|

|

市場調査レポート

商品コード

1330294

デジタルBSSの世界市場:提供別、ソリューション別、業界別、地域別 - 予測(~2028年)Digital BSS Market by Offering (Solutions & Services), Solution (Revenue & Billing Management, Customer Management, Order Management, and Product Management), Vertical (BFSI, Telecom, and Retail & eCommerce) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| デジタルBSSの世界市場:提供別、ソリューション別、業界別、地域別 - 予測(~2028年) |

|

出版日: 2023年08月01日

発行: MarketsandMarkets

ページ情報: 英文 207 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のデジタルBSSの市場規模は、2023年に58億米ドル、2028年までに125億米ドルに達し、年間平均成長率(CAGR)で16.6%の成長が予測されています。

従来のオンプレミスソリューションよりもクラウドベースソリューションの採用が増加していることが、市場成長を促進しています。クラウドコンピューティングは通信業界の大きな動向であり、デジタルBSSにも大きな影響を与えています。クラウドベースのBSSソリューションは、拡張性、柔軟性、費用対効果など、従来のオンプレミスソリューションにはない多くの利点を提供します。

"提供別では、ライセンス・メンテナンスセグメントが予測期間中に最大の市場規模を占める見込みです。"

"ソリューション別では、顧客管理セグメントが予測期間中にもっとも高い成長率を記録する見込みです。"

"予測期間中、欧州が第2位の市場規模を記録する見込みです。"

欧州は英国やドイツなどの主要な経済成長国で構成されており、これらが市場に大きな成長機会をもたらします。より迅速なコンピューティング能力、分析、セキュリティ、デジタル化、大容量ネットワーキング、デジタルBSSソリューションの全体のスピードと応答性の向上に対する要件の高まりが、欧州市場のもっとも重要な促進要因となっています。

当レポートでは、世界のデジタルBSS市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主要考察

- デジタルBSS市場の企業にとっての魅力的な機会

- デジタルBSS市場:主要セグメント

- デジタルBSS市場:提供別

- デジタルBSS市場:ソリューション別

- デジタルBSS市場:業界別

- 北米のデジタルBSS市場:国別、主要業界別

第5章 市場の概要と業界動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 業界の動向

- ケーススタディ分析

- エコシステム分析

- バリューチェーン分析

- 規制情勢

- 平均販売価格分析

- ポーターのファイブフォース分析

- 技術分析

- 特許分析

- 購買者/クライアントに影響を与える動向と混乱

- 主なステークホルダーと購入基準

- 主な会議とイベント

第6章 デジタルBSS市場:提供別

- イントロダクション

- ソリューション

- 収益・請求管理

- 顧客管理

- 注文管理

- 製品管理

- その他のソリューション

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 デジタルBSS市場:業界別

- イントロダクション

- BFSI

- IT・ITES

- 通信

- 小売・eコマース

- メディア・エンターテインメント

- 製造

- エネルギー・公共事業

- 医療

- その他の業界

第8章 デジタルBSS市場:地域別

- イントロダクション

- 北米

- 北米:デジタルBSS市場の促進要因

- 北米:不況の影響

- 米国

- カナダ

- 欧州

- 欧州:デジタルBSS市場の促進要因

- 欧州:不況の影響

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋:デジタルBSS市場の促進要因

- アジア太平洋:不況の影響

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- 韓国

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカ:デジタルBSS市場の促進要因

- 中東・アフリカ:不況の影響

- 中東

- アフリカ

- ラテンアメリカ

- ラテンアメリカ:デジタルBSS市場の促進要因

- ラテンアメリカ:不況の影響

- ブラジル

- メキシコ

- その他のラテンアメリカ

第9章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 主要企業の収益の実績の分析

- 主要企業の市場シェアの分析

- 競合ベンチマーキング

- 主要企業の評価マトリクス(2023年)

- スタートアップ/中小企業の評価マトリクス(2023年)

- 競合シナリオ

第10章 企業プロファイル

- 主要企業

- AMDOCS

- HUAWEI

- ERICSSON

- CSG INTERNATIONAL

- NETCRACKER

- ORACLE

- CAPGEMINI

- NOKIA

- ZTE

- INFOSYS

- TCS

- IBM

- ACCENTURE

- HANSEN TECHNOLOGIES

- STERLITE TECHNOLOGIES

- COMARCH

- BEARINGPOINT

- MAHINDRA COMVIVA

- SIGMA SOFTWARE

- スタートアップ/中小企業

- OPTIVA

- CERILLION TECHNOLOGIES

- QVANTEL

- MIND CTI

- MATRIXX SOFTWARE

- MAGIC SOFTWARE GROUP

- AVEMA CORPORATION

- MYCOM OSI

- SUNTECH SA

第11章 隣接/関連市場

- イントロダクション

- クラウドOSS BSS市場

- 市場の定義

- 市場の概要

- クラウドOSS BSS市場:コンポーネント別

- クラウドOSS BSS市場:ソリューション別

- クラウドOSS BSS市場:サービス別

- クラウドOSS BSS市場:クラウドタイプ別

- クラウドOSS BSS市場:事業者タイプ別

- クラウドOSS BSS市場:地域別

- サブスクリプション・請求管理市場

- 市場の定義

- 市場の概要

- サブスクリプション・請求管理市場:コンポーネント別

- サブスクリプション・課金管理市場:展開タイプ別

- サブスクリプション・請求管理市場:業界別

- サブスクリプション・請求管理市場:地域別

第12章 付録

The digital BSS market is estimated at USD 5.8 billion in 2023 to USD 12.5 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 16.6%. The increasing adoption of cloud-based solutions over traditional on-premises solutions is driving the growth of the digital BSS market. Cloud computing is a major trend in the telecommunications industry, and it is also having a significant impact on digital BSS. Cloud-based BSS solutions offer a number of benefits over traditional on-premises solutions, including scalability, flexibility, and cost-effectiveness.

"By offering, license and maintenance segment to hold the largest market size during the forecast period."

License and maintenance service is a significant part of ensuring that digital BSS solutions are used effectively and efficiently. It helps to keep the software up-to-date and secure, and it provides users with the support they need to get the most out of the software. License and maintenance service helps to enhance the user experience by providing training on the software use. Also, the license and maintenance service help to improve security by providing security patches and updates.

"Based on the Solution, the customer management segment is expected to register the highest growth rate during the forecast period."

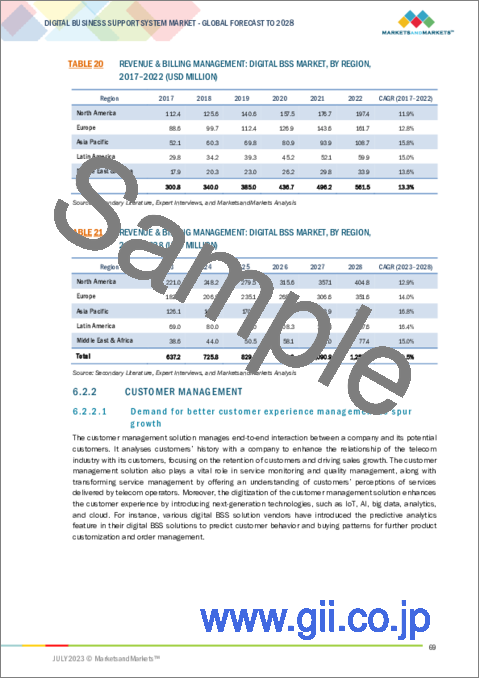

The digitization of the customer management solution enhances the customer experience by introducing next-generation technologies, such as IoT, AI, big data, analytics, and cloud. For instance, various digital BSS solution vendors have introduced the predictive analytics feature in their digital BSS solutions to predict customer behavior and their buying pattern for further product customization and order management.

"Europe to register the second largest market size during the forecast period."

Europe is expected to hold the second-largest market share in the global digital BSS market. The region comprises major growing economies, such as the UK and Germany, which offer great growth opportunities to the digital BSS market. The increasing requirement for quicker computing abilities, virtualized environment with analytics, security, digitalization, high-volume networking, and increased overall speed and responsiveness of digital BSS solutions are the most important driving factors for the European digital BSS market.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level - 35%, D-level - 25%, and Others - 40%

- By Region: North America - 45%, Europe - 20%, Asia Pacific - 30%, and the Rest of the World- 5%.

The major players in the digital BSS market include Amdocs Limited (US), Huawei Technologies Co. Ltd (China), LM Ericsson Telephone Company (Sweden), CSG Systems International, Inc. (US), Nokia Corporation (Finland), International Business Machines Corporation (US), ZTE Corporation (China), Optiva Inc. (Canada), Sigma Systems Canada LP. (US), Cerillion Technologies Limited (UK), Sterlite Technologies Limited (India), Accenture plc (Ireland), Capgemini SE (France), Infosys Limited (India), Oracle Corporation (US), Mahindra Comviva (India), Qvantel (Finland), BearingPoint (Netherlands), Formula Telecom Solutions Ltd. (US), MATRIXX Software, Inc. (US), MIND C.T.I. Ltd. (UK), and Tata Consultancy Services Limited (India). Hansen Technologies (Australia), Comarch SA (Poland), Avema Corporation (Ontario), and Suntech S.A. (Poland).These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their footprint in the digital BSS market.

Research Coverage

The market study covers the digital BSS market size across different segments. It aims at estimating the market size and the growth potential across different segments, including offerings (solutions and services), solutions, verticals, and regions. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the global digital BSS market's revenue numbers and subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (advent of tailored BSS solutions and new commercial models, reduced operational costs, and increasing online transactions and use of multiple mobile devices), restraints (time and cost constraints), opportunities (outcome and pull economies, and NGOSS proliferates traditional BSS solutions in the telecom vertical), and challenges (increasing complexities in network transactions and integration of digital BSS solutions with legacy systems, and lack of expertise in telecom companies to implement digital BSS solutions) influencing the growth of the digital BSS market. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the digital BSS market. Market Development: Comprehensive information about lucrative markets - the report analyses the digital BSS market across various regions. Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the digital BSS market. Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, including Amdocs Limited (US), Huawei Technologies Co. Ltd (China), LM Ericsson Telephone Company (Sweden), CSG Systems International, Inc. (US), Nokia Corporation (Finland), International Business Machines Corporation (US), ZTE Corporation (China), Optiva Inc. (Canada), Sigma Systems Canada LP. (US), Cerillion Technologies Limited (UK), Sterlite Technologies Limited (India), Accenture plc (Ireland), Capgemini SE (France), Infosys Limited (India), Oracle Corporation (US), Mahindra Comviva (India), Qvantel (Finland), BearingPoint (Netherlands), Formula Telecom Solutions Ltd. (US), MATRIXX Software, Inc. (US), MIND C.T.I. Ltd. (UK), and Tata Consultancy Services Limited (India). Hansen Technologies (Australia), Comarch SA (Poland), Avema Corporation (Ontario), and Suntech S.A. (Poland).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2022

- 1.6 STAKEHOLDERS

- 1.7 RECESSION IMPACT

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 2 MARKET SIZE ESTIMATION APPROACHES

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1: SUPPLY-SIDE ANALYSIS OF REVENUE FROM VENDORS OF DIGITAL BSS SOLUTIONS AND SERVICES

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF DIGITAL BSS VENDORS

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- 2.2.3 DIGITAL BSS MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

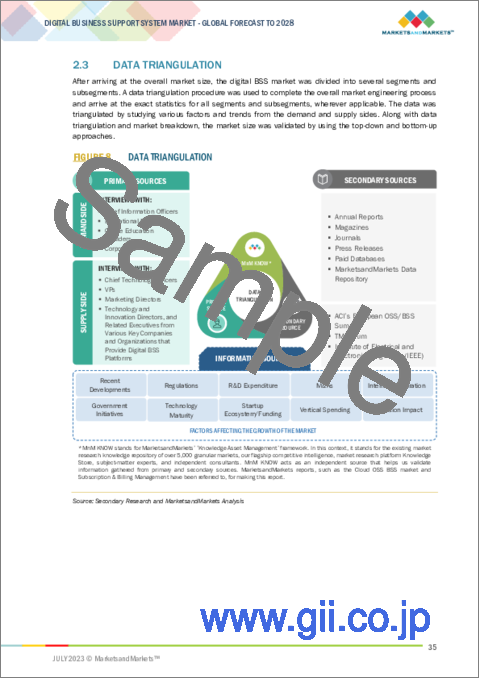

- 2.3 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- TABLE 2 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND RISK ASSESSMENT

- 2.7 IMPACT OF RECESSION ON DIGITAL BSS MARKET

- FIGURE 9 IMPACT OF RECESSION ON DIGITAL BSS MARKET

3 EXECUTIVE SUMMARY

- FIGURE 10 DIGITAL BSS MARKET, 2021-2028 (USD MILLION)

- FIGURE 11 DIGITAL BSS MARKET, BY REGION, 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DIGITAL BSS MARKET

- FIGURE 12 INCREASING SERVICE OPTIONS AND COMPLEX IT INFRASTRUCTURE TO DRIVE MARKET EXPANSION

- 4.2 DIGITAL BSS MARKET: MAJOR SEGMENTS

- FIGURE 13 SERVICES, REVENUE AND BILLING MANAGEMENT, AND BFSI SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- 4.3 DIGITAL BSS MARKET, BY OFFERING

- FIGURE 14 SERVICES SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2023

- 4.4 DIGITAL BSS MARKET, BY SOLUTION

- FIGURE 15 REVENUE & BILLING MANAGEMENT SEGMENT TO LEAD MARKET IN 2023

- 4.5 DIGITAL BSS MARKET, BY VERTICAL

- FIGURE 16 BFSI SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- 4.6 NORTH AMERICA: DIGITAL BSS MARKET, BY COUNTRY AND KEY VERTICAL

- FIGURE 17 US AND BFSI SEGMENT TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DIGITAL BSS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Advent of tailored BSS solutions and commercial models

- 5.2.1.2 Need for reduced operational costs

- 5.2.1.3 Increase in online transactions and use of multiple mobile devices

- 5.2.2 RESTRAINTS

- 5.2.2.1 Expensive and time-consuming implementation of digital BSS solutions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing emphasis on outcome and pull economies

- 5.2.3.2 Development and optimization of telecom operators' businesses

- 5.2.4 CHALLENGES

- 5.2.4.1 Increasing complexities in network transactions and integration of digital BSS solutions with legacy systems

- 5.2.4.2 Lack of expertise in telecom companies

- 5.3 INDUSTRY TRENDS

- 5.3.1 CASE STUDY ANALYSIS

- 5.3.1.1 Case Study 1: MVNO adopted Optiva's BSS Platform in SaaS model to improve customer satisfaction

- 5.3.1.2 Case Study 2: Optiva's BSS Suite enabled rapid MVNO onboarding and enhanced customer experience for leading Mexican telecom provider

- 5.3.1.3 Case Study 3: Cerillion's Convergent CRM & Billing Solution revolutionized BTC's service offerings and customer experience

- 5.3.1.4 Case Study 4: Cerillion provided SWAN with solutions comprising various modules from its Enterprise BSS/OSS Suite

- 5.3.2 ECOSYSTEM ANALYSIS

- FIGURE 19 ECOSYSTEM MAP

- TABLE 3 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- 5.3.2.1 Communication service providers

- 5.3.2.2 System integrators

- 5.3.2.3 Technology partners

- 5.3.2.4 Solution providers

- 5.3.3 VALUE CHAIN ANALYSIS

- FIGURE 20 VALUE CHAIN ANALYSIS

- 5.3.4 REGULATORY LANDSCAPE

- 5.3.4.1 Regulatory bodies, government agencies, and other organizations

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.4.2 North America

- 5.3.4.2.1 US

- 5.3.4.2.2 Canada

- 5.3.4.3 Europe

- 5.3.4.3.1 UK

- 5.3.4.3.2 Germany

- 5.3.4.4 Asia Pacific

- 5.3.4.4.1 China

- 5.3.4.4.2 India

- 5.3.4.4.3 Japan

- 5.3.4.5 Middle East & Africa

- 5.3.4.5.1 UAE

- 5.3.4.5.2 South Africa

- 5.3.4.6 Latin America

- 5.3.4.6.1 Mexico

- 5.3.4.2 North America

- 5.3.5 AVERAGE SELLING PRICE ANALYSIS

- 5.3.5.1 Average selling price analysis for key players

- TABLE 8 AVERAGE SELLING PRICE ANALYSIS FOR KEY PLAYERS

- 5.3.5.2 Pricing models

- 5.3.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 IMPACT OF PORTER'S FORCES ON DIGITAL BSS MARKET

- 5.3.6.1 Threat of new entrants

- 5.3.6.2 Threat of substitutes

- 5.3.6.3 Bargaining power of buyers

- 5.3.6.4 Bargaining power of suppliers

- 5.3.6.5 Intensity of competitive rivalry

- 5.3.7 TECHNOLOGY ANALYSIS

- 5.3.7.1 Cloud Computing

- 5.3.7.2 Artificial Intelligence

- 5.3.7.3 Machine Learning

- 5.3.7.4 Big Data Analytics

- 5.3.8 PATENT ANALYSIS

- 5.3.8.1 Methodology

- 5.3.8.2 Document types

- TABLE 10 PATENTS FILED, 2021-2023

- 5.3.8.3 Innovation and patent applications

- FIGURE 21 NUMBER OF PATENTS GRANTED ANNUALLY, 2021-2023

- 5.3.8.3.1 Top applicants

- FIGURE 22 TOP TEN PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2021-2023

- 5.3.9 TRENDS AND DISRUPTIONS IMPACTING BUYERS/CLIENTS

- 5.3.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.10.1 Key stakeholders in buying process

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.3.10.2 Buying criteria

- FIGURE 24 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.3.11 KEY CONFERENCES & EVENTS

- TABLE 13 KEY CONFERENCES & EVENTS, 2023-2024

- 5.3.1 CASE STUDY ANALYSIS

6 DIGITAL BSS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 25 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 6.1.1 OFFERINGS: DIGITAL BSS MARKET DRIVERS

- TABLE 14 DIGITAL BSS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 15 DIGITAL BSS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 SOLUTIONS

- TABLE 16 SOLUTIONS: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 17 SOLUTIONS: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 18 DIGITAL BSS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 19 DIGITAL BSS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- FIGURE 26 PRODUCT MANAGEMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 6.2.1 REVENUE & BILLING MANAGEMENT

- 6.2.1.1 Need for increased converged billing across various channels to drive demand

- TABLE 20 REVENUE & BILLING MANAGEMENT: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 21 REVENUE & BILLING MANAGEMENT: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2 CUSTOMER MANAGEMENT

- 6.2.2.1 Demand for better customer experience management to spur growth

- TABLE 22 CUSTOMER MANAGEMENT: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 23 CUSTOMER MANAGEMENT: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.3 ORDER MANAGEMENT

- 6.2.3.1 Growing use of advanced analytics to simplify order management process to boost growth

- TABLE 24 ORDER MANAGEMENT: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 25 ORDER MANAGEMENT: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.4 PRODUCT MANAGEMENT

- 6.2.4.1 Need for optimizing product portfolio and life cycle management to boost demand

- TABLE 26 PRODUCT MANAGEMENT: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 27 PRODUCT MANAGEMENT: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.5 OTHER SOLUTIONS

- TABLE 28 OTHER SOLUTIONS: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 29 OTHER SOLUTIONS: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SERVICES

- FIGURE 27 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 30 DIGITAL BSS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 31 DIGITAL BSS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 32 SERVICES: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 33 SERVICES: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1 PROFESSIONAL SERVICES

- TABLE 34 PROFESSIONAL SERVICES: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 35 PROFESSIONAL SERVICES: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 36 DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 37 DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- 6.3.1.1 Consulting

- 6.3.1.1.1 BSS consultants to help in vendor evaluation and seamless integration with existing systems

- 6.3.1.1 Consulting

- TABLE 38 CONSULTING: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 39 CONSULTING: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1.2 Implementation

- 6.3.1.2.1 Need for effective BSS implementation services and solutions to drive market

- 6.3.1.2 Implementation

- TABLE 40 IMPLEMENTATION: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 41 IMPLEMENTATION: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1.3 License & Maintenance

- 6.3.1.3.1 Demand to ensure proper functioning and continuous support of BSS software to boost growth

- 6.3.1.3 License & Maintenance

- TABLE 42 LICENSE & MAINTENANCE: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 43 LICENSE & MAINTENANCE: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1.4 Training & Education

- 6.3.1.4.1 Rising focus on ensuring successful adoption and effective utilization of digital BSS services to propel growth

- 6.3.1.4 Training & Education

- TABLE 44 TRAINING & EDUCATION: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 45 TRAINING & EDUCATION: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Demand for support and maintenance services by third-party service providers to boost market

- TABLE 46 MANAGED SERVICES: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 47 MANAGED SERVICES: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

7 DIGITAL BSS MARKET, BY VERTICAL

- 7.1 INTRODUCTION

- FIGURE 28 HEALTHCARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 7.1.1 VERTICALS: DIGITAL BSS MARKET DRIVERS

- TABLE 48 DIGITAL BSS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 49 DIGITAL BSS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 7.2 BFSI

- 7.2.1 AIM OF BUSINESSES TO ENHANCE OPERATIONAL EFFICIENCY AND UNLOCK REVENUE OPPORTUNITIES TO DRIVE ADOPTION OF DIGITAL BSS SOLUTIONS

- TABLE 50 BFSI: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 51 BFSI: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 IT & ITES

- 7.3.1 GROWING NEED TO STREAMLINE SERVICE DELIVERY PROCESSES AND AUTOMATE TASKS TO BOOST ADOPTION OF DIGITAL BSS SERVICES

- TABLE 52 IT & ITES: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 53 IT & ITES: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 TELECOM

- 7.4.1 NEED TO OFFER PERSONALIZED EXPERIENCE TO TELECOM CUSTOMERS TO ENCOURAGE MARKET GROWTH

- TABLE 54 TELECOM: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 55 TELECOM: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 RETAIL & ECOMMERCE

- 7.5.1 DEMAND FOR SEAMLESS SHOPPING SOLUTIONS FROM CUSTOMERS TO ENCOURAGE ADOPTION OF DIGITAL BSS SOLUTIONS

- TABLE 56 RETAIL & ECOMMERCE: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 57 RETAIL & ECOMMERCE: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 MEDIA & ENTERTAINMENT

- 7.6.1 FOCUS ON LEVERAGING EFFECTIVE CONTENT CONSUMPTION STRATEGIES TO DRIVE MARKET

- TABLE 58 MEDIA & ENTERTAINMENT: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 59 MEDIA & ENTERTAINMENT: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.7 MANUFACTURING

- 7.7.1 INCREASING DIGITALIZATION AND AUTOMATION IN MANUFACTURING SECTOR TO ENCOURAGE MARKET EXPANSION

- TABLE 60 MANUFACTURING: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 61 MANUFACTURING: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.8 ENERGY & UTILITIES

- 7.8.1 GROWING DEMAND FOR ENERGY MANAGEMENT AND SMART METERING SOLUTIONS TO SPUR GROWTH

- TABLE 62 ENERGY & UTILITIES: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 63 ENERGY & UTILITIES: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.9 HEALTHCARE

- 7.9.1 DIGITALIZATION IN PATIENT CARE AND AUTOMATION IN MANUAL HEALTHCARE OPERATIONAL PROCESSES TO BOOST GROWTH

- TABLE 64 HEALTHCARE: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 65 HEALTHCARE: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.10 OTHER VERTICALS

- TABLE 66 OTHER VERTICALS: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 67 OTHER VERTICALS: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 DIGITAL BSS MARKET, BY REGION

- 8.1 INTRODUCTION

- TABLE 68 DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 69 DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2 NORTH AMERICA

- 8.2.1 NORTH AMERICA: DIGITAL BSS MARKET DRIVERS

- 8.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 70 NORTH AMERICA: DIGITAL BSS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: DIGITAL BSS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: DIGITAL BSS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: DIGITAL BSS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: DIGITAL BSS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: DIGITAL BSS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: DIGITAL BSS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: DIGITAL BSS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: DIGITAL BSS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: DIGITAL BSS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.2.3 US

- 8.2.3.1 Adoption of cloud-native and cloud-ready solutions in telecom industry to drive growth

- TABLE 82 US: DIGITAL BSS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 83 US: DIGITAL BSS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 84 US: DIGITAL BSS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 85 US: DIGITAL BSS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 86 US: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 87 US: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 88 US: DIGITAL BSS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 89 US: DIGITAL BSS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 90 US: DIGITAL BSS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 91 US: DIGITAL BSS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.2.4 CANADA

- 8.2.4.1 Increasing number of mergers and acquisitions in country's telecom sector to drive adoption of OSS/BSS solutions

- TABLE 92 CANADA: DIGITAL BSS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 93 CANADA: DIGITAL BSS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 94 CANADA: DIGITAL BSS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 95 CANADA: DIGITAL BSS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 96 CANADA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 97 CANADA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 98 CANADA: DIGITAL BSS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 99 CANADA: DIGITAL BSS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 100 CANADA: DIGITAL BSS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 101 CANADA: DIGITAL BSS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.3 EUROPE

- 8.3.1 EUROPE: DIGITAL BSS MARKET DRIVERS

- 8.3.2 EUROPE: RECESSION IMPACT

- TABLE 102 EUROPE: DIGITAL BSS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 103 EUROPE: DIGITAL BSS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 104 EUROPE: DIGITAL BSS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 105 EUROPE: DIGITAL BSS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 106 EUROPE: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 107 EUROPE: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 108 EUROPE: DIGITAL BSS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 109 EUROPE: DIGITAL BSS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 110 EUROPE: DIGITAL BSS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 111 EUROPE: DIGITAL BSS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 112 EUROPE: DIGITAL BSS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 113 EUROPE: DIGITAL BSS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.3.3 UK

- 8.3.3.1 Need to transform and modernize telecom operations to drive growth

- TABLE 114 UK: DIGITAL BSS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 115 UK: DIGITAL BSS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 116 UK: DIGITAL BSS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 117 UK: DIGITAL BSS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 118 UK: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 119 UK: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 120 UK: DIGITAL BSS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 121 UK: DIGITAL BSS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 122 UK: DIGITAL BSS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 123 UK: DIGITAL BSS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.3.4 GERMANY

- 8.3.4.1 Adoption of cloud computing services to boost market

- 8.3.5 FRANCE

- 8.3.5.1 Presence of major players providing digital BSS solutions to propel growth

- 8.3.6 SPAIN

- 8.3.6.1 Demand for personalized customer experience to drive market expansion

- 8.3.7 ITALY

- 8.3.7.1 Emergence of advanced technologies to encourage adoption of BSS solutions and services

- 8.3.8 REST OF EUROPE

- 8.4 ASIA PACIFIC

- 8.4.1 ASIA PACIFIC: DIGITAL BSS MARKET DRIVERS

- 8.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 124 ASIA PACIFIC: DIGITAL BSS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: DIGITAL BSS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: DIGITAL BSS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: DIGITAL BSS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: DIGITAL BSS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: DIGITAL BSS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: DIGITAL BSS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: DIGITAL BSS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: DIGITAL BSS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: DIGITAL BSS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.4.3 CHINA

- 8.4.3.1 Increasing trend of technological adoption to boost market

- TABLE 136 CHINA: DIGITAL BSS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 137 CHINA: DIGITAL BSS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 138 CHINA: DIGITAL BSS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 139 CHINA: DIGITAL BSS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 140 CHINA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 141 CHINA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 142 CHINA: DIGITAL BSS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 143 CHINA: DIGITAL BSS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 144 CHINA: DIGITAL BSS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 145 CHINA: DIGITAL BSS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.4.4 INDIA

- 8.4.4.1 Advancements in 5G and IoT technologies to drive opportunities for digital BSS market

- 8.4.5 JAPAN

- 8.4.5.1 Presence of highly efficient and competitive digital BSS players across sectors to propel growth

- 8.4.6 AUSTRALIA & NEW ZEALAND

- 8.4.6.1 Use of advanced IoT technologies to drive digital BSS market

- 8.4.7 SOUTH KOREA

- 8.4.7.1 Increasing popularity of mobile devices and growth of e-commerce to spur growth

- 8.4.8 REST OF ASIA PACIFIC

- 8.5 MIDDLE EAST & AFRICA

- 8.5.1 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET DRIVERS

- 8.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 146 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: DIGITAL BSS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5.3 MIDDLE EAST

- 8.5.3.1 Business expansions to increase adoption of digital BSS solutions

- TABLE 158 MIDDLE EAST: DIGITAL BSS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 159 MIDDLE EAST: DIGITAL BSS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 160 MIDDLE EAST: DIGITAL BSS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 161 MIDDLE EAST: DIGITAL BSS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 162 MIDDLE EAST: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 163 MIDDLE EAST: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 164 MIDDLE EAST: DIGITAL BSS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 165 MIDDLE EAST: DIGITAL BSS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 166 MIDDLE EAST: DIGITAL BSS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 167 MIDDLE EAST: DIGITAL BSS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.5.4 AFRICA

- 8.5.4.1 Convergence of telecom and IT industries to drive growth

- 8.6 LATIN AMERICA

- 8.6.1 LATIN AMERICA: DIGITAL BSS MARKET DRIVERS

- 8.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 168 LATIN AMERICA: DIGITAL BSS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 169 LATIN AMERICA: DIGITAL BSS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 170 LATIN AMERICA: DIGITAL BSS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 171 LATIN AMERICA: DIGITAL BSS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 172 LATIN AMERICA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 173 LATIN AMERICA: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 174 LATIN AMERICA: DIGITAL BSS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 175 LATIN AMERICA: DIGITAL BSS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 176 LATIN AMERICA: DIGITAL BSS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 177 LATIN AMERICA: DIGITAL BSS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 178 LATIN AMERICA: DIGITAL BSS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 179 LATIN AMERICA: DIGITAL BSS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.6.3 BRAZIL

- 8.6.3.1 Rapid implementation of various projects and initiatives to boost adoption of digital BSS solutions

- TABLE 180 BRAZIL: DIGITAL BSS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 181 BRAZIL: DIGITAL BSS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 182 BRAZIL: DIGITAL BSS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 183 BRAZIL: DIGITAL BSS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 184 BRAZIL: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 185 BRAZIL: DIGITAL BSS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 186 BRAZIL: DIGITAL BSS MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 187 BRAZIL: DIGITAL BSS MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 188 BRAZIL: DIGITAL BSS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 189 BRAZIL: DIGITAL BSS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.6.4 MEXICO

- 8.6.4.1 Steady growth of industries and economy to drive market expansion

- 8.6.5 REST OF LATIN AMERICA

9 COMPETITIVE LANDSCAPE

- 9.1 INTRODUCTION

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 190 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 9.3 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS

- FIGURE 31 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS, 2020-2022 (USD MILLION)

- 9.4 MARKET SHARE ANALYSIS FOR KEY PLAYERS

- TABLE 191 DIGITAL BSS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 9.5 COMPETITIVE BENCHMARKING

- TABLE 192 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 193 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 9.6 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 32 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- 9.6.1 STARS

- 9.6.2 EMERGING LEADERS

- 9.6.3 PERVASIVE PLAYERS

- 9.6.4 PARTICIPANTS

- FIGURE 33 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- 9.7 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023

- FIGURE 34 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- 9.7.1 PROGRESSIVE COMPANIES

- 9.7.2 RESPONSIVE COMPANIES

- 9.7.3 DYNAMIC COMPANIES

- 9.7.4 STARTING BLOCKS

- FIGURE 35 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2023

- 9.8 COMPETITIVE SCENARIO

- 9.8.1 PRODUCT LAUNCHES

- TABLE 194 PRODUCT LAUNCHES, 2023

- 9.8.2 DEALS

- TABLE 195 DEALS, 2021-2023

10 COMPANY PROFILES

- 10.1 MAJOR PLAYERS

- (Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and competitive threats)**

- 10.1.1 AMDOCS

- TABLE 196 AMDOCS: BUSINESS OVERVIEW

- FIGURE 36 AMDOCS: COMPANY SNAPSHOT

- TABLE 197 AMDOCS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 AMDOCS: DEALS

- 10.1.2 HUAWEI

- TABLE 199 HUAWEI: BUSINESS OVERVIEW

- FIGURE 37 HUAWEI: COMPANY SNAPSHOT

- TABLE 200 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 HUAWEI: DEALS

- 10.1.3 ERICSSON

- TABLE 202 ERICSSON: BUSINESS OVERVIEW

- FIGURE 38 ERICSSON: COMPANY SNAPSHOT

- TABLE 203 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 ERICSSON: DEALS

- 10.1.4 CSG INTERNATIONAL

- TABLE 205 CSG INTERNATIONAL: BUSINESS OVERVIEW

- FIGURE 39 CSG INTERNATIONAL: COMPANY SNAPSHOT

- TABLE 206 CSG INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 CSG INTERNATIONAL: DEALS

- 10.1.5 NETCRACKER

- TABLE 208 NETCRACKER: BUSINESS OVERVIEW

- TABLE 209 NETCRACKER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 NETCRACKER: PRODUCT LAUNCHES

- TABLE 211 NETCRACKER: DEALS

- 10.1.6 ORACLE

- TABLE 212 ORACLE: BUSINESS OVERVIEW

- FIGURE 40 ORACLE: COMPANY SNAPSHOT

- TABLE 213 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 ORACLE: DEALS

- 10.1.7 CAPGEMINI

- TABLE 215 CAPGEMINI: BUSINESS OVERVIEW

- FIGURE 41 CAPGEMINI: COMPANY SNAPSHOT

- TABLE 216 CAPGEMINI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 CAPGEMINI: DEALS

- 10.1.8 NOKIA

- TABLE 218 NOKIA: BUSINESS OVERVIEW

- FIGURE 42 NOKIA: COMPANY SNAPSHOT

- TABLE 219 NOKIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 NOKIA: DEALS

- 10.1.9 ZTE

- TABLE 221 ZTE: BUSINESS OVERVIEW

- FIGURE 43 ZTE: COMPANY SNAPSHOT

- TABLE 222 ZTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 ZTE: DEALS

- 10.1.10 INFOSYS

- TABLE 224 INFOSYS: BUSINESS OVERVIEW

- FIGURE 44 INFOSYS: COMPANY SNAPSHOT

- TABLE 225 INFOSYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 INFOSYS: DEALS

- 10.1.11 TCS

- TABLE 227 TCS: BUSINESS OVERVIEW

- FIGURE 45 TCS: COMPANY SNAPSHOT

- TABLE 228 TCS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 TCS: DEALS

- 10.1.12 IBM

- TABLE 230 IBM: BUSINESS OVERVIEW

- FIGURE 46 IBM: COMPANY SNAPSHOT

- TABLE 231 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 IBM: DEALS

- 10.1.13 ACCENTURE

- TABLE 233 ACCENTURE: BUSINESS OVERVIEW

- FIGURE 47 ACCENTURE: COMPANY SNAPSHOT

- TABLE 234 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 ACCENTURE: DEALS

- 10.1.14 HANSEN TECHNOLOGIES

- 10.1.15 STERLITE TECHNOLOGIES

- 10.1.16 COMARCH

- 10.1.17 BEARINGPOINT

- 10.1.18 MAHINDRA COMVIVA

- 10.1.19 SIGMA SOFTWARE

- 10.2 STARTUPS/SMES

- 10.2.1 OPTIVA

- 10.2.2 CERILLION TECHNOLOGIES

- 10.2.3 QVANTEL

- 10.2.4 MIND CTI

- 10.2.5 MATRIXX SOFTWARE

- 10.2.6 MAGIC SOFTWARE GROUP

- 10.2.7 AVEMA CORPORATION

- 10.2.8 MYCOM OSI

- 10.2.9 SUNTECH SA

*Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 ADJACENT/RELATED MARKETS

- 11.1 INTRODUCTION

- 11.2 CLOUD OSS BSS MARKET

- 11.2.1 MARKET DEFINITION

- 11.2.2 MARKET OVERVIEW

- 11.2.3 CLOUD OSS BSS MARKET, BY COMPONENT

- TABLE 236 CLOUD OSS BSS MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 237 CLOUD OSS BSS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 11.2.4 CLOUD OSS BSS MARKET, BY SOLUTION

- TABLE 238 CLOUD OSS BSS MARKET, BY SOLUTION, 2017-2021 (USD MILLION)

- TABLE 239 CLOUD OSS BSS MARKET, BY SOLUTION, 2022-2027 (USD MILLION)

- TABLE 240 CLOUD OSS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 241 CLOUD OSS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 242 CLOUD BSS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 243 CLOUD BSS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.2.5 CLOUD OSS BSS MARKET, BY SERVICE

- TABLE 244 CLOUD OSS BSS MARKET, BY SERVICE, 2017-2021 (USD MILLION)

- TABLE 245 CLOUD OSS BSS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 246 PROFESSIONAL SERVICES: CLOUD OSS BSS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 247 PROFESSIONAL SERVICES: CLOUD OSS BSS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.2.6 CLOUD OSS BSS MARKET, BY CLOUD TYPE

- TABLE 248 CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2017-2021 (USD MILLION)

- TABLE 249 CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2022-2027 (USD MILLION)

- 11.2.7 CLOUD OSS BSS MARKET, BY OPERATOR TYPE

- TABLE 250 CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2017-2021 (USD MILLION)

- TABLE 251 CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2022-2027 (USD MILLION)

- 11.2.8 CLOUD OSS BSS MARKET, BY REGION

- TABLE 252 CLOUD OSS BSS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 253 CLOUD OSS BSS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.3 SUBSCRIPTION & BILLING MANAGEMENT MARKET

- 11.3.1 MARKET DEFINITION

- 11.3.2 MARKET OVERVIEW

- 11.3.3 SUBSCRIPTION & BILLING MANAGEMENT MARKET, BY COMPONENT

- TABLE 254 SUBSCRIPTION & BILLING MANAGEMENT MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

- TABLE 255 SERVICES: SUBSCRIPTION & BILLING MANAGEMENT MARKET, BY TYPE, 2018-2025 (USD MILLION)

- 11.3.4 SUBSCRIPTION & BILLING MANAGEMENT MARKET, BY DEPLOYMENT TYPE

- TABLE 256 SUBSCRIPTION & BILLING MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2018-2025 (USD MILLION)

- TABLE 257 CLOUD: SUBSCRIPTION & BILLING MANAGEMENT MARKET, BY VERTICAL, 2018-2025 (USD MILLION)

- TABLE 258 ON-PREMISES: SUBSCRIPTION & BILLING MANAGEMENT MARKET, BY VERTICAL, 2018-2025 (USD MILLION)

- 11.3.5 SUBSCRIPTION & BILLING MANAGEMENT MARKET, BY VERTICAL

- TABLE 259 SUBSCRIPTION & BILLING MANAGEMENT MARKET, BY VERTICAL, 2018-2025 (USD MILLION)

- 11.3.6 SUBSCRIPTION & BILLING MANAGEMENT MARKET, BY REGION

- TABLE 260 SUBSCRIPTION & BILLING MANAGEMENT MARKET, BY REGION, 2018-2025 (USD MILLION)

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS