|

|

市場調査レポート

商品コード

1357254

3Dスタッキングの世界市場:パッケージング方法別、手法別、相互接続技術別、デバイスタイプ別、エンドユーザー別 - 2028年までの予測3D Stacking Market by Method, Technology, Device - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 3Dスタッキングの世界市場:パッケージング方法別、手法別、相互接続技術別、デバイスタイプ別、エンドユーザー別 - 2028年までの予測 |

|

出版日: 2023年10月02日

発行: MarketsandMarkets

ページ情報: 英文 237 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

3Dスタッキングの市場規模は、2023年の12億米ドルから2028年には31億米ドルに達すると予測され、2023年から2028年までのCAGRは20.4%と見込まれています。

3Dスタッキング市場の成長を牽引すると期待される主な機会には、高帯域幅メモリ(HBM)デバイスの採用拡大、自動車産業における先進エレクトロニクスの統合などが含まれます。

| 調査範囲 | |

|---|---|

| 対象範囲 | 2019-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 米ドル |

| セグメント | 手法, 相互接続技術, デバイスタイプ, エンドユーザー, 地域 |

| 対象地域 | 北米, 欧州,アジア太平洋, その他の地域 |

ロジック集積回路(IC)はデジタル電子機器に不可欠なコンポーネントであり、電子機器内の計算操作や意思決定プロセスを促進します。3D積層では、ロジックICは計算効率の向上と実装面積の削減において重要な役割を果たします。高性能コンピューティングとエネルギー効率の高いデバイスに対する需要の高まりが、ロジックICの3Dスタッキングの成長に拍車をかけています。より高速で信頼性の高い電子機器に対する消費者の期待が高まり続ける中、3Dスタッキングは、より小さな物理的フットプリントで計算能力の大幅な向上を可能にします。

ハイブリッド接合のプロセスには、プレボンディング層の準備と作成から始まるいくつかの重要なステップがあります。これらの層は、接合を成功させるために極めて重要です。半導体ウエハーの融合を特徴とするボンディング・プロセス自体には、ボンディング後のアニール工程が続き、ボンディングの強度と信頼性を高める。これらの工程を通じて、接合構造の品質と完全性を保証するために、厳格な検査と計測手段が設けられています。

ウエハー・オン・ウエハー(WoW)は3D集積手法の一つで、半導体デバイスやチップを搭載した2枚以上のウエハーを接合・積層し、垂直方向に集積した構造を作る。この方法により、別々のウエハーから異なる機能を統合することが容易になり、性能の向上、配線長の短縮、システム密度の向上が可能になります。

当レポートでは、世界の3Dスタッキング市場について調査し、パッケージング方法別、手法別、相互接続技術別、デバイスタイプ別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- サプライチェーン分析

- 生態系マッピング

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- 技術動向

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 2023年~2025年の主要な会議とイベント

- 基準と規制状況

第6章 3Dスタッキング市場、パッケージング方法別

- イントロダクション

- 3Dパッケージオンパッケージ(POP)

- 3Dシステムインパッケージ(SIP)

- 3Dチップオンチップ(COC)

- ウエハーレベルチップスケールパッケージング(WLCSP)

第7章 3Dスタッキング市場、手法別

- イントロダクション

- ダイトゥーダイ

- ダイトゥーウエハ

- ウエハトゥーウエハ

- ウエハトゥーチップ

- チップトゥーチップ

第8章 3Dスタッキング市場、相互接続技術別

- イントロダクション

- 3Dハイブリッドボンディング

- 3Dスルーシリコンビア(TSV)

- モノリシック3D

第9章 3Dスタッキング市場、デバイスタイプ別

- イントロダクション

- ロジックICS

- イメージングとオプトエレクトロニクス

- メモリデバイス

- MEMS/センサー

- 発光ダイオード(LED)

- その他

第10章 3Dスタッキング市場、エンドユーザー別

- イントロダクション

- 家電

- 製造業

- 通信

- 自動車

- ヘルスケア

- その他

第11章 3Dスタッキング市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第12章 競合情勢

- イントロダクション

- 主要参入企業が採用した戦略

- 市場シェア分析、2022年

- 3Dスタッキング市場の主要企業の収益分析

- 主要企業評価マトリックス、2022年

- 競合ベンチマーキング

- スタートアップ/中小企業(SMES)の評価マトリックス、2022年

- 競争シナリオと動向

第13章 企業プロファイル

- イントロダクション

- 主要参入企業

- TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED

- SAMSUNG

- INTEL CORPORATION

- SK HYNIX INC.

- ADVANCED MICRO DEVICES, INC.

- ASE TECHNOLOGY HOLDING CO., LTD.

- AMKOR TECHNOLOGY

- JIANGSU CHANGDIAN TECHNOLOGY CO., LTD.

- TEXAS INSTRUMENTS INCORPORATED

- UNITED MICROELECTRONICS CORPORATION

- POWERTECH TECHNOLOGY INC

- CADENCE DESIGN SYSTEMS, INC.

- BROADCOM

- TOWER SEMICONDUCTOR

- IBM

- TOKYO ELECTRON LIMITED

- CEA-LETI

- その他の企業

- SILICONWARE PRECISION INDUSTRIES CO., LTD.

- GLOBALFOUNDRIES INC.

- NHANCED SEMICONDUCTORS

- DECA TECHNOLOGIES

- TEZZARON

- TELEDYNE TECHNOLOGIES INCORPORATED

- HUAWEI TECHNOLOGIES CO. LTD.

- QUALCOMM TECHNOLOGIES, INC.

- 3M

- AYAR LABS, INC.

- APPLIED MATERIALS, INC.

