|

|

市場調査レポート

商品コード

1812621

デジタルヘルスの世界市場:オファリング別、疾患別、使用事例別、エンドユーザー別、地域別 - 2030年までの予測Digital Health Market by Offering (Hardware, Apps (Telehealth, DTx, Patient Portals, Pharmacy)), Disease, Use Case, End User, and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| デジタルヘルスの世界市場:オファリング別、疾患別、使用事例別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年09月06日

発行: MarketsandMarkets

ページ情報: 英文 452 Pages

納期: 即納可能

|

概要

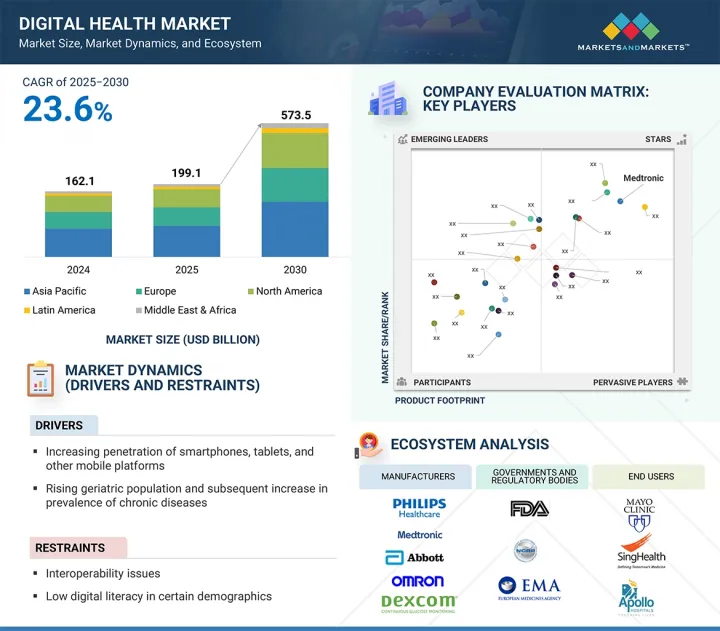

世界のデジタルヘルスの市場規模は、予測期間中に23.6%の高いCAGRで拡大し、2025年の1,991億米ドルから2030年には5,735億米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | オファリング別、疾患別、使用事例別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

価値観に基づくケアに対する需要の高まり、慢性疾患の負担増、予防ヘルスケア重視の高まりに後押しされ、市場は着実に前進しています。人口の高齢化とヘルスケアコストの高騰に伴い、医療提供者と支払者は、リソースの利用を最適化しながらケア成果を改善するデジタルツールに注目しています。

遠隔患者モニタリング、デジタル治療薬、モバイルヘルスアプリなどのソリューションは、特に糖尿病、高血圧、心臓病などの慢性疾患の継続的な在宅ケアを可能にする上で重要な役割を果たしています。市場はさらに、デジタル介入に対する保険適用範囲の拡大、健康追跡に対する消費者の強い関心、医療技術および大手ハイテク企業の双方によるイノベーションによって支えられています。このような勢いにもかかわらず、この分野は持続的な課題に直面しています。その最たるものが、データのセキュリティとプライバシーに対する懸念、新興デジタル治療薬に対する規制の不確実性、高齢者や低所得層のアクセスを制限するデジタルデバイドです。スケーラブルで公平かつ質の高いケアを提供するデジタルヘルスの可能性を十分に実現するためには、これらの障壁に対処しなければなりません。

2024年、メンタル&行動ヘルスはデジタルヘルス市場で最も急成長するセグメントとして浮上しました。この背景には、精神衛生に対する意識の高まり、ストレス、不安、うつ病の有病率の増加、助けを求めることに対する偏見の減少があります。遠隔精神医療、セラピーアプリ、AI主導のメンタルヘルス・プラットフォームの拡大により、アクセスしやすく、手頃な価格で、秘密厳守のサポートが提供される一方、ウェアラブルデバイスや遠隔モニタリングとの統合により、行動パターンのリアルタイム追跡が可能になります。これらの要因は、雇用者のウェルネスプログラムや支援的なヘルスケア政策と相まって、このセグメントの急速な普及と市場拡大を促進しています。

2024年、デジタルヘルス市場で最も急成長しているエンドユーザー分野は患者・消費者です。これは、健康意識の高まり、スマートフォンやウェアラブルの普及率の上昇、パーソナライズされたオンデマンドヘルスケアソリューションの需要によるものです。デジタルヘルスアプリ、遠隔医療プラットフォーム、遠隔モニタリングツールにより、個人は自分の健康を積極的に管理し、いつでもケアにアクセスし、バイタルサインやライフスタイル指標をリアルタイムで追跡できるようになります。予防医療、利便性を重視したヘルスケア提供、慢性疾患の自己管理へのシフトにより、患者と消費者が市場の最もダイナミックな成長要因となっています。

アジア太平洋は、予測期間中にデジタルヘルス市場で最も速い成長を記録すると予想されています。遠隔医療、電子カルテ、AI主導型ヘルスケアを推進する政府の取り組みが、ヘルスケア投資の増加や民間セクターの参入拡大と相まって、導入を加速させています。Halodoc(インドネシア)などの企業は1億米ドルを調達し(2023年)、その総額は2億5,800万米ドルに達し、同社のプラットフォームの月間利用者数は2,000万人を超えています。インドのアユシュマン・バラット・デジタル・ミッション(ABDM)のような政府主導のイニシアチブは、EHR、市民健康ID、アナリティクスにまたがる国家デジタル・ヘルス・インフラを構築しています。さらに、民間企業の強力な参加、ベンチャーキャピタルからの投資の増加、テクノロジー企業とヘルスケアプロバイダーとの戦略的提携がイノベーションを促進しています。

当レポートでは、世界のデジタルヘルス市場について調査し、オファリング別、疾患別、使用事例別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/ディスラプション

- 業界動向

- エコシステム分析

- サプライチェーン分析

- 技術分析

- 関税および規制分析

- 価格分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 特許分析

- アンメットニーズとエンドユーザーの期待

- 主要な会議とイベント

- ケーススタディ分析

- デジタルヘルス市場:投資情勢と資金調達シナリオ

- 貿易分析

- デジタルヘルス市場のビジネスモデル

- デジタルヘルス市場におけるAI/生成AIの影響

- 2025年の米国関税の影響- デジタルヘルス市場

- 償還分析

- リスク要因と市場参入障壁

- 将来の見通しと混乱のシナリオ

第6章 デジタルヘルス市場(オファリング別)

- イントロダクション

- ハードウェア

- ソリューション/アプリケーション

- mヘルスアプリ

- デジタルセラピューティクス

- デジタル薬局と医薬品アクセス

- デジタル診断と在宅検査

- 患者ポータル

- その他

第7章 デジタルヘルス市場(疾患別)

- イントロダクション

- 糖尿病

- 心臓病

- メンタルヘルスと行動ヘルス

- 呼吸器疾患

- ライフスタイルと健康の改善

- 神経学

- 筋骨格系障害/疼痛管理

- 腫瘍学

- 女性の健康と生殖に関する健康

- その他

第8章 デジタルヘルス市場(使用事例別)

- イントロダクション

- 予防ケアとウェルネス

- 診断

- 治療

- 患者モニタリング

- リハビリテーションと回復

- その他

第9章 デジタルヘルス市場(エンドユーザー別)

- イントロダクション

- ヘルスケア提供者

- ヘルスケア支払者

- 患者と消費者

- 製薬、バイオテクノロジー、医療技術企業

- その他

第10章 デジタルヘルス市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他

- ラテンアメリカ

- ラテンアメリカのマクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカのマクロ経済見通し

- GCC

- 南アフリカ

- その他

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 主要参入企業の収益シェア分析

- 市場シェア分析、2024年

- ブランド/ソフトウェア比較

- 企業評価と財務指標

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- MEDTRONIC

- ABBOTT

- DEXCOM, INC.

- KONINKLIJKE PHILIPS N.V.

- FITBIT, INC.(GOOGLE)

- OMRON HEALTHCARE, INC.

- APPLE, INC.

- BOSTON SCIENTIFIC CORPORATION

- MASIMO

- TELADOC HEALTH, INC.

- AMERICAN WELL

- HIMS & HERS HEALTH, INC.

- HEADSPACE

- NOOM, INC.

- CEREBRAL INC.

- EPIC SYSTEMS CORPORATION

- OMADA HEALTH INC.

- ORACLE

- CLICK THERAPEUTICS, INC.

- WELLDOC, INC.

- EVERLYWELL

- その他の企業

- TRUDOC HEALTHCARE LLC

- CARESIMPLE INC.

- VIVALNK, INC.

- BIOBEAT

- VIRTUAL THERAPEUTICS CORP.