|

|

市場調査レポート

商品コード

1355385

自動車用グリーンタイヤの世界市場:車両タイプ別、リムサイズ別、推進タイプ別、用途別、販売チャネル別、地域別 - 予測(~2028年)Automotive Green Tires Market by Vehicle Type (PC, LCV, Trucks and Buses), Rim Size (13-15", 16-18", 19-21" and >21"), Propulsion Type (ICE and EV), Application (On-road and off-road), Sales Channel & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用グリーンタイヤの世界市場:車両タイプ別、リムサイズ別、推進タイプ別、用途別、販売チャネル別、地域別 - 予測(~2028年) |

|

出版日: 2023年09月25日

発行: MarketsandMarkets

ページ情報: 英文 212 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の自動車用グリーンタイヤの市場規模は、2023年に115億米ドル、2028年までに158億米ドルに達し、CAGRで6.5%の成長が予測されています。

世界各国の政府は、燃費や排出に関する規制をますます強化しています。こうした規制が、燃料消費と排出を削減するよう設計されたグリーンタイヤの需要を促進しています。グリーンタイヤは持続可能な材料から作られており、燃費の向上、排出ガスの削減、タイヤの長寿命化に役立ちます。グリーンタイヤへの需要の高まりは、タイヤメーカーやサプライヤーに新たな機会をもたらしています。

大型トラックセグメントは予測期間中にかなりのCAGRで成長すると予測されます。

グリーンタイヤは従来のタイヤよりも長寿命です。これは、特に運搬に多く使用される車両にとっては、交換費用を節約することができます。2022年5月、Goodyearは大型トラック用ハイエンドタイヤから石油由来材料を排除すると発表しました。欧州と米国はともに、タイヤの品質やメンテナンスを含め、自動車の安全性に関する厳しい規制や基準を設けています。これらの規制は、より耐久性が高く効率的に設計された高品質なタイヤの使用を奨励し、市場を牽引します。世界中でCO2排出の削減に向けた環境規制が強化されているため、大型トラック用グリーンタイヤの需要が高まると予想されます。

16~18インチセグメントが予測期間中に市場を独占する可能性があります。

成長するロジスティクス産業は、LCVの売上の増加により16~18インチタイヤの新たな機会を生み出しています。ロジスティクス企業は、困難な地形で重い荷物を扱うことができる車両を必要としており、より大きなタイヤは優れた牽引力と性能を提供できます。ロジスティクス産業は常に進化しており、重量物の輸送に使用される車両のタイプも進化しています。新しい技術が登場するにつれて、重い荷物をより効率的かつ安全に輸送できる新しいタイプの車両が開発されています。多くのOEMが、ランフラットタイヤや自己膨張タイヤなどの新技術を開発しており、そのほとんどが16~18インチのリムサイズのタイヤで提供されています。これらのタイヤは、従来のタイヤよりも多くの利点を提供するため、需要の増加につながる可能性があります。したがって、グリーンタイヤ市場は成長する見込みです。

アジア太平洋が自動車用グリーンタイヤ市場の高い成長可能性を示します。

中国は自動車産業の製造拠点と考えられています。このことが、アジア太平洋におけるグリーンタイヤ市場の成長を促進すると推定されます。ここ数年、アジア太平洋では高級車やプレミアムセグメント車の需要が増加しています。アジア太平洋は、2023年6月現在、Continental(ドイツ)、Goodyear(米国)、Cooper(米国)、Pirelli(イタリア)、Michelin(シンガポール)、Bridgestone Corporation、Yokohama、Hankook Technology Group(韓国)、Nokian(フィンランド)、Apollo Tyres(インド)、Sumitomo Rubber Industries(日本)といった主要タイヤメーカーの生産拠点として台頭しています。2021年、日本のAsahi Kaseiは環境に優しいタイヤ向けの持続可能な溶液重合スチレンブタジエンゴム(S-SBR)を生産すると発表しました。

当レポートでは、世界の自動車用グリーンタイヤ市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- グリーンタイヤ市場の企業にとっての魅力的な機会

- グリーンタイヤ市場:用途別

- グリーンタイヤ市場:車両タイプ別

- グリーンタイヤ市場:推進タイプ別

- グリーンタイヤ市場:リムサイズ別

- グリーンタイヤ市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サプライチェーン分析

- エコシステムマッピング

- ケーススタディ

- MICHELIN、AXENS、IFP ENERGIES NOUVELLES

- BRIDGESTONE CORPORATION、ARLANXEO、SOLVAY

- MICHELIN、ENVIRO

- 価格分析

- グリーンタイヤの平均販売価格:主要企業別

- グリーンタイヤの平均販売価格:地域別

- 特許分析

- 技術分析

- スマートタイヤ

- 3Dプリントタイヤ

- ランフラットタイヤ

- 規制情勢

- 主な会議とイベント(2023年~2024年)

- 主なステークホルダーと購入基準

- 購入プロセスにおける主なステークホルダー

- 購入基準

- 顧客のビジネスに影響を与える動向と混乱

- グリーンタイヤに使用される材料に関するMNMの考察

- シリカ

- 天然ゴム

- スチールベルト

- シラン

- バイオベース樹脂

- グリーンタイヤ市場のシナリオ(2023年~2028年)

- もっとも可能性の高いシナリオ

- 楽観的なシナリオ

- 悲観的なシナリオ

第6章 グリーンタイヤ市場:推進タイプ別

- イントロダクション

- EV

- ICE

- 主な産業の考察

第7章 グリーンタイヤ市場:車両タイプ別

- イントロダクション

- 乗用車

- 小型商用車

- トラック

- バス

- 二輪車

- 主な産業の考察

第8章 グリーンタイヤ市場:用途別

- イントロダクション

- オンロード

- オフロード

- 主な産業の考察

第9章 グリーンタイヤ市場:リムサイズ別

- イントロダクション

- 13~15インチ

- 16~18インチ

- 19~21インチ

- 21インチ超

- 主な産業の考察

第10章 グリーンタイヤ市場:販売チャネル別

- イントロダクション

- OEM

- アフターマーケット

- 主な産業の考察

第11章 グリーンタイヤ市場:地域別

- イントロダクション

- アジア太平洋

- 景気後退の影響の分析

- 中国

- 韓国

- 日本

- インド

- タイ

- その他のアジア太平洋

- 欧州

- 景気後退の影響の分析

- ドイツ

- スペイン

- 英国

- フランス

- イタリア

- ロシア

- トルコ

- その他の欧州

- 北米

- 景気後退の影響の分析

- 米国

- カナダ

- メキシコ

- ラテンアメリカ

- 景気後退の影響の分析

- ブラジル

- アルゼンチン

- その他のラテンアメリカ

- 中東・アフリカ

- 景気後退の影響の分析

- イラン

- 南アフリカ

- その他の中東・アフリカ

第12章 競合情勢

- 概要

- 主要企業が採用した戦略(2021年~2023年)

- 市場シェア分析(2022年)

- MICHELIN

- BRIDGESTONE CORPORATION

- THE GOODYEAR TIRE & RUBBER COMPANY

- CONTINENTAL AG

- PIRELLI & C. S.P.A.

- 収益分析(2018年~2022年)

- 企業の評価マトリクス

- 企業のフットプリント

- スタートアップ/中小企業の評価マトリクス

- 競合ベンチマーキング

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- MICHELIN

- BRIDGESTONE CORPORATION

- THE GOODYEAR TIRE & RUBBER COMPANY

- CONTINENTAL AG

- PIRELLI & C. S.P.A.

- SUMITOMO RUBBER INDUSTRIES, LTD.

- HANKOOK TIRE & TECHNOLOGY CO., LTD.

- NOKIAN TYRES PLC

- CHENG SHIN RUBBER IND. CO., LTD.

- ZHONGCE RUBBER GROUP CO., LTD.

- KUMHO TIRE CO., INC.

- その他の企業

- APOLLO TYRES LTD.

- SHANDONG LINGLONG TIRE CO., LTD.

- KENDA TIRES

- GITI TIRE

- COOPER TIRE & RUBBER COMPANY

- THE YOKOHAMA RUBBER CO., LTD.

- NEXEN TIRE

- MRF LIMITED

- PETLAS

- BALKRISHNA INDUSTRIES LTD.

- TOYO TIRE CORPORATION

- CEAT LIMITED

第14章 MARKETSANDMARKETSによる推奨

- アジア太平洋はグリーンタイヤメーカーにとって重要な市場となる

- 企業は高性能グリーンタイヤを重視する必要がある

- 結論

第15章 付録

The global automotive green tires market size is projected to grow from USD 11.5 billion in 2023 to USD 15.8 billion by 2028, at a CAGR of 6.5%. Governments around the world are increasingly imposing regulations on fuel efficiency and emissions. These regulations are driving demand for green tires, which are designed to reduce fuel consumption and emissions. Green tires are made from sustainable materials and can help to improve fuel efficiency, reduce emissions, and extend the life of tires. The growing demand for green tires is creating new opportunities for tire manufacturers and suppliers.

The Heavy Trucks segment is estimated to grow at a noticeable CAGR during the forecast period

Heavy trucks are used to transport heavy goods and include, trailers and towing trucks. The weight carrying capacity of heavy trucks is more than that of LCVs. Heavy trucks have more than four tires. In August 2023, Bridgestone Corporation launched Greatec M703 Ecopia which is ultra-wide base tire designed for long-haul and regional commercial vehicles. It is designed with a high-density, ultra-wide tread pattern and a long-wearing compound to provide high mileage over its service life. Green tires can also have a longer lifespan than traditional tires. This can save money on replacement costs, especially for vehicles that are used for a lot of hauling. In May 2022, Goodyear announced to eliminate petroleum-based materials from its high-end tires for heavy trucks Both Europe and the US have stringent regulations and standards for vehicle safety, including tire quality and maintenance. These regulations encourage the use of higher-quality tires that are designed to be more durable and efficient which will drive the market. The environmental regulations for the reduction of CO2 emissions across the globe are expected to drive the demand for green tires in heavy trucks.

16-18" segment is likely to dominate the automotive green tires market during the forecast period

Growing logistics industry is creating new opportunities for 16-18" tires, due to increase in sales of LCVs. Logistics companies require vehicles that can handle heavy loads, with difficult terrains, and larger tires can provide better traction and performance. The logistics industry is constantly evolving, and the types of vehicles used to transport heavy loads are also evolving. As new technologies emerge, new types of vehicles are being developed that can transport heavy loads more efficiently and safely. Many OEMs are developing new technologies, such as run-flat tires and self-inflating tires, which are mostly offered in 16-18" rim-size tires. This could lead to an increase in demand for these tires, as they offer a number of advantages over traditional tires. Hence, the green tires market will grow

Asia Pacific shows high growth potential for automotive green tires market

China is considered as the manufacturing hub for the automotive industry. This, in turn, is estimated to drive the growth of the green tire market in the Asia Pacific region. In the past few years, the Asia Pacific region has experienced an increase in the demand for luxury or premium segment vehicles. Asia Pacific has emerged as a production hub for major tire manufacturing companies such as Continental (Germany), Goodyear (US), Cooper (US), Pirelli (Italy), Michelin (Singapore), Bridgestone Corporation, Yokohama, Hankook Technology Group Co. Ltd. (South Korea), Nokian (Finland), Apollo Tyres (India), and Sumitomo Rubber Industries (Japan) as of June 2023. In 2021, Asahi Kasei, a Japanese company announced to produce sustainable solution-polymerized styrene-butadiene rubber (S-SBR) for eco friendly tires.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in the automotive green tires market. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 80%, OEMs - 20%

- By Designation: Director Level - 10%, C Level Executives - 60%, and Others - 30%

- By Region: North America - 10%, Europe - 20%, Asia Pacific - 60% South America - 5%, Middle East and Africa - 5% and

The automotive green tires market comprises major manufacturers such as Bridgestone Corporation (Japan), Michelin (France), Goodyear (US), Pirelli (Italy), Continental (Germany), etc.

Research Coverage:

The study covers the automotive green tires market across various segments. It aims at estimating the market size and future growth potential of this market across different segments such as green tires propulsion, vehicle type, rim size, application, sales channel, and region. The study also includes an in-depth competitive analysis of key market players, their company profiles, key observations related to product and business offerings, recent developments, and acquisitions.

This research report categorizes Automotive green tires Market by propulsion Type (ICE and EV), Sales Channel type (OEM and aftermarket), application (On-road and off-road), vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Buses and Two-wheelers), Rim Size (13-15", 16-18", 19-21" and >21"), and Region (Asia Pacific, Europe, North America, South America and Middle East & Africa).

The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the automotive green tires market. A detailed analysis of the key industry players provides insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, and recent developments associated with the automotive green tires market. Competitive analysis of SMEs/startups in the automotive green tires market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall automotive green tires market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Government initiatives for clean and green environment, Increasing vehicle range, Increase in fuel efficiency, High demand for low rolling resistance tires), restraints (Lack of awareness in emerging economies), opportunities (Green replacement tires, Development of green tires owing to stringent regulations), and challenges (Increasing number of mandatory tests to be performed before commercial use of tires, Structural limitation may impede future adoption) influencing the growth of the automotive green tires market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive green tires market

- Market Development: Comprehensive information about lucrative markets - the report analyses the automotive green tires market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the automotive green tires market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Bridgestone Corporation (Japan), Michelin (France), Goodyear (US), Pirelli (Italy), Continental (Germany) among others in the automotive green tires market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 GREEN TIRES MARKET, DEFINITION BY VEHICLE TYPE

- TABLE 2 GREEN TIRES MARKET, DEFINITION BY PROPULSION TYPE

- TABLE 3 GREEN TIRES MARKET, DEFINITION BY SALES CHANNEL

- 1.3 INCLUSIONS AND EXCLUSIONS

- TABLE 4 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- FIGURE 1 GREEN TIRES MARKET SEGMENTATION

- 1.4.1 REGIONS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 5 CURRENCY EXCHANGE RATES (PER USD)

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary participants

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- FIGURE 6 FACTORS IMPACTING MARKET GROWTH

- FIGURE 7 REGIONAL FACTOR ANALYSIS

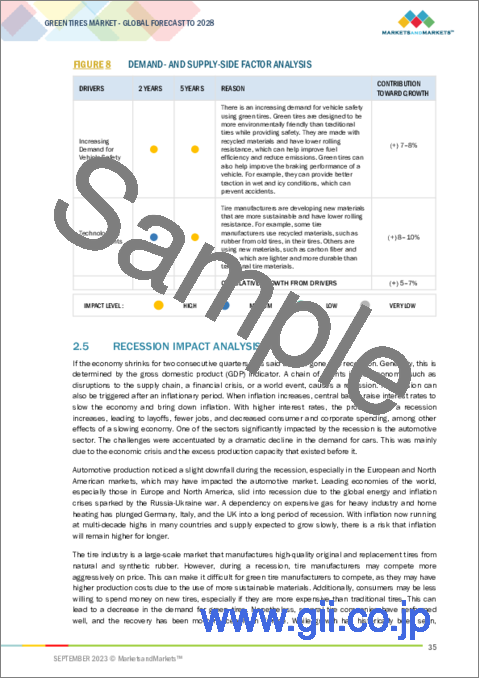

- FIGURE 8 DEMAND- AND SUPPLY-SIDE FACTOR ANALYSIS

- 2.5 RECESSION IMPACT ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 9 REPORT SUMMARY

- FIGURE 10 ASIA PACIFIC TO BE LARGEST MARKET FOR GREEN TIRES DURING FORECAST PERIOD

- FIGURE 11 PASSENGER CARS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GREEN TIRES MARKET

- FIGURE 12 INCREASED PREFERNCE FOR ADVANCED TIRE TECHNOLOGIES

- 4.2 GREEN TIRES MARKET, BY APPLICATION

- FIGURE 13 ON-ROAD SEGMENT TO ACQUIRE LARGEST MARKET SHARE BY VALUE IN 2028

- 4.3 GREEN TIRES MARKET, BY VEHICLE TYPE

- FIGURE 14 PASSENGER CARS TO SECURE LEADING MARKET POSITION BY VALUE DURING FORECAST PERIOD

- 4.4 GREEN TIRES MARKET, BY PROPULSION TYPE

- FIGURE 15 ICE TO BE LARGEST SEGMENT BY VALUE DURING FORECAST PERIOD

- 4.5 GREEN TIRES MARKET, BY RIM SIZE

- FIGURE 16 19-21" TO BE FASTEST-GROWING SEGMENT BY VALUE DURING FORECAST PERIOD

- 4.6 GREEN TIRES MARKET, BY REGION

- FIGURE 17 ASIA PACIFIC TO SECURE MAXIMUM MARKET SHARE IN 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 GREEN TIRES MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Government initiatives to reduce carbon emissions

- TABLE 6 CARBON EMISSION REDUCTION TARGETS

- 5.2.1.2 Increasing preference for long-range electric vehicles

- 5.2.1.3 High demand for fuel-efficient vehicles

- TABLE 7 FACTORS IMPROVING FUEL EFFICIENCY

- 5.2.1.4 Rising adoption of low rolling resistance tires

- TABLE 8 PRODUCTS OFFERED BY KEY PLAYERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of awareness in emerging economies

- TABLE 9 FACTORS LEADING TO LOW AWARENESS IN EMERGING ECONOMIES

- 5.2.2.2 Longevity of tires to affect aftermarket sales

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing replacement tires market

- TABLE 10 FACTORS PROMOTING USE OF GREEN TIRES

- 5.2.3.2 Rising focus on environmental sustainability

- TABLE 11 IMPACT OF ECO-FRIENDLY MATERIALS ON TIRE PERFORMANCE

- 5.2.4 CHALLENGES

- 5.2.4.1 Compliance with mandatory tests for commercialization of tires

- TABLE 12 COMMERCIALIZATION OF GREEN TIRES BY TEST CATEGORY

- 5.2.4.2 Structural limitations to impede future adoption

- FIGURE 19 STRUCTURE OF GREEN TIRE

- TABLE 13 IMPACT OF MARKET DYNAMICS

- 5.3 SUPPLY CHAIN ANALYSIS

- FIGURE 20 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM MAPPING

- FIGURE 21 ECOSYSTEM MAPPING

- TABLE 14 ROLE OF KEY PLAYERS IN ECOSYSTEM

- 5.5 CASE STUDIES

- 5.5.1 MICHELIN, AXENS, AND IFP ENERGIES NOUVELLES

- 5.5.2 BRIDGESTONE CORPORATION, ARLANXEO, AND SOLVAY

- 5.5.3 MICHELIN AND ENVIRO

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF GREEN TIRES, BY KEY PLAYER

- TABLE 15 AVERAGE SELLING PRICE OF GREEN TIRES, BY KEY PLAYER (USD)

- 5.6.2 AVERAGE SELLING PRICE OF GREEN TIRES, BY REGION

- TABLE 16 AVERAGE SELLING PRICE OF GREEN TIRES, BY REGION (USD)

- 5.7 PATENT ANALYSIS

- TABLE 17 KEY PATENT REGISTRATIONS

- TABLE 18 PATENTED DOCUMENTS ANALYSIS, BY PUBLISHED, FILED, AND GRANTED, 2018-2022

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 SMART TIRES

- 5.8.2 3D PRINTED TIRES

- 5.8.3 RUN-FLAT TIRES

- 5.9 REGULATORY LANDSCAPE

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 22 KEY CONFERENCES AND EVENTS, 2023-2024

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF GREEN TIRES, BY VEHICLE TYPE (%)

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF GREEN TIRES, BY VEHICLE TYPE

- 5.11.2 BUYING CRITERIA

- FIGURE 23 KEY BUYING CRITERIA FOR GREEN TIRES

- 5.12 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 24 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.13 MNM INSIGHTS ON MATERIALS USED IN GREEN TIRES

- 5.13.1 SILICA

- 5.13.2 NATURAL RUBBER

- 5.13.3 STEEL BELT

- 5.13.4 SILANE

- 5.13.5 BIO-BASED RESIN

- 5.14 GREEN TIRES MARKET SCENARIOS, 2023-2028

- 5.14.1 MOST LIKELY SCENARIO

- TABLE 24 MOST LIKELY SCENARIO: GREEN TIRES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 5.14.2 OPTIMISTIC SCENARIO

- TABLE 25 OPTIMISTIC SCENARIO: GREEN TIRES MARKET, BY REGION, 2023-2028 (USD MILLION)

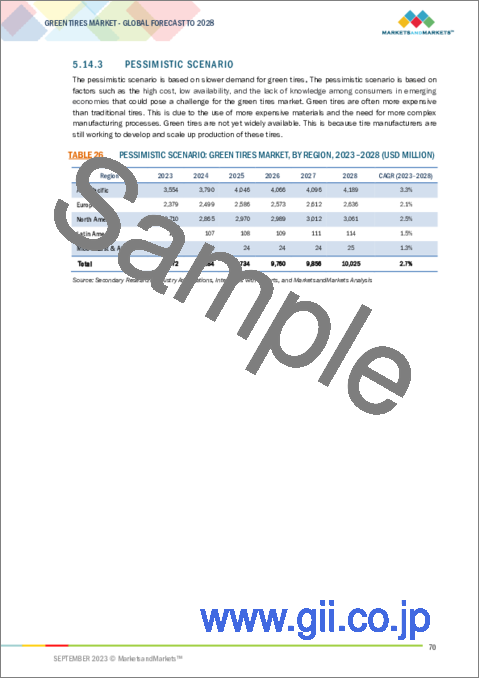

- 5.14.3 PESSIMISTIC SCENARIO

- TABLE 26 PESSIMISTIC SCENARIO: GREEN TIRES MARKET, BY REGION, 2023-2028 (USD MILLION)

6 GREEN TIRES MARKET, BY PROPULSION TYPE

- 6.1 INTRODUCTION

- FIGURE 25 GREEN TIRES MARKET, BY PROPULSION TYPE, 2023-2028 (USD MILLION)

- TABLE 27 GREEN TIRES MARKET, BY PROPULSION TYPE, 2018-2022 (MILLION UNITS)

- TABLE 28 GREEN TIRES MARKET, BY PROPULSION TYPE, 2023-2028 (MILLION UNITS)

- TABLE 29 GREEN TIRES MARKET, BY PROPULSION TYPE, 2018-2022 (USD MILLION)

- TABLE 30 GREEN TIRES MARKET, BY PROPULSION TYPE, 2023-2028 (USD MILLION)

- 6.2 EV

- 6.2.1 RISE IN ADOPTION OF ELECTRIC VEHICLES TO DRIVE GROWTH

- TABLE 31 EV: GREEN TIRES MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 32 EV: GREEN TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- TABLE 33 EV: GREEN TIRES MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 34 EV: GREEN TIRES MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 6.3 ICE

- 6.3.1 RAPID DEVELOPMENT OF NEW TIRE TECHNOLOGIES TO DRIVE GROWTH

- TABLE 35 ICE: GREEN TIRES MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 36 ICE: GREEN TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- TABLE 37 ICE: GREEN TIRES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 38 ICE: GREEN TIRES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 KEY INDUSTRY INSIGHTS

7 GREEN TIRES MARKET, BY VEHICLE TYPE

- 7.1 INTRODUCTION

- FIGURE 26 GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 39 GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (MILLION UNITS)

- TABLE 40 GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION UNITS)

- TABLE 41 GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 42 GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 7.2 PASSENGER CARS

- 7.2.1 RISE IN DEMAND FOR IMPROVED SAFETY TO DRIVE GROWTH

- TABLE 43 PASSENGER CARS: GREEN TIRES MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 44 PASSENGER CARS: GREEN TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- TABLE 45 PASSENGER CARS: GREEN TIRES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 46 PASSENGER CARS: GREEN TIRES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 LIGHT COMMERCIAL VEHICLES

- 7.3.1 REDUCTION IN OPERATING COSTS TO DRIVE GROWTH

- TABLE 47 LIGHT COMMERCIAL VEHICLES: GREEN TIRES MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 48 LIGHT COMMERCIAL VEHICLES: GREEN TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- TABLE 49 LIGHT COMMERCIAL VEHICLES: GREEN TIRES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 50 LIGHT COMMERCIAL VEHICLES: GREEN TIRES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 TRUCKS

- 7.4.1 STRINGENT REGULATIONS FOR VEHICLE SAFETY TO DRIVE GROWTH

- TABLE 51 TRUCKS: GREEN TIRES MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 52 TRUCKS: GREEN TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- TABLE 53 TRUCKS: GREEN TIRES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 54 TRUCKS: GREEN TIRES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 BUSES

- 7.5.1 SURGE IN DEMAND FOR SUSTAINABLE TRANSPORTATION SOLUTIONS TO DRIVE GROWTH

- TABLE 55 BUSES: GREEN TIRES MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 56 BUSES: GREEN TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- TABLE 57 BUSES: GREEN TIRES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 58 BUSES: GREEN TIRES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 TWO-WHEELERS

- 7.6.1 INCREASE IN PRODUCTION OF LOW ROLLING RESISTANCE TIRES TO DRIVE GROWTH

- 7.7 KEY INDUSTRY INSIGHTS

8 GREEN TIRES MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 27 GREEN TIRES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 59 GREEN TIRES MARKET, BY APPLICATION, 2018-2022 (THOUSAND UNITS)

- TABLE 60 GREEN TIRES MARKET, BY APPLICATION, 2023-2028 (THOUSAND UNITS)

- TABLE 61 GREEN TIRES MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 62 GREEN TIRES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 ON-ROAD

- 8.2.1 INCREASE IN DEMAND FOR ON-ROAD VEHICLES TO DRIVE GROWTH

- TABLE 63 ON-ROAD: GREEN TIRES MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 64 ON-ROAD: GREEN TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- TABLE 65 ON-ROAD: GREEN TIRES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 66 ON-ROAD: GREEN TIRES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 OFF-ROAD

- 8.3.1 BOOST IN CONSTRUCTION AND MINING ACTIVITIES TO DRIVE GROWTH

- TABLE 67 OFF-ROAD: GREEN TIRES MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 68 OFF-ROAD: GREEN TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- TABLE 69 OFF-ROAD: GREEN TIRES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 70 OFF-ROAD: GREEN TIRES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 KEY INDUSTRY INSIGHTS

9 GREEN TIRES MARKET, BY RIM SIZE

- 9.1 INTRODUCTION

- FIGURE 28 GREEN TIRES MARKET, BY RIM SIZE, 2023-2028 (USD MILLION)

- TABLE 71 GREEN TIRES MARKET, BY RIM SIZE, 2018-2022 (MILLION UNITS)

- TABLE 72 GREEN TIRES MARKET, BY RIM SIZE, 2023-2028 (MILLION UNITS)

- TABLE 73 GREEN TIRES MARKET, BY RIM SIZE, 2018-2022 (USD MILLION)

- TABLE 74 GREEN TIRES MARKET, BY RIM SIZE, 2023-2028 (USD MILLION)

- 9.2 13-15"

- 9.2.1 RISING PREFERENCE FOR COMPACT CARS TO DRIVE GROWTH

- TABLE 75 13-15": GREEN TIRES MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 76 13-15": GREEN TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- TABLE 77 13-15": GREEN TIRES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 78 13-15": GREEN TIRES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 16-18"

- 9.3.1 EXPANDING LOGISTICS INDUSTRY TO DRIVE GROWTH

- TABLE 79 16-18": GREEN TIRES MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 80 16-18": GREEN TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- TABLE 81 16-18": GREEN TIRES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 82 16-18": GREEN TIRES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 19-21"

- 9.4.1 SURGE IN SALES OF LUXURY CARS TO DRIVE GROWTH

- TABLE 83 19-21": GREEN TIRES MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 84 19-21": GREEN TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- TABLE 85 19-21": GREEN TIRES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 86 19-21": GREEN TIRES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 >21"

- 9.5.1 EXTENSIVE USE IN HEAVY COMMERCIAL VEHICLES TO DRIVE GROWTH

- TABLE 87 >21": GREEN TIRES MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 88 >21": GREEN TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- TABLE 89 >21": GREEN TIRES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 90 >21": GREEN TIRES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 KEY INDUSTRY INSIGHTS

10 GREEN TIRES MARKET, BY SALES CHANNEL

- 10.1 INTRODUCTION

- 10.2 OEM

- 10.3 AFTERMARKET

- 10.4 KEY INDUSTRY INSIGHTS

11 GREEN TIRES MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 29 GREEN TIRES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 91 GREEN TIRES MARKET, BY REGION, 2018-2022 (THOUSAND UNITS)

- TABLE 92 GREEN TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- TABLE 93 GREEN TIRES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 94 GREEN TIRES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 ASIA PACIFIC

- 11.2.1 RECESSION IMPACT ANALYSIS

- FIGURE 30 ASIA PACIFIC: GREEN TIRES MARKET SNAPSHOT

- TABLE 95 ASIA PACIFIC: GREEN TIRES MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNITS)

- TABLE 96 ASIA PACIFIC: GREEN TIRES MARKET, BY COUNTRY, 2023-2028 (THOUSAND UNITS)

- TABLE 97 ASIA PACIFIC: GREEN TIRES MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: GREEN TIRES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.2.2 CHINA

- 11.2.2.1 Government initiatives to promote adoption of electric vehicles to drive growth

- TABLE 99 CHINA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 100 CHINA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 101 CHINA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 102 CHINA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 11.2.3 SOUTH KOREA

- 11.2.3.1 Rising partnerships for development of sustainable tires to drive growth

- TABLE 103 SOUTH KOREA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 104 SOUTH KOREA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 105 SOUTH KOREA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 106 SOUTH KOREA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 11.2.4 JAPAN

- 11.2.4.1 Increase in R&D investments to drive growth

- TABLE 107 JAPAN: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 108 JAPAN: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 109 JAPAN: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 110 JAPAN: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 11.2.5 INDIA

- 11.2.5.1 Boost in automobile sales to drive growth

- TABLE 111 INDIA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 112 INDIA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 113 INDIA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 114 INDIA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 11.2.6 THAILAND

- 11.2.6.1 Rise in production of pickup trucks to drive market

- TABLE 115 THAILAND: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 116 THAILAND: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 117 THAILAND: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 118 THAILAND: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 11.2.7 REST OF ASIA PACIFIC

- 11.3 EUROPE

- 11.3.1 RECESSION IMPACT ANALYSIS

- FIGURE 31 EUROPE: GREEN TIRES MARKET SNAPSHOT

- TABLE 119 EUROPE: GREEN TIRES MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNITS)

- TABLE 120 EUROPE: GREEN TIRES MARKET, BY COUNTRY, 2023-2028 (THOUSAND UNITS)

- TABLE 121 EUROPE: GREEN TIRES MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 122 EUROPE: GREEN TIRES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.3.2 GERMANY

- 11.3.2.1 Presence of leading tire manufacturers to drive growth

- TABLE 123 GERMANY: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 124 GERMANY: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 125 GERMANY: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 126 GERMANY: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 11.3.3 SPAIN

- 11.3.3.1 Increasing focus on environmental sustainability to drive growth

- TABLE 127 SPAIN: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 128 SPAIN: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 129 SPAIN: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 130 SPAIN: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 11.3.4 UK

- 11.3.4.1 Government efforts to achieve net zero emissions to drive growth

- TABLE 131 UK: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 132 UK: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 133 UK: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 134 UK: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 11.3.5 FRANCE

- 11.3.5.1 Stringent emission laws to drive growth

- TABLE 135 FRANCE: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 136 FRANCE: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 137 FRANCE: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 138 FRANCE: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 11.3.6 ITALY

- 11.3.6.1 Growing emphasis on reducing carbon emissions to drive growth

- TABLE 139 ITALY: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 140 ITALY: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 141 ITALY: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 142 ITALY: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 11.3.7 RUSSIA

- 11.3.7.1 Rising adoption of eco-friendly technologies to drive growth

- TABLE 143 RUSSIA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 144 RUSSIA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 145 RUSSIA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 146 RUSSIA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 11.3.8 TURKEY

- 11.3.8.1 Extensive use of trucks in mining industry to drive growth

- TABLE 147 TURKEY: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 148 TURKEY: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 149 TURKEY: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 150 TURKEY: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 11.3.9 REST OF EUROPE

- 11.4 NORTH AMERICA

- 11.4.1 RECESSION IMPACT ANALYSIS

- TABLE 151 NORTH AMERICA: GREEN TIRES MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNITS)

- TABLE 152 NORTH AMERICA: GREEN TIRES MARKET, BY COUNTRY, 2023-2028 (THOUSAND UNITS)

- TABLE 153 NORTH AMERICA: GREEN TIRES MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 154 NORTH AMERICA: GREEN TIRES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.4.2 US

- 11.4.2.1 Integration of new technologies in automobiles to drive growth

- TABLE 155 US: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 156 US: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 157 US: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 158 US: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 11.4.3 CANADA

- 11.4.3.1 Development of innovative green tires to drive growth

- TABLE 159 CANADA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 160 CANADA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 161 CANADA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 162 CANADA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 11.4.4 MEXICO

- 11.4.4.1 Rising consumer awareness regarding green tire technologies to drive growth

- TABLE 163 MEXICO: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 164 MEXICO: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 165 MEXICO: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 166 MEXICO: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 11.5 LATIN AMERICA

- 11.5.1 RECESSION IMPACT ANALYSIS

- TABLE 167 LATIN AMERICA: GREEN TIRES MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNITS)

- TABLE 168 LATIN AMERICA: GREEN TIRES MARKET, BY COUNTRY, 2023-2028 (THOUSAND UNITS)

- TABLE 169 LATIN AMERICA: GREEN TIRES MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 170 LATIN AMERICA: GREEN TIRES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.5.2 BRAZIL

- 11.5.2.1 Presence of leading automotive companies to drive growth

- TABLE 171 BRAZIL: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 172 BRAZIL: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 173 BRAZIL: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 174 BRAZIL: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 11.5.3 ARGENTINA

- 11.5.3.1 Government policies for use of fuel-efficient vehicles to drive growth

- TABLE 175 ARGENTINA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (THOUSAND UNITS)

- TABLE 176 ARGENTINA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (THOUSAND UNITS)

- TABLE 177 ARGENTINA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 178 ARGENTINA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 RECESSION IMPACT ANALYSIS

- TABLE 179 MIDDLE EAST & AFRICA: GREEN TIRES MARKET, BY COUNTRY, 2018-2022 (THOUSAND UNITS)

- TABLE 180 MIDDLE EAST & AFRICA: GREEN TIRES MARKET, BY COUNTRY, 2023-2028 (THOUSAND UNITS)

- TABLE 181 MIDDLE EAST & AFRICA: GREEN TIRES MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: GREEN TIRES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.6.2 IRAN

- 11.6.2.1 Booming automotive industry to drive growth

- TABLE 183 IRAN: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (UNITS)

- TABLE 184 IRAN: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (UNITS)

- TABLE 185 IRAN: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD THOUSAND)

- TABLE 186 IRAN: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD THOUSAND)

- 11.6.3 SOUTH AFRICA

- 11.6.3.1 Sustainability initiatives by domestic associations to drive growth

- TABLE 187 SOUTH AFRICA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (UNITS)

- TABLE 188 SOUTH AFRICA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (UNITS)

- TABLE 189 SOUTH AFRICA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2018-2022 (USD THOUSAND)

- TABLE 190 SOUTH AFRICA: GREEN TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (USD THOUSAND)

- 11.6.4 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2023

- TABLE 191 STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2023

- 12.3 MARKET SHARE ANALYSIS, 2022

- TABLE 192 MARKET SHARE ANALYSIS, 2022

- FIGURE 32 MARKET SHARE ANALYSIS, 2022

- 12.3.1 MICHELIN

- 12.3.2 BRIDGESTONE CORPORATION

- 12.3.3 THE GOODYEAR TIRE & RUBBER COMPANY

- 12.3.4 CONTINENTAL AG

- 12.3.5 PIRELLI & C. S.P.A.

- 12.4 REVENUE ANALYSIS, 2018-2022

- FIGURE 33 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018-2022

- 12.5 COMPANY EVALUATION MATRIX

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 34 COMPANY EVALUATION MATRIX, 2023

- 12.6 COMPANY FOOTPRINT

- TABLE 193 COMPANY FOOTPRINT, 2023

- TABLE 194 PRODUCT FOOTPRINT, 2023

- TABLE 195 REGION FOOTPRINT, 2023

- 12.7 START-UP/SME EVALUATION MATRIX

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 35 START-UP/SME EVALUATION MATRIX, 2023

- 12.8 COMPETITIVE BENCHMARKING

- TABLE 196 KEY START-UPS/SMES

- TABLE 197 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT DEVELOPMENTS

- TABLE 198 PRODUCT DEVELOPMENTS, 2020-2023

- 12.9.2 DEALS

- TABLE 199 DEALS, 2020-2023

- 12.9.3 OTHERS

- TABLE 200 OTHERS, 2020-2023

13 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 13.1 KEY PLAYERS

- 13.1.1 MICHELIN

- TABLE 201 MICHELIN: COMPANY OVERVIEW

- FIGURE 36 MICHELIN: COMPANY SNAPSHOT

- FIGURE 37 MICHELIN'S PARTNERSHIPS WITH LEADING ELECTRIC VEHICLE OEMS

- TABLE 202 MICHELIN: PRODUCTS OFFERED

- TABLE 203 MICHELIN: PRODUCT DEVELOPMENTS

- TABLE 204 MICHELIN: DEALS

- TABLE 205 MICHELIN: OTHERS

- 13.1.2 BRIDGESTONE CORPORATION

- TABLE 206 BRIDGESTONE CORPORATION: COMPANY OVERVIEW

- FIGURE 38 BRIDGESTONE CORPORATION: COMPANY SNAPSHOT

- FIGURE 39 GLOBAL PRESENCE OF BRIDGESTONE CORPORATION

- TABLE 207 BRIDGESTONE CORPORATION: PRODUCTS OFFERED

- TABLE 208 BRIDGESTONE CORPORATION: PRODUCT DEVELOPMENTS

- TABLE 209 BRIDGESTONE CORPORATION: OTHERS

- 13.1.3 THE GOODYEAR TIRE & RUBBER COMPANY

- TABLE 210 THE GOODYEAR TIRE & RUBBER COMPANY: COMPANY OVERVIEW

- FIGURE 40 THE GOODYEAR TIRE & RUBBER COMPANY: COMPANY SNAPSHOT

- TABLE 211 THE GOODYEAR TIRE & RUBBER COMPANY: PRODUCTS OFFERED

- TABLE 212 THE GOODYEAR TIRE & RUBBER COMPANY: PRODUCT DEVELOPMENTS

- TABLE 213 THE GOODYEAR TIRE & RUBBER COMPANY: OTHERS

- 13.1.4 CONTINENTAL AG

- TABLE 214 CONTINENTAL AG: COMPANY OVERVIEW

- FIGURE 41 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 42 GLOBAL PRESENCE OF CONTINENTAL AG

- TABLE 215 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 216 CONTINENTAL AG: PRODUCT DEVELOPMENTS

- 13.1.5 PIRELLI & C. S.P.A.

- TABLE 217 PIRELLI & C. S.P.A.: COMPANY OVERVIEW

- FIGURE 43 PIRELLI & C. S.P.A.: COMPANY SNAPSHOT

- TABLE 218 PIRELLI & C. S.P.A.: PRODUCTS OFFERED

- TABLE 219 PIRELLI & C. S.P.A.: PRODUCT DEVELOPMENTS

- TABLE 220 PIRELLI & C. S.P.A.: DEALS

- TABLE 221 PIRELLI & C. S.P.A.: OTHERS

- 13.1.6 SUMITOMO RUBBER INDUSTRIES, LTD.

- TABLE 222 SUMITOMO RUBBER INDUSTRIES, LTD.: COMPANY OVERVIEW

- FIGURE 44 SUMITOMO RUBBER INDUSTRIES, LTD.: COMPANY SNAPSHOT

- TABLE 223 SUMITOMO RUBBER INDUSTRIES, LTD.: PRODUCTS OFFERED

- TABLE 224 SUMITOMO RUBBER INDUSTRIES, LTD.: PRODUCT DEVELOPMENTS

- TABLE 225 SUMITOMO RUBBER INDUSTRIES, LTD.: OTHERS

- 13.1.7 HANKOOK TIRE & TECHNOLOGY CO., LTD.

- TABLE 226 HANKOOK TIRE & TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- FIGURE 45 HANKOOK TIRE & TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- TABLE 227 HANKOOK TIRE & TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 228 HANKOOK TIRE & TECHNOLOGY CO., LTD.: PRODUCT DEVELOPMENTS

- TABLE 229 HANKOOK TIRE & TECHNOLOGY CO., LTD.: DEALS

- TABLE 230 HANKOOK TIRE & TECHNOLOGY CO., LTD.: OTHERS

- 13.1.8 NOKIAN TYRES PLC

- TABLE 231 NOKIAN TYRES PLC: COMPANY OVERVIEW

- FIGURE 46 NOKIAN TYRES PLC: COMPANY SNAPSHOT

- TABLE 232 NOKIAN TYRES PLC: PRODUCTS OFFERED

- TABLE 233 NOKIAN TYRES PLC: PRODUCT DEVELOPMENTS

- TABLE 234 NOKIAN TYRES PLC: OTHERS

- 13.1.9 CHENG SHIN RUBBER IND. CO., LTD.

- TABLE 235 CHENG SHIN RUBBER IND. CO., LTD.: COMPANY OVERVIEW

- FIGURE 47 CHENG SHIN RUBBER IND. CO., LTD.: COMPANY SNAPSHOT

- TABLE 236 CHENG SHIN RUBBER IND. CO., LTD.: PRODUCTS OFFERED

- TABLE 237 CHENG SHIN RUBBER IND. CO., LTD.: PRODUCT DEVELOPMENTS

- TABLE 238 CHENG SHIN RUBBER IND. CO., LTD.: OTHERS

- 13.1.10 ZHONGCE RUBBER GROUP CO., LTD.

- TABLE 239 ZHONGCE RUBBER GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 240 ZHONGCE RUBBER GROUP CO., LTD.: PRODUCTS OFFERED

- TABLE 241 ZHONGCE RUBBER GROUP CO., LTD.: OTHERS

- 13.1.11 KUMHO TIRE CO., INC.

- TABLE 242 KUMHO TIRE CO., INC.: COMPANY OVERVIEW

- TABLE 243 KUMHO TIRE CO., INC.: PRODUCTS OFFERED

- TABLE 244 KUMHO TIRE CO., INC.: PRODUCT DEVELOPMENTS

- TABLE 245 KUMHO TIRE CO., INC.: DEALS

- TABLE 246 KUMHO TIRE CO., INC.: OTHERS

- 13.2 OTHER PLAYERS

- 13.2.1 APOLLO TYRES LTD.

- 13.2.2 SHANDONG LINGLONG TIRE CO., LTD.

- 13.2.3 KENDA TIRES

- 13.2.4 GITI TIRE

- 13.2.5 COOPER TIRE & RUBBER COMPANY

- 13.2.6 THE YOKOHAMA RUBBER CO., LTD.

- 13.2.7 NEXEN TIRE

- 13.2.8 MRF LIMITED

- 13.2.9 PETLAS

- 13.2.10 BALKRISHNA INDUSTRIES LTD.

- 13.2.11 TOYO TIRE CORPORATION

- 13.2.12 CEAT LIMITED

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 RECOMMENDATIONS' BY MARKETSANDMARKETS

- 14.1 ASIA PACIFIC TO BE KEY MARKET FOR GREEN TIRE MANUFACTURERS

- 14.2 COMPANIES MUST EMPHASIZE HIGH-PERFORMANCE GREEN TIRES

- 14.3 CONCLUSION

15 APPENDIX

- 15.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS