|

|

市場調査レポート

商品コード

1503304

軟磁性材料の2030年までの市場予測:材料別、エンドユーザー別、地域別の世界分析Soft Magnetic Materials Market Forecasts to 2030 - Global Analysis By Material (Electrical Steel, Permalloy, Ferrite, Cobalt, Iron and Other Materials), End User (Automotive, Energy, Industrial, Telecommunications and Other End Users) and By Geography |

||||||

カスタマイズ可能

|

|||||||

| 軟磁性材料の2030年までの市場予測:材料別、エンドユーザー別、地域別の世界分析 |

|

出版日: 2024年06月06日

発行: Stratistics Market Research Consulting

ページ情報: 英文 200+ Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

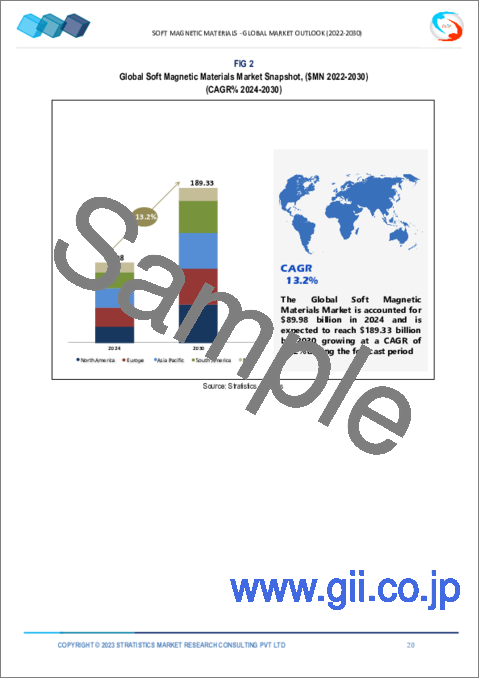

Stratistics MRCによると、軟磁性材料の世界市場は2024年に899億8,000万米ドルを占め、予測期間中のCAGRは13.2%で2030年には1,893億3,000万米ドルに達すると予測されています。

軟磁性材料は、変化する磁場に対応して迅速かつ効率的に磁化・消磁するユニークな能力を持つため、電気工学や電子工学に不可欠な部品です。一度磁化されると磁化を保持する硬磁性材料とは異なり、軟磁性材料は高い透磁率と低い保磁力を示すため、変圧器、電気モーター、インダクター、磁気シールドなど、迅速かつ可逆的な磁化が必要な用途に最適です。

日本電子情報技術産業協会(JEITA)によると、世界の電子・IT産業の生産額は2023年までに3兆4,368億米ドル(前年比3%増)に達すると予想されています。

インフラの開発と近代化

インフラの整備と近代化により、軟磁性材料の需要と応用は著しく高まっています。磁場を効率的に誘導・制御する能力で知られるこれらの材料は、幅広いインフラ関連技術において重要な部品となっています。スマートグリッド、再生可能エネルギーシステム、電気自動車、通信ネットワークなどのインフラストラクチャーの進歩には、電気エネルギーの効率的な管理と変換が必要であり、これは軟磁性材料に大きく依存しています。

原材料の高コスト

しかし、その製造に使われる鉄、ニッケル、コバルト、各種合金などの主要原材料は、近年値上がりしています。このコスト高騰はメーカーに直接影響し、生産費の上昇につながり、最終的には最終製品価格に影響を及ぼします。その結果、企業は競争力のある価格と収益性を維持するという課題に直面しています。原材料コストの変動は、サプライチェーンや生産計画を混乱させ、市場の需要に一貫して対応する努力をさらに複雑にする可能性があります。

新興経済国の需要増加

新興国からの需要の高まりは、軟磁性材料市場を大きく後押ししています。インド、中国、ブラジルなどの新興国では、急速な工業化と都市化が進んでおり、効率的なエネルギー・ソリューションと高度な電子機器へのニーズが高まっています。軟磁性材料は、素早く磁化・脱磁する能力で知られ、これらの機器の効率と性能を向上させるのに不可欠です。さらに、これらの経済圏が再生可能エネルギーの拡大と電気自動車の生産に注力するにつれて、軟磁性材料に対する需要はさらに高まっています。メーカーは、磁気特性、耐久性、費用対効果を改善した材料を開発することで、この増大する需要に応えるべく技術革新を進めています。

希土類元素の限られた入手可能性

希土類元素の利用可能量に限りがあることが、軟磁性材料の開発と生産に大きな課題をもたらしています。エレクトロニクス、通信、風力タービンや電気自動車などの再生可能エネルギー技術への応用に不可欠なこれらの材料は、その磁気特性においてネオジム、ジスプロシウム、サマリウムなどの希土類元素に大きく依存しています。しかし、これらの元素は希少であるだけでなく、地理的に集中しており、世界供給の大部分は数カ国、特に中国からもたらされています。この集中はサプライチェーンの脆弱性と価格変動を生み、これらの材料への安定的なアクセスに依存する産業に影響を与えます。

COVID-19の影響:

COVID-19パンデミックは軟磁性材料セクターに大きな影響を与えました。サプライチェーンは、工場の閉鎖、輸送の制限、労働力の減少による混乱に見舞われ、材料の生産と流通に遅れが生じました。需要の変動や原材料不足による市場の不確実性は、状況をさらに複雑にしました。加えて、遠隔地作業へのシフトと産業活動の縮小が、当初は需要全体を減退させたが、その後、産業界が新たな業務規範に適応するにつれて回復が見られました。

予測期間中はパーマロイ・セグメントが最大になる見込み

予測期間中、パーマロイ・セグメントが最大になると予想されます。軟磁性材料の一種であるパーマロイは、軟磁性材料市場の成長に大きく寄与しています。これは一般的に鉄と様々な量のニッケル(約20~80%)から成る合金で、高透磁率、低保磁力、低コアロスといった優れた磁気特性を示します。特にIT・通信、自動車、再生可能エネルギーなどの産業において、電子機器や電力システムの性能と効率を高める能力があるため、パーマロイ・セグメントの需要が高まっています。

予測期間中、産業用セグメントのCAGRが最も高くなる見込み

予測期間中、CAGRが最も高くなると予想されるのは産業用セグメントです。鉄ケイ素合金やフェライトなどの軟磁性材料は、電気モーター、変圧器、電磁デバイスの効率的な動作において重要な役割を果たしています。最小限のエネルギー損失(低ヒステリシス)で迅速に磁化・減磁できるため、高周波変圧器や電気自動車用モーターのように頻繁な磁場変化を必要とする用途に最適です。最近の動向は、合金化、微細構造制御、加工技術を通じて、これらの材料の磁気特性を向上させることに焦点が当てられています。この改良は、より高い透磁率、より低い保磁力、コア損失の低減を達成し、それによって産業機器の効率と信頼性を高めることを目的としています。

最大のシェアを占める地域

予測期間中、アジア太平洋地域が市場で最大のシェアを占めました。政府や産業界が持続可能性とエネルギー効率を優先させる中、軟磁性材料への需要が大きく伸びています。中国、日本、韓国、インドなどの国々は、急速な工業化、都市化、先端技術の採用によって、この市場拡大の最前線にいます。さらに、再生可能エネルギー発電を推進するイニシアチブが、発電・配電システムにおける軟磁性材料の需要をさらに強化しています。

CAGRが最も高い地域:

欧州地域は、予測期間中に有益な成長を示すと推定されます。厳しい環境基準や支援政策を通じて、欧州政府は業界内の技術革新と持続可能な実践を促進しています。REACH(化学物質の登録、評価、認可、制限)などの規制は、材料の安全な使用を保証し、よりクリーンな生産方法を促進し、環境への影響を低減します。さらに、先端材料技術の研究開発促進を目的としたイニシアチブは、世界市場における欧州企業の競争力を強化しています。

無料カスタマイズサービス:

本レポートをご購読のお客様には、以下の無料カスタマイズオプションのいずれかをご利用いただけます:

- 企業プロファイル

- 追加市場企業の包括的プロファイリング(3社まで)

- 主要企業のSWOT分析(3社まで)

- 地域セグメンテーション

- 顧客の関心に応じた主要国の市場推計・予測・CAGR(注:フィージビリティチェックによる)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携に基づく主要企業のベンチマーキング

目次

第1章 エグゼクティブサマリー

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査情報源

- 1次調査情報源

- 2次調査情報源

- 前提条件

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- エンドユーザー分析

- 新興市場

- COVID-19の影響

第4章 ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 世界の軟磁性材料市場:材料別

- 電気鋼

- パーマロイ

- フェライト

- コバルト

- 鉄

- その他の材料

第6章 世界の軟磁性材料市場:エンドユーザー別

- 自動車

- エネルギー

- 産業

- 通信

- その他のエンドユーザー

第7章 世界の軟磁性材料市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他アジア太平洋

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他中東・アフリカ

第8章 主な発展

- 契約、パートナーシップ、コラボレーション、合弁事業

- 買収と合併

- 新製品発売

- 事業拡大

- その他の主要戦略

第9章 企業プロファイリング

- Dexter Magnetic Technologies

- Electron Energy Corporation

- Carpenter Technology Corporation

- Mitsubishi Materials Corporation

- TDK Corporation

- Hitachi Metals, Ltd

- Voestalpine AG

- Mate Group

- Intermetallics India Pvt. Ltd

List of Tables

- Table 1 Global Soft Magnetic Materials Market Outlook, By Region (2022-2030) ($MN)

- Table 2 Global Soft Magnetic Materials Market Outlook, By Material (2022-2030) ($MN)

- Table 3 Global Soft Magnetic Materials Market Outlook, By Electrical Steel (2022-2030) ($MN)

- Table 4 Global Soft Magnetic Materials Market Outlook, By Permalloy (2022-2030) ($MN)

- Table 5 Global Soft Magnetic Materials Market Outlook, By Ferrite (2022-2030) ($MN)

- Table 6 Global Soft Magnetic Materials Market Outlook, By Cobalt (2022-2030) ($MN)

- Table 7 Global Soft Magnetic Materials Market Outlook, By Iron (2022-2030) ($MN)

- Table 8 Global Soft Magnetic Materials Market Outlook, By Other Materials (2022-2030) ($MN)

- Table 9 Global Soft Magnetic Materials Market Outlook, By End User (2022-2030) ($MN)

- Table 10 Global Soft Magnetic Materials Market Outlook, By Automotive (2022-2030) ($MN)

- Table 11 Global Soft Magnetic Materials Market Outlook, By Energy (2022-2030) ($MN)

- Table 12 Global Soft Magnetic Materials Market Outlook, By Industrial (2022-2030) ($MN)

- Table 13 Global Soft Magnetic Materials Market Outlook, By Telecommunications (2022-2030) ($MN)

- Table 14 Global Soft Magnetic Materials Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 15 North America Soft Magnetic Materials Market Outlook, By Country (2022-2030) ($MN)

- Table 16 North America Soft Magnetic Materials Market Outlook, By Material (2022-2030) ($MN)

- Table 17 North America Soft Magnetic Materials Market Outlook, By Electrical Steel (2022-2030) ($MN)

- Table 18 North America Soft Magnetic Materials Market Outlook, By Permalloy (2022-2030) ($MN)

- Table 19 North America Soft Magnetic Materials Market Outlook, By Ferrite (2022-2030) ($MN)

- Table 20 North America Soft Magnetic Materials Market Outlook, By Cobalt (2022-2030) ($MN)

- Table 21 North America Soft Magnetic Materials Market Outlook, By Iron (2022-2030) ($MN)

- Table 22 North America Soft Magnetic Materials Market Outlook, By Other Materials (2022-2030) ($MN)

- Table 23 North America Soft Magnetic Materials Market Outlook, By End User (2022-2030) ($MN)

- Table 24 North America Soft Magnetic Materials Market Outlook, By Automotive (2022-2030) ($MN)

- Table 25 North America Soft Magnetic Materials Market Outlook, By Energy (2022-2030) ($MN)

- Table 26 North America Soft Magnetic Materials Market Outlook, By Industrial (2022-2030) ($MN)

- Table 27 North America Soft Magnetic Materials Market Outlook, By Telecommunications (2022-2030) ($MN)

- Table 28 North America Soft Magnetic Materials Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 29 Europe Soft Magnetic Materials Market Outlook, By Country (2022-2030) ($MN)

- Table 30 Europe Soft Magnetic Materials Market Outlook, By Material (2022-2030) ($MN)

- Table 31 Europe Soft Magnetic Materials Market Outlook, By Electrical Steel (2022-2030) ($MN)

- Table 32 Europe Soft Magnetic Materials Market Outlook, By Permalloy (2022-2030) ($MN)

- Table 33 Europe Soft Magnetic Materials Market Outlook, By Ferrite (2022-2030) ($MN)

- Table 34 Europe Soft Magnetic Materials Market Outlook, By Cobalt (2022-2030) ($MN)

- Table 35 Europe Soft Magnetic Materials Market Outlook, By Iron (2022-2030) ($MN)

- Table 36 Europe Soft Magnetic Materials Market Outlook, By Other Materials (2022-2030) ($MN)

- Table 37 Europe Soft Magnetic Materials Market Outlook, By End User (2022-2030) ($MN)

- Table 38 Europe Soft Magnetic Materials Market Outlook, By Automotive (2022-2030) ($MN)

- Table 39 Europe Soft Magnetic Materials Market Outlook, By Energy (2022-2030) ($MN)

- Table 40 Europe Soft Magnetic Materials Market Outlook, By Industrial (2022-2030) ($MN)

- Table 41 Europe Soft Magnetic Materials Market Outlook, By Telecommunications (2022-2030) ($MN)

- Table 42 Europe Soft Magnetic Materials Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 43 Asia Pacific Soft Magnetic Materials Market Outlook, By Country (2022-2030) ($MN)

- Table 44 Asia Pacific Soft Magnetic Materials Market Outlook, By Material (2022-2030) ($MN)

- Table 45 Asia Pacific Soft Magnetic Materials Market Outlook, By Electrical Steel (2022-2030) ($MN)

- Table 46 Asia Pacific Soft Magnetic Materials Market Outlook, By Permalloy (2022-2030) ($MN)

- Table 47 Asia Pacific Soft Magnetic Materials Market Outlook, By Ferrite (2022-2030) ($MN)

- Table 48 Asia Pacific Soft Magnetic Materials Market Outlook, By Cobalt (2022-2030) ($MN)

- Table 49 Asia Pacific Soft Magnetic Materials Market Outlook, By Iron (2022-2030) ($MN)

- Table 50 Asia Pacific Soft Magnetic Materials Market Outlook, By Other Materials (2022-2030) ($MN)

- Table 51 Asia Pacific Soft Magnetic Materials Market Outlook, By End User (2022-2030) ($MN)

- Table 52 Asia Pacific Soft Magnetic Materials Market Outlook, By Automotive (2022-2030) ($MN)

- Table 53 Asia Pacific Soft Magnetic Materials Market Outlook, By Energy (2022-2030) ($MN)

- Table 54 Asia Pacific Soft Magnetic Materials Market Outlook, By Industrial (2022-2030) ($MN)

- Table 55 Asia Pacific Soft Magnetic Materials Market Outlook, By Telecommunications (2022-2030) ($MN)

- Table 56 Asia Pacific Soft Magnetic Materials Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 57 South America Soft Magnetic Materials Market Outlook, By Country (2022-2030) ($MN)

- Table 58 South America Soft Magnetic Materials Market Outlook, By Material (2022-2030) ($MN)

- Table 59 South America Soft Magnetic Materials Market Outlook, By Electrical Steel (2022-2030) ($MN)

- Table 60 South America Soft Magnetic Materials Market Outlook, By Permalloy (2022-2030) ($MN)

- Table 61 South America Soft Magnetic Materials Market Outlook, By Ferrite (2022-2030) ($MN)

- Table 62 South America Soft Magnetic Materials Market Outlook, By Cobalt (2022-2030) ($MN)

- Table 63 South America Soft Magnetic Materials Market Outlook, By Iron (2022-2030) ($MN)

- Table 64 South America Soft Magnetic Materials Market Outlook, By Other Materials (2022-2030) ($MN)

- Table 65 South America Soft Magnetic Materials Market Outlook, By End User (2022-2030) ($MN)

- Table 66 South America Soft Magnetic Materials Market Outlook, By Automotive (2022-2030) ($MN)

- Table 67 South America Soft Magnetic Materials Market Outlook, By Energy (2022-2030) ($MN)

- Table 68 South America Soft Magnetic Materials Market Outlook, By Industrial (2022-2030) ($MN)

- Table 69 South America Soft Magnetic Materials Market Outlook, By Telecommunications (2022-2030) ($MN)

- Table 70 South America Soft Magnetic Materials Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 71 Middle East & Africa Soft Magnetic Materials Market Outlook, By Country (2022-2030) ($MN)

- Table 72 Middle East & Africa Soft Magnetic Materials Market Outlook, By Material (2022-2030) ($MN)

- Table 73 Middle East & Africa Soft Magnetic Materials Market Outlook, By Electrical Steel (2022-2030) ($MN)

- Table 74 Middle East & Africa Soft Magnetic Materials Market Outlook, By Permalloy (2022-2030) ($MN)

- Table 75 Middle East & Africa Soft Magnetic Materials Market Outlook, By Ferrite (2022-2030) ($MN)

- Table 76 Middle East & Africa Soft Magnetic Materials Market Outlook, By Cobalt (2022-2030) ($MN)

- Table 77 Middle East & Africa Soft Magnetic Materials Market Outlook, By Iron (2022-2030) ($MN)

- Table 78 Middle East & Africa Soft Magnetic Materials Market Outlook, By Other Materials (2022-2030) ($MN)

- Table 79 Middle East & Africa Soft Magnetic Materials Market Outlook, By End User (2022-2030) ($MN)

- Table 80 Middle East & Africa Soft Magnetic Materials Market Outlook, By Automotive (2022-2030) ($MN)

- Table 81 Middle East & Africa Soft Magnetic Materials Market Outlook, By Energy (2022-2030) ($MN)

- Table 82 Middle East & Africa Soft Magnetic Materials Market Outlook, By Industrial (2022-2030) ($MN)

- Table 83 Middle East & Africa Soft Magnetic Materials Market Outlook, By Telecommunications (2022-2030) ($MN)

- Table 84 Middle East & Africa Soft Magnetic Materials Market Outlook, By Other End Users (2022-2030) ($MN)

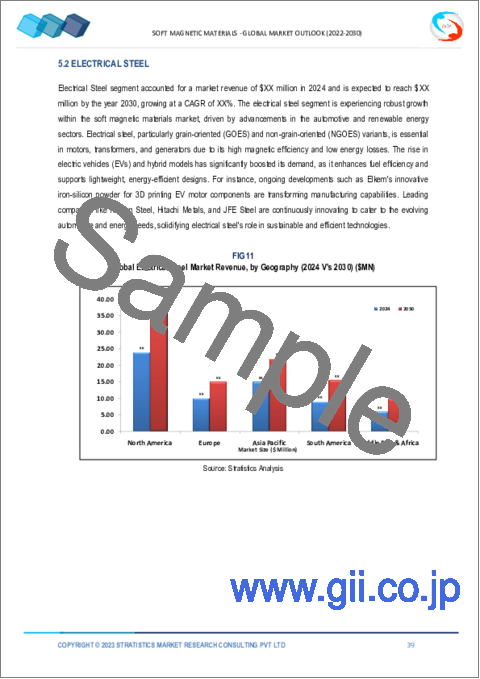

According to Stratistics MRC, the Global Soft Magnetic Materials Market is accounted for $89.98 billion in 2024 and is expected to reach $189.33 billion by 2030 growing at a CAGR of 13.2% during the forecast period. Soft magnetic materials are essential components in electrical engineering and electronics due to their unique ability to magnetize and demagnetize quickly and efficiently in response to changing magnetic fields. Unlike hard magnetic materials, which retain their magnetization once magnetized, soft magnetic materials exhibit high permeability and low coercivity, making them ideal for applications where rapid and reversible magnetization is necessary, such as in transformers, electric motors, inductors, and magnetic shielding.

According to the Japan Electronics and Information Technology Industries Association (JEITA), the production by the global electronics and IT industry was expected to reach USD 3,436.8 billion, with a growth rate of 3 percent year on year, by 2023.

Market Dynamics:

Driver:

Development and modernization of infrastructure

The development and modernization of infrastructure have significantly enhanced the demand and application of soft magnetic materials. These materials, known for their ability to efficiently direct and control magnetic fields, are crucial components in a wide array of infrastructure-related technologies. Advancements in infrastructure, such as smart grids, renewable energy systems, electric vehicles, and telecommunications networks, require efficient management and conversion of electrical energy, which relies heavily on soft magnetic materials.

Restraint:

High cost of raw materials

However, the primary raw materials used in their production, such as iron, nickel, cobalt, and various alloys, have experienced price increases in recent years. This escalation in costs directly impacts manufacturers, leading to higher production expenses and ultimately influencing the final product prices. As a result, companies face challenges in maintaining competitive pricing and profitability. Fluctuations in raw material costs can disrupt supply chains and production planning, further complicating efforts to meet market demand consistently.

Opportunity:

Rising demand from emerging economies

The increasing demand from emerging economies is significantly bolstering the market for soft magnetic materials. Emerging economies like India, China, Brazil, and others are experiencing rapid industrialization and urbanization, driving up the need for efficient energy solutions and advanced electronic equipment. Soft magnetic materials, known for their ability to quickly magnetize and demagnetize, are essential in improving the efficiency and performance of these devices. Moreover, as these economies focus on renewable energy expansion and electric vehicle production, the demand for soft magnetic materials further intensifies. Manufacturers are innovating to meet this growing demand by developing materials with improved magnetic properties, durability, and cost-effectiveness.

Threat:

Limited availability of rare earth elements

The limited availability of rare earth elements poses a significant challenge to the development and production of soft magnetic materials. These materials, crucial for applications in electronics, telecommunications, and renewable energy technologies like wind turbines and electric vehicles, rely heavily on rare earth elements such as neodymium, dysprosium, and samarium for their magnetic properties. However, these elements are not only scarce but also geographically concentrated, with a significant portion of global supply coming from a few countries, particularly China. This concentration creates supply chain vulnerabilities and price volatility, impacting industries that depend on consistent access to these materials.

Covid-19 Impact:

The COVID-19 pandemic significantly affected the soft magnetic materials sector. Supply chains experienced disruptions due to factory closures, transportation restrictions, and reduced workforce capacity, leading to delays in material production and distribution. Market uncertainties caused by fluctuating demand and raw material shortages further complicated the situation. Additionally, the shift towards remote work and reduced industrial activities initially dampened overall demand but later saw a recovery as industries adapted to new operational norms.

The Permalloy segment is expected to be the largest during the forecast period

Permalloy segment is expected to be the largest during the forecast period. Permalloy, a type of soft magnetic material, is significantly contributing to the growth of the soft magnetic materials market. It is an alloy typically composed of iron and varying amounts of nickel (around 20-80%) and exhibits excellent magnetic properties such as high permeability, low coercivity, and low core loss. The demand for Permalloy segments is rising due to its ability to enhance the performance and efficiency of electronic devices and power systems, particularly in industries like telecommunications, automotive, and renewable energy.

The Industrial segment is expected to have the highest CAGR during the forecast period

Industrial segment is expected to have the highest CAGR during the forecast period. Soft magnetic materials, such as iron-silicon alloys and ferrites, play a crucial role in the efficient operation of electric motors, transformers, and electromagnetic devices. Their ability to magnetize and demagnetize rapidly with minimal energy loss (low hysteresis) makes them ideal for applications requiring frequent magnetic field changes, like in high-frequency transformers and electric vehicle motors. Recent developments focus on improving the magnetic properties of these materials through alloying, microstructural control, and processing techniques. This enhancement aims to achieve higher magnetic permeability, lower coercivity, and reduced core losses, thereby increasing the efficiency and reliability of industrial equipment.

Region with largest share:

Asia Pacific region commanded the largest share of the market over the projection period. As governments and industries prioritize sustainability and energy efficiency, the demand for soft magnetic materials has grown significantly. Countries like China, Japan, South Korea, and India are at the forefront of this market expansion, driven by rapid industrialization, urbanization, and the adoption of advanced technologies. Moreover, initiatives promoting renewable energy sources further bolster the demand for soft magnetic materials in power generation and distribution systems.

Region with highest CAGR:

Europe region is estimated to witness profitable growth during the extrapolated period. Through stringent environmental standards and supportive policies, European governments are fostering innovation and sustainable practices within the industry. Regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) ensure the safe use of materials, promoting cleaner production methods and reducing environmental impact. Moreover, initiatives aimed at promoting research and development in advanced materials technology are bolstering the competitiveness of European firms in global markets.

Key players in the market

Some of the key players in Soft Magnetic Materials market include Dexter Magnetic Technologies, Electron Energy Corporation, Carpenter Technology Corporation, Mitsubishi Materials Corporation, TDK Corporation, Hitachi Metals, Ltd, Voestalpine AG, Mate Group and Intermetallics India Pvt. Ltd.

Key Developments:

In January 2022, Daido Steel Co., Ltd. has introduced a new product, called STARPAS-50PC2S permalloy foil, which is designed to effectively suppress EMC noise, particularly magnetic noise, at low frequencies below approximately 100kHz. This noise is usually caused by higher frequencies in communication and IoT devices, as well as electric automobiles.

In January 2022, JFE Steel Corporation has also launched Denjiro, which is an insulation-coated pure iron powder for soft magnetic composites. This product is ideally suited to axial gap motors and has been added to their broad lineup of soft magnetic materials.

Materials Covered:

- Electrical Steel

- Permalloy

- Ferrite

- Cobalt

- Iron

- Other Materials

End Users Covered:

- Automotive

- Energy

- Industrial

- Telecommunications

- Other End Users

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2022, 2023, 2024, 2026, and 2030

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 End User Analysis

- 3.7 Emerging Markets

- 3.8 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Soft Magnetic Materials Market, By Material

- 5.1 Introduction

- 5.2 Electrical Steel

- 5.3 Permalloy

- 5.4 Ferrite

- 5.5 Cobalt

- 5.6 Iron

- 5.7 Other Materials

6 Global Soft Magnetic Materials Market, By End User

- 6.1 Introduction

- 6.2 Automotive

- 6.3 Energy

- 6.4 Industrial

- 6.5 Telecommunications

- 6.6 Other End Users

7 Global Soft Magnetic Materials Market, By Geography

- 7.1 Introduction

- 7.2 North America

- 7.2.1 US

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 Italy

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 Japan

- 7.4.2 China

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 New Zealand

- 7.4.6 South Korea

- 7.4.7 Rest of Asia Pacific

- 7.5 South America

- 7.5.1 Argentina

- 7.5.2 Brazil

- 7.5.3 Chile

- 7.5.4 Rest of South America

- 7.6 Middle East & Africa

- 7.6.1 Saudi Arabia

- 7.6.2 UAE

- 7.6.3 Qatar

- 7.6.4 South Africa

- 7.6.5 Rest of Middle East & Africa

8 Key Developments

- 8.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 8.2 Acquisitions & Mergers

- 8.3 New Product Launch

- 8.4 Expansions

- 8.5 Other Key Strategies

9 Company Profiling

- 9.1 Dexter Magnetic Technologies

- 9.2 Electron Energy Corporation

- 9.3 Carpenter Technology Corporation

- 9.4 Mitsubishi Materials Corporation

- 9.5 TDK Corporation

- 9.6 Hitachi Metals, Ltd

- 9.7 Voestalpine AG

- 9.8 Mate Group

- 9.9 Intermetallics India Pvt. Ltd