|

|

市場調査レポート

商品コード

1374759

CPO(Co-packaged Optics)の世界市場:タイプ別、データレート別、用途別、パッケージング技術別、地域別-2028年までの予測Co-Packaged Optics Market by Type (CPO, NPO), Data Rates (less than 1.6 T & 1.6 T, 3.2 T, 6.4 T), Application (Data Center and High-performance Computing, and Telecommunication and Networking), Packaging Technology and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| CPO(Co-packaged Optics)の世界市場:タイプ別、データレート別、用途別、パッケージング技術別、地域別-2028年までの予測 |

|

出版日: 2023年10月26日

発行: MarketsandMarkets

ページ情報: 英文 157 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント | タイプ別、データレート別、用途別、パッケージング技術別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

世界のCPO(Co-packaged Optics)の市場規模は、2023年の1,500万米ドルから2028年には4,900万米ドルに成長すると予測されており、予測期間中のCAGRは26.5%と見込まれています。

CPO(Co-packaged Optics)市場の成長を促進する主な要因には、超高精細ビデオストリーミングの導入、データセンタにおけるAI/MLベースのユースケースのワークロード増大、データセンタ開発のための技術大手による投資拡大などがあります。しかし、ネットワークの複雑化とスイッチあたりのファイバー数の増加は、今後の市場の課題として作用します。市場関係者にとっての主な成長機会は、教育やヘルスケア分野でのIoTやコネクテッドデバイスの普及です。

CPO(Co-packaged Optics)市場の通信とネットワーキング分野が、予測期間中に最高のCAGRを示すと見られています。ストリーミング、クラウドコンピューティング、IoT、5Gなどのサービスによってデータトラフィックが急増したため、通信やネットワーキングのインフラストラクチャでは、より広帯域で低遅延の需要が高まっています。このため、CPOに対する需要が増加し、その結果、性能と効率が向上しています。さらに、5GネットワークとIoTの増加は、相互接続ルーターとスイッチの需要を促進し、通信・ネットワーク業界のCPO需要をさらに押し上げています。

CPO(Co-packaged Optics)市場の6.4Tセグメントは、予測期間で最高のCAGRを占めると見られています。6.4TのCPO開拓は難しい課題であるが、高速で信頼性の高いデータ通信への需要が急増しており、市場成長の原動力となっています。さらに、データセンターやハイパフォーマンス・コンピューティング(HPC)市場でも、今後ますます重要な役割を果たすと予想されます。Skorpios Technologies社、Broadcom社、Marvell社など、多くの企業が6.4 T CPO製品を開発しています。

予測期間中、北米がCPO(Co-packaged Optics)市場を独占すると見られています。北米は、今後もCPO(Co-packaged Optics)市場を独占し続け、最大の市場シェアを占めると見られています。これは、北米には多くの技術企業や研究開発施設があり、これが大きなイノベーションと技術進歩につながっているからです。

当レポートでは、世界のCPO(Co-packaged Optics)市場について調査し、タイプ別、データレート別、用途別、パッケージング技術別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- 生態系マッピング

- 技術分析

- 特許分析

- 貿易と関税の分析

- 2023年~2024年の主要な会議とイベント

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

第6章 CPO(Co-packaged Optics)市場、タイプ別

- イントロダクション

- CPO(Co-packaged Optics)系(CPO)

- ニアパッケージオプティクス(NPO)

第7章 CPO(Co-packaged Optics)市場、データレート別

- イントロダクション

- 1.6T未満および1.6T未満

- 3.2T

- 6.4T

第8章 CPO(Co-packaged Optics)に使用される技術

- イントロダクション

- 2.5D CPO

- 3D CPO

第9章 CPO(Co-packaged Optics)市場、用途別

- イントロダクション

- データセンターとハイパフォーマンスコンピューティング

- 通信とネットワーク

- その他

第10章 CPO(Co-packaged Optics)市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第11章 競合情勢

- 概要

- 市場シェア分析、2022年

- 収益分析、2022年

- 企業評価マトリックス、2022年

- 新興企業/中小企業(SMES)の評価マトリックス、2022年

- 企業のフットプリント

- 競合ベンチマーキング

- 競争シナリオと動向

第12章 企業プロファイル

- イントロダクション

- 主要参入企業

- BROADCOM

- RANOVUS

- MARVELL

- QUANTA COMPUTER INC.

- RAGILE NETWORKS INC.

- MOLEX

- SENKO

- FURUKAWA ELECTRIC CO., LTD.

- その他の企業

- TE CONNECTIVITY

- SABIC

- RAIN TREE PHOTONICS PTE. LTD.

- RUIJIE NETWORKS CO., LTD.

- SYNOPSYS, INC.

第13章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million) |

| Segments | By Type, Data Rates, Application, Packaging Technology and Region |

| Regions covered | North America, Europe, APAC, RoW |

The co-packaged optics market is projected to grow from USD 15 million in 2023 to USD 49 million by 2028, registering a CAGR of 26.5% during the forecast period. Some of the major factors driving the growth of the co-packaged optics market include the Introduction of ultra-high-definition video streaming, growing workload of AI/ML-based use cases in data centers, and growing investment by tech giants to develop data centers. However, increased network complexity and increasing fiber counts per switch act as a challenge for the market in the future. The major growth opportunities for the market players are the penetration of IoT and connected devices in education and healthcare sectors.

"Market for telecommunication and networking will have the highest CAGR during the forecast period."

The telecommunication and networking segment of the co-packaged optics market is expected to witness the highest CAGR during the forecast period. The demand for higher bandwidth and lower latency in telecommunication and networking infrastructure has increased due to the rapid growth of data traffic driven by services such as streaming, cloud computing, IoT, and 5G. This has led to a rise in the demand for CPO, which has consequently improved performance and efficiency. Moreover, the increasing 5G network and IoT are driving the demand for interconnect routers and switches, further driving the demand for CPO in the telecommunications and networking industry.

"6.4 T expected to register the highest CAGR during the forecast period."

The co-packaged optics market's 6.4 T segment is expected to account for the highest CAGR in the forecast period. The development of 6.4 T CPO is a challenging task, but the demand for high-speed and reliable data communication is growing rapidly and is driving the market growth. Moreover, it is expected to play an increasingly important role in the data center and high-performance computing (HPC) markets in the coming years. A number of companies are developing 6.4 T CPO products, including Skorpios Technologies Inc., Broadcom, and Marvell.

"North America to account for the highest market share among other regions during the forecast period."

North America is expected to dominate the co-packaged optics market during the forecast period. It is expected that North America will continue to dominate the co-packaged optics market in the coming years, accounting for the largest market share. This is because North America is home to many technology companies and research and development establishments, which lead to significant innovations and technological advancements.

It is set to grow significantly in the coming years due to the rising need for reliable and high-speed optical interconnects across various industries, including data centers, telecommunications, and industrial automation. With the introduction of 5G networks and the expansion of edge computing infrastructure, the increasing demand for low latency and high bandwidth are creating opportunities for CPO technology in the upcoming years.

The break-up of primary participants for the report has been shown below:

- By company type: Tier 1 - 38%, Tier 2 - 28%, and Tier 3 - 34%

- By designation: C-Level Executives - 40%, Managers - 30%, and Others - 30%

- By region: North America - 35%, Europe - 20%, Asia Pacific - 35%, and RoW - 10%

The report profiles key players in the co-packaged optics market with their respective market ranking analyses. Prominent players profiled in this report include Broadcom (US), Molex (US), Marvell (US), RANOVUS (Canada), Ragile Networks Inc. (US), SENKO (US), Quanta Computer Inc. (Taiwan), Furukawa Electric Co., Ltd. (Japan), among others.

Research Coverage

This research report categorizes the co-packaged optics market based on type, data rates, application, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the co-packaged optics market and forecasts the same till 2028. The report also consists of leadership mapping and analysis of companies in the co-packaged optics ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall co-packaged optics market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (growing investment by tech giants to develop data centers, growing workload of ai/ml-based use cases in data centers, introduction of ultra-high-definition video streaming, and need for performance improvement of data centers), restraints (complicated design and fabrication process and increased network complexity), opportunities (penetration of iot and connected devices in education and healthcare sectors and rising deployment of 5g network), and challenges (increasing fiber counts per switch and fiber routing complexity and risk of damage to the fibers during installation) influencing the growth of the co-packaged optics market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the co-packaged optics market

- Market Development: Comprehensive information about lucrative markets - the report analyses the co-packaged optics market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the co-packaged optics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product/service offerings of leading players like Broadcom (US), Molex (US), Marvell (US), RANOVUS (Canada), Ragile Networks Inc. (US), SENKO (US), Quanta Computer Inc. (Taiwan), Furukawa Electric Co., Ltd. (Japan), among others in the co-packaged optics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 CO-PACKAGED OPTICS MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 2 CO-PACKAGED OPTICS MARKET: RESEARCH DESIGN

- 2.2 SECONDARY AND PRIMARY RESEARCH

- FIGURE 3 CO-PACKAGED OPTICS MARKET: RESEARCH APPROACH

- 2.2.1 SECONDARY DATA

- 2.2.1.1 List of major secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Breakdown of primaries

- 2.2.2.3 Key industry insights

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach to derive market size using bottom-up analysis

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Approach to derive market size using top-down analysis (supply side)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON CO-PACKAGED OPTICS MARKET

- 2.7 LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 8 CPO SEGMENT TO RECORD HIGHER CAGR FROM 2023 TO 2028

- FIGURE 9 3.2 T SEGMENT TO SECURE LARGEST MARKET SHARE IN 2028

- FIGURE 10 DATA CENTERS AND HIGH-PERFORMANCE COMPUTING SEGMENT TO DOMINATE MARKET IN 2023

- FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CO-PACKAGED OPTICS MARKET

- FIGURE 12 GROWTH IN HIGH-PERFORMANCE COMPUTING TO DRIVE MARKET

- 4.2 CO-PACKAGED OPTICS MARKET, BY TYPE

- FIGURE 13 CPO SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 CO-PACKAGED OPTICS MARKET IN NORTH AMERICA, BY APPLICATION AND COUNTRY

- FIGURE 14 DATA CENTERS AND HIGH-PERFORMANCE COMPUTING SEGMENT AND US HELD LARGEST MARKET SHARES IN 2022

- 4.4 CO-PACKAGED OPTICS MARKET, BY COUNTRY

- FIGURE 15 INDIA TO DOMINATE GLOBAL CO-PACKAGED OPTICS MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 CO-PACKAGED OPTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- FIGURE 17 CO-PACKAGED OPTICS MARKET: IMPACT ANALYSIS OF DRIVERS

- 5.2.1.1 Growing investments by tech giants in data center infrastructure

- 5.2.1.2 Increasing use of AI/ML-based devices in data centers

- FIGURE 18 REGION-WISE INTERNET USERS, 2022

- 5.2.1.3 Introduction of ultra-high-definition video streaming

- 5.2.1.4 Need for performance improvement in data centers

- 5.2.2 RESTRAINTS

- FIGURE 19 CO-PACKAGED OPTICS MARKET: IMPACT ANALYSIS OF RESTRAINTS

- 5.2.2.1 Complicated design and fabrication process

- 5.2.2.2 Increased network complexity

- 5.2.3 OPPORTUNITIES

- FIGURE 20 CO-PACKAGED OPTICS MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.3.1 Penetration of IoT and connected devices in education and healthcare sectors

- 5.2.3.2 Rising deployment of 5G networks

- 5.2.4 CHALLENGES

- FIGURE 21 CO-PACKAGED OPTICS MARKET: IMPACT ANALYSIS OF CHALLENGES

- 5.2.4.1 Increasing fiber counts per switch

- 5.2.4.2 Complexities associated with fiber routing and installation of fibers

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN CO-PACKAGED OPTICS MARKET

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE (ASP) TREND OF OPTICAL TRANSCEIVERS

- TABLE 1 AVERAGE SELLING PRICE OF OPTICAL TRANSCEIVERS

- 5.4.2 AVERAGE SELLING PRICE (ASP) OF OPTICAL TRANSCEIVERS OFFERED BY KEY PLAYERS

- FIGURE 23 AVERAGE SELLING PRICE (ASP) OF OPTICAL TRANSCEIVERS OFFERED BY KEY PLAYERS

- TABLE 2 AVERAGE SELLING PRICE OF OPTICAL TRANSCEIVERS OFFERED BY TOP PLAYERS

- FIGURE 24 ASP TREND OF CO-PACKAGED OPTICS, BY DATA RATE

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 25 CO-PACKAGED OPTICS MARKET: VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM MAPPING

- TABLE 3 COMPANIES AND THEIR ROLE IN CO-PACKAGED OPTICS ECOSYSTEM

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 PLUGGABLE OPTICAL TRANSCEIVERS

- 5.7.2 ON-BOARD OPTICS

- 5.7.3 NEAR-PACKAGED OPTICS

- 5.7.4 FUTURE CO-PACKAGED OPTICS

- 5.8 PATENT ANALYSIS

- FIGURE 26 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 4 TOP 20 PATENT OWNERS IN US IN LAST 10 YEARS

- FIGURE 27 NUMBER OF PATENTS GRANTED PER YEAR, 2012-2022

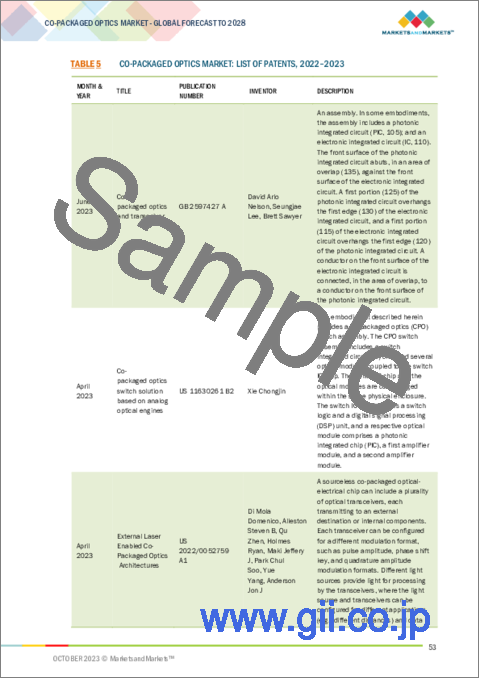

- TABLE 5 CO-PACKAGED OPTICS MARKET: LIST OF PATENTS, 2022-2023

- 5.9 TRADE AND TARIFF ANALYSIS

- 5.9.1 TRADE ANALYSIS

- 5.9.1.1 Trade data for HS code 851769

- FIGURE 28 IMPORT DATA FOR HS CODE 851769, BY COUNTRY, 2018-2022 (USD THOUSAND)

- FIGURE 29 EXPORT DATA FOR HS CODE 851769, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.9.2 TARIFF ANALYSIS

- TABLE 6 TARIFF LEVIED ON EXPORT OF TRANSMISSION OR RECEPTION APPARATUS BY CHINA, 2022

- TABLE 7 TARIFF LEVIED ON EXPORT OF TRANSMISSION OR RECEPTION APPARATUS BY US, 2022

- TABLE 8 TARIFF LEVIED ON EXPORT OF TRANSMISSION OR RECEPTION APPARATUS BY GERMANY, 2022

- TABLE 9 TARIFF LEVIED ON EXPORT OF TRANSMISSION OR RECEPTION APPARATUS BY NETHERLANDS, 2022

- TABLE 10 TARIFF LEVIED ON EXPORT OF TRANSMISSION OR RECEPTION APPARATUS BY MEXICO, 2022

- 5.9.1 TRADE ANALYSIS

- 5.10 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 11 CO-PACKAGED OPTICS MARKET: LIST OF CONFERENCES AND EVENTS

- 5.10.1 REGULATORY LANDSCAPE

- 5.10.1.1 Standards and regulatory bodies

- 5.10.1.1.1 International Electrotechnical Commission

- 5.10.1.2 International Organization for Standardization

- 5.10.1.3 European Union directives

- 5.10.1.4 Federal Communications Commission regulations

- 5.10.1.5 National Institute of Standards and Technology guidelines

- 5.10.1.1 Standards and regulatory bodies

- 5.10.2 REGULATIONS

- 5.10.2.1 Environmental regulations

- 5.10.2.2 Safety regulations

- 5.10.2.3 Intellectual property regulations

- 5.10.2.4 Export regulations

- 5.10.2.5 Standards and certification requirements

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 CO-PACKAGED OPTICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 CO-PACKAGED OPTICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.11.2 BARGAINING POWER OF SUPPLIERS

- 5.11.3 BARGAINING POWER OF BUYERS

- 5.11.4 THREAT OF SUBSTITUTES

- 5.11.5 THREAT OF NEW ENTRANTS

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- 5.12.2 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

6 CO-PACKAGED OPTICS MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 33 CPO SEGMENT TO DISPLAY HIGHER CAGR DURING FORECAST PERIOD

- TABLE 15 CO-PACKAGED OPTICS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 6.2 CO-PACKAGED OPTICS (CPO)

- 6.2.1 INCREASING NUMBER OF MEGA DATA CENTERS TO FOSTER SEGMENTAL GROWTH

- TABLE 16 CPO: CO-PACKAGED OPTICS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 17 CPO: CO-PACKAGED OPTICS MARKET FOR DATA CENTERS AND HIGH-PERFORMANCE COMPUTING, BY REGION, 2022-2028 (USD MILLION)

- TABLE 18 CPO: CO-PACKAGED OPTICS MARKET FOR TELECOMMUNICATIONS AND NETWORKING, BY REGION, 2022-2028 (USD MILLION)

- TABLE 19 CPO: CO-PACKAGED OPTICS MARKET FOR OTHERS, BY REGION, 2022-2028 (USD MILLION)

- TABLE 20 CPO: CO-PACKAGED OPTICS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 6.3 NEAR-PACKAGED OPTICS (NPO)

- 6.3.1 ABILITY TO IMPROVE SIGNAL INTEGRITY TO DRIVE DEMAND

- TABLE 21 NPO: CO-PACKAGED OPTICS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 22 NPO: CO-PACKAGED OPTICS MARKET FOR DATA CENTERS AND HIGH-PERFORMANCE COMPUTING, BY REGION, 2022-2028 (USD MILLION)

- TABLE 23 NPO: CO-PACKAGED OPTICS MARKET FOR TELECOMMUNICATIONS AND NETWORKING, BY REGION, 2022-2028 (USD MILLION)

- TABLE 24 NPO: CO-PACKAGED OPTICS MARKET FOR OTHERS, BY REGION, 2022-2028 (USD MILLION)

- TABLE 25 NPO: CO-PACKAGED OPTICS MARKET, BY REGION, 2022-2028 (USD MILLION)

7 CO-PACKAGED OPTICS MARKET, BY DATA RATE

- 7.1 INTRODUCTION

- FIGURE 34 CO-PACKAGED OPTICS MARKET, BY DATA RATE

- FIGURE 35 LESS THAN 1.6 T & 1.6 T SEGMENT TO DOMINATE MARKET IN 2023

- TABLE 26 CO-PACKAGED OPTICS MARKET, BY DATA RATE, 2022-2028 (USD MILLION)

- TABLE 27 CO-PACKAGED OPTICS MARKET, BY DATA RATES, 2022-2028 (THOUSAND UNITS)

- 7.2 LESS THAN 1.6 T & 1.6 T

- 7.2.1 EXPANDING TELECOMMUNICATION SECTOR TO FOSTER SEGMENTAL GROWTH

- 7.3 3.2 T

- 7.3.1 INCREASING PENETRATION OF CLOUD COMPUTING TO CONTRIBUTE TO MARKET GROWTH

- 7.4 6.4 T

- 7.4.1 INCREASING DEMAND FOR HIGH-SPEED AND RELIABLE DATA COMMUNICATION TO DRIVE MARKET

8 TECHNOLOGIES USED IN CO-PACKAGING OPTICS

- 8.1 INTRODUCTION

- FIGURE 36 TECHNOLOGIES USED IN CO-PACKAGED OPTICS

- 8.2 2.5D CPO

- 8.2.1 ABILITY TO COMBINE OPTICAL AND ELECTRONIC COMPONENTS INTO SINGLE PACKAGES TO DRIVE MARKET

- 8.3 3D CPO

- 8.3.1 NEED TO REDUCE INTERCONNECT DELAYS TO BOOST DEMAND

9 CO-PACKAGED OPTICS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 37 CO-PACKAGED OPTICS MARKET, BY APPLICATION

- FIGURE 38 DATA CENTERS AND HIGH-PERFORMANCE COMPUTING SEGMENT TO DOMINATE MARKET IN 2023

- TABLE 28 CO-PACKAGED OPTICS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.2 92

- 9.3 DATA CENTER AND HIGH-PERFORMANCE COMPUTING

- 9.3.1 ABILITY TO INTEGRATE OPTICAL COMPONENTS DIRECTLY INTO SEMICONDUCTOR PACKAGES TO DRIVE MARKET

- TABLE 29 DATA CENTERS AND HIGH-PERFORMANCE COMPUTING: CO-PACKAGED OPTICS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 30 DATA CENTERS AND HIGH-PERFORMANCE COMPUTING: CO-PACKAGED OPTICS MARKET BY REGION, 2022-2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: CO-PACKAGED OPTICS MARKET FOR DATA CENTERS AND HIGH-PERFORMANCE COMPUTING, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 32 EUROPE: CO-PACKAGED OPTICS MARKET FOR DATA CENTERS AND HIGH-PERFORMANCE COMPUTING, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC: CO-PACKAGED OPTICS MARKET FOR DATA CENTERS AND HIGH-PERFORMANCE COMPUTING, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 34 ROW: CO-PACKAGED OPTICS MARKET FOR DATA CENTERS AND HIGH-PERFORMANCE COMPUTING, BY REGION, 2022-2028 (USD MILLION)

- 9.4 TELECOMMUNICATIONS AND NETWORKING

- 9.4.1 INCREASED DATA TRAFFIC DUE TO 5G AND IOT TO FUEL MARKET GROWTH

- TABLE 35 TELECOMMUNICATIONS AND NETWORKING: CO-PACKAGED OPTICS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 36 TELECOMMUNICATIONS AND NETWORKING: CO-PACKAGED OPTICS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 9.5 OTHERS

- TABLE 37 OTHERS: CO-PACKAGED OPTICS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 38 OTHERS: CO-PACKAGED OPTICS MARKET, BY REGION, 2022-2028 (USD MILLION)

10 CO-PACKAGED OPTICS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 39 CO-PACKAGED OPTICS MARKET, BY REGION

- FIGURE 40 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 39 CO-PACKAGED OPTICS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 41 NORTH AMERICA: CO-PACKAGED OPTICS MARKET SNAPSHOT

- TABLE 40 NORTH AMERICA: CO-PACKAGED OPTICS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: CO-PACKAGED OPTICS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: CO-PACKAGED OPTICS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Expansion of edge computing infrastructure to drive market

- 10.2.2 CANADA

- 10.2.2.1 Accelerated demand for high-speed and wireless networking to foster growth

- 10.2.3 MEXICO

- 10.2.3.1 Expansion and modernization of telecommunications infrastructure to fuel market growth

- 10.2.4 IMPACT OF RECESSION ON CO-PACKAGED OPTICS MARKET IN NORTH AMERICA

- 10.3 EUROPE

- FIGURE 42 EUROPE: CO-PACKAGED OPTICS MARKET SNAPSHOT

- TABLE 43 EUROPE: CO-PACKAGED OPTICS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 44 EUROPE: CO-PACKAGED OPTICS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 45 EUROPE: CO-PACKAGED OPTICS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 10.3.1 UK

- 10.3.1.1 Government-led initiatives promoting adoption of AI and big data analytics to support market growth

- 10.3.2 GERMANY

- 10.3.2.1 Advent of Industry 4.0 and IoT to offer lucrative growth opportunities to market players

- 10.3.3 FRANCE

- 10.3.3.1 Adoption of AI and ML in various public sector applications to drive market

- 10.3.4 ITALY

- 10.3.4.1 Ongoing expansion of data centers to drive market

- 10.3.5 REST OF EUROPE

- 10.3.6 IMPACT OF RECESSION ON CO-PACKAGED OPTICS MARKET IN EUROPE

- 10.4 ASIA PACIFIC

- FIGURE 43 ASIA PACIFIC: CO-PACKAGED OPTICS MARKET SNAPSHOT

- TABLE 46 ASIA PACIFIC: CO-PACKAGED OPTICS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: CO-PACKAGED OPTICS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 48 ASIA PACIFIC: CO-PACKAGED OPTICS MARKET, TYPE, 2022-2028 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 Rapid development of IT infrastructure to boost demand

- 10.4.2 JAPAN

- 10.4.2.1 Increasing focus of data centers on high-performance computing applications to drive market

- 10.4.3 INDIA

- 10.4.3.1 Growing preference for cloud services to fuel market growth

- 10.4.4 REST OF ASIA PACIFIC

- 10.4.5 IMPACT OF RECESSION ON CO-PACKAGED OPTICS MARKET IN ASIA PACIFIC

- 10.5 ROW

- FIGURE 44 ROW: CO-PACKAGED OPTICS MARKET SNAPSHOT

- TABLE 49 ROW: CO-PACKAGED OPTICS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 50 ROW: CO-PACKAGED OPTICS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 51 ROW: CO-PACKAGED OPTICS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 10.5.1 MIDDLE EAST & AFRICA

- 10.5.1.1 Increasing investments in telecom infrastructure development to drive market growth

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Rising emphasis on strengthening network infrastructure to drive market

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.1.1 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- TABLE 52 CO-PACKAGED OPTICS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 11.1.1.1 Product portfolio

- 11.1.1.2 Regional focus

- 11.1.1.3 Organic/Inorganic growth strategies

- 11.2 MARKET SHARE ANALYSIS, 2022

- FIGURE 45 CO-PACKAGED OPTICS MARKET SHARE ANALYSIS, 2022

- TABLE 53 CO-PACKAGED OPTICS MARKET SHARE ANALYSIS, 2022

- 11.3 REVENUE ANALYSIS, 2022

- FIGURE 46 REVENUE ANALYSIS OF KEY PLAYERS

- 11.4 COMPANY EVALUATION MATRIX, 2022

- 11.4.1 STARS

- 11.4.2 PERVASIVE PLAYERS

- 11.4.3 EMERGING LEADERS

- 11.4.4 PARTICIPANTS

- FIGURE 47 CO-PACKAGED OPTICS MARKET: EVALUATION MATRIX FOR KEY COMPANIES, 2022

- 11.5 EVALUATION MATRIX FOR START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES), 2022

- 11.5.1 PROGRESSIVE COMPANIES

- 11.5.2 RESPONSIVE COMPANIES

- 11.5.3 DYNAMIC COMPANIES

- 11.5.4 STARTING BLOCKS

- FIGURE 48 CO-PACKAGED OPTICS MARKET: EVALUATION MATRIX FOR START-UPS/SMES, 2022

- 11.6 COMPANY FOOTPRINT

- TABLE 54 COMPANY FOOTPRINT

- TABLE 55 DATA RATE: COMPANY FOOTPRINT

- TABLE 56 APPLICATION: COMPANY FOOTPRINT

- TABLE 57 REGION: COMPANY FOOTPRINT

- 11.7 COMPETITIVE BENCHMARKING

- TABLE 58 CO-PACKAGED OPTICS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 59 CO-PACKAGED OPTICS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 11.8 COMPETITIVE SCENARIOS AND TRENDS

- 11.8.1 PRODUCT LAUNCHES

- TABLE 60 CO-PACKAGED OPTICS MARKET: PRODUCT LAUNCHES, 2021-2023

- 11.8.2 DEALS

- TABLE 61 CO-PACKAGED OPTICS MARKET: DEALS, 2021-2023

12 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 BROADCOM

- TABLE 62 BROADCOM: COMPANY OVERVIEW

- FIGURE 49 BROADCOM: COMPANY SNAPSHOT

- TABLE 63 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 64 BROADCOM: PRODUCT LAUNCHES

- TABLE 65 BROADCOM: DEALS

- 12.2.2 RANOVUS

- TABLE 66 RANOVUS: COMPANY OVERVIEW

- TABLE 67 RANOVUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 68 RANOVUS: PRODUCT LAUNCHES

- TABLE 69 RANOVUS: DEALS

- 12.2.3 MARVELL

- TABLE 70 MARVELL: COMPANY OVERVIEW

- FIGURE 50 MARVELL: COMPANY SNAPSHOT

- TABLE 71 MARVELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 72 MARVELL: PRODUCT LAUNCHES

- TABLE 73 MARVELL: DEALS

- 12.2.4 QUANTA COMPUTER INC.

- TABLE 74 QUANTA COMPUTER INC.: COMPANY OVERVIEW

- FIGURE 51 QUANTA COMPUTER INC.: COMPANY SNAPSHOT

- TABLE 75 QUANTA COMPUTER INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 76 QUANTA COMPUTER INC.: DEALS

- 12.2.5 RAGILE NETWORKS INC.

- TABLE 77 RAGILE NETWORKS INC.: COMPANY OVERVIEW

- TABLE 78 RAGILE NETWORKS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 79 RAGILE NETWORKS INC.: PRODUCT LAUNCHES

- 12.2.6 MOLEX

- TABLE 80 MOLEX: COMPANY OVERVIEW

- TABLE 81 MOLEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 82 MOLEX: PRODUCT LAUNCHES

- TABLE 83 MOLEX: DEALS

- 12.2.7 SENKO

- TABLE 84 SENKO: COMPANY OVERVIEW

- TABLE 85 SENKO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 86 SENKO: DEALS

- 12.2.8 FURUKAWA ELECTRIC CO., LTD.

- TABLE 87 FURUKAWA ELECTRIC CO., LTD.: COMPANY OVERVIEW

- FIGURE 52 FURUKAWA ELECTRIC CO., LTD.: COMPANY SNAPSHOT

- TABLE 88 FURUKAWA ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 89 FURUKAWA ELECTRIC CO., LTD.: PRODUCT LAUNCHES

- 12.3 OTHER PLAYERS

- 12.3.1 TE CONNECTIVITY

- 12.3.2 SABIC

- 12.3.3 RAIN TREE PHOTONICS PTE. LTD.

- 12.3.4 RUIJIE NETWORKS CO., LTD.

- 12.3.5 SYNOPSYS, INC.

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS