3.5.1 CASE STUDY 1: RFI overcame Cannes Festival network congestion using Marlink's VSAT and Satcube

- 5.3.5.2 CASE STUDY 2: Thuraya's Push-To-Talk solution revolutionized maritime communications for luxury yachts

- 5.3.5.3 CASE STUDY 3: British Army enhanced remote telemedicine in Mali using Intelsat's FlexMove and Satcube terminal

- 5.3.5.4 CASE STUDY 4: GOST enhances marine security with ORBCOMM for theft prevention and vessel protection

- 5.3.5.5 CASE STUDY 5: IGC boosts military satellite network performance with iDirect evolution on Intelsat Epic

- 5.3.6 TARIFF AND REGULATORY LANDSCAPE

- 5.3.6.1 Tariffs related to M2M satellite communication market

- TABLE 7 TARIFF RELATED TO M2M SATELLITE COMMUNICATION

- 5.3.6.2 Regulatory bodies, government agencies, and other organizations

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.6.3 North America

- 5.3.6.3.1 US

- 5.3.6.3.2 Canada

- 5.3.6.4 Europe

- 5.3.6.5 Asia Pacific

- 5.3.6.5.1 China

- 5.3.6.5.2 India

- 5.3.6.5.3 Japan

- 5.3.6.6 Middle East & Africa

- 5.3.6.6.1 UAE

- 5.3.6.6.2 KSA

- 5.3.6.6.3 Nigeria

- 5.3.6.7 Latin America

- 5.3.6.7.1 Brazil

- 5.3.6.7.2 Mexico

- 5.3.6.3 North America

- 5.3.7 PATENT ANALYSIS

- 5.3.7.1 Methodology

- 5.3.7.2 Patents filed, by document type

- TABLE 13 PATENTS FILED, 2013-2023

- 5.3.7.3 Innovation and patent applications

- FIGURE 26 NUMBER OF PATENTS GRANTED, 2013-2023

- 5.3.7.3.1 Top 10 applicants in M2M satellite communication market

- FIGURE 27 TOP 10 APPLICANTS IN M2M SATELLITE COMMUNICATION MARKET, 2013-2023

- FIGURE 28 REGIONAL ANALYSIS OF PATENTS GRANTED, 2013-2023

- TABLE 14 TOP 20 PATENT OWNERS IN M2M SATELLITE COMMUNICATION MARKET, 2013-2023

- TABLE 15 PATENTS GRANTED IN M2M SATELLITE COMMUNICATION MARKET

- 5.3.8 TRADE ANALYSIS

- 5.3.8.1 Import scenario of antennas and antenna reflectors

- FIGURE 29 ANTENNAS AND ANTENNA REFLECTOR IMPORTS, BY KEY COUNTRIES, 2015-2022 (USD BILLION)

- 5.3.8.2 Export scenario of antennas and antenna reflectors

- FIGURE 30 ANTENNAS AND ANTENNA REFLECTOR EXPORTS, BY KEY COUNTRIES, 2015-2022 (USD BILLION)

- 5.3.9 TECHNOLOGY ANALYSIS

- FIGURE 31 M2M SATELLITE COMMUNICATION MARKET: TECHNOLOGY ANALYSIS

- 5.3.9.1 Key technologies

- 5.3.9.1.1 Telemetry

- 5.3.9.1.2 VSAT

- 5.3.9.1.3 AIS

- 5.3.9.2 Complementary technologies

- 5.3.9.2.1 AI/ML

- 5.3.9.2.2 IoT

- 5.3.9.2.3 Big Data & Analytics

- 5.3.9.3 Adjacent technologies

- 5.3.9.3.1 AR/VR

- 5.3.9.3.2 Digital twin

- 5.3.9.3.3 5G technology & networking

- 5.3.9.1 Key technologies

- 5.3.10 PRICING ANALYSIS

- 5.3.10.1 Average selling price trends of key players, by hardware

- FIGURE 32 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP 3 HARDWARE

- TABLE 16 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP 3 HARDWARE

- 5.3.10.2 Indicative pricing analysis by M2M satellite communication vendors, by service

- TABLE 17 M2M SATELLITE COMMUNICATION: INDICATIVE PRICING LEVELS OF M2M SATELLITE COMMUNICATION, BY SERVICES

- 5.3.11 INVESTMENT AND FUNDING SCENARIO

- FIGURE 33 M2M SATELLITE COMMUNICATION MARKET: INVESTMENT LANDSCAPE, 2017-2022

- 5.3.12 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 M2M SATELLITE COMMUNICATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 18 M2M SATELLITE COMMUNICATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.12.1 Threat from new entrants

- 5.3.12.2 Threat of substitutes

- 5.3.12.3 Bargaining power of suppliers

- 5.3.12.4 Bargaining power of buyers

- 5.3.12.5 Intensity of competition rivalry

- 5.3.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 35 M2M SATELLITE COMMUNICATION MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.3.14 KEY CONFERENCES & EVENTS IN 2024-2025

- TABLE 19 M2M SATELLITE COMMUNICATION MARKET: KEY CONFERENCES & EVENTS, 2024-2025

- 5.3.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.15.1 Key stakeholders in buying process

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.3.15.2 Buying criteria

- FIGURE 37 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 21 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.3.16 TECHNOLOGY ROADMAP OF M2M SATELLITE COMMUNICATION MARKET

- TABLE 22 SHORT-TERM ROADMAP (UPTO 2027)

- TABLE 23 LONG-TERM ROADMAP (UPTO 2030)

- 5.3.17 BUSINESS MODELS OF M2M SATELLITE COMMUNICATION MARKET

- 5.3.17.1 Subscription-based model

- 5.3.17.2 Pay-per-use model

- 5.3.17.3 Vertical-specific solutions

- 5.3.17.4 Platform as a service (PaaS)

- 5.3.17.5 Integrated hardware and service bundles

- 5.3.18 TYPE OF SATELLITE COMMUNICATION SERVICES

- 5.3.18.1 Telecommunication services

- 5.3.18.2 Broadcasting services

- 5.3.18.3 Data communications services

- 5.3.19 TYPE OF SATELLITE COMMUNICATION CHANNELS

6 M2M SATELLITE COMMUNICATION MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: M2M SATELLITE COMMUNICATION MARKET DRIVERS

- FIGURE 38 SERVICES SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 24 M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 25 M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 HARDWARE

- 6.2.1 INCREASING ADOPTION OF IOT SOLUTIONS TO FUEL DEMAND FOR ROBUST HARDWARE

- FIGURE 39 ANTENNAS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 26 M2M SATELLITE COMMUNICATION MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 27 M2M SATELLITE COMMUNICATION MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 28 HARDWARE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 29 HARDWARE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2 ANTENNAS

- TABLE 30 ANTENNAS: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 31 ANTENNAS: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2.1 Parabolic antennas

- 6.2.2.2 Flat panel antennas

- 6.2.2.3 Patch antennas

- 6.2.2.4 Others

- 6.2.3 TERMINALS

- TABLE 32 TERMINALS: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 33 TERMINALS: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.3.1 Ruggedized terminals

- 6.2.3.2 Compact terminals

- 6.2.3.3 Machine-to-machine (M2M) modules

- 6.2.3.4 Others

- 6.2.4 MODEMS

- TABLE 34 MODEMS: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 35 MODEMS: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.4.1 Satellite modems

- 6.2.4.1.1 Low-power modems

- 6.2.4.1.2 High-throughput modems

- 6.2.4.2 Others

- 6.2.4.1 Satellite modems

- 6.2.5 OTHER HARDWARE

- TABLE 36 OTHER HARDWARE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 37 OTHER HARDWARE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SOFTWARE

- 6.3.1 INCREASING DEMAND FOR REAL-TIME DATA ANALYTICS AND SECURE CONNECTIVITY IN REMOTE LOCATIONS TO DRIVE DEMAND

- FIGURE 40 GEOSPATIAL ANALYSIS & MAPPING SOFTWARE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 38 M2M SATELLITE COMMUNICATION MARKET, BY SOFTWARE, 2018-2022 (USD MILLION)

- TABLE 39 M2M SATELLITE COMMUNICATION MARKET, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 40 SOFTWARE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 41 SOFTWARE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 CONNECTIVITY MANAGEMENT PLATFORM

- TABLE 42 CONNECTIVITY MANAGEMENT PLATFORM: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 43 CONNECTIVITY MANAGEMENT PLATFORM: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2.1 Network management software

- 6.3.2.2 Device provisioning and management

- 6.3.3 DATA PROCESSING & ANALYTICS SOFTWARE

- TABLE 44 DATA PROCESSING & ANALYTICS SOFTWARE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 45 DATA PROCESSING & ANALYTICS SOFTWARE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.3.1 Edge computing software

- 6.3.3.2 Data analytics platform

- 6.3.3.3 Big data analytics

- 6.3.4 SECURITY & ENCRYPTION SOFTWARE

- TABLE 46 SECURITY & ENCRYPTION SOFTWARE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 47 SECURITY & ENCRYPTION SOFTWARE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.4.1 Data encryption software

- 6.3.4.2 Authentication mechanisms

- 6.3.4.3 Security protocols

- 6.3.4.4 VPNs

- 6.3.5 REMOTE MONITORING & CONTROL SOFTWARE

- TABLE 48 REMOTE MONITORING & CONTROL SOFTWARE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 49 REMOTE MONITORING & CONTROL SOFTWARE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.5.1 SCADA (Supervisory Control and Data Acquisition) systems

- 6.3.5.2 Command and control software

- 6.3.6 GEOSPATIAL ANALYSIS & MAPPING SOFTWARE

- TABLE 50 GEOSPATIAL ANALYSIS & MAPPING: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 51 GEOSPATIAL ANALYSIS & MAPPING: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.6.1 Geographic information system (GIS) software

- 6.3.6.2 Satellite imaging and interpretation tools

- 6.3.6.3 Geospatial software

- 6.3.7 OTHER SOFTWARE

- TABLE 52 OTHER SOFTWARE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 53 OTHER SOFTWARE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 SERVICES

- 6.4.1 INCREASING DEMAND FOR RELIABLE AND GLOBAL CONNECTIVITY IN REMOTE OR CHALLENGING ENVIRONMENTS TO DRIVE MARKET

- FIGURE 41 SATELLITE SERVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 54 M2M SATELLITE COMMUNICATION MARKET, BY SERVICES, 2018-2022 (USD MILLION)

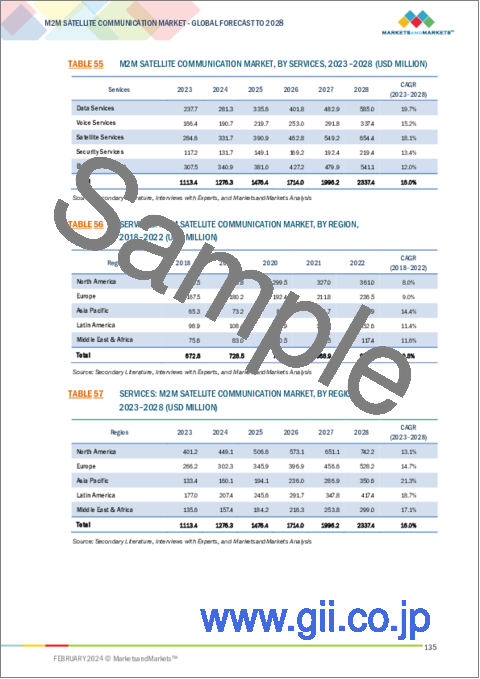

- TABLE 55 M2M SATELLITE COMMUNICATION MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 56 SERVICES: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 57 SERVICES: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.2 DATA SERVICES

- TABLE 58 DATA SERVICES: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 59 DATA SERVICES: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.2.1 Data transmission services

- 6.4.2.2 Data analytics and reporting services

- 6.4.3 VOICE SERVICES

- TABLE 60 VOICE SERVICES: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 61 VOICE SERVICES: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.3.1 Voice connectivity services

- 6.4.3.2 Push-to-talk services

- 6.4.4 SATELLITE SERVICES

- TABLE 62 SATELLITE SERVICES: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 63 SATELLITE SERVICES: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.4.1 Telemetry and remote monitoring services

- 6.4.4.2 Satellite IoT platform services

- 6.4.4.3 Geospatial services

- 6.4.5 SECURITY SERVICES

- TABLE 64 SECURITY SERVICES: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 65 SECURITY SERVICES: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.5.1 Device management services

- 6.4.5.2 Regulatory compliance services

- 6.4.6 BUSINESS SERVICES

- TABLE 66 BUSINESS SERVICES: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 67 BUSINESS SERVICES: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.6.1 Custom application development services

- 6.4.6.2 Consulting and integration services

- 6.4.6.3 Training and support services

- 6.4.6.4 Cloud services

7 M2M SATELLITE COMMUNICATION MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.1.1 TECHNOLOGY: M2M SATELLITE COMMUNICATION MARKET DRIVERS

- FIGURE 42 SATELLITE CONSTELLATION TECHNOLOGY TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 68 M2M SATELLITE COMMUNICATION MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 69 M2M SATELLITE COMMUNICATION MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 7.2 SATELLITE CONSTELLATION

- 7.2.1 NEED FOR GLOBAL CONNECTIVITY TO DRIVE MARKET

- TABLE 70 M2M SATELLITE COMMUNICATION MARKET, BY SATELLITE CONSTELLATION, 2018-2022 (USD MILLION)

- TABLE 71 M2M SATELLITE COMMUNICATION MARKET, BY SATELLITE CONSTELLATION, 2023-2028 (USD MILLION)

- TABLE 72 SATELLITE CONSTELLATION: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 73 SATELLITE CONSTELLATION: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.2 LOW EARTH ORBIT

- TABLE 74 LOW EARTH ORBIT: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 75 LOW EARTH ORBIT: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.3 MEDIUM EARTH ORBIT

- TABLE 76 MEDIUM EARTH ORBIT: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 77 MEDIUM EARTH ORBIT: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.4 GEOSTATIONARY ORBIT

- TABLE 78 GEOSTATIONARY EARTH ORBIT: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 79 GEOSTATIONARY EARTH ORBIT: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 DATA TRANSMISSION

- 7.3.1 INCREASING ADOPTION OF M2M COMMUNICATION IN REAL-TIME APPLICATIONS TO BOOST MARKET

- TABLE 80 DATA TRANSMISSION: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 81 DATA TRANSMISSION: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.2 MODULATION SCHEMES

- 7.3.3 ERROR CORRECTION AND COMPRESSION

- 7.4 VERY SMALL APERTURE TERMINAL

- 7.4.1 EASE OF DEPLOYMENT AND ADAPTABILITY TO FUEL MARKET

- TABLE 82 VERY SMALL APERTURE TERMINAL: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 83 VERY SMALL APERTURE TERMINAL: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 AUTOMATIC IDENTIFICATION SYSTEM

- 7.5.1 IMPERATIVE FOR IMPROVED MARITIME SAFETY AND NAVIGATION TO DRIVE MARKET

- TABLE 84 AUTOMATIC IDENTIFICATION SYSTEM: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 85 AUTOMATIC IDENTIFICATION SYSTEM: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 NETWORKING

- 7.6.1 INCREASING DEMAND FOR GLOBAL AND RELIABLE CONNECTIVITY TO BOOST MARKET

- TABLE 86 NETWORKING: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 87 NETWORKING: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6.2 NARROWBAND IOT

- 7.6.3 LONG-TERM EVOLUTION FOR MACHINES

- 7.6.4 LONG-RANGE WIDE AREA NETWORK

- 7.7 SATELLITE COMMUNICATION PROTOCOL

- 7.7.1 STANDARDIZATION AND INTEROPERABILITY OF COMMUNICATION PROTOCOLS TO DRIVE MARKET

- TABLE 88 SATELLITE COMMUNICATION PROTOCOL: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 89 SATELLITE COMMUNICATION PROTOCOL: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.7.2 DIGITAL VIDEO BROADCASTING-SATELLITE-SECOND GENERATION

- 7.7.3 DUAL-TONE MULTI-FREQUENCY SIGNALING

- 7.7.4 SINGLE CHANNEL PER CARRIER

- 7.8 OTHER TECHNOLOGIES

- TABLE 90 OTHER TECHNOLOGIES: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 91 OTHER TECHNOLOGIES: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

8 M2M SATELLITE COMMUNICATION MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- 8.1.1 VERTICAL: M2M SATELLITE COMMUNICATION MARKET DRIVERS

- FIGURE 43 MILITARY & DEFENSE VERTICAL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 92 M2M SATELLITE COMMUNICATION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 93 M2M SATELLITE COMMUNICATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.2 MINING

- TABLE 94 MINING: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 95 MINING: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 96 MINING: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 97 MINING: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.1 ASSET TRACKING & MANAGEMENT

- 8.2.2 SAFETY & EMERGENCY RESPONSE

- 8.2.3 ENVIRONMENTAL MONITORING AND COMPLIANCE

- 8.2.4 REMOTE OPERATIONS AND CONTROL

- 8.2.5 OTHER MINING APPLICATIONS

- 8.3 AGRICULTURE

- TABLE 98 AGRICULTURE: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 99 AGRICULTURE: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 100 AGRICULTURE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 101 AGRICULTURE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.1 PRECISION FARMING

- 8.3.2 CROP MONITORING

- 8.3.3 LIVESTOCK TRACKING

- 8.3.4 IRRIGATION CONTROL

- 8.3.5 SOIL CONDITION MONITORING

- 8.3.6 OTHERS

- 8.4 ENERGY & UTILITIES

- TABLE 102 ENERGY & UTILITIES: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 103 ENERGY & UTILITIES: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 104 ENERGY & UTILITIES: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 105 ENERGY & UTILITIES: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4.1 SMART GRID MONITORING

- 8.4.2 OIL & GAS PIPELINE MONITORING

- 8.4.3 REMOTE MONITORING OF ENERGY INFRASTRUCTURE

- 8.4.4 WIND TURBINE CONDITION MONITORING

- 8.4.5 SOLAR FARM PERFORMANCE MONITORING

- 8.4.6 SMART METERING

- 8.4.7 WATER RESOURCE MANAGEMENT

- 8.4.8 GAS PIPELINE MONITORING

- 8.4.9 UTILITY POLE MONITORING

- 8.4.10 SUBSTATION MONITORING

- 8.4.11 OTHERS

- 8.5 GOVERNMENT & PUBLIC SECTOR

- TABLE 106 GOVERNMENT & PUBLIC SECTOR: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 107 GOVERNMENT & PUBLIC SECTOR: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 108 GOVERNMENT & PUBLIC SECTOR: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 109 GOVERNMENT & PUBLIC SECTOR: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5.1 ENVIRONMENTAL MONITORING

- 8.5.1.1 Weather station data collection

- 8.5.1.2 Air quality monitoring

- 8.5.1.3 Water quality monitoring

- 8.5.1.4 Forest fire detection

- 8.5.1.5 Natural disaster monitoring

- 8.5.1.6 Others

- 8.5.2 DISASTER MANAGEMENT

- 8.5.2.1 Remote sensing for disaster assessment

- 8.5.2.2 Emergency communication

- 8.5.2.3 Search and rescue operations

- 8.5.2.4 Post-disaster infrastructure monitoring

- 8.5.2.5 Evacuation route monitoring

- 8.5.2.6 Others

- 8.5.3 SMART CITIES MANAGEMENT

- 8.5.3.1 Traffic management

- 8.5.3.2 Public infrastructure monitoring

- 8.5.3.3 Waste management optimization

- 8.5.3.4 Environmental monitoring in urban areas

- 8.5.3.5 Smart street lighting

- 8.5.3.6 Others

- 8.5.4 OTHERS

- 8.6 AUTOMOTIVE & TRANSPORTATION

- TABLE 110 AUTOMOTIVE & TRANSPORTATION: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 111 AUTOMOTIVE & TRANSPORTATION: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 112 AUTOMOTIVE & TRANSPORTATION: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 113 AUTOMOTIVE & TRANSPORTATION: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6.1 FLEET MANAGEMENT

- 8.6.2 SAFETY AND EMERGENCY RESPONSE

- 8.6.3 ENVIRONMENTAL MONITORING AND COMPLIANCE

- 8.6.4 REMOTE OPERATIONS AND CONTROL

- 8.6.5 OTHER AUTOMOTIVE & TRANSPORTATION APPLICATIONS

- 8.7 MARITIME

- TABLE 114 MARITIME: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 115 MARITIME: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 116 MARITIME: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 117 MARITIME: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.7.1 VESSEL TRACKING

- 8.7.2 MARITIME SAFETY & NAVIGATION

- 8.7.3 FISHERIES MONITORING

- 8.7.4 OCEANOGRAPHIC DATA COLLECTION

- 8.7.5 ICEBERG DETECTION

- 8.7.6 OTHER MARITIME APPLICATIONS

- 8.8 RETAIL

- TABLE 118 RETAIL: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 119 RETAIL: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 120 RETAIL: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 121 RETAIL: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.8.1 SUPPLY CHAIN MONITORING

- 8.8.2 INVENTORY MANAGEMENT

- 8.8.3 POINT-OF-SALE DATA ANALYTICS

- 8.8.4 SHELF AND MERCHANDISE TRACKING

- 8.8.5 OTHER RETAIL APPLICATIONS

- 8.9 MILITARY & DEFENSE

- TABLE 122 MILITARY & DEFENSE: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 123 MILITARY & DEFENSE: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 124 MILITARY & DEFENSE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 125 MILITARY & DEFENSE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.9.1 BORDER CONTROL & SURVEILLANCE

- 8.9.2 MILITARY ASSET TRACKING

- 8.9.3 DISASTER RESPONSE COORDINATION

- 8.9.4 INTELLIGENCE GATHERING

- 8.9.5 OTHER MILITARY & DEFENSE APPLICATIONS

- 8.10 MANUFACTURING

- TABLE 126 MANUFACTURING: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 127 MANUFACTURING: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 128 MANUFACTURING: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 129 MANUFACTURING: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.10.1 INVENTORY MANAGEMENT

- 8.10.2 PREDICTIVE MAINTENANCE

- 8.10.3 PROCESS MONITORING

- 8.10.4 INTELLIGENCE GATHERING

- 8.10.5 OTHER MANUFACTURING APPLICATIONS

- 8.11 HEALTHCARE

- TABLE 130 HEALTHCARE: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 131 HEALTHCARE: M2M SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 132 HEALTHCARE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 133 HEALTHCARE: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.11.1 TELEMEDICINE & REMOTE PATIENT MONITORING

- 8.11.2 EMS CONNECTIVITY

- 8.11.3 CONNECTED MEDICAL DEVICES

- 8.11.4 DRUG & VACCINE SUPPLY CHAIN MANAGEMENT

- 8.11.5 OTHER HEALTHCARE APPLICATIONS

- 8.12 OTHER VERTICALS

- TABLE 134 OTHER VERTICALS: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 135 OTHER VERTICALS: M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

9 M2M SATELLITE COMMUNICATION MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 44 INDIA TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 136 M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 137 M2M SATELLITE COMMUNICATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: M2M SATELLITE COMMUNICATION MARKET DRIVERS

- 9.2.2 NORTH AMERICA: IMPACT OF RECESSION

- FIGURE 46 NORTH AMERICA: M2M SATELLITE COMMUNICATION MARKET SNAPSHOT

- TABLE 138 NORTH AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 139 NORTH AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 140 NORTH AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 141 NORTH AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 142 NORTH AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 143 NORTH AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY SOFTWARE, 2018-2022 (USD MILLION)

- TABLE 145 NORTH AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 146 NORTH AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY SERVICES, 2018-2022 (USD MILLION)

- TABLE 147 NORTH AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 148 NORTH AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 149 NORTH AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 150 NORTH AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY SATELLITE CONSTELLATION, 2018-2022 (USD MILLION)

- TABLE 151 NORTH AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY SATELLITE CONSTELLATION, 2023-2028 (USD MILLION)

- TABLE 152 NORTH AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 153 NORTH AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.2.3 US

- 9.2.3.1 Modernization of satellite infrastructure to propel growth of market

- TABLE 154 US: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 155 US: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 9.2.4 CANADA

- 9.2.4.1 Strategic investments in satellite technology to foster market growth

- TABLE 156 CANADA: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 157 CANADA: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 9.3 EUROPE

- 9.3.1 EUROPE: M2M SATELLITE COMMUNICATION MARKET DRIVERS

- 9.3.2 EUROPE: IMPACT OF RECESSION

- TABLE 158 EUROPE: M2M SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 159 EUROPE: M2M SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 160 EUROPE: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 161 EUROPE: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 162 EUROPE: M2M SATELLITE COMMUNICATION MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 163 EUROPE: M2M SATELLITE COMMUNICATION MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 164 EUROPE: M2M SATELLITE COMMUNICATION MARKET, BY SOFTWARE, 2018-2022 (USD MILLION)

- TABLE 165 EUROPE: M2M SATELLITE COMMUNICATION MARKET, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 166 EUROPE: M2M SATELLITE COMMUNICATION MARKET, BY SERVICES, 2018-2022 (USD MILLION)

- TABLE 167 EUROPE: M2M SATELLITE COMMUNICATION MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 168 EUROPE: M2M SATELLITE COMMUNICATION MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 169 EUROPE: M2M SATELLITE COMMUNICATION MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 170 EUROPE: M2M SATELLITE COMMUNICATION MARKET, BY SATELLITE CONSTELLATION, 2018-2022 (USD MILLION)

- TABLE 171 EUROPE: M2M SATELLITE COMMUNICATION MARKET, BY SATELLITE CONSTELLATION, 2023-2028 (USD MILLION)

- TABLE 172 EUROPE: M2M SATELLITE COMMUNICATION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 173 EUROPE: M2M SATELLITE COMMUNICATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Strategic investments and innovations in satellite technology driving M2M communication growth in UK

- TABLE 174 UK: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 175 UK: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 9.3.4 GERMANY

- 9.3.4.1 Advancements in hyperspectral satellite technology and strategic research propel to drive growth

- TABLE 176 GERMANY: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 177 GERMANY: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 9.3.5 FRANCE

- 9.3.5.1 Advancements in military satellite technology and international collaborations to support market growth

- TABLE 178 FRANCE: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 179 FRANCE: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 9.3.6 SPAIN

- 9.3.6.1 Focus on 5G, satellite upgrades, and space agency development to boost market

- 9.3.7 ITALY

- 9.3.7.1 Vibrant tech ecosystem and strategic government initiatives to drive market

- 9.3.8 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: M2M SATELLITE COMMUNICATION MARKET DRIVERS

- 9.4.2 ASIA PACIFIC: IMPACT OF RECESSION

- FIGURE 47 ASIA PACIFIC: M2M SATELLITE COMMUNICATION MARKET SNAPSHOT

- TABLE 180 ASIA PACIFIC: M2M SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 181 ASIA PACIFIC: M2M SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 182 ASIA PACIFIC: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 183 ASIA PACIFIC: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 184 ASIA PACIFIC: M2M SATELLITE COMMUNICATION MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 185 ASIA PACIFIC: M2M SATELLITE COMMUNICATION MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 186 ASIA PACIFIC: M2M SATELLITE COMMUNICATION MARKET, BY SOFTWARE, 2018-2022 (USD MILLION)

- TABLE 187 ASIA PACIFIC: M2M SATELLITE COMMUNICATION MARKET, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 188 ASIA PACIFIC: M2M SATELLITE COMMUNICATION MARKET, BY SERVICES, 2018-2022 (USD MILLION)

- TABLE 189 ASIA PACIFIC: M2M SATELLITE COMMUNICATION MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 190 ASIA PACIFIC: M2M SATELLITE COMMUNICATION MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 191 ASIA PACIFIC: M2M SATELLITE COMMUNICATION MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 192 ASIA PACIFIC: M2M SATELLITE COMMUNICATION MARKET, BY SATELLITE CONSTELLATION, 2018-2022 (USD MILLION)

- TABLE 193 ASIA PACIFIC: M2M SATELLITE COMMUNICATION MARKET, BY SATELLITE CONSTELLATION, 2023-2028 (USD MILLION)

- TABLE 194 ASIA PACIFIC: M2M SATELLITE COMMUNICATION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 195 ASIA PACIFIC: M2M SATELLITE COMMUNICATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.4.3 CHINA

- 9.4.3.1 Focus on IoT and machine-to-machine services driving M2M satellite communication market

- 9.4.4 JAPAN

- 9.4.4.1 Increasing reliance on IoT, smart city initiatives, and defense applications to drive growth

- 9.4.5 INDIA

- 9.4.5.1 Expanding telecom sector and robust infrastructure of Indian National Satellite system promoting market growth

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Strategic push for advanced military surveillance driving demand for M2M satellite communication

- 9.4.7 AUSTRALIA & NEW ZEALAND

- 9.4.7.1 Rising demand for remote enterprise connectivity and enhanced air traffic safety to drive market

- 9.4.8 ASEAN COUNTRIES

- 9.4.8.1 Rapid digitalization fueling demand for M2M satellite communication

- 9.4.9 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: M2M SATELLITE COMMUNICATION MARKET DRIVERS

- 9.5.2 MIDDLE EAST & AFRICA: IMPACT OF RECESSION

- TABLE 196 MIDDLE EAST & AFRICA: M2M SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: M2M SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: M2M SATELLITE COMMUNICATION MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: M2M SATELLITE COMMUNICATION MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: M2M SATELLITE COMMUNICATION MARKET, BY SOFTWARE, 2018-2022 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: M2M SATELLITE COMMUNICATION MARKET, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: M2M SATELLITE COMMUNICATION MARKET, BY SERVICES, 2018-2022 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: M2M SATELLITE COMMUNICATION MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: M2M SATELLITE COMMUNICATION MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: M2M SATELLITE COMMUNICATION MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: M2M SATELLITE COMMUNICATION MARKET, BY SATELLITE CONSTELLATION, 2018-2022 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: M2M SATELLITE COMMUNICATION MARKET, BY SATELLITE CONSTELLATION, 2023-2028 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: M2M SATELLITE COMMUNICATION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: M2M SATELLITE COMMUNICATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.5.3 UAE

- 9.5.3.1 Strategic partnerships and government investments to propel growth in UAE

- 9.5.4 SAUDI ARABIA

- 9.5.4.1 Enhanced satellite infrastructure to meet growing connectivity demands to drive market

- 9.5.5 SOUTH AFRICA

- 9.5.5.1 Growing demand for local satellites fostering economic development

- 9.5.6 EGYPT

- 9.5.6.1 Advancements in space program to drive M2M satellite communication growth

- 9.5.7 TURKEY

- 9.5.7.1 Strong commitment to space innovation to drive growth of M2M satellite communication market

- 9.5.8 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: M2M SATELLITE COMMUNICATION MARKET DRIVERS

- 9.6.2 LATIN AMERICA: IMPACT OF RECESSION

- TABLE 212 LATIN AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 213 LATIN AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 214 LATIN AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 215 LATIN AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 216 LATIN AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY HARDWARE, 2018-2022 (USD MILLION)

- TABLE 217 LATIN AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 218 LATIN AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY SOFTWARE, 2018-2022 (USD MILLION)

- TABLE 219 LATIN AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 220 LATIN AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY SERVICES, 2018-2022 (USD MILLION)

- TABLE 221 LATIN AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 222 LATIN AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 223 LATIN AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 224 LATIN AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY SATELLITE CONSTELLATION, 2018-2022 (USD MILLION)

- TABLE 225 LATIN AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY SATELLITE CONSTELLATION, 2023-2028 (USD MILLION)

- TABLE 226 LATIN AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 227 LATIN AMERICA: M2M SATELLITE COMMUNICATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.6.3 BRAZIL

- 9.6.3.1 Expansive territories and global coverage by key providers fueling market for M2M satellite communication

- 9.6.4 MEXICO

- 9.6.4.1 Integration of MEXSAT satellites and SIRIS platform driving growth of M2M satellite communication

- 9.6.5 ARGENTINA

- 9.6.5.1 Inter-American Development Bank investment to support Argentina's M2M satellite growth

- 9.6.6 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES

- TABLE 228 OVERVIEW OF STRATEGIES ADOPTED BY KEY M2M SATELLITE COMMUNICATION VENDORS

- 10.3 REVENUE ANALYSIS

- FIGURE 48 TOP 5 PLAYERS DOMINATED MARKET IN LAST 5 YEARS

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 49 MARKET SHARE ANALYSIS FOR KEY PLAYERS, 2022

- TABLE 229 M2M SATELLITE COMMUNICATION MARKET: DEGREE OF COMPETITION

- 10.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 50 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 10.6 COMPANY EVALUATION MATRIX, 2022

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- FIGURE 51 M2M SATELLITE COMMUNICATION MARKET: COMPANY EVALUATION MATRIX, 2022

- 10.6.5 FOOTPRINT OF KEY PLAYERS

- TABLE 230 PRODUCT FOOTPRINT (23 COMPANIES)

- TABLE 231 VERTICAL FOOTPRINT (23 COMPANIES)

- TABLE 232 REGION FOOTPRINT (23 COMPANIES)

- TABLE 233 COMPANY FOOTPRINT (23 COMPANIES)

- 10.7 STARTUP/SME EVALUATION MATRIX, 2022

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- FIGURE 52 M2M SATELLITE COMMUNICATION MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- 10.7.5 COMPETITIVE BENCHMARKING

- TABLE 234 M2M SATELLITE COMMUNICATION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 235 M2M SATELLITE COMMUNICATION MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- 10.8 COMPETITIVE SCENARIO AND TRENDS

- 10.8.1 PRODUCT LAUNCHES

- TABLE 236 M2M SATELLITE COMMUNICATION MARKET: PRODUCT LAUNCHES, 2021-2023

- 10.8.2 DEALS

- TABLE 237 M2M SATELLITE COMMUNICATION MARKET: DEALS, 2021-2023

- 10.8.3 OTHERS

- TABLE 238 M2M SATELLITE COMMUNICATION MARKET: EXPANSIONS, 2021-2023

- 10.9 VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 53 VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 10.10 YTD PRICE TOTAL RETURN AND STOCK BETA OF KEY VENDORS

- FIGURE 54 YTD PRICE TOTAL RETURN AND STOCK BETA OF KEY VENDORS

11 COMPANY PROFILES

- 11.1 INTRODUCTION

- 11.2 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 11.2.1 MARLINK

- TABLE 239 MARLINK: COMPANY OVERVIEW

- TABLE 240 MARLINK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 MARLINK: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 242 MARLINK: DEALS

- 11.2.2 VIASAT

- TABLE 243 VIASAT: COMPANY OVERVIEW

- FIGURE 55 VIASAT: COMPANY SNAPSHOT

- TABLE 244 VIASAT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 VIASAT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 246 VIASAT: DEALS

- 11.2.3 THALES

- TABLE 247 THALES: COMPANY OVERVIEW

- FIGURE 56 THALES: COMPANY SNAPSHOT

- TABLE 248 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 THALES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 250 THALES: DEALS

- 11.2.4 ORBCOMM

- TABLE 251 ORBCOMM: COMPANY OVERVIEW

- TABLE 252 ORBCOMM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 ORBCOMM: PRODUCT LAUNCHES

- TABLE 254 ORBCOMM: DEALS

- 11.2.5 IRIDIUM COMMUNICATIONS

- TABLE 255 IRIDIUM COMMUNICATIONS: COMPANY OVERVIEW

- FIGURE 57 IRIDIUM COMMUNICATIONS: COMPANY SNAPSHOT

- TABLE 256 IRIDIUM COMMUNICATIONS: PRODUCTS/ SOLUTIONS/SERVICES OFFERED

- TABLE 257 IRIDIUM COMMUNICATIONS: PRODUCT LAUNCHES

- TABLE 258 IRIDIUM COMMUNICATIONS: DEALS

- 11.2.6 GLOBALSTAR

- TABLE 259 GLOBALSTAR: COMPANY OVERVIEW

- FIGURE 58 GLOBALSTAR: COMPANY SNAPSHOT

- TABLE 260 GLOBALSTAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 GLOBALSTAR: PRODUCT LAUNCHES

- TABLE 262 GLOBALSTAR: DEALS

- 11.2.7 ORANGE

- TABLE 263 ORANGE: COMPANY OVERVIEW

- FIGURE 59 ORANGE: COMPANY SNAPSHOT

- TABLE 264 ORANGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 ORANGE: DEALS

- 11.2.8 ECHOSTAR

- TABLE 266 ECHOSTAR: COMPANY OVERVIEW

- FIGURE 60 ECHOSTAR: COMPANY SNAPSHOT

- TABLE 267 ECHOSTAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 ECHOSTAR: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 269 ECHOSTAR: DEALS

- 11.2.9 INTELSAT

- TABLE 270 INTELSAT: COMPANY OVERVIEW

- TABLE 271 INTELSAT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 INTELSAT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 273 INTELSAT: DEALS

- TABLE 274 INTELSAT: EXPANSIONS

- 11.2.10 ROGERS COMMUNICATIONS

- TABLE 275 ROGERS COMMUNICATIONS: COMPANY OVERVIEW

- FIGURE 61 ROGERS COMMUNICATIONS: COMPANY SNAPSHOT

- TABLE 276 ROGERS COMMUNICATIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 ROGERS COMMUNICATIONS: DEALS

- 11.2.11 SES

- TABLE 278 SES: COMPANY OVERVIEW

- FIGURE 62 SES: COMPANY SNAPSHOT

- TABLE 279 SES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 SES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 281 SES: DEALS

- TABLE 282 SES: EXPANSIONS

- 11.2.12 GILAT

- TABLE 283 GILAT: COMPANY OVERVIEW

- FIGURE 63 GILAT: COMPANY SNAPSHOT

- TABLE 284 GILAT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 GILAT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 286 GILAT: DEALS

- 11.3 OTHER PLAYERS

- 11.3.1 TELIA

- 11.3.2 KORE WIRELESS

- 11.3.3 HONEYWELL

- 11.3.4 QUALCOMM

- 11.3.5 TELESAT

- 11.3.6 WIRELESS LOGIC

- 11.3.7 OUTERLINK GLOBAL SOLUTIONS

- 11.3.8 NUPOINT SYSTEMS

- 11.3.9 BUSINESSCOM NETWORKS

- 11.3.10 SEMTECH

- 11.3.11 YAHSAT

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 11.4 STARTUPS/SMES

- 11.4.1 AST SPACEMOBILE

- 11.4.2 ASTROCAST

- 11.4.3 SKY AND SPACE GLOBAL

- 11.4.4 SAT4M2M

- 11.4.5 HIBER

- 11.4.6 ALEN SPACE

- 11.4.7 SATELIOT

12 ADJACENT AND RELATED MARKETS

- 12.1 ADJACENT AND RELATED MARKETS

- 12.1.1 INTRODUCTION

- 12.2 SATELLITE IOT MARKET - GLOBAL FORECAST TO 2027

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.3 SATELLITE IOT MARKET, BY SERVICE TYPE

- TABLE 287 SATELLITE IOT MARKET, BY SERVICE TYPE, 2017-2021 (USD MILLION)

- TABLE 288 SATELLITE IOT MARKET, BY SERVICE TYPE, 2022-2027 (USD MILLION)

- 12.2.4 SATELLITE IOT MARKET, BY FREQUENCY BAND

- TABLE 289 SATELLITE IOT MARKET, BY FREQUENCY BAND, 2017-2021 (USD MILLION)

- TABLE 290 SATELLITE IOT MARKET, BY FREQUENCY BAND, 2022-2027 (USD MILLION)

- 12.2.5 SATELLITE IOT MARKET, BY ORGANIZATION SIZE

- TABLE 291 SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 292 SATELLITE IOT MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 12.2.6 SATELLITE IOT MARKET, BY VERTICAL

- TABLE 293 SATELLITE IOT MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 294 SATELLITE IOT MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 12.2.7 SATELLITE IOT MARKET, BY REGION

- TABLE 295 SATELLITE IOT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 296 SATELLITE IOT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.3 METADATA MANAGEMENT MARKET - GLOBAL FORECAST TO 2026

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- TABLE 297 GLOBAL MARITIME SAFETY MARKET AND GROWTH RATE, 2016-2020 (USD MILLION, Y-O-Y %)

- TABLE 298 GLOBAL MARITIME SAFETY MARKET AND GROWTH RATE, 2021-2026 (USD MILLION, Y-O-Y %)

- 12.3.3 MARITIME SAFETY MARKET, BY COMPONENT

- TABLE 299 MARITIME SAFETY MARKET, BY COMPONENT, 2016-2020 (USD MILLION)

- TABLE 300 MARITIME SAFETY MARKET, BY COMPONENT, 2021-2026 (USD MILLION)

- 12.3.4 MARITIME SAFETY MARKET, BY SECURITY TYPE

- TABLE 301 MARITIME SAFETY MARKET, BY SECURITY TYPE, 2016-2020 (USD MILLION)

- TABLE 302 MARITIME SAFETY MARKET, BY SECURITY TYPE, 2021-2026 (USD MILLION)

- 12.3.5 MARITIME SAFETY MARKET, BY SYSTEM

- TABLE 303 MARITIME SAFETY MARKET, BY SYSTEM, 2016-2020 (USD MILLION)

- TABLE 304 MARITIME SAFETY MARKET, BY SYSTEM, 2021-2026 (USD MILLION)

- 12.3.6 MARITIME SAFETY MARKET, BY APPLICATION

- TABLE 305 MARITIME SAFETY MARKET, BY APPLICATION, 2016-2020 (USD MILLION)

- TABLE 306 MARITIME SAFETY MARKET, BY APPLICATION, 2021-2026 (USD MILLION)

- 12.3.7 MARITIME SAFETY MARKET, BY END-USER

- TABLE 307 MARITIME SAFETY MARKET, BY END-USER, 2016-2020 (USD MILLION)

- TABLE 308 MARITIME SAFETY MARKET, BY END-USER, 2021-2026 (USD MILLION)

- 12.3.8 MARITIME SAFETY MARKET, BY REGION

- TABLE 309 MARITIME SAFETY MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 310 MARITIME SAFETY MARKET, BY REGION, 2021-2026 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 AVAILABLE CUSTOMIZATIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS