|

|

市場調査レポート

商品コード

1424579

計器用変成器の世界市場:タイプ別、設置別、エンクロージャー別、電圧別、エンドユーザー別、地域別 - 予測(~2030年)Instrument Transformers Market by Type, Installation, Enclosure, Voltage, End-User, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 計器用変成器の世界市場:タイプ別、設置別、エンクロージャー別、電圧別、エンドユーザー別、地域別 - 予測(~2030年) |

|

出版日: 2024年02月08日

発行: MarketsandMarkets

ページ情報: 英文 305 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

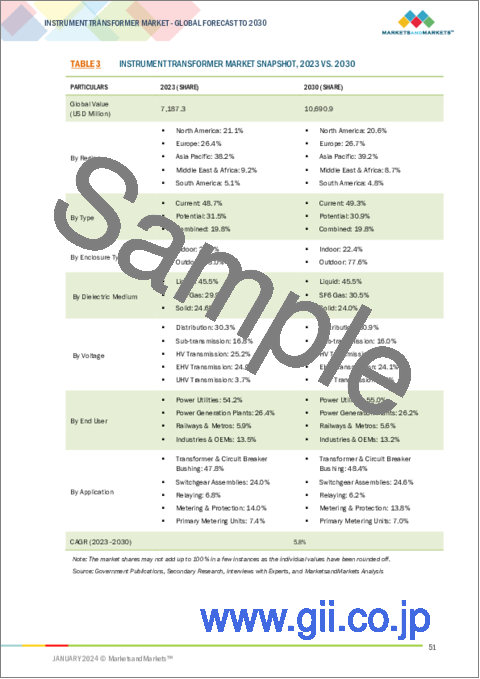

世界の計器用変成器の市場規模は、2023年の推定71億米ドルから2030年までに106億米ドルに達し、2023年~2030年にCAGRで5.8%の安定した成長が見込まれています

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2030年 |

| 単位 | 10億米ドル |

| セグメント | タイプ別、設置別、電圧別、エンクロージャー別、エンドユーザー別、用途別 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

「誘電媒体別では、液体誘電体が2023年~2030年に最大の成長市場となります。」

液体誘電体変成器は、再生可能エネルギー発電が世界のエネルギーミックスの大部分を占めるようになるにつれて、その予測不可能で断続的な性質を制御するために必要とされています。世界の電力業界、特に新興国における投資の増加が送配電網の拡大を助け、液体誘電体変成器へのニーズを高めています。エネルギー効率に対する意識の高まりは、より優れた絶縁材料と設計を備えた液体誘電体変成器の開発を促進し、送電中のエネルギー損失を低減しています。これらが、液体誘電体セグメントの成長促進要因となっています。

「エンドユーザー別では、2023年~2030年に電力企業セグメントが最大の市場となります。」

太陽光や風力などの再生可能エネルギー源に注目が集まっていることから、効率的な配電に向けて変成器が必要とされています。これらの変成器は、再生可能エネルギーを既存の電力システムに統合する上で重要なコンポーネントです。信頼性と効率を高めるため、多くの国が古い電力インフラの近代化に投資しています。変成器は、効率を高めることによりエネルギー伝送を近代化する上で重要な役割を果たしています。変成器の需要は、特に新興国における送電プロジェクトへの投資の増加によって促進されています。変成器は長距離にわたる効率的な送電に不可欠です。

「欧州が計器用変成器市場で第2位の地域となります。」

2022年、欧州は計器用変成器市場で第2位の地位を確保し、18億3,210万米ドルの市場規模で26.4%のシェアを占めています。

欧州におけるスマートグリッドの展開、効率と応答性を高めるための革新的な技術の統合を通じて、既存の配電網の変革を目指す戦略的な試みです。スマートグリッドはデジタル接続性とリアルタイムモニタリングを利用し、電力網のインテリジェンスを向上させます。スマートグリッドは、徹底したデータの収集と分析を可能にします。スマートグリッド内の計器用変成器には、電圧、電流、その他の重要な特性に関するリアルタイムのデータを提供するセンサーと通信機能が装備されています。このデータは、電力網を正確にモニターするために使用されます。欧州では、さまざまな取り組みで地域の電力網の統合が重視されており、完璧な送電を実現するための計器用変成器展開の可能性が広がっています。相互接続性への取り組みは、欧州全域のさまざまな地域の電力網をつなごうとするものです。この接続により、電力資源をプールすることが可能になり、需給のバランスがとれ、全体的な送電網の安定性が向上します。電力インフラを統合することで、欧州は電力供給の信頼性を向上させることができます。ある場所で停電や電力供給停止が発生した場合、リンクされたネットワークは、電力が余っている場所から電力を転送することで支援することができます。

当レポートでは、世界の計器用変成器市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 計器用変成器市場の企業にとって魅力的な機会

- 計器用変成器市場:地域別

- アジア太平洋の計器用変成器市場:エンクロージャータイプ別、国別(2022年)

- 計器用変成器市場:タイプ別

- 計器用変成器市場:エンクロージャータイプ別

- 計器用変成器市場:電圧別

- 計器用変成器市場:用途別

- 計器用変成器市場:エンドユーザー別

- 計器用変成器市場:誘電媒体別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- バリューチェーン分析

- 原材料のサプライヤー

- コンポーネントメーカー

- 計器用変成器メーカー

- 販売業者

- エンドユーザー

- 販売後サービスプロバイダー

- エコシステム分析

- 技術動向

- デジタル技術、スマートグリッド技術の採用

- 先進の材料と3Dプリンティング技術の使用

- 特許分析

- 貿易分析

- 輸入シナリオ

- 輸出シナリオ

- 主な会議とイベント(2024年~2025年)

- 関税と規制情勢

- 料金分析

- 規制機関、政府機関、その他の組織

- 規制枠組み

- 価格分析

- 平均販売価格の動向:地域別

- 参考価格分析:電圧別

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

第6章 計器用変成器市場:タイプ別

- イントロダクション

- 電流

- ポテンシャル

- 複合

第7章 計器用変成器市場:エンクロージャータイプ別

- イントロダクション

- 屋内

- 屋外

第8章 計器用変成器市場:誘電媒体別

- イントロダクション

- 液体

- SF6ガス

- 固体

第9章 計器用変成器市場:電圧別

- イントロダクション

- 配電

- 低圧送電

- HV送電

- EHV送電

- UHV送電

第10章 計器用変成器市場:用途別

- イントロダクション

- 変成器・回路遮断器ブッシング

- スイッチギアアセンブリ

- 継電

- 計測・保護

- 一次計測ユニット

第11章 計器用変成器市場:エンドユーザー別

- イントロダクション

- 電力企業

- 送電企業

- 配電企業

- 発電所

- 鉄道・地下鉄

- 産業・OEM

- 需要を加速させるため、製造プラント内の高価な機械の損傷を防ぐ必要性

- 石油・ガス

- セメント

- 化学品

- 自動車

- 産業機械

第12章 計器用変成器市場:地域別

- イントロダクション

- アジア太平洋

- アジア太平洋の市場に対する景気後退の影響

- タイプ別

- 誘電媒体別

- 電圧別

- エンクロージャータイプ別

- 用途別

- エンドユーザー別

- 国別

- 欧州

- 欧州市場に対する景気後退の影響

- タイプ別

- 誘電媒体別

- 電圧別

- エンクロージャータイプ別

- 用途別

- エンドユーザー別

- 国別

- 北米

- タイプ別

- 誘電媒体別

- 電圧別

- エンクロージャータイプ別

- 用途別

- エンドユーザー別

- 国別

- 中東・アフリカ

- 中東・アフリカ市場に対する景気後退の影響

- タイプ別

- 誘電媒体別

- 電圧別

- エンクロージャータイプ別

- 用途別

- エンドユーザー別

- 国別

- 南米

- 市場の成長を促進する石油・ガスの探査・生産活動への注目の高まり

- 南米市場に対する景気後退の影響

- タイプ別

- 誘電媒体別

- 電圧別

- エンクロージャータイプ別

- 用途別

- エンドユーザー別

- 国別

第13章 競合情勢

- イントロダクション

- 主要企業が採用した戦略(2019年~2022年)

- 市場シェア分析(2022年)

- 主要企業の収益の分析(2018年~2022年)

- 企業の評価マトリクス(2022年)

- スタートアップ/中小企業の評価マトリクス(2022年)

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- ABB

- GENERAL ELECTRIC

- MITSUBISHI ELECTRIC

- SCHNEIDER ELECTRIC

- SIEMENS ENERGY

- ARTECHE

- BHARAT HEAVY ELECTRICALS LIMITED (BHEL)

- CG POWER AND INDUSTRIAL SOLUTIONS

- NISSIN ELECTRIC CO., LTD.

- EMEK ELEKTRIK ENDUSTRISI A.S

- INDIAN TRANSFORMERS AND ELECTRICALS PVT. LTD

- MEHRU

- KONCAR - INSTRUMENT TRANSFORMERS INC.

- PFIFFNER GROUP

- RITZ INSTRUMENT TRANSFORMERS GMBH

- その他の企業

- CHINT GROUP

- WEG

- AMRAN, INC.

- STRATON ELECTRICALS PVT. LTD.

- DALIAN HUAYI ELECTRIC POWER ELECTRIC APPLIANCES CO., LTD.

- ENPAY ENDUSTRIYEL PAZARLAMA VE YATIRIM A.S.(ENPAY)

- DALIAN NORTH INSTRUMENT TRANSFORMER GROUP CO., LTD.

- SIEYUAN ELECTRIC CO., LTD.

- AUTOMATIC ELECTRIC LTD.

- VAMET INDUSTRIES

第15章 付録

The global market for instrument transformers is on a trajectory to reach USD 10.6 billion by 2030, a notable increase from the estimated USD 7.1 billion in 2023, with a steady CAGR of 5.8% spanning the period from 2023 to 2030. Instrument transformers are devices used in electrical power systems to measure voltage and current. They play a crucial role in ensuring the safe and accurate monitoring, protection, and control of power systems. There are three main types of instrument transformers: current transformers (CTs) and voltage transformers (VTs), also known as potential transformers (PTs), and combined instrument transformers. CTs are used to step down high currents in power systems to levels suitable for measurement and protection devices. They provide a proportional current output that is a fraction of the primary current, allowing safe and accurate measurement and protection of the power system. VTs step down high voltages in power systems to levels suitable for measurement and protection devices. Similar to CTs, VTs provide a scaled-down voltage output that accurately represents the primary voltage. This voltage is used for various purposes, including metering, protective relaying, and control systems. Instrument transformers are crucial for providing accurate voltage and current measurements for billing and monitoring purposes. They play a vital role in power system protection by providing signals for protective relays, which can detect and isolate faults or abnormal conditions in the system. The scaled-down signals from instrument transformers are often used in control systems to maintain the desired operating conditions in the power system. Instrument transformers are used in various applications, including power generation, transmission, distribution, and industrial systems.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, By Installation, By Voltage, By Enclosure, By End-User, and By Application |

| Regions covered | Asia Pacific, North America, Europe, Middle East and Africa, and South America |

"Liquid dielectric, by dielectric medium, to be largest growing market from 2023 to 2030."

Liquid dielectric transformers are required to control the unpredictable and intermittent nature of renewable power generation as it becomes a larger part of the global energy mix. Increased investments in the global power industry, particularly in emerging nations, help to expand transmission and distribution networks, which boosts the need for liquid dielectric transformers. The growing awareness of energy efficiency is driving the development of liquid dielectric transformers with better insulating materials and design, which reduces energy losses during power transmission. These are the drivers responsible for the growth of liquid dielectric segment.

"Power utilities segment, by End-User, to be the largest market from 2023 to 2030."

Transformers are required for efficient power distribution as the emphasis shifts toward renewable energy sources such as solar and wind. These transformers are critical components in integrating renewable energy into existing power systems. Many countries are investing in modernizing their old electricity infrastructure to increase reliability and efficiency. Transformers play an important role in modernizing energy transmission by increasing efficiency. Transformer demand is being driven by increased investment in power transmission projects, particularly in emerging countries. Transformers are vital for effectively transporting power across great distances.

"Europe to be second-largest region in instrument transformers market."

In 2022, Europe secured the second-largest position in the instrument transformers market, holding a share of 26.4% with a market valuation of USD 1,832.1 million. The European instrument transformers market is further divided by country, including the UK, Germany, France, Italy, Spain, Sweden, Norway, Russia, and the Rest of Europe.

Smart grid deployment in Europe is a strategic endeavor aiming at transforming existing power distribution networks via the integration of innovative technology for increased efficiency and responsiveness. Smart grids use digital connectivity and real-time monitoring to improve the intelligence of the electrical grid. Smart grids allow for thorough data collecting and analysis. Instrument transformers in a smart grid are outfitted with sensors and communication capabilities that offer real-time data on voltage, current, and other vital characteristics. This data is then used to precisely monitor the electrical network. Europe's emphasis on integrating regional power networks through various initiatives opens up potential for instrument transformer deployment to ensure flawless power transfer. Interconnection initiatives seek to link the electrical networks of various areas across Europe. This connection enables the pooling of power resources, which balances supply and demand and improves overall grid stability. By integrating power infrastructure, Europe may improve its electrical supply dependability. In the case of a power outage or interruption in one location, linked networks can assist by transferring power from places with excess electricity.

Breakdown of Primaries:

In-depth interviews with key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, were conducted to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The primary interviews were distributed as follows:

By Company Type: Tier 1-41%, Tier 2-37%, and Tier 3-22%

By Designation: C-Level-44%, D-Level-31%, and Others-25%

By Region: North America-32%, Europe-21%, Asia Pacific-26%, South America-5% and

Middle East-11% and Africa-5%.

Note: "Others" includes sales managers, marketing managers, product managers, and engineers

The tiers of the companies are defined based on their total revenue as of 2021: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: <USD 500 million.

The instrument transformers market consists of several eminent players. Notable players in the instrument transformers market include ABB (Switzerland), General Electric (US), Mitsubishi Electric (Japan), Siemens Energy (Germany), Schneider Electric (France), Arteche (Spain), Bharat Heavy Electricals Limited (BHEL) (India), CG Power (India), Nissin Electric Co., Ltd. (Japan), EMEK (Turkey), Indian Transformers and Electricals Pvt. Ltd (India), Mehru (India), Koncar-Instrument Transformers Inc. (Croatia), Pfiffner Group (Switzerland), RITZ Instrument Transformers GmbH (Germany), and several others.

Research Coverage:

The report provides a comprehensive definition, description, and forecast of the instrument transformers market based on various parameters, including by type (Current, potential, and combined), by installation (liquid, SF6 gas, solid), by enclosure (indoor and outdoor), by voltage, by End-User, and region (Asia Pacific, North America, Europe, Middle East and Africa, South America). The report also offers a thorough qualitative and quantitative analysis of the instrument transformers market, encompassing a comprehensive examination of the key market drivers, limitations, opportunities, and challenges. Additionally, it covers critical facets of the market, such as an assessment of the competitive landscape, an analysis of market dynamics, value-based market estimates, and future trends in the instrument transformers market.

Key Benefits of Buying the Report

The report is thoughtfully designed to benefit both established industry leaders and newcomers in the instrument transformers market. It provides reliable revenue forecasts for the entire market as well as its individual sub-segments. This data is a valuable resource for stakeholders, enabling them to gain a comprehensive understanding of the competitive landscape and formulate effective market strategies for their businesses. Furthermore, the report serves as a channel for stakeholders to grasp the current state of the market, providing essential insights into market drivers, limitations, challenges, and growth opportunities. By incorporating these insights, stakeholders can make well-informed decisions and stay informed about the constantly evolving dynamics of the instrument transformers industry.

- Analysis of key drivers: (Rising electricity demand, Grid Modernization, The increasing emphasis on renewable energy integration), restraints (High initial cost of instrument transformers, fluctuating prices of raw materials like copper and steel), opportunities (Digitalization and smart sensors, emerging markets for instrument transformers), and challenges (Cybersecurity threats, environmental concerns) fostering the growth of the instrument transformers market.

- Market Diversification: Market diversification in the context of the instrument transformer market refers to the strategy of expanding the market reach and reducing risk by entering new geographical regions, industries, or product segments. Diversification can provide several benefits, including increased revenue streams, improved resilience to market fluctuations, and a broader customer base. Instrument transformer manufacturers may explore opportunities in different countries or regions to tap into emerging markets or regions with growing energy infrastructure needs. Understanding and adhering to the regulatory requirements of different countries is crucial when diversifying geographically. Instrument transformers are used in various energy-related sectors, including power generation (renewable and conventional), transmission, and distribution. Diversifying across these sectors can help companies mitigate risks associated with fluctuations in a specific segment. Exploring applications in industrial sectors such as manufacturing, mining, and oil and gas can provide additional revenue streams. Introducing new and innovative instrument transformer products can open up opportunities in niche markets or applications.The integration of digital technologies in instrument transformers is a growing trend that can offer new possibilities for market expansion. Traditional customers include utilities and power companies. Exploring opportunities with different types of customers, such as industrial facilities, data centers, and renewable energy projects, can contribute to diversification. Partnering with engineering, procurement, and construction (EPC) contractors can be a strategic approach to reach new projects and customers. Diversification helps companies navigate economic cycles and industry-specific fluctuations.

- Product Development/ Innovation: The instrument transformer industry is constantly evolving, with a strong focus on product development and innovation. Leading industry leaders like as ABB, Siemens, Schneider Electric, and General Electric are at the forefront of developing new product solutions to meet changing needs and environmental concerns. There is a noticeable trend toward increasing the intelligence of instrument transformers.

- Market Development: The instrument transformers market is driven by several drivers. Global power consumption is expected to rise dramatically by 2030, with an increase of 5,900 terawatt-hours (TWh) in the Stated Policies Scenario (STEPS) and more than 7,000 TWh in the Announced Pledges Scenario (APS). This spike is similar to combining the current demand levels of the United States with the European Union. In developed nations, the rising popularity of electric vehicles is the key source of increased energy consumption, contributing to a significant increase from around 8% market share in 2021 to 32% in the STEPS and over 50% in the APS by 2030. Smart grids facilitate the bidirectional movement of information and electricity, optimizing energy use and simplifying the incorporation of renewable energy sources. Modernization entails upgrading communication protocols and cyber defenses to protect critical infrastructure from cyberattacks. In late 2022, the European Commission announced the EU action plan dubbed "Digitalization of the Energy System." The Commission anticipates considerable expansion, with investments in the European electrical infrastructure totaling around EUR 584 billion (USD 633 billion) by 2030.

- Competitive Assessment: A comprehensive evaluation has been conducted to scrutinize the market presence, growth strategies, and service offerings of key players in the instrument transformers market. These eminent players include ABB (Switzerland), General Electric (US), Mitsubishi Electric (Japan), Siemens Energy (Germany), Schneider Electric (France) and others. This analysis provides in-depth insights into the competitive positions of these major players, their approaches to propelling the market growth, and the range of services they provide within the instrument transformers market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.3.1 INSTRUMENT TRANSFORMER MARKET, BY TYPE

- 1.3.2 INSTRUMENT TRANSFORMER MARKET, BY A DIELECTRIC MEDIUM

- 1.3.3 INSTRUMENT TRANSFORMER MARKET, BY VOLTAGE

- 1.3.4 INSTRUMENT TRANSFORMER MARKET, BY ENCLOSURE TYPE

- 1.3.5 INSTRUMENT TRANSFORMER MARKET, BY APPLICATION

- 1.3.6 INSTRUMENT TRANSFORMER MARKET, BY END USER

- 1.3.7 INSTRUMENT TRANSFORMER MARKET, BY REGION

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 INSTRUMENT TRANSFORMER MARKET SEGMENTATION

- 1.4.2 REGIONAL SCOPE

- FIGURE 2 COUNTRIES COVERED

- 1.4.3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 INSTRUMENT TRANSFORMER MARKET: RESEARCH DESIGN

- 2.2 DATA TRIANGULATION

- FIGURE 4 DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- TABLE 1 LIST OF MAJOR SECONDARY SOURCES

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- TABLE 2 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Breakdown of primaries

- FIGURE 5 BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 6 INSTRUMENT TRANSFORMER MARKET: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 7 INSTRUMENT TRANSFORMER MARKET: TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- 2.3.4 DEMAND-SIDE METRICS

- FIGURE 8 METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR INSTRUMENT TRANSFORMERS

- 2.3.5 DEMAND-SIDE ASSUMPTIONS

- 2.3.6 DEMAND-SIDE CALCULATIONS

- 2.3.7 SUPPLY-SIDE ANALYSIS

- FIGURE 9 METRICS CONSIDERED TO ASSESS SUPPLY OF INSTRUMENT TRANSFORMERS

- FIGURE 10 INSTRUMENT TRANSFORMER MARKET: SUPPLY-SIDE ANALYSIS

- 2.3.8 SUPPLY-SIDE ASSUMPTIONS

- 2.3.9 SUPPLY-SIDE CALCULATIONS

- 2.3.10 PARAMETERS CONSIDERED TO ANALYZE GROWTH TRENDS

- 2.4 RISK ASSESSMENT

- 2.5 IMPACT OF RECESSION

3 EXECUTIVE SUMMARY

- TABLE 3 INSTRUMENT TRANSFORMER MARKET SNAPSHOT, 2023 VS. 2030

- FIGURE 11 ASIA PACIFIC DOMINATED INSTRUMENT TRANSFORMER MARKET IN 2022

- FIGURE 12 CURRENT TRANSFORMERS TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 13 OUTDOOR ENCLOSURES TO ACCOUNT FOR LARGER MARKET SHARE IN 2023

- FIGURE 14 DISTRIBUTION SEGMENT TO HOLD LARGEST SHARE OF INSTRUMENT TRANSFORMER MARKET IN 2023

- FIGURE 15 TRANSFORMER & CIRCUIT BREAKER BUSHING APPLICATION TO LEAD INSTRUMENT TRANSFORMER MARKET IN 2023

- FIGURE 16 POWER UTILITIES TO LEAD INSTRUMENT TRANSFORMER MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 17 LIQUID DIELECTRIC INSTRUMENT TRANSFORMERS TO CAPTURE LARGEST MARKET SHARE IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INSTRUMENT TRANSFORMER MARKET

- FIGURE 18 SURGING DEMAND FOR ELECTRICITY TO BOOST ADOPTION OF INSTRUMENT TRANSFORMERS IN COMING YEARS

- 4.2 INSTRUMENT TRANSFORMER MARKET, BY REGION

- FIGURE 19 INSTRUMENT TRANSFORMER MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 INSTRUMENT TRANSFORMER MARKET IN ASIA PACIFIC, BY ENCLOSURE TYPE AND COUNTRY, 2022

- FIGURE 20 OUTDOOR SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES OF INSTRUMENT TRANSFORMER MARKET IN ASIA PACIFIC IN 2022

- 4.4 INSTRUMENT TRANSFORMER MARKET, BY TYPE

- FIGURE 21 CURRENT TRANSFORMERS TO HOLD LARGEST SHARE OF INSTRUMENT TRANSFORMER MARKET IN 2030

- 4.5 INSTRUMENT TRANSFORMER MARKET, BY ENCLOSURE TYPE

- FIGURE 22 OUTDOOR ENCLOSURES TO ACCOUNT FOR LARGER SHARE OF INSTRUMENT TRANSFORMER MARKET IN 2030

- 4.6 INSTRUMENT TRANSFORMER MARKET, BY VOLTAGE

- FIGURE 23 DISTRIBUTION SEGMENT TO CAPTURE LARGEST SHARE OF INSTRUMENT TRANSFORMER MARKET IN 2030

- 4.7 INSTRUMENT TRANSFORMER MARKET, BY APPLICATION

- FIGURE 24 TRANSFORMER & CIRCUIT BREAKER BUSHING SEGMENT TO DOMINATE INSTRUMENT TRANSFORMER MARKET IN 2030

- 4.8 INSTRUMENT TRANSFORMER MARKET, BY END USER

- FIGURE 25 POWER UTILITIES SEGMENT LED INSTRUMENT TRANSFORMER MARKET IN 2030

- 4.9 INSTRUMENT TRANSFORMER MARKET, BY DIELECTRIC MEDIUM

- FIGURE 26 LIQUID SEGMENT TO LEAD INSTRUMENT TRANSFORMER MARKET IN 2030

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- TABLE 4 COMPARISON OF CURRENT AND POTENTIAL TRANSFORMERS

- 5.2 MARKET DYNAMICS

- FIGURE 27 INSTRUMENT TRANSFORMERS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND THREATS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for electricity

- TABLE 5 GLOBAL ELECTRICITY DEMAND AND SUPPLY, BY SCENARIO (TWH)

- 5.2.1.2 Strategic focus on grid modernization

- FIGURE 28 GLOBAL INVESTMENTS IN POWER GRIDS, 2015-2022

- 5.2.1.3 High emphasis on integrating renewable energy sources into power grids

- FIGURE 29 GLOBAL RENEWABLE ELECTRICITY CAPACITY EXPANSION, 2005-2028

- 5.2.2 RESTRAINTS

- 5.2.2.1 Substantial upfront cost associated with instrument transformers

- 5.2.2.2 Fluctuating raw material prices

- FIGURE 30 AVERAGE ANNUAL PRICE OF COPPER, 2017-2023 (USD/KG)

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing use of digital technologies and smart sensors in instrument transformers

- FIGURE 31 CUMULATIVE ENERGY SAVINGS IN BUILDINGS IN SELECTED COUNTRIES, 2017-2040

- 5.2.3.2 Rapid economic development and population growth in emerging markets

- FIGURE 32 ENERGY INVESTMENTS IN EMERGING MARKETS, BY SOURCE TYPE, 2019 AND 2022

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of standardized cybersecurity protocols

- 5.2.4.2 Environmental concerns associated with manufacturing, use, and disposal of instrument transformers

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.3.1 TRENDS INFLUENCING CUSTOMER BUSINESS

- FIGURE 33 TRENDS INFLUENCING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 34 VALUE CHAIN ANALYSIS: INSTRUMENT TRANSFORMER MARKET

- 5.4.1 RAW MATERIAL SUPPLIERS

- 5.4.2 COMPONENT MANUFACTURERS

- 5.4.3 INSTRUMENT TRANSFORMER MANUFACTURERS

- 5.4.4 DISTRIBUTORS

- 5.4.5 END USERS

- 5.4.6 POST-SALES SERVICE PROVIDERS

- 5.5 ECOSYSTEM ANALYSIS

- FIGURE 35 INSTRUMENT TRANSFORMER BUSINESS ECOSYSTEM

- TABLE 6 ROLE OF KEY COMPANIES IN ECOSYSTEM

- 5.6 TECHNOLOGY TRENDS

- 5.6.1 ADOPTION OF DIGITAL AND SMART GRID TECHNOLOGIES

- 5.6.2 USE OF ADVANCED MATERIALS AND 3D PRINTING TECHNOLOGY

- 5.7 PATENT ANALYSIS

- FIGURE 36 INSTRUMENT TRANSFORMER MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2013-2023

- TABLE 7 INSTRUMENT TRANSFORMER MARKET: INNOVATIONS AND PATENT REGISTRATIONS, MARCH 2021-DECEMBER 2023

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO

- TABLE 8 IMPORT SCENARIO FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND )

- FIGURE 37 IMPORT VALUE OF HS CODE 8504-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2018-2022 (USD THOUSAND)

- 5.8.2 EXPORT SCENARIO

- TABLE 9 EXPORT SCENARIO FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 38 EXPORT VALUE OF HS CODE 8504-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2018-2022 (USD THOUSAND)

- 5.9 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 10 INSTRUMENT TRANSFORMERS MARKET: LIST OF KEY CONFERENCES AND EVENTS

- 5.10 TARIFF AND REGULATORY LANDSCAPE

- 5.10.1 TARIFF ANALYSIS

- TABLE 11 COUNTRY-WISE IMPORT TARIFF FOR HS CODE 8504-COMPLIANT PRODUCTS, 2022

- 5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.3 REGULATORY FRAMEWORK

- TABLE 16 INSTRUMENT TRANSFORMER MARKET: CODES AND REGULATIONS

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE TREND, BY REGION

- FIGURE 39 AVERAGE SELLING PRICE OF INSTRUMENT TRANSFORMERS, BY REGION, 2019-2030 (USD/UNIT)

- 5.11.2 INDICATIVE PRICING ANALYSIS, BY VOLTAGE

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 40 INSTRUMENT TRANSFORMER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 INSTRUMENT TRANSFORMER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 BARGAINING POWER OF SUPPLIERS

- 5.12.3 BARGAINING POWER OF BUYERS

- 5.12.4 THREAT OF SUBSTITUTES

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 41 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- TABLE 18 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- 5.13.2 BUYING CRITERIA

- FIGURE 42 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- TABLE 19 KEY BUYING CRITERIA FOR END USERS

6 INSTRUMENT TRANSFORMER MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 43 INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2022

- TABLE 20 INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 21 INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 6.2 CURRENT

- 6.2.1 ABILITY TO MEASURE CURRENTS WITH HIGH ACCURACY TO BOOST DEMAND

- TABLE 22 CURRENT: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 23 CURRENT: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

- 6.3 POTENTIAL

- 6.3.1 UTILIZATION IN METERING, PROTECTION, AND CONTROL OF POWER SYSTEMS TO FUEL SEGMENTAL GROWTH

- TABLE 24 POTENTIAL: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 25 POTENTIAL: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

- 6.3.2 INDUCTIVE

- 6.3.3 CAPACITIVE

- 6.4 COMBINED

- 6.4.1 REDUCED TOTAL COST, LOWER MATERIAL COSTS, AND LESS SPACE REQUIREMENT TO ACCELERATE DEMAND

- TABLE 26 COMBINED: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

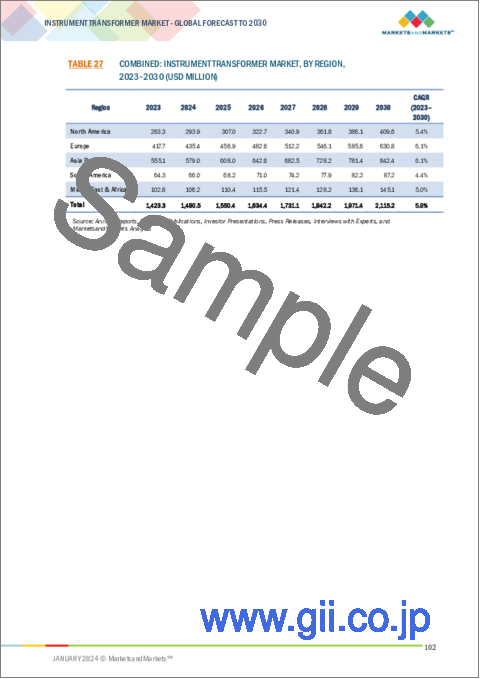

- TABLE 27 COMBINED: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

7 INSTRUMENT TRANSFORMER MARKET, BY ENCLOSURE TYPE

- 7.1 INTRODUCTION

- FIGURE 44 INSTRUMENT TRANSFORMER MARKET, BY ENCLOSURE TYPE, 2023

- TABLE 28 INSTRUMENT TRANSFORMER MARKET, BY ENCLOSURE TYPE, 2019-2022 (USD MILLION)

- TABLE 29 INSTRUMENT TRANSFORMER MARKET, BY ENCLOSURE TYPE, 2023-2030 (USD MILLION)

- 7.2 INDOOR

- 7.2.1 PROTECTION AGAINST ACCIDENTAL CONTACT WITH HAZARDOUS INTERNAL COMPONENTS, DRIPPING WATER, AND FIBERS TO BOOST DEMAND

- TABLE 30 INDOOR: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 31 INDOOR: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

- 7.3 OUTDOOR

- 7.3.1 NEED TO PROTECT TRANSFORMERS FROM HARSH ENVIRONMENTAL CONDITIONS AND POSSIBLE CONTAMINATION TO FUEL DEMAND

- TABLE 32 OUTDOOR: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 33 OUTDOOR: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

8 INSTRUMENT TRANSFORMER MARKET, BY DIELECTRIC MEDIUM

- 8.1 INTRODUCTION

- FIGURE 45 INSTRUMENT TRANSFORMER MARKET, BY DIELECTRIC MEDIUM, 2023

- TABLE 34 INSTRUMENT TRANSFORMER MARKET, BY DIELECTRIC MEDIUM, 2019-2022 (USD MILLION)

- TABLE 35 INSTRUMENT TRANSFORMER MARKET, BY DIELECTRIC MEDIUM, 2023-2030 (USD MILLION)

- 8.2 LIQUID

- 8.2.1 HIGH-VOLTAGE APPLICATIONS TO DRIVE MARKET

- TABLE 36 LIQUID: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 37 LIQUID: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.3 SF6 GAS

- 8.3.1 LESS SPACE REQUIREMENTS TO BOOST DEMAND

- TABLE 38 SF6 GAS: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 39 SF6 GAS: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.4 SOLID

- 8.4.1 HIGH MECHANICAL STRENGTH, RESISTANCE TO AGING AND CHEMICAL DEGRADATION, AND LOW MOISTURE ABSORPTION FEATURES TO BOOST DEMAND

- TABLE 40 SOLID: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 41 SOLID: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

9 INSTRUMENT TRANSFORMER MARKET, BY VOLTAGE

- 9.1 INTRODUCTION

- FIGURE 46 INSTRUMENT TRANSFORMER MARKET, BY VOLTAGE, 2023

- TABLE 42 INSTRUMENT TRANSFORMER MARKET, BY VOLTAGE, 2019-2022 (USD MILLION)

- TABLE 43 INSTRUMENT TRANSFORMER MARKET, BY VOLTAGE, 2023-2030 (USD MILLION)

- 9.2 DISTRIBUTION

- 9.2.1 NEED FOR ACCURATE MEASUREMENT AND MONITORING OF ELECTRICAL PARAMETERS TO FUEL DEMAND

- TABLE 44 DISTRIBUTION: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 45 DISTRIBUTION: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

- 9.3 SUB-TRANSMISSION

- 9.3.1 INCREASING USE IN SUBSTATIONS AND SWITCHYARDS OF CAPTIVE POWER PLANTS TO FOSTER SEGMENTAL GROWTH

- TABLE 46 SUB-TRANSMISSION: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 47 SUB-TRANSMISSION: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

- 9.4 HV TRANSMISSION

- 9.4.1 NEED TO TRANSMIT POWER OVER LONG DISTANCES TO BOOST INSTRUMENT TRANSFORMER DEMAND

- TABLE 48 HV TRANSMISSION: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 49 HV TRANSMISSION: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

- 9.5 EHV TRANSMISSION

- 9.5.1 IMPLEMENTATION OF CAPACITIVE POTENTIAL TRANSFORMERS IN EHV TRANSMISSION SYSTEMS TO ACCELERATE MARKET GROWTH

- TABLE 50 EHV TRANSMISSION: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 51 EHV TRANSMISSION: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

- 9.6 UHV TRANSMISSION

- 9.6.1 RISING USE OF CAPACITIVE POTENTIAL TRANSFORMERS IN UHV TRANSMISSION GRIDS TO DRIVE MARKET

- TABLE 52 UHV TRANSMISSION: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 53 UHV TRANSMISSION: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

10 INSTRUMENT TRANSFORMER MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 47 INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023

- TABLE 54 INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 55 INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 10.2 TRANSFORMER & CIRCUIT BREAKER BUSHING

- 10.2.1 IMPROVED PERFORMANCE, RELIABILITY, AND DURABILITY BENEFITS TO DRIVE MARKET

- TABLE 56 TRANSFORMER & CIRCUIT BREAKER BUSHING: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 57 TRANSFORMER & CIRCUIT BREAKER BUSHING: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

- 10.3 SWITCHGEAR ASSEMBLIES

- 10.3.1 INCREASING NEED FOR ACCURATE MONITORING, CONTROL, AND PROTECTION OF ELECTRICAL POWER SYSTEMS TO BOOST DEMAND

- TABLE 58 SWITCHGEAR ASSEMBLIES: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 59 SWITCHGEAR ASSEMBLIES: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

- 10.4 RELAYING

- 10.4.1 RISING FOCUS OF HEAVY INDUSTRIES ON PROTECTING CRITICAL ELECTRICAL EQUIPMENT TO PROPEL MARKET

- TABLE 60 RELAYING: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 61 RELAYING: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

- 10.5 METERING & PROTECTION

- 10.5.1 SURGING DEMAND FOR PRECISE MEASUREMENT AND MONITORING OF ELECTRICAL PARAMETERS IN POWER SYSTEMS TO DRIVE MARKET

- TABLE 62 METERING & PROTECTION: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 63 METERING & PROTECTION: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

- 10.6 PRIMARY METERING UNITS

- 10.6.1 PRESSING NEED FOR ACCURATE MEASUREMENT OF HIGH INCOMING VOLTAGE TO BOOST DEMAND

- TABLE 64 PRIMARY METERING UNITS: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 65 PRIMARY METERING UNITS: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

11 INSTRUMENT TRANSFORMER MARKET, BY END USER

- 11.1 INTRODUCTION

- FIGURE 48 INSTRUMENT TRANSFORMER MARKET, BY END USER, 2023

- TABLE 66 INSTRUMENT TRANSFORMER MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 67 INSTRUMENT TRANSFORMER MARKET, BY END USER, 2023-2030 (USD MILLION)

- 11.2 POWER UTILITIES

- 11.2.1 INCREASING FOCUS OF POWER UTILITIES ON EFFICIENT ENERGY MANAGEMENT TO BOOST DEMAND

- TABLE 68 POWER UTILITIES: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 69 POWER UTILITIES: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 70 POWER UTILITIES: INSTRUMENT TRANSFORMER MARKET, BY UTILITY TYPE, 2019-2022 (USD MILLION)

- TABLE 71 POWER UTILITIES: INSTRUMENT TRANSFORMER MARKET, BY UTILITY TYPE, 2023-2030 (USD MILLION)

- 11.3 TRANSMISSION UTILITIES

- 11.3.1 NEED TO TRANSMIT ELECTRICITY OVER LONG DISTANCES WITH MINIMAL POWER LOSSES TO BOOST DEMAND

- 11.4 DISTRIBUTION UTILITIES

- 11.4.1 RISING USE OF INSTRUMENT TRANSFORMERS TO ENSURE ACCURATE MEASUREMENT AND MONITORING OF ELECTRICAL PARAMETERS IN HIGH-VOLTAGE SYSTEMS TO DRIVE MARKET

- 11.5 POWER GENERATION PLANTS

- 11.5.1 INCREASING EMPHASIS ON REFURBISHING AGING POWER INFRASTRUCTURE TO FUEL MARKET GROWTH

- TABLE 72 POWER GENERATION PLANTS: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 73 POWER GENERATION PLANTS: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

- 11.6 RAILWAYS & METROS

- 11.6.1 GROWING INVESTMENTS IN RAIL INFRASTRUCTURE EXPANSION TO BOOST DEMAND

- TABLE 74 RAILWAYS & METROS: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 75 RAILWAYS & METROS: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

- 11.7 INDUSTRIES & OEMS

- 11.7.1 NEED TO PREVENT DAMAGE TO EXPENSIVE MACHINERY IN MANUFACTURING PLANTS TO ACCELERATE DEMAND

- TABLE 76 INDUSTRIES & OEMS: INSTRUMENT TRANSFORMER MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 77 INDUSTRIES & OEMS: INSTRUMENT TRANSFORMER MARKET, BY INDUSTRY, 2023-2030 (USD MILLION)

- TABLE 78 INDUSTRIES & OEMS: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 79 INDUSTRIES & OEMS: INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

- 11.7.2 OIL & GAS

- 11.7.3 CEMENT

- 11.7.4 CHEMICALS

- 11.7.5 AUTOMOTIVE

- 11.7.6 INDUSTRIAL MACHINERY

12 INSTRUMENT TRANSFORMER MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 49 INSTRUMENT TRANSFORMER MARKET SHARE, BY REGION, 2023

- FIGURE 50 ASIA PACIFIC TO WITNESS HIGHEST CAGR IN INSTRUMENT TRANSFORMER MARKET DURING FORECAST PERIOD

- TABLE 80 INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 81 INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 82 INSTRUMENT TRANSFORMER MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 83 INSTRUMENT TRANSFORMER MARKET, BY REGION, 2023-2030 (THOUSAND UNITS)

- 12.2 ASIA PACIFIC

- 12.2.1 RECESSION IMPACT ON MARKET IN ASIA PACIFIC

- FIGURE 51 ASIA PACIFIC: INSTRUMENT TRANSFORMER MARKET SNAPSHOT

- 12.2.2 BY TYPE

- TABLE 84 ASIA PACIFIC: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 85 ASIA PACIFIC: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.2.3 BY DIELECTRIC MEDIUM

- TABLE 86 ASIA PACIFIC: INSTRUMENT TRANSFORMER MARKET, BY DIELECTRIC MEDIUM, 2019-2022 (USD MILLION)

- TABLE 87 ASIA PACIFIC: INSTRUMENT TRANSFORMER MARKET, BY DIELECTRIC MEDIUM, 2023-2030 (USD MILLION)

- 12.2.4 BY VOLTAGE

- TABLE 88 ASIA PACIFIC: INSTRUMENT TRANSFORMER MARKET, BY VOLTAGE, 2019-2022 (USD MILLION)

- TABLE 89 ASIA PACIFIC: INSTRUMENT TRANSFORMER MARKET, BY VOLTAGE, 2023-2030 (USD MILLION)

- 12.2.5 BY ENCLOSURE TYPE

- TABLE 90 ASIA PACIFIC: INSTRUMENT TRANSFORMER MARKET, BY ENCLOSURE TYPE, 2019-2022 (USD MILLION)

- TABLE 91 ASIA PACIFIC: INSTRUMENT TRANSFORMER MARKET, BY ENCLOSURE TYPE, 2023-2030 (USD MILLION)

- 12.2.6 BY APPLICATION

- TABLE 92 ASIA PACIFIC: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 93 ASIA PACIFIC: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.2.7 BY END USER

- TABLE 94 ASIA PACIFIC: INSTRUMENT TRANSFORMER MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 95 ASIA PACIFIC: INSTRUMENT TRANSFORMER MARKET, BY END USER, 2023-2030 (USD MILLION)

- 12.2.8 BY COUNTRY

- TABLE 96 ASIA PACIFIC: INSTRUMENT TRANSFORMER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 97 ASIA PACIFIC: INSTRUMENT TRANSFORMER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- 12.2.8.1 China

- 12.2.8.1.1 Rising investments in clean energy products to fuel market growth

- 12.2.8.1 China

- TABLE 98 CHINA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 99 CHINA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 100 CHINA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 101 CHINA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.2.8.2 India

- 12.2.8.2.1 Government initiatives in electrification projects to stimulate market growth

- 12.2.8.2 India

- TABLE 102 INDIA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 103 INDIA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 104 INDIA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 105 INDIA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.2.8.3 Japan

- 12.2.8.3.1 Need to upgrade aging infrastructure to boost demand

- 12.2.8.3 Japan

- TABLE 106 JAPAN: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 107 JAPAN: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 108 JAPAN: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 109 JAPAN: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.2.8.4 South Korea

- 12.2.8.4.1 Rapid transition toward renewable energy sources to accelerate demand

- 12.2.8.4 South Korea

- TABLE 110 SOUTH KOREA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 111 SOUTH KOREA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 112 SOUTH KOREA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 113 SOUTH KOREA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.2.8.5 Australia

- 12.2.8.5.1 Electrification projects by railway industry to create lucrative opportunities for instrument transformer manufacturers

- 12.2.8.5 Australia

- TABLE 114 AUSTRALIA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 115 AUSTRALIA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 116 AUSTRALIA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 117 AUSTRALIA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.2.8.6 Rest of Asia Pacific

- TABLE 118 REST OF ASIA PACIFIC: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 119 REST OF ASIA PACIFIC: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 RECESSION IMPACT ON MARKET IN EUROPE

- FIGURE 52 EUROPE: INSTRUMENT TRANSFORMER MARKET SNAPSHOT

- 12.3.2 BY TYPE

- TABLE 122 EUROPE: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 123 EUROPE: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.3.3 BY DIELECTRIC MEDIUM

- TABLE 124 EUROPE: INSTRUMENT TRANSFORMER MARKET, BY DIELECTRIC MEDIUM, 2019-2022 (USD MILLION)

- TABLE 125 EUROPE: INSTRUMENT TRANSFORMER MARKET, BY DIELECTRIC MEDIUM, 2023-2030 (USD MILLION)

- 12.3.4 BY VOLTAGE

- TABLE 126 EUROPE: INSTRUMENT TRANSFORMER MARKET, BY VOLTAGE, 2019-2022 (USD MILLION)

- TABLE 127 EUROPE: INSTRUMENT TRANSFORMER MARKET, BY VOLTAGE, 2023-2030 (USD MILLION)

- 12.3.5 BY ENCLOSURE TYPE

- TABLE 128 EUROPE: INSTRUMENT TRANSFORMER MARKET, BY ENCLOSURE TYPE, 2019-2022 (USD MILLION)

- TABLE 129 EUROPE: INSTRUMENT TRANSFORMER MARKET, BY ENCLOSURE TYPE, 2023-2030 (USD MILLION)

- 12.3.6 BY APPLICATION

- TABLE 130 EUROPE: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 131 EUROPE: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.3.7 BY END USER

- TABLE 132 EUROPE: INSTRUMENT TRANSFORMER MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 133 EUROPE: INSTRUMENT TRANSFORMER MARKET, BY END USER, 2023-2030 (USD MILLION)

- 12.3.8 BY COUNTRY

- TABLE 134 EUROPE: INSTRUMENT TRANSFORMER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 135 EUROPE: INSTRUMENT TRANSFORMER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- 12.3.8.1 Germany

- 12.3.8.1.1 Significant focus on expanding grid infrastructure and power transmission network to drive market

- 12.3.8.1 Germany

- TABLE 136 GERMANY: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 137 GERMANY: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 138 GERMANY: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 139 GERMANY: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.3.8.2 UK

- 12.3.8.2.1 Increasing focus on renewable energy sources to propel market

- 12.3.8.2 UK

- TABLE 140 UK: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 141 UK: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 142 UK: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 143 UK: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.3.8.3 France

- 12.3.8.3.1 Smart grid development projects to provide growth opportunities

- 12.3.8.3 France

- TABLE 144 FRANCE: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 145 FRANCE: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 146 FRANCE: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 147 FRANCE: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.3.8.4 Spain

- 12.3.8.4.1 Prominent presence of international players, including ABB, GE, and Siemens, to stimulate demand

- 12.3.8.4 Spain

- TABLE 148 SPAIN: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 149 SPAIN: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 SPAIN: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 151 SPAIN: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.3.8.5 Sweden

- 12.3.8.5.1 Rapid transition toward smart grid technology to boost demand

- 12.3.8.5 Sweden

- TABLE 152 SWEDEN: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 153 SWEDEN: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 154 SWEDEN: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 155 SWEDEN: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.3.8.6 Norway

- 12.3.8.6.1 Growing focus on improving hydropower expertise to fuel market growth

- 12.3.8.6 Norway

- TABLE 156 NORWAY: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 157 NORWAY: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 NORWAY: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 159 NORWAY: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.3.8.7 Russia

- 12.3.8.7.1 Geopolitical tensions to impact market growth

- 12.3.8.7 Russia

- TABLE 160 RUSSIA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 161 RUSSIA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 162 RUSSIA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 163 RUSSIA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.3.8.8 Rest of Europe

- TABLE 164 REST OF EUROPE: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 165 REST OF EUROPE: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 166 REST OF EUROPE: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 167 REST OF EUROPE: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.4 NORTH AMERICA

- 12.4.1 BY TYPE

- TABLE 168 NORTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 169 NORTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.4.2 BY DIELECTRIC MEDIUM

- TABLE 170 NORTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY DIELECTRIC MEDIUM, 2019-2022 (USD MILLION)

- TABLE 171 NORTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY DIELECTRIC MEDIUM, 2023-2030 (USD MILLION)

- 12.4.3 BY VOLTAGE

- TABLE 172 NORTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY VOLTAGE, 2019-2022 (USD MILLION)

- TABLE 173 NORTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY VOLTAGE, 2023-2030 (USD MILLION)

- 12.4.4 BY ENCLOSURE TYPE

- TABLE 174 NORTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY ENCLOSURE TYPE, 2019-2022 (USD MILLION)

- TABLE 175 NORTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY ENCLOSURE TYPE, 2023-2030 (USD MILLION)

- 12.4.5 BY APPLICATION

- TABLE 176 NORTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 177 NORTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.4.6 BY END USER

- TABLE 178 NORTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 179 NORTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY END USER, 2023-2030 (USD MILLION)

- 12.4.7 BY COUNTRY

- TABLE 180 NORTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 181 NORTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- 12.4.7.1 US

- 12.4.7.1.1 Pressing need to shift from aging coal-fired power plants to gas-fired flexible power plants to boost demand

- 12.4.7.1 US

- TABLE 182 US: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 183 US: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 US: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 185 US: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.4.7.2 Canada

- 12.4.7.2.1 Growing implementation of captive power plants to stimulate market growth

- 12.4.7.2 Canada

- TABLE 186 CANADA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 187 CANADA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 188 CANADA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 189 CANADA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.4.7.3 Mexico

- 12.4.7.3.1 Increasing investments in power infrastructure to boost demand

- 12.4.7.3 Mexico

- TABLE 190 MEXICO: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 191 MEXICO: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 192 MEXICO: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 193 MEXICO: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 RECESSION IMPACT ON MARKET IN MIDDLE EAST & AFRICA

- 12.5.2 BY TYPE

- TABLE 194 MIDDLE EAST & AFRICA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.5.3 BY DIELECTRIC MEDIUM

- TABLE 196 MIDDLE EAST & AFRICA: INSTRUMENT TRANSFORMER MARKET, BY DIELECTRIC MEDIUM, 2019-2022 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: INSTRUMENT TRANSFORMER MARKET, BY DIELECTRIC MEDIUM, 2023-2030 (USD MILLION)

- 12.5.4 BY VOLTAGE

- TABLE 198 MIDDLE EAST & AFRICA: INSTRUMENT TRANSFORMER MARKET, BY VOLTAGE, 2019-2022 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: INSTRUMENT TRANSFORMER MARKET, BY VOLTAGE, 2023-2030 (USD MILLION)

- 12.5.5 BY ENCLOSURE TYPE

- TABLE 200 MIDDLE EAST & AFRICA: INSTRUMENT TRANSFORMER MARKET, BY ENCLOSURE TYPE, 2019-2022 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: INSTRUMENT TRANSFORMER MARKET, BY ENCLOSURE TYPE, 2023-2030 (USD MILLION)

- 12.5.6 BY APPLICATION

- TABLE 202 MIDDLE EAST & AFRICA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.5.7 BY END USER

- TABLE 204 MIDDLE EAST & AFRICA: INSTRUMENT TRANSFORMER MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: INSTRUMENT TRANSFORMER MARKET, BY END USER, 2023-2030 (USD MILLION)

- 12.5.8 BY COUNTRY

- TABLE 206 MIDDLE EAST & AFRICA: INSTRUMENT TRANSFORMER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: INSTRUMENT TRANSFORMER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- 12.5.8.1 GCC countries

- 12.5.8.1.1 Saudi Arabia

- 12.5.8.1.1.1 Government policies aiming to reduce carbon emissions to drive market growth

- 12.5.8.1.1 Saudi Arabia

- 12.5.8.1 GCC countries

- TABLE 208 SAUDI ARABIA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 209 SAUDI ARABIA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 210 SAUDI ARABIA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 211 SAUDI ARABIA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.5.8.1.2 UAE

- 12.5.8.1.2.1 Rapid economic development and increasing demand for power to propel market

- 12.5.8.1.2 UAE

- TABLE 212 UAE: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 213 UAE: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 214 UAE: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 215 UAE: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.5.8.1.3 Qatar

- 12.5.8.1.3.1 Government policies favoring utilization of renewables in power generation to boost demand

- 12.5.8.1.3 Qatar

- TABLE 216 QATAR: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 217 QATAR: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 218 QATAR: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 219 QATAR: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.5.8.1.4 Rest of GCC countries

- TABLE 220 REST OF GCC COUNTRIES: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 221 REST OF GCC COUNTRIES: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 222 REST OF GCC COUNTRIES: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 223 REST OF GCC COUNTRIES: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.5.8.2 South Africa

- 12.5.8.2.1 Grid modernization initiative to fuel market growth

- 12.5.8.2 South Africa

- TABLE 224 SOUTH AFRICA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 225 SOUTH AFRICA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 226 SOUTH AFRICA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 227 SOUTH AFRICA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.5.8.3 Rest of Middle East & Africa

- TABLE 228 REST OF MIDDLE EAST & AFRICA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 229 REST OF MIDDLE EAST & AFRICA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 230 REST OF MIDDLE EAST & AFRICA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 231 REST OF MIDDLE EAST & AFRICA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.6 SOUTH AMERICA

- 12.6.1 GROWING FOCUS ON OIL AND GAS EXPLORATION AND PRODUCTION ACTIVITIES TO FOSTER MARKET GROWTH

- 12.6.2 RECESSION IMPACT ON MARKET IN SOUTH AMERICA

- 12.6.3 BY TYPE

- TABLE 232 SOUTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 233 SOUTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.6.4 BY DIELECTRIC MEDIUM

- TABLE 234 SOUTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY DIELECTRIC MEDIUM, 2019-2022 (USD MILLION)

- TABLE 235 SOUTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY DIELECTRIC MEDIUM, 2023-2030 (USD MILLION)

- 12.6.5 BY VOLTAGE

- TABLE 236 SOUTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY VOLTAGE, 2019-2022 (USD MILLION)

- TABLE 237 SOUTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY VOLTAGE, 2023-2030 (USD MILLION)

- 12.6.6 BY ENCLOSURE TYPE

- TABLE 238 SOUTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY ENCLOSURE TYPE, 2019-2022 (USD MILLION)

- TABLE 239 SOUTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY ENCLOSURE TYPE, 2023-2030 (USD MILLION)

- 12.6.7 BY APPLICATION

- TABLE 240 SOUTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 241 SOUTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.6.8 BY END USER

- TABLE 242 SOUTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 243 SOUTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY END USER, 2023-2030 (USD MILLION)

- 12.6.9 BY COUNTRY

- TABLE 244 SOUTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 245 SOUTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- 12.6.9.1 Brazil

- 12.6.9.1.1 Increasing electrification initiatives to boost demand

- 12.6.9.1 Brazil

- TABLE 246 BRAZIL: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 247 BRAZIL: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 248 BRAZIL: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 249 BRAZIL: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.6.9.2 Argentina

- 12.6.9.2.1 Thriving industrial sector to boost demand

- 12.6.9.2 Argentina

- TABLE 250 ARGENTINA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 251 ARGENTINA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 252 ARGENTINA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 253 ARGENTINA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.6.9.3 Chile

- 12.6.9.3.1 Advancements in power infrastructure to drive market

- 12.6.9.3 Chile

- TABLE 254 CHILE: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 255 CHILE: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 256 CHILE: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 257 CHILE: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 12.6.9.4 Rest of South America

- TABLE 258 REST OF SOUTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 259 REST OF SOUTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 260 REST OF SOUTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 261 REST OF SOUTH AMERICA: INSTRUMENT TRANSFORMER MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2019-2022

- TABLE 262 STRATEGIES ADOPTED BY MAJOR PLAYERS, 2019-2022

- 13.3 MARKET SHARE ANALYSIS, 2022

- TABLE 263 INSTRUMENT TRANSFORMER MARKET: DEGREE OF COMPETITION

- FIGURE 53 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- 13.4 REVENUE ANALYSIS OF TOP PLAYERS, 2018-2022

- FIGURE 54 INSTRUMENT TRANSFORMER MARKET: REVENUE ANALYSIS OF TOP 5 PLAYERS, 2018-2022

- 13.5 COMPANY EVALUATION MATRIX, 2022

- 13.5.1 STARS

- 13.5.2 PERVASIVE PLAYERS

- 13.5.3 EMERGING LEADERS

- 13.5.4 PARTICIPANTS

- FIGURE 55 INSTRUMENT TRANSFORMER MARKET: COMPANY EVALUATION MATRIX, 2022

- 13.5.5 COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 264 TYPE FOOTPRINT

- TABLE 265 DIELECTRIC MEDIUM FOOTPRINT

- TABLE 266 ENCLOSURE TYPE FOOTPRINT

- TABLE 267 APPLICATION FOOTPRINT

- TABLE 268 END USER FOOTPRINT

- TABLE 269 REGION FOOTPRINT

- TABLE 270 OVERALL COMPANY FOOTPRINT

- 13.6 START-UP/SME EVALUATION MATRIX, 2022

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- FIGURE 56 INSTRUMENT TRANSFORMER MARKET: START-UP/SME EVALUATION MATRIX, 2022

- 13.6.5 COMPETITIVE BENCHMARKING

- TABLE 271 INSTRUMENT TRANSFORMER MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 272 INSTRUMENT TRANSFORMER MARKET: LIST OF KEY START-UPS/SMES

- 13.7 COMPETITIVE SCENARIOS

- 13.7.1 PRODUCT LAUNCHES

- TABLE 273 INSTRUMENT TRANSFORMER MARKET: PRODUCT LAUNCHES, FEBRUARY 2020-MARCH 2023

- 13.7.2 DEALS

- TABLE 274 INSTRUMENTAL TRANSFORMER MARKET: DEALS, OCTOBER 2021- DECEMBER 2023

- 13.7.3 OTHERS

- TABLE 275 INSTRUMENT TRANSFORMER MARKET: OTHERS, APRIL 2019-DECEMBER 2023

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 14.1.1 ABB

- TABLE 276 ABB: COMPANY OVERVIEW

- FIGURE 57 ABB: COMPANY SNAPSHOT

- TABLE 277 ABB: PRODUCTS OFFERED

- TABLE 278 ABB: DEALS

- 14.1.2 GENERAL ELECTRIC

- TABLE 279 GENERAL ELECTRIC: COMPANY OVERVIEW

- FIGURE 58 GENERAL ELECTRIC: COMPANY SNAPSHOT

- TABLE 280 GENERAL ELECTRIC: PRODUCTS OFFERED

- TABLE 281 GENERAL ELECTRIC: PRODUCT LAUNCHES

- TABLE 282 GENERAL ELECTRIC: DEALS

- 14.1.3 MITSUBISHI ELECTRIC

- TABLE 283 MITSUBISHI ELECTRIC: COMPANY OVERVIEW

- FIGURE 59 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

- TABLE 284 MITSUBISHI ELECTRIC: PRODUCTS OFFERED

- TABLE 285 MITSUBISHI ELECTRIC: DEALS

- 14.1.4 SCHNEIDER ELECTRIC

- TABLE 286 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- FIGURE 60 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 287 SCHNEIDER ELECTRIC: PRODUCTS OFFERED

- 14.1.5 SIEMENS ENERGY

- TABLE 288 SIEMENS ENERGY: COMPANY OVERVIEW

- FIGURE 61 SIEMENS ENERGY: COMPANY SNAPSHOT

- TABLE 289 SIEMENS ENERGY: PRODUCTS OFFERED

- TABLE 290 SIEMENS ENERGY: DEALS

- 14.1.6 ARTECHE

- TABLE 291 ARTECHE: COMPANY OVERVIEW

- FIGURE 62 ARTECHE: COMPANY SNAPSHOT

- TABLE 292 ARTECHE: PRODUCTS OFFERED

- TABLE 293 ARTECHE: PRODUCT LAUNCHES

- TABLE 294 ARTECHE: DEALS

- TABLE 295 ARTECHE: OTHER DEVELOPMENTS

- 14.1.7 BHARAT HEAVY ELECTRICALS LIMITED (BHEL)

- TABLE 296 BHEL: COMPANY OVERVIEW

- FIGURE 63 BHEL: COMPANY SNAPSHOT

- TABLE 297 BHEL: PRODUCTS OFFERED

- 14.1.8 CG POWER AND INDUSTRIAL SOLUTIONS

- TABLE 298 CG POWER AND INDUSTRIAL SOLUTIONS: COMPANY OVERVIEW

- FIGURE 64 CG POWER AND INDUSTRIAL SOLUTIONS: COMPANY SNAPSHOT

- TABLE 299 CG POWER AND INDUSTRIAL SOLUTIONS: PRODUCTS OFFERED

- TABLE 300 CG POWER AND INDUSTRIAL SOLUTIONS: PRODUCT LAUNCHES

- 14.1.9 NISSIN ELECTRIC CO., LTD.

- TABLE 301 NISSIN ELECTRIC CO., LTD.: COMPANY OVERVIEW

- FIGURE 65 NISSIN ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- TABLE 302 NISSIN ELECTRIC CO., LTD.: PRODUCTS OFFERED

- 14.1.10 EMEK ELEKTRIK ENDUSTRISI A.S

- TABLE 303 EMEK ELEKTRIK ENDUSTRISI A.S: COMPANY OVERVIEW

- TABLE 304 EMEK ELEKTRIK ENDUSTRISI A.S: PRODUCTS OFFERED

- 14.1.11 INDIAN TRANSFORMERS AND ELECTRICALS PVT. LTD

- TABLE 305 INDIAN TRANSFORMERS AND ELECTRICALS PVT. LTD: COMPANY OVERVIEW

- TABLE 306 INDIAN TRANSFORMERS AND ELECTRICALS PVT. LTD: PRODUCTS OFFERED

- 14.1.12 MEHRU

- TABLE 307 MEHRU: COMPANY OVERVIEW

- TABLE 308 MEHRU: PRODUCTS OFFERED

- 14.1.13 KONCAR - INSTRUMENT TRANSFORMERS INC.

- TABLE 309 KONCAR - INSTRUMENT TRANSFORMERS INC.: COMPANY OVERVIEW

- FIGURE 66 KONCAR- INSTRUMENT TRANSFORMERS INC.: COMPANY SNAPSHOT

- TABLE 310 KONCAR - INSTRUMENT TRANSFORMERS INC.: PRODUCTS OFFERED

- 14.1.14 PFIFFNER GROUP

- TABLE 311 PFIFFNER GROUP: COMPANY OVERVIEW

- TABLE 312 PFIFFNER GROUP: PRODUCTS OFFERED

- TABLE 313 PFIFFNER GROUP: DEALS

- 14.1.15 RITZ INSTRUMENT TRANSFORMERS GMBH

- TABLE 314 RITZ INSTRUMENT TRANSFORMERS GMBH: COMPANY OVERVIEW

- TABLE 315 RITZ INSTRUMENT TRANSFORMERS GMBH: PRODUCTS OFFERED

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 14.2 OTHER PLAYERS

- 14.2.1 CHINT GROUP

- 14.2.2 WEG

- 14.2.3 AMRAN, INC.

- 14.2.4 STRATON ELECTRICALS PVT. LTD.

- 14.2.5 DALIAN HUAYI ELECTRIC POWER ELECTRIC APPLIANCES CO., LTD.

- 14.2.6 ENPAY ENDUSTRIYEL PAZARLAMA VE YATIRIM A.S. (ENPAY)

- 14.2.7 DALIAN NORTH INSTRUMENT TRANSFORMER GROUP CO., LTD.

- 14.2.8 SIEYUAN ELECTRIC CO., LTD.

- 14.2.9 AUTOMATIC ELECTRIC LTD.

- 14.2.10 VAMET INDUSTRIES

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS