|

|

市場調査レポート

商品コード

1331463

AIOpsプラットフォームの世界市場:オファリング別(プラットフォーム(ドメインセントリック、ドメインアグノスティック)、サービス別(プロフェッショナル、マネージド))、用途別、展開モード別、業界別、地域別-2028年までの予測AIOps Platform Market by Offering (Platforms (Domain-centric, Domain-agnostic), Services (Professional, Managed)), Application (Infrastructure Management, ITSM, Security & Event Management), Deployment Mode, Vertical and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| AIOpsプラットフォームの世界市場:オファリング別(プラットフォーム(ドメインセントリック、ドメインアグノスティック)、サービス別(プロフェッショナル、マネージド))、用途別、展開モード別、業界別、地域別-2028年までの予測 |

|

出版日: 2023年08月08日

発行: MarketsandMarkets

ページ情報: 英文 336 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のAIOpsプラットフォームの市場規模は、2023年の117億米ドルから2028年には324億米ドルに成長し、予測期間中のCAGRは22.7%になると予測されています。

AIOpsプラットフォーム市場の成長は、いくつかの重要な要因によって牽引されています。デジタル時代におけるITインフラの複雑化により、効率的な管理と監視のための高度なAI主導型ソリューションが必要とされています。組織はAIOpsを採用して多様なシステムをリアルタイムで可視化し、事前のインシデント解決とサービスの信頼性向上に役立てています。さらに、クラウドサービスとハイブリッド環境に対する需要の高まりは、企業がリソース割り当てを最適化し、シームレスなパフォーマンスを確保しようとしているため、AIOpsの採用をさらに後押ししています。さらに、データ主導の意思決定というトレンドの高まりは、膨大な量のデータを分析し、予測的な洞察を提供して運用効率を向上させるAIOpsの能力の重要性を強調しています。こうした促進要因により、AIOpsプラットフォームはIT管理とパフォーマンス最適化の最前線に位置付けられ、市場の成長と注目を集めることになります。

BFSI部門は、IT運用を最適化し、ビジネスパフォーマンスを強化するためにAIOpsプラットフォームを採用しています。AIOpsはリアルタイムの監視、不正検知、予測分析を可能にし、セキュリティ、業務効率、顧客体験を向上させます。タスクを自動化し、データに基づく洞察を提供することで、AIOpsはBFSI組織が十分な情報に基づいた意思決定を行い、規制コンプライアンスを確保するのに役立ちます。AIOpsの統合により、リスク管理が強化され、ダウンタイムが最小限に抑えられ、プロアクティブなメンテナンスが容易になるため、競争力を維持し、顧客により良いサービスを提供しようとする現代の金融機関にとって、貴重なツールとなります。

ITサービス管理(ITSM)は、その機能を強化し、IT運用を合理化するために、AIOpsプラットフォームの採用が増加しています。AIOpsをITSMプロセスに統合することで、インテリジェントな自動化、リアルタイムの分析、予測的洞察が可能になり、従来のITSM業務に革命をもたらします。AIOpsプラットフォームは、AIとMLアルゴリズムを活用して、ログ、メトリクス、監視ツールなど、さまざまなITソースからの膨大なデータを分析し、プロアクティブな問題管理と迅速なインシデント解決を可能にします。ルーチン・タスクを自動化し、インテリジェントなレコメンデーションを提供することで、AIOpsはITSMの効率を高め、手作業を減らし、全体的なサービス・デリバリーを改善します。ITSMチームはAIOpsを活用することで、データ主導の意思決定、リソース配分の最適化、サービスの信頼性向上を実現し、最終的には顧客体験の向上につなげることができます。

プラットフォームセグメントは、データ集約、分析、機械学習、自動化、視覚化などのAI戦略を組み合わせた包括的なソリューションであるため、AIOpsプラットフォーム市場で最大の市場シェアを占めると予測されます。一元化された柔軟な機能を提供するAIOpsプラットフォームは、さまざまなソースからのIT運用データを効率的に管理することで、さまざまな組織のニーズに適応し、その普及に貢献しています。

北米がAIOpsプラットフォーム市場で最大のシェアを占めると推定されます。北米では、デジタルトランスフォーメーションとクラウドの導入が重視されていることから、AIOpsプラットフォームへの投資が大きく伸びています。大企業から新興企業まで、さまざまな分野の企業が、複雑なIT環境を最適化し、デジタルイニシアチブをサポートするAIOpsの価値を認識しています。この地域の強力なAIとMLの研究エコシステムは、AIOpsの進歩を加速させ、ハイテク大手やベンチャーキャピタルからの投資を誘致しています。AIOpsプラットフォームは、IT運用を改善し、顧客体験を向上させ、データ主導の意思決定を促進することで、競争優位性を提供します。北米の企業がITパフォーマンスと業務効率の向上を目指し、AIOpsをデジタル革新の最前線に位置付けているため、革新的な新興企業の存在が投資をさらに促進しています。

当レポートでは、世界のAIOpsプラットフォーム市場について調査し、オファリング別、サービス別、用途別、展開モード別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- AIOpsプラットフォームのアーキテクチャ

- AIOpsとMLOPsの違い

- AIOpsプラットフォームの進化

- AIOpsプラットフォーム市場エコシステム

- ケーススタディ分析

- サプライチェーン分析

- ポーターのファイブフォース分析

- 価格モデルの分析

- 特許分析

- 2023年から2024年の主要な会議とイベント

- 関税と規制状況

- 主要な利害関係者と購入基準

- AIOpsプラットフォーム市場の購入者/クライアントに影響を与える動向/混乱

- AIOpsプラットフォーム実装のベストプラクティス

- AIOpsプラットフォーム市場の技術ロードマップ

- AIOpsプラットフォーム市場のビジネスモデル

- AIOpsプラットフォームの機能

- AIOpsプラットフォームの主要な段階

- AIOpsプラットフォームの成熟度のレベル

第6章 AIOpsプラットフォーム市場、オファリング別

- イントロダクション

- プラットフォーム

- サービス

第7章 AIOpsプラットフォーム市場、サービス別

- イントロダクション

- プロフェッショナルサービス

- マネージドサービス

第8章 AIOpsプラットフォーム市場、展開モード別

- イントロダクション

- クラウド

- オンプレミス

第9章 AIOpsプラットフォーム市場、用途別

- イントロダクション

- インフラストラクチャ管理

- ITSM

- セキュリティとイベント管理

第10章 AIOpsプラットフォーム市場、業界別

- イントロダクション

- BFSI

- 小売と電子商取引

- 輸送と物流

- 政府と防衛

- ヘルスケアとライフサイエンス

- テレコム

- エネルギーと公共事業

- 製造業

- IT/ITE

- メディアとエンターテイメント

- その他

第11章 AIOpsプラットフォーム市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

The global market for AIOps Platform is projected to grow from USD 11.7 billion in 2023 to USD 32.4 billion by 2028, at a CAGR of 22.7% during the forecast period. The growth of the AIOps platform market is being driven by several key factors. The increasing complexity of IT infrastructures in the digital era necessitates advanced AI-driven solutions for efficient management and monitoring. Organizations are adopting AIOps to gain real-time visibility into their diverse systems, leading to proactive incident resolution and enhanced service reliability. Additionally, the rising demand for cloud services and hybrid environments further fuels the adoption of AIOps, as businesses seek to optimize resource allocation and ensure seamless performance. Furthermore, the growing trend of data-driven decision-making underscores the importance of AIOps' ability to analyze vast data volumes and deliver predictive insights for improved operational efficiency. These driving factors position AIOps platforms at the forefront of IT management and performance optimization, propelling their market growth and prominence.

The BFSI vertical is projected to be the largest market during the forecast period

The BFSI sector is adopting AIOps platforms to optimize IT operations and enhance business performance. AIOps enables real-time monitoring, fraud detection, and predictive analytics, improving security, operational efficiency, and customer experiences. By automating tasks and providing data-driven insights, AIOps helps BFSI organizations make informed decisions and ensure regulatory compliance. The integration of AIOps enhances risk management, minimizes downtime, and facilitates proactive maintenance, making it a valuable tool for modern financial institutions seeking to stay competitive and provide better services to their customers.

Among application, ITSM segment is registered to grow at the highest CAGR during the forecast period

IT Service Management (ITSM) is increasingly adopting AIOps platforms to enhance its capabilities and streamline IT operations. AIOps integration into ITSM processes enables intelligent automation, real-time analytics, and predictive insights, revolutionizing traditional ITSM practices. AIOps platforms leverage AI and ML algorithms to analyze vast amounts of data from various IT sources, such as logs, metrics, and monitoring tools, enabling proactive problem management and faster incident resolution. By automating routine tasks and offering intelligent recommendations, AIOps enhances ITSM efficiency, reduces manual efforts, and improves overall service delivery. ITSM teams can leverage AIOps to make data-driven decisions, optimize resource allocation, and ensure better service reliability, ultimately leading to enhanced customer experiences.

Among offering, platform segment is anticipated to account for the largest market share during the forecast period

The platforms segment is expected to hold the largest market share in the AIOps platform market due to its comprehensive solutions, incorporating a combination of AI strategies such as data aggregation, analytics, machine learning, automation, and visualization. Offering centralized and flexible capabilities, AIOps platforms efficiently manage IT operations data from various sources, making them adaptable to different organizations' needs and contributing to their widespread adoption.

North America to account for the largest market size during the forecast period

North America is estimated to account for the largest share of the AIOps Platform market. In North America, investments in AIOps platforms have seen significant growth driven by the region's emphasis on digital transformation and cloud adoption. Businesses across various sectors, from large enterprises to startups, recognize the value of AIOps in optimizing complex IT environments and supporting digital initiatives. The region's strong AI and ML research ecosystem accelerates AIOps advancements, attracting investments from tech giants and venture capitalists. AIOps platforms offer a competitive edge by improving IT operations, enhancing customer experiences, and facilitating data-driven decision-making. The presence of innovative startups further fuels investment, as North American organizations aim to boost IT performance and operational efficiency, positioning AIOps at the forefront of digital innovation.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the AIOps Platform market.

- By Company: Tier I: 35%, Tier II: 45%, and Tier III: 20%

- By Designation: C-Level Executives: 35%, Directors: 25%, and Others: 40%

- By Region: North America: 40%, Europe: 20%, APAC: 30%, MEA: 5%, Latin America: 5%

Major vendors offering AIOps Platform solutions and services across the globe are IBM (US), Splunk (US), Broadcom (US), OpenText (Canada), Dynatrace (US), Cisco (US), HCL Technologies (India), Elastic (US), ServiceNow (US), HPE (US), Datadog (US), New Relic (US), SolarWinds (US), BMC Software (US), ScienceLogic (US), BigPanda (US), LogicMonitor (US), Sumo Logic (US), Moogsoft (US), Resolve Systems (US), AIMS Innovation (Norway), Interlink Software (UK), CloudFabrix (US), PagerDuty (US), Aisera (US), ManageEngine (US), Digitate (US), ZIF.ai (US), Autointelli (India), UST (US), Freshworks (US), Everbridge (US), StackState (US), Logz.io (US).

Research Coverage

The market study covers AIOps Platform across segments. It aims at estimating the market size and the growth potential across different segments, such as offering, application, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market for AIOps Platform and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising complexity and hybridization of IT environments, Streamlining IT operation for digital transformation through AI and automation, Growing demand for real-time monitoring, proactive incident response, and predictive analytic), restraints (Growing changes in the IT operations, Addressing data quality and availability in AIOps implementation), opportunities (Rising demand to enhance automation and increased business innovation, Growing demand for increased security threats mitigation and compliance requirements), and challenges (Lack of skilled personnel, Lack of transparency and explainability) influencing the growth of the AIOps Platform market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the AIOps Platform market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the AIOps Platform market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in AIOps Platform market strategies; the report also helps stakeholders understand the pulse of the AIOps Platform market and provides them with information on key market drivers, restraints, challenges, and opportunities

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as IBM (US), Splunk (US), Dynatrace (US), Cisco (US), Datadog (US), New Relic (US), and others in the AIOps Platform market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATE, 2020-2022

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 AIOPS PLATFORM MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- TABLE 2 PRIMARY INTERVIEWS

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 AIOPS PLATFORM MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE), REVENUE FROM SOLUTIONS/SERVICES OF AIOPS PLATFORM

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2, BOTTOM-UP (SUPPLY-SIDE), COLLECTIVE REVENUE FROM ALL SOLUTIONS/ SERVICES OF AIOPS PLATFORM

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3, BOTTOM-UP (SUPPLY-SIDE), COLLECTIVE REVENUE FROM ALL SOLUTIONS/ SERVICES OF AIOPS PLATFORM

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4, BOTTOM-UP (DEMAND-SIDE), SHARE OF AIOPS PLATFORM THROUGH OVERALL AIOPS PLATFORM SPENDING

- 2.4 MARKET FORECAST

- TABLE 3 FACTOR ANALYSIS

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 IMPLICATION OF RECESSION ON GLOBAL AIOPS PLATFORM MARKET

3 EXECUTIVE SUMMARY

- TABLE 4 GLOBAL AIOPS PLATFORM MARKET AND GROWTH RATE, 2017-2022 (USD MILLION, Y-O-Y%)

- TABLE 5 GLOBAL AIOPS PLATFORM MARKET AND GROWTH RATE, 2023-2028 (USD BILLION, Y-O-Y%)

- FIGURE 8 PLATFORM SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET IN 2023

- FIGURE 9 PROFESSIONAL SERVICES SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 10 CONSULTING SERVICES SEGMENT TO DOMINATE MARKET IN 2023

- FIGURE 11 MANAGED CLOUD SERVICES SEGMENT ESTIMATED TO ACCOUNT FOR LARGER MARKET SIZE IN 2023

- FIGURE 12 CLOUD SEGMENT ESTIMATED TO DOMINATE MARKET IN 2023

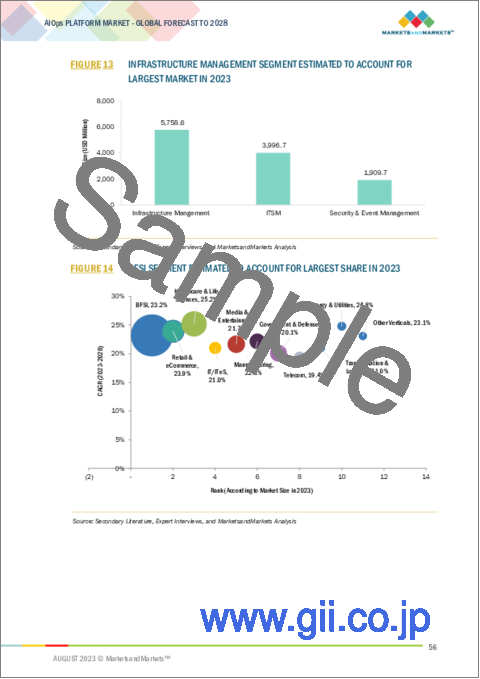

- FIGURE 13 INFRASTRUCTURE MANAGEMENT SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST MARKET IN 2023

- FIGURE 14 BFSI SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 15 NORTH AMERICA MARKET ESTIMATED TO ACCOUNT FOR LARGEST SHARE IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN AIOPS PLATFORM MARKET

- FIGURE 16 RISING INVESTMENTS IN AIOPS PLATFORM RESEARCH AND DEVELOPMENT TO DRIVE MARKET GROWTH

- 4.2 OVERVIEW OF RECESSION IN GLOBAL AIOPS PLATFORM MARKET

- FIGURE 17 AIOPS PLATFORM MARKET TO WITNESS MINOR DECLINE IN Y-O-Y GROWTH IN 2023

- 4.3 AIOPS PLATFORM MARKET, BY KEY APPLICATIONS, 2022-2028

- FIGURE 18 INFRASTRUCTURE MANAGEMENT SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST MARKET

- 4.4 AIOPS PLATFORM MARKET, BY APPLICATIONS AND KEY VERTICALS, 2023

- FIGURE 19 INFRASTRUCTURE MANAGEMENT AND BFSI SEGMENTS ESTIMATED TO ACCOUNT FOR SIGNIFICANT MARKET SHARE

- 4.5 AIOPS PLATFORM MARKET, BY REGION, 2023

- FIGURE 20 NORTH AMERICA ESTIMATED TO DOMINATE AIOPS PLATFORM MARKET IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: AIOPS PLATFORM MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Rising complexity and hybridization of IT environments

- 5.2.1.2 Streamlining IT operations for digital transformation through AI and automation

- 5.2.1.3 Growing demand for real-time monitoring, proactive incident response, and predictive analytics

- 5.2.2 RESTRAINTS

- 5.2.2.1 Growing changes in IT operations

- 5.2.2.2 Insufficient or poor-quality data adversely impact accuracy and reliability of AIOps algorithms

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand to enhance automation and increased business innovation

- 5.2.3.2 Growing demand for mitigating security threats and meeting compliance requirements

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of skilled personnel

- 5.2.4.2 Lack of transparency and explainability

- 5.3 ARCHITECTURE OF AIOPS PLATFORM

- 5.4 DIFFERENCE BETWEEN AIOPS AND MLOPS

- 5.5 EVOLUTION OF AIOPS PLATFORM

- FIGURE 22 EVOLUTION OF AIOPS PLATFORM

- 5.6 AIOPS PLATFORM MARKET ECOSYSTEM

- FIGURE 23 AIOPS PLATFORM ECOSYSTEM

- TABLE 6 AIOPS PLATFORM MARKET: PLATFORM PROVIDERS

- TABLE 7 AIOPS PLATFORM MARKET: SERVICE PROVIDERS

- TABLE 8 AIOPS PLATFORM MARKET: CLOUD PROVIDERS

- TABLE 9 AIOPS PLATFORM MARKET: END USERS

- TABLE 10 AIOPS PLATFORM MARKET: REGULATORY BODIES

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 RETAIL & E-COMMERCE

- 5.7.1.1 Coty leverages AIOps platform from Broadcom to manage IT operations

- 5.7.2 TELECOM

- 5.7.2.1 Vodafone adopted OpenText Operations Bridge to focus on root cause analysis and automate incident resolution

- 5.7.3 BFSI

- 5.7.3.1 ServiceNow helps DNB improve its IT environment visibility

- 5.7.4 IT/ITES

- 5.7.4.1 OpsRamp enables Tietoevry to manage multi-cloud environments

- 5.7.5 HEALTHCARE & LIFE SCIENCE

- 5.7.5.1 Cambia Health Solutions leverages BigPanda's AIOps solution to identify actionable incidents for priority resolution

- 5.7.1 RETAIL & E-COMMERCE

- 5.8 SUPPLY CHAIN ANALYSIS

- FIGURE 24 SUPPLY CHAIN ANALYSIS: AIOPS PLATFORM MARKET

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Machine learning

- 5.8.1.2 Big data

- 5.8.1.3 Causal AI

- 5.8.1.4 Natural language processing

- 5.8.2 ADJACENT TECHNOLOGIES

- 5.8.2.1 Cloud computing

- 5.8.2.2 IoT

- 5.8.2.3 Predictive analytics

- 5.8.2.4 MLOps

- 5.8.2.5 DevOps

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 BARGAINING POWER OF SUPPLIERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 PRICING MODEL ANALYSIS

- 5.10.1 INDICATIVE PRICING ANALYSIS, BY PLATFORM

- TABLE 12 PRICING ANALYSIS OF AIOPS PLATFORM PROVIDERS

- 5.10.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION

- TABLE 13 AVERAGE SELLING PRICE ANALYSIS OF AIOPS PLATFORM PROVIDERS, BY APPLICATION

- 5.11 PATENT ANALYSIS

- 5.11.1 METHODOLOGY

- 5.11.2 DOCUMENT TYPE

- TABLE 14 PATENTS FILED, 2013-2023

- 5.11.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 26 TOTAL NUMBER OF PATENTS GRANTED, 2013-2023

- 5.11.3.1 Top applicants

- FIGURE 27 TOP COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2013-2023

- TABLE 15 TOP 12 PATENT OWNERS, 2013-2023

- TABLE 16 LIST OF PATENTS IN AIOPS PLATFORM MARKET, 2022-2023

- 5.12 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 17 DETAILED LIST OF CONFERENCES & EVENTS, 2023-2024

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 NORTH AMERICA

- 5.13.2.1 US

- 5.13.2.1.1 California Consumer Privacy Act (CCPA)

- 5.13.2.1.2 Health Insurance Portability and Accountability Act (HIPAA)

- 5.13.2.1.3 Artificial Intelligence Risk Management Framework 1.0 (RMF)

- 5.13.2.2 Canada

- 5.13.2.2.1 Public Safety Canada regulation

- 5.13.2.1 US

- 5.13.3 EUROPE

- 5.13.3.1 General Data Protection Regulation (GDPR)

- 5.13.3.2 EU regulatory framework for AI

- 5.13.4 ASIA PACIFIC

- 5.13.4.1 South Korea

- 5.13.4.1.1 Personal Information Protection Act ("PIPA")

- 5.13.4.2 China

- 5.13.4.3 India

- 5.13.4.1 South Korea

- 5.13.5 MIDDLE EAST & AFRICA

- 5.13.5.1 UAE

- 5.13.5.1.1 UAE AI regulations

- 5.13.5.2 KSA

- 5.13.5.2.1 Saudi Arabia AI Strategy

- 5.13.5.3 Bahrain

- 5.13.5.3.1 Bahrain AI Ethics Framework

- 5.13.5.1 UAE

- 5.13.6 LATIN AMERICA

- 5.13.6.1 Brazil

- 5.13.6.1.1 Brazil's General Data Protection Law

- 5.13.6.2 Mexico

- 5.13.6.2.1 Mexico's National Artificial Intelligence Strategy

- 5.13.6.1 Brazil

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.14.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 23 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.15 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS IN AIOPS PLATFORM MARKET

- FIGURE 30 AIOPS PLATFORM MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- 5.16 BEST PRACTICES IN IMPLEMENTING AIOPS PLATFORM

- 5.17 TECHNOLOGY ROADMAP OF AIOPS PLATFORM MARKET

- 5.18 BUSINESS MODELS OF AIOPS PLATFORM MARKET

- 5.19 FUNCTIONS OF AIOPS PLATFORMS

- 5.20 KEY STAGES OF AIOPS PLATFORM

- 5.21 LEVELS OF AIOPS PLATFORM MATURITY

6 AIOPS PLATFORM MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: AIOPS PLATFORM MARKET DRIVERS

- FIGURE 31 SERVICES SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 24 AIOPS PLATFORM MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 25 AIOPS PLATFORM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 PLATFORMS

- 6.2.1 RISING DEMAND FOR CONTINUOUS ANALYSIS OF DATA TO BOOST MARKET

- TABLE 26 PLATFORMS: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 27 PLATFORMS: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2 DOMAIN-CENTRIC AIOPS

- 6.2.2.1 Rising need for streamlining workflows with domain-specific data models to boost market

- 6.2.2.2 Monitoring-centric AIOps

- 6.2.2.3 ITSM-centric AIOps

- 6.2.2.4 Data-lake-centric AIOps

- 6.2.3 DOMAIN-AGNOSTIC AIOPS

- 6.2.3.1 Ability to work seamlessly across domains to fuel market

- 6.3 SERVICES

- 6.3.1 RISING DEMAND FOR INTEGRATION OF DIVERSE IT SOLUTIONS WITHIN ENTERPRISE ECOSYSTEM TO PROPEL MARKET

- TABLE 28 SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 29 SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

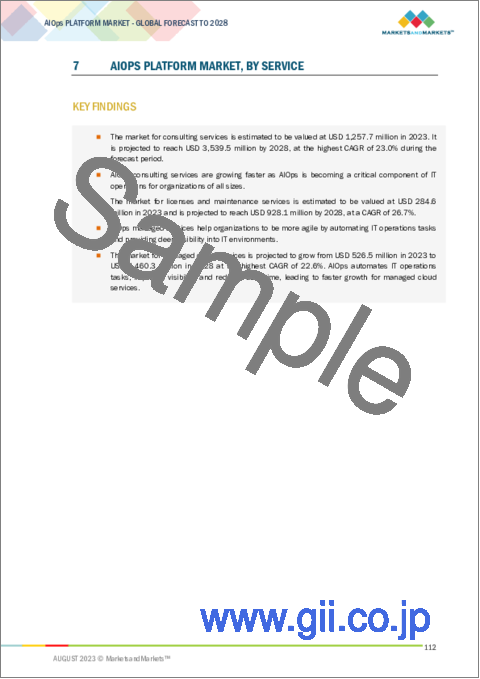

7 AIOPS PLATFORM MARKET, BY SERVICE

- 7.1 INTRODUCTION

- 7.1.1 SERVICES: AIOPS PLATFORM MARKET DRIVERS

- FIGURE 32 MANAGED SERVICES SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 30 AIOPS PLATFORM MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 31 AIOPS PLATFORM MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 7.2 PROFESSIONAL SERVICES

- 7.2.1 GROWING DEMAND TO MEET SPECIFIC ORGANIZATIONAL NEEDS TO FUEL MARKET GROWTH

- FIGURE 33 LICENSES & MAINTENANCE SERVICES SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 32 AIOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2017-2022 (USD MILLION)

- TABLE 33 AIOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2023-2028 (USD MILLION)

- TABLE 34 PROFESSIONAL SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 35 PROFESSIONAL SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.2 CONSULTING SERVICES

- TABLE 36 CONSULTING SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 37 CONSULTING SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.3 IMPLEMENTATION SERVICES

- TABLE 38 IMPLEMENTATION SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 39 IMPLEMENTATION SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.4 TRAINING & EDUCATION SERVICES

- TABLE 40 TRAINING & EDUCATION SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 41 TRAINING & EDUCATION SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.5 LICENSES & MAINTENANCE SERVICES

- TABLE 42 LICENSES & MAINTENANCE SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 43 LICENSES & MAINTENANCE SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 MANAGED SERVICES

- 7.3.1 RISING DEMAND FOR EXPERT ASSISTANCE TO ENSURE SEAMLESS AIOPS TO DRIVE MARKET

- TABLE 44 AIOPS PLATFORM MARKET, BY MANAGED SERVICES, 2017-2022 (USD MILLION)

- TABLE 45 AIOPS PLATFORM MARKET, BY MANAGED SERVICES, 2023-2028 (USD MILLION)

- TABLE 46 MANAGED SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 47 MANAGED SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.2 MANAGED CLOUD SERVICES

- TABLE 48 MANAGED CLOUD SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 49 MANAGED CLOUD SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.3 MANAGED SECURITY SERVICES

- TABLE 50 MANAGED SECURITY SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 51 MANAGED SECURITY SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.4 MANAGED NETWORK SERVICES

- TABLE 52 MANAGED NETWORK SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 53 MANAGED NETWORK SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.5 MANAGED AUTOMATION SERVICES

- TABLE 54 MANAGED AUTOMATION SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 55 MANAGED AUTOMATION SERVICES: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

8 AIOPS PLATFORM MARKET, BY DEPLOYMENT MODE

- 8.1 INTRODUCTION

- 8.1.1 DEPLOYMENT MODE: AIOPS PLATFORM MARKET DRIVERS

- FIGURE 34 ON-PREMISES SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 56 AIOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 57 AIOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- 8.2 CLOUD

- 8.2.1 ABILITY TO SIMPLIFY UPDATES AND REDUCE BURDEN ON BUSINESSES TO BOOST MARKET

- TABLE 58 CLOUD: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 59 CLOUD: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 60 AIOPS PLATFORM MARKET, BY CLOUD TYPE, 2017-2022 (USD MILLION)

- TABLE 61 AIOPS PLATFORM MARKET, BY CLOUD TYPE, 2023-2028 (USD MILLION)

- 8.2.2 PUBLIC CLOUD

- TABLE 62 PUBLIC CLOUD: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 63 PUBLIC CLOUD: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.3 PRIVATE CLOUD

- TABLE 64 PRIVATE CLOUD: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 65 PRIVATE CLOUD: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.4 HYBRID CLOUD

- TABLE 66 HYBRID CLOUD: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 67 HYBRID CLOUD: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 ON-PREMISES

- 8.3.1 GROWING NEED TO OFFER CONTROL AND SECURITY TO PROPEL MARKET GROWTH

- TABLE 68 ON-PREMISES: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 69 ON-PREMISES: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

9 AIOPS PLATFORM MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.1.1 APPLICATION: AIOPS PLATFORM MARKET DRIVERS

- FIGURE 35 ITSM SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 70 AIOPS PLATFORM MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 71 AIOPS PLATFORM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.2 INFRASTRUCTURE MANAGEMENT

- 9.2.1 ABILITY TO HANDLE COMPLEX AND DISTRIBUTED INFRASTRUCTURE TO DRIVE MARKET

- TABLE 72 INFRASTRUCTURE MANAGEMENT: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 73 INFRASTRUCTURE MANAGEMENT: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2.2 ANOMALY DETECTION AND ROOT CAUSE ANALYSIS

- 9.2.3 AUTOMATED INCIDENT MANAGEMENT

- 9.2.4 CAPACITY PLANNING AND OPTIMIZATION

- 9.2.5 PERFORMANCE MONITORING AND OPTIMIZATION

- 9.2.6 SERVER MONITORING AND MANAGEMENT

- 9.2.7 STORAGE MONITORING AND MANAGEMENT

- 9.2.8 APPLICATION PERFORMANCE MONITORING

- 9.2.9 NETWORK MONITORING

- 9.2.9.1 Network performance monitoring

- 9.2.9.2 Network traffic analysis

- 9.2.9.3 Network security management

- 9.2.9.4 Self-healing IT systems

- 9.3 ITSM

- 9.3.1 ABILITY TO AUTOMATE ROUTINE TASKS TO DRIVE ADOPTION OF AIOPS PLATFORMS

- TABLE 74 ITSM: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 75 ITSM: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3.2 SERVICE LEVEL MANAGEMENT

- 9.3.3 CONFIGURATION MANAGEMENT

- 9.3.4 ACTIONABLE INTELLIGENCE

- 9.3.5 IT ASSET MANAGEMENT

- 9.3.6 SERVICE DESK AUTOMATION (CHATBOT)

- 9.4 SECURITY & EVENT MANAGEMENT

- 9.4.1 RISING NEED TO PROACTIVELY DETECT THREAT TO PROPEL ADOPTION OF AIOPS PLATFORMS

- TABLE 76 SECURITY & EVENT MANAGEMENT: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 77 SECURITY & EVENT MANAGEMENT: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4.2 SECURITY INCIDENT AND EVENT MANAGEMENT (SIEM)

- 9.4.3 THREAT INTELLIGENCE AND DETECTION

- 9.4.4 SECURITY AUTOMATION AND ORCHESTRATION

- 9.4.5 SECURITY EVENT CORRELATION

- 9.4.6 USER AND ENTITY BEHAVIOR ANALYTICS

- 9.4.7 VULNERABILITY MANAGEMENT

10 AIOPS PLATFORM MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.1.1 VERTICAL: AIOPS PLATFORM MARKET DRIVERS

- FIGURE 36 HEALTHCARE & LIFE SCIENCES SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 78 AIOPS PLATFORM MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 79 AIOPS PLATFORM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.2 BFSI

- 10.2.1 GROWING NEED TO IMPROVE QUALITY OF FINANCIAL SERVICES TO BOOST MARKET

- TABLE 80 BFSI: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 81 BFSI: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 RETAIL & ECOMMERCE

- 10.3.1 NEED TO STREAMLINE OPERATIONS AND ENHANCE CUSTOMER EXPERIENCES TO BOOST MARKET

- TABLE 82 RETAIL & ECOMMERCE: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 83 RETAIL & ECOMMERCE: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 TRANSPORTATION & LOGISTICS

- 10.4.1 ABILITY TO PREDICT DELAYS AND ADJUST ROUTES TO FUEL GROWTH OF MARKET

- TABLE 84 TRANSPORTATION & LOGISTICS: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 85 TRANSPORTATION & LOGISTICS: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5 GOVERNMENT & DEFENSE

- 10.5.1 RISING NEED TO IMPROVE SECURITY AND DECISION-MAKING TO FUEL ADOPTION OF AIOPS PLATFORMS

- TABLE 86 GOVERNMENT & DEFENSE: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 87 GOVERNMENT & DEFENSE: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.6 HEALTHCARE & LIFESCIENCES

- 10.6.1 GROWING NEED TO ENHANCE PATIENT CARE AND MEDICAL ADVANCEMENTS TO PROPEL MARKET

- TABLE 88 HEALTHCARE & LIFE SCIENCES: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 89 HEALTHCARE & LIFE SCIENCES: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.7 TELECOM

- 10.7.1 GROWING NEED TO OPTIMIZE NETWORK PERFORMANCE TO DRIVE MARKET

- TABLE 90 TELECOM: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 91 TELECOM: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.8 ENERGY & UTILITIES

- 10.8.1 ABILITY TO REDUCE MANUAL INTERVENTION AND STREAMLINE PROCESSES TO BOOST MARKET

- TABLE 92 ENERGY & UTILITIES: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 93 ENERGY & UTILITIES: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.9 MANUFACTURING

- 10.9.1 RISING NEED TO BOOST EFFICIENCY AND QUALITY WITH ADVANCED ANALYTICS TO DRIVE MARKET

- TABLE 94 MANUFACTURING: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 95 MANUFACTURING: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.10 IT/ITES

- 10.10.1 RISING OPPORTUNITIES TO ENHANCE SERVICE RELIABILITY IN DYNAMIC IT LANDSCAPE TO BOOST MARKET

- TABLE 96 IT/ITES: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 97 IT/ITES: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.11 MEDIA & ENTERTAINMENT

- 10.11.1 RISING NEED TO DELIVER HIGH-QUALITY CONTENT TO AUDIENCES TO DRIVE MARKET

- TABLE 98 MEDIA & ENTERTAINMENT: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 99 MEDIA & ENTERTAINMENT: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.12 OTHER VERTICALS

- 10.12.1 GROWING DEMAND FOR UNLOCKING EFFICIENCY AND PERSONALIZATION TO PROPEL MARKET

- TABLE 100 OTHER VERTICALS: AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 101 OTHER VERTICALS: AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

11 AIOPS PLATFORM MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 37 INDIA TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 102 AIOPS PLATFORM MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 103 AIOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: AIOPS PLATFORM MARKET DRIVERS

- 11.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 104 NORTH AMERICA: AIOPS PLATFORM MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: AIOPS PLATFORM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: AIOPS PLATFORM MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 107 NORTH AMERICA: AIOPS PLATFORM MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 108 NORTH AMERICA: AIOPS PLATFORM MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 109 NORTH AMERICA: AIOPS PLATFORM MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 110 NORTH AMERICA: AIOPS PLATFORM MARKET, BY MANAGED SERVICE, 2017-2022 (USD MILLION)

- TABLE 111 NORTH AMERICA: AIOPS PLATFORM MARKET, BY MANAGED SERVICE, 2023-2028 (USD MILLION)

- TABLE 112 NORTH AMERICA: AIOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 113 NORTH AMERICA: AIOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: AIOPS PLATFORM MARKET, BY CLOUD TYPE, 2017-2022 (USD MILLION)

- TABLE 115 NORTH AMERICA: AIOPS PLATFORM MARKET, BY CLOUD TYPE, 2023-2028 (USD MILLION)

- TABLE 116 NORTH AMERICA: AIOPS PLATFORM MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 117 NORTH AMERICA: AIOPS PLATFORM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 118 NORTH AMERICA: AIOPS PLATFORM MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 119 NORTH AMERICA: AIOPS PLATFORM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 120 NORTH AMERICA: AIOPS PLATFORM MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 121 NORTH AMERICA: AIOPS PLATFORM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.2.3 US

- 11.2.3.1 AI regulations to play a vital role in promoting ethical and responsible use of AI

- TABLE 122 US: AIOPS PLATFORM MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 123 US: AIOPS PLATFORM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 124 US: AIOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 125 US: AIOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 126 US: AIOPS PLATFORM MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 127 US: AIOPS PLATFORM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.4 CANADA

- 11.2.4.1 Complex IT landscape in Canada to drive players to adopt AIOps platforms

- 11.3 EUROPE

- 11.3.1 EUROPE: AIOPS PLATFORM MARKET DRIVERS

- 11.3.2 EUROPE: RECESSION IMPACT

- TABLE 128 EUROPE: AIOPS PLATFORM MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 129 EUROPE: AIOPS PLATFORM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 130 EUROPE: AIOPS PLATFORM MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 131 EUROPE: AIOPS PLATFORM MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 132 EUROPE: AIOPS PLATFORM MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 133 EUROPE: AIOPS PLATFORM MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 134 EUROPE: AIOPS PLATFORM MARKET, BY MANAGED SERVICE, 2017-2022 (USD MILLION)

- TABLE 135 EUROPE: AIOPS PLATFORM MARKET, BY MANAGED SERVICE, 2023-2028 (USD MILLION)

- TABLE 136 EUROPE: AIOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 137 EUROPE: AIOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 138 EUROPE: AIOPS PLATFORM MARKET, BY CLOUD TYPE, 2017-2022 (USD MILLION)

- TABLE 139 EUROPE: AIOPS PLATFORM MARKET, BY CLOUD TYPE, 2023-2028 (USD MILLION)

- TABLE 140 EUROPE: AIOPS PLATFORM MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 141 EUROPE: AIOPS PLATFORM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 142 EUROPE: AIOPS PLATFORM MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 143 EUROPE: AIOPS PLATFORM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 144 EUROPE: AIOPS PLATFORM MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 145 EUROPE: AIOPS PLATFORM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.3.3 UK

- 11.3.3.1 Rising need to enhance customer satisfaction and drive innovation to boost market

- TABLE 146 UK: AIOPS PLATFORM MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 147 UK: AIOPS PLATFORM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 148 UK: AIOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 149 UK: AIOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 150 UK: AIOPS PLATFORM MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 151 UK: AIOPS PLATFORM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.4 GERMANY

- 11.3.4.1 Rising demand for smarter and more efficient approaches to IT operations to boost market

- 11.3.5 FRANCE

- 11.3.5.1 Rising need to navigate complexities of modern IT landscapes to propel market

- 11.3.6 ITALY

- 11.3.6.1 Rising demand to seek advanced IT management solutions to bolster market growth

- 11.3.7 SPAIN

- 11.3.7.1 Need to drive digital innovation and operational efficiency to boost market

- 11.3.8 REST OF EUROPE

- 11.3.8.1 Growing adoption of AIOps platform to fuel IT transformation across countries

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: AIOPS PLATFORM MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: IMPACT OF RECESSION

- FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 152 ASIA PACIFIC: AIOPS PLATFORM MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 153 ASIA PACIFIC: AIOPS PLATFORM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 154 ASIA PACIFIC: AIOPS PLATFORM MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 155 ASIA PACIFIC: AIOPS PLATFORM MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 156 ASIA PACIFIC: AIOPS PLATFORM MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 157 ASIA PACIFIC: AIOPS PLATFORM MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 158 ASIA PACIFIC: AIOPS PLATFORM MARKET, BY MANAGED SERVICE, 2017-2022 (USD MILLION)

- TABLE 159 ASIA PACIFIC: AIOPS PLATFORM MARKET, BY MANAGED SERVICE, 2023-2028 (USD MILLION)

- TABLE 160 ASIA PACIFIC: AIOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 161 ASIA PACIFIC: AIOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 162 ASIA PACIFIC: AIOPS PLATFORM MARKET, BY CLOUD TYPE, 2017-2022 (USD MILLION)

- TABLE 163 ASIA PACIFIC: AIOPS PLATFORM MARKET, BY CLOUD TYPE, 2023-2028 (USD MILLION)

- TABLE 164 ASIA PACIFIC: AIOPS PLATFORM MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 165 ASIA PACIFIC: AIOPS PLATFORM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 166 ASIA PACIFIC: AIOPS PLATFORM MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 167 ASIA PACIFIC: AIOPS PLATFORM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 168 ASIA PACIFIC: AIOPS PLATFORM MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 169 ASIA PACIFIC: AIOPS PLATFORM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.4.3 CHINA

- 11.4.3.1 Rising demand for digital transformation to fuel market growth

- TABLE 170 CHINA: AIOPS PLATFORM MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 171 CHINA: AIOPS PLATFORM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 172 CHINA: AIOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 173 CHINA: AIOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 174 CHINA: AIOPS PLATFORM MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 175 CHINA: AIOPS PLATFORM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.4 JAPAN

- 11.4.4.1 Government support for technological innovation and presence of leading tech companies to boost market

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Rising government support for AI research and development to propel market

- 11.4.6 INDIA

- 11.4.6.1 Thriving technology landscape and increasing digitalization efforts to fuel market growth

- 11.4.7 ANZ

- 11.4.7.1 Growing need to revolutionize IT infrastructure with AI and analytics to fuel market growth

- 11.4.8 ASEAN

- 11.4.8.1 Growing need to respond and resolve incidents before they occur to boost market

- 11.4.9 REST OF ASIA PACIFIC

- 11.4.9.1 Growing need to optimize IT processes and system performance to boost market

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: AIOPS PLATFORM MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: IMPACT OF RECESSION

- TABLE 176 MIDDLE EAST & AFRICA: AIOPS PLATFORM MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: AIOPS PLATFORM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: AIOPS PLATFORM MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: AIOPS PLATFORM MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: AIOPS PLATFORM MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: AIOPS PLATFORM MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: AIOPS PLATFORM MARKET, BY MANAGED SERVICE, 2017-2022 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: AIOPS PLATFORM MARKET, BY MANAGED SERVICE, 2023-2028 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: AIOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: AIOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: AIOPS PLATFORM MARKET, BY CLOUD TYPE, 2017-2022 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: AIOPS PLATFORM MARKET, BY CLOUD TYPE, 2023-2028 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: AIOPS PLATFORM MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: AIOPS PLATFORM MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: AIOPS PLATFORM MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: AIOPS PLATFORM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: AIOPS PLATFORM MARKET, BY COUNTRY, 2017- 2022 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: AIOPS PLATFORM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.5.3 KSA

- 11.5.3.1 Growing emphasis on AI development across key industry verticals to boost market

- 11.5.4 UAE

- 11.5.4.1 Ability to rapidly detect anomalies and patterns in IT landscape to drive market

- 11.5.5 ISRAEL

- 11.5.5.1 Growing applications of AIOps platforms across various industry verticals to propel market

- 11.5.6 EGYPT

- 11.5.6.1 Government initiatives to gain competitive advantage and enhance operational efficiency to fuel market growth

- 11.5.7 SOUTH AFRICA

- 11.5.7.1 Rapid adoption of cutting-edge technologies to enhance IT performance monitoring to boost market

- 11.5.8 REST OF MIDDLE EAST & AFRICA

- 11.5.8.1 Significant strides made by businesses to enhance efficiency and improve service delivery to fuel market growth

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: AIOPS PLATFORM MARKET DRIVERS

- 11.6.2 LATIN AMERICA: IMPACT OF RECESSION

- TABLE 194 LATIN AMERICA: AIOPS PLATFORM MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 195 LATIN AMERICA: AIOPS PLATFORM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 196 LATIN AMERICA: AIOPS PLATFORM MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 197 LATIN AMERICA: AIOPS PLATFORM MARKET, BY SERVICE,