- MONOLITHIC 3D INC.

- MOLDEX3D

- CEREBRAS

- XPERI INC.

第14章 付録

The 3D stacking market is projected to reach USD 3.1 billion by 2028 from USD 1.2 billion in 2023, at a CAGR of 20.4% from 2023 to 2028. The major opportunities that are expected to drive the market growth of the 3D stacking market include growing adoption of high-bandwidth memory (HBM) devices and integration of advanced electronics within the automotive industry

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | USD |

| Segments | Method, Interconnecting technology, Device type, End user, region |

| Regions covered | North America, Europe, APAC, RoW |

Increasing demand for high-performance computing and energy-efficient Logics ICs

Logic Integrated Circuits (ICs) are an integral component of digital electronics, facilitating computational operations and decision-making processes within electronic devices. In 3D stacking, Logic ICs play a crucial role in enhancing computational efficiency and reducing footprint. The increasing demand for high-performance computing and energy-efficient devices has fueled the growth of 3D stacking in logic ICs. As consumer expectations for faster and more reliable electronic devices continue to rise, 3D stacking enables a significant increase in computational capabilities within a smaller physical footprint.

Need for enhanced performance and miniaturization in electronic applications to drive market growth for hybrid bonding

The process of hybrid bonding involves several key steps, starting with the preparation and creation of pre-bonding layers. These layers are crucial to ensuring a successful bond. The bonding process itself, characterized by the fusion of semiconductor wafers, is followed by a post-bond annealing step to enhance the bond's strength and reliability. Throughout these processes, rigorous inspection and metrology measures are in place to guarantee the quality and integrity of the bonded structures.

Rising need for advanced and compact packaging solutions in high-performance computing applications to drive market growth for wafer-to-wafer 3D Stacking

Wafer-on-Wafer (WoW) is a 3D integration method that involves bonding and stacking two or more complete wafers, each containing semiconductor devices or chips, to create a vertically integrated structure. This method facilitates the integration of different functionalities from separate wafers, enabling enhanced performance, reduced interconnect lengths, and increased system density.

North America is expected to account for the second largest market share during the forecast period

Being home to some of the leading semiconductor companies, such as Intel Corporation (US), Texas Instruments Inc. (US), Qualcomm Incorporated (US), and Advanced Micro Devices, Inc. (US), makes the region technologically advanced. Semiconductor organizations such as Global Semiconductor Alliance (GSA) (US) and International Microelectronics and Packaging Society (IMAPS) (US) are dedicated associations for the advancement and growth of microelectronics and packaging in North America.

The break-up of profile of primary participants in the 3D stacking market-

- By Company Type: Tier 1 - 38%, Tier 2 - 28%, Tier 3 - 34%

- By Designation Type: C Level - 40%, Director Level - 30% , Others - 30%

- By Region Type: North America - 35%, Europe - 20%, Asia Pacific - 35%, Rest of the World - 10%

The major players of 3D stacking market are Samsung (South Korea), Taiwan Semiconductor Manufacturing Company, Ltd. (Taiwan), Intel Corporation (US), ASE Technology Holding Co., Ltd. (Taiwan), Amkor Technology (US) among others.

Research Coverage

The report segments the 3D stacking market and forecasts its size based on method, interconnecting technology, device type, end user and region. The report also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing the market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall 3D stacking market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing focus on miniaturization and efficient space utilization in electronic devices; Cost advantage offered by 3D stacking technology is increasing its adoption; Growing demand for consumer electronics and gaming devices; Heterogeneous integration and component optimization to improve manufacturing of electronic components; 3D stacking technology to provide shorter interconnect and reduced power consumption boosting its adoption), restraints (High cost of 3D stacking technology to limit adoption; Lack of standardization governing 3D stacking technology), opportunities (Growing adoption of high-bandwidth memory (HBM) devices; Rapid expansion of semiconductor applications across various industries; The integration of advanced electronics within the automotive industry), and challenges (Growing adoption of high-bandwidth memory (HBM) devices; Rapid expansion of semiconductor applications across various industries).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the 3D stacking market

- Market Development: Comprehensive information about lucrative markets - the report analyses the 3D stacking market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the 3D stacking market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like Intel Corporation (US), Samsung (South Korea), Taiwan Semiconductor Manufacturing Company, Ltd. (Taiwan), SK HYNIX INC. (South Korea), Amkor Technology (US) and ASE Technology Holding Co., Ltd. (Taiwan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- FIGURE 1 3D STACKING MARKET: MARKET SEGMENTATION

- 1.3.1 REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 3D STACKING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY & PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Major secondary sources

- 2.1.2.2 Secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.4 BREAKDOWN OF PRIMARIES

- 2.1.4.1 Key data from primary sources

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 PROCESS FLOW OF MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market share by bottom-up analysis (demand side)

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market share by top-down analysis (supply side)

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH (SUPPLY SIDE)-REVENUE GENERATED FROM 3D STACKING SOLUTIONS AND SERVICES

- 2.3 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- TABLE 1 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RECESSION IMPACT ANALYSIS: PARAMETERS CONSIDERED

3 EXECUTIVE SUMMARY

- FIGURE 8 CONSUMER ELECTRONICS SEGMENT TO CAPTURE LARGEST SHARE OF 3D STACKING MARKET IN 2028

- FIGURE 9 MEMORY DEVICES SEGMENT TO HOLD LARGEST SHARE OF 3D STACKING MARKET IN 2028

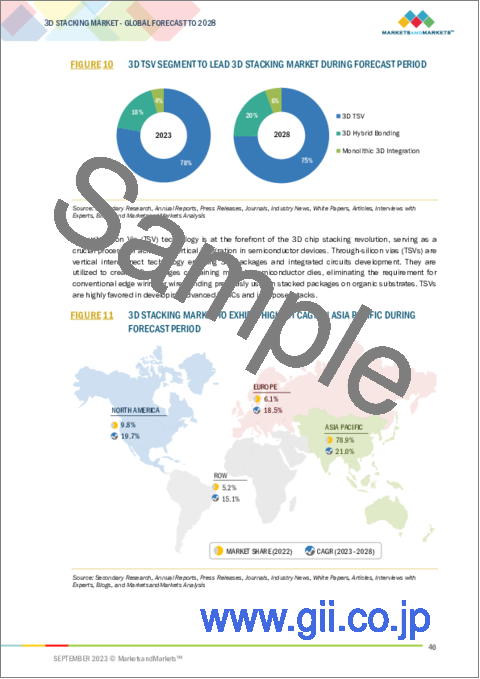

- FIGURE 10 3D TSV SEGMENT TO LEAD 3D STACKING MARKET DURING FORECAST PERIOD

- FIGURE 11 3D STACKING MARKET TO EXHIBIT HIGHEST CAGR IN ASIA PACIFIC DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN 3D STACKING MARKET

- FIGURE 12 INCREASING FOCUS ON MINIATURIZATION AND EFFICIENT SPACE UTILIZATION IN ELECTRONIC DEVICES TO BOOST MARKET GROWTH

- 4.2 3D STACKING MARKET, BY METHOD

- FIGURE 13 DIE-TO-DIE SEGMENT TO HOLD LARGEST SHARE OF 3D STACKING MARKET IN 2028

- 4.3 3D STACKING MARKET, BY END USER

- FIGURE 14 AUTOMOTIVE SEGMENT TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- 4.4 3D STACKING MARKET, BY PACKAGING TECHNOLOGY

- FIGURE 15 3D TSV SEGMENT TO ACCOUNT FOR LARGEST SHARE OF 3D STACKING MARKET FROM 2023 TO 2028

- 4.5 3D STACKING MARKET, BY DEVICE TYPE

- FIGURE 16 MEMORY DEVICES SEGMENT TO HOLD LARGEST SHARE OF 3D STACKING MARKET FROM 2023 TO 2028

- 4.6 ASIA PACIFIC: 3D STACKING MARKET, BY END USER AND COUNTRY

- FIGURE 17 CONSUMER ELECTRONICS SEGMENT AND CHINA HELD LARGEST SHARE OF 3D STACKING MARKET IN ASIA PACIFIC IN 2022

- 4.7 3D STACKING MARKET, BY COUNTRY

- FIGURE 18 TAIWAN TO BE FASTEST-GROWING COUNTRY-LEVEL MARKET FOR 3D STACKING DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 3D STACKING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- FIGURE 20 ANALYSIS OF IMPACT OF DRIVERS ON 3D STACKING MARKET

- 5.2.1.1 Increasing focus on miniaturization and efficient space utilization in electronic devices

- 5.2.1.2 Cost advantage offered by 3D stacking technology

- 5.2.1.3 Growing demand for consumer electronics and gaming devices

- FIGURE 21 NUMBER OF SMARTPHONE AND MOBILE PHONE USERS GLOBALLY, 2020-2025

- 5.2.1.4 Unparalleled flexibility and customization benefits offered by 3D stacking in electronic component manufacturing

- 5.2.1.5 Reduced power consumption and operational costs over 2D stacking

- 5.2.2 RESTRAINTS

- FIGURE 22 ANALYSIS OF IMPACT OF RESTRAINTS ON 3D STACKING MARKET

- 5.2.2.1 Need for substantial upfront investment

- 5.2.2.2 Lack of standardization governing 3D stacking technology

- 5.2.3 OPPORTUNITIES

- FIGURE 23 ANALYSIS OF IMPACT OF OPPORTUNITIES ON 3D STACKING MARKET

- 5.2.3.1 Growing adoption of high-bandwidth memory (HBM) devices

- 5.2.3.2 Rapid expansion of semiconductor applications across various industries

- 5.2.3.3 Integration of advanced electronics into automobiles

- 5.2.4 CHALLENGES

- FIGURE 24 ANALYSIS OF IMPACT OF CHALLENGES ON 3D STACKING MARKET

- 5.2.4.1 Maintaining effective supply chain in 3D stacking

- 5.2.4.2 Designing complexities associated with 3D stacking technology

- 5.3 SUPPLY CHAIN ANALYSIS

- FIGURE 25 3D STACKING MARKET: SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM MAPPING

- FIGURE 26 3D STACKING ECOSYSTEM

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN 3D STACKING MARKET

- 5.6 PRICING ANALYSIS

- TABLE 2 AVERAGE SELLING PRICE OF 12-INCH EQUIVALENT WAFERS, 2022 (USD)

- 5.6.1 AVERAGE SELLING PRICE OF 12-INCH EQUIVALENT WAFERS OFFERED BY KEY PLAYERS

- FIGURE 28 AVERAGE SELLING PRICE OF 12-INCH WAFERS EQUIVALENT OFFERED BY KEY PLAYERS

- 5.6.2 AVERAGE SELLING PRICE TREND

- TABLE 3 AVERAGE SELLING PRICE OF 12-INCH EQUIVALENT WAFERS, 2018-2022 (USD/THOUSAND UNITS)

- FIGURE 29 AVERAGE SELLING PRICE OF WAFERS, 2018-2022

- 5.7 TECHNOLOGY TRENDS

- 5.7.1 FAN-OUT WAFER-LEVEL PACKAGING

- 5.7.2 FAN-OUT PANEL-LEVEL PACKAGING

- 5.7.3 ADVANCED MATERIALS

- 5.7.4 MONOLITHIC 3D INTEGRATION

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 3D STACKING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 6 KEY BUYING CRITERIA, BY END USER

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 SEMICONDUCTOR WAFER PRODUCER REDUCED WAFER REJECTIONS THROUGH CLOSED-LOOP MONITORING

- 5.10.2 SPTS'S DRIE TECHNOLOGY STRENGTHENED IMEC'S SILICON ETCH PLATFORM

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO

- TABLE 7 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 381800, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.11.2 EXPORT SCENARIO

- TABLE 8 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 381800, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.12 PATENT ANALYSIS

- TABLE 9 PATENTS RELATED TO 3D STACKING MARKET, 2020-2023

- FIGURE 33 NUMBER OF PATENTS GRANTED PER YEAR FROM 2013 TO 2022

- TABLE 10 NUMBER OF PATENTS RELATED TO 3D STACKING REGISTERED IN LAST 10 YEARS

- FIGURE 34 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2025

- TABLE 11 3D STACKING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.14 STANDARDS AND REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 KEY REGULATIONS AND STANDARDS

- 5.14.2.1 Regulations

- 5.14.2.2 Standards

6 3D STACKING MARKET, BY PACKAGING METHODOLOGY

- 6.1 INTRODUCTION

- 6.2 3D PACKAGE-ON-PACKAGE (POP)

- 6.2.1 GROWING DEMAND FOR COMPACT AND FEATURE-RICH ELECTRONIC DEVICES TO PROPEL SEGMENTAL GROWTH

- 6.3 3D SYSTEM-IN-PACKAGE (SIP)

- 6.3.1 NEED FOR MINIATURIZED AND POWER-EFFICIENT DEVICES ACROSS DIVERSE APPLICATIONS TO DRIVE SEGMENT

- 6.4 3D CHIP-ON-CHIP (COC)

- 6.4.1 NEED FOR COMPACT SOLUTIONS IN HIGH-PERFORMANCE COMPUTING APPLICATIONS TO FUEL SEGMENTAL GROWTH

- 6.5 WAFER LEVEL CHIP SCALE PACKAGING (WLCSP)

- 6.5.1 NEED TO REDUCE CONSUMPTION OF PACKAGING MATERIAL TO PROPEL ADOPTION OF WLCSP TECHNOLOGY

7 3D STACKING MARKET, BY METHOD

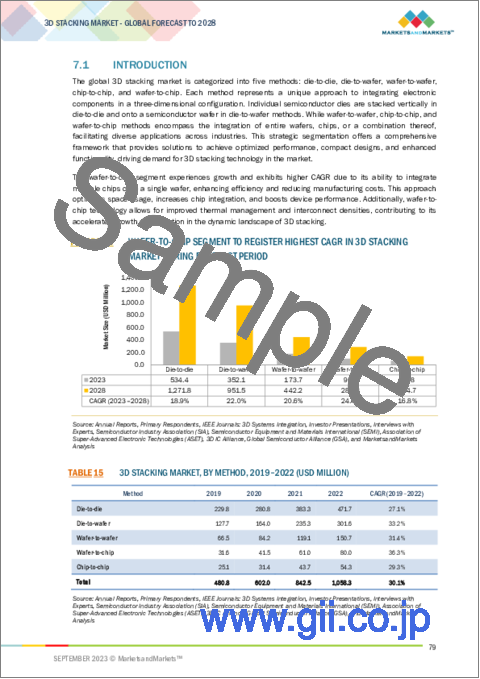

- 7.1 INTRODUCTION

- FIGURE 35 WAFER-TO-CHIP SEGMENT TO REGISTER HIGHEST CAGR IN 3D STACKING MARKET DURING FORECAST PERIOD

- TABLE 15 3D STACKING MARKET, BY METHOD, 2019-2022 (USD MILLION)

- TABLE 16 3D STACKING MARKET, BY METHOD, 2023-2028 (USD MILLION)

- 7.2 DIE-TO-DIE

- 7.2.1 RISING NEED FOR COMPACT AND EFFICIENT DEVICE STRUCTURES TO BOOST ADOPTION OF DIE-TO-DIE STACKING

- TABLE 17 DIE-TO-DIE: 3D STACKING MARKET, BY INTERCONNECTING TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 18 DIE-TO-DIE: 3D STACKING MARKET, BY INTERCONNECTING TECHNOLOGY, 2023-2028 (USD MILLION)

- 7.3 DIE-TO-WAFER

- 7.3.1 INCREASING FOCUS ON DEVICE PERFORMANCE ENHANCEMENT TO FUEL ADOPTION OF DIE-TO-WAFER INTEGRATION IN 3D STACKING

- TABLE 19 DIE-TO-WAFER: 3D STACKING MARKET, BY INTERCONNECTING TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 20 DIE-TO-WAFER: 3D STACKING MARKET, BY INTERCONNECTING TECHNOLOGY, 2023-2028 (USD MILLION)

- 7.4 WAFER-TO-WAFER

- 7.4.1 GROWING DEMAND FOR ADVANCED COMPACT PACKAGING SOLUTIONS TO FUEL SEGMENTAL GROWTH

- TABLE 21 WAFER-TO-WAFER: 3D STACKING MARKET, BY INTERCONNECTING TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 22 WAFER-TO-WAFER: 3D STACKING MARKET, BY INTERCONNECTING TECHNOLOGY, 2023-2028 (USD MILLION)

- 7.5 WAFER-TO-CHIP

- 7.5.1 RISING NEED FOR COMPACT AND EFFICIENT PACKAGING SOLUTIONS IN AUTOMOTIVE ELECTRONICS TO DRIVE SEGMENT

- TABLE 23 WAFER-TO-CHIP: 3D STACKING MARKET, BY INTERCONNECTING TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 24 WAFER-TO-CHIP: 3D STACKING MARKET, BY INTERCONNECTING TECHNOLOGY, 2023-2028 (USD MILLION)

- 7.6 CHIP-TO-CHIP

- 7.6.1 GROWING NEED FOR HIGH-PERFORMANCE AND POWER-EFFICIENT ELECTRONIC DEVICES TO PROPEL SEGMENTAL GROWTH

- TABLE 25 CHIP-TO-CHIP: 3D STACKING MARKET, BY INTERCONNECTING TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 26 CHIP-TO-CHIP: 3D STACKING MARKET, BY INTERCONNECTING TECHNOLOGY, 2023-2028 (USD MILLION)

8 3D STACKING MARKET, BY INTERCONNECTING TECHNOLOGY

- 8.1 INTRODUCTION

- FIGURE 36 3D TSV SEGMENT TO CAPTURE LARGEST SHARE OF 3D STACKING MARKET DURING FORECAST PERIOD

- TABLE 27 3D STACKING MARKET, BY INTERCONNECTING TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 28 3D STACKING MARKET, BY INTERCONNECTING TECHNOLOGY, 2023-2028 (USD MILLION)

- 8.2 3D HYBRID BONDING

- 8.2.1 ADOPTION OF 3D HYBRID BONDING IN HIGH-PERFORMANCE COMPUTING AND DATA-INTENSIVE APPLICATIONS TO DRIVE MARKET

- TABLE 29 3D HYBRID BONDING: 3D STACKING MARKET, BY METHOD, 2019-2022 (USD MILLION)

- TABLE 30 3D HYBRID BONDING: 3D STACKING MARKET, BY METHOD, 2023-2028 (USD MILLION)

- 8.3 3D THROUGH-SILICON VIA (TSV)

- TABLE 31 3D TSV: 3D STACKING MARKET, BY METHOD, 2019-2022 (USD MILLION)

- TABLE 32 3D TSV: 3D STACKING MARKET, BY METHOD, 2023-2028 (USD MILLION)

- 8.3.1 VIA-FIRST TSV

- 8.3.1.1 Increasing adoption of via-first TSV in applications requiring early-stage integration to drive market

- 8.3.2 VIA-MIDDLE TSV

- 8.3.2.1 Need for flexibility in vertical connections in semiconductor design to increase demand for via-middle TSV technology

- 8.3.3 VIA-LAST TSV

- 8.3.3.1 Growing adoption of via-last TSV technology in applications requiring late-stage interconnection to drive market

- 8.3.4 HYBRID TSV

- 8.3.4.1 Ability to meet specific design and performance requirements to fuel adoption of hybrid TSV

- 8.3.5 DEEP TRENCH TSV

- 8.3.5.1 Rising demand for enhanced electrical performance in advanced microprocessors and memory devices to drive market

- 8.3.6 MICROBUMP TSV

- 8.3.6.1 Rising demand for miniaturized and densely interconnected semiconductor devices to fuel market growth

- 8.3.7 THROUGH GLASS VIA (TGV)

- 8.3.7.1 Rising adoption of TGV technique in applications requiring transparent and hermetic packaging to drive market

- 8.4 MONOLITHIC 3D

- 8.4.1 ABILITY TO ADDRESS LIMITATIONS OF ADVANCED CMOS SCALING TO FUEL DEMAND FOR MONOLITHIC 3D INTEGRATION

- TABLE 33 MONOLITHIC 3D INTEGRATION: 3D STACKING MARKET, BY METHOD, 2019-2022 (USD MILLION)

- TABLE 34 MONOLITHIC 3D INTEGRATION: 3D STACKING MARKET, BY METHOD, 2023-2028 (USD MILLION)

9 3D STACKING MARKET, BY DEVICE TYPE

- 9.1 INTRODUCTION

- FIGURE 37 MEMS/SENSORS SEGMENT TO REGISTER HIGHEST CAGR IN 3D STACKING MARKET DURING FORECAST PERIOD

- TABLE 35 3D STACKING MARKET, BY DEVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 36 3D STACKING MARKET, BY DEVICE TYPE, 2023-2028 (USD MILLION)

- 9.2 LOGIC ICS

- 9.2.1 RISING NEED FOR HIGH COMPUTATIONAL EFFICIENCY TO INDUCE DEMAND FOR LOGIC ICS

- TABLE 37 LOGIC ICS: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 38 LOGIC ICS: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 9.3 IMAGING & OPTOELECTRONICS

- 9.3.1 POTENTIAL TO IMPROVE IMAGE PROCESSING AND OPTICAL FUNCTIONALITIES TO SPUR ADOPTION OF 3D STACKING

- TABLE 39 IMAGING & OPTOELECTRONICS: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 40 IMAGING & OPTOELECTRONICS: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 9.4 MEMORY DEVICES

- 9.4.1 SURGING DEMAND FOR HIGH-BANDWIDTH MEMORY TO FOSTER MARKET GROWTH

- TABLE 41 MEMORY DEVICES: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 42 MEMORY DEVICES: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 9.5 MEMS/SENSORS

- 9.5.1 GROWING REQUIREMENT FOR COMPACT AND ACCURATE SENSING TECHNOLOGIES TO FUEL UPTAKE OF 3D STACKING

- TABLE 43 MEMS/SENSORS: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 44 MEMS/SENSORS: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 9.6 LIGHT EMITTING DIODES (LEDS)

- 9.6.1 RISING DEMAND FOR INNOVATIVE DESIGNS AND IMPROVED LUMINOSITY IN LEDS TO FUEL SEGMENTAL GROWTH

- TABLE 45 LEDS: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 46 LEDS: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 9.7 OTHERS

- TABLE 47 OTHERS: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 48 OTHERS: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

10 3D STACKING MARKET, BY END USER

- 10.1 INTRODUCTION

- FIGURE 38 AUTOMOTIVE SEGMENT TO RECORD HIGHEST CAGR IN 3D STACKING MARKET DURING FORECAST PERIOD

- TABLE 49 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 50 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 10.2 CONSUMER ELECTRONICS

- 10.2.1 INCREASING TECHNOLOGICAL ADVANCEMENTS IN CONSUMER ELECTRONICS TO DRIVE ADOPTION OF 3D STACKING

- TABLE 51 CONSUMER ELECTRONICS: 3D STACKING MARKET, BY DEVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 52 CONSUMER ELECTRONICS: 3D STACKING MARKET, BY DEVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 53 CONSUMER ELECTRONICS: 3D STACKING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 54 CONSUMER ELECTRONICS: 3D STACKING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 MANUFACTURING

- 10.3.1 INCREASING SHIFT TOWARD SMART FACTORIES AND INDUSTRY 4.0 TO FUEL ADOPTION OF 3D STACKING

- TABLE 55 MANUFACTURING: 3D STACKING MARKET, BY DEVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 56 MANUFACTURING: 3D STACKING MARKET, BY DEVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 57 MANUFACTURING: 3D STACKING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 58 MANUFACTURING: 3D STACKING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 COMMUNICATIONS

- 10.4.1 INTEGRATION OF ADVANCED FUNCTIONALITIES IN HIGH-PERFORMANCE COMPUTING APPLICATIONS TO DRIVE MARKET

- TABLE 59 COMMUNICATIONS: 3D STACKING MARKET, BY DEVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 60 COMMUNICATIONS: 3D STACKING MARKET, BY DEVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 61 COMMUNICATIONS: 3D STACKING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 62 COMMUNICATIONS: 3D STACKING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5 AUTOMOTIVE

- 10.5.1 RISING DEMAND FOR COMPACT AND POWERFUL AUTOMOTIVE ELECTRONIC SYSTEMS TO PROPEL MARKET GROWTH

- TABLE 63 AUTOMOTIVE: 3D STACKING MARKET, BY DEVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 64 AUTOMOTIVE: 3D STACKING MARKET, BY DEVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 65 AUTOMOTIVE: 3D STACKING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 66 AUTOMOTIVE: 3D STACKING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.6 HEALTHCARE

- 10.6.1 SURGING DEMAND FOR ADVANCED MEDICAL EQUIPMENT FOR HIGH PERFORMANCE AND EFFICIENCY TO FUEL MARKET GROWTH

- TABLE 67 HEALTHCARE: 3D STACKING MARKET, BY DEVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 68 HEALTHCARE: 3D STACKING MARKET, BY DEVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 69 HEALTHCARE: 3D STACKING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 70 HEALTHCARE: 3D STACKING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.7 OTHERS

- TABLE 71 OTHERS: 3D STACKING MARKET, BY DEVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 72 OTHERS: 3D STACKING MARKET, BY DEVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 73 OTHERS: 3D STACKING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 74 OTHERS: 3D STACKING MARKET, BY REGION, 2023-2028 (USD MILLION)

11 3D STACKING MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 39 ASIA PACIFIC TO RECORD HIGHEST CAGR IN 3D STACKING MARKET DURING FORECAST PERIOD

- TABLE 75 3D STACKING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 76 3D STACKING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- FIGURE 40 NORTH AMERICA: 3D STACKING MARKET SNAPSHOT

- TABLE 77 NORTH AMERICA: 3D STACKING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: 3D STACKING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.2.1 US

- 11.2.1.1 Presence of fabrication business giants to support market growth

- TABLE 81 US: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 82 US: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.2.2 CANADA

- 11.2.2.1 Increasing focus on innovation and technological advancements to foster market growth

- TABLE 83 CANADA: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 84 CANADA: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.2.3 MEXICO

- 11.2.3.1 Government-led initiatives to develop semiconductor industry to fuel market growth

- TABLE 85 MEXICO: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 86 MEXICO: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.2.4 NORTH AMERICA: RECESSION IMPACT

- 11.3 EUROPE

- FIGURE 41 EUROPE: 3D STACKING MARKET SNAPSHOT

- TABLE 87 EUROPE: 3D STACKING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 88 EUROPE: 3D STACKING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 89 EUROPE: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 90 EUROPE: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.3.1 GERMANY

- 11.3.1.1 Growing production of automobiles to create demand for 3D stacking

- TABLE 91 GERMANY: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 92 GERMANY: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.3.2 FRANCE

- 11.3.2.1 Increasing R&D in 3D stacking to drive market

- TABLE 93 FRANCE: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 94 FRANCE: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.3.3 UK

- 11.3.3.1 5G implementation to create conducive environment for market growth

- TABLE 95 UK: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 96 UK: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.3.4 REST OF EUROPE

- TABLE 97 REST OF EUROPE: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 98 REST OF EUROPE: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.3.5 EUROPE: RECESSION IMPACT

- 11.4 ASIA PACIFIC

- FIGURE 42 ASIA PACIFIC: 3D STACKING MARKET SNAPSHOT

- TABLE 99 ASIA PACIFIC: 3D STACKING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 100 ASIA PACIFIC: 3D STACKING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4.1 CHINA

- 11.4.1.1 Increasing investments in semiconductor industry to drive market

- TABLE 103 CHINA: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 104 CHINA: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4.2 JAPAN

- 11.4.2.1 Increasing focus on precision engineering to boost adoption of 3D stacking

- TABLE 105 JAPAN: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 106 JAPAN: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4.3 SOUTH KOREA

- 11.4.3.1 Growing focus on innovation and research to contribute to market growth

- TABLE 107 SOUTH KOREA: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 108 SOUTH KOREA: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4.4 TAIWAN

- 11.4.4.1 Rising demand for compact, efficient, and high-performing chips to support market growth

- TABLE 109 TAIWAN: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 110 TAIWAN: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4.5 REST OF ASIA PACIFIC

- TABLE 111 REST OF ASIA PACIFIC: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 112 REST OF ASIA PACIFIC: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4.6 ASIA PACIFIC: RECESSION IMPACT

- 11.5 REST OF THE WORLD (ROW)

- TABLE 113 ROW: 3D STACKING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 114 ROW: 3D STACKING MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 115 ROW: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 116 ROW: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.5.1 MIDDLE EAST & AFRICA

- 11.5.1.1 Government initiatives to strengthen semiconductor industry to favor market growth

- TABLE 117 MIDDLE EAST & AFRICA: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 Growing demand for advanced architecture and high-end computing to contribute to market growth

- TABLE 119 SOUTH AMERICA: 3D STACKING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 120 SOUTH AMERICA: 3D STACKING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.5.3 ROW: RECESSION IMPACT

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 121 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN 3D STACKING MARKET

- 12.2.1 PRODUCT PORTFOLIO

- 12.2.2 REGIONAL FOCUS

- 12.2.3 ORGANIC/INORGANIC GROWTH STRATEGIES

- 12.3 MARKET SHARE ANALYSIS, 2022

- TABLE 122 3D STACKING MARKET: MARKET SHARE ANALYSIS, 2022

- 12.4 REVENUE ANALYSIS OF KEY PLAYERS IN 3D STACKING MARKET

- FIGURE 43 FIVE-YEAR REVENUE ANALYSIS OF KEY PLAYERS IN 3D STACKING MARKET

- 12.5 KEY COMPANY EVALUATION MATRIX, 2022

- 12.5.1 STARS

- 12.5.2 PERVASIVE PLAYERS

- 12.5.3 EMERGING LEADERS

- 12.5.4 PARTICIPANTS

- FIGURE 44 3D STACKING MARKET (GLOBAL): KEY COMPANY EVALUATION MATRIX, 2022

- 12.6 COMPETITIVE BENCHMARKING

- 12.6.1 COMPANY FOOTPRINT, BY INTERCONNECTING METHOD

- 12.6.2 COMPANY FOOTPRINT, BY DEVICE TYPE

- 12.6.3 COMPANY FOOTPRINT, BY END USER

- 12.6.4 COMPANY FOOTPRINT, BY REGION

- 12.6.5 OVERALL COMPANY FOOTPRINT

- 12.7 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022

- TABLE 123 3D STACKING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 12.7.1 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 124 COMPANY FOOTPRINT, BY INTERCONNECTING METHODS

- TABLE 125 COMPANY FOOTPRINT, BY DEVICE TYPE

- TABLE 126 COMPANY FOOTPRINT, BY END USER INDUSTRY

- TABLE 127 COMPANY FOOTPRINT, BY REGION

- 12.7.2 PROGRESSIVE COMPANIES

- 12.7.3 RESPONSIVE COMPANIES

- 12.7.4 DYNAMIC COMPANIES

- 12.7.5 STARTING BLOCKS

- FIGURE 45 3D STACKING MARKET (GLOBAL): STARTUPS/SMES EVALUATION MATRIX, 2022

- 12.8 COMPETITIVE SCENARIOS AND TRENDS

- 12.8.1 PRODUCT LAUNCHES & DEVELOPMENTS

- TABLE 128 3D STACKING MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2020-2023

- 12.8.2 DEALS

- TABLE 129 3D STACKING MARKET: DEALS, 2020-2023

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- (Business overview, Products/Solutions/Services offered, Recent developments, Product launches, Deals, MnM view, Key strengths/Right to win, Strategic choices, and Weaknesses/Competitive threats)**

- 13.2.1 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED

- TABLE 130 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED: COMPANY OVERVIEW

- FIGURE 46 TAIWAN SEMICONDUCTOR MANUFACTURING CO LTD: COMPANY SNAPSHOT

- TABLE 131 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 132 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED: PRODUCT LAUNCHES

- TABLE 133 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED: DEALS

- TABLE 134 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED: OTHERS

- 13.2.2 SAMSUNG

- TABLE 135 SAMSUNG: COMPANY OVERVIEW

- FIGURE 47 SAMSUNG: COMPANY SNAPSHOT

- TABLE 136 SAMSUNG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 137 SAMSUNG: PRODUCT LAUNCHES

- TABLE 138 SAMSUNG: DEALS

- 13.2.3 INTEL CORPORATION

- TABLE 139 INTEL CORPORATION: COMPANY OVERVIEW

- FIGURE 48 INTEL CORPORATION: COMPANY SNAPSHOT

- TABLE 140 INTEL CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.2.4 SK HYNIX INC.

- TABLE 141 SK HYNIX INC.: COMPANY OVERVIEW

- FIGURE 49 SK HYNIX INC.: COMPANY SNAPSHOT

- TABLE 142 SK HYNIX INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 143 SK HYNIX INC.: DEALS

- 13.2.5 ADVANCED MICRO DEVICES, INC.

- TABLE 144 ADVANCED MICRO DEVICES, INC.: COMPANY OVERVIEW

- FIGURE 50 ADVANCED MICRO DEVICES, INC.: COMPANY SNAPSHOT

- TABLE 145 ADVANCED MICRO DEVICES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 146 ADVANCED MICRO DEVICES, INC.: DEALS

- 13.2.6 ASE TECHNOLOGY HOLDING CO., LTD.

- TABLE 147 ASE TECHNOLOGY HOLDING CO., LTD.: COMPANY OVERVIEW

- FIGURE 51 ASE TECHNOLOGY HOLDING CO., LTD.: COMPANY SNAPSHOT

- TABLE 148 ASE TECHNOLOGY HOLDING CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 149 ASE TECHNOLOGY HOLDING CO., LTD.: PRODUCT LAUNCHES

- 13.2.7 AMKOR TECHNOLOGY

- TABLE 150 AMKOR TECHNOLOGY: COMPANY OVERVIEW

- FIGURE 52 AMKOR TECHNOLOGY: COMPANY SNAPSHOT

- TABLE 151 AMKOR TECHNOLOGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 152 AMKOR TECHNOLOGY: DEALS

- 13.2.8 JIANGSU CHANGDIAN TECHNOLOGY CO., LTD.

- TABLE 153 JIANGSU CHANGDIAN TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- FIGURE 53 JIANGSU CHANGDIAN TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- TABLE 154 JIANGSU CHANGDIAN TECHNOLOGY CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 155 JIANGSU CHANGDIAN TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 156 JIANGSU CHANGDIAN TECHNOLOGY CO., LTD.: DEALS

- 13.2.9 TEXAS INSTRUMENTS INCORPORATED

- TABLE 157 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- FIGURE 54 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- TABLE 158 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 159 TEXAS INSTRUMENTS INCORPORATED: DEALS

- 13.2.10 UNITED MICROELECTRONICS CORPORATION

- TABLE 160 UNITED MICROELECTRONICS CORPORATION: COMPANY OVERVIEW

- FIGURE 55 UNITED MICROELECTRONICS CORPORATION: COMPANY SNAPSHOT

- TABLE 161 UNITED MICROELECTRONICS CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 162 UNITED MICROELECTRONICS CORPORATION: DEALS

- 13.2.11 POWERTECH TECHNOLOGY INC

- TABLE 163 POWERTECH TECHNOLOGY INC: COMPANY OVERVIEW

- FIGURE 56 POWERTECH TECHNOLOGY INC: COMPANY SNAPSHOT

- TABLE 164 POWERTECH TECHNOLOGY INC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.2.12 CADENCE DESIGN SYSTEMS, INC.

- TABLE 165 CADENCE DESIGN SYSTEMS, INC.: COMPANY OVERVIEW

- FIGURE 57 CADENCE DESIGN SYSTEMS, INC.: COMPANY SNAPSHOT

- TABLE 166 CADENCE DESIGN SYSTEMS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 167 CADENCE DESIGN SYSTEMS, INC.: DEALS

- 13.2.13 BROADCOM

- TABLE 168 BROADCOM: COMPANY OVERVIEW

- FIGURE 58 BROADCOM: COMPANY SNAPSHOT

- TABLE 169 BROADCOM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 170 BROADCOM: DEALS

- 13.2.14 TOWER SEMICONDUCTOR

- TABLE 171 TOWER SEMICONDUCTOR: COMPANY OVERVIEW

- FIGURE 59 TOWER SEMICONDUCTOR: COMPANY SNAPSHOT

- TABLE 172 TOWER SEMICONDUCTOR: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 173 TOWER SEMICONDUCTOR: DEALS

- 13.2.15 IBM

- TABLE 174 IBM: COMPANY OVERVIEW

- FIGURE 60 IBM: COMPANY SNAPSHOT

- TABLE 175 IBM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 176 IBM: PRODUCT LAUNCHES

- 13.2.16 TOKYO ELECTRON LIMITED

- TABLE 177 TOKYO ELECTRON LIMITED: COMPANY OVERVIEW

- FIGURE 61 TOKYO ELECTRON LIMITED: COMPANY SNAPSHOT

- TABLE 178 TOKYO ELECTRON LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 179 TOKYO ELECTRON LIMITED: PRODUCT LAUNCHES

- 13.2.17 CEA-LETI

- TABLE 180 CEA-LETI: COMPANY OVERVIEW

- TABLE 181 CEA-LETI: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- *Details on Business overview, Products/Solutions/Services offered, Recent developments, Product launches, Deals, MnM view, Key strengths/Right to win, Strategic choices, and Weaknesses/Competitive threats might not be captured in case of unlisted companies.

- 13.3 OTHER PLAYERS

- 13.3.1 SILICONWARE PRECISION INDUSTRIES CO., LTD.

- 13.3.2 GLOBALFOUNDRIES INC.

- 13.3.3 NHANCED SEMICONDUCTORS

- 13.3.4 DECA TECHNOLOGIES

- 13.3.5 TEZZARON

- 13.3.6 TELEDYNE TECHNOLOGIES INCORPORATED

- 13.3.7 HUAWEI TECHNOLOGIES CO. LTD.

- 13.3.8 QUALCOMM TECHNOLOGIES, INC.

- 13.3.9 3M

- 13.3.10 AYAR LABS, INC.

- 13.3.11 APPLIED MATERIALS, INC.

- 13.3.12 MONOLITHIC 3D INC.

- 13.3.13 MOLDEX3D

- 13.3.14 CEREBRAS

- 13.3.15 XPERI INC.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS