|

|

市場調査レポート

商品コード

1572693

アンモニアの世界市場:タイプ (無水・水)・販売チャネル (直接・間接)・最終用途産業 (農業・テキスタイル・冷凍・鉱業・製薬)・地域別 - 予測(~2029年)Ammonia Market by Type (Anhydrous, Aqueous), Sales Channel (Direct and Indirect), End-use Industry (Agriculture, Textile, Refrigeration, Mining, and Pharmaceutical), and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| アンモニアの世界市場:タイプ (無水・水)・販売チャネル (直接・間接)・最終用途産業 (農業・テキスタイル・冷凍・鉱業・製薬)・地域別 - 予測(~2029年) |

|

出版日: 2024年10月16日

発行: MarketsandMarkets

ページ情報: 英文 232 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アンモニアの市場規模は、2024年の794億7,000万米ドルから、予測期間中はCAGR 3.0%で推移し、2029年には919億5,000万米ドルの規模に成長すると予測されています。

世界人口の継続的な増加に伴い、食糧生産の需要が増加しており、農業部門は窒素ベースの肥料への依存度を高めており、アンモニアは不可欠な要素となっています。アンモニアは尿素などの肥料の生産において重要な役割を果たしており、作物収量の増加と土壌肥沃度の維持に貢献しています。インドや中国などの大規模な農業部門を持つ国々は、拡大する人口のために食糧を確保するため、アンモニア系肥料の使用を増やしています。農業部門からのコンスタントな需要は、アンモニア市場の継続的成長において重要な役割を果たしています。クリーンエネルギーへの移行におけるアンモニアの可能性も市場成長の重要な促進要因です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 対象ユニット | 金額 (米ドル) および数量 (キロトン) |

| セグメント | タイプ・販売チャネル・用途・地域 |

| 対象地域 | 北米・アジア太平洋・欧州・中東&アフリカ・南米 |

”タイプ別では、無水アンモニアの部門が最大の規模を示す見通し"

持続可能性はますます最重要視されており、無水アンモニアの効率的な使用方法が消費者への魅力を高めています。効果的に使用すれば、窒素の損失を減らし、他のタイプの窒素肥料と比較して環境への影響を減らすことができます。これは、特に農業排出に関する規制が厳しい地域では、長期的な環境の持続可能性を高めます。無水アンモニアは、その高い効率性、費用対効果、工業的汎用性で知られ、市場最大の規模を維持する予想されています。

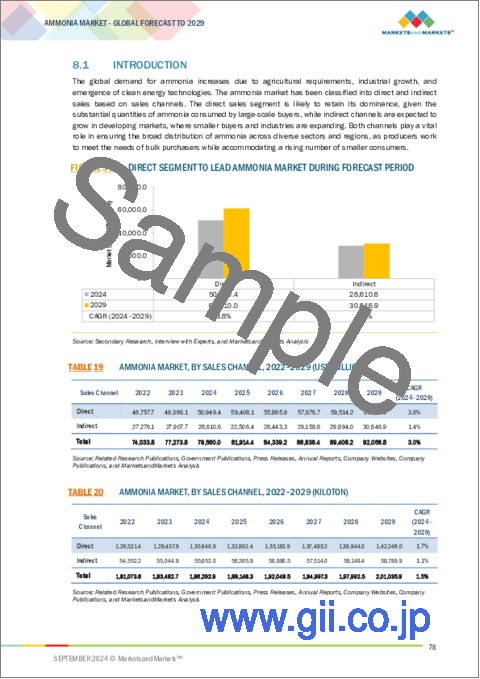

"販売チャネル別では、直接販売の部門が最大の規模を示す見通し"

直接販売により、メーカーはエンドユーザーとの結びつきを強め、一定の供給と特定の要件に合わせたカスタマイズ製品を提供することができます。このアプローチはさらに、中間業者を減らし、経費を削減し、サプライヤーとバイヤーの双方にとって効率を高めます。バルクアンモニアに対する需要の増加は、特に農業と化学セクターにおいて顕著であるため、直販は信頼性が高く経済的なチャネルであり、同市場における主要な販売チャネルとなっています。

"地域別では、中東・アフリカ地域が市場シェア第3位に位置付ける"

サウジアラビア、UAE、カタールなどの中東諸国は、石油への依存度を下げるために化学産業に投資しています。SABIC (Saudi Basic Industries Corporation) とQAFCO (Qatar Fertiliser Company) は、中東・アフリカ全域の化学・肥料生産に影響を与える主要企業です。世界の石油化学業界をリードするSABICは、アンモニアの重要な生産者であり、サウジアラビアのVision 2030において重要な役割を果たしています。SABICのアンモニアは肥料の生産において重要な役割を果たしています。同社はアンモニア生産能力の増強と大規模なアンモニアプラントの設立に力を入れており、国内ニーズと輸出機会の両方に対応することで、中東・アフリカ地域のアンモニア市場全体を拡大しています。

当レポートでは、世界のアンモニアの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界の動向

- 顧客の事業に影響を与える動向とディスラプション

- 価格分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- バリューチェーン分析

- エコシステム分析

- 貿易分析

- 技術分析

- 生成AIがアンモニア市場に与える影響

- 規制状況

- ケーススタディ分析

- 特許分析

- 主な会議とイベント

- マクロ経済分析

- 投資と資金調達のシナリオ

第7章 アンモニア市場:タイプ別

- 無水

- 水性

第8章 アンモニア市場:販売チャネル別

- 直接

- 間接

第9章 アンモニア市場:最終用途産業別

- 農業

- テキスタイル

- 冷凍

- 鉱業

- 医薬品

- その他

第10章 アンモニア市場:地域別

- アジア太平洋

- 欧州

- 北米

- 中東・アフリカ

- 南米

第11章 競合情勢

- 概要

- 主要企業の戦略/有力企業

- 市場シェア分析

- 収益分析

- 企業評価と財務指標

- 企業価値評価

- 財務マトリックス

- ブランド/製品比較

- 企業評価マトリックス:主要企業

- 企業フットプリント:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- CF INDUSTRIES HOLDINGS, INC.

- YARA INTERNATIONAL ASA

- SAUDI BASIC INDUSTRIES CORPORATION

- OCI GLOBAL

- BASF SE

- NUTRIEN

- QATAR FERTILISER COMPANY

- KOCH FERTILIZER, LLC

- EUROCHEM GROUP

- CSBP LIMITED

- その他の企業

- GROUP DF

- GUJARAT STATE FERTILIZERS & CHEMICALS LIMITED

- JSC TOGLIATTIAZOT

- PT PUPUK SRIWIDJAJA PALEMBANG

- GULF COAST AMMONIA LLC

- DEEPAK FERTILISERS AND PETROCHEMICALS CORPORATION LIMITED

- JAYSONS CHEMICAL INDUSTRIES

- MYSORE AMMONIA PVT. LTD.

- STEELMAN GASES PVT. LTD.

- SUMITOMO CHEMICAL CO., LTD.

- SURAT AMMONIA AND CHEMICAL COMPANY

- J.R. SIMPLOT COMPANY

- ANMOL CHEMICALS PRIVATE LIMITED

- UBE CORPORATION

- GRUPA AZOTY S.A.

第13章 隣接市場と関連市場

第14章 付録

List of Tables

- TABLE 1 GLOBAL MARKET SIZE OF GROCERY RETAIL - TOP 10 COUNTRIES

- TABLE 2 INDICATIVE PRICING TREND OF TYPE, BY KEY PLAYER, 2023 (USD/KILOGRAM)

- TABLE 3 AVERAGE SELLING PRICE TREND, BY REGION, 2023-2029 (USD/KILOGRAM)

- TABLE 4 AMMONIA MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO VERTICALS

- TABLE 6 KEY BUYING CRITERIA FOR TOP TWO END-USE INDUSTRIES

- TABLE 7 AMMONIA MARKET: ROLE IN ECOSYSTEM

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 GREEN AMMONIA IMPACT ASSESSMENT CASE STUDY

- TABLE 13 AMMONIA WASTEWATER TREATMENT

- TABLE 14 LIST OF PATENTS FOR AMMONIA

- TABLE 15 DETAILED LIST OF CONFERENCES & EVENTS, 2024-2025

- TABLE 16 GLOBAL GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- TABLE 17 AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 18 AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 19 AMMONIA MARKET, BY SALES CHANNEL, 2022-2029 (USD MILLION)

- TABLE 20 AMMONIA MARKET, BY SALES CHANNEL, 2022-2029 (KILOTON)

- TABLE 21 AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 22 AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 23 AMMONIA MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 24 AMMONIA MARKET, BY REGION, 2022-2029 (KILOTON)

- TABLE 25 ASIA PACIFIC: AMMONIA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 26 ASIA PACIFIC: AMMONIA MARKET, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 27 ASIA PACIFIC: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 28 ASIA PACIFIC: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 29 ASIA PACIFIC: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 30 ASIA PACIFIC: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 31 CHINA: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 32 CHINA: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 33 CHINA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 34 CHINA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 35 INDIA: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 36 INDIA: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 37 INDIA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 38 INDIA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 39 JAPAN: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 40 JAPAN: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 41 JAPAN: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 42 JAPAN: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 43 INDONESIA: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 44 INDONESIA: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 45 INDONESIA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 46 INDONESIA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 47 REST OF ASIA PACIFIC: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 48 REST OF ASIA PACIFIC: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 49 REST OF ASIA PACIFIC: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 50 REST OF ASIA PACIFIC: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 51 EUROPE: AMMONIA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 52 EUROPE: AMMONIA MARKET, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 53 EUROPE: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 54 EUROPE: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 55 EUROPE: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 56 EUROPE: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 57 GERMANY: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 58 GERMANY: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 59 GERMANY: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 60 GERMANY: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 61 FRANCE: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 62 FRANCE: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 63 FRANCE: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 64 FRANCE: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 65 UK: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 66 UK: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 67 UK: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 68 UK: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 69 SPAIN: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 70 SPAIN: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 71 SPAIN: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 72 SPAIN: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 73 ITALY: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 74 ITALY: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 75 ITALY: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 76 ITALY: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 77 RUSSIA: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 78 RUSSIA: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 79 RUSSIA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 80 RUSSIA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 81 REST OF EUROPE: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 82 REST OF EUROPE: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 83 REST OF EUROPE: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 84 REST OF EUROPE: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 85 NORTH AMERICA: AMMONIA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 86 NORTH AMERICA: AMMONIA MARKET, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 87 NORTH AMERICA: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 88 NORTH AMERICA: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 89 NORTH AMERICA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 90 NORTH AMERICA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 91 US: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 92 US: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 93 US: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 94 US: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 95 CANADA: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 96 CANADA: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 97 CANADA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 98 CANADA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 99 MEXICO: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 100 MEXICO: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 101 MEXICO: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 102 MEXICO: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 103 MIDDLE EAST & AFRICA: AMMONIA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 104 MIDDLE EAST & AFRICA: AMMONIA MARKET, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 105 MIDDLE EAST & AFRICA: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 106 MIDDLE EAST & AFRICA: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 107 MIDDLE EAST & AFRICA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 108 MIDDLE EAST & AFRICA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 109 GCC COUNTRIES: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 110 GCC COUNTRIES: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 111 GCC COUNTRIES: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 112 GCC COUNTRIES: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 113 SAUDI ARABIA: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 114 SAUDI ARABIA: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 115 SAUDI ARABIA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 116 SAUDI ARABIA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 117 UAE: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 118 UAE: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 119 UAE: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 120 UAE: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 121 REST OF GCC COUNTRIES: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 122 REST OF GCC COUNTRIES: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 123 REST OF GCC COUNTRIES: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 124 REST OF GCC COUNTRIES: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 125 IRAN: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 126 IRAN: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 127 IRAN: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 128 IRAN: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 129 REST OF MIDDLE EAST & AFRICA: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 130 REST OF MIDDLE EAST & AFRICA: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 131 REST OF MIDDLE EAST & AFRICA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 132 REST OF MIDDLE EAST & AFRICA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 133 SOUTH AMERICA: AMMONIA MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 134 SOUTH AMERICA: AMMONIA MARKET, BY COUNTRY, 2022-2029 (KILOTON)

- TABLE 135 SOUTH AMERICA: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 136 SOUTH AMERICA: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 137 SOUTH AMERICA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 138 SOUTH AMERICA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 139 BRAZIL: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 140 BRAZIL: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 141 BRAZIL: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 142 BRAZIL: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 143 ARGENTINA: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 144 ARGENTINA: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 145 ARGENTINA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 146 ARGENTINA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 147 REST OF SOUTH AMERICA: AMMONIA MARKET, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 148 REST OF SOUTH AMERICA: AMMONIA MARKET, BY TYPE, 2022-2029 (KILOTON)

- TABLE 149 REST OF SOUTH AMERICA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (USD MILLION)

- TABLE 150 REST OF SOUTH AMERICA: AMMONIA MARKET, BY END-USE INDUSTRY, 2022-2029 (KILOTON)

- TABLE 151 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN AMMONIA MARKET, JANUARY 2019-AUGUST 2024

- TABLE 152 AMMONIA MARKET: DEGREE OF COMPETITION

- TABLE 153 AMMONIA MARKET: TYPE FOOTPRINT, 2023

- TABLE 154 AMMONIA MARKET: SALES CHANNEL FOOTPRINT, 2023

- TABLE 155 AMMONIA MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 156 AMMONIA MARKET: REGION FOOTPRINT, 2023

- TABLE 157 AMMONIA MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 158 AMMONIA MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 159 AMMONIA MARKET: PRODUCT LAUNCHES, JANUARY 2019-AUGUST 2024

- TABLE 160 AMMONIA MARKET: DEALS, JANUARY 2019-AUGUST 2024

- TABLE 161 AMMONIA MARKET: EXPANSIONS, JANUARY 2019-AUGUST 2024

- TABLE 162 AMMONIA MARKET: OTHER DEVELOPMENTS, JANUARY 2019-AUGUST 2024

- TABLE 163 CF INDUSTRIES HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 164 CF INDUSTRIES HOLDINGS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 165 CF INDUSTRIES HOLDINGS, INC.: DEALS, JANUARY 2019-AUGUST 2024

- TABLE 166 CF INDUSTRIES HOLDINGS, INC.: OTHER DEVELOPMENTS, JANUARY 2019-AUGUST 2024

- TABLE 167 YARA INTERNATIONAL ASA: COMPANY OVERVIEW

- TABLE 168 YARA INTERNATIONAL ASA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 YARA INTERNATIONAL ASA: DEALS, JANUARY 2019-AUGUST 2024

- TABLE 170 YARA INTERNATIONAL ASA: EXPANSIONS, JANUARY 2019-AUGUST 2024

- TABLE 171 SAUDI BASIC INDUSTRIES CORPORATION: COMPANY OVERVIEW

- TABLE 172 SAUDI BASIC INDUSTRIES CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 173 SAUDI BASIC INDUSTRIES CORPORATION: DEALS, JANUARY 2019-AUGUST 2024

- TABLE 174 OCI GLOBAL: COMPANY OVERVIEW

- TABLE 175 OCI GLOBAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 OCI GLOBAL: DEALS, JANUARY 2019-AUGUST 2024

- TABLE 177 OCI GLOBAL: EXPANSIONS, JANUARY 2019-AUGUST 2024

- TABLE 178 BASF SE: COMPANY OVERVIEW

- TABLE 179 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 BASF SE: PRODUCT LAUNCHES, JANUARY 2019-AUGUST 2024

- TABLE 181 BASF SE: DEALS, JANUARY 2019-AUGUST 2024

- TABLE 182 BASF SE: OTHER DEVELOPMENTS, JANUARY 2019-AUGUST 2024

- TABLE 183 NUTRIEN: COMPANY OVERVIEW

- TABLE 184 NUTRIEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 NUTRIEN: DEALS, JANUARY 2019-AUGUST 2024

- TABLE 186 NUTRIEN: EXPANSIONS, JANUARY 2019-AUGUST 2024

- TABLE 187 QATAR FERTILISER COMPANY: COMPANY OVERVIEW

- TABLE 188 QATAR FERTILISER COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 QATAR FERTILISER COMPANY: DEALS, JANUARY 2019-AUGUST 2024

- TABLE 190 KOCH FERTILIZER, LLC: COMPANY OVERVIEW

- TABLE 191 KOCH FERTILIZER, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 KOCH FERTILIZER, LLC: EXPANSIONS, JANUARY 2019-AUGUST 2024

- TABLE 193 EUROCHEM GROUP: COMPANY OVERVIEW

- TABLE 194 EUROCHEM GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 EUROCHEM GROUP: DEALS, JANUARY 2019-AUGUST 2024

- TABLE 196 EUROCHEM GROUP: EXPANSIONS, JANUARY 2019-AUGUST 2024

- TABLE 197 CSBP LIMITED: COMPANY OVERVIEW

- TABLE 198 CSBP LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 GROUP DF: COMPANY OVERVIEW

- TABLE 200 GUJARAT STATE FERTILIZERS & CHEMICALS LIMITED: COMPANY OVERVIEW

- TABLE 201 JSC TOGLIATTIAZOT: COMPANY OVERVIEW

- TABLE 202 PT PUPUK SRIWIDJAJA PALEMBANG: COMPANY OVERVIEW

- TABLE 203 GULF COAST AMMONIA LLC: COMPANY OVERVIEW

- TABLE 204 DEEPAK FERTILISERS AND PETROCHEMICALS CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 205 JAYSONS CHEMICAL INDUSTRIES: COMPANY OVERVIEW

- TABLE 206 MYSORE AMMONIA PVT. LTD.: COMPANY OVERVIEW

- TABLE 207 STEELMAN GASES PVT. LTD.: COMPANY OVERVIEW

- TABLE 208 SUMITOMO CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 209 SURAT AMMONIA AND CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 210 J.R. SIMPLOT COMPANY: COMPANY OVERVIEW

- TABLE 211 ANMOL CHEMICALS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 212 UBE CORPORATION: COMPANY OVERVIEW

- TABLE 213 GRUPA AZOTY S.A.: COMPANY OVERVIEW

- TABLE 214 REFRIGERANTS MARKET, BY TYPE, 2016-2021 (KILOTON)

- TABLE 215 REFRIGERANTS MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 216 REFRIGERANTS MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 217 REFRIGERANTS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 218 REFRIGERANTS MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 219 REFRIGERANTS MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 220 REFRIGERANTS MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 221 REFRIGERANTS MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- TABLE 222 REFRIGERANTS MARKET, BY REGION, 2016-2021 (KILOTON)

- TABLE 223 REFRIGERANTS MARKET, BY REGION, 2022-2028 (KILOTON)

- TABLE 224 REFRIGERANTS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 225 REFRIGERANTS MARKET, BY REGION, 2022-2028 (USD MILLION)

_

List of Figures

- FIGURE 1 AMMONIA MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 AMMONIA MARKET: APPROACH 1

- FIGURE 5 AMMONIA MARKET: APPROACH 2

- FIGURE 6 AMMONIA MARKET: DATA TRIANGULATION

- FIGURE 7 ANHYDROUS TO BE LARGER SEGMENT OF AMMONIA MARKET

- FIGURE 8 DIRECT SALES TO BE LARGER SALES CHANNEL

- FIGURE 9 AGRICULTURE TO REMAIN LARGEST END-USE INDUSTRY

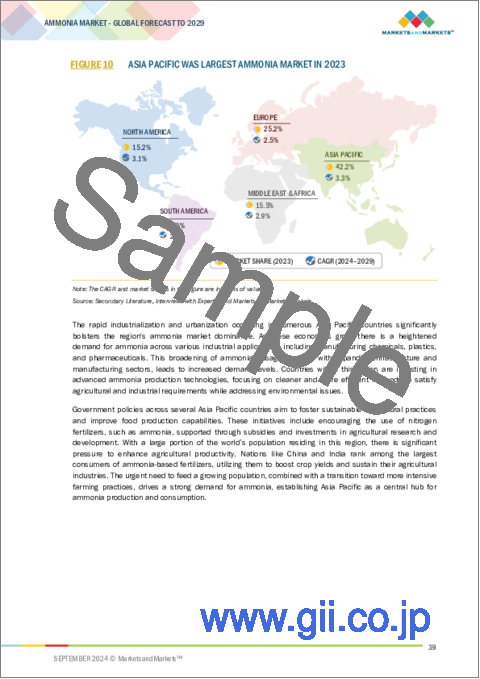

- FIGURE 10 ASIA PACIFIC WAS LARGEST AMMONIA MARKET IN 2023

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING REGION IN AMMONIA MARKET DURING FORECAST PERIOD

- FIGURE 12 ANHYDROUS TO LEAD AMMONIA MARKET DURING FORECAST PERIOD

- FIGURE 13 DIRECT TO LEAD AMMONIA MARKET DURING FORECAST PERIOD

- FIGURE 14 AGRICULTURE TO BE LARGEST END-USE INDUSTRY SEGMENT OF AMMONIA MARKET DURING FORECAST PERIOD

- FIGURE 15 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN ASIA PACIFIC

- FIGURE 16 INDIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AMMONIA MARKET

- FIGURE 18 GLOBAL FERTILIZER CONSUMPTION FOR NITROGEN (N), PHOSPHATE (P2O5), AND POTASH (K2O), 2019- 2022 ('000 TONS NUTRIENTS)

- FIGURE 19 GLOBAL FERTILIZER CONSUMPTION FOR AMMONIA, 2019-2022 ('000 METRIC TONS OF NUTRIENTS)

- FIGURE 20 GLOBAL POPULATION GROWTH (BILLION)

- FIGURE 21 GLOBAL GRAIN AND OILSEED DEMAND (BILLION TONS)

- FIGURE 22 US MONTHLY DRY NATURAL GAS PRODUCTION AND MONTHLY AVERAGE CITYGATE PRICE, 2019-2022

- FIGURE 23 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE, 2023 (USD/KILOGRAM)

- FIGURE 25 AVERAGE SELLING PRICE TREND OF AMMONIA, BY REGION, 2022-2029 (USD/KILOGRAM)

- FIGURE 26 AMMONIA MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO END-USE INDUSTRIES

- FIGURE 28 KEY BUYING CRITERIA FOR TOP TWO VERTICALS

- FIGURE 29 AMMONIA MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 AMMONIA MARKET: KEY PLAYERS IN ECOSYSTEM

- FIGURE 31 EXPORT OF AMMONIA, BY KEY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 32 IMPORT OF AMMONIA, BY KEY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 33 LIST OF SIGNIFICANT PATENTS FOR AMMONIA MARKET, 2013-2023

- FIGURE 34 INVESTOR DEALS & FUNDING IN AMMONIA

- FIGURE 35 ANHYDROUS SEGMENT TO LEAD AMMONIA MARKET DURING FORECAST PERIOD

- FIGURE 36 DIRECT SEGMENT TO LEAD AMMONIA MARKET DURING FORECAST PERIOD

- FIGURE 37 AGRICULTURE SEGMENT TO LEAD AMMONIA MARKET DURING FORECAST PERIOD

- FIGURE 38 GEOGRAPHICAL SNAPSHOT: AMMONIA MARKET GROWTH RATE, BY COUNTRY, 2024-2029

- FIGURE 39 ASIA PACIFIC: AMMONIA MARKET SNAPSHOT

- FIGURE 40 EUROPE: AMMONIA MARKET SNAPSHOT

- FIGURE 41 AMMONIA MARKET SHARE ANALYSIS, 2023

- FIGURE 42 AMMONIA MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023 (USD MILLION)

- FIGURE 43 COMPANY VALUATION, 2024 (USD BILLION)

- FIGURE 44 FINANCIAL MATRIX: EV/EBITDA RATIO, 2024

- FIGURE 45 AMMONIA MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 46 AMMONIA MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 47 AMMONIA MARKET: OVERALL COMPANY FOOTPRINT, 2023

- FIGURE 48 AMMONIA MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 49 CF INDUSTRIES HOLDINGS, INC.: COMPANY SNAPSHOT

- FIGURE 50 YARA INTERNATIONAL ASA: COMPANY SNAPSHOT

- FIGURE 51 SAUDI BASIC INDUSTRIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 OCI GLOBAL: COMPANY SNAPSHOT

- FIGURE 53 BASF SE: COMPANY SNAPSHOT

- FIGURE 54 NUTRIEN: COMPANY SNAPSHOT

The ammonia market size is projected to grow from USD 79.47 billion in 2024 and is projected to reach USD 91.95 billion by 2029, at a CAGR of 3.0%. With the ongoing increase in the global population, the demand for food production is increasing, resulting in the agricultural sector relying increasingly on nitrogen-based fertilizers, with ammonia being an essential component. Ammonia plays a crucial role in the production of fertilizers such as urea which contributes to increased crop yields and the maintenance of soil fertility. Countries like India and China, which have large agricultural sectors, are boosting their use of ammonia-based fertilizers to secure food for their expanding populations. The regular demand from the agricultural sector plays a crucial role in the ongoing growth of the ammonia market. The potential of ammonia in the clean energy transition is a significant driver of market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Type, Sales Channel, Application, and Region |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

"Anhydrous is projected to be the largest segment by type in ammonia market"

Sustainability is increasingly at the forefront, efficient usage methods of anhydrous ammonia enhance its appeal to consumers. When used effectively, it reduces nitrogen loss and reduces the environmental impact in comparison to other types of nitrogen fertilizers. This boosts long-term environmental sustainability, especially in areas carrying out stricter regulations on agricultural emissions. Anhydrous ammonia, known for its high efficiency, cost-effectiveness, and industrial versatility, is anticipated to stay as the largest segment in the ammonia market.

"Direct is projected to be the largest segment by sales channel in ammonia market"

Direct sales enable manufacturers to grow greater ties with end-users, providing constant supply and customized products created to meet specific requirements. This approach additionally reduces intermediaries, lowering expenses and enhancing efficiency for both suppliers and buyers. The increasing demand for bulk ammonia, especially within the agriculture and chemical sectors, places direct sales as a dependable and economical channel, establishing it as the leading channel for sales in the market.

"Refrigeration is the third largest segment by end-use industry in ammonia market during forecast region."

The growth of the cold chain logistics industry increases the demand for ammonia in refrigeration. The growth of global trade in perishable goods has led to an increased demand for refrigeration systems to maintain product quality during transportation. Ammonia is good in low-temperature applications, making it the ideal choice for refrigerated warehouses and transport vehicles. Major logistics companies are implementing ammonia refrigeration systems to enhance their cold chain operations, ensuring that food and pharmaceuticals are maintained at optimal temperatures during transit.

"Middle East & Africa accounts for the third-largest share in ammonia market by region"

Countries in the Middle East, including Saudi Arabia, the UAE, and Qatar, are investing in chemical industries to reduce their dependence on oil. SABIC (Saudi Basic Industries Corporation) and Qatar Fertiliser Company (QAFCO) are key players influencing chemical and fertilizer production throughout the Middle East and Africa. SABIC, a leading player in the global petrochemical industry is a crucial producer of ammonia and plays an important part in Saudi Arabia's Vision 2030. SABIC's ammonia plays an important role in the production of fertilizers. The company's emphasis on increasing its ammonia production capacity and establishing large-scale ammonia plants addresses both domestic needs and export opportunities, thereby increasing the overall ammonia market in the Middle East and Africa region.

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Others: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, Middle East & Africa 20%

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

Companies Covered: CF Industries Holdings, Inc. (US), Yara International ASA (Norway), OCI Global (Netherlands), BASF SE (Germany), and Nutrien (Canada), and others are covered in the ammonia market.

The study includes an in-depth competitive analysis of these key players in the ammonia market, with their company profiles, recent developments, and key market strategies

Research Coverage

This research report categorizes the ammonia market by type, (anhydrous, aqueous), by sales channel, (direct, indirect), by end-use industry (agriculture, textile, refrigeration, mining, pharmaceutical, and other end-use, industries), and by region (Asia Pacific, North America, Europe, South America, and Middle East & Africa). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the ammonia market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. new product launches, acquisitions, and recent developments associated with the ammonia market. Competitive analysis of upcoming startups in the ammonia market ecosystem is covered in this report.

Reasons to buy the report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall ammonia market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising agricultural demand for ammonia), restraints (Fluctuations in pricing), opportunities (Growing emphasis on low carbon solutions) and challenges (Alternative technologies).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the ammonia market

- Market Development: Comprehensive information about profitable markets - the report analyses the ammonia market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the ammonia market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players CF Industries Holdings, Inc. (US), Yara International ASA (Norway), OCI Global (Netherlands), BASF SE (Germany), and Nutrien (Canada)and among others in the ammonia market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 AMMONIA MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 DEMAND-SIDE APPROACH

- 2.3.2 SUPPLY-SIDE APPROACH

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AMMONIA MARKET

- 4.2 AMMONIA MARKET GROWTH, BY TYPE

- 4.3 AMMONIA MARKET GROWTH, BY SALES CHANNEL

- 4.4 AMMONIA MARKET, BY END-USE INDUSTRY

- 4.5 ASIA PACIFIC: AMMONIA MARKET, BY TYPE & COUNTRY

- 4.6 AMMONIA MARKET: MAJOR COUNTRIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising agricultural demand for ammonia

- 5.2.1.2 Rising demand for grain and oilseed crops and increasing population

- 5.2.1.3 Growing demand for refrigeration

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fluctuations in pricing

- 5.2.2.2 High production costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing emphasis on low carbon solutions

- 5.2.3.2 Increasing demand from emerging markets

- 5.2.4 CHALLENGES

- 5.2.4.1 Alternative technologies

- 5.2.4.2 Regulatory compliance

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY TYPE

- 6.2.2 AVERAGE SELLING PRICE TREND OF AMMONIA, BY REGION, 2022-2029

- 6.3 PORTER'S FIVE FORCES ANALYSIS

- 6.3.1 THREAT OF NEW ENTRANTS

- 6.3.2 THREAT OF SUBSTITUTES

- 6.3.3 BARGAINING POWER OF SUPPLIERS

- 6.3.4 BARGAINING POWER OF BUYERS

- 6.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.4 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.4.2 BUYING CRITERIA

- 6.5 VALUE CHAIN ANALYSIS

- 6.6 ECOSYSTEM ANALYSIS

- 6.7 TRADE ANALYSIS

- 6.7.1 EXPORT SCENARIO (HS CODE 2814)

- 6.7.2 IMPORT SCENARIO (HS CODE 2814)

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.1.1 Haber-Bosch Process

- 6.8.1.2 Electrochemical Nitrogen Reduction

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.8.2.1 Renewable Energy Integration

- 6.8.2.2 Advanced Heat Recovery Systems

- 6.8.1 KEY TECHNOLOGIES

- 6.9 IMPACT OF GEN AI ON AMMONIA MARKET

- 6.9.1 INTEGRATING AI IN AMMONIA SECTOR

- 6.9.2 BEST PRACTICES TO LEVERAGE AI FOR AMMONIA MARKET

- 6.9.3 USE CASES OF AI IN AMMONIA MARKET

- 6.10 REGULATORY LANDSCAPE

- 6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 GREEN AMMONIA IMPACT ASSESSMENT CASE STUDY

- 6.11.2 AMMONIA WASTEWATER TREATMENT

- 6.12 PATENT ANALYSIS

- 6.12.1 METHODOLOGY

- 6.12.2 PATENT ANALYSIS

- 6.13 KEY CONFERENCES & EVENTS, 2024-2025

- 6.14 MACROECONOMIC ANALYSIS

- 6.14.1 INTRODUCTION

- 6.14.2 GDP

- 6.15 INVESTMENT & FUNDING SCENARIO

7 AMMONIA MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 ANHYDROUS

- 7.2.1 GROWING SIGNIFICANCE IN FERTILIZER PRODUCTION

- 7.3 AQUEOUS

- 7.3.1 RISING DEMAND FOR EFFICIENT WATER TREATMENT SOLUTIONS

8 AMMONIA MARKET, BY SALES CHANNEL

- 8.1 INTRODUCTION

- 8.2 DIRECT

- 8.2.1 STRONG DEMAND FROM LARGE-SCALE BUYERS

- 8.3 INDIRECT

- 8.3.1 GROWTH OF E-COMMERCE SECTOR

9 AMMONIA MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 AGRICULTURE

- 9.2.1 CRUCIAL FOR SUSTAINING AGRICULTURAL PRODUCTIVITY

- 9.3 TEXTILE

- 9.3.1 GROWING DEMAND FOR HIGH-QUALITY TEXTILES

- 9.4 REFRIGERATION

- 9.4.1 RAPID EXPANSION OF COLD CHAIN LOGISTICS SECTOR

- 9.5 MINING

- 9.5.1 GROWING USE AS LEACHING AGENT IN EXTRACTING AND PROCESSING METALS

- 9.6 PHARMACEUTICAL

- 9.6.1 RISING AGING POPULATION AND CHRONIC DISEASES

- 9.7 OTHER END-USE INDUSTRIES

10 AMMONIA MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 High use of ammonia for clean energy transition

- 10.2.2 INDIA

- 10.2.2.1 Expansion of food processing industry

- 10.2.3 JAPAN

- 10.2.3.1 Ambitious carbon neutrality strategy for 2050

- 10.2.4 INDONESIA

- 10.2.4.1 Growing agricultural sector

- 10.2.5 RESF OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Increasing imports of green ammonia and agricultural demand

- 10.3.2 FRANCE

- 10.3.2.1 Strong export performance to expand market

- 10.3.3 UK

- 10.3.3.1 Green initiatives driving demand for ammonia

- 10.3.4 SPAIN

- 10.3.4.1 Plans to generate substantial quantities of green ammonia by 2030

- 10.3.5 ITALY

- 10.3.5.1 Strong economy and agricultural leadership

- 10.3.6 RUSSIA

- 10.3.6.1 Growing domestic demand and export opportunities

- 10.3.7 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 NORTH AMERICA

- 10.4.1 US

- 10.4.1.1 Rising population and global textile demand

- 10.4.2 CANADA

- 10.4.2.1 Leveraging clean energy and incentives to drive market

- 10.4.3 MEXICO

- 10.4.3.1 Strategic role in global trade and investment in ammonia industry

- 10.4.1 US

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 SAUDI ARABIA

- 10.5.1.1.1 Saudi Arabia's vision 2030 promoting sustainable energy solutions

- 10.5.1.2 UAE

- 10.5.1.2.1 Commitment to a carbon-free future to drive market

- 10.5.1.3 Rest of GCC Countries

- 10.5.1.1 SAUDI ARABIA

- 10.5.2 IRAN

- 10.5.2.1 Increasing agricultural productivity

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Initiatives like Project Iracema to produce renewable ammonia

- 10.6.2 ARGENTINA

- 10.6.2.1 Establishment of regulatory framework to drive market

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

- 11.5 COMPANY VALUATION & FINANCIAL METRICS

- 11.6 COMPANY VALUATION

- 11.7 FINANCIAL MATRIX

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.9.1 STARS

- 11.9.2 EMERGING LEADERS

- 11.9.3 PERVASIVE PLAYERS

- 11.9.4 PARTICIPANTS

- 11.9.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.9.5.1 Company footprint

- 11.9.5.2 Type footprint

- 11.9.5.3 Sales channel footprint

- 11.9.5.4 End-use industry footprint

- 11.9.5.5 Region footprint

- 11.10 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.10.1 PROGRESSIVE COMPANIES

- 11.10.2 RESPONSIVE COMPANIES

- 11.10.3 DYNAMIC COMPANIES

- 11.10.4 STARTING BLOCKS

- 11.10.5 COMPETITIVE BENCHMARKING

- 11.10.5.1 Detailed list of key startups/SMEs

- 11.10.5.2 Competitive benchmarking of key startups/SMEs

- 11.11 COMPETITIVE SCENARIO

- 11.11.1 PRODUCT LAUNCHES

- 11.11.2 DEALS

- 11.11.3 EXPANSIONS

- 11.11.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 CF INDUSTRIES HOLDINGS, INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 YARA INTERNATIONAL ASA

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 SAUDI BASIC INDUSTRIES CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 OCI GLOBAL

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 BASF SE

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 NUTRIEN

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.6.3.2 Expansions

- 12.1.6.4 MnM view

- 12.1.7 QATAR FERTILISER COMPANY

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.7.4 MnM view

- 12.1.8 KOCH FERTILIZER, LLC

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Expansions

- 12.1.8.4 MnM view

- 12.1.9 EUROCHEM GROUP

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Expansions

- 12.1.9.4 MnM view

- 12.1.10 CSBP LIMITED

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 MnM view

- 12.1.1 CF INDUSTRIES HOLDINGS, INC.

- 12.2 OTHER PLAYERS

- 12.2.1 GROUP DF

- 12.2.2 GUJARAT STATE FERTILIZERS & CHEMICALS LIMITED

- 12.2.3 JSC TOGLIATTIAZOT

- 12.2.4 PT PUPUK SRIWIDJAJA PALEMBANG

- 12.2.5 GULF COAST AMMONIA LLC

- 12.2.6 DEEPAK FERTILISERS AND PETROCHEMICALS CORPORATION LIMITED

- 12.2.7 JAYSONS CHEMICAL INDUSTRIES

- 12.2.8 MYSORE AMMONIA PVT. LTD.

- 12.2.9 STEELMAN GASES PVT. LTD.

- 12.2.10 SUMITOMO CHEMICAL CO., LTD.

- 12.2.11 SURAT AMMONIA AND CHEMICAL COMPANY

- 12.2.12 J.R. SIMPLOT COMPANY

- 12.2.13 ANMOL CHEMICALS PRIVATE LIMITED

- 12.2.14 UBE CORPORATION

- 12.2.15 GRUPA AZOTY S.A.

13 ADJACENT & RELATED MARKET

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.2.1 REFRIGERANTS MARKET

- 13.2.1.1 Market definition

- 13.2.1.2 Refrigerants market, by type

- 13.2.1.3 Refrigerants market, by application

- 13.2.1.4 Refrigerants market, by region

- 13.2.1 REFRIGERANTS MARKET

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS