|

|

市場調査レポート

商品コード

1394075

グラフィックフィルムの世界市場:製品タイプ別、フィルムタイプ別、製造プロセス別、印刷技術別、最終用途産業別、地域別- 2028年までの予測Graphic Film Market by Product Type (Polyethylene, Polypropylene, Polyvinyl Chloride), Film Type (Opaque, Transparent, Translucent, Reflective), Manufacturing Process, Printing Technology, End-Use Industry, and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| グラフィックフィルムの世界市場:製品タイプ別、フィルムタイプ別、製造プロセス別、印刷技術別、最終用途産業別、地域別- 2028年までの予測 |

|

出版日: 2023年12月04日

発行: MarketsandMarkets

ページ情報: 英文 231 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

レポート概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル)・数量 (平方メートル) |

| セグメント | フィルムタイプ・製造プロセス・印刷技術・製品タイプ・最終用途産業・地域 |

| 対象地域 | アジア太平洋・北米・欧州・南米・中東&アフリカ |

グラフィックフィルムの市場規模は、2023年の289億米ドルから、予測期間中は4.6%のCAGRで推移し、2028年には362億米ドルの規模に成長すると予測されています。

世界のグラフィックフィルム市場は、製品・サービスに関する情報提供に役立つ販促・広告活動の増加により、上昇基調にあります。また、同市場の成長は、グラフィックフィルムが車両のラッピングに用いられることから、自動車産業の成長にも起因しています。一方で、原材料価格の変動により、市場成長は抑制される可能性があります。

フィルムタイプ別では、不透明フィルムの部門が予測期間中に最大のCAGRを示すと予測されています。不透明グラフィックフィルムは汎用性があり、さまざまな用途に使用できます。また、屋内外で使用でき、さまざまな環境に適応できます。

製品タイプ別では、ポリ塩化ビニル (PVC) の部門が予測期間中に最大の規模を維持する見通しです。PVCタイプのグラフィックフィルムは、耐湿性、耐薬品性、耐候性などの品質でよく選ばれ、屋内・屋外の両方の用途に適しています。PVCタイプのグラフィックフィルムの使用は、その汎用性とさまざまな環境条件に耐える能力から、看板や印刷業界で人気のある選択肢となっています。

地域別では、アジア太平洋地域が予測期間中、最大のCAGRを示す見通しです。工業化や都市化の進展、ブランディングや広告、製品強化のための製品へのグラフィックフィルム利用、各種製品・サービスに対する需要の高まりなどの要因が同地域の成長を促進しています。また、同地域では、大規模な建設やインフラ開発、自動車産業の成長なども、グラフィックフィルム市場の成長に寄与しています。

当レポートでは、世界のグラフィックフィルムの市場を調査し、市場概要、市場成長への各種影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界の動向

- ポーターのファイブフォース分析

- バリューチェーン分析

- 顧客の事業に影響を与える動向/ディスラプション

- 関税と規制状況

- 規制機関および政府機関

- 価格分析

- 技術分析

第7章 グラフィックフィルム市場:印刷技術別

- フレキソグラフィ

- ロトグラビア

- オフセット

- デジタル

第8章 グラフィックフィルム市場:フィルムタイプ別

- 不透明フィルム

- 反射フィルム

- 透明フィルム

- 半透明フィルム

第9章 グラフィックフィルム市場:最終用途産業別

- 自動車

- プロモーション・広告

- 工業

- その他

第10章 グラフィックフィルム市場:製造プロセス別

- カレンダー

- 鋳造

- その他

第11章 グラフィックフィルム市場:製品タイプ別

- ポリ塩化ビニル (PVC)

- ポリプロピレン (PP)

- ポリエチレン (PE)

- その他

第12章 グラフィックフィルム市場:地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

第13章 競合情勢

- 概要

- 市場シェア分析

- 主要企業の収益分析

- 企業評価マトリックス

- 新興企業/中小企業評価マトリックス

- 競合シナリオと動向

第14章 企業プロファイル

- 主要企業

- AVERY DENNISON CORPORATION

- 3M

- DUPONT DE NEMOURS, INC.

- CCL INDUSTRIES

- ORAFOL EUROPE GMBH

- HEXIS S.A.S.

- ARLON GRAPHICS, LLC

- ACHILLES USA INC.

- DUNMORE

- DRYTAC

- LX HAUSYS

- FEDRIGONI S.P.A.

- その他の企業

- LINTEC CORPORATION

- CONTRA VISION LIMITED

- MATIV

- COSMO FILMS LIMITED

- TAGHLEEF INDUSTRIES

- ACCO BRANDS

- ULTRAFLEX SYSTEMS INC.

- THE GRIFF NETWORK

- BRIDGEHEAD CO., LTD.

- JESSUP MANUFACTURING COMPANY

- GARWARE HI-TECH FILMS LIMITED

- CELADON TECHNOLOGY COMPANY LTD.

- NEKOOSA

- CONTINENTAL GRAFIX USA, INC.

- JIANGSU AOLI NEW MATERIALS CO., LTD.

第15章 隣接市場

第16章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million/Billion), Volume (Million Square Meters) |

| Segments | Film Type, Manufacturing Process, Printing Technology, Product Type, End-Use Industry, and Region |

| Regions covered | Asia-Pacific, North America, Europe, South America, and Middle East & Africa. |

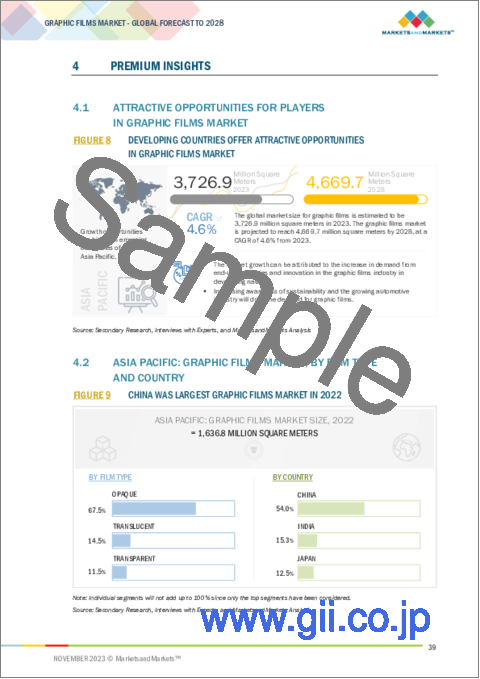

The graphic film market size is estimated to be USD 28.9 billion in 2023, and it is projected to reach USD 36.2 billion by 2028 at a CAGR of 4.6%. The market of global graphic film is on an upward trajectory due to the increasing promotional and advertising activities which help in providing information about the products & services. Apart from this, the market growth is attributed to the rising automotive industry, where these films are used to wrap the vehicles. However, the progress of the market may face hindrances due to the fluctuations in the prices of raw materials.

Graphic film, a versatile layers or sheets that are composed of polymer compounds, plays a pivotal role in storing diverse information and serves as an effective means of communication. Hence as a result of this, it is widely used to notify and guide the customers about the services and products. Apart from this, It is also used to provide a protective coating while simultaneously enhancing the aesthetic appeal of products.

"Opaque films is the biggest film type segment of the graphic films market."

The opaque films segment within the graphic film market is anticipated to exhibit the most substantial compound annual growth rate (CAGR), particularly in terms of value, during the forecast period. Opaque graphic films are versatile and can be used in various applications. They are suitable for both indoor and outdoor use, making them adaptable to different environments. Opaque films provide excellent coverage, ensuring that the graphics or information displayed on them are not affected by background elements. This makes them highly visible and impactful, particularly in situations where clarity and legibility are crucial.

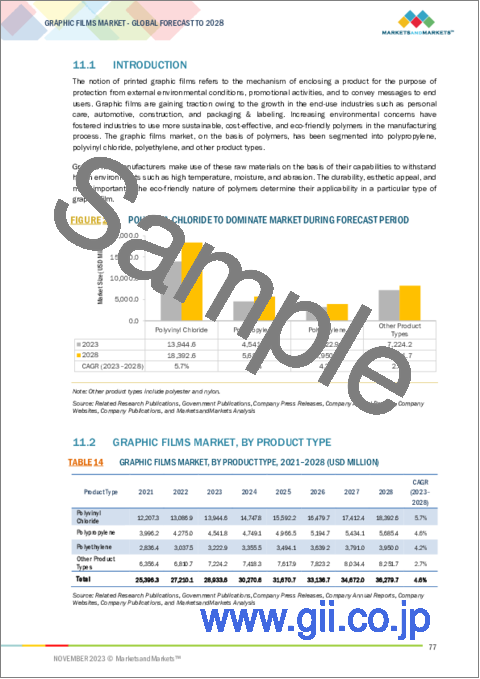

"Polyvinyl Chloride is the largest by-product type segment of the graphic film market."

The polyvinyl chloride by-product type segment is going to take the lead in the graphic film market from 2023 to 2028, in terms of value. PVC-type graphic film may be chosen for its qualities, such as being resistant to moisture, chemicals, and weathering, making it suitable for both indoor and outdoor applications. The use of PVC-type graphic films contributes to their versatility and ability to withstand different environmental conditions, making them a popular choice in the signage and printing industries.

"Automotive is the second-fastest end-use industry segment of the graphic films market."

In the graphic film market, the automotive industry emerged as the second fastest segment during the forecast period. The graphic film used in the automotive industry, particularly vehicle wrap films, offers a combination of aesthetic appeal, customization, and protective functionality. It is a popular choice for businesses and individuals looking to enhance the visual impact of vehicles. It is designed to withstand outdoor elements, including UV exposure, harsh weather conditions, and road debris. It also helps in providing protection to the underlying paint and can extend the life of the vehicle's finish.

"Digital is the second-fastest printing technology segment of the graphic films market."

In the graphic film market, digital printing technology emerged as the second-fastest segment during the forecast period. Unlike traditional printing methods, digital printing allows for shorter print runs, reduced setup times, and the ability to produce high-quality, vibrant images with intricate details. This versatility has captured the attention of businesses across various sectors, driving the demand for graphic film that can be seamlessly integrated into diverse applications such as advertising, decoration, signage, and others.

"Calendered is the most preferable manufacturing process in the graphic films market."

The calendered process has gained traction due to its cost-effectiveness and efficiency in large-scale production, making it an attractive choice for a diverse range of applications in several end-use industries such as automotive, promotional & advertisement, industrial, and others. From outdoor signage and banners to vehicle wraps and architectural graphics, the calendered process offers versatility and durability, meeting the demands of various end-users. As technology continues to enhance the performance of calendered films, providing improved printability and color retention, its prominence in the graphic film market is set to grow even further.

"APAC is the fastest-growing market for graphic films."

The Asia-Pacific graphic film market is anticipated to achieve the highest Compound Annual Growth Rate (CAGR) in terms of value from 2023 to 2028. This outstanding growth of the market in the region is attributed to several factors such as increasing industrialization, and rising urbanization which leads to a higher demand for various products and services, including those that utilize graphic films for branding, advertising, and product enhancement. Apart from the region also witnesses extensive construction and infrastructure development, and the rising automotive industry which helps in growing the market of graphic film.

The breakdown of primary interviews is given below:

- By Company Type: Tier 1 - 35%, Tier 2 - 30%, and Tier 3 -35%

- By Designation: C-Level - 50%, Manager-Level - 30%, and Others - 20%

- By Region: North America - 23%, Europe - 23%, APAC - 40%, Middle East & Africa - 10%, and South America - 5%

The key companies profiled in this report on the graphic films market include 3M (US), Avery Dennison Corporation (US), DuPont de Nemours Inc. (US), CCL Industries (Canada), Fedrigoni S.P.A. (Italy), ORAFOL Europe GmbH (Germany), HEXIS S.A.S. (France), Arlon Graphics, LLC (US), Achilles USA Inc.(US), Dunmore (US), Drytac (US), LX Hausys (South Korea), and others are the key players operating in the graphic film market.

Research Coverage

The graphic film market has been segmented based on product type, film type, end-use industry, printing technology, manufacturing process, and region. This report covers the graphic film market and forecasts its market size until 2028. It also provides detailed information on company profiles and competitive strategies adopted by the key players to strengthen their position in the graphic film market. The report also provides insights into the drivers and restraints in the graphic film market along with opportunities and challenges. The report also includes profiles of top manufacturers in the graphic film market.

Reasons to Buy the Report

The report is expected to help market leaders/new entrants in the following ways:

1. This report segments the graphic film market and provides the closest approximations of revenue numbers for the overall market and its segments across different verticals and regions.

2. This report is expected to help stakeholders understand the pulse of the graphic film market and provide information on key market drivers, restraints, challenges, and opportunities influencing the market growth.

3. This report is expected to help stakeholders obtain an in-depth understanding of the competitive landscape of the graphic films market and gain insights to improve the position of their businesses. The competitive landscape section includes detailed information on strategies, such as acquisitions, expansions, new product developments, and partnerships/collaborations/agreements.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising construction industry and improved living standards, low installation & maintenance cost, rising demand for wrap advertisements), restraints (Volatile raw material prices, and stringent government regulations regarding raw materials used for graphic film manufacturing), opportunities (Increase in demand for bioplastic polymers, and continuous advancements in digital printing techniques), and challenges (limited recycling options) influencing the growth of the graphic films market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the graphic film market

- Market Development: Comprehensive information about lucrative markets - the report analyses the graphic film market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the graphic film market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like 3M (US), Avery Dennison Corporation (US), DuPont de Nemours Inc. (US), CCL Industries (Canada), Fedrigoni S.P.A. (Italy), ORAFOL Europe GmbH (Germany), HEXIS S.A.S. (France), Arlon Graphics, LLC (US), Achilles USA Inc.(US), Dunmore (US), Drytac (US), LX Hausys (South Korea), and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 GRAPHIC FILMS MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 LIMITATIONS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 GRAPHIC FILMS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of interviews with experts

- 2.1.2.3 Key industry insights

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE APPROACH

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 3 GRAPHIC FILMS MARKET: DATA TRIANGULATION

- 2.5 ASSUMPTIONS

- 2.6 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 4 POLYVINYL CHLORIDE LEAD GRAPHIC FILMS MARKET DURING FORECAST PERIOD

- FIGURE 5 OPAQUE FILM SEGMENT TO BE LARGEST SEGMENT THROUGH 2028

- FIGURE 6 PROMOTIONAL & ADVERTISEMENT TO DOMINATE GRAPHIC FILMS MARKET BY 2028

- FIGURE 7 ASIA PACIFIC TO BE FASTEST-GROWING MARKET IN FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GRAPHIC FILMS MARKET

- FIGURE 8 DEVELOPING COUNTRIES OFFER ATTRACTIVE OPPORTUNITIES IN GRAPHIC FILMS MARKET

- 4.2 ASIA PACIFIC: GRAPHIC FILMS MARKET, BY FILM TYPE AND COUNTRY

- FIGURE 9 CHINA WAS LARGEST GRAPHIC FILMS MARKET IN 2022

- 4.3 GRAPHIC FILMS MARKET, BY FILM TYPE

- FIGURE 10 OPAQUE SEGMENT TO LEAD GRAPHIC FILMS MARKET DURING FORECAST PERIOD

- 4.4 GRAPHIC FILMS MARKET, BY PRODUCT TYPE

- FIGURE 11 POLYVINYL CHLORIDE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- 4.5 GRAPHIC FILMS MARKET, BY PRINTING TECHNOLOGY

- FIGURE 12 FLEXOGRAPHY TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- 4.6 GRAPHIC FILMS MARKET, BY END-USE INDUSTRY

- FIGURE 13 PROMOTIONAL AND ADVERTISEMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.7 GRAPHIC FILMS MARKET, BY COUNTRY

- FIGURE 14 INDIA GRAPHIC FILMS MARKET TO RECORD HIGHEST CAGR FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN GRAPHIC FILMS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Rising construction industry and improved living standards

- 5.2.1.2 Low installation and maintenance costs

- 5.2.1.3 Rising demand for wrap advertisements

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatile raw material costs

- 5.2.2.2 Stringent government regulations regarding raw materials used for graphic film manufacturing

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increase in demand for bioplastic polymers

- 5.2.3.2 Continuous advancements in digital printing techniques

- 5.2.4 CHALLENGES

- 5.2.4.1 Technological obsolescence

- 5.2.4.2 Limited recycling options

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 GRAPHIC FILMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 1 GRAPHIC FILMS MARKET: PORTER'S FIVE FORCE ANALYSIS

- 6.1.1 BARGAINING POWER OF SUPPLIERS

- 6.1.2 THREAT OF NEW ENTRANTS

- 6.1.3 THREAT OF SUBSTITUTES

- 6.1.4 BARGAINING POWER OF BUYERS

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.2 VALUE CHAIN ANALYSIS

- FIGURE 17 PRODUCTION PROCESS CONTRIBUTES MOST VALUE TO OVERALL PRICE OF GRAPHIC FILMS

- 6.3 TRENDS /DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 6.3.1 GRAPHIC FILMS MARKET - GLOBAL FORECAST TO 2028

- 6.3.1.1 Trends/Disruptions impacting customer's business

- FIGURE 18 TRENDS /DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.3.1 GRAPHIC FILMS MARKET - GLOBAL FORECAST TO 2028

- 6.4 TARIFF AND REGULATORY LANDSCAPE

- 6.4.1 GRAPHIC FILMS MARKET, GLOBAL FORECAST TO 2028

- 6.4.2 TARIFF RELATED TO GRAPHIC FILMS

- 6.5 REGULATORY BODIES AND GOVERNMENT AGENCIES

- 6.5.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 2 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY

- FIGURE 19 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP 3 END-USE INDUSTRIES

- TABLE 6 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP END-USE INDUSTRIES (USD/SQUARE METER)

- 6.6.2 AVERAGE SELLING PRICE TREND, BY REGION

- FIGURE 20 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 7 AVERAGE SELLING PRICE TREND, BY REGION (USD/SQUARE METER)

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 GRAPHIC FILMS MARKET - FORECAST TO 2028

- 6.7.1.1 Technology analysis

- 6.7.1 GRAPHIC FILMS MARKET - FORECAST TO 2028

7 GRAPHIC FILMS MARKET, BY PRINTING TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 21 FLEXOGRAPHY TO REMAIN LARGEST MARKET SEGMENT

- TABLE 8 GRAPHIC FILMS MARKET, BY PRINTING TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 9 GRAPHIC FILMS MARKET, BY PRINTING TECHNOLOGY, 2021-2028 (MILLION SQUARE METER)

- 7.2 FLEXOGRAPHY

- 7.2.1 ADAPTABILITY AND COST-EFFECTIVENESS TO DRIVE MARKET

- 7.3 ROTOGRAVURE

- 7.3.1 VERSATILITY AND EFFICIENCY TO DRIVE MARKET

- 7.4 OFFSET

- 7.4.1 TECHNOLOGICAL ADVANCEMENTS AND INCREASED AUTOMATION TO ENHANCE EFFICIENCY

- 7.5 DIGITAL

- 7.5.1 COST-EFFECTIVENESS FOR SHORT PRINT RUNS MAKING IT ECONOMICALLY VIABLE TO DRIVE MARKET

8 GRAPHIC FILMS MARKET, BY FILM TYPE

- 8.1 INTRODUCTION

- FIGURE 22 OPAQUE FILMS TO DOMINATE GRAPHIC FILMS MARKET IN 2023

- TABLE 10 GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 11 GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 8.2 OPAQUE FILMS

- 8.2.1 EFFECTIVE WAY TO ENHANCE PRIVACY TO DRIVE DEMAND

- 8.3 REFLECTIVE FILMS

- 8.3.1 REFLECTIVE PROPERTIES TO INCREASE DEMAND

- 8.4 TRANSPARENT FILMS

- 8.4.1 ABILITY TO ALLOW LIGHT TO PASS THROUGH TO DRIVE DEMAND

- 8.5 TRANSLUCENT FILMS

- 8.5.1 ABILITY TO SOFTEN TRANSMITTED LIGHT TO DRIVE DEMAND

9 GRAPHIC FILMS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 23 PROMOTIONAL & ADVERTISEMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- TABLE 12 GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 13 GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- 9.2 AUTOMOTIVE

- 9.2.1 ABILITY TO TRANSFORM EXTERNAL APPEARANCE OF VEHICLES TO DRIVE DEMAND

- 9.3 PROMOTIONAL & ADVERTISEMENT

- 9.3.1 EFFECTIVE IN CAPTURING ATTENTION AND CONVEYING MESSAGE TO DRIVE DEMAND

- 9.4 INDUSTRIAL

- 9.4.1 DURABILITY TO DRIVE DEMAND

- 9.5 OTHER END-USE INDUSTRIES

10 GRAPHIC FILMS MARKET, BY MANUFACTURING PROCESS

- 10.1 INTRODUCTION

- 10.2 CALENDERED

- 10.2.1 PRECISE CONTROL OVER THICKNESS AND SURFACE CHARACTERISTICS TO DRIVE MARKET

- 10.3 CASTING

- 10.3.1 VERSATILITY OF CASTING TO EXTEND ACROSS INDUSTRIES

- 10.4 OTHER MANUFACTURING PROCESSES

- 10.4.1 ADVANCES IN COMPUTER-TO-PLATE SYSTEMS AND INCREASED AUTOMATION TO ENHANCE DEMAND

11 GRAPHIC FILMS MARKET, BY PRODUCT TYPE

- 11.1 INTRODUCTION

- FIGURE 24 POLYVINYL CHLORIDE TO DOMINATE MARKET DURING FORECAST PERIOD

- 11.2 GRAPHIC FILMS MARKET, BY PRODUCT TYPE

- TABLE 14 GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 15 GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- 11.3 POLYVINYL CHLORIDE (PVC)

- TABLE 16 POLYVINYL CHLORIDE PROPERTIES

- 11.4 POLYPROPYLENE (PP)

- TABLE 17 POLYPROPYLENE PROPERTIES

- 11.5 POLYETHYLENE (PE)

- TABLE 18 POLYETHYLENE PROPERTIES

- 11.6 OTHER PRODUCT TYPES

12 GRAPHIC FILMS MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 25 GRAPHIC FILMS MARKET GROWTH RATE, BY COUNTRY, 2023-2028

- TABLE 19 GRAPHIC FILMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 20 GRAPHIC FILMS MARKET, BY REGION 2021-2028 (MILLION SQUARE METERS)

- 12.2 NORTH AMERICA

- 12.2.1 RECESSION IMPACT

- TABLE 21 NORTH AMERICA: GRAPHIC FILMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 22 NORTH AMERICA: GRAPHIC FILMS MARKET, BY COUNTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 23 NORTH AMERICA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 24 NORTH AMERICA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 25 NORTH AMERICA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 26 NORTH AMERICA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 27 NORTH AMERICA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 28 NORTH AMERICA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.2.2 US

- 12.2.2.1 Investment by automotive companies to drive demand

- TABLE 29 US: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 30 US: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 31 US: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 32 US: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 33 US: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 34 US: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.2.3 CANADA

- 12.2.3.1 Rising automotive industry to drive demand

- TABLE 35 CANADA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 36 CANADA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 37 CANADA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 38 CANADA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 39 CANADA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 40 CANADA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.2.4 MEXICO

- 12.2.4.1 Rising automotive industry to drive market

- TABLE 41 MEXICO: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 42 MEXICO: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 43 MEXICO: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 44 MEXICO: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 45 MEXICO: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 46 MEXICO: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.3 EUROPE

- 12.3.1 RECESSION IMPACT

- FIGURE 26 EUROPE: MARKET SNAPSHOT

- TABLE 47 EUROPE: GRAPHIC FILMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 48 EUROPE: GRAPHIC FILMS MARKET, BY COUNTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 49 EUROPE: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 50 EUROPE: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 51 EUROPE: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 52 EUROPE: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 53 EUROPE: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 54 EUROPE: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 55 EUROPE: GRAPHIC FILMS MARKET, BY PRINTING TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 56 EUROPE: GRAPHIC FILMS MARKET, PRINTING TECHNOLOGY, 2021-2028 (MILLION SQUARE METERS)

- 12.3.2 GERMANY

- 12.3.2.1 Growing automotive and advertising industries to increase demand

- TABLE 57 GERMANY: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 58 GERMANY: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 59 GERMANY: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 60 GERMANY: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 61 GERMANY: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 62 GERMANY: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.3.3 UK

- 12.3.3.1 Increased spending on advertising sector to provide growth opportunities

- TABLE 63 UK: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 64 UK: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 65 UK: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 66 UK: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 67 UK: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 68 UK: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.3.4 FRANCE

- 12.3.4.1 Government initiatives to boost demand

- TABLE 69 FRANCE: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 70 FRANCE: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 71 FRANCE: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 72 FRANCE: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 73 FRANCE: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 74 FRANCE: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.3.5 ITALY

- 12.3.5.1 Government initiatives to drive market

- TABLE 75 ITALY: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 76 ITALY: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 77 ITALY: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 78 ITALY: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 79 ITALY: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 80 ITALY: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.3.6 RUSSIA

- 12.3.6.1 Government initiatives to lead the market growth

- TABLE 81 RUSSIA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 82 RUSSIA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 83 RUSSIA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 84 RUSSIA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 85 RUSSIA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 86 RUSSIA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.3.7 REST OF EUROPE

- TABLE 87 REST OF EUROPE: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 88 REST OF EUROPE: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 89 REST OF EUROPE: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 90 REST OF EUROPE: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 91 REST OF EUROPE: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 92 REST OF EUROPE: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.4 ASIA PACIFIC

- 12.4.1 RECESSION IMPACT

- FIGURE 27 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 93 ASIA PACIFIC: GRAPHIC FILMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: GRAPHIC FILMS MARKET, BY COUNTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 95 ASIA PACIFIC: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 97 ASIA PACIFIC: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 99 ASIA PACIFIC: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 101 ASIA PACIFIC: GRAPHIC FILMS MARKET, BY PRINTING TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: GRAPHIC FILMS MARKET, BY PRINTING TECHNOLOGY, 2021-2028 (MILLION SQUARE METERS)

- 12.4.2 CHINA

- 12.4.2.1 Expanding automotive industry to drive market

- TABLE 103 CHINA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 104 CHINA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 105 CHINA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 106 CHINA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 107 CHINA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 108 CHINA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.4.3 INDIA

- 12.4.3.1 Rising advertising and automotive industries to drive demand

- TABLE 109 INDIA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 110 INDIA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 111 INDIA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 112 INDIA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 113 INDIA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 114 INDIA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.4.4 JAPAN

- 12.4.4.1 Growing automotive industry to support market

- TABLE 115 JAPAN: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 116 JAPAN: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 117 JAPAN: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 118 JAPAN: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 119 JAPAN: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 120 JAPAN: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Growing electric vehicles market to drive demand

- TABLE 121 SOUTH KOREA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 122 SOUTH KOREA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 123 SOUTH KOREA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 124 SOUTH KOREA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 125 SOUTH KOREA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 126 SOUTH KOREA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.4.6 AUSTRALIA

- 12.4.6.1 Increasing sales of automotive vehicles to drive market

- TABLE 127 AUSTRALIA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 128 AUSTRALIA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 129 AUSTRALIA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 130 AUSTRALIA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 131 AUSTRALIA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 132 AUSTRALIA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.4.7 REST OF ASIA PACIFIC

- TABLE 133 REST OF ASIA PACIFIC: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 134 REST OF ASIA PACIFIC: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 135 REST OF ASIA PACIFIC: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 137 REST OF ASIA PACIFIC: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 138 REST OF ASIA PACIFIC: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.5 SOUTH AMERICA

- 12.5.1 RECESSION IMPACT

- TABLE 139 SOUTH AMERICA: GRAPHIC FILMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 140 SOUTH AMERICA: GRAPHIC FILMS MARKET, BY COUNTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 141 SOUTH AMERICA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 142 SOUTH AMERICA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 143 SOUTH AMERICA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 144 SOUTH AMERICA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 145 SOUTH AMERICA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 146 SOUTH AMERICA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 147 SOUTH AMERICA: GRAPHIC FILMS MARKET, BY PRINTING TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 148 SOUTH AMERICA: GRAPHIC FILMS MARKET, BY PRINTING TECHNOLOGY, 2021-2028 (MILLION SQUARE METERS)

- 12.5.2 BRAZIL

- 12.5.2.1 Rising digital printing technology to drive market

- TABLE 149 BRAZIL: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 150 BRAZIL: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 151 BRAZIL: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 152 BRAZIL: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 153 BRAZIL: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 154 BRAZIL: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.5.3 ARGENTINA

- 12.5.3.1 Automotive sector growth to drive market

- TABLE 155 ARGENTINA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 156 ARGENTINA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 157 ARGENTINA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 158 ARGENTINA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 159 ARGENTINA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 160 ARGENTINA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.5.4 REST OF SOUTH AMERICA

- TABLE 161 REST OF SOUTH AMERICA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 162 REST OF SOUTH AMERICA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 163 REST OF SOUTH AMERICA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 164 REST OF SOUTH AMERICA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 165 REST OF SOUTH AMERICA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 166 REST OF SOUTH AMERICA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.6 MIDDLE EAST & AFRICA

- 12.6.1 RECESSION IMPACT

- TABLE 167 MIDDLE EAST & AFRICA: GRAPHIC FILMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: GRAPHIC FILMS MARKET, BY COUNTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 169 MIDDLE EAST & AFRICA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 171 MIDDLE EAST & AFRICA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 173 MIDDLE EAST & AFRICA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 175 MIDDLE EAST & AFRICA: GRAPHIC FILMS MARKET, BY PRINTING TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: GRAPHIC FILMS MARKET, BY PRINTING TECHNOLOGY, 2021-2028 (MILLION SQUARE METERS)

- 12.6.2 GCC COUNTRIES

- 12.6.2.1 Growing electric vehicle demand to drive market

- TABLE 177 GCC COUNTRIES: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 178 GCC COUNTRIES: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 179 GCC COUNTRIES: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 180 GCC COUNTRIES: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 181 GCC COUNTRIES: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 182 GCC COUNTRIES: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.6.3 UAE

- 12.6.3.1 Growing end-use industries to drive market

- TABLE 183 UAE: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 184 UAE: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 185 UAE: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 186 UAE: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 187 UAE: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 188 UAE: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.6.4 REST OF GCC

- TABLE 189 REST OF GCC COUNTRIES: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 190 REST OF GCC COUNTRIES: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 191 REST OF GCC COUNTRIES: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 192 REST OF GCC COUNTRIES: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 193 REST OF GCC COUNTRIES: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 194 REST OF GCC COUNTRIES: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.6.5 SOUTH AFRICA

- 12.6.5.1 Enhanced macroeconomic management to play vital role

- TABLE 195 SOUTH AFRICA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 196 SOUTH AFRICA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 197 SOUTH AFRICA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 198 SOUTH AFRICA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 199 SOUTH AFRICA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 200 SOUTH AFRICA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

- 12.6.6 REST OF MIDDLE EAST & AFRICA

- TABLE 201 REST OF MIDDLE EAST & AFRICA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 202 REST OF MIDDLE EAST & AFRICA: GRAPHIC FILMS MARKET, BY PRODUCT TYPE, 2021-2028 (MILLION SQUARE METERS)

- TABLE 203 REST OF MIDDLE EAST & AFRICA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 204 REST OF MIDDLE EAST & AFRICA: GRAPHIC FILMS MARKET, BY END-USE INDUSTRY, 2021-2028 (MILLION SQUARE METERS)

- TABLE 205 REST OF MIDDLE EAST & AFRICA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (USD MILLION)

- TABLE 206 REST OF MIDDLE EAST & AFRICA: GRAPHIC FILMS MARKET, BY FILM TYPE, 2021-2028 (MILLION SQUARE METERS)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- TABLE 207 OVERVIEW OF STRATEGIES ADOPTED BY KEY GRAPHIC FILM PLAYERS

- 13.2 MARKET SHARE ANALYSIS

- FIGURE 28 GRAPHIC FILMS MARKET: MARKET SHARE ANALYSIS

- TABLE 208 GRAPHIC FILMS MARKET: DEGREE OF COMPETITION

- 13.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 29 REVENUE ANALYSIS FOR KEY COMPANIES IN GRAPHIC FILMS MARKET IN PAST FIVE YEARS

- 13.4 COMPANY EVALUATION MATRIX

- 13.4.1 STARS

- 13.4.2 EMERGING LEADERS

- 13.4.3 PERVASIVE PLAYERS

- 13.4.4 PARTICIPANTS

- FIGURE 30 COMPANY EVALUATION MATRIX, 2022

- 13.4.5 COMPANY FOOTPRINT

- FIGURE 31 GRAPHIC FILMS MARKET: PRODUCT FOOTPRINT (27 COMPANIES)

- TABLE 209 GRAPHIC FILMS MARKET: END-USE INDUSTRY FOOTPRINT (27 COMPANIES)

- TABLE 210 GRAPHIC FILMS MARKET: REGIONAL FOOTPRINT (25 COMPANIES)

- TABLE 211 GRAPHIC FILMS MARKET: COMPANY FOOTPRINT (25 COMPANIES)

- 13.5 START-UPS/SMES EVALUATION MATRIX, 2022

- 13.5.1 PROGRESSIVE COMPANIES

- 13.5.2 RESPONSIVE COMPANIES

- 13.5.3 DYNAMIC COMPANIES

- 13.5.4 STARTING BLOCKS

- FIGURE 32 START-UPS/SMES EVALUATION MATRIX: GRAPHIC FILMS MARKET, 2022

- 13.5.5 COMPETITIVE BENCHMARKING

- TABLE 212 GRAPHIC FILMS MARKET: DETAILED LIST OF KEY START-UP/SMES

- TABLE 213 GRAPHIC FILMS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UP/SMES

- 13.6 COMPETITIVE SCENARIO AND TRENDS

- 13.6.1 PRODUCT LAUNCHES

- TABLE 214 PRODUCT LAUNCHES, 2019-2023

- 13.6.2 DEALS

- TABLE 215 DEALS, 2019-2023

14 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strength/Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 14.1 KEY PLAYERS

- 14.1.1 AVERY DENNISON CORPORATION

- TABLE 216 AVERY DENNISON CORPORATION: COMPANY OVERVIEW

- FIGURE 33 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

- TABLE 217 AVERY DENNISON CORPORATION: DEALS

- TABLE 218 AVERY DENNISON CORPORATION: PRODUCT LAUNCHES

- 14.1.2 3M

- TABLE 219 3M: COMPANY OVERVIEW

- FIGURE 34 3M: COMPANY SNAPSHOT

- TABLE 220 3M: DEALS

- TABLE 221 3M: OTHERS

- 14.1.3 DUPONT DE NEMOURS, INC.

- TABLE 222 DUPONT DE NEMOURS, INC.: COMPANY OVERVIEW

- FIGURE 35 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT

- TABLE 223 DUPONT DE NEMOURS, INC.: DEALS

- TABLE 224 DUPONT DE NEMOURS, INC.: PRODUCT LAUNCHES

- 14.1.4 CCL INDUSTRIES

- TABLE 225 CCL INDUSTRIES.: COMPANY OVERVIEW

- FIGURE 36 CCL INDUSTRIES: COMPANY SNAPSHOT

- TABLE 226 CCL INDUSTRIES: PRODUCT LAUNCHES

- TABLE 227 CCL INDUSTRIES: OTHERS

- 14.1.5 ORAFOL EUROPE GMBH

- TABLE 228 ORAFOL EUROPE GMBH: COMPANY OVERVIEW

- TABLE 229 ORAFOL EUROPE GMBH: DEALS

- TABLE 230 ORAFOL EUROPE GMBH: PRODUCT LAUNCHES

- 14.1.6 HEXIS S.A.S.

- TABLE 231 HEXIS S.A.S.: COMPANY OVERVIEW

- TABLE 232 HEXIS S.A.S.: DEALS

- TABLE 233 HEXIS S.A.S: PRODUCT LAUNCHES

- TABLE 234 HEXIS S.A.S.: OTHERS

- 14.1.7 ARLON GRAPHICS, LLC

- TABLE 235 ARLON GRAPHICS, LLC: COMPANY OVERVIEW

- TABLE 236 ARLON GRAPHICS, LLC: DEALS

- TABLE 237 ARLON GRAPHICS, LLC: PRODUCT LAUNCHES

- 14.1.8 ACHILLES USA INC.

- TABLE 238 ACHILLES USA INC.: COMPANY OVERVIEW

- 14.1.9 DUNMORE

- TABLE 239 DUNMORE: COMPANY OVERVIEW

- TABLE 240 DUNMORE: PRODUCT LAUNCHES

- 14.1.10 DRYTAC

- TABLE 241 DRYTAC: COMPANY OVERVIEW

- TABLE 242 DRYTAC: PRODUCT LAUNCHES

- 14.1.11 LX HAUSYS

- TABLE 243 LX HAUSYS: COMPANY OVERVIEW

- 14.1.12 FEDRIGONI S.P.A.

- TABLE 244 FEDRIGONI S.P.A.: COMPANY OVERVIEW

- FIGURE 37 FEDRIGONI S.P.A.: COMPANY SNAPSHOT

- TABLE 245 FEDRIGONI S.P.A.: DEALS

- TABLE 246 FEDRIGONI S.P.A.: OTHERS

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

- 14.2 OTHER PLAYERS

- 14.2.1 LINTEC CORPORATION

- TABLE 247 LINTEC CORPORATION: COMPANY OVERVIEW

- 14.2.2 CONTRA VISION LIMITED

- TABLE 248 CONTRA VISION LIMITED: COMPANY OVERVIEW

- 14.2.3 MATIV

- TABLE 249 MATIV: COMPANY OVERVIEW

- 14.2.4 COSMO FILMS LIMITED

- TABLE 250 COSMO FILMS LIMITED: COMPANY OVERVIEW

- 14.2.5 TAGHLEEF INDUSTRIES

- TABLE 251 TAGHLEEF INDUSTRIES: COMPANY OVERVIEW

- 14.2.6 ACCO BRANDS

- TABLE 252 ACCO BRANDS: COMPANY OVERVIEW

- 14.2.7 ULTRAFLEX SYSTEMS INC.

- TABLE 253 ULTRAFLEX SYSTEMS INC.: COMPANY OVERVIEW

- 14.2.8 THE GRIFF NETWORK

- TABLE 254 THE GRIFF NETWORK: COMPANY OVERVIEW

- 14.2.9 BRIDGEHEAD CO., LTD.

- TABLE 255 BRIDGEHEAD CO., LTD.: COMPANY OVERVIEW

- 14.2.10 JESSUP MANUFACTURING COMPANY

- TABLE 256 JESSUP MANUFACTURING COMPANY: COMPANY OVERVIEW

- 14.2.11 GARWARE HI-TECH FILMS LIMITED

- TABLE 257 GARWARE HI-TECH FILMS LIMITED: COMPANY OVERVIEW

- 14.2.12 CELADON TECHNOLOGY COMPANY LTD.

- TABLE 258 CELADON TECHNOLOGY COMPANY LTD.: COMPANY OVERVIEW

- 14.2.13 NEKOOSA

- TABLE 259 NEKOOSA: COMPANY OVERVIEW

- 14.2.14 CONTINENTAL GRAFIX USA, INC.

- TABLE 260 CONTINENTAL GRAFIX USA, INC.: COMPANY OVERVIEW

- 14.2.15 JIANGSU AOLI NEW MATERIALS CO., LTD.

- TABLE 261 JIANGSU AOLI NEW MATERIALS CO., LTD.: COMPANY OVERVIEW

15 ADJACENT MARKET

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 LARGE FORMAT PRINTER MARKET

- TABLE 262 LARGE FORMAT PRINTER MARKET, BY REGION, 2019-2022 (USD BILLION)

- TABLE 263 LARGE FORMAT PRINTER MARKET, BY REGION, 2023-2028 (USD BILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS