|

|

市場調査レポート

商品コード

1730052

CPO(Co-Packaged Optic)市場レポート:2031年までの動向、予測、競合分析Co-Packaged Optic Market Report: Trends, Forecast and Competitive Analysis to 2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| CPO(Co-Packaged Optic)市場レポート:2031年までの動向、予測、競合分析 |

|

出版日: 2025年05月16日

発行: Lucintel

ページ情報: 英文 150 Pages

納期: 3営業日

|

全表示

- 概要

- 目次

世界のCPO(Co-Packaged Optic)市場の将来は、データセンタ・HPC、通信・ネットワーキング市場にチャンスがありそうです。世界のCPO(Co-Packaged Optic)市場は、2025年から2031年にCAGR42.9%で成長すると見られています。この市場の主な促進要因は、帯域需要の増加、エネルギー効率ニーズの高まり、AIワークロード利用の拡大です。

- Lucintelの予測によると、タイプ別では1.6T未満が予測期間中に最も高い成長を遂げる見込みです。

- 用途カテゴリーでは、データセンター・HPCが高い成長を遂げる見込みです。

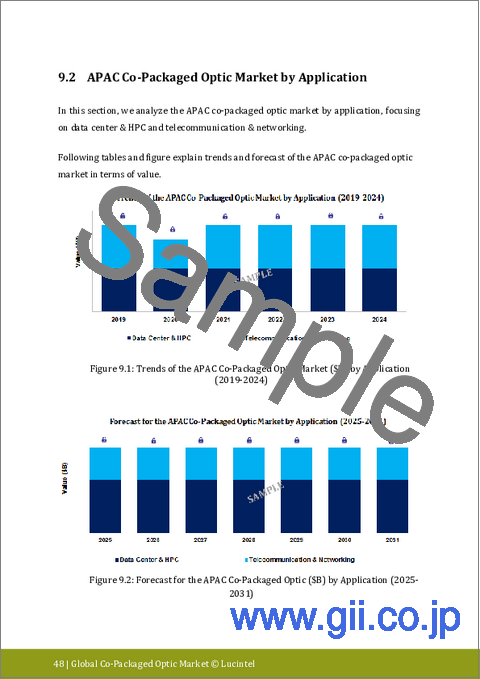

- 地域別では、アジア太平洋が予測期間で最も高い成長が見込まれています。

CPO(Co-Packaged Optic)市場の動向

CPO(Co-Packaged Optic)市場は、技術革新や省電力ソリューションニーズの高まりによって速いペースで変化しています。市場を変化させている主な動向は以下の通りです:

- 光学部品と電気部品の統合最も顕著な動向は、光コンポーネントと電気コンポーネントを1つのパッケージに統合することに重点が置かれていることです。このタイプの統合は、遅延を最小化し、帯域幅効率を最大化し、消費電力を削減するため、データセンター、クラウドコンピューティング、通信にとって最適なソリューションとなります。

- データセンターの最適化重視の高まり:データセンターにおける高速データ伝送の必要性が、CPO(Co-Packaged Optic)の開発を後押ししています。企業は、省電力とデータスループット向上のために、ますますCPO(Co-Packaged Optic)技術を利用するようになっています。これは、AI、機械学習、ビッグデータ解析の成長に後押しされています。

- 5Gと次世代ネットワークの拡大:世界の5Gネットワークの拡大は、CPO(Co-Packaged Optic)の利用を大きく後押ししています。これらのネットワークでは、CPO(Co-Packaged Optic)が提供する広帯域、低遅延技術が求められます。高速インターネット接続の需要が、通信インフラで使用される光技術の需要を牽引しています。

- 次世代パッケージング技術の進化:CPO(Co-Packaged Optic)は、シリコンフォトニクスのような斬新な次世代パッケージング技術の進化に直接関係しています。これらの技術は、高速データ伝送、高帯域幅、低遅延を促進し、5Gやbeyondを含む次世代通信システムに適しています。

- 持続可能性とエネルギー効率:環境への関心が高まる中、エネルギー効率の高い技術の開発にますます注目が集まっています。CPO(Co-Packaged Optic)は、消費電力が少なく、余分な熱を発生させることなく高データトラフィックを処理できるため、持続可能な選択肢であると認識されています。

これらの動向は、AI、5G、クラウドコンピューティングなどの新興技術で増大するデータ伝送ニーズを満たすことに焦点を当てた、より集積化された高性能で効率的な光ソリューションへの動きを反映しています。

CPO(Co-Packaged Optic)市場の最近の動向

CPO(Co-Packaged Optic)市場は過去数年間に大きな開拓を遂げており、それぞれが光技術の急速な進化に貢献しています。以下は5つの主要動向です:

- 光集積技術の進歩:光学部品の半導体パッケージへの集積化が各社で進んでいます。この技術革新は、光モジュールの小型化、低コスト化、低消費電力化をもたらし、データセンター、高性能コンピューティング、通信への応用に適しています。

- 5Gインフラの展開:世界中で5Gの展開が行われており、高性能の光相互接続に対する需要が高まっています。CPO(Co-Packaged Optic)は、5Gの高速・低遅延ニーズに対応する完璧なソリューションであり、世界中の光技術への投資と技術革新を促進しています。

- 政府と産業界の支援:各国の政府、特に米国と中国は、CPO(Co-Packaged Optic)の開発に投資しています。この投資は、高速データ伝送技術に依存する5GやAIなどの次世代通信インフラに資金を提供するために行われています。

- 大手テクノロジー企業のコラボレーション:Intel、Intel、IBMなどの業界大手は、CPO(Co-Packaged Optic)の進化を推進するために協力しています。これらのコラボレーションは、エネルギー使用量の最小化とパフォーマンスの向上に重点を置き、企業のデータセンターやクラウドコンピューティングへのこれらの技術の導入を急いでいます。

- シリコンフォトニクスの出現:シリコンフォトニクスは、CPO(Co-Packaged Optic)の中心的なイネーブラーとなっています。シリコンフォトニクスは、消費電力を抑えながら短時間でのデータ伝送を可能にし、将来のデータセンター、IT・通信ネットワーク、高性能コンピューティングの中心的な構成要素となっています。

これらの技術革新は、CPO(Co-Packaged Optic)市場の将来を定義し、次世代通信およびデータインフラの不可欠な要素になることを確実にしています。

目次

第1章 エグゼクティブサマリー

第2章 世界のCPO(Co-Packaged Optic)市場:市場力学

- イントロダクション、背景、分類

- サプライチェーン

- 業界の促進要因と課題

第3章 市場動向と予測分析、2019年~2031年

- マクロ経済動向(2019年~2024年)と予測(2025年~2031年)

- 世界のCPO(Co-Packaged Optic)市場の動向(2019年~2024年)と予測(2025年~2031年)

- 世界のCPO(Co-Packaged Optic)市場:タイプ別

- 1.6 T未満

- 1.6~3.2 T

- 3.2 T以上

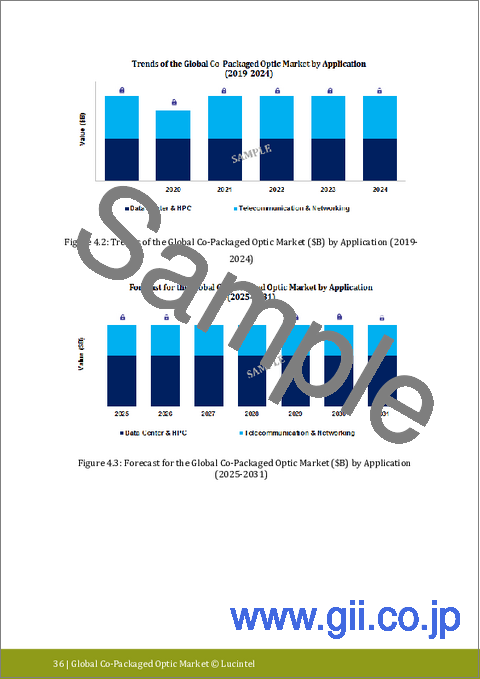

- 世界のCPO(Co-Packaged Optic)市場:用途別

- データセンター・HPC

- 通信・ネットワーク

第4章 市場動向と予測分析:地域別、2019年~2031年

- 世界のCPO(Co-Packaged Optic)市場:地域別

- 北米のCPO(Co-Packaged Optic)市場

- 欧州のCPO(Co-Packaged Optic)市場

- アジア太平洋のCPO(Co-Packaged Optic)市場

- その他地域のCPO(Co-Packaged Optic)市場

第5章 競合分析

- 製品ポートフォリオ分析

- 運用統合

- ポーターのファイブフォース分析

第6章 成長機会と戦略分析

- 成長機会分析

- 世界のCPO(Co-Packaged Optic)市場の成長機会:タイプ別

- 世界のCPO(Co-Packaged Optic)市場の成長機会:用途別

- 世界のCPO(Co-Packaged Optic)市場の成長機会:地域別

- 世界のCPO(Co-Packaged Optic)市場における新たな動向

- 戦略分析

- 新製品開発

- 世界のCPO(Co-Packaged Optic)市場の生産能力拡大

- 世界なCPO(Co-Packaged Optic)市場の合併、買収、合弁事業

- 認証とライセンシング

第7章 主要企業の企業プロファイル

- Broadcom

- NVIDIA

- Cisco

- Ranovus

- Intel

The future of the global co-packaged optic market looks promising with opportunities in the data center & HPC and telecommunication & networking markets. The global co-packaged optic market is expected to grow with a CAGR of 42.9% from 2025 to 2031. The major drivers for this market are the increasing demand for bandwidth, the rising need for energy efficiency, and the growing use of AI workloads.

- Lucintel forecasts that, within the type category, less than 1.6 T is expected to witness the highest growth over the forecast period.

- Within the application category, data center & HPC is expected to witness higher growth.

- In terms of region, APAC is expected to witness the highest growth over the forecast period.

Emerging Trends in the Co-Packaged Optic Market

The market for co-packaged optics is changing at a fast pace as a result of technological innovations and increasing needs for power-saving solutions. The following are the dominant trends changing the market:

- Optical and Electrical Component Integration: The most prominent trend is the increased emphasis on integrating optical and electrical components into a single package. Integration of this type minimizes latency, maximizes bandwidth efficiency, and reduces power consumption, making it the best solution for data centers, cloud computing, and telecommunications.

- Growing Emphasis on Data Center Optimization: The need for fast data transmission in data centers is driving the development of co-packaged optics. Organizations are increasingly using co-packaged optic technologies to save power and increase data throughput. This is being catalyzed by the growth in AI, machine learning, and big data analytics.

- Expansion of 5G and Next-Generation Networks: Expansion of 5G networks worldwide is a major push for the usage of co-packaged optics. These networks call for high-bandwidth, low-latency technology that is offered by co-packaged optics. The demand for high-speed internet connectivity is driving demand for optical technologies used in telecom infrastructure.

- Evolution of Next-Generation Packaging Technologies: Co-packaged optics is directly related to the evolution of novel and next-generation packaging technologies, like silicon photonics. These technologies facilitate high-speed data transmission, high bandwidth, and low latency and are well suited for next-generation communications systems, including 5G and beyond.

- Sustainability and Energy Efficiency: With greater concern for the environment, there is an increasing focus on developing energy-efficient technology. Co-packaged optics are perceived to be a sustainable option because they consume less power and can process high data traffic without producing excess heat.

These trends reflect the move towards more integrated, high-performance, and efficient optical solutions, with the focus on fulfilling the increasing needs for data transmission in emerging technologies such as AI, 5G, and cloud computing.

Recent Developments in the Co-Packaged Optic Market

The co-packaged optic market has witnessed great developments over the past few years, each making a contribution to the fast evolution of optical technologies. The following are five major developments:

- Optical Integration Technology Advancements: Optical components are increasingly being integrated in semiconductor packages by companies. The technological change has resulted in size, cost, and power reduction in optical modules, making them more fit for application in data centers, high-performance computing, as well as telecommunications.

- Rollout of 5G Infrastructure: With 5G deployments taking place across the globe, there is growing demand for optical interconnects with high performance. Co-packaged optics present a perfect solution to accommodate the high-speed and low-latency needs of 5G, fueling investment and innovation in optical technology around the world.

- Government and Industry Support: Governments from different countries, particularly the U.S. and China, are investing in co-packaged optics development. The investments are being made to fund next-generation communication infrastructures, including 5G and AI, which rely on high-speed data transmission technology.

- Tech Giants' Collaboration: Industry leaders such as Intel, Cisco, and IBM are coming together to propel the evolution of co-packaged optics. These collaborations are hastening the implementation of these technologies in data centers of enterprises and cloud computing with an emphasis on minimizing energy usage and improving performance.

- Silicon Photonics Emergence: Silicon photonics has become a central enabler for co-packaged optics. Silicon photonics enables transmitting data in a short time while consuming less power, making it a central building block of the future data centers, telecommunication networks, and high-performance computing.

These innovations are defining the future of the co-packaged optic market, ensuring that it becomes an essential element of next-generation communication and data infrastructure.

Strategic Growth Opportunities in the Co-Packaged Optic Market

The co-packaged optic industry offers several growth prospects in various applications. Five major prospects are as follows:

- Data Centers: As the need for cloud computing and big data analysis rises, data centers are emerging as a key application for co-packaged optics. Such technologies provide better performance and less power consumption, saving substantial costs for operators and providing accelerated data processing.

- Telecommunications: Co-packaged optics are ideal for the growth of 5G and future-generation telecom networks. They offer the high-speed, low-latency connections needed for 5G infrastructure, and therefore are essential for telecom operators looking to increase network capacity and efficiency.

- High-Performance Computing (HPC): In high-performance computing, the need for higher data throughput and lower power consumption is growing. Co-packaged optics address these requirements by providing faster, more efficient interconnect solutions, and thus they are a central element in supercomputing and AI-based research applications.

- Machine Learning and AI: The increasing requirement for machine learning and AI solutions fuels the demand for cutting-edge data processing technology. Co-packaged optics is important to make data transmission and processing faster, which is critical for AI-powered systems to perform optimally at scale.

- Automotive and IoT: Co-packaged optics find use in the automotive sector, particularly in autonomous vehicles that need high-speed data exchange between processors and sensors. In the same vein, IoT devices that must communicate across large networks can use the energy-efficient and high-bandwidth aspect of co-packaged optics.

These opportunities for growth bring to light the potential of co-packaged optics to revolutionize industries from telecommunications to AI and IoT, pushing technological development and market growth.

Co-Packaged Optic Market Driver and Challenges

The market for co-packaged optics is influenced by drivers and challenges. An understanding of these factors is essential for market stakeholders to play the market effectively.

The factors responsible for driving the co-packaged optic market include:

1. Technological Advancements: Technological developments like silicon photonics and integration technologies are principal forces behind the co-packaged optic market. They allow higher data rates, lower power requirements, and greater performance, all of which are crucial for data centers and telecommunications networks today.

2. 5G Deployment: The worldwide deployment of 5G networks necessitates high-end optical solutions that can fulfill the requirements of high-speed, low-latency 5G infrastructure. Co-packaged optics are vital to ensuring the efficiency and performance of future telecom networks.

3. Energy Efficiency: There is increasing recognition of energy use and environmental stewardship that is leading to the adoption of co-packaged optics, which minimize power usage as compared to traditional electrical interconnects. Such energy efficiency is particularly important for large data centers and telecom networks.

4. Cloud Computing Growth: The increasing adoption of cloud computing services demands faster and more efficient data transmission technologies. Co-packaged optics provide the high-performance and low-latency interconnects necessary for cloud services to scale.

5. AI and Big Data: Growth in AI and big data analytics is another significant reason for co-packaged optics since these technologies require greater bandwidth and quicker data processing. Co-packaged optics offer the required infrastructure to handle these data-hungry technologies.

Challenges in the co-packaged optic market are:

1. Significant Development Cost: Co-packaged optics require high R&D investment in development and integration. The cost of manufacturing these high-tech components can prove to be a limitation to adoption, especially for medium and small businesses.

2. Integration Challenges: Although co-packaged optics have several benefits, it is technically challenging to integrate optical devices with electronic systems and entails addressing compatibility, packaging, and scalability concerns.

3. Regulatory Barriers: The market for co-packaged optics is faced with several regulatory barriers, particularly intellectual property rights, global trade policies, and standards compliance. These barriers may hinder market growth and bring about uncertainties among manufacturers.

The market for co-packaged optics is fueled by advancements in technology, the need for energy-efficient solutions, and increasing demand for high-speed data transfer across all industries. The drivers are however still hindered by challenges including high development expenditure, integration difficulties, and compliance challenges that affect market growth. Careful consideration of these drivers and challenges must be taken in order to unlock the full value of co-packaged optics.

List of Co-Packaged Optic Companies

Companies in the market compete on the basis of product quality offered. Major players in this market focus on expanding their manufacturing facilities, R&D investments, infrastructural development, and leverage integration opportunities across the value chain. With these strategies co-packaged optic companies cater increasing demand, ensure competitive effectiveness, develop innovative products & technologies, reduce production costs, and expand their customer base. Some of the co-packaged optic companies profiled in this report include-

- Broadcom

- NVIDIA

- Cisco

- Ranovus

- Intel

Co-Packaged Optic Market by Segment

The study includes a forecast for the global co-packaged optic market by type, application, and region.

Co-Packaged Optic Market by Type [Value from 2019 to 2031]:

- Less Than 1.6 T

- 1.6 To 3.2 T

- More Than 3.2 T

Co-Packaged Optic Market by Application [Value from 2019 to 2031]:

- Data Center & HPC

- Telecommunication & Networking

Co-Packaged Optic Market by Region [Value from 2019 to 2031]:

- North America

- Europe

- Asia Pacific

- The Rest of the World

Country Wise Outlook for the Co-Packaged Optic Market

The co-packaged optic (CPO) industry is on a high growth trajectory, fueled by escalating demand for high-speed data transmission and power-efficient technologies. CPO is a technology of integrating the optical and electrical components into a single package, resulting in high power savings and enhanced performance for high-bandwidth applications. The United States, China, Germany, India, and Japan are the main contributors to this market, with numerous technological, economic, and regulatory forces driving the growth of this industry in each of these countries. This study identifies the current trends, advancements, and strategic growth prospects of the co-packaged optic market in these countries.

- United States: The United States is still the leader in innovation within the co-packaged optic market, with some of the major developments coming in data center technologies. Large firms like Intel and Cisco are heavily investing in co-packaged optics as a way to make data centers more efficient and conserve energy. The efforts by the U.S. government to accelerate technological innovation in 5G and AI also help in the growth of this industry.

- China: China has established a strong leap forward in the co-packaged optics, particularly in its communication infrastructure. Its intense focus on the rollout of 5G infrastructure and artificial intelligence technologies is pushing the call for high-speed and energy-saving data transmission. China's supportive government policies backing the development of semiconductor and fiber-optic technologies are essential in fueling the expansion.

- Germany: Germany's co-packaged optic market has expanded because of its industrial prowess in semiconductor production and focus on high-tech innovation. Companies like Siemens and Bosch are incorporating co-packaged optics into their high-speed computing and telecommunications equipment, in line with the European Union policies promoting technological independence.

- India: India is becoming a key player in the co-packaged optic industry, primarily fueled by rising demand for data infrastructure and 5G services. The government's Digital India push and investment in data centers are improving the country's skills in the optics and semiconductor segments.

- Japan: Japan has been making significant strides in co-packaged optics, particularly in automotive and telecommunications applications. Japan's global leadership in robotics and AI is shaping the demand for energy-saving, high-speed data solutions. NEC and Fujitsu are some of the companies venturing into co-packaged optic technologies to expand their product lines.

Features of the Global Co-Packaged Optic Market

Market Size Estimates: Co-packaged optic market size estimation in terms of value ($B).

Trend and Forecast Analysis: Market trends (2019 to 2024) and forecast (2025 to 2031) by various segments and regions.

Segmentation Analysis: Co-packaged optic market size by type, application, and region in terms of value ($B).

Regional Analysis: Co-packaged optic market breakdown by North America, Europe, Asia Pacific, and Rest of the World.

Growth Opportunities: Analysis of growth opportunities in different type, application, and regions for the co-packaged optic market.

Strategic Analysis: This includes M&A, new product development, and competitive landscape of the co-packaged optic market.

Analysis of competitive intensity of the industry based on Porter's Five Forces model.

This report answers following 11 key questions:

- Q.1. What are some of the most promising, high-growth opportunities for the co-packaged optic market by type (less than 1.6 T, 1.6 to 3.2 T, and more than 3.2 T), application (data center & HPC and telecommunication & networking), and region (North America, Europe, Asia Pacific, and the Rest of the World)?

- Q.2. Which segments will grow at a faster pace and why?

- Q.3. Which region will grow at a faster pace and why?

- Q.4. What are the key factors affecting market dynamics? What are the key challenges and business risks in this market?

- Q.5. What are the business risks and competitive threats in this market?

- Q.6. What are the emerging trends in this market and the reasons behind them?

- Q.7. What are some of the changing demands of customers in the market?

- Q.8. What are the new developments in the market? Which companies are leading these developments?

- Q.9. Who are the major players in this market? What strategic initiatives are key players pursuing for business growth?

- Q.10. What are some of the competing products in this market and how big of a threat do they pose for loss of market share by material or product substitution?

- Q.11. What M&A activity has occurred in the last 5 years and what has its impact been on the industry?

Table of Contents

1. Executive Summary

2. Global Co-Packaged Optic Market : Market Dynamics

- 2.1: Introduction, Background, and Classifications

- 2.2: Supply Chain

- 2.3: Industry Drivers and Challenges

3. Market Trends and Forecast Analysis from 2019 to 2031

- 3.1. Macroeconomic Trends (2019-2024) and Forecast (2025-2031)

- 3.2. Global Co-Packaged Optic Market Trends (2019-2024) and Forecast (2025-2031)

- 3.3: Global Co-Packaged Optic Market by Type

- 3.3.1: Less than 1.6 T

- 3.3.2: 1.6 to 3.2 T

- 3.3.3: More than 3.2 T

- 3.4: Global Co-Packaged Optic Market by Application

- 3.4.1: Data Center & HPC

- 3.4.2: Telecommunication & Networking

4. Market Trends and Forecast Analysis by Region from 2019 to 2031

- 4.1: Global Co-Packaged Optic Market by Region

- 4.2: North American Co-Packaged Optic Market

- 4.2.1: North American Market by Type: Less than 1.6 T, 1.6 to 3.2 T, and More than 3.2 T

- 4.2.2: North American Market by Application: Data Center & HPC and Telecommunication & Networking

- 4.3: European Co-Packaged Optic Market

- 4.3.1: European Market by Type: Less than 1.6 T, 1.6 to 3.2 T, and More than 3.2 T

- 4.3.2: European Market by Application: Data Center & HPC and Telecommunication & Networking

- 4.4: APAC Co-Packaged Optic Market

- 4.4.1: APAC Market by Type: Less than 1.6 T, 1.6 to 3.2 T, and More than 3.2 T

- 4.4.2: APAC Market by Application: Data Center & HPC and Telecommunication & Networking

- 4.5: ROW Co-Packaged Optic Market

- 4.5.1: ROW Market by Type: Less than 1.6 T, 1.6 to 3.2 T, and More than 3.2 T

- 4.5.2: ROW Market by Application: Data Center & HPC and Telecommunication & Networking

5. Competitor Analysis

- 5.1: Product Portfolio Analysis

- 5.2: Operational Integration

- 5.3: Porter's Five Forces Analysis

6. Growth Opportunities and Strategic Analysis

- 6.1: Growth Opportunity Analysis

- 6.1.1: Growth Opportunities for the Global Co-Packaged Optic Market by Type

- 6.1.2: Growth Opportunities for the Global Co-Packaged Optic Market by Application

- 6.1.3: Growth Opportunities for the Global Co-Packaged Optic Market by Region

- 6.2: Emerging Trends in the Global Co-Packaged Optic Market

- 6.3: Strategic Analysis

- 6.3.1: New Product Development

- 6.3.2: Capacity Expansion of the Global Co-Packaged Optic Market

- 6.3.3: Mergers, Acquisitions, and Joint Ventures in the Global Co-Packaged Optic Market

- 6.3.4: Certification and Licensing

7. Company Profiles of Leading Players

- 7.1: Broadcom

- 7.2: NVIDIA

- 7.3: Cisco

- 7.4: Ranovus

- 7.5: Intel