|

|

市場調査レポート

商品コード

1351327

中東・アフリカのクラウドコンピューティング市場:IaaS別、PaaS別、SaaS別、オファリング別、展開モード別、業界別、地域別-2028年までの予測MEA Cloud Computing Market by Offering (Service Model (laaS, PaaS, and SaaS)), Deployment Mode (Public Cloud, Private Cloud, and Hybrid Cloud), Vertical (BFSI, Energy and Utilities, and Manufacturing) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 中東・アフリカのクラウドコンピューティング市場:IaaS別、PaaS別、SaaS別、オファリング別、展開モード別、業界別、地域別-2028年までの予測 |

|

出版日: 2023年09月21日

発行: MarketsandMarkets

ページ情報: 英文 290 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

中東・アフリカのクラウドコンピューティングの市場規模は、予測期間中に18.6%のCAGR(年間平均成長率)で成長し、2023年の211億米ドルから2028年には495億米ドルに達すると予測されています。

中東・アフリカ地域の各国政府は、デジタルトランスフォーメーションの一環としてクラウドの導入を推進しています。政府はクラウドインフラに投資し、公共機関や民間企業にクラウド技術の導入を奨励しています。

中東・アフリカにおけるIaaS(Infrastructure as a Service)は、インターネット経由でさまざまなインフラリソースを提供するクラウドコンピューティングの急成長分野です。中東・アフリカでは、他の地域と同様、IaaSが企業や組織のITインフラ管理の方法を変革しつつあります。IaaSは、インターネット上で仮想化されたコンピューティングリソースを提供するクラウドコンピューティングモデルです。これらのリソースには通常、仮想マシン(VM)、ストレージ、ネットワーキングのほか、ロードバランサー、ファイアウォール、データベースなどの追加サービスが含まれることもあります。

中東・アフリカ地域におけるハイブリッドクラウドの導入は、柔軟でスケーラブルなITソリューションへの要望が原動力となり、著しい成長を遂げています。MEAの企業は、オンプレミスのインフラとパブリックまたはプライベートのクラウドサービスを組み合わせて活用し、ワークロードとデータ管理を最適化する傾向が強まっています。このアプローチにより、機密データの管理を維持しながら、クラウドコンピューティングが提供する俊敏性、コスト効率、拡張性の恩恵を受けることができます。

中東・アフリカ地域の小売・消費財業界は、クラウドコンピューティングの導入により大きな変革を遂げました。MEAの小売・消費財企業はクラウド技術を活用し、業務の強化、サプライチェーン管理の合理化、顧客エンゲージメントの向上、在庫管理の最適化を図っています。クラウドコンピューティングソリューションにより、これらの企業はスケーラブルなコンピューティングリソースにアクセスし、膨大な量のデータを分析して市場を洞察し、革新的なeコマースプラットフォーム、モバイルアプリ、デジタルマーケティング戦略を展開することができます。

当レポートでは、中東・アフリカのクラウドコンピューティング市場について調査し、IaaS別、PaaS別、SaaS別、オファリング別、展開モード別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- ケーススタディ分析

- バリューチェーン分析

- 生態系

- 技術分析

- 価格分析

- 中東・アフリカのクラウドコンピューティング市場のバイヤー/クライアントに影響を与える動向/混乱

- 特許分析

- ポーターのファイブフォース分析

- 関税と規制状況

第6章 中東・アフリカのクラウドコンピューティング市場、オファリング別

- イントロダクション

- サービスモデル

第7章 中東・アフリカのクラウドコンピューティング市場、IaaS別

- イントロダクション

- コンピューティング

- ストレージ、ウェアハウス

- リカバリ、バックアップ

- その他

第8章 中東・アフリカのクラウドコンピューティング市場、PaaS別

- イントロダクション

- アプリケーション開発とプラットフォーム

- アプリケーションのテストと品質

- 分析とレポート

- 統合とオーケストレーション

- データ管理

- その他

第9章 中東・アフリカのクラウドコンピューティング市場、SaaS別

- イントロダクション

- 顧客関係管理

- エンタープライズリソース管理

- 人的資本管理

- コンテンツ管理

- コラボレーションおよび生産性スイート

- サプライチェーンマネジメント

- その他

第10章 中東・アフリカのクラウドコンピューティング市場、展開モード別

- イントロダクション

- パブリッククラウド

- プライベートクラウド

- ハイブリッドクラウド

第11章 中東・アフリカのクラウドコンピューティング市場、業界別

- イントロダクション

- BFSI

- エネルギー、公共事業

- 政府、公共部門

- ヘルスケア、ライフサイエンス

- 製造業

- 小売、消費財

- 電気通信

- ITとITES

- メディア、エンターテイメント

- その他

第12章 中東・アフリカのクラウドコンピューティング市場、地域別

- イントロダクション

- 中東

- アフリカ

第13章 競合情勢

- 概要

- 主要参入企業が採用した戦略/有力企業

- 過去の事業セグメントの収益分析

- 市場シェア分析

- 中東・アフリカのクラウドコンピューティング:ブランド/製品の比較情勢

- 企業評価マトリックス

- 新興企業と中小企業の評価マトリックス

- 競合ベンチマーキング

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- MICROSOFT

- IBM

- ALIBABA CLOUD

- AWS

- ORACLE

- SAP

- SALESFORCE

- ETISALAT

- INJAZAT DATA SYSTEMS

- その他の企業

- EHOSTING DATAFORT

- STC CLOUD

- OOREDOO

- GULF BUSINESS MACHINES

- INTERTEC SYSTEMS

- FUJITSU

- HUAWEI

- CISCO

- INFOSYS

- TCS

- COMPRO

- TERACO DATA ENVIRONMENTS

- LIQUID INTELLIGENT TECHNOLOGIES

- COMPREHENSIVE COMPUTING INNOVATIONS

- INSOMEA COMPUTER SOLUTIONS

- CLOUDBOX TECH

- ZONKE TECH

- CLOUD4RAIN

- MALOMATIA

- ORIXCOM

第15章 隣接市場

第16章 付録

The MEA Cloud Computing Market size is expected to grow at a Compound Annual Growth Rate (CAGR) of 18.6 % during the forecast period, to reach USD 49.5 billion by 2028 from USD 21.1 billion in 2023. Governments in the MEA region were promoting cloud adoption as part of their digital transformation agendas. They were often investing in cloud infrastructure and encouraging public and private sector organizations to embrace cloud technologies.

By service model , IaaS segment to have the largest CAGR during the forecast period

Infrastructure as a Service (IaaS) in the Middle East and Africa (MEA) is a rapidly growing segment of cloud computing that offers a range of infrastructure resources over the internet. In MEA, like in other regions, IaaS is transforming the way businesses and organizations manage their IT infrastructure. IaaS is a cloud computing model that provides virtualized computing resources over the internet. These resources typically include virtual machines (VMs), storage, networking, and sometimes additional services like load balancers, firewalls, and databases.

By deployment mode , hybrid cloud segment to have the largest CAGR during the forecast period

Hybrid cloud adoption in the Middle East and Africa (MEA) region is witnessing significant growth, driven by a desire for flexible and scalable IT solutions. Organizations in MEA are increasingly leveraging a combination of on-premises infrastructure and public or private cloud services to optimize their workloads and data management. This approach allows them to maintain control over sensitive data while benefiting from the agility, cost-efficiency, and scalability offered by cloud computing.

By vertical , retail and consumer goods segment to have the largest CAGR during the forecast period

The retail and consumer goods industry in the Middle East and Africa (MEA) region has undergone a significant transformation with the adoption of cloud computing. Retailers and consumer goods companies in MEA are leveraging cloud technologies to enhance their operations, streamline supply chain management, improve customer engagement, and optimize inventory management. Cloud computing solutions enable these businesses to access scalable computing resources, analyze vast amounts of data for market insights, and deploy innovative e-commerce platforms, mobile apps, and digital marketing strategies.

Middle East to hold the largest market size during the forecast period

The Middle East's cloud computing market has experienced rapid growth in recent years, driven by increasing digitalization, a burgeoning startup ecosystem, and government initiatives promoting digital transformation. Major cloud providers have established a strong presence in the region, offering a wide array of services to meet the demands of enterprises, governments, and small businesses.This section of the report segments the cloud applications industry in the Middle East, based on countries such as Saudi Arabia, UAE, Qatar, Israel, Turkey and other countries (Oman, Kuwait, and Bahrain).

In the process of determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews were conducted with the key people. The breakup of the profiles of the primary participants as follows:

- By Company Type: Tier I: 37%, Tier II: 25%, and Tier III: 38%

- By Designation: C-Level: 22%, D-Level: 33%, and Others: 45%

- By Region: North America: 42%, Europe: 25%, APAC: 18%, Row: 15%

Research Coverage

The report segments the MEA cloud computing market by offering (service model), deployment mode, vertical, and region. The MEA cloud computing market has been segmented into service model and service type. The service model segment is further segmented into IaaS, PaaS, and SaaS. By the deployment model, the MEA cloud computing market has been segmented into public cloud, private cloud and hybrid cloud. By verticals, the MEA cloud computing market is segmented into BFSI, energy and utilities, government and public sector, healthcare and life sciences, manufacturing, IT/ITeS, retail and consumer goods, telecommunications, media and entertainment, and other verticals. By region, the market has been segmented into Middle East and Africa.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market for MEA cloud computing and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers

(Adoption of cloud computing solutions across Middle East and Africa, Business expansion by market leaders in Middle East and Africa to cater to untapped clientele, Growing investments in cutting-edge technologies and governmental initiatives toward digital transformation), restraints (Lack of technical expertise among enterprises in technologically developing geographies, Difficulty in addressing governance and compliance requirements), opportunities (Increase in adoption of hybrid cloud services, Rising number of SMEs to create revenue opportunities for cloud vendors, Telecom service providers leveraging existing infrastructure to offer cloud-based services, Incorporation of AI and ML in cloud computing solutions), and challenges (Fear of vendor lock-in, Rising number of cloud cyberattacks and security breach incidents, Compatibility complexities with legacy systems) influencing the growth of the MEA cloud computing market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the MEA cloud computing market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the MEA cloud computing market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in MEA cloud computing market strategies; the report also helps stakeholders understand the pulse of the MEA cloud computing market and provides them with information on key market drivers, restraints, challenges, and opportunities

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Microsoft (US), SAP (Germany),and IBM (US) among others in the MEA cloud computing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATE, 2020-2022

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 MEA CLOUD COMPUTING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- TABLE 2 PRIMARY RESPONDENTS: MEA CLOUD COMPUTING MARKET

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 4 MEA CLOUD COMPUTING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF MEA CLOUD COMPUTING FROM VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF MEA CLOUD COMPUTING VENDORS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - (SUPPLY SIDE): CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM VERTICALS (1/2)

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM VERTICALS (2/2)

- 2.4 MARKET FORECAST

- TABLE 3 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 IMPLICATIONS OF RECESSION ON MEA CLOUD COMPUTING MARKET

3 EXECUTIVE SUMMARY

- TABLE 4 MEA CLOUD COMPUTING MARKET SIZE AND GROWTH RATE, 2018-2022 (USD MILLION, Y-O-Y%)

- TABLE 5 MEA CLOUD COMPUTING MARKET SIZE AND GROWTH RATE, 2023-2028 (USD MILLION, Y-O-Y%)

- FIGURE 10 SAAS SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 11 PUBLIC CLOUD TO DOMINATE DURING FORECAST PERIOD

- FIGURE 12 BANKING, FINANCIAL SERVICES, AND INSURANCE TO DOMINATE DURING FORECAST PERIOD

- FIGURE 13 MEA CLOUD COMPUTING MARKET: REGIONAL SNAPSHOT IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR COMPANIES IN MEA CLOUD COMPUTING MARKET

- FIGURE 14 INCREASING NEED TO SHIFT ENTERPRISE WORKLOADS TO CLOUD TO DRIVE MEA CLOUD COMPUTING MARKET

- 4.2 OVERVIEW OF RECESSION IN MEA CLOUD COMPUTING MARKET

- FIGURE 15 MEA CLOUD COMPUTING MARKET TO WITNESS MINOR DECLINE IN Y-O-Y GROWTH IN 2023

- 4.3 MIDDLE EAST: CLOUD COMPUTING MARKET, BY SERVICE MODEL AND COUNTRY

- FIGURE 16 SAAS TO DOMINATE MIDDLE EAST IN 2023

- 4.4 AFRICA: CLOUD COMPUTING MARKET, BY SERVICE MODEL AND COUNTRY

- FIGURE 17 SAAS SEGMENT TO HOLD LARGEST MARKET IN AFRICA IN 2023

- 4.5 MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2028

- FIGURE 18 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO HOLD LARGEST MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MEA CLOUD COMPUTING MARKET

- 5.1.1 DRIVERS

- 5.1.1.1 Adoption of cloud computing solutions across Middle East and Africa

- 5.1.1.2 Business expansion by market leaders in Middle East and Africa to cater to untapped clientele

- 5.1.1.3 Growing investments in cutting-edge technologies and government initiatives toward digital transformation

- 5.1.2 RESTRAINTS

- 5.1.2.1 Lack of technical expertise among enterprises in technologically developing geographies

- 5.1.2.2 Difficulty in addressing governance and compliance requirements

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Increase in adoption of hybrid cloud services

- 5.1.3.2 Rising number of SMEs to create revenue opportunities for cloud vendors

- 5.1.3.3 Telecom service providers leveraging existing infrastructure to offer cloud-based services

- 5.1.3.4 Incorporation of AI and ML in cloud computing solutions

- 5.1.4 CHALLENGES

- 5.1.4.1 Fear of vendor lock-in

- 5.1.4.2 Rising number of cloud cyberattacks and security breach incidents

- 5.1.4.3 Compatibility complexities with legacy systems

- 5.2 CASE STUDY ANALYSIS

- 5.2.1 CASE STUDY 1: CLOUD SERVICE DEPLOYMENT

- 5.2.2 CASE STUDY 2: CONNECTIVITY

- 5.2.3 CASE STUDY 3: CLOUD MIGRATION

- 5.2.4 CASE STUDY 4: PERFORMANCE ENHANCEMENT WITH CLOUD PLATFORM

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 20 VALUE CHAIN ANALYSIS: MEA CLOUD COMPUTING MARKET

- 5.4 ECOSYSTEM

- FIGURE 21 MEA CLOUD COMPUTING MARKET ECOSYSTEM

- TABLE 6 MEA CLOUD COMPUTING MARKET: ECOSYSTEM

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 KEY TECHNOLOGIES

- 5.5.1.1 AI & ML

- 5.5.1.2 Edge Computing

- 5.5.1.3 IoT

- 5.5.1.4 Augmented Reality

- 5.5.2 ADJACENT TECHNOLOGIES

- 5.5.2.1 Blockchain

- 5.5.2.2 Big Data & Analytics

- 5.5.2.3 DevOps

- 5.5.1 KEY TECHNOLOGIES

- 5.6 PRICING ANALYSIS

- 5.6.1 INTRODUCTION

- 5.6.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING

- TABLE 7 MEA CLOUD COMPUTING MARKET: PRICING LEVELS

- 5.7 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS IN MEA CLOUD COMPUTING MARKET

- FIGURE 22 MEA CLOUD COMPUTING MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- 5.8 PATENT ANALYSIS

- 5.8.1 METHODOLOGY

- 5.8.2 DOCUMENT TYPE

- TABLE 8 PATENTS FILED, 2013-2023

- 5.8.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 23 TOTAL NUMBER OF PATENTS GRANTED, 2013-2023

- 5.8.3.1 Top applicants

- FIGURE 24 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2013-2023

- TABLE 9 TOP 20 PATENT OWNERS IN MEA CLOUD COMPUTING MARKET, 2013-2023

- TABLE 10 LIST OF PATENTS IN MEA CLOUD COMPUTING MARKET, 2021-2023

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 MEA CLOUD COMPUTING: PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 MEA CLOUD COMPUTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 TARIFF AND REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1.1 MIDDLE EAST

- TABLE 12 MIDDLE EAST: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1.2 AFRICA

- TABLE 13 AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 MEA CLOUD COMPUTING MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 SERVICE MODEL

- FIGURE 26 SAAS TO HOLD LARGEST MARKET SIZE IN 2023

- 6.2.1 SERVICE MODELS: MEA CLOUD COMPUTING MARKET DRIVERS

- TABLE 14 MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018-2022 (USD MILLION)

- TABLE 15 MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- 6.2.2 INFRASTRUCTURE AS A SERVICE

- 6.2.2.1 Adoption of IaaS to noticeably increase in MEA among large enterprises due to security and reduced cost of hardware resources

- TABLE 16 INFRASTRUCTURE AS A SERVICE: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 17 INFRASTRUCTURE AS A SERVICE: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.3 PLATFORM AS A SERVICE

- 6.2.3.1 PaaS to offer rich tools to end users for developing cloud-based solutions on uniform platform

- TABLE 18 PLATFORM AS A SERVICE: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 19 PLATFORM AS A SERVICE: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.4 SOFTWARE AS A SERVICE

- 6.2.4.1 SaaS to help modernize businesses of SMEs with service model at low cost

- TABLE 20 SOFTWARE AS A SERVICE: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 21 SOFTWARE AS A SERVICE: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

7 MEA CLOUD COMPUTING MARKET, BY IAAS

- 7.1 INTRODUCTION

- FIGURE 27 STORAGE & WAREHOUSE TO ACCOUNT FOR LARGEST MARKET SIZE IN 2023

- 7.1.1 IAAS: MEA CLOUD COMPUTING MARKET DRIVERS

- TABLE 22 MEA CLOUD COMPUTING MARKET, BY IAAS, 2018-2022 (USD MILLION)

- TABLE 23 MEA CLOUD COMPUTING MARKET, BY IAAS, 2023-2028 (USD MILLION)

- 7.2 COMPUTATION

- 7.2.1 RISING PREFERENCE FOR SMOOTH RECEIVING, ANALYZING, AND STORING DATA BETWEEN BUSINESS APPS AND WEB TO DRIVE MARKET

- TABLE 24 COMPUTATION: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 25 COMPUTATION: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 STORAGE & WAREHOUSE

- 7.3.1 INCREASING NEED TO MANAGE BIG DATA AND ANALYTICS, MEDIA PROCESSING, AND CONTENT MANAGEMENT TO FUEL GROWTH

- TABLE 26 STORAGE & WAREHOUSE: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 27 STORAGE & WAREHOUSE: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 RECOVERY & BACKUP

- 7.4.1 NEED FOR COST-EFFICIENCY, SCALABILITY, AND RELIABILITY IN CLOUD COMPUTING AMONG SMES TO DRIVE MARKET

- TABLE 28 RECOVERY & BACKUP: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 29 RECOVERY & BACKUP: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 OTHERS

- TABLE 30 OTHER IAAS: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 31 OTHER IAAS: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

8 MEA CLOUD COMPUTING MARKET, BY PAAS

- 8.1 INTRODUCTION

- FIGURE 28 DATA MANAGEMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE IN 2023

- 8.1.1 PAAS: MEA CLOUD COMPUTING MARKET DRIVERS

- TABLE 32 MEA CLOUD COMPUTING MARKET, BY PAAS, 2018-2022 (USD MILLION)

- TABLE 33 MEA CLOUD COMPUTING MARKET, BY PAAS, 2023-2028 (USD MILLION)

- 8.2 APPLICATION DEVELOPMENT AND PLATFORMS

- 8.2.1 NEED FOR BUSINESS AND IT TEAMS TO COLLABORATE AND DELIVER NEW WEB AND MOBILE APPLICATIONS TO BOOST GROWTH

- TABLE 34 APPLICATION DEVELOPMENT AND PLATFORMS: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 35 APPLICATION DEVELOPMENT AND PLATFORMS: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 APPLICATION TESTING AND QUALITY

- 8.3.1 GROWING PREFERENCE FOR EFFECTIVE TESTING STRATEGY SYSTEMS, USER INTERFACES, AND APIS TO DRIVE MARKET

- TABLE 36 APPLICATION TESTING AND QUALITY: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 37 APPLICATION TESTING AND QUALITY: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 ANALYTICS AND REPORTING

- 8.4.1 AWARENESS ABOUT COMPREHENSIVE BUSINESS METRICS IN NEAR-REAL-TIME TO SUPPORT BETTER DECISION-MAKING

- TABLE 38 ANALYTICS AND REPORTING: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 39 ANALYTICS AND REPORTING: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 INTEGRATION AND ORCHESTRATION

- 8.5.1 INTEGRATION AND ORCHESTRATION TO AID AUTOMATION AND SYNCHRONIZATION OF DATA IN REAL-TIME

- TABLE 40 INTEGRATION AND ORCHESTRATION: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 41 INTEGRATION AND ORCHESTRATION: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

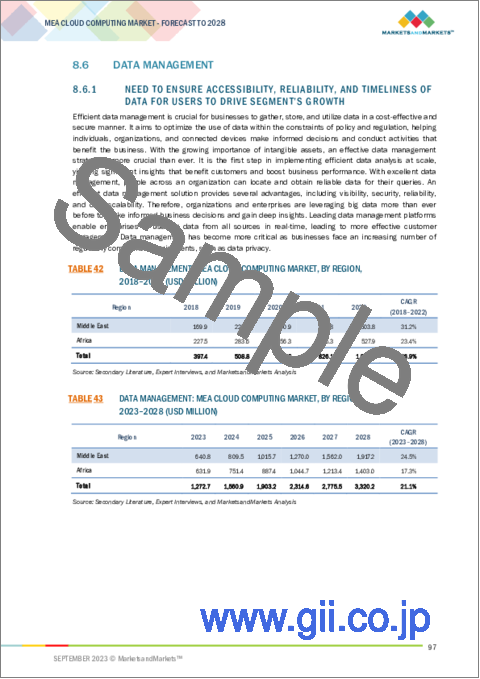

- 8.6 DATA MANAGEMENT

- 8.6.1 NEED TO ENSURE ACCESSIBILITY, RELIABILITY, AND TIMELINESS OF DATA FOR USERS TO DRIVE SEGMENT'S GROWTH

- TABLE 42 DATA MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 43 DATA MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.7 OTHERS

- TABLE 44 OTHER PAAS: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 45 OTHER PAAS: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

9 MEA CLOUD COMPUTING MARKET, BY SAAS

- 9.1 INTRODUCTION

- FIGURE 29 CUSTOMER RELATIONSHIP MANAGEMENT TO ACCOUNT FOR LARGEST MARKET SIZE IN 2023

- 9.1.1 SAAS: MEA CLOUD COMPUTING MARKET DRIVERS

- TABLE 46 MEA CLOUD COMPUTING MARKET, BY SAAS, 2018-2022 (USD MILLION)

- TABLE 47 MEA CLOUD COMPUTING MARKET, BY SAAS, 2023-2028 (USD MILLION)

- 9.2 CUSTOMER RELATIONSHIP MANAGEMENT

- 9.2.1 CRM TO ENABLE ENTERPRISES TO STORE AND UTILIZE CUSTOMER DATA AT SCALE

- TABLE 48 CUSTOMER RELATIONSHIP MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 49 CUSTOMER RELATIONSHIP MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 ENTERPRISE RESOURCE MANAGEMENT

- 9.3.1 GROWING NEED FOR FLEXIBLE BUSINESS PROCESS TRANSFORMATION TO DRIVE MARKET GROWTH

- TABLE 50 ENTERPRISE RESOURCE MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 51 ENTERPRISE RESOURCE MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 HUMAN CAPITAL MANAGEMENT

- 9.4.1 NEED FOR EFFECTIVE STUDY OF VARIOUS ASPECTS OF EMPLOYEE MANAGEMENT TO DRIVE MARKET

- TABLE 52 HUMAN CAPITAL MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 53 HUMAN CAPITAL MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 CONTENT MANAGEMENT

- 9.5.1 RISING PREFERENCE FOR INFORMATION MANAGEMENT, RESPONSIVENESS, AND SCALABILITY TO FUEL MARKET

- TABLE 54 CONTENT MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 55 CONTENT MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 COLLABORATION AND PRODUCTIVITY SUITES

- 9.6.1 SHARING OF DOCUMENTS AND FILES TO BE MADE EASY BY DEPLOYMENT OF COLLABORATION AND PRODUCTIVITY SUITES

- TABLE 56 COLLABORATION AND PRODUCTIVITY SUITES: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 57 COLLABORATION AND PRODUCTIVITY SUITES: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.7 SUPPLY CHAIN MANAGEMENT

- 9.7.1 NEED TO IMPROVE SUPPLY CHAIN OPERATIONS FOR DIFFERENT CAPITAL-INTENSIVE INDUSTRY REQUIREMENTS TO DRIVE GROWTH

- TABLE 58 SUPPLY CHAIN MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 59 SUPPLY CHAIN MANAGEMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.8 OTHERS

- TABLE 60 OTHER SAAS: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 61 OTHER SAAS: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

10 MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE

- 10.1 INTRODUCTION

- FIGURE 30 PUBLIC CLOUD SEGMENT TO HOLD LARGEST MARKET SIZE IN 2023

- 10.1.1 DEPLOYMENT MODES: MEA CLOUD COMPUTING MARKET DRIVERS

- TABLE 62 MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 63 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- 10.2 PUBLIC CLOUD

- 10.2.1 LOWER COSTS AND EASY DEPLOYMENT TO BE MAJOR DRIVING FACTORS OF PUBLIC CLOUD ADOPTION

- TABLE 64 PUBLIC CLOUD: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 65 PUBLIC CLOUD: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 PRIVATE CLOUD

- 10.3.1 CORPORATES TO OPT FOR PRIVATE CLOUD DUE TO SECURITY CONCERNS CAUSED BY INCREASING NUMBER OF CYBERATTACKS

- TABLE 66 PRIVATE CLOUD: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 67 PRIVATE CLOUD: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 HYBRID CLOUD

- 10.4.1 HYBRID CLOUD TO HELP MANAGE COST BY OPTIMIZING RESOURCE USAGE

- TABLE 68 HYBRID CLOUD: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 69 HYBRID CLOUD: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

11 MEA CLOUD COMPUTING MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- FIGURE 31 RETAIL AND CONSUMER GOODS VERTICAL TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- 11.1.1 VERTICALS: MEA CLOUD COMPUTING MARKET DRIVERS

- TABLE 70 MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 71 MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.2 BFSI

- 11.2.1 RISING DEMAND FOR AGILITY IN BANKING PROCESSES TO BOOST CLOUD COMPUTING ADOPTION IN BFSI SECTOR

- TABLE 72 BFSI: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 73 BFSI: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 ENERGY AND UTILITIES

- 11.3.1 REGULATORY STANDARDS AND CONVERGENCE OF IT IN ENERGY AND UTILITIES TO FUEL DEMAND FOR CLOUD COMPUTING SOLUTIONS

- TABLE 74 ENERGY AND UTILITIES: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 75 ENERGY AND UTILITIES: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.4 GOVERNMENT AND PUBLIC SECTOR

- 11.4.1 GOVERNMENT INITIATIVES AND INVESTMENTS IN LATEST TECHNOLOGIES, SUCH AS AI, ML, AND IOT, TO FOSTER CLOUD ADOPTION

- TABLE 76 GOVERNMENT AND PUBLIC SECTOR: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 77 GOVERNMENT AND PUBLIC SECTOR: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.5 HEALTHCARE AND LIFE SCIENCES

- 11.5.1 INCREASED DEMAND FOR EFFECTIVE SYSTEM MANAGEMENT IN HEALTHCARE SECTOR TO BOOST DEMAND FOR CLOUD COMPUTING

- TABLE 78 HEALTHCARE AND LIFE SCIENCES: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 79 HEALTHCARE AND LIFE SCIENCES: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.6 MANUFACTURING

- 11.6.1 RISING NEED TO MAINTAIN SEAMLESS MANUFACTURING PROCESSES TO AMPLIFY DEMAND FOR CLOUD COMPUTING

- TABLE 80 MANUFACTURING: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 81 MANUFACTURING: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.7 RETAIL AND CONSUMER GOODS

- 11.7.1 RETAILERS SHIFTING BUSINESS OPERATIONS ONLINE TO CONTINUE BUSINESSES DURING LOCKDOWNS TO BOOST CLOUD COMPUTING DEMAND

- TABLE 82 RETAIL AND CONSUMER GOODS: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 83 RETAIL AND CONSUMER GOODS: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.8 TELECOMMUNICATIONS

- 11.8.1 HUGE DATA GENERATION IN TELECOMMUNICATION INDUSTRY TO DRIVE DEMAND FOR CLOUD-BASED SYSTEMS FOR DATA MANAGEMENT

- TABLE 84 TELECOMMUNICATIONS: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 85 TELECOMMUNICATIONS: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.9 IT AND ITES

- 11.9.1 IT AND ITES COMPANIES INVEST IN NEW TECHNOLOGIES TO SPUR INNOVATION AND ATTRACT CONSUMERS

- TABLE 86 IT AND ITES: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 87 IT AND ITES: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.10 MEDIA AND ENTERTAINMENT

- 11.10.1 HYBRID OR MULTI-CLOUD DEPLOYMENTS ALLOW WORKLOADS TO BE SHIFTED ACROSS PUBLIC AND PRIVATE INFRASTRUCTURES

- TABLE 88 MEDIA AND ENTERTAINMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 89 MEDIA AND ENTERTAINMENT: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.11 OTHER VERTICALS

- TABLE 90 OTHER VERTICALS: MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 91 OTHER VERTICALS: MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

12 MEA CLOUD COMPUTING MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 32 MIDDLE EAST TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- TABLE 92 MEA CLOUD COMPUTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 93 MEA CLOUD COMPUTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.2 MIDDLE EAST

- 12.2.1 MIDDLE EAST: MEA CLOUD COMPUTING MARKET DRIVERS

- 12.2.2 MIDDLE EAST: IMPACT OF RECESSION

- FIGURE 33 MIDDLE EAST: MARKET SNAPSHOT

- TABLE 94 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018-2022 (USD MILLION)

- TABLE 95 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 96 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018-2022 (USD MILLION)

- TABLE 97 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023-2028 (USD MILLION)

- TABLE 98 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018-2022 (USD MILLION)

- TABLE 99 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023-2028 (USD MILLION)

- TABLE 100 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018-2022 (USD MILLION)

- TABLE 101 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023-2028 (USD MILLION)

- TABLE 102 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 103 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 104 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 105 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 106 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 107 MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.2.3 UNITED ARAB EMIRATES

- 12.2.3.1 Rapid technological proliferation and huge IT spending to drive growth of cloud computing in UAE

- TABLE 108 UAE: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018-2022 (USD MILLION)

- TABLE 109 UAE: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 110 UAE: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018-2022 (USD MILLION)

- TABLE 111 UAE: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023-2028 (USD MILLION)

- TABLE 112 UAE: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018-2022 (USD MILLION)

- TABLE 113 UAE: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023-2028 (USD MILLION)

- TABLE 114 UAE: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018-2022 (USD MILLION)

- TABLE 115 UAE: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023-2028 (USD MILLION)

- TABLE 116 UAE: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 117 UAE: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 118 UAE: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 119 UAE: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.2.4 SAUDI ARABIA

- 12.2.4.1 Robust government initiatives and smart city projects in KSA to foster cloud computing growth

- TABLE 120 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018-2022 (USD MILLION)

- TABLE 121 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 122 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018-2022 (USD MILLION)

- TABLE 123 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023-2028 (USD MILLION)

- TABLE 124 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018-2022 (USD MILLION)

- TABLE 125 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023-2028 (USD MILLION)

- TABLE 126 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018-2022 (USD MILLION)

- TABLE 127 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023-2028 (USD MILLION)

- TABLE 128 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 129 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 130 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 131 SAUDI ARABIA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.2.5 TURKEY

- 12.2.5.1 Cloud services in Turkey to offer scalability, allowing businesses to easily adjust their computing resources

- TABLE 132 TURKEY: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018-2022 (USD MILLION)

- TABLE 133 TURKEY: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 134 TURKEY: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018-2022 (USD MILLION)

- TABLE 135 TURKEY: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023-2028 (USD MILLION)

- TABLE 136 TURKEY: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018-2022 (USD MILLION)

- TABLE 137 TURKEY: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023-2028 (USD MILLION)

- TABLE 138 TURKEY: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018-2022 (USD MILLION)

- TABLE 139 TURKEY: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023-2028 (USD MILLION)

- TABLE 140 TURKEY: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 141 TURKEY: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 142 TURKEY: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 143 TURKEY: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.2.6 ISRAEL

- 12.2.6.1 Advancements in healthcare and biotechnology, with focus on medical research, pharmaceuticals, and digital health technologies, to drive growth in Israel

- TABLE 144 ISRAEL: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018-2022 (USD MILLION)

- TABLE 145 ISRAEL: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 146 ISRAEL: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018-2022 (USD MILLION)

- TABLE 147 ISRAEL: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023-2028 (USD MILLION)

- TABLE 148 ISRAEL: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018-2022 (USD MILLION)

- TABLE 149 ISRAEL: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023-2028 (USD MILLION)

- TABLE 150 ISRAEL: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018-2022 (USD MILLION)

- TABLE 151 ISRAEL: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023-2028 (USD MILLION)

- TABLE 152 ISRAEL: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 153 ISRAEL: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 154 ISRAEL: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 155 ISRAEL: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.2.7 QATAR

- 12.2.7.1 Rapid pace of digital transformation and data center development by leading cloud vendors to drive cloud computing market

- TABLE 156 QATAR: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018-2022 (USD MILLION)

- TABLE 157 QATAR: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 158 QATAR: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018-2022 (USD MILLION)

- TABLE 159 QATAR: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023-2028 (USD MILLION)

- TABLE 160 QATAR: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018-2022 (USD MILLION)

- TABLE 161 QATAR: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023-2028 (USD MILLION)

- TABLE 162 QATAR: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018-2022 (USD MILLION)

- TABLE 163 QATAR: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023-2028 (USD MILLION)

- TABLE 164 QATAR: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 165 QATAR: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 166 QATAR: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 167 QATAR: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.2.8 REST OF MIDDLE EAST

- TABLE 168 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018-2022 (USD MILLION)

- TABLE 169 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 170 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018-2022 (USD MILLION)

- TABLE 171 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023-2028 (USD MILLION)

- TABLE 172 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018-2022 (USD MILLION)

- TABLE 173 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023-2028 (USD MILLION)

- TABLE 174 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018-2022 (USD MILLION)

- TABLE 175 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023-2028 (USD MILLION)

- TABLE 176 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 177 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 178 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 179 REST OF MIDDLE EAST: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3 AFRICA

- 12.3.1 AFRICA: MEA CLOUD COMPUTING MARKET DRIVERS

- 12.3.2 AFRICA: IMPACT OF RECESSION

- FIGURE 34 AFRICA: MARKET SNAPSHOT

- TABLE 180 AFRICA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018-2022 (USD MILLION)

- TABLE 181 AFRICA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 182 AFRICA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018-2022 (USD MILLION)

- TABLE 183 AFRICA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023-2028 (USD MILLION)

- TABLE 184 AFRICA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018-2022 (USD MILLION)

- TABLE 185 AFRICA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023-2028 (USD MILLION)

- TABLE 186 AFRICA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018-2022 (USD MILLION)

- TABLE 187 AFRICA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023-2028 (USD MILLION)

- TABLE 188 AFRICA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 189 AFRICA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 190 AFRICA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 191 AFRICA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 192 AFRICA: MEA CLOUD COMPUTING MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 193 AFRICA: MEA CLOUD COMPUTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.3.3 SOUTH AFRICA

- 12.3.3.1 Growing number of SMEs in retail and consumer goods vertical and ICT industry to boost cloud computing growth in South Africa

- TABLE 194 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018-2022 (USD MILLION)

- TABLE 195 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 196 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018-2022 (USD MILLION)

- TABLE 197 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023-2028 (USD MILLION)

- TABLE 198 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018-2022 (USD MILLION)

- TABLE 199 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023-2028 (USD MILLION)

- TABLE 200 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018-2022 (USD MILLION)

- TABLE 201 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023-2028 (USD MILLION)

- TABLE 202 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 203 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 204 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 205 SOUTH AFRICA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3.4 EGYPT

- 12.3.4.1 Strategic partnerships of local cloud vendors with leading cloud service providers to drive cloud computing growth in Egypt

- TABLE 206 EGYPT: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018-2022 (USD MILLION)

- TABLE 207 EGYPT: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 208 EGYPT: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018-2022 (USD MILLION)

- TABLE 209 EGYPT: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023-2028 (USD MILLION)

- TABLE 210 EGYPT: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018-2022 (USD MILLION)

- TABLE 211 EGYPT: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023-2028 (USD MILLION)

- TABLE 212 EGYPT: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018-2022 (USD MILLION)

- TABLE 213 EGYPT: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023-2028 (USD MILLION)

- TABLE 214 EGYPT: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 215 EGYPT: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 216 EGYPT: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 217 EGYPT: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3.5 NIGERIA

- 12.3.5.1 Scalability to be crucial in Nigeria's dynamic business environment

- TABLE 218 NIGERIA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018-2022 (USD MILLION)

- TABLE 219 NIGERIA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 220 NIGERIA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018-2022 (USD MILLION)

- TABLE 221 NIGERIA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023-2028 (USD MILLION)

- TABLE 222 NIGERIA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018-2022 (USD MILLION)

- TABLE 223 NIGERIA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023-2028 (USD MILLION)

- TABLE 224 NIGERIA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018-2022 (USD MILLION)

- TABLE 225 NIGERIA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023-2028 (USD MILLION)

- TABLE 226 NIGERIA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 227 NIGERIA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 228 NIGERIA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 229 NIGERIA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3.6 REST OF AFRICA

- TABLE 230 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2018-2022 (USD MILLION)

- TABLE 231 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 232 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2018-2022 (USD MILLION)

- TABLE 233 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY IAAS, 2023-2028 (USD MILLION)

- TABLE 234 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2018-2022 (USD MILLION)

- TABLE 235 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY PAAS, 2023-2028 (USD MILLION)

- TABLE 236 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2018-2022 (USD MILLION)

- TABLE 237 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY SAAS, 2023-2028 (USD MILLION)

- TABLE 238 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 239 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 240 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 241 REST OF AFRICA: MEA CLOUD COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

- TABLE 242 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN MEA CLOUD COMPUTING MARKET

- 13.3 HISTORICAL BUSINESS SEGMENT REVENUE ANALYSIS

- FIGURE 35 HISTORICAL BUSINESS SEGMENT REVENUE ANALYSIS, 2020 TO 2022

- 13.4 MARKET SHARE ANALYSIS

- FIGURE 36 MEA CLOUD COMPUTING MARKET: MARKET SHARE ANALYSIS

- TABLE 243 MEA CLOUD COMPUTING MARKET: DEGREE OF COMPETITION

- 13.5 MEA CLOUD COMPUTING: COMPARISON LANDSCAPE OF BRANDS/PRODUCTS

- 13.5.1 MEA CLOUD COMPUTING: TRENDING PRODUCTS/BRAND COMPARISON

- 13.6 COMPANY EVALUATION MATRIX

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- FIGURE 37 MEA CLOUD COMPUTING MARKET: COMPANY EVALUATION MATRIX, 2022

- TABLE 244 MEA CLOUD COMPUTING MARKET: COMPANY FOOTPRINT OF KEY PLAYERS

- TABLE 245 MEA CLOUD COMPUTING MARKET: COMPANY FOOTPRINT OF STARTUPS/SMES

- 13.7 STARTUP AND SME EVALUATION MATRIX

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- FIGURE 38 MEA CLOUD COMPUTING MARKET: EVALUATION MATRIX FOR STARTUPS AND SMES, 2022

- 13.8 COMPETITIVE BENCHMARKING

- TABLE 246 MEA CLOUD COMPUTING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- TABLE 247 PRODUCT LAUNCHES AND ENHANCEMENTS, 2019-2023

- 13.9.2 DEALS

- TABLE 248 DEALS, 2021-2023

14 COMPANY PROFILES

- 14.1 MAJOR PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 14.1.1 MICROSOFT

- TABLE 249 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 39 MICROSOFT: COMPANY SNAPSHOT

- TABLE 250 MICROSOFT: SOLUTIONS OFFERED

- TABLE 251 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 252 MICROSOFT: DEALS

- 14.1.2 IBM

- TABLE 253 IBM: BUSINESS OVERVIEW

- FIGURE 40 IBM: COMPANY SNAPSHOT

- TABLE 254 IBM: SOLUTIONS AND SERVICES OFFERED

- TABLE 255 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 256 IBM: DEALS

- 14.1.3 GOOGLE

- TABLE 257 GOOGLE: BUSINESS OVERVIEW

- FIGURE 41 GOOGLE: COMPANY SNAPSHOT

- TABLE 258 GOOGLE: SOLUTIONS OFFERED

- TABLE 259 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 260 GOOGLE: DEALS

- 14.1.4 ALIBABA CLOUD

- TABLE 261 ALIBABA CLOUD: BUSINESS OVERVIEW

- FIGURE 42 ALIBABA CLOUD: COMPANY SNAPSHOT

- TABLE 262 ALIBABA CLOUD: SOLUTIONS OFFERED

- TABLE 263 ALIBABA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 264 ALIBABA: DEALS

- 14.1.5 AWS

- TABLE 265 AWS: BUSINESS OVERVIEW

- FIGURE 43 AWS: COMPANY SNAPSHOT

- TABLE 266 AWS: PLATFORM AND SERVICES OFFERED

- TABLE 267 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 268 AWS: DEALS

- 14.1.6 ORACLE

- TABLE 269 ORACLE: BUSINESS OVERVIEW

- FIGURE 44 ORACLE: COMPANY SNAPSHOT

- TABLE 270 ORACLE: PRODUCT OFFERED

- TABLE 271 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 272 ORACLE: DEALS

- 14.1.7 SAP

- TABLE 273 SAP: BUSINESS OVERVIEW

- FIGURE 45 SAP: COMPANY SNAPSHOT

- TABLE 274 SAP: PRODUCTS AND SERVICES OFFERED

- TABLE 275 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 276 SAP: DEALS

- 14.1.8 SALESFORCE

- TABLE 277 SALESFORCE: BUSINESS OVERVIEW

- FIGURE 46 SALESFORCE: COMPANY SNAPSHOT

- TABLE 278 SALESFORCE: SOLUTIONS OFFERED

- TABLE 279 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 280 SALESFORCE: DEALS

- 14.1.9 ETISALAT

- TABLE 281 ETISALAT: BUSINESS OVERVIEW

- FIGURE 47 ETISALAT: COMPANY SNAPSHOT

- TABLE 282 ETISALAT: SOLUTIONS OFFERED

- TABLE 283 ETISALAT: NEW PRODUCT DEVELOPMENTS

- TABLE 284 ETISALAT: DEALS

- 14.1.10 INJAZAT DATA SYSTEMS

- TABLE 285 INJAZAT DATA SYSTEMS: BUSINESS OVERVIEW

- TABLE 286 INJAZAT DATA SYSTEMS: SERVICES OFFERED

- TABLE 287 INJAZAT DATA SYSTEMS: DEALS

- 14.2 OTHER PLAYERS

- 14.2.1 EHOSTING DATAFORT

- 14.2.2 STC CLOUD

- 14.2.3 OOREDOO

- 14.2.4 GULF BUSINESS MACHINES

- 14.2.5 INTERTEC SYSTEMS

- 14.2.6 FUJITSU

- 14.2.7 HUAWEI

- 14.2.8 CISCO

- 14.2.9 INFOSYS

- 14.2.10 TCS

- 14.2.11 COMPRO

- 14.2.12 TERACO DATA ENVIRONMENTS

- 14.2.13 LIQUID INTELLIGENT TECHNOLOGIES

- 14.2.14 COMPREHENSIVE COMPUTING INNOVATIONS

- 14.2.15 INSOMEA COMPUTER SOLUTIONS

- 14.2.16 CLOUDBOX TECH

- 14.2.17 ZONKE TECH

- 14.2.18 CLOUD4RAIN

- 14.2.19 MALOMATIA

- 14.2.20 ORIXCOM

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

15 ADJACENT MARKETS

- 15.1 INTRODUCTION

- 15.2 EDGE COMPUTING MARKET - GLOBAL FORECAST TO 2028

- TABLE 288 EDGE COMPUTING MARKET, BY COMPONENT, 2018-2022 (USD MILLION)

- TABLE 289 EDGE COMPUTING MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- TABLE 290 EDGE COMPUTING MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 291 EDGE COMPUTING MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 292 EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 293 EDGE COMPUTING MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 294 EDGE COMPUTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 295 EDGE COMPUTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 15.3 SERVERLESS ARCHITECTURE MARKET - GLOBAL FORECAST TO 2025

- TABLE 296 SERVERLESS ARCHITECTURE MARKET, BY SERVICE TYPE, 2018-2025 (USD MILLION)

- TABLE 297 SERVERLESS ARCHITECTURE MARKET, BY DEPLOYMENT MODEL, 2018-2025 (USD MILLION)

- TABLE 298 SERVERLESS ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2018-2025 (USD MILLION)

- TABLE 299 SERVERLESS ARCHITECTURE MARKET, BY VERTICAL, 2018-2025 (USD MILLION)

- TABLE 300 SERVERLESS ARCHITECTURE MARKET, BY REGION, 2018-2025 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS