|

|

市場調査レポート

商品コード

1344198

ブルーアンモニアの世界市場:技術別、最終用途別、地域別 - 予測(~2030年)Blue Ammonia Market by Technology (Steam Methane Reforming (SMR), Autothermal Reforming (ATR), Gas Partial Oxidation), End-use Application (Industrial Feedstock, Power Generation, Transportation) and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ブルーアンモニアの世界市場:技術別、最終用途別、地域別 - 予測(~2030年) |

|

出版日: 2023年09月01日

発行: MarketsandMarkets

ページ情報: 英文 175 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のブルーアンモニアの市場規模は、2023年に7,800万米ドル、2030年までに76億6,400万米ドルに達し、2024年~2030年にCAGRで62.3%の成長が予測されています。

各国政府は、ブルーアンモニア技術の使用を奨励するため、有利な規則を制定し、財政的インセンティブを提供しています。こうしたプログラムには、研究開発資金、ブルーアンモニアの生産とインフラに対する補助金、さまざまな産業でのブルーアンモニアの使用を奨励する法律などが含まれます。こうした取り組みが、ブルーアンモニア市場の拡大に寄与しています。

技術別では、水蒸気メタン改質が市場の最大のセグメントとなっています。"

水蒸気メタン改質は予測期間中に2番目に大きなセグメントになると予測され、自動熱改質が続きます。企業や地域がカーボンフットプリントの削減を目指す中、ブルーアンモニアは、より持続可能なエネルギー源に移行しながら既存の天然ガスインフラの使用を継続できるように橋渡しをするソリューションとしての役割を果たします。

用途別では、工業用原料セグメントが予測期間中に最大のセグメントになると予測されます。

工業用原料セグメントは、肥料産業からの需要の増加により、予測期間中、市場の最大セグメントになると予想されます。

アジア太平洋が市場で第2位の規模となっています。

アジア太平洋の市場シェアが2023年~2030年に市場で第2位になると予測され、欧州、北米がそれに続きます。アジア太平洋は、温室効果ガス排出削減の政府目標を達成するためのグリーン技術採用の大きな市場です。日本と韓国は、日本の燃料電池マイクロCHP製品の商品化により、2009年以来、燃料電池の採用に多額の投資を行っています。エネルギー部門への投資は過去5年間で劇的に拡大しており、これがブルーアンモニア生成市場を支援すると予測されます。中国とインドは世界でもっとも人口の多い国々であり、農業が依然として経済の主な要素となっています。

当レポートでは、世界のブルーアンモニア市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- ブルーアンモニア市場の企業にとっての魅力的な機会

- ブルーアンモニア市場:地域別

- アジア太平洋のブルーアンモニア市場:最終用途別、国別

- ブルーアンモニア市場:技術別

- ブルーアンモニア市場:最終用途別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- サプライチェーン分析

- 技術プロバイダーとEPC請負業者

- 原料のサプライヤー

- ブルー水素のサプライヤー

- ブルーアンモニアメーカー

- エンドユーザー

- 市場マッピング

- 技術分析

- 特許分析

- 関税と規制の枠組み

- 規制機関、政府機関、その他の組織

- 規制の枠組み

- 主な会議とイベント(2023年~2024年)

- 貿易分析

- 価格分析

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 購入プロセスにおける主なステークホルダー

- 購入基準

第6章 ブルーアンモニア市場:技術別

- イントロダクション

- 水蒸気メタン改質

- 自動熱改質

- ガス部分酸化

第7章 ブルーアンモニア市場:最終用途別

- イントロダクション

- 発電

- 輸送

- 工業用原料

第8章 ブルーアンモニア市場:地域別

- イントロダクション

- 北米

- 景気後退の影響:北米

- 技術別

- 最終用途別

- 国別

- 欧州

- 景気後退の影響:欧州

- 技術別

- 最終用途別

- 国別

- アジア太平洋

- 景気後退の影響:アジア太平洋

- 技術別

- 最終用途別

- 国別

- その他の地域

- 景気後退の影響:その他の地域

- 技術別

- 最終用途別

- 国別

第9章 競合情勢

- 概要

- 主要企業の産業集中(2022年)

- 企業の評価の枠組み

- 上位5社のセグメント収益分析

- 主要企業の評価マトリクス(2022年)

- スタートアップ/中小企業の評価マトリクス(2022年)

- 最近の発展

第10章 企業プロファイル

- ブルーアンモニアメーカー

- YARA INTERNATIONAL ASA

- SAUDI ARABIAN OIL CO.

- OCI

- CF INDUSTRIES HOLDINGS, INC.

- MA'ADEN

- QATAR FERTILISER COMPANY (QAFCO)

- SHELL PLC

- EXXONMOBIL CORPORATION

- LINDE PLC

- NUTRIEN LTD.

- UNIPER SE

- ADNOC GROUP

- LSB INDUSTRIES

- その他のブルーアンモニアメーカー

- EUROCHEM GROUP

- ITOCHU CORPORATION

- TECNICAS REUNIDAS S.A.

- PAO NOVATEK

- 技術プロバイダー

- KBR INC.

- TOPSOE

- THYSSENKRUPP UHDE GMBH

- EPC企業

- TECHNIP ENERGIES N.V.

- MAIRETECNIMONT S.P.A.

- SAIPEM

第11章 付録

The global Blue ammonia market is estimated to grow from USD 78 million in 2023 to USD 7,664 million by 2030; it is expected to record a CAGR of 62.3% from 2024 to 2030. Governments are passing favourable rules and providing financial incentives to encourage the use of blue ammonia technologies. These programmes include research and development funding, subsidies for blue ammonia production and infrastructure, and legislation encouraging the use of blue ammonia in various industries. These types of initiatives have contributed to the expansion of the blue ammonia market.

"Steam Methane Reforming: The largest segment of the blue ammonia market, by technology "

Based on sector, the blue ammonia market has been split into three segments: steam methane reforming, autothermal reforming and gas partial oxidation. Steam methane reforming is expected to be the second largest segment during the forecast period followed by autothermal reforming. As companies and regions seek to reduce their carbon footprints, blue ammonia serves as a bridge solution, allowing them to continue using existing natural gas infrastructure while shifting to a more sustainable energy source.

"By application, the industrial feestock segment is expected to be the largest segment during the forecast period."

Based on application, the blue ammonia market is segmented into transportation, power generation and industrial feedstock. The industrial feedstock segment is expected to be the largest segment the blue ammonia market during the forecast period owing to the rise in demand from the fertilizer industry. Furthermore, the burgeoning blue ammonia economy in the chemical industry is supported by policymaker initiatives at the European and national levels, with an estimated investment of € 430 billion necessary by 2030. Methanol output in North America is likely to increase significantly. Companies in North America are forging strategic alliances to boost methane and ammonia production. For example, CF Industries Holdings, Inc. purchased an ammonia production facility in Waggaman from Incitec Pivot Limited.

"Asia Pacific": The second-largest in the blue ammonia market"

Asia Pacific is expected to have the second-largest market share in the blue ammonia market between 2023-2030, followed by Europe and North America. Asia Pacific is a significant market for green technology adoption to meet government targets for cutting GHG emissions. Japan and South Korea have been heavily investing in fuel cell adoption since 2009, owing to the commercialization of Japanese fuel cell micro-CHP products. Investment in the energy sector has expanded dramatically over the previous five years, which is expected to assist the blue ammonia generation market. China and India are the world's most populous countries, and agriculture remains a key element of their economies..

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 60%, Tier 2- 25%, and Tier 3- 15%

By Designation: C-Level- 35%, Director Levels- 25%, and Others- 40%

By Region: North America- 25%, Europe- 25%, Asia-Pacific - 30 %, Rest of the World - 20%.

Note: Others include sales managers, engineers, and regional managers.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2022. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The blue ammonia market is dominated by a few major players that have a wide regional presence. The leading players in the blue ammonia market are Linde plc (Ireland), Air products and Chemicals, Inc. (US), Air Liquide (France), Worthington Industries (US), Cryolor (France), Hexagon Purus (Norway), and NPROXX (Netherlands). The major strategy adopted by the players includes new product launches, contracts & agreements and, investments & expansions.

Research Coverage:

The report defines, describes, and forecasts the global blue ammonia market by sector, application, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the blue ammonia market.

Key Benefits of Buying the Report

- The key element driving the blue ammonia market is increased regulations addressing greenhouse gas emissions. Furthermore, governments are expanding their efforts to establish blue ammonia as maritime fuel, as well as their focus on achieving net zero emissions targets by 2050 in the blue ammonia market. Despite the fact that the high production cost of blue ammonia is the biggest difficulty confronting countries in the blue ammonia market.

- Product Development/ Innovation: The growing demand for blue ammonia from industries is driving substantial product development and innovation in the blue ammonia market. Companies are investing in the development of modern blue ammonia production technology that is tailored to the specific needs of industry.

- Market Development: Linde plc has agreed to supply green blue ammonia to Evonik, a well-known specialty chemicals company, on a long-term basis. Under this agreement, Linde will construct, own, and manage a nine-megawatt alkaline electrolyzer facility on Singapore's Jurong Island. This plant's major output will be green blue ammonia, which Evonik wants to employ in the synthesis of methionine, an essential element in animal feed.

- Market Diversification: Edmonton International Airport has selected Air Products & Chemicals, Inc. as the blue ammonia and technology provider for Alberta's first blue ammonia fuel cell passenger car fleet. Air Products will station a mobile blue ammonia refueler at the airport to supply blue ammonia to the Toyota Mirai fleet of blue ammonia fuel cell vehicles.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like include Yara International ASA (Norway), Saudi Arabian Oil Co. (Saudi Arabia), OCI (UK), Ma'aden (Saudi Arabia), and CF Industries Holdings, Inc. (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKET SEGMENTATION

- 1.4.2 REGIONAL SCOPE

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

- 1.9 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 BLUE AMMONIA MARKET: RESEARCH DESIGN

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 4 BLUE AMMONIA MARKET: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 BLUE AMMONIA MARKET: TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- FIGURE 6 METRICS CONSIDERED TO ANALYZE DEMAND FOR BLUE AMMONIA

- 2.3.3.1 Demand-side assumptions and limitations

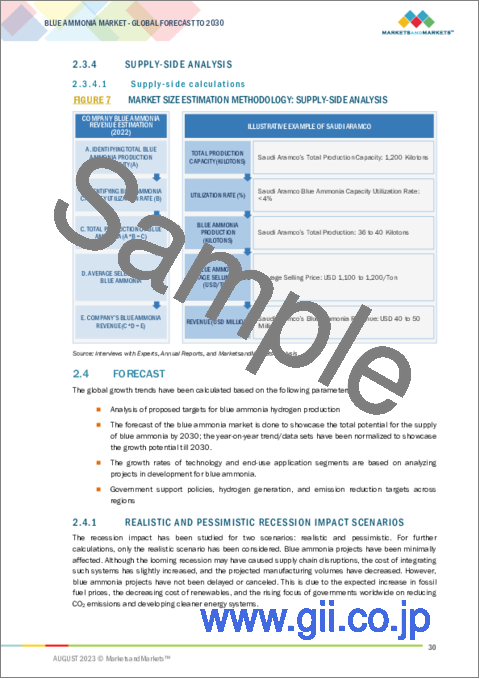

- 2.3.4 SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Supply-side calculations

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- 2.4 FORECAST

- 2.4.1 REALISTIC AND PESSIMISTIC RECESSION IMPACT SCENARIOS

3 EXECUTIVE SUMMARY

- TABLE 1 BLUE AMMONIA MARKET SNAPSHOT

- FIGURE 8 ASIA PACIFIC TO HOLD LARGEST SHARE OF BLUE AMMONIA MARKET IN 2024

- FIGURE 9 STEAM METHANE REFORMING SEGMENT TO ACCOUNT FOR LARGEST SHARE OF BLUE AMMONIA MARKET, BY TECHNOLOGY, IN 2030

- FIGURE 10 INDUSTRIAL FEEDSTOCK SEGMENT TO CAPTURE LARGEST SHARE OF BLUE AMMONIA MARKET, BY END-USE APPLICATION, IN 2030

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BLUE AMMONIA MARKET

- FIGURE 11 GROWING FOCUS ON REDUCING GREENHOUSE GAS EMISSIONS TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- 4.2 BLUE AMMONIA MARKET, BY REGION

- FIGURE 12 BLUE AMMONIA MARKET IN NORTH AMERICA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 BLUE AMMONIA MARKET IN ASIA PACIFIC, BY END-USE APPLICATION AND COUNTRY

- FIGURE 13 INDUSTRIAL FEEDSTOCK AND CHINA TO DOMINATE ASIA PACIFIC BLUE AMMONIA MARKET IN 2024

- 4.4 BLUE AMMONIA MARKET, BY TECHNOLOGY

- FIGURE 14 AUTOTHERMAL REFORMING TECHNOLOGY TO HOLD LARGEST SHARE OF BLUE AMMONIA MARKET IN 2030

- 4.5 BLUE AMMONIA MARKET, BY END-USE APPLICATION

- FIGURE 15 INDUSTRIAL FEEDSTOCK SEGMENT TO ACCOUNT FOR LARGEST SHARE OF BLUE AMMONIA MARKET IN 2030

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 BLUE AMMONIA MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing focus on reducing greenhouse gas emissions

- 5.2.1.2 Increasing efforts toward empowering hydrogen economy

- 5.2.1.3 Rising demand for eco-friendly fertilizers

- 5.2.1.4 Increasing government investments in commercialization of emission control technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost associated with infrastructure set up for blue ammonia production

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Potential of blue ammonia as maritime fuel

- 5.2.3.2 Growing demand for blue ammonia to generate power

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited awareness about blue ammonia within specific industries

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PROVIDERS OF BLUE AMMONIA

- FIGURE 17 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN BLUE AMMONIA MARKET

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 18 BLUE AMMONIA SUPPLY CHAIN ANALYSIS

- 5.4.1 TECHNOLOGY PROVIDERS AND EPC CONTRACTORS

- 5.4.2 FEEDSTOCK SUPPLIERS

- 5.4.3 BLUE HYDROGEN SUPPLIERS

- 5.4.4 BLUE AMMONIA PRODUCERS

- 5.4.5 END USERS

- TABLE 2 ROLE OF KEY COMPANIES IN BLUE AMMONIA ECOSYSTEM

- 5.5 MARKET MAPPING

- FIGURE 19 BLUE AMMONIA MARKET MAPPING

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 RECENT ADVANCEMENTS IN BLUE AMMONIA PRODUCTION PROCESS

- 5.7 PATENT ANALYSIS

- 5.7.1 LIST OF MAJOR PATENTS

- TABLE 3 BLUE AMMONIA: INNOVATIONS AND PATENT REGISTRATIONS, JULY 2020-MARCH 2023

- 5.8 TARIFF AND REGULATORY FRAMEWORK

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.2 REGULATORY FRAMEWORK

- TABLE 7 BLUE AMMONIA MARKET: REGULATORY FRAMEWORK

- 5.9 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 8 LIST OF KEY CONFERENCES AND EVENTS IN BLUE AMMONIA MARKET, 2023-2024

- 5.10 TRADE ANALYSIS

- 5.10.1 HS CODE 2814

- 5.10.1.1 Export scenario

- TABLE 9 EXPORT SCENARIO FOR HS CODE 2814, BY COUNTRY, 2020-2022 (USD)

- FIGURE 20 HS CODE 2814: EXPORT DATA FOR TOP 5 COUNTRIES, 2020-2022 (USD)

- 5.10.1.2 Import scenario

- TABLE 10 IMPORT SCENARIO FOR HS CODE 2814, BY COUNTRY, 2020-2022 (USD)

- FIGURE 21 HS CODE 2814: IMPORT DATA FOR TOP 5 COUNTRIES, 2020-2022 (USD)

- 5.10.2 HS CODE 280410

- 5.10.2.1 Export scenario

- TABLE 11 EXPORT SCENARIO FOR HS CODE 280410, BY COUNTRY, 2020-2022 (USD)

- FIGURE 22 HS CODE 280410: EXPORT DATA FOR TOP 5 COUNTRIES, 2020-2022 (USD)

- 5.10.2.2 Import scenario

- TABLE 12 IMPORT SCENARIO FOR HS CODE 280410, BY COUNTRY, 2020-2022 (USD)

- FIGURE 23 HS CODE 280410: IMPORT DATA FOR TOP 5 COUNTRIES, 2020-2022 (USD)

- 5.10.1 HS CODE 2814

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE LEVELIZED COST, BY REGION

- TABLE 13 BLUE AMMONIA AVERAGE PRICE PER TON, BY REGION

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 QATARENERGY PLANS TO BUILD BLUE AMMONIA PRODUCTION FACILITY TO PROMOTE USE OF CLEAN FUEL AND REDUCE GHG EMISSIONS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 PORTER'S FIVE FORCES ANALYSIS FOR BLUE AMMONIA MARKET

- TABLE 14 BLUE AMMONIA MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF SUBSTITUTES

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF NEW ENTRANTS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE APPLICATIONS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE APPLICATIONS (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 26 KEY BUYING CRITERIA FOR TOP 3 END-USE APPLICATIONS

- TABLE 16 KEY BUYING CRITERIA FOR TOP 3 END-USE APPLICATIONS

6 BLUE AMMONIA MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- FIGURE 27 BLUE AMMONIA MARKET, BY TECHNOLOGY, 2024

- TABLE 17 BLUE AMMONIA MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- 6.2 STEAM METHANE REFORMING

- 6.2.1 ACCELERATING USE OF SMR TECHNOLOGY IN CHEMICAL AND INDUSTRIAL PLANTS TO DRIVE MARKET

- 6.3 AUTOTHERMAL REFORMING

- 6.3.1 RISING ADOPTION OF ATR TECHNOLOGY IN BLUE AMMONIA PLANTS TO CREATE OPPORTUNITIES FOR MARKET PLAYERS

- 6.4 GAS PARTIAL OXIDATION

- 6.4.1 INCREASING DEMAND FOR GAS PARTIAL OXIDATION TECHNOLOGY IN ENERGY SECTOR TO FUEL MARKET GROWTH

7 BLUE AMMONIA MARKET, BY END-USE APPLICATION

- 7.1 INTRODUCTION

- FIGURE 28 BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2024

- TABLE 18 BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

- TABLE 19 BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (KILOTONS)

- 7.2 POWER GENERATION

- 7.2.1 SIGNIFICANT DEMAND FROM COUNTRIES LACKING RENEWABLE ENERGY INFRASTRUCTURE TO DRIVE SEGMENTAL GROWTH

- TABLE 20 POWER GENERATION: BLUE AMMONIA MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 21 POWER GENERATION: BLUE AMMONIA MARKET, BY REGION, 2022-2030 (KILOTONS)

- 7.3 TRANSPORTATION

- 7.3.1 POTENTIAL OF BLUE AMMONIA AS FUEL IN MARINE SHIPPING AND RAIL TRANSPORTATION TO CREATE SIGNIFICANT GROWTH OPPORTUNITIES

- TABLE 22 TRANSPORTATION: BLUE AMMONIA MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 23 TRANSPORTATION: BLUE AMMONIA MARKET, BY REGION, 2022-2030 (KILOTONS)

- 7.4 INDUSTRIAL FEEDSTOCK

- 7.4.1 CUSTOMER WILLINGNESS TO PAY FOR GREENER ALTERNATIVES TO BOOST DEMAND FOR BLUE AMMONIA IN INDUSTRIAL SECTOR

- TABLE 24 INDUSTRIAL FEEDSTOCK: BLUE AMMONIA MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 25 INDUSTRIAL FEEDSTOCK: BLUE AMMONIA MARKET, BY REGION, 2022-2030 (KILOTONS)

8 BLUE AMMONIA MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 29 NORTH AMERICA TO RECORD HIGHEST CAGR IN BLUE AMMONIA MARKET DURING FORECAST PERIOD

- FIGURE 30 BLUE AMMONIA MARKET SHARE, IN TERMS OF VALUE, BY REGION, 2024

- TABLE 26 BLUE AMMONIA MARKET, BY REGION, 2022-2030 (KILOTONS)

- TABLE 27 BLUE AMMONIA MARKET, BY REGION, 2022-2030 (USD MILLION)

- 8.2 NORTH AMERICA

- FIGURE 31 NORTH AMERICA: BLUE AMMONIA MARKET SNAPSHOT

- 8.2.1 RECESSION IMPACT: NORTH AMERICA

- 8.2.2 BY TECHNOLOGY

- TABLE 28 NORTH AMERICA: BLUE AMMONIA MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- 8.2.3 BY END-USE APPLICATION

- TABLE 29 NORTH AMERICA: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

- TABLE 30 NORTH AMERICA: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (KILOTONS)

- 8.2.4 BY COUNTRY

- TABLE 31 NORTH AMERICA: BLUE AMMONIA MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 32 NORTH AMERICA: BLUE AMMONIA MARKET, BY COUNTRY, 2022-2030 (KILOTONS)

- 8.2.4.1 US

- 8.2.4.1.1 Abundance of low-cost natural gas to drive market

- 8.2.4.1.2 Key blue ammonia projects in US

- 8.2.4.1 US

- TABLE 33 US: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

- 8.2.4.2 Canada

- 8.2.4.2.1 Increasing investments in liquified natural gas infrastructure to create opportunities for blue ammonia producers

- 8.2.4.2.2 Key blue ammonia projects in Canada

- 8.2.4.2 Canada

- TABLE 34 CANADA: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

- 8.3 EUROPE

- 8.3.1 RECESSION IMPACT: EUROPE

- 8.3.2 BY TECHNOLOGY

- TABLE 35 EUROPE: BLUE AMMONIA MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- 8.3.3 BY END-USE APPLICATION

- TABLE 36 EUROPE: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

- TABLE 37 EUROPE: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (KILOTONS)

- 8.3.4 BY COUNTRY

- TABLE 38 EUROPE: BLUE AMMONIA MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 39 EUROPE: BLUE AMMONIA MARKET, BY COUNTRY, 2022-2030 (KILOTONS)

- 8.3.4.1 UK

- 8.3.4.1.1 Stringent environmental regulations and commitment to reduce GHG emissions to drive market

- 8.3.4.1 UK

- TABLE 40 UK: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

- 8.3.4.2 France

- 8.3.4.2.1 Rising focus on reducing nuclear energy contribution in electricity mix to fuel market

- 8.3.4.2 France

- TABLE 41 FRANCE: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

- 8.3.4.3 Netherlands

- 8.3.4.3.1 Increasing adoption of low-carbon fuels to boost demand for blue ammonia

- 8.3.4.3 Netherlands

- TABLE 42 NETHERLANDS: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

- 8.3.4.4 Norway

- 8.3.4.4.1 Significant efforts of government and industrial players to decarbonize economy to foster demand for blue ammonia

- 8.3.4.4 Norway

- TABLE 43 NORWAY: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

- 8.3.4.5 Rest of Europe

- TABLE 44 REST OF EUROPE: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

- 8.4 ASIA PACIFIC

- FIGURE 32 ASIA PACIFIC: BLUE AMMONIA MARKET SNAPSHOT

- 8.4.1 RECESSION IMPACT: ASIA PACIFIC

- 8.4.2 BY TECHNOLOGY

- TABLE 45 ASIA PACIFIC: BLUE AMMONIA MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- 8.4.3 BY END-USE APPLICATION

- TABLE 46 ASIA PACIFIC: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

- TABLE 47 ASIA PACIFIC: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (KILOTONS)

- 8.4.4 BY COUNTRY

- TABLE 48 ASIA PACIFIC: BLUE AMMONIA MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 49 ASIA PACIFIC: BLUE AMMONIA MARKET, BY COUNTRY, 2022-2030 (KILOTONS)

- 8.4.4.1 Japan

- 8.4.4.1.1 Rising demand for blue ammonia in power generation to drive market

- 8.4.4.1 Japan

- TABLE 50 JAPAN: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

- 8.4.4.2 South Korea

- 8.4.4.2.1 Enforcement of stringent policies to decarbonize energy sector to boost demand for blue ammonia

- 8.4.4.2 South Korea

- TABLE 51 SOUTH KOREA: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

- 8.4.4.3 China

- 8.4.4.3.1 Increasing investments in R&D of blue ammonia technology to fuel market

- 8.4.4.3 China

- TABLE 52 CHINA: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

- 8.4.4.4 Australia

- 8.4.4.4.1 Net-zero emission target set by country to encourage adoption of blue ammonia in industrial and energy sectors

- 8.4.4.4 Australia

- TABLE 53 AUSTRALIA: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

- 8.4.4.5 Rest of Asia Pacific

- TABLE 54 REST OF ASIA PACIFIC: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

- 8.5 REST OF THE WORLD (ROW)

- 8.5.1 RECESSION IMPACT: ROW

- 8.5.2 BY TECHNOLOGY

- TABLE 55 ROW: BLUE AMMONIA MARKET, BY TECHNOLOGY, 2022-2030 (USD MILLION)

- 8.5.3 BY END-USE APPLICATION

- TABLE 56 ROW: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

- TABLE 57 ROW: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (KILOTONS)

- 8.5.4 BY COUNTRY

- TABLE 58 ROW: BLUE AMMONIA MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 59 ROW: BLUE AMMONIA MARKET, BY COUNTRY, 2022-2030 (KILOTONS)

- 8.5.4.1 Saudi Arabia

- 8.5.4.1.1 Presence of top companies, such as Saudi Aramco and Ma'aden, to drive market

- 8.5.4.1 Saudi Arabia

- TABLE 60 SAUDI ARABIA: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

- 8.5.4.2 UAE

- 8.5.4.2.1 Increasing use of hydrogen to generate electricity to fuel market growth

- 8.5.4.2 UAE

- TABLE 61 UAE: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

- 8.5.4.3 Other countries

- TABLE 62 OTHER COUNTRIES: BLUE AMMONIA MARKET, BY END-USE APPLICATION, 2022-2030 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- FIGURE 33 KEY DEVELOPMENTS IN BLUE AMMONIA MARKET, 2019-2023

- 9.2 INDUSTRY CONCENTRATION OF KEY PLAYERS, 2022

- FIGURE 34 KEY PLAYERS IN BLUE AMMONIA MARKET, 2022

- 9.3 COMPANY EVALUATION FRAMEWORK

- TABLE 63 COMPANY EVALUATION FRAMEWORK, 2019-2023

- 9.4 SEGMENTAL REVENUE ANALYSIS OF TOP 5 COMPANIES

- FIGURE 35 SEGMENTAL REVENUE ANALYSIS, 2018-2022

- 9.5 EVALUATION MATRIX FOR KEY COMPANIES, 2022

- 9.5.1 STARS

- 9.5.2 EMERGING LEADERS

- 9.5.3 PERVASIVE PLAYERS

- 9.5.4 PARTICIPANTS

- FIGURE 36 BLUE AMMONIA MARKET: EVALUATION MATRIX FOR KEY COMPANIES, 2022

- 9.5.5 COMPANY FOOTPRINT

- TABLE 64 TECHNOLOGY: COMPANY FOOTPRINT

- TABLE 65 END-USE APPLICATION: COMPANY FOOTPRINT

- TABLE 66 REGION: COMPANY FOOTPRINT

- 9.6 EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- 9.6.1 PROGRESSIVE COMPANIES

- 9.6.2 RESPONSIVE COMPANIES

- 9.6.3 DYNAMIC COMPANIES

- 9.6.4 STARTING BLOCKS

- FIGURE 37 BLUE AMMONIA MARKET: EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- 9.6.5 COMPETITIVE BENCHMARKING

- TABLE 67 BLUE AMMONIA MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 68 TECHNOLOGY: STARTUPS/SMES FOOTPRINT

- TABLE 69 END-USE APPLICATION: STARTUPS/SMES FOOTPRINT

- TABLE 70 REGION: STARTUPS/SMES FOOTPRINT

- 9.7 RECENT DEVELOPMENTS

- 9.7.1 DEALS

- TABLE 71 BLUE AMMONIA MARKET: DEALS, 2019-2023

- 9.7.2 OTHERS

- TABLE 72 BLUE AMMONIA MARKET: OTHERS, 2019-2023

10 COMPANY PROFILES

- 10.1 BLUE AMMONIA PRODUCERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 10.1.1 YARA INTERNATIONAL ASA

- TABLE 73 YARA INTERNATIONAL ASA: COMPANY OVERVIEW

- FIGURE 38 YARA INTERNATIONAL ASA: COMPANY SNAPSHOT

- TABLE 74 YARA INTERNATIONAL ASA: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 75 YARA INTERNATIONAL ASA: DEALS

- 10.1.2 SAUDI ARABIAN OIL CO.

- TABLE 76 SAUDI ARABIAN OIL CO.: COMPANY OVERVIEW

- FIGURE 39 SAUDI ARABIAN OIL CO.: COMPANY SNAPSHOT

- TABLE 77 SAUDI ARABIAN OIL CO.: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 78 SAUDI ARABIAN OIL CO.: DEALS

- 10.1.3 OCI

- TABLE 79 OCI: BUSINESS OVERVIEW

- FIGURE 40 OCI: COMPANY SNAPSHOT

- TABLE 80 OCI: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 81 OCI: DEALS

- TABLE 82 OCI: OTHERS

- 10.1.4 CF INDUSTRIES HOLDINGS, INC.

- TABLE 83 CF INDUSTRIES HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 84 CF INDUSTRIES HOLDINGS, INC.: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 85 CF INDUSTRIES HOLDINGS, INC.: DEALS

- 10.1.5 MA'ADEN

- TABLE 86 MA'ADEN: COMPANY OVERVIEW

- FIGURE 42 MA'ADEN: COMPANY SNAPSHOT

- TABLE 87 MA'ADEN: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 88 MA'ADEN: DEALS

- 10.1.6 QATAR FERTILISER COMPANY (QAFCO)

- TABLE 89 QATAR FERTILISER COMPANY (QAFCO): COMPANY OVERVIEW

- FIGURE 43 QATAR FERTILISER COMPANY (QAFCO): COMPANY SNAPSHOT

- TABLE 90 QATAR FERTILISER COMPANY (QAFCO): PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 91 QATAR FERTILISER COMPANY (QAFCO): DEALS

- 10.1.7 SHELL PLC

- TABLE 92 SHELL PLC: COMPANY OVERVIEW

- FIGURE 44 SHELL PLC: COMPANY SNAPSHOT

- TABLE 93 SHELL PLC: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 94 SHELL PLC: DEALS

- 10.1.8 EXXONMOBIL CORPORATION

- TABLE 95 EXXONMOBIL CORPORATION: COMPANY OVERVIEW

- FIGURE 45 EXXONMOBIL CORPORATION: COMPANY SNAPSHOT

- TABLE 96 EXXONMOBIL CORPORATION: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 97 EXXONMOBIL CORPORATION: OTHERS

- 10.1.9 LINDE PLC

- TABLE 98 LINDE PLC: COMPANY OVERVIEW

- FIGURE 46 LINDE PLC: COMPANY SNAPSHOT

- TABLE 99 LINDE PLC: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 100 LINDE PLC: OTHERS

- 10.1.10 NUTRIEN LTD.

- TABLE 101 NUTRIEN LTD.: COMPANY OVERVIEW

- FIGURE 47 NUTRIEN LTD.: COMPANY SNAPSHOT

- TABLE 102 NUTRIEN LTD.: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 103 NUTRIEN LTD.: DEALS

- 10.1.11 UNIPER SE

- TABLE 104 UNIPER SE: COMPANY OVERVIEW

- FIGURE 48 UNIPER SE: COMPANY SNAPSHOT

- TABLE 105 UNIPER SE: PRODUCT/SERVICE/SOLUTION OFFERINGS

- TABLE 106 UNIPER SE: DEALS

- 10.1.12 ADNOC GROUP

- TABLE 107 ADNOC GROUP: COMPANY OVERVIEW

- FIGURE 49 ADNOC GROUP: COMPANY SNAPSHOT

- TABLE 108 ADNOC GROUP: PRODUCT/SERVICE/SOLUTION OFFERINGS

- 10.1.13 LSB INDUSTRIES

- TABLE 109 LSB INDUSTRIES: COMPANY OVERVIEW

- FIGURE 50 LSB INDUSTRIES: COMPANY SNAPSHOT

- TABLE 110 LSB INDUSTRIES: PRODUCT/SERVICE/SOLUTION OFFERINGS

- 10.2 OTHER BLUE AMMONIA PRODUCERS

- 10.2.1 EUROCHEM GROUP

- 10.2.2 ITOCHU CORPORATION

- 10.2.3 TECNICAS REUNIDAS S.A.

- 10.2.4 PAO NOVATEK

- 10.3 TECHNOLOGY PROVIDERS

- 10.3.1 KBR INC.

- TABLE 111 KBR INC.: COMPANY OVERVIEW

- FIGURE 51 KBR INC.: COMPANY SNAPSHOT

- TABLE 112 KBR INC.: PRODUCT/SERVICE/SOLUTION OFFERINGS

- 10.3.2 TOPSOE

- TABLE 113 TOPSOE: COMPANY OVERVIEW

- TABLE 114 TOPSOE: PRODUCT/SERVICE/SOLUTION OFFERINGS

- 10.3.3 THYSSENKRUPP UHDE GMBH

- 10.4 EPC COMPANIES

- 10.4.1 TECHNIP ENERGIES N.V.

- TABLE 115 TECHNIP ENERGIES N.V.: COMPANY OVERVIEW

- FIGURE 52 TECHNIP ENERGIES N.V.: COMPANY SNAPSHOT

- TABLE 116 TECHNIP ENERGIES N.V.: PRODUCT/SERVICE/SOLUTION OFFERINGS

- 10.4.2 MAIRETECNIMONT S.P.A.

- TABLE 117 MAIRETECNIMONT S.P.A.: COMPANY OVERVIEW

- FIGURE 53 MAIRETECNIMONT S.P.A.: COMPANY SNAPSHOT

- TABLE 118 MAIRETECNIMONT S.P.A.: PRODUCT/SERVICE/SOLUTION OFFERINGS

- 10.4.3 SAIPEM

- TABLE 119 SAIPEM: COMPANY OVERVIEW

- FIGURE 54 SAIPEM: COMPANY SNAPSHOT

- TABLE 120 SAIPEM: PRODUCT/SERVICE/SOLUTION OFFERINGS

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 INSIGHTS FROM INDUSTRY EXPERTS

- 11.2 DISCUSSION GUIDE

- 11.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.4 CUSTOMIZATION OPTIONS

- 11.5 RELATED REPORTS

- 11.6 AUTHOR DETAILS