|

|

市場調査レポート

商品コード

1389907

デジタルアイソレータの世界市場 (~2028年):技術 (容量性・磁気・GMR)・データレート (25~75Mbps・75Mbps超)・チャネル・絶縁材料・用途 (ゲートドライバ・DC/DCコンバータ・ADC)・産業・地域別Digital Isolator Market by Technology (Capacitive, Magnetic, GMR), Data Rate (25 to 75 Mbps, More Than 75 Mbps), Channel, Insulation Material, Application (Gate Drivers, DC/DC Converters, ADCs), Vertical and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| デジタルアイソレータの世界市場 (~2028年):技術 (容量性・磁気・GMR)・データレート (25~75Mbps・75Mbps超)・チャネル・絶縁材料・用途 (ゲートドライバ・DC/DCコンバータ・ADC)・産業・地域別 |

|

出版日: 2023年11月23日

発行: MarketsandMarkets

ページ情報: 英文 235 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

レポート概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額(米ドル) |

| セグメント別 | 技術・データレート・チャネル・絶縁材料・用途・産業・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

デジタルアイソレータの市場規模は、2022年の19億米ドルから、予測期間中は8.6%のCAGRで推移し、2028年には31億米ドルの規模に成長すると予測されています。

ノイズフリーのエレクトロニクスや電気デバイスへの需要の高まりが同市場の成長を推進しており、また、過酷環境でのアイソレータの使用の増加や、高い動作効率と省スペース設計によるデジタルアイソレータの導入拡大も、デジタルアイソレータ市場に有利な機会をもたらしています。

チャネル別で見ると、4チャネルの部音が予測期間中、最大のシェアを示す見通しです。4チャンネルデジタルアイソレータは、工業、ヘルスケア、自動車産業での採用が増加しているため、2022年には金額ベースで最大のシェア(~31%)を示しました。

絶縁材料別では、二酸化ケイ素(SiO2)ベースの部門が予測期間中に最大の市場シェアを示す見通しです。SiO2ベースのデジタルアイソレータは、2023年に金額ベースで最大の市場シェア(~56%)を占めると推定されています。

当レポートでは、世界のデジタルアイソレータの市場を調査し、市場概要、市場成長への各種影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客の事業に影響を与える動向/ディスラプション

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 特許分析

- 貿易分析

- 主要な会議とイベント

- 規制状況と基準

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- ケーススタディ分析

第6章 デジタルアイソレータ市場:技術別

- 容量性カップリング

- 磁気カップリング

- GMR (Giant Magnetoresistive)

第7章 デジタルアイソレータ市場:データレート別

- 25MBPS未満

- 25~75MBPS

- 75MBPS超

第8章 デジタルアイソレータ市場:チャネル別

- 2チャンネル

- 4チャンネル

- 6チャンネル

- 8チャンネル

- その他

第9章 デジタルアイソレータ市場:絶縁材料別

- 二酸化ケイ素(SIO2)

- ポリイミド

- その他

第10章 デジタルアイソレータ市場:用途別

- ゲートドライバ

- DC/DCコンバータ

- アナログデジタルコンバータ

- USBおよびその他の通信ポート

- CANアイソレータ

- その他

第11章 デジタルアイソレータ市場:産業別

- 工業

- ヘルスケア

- 自動車

- 電気通信

- 航空宇宙・防衛

- エネルギー・電力

- その他

第12章 デジタルアイソレータ市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第13章 競合情勢

- 概要

- 主要事業の採用戦略

- トップ5社の収益分析

- 市場シェア分析

- 主要企業の評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ・動向

第14章 企業プロファイル

- 主要企業

- TEXAS INSTRUMENTS INCORPORATED

- ANALOG DEVICES, INC.

- SKYWORKS SOLUTIONS, INC.

- INFINEON TECHNOLOGIES AG

- NVE CORPORATION

- ROHM CO., LTD.

- BROADCOM

- VICOR CORPORATION

- STMICROELECTRONICS

- RENESAS ELECTRONICS CORPORATION

- その他の企業

- MURATA MANUFACTURING CO., LTD.

- SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- TT ELECTRONICS

- TE CONNECTIVITY

- ADVANTECH CO., LTD.

- AMPHENOL CORPORATION

- NXP SEMICONDUCTORS

- MICROCHIP TECHNOLOGY INC.

- LITTELFUSE, INC.

- MONOLITHIC POWER SYSTEMS, INC.

- KINETIC TECHNOLOGIES

- MORNSUN GUANGZHOU SCIENCE & TECHNOLOGY CO., LTD.

- HOPE MICROELECTRONICS CO., LTD.

- SUZHOU NAXIN MICROELECTRONICS CO., LTD.

- ETL SYSTEMS LTD

第15章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Billion) |

| Segments | By Technology, Data Rate, Channel, Insulation Material, Application, Vertical and Region |

| Regions covered | North America, Europe, Asia Pacific, and ROW |

The digital isolator market was valued at USD 1.9 billion in 2022 and is projected to reach USD 3.1 billion by 2028, growing at a CAGR of 8.6% during the forecast period from 2023 to 2028. Accelerated demand for noise-free electronics and electrical devices acts as a driver whereas increasing use of isolators in harsh environmental applications, and growing deployment of digital isolators owing to high operating efficiency and space-saving design provide lucrative opportunities to the digital isolator market.

"4-channel segment of the digital isolator market holds the largest market share during the forecast period."

4-channel digital isolators accounted for the largest market share (~31%), in terms of value, in 2022 owing to the rising adoption of these digital isolators in industrial, healthcare, and automotive verticals. Analog Devices, Inc. (US), Broadcom (US), Skyworks Solutions, Inc. (US), and Texas Instruments Incorporated (US) are among a few major players offering 4-channel digital isolators.

"Silicon dioxide (SiO2)-based digital isolators segment is expected to hold the largest market share during the forecast period."

Silicon dioxide (SiO2)-based digital isolators are estimated to account for the largest market share (~56%), in terms of value, in 2023. SiO2 is a commonly used material in digital isolators manufactured by companies such as Texas Instruments Incorporated (US) and Skyworks Solutions, Inc. (US). Polyimide-based digital isolators are expected to experience the highest CAGR during the forecast period. This growth can be attributed to their superior performance, high protection, and longer lifespan compared to digital isolators based on silicon dioxide (SiO2).

"US in North America is expected to hold the largest market share during the forecast period."

The US accounted for the largest share of the digital isolator market in North America in 2022 and is expected to retain its position during the forecast. The significant presence of key players such as Analog Devices, Inc. (US); Vicor Corporation (US); and NVE Corporation (US) and the growing adoption of gate drivers in the industrial and automotive sectors are the major factors driving the market growth in the US.

In determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key officials in the digital isolator market. Following is the breakup of the profiles of the primary participants for the report.

- By Company Type: Tier 1 - 45 %, Tier 2 - 35%, and Tier 3 - 20%

- By Designation: C-Level Executives -32%, Directors- 40%, and Others - 28%

- By Region: North America- 37%, Asia Pacific - 40%, Europe- 15%, and RoW - 8%

The report profiles key digital isolator players and analyzes their market shares. Players profiled in this report are Texas Instruments Incorporated (US); Analog Devices, Inc. (US); Skyworks Solutions, Inc. (US); Infineon Technologies AG (Germany); NVE Corporation (US); ROHM CO., LTD. (Japan); Broadcom (US); Vicor Corporation (US); STMicroelectronics (Switzerland); Renesas Electronics Corporation (Japan); Murata Manufacturing Co., Ltd. (Japan), etc.

Research Coverage

The report defines, describes, and forecasts the digital isolator market based on Technology, Data Rate, Channel, Insulating Material, Applications, Vertical, and Region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the digital isolator market. It also analyzes competitive developments such as product launches, acquisitions, expansions, contracts, partnerships, and actions conducted by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall digital isolator market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increased adoption of digital isolators as substitute for optocouplers, high demand for digital isolators from electric vehicle and battery pack manufacturers, elevated use of renewable energy sources worldwide, accelerated demand for noise-free electronics and electrical devices, surged adoption of digital isolators as gate drivers, and significant demand for digital isolators in industrial motor-drive applications), restraints (Inability of digital isolators to transmit low-frequency signals without modulators), opportunities (Rising adoption of electric vehicles globally, increasing safety regulations in industrial automation, growing focus on utilizing digital isolators in high-altitude operations, increasing use of isolators in harsh environmental applications, and growing deployment of digital isolators owing to high operating efficiency and space-saving design), and challenges (High cost of digital isolators compared to optocouplers) influencing the growth of the digital isolator market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the digital isolator market

- Market Development: Comprehensive information about lucrative markets - the report analyses the digital isolator market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the digital isolator market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Texas Instruments Incorporated (US); Analog Devices, Inc. (US); Skyworks Solutions, Inc. (US); Infineon Technologies AG (Germany); NVE Corporation (US); ROHM CO., LTD. (Japan); Broadcom (US); Vicor Corporation (US); STMicroelectronics (Switzerland); Renesas Electronics Corporation (Japan); Murata Manufacturing Co., Ltd. (Japan); Semiconductor Components Industries, LLC (Onsemi) (US); TT Electronics (UK); TE Connectivity (Switzerland); Advantech Co., Ltd. (Taiwan); Amphenol Corporation (US); NXP Semiconductors (Netherlands); Microchip Technology Inc. (US); Littelfuse, Inc. (US); Monolithic Power Systems, Inc. (US); Kinetic Technologies (US), among others in the digital isolator market strategies. The report also helps stakeholders understand the pulse of the digital isolator market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 DIGITAL ISOLATOR MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 DIGITAL ISOLATOR MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND-SIDE ANALYSIS)

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE ANALYSIS) - REVENUES GENERATED BY COMPANIES FROM SALES OF PRODUCTS OFFERED IN DIGITAL ISOLATOR MARKET

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON DIGITAL ISOLATOR MARKET

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 9 CAPACITIVE COUPLING TECHNOLOGY TO HOLD LARGEST SHARE OF DIGITAL ISOLATOR MARKET IN 2023

- FIGURE 10 MORE THAN 75 MBPS SEGMENT TO LEAD DIGITAL ISOLATOR MARKET, BY DATA RATE, DURING FORECAST PERIOD

- FIGURE 11 4-CHANNEL DIGITAL ISOLATORS TO CAPTURE MAJORITY OF MARKET SHARE IN 2028

- FIGURE 12 SILICON DIOXIDE (SIO2) SEGMENT TO ACCOUNT FOR LARGEST SHARE OF DIGITAL ISOLATOR MARKET, BY INSULATING MATERIAL, IN 2028

- FIGURE 13 GATE DRIVERS TO CAPTURE LARGEST SHARE OF DIGITAL ISOLATOR MARKET, BY APPLICATION, IN 2028

- FIGURE 14 AUTOMOTIVE VERTICAL TO RECORD HIGHEST CAGR IN DIGITAL ISOLATOR MARKET DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF DIGITAL ISOLATOR MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 MAJOR OPPORTUNITIES FOR PLAYERS IN DIGITAL ISOLATOR MARKET

- FIGURE 16 INCREASING ADOPTION OF DIGITAL ISOLATORS AS SUBSTITUTE FOR OPTOCOUPLERS TO CREATE OPPORTUNITIES FOR PLAYERS IN DIGITAL ISOLATOR MARKET

- 4.2 DIGITAL ISOLATOR MARKET, BY TECHNOLOGY

- FIGURE 17 CAPACITIVE COUPLING TECHNOLOGY TO ACCOUNT FOR LARGEST SHARE OF DIGITAL ISOLATOR MARKET THROUGHOUT FORECAST PERIOD

- 4.3 DIGITAL ISOLATOR MARKET, BY DATA RATE

- FIGURE 18 DIGITAL ISOLATORS WITH DATA RATES OF MORE THAN 75 MBPS TO COMMAND MARKET FROM 2023 TO 2028

- 4.4 DIGITAL ISOLATOR MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

- FIGURE 19 GATE DRIVERS AND CHINA TO HOLD LARGEST MARKET SHARES OF ASIA PACIFIC DIGITAL ISOLATOR MARKET, BY APPLICATION AND COUNTRY, RESPECTIVELY, IN 2023

- 4.5 DIGITAL ISOLATOR MARKET, BY VERTICAL

- FIGURE 20 INDUSTRIAL VERTICAL TO HOLD LARGEST MARKET SHARE IN 2028

- 4.6 DIGITAL ISOLATOR MARKET, BY COUNTRY

- FIGURE 21 INDIA TO REGISTER HIGHEST CAGR IN GLOBAL DIGITAL ISOLATOR MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 DIGITAL ISOLATOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increased adoption of digital isolators as substitute for optocouplers

- TABLE 1 COMPARISON OF OPTOCOUPLERS WITH DIGITAL ISOLATORS

- 5.2.1.2 High demand for digital isolators from electric vehicle and battery pack manufacturers

- 5.2.1.3 Elevated use of renewable energy sources worldwide

- FIGURE 23 GLOBAL SOLAR PV AND WIND INSTALLATIONS, 2018-2027 (GW)

- FIGURE 24 GLOBAL INVESTMENTS IN CLEAN ENERGY AND ENERGY EFFICIENCY PROJECTS, 2019-2022

- 5.2.1.4 Accelerated demand for noise-free electronics and electrical devices

- 5.2.1.5 Surged adoption of digital isolators as gate drivers

- 5.2.1.6 Significant demand for digital isolators in industrial motor-drive applications

- FIGURE 25 IMPACT ANALYSIS OF DRIVERS ON DIGITAL ISOLATOR MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 Inability of digital isolators to transmit low-frequency signals without modulators

- FIGURE 26 IMPACT ANALYSIS OF RESTRAINTS ON DIGITAL ISOLATOR MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising adoption of electric vehicles globally

- FIGURE 27 SALES OF ELECTRIC VEHICLES, BY GEOGRAPHY, 2019-2022 (MILLION UNITS)

- 5.2.3.2 Increasing safety regulations in industrial automation

- 5.2.3.3 Growing focus on utilizing digital isolators in high-altitude operations

- TABLE 2 MULTIPLICATION FACTORS REQUIRED FOR CLEARANCES AT HIGH ALTITUDES

- 5.2.3.4 Increasing use of isolators in harsh environmental applications

- 5.2.3.5 Growing deployment of digital isolators owing to high operating efficiency and space-saving design

- FIGURE 28 IMPACT ANALYSIS OF OPPORTUNITIES ON DIGITAL ISOLATOR MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of digital isolators than optocouplers

- FIGURE 29 IMPACT ANALYSIS OF CHALLENGES ON DIGITAL ISOLATOR MARKET

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 30 TRENDS/DISRUPTIONS AFFECTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- FIGURE 31 AVERAGE SELLING PRICE (ASP) OF DIGITAL ISOLATORS, BY TECHNOLOGY, 2019-2028 (USD)

- TABLE 3 AVERAGE SELLING PRICE OF DIGITAL ISOLATORS OFFERED BY KEY SUPPLIERS (USD)

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 32 DIGITAL ISOLATOR MARKET: VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- FIGURE 33 ECOSYSTEM FOR DIGITAL ISOLATORS

- TABLE 4 ROLE OF PLAYERS IN DIGITAL ISOLATOR ECOSYSTEM

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 5G TECHNOLOGY

- 5.7.2 BATTERY MANAGEMENT SYSTEMS (BMS) IN ELECTRIC VEHICLES

- 5.7.3 GIANT MAGNETORESISTIVE COUPLING TECHNOLOGY

- 5.8 PATENT ANALYSIS

- FIGURE 34 ANALYSIS OF PATENTS APPLIED AND GRANTED FOR PRODUCTS OFFERED IN DIGITAL ISOLATOR MARKET, 2012-2022

- 5.8.1 LIST OF MAJOR PATENTS

- TABLE 5 LIST OF MAJOR PATENTS IN DIGITAL ISOLATOR MARKET

- 5.9 TRADE ANALYSIS

- 5.9.1 TRADE DATA FOR HS CODE 854239

- FIGURE 35 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 854239, BY COUNTRY, 2018-2022 (USD THOUSAND)

- FIGURE 36 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 854239, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.9.2 TARIFF ANALYSIS

- TABLE 6 MFN TARIFFS FOR HS CODE 854239-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 7 MFN TARIFFS FOR HS CODE 854239-COMPLIANT PRODUCTS EXPORTED BY SINGAPORE

- TABLE 8 MFN TARIFFS FOR HS CODE 854239-COMPLIANT PRODUCTS EXPORTED BY TAIWAN

- 5.10 KEY CONFERENCES AND EVENTS, 2024

- TABLE 9 DIGITAL ISOLATOR MARKET: LIST OF CONFERENCES AND EVENTS

- 5.11 REGULATORY LANDSCAPE AND STANDARDS

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 STANDARDS RELATED TO DIGITAL ISOLATORS

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- TABLE 15 IMPACT OF PORTER'S FIVE FORCES ON DIGITAL ISOLATOR MARKET

- FIGURE 37 DIGITAL ISOLATOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

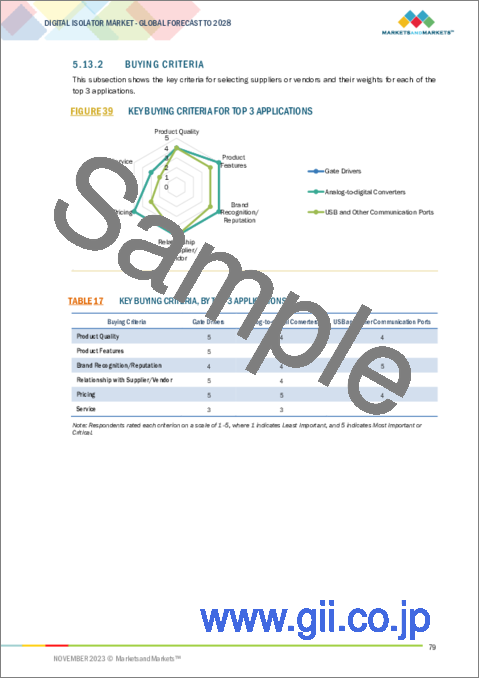

- 5.13.2 BUYING CRITERIA

- FIGURE 39 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 17 KEY BUYING CRITERIA, BY TOP 3 APPLICATIONS

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 TEXAS INSTRUMENTS DEPLOYED ISOS141-SEP ISOLATOR TO ENHANCE SYSTEM INTEGRITY AND PERFORMANCE OF LOW EARTH ORBIT SATELLITE

6 DIGITAL ISOLATOR MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- FIGURE 40 DIGITAL ISOLATOR MARKET, BY TECHNOLOGY

- FIGURE 41 GIANT MAGNETORESISTIVE DIGITAL ISOLATORS TO RECORD HIGHEST CAGR FROM 2023 TO 2028

- TABLE 18 DIGITAL ISOLATOR MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 19 DIGITAL ISOLATOR MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 20 DIGITAL ISOLATOR MARKET, BY TECHNOLOGY, 2019-2022 (MILLION UNITS)

- TABLE 21 DIGITAL ISOLATOR MARKET, BY TECHNOLOGY, 2023-2028 (MILLION UNITS)

- 6.2 CAPACITIVE COUPLING

- 6.2.1 LOW-POWER DISSIPATION AND HIGH-SPEED OPERATIONS TO BOOST DEMAND FOR CAPACITIVE COUPLING DIGITAL ISOLATORS

- 6.3 MAGNETIC COUPLING

- 6.3.1 USE OF MAGNETIC COUPLING TO ELIMINATE EFFECT OF ELECTRIC FIELD ON ENCLOSED CIRCUITS TO BOOST SEGMENTAL GROWTH

- 6.4 GIANT MAGNETORESISTIVE

- 6.4.1 SUPERIOR ISOLATION AND RADIATION TOLERANCE OF GMR TECHNOLOGY TO ACCELERATE DEMAND

7 DIGITAL ISOLATOR MARKET, BY DATA RATE

- 7.1 INTRODUCTION

- FIGURE 42 DIGITAL ISOLATOR MARKET, BY DATA RATE

- FIGURE 43 DIGITAL ISOLATORS WITH DATA RATES OF MORE THAN 75 MBPS TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 22 DIGITAL ISOLATOR MARKET, BY DATA RATE, 2019-2022 (USD MILLION)

- TABLE 23 DIGITAL ISOLATOR MARKET, BY DATA RATE, 2023-2028 (USD MILLION)

- TABLE 24 DIGITAL ISOLATOR MARKET, BY DATA RATE, 2019-2022 (MILLION UNITS)

- TABLE 25 DIGITAL ISOLATOR MARKET, BY DATA RATE, 2023-2028 (MILLION UNITS)

- 7.2 LESS THAN 25 MBPS

- 7.2.1 GROWING ADOPTION IN SINGLE- AND DUAL-CHANNEL ISOLATION APPLICATIONS TO DRIVE MARKET

- 7.3 25 TO 75 MBPS

- 7.3.1 INCREASING USE IN 4- AND 6-CHANNEL ISOLATION APPLICATIONS TO BOOST SEGMENTAL GROWTH

- 7.4 MORE THAN 75 MBPS

- 7.4.1 RISING INTEGRATION INTO PRINTED CIRCUIT BOARD TRACES, BACKPLANES, AND CABLES TO FUEL SEGMENTAL GROWTH

8 DIGITAL ISOLATOR MARKET, BY CHANNEL

- 8.1 INTRODUCTION

- FIGURE 44 DIGITAL ISOLATOR MARKET, BY CHANNEL

- FIGURE 45 8-CHANNEL DIGITAL ISOLATORS TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- TABLE 26 DIGITAL ISOLATOR MARKET, BY CHANNEL, 2019-2022 (USD MILLION)

- TABLE 27 DIGITAL ISOLATOR MARKET, BY CHANNEL, 2023-2028 (USD MILLION)

- TABLE 28 DIGITAL ISOLATOR MARKET, BY CHANNEL, 2019-2022 (MILLION UNITS)

- TABLE 29 DIGITAL ISOLATOR MARKET, BY CHANNEL, 2023-2028 (MILLION UNITS)

- 8.2 2-CHANNEL

- 8.2.1 RISING USE AS SUBSTITUTE FOR OPTICAL ISOLATORS TO DRIVE MARKET

- 8.3 4-CHANNEL

- 8.3.1 INCREASING ADOPTION IN DC/DC CONVERTERS AND SERIAL PERIPHERAL INTERFACES TO FUEL MARKET GROWTH

- 8.4 6-CHANNEL

- 8.4.1 GROWING DEPLOYMENT IN USB PORTS, SPI-BUS ISOLATORS, PLCS, AND DC/DC CONVERTERS TO SUPPORT MARKET GROWTH

- 8.5 8-CHANNEL

- 8.5.1 SURGING UTILIZATION IN INDUSTRIAL AUTOMATION AND AUTOMOTIVE APPLICATIONS TO FOSTER MARKET GROWTH

- 8.6 OTHERS

9 DIGITAL ISOLATOR MARKET, BY INSULATING MATERIAL

- 9.1 INTRODUCTION

- FIGURE 46 DIGITAL ISOLATOR MARKET, BY INSULATING MATERIAL

- FIGURE 47 SILICON DIOXIDE (SIO2)-BASED DIGITAL ISOLATORS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- TABLE 30 DIGITAL ISOLATOR MARKET, BY INSULATING MATERIAL, 2019-2022 (USD MILLION)

- TABLE 31 DIGITAL ISOLATOR MARKET, BY INSULATING MATERIAL, 2023-2028 (USD MILLION)

- 9.2 SILICON DIOXIDE (SIO2)

- 9.2.1 HIGH DURABILITY AND CAPACITY TO WITHSTAND EXTREMELY HIGH VOLTAGES TO BOOST DEMAND

- TABLE 32 COMPARISON OF DIELECTRIC STRENGTH OF DIFFERENT INSULATING MATERIALS

- 9.3 POLYIMIDE

- 9.3.1 BETTER PROTECTION AND THERMAL STABILITY AND DELAYED AGING IN POLYIMIDE-BASED DIGITAL ISOLATORS TO DRIVE MARKET

- TABLE 33 COMPARISON BETWEEN POLYIMIDE- AND SIO2-BASED INSULATING MATERIALS

- 9.4 OTHER MATERIALS

10 DIGITAL ISOLATOR MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 48 DIGITAL ISOLATOR MARKET, BY APPLICATION

- FIGURE 49 ANALOG-TO-DIGITAL CONVERTERS TO WITNESS HIGHEST CAGR IN DIGITAL ISOLATOR MARKET DURING FORECAST PERIOD

- TABLE 34 DIGITAL ISOLATOR MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 35 DIGITAL ISOLATOR MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2 GATE DRIVERS

- 10.2.1 INCREASING FOCUS ON SAFETY, RELIABILITY, AND PRECISE CONTROL IN POWER ELECTRONICS TO FUEL SEGMENTAL GROWTH

- TABLE 36 GATE DRIVERS: DIGITAL ISOLATOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 37 GATE DRIVERS: DIGITAL ISOLATOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 38 GATE DRIVERS: DIGITAL ISOLATOR MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 39 GATE DRIVERS: DIGITAL ISOLATOR MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 40 GATE DRIVERS: DIGITAL ISOLATOR MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 41 GATE DRIVERS: DIGITAL ISOLATOR MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 42 GATE DRIVERS: DIGITAL ISOLATOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 43 GATE DRIVERS: DIGITAL ISOLATOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 44 GATE DRIVERS: DIGITAL ISOLATOR MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 45 GATE DRIVERS: DIGITAL ISOLATOR MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- TABLE 46 GATE DRIVERS: DIGITAL ISOLATOR MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 47 GATE DRIVERS: DIGITAL ISOLATOR MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.3 DC/DC CONVERTERS

- 10.3.1 GROWING ADOPTION OF DC/DC CONVERTERS TO REDUCE OPERATING TEMPERATURE OF DEVICES TO BOOST DEMAND FOR DIGITAL ISOLATORS

- TABLE 48 DC/DC CONVERTERS: DIGITAL ISOLATOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 49 DC/DC CONVERTERS: DIGITAL ISOLATOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 50 DC/DC CONVERTERS: DIGITAL ISOLATOR MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 51 DC/DC CONVERTERS: DIGITAL ISOLATOR MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 52 DC/DC CONVERTERS: DIGITAL ISOLATOR MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 53 DC/DC CONVERTERS: DIGITAL ISOLATOR MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 54 DC/DC CONVERTERS: DIGITAL ISOLATOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 55 DC/DC CONVERTERS: DIGITAL ISOLATOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 56 DC/DC CONVERTERS: DIGITAL ISOLATOR MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 57 DC/DC CONVERTERS: DIGITAL ISOLATOR MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- TABLE 58 DC/DC CONVERTERS: DIGITAL ISOLATOR MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 59 DC/DC CONVERTERS: DIGITAL ISOLATOR MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.4 ANALOG-TO-DIGITAL CONVERTERS

- 10.4.1 INTEGRATION OF DIGITAL ISOLATORS INTO ADCS TO MINIMIZE EMI AND VOLTAGE OFFSET ISSUES TO DRIVE MARKET

- TABLE 60 ANALOG-TO-DIGITAL CONVERTERS: DIGITAL ISOLATOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 61 ANALOG-TO-DIGITAL CONVERTERS: DIGITAL ISOLATOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 62 ANALOG-TO-DIGITAL CONVERTERS: DIGITAL ISOLATOR MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 63 ANALOG-TO-DIGITAL CONVERTERS: DIGITAL ISOLATOR MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 64 ANALOG-TO-DIGITAL CONVERTERS: DIGITAL ISOLATOR MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 65 ANALOG-TO-DIGITAL CONVERTERS: DIGITAL ISOLATOR MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 66 ANALOG-TO-DIGITAL CONVERTERS: DIGITAL ISOLATOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 67 ANALOG-TO-DIGITAL CONVERTERS: DIGITAL ISOLATOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 68 ANALOG-TO-DIGITAL CONVERTERS: DIGITAL ISOLATOR MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 69 ANALOG-TO-DIGITAL CONVERTERS: DIGITAL ISOLATOR MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- TABLE 70 ANALOG-TO-DIGITAL CONVERTERS: DIGITAL ISOLATOR MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 71 ANALOG-TO-DIGITAL CONVERTERS: DIGITAL ISOLATOR MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.5 USB AND OTHER COMMUNICATION PORTS

- 10.5.1 RISING DEMAND FROM HEALTHCARE AND INDUSTRIAL VERTICALS TO ACCELERATE SEGMENTAL GROWTH

- TABLE 72 USB AND OTHER COMMUNICATION PORTS: DIGITAL ISOLATOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 73 USB AND OTHER COMMUNICATION PORTS: DIGITAL ISOLATOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 74 USB AND OTHER COMMUNICATION PORTS: DIGITAL ISOLATOR MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 75 USB AND OTHER COMMUNICATION PORTS: DIGITAL ISOLATOR MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 76 USB AND OTHER COMMUNICATION PORTS: DIGITAL ISOLATOR MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 77 USB AND OTHER COMMUNICATION PORTS: DIGITAL ISOLATOR MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 78 USB AND OTHER COMMUNICATION PORTS: DIGITAL ISOLATOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 79 USB AND OTHER COMMUNICATION PORTS: DIGITAL ISOLATOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 80 USB AND OTHER COMMUNICATION PORTS: DIGITAL ISOLATOR MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 81 USB AND OTHER COMMUNICATION PORTS: DIGITAL ISOLATOR MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- TABLE 82 USB AND OTHER COMMUNICATION PORTS: DIGITAL ISOLATOR MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 83 USB AND OTHER COMMUNICATION PORTS: DIGITAL ISOLATOR MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.6 CAN ISOLATORS

- 10.6.1 INSTALLATION OF CAN BUS INTO EVS AND HEVS TO ACCELERATE DEMAND FOR DIGITAL ISOLATORS

- TABLE 84 CAN ISOLATORS: DIGITAL ISOLATOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 85 CAN ISOLATORS: DIGITAL ISOLATOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 86 CAN ISOLATORS: DIGITAL ISOLATOR MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 87 CAN ISOLATORS: DIGITAL ISOLATOR MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 88 CAN ISOLATORS: DIGITAL ISOLATOR MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 89 CAN ISOLATORS: DIGITAL ISOLATOR MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 90 CAN ISOLATORS: DIGITAL ISOLATOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 91 CAN ISOLATORS: DIGITAL ISOLATOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 92 CAN ISOLATORS: DIGITAL ISOLATOR MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 93 CAN ISOLATORS: DIGITAL ISOLATOR MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- TABLE 94 CAN ISOLATORS: DIGITAL ISOLATOR MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 95 CAN ISOLATORS: DIGITAL ISOLATOR MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.7 OTHER APPLICATIONS

- TABLE 96 OTHER APPLICATIONS: DIGITAL ISOLATOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 97 OTHER APPLICATIONS: DIGITAL ISOLATOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 98 OTHER APPLICATIONS: DIGITAL ISOLATOR MARKET IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 99 OTHER APPLICATIONS: DIGITAL ISOLATOR MARKET IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 100 OTHER APPLICATIONS: DIGITAL ISOLATOR MARKET IN EUROPE, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 101 OTHER APPLICATIONS: DIGITAL ISOLATOR MARKET IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 102 OTHER APPLICATIONS: DIGITAL ISOLATOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 103 OTHER APPLICATIONS: DIGITAL ISOLATOR MARKET IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 104 OTHER APPLICATIONS: DIGITAL ISOLATOR MARKET IN ROW, BY REGION, 2019-2022 (USD MILLION)

- TABLE 105 OTHER APPLICATIONS: DIGITAL ISOLATOR MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- TABLE 106 OTHER APPLICATIONS: DIGITAL ISOLATOR MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 107 OTHER APPLICATIONS: DIGITAL ISOLATOR MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

11 DIGITAL ISOLATOR MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- FIGURE 50 DIGITAL ISOLATOR MARKET, BY VERTICAL

- FIGURE 51 INDUSTRIAL VERTICAL TO HOLD LARGEST SHARE OF DIGITAL ISOLATOR MARKET IN 2028

- TABLE 108 DIGITAL ISOLATOR MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 109 DIGITAL ISOLATOR MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.2 INDUSTRIAL

- 11.2.1 INCREASING FOCUS ON RESOLVING SAFETY, NOISE, AND COMMON-MODE VOLTAGE ISSUES IN INDUSTRIAL AUTOMATION TO BOOST DEMAND

- TABLE 110 INDUSTRIAL: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 111 INDUSTRIAL: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3 HEALTHCARE

- 11.3.1 GROWING USE OF DIGITAL ISOLATORS IN PATIENT MONITORING SYSTEMS, IMAGING EQUIPMENT, AND ANALYZERS TO DRIVE MARKET

- TABLE 112 HEALTHCARE: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 113 HEALTHCARE: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4 AUTOMOTIVE

- 11.4.1 RISING ADOPTION OF ELECTRIC VEHICLES TO FUEL NEED FOR DIGITAL ISOLATORS TO IMPROVE SAFETY AND NOISE IMMUNITY

- TABLE 114 AUTOMOTIVE: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 115 AUTOMOTIVE: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5 TELECOMMUNICATIONS

- 11.5.1 DEPLOYMENT OF DIGITAL ISOLATORS IN TELECOM EQUIPMENT TO ENSURE SIGNAL INTEGRITY AND RELIABILITY TO SUPPORT MARKET GROWTH

- TABLE 116 TELECOMMUNICATIONS: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 117 TELECOMMUNICATIONS: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6 AEROSPACE & DEFENSE

- 11.6.1 HIGH RELIABILITY, NOISE IMMUNITY, AND FAULT TOLERANCE OF DIGITAL ISOLATORS TO STIMULATE ADOPTION IN AEROSPACE & DEFENSE APPLICATIONS

- TABLE 118 AEROSPACE & DEFENSE: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 119 AEROSPACE & DEFENSE: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.7 ENERGY & POWER

- 11.7.1 STRONG FOCUS ON MINIMIZING POWER LOSSES TO ACCELERATE DEMAND FOR DIGITAL ISOLATORS

- TABLE 120 ENERGY & POWER: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 121 ENERGY & POWER: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.8 OTHER VERTICALS

- TABLE 122 OTHER VERTICALS: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 123 OTHER VERTICALS: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

12 DIGITAL ISOLATOR MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 52 DIGITAL ISOLATOR MARKET: BY REGION

- FIGURE 53 ASIA PACIFIC TO DOMINATE DIGITAL ISOLATOR MARKET DURING FORECAST PERIOD

- TABLE 124 DIGITAL ISOLATOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 125 DIGITAL ISOLATOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.2 NORTH AMERICA

- FIGURE 54 NORTH AMERICA: DIGITAL ISOLATOR MARKET, BY COUNTRY

- FIGURE 55 SNAPSHOT: DIGITAL ISOLATOR MARKET IN NORTH AMERICA

- TABLE 126 NORTH AMERICA: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 127 NORTH AMERICA: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 128 NORTH AMERICA: DIGITAL ISOLATOR MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 129 NORTH AMERICA: DIGITAL ISOLATOR MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.2.1 IMPACT OF RECESSION ON DIGITAL ISOLATOR MARKET IN NORTH AMERICA

- FIGURE 56 ANALYSIS OF DIGITAL ISOLATOR MARKET IN NORTH AMERICA: PRE- AND POST-RECESSION SCENARIOS

- 12.2.2 US

- 12.2.2.1 Growing need for battery management systems in US to fuel demand for digital isolators

- 12.2.3 CANADA

- 12.2.3.1 Increasing sales of electric vehicles in Canada to support market growth

- 12.2.4 MEXICO

- 12.2.4.1 Prominent presence of major automobile manufacturers to stimulate demand for digital isolators

- 12.3 EUROPE

- FIGURE 57 EUROPE: DIGITAL ISOLATOR MARKET, BY COUNTRY

- FIGURE 58 SNAPSHOT: DIGITAL ISOLATOR MARKET IN EUROPE

- TABLE 130 EUROPE: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 131 EUROPE: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 132 EUROPE: DIGITAL ISOLATOR MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 133 EUROPE: DIGITAL ISOLATOR MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.3.1 IMPACT OF RECESSION ON DIGITAL ISOLATOR MARKET IN EUROPE

- FIGURE 59 ANALYSIS OF DIGITAL ISOLATOR MARKET IN EUROPE: PRE- AND POST-RECESSION SCENARIOS

- 12.3.2 UK

- 12.3.2.1 Presence of several medical device manufacturers to spur demand for digital isolators

- 12.3.3 GERMANY

- 12.3.3.1 Significant presence of OEMs in robotics and automation fields to drive market

- 12.3.4 FRANCE

- 12.3.4.1 Smart factory initiatives to boost demand for digital isolators

- 12.3.5 REST OF EUROPE

- 12.4 ASIA PACIFIC

- FIGURE 60 ASIA PACIFIC: DIGITAL ISOLATOR MARKET, BY COUNTRY

- FIGURE 61 SNAPSHOT: DIGITAL ISOLATOR MARKET IN ASIA PACIFIC

- TABLE 134 ASIA PACIFIC: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 136 ASIA PACIFIC: DIGITAL ISOLATOR MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 137 ASIA PACIFIC: DIGITAL ISOLATOR MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.4.1 IMPACT OF RECESSION ON DIGITAL ISOLATOR MARKET IN ASIA PACIFIC

- FIGURE 62 ANALYSIS OF DIGITAL ISOLATOR MARKET IN ASIA PACIFIC: PRE- AND POST-RECESSION SCENARIOS

- 12.4.2 CHINA

- 12.4.2.1 Increasing investments in medical equipment and devices to support market growth

- 12.4.3 JAPAN

- 12.4.3.1 Presence of major manufacturers of electronic devices and components to drive market

- 12.4.4 INDIA

- 12.4.4.1 Make in India initiatives by government to fuel demand for digital isolators

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Rising investments in EV industry to accelerate market growth

- 12.4.6 REST OF ASIA PACIFIC

- 12.5 ROW

- FIGURE 63 ROW: DIGITAL ISOLATOR MARKET, BY REGION

- TABLE 138 ROW: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 139 ROW: DIGITAL ISOLATOR MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 140 ROW: DIGITAL ISOLATOR MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 141 ROW: DIGITAL ISOLATOR MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.5.1 IMPACT OF RECESSION ON DIGITAL ISOLATOR MARKET IN ROW

- FIGURE 64 ANALYSIS OF DIGITAL ISOLATOR MARKET IN ROW: PRE- AND POST-RECESSION SCENARIOS

- 12.5.2 MIDDLE EAST & AFRICA

- 12.5.2.1 Increasing use of digital isolators in solar energy applications to drive market

- 12.5.3 SOUTH AMERICA

- 12.5.3.1 Growing renewable energy production to boost demand for digital isolators

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.1.1 INTRODUCTION

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 142 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN DIGITAL ISOLATOR MARKET

- 13.3 REVENUE ANALYSIS OF TOP 5 PLAYERS

- FIGURE 65 THREE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN DIGITAL ISOLATOR MARKET, 2020-2022

- 13.4 MARKET SHARE ANALYSIS

- TABLE 143 DIGITAL ISOLATOR MARKET: DEGREE OF COMPETITION

- TABLE 144 DIGITAL ISOLATOR MARKET: RANKING ANALYSIS

- FIGURE 66 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- 13.5 EVALUATION MATRIX FOR MAJOR PLAYERS, 2022

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 67 DIGITAL ISOLATOR MARKET: EVALUATION MATRIX FOR MAJOR COMPANIES, 2022

- 13.5.5 COMPANY FOOTPRINT

- TABLE 145 DATA RATE FOOTPRINT (16 COMPANIES)

- TABLE 146 CHANNEL FOOTPRINT (16 COMPANIES)

- TABLE 147 TECHNOLOGY FOOTPRINT (16 COMPANIES)

- TABLE 148 VERTICAL FOOTPRINT (16 COMPANIES)

- TABLE 149 REGION FOOTPRINT (16 COMPANIES)

- TABLE 150 OVERALL FOOTPRINT

- 13.6 EVALUATION MATRIX FOR STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES), 2022

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- FIGURE 68 DIGITAL ISOLATOR MARKET: EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- TABLE 151 DIGITAL ISOLATOR MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 152 DIGITAL ISOLATOR MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.7 COMPETITIVE SCENARIOS AND TRENDS

- 13.7.1 PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 153 DIGITAL ISOLATOR MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2020-2021

- 13.7.2 DEALS

- TABLE 154 DEALS, 2021-2023

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

(Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths/Right to win, Strategic choices, and Weaknesses/Competitive threats)**

- 14.2.1 TEXAS INSTRUMENTS INCORPORATED

- TABLE 155 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- FIGURE 69 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- TABLE 156 TEXAS INSTRUMENTS INCORPORATED: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 157 TEXAS INSTRUMENTS INCORPORATED: PRODUCT/SOLUTION/SERVICE LAUNCHES

- TABLE 158 TEXAS INSTRUMENTS INCORPORATED: DEALS

- 14.2.2 ANALOG DEVICES, INC.

- TABLE 159 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- FIGURE 70 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- TABLE 160 ANALOG DEVICES, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 161 ANALOG DEVICES, INC.: PRODUCT/SOLUTION/SERVICE LAUNCHES

- TABLE 162 ANALOG DEVICES, INC.: DEALS

- 14.2.3 SKYWORKS SOLUTIONS, INC.

- TABLE 163 SKYWORKS SOLUTIONS, INC.: COMPANY OVERVIEW

- FIGURE 71 SKYWORKS SOLUTIONS, INC.: COMPANY SNAPSHOT

- TABLE 164 SKYWORKS SOLUTIONS, INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 165 SKYWORKS SOLUTIONS, INC.: DEALS

- 14.2.4 INFINEON TECHNOLOGIES AG

- TABLE 166 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- FIGURE 72 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- TABLE 167 INFINEON TECHNOLOGIES AG: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 168 INFINEON TECHNOLOGIES AG: PRODUCT/SOLUTION/SERVICE LAUNCHES

- TABLE 169 INFINEON TECHNOLOGIES AG: DEALS

- 14.2.5 NVE CORPORATION

- TABLE 170 NVE CORPORATION: COMPANY OVERVIEW

- FIGURE 73 NVE CORPORATION: COMPANY SNAPSHOT

- TABLE 171 NVE CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 172 NVE CORPORATION: PRODUCT/SOLUTION/SERVICE LAUNCHES

- 14.2.6 ROHM CO., LTD.

- TABLE 173 ROHM CO., LTD.: COMPANY OVERVIEW

- FIGURE 74 ROHM CO., LTD.: COMPANY SNAPSHOT

- TABLE 174 ROHM CO., LTD.: PRODUCT/SOLUTION/SERVICE OFFERINGS

- 14.2.7 BROADCOM

- TABLE 175 BROADCOM: COMPANY OVERVIEW

- FIGURE 75 BROADCOM: COMPANY SNAPSHOT

- TABLE 176 BROADCOM: PRODUCT/SOLUTION/SERVICE OFFERINGS

- 14.2.8 VICOR CORPORATION

- TABLE 177 VICOR CORPORATION: COMPANY OVERVIEW

- FIGURE 76 VICOR CORPORATION: COMPANY SNAPSHOT

- TABLE 178 VICOR CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 179 VICOR CORPORATION: DEALS

- 14.2.9 STMICROELECTRONICS

- TABLE 180 STMICROELECTRONICS: COMPANY OVERVIEW

- FIGURE 77 STMICROELECTRONICS: COMPANY SNAPSHOT

- TABLE 181 STMICROELECTRONICS: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 182 STMICROELECTRONICS: PRODUCT/SOLUTION/SERVICE LAUNCHES

- 14.2.10 RENESAS ELECTRONICS CORPORATION

- TABLE 183 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- FIGURE 78 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- TABLE 184 RENESAS ELECTRONICS CORPORATION: PRODUCT/SOLUTION/SERVICE OFFERINGS

- TABLE 185 RENESAS ELECTRONICS CORPORATION: PRODUCT/SOLUTION/SERVICE LAUNCHES

- TABLE 186 RENESAS ELECTRONICS CORPORATION: DEALS

- 14.3 OTHER PLAYERS

- 14.3.1 MURATA MANUFACTURING CO., LTD.

- 14.3.2 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- 14.3.3 TT ELECTRONICS

- 14.3.4 TE CONNECTIVITY

- 14.3.5 ADVANTECH CO., LTD.

- 14.3.6 AMPHENOL CORPORATION

- 14.3.7 NXP SEMICONDUCTORS

- 14.3.8 MICROCHIP TECHNOLOGY INC.

- 14.3.9 LITTELFUSE, INC.

- 14.3.10 MONOLITHIC POWER SYSTEMS, INC.

- 14.3.11 KINETIC TECHNOLOGIES

- 14.3.12 MORNSUN GUANGZHOU SCIENCE & TECHNOLOGY CO., LTD.

- 14.3.13 HOPE MICROELECTRONICS CO., LTD.

- 14.3.14 SUZHOU NAXIN MICROELECTRONICS CO., LTD.

- 14.3.15 ETL SYSTEMS LTD

- *Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths/Right to win, Strategic choices, and Weaknesses/Competitive threats might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS