|

|

市場調査レポート

商品コード

1798379

失禁ケア用品の世界市場:製品別、タイプ別、使用法別、性別、エンドユーザー別、地域別 - 予測(~2030年)Incontinence Care Products Market by Product (Absorbents, Non-absorbents ), Type, Usage, Gender, End User, Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 失禁ケア用品の世界市場:製品別、タイプ別、使用法別、性別、エンドユーザー別、地域別 - 予測(~2030年) |

|

出版日: 2025年08月18日

発行: MarketsandMarkets

ページ情報: 英文 305 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

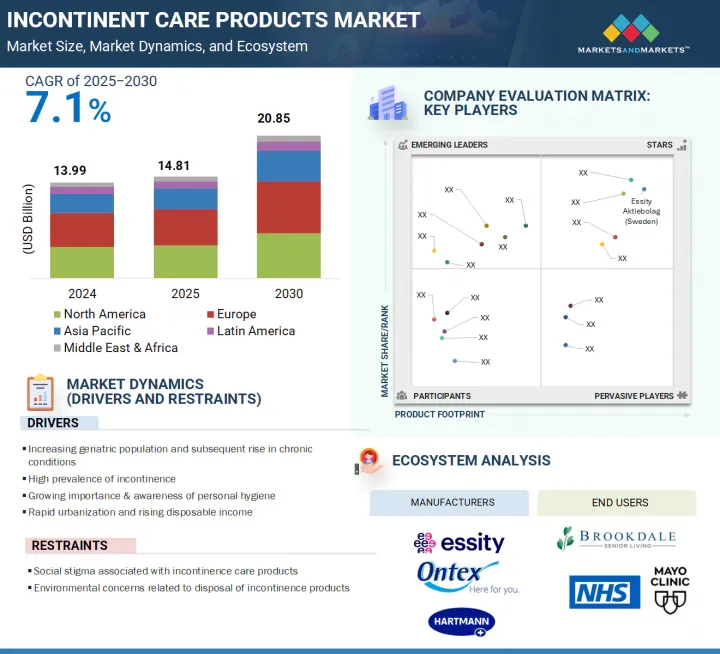

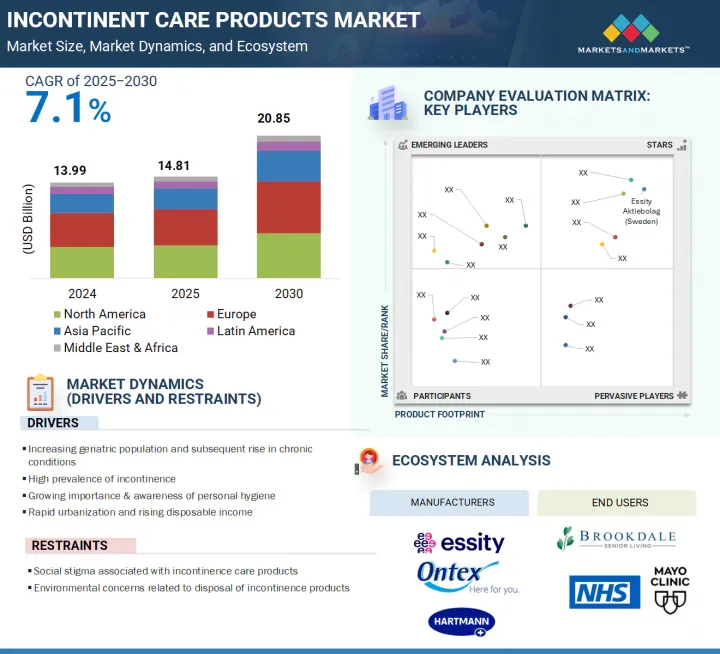

世界の失禁ケア用品の市場規模は、2025年の148億1,000万米ドルから2030年までに208億5,000万米ドルに達すると予測され、予測期間にCAGRで7.1%の成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 製品、タイプ、使用法、性、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカの、中東・アフリカ |

人口動態、医療、ライフスタイルが組み合わさり、失禁ケア用品(ICP)市場の成長を後押ししています。主な成長促進要因は老年人口の拡大であり、老年人口は加齢関連疾患の結果として尿失禁や便失禁を起こしやすいです。さらに、超薄型吸収体、尿漏れ防止バリア、通気性クロスなどの製品の新規開発も市場成長を後押しするとみられます。

製品別では、吸収体セグメントが予測期間にもっとも高いCAGRを記録する見込みです。

2024年、吸収剤セグメントが予測期間にもっとも高いCAGRを記録しました。吸収剤セグメントの成長は、特に高齢者や妊娠後の女性における尿失禁率の上昇に起因しており、定期的かつ確実な保護が必要です。また、通気性材料の導入や漏れ防止設計など、吸収体ケアの技術革新も市場成長に寄与すると予測されます。

タイプ別では、尿失禁セグメントが予測期間にもっとも高いCAGRで成長する見込みです。

加齢に伴う骨盤底筋の衰え、前立腺の問題、更年期や出産に伴うホルモンの変化が尿失禁の主因です。政府主導の啓発、診断率の向上、新興経済圏における啓発プログラムの発達も、このセグメントの成長を後押ししています。

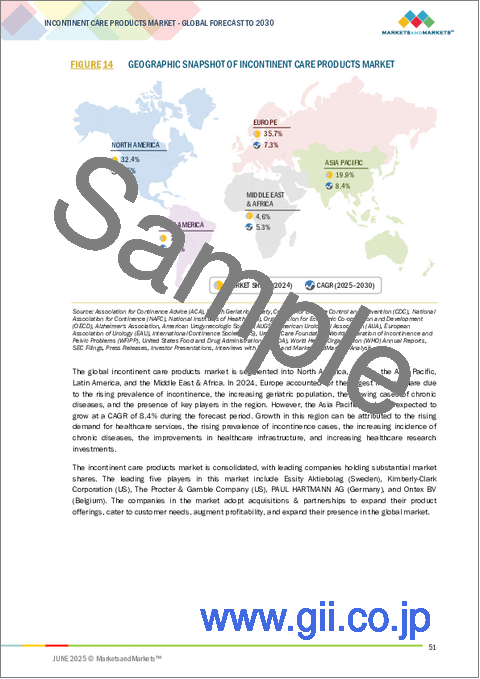

2024年、欧州が失禁ケア用品市場で最大の市場シェアを占めました。

欧州は、失禁用品に対する国民健康保険の適用など、強力な政府支援の恩恵を受けており、特に老人ホームや高齢者介護施設などの施設環境での採用が大幅に後押しされています。同地域の主要な市場参入企業も市場成長の促進要因となることが予測されます。

当レポートでは、世界の失禁ケア用品市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 失禁ケア用品市場の概要

- 欧州の失禁ケア用品市場:製品別(2024年)

- 地理的成長機会

- 失禁ケア用品市場:地理的構成

- 失禁ケア用品市場:新興市場と先進市場

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- カスタマービジネスに影響を与える動向/混乱

- 価格設定の分析

- 平均販売価格の動向:主要企業別(2022年~2024年)

- 平均販売価格の動向:地域別(2022年~2024年)

- 平均販売価格の動向:製品別

- バリューチェーン分析

- 研究・製品開発

- 原材料調達

- 製造

- 流通、マーケティング、販売、アフターサービス

- サプライチェーン分析

- 著名企業

- 中小企業

- エンドユーザー

- 技術分析

- 主要技術

- 補完技術

- 特許分析

- 貿易分析

- 失禁ケア用品(吸収体)の貿易分析

- 失禁ケア用品(非吸収体)の貿易分析

- 主な会議とイベント(2025年~2026年)

- 規制分析

- 規制機関、政府機関、その他の組織

- 規制情勢

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 失禁ケア用品市場に対するAI/生成AIの影響

- イントロダクション

- 失禁ケア用品市場におけるAIの可能性

- AIユースケース

- AIを導入している主要企業

- 失禁ケア用品市場における生成AIの将来

- 失禁ケア用品市場に対するトランプ関税の影響

- イントロダクション

- 主な関税率

- 価格設定に対する関税の影響

- さまざまな地域への重要な影響

- 最終用途産業に対する影響

第6章 失禁ケア用品市場:製品別

- イントロダクション

- 吸収体

- パッド・ガード

- 下着・ブリーフ

- ベッドプロテクター

- その他の吸収体

- 非吸収体

- カテーテル

- 排液バッグ

- 刺激装置

- その他の非吸収体

第7章 失禁ケア用品市場:タイプ別

- イントロダクション

- 尿失禁

- 便失禁

第8章 失禁ケア用品市場:使用法別

- イントロダクション

- 使い捨て

- 再使用可能

第9章 失禁ケア用品市場:性別

- イントロダクション

- 女性

- 男性

第10章 失禁ケア用品市場:エンドユーザー別

- イントロダクション

- 在宅ケア

- 病院・外来手術センター(ASC)

- その他のエンドユーザー

第11章 失禁ケア用品市場:地域別

- イントロダクション

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

- 中東・アフリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析(2022年~2024年)

- 市場シェア分析(2024年)

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:中小企業/スタートアップ(2024年)

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- ESSITY AKTIEBOLAG

- KIMBERLY-CLARK CORPORATION

- THE PROCTER & GAMBLE COMPANY

- ONTEX BV

- PAUL HARTMANN AG

- COLOPLAST A/S

- UNICHARM CORPORATION

- CARDINAL HEALTH, INC

- MEDLINE INDUSTRIES, LP

- MCKESSON CORPORATION

- ABENA A/S

- ATTINDAS HYGIENE PARTNERS GROUP

- HOLLISTER INCORPORATED

- DYNAREX CORPORATION

- その他の企業

- CONVATEC GROUP PLC

- BECTON, DICKINSON AND COMPANY

- DENTSPLY SIRONA

- STRYKER CORPORATION

- FIRST QUALITY ENTERPRISES, INC.

- PRINCIPLE BUSINESS ENTERPRISES, INC.

- TZMO SA

- PRIMARE INTERNATIONAL LTD.

- DRYLOCK TECHNOLOGIES

- NORTHSHORE CARE SUPPLY

- NOBEL HYGIENE PVT. LTD.

第14章 付録

List of Tables

- TABLE 1 INCLUSIONS & EXCLUSIONS

- TABLE 2 RISK ASSESSMENT ANALYSIS

- TABLE 3 INDICATIVE LIST OF COUNTRIES WITH GERIATRIC POPULATION, 2023

- TABLE 4 WORLD DISPOSABLE INCOME PER CAPITA, BY REGION

- TABLE 5 ADULT OBESITY RATES, BY COUNTRY, 2022

- TABLE 6 AVERAGE SELLING PRICE TREND OF INCONTINENCE CARE PRODUCTS, BY KEY PLAYER, 2022-2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF INCONTINENT CARE PRODUCTS FOR UNDERWEAR & BRIEFS, BY REGION, 2022-2024 (USD)

- TABLE 8 AVERAGE SELLING PRICE TREND OF INCONTINENCE CARE ABSORBENT PRODUCTS, BY TYPE, 2022-2024 (USD)

- TABLE 9 INCONTINENT CARE PRODUCTS MARKET: INNOVATIONS & PATENT REGISTRATIONS, 2022-2024

- TABLE 10 IMPORT DATA FOR HS CODE 961900, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 961900, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 12 IMPORT DATA FOR HS CODE 901839, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 EXPORT DATA FOR HS CODE 901839, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 14 INCONTINENT CARE PRODUCTS MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 CLASS I, II, AND III URINARY INCONTINENCE DEVICES

- TABLE 21 INCONTINENT CARE PRODUCTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF INCONTINENT CARE PRODUCTS (%)

- TABLE 23 KEY BUYING CRITERIA, BY END USER

- TABLE 24 ADOPTION OF AI BY KEY INDUSTRY PLAYERS

- TABLE 25 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 26 INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 27 INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 28 INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 29 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 30 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 31 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 32 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 33 INCONTINENT CARE PRODUCTS MARKET FOR PADS & GUARDS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR PADS & GUARDS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 35 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR PADS & GUARDS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 36 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR PADS & GUARDS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 37 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR PADS & GUARDS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 38 INCONTINENT CARE PRODUCTS MARKET FOR UNDERWEAR & BRIEFS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR UNDERWEAR & BRIEFS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR UNDERWEAR & BRIEFS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 41 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR UNDERWEAR & BRIEFS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR UNDERWEAR & BRIEFS, BY COUNTRY, 2023-2030 (USD MILLION)

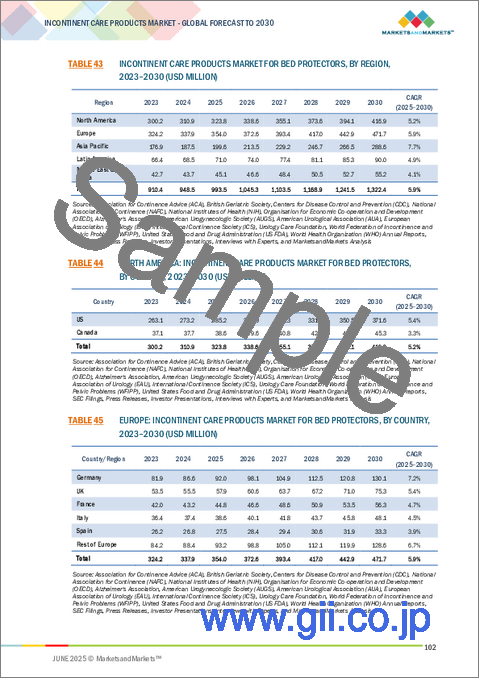

- TABLE 43 INCONTINENT CARE PRODUCTS MARKET FOR BED PROTECTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR BED PROTECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR BED PROTECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 46 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR BED PROTECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 47 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR BED PROTECTORS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 INCONTINENT CARE PRODUCTS MARKET FOR OTHER ABSORBENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR OTHER ABSORBENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 50 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR OTHER ABSORBENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 51 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR OTHER ABSORBENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 52 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR OTHER ABSORBENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 53 INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 54 INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 56 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 58 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 59 INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 60 INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 61 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 62 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 63 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 64 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 65 INCONTINENT CARE PRODUCTS MARKET FOR INTERMITTENT CATHETERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 66 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR INTERMITTENT CATHETERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 67 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR INTERMITTENT CATHETERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 68 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR INTERMITTENT CATHETERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 69 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR INTERMITTENT CATHETERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 70 US: NUMBER OF INDWELLING CATHETERS SOLD IN US, 2023-2030 (MILLION)

- TABLE 71 INCONTINENT CARE PRODUCTS MARKET FOR INDWELLING CATHETERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 72 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR INDWELLING CATHETERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 73 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR INDWELLING CATHETERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 74 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR INDWELLING CATHETERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 75 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR INDWELLING CATHETERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 76 INCONTINENT CARE PRODUCTS MARKET FOR EXTERNAL CATHETERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR EXTERNAL CATHETERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 78 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR EXTERNAL CATHETERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 79 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR EXTERNAL CATHETERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 80 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR EXTERNAL CATHETERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 81 INCONTINENT CARE PRODUCTS MARKET FOR DRAINAGE BAGS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR DRAINAGE BAGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR DRAINAGE BAGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 84 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR DRAINAGE BAGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 85 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR DRAINAGE BAGS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 86 INCONTINENT CARE PRODUCTS MARKET FOR STIMULATION DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR STIMULATION DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 88 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR STIMULATION DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 89 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR STIMULATION DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 90 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR STIMULATION DEVICES, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 91 INCONTINENT CARE PRODUCTS MARKET FOR OTHER NON-ABSORBENTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR OTHER NON-ABSORBENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 93 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR OTHER NON-ABSORBENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 94 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR OTHER NON-ABSORBENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 95 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR OTHER NON-ABSORBENTS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 96 INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 97 INCONTINENT CARE PRODUCTS MARKET FOR URINARY INCONTINENCE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR URINARY INCONTINENCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 99 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR URINARY INCONTINENCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 100 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR URINARY INCONTINENCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR URINARY INCONTINENCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 102 INCONTINENT CARE PRODUCTS MARKET FOR FECAL INCONTINENCE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR FECAL INCONTINENCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 104 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR FECAL INCONTINENCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR FECAL INCONTINENCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 106 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR FECAL INCONTINENCE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 107 INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 108 DISPOSABLE INCONTINENT CARE PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: DISPOSABLE INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 110 EUROPE: DISPOSABLE INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 111 ASIA PACIFIC: DISPOSABLE INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 112 LATIN AMERICA: DISPOSABLE INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 113 REUSABLE INCONTINENT CARE PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 114 NORTH AMERICA: REUSABLE INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 115 EUROPE: REUSABLE INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: REUSABLE INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 117 LATIN AMERICA: REUSABLE INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 118 INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 119 FEMALE INCONTINENT CARE PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 120 NORTH AMERICA: FEMALE INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 121 EUROPE: FEMALE INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 122 ASIA PACIFIC: FEMALE INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 123 LATIN AMERICA: FEMALE INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 124 MALE INCONTINENT CARE PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: MALE INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 126 EUROPE: MALE INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 127 ASIA PACIFIC: MALE INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 128 LATIN AMERICA: MALE INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 129 INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 130 INCONTINENT CARE PRODUCTS MARKET FOR HOME CARE, BY REGION, 2023-2030 (USD MILLION)

- TABLE 131 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR HOME CARE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 132 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR HOME CARE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR HOME CARE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 134 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR HOME CARE, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 135 INCONTINENT CARE PRODUCTS MARKET FOR HOSPITALS & ASCS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 136 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR HOSPITALS & ASCS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 137 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR HOSPITALS & ASCS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR HOSPITALS & ASCS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 139 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR HOSPITALS & ASCS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 140 INCONTINENT CARE PRODUCTS MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 141 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 142 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 144 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 145 INCONTINENT CARE PRODUCTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 146 EUROPE: KEY MACROECONOMIC INDICATORS

- TABLE 147 EUROPE: INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 148 EUROPE: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 149 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 150 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 151 EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 152 EUROPE: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 153 EUROPE: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 154 EUROPE: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 155 EUROPE: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 156 GERMANY: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 157 GERMANY: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 158 GERMANY: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 159 GERMANY: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 160 GERMANY: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 161 GERMANY: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 162 GERMANY: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 163 GERMANY: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 164 UK: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 165 UK: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 166 UK: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 167 UK: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 168 UK: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 169 UK: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 170 UK: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 171 UK: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 172 FRANCE: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 173 FRANCE: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 174 FRANCE: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 175 FRANCE: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 176 FRANCE: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 177 FRANCE: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 178 FRANCE: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 179 FRANCE: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 180 ITALY: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 181 ITALY: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 182 ITALY: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 183 ITALY: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 184 ITALY: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 185 ITALY: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 186 ITALY: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 187 ITALY: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 188 SPAIN: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 189 SPAIN: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 190 SPAIN: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 191 SPAIN: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 192 SPAIN: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 193 SPAIN: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 194 SPAIN: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 195 SPAIN: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 196 REST OF EUROPE: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 197 REST OF EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 198 REST OF EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 199 REST OF EUROPE: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 200 REST OF EUROPE: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 201 REST OF EUROPE: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 202 REST OF EUROPE: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 203 REST OF EUROPE: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 204 NORTH AMERICA: KEY MACROECONOMIC INDICATORS

- TABLE 205 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 206 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 207 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 208 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 209 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 210 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 211 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 212 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 213 NORTH AMERICA: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 214 US: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 215 US: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 216 US: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 217 US: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 218 US: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 219 US: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 220 US: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 221 US: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 222 CANADA: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 223 CANADA: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 224 CANADA: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 225 CANADA: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 226 CANADA: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 227 CANADA: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 228 CANADA: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 229 CANADA: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 230 ASIA PACIFIC: KEY MACROECONOMIC INDICATORS

- TABLE 231 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 232 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 233 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 234 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 235 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 236 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 237 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 238 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 239 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 240 CHINA: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 241 CHINA: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 242 CHINA: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 243 CHINA: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 244 CHINA: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 245 CHINA: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 246 CHINA: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 247 CHINA: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 248 JAPAN: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 249 JAPAN: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 250 JAPAN: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 251 JAPAN: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 252 JAPAN: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 253 JAPAN: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 254 JAPAN: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 255 JAPAN: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 256 INDIA: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 257 INDIA: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 258 INDIA: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 259 INDIA: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 260 INDIA: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 261 INDIA: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 262 INDIA: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 263 INDIA: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 264 SOUTH KOREA: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 265 SOUTH KOREA: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 266 SOUTH KOREA: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 267 SOUTH KOREA: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 268 SOUTH KOREA: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 269 SOUTH KOREA: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 270 SOUTH KOREA: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 271 SOUTH KOREA: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 272 REST OF ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 273 REST OF ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 274 REST OF ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 275 REST OF ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 276 REST OF ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 277 REST OF ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 278 REST OF ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 279 REST OF ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 280 LATIN AMERICA: MACROECONOMIC INDICATORS

- TABLE 281 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 282 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 283 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 284 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 285 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 286 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 287 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 288 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 289 LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 290 BRAZIL: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 291 BRAZIL: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 292 BRAZIL: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 293 BRAZIL: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 294 BRAZIL: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 295 BRAZIL: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 296 BRAZIL: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 297 BRAZIL: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 298 MEXICO: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 299 MEXICO: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 300 MEXICO: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 301 MEXICO: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 302 MEXICO: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 303 MEXICO: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 304 MEXICO: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 305 MEXICO: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 306 REST OF LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 307 REST OF LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 308 REST OF LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 309 REST OF LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 310 REST OF LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 311 REST OF LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 312 REST OF LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 313 REST OF LATIN AMERICA: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 314 MIDDLE EAST & AFRICA: MACROECONOMIC INDICATORS

- TABLE 315 MIDDLE EAST & AFRICA: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 316 MIDDLE EAST & AFRICA: INCONTINENT CARE PRODUCTS MARKET FOR ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 317 MIDDLE EAST & AFRICA: INCONTINENT CARE PRODUCTS MARKET FOR NON-ABSORBENTS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 318 MIDDLE EAST & AFRICA: INCONTINENT CARE PRODUCTS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 319 MIDDLE EAST & AFRICA: INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 320 MIDDLE EAST & AFRICA: INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2023-2030 (USD MILLION)

- TABLE 321 MIDDLE EAST & AFRICA: INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2023-2030 (USD MILLION)

- TABLE 322 MIDDLE EAST & AFRICA: INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 323 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2022-MAY 2025

- TABLE 324 INCONTINENT CARE PRODUCTS MARKET: DEGREE OF COMPETITION

- TABLE 325 INCONTINENT CARE PRODUCTS MARKET: REGION FOOTPRINT

- TABLE 326 INCONTINENT CARE PRODUCTS MARKET: PRODUCT FOOTPRINT

- TABLE 327 INCONTINENT CARE PRODUCTS MARKET: TYPE FOOTPRINT

- TABLE 328 INCONTINENT CARE PRODUCTS MARKET: END-USER FOOTPRINT

- TABLE 329 INCONTINENT CARE PRODUCTS MARKET: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 330 INCONTINENT CARE PRODUCTS MARKET: DEALS, JANUARY 2022-MAY 2025

- TABLE 331 INCONTINENT CARE PRODUCTS MARKET: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 332 ESSITY AKTIEBOLAG: COMPANY OVERVIEW

- TABLE 333 ESSITY AKTIEBOLAG: CURRENCY CONVERSION, 2022-2024

- TABLE 334 ESSITY AKTIEBOLAG: PRODUCTS OFFERED

- TABLE 335 ESSITY AKTIEBOLAG (PUBL): PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 336 ESSITY AKTIEBOLAG (PUBL): DEALS, JANUARY 2022-MAY 2025

- TABLE 337 KIMBERLY-CLARK CORPORATION: COMPANY OVERVIEW

- TABLE 338 KIMBERLY-CLARK CORPORATION: PRODUCTS OFFERED

- TABLE 339 KIMBERLY-CLARK CORPORATION: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 340 KIMBERLY-CLARK CORPORATION: DEALS, JANUARY 2022-MAY 2025

- TABLE 341 KIMBERLY-CLARK CORPORATION: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 342 THE PROCTER & GAMBLE COMPANY: COMPANY OVERVIEW

- TABLE 343 THE PROCTER & GAMBLE COMPANY: PRODUCTS OFFERED

- TABLE 344 ONTEX BV: COMPANY OVERVIEW

- TABLE 345 ONTEX BV: CURRENCY CONVERSION, 2022-2024

- TABLE 346 ONTEX BV: PRODUCTS OFFERED

- TABLE 347 ONTEX BV.: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 348 ONTEX BV: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 349 PAUL HARTMANN AG: COMPANY OVERVIEW

- TABLE 350 PAUL HARTMANN AG: CURRENCY CONVERSION, 2022-2024

- TABLE 351 PAUL HARTMANN AG: PRODUCTS OFFERED

- TABLE 352 COLOPLAST A/S: COMPANY OVERVIEW

- TABLE 353 COLOPLAST A/S: CURRENCY CONVERSION, 2022-2024

- TABLE 354 COLOPLAST A/S: PRODUCTS OFFERED

- TABLE 355 COLOPLAST A/S: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 356 COLOPLAST A/S: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 357 UNICHARM CORPORATION: COMPANY OVERVIEW

- TABLE 358 UNICHARM CORPORATION: CURRENCY CONVERSION, 2022-2024

- TABLE 359 UNICHARM CORPORATION: PRODUCTS OFFERED

- TABLE 360 UNICHARM COR: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 361 CARDINAL HEALTH, INC: COMPANY OVERVIEW

- TABLE 362 CARDINAL HEALTH, INC: PRODUCTS OFFERED

- TABLE 363 CARDINAL HEALTH, INC: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 364 MEDLINE INDUSTRIES, LP: COMPANY OVERVIEW

- TABLE 365 MEDLINE INDUSTRIES, LP: DEALS, JANUARY 2022-MAY 2025

- TABLE 366 MCKESSON CORPORATION: COMPANY OVERVIEW

- TABLE 367 MCKESSON CORPORATION: PRODUCTS OFFERED

- TABLE 368 ABENA A/S: COMPANY OVERVIEW

- TABLE 369 ABENA A/S: CURRENCY CONVERSION, 2021-2023

- TABLE 370 ABENA A/S: PRODUCTS OFFERED

- TABLE 371 ABENA A/S: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 372 ATTINDAS HYGIENE PARTNERS GROUP: COMPANY OVERVIEW

- TABLE 373 ATTINDAS HYGIENE PARTNERS GROUP: PRODUCTS OFFERED

- TABLE 374 ATTINDAS HYGIENE PARTNERS GROUP: PRODUCT LAUNCHES, JANUARY 2022-MAY 2025

- TABLE 375 HOLLISTER INCORPORATED: COMPANY OVERVIEW

- TABLE 376 HOLLISTER INCORPORATED: PRODUCTS OFFERED

- TABLE 377 HOLLISTER INCORPORATED: EXPANSIONS, JANUARY 2022-MAY 2025

- TABLE 378 DYNAREX CORPORATION: COMPANY OVERVIEW

- TABLE 379 DYNAREX CORPORATION: PRODUCTS OFFERED

- TABLE 380 CONVATEC GROUP PLC: COMPANY OVERVIEW

- TABLE 381 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- TABLE 382 DENTSPLY SIRONA: COMPANY OVERVIEW

- TABLE 383 STRYKER CORPORATION: COMPANY OVERVIEW

- TABLE 384 FIRST QUALITY ENTERPRISES, INC.: COMPANY OVERVIEW

- TABLE 385 PRINCIPLE BUSINESS ENTERPRISES, INC.: COMPANY OVERVIEW

- TABLE 386 TZMO SA: COMPANY OVERVEIW

- TABLE 387 PRIMARE INTERNATIONAL LTD.: COMPANY OVERVIEW

- TABLE 388 DRYLOCK TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 389 NORTHSHORE CARE SUPPLY: COMPANY OVERVIEW

- TABLE 390 NOBEL HYGIENE PVT. LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 GLOBAL INCONTINENT CARE PRODUCTS MARKET: REVENUE SHARE ANALYSIS

- FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- FIGURE 10 INCONTINENT CARE PRODUCTS MARKET, BY TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 11 INCONTINENT CARE PRODUCTS MARKET, BY USAGE, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 INCONTINENT CARE PRODUCTS MARKET, BY GENDER, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 INCONTINENT CARE PRODUCTS MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 GEOGRAPHIC SNAPSHOT OF INCONTINENT CARE PRODUCTS MARKET

- FIGURE 15 EXPANSION OF GERIATRIC POPULATION AND RISING INCIDENCE OF INCONTINENCE TO PROPEL MARKET

- FIGURE 16 HOME CARE SEGMENT IN GERMANY ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 17 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 20 INCONTINENT CARE PRODUCTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 CHALLENGING HEALTH ISSUES ASSOCIATED WITH SOCIAL STIGMA (%)

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 23 INCONTINENT CARE PRODUCTS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 INCONTINENT CARE PRODUCTS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 25 INCONTINENT CARE PRODUCTS MARKET: PATENT ANALYSIS, 2014-2024

- FIGURE 26 INCONTINENT CARE PRODUCTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR INCONTINENCE CARE PRODUCTS, BY END USER

- FIGURE 28 KEY BUYING CRITERIA, BY END USER

- FIGURE 29 AI USE CASES

- FIGURE 30 EUROPE: INCONTINENT CARE PRODUCTS MARKET SNAPSHOT

- FIGURE 31 ASIA PACIFIC: INCONTINENT CARE PRODUCTS MARKET SNAPSHOT

- FIGURE 32 REVENUE ANALYSIS OF KEY PLAYERS IN INCONTINENT CARE PRODUCTS MARKET, 2022-2024 (USD BILLION)

- FIGURE 33 MARKET SHARE ANALYSIS OF KEY PLAYERS IN INCONTINENT CARE PRODUCTS MARKET, 2024

- FIGURE 34 RANKING OF KEY PLAYERS, 2024

- FIGURE 35 INCONTINENT CARE PRODUCTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 36 INCONTINENT CARE PRODUCTS MARKET: COMPANY FOOTPRINT

- FIGURE 37 INCONTINENT CARE PRODUCTS MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2024

- FIGURE 38 ESSITY AKTIEBOLAG: COMPANY SNAPSHOT (2024)

- FIGURE 39 KIMBERLY-CLARK CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 40 THE PROCTER & GAMBLE COMPANY: COMPANY SNAPSHOT (2024)

- FIGURE 41 ONTEX BV: COMPANY SNAPSHOT (2024)

- FIGURE 42 PAUL HARTMANN AG: COMPANY SNAPSHOT (2024)

- FIGURE 43 COLOPLAST A/S: COMPANY SNAPSHOT (2024)

- FIGURE 44 UNICHARM CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 45 CARDINAL HEALTH, INC: COMPANY SNAPSHOT (2024)

- FIGURE 46 MCKESSON CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 47 ABENA A/S: COMPANY SNAPSHOT (2024)

The global incontinence care products market is projected to reach USD 20.85 billion by 2030 from USD 14.81 billion in 2025, at a CAGR of 7.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Type, Usage, Gender, End User, and Region |

| Regions covered | North America, Europe, APAC, LATAM, MEA |

A combination of demographic, medical, and lifestyle forces is fueling the growth of the incontinence care products (ICP) market. A key growth driver is the expanding geriatric population, which is susceptible to urinary & fecal incontinence as a result of age-related diseases. Moreover, new developments in products, such as ultra-thin absorbents, anti-leak barriers, and breathable cloths, are also expected to fuel market growth.

By product, the absorbents segment is expected to register the highest CAGR during the forecast period.

By product, the incontinence care products market is categorized into absorbents and non-absorbents. In 2024, the absorbents segment experienced the highest CAGR during the forecast period. The growth of the absorbents segment is attributed to the rising rate of urinary incontinence, especially in elderly people and women after pregnancy, which requires regular and secure protection. Innovations in the technology of absorbent care, such as the introduction of breathable material and anti-leak designs, are also expected to contribute to market growth.

By type, the urinary incontinence segment is expected to grow at the highest CAGR during the forecast period.

By type, the urinary incontinence segment is categorized into urinary and fecal incontinence. The urinary incontinence segment is the fastest-growing segment during the forecast period. Aging-related weakening of pelvic floor muscles, prostate problems, and hormonal changes following menopause and childbirth are the primary causes of urinary incontinence. Government-sponsored awareness, improved diagnosis rates, and the development of awareness programs in emerging economies also fuel growth in the segment.

In 2024, Europe accounted for the largest market share of the incontinence products market.

The global incontinence care products market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Europe accounted for the largest market share. The region benefits from strong government support, including national health insurance coverage for incontinence products, which significantly boosts adoption, especially in institutional settings like nursing homes and elderly care facilities. The region's leading market players are also expected to drive market growth.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 (27%), Tier 2 (38%), and Tier 3 (35%)

- By Designation: C-level Executives (28%), Director-level Executives (32%), and Others (40%)

- By Region: North America (25%), Europe (40%), the Asia Pacific (32%), Latin America (2%), and the Middle East & Africa (1%)

Note 1: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.0 billion, Tier 2 = USD 1.0 billion to USD 10.0 billion, and Tier 3 = <USD 1.0 billion.

Note 2: C-level executives include CEOs, CFOs, COOs, and VPs.

Note 3: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The players operating in the incontinence care products market include Essity Aktiebolag (Sweden), Kimberly-Clark Corporation (US), The Procter & Gamble Company (US), PAUL HARTMANN AG (Germany), Ontex BV (Belgium), Unicharm Corporation (Japan), Coloplast A/S (Denmark), Cardinal Health, Inc. (US), Medline Industries, LP (US), McKesson Corporation (US), ABENA A/S (Denmark), Attindas Hygiene Partners Group (US), and Hollister Incorporated (US), among others.

Research Coverage

This report examines the incontinence care products market by focusing on product, type, usage, gender, end user, and region. It also explores the various elements influencing market growth, including drivers, restraints, opportunities, and challenges, while providing insights into the competitive landscape among market leaders. Additionally, the report analyzes micromarkets by assessing their individual growth trends and forecasting the revenue of market segments across five major regions and their respective countries.

Reasons to Buy the Report

The report will help established and new or smaller firms understand the current market trends, allowing them to increase their market share. Companies that purchase the report can implement one or more of the following strategies to enhance their market presence.

This report provides insights into the following pointers:

- Analysis of key drivers (Increasing geriatric population and subsequent rise in chronic conditions, the high prevalence of incontinence, the growing importance & awareness of personal hygiene, the rapid urbanization & rising disposable income, and the increasing cases of obesity), restraints (social stigma associated with incontinence care products, and environmental concerns related to disposal of incontinence products), opportunities (development of bio-based superabsorbent polymers, the increasing adoption of smart diapers, and expansion of home healthcare), and challenges (underreporting of fecal incontinence and disparities in reimbursement for incontinence care products)

- Market Penetration: Complete knowledge of the spectrum of products presented by the leading companies in the incontinence care products market

- Product Development/Innovation: Comprehensive understanding of the forthcoming trends, research and development initiatives, and product launches within the incontinence care products market

- Market Development: Complete knowledge about profitable developing regions

- Market Diversification: Exhaustive knowledge of new products, expanding geographies, and current changes in the incontinence care products industry helps to diversify the market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Essity Aktiebolag (Sweden), Kimberly-Clark Corporation (US), The Procter & Gamble Company (US), PAUL HARTMANN AG (Germany), and Ontex BV (Belgium)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation approach

- 2.2.1.2 Approach 2: Presentations of companies and primary interviews

- 2.2.1.3 Growth forecast

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 MARKET SHARE ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.5.1 PARAMETRIC ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 INCONTINENT CARE PRODUCTS MARKET OVERVIEW

- 4.2 EUROPE: INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT (2024)

- 4.3 GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 INCONTINENT CARE PRODUCTS MARKET: GEOGRAPHICAL MIX

- 4.5 INCONTINENT CARE PRODUCTS MARKET: EMERGING VS. DEVELOPED MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing geriatric population and subsequent rise in chronic conditions

- 5.2.1.2 High prevalence of incontinence

- 5.2.1.3 Growing importance & awareness of personal hygiene

- 5.2.1.4 Rapid urbanization and rising disposable income

- 5.2.1.5 Increasing cases of obesity

- 5.2.2 RESTRAINTS

- 5.2.2.1 Social stigma associated with incontinence care products

- 5.2.2.2 Environmental concerns related to disposal of incontinence products

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of bio-based superabsorbent polymers

- 5.2.3.2 Increasing adoption of smart diapers

- 5.2.3.3 Expansion of home healthcare

- 5.2.4 CHALLENGES

- 5.2.4.1 Underreporting of fecal incontinence

- 5.2.4.2 Disparities in reimbursement for incontinence care products

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER, 2022-2O24

- 5.4.2 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 5.4.3 AVERAGE SELLING PRICE TREND, BY PRODUCT

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 RESEARCH & PRODUCT DEVELOPMENT

- 5.5.2 RAW MATERIAL PROCUREMENT

- 5.5.3 MANUFACTURING

- 5.5.4 DISTRIBUTION, MARKETING & SALES, AND POST-SALES SERVICES

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 5.6.3 END USERS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Super Absorbent Polymers (SAPs)

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Sensor technology

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 TRADE ANALYSIS FOR INCONTINENT CARE PRODUCTS (ABSORBENTS)

- 5.9.1.1 Import data for HS code 961900

- 5.9.1.2 Export data for HS code 961900

- 5.9.2 TRADE ANALYSIS FOR INCONTINENT CARE PRODUCTS (NON-ABSORBENTS)

- 5.9.2.1 Import data for HS code 901839

- 5.9.2.2 Export data for HS code 901839

- 5.9.1 TRADE ANALYSIS FOR INCONTINENT CARE PRODUCTS (ABSORBENTS)

- 5.10 KEY CONFERENCES & EVENTS, 2025-2026

- 5.11 REGULATORY ANALYSIS

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 REGULATORY LANDSCAPE

- 5.11.2.1 North America

- 5.11.2.1.1 US

- 5.11.2.1.2 Canada

- 5.11.2.2 Europe

- 5.11.2.3 Asia Pacific

- 5.11.2.3.1 China

- 5.11.2.3.2 Japan

- 5.11.2.3.3 India

- 5.11.2.3.4 South Korea

- 5.11.2.4 Latin America

- 5.11.2.4.1 Brazil

- 5.11.2.4.2 Mexico

- 5.11.2.5 Middle East

- 5.11.2.6 Africa

- 5.11.2.1 North America

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.12.2 BARGAINING POWER OF SUPPLIERS

- 5.12.3 BARGAINING POWER OF BUYERS

- 5.12.4 THREAT FROM SUBSTITUTES

- 5.12.5 THREAT FROM NEW ENTRANTS

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 IMPACT OF AI/GENERATIVE AI ON INCONTINENT CARE PRODUCTS MARKET

- 5.14.1 INTRODUCTION

- 5.14.2 POTENTIAL OF AI IN INCONTINENT CARE PRODUCTS MARKET

- 5.14.3 AI USE CASES

- 5.14.4 KEY COMPANIES IMPLEMENTING AI

- 5.14.5 FUTURE OF GENERATIVE AI ON INCONTINENT CARE PRODUCTS MARKET

- 5.15 TRUMP TARIFF IMPACT ON INCONTINENT CARE PRODUCTS MARKET

- 5.15.1 INTRODUCTION

- 5.15.2 KEY TARIFF RATES

- 5.15.3 IMPACT OF TARIFFS ON PRICING

- 5.15.4 KEY IMPACT ON VARIOUS REGIONS

- 5.15.4.1 North America

- 5.15.4.2 Europe

- 5.15.4.3 Asia Pacific

- 5.15.5 END-USER INDUSTRY IMPACT

6 INCONTINENT CARE PRODUCTS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 ABSORBENTS

- 6.2.1 PADS & GUARDS

- 6.2.1.1 Ease of use to drive market

- 6.2.2 UNDERWEAR & BRIEFS

- 6.2.2.1 Increased absorbency to fuel demand

- 6.2.3 BED PROTECTORS

- 6.2.3.1 Gradual shift towards home-based care to fuel demand

- 6.2.4 OTHER ABSORBENTS

- 6.2.1 PADS & GUARDS

- 6.3 NON-ABSORBENTS

- 6.3.1 CATHETERS

- 6.3.1.1 Intermittent catheters

- 6.3.1.1.1 Reduced risk of infections to boost market

- 6.3.1.2 Indwelling catheters

- 6.3.1.2.1 Rising usage by critically ill patients to boost demand

- 6.3.1.3 External catheters

- 6.3.1.3.1 Ease of use to boost demand

- 6.3.1.1 Intermittent catheters

- 6.3.2 DRAINAGE BAGS

- 6.3.2.1 Increasing rates of catheterization to support market uptake

- 6.3.3 STIMULATION DEVICES

- 6.3.3.1 Growing use in home settings to drive market

- 6.3.4 OTHER NON-ABSORBENTS

- 6.3.1 CATHETERS

7 INCONTINENT CARE PRODUCTS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 URINARY INCONTINENCE

- 7.2.1 GROWING PREVALENCE AMONG WOMEN TO DRIVE MARKET

- 7.3 FECAL INCONTINENCE

- 7.3.1 INCREASE IN GERIATRIC POPULATION TO SUPPORT MARKET GROWTH

8 INCONTINENT CARE PRODUCTS MARKET, BY USAGE

- 8.1 INTRODUCTION

- 8.2 DISPOSABLE

- 8.2.1 EASY AVAILABILITY AND CONVENIENCE TO DRIVE MARKET

- 8.3 REUSABLE

- 8.3.1 ENVIRONMENTAL SUSTAINABILITY TO FUEL DEMAND

9 INCONTINENT CARE PRODUCTS MARKET, BY GENDER

- 9.1 INTRODUCTION

- 9.2 FEMALE

- 9.2.1 HIGHER RATE OF INCONTINENCE DUE TO HORMONAL CHANGES TO PROPEL MARKET

- 9.3 MALE

- 9.3.1 RISING PREVALENCE OF BPH TO SUPPORT MARKET GROWTH

10 INCONTINENT CARE PRODUCTS MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 HOME CARE

- 10.2.1 COST-EFFICIENCY AND HIGH COMFORT TO PROPEL MARKET

- 10.3 HOSPITALS & AMBULATORY SURGERY CENTERS (ASCS)

- 10.3.1 AVAILABILITY OF CRITICAL CARE SERVICES TO DRIVE DEMAND

- 10.4 OTHER END USERS

11 INCONTINENT CARE PRODUCTS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 EUROPE

- 11.2.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.2.2 GERMANY

- 11.2.2.1 Growing incidence of neurological conditions to boost demand

- 11.2.3 UK

- 11.2.3.1 High prevalence of chronic diseases to drive market

- 11.2.4 FRANCE

- 11.2.4.1 Large target population to support market growth

- 11.2.5 ITALY

- 11.2.5.1 Growing awareness initiatives for urinary & fecal incontinence to fuel market

- 11.2.6 SPAIN

- 11.2.6.1 Increasing prevalence of CKD to drive market

- 11.2.7 REST OF EUROPE

- 11.3 NORTH AMERICA

- 11.3.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.3.2 US

- 11.3.2.1 Rising prevalence of incontinence to drive market

- 11.3.3 CANADA

- 11.3.3.1 High incidence of Alzheimer's disease to fuel market

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Rising prevalence of incontinence among women to propel market

- 11.4.3 JAPAN

- 11.4.3.1 Established healthcare system and favorable reimbursements to drive market

- 11.4.4 INDIA

- 11.4.4.1 R&D initiatives on innovative product development to boost market

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Increasing prevalence of Urinary incontinence to boost market

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Advancements in ICP products to support market uptake

- 11.5.3 MEXICO

- 11.5.3.1 Rising prevalence of fecal incontinence to support market growth

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 IMPROVEMENTS IN HEALTHCARE INFRASTRUCTURE TO SUPPORT MARKET GROWTH

- 11.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN INCONTINENT CARE PRODUCTS MARKET

- 12.3 REVENUE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Product footprint

- 12.5.5.4 Type footprint

- 12.5.5.5 End-user footprint

- 12.6 COMPANY EVALUATION MATRIX: SMES/STARTUPS, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 STARTING BLOCKS

- 12.6.3 RESPONSIVE COMPANIES

- 12.6.4 DYNAMIC COMPANIES

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PRODUCT LAUNCHES

- 12.7.2 DEALS

- 12.7.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ESSITY AKTIEBOLAG

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 KIMBERLY-CLARK CORPORATION

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 THE PROCTER & GAMBLE COMPANY

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Key strengths

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses & competitive threats

- 13.1.4 ONTEX BV

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 PAUL HARTMANN AG

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses & competitive threats

- 13.1.6 COLOPLAST A/S

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Expansions

- 13.1.7 UNICHARM CORPORATION

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.8 CARDINAL HEALTH, INC

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Expansions

- 13.1.9 MEDLINE INDUSTRIES, LP

- 13.1.9.1 Business overview

- 13.1.9.2 Recent developments

- 13.1.9.2.1 Deals

- 13.1.10 MCKESSON CORPORATION

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 ABENA A/S

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Expansions

- 13.1.12 ATTINDAS HYGIENE PARTNERS GROUP

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Product launches

- 13.1.13 HOLLISTER INCORPORATED

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Expansions

- 13.1.14 DYNAREX CORPORATION

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.1 ESSITY AKTIEBOLAG

- 13.2 OTHER PLAYERS

- 13.2.1 CONVATEC GROUP PLC

- 13.2.2 BECTON, DICKINSON AND COMPANY

- 13.2.3 DENTSPLY SIRONA

- 13.2.4 STRYKER CORPORATION

- 13.2.5 FIRST QUALITY ENTERPRISES, INC.

- 13.2.6 PRINCIPLE BUSINESS ENTERPRISES, INC.

- 13.2.7 TZMO SA

- 13.2.8 PRIMARE INTERNATIONAL LTD.

- 13.2.9 DRYLOCK TECHNOLOGIES

- 13.2.10 NORTHSHORE CARE SUPPLY

- 13.2.11 NOBEL HYGIENE PVT. LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS