|

|

市場調査レポート

商品コード

1564696

SOI(Silicon On Insulator)の世界市場:スマートカットSOI、ボンディングSOI、レイヤートランスファーSOI、RF-SOI、パワーSOI、FD-SOI、RF FEM、MEMSデバイス、光通信、画像センシングデバイス、自動車、軍事・防衛 - 予測(~2029年)Silicon on Insulator Market by Smart Cut SOI, Bonding SOI, Layer Transfer SOI, RF-SOI, Power -SOI, FD-SOI, RF FEM, MEMS Devices, Optical Communication, Image Sensing Devices, Automotive and Military & Defense - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| SOI(Silicon On Insulator)の世界市場:スマートカットSOI、ボンディングSOI、レイヤートランスファーSOI、RF-SOI、パワーSOI、FD-SOI、RF FEM、MEMSデバイス、光通信、画像センシングデバイス、自動車、軍事・防衛 - 予測(~2029年) |

|

出版日: 2024年09月28日

発行: MarketsandMarkets

ページ情報: 英文 218 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のSOI(Silicon On Insulator)の市場規模は、2024年に12億9,000万米ドルであり、2029年までに25億5,000万米ドルに達すると予測され、予測期間にCAGRで14.7%の成長が見込まれます。

SOI技術は、より小さなトランジスタの製造に適しており、デバイスの高密度化と機能性の向上を可能にし、薄いウエハーの製造と確立におけるシリコンの浪費防止がSOI(Silicon On Insulator)市場の成長を促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | ウエハーサイズ別、ウエハータイプ別、技術別、製品別、用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「ボンディングセグメントが予測期間に大幅なCAGRで成長する見込みです。」

このセグメントの成長は、SOIウエハーの製造を低コストで改良したボンディング技術の進歩によるものです。この結果、SOI技術を導入するコストが削減され、コンシューマーエレクトロニクスや自動車産業などの他分野での応用が拡大します。さらに、ウエハー接合技術の向上は、通信、自動車、コンシューマーエレクトロニクス産業で需要の高い用途の発展に必要とされる、より大きなサイズのSOIウエハーの製造を可能にします。ウエハーの大型化により、1枚のシリコンから多くのチップを生産することが可能となり、高い生産性を実現します。

「RF-SOIが2023年に最高のシェアを獲得する可能性が高いです。」

RF-SOIウエハー需要の拡大は、無線通信、自動車産業、航空宇宙・防衛、医療機器、コンシューマーエレクトロニクスの進歩によってもたらされます。すべてのスマートフォンはRF-SOIウエハーを使用しています。レーダー、LiDAR、無線接続などのADAS機能の自動車への採用が増加しており、高性能なRFコンポーネントが必要とされています。RF-SOIウエハーは、これらの用途に必要な特性を提供します。また、デジタルチップやRFチップなどのその他のコンポーネントに対する需要の増加も、RF-SOIウエハー市場を牽引しています。低消費電力、高集積密度、優れたRF性能といった独自の特性を持つRF-SOIウエハーは、幅広い用途で利用価値の高い技術となっています。

「欧州が2023年に最高のシェアを獲得する可能性が高いです。」

この市場成長は、SOI技術を製品に採用してきた欧州の自動車市場によるものと考えられます。主な自動車製造産業の存在には、Audi、Mercedes-Benz、BMW Group、Daimler、Fiat Chrysler Automobiles、Opel Group、PSA Group、Renault organization、Volkswagen Groupなどが含まれます。さらに、2024年3月、製造ユニットであるSTMicroelectronicsは、STM32マイクロコントローラーを、Phase Change Memoryを統合した18nmのFD-SOI(Fully Depleted Silicon On Insulator)製造プロセスに変更しました。

当レポートでは、世界のSOI(Silicon On Insulator)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- SOI(Silicon On Insulator)市場の企業にとって魅力的な機会

- SOI(Silicon On Insulator)市場:用途別

- SOI(Silicon On Insulator)市場:ウエハータイプ別

- SOI(Silicon On Insulator)市場:技術別

- SOI(Silicon On Insulator)市場:製品別

- SOI(Silicon On Insulator)市場:ウエハーサイズ別

- アジア太平洋のSOI(Silicon On Insulator)市場:用途別、国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 価格分析

- 主要企業の平均販売価格の動向:ウエハーサイズ別

- 平均販売価格の動向:ウエハーサイズ別

- SOI(Silicon On Insulator)の平均販売価格の動向:地域別

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- SOI(Silicon On Insulator)市場に対するAI/生成AIの影響

- ケーススタディ

- 貿易分析

- 輸入シナリオ(HSコード:854690)

- 輸出シナリオ(HSコード:854690)

- 特許分析

- 規制情勢

- 標準

- 政府規制

- 主な会議とイベント(2024年~2025年)

第6章 SOI(Silicon On Insulator)市場:ウエハーサイズ別

- イントロダクション

- 200mm未満

- 300mm

第7章 SOI(Silicon On Insulator)市場:ウエハータイプ別

- イントロダクション

- RF-SOI

- パワーSOI

- FD-SOI

- PD-SOI

- その他のウエハータイプ

- フォトニクスSOI

- イメージャーSOI

第8章 SOI(Silicon On Insulator)市場:技術別

- イントロダクション

- スマートカットSOI

- ボンディングSOI

- レイヤートランスファーSOI

第9章 SOI(Silicon On Insulator)市場:製品別

- イントロダクション

- RF FEM製品

- MEMSデバイス

- パワー製品

- 光通信デバイス

- イメージセンシング製品

第10章 SOI(Silicon On Insulator)市場:用途別

- イントロダクション

- コンシューマーエレクトロニクス

- 自動車

- データ通信・通信

- 工業

- 軍事・防衛、航空宇宙

第11章 SOI(Silicon On Insulator)市場:厚さ別

- 薄膜SOIウエハー(厚さ1μm以下)

- 厚膜SOIウエハー(厚さ1μm~3μm)

第12章 SOI(Silicon On Insulator)市場:地域別

- イントロダクション

- 北米

- マクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- マクロ経済の見通し

- フランス

- 英国

- ドイツ

- イタリア

- その他の欧州

- アジア太平洋

- マクロ経済の見通し

- 中国

- 日本

- 台湾

- その他のアジア太平洋

- その他の地域

- マクロ経済の見通し

- 中東・アフリカ

- 南米

第13章 競合情勢

- 概要

- 主要企業戦略/有力企業(2020年~2024年)

- 市場シェア分析(2023年)

- 収益分析(2019年~2023年)

- 企業の評価と財務指標

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- ブランド/製品の比較

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- SOITEC

- SHIN-ETSU CHEMICAL CO., LTD.

- GLOBALWAFERS

- SUMCO CORPORATION

- SHANGHAI SIMGUI TECHNOLOGY CO., LTD.

- GLOBALFOUNDRIES

- STMICROELECTRONICS

- TOWER SEMICONDUCTOR

- SILICON VALLEY MICROELECTRONICS, INC.

- WAFERPRO

- その他の企業

- NANOGRAFI NANO TECHNOLOGY

- OKMETIC

- PRECISION MICRO-OPTICS INC.

- UNITED MICROELECTRONICS CORPORATION

- ULTRASIL LLC

- PLUTOSEMI CO., LTD

- NXP SEMICONDUCTORS

- MURATA MANUFACTURING CO., LTD.

- ICEMOS TECHNOLOGY LTD.

- PROLYX MICROELECTRONICS PRIVATE LIMITED

- NOVA ELECTRONIC MATERIALS, LLC

- VANGUARD INTERNATIONAL SEMICONDUCTOR CORPORATION

- ROGUE VALLEY MICRODEVICES

- SOKA TECHNOLOGY

- ADVANCED MICRO FOUNDRY PTE LTD

第15章 付録

List of Tables

- TABLE 1 RISK ASSESSMENT

- TABLE 2 ROLE OF PLAYERS IN SILICON-ON-INSULATOR MARKET ECOSYSTEM

- TABLE 3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS FOR LESS THAN OR EQUAL TO 200MM SILICON-ON-INSULATORS, 2020-2023 (USD)

- TABLE 4 AVERAGE SELLING PRICE TREND FOR WAFER SIZES, 2020-2023 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND FOR SILICON-ON-INSULATORS, BY REGION, 2020-2023 (USD)

- TABLE 6 SILICON-ON-INSULATOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 9 IMPORT DATA FOR HS CODE: 854690-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 10 EXPORT DATA FOR HS CODE: 854690-COMPLIANT PRODUCTS, BY COUNTRY 2019-2023 (USD MILLION)

- TABLE 11 PATENTS FILED, 2013-2023

- TABLE 12 LIST OF PATENTS ISSUED IN SILICON-ON-INSULATOR MARKET, 2021-2024

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 LIST OF CONFERENCES & EVENTS, 2024-2025

- TABLE 18 SILICON-ON-INSULATOR MARKET, BY WAFER SIZE, 2020-2023 (USD MILLION)

- TABLE 19 SILICON-ON-INSULATOR MARKET, BY WAFER SIZE, 2024-2029 (USD MILLION)

- TABLE 20 SILICON-ON-INSULATOR MARKET, BY WAFER SIZE, 2020-2023 (MILLION UNITS)

- TABLE 21 SILICON-ON-INSULATOR MARKET, BY WAFER SIZE, 2024-2029 (MILLION UNITS)

- TABLE 22 LESS THAN OR EQUAL TO 200MM: SILICON-ON-INSULATOR MARKET, BY WAFER TYPE, 2020-2023 (USD MILLION)

- TABLE 23 LESS THAN OR EQUAL TO 200MM: SILICON-ON-INSULATOR MARKET, BY WAFER TYPE, 2024-2029 (USD MILLION)

- TABLE 24 300MM: SILICON-ON-INSULATOR MARKET, BY WAFER TYPE, 2020-2023 (USD MILLION)

- TABLE 25 300MM: SILICON-ON-INSULATOR MARKET, BY WAFER TYPE, 2024-2029 (USD MILLION)

- TABLE 26 SILICON-ON-INSULATOR MARKET, BY WAFER TYPE, 2020-2023 (USD MILLION)

- TABLE 27 SILICON-ON-INSULATOR MARKET, BY WAFER TYPE, 2024-2029 (USD MILLION)

- TABLE 28 RF-SOI: SILICON-ON-INSULATOR MARKET, BY WAFER SIZE, 2020-2023 (USD MILLION)

- TABLE 29 RF-SOI: SILICON-ON-INSULATOR MARKET, BY WAFER SIZE, 2024-2029 (USD MILLION)

- TABLE 30 RF-SOI: SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 31 RF-SOI: SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 32 POWER-SOI: SILICON-ON-INSULATOR MARKET, BY WAFER SIZE, 2020-2023 (USD MILLION)

- TABLE 33 POWER-SOI: SILICON-ON-INSULATOR MARKET, BY WAFER SIZE, 2024-2029 (USD MILLION)

- TABLE 34 POWER-SOI: SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 35 POWER-SOI: SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 36 FD-SOI: SILICON-ON-INSULATOR MARKET, BY WAFER SIZE, 2020-2023 (USD MILLION)

- TABLE 37 FD-SOI: SILICON-ON-INSULATOR MARKET, BY WAFER SIZE, 2024-2029 (USD MILLION)

- TABLE 38 FD-SOI: SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 39 FD-SOI: SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 40 PD-SOI: SILICON-ON-INSULATOR MARKET, BY WAFER SIZE, 2020-2023 (USD MILLION)

- TABLE 41 PD-SOI: SILICON-ON-INSULATOR MARKET, BY WAFER SIZE, 2024-2029 (USD MILLION)

- TABLE 42 PD-SOI: SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 43 PD-SOI: SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 44 OTHER WAFER TYPES: SILICON-ON-INSULATOR MARKET, BY WAFER SIZE, 2020-2023 (USD MILLION)

- TABLE 45 OTHER WAFER TYPES: SILICON-ON-INSULATOR MARKET, BY WAFER SIZE, 2024-2029 (USD MILLION)

- TABLE 46 OTHER WAFER TYPES: SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 47 OTHER WAFER TYPES: SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 48 SILICON-ON-INSULATOR MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 49 SILICON-ON-INSULATOR MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 50 SILICON-ON-INSULATOR MARKET, BY PRODUCT, 2020-2023 (USD MILLION)

- TABLE 51 SILICON-ON-INSULATOR MARKET, BY PRODUCT, 2024-2029 (USD MILLION)

- TABLE 52 SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 53 SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 54 CONSUMER ELECTRONICS: SILICON-ON-INSULATOR MARKET, BY WAFER TYPE, 2020-2023 (USD MILLION)

- TABLE 55 CONSUMER ELECTRONICS: SILICON-ON-INSULATOR MARKET, BY WAFER TYPE, 2024-2029 (USD MILLION)

- TABLE 56 CONSUMER ELECTRONICS: SILICON-ON-INSULATOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 57 CONSUMER ELECTRONICS: SILICON-ON-INSULATOR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 58 AUTOMOTIVE: SILICON-ON-INSULATOR MARKET, BY WAFER TYPE, 2020-2023 (USD MILLION)

- TABLE 59 AUTOMOTIVE: SILICON-ON-INSULATOR MARKET, BY WAFER TYPE, 2024-2029 (USD MILLION)

- TABLE 60 AUTOMOTIVE: SILICON-ON-INSULATOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 61 AUTOMOTIVE: SILICON-ON-INSULATOR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 62 DATACOM & TELECOM: SILICON-ON-INSULATOR MARKET, BY WAFER TYPE, 2020-2023 (USD MILLION)

- TABLE 63 DATACOM & TELECOM: SILICON-ON-INSULATOR MARKET, BY WAFER TYPE, 2024-2029 (USD MILLION)

- TABLE 64 DATACOM & TELECOM: SILICON-ON-INSULATOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 65 DATACOM & TELECOM: SILICON-ON-INSULATOR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 66 INDUSTRIAL: SILICON-ON-INSULATOR MARKET, BY WAFER TYPE, 2020-2023 (USD MILLION)

- TABLE 67 INDUSTRIAL: SILICON-ON-INSULATOR MARKET, BY WAFER TYPE, 2024-2029 (USD MILLION)

- TABLE 68 INDUSTRIAL: SILICON-ON-INSULATOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 69 INDUSTRIAL: SILICON-ON-INSULATOR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 70 MILITARY, DEFENSE, AND AEROSPACE: SILICON-ON-INSULATOR MARKET, BY WAFER TYPE, 2020-2023 (USD MILLION)

- TABLE 71 MILITARY, DEFENSE, AND AEROSPACE: SILICON-ON-INSULATOR MARKET, BY WAFER TYPE, 2024-2029 (USD MILLION)

- TABLE 72 MILITARY, DEFENSE, AND AEROSPACE: SILICON-ON-INSULATOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 73 MILITARY, DEFENSE, AND AEROSPACE: SILICON-ON-INSULATOR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 74 SILICON-ON-INSULATOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 75 SILICON-ON-INSULATOR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 76 NORTH AMERICA: SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 77 NORTH AMERICA: SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 78 NORTH AMERICA: SILICON-ON-INSULATOR MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 79 NORTH AMERICA: SILICON-ON-INSULATOR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 80 EUROPE: SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 81 EUROPE: SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 82 EUROPE: SILICON-ON-INSULATOR MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 83 EUROPE: SILICON-ON-INSULATOR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 84 ASIA PACIFIC: SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 85 ASIA PACIFIC: SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 86 ASIA PACIFIC: SILICON-ON-INSULATOR MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 87 ASIA PACIFIC: SILICON-ON-INSULATOR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 88 ROW: SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 89 ROW: SILICON-ON-INSULATOR MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 90 ROW: SILICON-ON-INSULATOR MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 91 ROW: SILICON-ON-INSULATOR MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 92 MIDDLE EAST & AFRICA: SILICON-ON-INSULATOR MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 93 MIDDLE EAST & AFRICA: SILICON-ON-INSULATOR MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 94 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 95 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2023

- TABLE 96 SILICON-ON-INSULATOR MARKET: REGION FOOTPRINT

- TABLE 97 SILICON-ON-INSULATOR MARKET: WAFER SIZE FOOTPRINT

- TABLE 98 SILICON-ON-INSULATOR MARKET: WAFER TYPE FOOTPRINT

- TABLE 99 SILICON-ON-INSULATOR MARKET: TECHNOLOGY FOOTPRINT

- TABLE 100 SILICON-ON-INSULATOR MARKET: PRODUCT FOOTPRINT

- TABLE 101 SILICON-ON-INSULATOR MARKET: APPLICATION FOOTPRINT

- TABLE 102 SILICON-ON-INSULATOR MARKET: KEY STARTUPS/SMES

- TABLE 103 SILICON-ON-INSULATOR MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 104 SILICON-ON-INSULATOR MARKET: PRODUCT LAUNCHES, JANUARY 2020- JUNE 2024

- TABLE 105 SILICON-ON-INSULATOR MARKET: DEALS, JANUARY 2020-JUNE 2024

- TABLE 106 SILICON-ON-INSULATOR MARKET: EXPANSION, JANUARY 2020-JUNE 2024

- TABLE 107 SILICON-ON-INSULATOR MARKET: OTHER DEVELOPMENTS, JANUARY 2020-JUNE 2024

- TABLE 108 SOITEC: COMPANY OVERVIEW

- TABLE 109 SOITEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 110 SOITEC: DEALS

- TABLE 111 SOITEC: EXPANSION

- TABLE 112 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 113 SHIN-ETSU CHEMICAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 114 SHIN-ETSU CHEMICAL CO., LTD.: DEALS

- TABLE 115 SHIN-ETSU CHEMICAL CO., LTD.: EXPANSION

- TABLE 116 GLOBALWAFERS: COMPANY OVERVIEW

- TABLE 117 GLOBALWAFERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 118 GLOBALWAFERS: DEALS

- TABLE 119 GLOBALWAFERS: EXPANSION

- TABLE 120 GLOBALWAFERS: OTHER DEVELOPMENTS

- TABLE 121 SUMCO CORPORATION: COMPANY OVERVIEW

- TABLE 122 SUMCO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 123 SHANGHAI SIMGUI TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 124 SHANGHAI SIMGUI TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 125 GLOBALFOUNDRIES: COMPANY OVERVIEW

- TABLE 126 GLOBALFOUNDRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 127 GLOBALFOUNDRIES: PRODUCT/SERVICE LAUNCHES

- TABLE 128 GLOBALFOUNDRIES: DEALS

- TABLE 129 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 130 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 131 STMICROELECTRONICS: PRODUCT/SERVICE LAUNCHES

- TABLE 132 STMICROELECTRONICS: DEALS

- TABLE 133 TOWER SEMICONDUCTOR: COMPANY OVERVIEW

- TABLE 134 TOWER SEMICONDUCTOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 TOWER SEMICONDUCTOR: DEALS

- TABLE 136 SILICON VALLEY MICROELECTRONICS: COMPANY OVERVIEW

- TABLE 137 SILICON VALLEY MICROELECTRONICS: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 138 WAFERPRO: COMPANY OVERVIEW

- TABLE 139 WAFERPRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 NANOGRAFI NANO TECHNOLOGY: COMPANY OVERVIEW

- TABLE 141 OKMETIC: COMPANY OVERVIEW

- TABLE 142 PRECISION MICRO-OPTICS INC.: COMPANY OVERVIEW

- TABLE 143 UNITED MICROELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 144 ULTRASIL LLC: COMPANY OVERVIEW

- TABLE 145 PLUTOSEMI CO., LTD: COMPANY OVERVIEW

- TABLE 146 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 147 MURATA MANUFACTURING CO., LTD.: COMPANY OVERVIEW

- TABLE 148 ICEMOS TECHNOLOGY LTD.: COMPANY OVERVIEW

- TABLE 149 PROLYX MICROELECTRONICS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 150 NOVA ELECTRONIC MATERIALS, LTD.: COMPANY OVERVIEW

- TABLE 151 VANGUARD INTERNATIONAL SEMICONDUCTOR CORPORATION: COMPANY OVERVIEW

- TABLE 152 ROGUE VALLEY MICRODEVICES: COMPANY OVERVIEW

- TABLE 153 SOKA TECHNOLOGY: COMPANY OVERVIEW

- TABLE 154 ADVANCED MICRO FOUNDRY PTE LTD: COMPANY OVERVIEW

List of Figures

- FIGURE 1 SILICON-ON-INSULATOR MARKET: RESEARCH DESIGN

- FIGURE 2 SECONDARY AND PRIMARY RESEARCH

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS (APPROACH 1)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS (APPROACH 2)

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 3) - BOTTOM-UP (DEMAND SIDE): DEMAND FOR SOI WAFERS IN DIFFERENT APPLICATIONS

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 SILICON-ON-INSULATOR MARKET: GLOBAL SNAPSHOT, 2020-2029 (USD BILLION)

- FIGURE 10 300MM SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 RF-SOI SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 SMART CUT SOI SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 MEMS DEVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET BY 2029

- FIGURE 14 AUTOMOTIVE SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO DOMINATE GLOBAL MARKET DURING FORECAST PERIOD

- FIGURE 16 GROWING DEMAND FOR HIGH-PERFORMANCE, ENERGY-EFFICIENT DEVICES TO DRIVE MARKET GROWTH

- FIGURE 17 CONSUMER ELECTRONICS SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 18 RF-SOI SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 19 SMART CUT SOI SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 20 MEMS DEVICES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 21 300MM SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 22 CONSUMER ELECTRONICS SEGMENT AND CHINA TO ACCOUNT FOR SIGNIFICANT SHARE IN 2024

- FIGURE 23 SILICON-ON-INSULATOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 ELECTRIC CAR SALES, BY REGION, 2020-2024 (MILLION UNITS)

- FIGURE 25 SILICON-ON-INSULATOR MARKET DRIVERS: IMPACT ANALYSIS

- FIGURE 26 SILICON-ON-INSULATOR MARKET RESTRAINTS: IMPACT ANALYSIS

- FIGURE 27 SILICON-ON-INSULATOR MARKET OPPORTUNITIES: IMPACT ANALYSIS

- FIGURE 28 SILICON-ON-INSULATOR MARKET CHALLENGES: IMPACT ANALYSIS

- FIGURE 29 VALUE CHAIN ANALYSIS

- FIGURE 30 SILICON-ON-INSULATOR MARKET: ECOSYSTEM

- FIGURE 31 INVESTMENT AND FUNDING SCENARIO, 2022-2024

- FIGURE 32 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 33 AVERAGE SELLING PRICE TREND OF KEY PLAYERS FOR LESS THAN OR EQUAL TO 200MM SILICON-ON-INSULATORS

- FIGURE 34 AVERAGE SELLING PRICE TREND FOR WAFER SIZES, 2020-2023 (USD)

- FIGURE 35 AVERAGE SELLING PRICE TREND FOR SILICON-ON-INSULATORS, BY REGION, 2020-2023 (USD)

- FIGURE 36 SILICON-ON-INSULATOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 38 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 39 IMPACT OF AI/GEN AI ON SILICON-ON-INSULATOR MARKET

- FIGURE 40 IMPORT DATA FOR HS CODE: 854690-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 41 EXPORT DATA FOR HS CODE: 854690-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 42 NUMBER OF PATENTS GRANTED FOR SILICON-ON-INSULATOR MARKET, 2013-2023

- FIGURE 43 300MM SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 44 RF-SOI SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 45 SMART CUT SOI SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 46 MEMS DEVICES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 47 AUTOMOTIVE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 NORTH AMERICA: SILICON-ON-INSULATOR MARKET SNAPSHOT

- FIGURE 50 EUROPE: SILICON-ON-INSULATOR MARKET SNAPSHOT

- FIGURE 51 ASIA PACIFIC: SILICON-ON-INSULATOR MARKET SNAPSHOT

- FIGURE 52 MARKET SHARE ANALYSIS, 2023

- FIGURE 53 REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023 (USD MILLION)

- FIGURE 54 COMPANY VALUATION

- FIGURE 55 FINANCIAL METRICS

- FIGURE 56 SILICON-ON-INSULATOR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 57 SILICON-ON-INSULATOR MARKET: COMPANY FOOTPRINT

- FIGURE 58 SILICON-ON-INSULATOR MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 59 BRAND/PRODUCT COMPARISON

- FIGURE 60 SOITEC: COMPANY SNAPSHOT

- FIGURE 61 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 62 GLOBALWAFERS: COMPANY SNAPSHOT

- FIGURE 63 SUMCO CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 GLOBALFOUNDRIES: COMPANY SNAPSHOT

- FIGURE 65 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 66 TOWER SEMICONDUCTOR: COMPANY SNAPSHOT

The global silicon on insulator market was valued at USD 1.29 billion in 2024 and is projected to reach USD 2.55 billion by 2029; it is expected to register a CAGR of 14.7% during the forecast period. SOI technology is well-suited for the fabrication of smaller transistors, enabling higher device densities and increased functionality and silicon wastage prevention in thin-wafer manufacturing and establishment is driving the growth of the silicon on insulator market, while floating body and self-heating effects in SOI-based devices are restraining it.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By wafer size, wafer type, technology, product, application, and region |

| Regions covered | North America, Europe, APAC, RoW |

"The bonding segment is expected to grow at a significant CAGR during the forecast period."

The bonding segment is projected to grow at a significant rate while attaining a CAGR during the forecast. The growth of the segment is attributed to the advancements in bonding technologies that improved the manufacturing of SOI wafers at lower costs. This results in reduced cost of implementing SOI technology, hence expanding its further applicability in other fields such as consumer electronics and automotive industries, among others. Moreover, increased material bonding technology allows the manufacturing of larger sized SOI wafers, a requirement for the developing high-demanding applications in telecommunication, automobile, and consumer electronics industries. Bigger wafers enable many chips to be produced from a single piece of silicon, resulting in high productivity.

"RF-SOI is likely to capture the highest share during the 2023"

The market in RF-SOI wafer type is expected to capture the highest share in 2023. The growing demand for RF-SOI wafers is driven by advancements in wireless communication, the automotive industry, aerospace and defense, medical devices, and consumer electronic. All smartphones use RF-SOI wafers. The increasing adoption of ADAS features in vehicles, such as radar, lidar, and wireless connectivity, necessitates high-performance RF components. RF-SOI wafers provide the necessary characteristics for these applications. Also, the increasing demand for other components, such as digital and RF chips, also drives the market for RF-SOI wafers. Their unique properties, such as low power consumption, high integration density, and excellent RF performance, make them a valuable technology for a wide range of applications.

"The Europe is likely to capture the highest share during the 2023."

The market in Europe is expected to capture the highest share in 2023. The market growth can be attributed to the European automotive market that has been using SOI technology in its products. The existence of major auto manufacturing industries includes Audi, Mercedes Benz, BMW Group, Daimler, Fiat Chrysler Automobiles, Opel Group, PSA Group, Renault organization, and Volkswagen Group, among others. Moreover, in March 2024, the manufacturing unit STMicroelectronics changed the STM32 microcontrollers to an 18nm Fully Depleted Silicon On Insulator (FD-SOI) manufacturing process with integrated Phase Change Memory.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 35%, Tier 2 - 45%, Tier 3 - 20%

- By Designation- C-level Executives - 40%, Directors - 30%, Others - 30%

- By Region-North America - 40%, Europe - 20%, Asia Pacific - 30%, RoW - 10%

The silicon on insulator market is dominated by a few globally established players such as SOITEC (France), Shin-Etsu Chemical Co., Ltd. (Japan), GlobalWafers (Taiwan), SUMCO Corporation (Japan), Shanghai Simgui Technology Co., Ltd. (China), GlobalFoundries (US), STMicroelectronics (Switzerland), Tower Semiconductors (Israel), Silicon Valley Microelectronics, Inc (US). The study includes an in-depth competitive analysis of these key players in the silicon on insulator market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the silicon on insulator market and forecasts its size by wafer size, wafer type, technology, product, application, and region. The report also discusses the drivers, restraints, opportunities, and challenges of the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. Supply chain analysis has been included in the report, along with the key players and their competitive analysis in the silicon on insulator ecosystem.

Key Benefits to Buy the Report:

- Analysis of key drivers (Increased investments in the SOI ecosystem, growth in the use of SOI wafers in consumer electronics, reduced overall cost of semiconductor devices by minimizing silicon wastage while manufacturing thin SOI wafers). Restraint (Floating body and self-heating effects in SOI-based devices, Limited availability of existing intellectual property ecosystems to fabless companies), Opportunity (Growing integrated chip industry and expanding SOI ecosystem in the Asia Pacific, Increasing use of SOI technology in IoT devices and applications), Challenges (Volatility and susceptibility of SOI-based wafers to damage caused by pressure or stress)

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the silicon on insulator market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the silicon on insulator market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the silicon on insulator market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the silicon on insulator market, such as SOITEC (France), Shin-Etsu Chemical Co., Ltd. (Japan), GlobalWafers (Taiwan), SUMCO Corporation (Japan), and Shanghai Simgui Technology Co., Ltd. (China).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.2.1 Inclusions & exclusions at company level

- 1.3.2.2 Inclusions & exclusions at wafer size level

- 1.3.2.3 Inclusions & exclusions at product level

- 1.3.2.4 Inclusions & exclusions at technology level

- 1.3.2.5 Inclusions & exclusions at application level

- 1.3.2.6 Inclusions & exclusions at wafer type level

- 1.3.2.7 Inclusions & exclusions at regional level

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STUDY LIMITATIONS

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to obtain market share using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to obtain market share using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 SUPPLY-SIDE ANALYSIS

- 2.3.2 GROWTH FORECAST

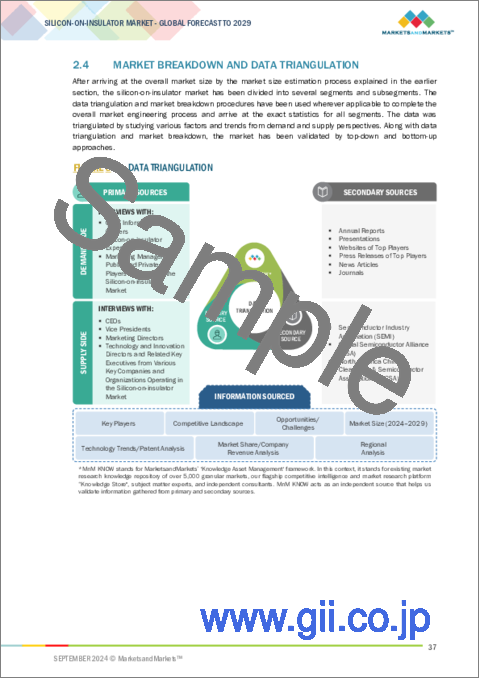

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SILICON-ON-INSULATOR MARKET

- 4.2 SILICON-ON-INSULATOR MARKET, BY APPLICATION

- 4.3 SILICON-ON-INSULATOR MARKET, BY WAFER TYPE

- 4.4 SILICON-ON-INSULATOR MARKET, BY TECHNOLOGY

- 4.5 SILICON-ON-INSULATOR MARKET, BY PRODUCT

- 4.6 SILICON-ON-INSULATOR MARKET, BY WAFER SIZE

- 4.7 ASIA PACIFIC: SILICON-ON-INSULATOR MARKET, BY APPLICATION AND COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for high-performance, energy-efficient devices

- 5.2.1.2 Adoption of 5G and IoT technologies

- 5.2.1.3 Need for miniaturization

- 5.2.1.4 Demand for electric vehicles and smart automotive systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 Global shortage of semiconductor chips

- 5.2.2.2 Availability of alternative semiconductor technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Focus on energy efficiency and sustainability

- 5.2.3.2 Ongoing technological advancements

- 5.2.4 CHALLENGES

- 5.2.4.1 Presence of device limitations

- 5.2.4.2 Complexity in process control and lack of skilled workforce

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Wafer bonding

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 SiC (Silicon Carbide)

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 POI (Piezoelectric-on-Insulator)

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY WAFER SIZE

- 5.8.2 AVERAGE SELLING PRICE TREND, BY WAFER SIZE

- 5.8.3 AVERAGE SELLING PRICE TREND FOR SILICON-ON-INSULATORS, BY REGION

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 IMPACT OF AI/GEN AI ON SILICON-ON-INSULATOR MARKET

- 5.12 CASE STUDIES

- 5.12.1 UMC UTILIZED SOITEC'S HIGH-PERFORMANCE SOI WAFER TO ADVANCE ITS TECHNOLOGICAL CAPABILITIES

- 5.12.2 GLOBALFOUNDRIES ENTERED INTO MULTIPLE LONG-TERM SUPPLY AGREEMENTS WITH SOITEC TO MAINTAIN HIGH PRODUCTION LEVELS

- 5.12.3 CHINA MOBILE INTEGRATED WITH SOITEC'S ADVANCED SOI TECHNOLOGY TO ACCELERATE 5G DEVELOPMENT EFFORTS

- 5.12.4 VTT CHOSE OKMETIC'S E-SOI WAFERS TO IMPROVE ITS PHOTONICS TECHNOLOGY

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT SCENARIO (HS CODE: 854690)

- 5.13.2 EXPORT SCENARIO (HS CODE: 854690)

- 5.14 PATENT ANALYSIS

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 STANDARDS

- 5.15.2 GOVERNMENT REGULATIONS

- 5.16 KEY CONFERENCES & EVENTS, 2024-2025

6 SILICON-ON-INSULATOR MARKET, BY WAFER SIZE

- 6.1 INTRODUCTION

- 6.2 LESS THAN OR EQUAL TO 200MM

- 6.2.1 IMPROVED STABILITY AND LOW SENSITIVITY OFFERED BY LESS THAN OR EQUAL TO 200MM SOI TO DRIVE GROWTH

- 6.3 300MM

- 6.3.1 RISING DEMAND FOR TECHNOLOGICALLY ADVANCED SOI WAFERS IN END-USE APPLICATIONS TO FUEL SEGMENT GROWTH

7 SILICON-ON-INSULATOR MARKET, BY WAFER TYPE

- 7.1 INTRODUCTION

- 7.2 RF-SOI

- 7.2.1 NEED FOR WIRELESS DATA TRANSMISSION TO INFLUENCE DEMAND FOR RF-SOI

- 7.3 POWER-SOI

- 7.3.1 DEMAND FOR ENHANCED POWER MANAGEMENT SYSTEMS TO BOOST GROWTH

- 7.4 FD-SOI

- 7.4.1 NEED FOR DEVICES WITH RELIABILITY AND HIGH PERFORMANCE TO SPUR DEMAND FOR FD-SOI

- 7.5 PD-SOI

- 7.5.1 PD-SOI WAFERS OFFER REDUCED JUNCTION CAPACITANCE, SIMPLIFIED TAP STRUCTURE, AND REDUCED SUSCEPTIBILITY TO ERRORS

- 7.6 OTHER WAFER TYPES

- 7.6.1 PHOTONICS-SOI

- 7.6.2 IMAGER-SOI

8 SILICON-ON-INSULATOR MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 SMART CUT SOI

- 8.2.1 GROWING USE OF SMART CUT TECHNOLOGY AT WAFER MANUFACTURING SITES FOR HIGH-VOLUME PRODUCTION TO BOOST MARKET

- 8.3 BONDING SOI

- 8.3.1 NEED FOR BONDING SOI TECHNOLOGY IN HIGH-TEMPERATURE, HIGH-VOLTAGE APPLICATIONS TO DRIVE MARKET

- 8.4 LAYER TRANSFER SOI

- 8.4.1 LAYER TRANSFER SOI TECHNOLOGY IS KNOWN FOR ITS HIGH-ACCURACY, THIN-FILM LAYER TRANSFER PROCESS

9 SILICON-ON-INSULATOR MARKET, BY PRODUCT

- 9.1 INTRODUCTION

- 9.2 RF FEM PRODUCTS

- 9.2.1 WIDE USAGE OF RF FEM IN SMARTPHONES TO PROPEL SEGMENT GROWTH

- 9.3 MEMS DEVICES

- 9.3.1 INCREASING USE OF SOI WAFER-BASED MEMS IN TELECOMMUNICATION TO DRIVE MARKET

- 9.4 POWER PRODUCTS

- 9.4.1 SUSTAINABILITY OF POWER PRODUCTS IN HARSH ENVIRONMENTS TO BOOST THEIR ADOPTION

- 9.5 OPTICAL COMMUNICATION DEVICES

- 9.5.1 RISING NUMBER OF DATA CENTERS TO DRIVE MARKET GROWTH

- 9.6 IMAGE SENSING PRODUCTS

- 9.6.1 APPLICATION OF SOI TECHNOLOGY IN THIN CIS CHIP DEVELOPMENT AND FACIAL RECOGNITION TO DRIVE GROWTH

10 SILICON-ON-INSULATOR MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 CONSUMER ELECTRONICS

- 10.2.1 RISING TECHNOLOGICAL ADVANCEMENTS AND NEED FOR SOI IN MOBILE AND PORTABLE DEVICES TO DRIVE MARKET

- 10.3 AUTOMOTIVE

- 10.3.1 GROWING DEMAND FOR COMFORT, CONVENIENCE, AND SECURITY IN AUTOMOBILES TO BOOST MARKET

- 10.4 DATACOM & TELECOM

- 10.4.1 GROWING EMPHASIS ON USING SOI IN FIBER-OPTIC CONNECTIONS TO BOOST GROWTH

- 10.5 INDUSTRIAL

- 10.5.1 INNOVATION IN EVOLVING INDUSTRIAL SYSTEMS TO BOLSTER GROWTH OF SOI WAFERS

- 10.6 MILITARY, DEFENSE, AND AEROSPACE

- 10.6.1 NEED FOR ENHANCED COMMUNICATION IN MILITARY, DEFENSE, AND AEROSPACE SECTORS TO DRIVE ADOPTION OF SOI-BASED WAFERS

11 SILICON-ON-INSULATOR MARKET, BY THICKNESS

- 11.1 THIN-FILM SOI WAFERS (THICKNESS UP TO 1µM)

- 11.2 THICK-FILM SOI WAFERS (THICKNESS BETWEEN 1µM AND 3µM)

12 SILICON-ON-INSULATOR MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK

- 12.2.2 US

- 12.2.2.1 Increasing focus on production of SOI technology to fuel growth

- 12.2.3 CANADA

- 12.2.3.1 Growing advancements in photonic industry to drive growth

- 12.2.4 MEXICO

- 12.2.4.1 Increased demand for RF-SOI devices to spur market growth

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK

- 12.3.2 FRANCE

- 12.3.2.1 Rising focus on research and development of SOI technology to fuel market growth

- 12.3.3 UK

- 12.3.3.1 Increased demand for IoT and 5G technologies to drive adoption of SOI

- 12.3.4 GERMANY

- 12.3.4.1 Adoption of SOI wafers in automotive sector to drive market

- 12.3.5 ITALY

- 12.3.5.1 Rapid innovation and technological advancements to propel growth

- 12.3.6 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK

- 12.4.2 CHINA

- 12.4.2.1 Growing demand for consumer electronics to drive adoption of SOI technology

- 12.4.3 JAPAN

- 12.4.3.1 Presence of well-established market players to spur demand for SOI technology

- 12.4.4 TAIWAN

- 12.4.4.1 Increasing demand for 5G technologies to spur growth

- 12.4.5 REST OF ASIA PACIFIC

- 12.5 REST OF THE WORLD (ROW)

- 12.5.1 MACROECONOMIC OUTLOOK

- 12.5.2 MIDDLE EAST & AFRICA

- 12.5.2.1 Growth in initiatives and improved focus on medical technologies to drive growth

- 12.5.2.2 GCC countries

- 12.5.2.3 Rest of Middle East & Africa

- 12.5.3 SOUTH AMERICA

- 12.5.3.1 Growing emphasis on adoption of solar energy to bolster innovation in SOI technology

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 13.3 MARKET SHARE ANALYSIS, 2023

- 13.4 REVENUE ANALYSIS, 2019-2023

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 13.6.5.1 Company footprint

- 13.6.5.2 Region footprint

- 13.6.5.3 Wafer size footprint

- 13.6.5.4 Wafer type footprint

- 13.6.5.5 Technology footprint

- 13.6.5.6 Product footprint

- 13.6.5.7 Application footprint

- 13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 13.7.5.1 Detailed list of startups/SMEs

- 13.7.5.2 Competitive benchmarking of startups/SMEs

- 13.8 BRAND/PRODUCT COMPARISON

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSION

- 13.9.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 SOITEC

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.3.2 Expansion

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 SHIN-ETSU CHEMICAL CO., LTD.

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.3.2 Expansion

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses/Competitive threats

- 14.1.3 GLOBALWAFERS

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.3.2 Expansion

- 14.1.3.3.3 Other developments

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses/Competitive threats

- 14.1.4 SUMCO CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 MnM view

- 14.1.4.3.1 Key strengths/Right to win

- 14.1.4.3.2 Strategic choices

- 14.1.4.3.3 Weaknesses/Competitive threats

- 14.1.5 SHANGHAI SIMGUI TECHNOLOGY CO., LTD.

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MnM view

- 14.1.5.3.1 Key strengths/Right to win

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses/Competitive threats

- 14.1.6 GLOBALFOUNDRIES

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Products/Service launches

- 14.1.6.3.2 Deals

- 14.1.7 STMICROELECTRONICS

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Products/Services launches

- 14.1.7.3.2 Deals

- 14.1.8 TOWER SEMICONDUCTOR

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.9 SILICON VALLEY MICROELECTRONICS, INC.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.10 WAFERPRO

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.1 SOITEC

- 14.2 OTHER PLAYERS

- 14.2.1 NANOGRAFI NANO TECHNOLOGY

- 14.2.2 OKMETIC

- 14.2.3 PRECISION MICRO-OPTICS INC.

- 14.2.4 UNITED MICROELECTRONICS CORPORATION

- 14.2.5 ULTRASIL LLC

- 14.2.6 PLUTOSEMI CO., LTD

- 14.2.7 NXP SEMICONDUCTORS

- 14.2.8 MURATA MANUFACTURING CO., LTD.

- 14.2.9 ICEMOS TECHNOLOGY LTD.

- 14.2.10 PROLYX MICROELECTRONICS PRIVATE LIMITED

- 14.2.11 NOVA ELECTRONIC MATERIALS, LLC

- 14.2.12 VANGUARD INTERNATIONAL SEMICONDUCTOR CORPORATION

- 14.2.13 ROGUE VALLEY MICRODEVICES

- 14.2.14 SOKA TECHNOLOGY

- 14.2.15 ADVANCED MICRO FOUNDRY PTE LTD

15 APPENDIX

- 15.1 KEY INSIGHTS BY INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS