|

|

市場調査レポート

商品コード

1423542

教育向けスマートディスプレイの世界市場:製品タイプ別、ディスプレイサイズ別、ディスプレイ技術別、解像度別、地域別 - 予測(~2029年)Education Smart Display Market by Product Type (Whiteboard, Video Wall), Display Size (Above 55", Up to 55"), Display Technology (LCD, Direct-view LED, OLED), Resolution (4K & Above, FHD, Less than HD & HD) and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 教育向けスマートディスプレイの世界市場:製品タイプ別、ディスプレイサイズ別、ディスプレイ技術別、解像度別、地域別 - 予測(~2029年) |

|

出版日: 2024年01月31日

発行: MarketsandMarkets

ページ情報: 英文 206 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の教育向けスマートディスプレイの市場規模は、2024年の34億米ドルから2029年までに41億米ドルに達し、予測期間にCAGRで4.0%の成長が見込まれています。

教育向けスマートディスプレイ市場の主な成長促進要因は、学習におけるデジタルトランスフォーメーション、協調学習に対する需要の高まり、技術の進歩です。さらに、eラーニング動向の高まりが、市場企業の新たな成長機会を切り開く意識を高めています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | 製品タイプ別、ディスプレイサイズ別、ディスプレイ技術別、解像度別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「55インチ以下のディスプレイサイズセグメントが予測期間にもっとも高いCAGRで成長します。」

55インチ以下の教育向けスマートディスプレイ市場の成長は、複数の主な要因によって促進されています。まず、教育現場ではインタラクティブで協調的な学習ツールの需要が大幅に増加しており、これらの適度なサイズのディスプレイは、スペースの制約が懸念される小規模な教室や会議室のニーズに対応しています。32インチ以上55インチ以下のサイズは、効果的なコミュニケーションとコラボレーションに十分な大きさのディスプレイを提供すると同時に、さまざまな部屋のサイズに対応できる汎用性を備えているという点でバランスが取れています。

「直視型LEDセグメントが予測期間に第2位のシェアを占めます。」

明るくハイコントラストな見た目を特徴とする直視型LEDディスプレイは、教育向けスマートディスプレイ市場で第2位のディスプレイ技術となっています。ViewSonic(米国)、SAMSUNG(韓国)、Sharp NEC Display Solutions(日本)などの主要企業がこの優位性に大きく寄与しています。ViewSonicは大型ビデオウォール向けにカスタマイズされたオプションを提供し、SAMSUNGは大型ディスプレイに直視型LEDを組み込み、Sharp NECは多様なディスプレイソリューションを提供しています。市場データは、影響力のあるプレゼンテーションや情報発信に対する需要の高まりによる、教育セグメントにおける直視型LED技術の大幅な市場シェアを裏付けています。このことは、教育環境で生き生きとした視覚体験を提供する上で、直視型LEDが選好されていることを明示しています。

「欧州が予測期間に2番目に高いCAGRを占めます。」

欧州の教育向けスマートディスプレイ市場の成長は、EdTech企業との提携によるスマートディスプレイの採用の増加によって推進されています。さらに、欧州政府による積極的な資金配分も、教育技術セグメントにおけるスマートディスプレイの拡大に寄与しています。この二要因戦略は、教育における革新と技術統合を推進し、スマートディスプレイの需要を促進し、欧州の教育機関全体の学習体験を向上させます。

当レポートでは、世界の教育向けスマートディスプレイ市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 教育向けスマートディスプレイ市場企業にとって魅力的な機会

- 教育向けスマートディスプレイ市場:製品タイプ別

- 教育向けスマートディスプレイ市場:ディスプレイ技術別

- 教育向けスマートディスプレイ市場:ディスプレイサイズ別

- 北米の教育向けスマートディスプレイ市場:製品タイプ別、国別(2023年)

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- 教育向けスマートディスプレイ市場のエコシステム

- 主な技術の動向

- 関連技術

- 今後の技術

- 透明ディスプレイ

- 隣接技術

- 価格分析

- 特許分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 貿易分析

- ケーススタディ

- LCDビデオウォールディスプレイによる生徒の学習体験の強化

- PANASONIC、アドホックチームワークセンターとアクティブラーニング教室にディスプレイ技術を提供

- 教室での明瞭さと可読性の向上

- 関税と規制

- 関税

- 標準

- 規制

- 顧客のビジネスに影響を与える動向/混乱

- 主な会議とイベント(2022年~2023年)

第6章 教育向けスマートディスプレイ市場:解像度別

- イントロダクション

- FHD

- 4K以上

- HD以下

第7章 教育向けスマートディスプレイ市場:製品タイプ別

- イントロダクション

- ホワイトボード

- ビデオウォール

第8章 教育向けスマートディスプレイ市場:ディスプレイサイズ別

- イントロダクション

- 55インチ以下

- 55インチ超

第9章 教育向けスマートディスプレイ市場:ディスプレイ技術別

- イントロダクション

- LCD

- 直視型LED

- OLED

- その他のディスプレイ技術

第10章 教育向けスマートディスプレイ市場:地域別

- イントロダクション

- 北米

- 北米の景気後退の影響

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州に対する景気後退の影響

- 英国

- ドイツ

- フランス

- その他の欧州

- アジア太平洋

- アジア太平洋に対する景気後退の影響

- 中国

- 日本

- 韓国

- インド

- その他のアジア太平洋

- その他の地域

- その他の地域に対する景気後退の影響

- 南米

- 中東・アフリカ

第11章 競合情勢

- イントロダクション

- 市場評価枠組み

- 有機/無機成長戦略

- 製品ポートフォリオ

- 地理的プレゼンス

- 製造、流通フットプリント

- 市場シェア分析(2023年)

- 企業の評価マトリクス

- スタートアップ/中小企業の評価マトリクス

- 企業のフットプリント

- 競合シナリオ

第12章 企業プロファイル

- イントロダクション

- 主要企業

- SAMSUNG

- LG ELECTRONICS

- NEWLINE INTERACTIVE

- PPDS (PHILIPS)

- SHARP NEC DISPLAY SOLUTIONS

- LEYARD

- SMART TECHNOLOGIES ULC

- SONY GROUP CORPORATION

- BARCO

- PANASONIC HOLDINGS CORPORATION

- BENQ

- VIEWSONIC CORPORATION

- PROMETHEAN WORLD LIMITED

- CLEARTOUCH

- OPTOMA CORPORATION

- その他の企業

- CLEVERTOUCH (BY BOXLIGHT)

- HDI LTD.

- PEERLESS-AV

- ABSEN INC.

- CHRISTIE DIGITAL SYSTEMS USA, INC.

- RICOH

- HITEVISION TECH ASIA PACIFIC CO., LTD.

- BOXLIGHT

- PRIMEVIEW GLOBAL

- PROMARK TECHSOLUTIONS PVT. LTD.

第13章 付録

The education smart display market is projected to reach USD 4.1 billion by 2029 from USD 3.4 billion in 2024 at a CAGR of 4.0% during the forecast period. The major factors driving the growth of the Education smart display market Digital transformation in learning, rising demand for collaborative learning, and technological advancements. Moreover, Rising e-learning trends are growing awareness to carve out new growth opportunities for market players.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Product Type, Display Size, Display Technology, Resolution and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Up to 55" display size segment to register the highest CAGR during the forecast period."

The growth of the up to 55" education smart display segment in the market is driven by several key factors. Firstly, the demand for interactive and collaborative learning tools has significantly increased in educational settings, and these moderately sized displays cater to the needs of smaller classrooms and meeting rooms where space constraints may be a concern. The sizes ranging from 32" to 55" strike a balance between providing an adequately large display for effective communication and collaboration while being versatile enough for various room sizes.

"Direct-view LEDs segment to register the second largest share during the forecast period."

Direct-view LED displays, characterized by bright and high-contrast visuals, have become the second-largest display technology in the education smart display market. Key players like ViewSonic (US), SAMSUNG (South Korea), and Sharp NEC Display Solutions (Japan) contribute significantly to this dominance. ViewSonic offers tailored options for large video walls, SAMSUNG incorporates direct-view LED in its large-format displays, and Sharp NEC provides diverse display solutions. Market data supports the substantial market share of direct-view LED technology in education, driven by the increasing demand for impactful presentations and information dissemination. This highlights the preference for direct-view LEDs in delivering vibrant visual experiences in educational environments.

"Europe region to register the 2nd highest CAGR during the forecast period."

The growth of the education smart display market in Europe is propelled by the increasing adoption of smart displays through collaborations with EdTech companies. Additionally, the proactive allocation of funds by European governments further contributes to the expansion of smart displays in the education technology sector. This dual factor strategy fosters innovation and technological integration in education, driving the demand for smart displays and enhancing the overall learning experience across European educational institutions.

The break-up of the profile of primary participants in the education smart display market-

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, Tier 3 - 20%

- By Designation Type: C Level - 35%, Director Level - 30%, Others - 35%

- By Region Type: North America - 40%, Europe - 25%, Asia Pacific - 20%, Rest of the World - 15%

The major players in the Education smart display marketwith a significant global presence include SAMSUNG (South Korea), LG Electronics (South korea), Newline Interactive (US), PPDS (Philips) (Netherlands), and Sharp NEC Display Solutions (US).

Research Coverage

The report segments the Education smart display marketand forecasts its size by product type, display technology, display size, and region. The report also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall Education smart display market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Digital transformation in learning, rising demand for collaborative learning, and technological advancements), restraints (budget constraints and integration challenges), opportunities (Rising e-learning trends, growing awareness, and adoption), and challenges (Security concerns, teacher training and adaptation, and maintenance and technical support)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the education smart display market

- Market Development: Comprehensive information about lucrative markets - the report analyses the Education smart display market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the education smart display market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like SAMSUNG (South Korea), LG Electronics (South Korea), Newline Interactive (US), PPDS (Philips) (Netherlands), and Sharp NEC Display Solutions (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS AT COMPANY LEVEL

- 1.2.2 INCLUSIONS AND EXCLUSIONS AT PRODUCT TYPE LEVEL

- 1.2.3 INCLUSIONS AND EXCLUSIONS AT DISPLAY TECHNOLOGY LEVEL

- 1.2.4 INCLUSIONS AND EXCLUSIONS AT DISPLAY SIZE LEVEL

- 1.2.5 INCLUSIONS AND EXCLUSIONS AT REGIONAL LEVEL

- 1.3 STUDY SCOPE

- FIGURE 1 EDUCATION SMART DISPLAY MARKET SEGMENTATION

- 1.3.1 REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to capture market using bottom-up analysis

- FIGURE 3 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to capturing market using top-down analysis

- FIGURE 4 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

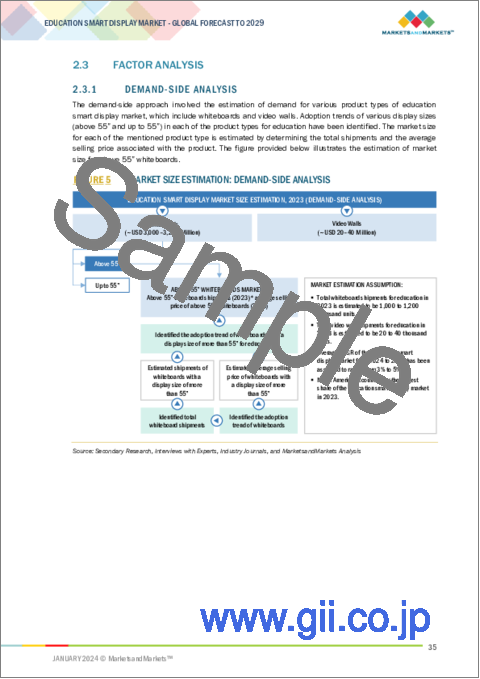

- 2.3.1 DEMAND-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3.2 SUPPLY-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- 2.3.3 GROWTH FORECAST ASSUMPTIONS

- TABLE 1 MARKET GROWTH ASSUMPTIONS

- 2.4 IMPACT OF RECESSION

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 8 EDUCATION SMART DISPLAY MARKET GLOBAL SNAPSHOT

- FIGURE 9 WHITEBOARDS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 LCDS SEGMENT TO LEAD EDUCATION SMART DISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 11 ABOVE 55" DISPLAY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR EDUCATION SMART DISPLAY MARKET PLAYERS

- FIGURE 13 SHIFT TOWARD COLLABORATIVE LEARNING IN NORTH AMERICA TO DRIVE MARKET GROWTH

- 4.2 EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE

- FIGURE 14 WHITEBOARDS SEGMENT TO ACCOUNT FOR LARGER SHARE OF EDUCATION SMART DISPLAY MARKET DURING FORECAST PERIOD

- 4.3 EDUCATION SMART DISPLAY MARKET, BY DISPLAY TECHNOLOGY

- FIGURE 15 LCDS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF EDUCATION SMART DISPLAY MARKET DURING FORECAST PERIOD

- 4.4 EDUCATION SMART DISPLAY MARKET, BY DISPLAY SIZE

- FIGURE 16 ABOVE 55" SEGMENT TO DOMINATE EDUCATION SMART DISPLAY MARKET DURING FORECAST PERIOD

- 4.5 NORTH AMERICA: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE AND COUNTRY, 2023

- FIGURE 17 WHITEBOARDS SEGMENT AND US LED EDUCATION SMART DISPLAY MARKET IN NORTH AMERICA IN 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Digital transformation in learning

- 5.2.1.2 Rising demand for collaborative learning

- 5.2.1.3 Technological advancements

- FIGURE 19 IMPACT ANALYSIS OF DRIVERS ON EDUCATION SMART DISPLAY MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 Budget constraints

- 5.2.2.2 Integration challenges

- FIGURE 20 IMPACT ANALYSIS OF RESTRAINTS ON EDUCATION SMART DISPLAY MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising e-learning trend

- 5.2.3.2 Growing adoption and awareness about numerous benefits of smart displays

- FIGURE 21 IMPACT ANALYSIS OF OPPORTUNITIES IN EDUCATION SMART DISPLAY MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 Security concerns

- 5.2.4.2 Teacher training and adaptation

- 5.2.4.3 Maintenance and technical support

- FIGURE 22 IMPACT ANALYSIS OF CHALLENGES ON EDUCATION SMART DISPLAY MARKET

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 23 VALUE CHAIN ANALYSIS

- TABLE 3 VALUE CHAIN ANALYSIS

- 5.4 EDUCATION SMART DISPLAY MARKET ECOSYSTEM

- FIGURE 24 EDUCATION SMART DISPLAY MARKET ECOSYSTEM

- 5.5 KEY TECHNOLOGY TRENDS

- 5.5.1 RELATED TECHNOLOGIES

- 5.5.1.1 Advanced touchscreen technologies

- 5.5.1.2 Interactive projection mapping

- 5.5.2 UPCOMING TECHNOLOGIES

- 5.5.2.1 Micro-LED

- 5.5.3 TRANSPARENT DISPLAYS

- 5.5.4 ADJACENT TECHNOLOGIES

- 5.5.4.1 5G connectivity

- 5.5.4.2 Edge computing for real-time interactivity

- 5.5.1 RELATED TECHNOLOGIES

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND

- FIGURE 25 AVERAGE SELLING PRICE, BY PRODUCT TYPE AND DISPLAY SIZE (IN USD)

- TABLE 4 AVERAGE SELLING PRICE, BY DISPLAY SIZE (USD)

- TABLE 5 AVERAGE SELLING PRICE FOR WHITEBOARDS (ABOVE 55"), BY REGION (USD)

- 5.7 PATENT ANALYSIS

- TABLE 6 NUMBER OF PATENTS GRANTED FOR INTERACTIVE DISPLAYS, 2013-2022

- FIGURE 26 NUMBER OF PATENTS GRANTED FOR INTERACTIVE DISPLAYS

- FIGURE 27 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS DURING REVIEW PERIOD

- TABLE 7 TOP 20 PATENT OWNERS DURING REVIEW PERIOD

- TABLE 8 KEY PATENTS RELATED TO INTERACTIVE DISPLAYS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 PORTER'S FIVE FORCES ANALYSIS-2022

- FIGURE 29 IMPACT OF PORTER'S FIVE FORCES ON EDUCATION SMART DISPLAY MARKET, 2023

- TABLE 9 PORTER'S FIVE FORCES ANALYSIS -2023

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR EDUCATION SMART DISPLAYS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR EDUCATION SMART DISPLAYS (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 31 KEY BUYING CRITERIA FOR EDUCATION SMART DISPLAYS

- TABLE 11 KEY BUYING CRITERIA FOR EDUCATION SMART DISPLAYS

- 5.10 TRADE ANALYSIS

- TABLE 12 IMPORT DATA FOR MONITORS AND PROJECTORS, HS CODE: 8528, BY COUNTRY, 2018-2022 (USD MILLION)

- FIGURE 32 HS CODE: 8528, IMPORT VALUES FOR MAJOR COUNTRIES, 2018-2022

- TABLE 13 EXPORT DATA FOR MONITORS AND PROJECTORS, HS CODE: 8528, BY COUNTRY, 2018-2022 (USD MILLION)

- FIGURE 33 HS CODE: 8528, EXPORT VALUES FOR MAJOR COUNTRIES, 2018-2022

- 5.11 CASE STUDIES

- 5.11.1 ENHANCED LEARNING EXPERIENCE FOR STUDENTS WITH LCD VIDEO WALL DISPLAY

- TABLE 14 SAMSUNG: LCD VIDEO WALL ENHANCED LEARNING EXPERIENCE FOR STUDENTS

- 5.11.2 PANASONIC TO PROVIDE DISPLAY TECHNOLOGIES FOR AD HOC TEAMWORK CENTERS AND ACTIVE-LEARNING CLASSROOMS

- TABLE 15 PANASONIC: VIDEO WALL DISPLAY PROMOTED ACTIVE-LEARNING IN CLASSROOMS

- 5.11.3 ENHANCED CLARITY AND READABILITY IN CLASSROOMS

- TABLE 16 OPTOMA: INTERACTIVE FLAT PANEL DISPLAYS ENHANCED CLARITY AND READABILITY IN CLASSROOMS

- 5.12 TARIFF AND REGULATIONS

- 5.12.1 TARIFFS

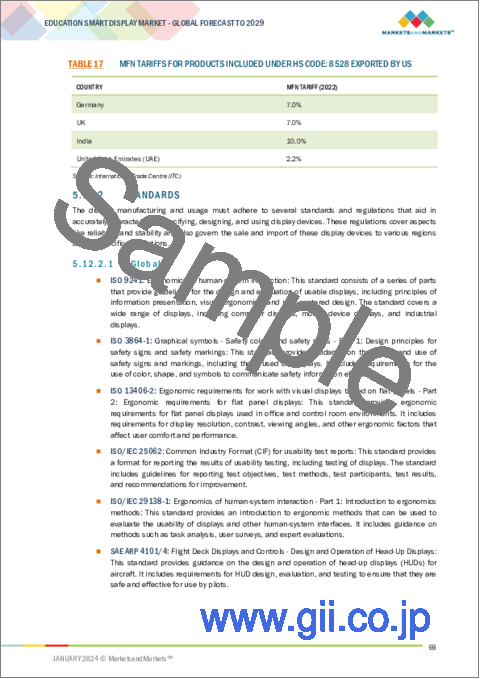

- TABLE 17 MFN TARIFFS FOR PRODUCTS INCLUDED UNDER HS CODE: 8528 EXPORTED BY US

- 5.12.2 STANDARDS

- 5.12.2.1 Global

- 5.12.2.2 Europe

- 5.12.2.3 Asia Pacific

- 5.12.2.4 North America

- 5.12.3 REGULATIONS

- 5.12.3.1 North America

- 5.12.3.2 Europe

- 5.12.3.3 Asia Pacific

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS BUSINESS

- FIGURE 34 REVENUE SHIFT FOR DISPLAYS MARKET

- 5.14 KEY CONFERENCES & EVENTS IN 2022-2023

- TABLE 18 DETAILED LIST OF CONFERENCES AND EVENTS, 2022-2023

6 EDUCATION SMART DISPLAY MARKET, BY RESOLUTION

- 6.1 INTRODUCTION

- 6.2 FHD

- 6.3 4K AND ABOVE

- 6.4 HD AND LOWER THAN HD

7 EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- FIGURE 35 WHITEBOARDS SEGMENT TO ACCOUNT FOR LARGER SHARE OF EDUCATION SMART DISPLAY MARKET DURING FORECAST PERIOD

- TABLE 19 EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 20 EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 21 EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 22 EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (THOUSAND UNITS)

- 7.2 WHITEBOARDS

- 7.2.1 SIGNIFICANT IMPROVEMENT IN STUDENT ENGAGEMENT AND FOSTERING COLLABORATIVE LEARNING TO DRIVE MARKET

- TABLE 23 WHITEBOARDS: EDUCATION SMART DISPLAY MARKET, BY DISPLAY SIZE, 2020-2023 (USD MILLION)

- TABLE 24 WHITEBOARDS: EDUCATION SMART DISPLAY MARKET, BY DISPLAY SIZE, 2024-2029 (USD MILLION)

- TABLE 25 WHITEBOARDS: EDUCATION SMART DISPLAY MARKET, BY DISPLAY SIZE, 2020-2023 (THOUSAND UNITS)

- TABLE 26 WHITEBOARDS: EDUCATION SMART DISPLAY MARKET, BY DISPLAY SIZE, 2024-2029 (THOUSAND UNITS)

- TABLE 27 WHITEBOARDS: EDUCATION SMART DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 28 WHITEBOARDS: EDUCATION SMART DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD MILLION)

- FIGURE 36 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN EDUCATION SMART DISPLAY MARKET FOR WHITEBOARDS DURING FORECAST PERIOD

- TABLE 29 WHITEBOARDS: EDUCATION SMART DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 30 WHITEBOARDS: EDUCATION SMART DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 31 WHITEBOARDS: EDUCATION SMART DISPLAY MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 32 WHITEBOARDS: EDUCATION SMART DISPLAY MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 33 WHITEBOARDS: EDUCATION SMART DISPLAY MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 34 WHITEBOARDS: EDUCATION SMART DISPLAY MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 35 WHITEBOARDS: EDUCATION SMART DISPLAY MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 36 WHITEBOARDS: EDUCATION SMART DISPLAY MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 37 WHITEBOARDS: EDUCATION SMART DISPLAY MARKET IN ROW, BY REGION, 2020-2023 (USD MILLION)

- TABLE 38 WHITEBOARDS: EDUCATION SMART DISPLAY MARKET IN ROW, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 WHITEBOARDS: EDUCATION SMART DISPLAY MARKET IN MIDDLE EAST & AFRICA, BY REGION, 2020-2023 (USD MILLION)

- TABLE 40 WHITEBOARDS: EDUCATION SMART DISPLAY MARKET IN MIDDLE EAST & AFRICA, BY REGION, 2024-2029 (USD MILLION)

- 7.3 VIDEO WALLS

- 7.3.1 GROWING DEMAND FOR LARGE FORMAT DISPLAYS FOR AUDITORIUMS TO DRIVE MARKET

- TABLE 41 VIDEO WALLS: EDUCATION SMART DISPLAY MARKET, BY DISPLAY SIZE, 2020-2023 (USD MILLION)

- TABLE 42 VIDEO WALLS: EDUCATION SMART DISPLAY MARKET, BY DISPLAY SIZE, 2024-2029 (USD MILLION)

- TABLE 43 VIDEO WALLS: EDUCATION SMART DISPLAY MARKET, BY DISPLAY SIZE, 2020-2023 (THOUSAND UNITS)

- TABLE 44 VIDEO WALLS: EDUCATION SMART DISPLAY MARKET, BY DISPLAY SIZE, 2024-2029 (THOUSAND UNITS)

- TABLE 45 VIDEO WALLS: EDUCATION SMART DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD THOUSAND)

- TABLE 46 VIDEO WALLS: EDUCATION SMART DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD THOUSAND)

- FIGURE 37 NORTH AMERICA TO LEAD EDUCATION SMART DISPLAY MARKET FOR VIDEO WALLS DURING FORECAST PERIOD

- TABLE 47 VIDEO WALLS: EDUCATION SMART DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 48 VIDEO WALLS: EDUCATION SMART DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 49 VIDEO WALLS: EDUCATION SMART DISPLAY MARKET IN NORTH AMERICA, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 50 VIDEO WALLS: EDUCATION SMART DISPLAY MARKET IN NORTH AMERICA, BY COUNTRY, 2024-2029 (USD THOUSAND)

- TABLE 51 VIDEO WALLS: EDUCATION SMART DISPLAY MARKET IN EUROPE, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 52 VIDEO WALLS: EDUCATION SMART DISPLAY MARKET IN EUROPE, BY COUNTRY, 2024-2029 (USD THOUSAND)

- TABLE 53 VIDEO WALLS: EDUCATION SMART DISPLAY MARKET IN ASIA PACIFIC, BY COUNTRY, 2020-2023 (USD THOUSAND)

- TABLE 54 VIDEO WALLS: EDUCATION SMART DISPLAY MARKET IN ASIA PACIFIC, BY COUNTRY, 2024-2029 (USD THOUSAND)

- TABLE 55 VIDEO WALLS: EDUCATION SMART DISPLAY MARKET IN ROW, BY REGION, 2020-2023 (USD THOUSAND)

- TABLE 56 VIDEO WALLS: EDUCATION SMART DISPLAY MARKET IN ROW, BY REGION, 2024-2029 (USD THOUSAND)

- TABLE 57 VIDEO WALLS: EDUCATION SMART DISPLAY MARKET IN MIDDLE EAST & AFRICA, BY REGION, 2020-2023 (USD THOUSAND)

- TABLE 58 VIDEO WALLS: EDUCATION SMART DISPLAY MARKET IN MIDDLE EAST & AFRICA, BY REGION, 2024-2029 (USD THOUSAND)

8 EDUCATION SMART DISPLAY MARKET, BY DISPLAY SIZE

- 8.1 INTRODUCTION

- TABLE 59 EDUCATION SMART DISPLAY MARKET, BY DISPLAY SIZE, 2020-2023 (USD MILLION)

- FIGURE 38 ABOVE 55" SEGMENT TO ACCOUNT FOR LARGER SHARE OF EDUCATION SMART DISPLAY MARKET BY 2029

- TABLE 60 EDUCATION SMART DISPLAY MARKET, BY DISPLAY SIZE, 2024-2029 (USD MILLION)

- TABLE 61 EDUCATION SMART DISPLAY MARKET, BY DISPLAY SIZE, 2020-2023 (THOUSAND UNITS)

- TABLE 62 EDUCATION SMART DISPLAY MARKET, BY DISPLAY SIZE, 2024-2029 (THOUSAND UNITS)

- 8.2 UP TO 55"

- 8.2.1 SUITABILITY FOR SMALLER CLASSROOMS, MEETING ROOMS, OR INTERACTIVE DISPLAYS IN LIMITED SPACES TO DRIVE MARKET

- TABLE 63 UP TO 55": EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- FIGURE 39 WHITEBOARDS SEGMENT TO ACCOUNT FOR LARGER SHARE FOR UP TO 55" DISPLAY SIZE OF EDUCATION SMART DISPLAY MARKET BY 2029

- TABLE 64 UP TO 55": EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 65 UP TO 55": EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 66 UP TO 55": EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (THOUSAND UNITS)

- 8.3 ABOVE 55"

- 8.3.1 HIGHER RESOLUTION, INTERACTIVE FUNCTIONALITIES, AND ADVANCED COLLABORATIVE TOOLS CATERING TO DIVERSE NEEDS TO DRIVE MARKET

- TABLE 67 ABOVE 55": EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- FIGURE 40 WHITEBOARDS SEGMENT TO ACCOUNT FOR LARGER SHARE FOR ABOVE 55" OF EDUCATION SMART DISPLAY MARKET BY 2029

- TABLE 68 ABOVE 55": EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- TABLE 69 ABOVE 55": EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 70 ABOVE 55": EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

9 EDUCATION SMART DISPLAY MARKET, BY DISPLAY TECHNOLOGY

- 9.1 INTRODUCTION

- TABLE 71 GLOBAL EDUCATION SMART DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2020-2023 (USD MILLION)

- FIGURE 41 LCD TECHNOLOGY TO ACCOUNT FOR LARGEST SHARE OF EDUCATION SMART DISPLAY MARKET BY 2029

- TABLE 72 GLOBAL EDUCATION SMART DISPLAY MARKET, BY DISPLAY TECHNOLOGY, 2024-2029 (USD MILLION)

- 9.2 LCDS

- 9.2.1 LOWER PRODUCTION COST AND VERSATILITY TO DRIVE MARKET

- TABLE 73 LCDS: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- FIGURE 42 WHITEBOARDS SEGMENT TO DOMINATE LCD TECHNOLOGY IN EDUCATION SMART DISPLAY MARKET

- TABLE 74 LCDS: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 9.3 DIRECT-VIEW LEDS

- 9.3.1 INCREASING DEMAND FOR LARGE VIDEO-WALLS AND DIGITAL SIGNAGE IN EDUCATIONAL INSTITUTIONS TO DRIVE MARKET

- TABLE 75 DIRECT-VIEW LEDS: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 76 DIRECT-VIEW LEDS: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 9.4 OLEDS

- 9.4.1 GROWING DEMAND FOR PREMIUM INTERACTIVE DISPLAYS DELIVERING ENHANCED VISUAL EXPERIENCES TO PROPEL MARKET

- TABLE 77 OLEDS: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- FIGURE 43 WHITEBOARDS SEGMENT TO DOMINATE OLED TECHNOLOGY IN EDUCATION SMART DISPLAY MARKET

- TABLE 78 OLEDS: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 9.5 OTHER DISPLAY TECHNOLOGIES

- TABLE 79 OTHER DISPLAY TECHNOLOGIES: EDUCATION SMART DISPLAY MARKET, BY PRODUCT, TYPE 2020-2023 (USD MILLION)

- TABLE 80 OTHER DISPLAY TECHNOLOGIES: EDUCATION SMART DISPLAY MARKET, BY PRODUCT, TYPE 2024-2029 (USD MILLION)

10 EDUCATION SMART DISPLAY MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 44 EDUCATION SMART DISPLAY MARKET, BY REGION

- TABLE 81 EDUCATION SMART DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 82 EDUCATION SMART DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 45 NORTH AMERICA: EDUCATION SMART DISPLAY MARKET SNAPSHOT

- TABLE 83 NORTH AMERICA: EDUCATION SMART DISPLAY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 84 NORTH AMERICA: EDUCATION SMART DISPLAY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 85 NORTH AMERICA: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 86 NORTH AMERICA: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 10.2.1 IMPACT OF RECESSION ON NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Strong education sector, government backing, major company presence, and fostering dynamic and interactive learning experiences to drive market

- TABLE 87 US: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 88 US: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Pioneer in embracing technology in education and tech-savvy population to contribute to market growth

- TABLE 89 CANADA: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 90 CANADA: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 10.2.4 MEXICO

- 10.2.4.1 Efforts to modernize classrooms and enhance overall learning environment to drive market

- TABLE 91 MEXICO: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 92 MEXICO: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 10.3 EUROPE

- FIGURE 46 EUROPE: EDUCATION SMART DISPLAY MARKET SNAPSHOT

- TABLE 93 EUROPE: EDUCATION SMART DISPLAY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 94 EUROPE: EDUCATION SMART DISPLAY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 95 EUROPE: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 96 EUROPE: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 10.3.1 IMPACT OF RECESSION ON EUROPE

- 10.3.2 UK

- 10.3.2.1 EdTech Strategy launched by Department for Education to drive market

- TABLE 97 UK: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 98 UK: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 10.3.3 GERMANY

- 10.3.3.1 Government initiatives and commitment to technological advancement in education to drive market

- TABLE 99 GERMANY: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 100 GERMANY: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 10.3.4 FRANCE

- 10.3.4.1 Implementing cutting-edge educational tools enabling technology-enhanced education to drive market

- TABLE 101 FRANCE: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 102 FRANCE: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 10.3.5 REST OF EUROPE (ROE)

- TABLE 103 REST OF EUROPE: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 104 REST OF EUROPE: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 10.4 ASIA PACIFIC

- FIGURE 47 ASIA PACIFIC: EDUCATION SMART DISPLAY MARKET SNAPSHOT

- TABLE 105 ASIA PACIFIC: EDUCATION SMART DISPLAY MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 106 ASIA PACIFIC: EDUCATION SMART DISPLAY MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 107 ASIA PACIFIC: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 108 ASIA PACIFIC: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 10.4.1 IMPACT OF RECESSION ON ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Implementation of comprehensive national plans focused on integrating technology into education to drive market

- TABLE 109 CHINA: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 110 CHINA: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 10.4.3 JAPAN

- 10.4.3.1 Integration of interactive displays providing students with dynamic and technologically enriched learning environments to drive market

- TABLE 111 JAPAN: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 112 JAPAN: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Educational innovation in government policies encouraging integration of modern teaching tools in classrooms to drive market

- TABLE 113 SOUTH KOREA: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 114 SOUTH KOREA: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 10.4.5 INDIA

- 10.4.5.1 Rising awareness among educators and institutions about multifaceted benefits of interactive displays to drive market

- TABLE 115 INDIA: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 116 INDIA: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 117 REST OF ASIA PACIFIC: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 118 REST OF ASIA PACIFIC: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 10.5 REST OF THE WORLD (ROW)

- TABLE 119 REST OF THE WORLD: EDUCATION SMART DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 120 REST OF THE WORLD: EDUCATION SMART DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 121 REST OF THE WORLD: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 122 REST OF THE WORLD: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 10.5.1 IMPACT OF RECESSION ON ROW

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Recognition of transformative impact of technology on education and emphasis on preparing students for digital future to drive market

- TABLE 123 SOUTH AMERICA: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 124 SOUTH AMERICA: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 10.5.3 MIDDLE EAST & AFRICA

- 10.5.3.1 Economic prosperity, high education standards, and proactive government policies to drive market

- TABLE 125 MIDDLE EAST & AFRICA: EDUCATION SMART DISPLAY MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: EDUCATION SMART DISPLAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 10.5.3.2 GCC countries

- 10.5.3.2.1 Focus on technology-driven solutions for continued growth in education sector to drive market

- 10.5.3.2 GCC countries

- TABLE 129 GCC COUNTRIES: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 130 GCC COUNTRIES: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

- 10.5.3.3 Rest of Middle East & Africa

- TABLE 131 REST OF MIDDLE EAST & AFRICA: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2020-2023 (USD MILLION)

- TABLE 132 REST OF MIDDLE EAST & AFRICA: EDUCATION SMART DISPLAY MARKET, BY PRODUCT TYPE, 2024-2029 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 MARKET EVALUATION FRAMEWORK

- TABLE 133 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 48 COMPANIES ADOPTED PARTNERSHIPS AS KEY GROWTH STRATEGY FROM 2020 TO 2023

- 11.2.1 ORGANIC/INORGANIC GROWTH STRATEGIES

- 11.2.2 PRODUCT PORTFOLIO

- 11.2.3 GEOGRAPHIC PRESENCE

- 11.2.4 MANUFACTURING AND DISTRIBUTION FOOTPRINT

- 11.3 MARKET SHARE ANALYSIS, 2023

- TABLE 134 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS IN EDUCATION SMART DISPLAY MARKET, 2023

- 11.4 COMPANY EVALUATION MATRIX

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- FIGURE 49 COMPANY EVALUATION MATRIX, 2023

- 11.5 STARTUP/SME EVALUATION MATRIX

- 11.5.1 COMPETITIVE BENCHMARKING

- TABLE 135 DETAILED LIST OF KEY STARTUP/SMES

- TABLE 136 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES: DISPLAY TECHNOLOGY (13 COMPANIES)

- TABLE 137 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES: PRODUCT TYPE (13 COMPANIES)

- TABLE 138 COMPETITIVE BENCHMARKING OF STARTUPS/SMES: REGION (13 COMPANIES)

- 11.5.2 PROGRESSIVE COMPANIES

- 11.5.3 RESPONSIVE COMPANIES

- 11.5.4 DYNAMIC COMPANIES

- 11.5.5 STARTING BLOCKS

- FIGURE 50 STARTUP/SME EVALUATION QUADRANT, 2023

- 11.6 COMPANY FOOTPRINT

- TABLE 139 COMPANY FOOTPRINT (25 COMPANIES)

- TABLE 140 COMPANY DISPLAY TECHNOLOGY FOOTPRINT (25 COMPANIES)

- TABLE 141 COMPANY PRODUCT TYPE FOOTPRINT (25 COMPANIES)

- TABLE 142 COMPANY REGION FOOTPRINT (25 COMPANIES)

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 PRODUCT LAUNCHES

- TABLE 143 PRODUCT LAUNCHES, 2020-2023

- 11.7.2 DEALS

- TABLE 144 DEALS, 2020-2023

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- (Business overview, Products /Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and Competitive threats)**

- 12.2.1 SAMSUNG

- TABLE 145 SAMSUNG: COMPANY OVERVIEW

- FIGURE 51 SAMSUNG: COMPANY SNAPSHOT

- TABLE 146 SAMSUNG: PRODUCT LAUNCHES

- TABLE 147 SAMSUNG: DEALS

- 12.2.2 LG ELECTRONICS

- TABLE 148 LG ELECTRONICS: COMPANY OVERVIEW

- FIGURE 52 LG ELECTRONICS: COMPANY SNAPSHOT

- TABLE 149 LG ELECTRONICS: PRODUCT LAUNCHES

- 12.2.3 NEWLINE INTERACTIVE

- TABLE 150 NEWLINE INTERACTIVE: COMPANY OVERVIEW

- TABLE 151 NEWLINE INTERACTIVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 NEWLINE INTERACTIVE: PRODUCT LAUNCHES

- TABLE 153 NEWLINE INTERACTIVE: DEALS

- 12.2.4 PPDS (PHILIPS)

- TABLE 154 PPDS (PHILIPS): COMPANY OVERVIEW

- TABLE 155 PPDS (PHILIPS): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 PPDS (PHILIPS): DEALS

- 12.2.5 SHARP NEC DISPLAY SOLUTIONS

- TABLE 157 SHARP NEC DISPLAY SOLUTIONS: COMPANY OVERVIEW

- TABLE 158 SHARP NEC DISPLAY SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 SHARP NEC DISPLAY SOLUTIONS: PRODUCT LAUNCHES

- 12.2.6 LEYARD

- TABLE 160 LEYARD: COMPANY OVERVIEW

- FIGURE 53 LEYARD: COMPANY SNAPSHOT

- TABLE 161 LEYARD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 LEYARD: PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 163 LEYARD: DEALS

- 12.2.7 SMART TECHNOLOGIES ULC

- TABLE 164 SMART TECHNOLOGIES ULC: COMPANY OVERVIEW

- TABLE 165 SMART TECHNOLOGIES ULC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 SMART TECHNOLOGIES ULC: PRODUCTS LAUNCHES & DEVELOPMENTS

- TABLE 167 SMART TECHNOLOGIES ULC: DEALS

- 12.2.8 SONY GROUP CORPORATION

- TABLE 168 SONY GROUP CORPORATION: COMPANY OVERVIEW

- FIGURE 54 SONY GROUP CORPORATION: COMPANY SNAPSHOT

- TABLE 169 SONY GROUP CORPORATION: PRODUCT LAUNCHES

- 12.2.9 BARCO

- TABLE 170 BARCO: COMPANY OVERVIEW

- FIGURE 55 BARCO: COMPANY SNAPSHOT

- TABLE 171 BARCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 172 BARCO: PRODUCT LAUNCHES & DEVELOPMENTS

- 12.2.10 PANASONIC HOLDINGS CORPORATION

- TABLE 173 PANASONIC HOLDINGS CORPORATION: COMPANY OVERVIEW

- FIGURE 56 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- TABLE 174 PANASONIC HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.11 BENQ

- TABLE 175 BENQ: COMPANY OVERVIEW

- TABLE 176 BENQ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 BENQ: DEALS

- 12.2.12 VIEWSONIC CORPORATION

- TABLE 178 VIEWSONIC CORPORATION: COMPANY OVERVIEW

- TABLE 179 VIEWSONIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 VIEWSONIC CORPORATION: PRODUCTS LAUNCHES & DEVELOPMENTS

- 12.2.13 PROMETHEAN WORLD LIMITED

- TABLE 181 PROMETHEAN WORLD LIMITED: COMPANY OVERVIEW

- TABLE 182 PROMETHEAN WORLD LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 PROMETHEAN WORLD LIMITED: PRODUCT LAUNCHES & DEVELOPMENTS

- 12.2.14 CLEARTOUCH

- TABLE 184 CLEARTOUCH: COMPANY OVERVIEW

- TABLE 185 CLEARTOUCH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 CLEARTOUCH: PRODUCT LAUNCHES & DEVELOPMENTS

- 12.2.15 OPTOMA CORPORATION

- TABLE 187 OPTOMA CORPORATION: COMPANY OVERVIEW

- TABLE 188 OPTOMA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.3 OTHER PLAYERS

- 12.3.1 CLEVERTOUCH (BY BOXLIGHT)

- 12.3.2 HDI LTD.

- 12.3.3 PEERLESS-AV

- 12.3.4 ABSEN INC.

- 12.3.5 CHRISTIE DIGITAL SYSTEMS USA, INC.

- 12.3.6 RICOH

- 12.3.7 HITEVISION TECH ASIA PACIFIC CO., LTD.

- 12.3.8 BOXLIGHT

- 12.3.9 PRIMEVIEW GLOBAL

- 12.3.10 PROMARK TECHSOLUTIONS PVT. LTD.

- *Details on Business overview, Products /Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and Competitive threats might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS