|

|

市場調査レポート

商品コード

1306571

API (アプリケーションプログラミングインターフェース) セキュリティの世界市場:提供別 (プラットフォーム・ソリューション、サービス)・展開方式別 (オンプレミス、ハイブリッド、クラウド)・組織規模別 (中小企業、大企業)・業種別・地域別の将来予測 (2028年まで)Application Programming Interface (API) Security Market by Offering (Platforms & Solutions and Services), Deployment Mode (On-Premises, Hybrid, and Cloud), Organization Size (SMEs and Large Enterprises), Vertical and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| API (アプリケーションプログラミングインターフェース) セキュリティの世界市場:提供別 (プラットフォーム・ソリューション、サービス)・展開方式別 (オンプレミス、ハイブリッド、クラウド)・組織規模別 (中小企業、大企業)・業種別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年07月06日

発行: MarketsandMarkets

ページ情報: 英文 259 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のAPI (アプリケーションプログラミングインターフェース) セキュリティの市場規模は、2023年の7億4,400万米ドルから、2028年には30億3,400万米ドルに成長し、予測期間中のCAGRは32.5%に達すると予測されています。

APIセキュリティ市場は、API関連の侵害の急増により大きな成長を遂げています。このため、アプリケーションとインテグレーションを保護し、進化するリスクと戦うための効果的なAPIセキュリティ対策に対する強いニーズが生み出されています。APIは、アプリケーション・エコシステム内での円滑な通信とデータ交換を促進する上で重要な役割を果たしており、これが堅牢なAPIセキュリティソリューションの採用にも拍車をかけています。APIが広く利用され、貴重なデータにアクセスできることから、ハッカーがAPIを標的にするケースが増えており、APIセキュリティ市場は拡大を続けています。

さらに、一貫した投資とAPIに対する需要の高まりが、APIセキュリティ市場の成長を促進しています。これらの要因は、組織がセキュリティとガバナンス対策の強化を優先していることから、有望な成長見通しがあることを示しています。その結果、APIセキュリティソリューションの需要は、当分の間、大幅に伸びると予想されます。

"業界別では、BFSIセグメントが大きな市場シェアを占める"

BFSIは世界で最も規制の厳しい業界の1つです。その結果、この分野の企業は、サイバー攻撃から機密データを保護しなければならないというプレッシャーに常にさらされています。APIセキュリティは、BFSI組織のサイバーセキュリティ戦略の重要な要素です。BFSI部門では、クラウドベースやマイクロサービスベースのアーキテクチャの採用が増加しており、APIセキュリティ・ソリューションの需要が高まっています。接続デバイスの増加やモバイルバンキングの人気の高まりも、BFSI分野のAPIセキュリティ市場の成長に寄与しています。

"展開方式別では、クラウドセグメントが大きな市場シェアを占める"

クラウド展開方式は、以下の理由でAPIセキュリティ市場全体で牽引力を増しています:

- 拡張性:クラウドベースのAPIセキュリティソリューションは、組織のニーズの変化に合わせて迅速にスケールアップまたはスケールダウンできます。ビジネスピーク時やマーケティングキャンペーン時など、APIトラフィックが急増するビジネスには不可欠です。

- 費用対効果:クラウドベースのAPIセキュリティソリューションは、オンプレミスソリューションよりも費用対効果が高い場合が多いです。クラウドプロバイダーは通常、従量課金モデルを提供しており、企業は使用したリソースに対してのみ料金を支払うことになります。

- 使いやすさ:クラウドベースのAPIセキュリティソリューションは通常、オンプレミスソリューションよりも簡単です。クラウドプロバイダーは通常、APIセキュリティポリシーの管理を容易にするユーザーフレンドリーなダッシュボードを提供しているからです。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 使用事例

- バリューチェーン分析

- アプリケーションセキュリティ市場のエコシステム

- ポーターのファイブフォース分析

- 価格分析

- 技術分析

- 特許分析

- APIセキュリティ市場の新たな動向

- 関税と規制状況

- 主要な利害関係者と購入基準

- 主な会議とイベント (2023年~2024年)

第6章 APIセキュリティ市場:提供別

- イントロダクション

- プラットフォーム・ソリューション

- サービス

- 設計・実装

- コンサルティング・訓練・教育

- サポート・整備

第7章 APIセキュリティ市場:展開方式別

- イントロダクション

- オンプレミス

- クラウド

- ハイブリッド

第8章 APIセキュリティ市場:組織規模別

- イントロダクション

- 中小企業

- 大企業

第9章 APIセキュリティ市場:業種別

- イントロダクション

- 銀行・金融サービス・保険 (BFSI)

- IT・ITeS

- 通信

- 政府

- 製造業

- 医療

- 小売業・eコマース

- メディア・エンターテイメント

- エネルギー・ユーティリティ

- その他の業種

第10章 APIセキュリティ市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- その他のアジア太平洋

- 中東・アフリカ

- 中東

- アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ

第11章 競合情勢

- 概要

- 主要企業の収益分析

- 上位企業の市場シェア分析

- 過去の収益分析

- 主要企業のランキング

- 主要企業の評価マトリックス

- 競合ベンチマーキング

- 中小企業/スタートアップの評価クアドラント

- APIセキュリティベンダーの評価と財務指標

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- GOOGLE (APIGEE)

- SALT SECURITY

- NONAME

- AKAMAI

- DATA THEOREM

- AXWAY

- IMPERVA

- TRACEABLE

- PALO ALTO NETWORKS

- FORTINET

- その他の企業

- RED HAT

- AIRLOCK BY ERGON

- AKANA BY PERFORCE

- WSO2

- FORUM SYSTEMS

- CEQUENCE SECURITY

- SENSEDIA

- SPHERICAL DEFENSE

- NEOSEC

- SIGNAL SCIENCES

- FIRETAIL

- RESURFACE LABS

- 42CRUNCH

- AICULUS

- GRAVITEE.IO

- NEVATECH

第13章 隣接市場

- イントロダクション

- 制限事項

- APIセキュリティのエコシステムと隣接市場

- Webアプリケーションファイアウォール市場

- API管理市場

第14章 付録

The global API security market size is projected to grow from USD 744 million in 2023 to USD 3,034 million by 2028 at a Compound Annual Growth Rate (CAGR) of 32.5% during the forecast period. The API security market is experiencing significant growth due to a surge in API-related breaches. This has created a strong need for effective API security measures to safeguard applications and integrations, combating evolving risks. APIs play a critical role in facilitating smooth communication and data exchange within application ecosystems, which has also fueled the adoption of robust API security solutions. As hackers increasingly target APIs due to their widespread usage and access to valuable data, the API security market continues to expand.

Furthermore, consistent investments and the rising demand for APIs are driving the growth of the API security market. These factors indicate promising growth prospects as organizations prioritize enhanced security and governance measures. Consequently, there is expected to be substantial growth in the demand for API security solutions in the foreseeable future.

By vertical, the BFSI segment accounts for a larger market share.

BFSI is one of the most heavily regulated industries in the world. As a result, businesses in this sector are under constant pressure to protect their sensitive data from cyberattacks. API security is a critical component of any BFSI organization's cybersecurity strategy. The increasing adoption of cloud-based and microservices-based architectures in the BFSI sector drives the demand for API security solutions. The growing number of connected devices and the rising popularity of mobile banking are also contributing to the growth of the API security market in the BFSI vertical.

By deployment mode, the cloud segment accounts for a larger market share

Cloud deployment mode is gaining traction across the API security market for the following reasons:

- Scalability: Cloud-based API security solutions can be scaled up or down quickly to meet the changing needs of an organization. It is essential for businesses that experience spikes in API traffic, such as during peak business hours or marketing campaigns.

- Cost-effectiveness: Cloud-based API security solutions are often more cost-effective than on-premises solutions. Cloud providers typically offer a pay-as-you-go pricing model, meaning businesses only pay for the resources they use.

- Ease of use: Cloud-based API security solutions are typically more straightforward than on-premises solutions. This is because cloud providers usually offer a user-friendly dashboard that makes it easy to manage API security policies.

Breakdown of primaries

The study contains various industry experts' insights, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 25%, Tier 2 - 40%, and Tier 3 - 35%

- By Designation: C-level - 30%, Directors - 35%, and Managers - 35%

- By Region: North America - 15%, Europe - 25%, Asia Pacific - 30%, Middle East and Africa - 20%, Latin America - 10%

Major vendors in the global API security market include Google (Apigee) (US), Salt (US), Noname (US), Akamai (US), Data Theorem (US), Axway (US), Imperva (US), Traceable (US), Palo Alto Networks (US), Fortinet (US), Red Hat (US), Airlock by Ergon (Switzerland), Akana by Perforce (US), WS02 (UK), Forum Systems (UK), Cequence (US), Sensidia (Brazil), Spherical Defense (US), Neosec (US), Signal Sciences (US), Firetail (US), Resurface Labs (US), 42Crunch (Ireland), Aiculus (Australia), Gravitee (France) and Nevatech (Georgia).

The study includes an in-depth competitive analysis of the key players in the API security market, their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the API security market and forecasts its size by offering (Platforms & Solutions and Services), Deployment mode (On-premises, Hybrid, and Cloud), Organization Size (SMEs and Large Enterprises), Vertical (BFSI, IT and ITeS, Telecom, Government, Manufacturing, Healthcare, Retail and eCommerce, Media and Entertainment, Energy and Utilities, and other Verticals), and Region (North America, Europe, Asia Pacific, Middle East and Africa, and Latin America).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall API security market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Surge in breaches involving APIs have fueled the growth of API security, and APIs have become a prime target for threat actors), restraints (Lack of skilled professionals for implementing API security solutions and impact of regulatory constraints on API security solutions), opportunities (Rapid demand of APIs to meet business needs and continuous rise in the investment in API security), and challenges (Traditional security controls may not provide sufficient protection for APIs and safeguarding sensitive data in decentralized architectures through consistent API management and security)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the API security market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the API security market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the API security market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players Google (Apigee) (US), Salt (US), Noname (US), Akamai (US), Palo Alto Networks (US), among others in the API security market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2022

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 GLOBAL APPLICATION PROGRAMMING INTERFACE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primary interviews

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS AND SERVICES IN API SECURITY MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1: SUPPLY-SIDE ANALYSIS

- FIGURE 5 API SECURITY- MARKET ESTIMATION APPROACH: SUPPLY-SIDE ANALYSIS (COMPANY REVENUE ESTIMATION)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1- BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS AND SERVICES IN API SECURITY MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 2- BOTTOM-UP (DEMAND SIDE): PRODUCTS/SOLUTIONS/SERVICES

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RECESSION IMPACT AND ASSUMPTIONS

- 2.5.1 RECESSION IMPACT

- 2.5.2 RESEARCH ASSUMPTIONS

- 2.6 STUDY LIMITATIONS

- FIGURE 8 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 3 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET AND GROWTH RATE, 2017-2022 (USD MILLION, Y-O-Y %)

- TABLE 4 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET AND GROWTH RATE, 2023-2028 (USD MILLION, Y-O-Y %)

- FIGURE 9 GLOBAL APPLICATION PROGRAMMING INTERFACE SECURITY MARKET AND Y-O-Y GROWTH RATE

- FIGURE 10 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE MARKET OPPORTUNITIES IN APPLICATION PROGRAMMING INTERFACE SECURITY MARKET

- FIGURE 11 API SECURITY OFFERINGS TO ADDRESS GROWING THREAT ACROSS WEB APPLICATIONS

- 4.2 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET SHARE OF TOP THREE VERTICALS AND REGIONS, 2023

- FIGURE 12 BFSI SEGMENT AND NORTH AMERICA TO HOLD LARGEST MARKET SHARES IN 2023

- 4.3 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028

- FIGURE 13 PLATFORM AND SOLUTIONS SEGMENT TO HAVE LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.4 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028

- FIGURE 14 CLOUD SEGMENT TO DOMINATE MARKET IN 2023

- 4.5 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028

- FIGURE 15 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.6 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET INVESTMENT SCENARIO, BY REGION

- FIGURE 16 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS BY 2028

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.1.1 TYPES OF API

- 5.1.2 API PROTOCOLS AND ARCHITECTURES

- 5.1.3 OPEN WEB APPLICATION SECURITY PROJECT (OWASP): TOP 10 API VULNERABILITIES IN 2023

- 5.2 MARKET DYNAMICS

- FIGURE 17 API SECURITY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in API breaches across industries

- 5.2.1.2 Exploitation by hackers

- FIGURE 18 UNDERLYING FACTORS CONTRIBUTING TO API SECURITY INCIDENTS

- 5.2.1.3 Growing complexity of ecosystem

- 5.2.1.4 Need to safeguard applications and protect sensitive data

- 5.2.2 RESTRAINTS

- 5.2.2.1 Impact of regulatory restraints

- 5.2.2.2 Lack of skilled professionals

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rapid demand for APIs to meet business needs

- 5.2.3.2 Increased awareness and rising investments

- 5.2.4 CHALLENGES

- 5.2.4.1 Safeguarding sensitive data in decentralized architectures

- 5.2.4.2 Traditional security controls limiting protection against API attacks

- 5.3 USE CASES

- 5.3.1 CASE STUDY 1: NOV INC. IMPLEMENTED PINGINTELLIGENCE AND AXWAY FOR ENHANCED API SECURITY AND GOVERNANCE

- 5.3.2 CASE STUDY 2: OFX ENHANCED APPLICATION SECURITY WITH SIGNAL SCIENCES FOR API AND MICROSERVICES PROTECTION

- 5.3.3 CASE STUDY 3: PAIDY IMPLEMENTED APISEC FOR AUTOMATED API SECURITY TESTING, IMPROVING COVERAGE, AND EFFICIENCY

- 5.3.4 CASE STUDY 4: THREATX SECURED SEGPAY'S APPS AND APIS WITH PRECISION AND VISIBILITY

- 5.3.5 CASE STUDY 5: DATA THEOREM ASSISTED WILDFLOWER IN ADDRESSING SECURITY ISSUES AND MEETING CUSTOMER DEMAND

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 19 API SECURITY MARKET: VALUE CHAIN ANALYSIS

- 5.5 APPLICATION SECURITY MARKET ECOSYSTEM

- FIGURE 20 API SECURITY MARKET ECOSYSTEM

- TABLE 5 API SECURITY MARKET: ECOSYSTEM ANALYSIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 API SECURITY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 IMPACT OF PORTER'S FIVE FORCES ON API SECURITY MARKET

- 5.6.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.6.2 BARGAINING POWER OF SUPPLIERS

- 5.6.3 BARGAINING POWER OF BUYERS

- 5.6.4 THREAT OF SUBSTITUTES

- 5.6.5 THREAT OF NEW ENTRANTS

- 5.7 PRICING ANALYSIS

- TABLE 7 PRICING/PRICING MODELS OF APISEC

- TABLE 8 PRICING/PRICING MODELS OF SALT SECURITY

- TABLE 9 PRICING/PRICING MODELS OF IMPERVA

- TABLE 10 PRICING/PRICING MODELS OF AICULUS

- TABLE 11 PRICING/PRICING MODELS OF WSO2

- TABLE 12 PRICING/PRICING MODELS OF NEOSEC

- TABLE 13 PRICING/PRICING MODELS OF RED HAT

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 5.8.2 API SECURITY TESTING TOOLS

- 5.8.3 ZERO TRUST ARCHITECTURE

- 5.8.4 WEB APPLICATION FIREWALLS (WAFS)

- 5.8.5 CONTAINERIZATION AND MICROSERVICES

- 5.8.6 BEHAVIORAL ANALYTICS AND THREAT INTELLIGENCE

- 5.9 PATENT ANALYSIS

- FIGURE 22 PATENT ANALYSIS: API SECURITY

- 5.10 EMERGING TRENDS IN API SECURITY MARKET

- FIGURE 23 MAJOR YCC TRENDS TO DRIVE FUTURE REVENUE PROSPECTS IN API SECURITY MARKET

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

- 5.11.2 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

- 5.11.3 SARBANES-OXLEY ACT (SOX)

- 5.11.4 EUROPEAN UNION GENERAL DATA PROTECTION REGULATION

- 5.11.5 NIS DIRECTIVE

- 5.11.6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- 5.13 KEY CONFERENCES AND EVENTS IN 2023-2024

- TABLE 16 API SECURITY MARKET: KEY CONFERENCES AND EVENTS

6 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: API SECURITY MARKET DRIVERS

- FIGURE 25 SERVICES SEGMENT TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

- TABLE 17 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 18 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 PLATFORM AND SOLUTIONS

- 6.2.1 SMART TECHNOLOGIES TO MITIGATE ADVANCED CYBERATTACKS

- TABLE 19 PLATFORM AND SOLUTIONS: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 20 PLATFORM AND SOLUTIONS: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SERVICES

- 6.3.1 INTEGRATION AND HYBRID DEPLOYMENT OF API SECURITY SERVICES TO PROPEL GROWTH

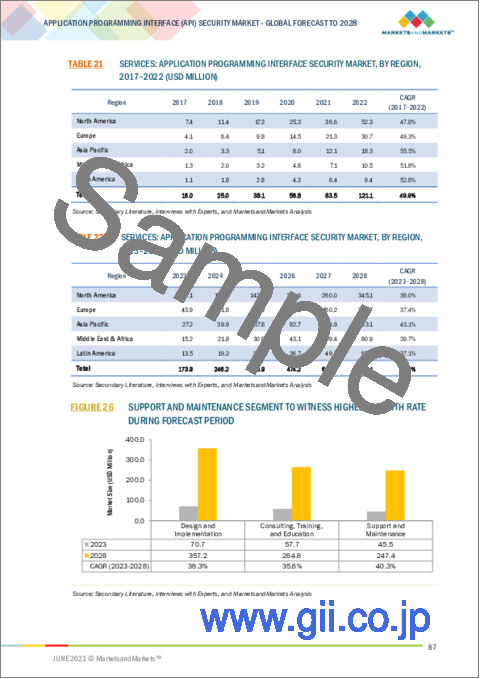

- TABLE 21 SERVICES: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 22 SERVICES: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- FIGURE 26 SUPPORT AND MAINTENANCE SEGMENT TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- TABLE 23 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY SERVICES, 2017-2022 (USD MILLION)

- TABLE 24 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- 6.3.2 DESIGN AND IMPLEMENTATION

- TABLE 25 DESIGN AND IMPLEMENTATION: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 26 DESIGN AND IMPLEMENTATION: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.3 CONSULTING, TRAINING, AND EDUCATION

- TABLE 27 CONSULTING, TRAINING, AND EDUCATION: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 28 CONSULTING, TRAINING, AND EDUCATION: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.4 SUPPORT AND MAINTENANCE

- TABLE 29 SUPPORT AND MAINTENANCE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 30 SUPPORT AND MAINTENANCE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

7 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE

- 7.1 INTRODUCTION

- 7.1.1 DEPLOYMENT MODE: API SECURITY MARKET DRIVERS

- FIGURE 27 CLOUD DEPLOYMENT MODE SEGMENT TO ACCOUNT FOR LARGER MARKET DURING FORECAST PERIOD

- TABLE 31 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 32 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- 7.2 ON-PREMISES

- 7.2.1 CUSTOMIZATION OF ON-PREMISES SOLUTIONS TO BOOST DEMAND

- TABLE 33 ON-PREMISES: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 34 ON-PREMISES: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 CLOUD

- 7.3.1 COST OPTIMIZATION, SCALABILITY, AND FLEXIBILITY TO DRIVE DEMAND

- TABLE 35 CLOUD: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 36 CLOUD: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 HYBRID

- 7.4.1 STRENGTHENING HYBRID CONNECTIVITY ACROSS ENTERPRISES TO DRIVE DEMAND

- TABLE 37 HYBRID: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 38 HYBRID: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

8 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE

- 8.1 INTRODUCTION

- 8.1.1 ORGANIZATION SIZE: API SECURITY MARKET DRIVERS

- FIGURE 28 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- TABLE 39 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 40 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 8.2.1 FLEXIBILITY AND AFFORDABILITY TO BOOST SALES OF SECURITY SOLUTIONS

- TABLE 41 SMALL AND MEDIUM-SIZED ENTERPRISES: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 42 SMALL AND MEDIUM-SIZED ENTERPRISES: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 LARGE ENTERPRISES

- 8.3.1 RISING CONCERNS ABOUT REGULATORY COMPLIANCE TO FUEL ADOPTION

- TABLE 43 LARGE ENTERPRISES: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 44 LARGE ENTERPRISES: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

9 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.1.1 VERTICAL: API SECURITY MARKET DRIVERS

- FIGURE 29 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 45 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 46 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 9.2.1 RISING DEMAND FOR DATA PROTECTION SERVICES IN BANKING COMPANIES TO DRIVE MARKET

- TABLE 47 BANKING, FINANCIAL SERVICES, AND INSURANCE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 48 BANKING, FINANCIAL SERVICES, AND INSURANCE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 IT AND ITES

- 9.3.1 GROWING CONCERNS OF FRAUD AND COMPLIANCE TO PROPEL MARKET

- TABLE 49 IT AND ITES: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 50 IT AND ITES: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 TELECOM

- 9.4.1 ADVANCED TECHNOLOGIES TO HELP WITH API ADOPTION

- TABLE 51 TELECOM: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 52 TELECOM: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 GOVERNMENT

- 9.5.1 RISING CONCERNS ABOUT IDENTITY THEFT AND BUSINESS FRAUD TO DRIVE MARKET

- TABLE 53 GOVERNMENT: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 54 GOVERNMENT: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 MANUFACTURING

- 9.6.1 API SECURITY TO BOOST MANAGED API SECURITY INFRASTRUCTURE

- TABLE 55 MANUFACTURING: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 56 MANUFACTURING: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.7 HEALTHCARE

- 9.7.1 NEED TO SECURE CRITICAL PATIENT DATA ACROSS CLOUD ENVIRONMENT TO BOOST DEMAND

- TABLE 57 HEALTHCARE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 58 HEALTHCARE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.8 RETAIL AND E-COMMERCE

- 9.8.1 AUTOMATION ACROSS RETAIL CHANNELS FOR CURBING DATA THEFT TO BOOST MARKET

- TABLE 59 RETAIL AND E-COMMERCE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 60 RETAIL AND E-COMMERCE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.9 MEDIA AND ENTERTAINMENT

- 9.9.1 NEED TO SECURE DIGITAL ASSETS TO FUEL GROWTH

- TABLE 61 MEDIA AND ENTERTAINMENT: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 62 MEDIA AND ENTERTAINMENT: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.10 ENERGY AND UTILITIES

- 9.10.1 NEED TO SECURE CRITICAL INFRASTRUCTURE TO DRIVE GROWTH

- TABLE 63 ENERGY AND UTILITIES: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 64 ENERGY AND UTILITIES: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.11 OTHER VERTICALS

- TABLE 65 OTHER VERTICALS: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 66 OTHER VERTICALS: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

10 APPLICATION PROGRAMMING INTERFACE (API) SECURITY MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 67 APPLICATION PR0GRAMMING INTERFACE SECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 68 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: API SECURITY MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- 10.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

- FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 69 NORTH AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: APPLICATION PROGRAMMING INTERFACE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.2.4 US

- 10.2.4.1 Rising cybersecurity threats and vulnerabilities to drive market

- TABLE 79 US: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 80 US: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 81 US: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 82 US: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 83 US: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 84 US: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 85 US: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 86 US: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.2.5 CANADA

- 10.2.5.1 Growing digital landscape to drive focus on robust api security

- TABLE 87 CANADA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 88 CANADA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 89 CANADA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 90 CANADA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 91 CANADA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 92 CANADA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 93 CANADA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 94 CANADA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: API SECURITY MARKET DRIVERS

- 10.3.2 EUROPE: RECESSION IMPACT

- 10.3.3 EUROPE: REGULATORY LANDSCAPE

- TABLE 95 EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 96 EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 97 EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 98 EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 99 EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 100 EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 101 EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 102 EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 103 EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 104 EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.4 UNITED KINGDOM

- 10.3.4.1 Government initiatives to drive adoption of API security with comprehensive guidelines

- TABLE 105 UK: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 106 UK: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 107 UK: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 108 UK: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 109 UK: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE,2017-2022 (USD MILLION)

- TABLE 110 UK: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 111 UK: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 112 UK: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.3.5 GERMANY

- 10.3.5.1 Digitalization and industrial growth to drive demand

- TABLE 113 GERMANY: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 114 GERMANY: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 115 GERMANY: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 116 GERMANY: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 117 GERMANY: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 118 GERMANY: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 119 GERMANY: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 120 GERMANY: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.3.6 FRANCE

- 10.3.6.1 Digital revolution and e-commerce to drive demand

- TABLE 121 FRANCE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 122 FRANCE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 123 FRANCE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 124 FRANCE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 125 FRANCE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 126 FRANCE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 127 FRANCE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 128 FRANCE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.3.7 REST OF EUROPE

- TABLE 129 REST OF EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 130 REST OF EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 131 REST OF EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 132 REST OF EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 133 REST OF EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 134 REST OF EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 135 REST OF EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 136 REST OF EUROPE: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: API SECURITY MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- 10.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

- FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 137 ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 138 ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 139 ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 140 ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 141 ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 142 ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 143 ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 144 ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 146 ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.4 CHINA

- 10.4.4.1 Digital economy to drive demand

- TABLE 147 CHINA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 148 CHINA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 149 CHINA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 150 CHINA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 151 CHINA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 152 CHINA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 153 CHINA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 154 CHINA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.4.5 JAPAN

- 10.4.5.1 Cybersecurity challenges and digital infrastructure to boost market

- TABLE 155 JAPAN: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 156 JAPAN: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 157 JAPAN: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 158 JAPAN: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 159 JAPAN: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 160 JAPAN: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 161 JAPAN: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 162 JAPAN: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.4.6 INDIA

- 10.4.6.1 Initiatives taken by government to promote api security

- TABLE 163 INDIA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 164 INDIA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 165 INDIA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 166 INDIA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 167 INDIA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 168 INDIA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 169 INDIA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 170 INDIA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.4.7 REST OF ASIA PACIFIC

- TABLE 171 REST OF ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 177 REST OF ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: API SECURITY MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.5.3 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

- TABLE 179 MIDDLE EAST & AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.4 MIDDLE EAST

- 10.5.4.1 Cloud computing and digital infrastructure to drive demand

- TABLE 189 MIDDLE EAST: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 190 MIDDLE EAST: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 191 MIDDLE EAST: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 192 MIDDLE EAST: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 193 MIDDLE EAST: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 194 MIDDLE EAST: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 195 MIDDLE EAST: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 196 MIDDLE EAST: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.5.5 AFRICA

- 10.5.5.1 Technological advancements to fuel cloud services and api security growth

- TABLE 197 AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 198 AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 199 AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 200 AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 201 AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 202 AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 203 AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 204 AFRICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: API SECURITY MARKET DRIVERS

- 10.6.2 LATIN AMERICA: RECESSION IMPACT

- 10.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

- TABLE 205 LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 206 LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 207 LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 208 LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 209 LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 210 LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 211 LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 212 LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL,2023-2028 (USD MILLION)

- TABLE 213 LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 214 LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.6.4 BRAZIL

- 10.6.4.1 Evolving tech landscape to boost demand

- TABLE 215 BRAZIL: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 216 BRAZIL: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 217 BRAZIL: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 218 BRAZIL: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 219 BRAZIL: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 220 BRAZIL: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 221 BRAZIL: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 222 BRAZIL: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.6.5 MEXICO

- 10.6.5.1 Strengthening digital infrastructure to boost demand

- TABLE 223 MEXICO: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 224 MEXICO: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 225 MEXICO: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 226 MEXICO: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 227 MEXICO: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 228 MEXICO: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 229 MEXICO: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 230 MEXICO: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.6.6 REST OF LATIN AMERICA

- TABLE 231 REST OF LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 232 REST OF LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 233 REST OF LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 234 REST OF LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 235 REST OF LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 236 REST OF LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 237 REST OF LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 238 REST OF LATIN AMERICA: APPLICATION PROGRAMMING INTERFACE SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 REVENUE ANALYSIS OF LEADING PLAYERS

- FIGURE 33 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET: REVENUE ANALYSIS

- 11.3 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

- TABLE 239 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET: DEGREE OF COMPETITION

- 11.4 HISTORICAL REVENUE ANALYSIS

- FIGURE 34 APPLICATION PROGRAMMING INTERFACE SECURITY PROVIDERS: HISTORICAL THREE-YEAR SEGMENTAL REVENUE ANALYSIS OF KEY PUBLIC SECTORS

- 11.5 RANKING OF KEY PLAYERS

- FIGURE 35 KEY PLAYERS' RANKING

- 11.6 EVALUATION MATRIX FOR KEY PLAYERS

- 11.6.1 DEFINITIONS AND METHODOLOGY

- FIGURE 36 EVALUATION QUADRANT FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 37 EVALUATION MATRIX FOR KEY PLAYERS, 2023

- 11.6.2 STARS

- 11.6.3 EMERGING LEADERS

- 11.6.4 PERVASIVE PLAYERS

- 11.6.5 PARTICIPANTS

- 11.7 COMPETITIVE BENCHMARKING

- FIGURE 38 REGIONAL SNAPSHOT OF KEY MARKET PLAYERS AND THEIR HEADQUARTERS

- 11.7.1 KEY COMPANY EVALUATION CRITERIA

- TABLE 240 KEY COMPANY INDUSTRY FOOTPRINT

- TABLE 241 KEY COMPANY REGION FOOTPRINT

- 11.7.2 SME/STARTUP COMPANY EVALUATION CRITERIA

- TABLE 242 DETAILED LIST OF STARTUPS

- TABLE 243 SME/STARTUP INDUSTRY FOOTPRINT

- TABLE 244 SME/STARTUP REGION FOOTPRINT

- 11.8 SME/STARTUP COMPANY EVALUATION QUADRANT

- 11.8.1 DEFINITIONS AND METHODOLOGY

- FIGURE 39 EVALUATION QUADRANT FOR SME/STARTUP: CRITERIA WEIGHTAGE

- FIGURE 40 EVALUATION MATRIX FOR SME/STARTUP, 2023

- 11.8.2 PROGRESSIVE COMPANIES

- 11.8.3 RESPONSIVE COMPANIES

- 11.8.4 DYNAMIC COMPANIES

- 11.8.5 STARTING BLOCKS

- 11.9 VALUATION AND FINANCIAL METRICS OF API SECURITY VENDORS

- FIGURE 41 VALUATION AND FINANCIAL METRICS OF VENDORS

- 11.10 COMPETITIVE SCENARIO AND TRENDS

- 11.10.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 245 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2020-2022

- 11.10.2 DEALS

- TABLE 246 APPLICATION PROGRAMMING INTERFACE SECURITY MARKET: DEALS, 2020-2023

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 12.1.1 GOOGLE (APIGEE)

- TABLE 247 GOOGLE (APIGEE): BUSINESS OVERVIEW

- FIGURE 42 GOOGLE (APIGEE): COMPANY SNAPSHOT

- TABLE 248 GOOGLE (APIGEE): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 GOOGLE (APIGEE): PRODUCT LAUNCHES

- 12.1.2 SALT SECURITY

- TABLE 250 SALT SECURITY: BUSINESS OVERVIEW

- TABLE 251 SALT SECURITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 SALT SECURITY: PRODUCT LAUNCHES

- 12.1.3 NONAME

- TABLE 253 NONAME: BUSINESS OVERVIEW

- TABLE 254 NONAME: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 NONAME: PRODUCT LAUNCHES

- TABLE 256 NONAME: DEALS

- 12.1.4 AKAMAI

- TABLE 257 AKAMAI: BUSINESS OVERVIEW

- FIGURE 43 AKAMAI: COMPANY SNAPSHOT

- TABLE 258 AKAMAI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 AKAMAI: DEALS

- 12.1.5 DATA THEOREM

- TABLE 260 DATA THEOREM: BUSINESS OVERVIEW

- TABLE 261 DATA THEOREM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.6 AXWAY

- TABLE 262 AXWAY: BUSINESS OVERVIEW

- FIGURE 44 AXWAY: COMPANY SNAPSHOT

- TABLE 263 AXWAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.7 IMPERVA

- TABLE 264 IMPERVA: BUSINESS OVERVIEW

- TABLE 265 IMPERVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 IMPERVA: PRODUCT LAUNCHES

- TABLE 267 IMPERVA: DEALS

- 12.1.8 TRACEABLE

- TABLE 268 TRACEABLE: BUSINESS OVERVIEW

- TABLE 269 TRACEABLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.9 PALO ALTO NETWORKS

- TABLE 270 PALO ALTO NETWORKS: BUSINESS OVERVIEW

- FIGURE 45 PALO ALTO NETWORKS: COMPANY SNAPSHOT

- TABLE 271 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 PALO ALTO NETWORKS: PRODUCT LAUNCHES

- 12.1.10 FORTINET

- TABLE 273 FORTINET: BUSINESS OVERVIEW

- FIGURE 46 FORTINET: COMPANY SNAPSHOT

- TABLE 274 FORTINET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2 OTHER PLAYERS

- 12.2.1 RED HAT

- 12.2.2 AIRLOCK BY ERGON

- 12.2.3 AKANA BY PERFORCE

- 12.2.4 WSO2

- 12.2.5 FORUM SYSTEMS

- 12.2.6 CEQUENCE SECURITY

- 12.2.7 SENSEDIA

- 12.2.8 SPHERICAL DEFENSE

- 12.2.9 NEOSEC

- 12.2.10 SIGNAL SCIENCES

- 12.2.11 FIRETAIL

- 12.2.12 RESURFACE LABS

- 12.2.13 42CRUNCH

- 12.2.14 AICULUS

- 12.2.15 GRAVITEE.IO

- 12.2.16 NEVATECH

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 ADJACENT MARKETS

- 13.1 INTRODUCTION

- TABLE 275 ADJACENT MARKETS AND FORECASTS

- 13.2 LIMITATIONS

- 13.3 APPLICATION PROGRAMMING INTERFACE SECURITY ECOSYSTEM AND ADJACENT MARKETS

- 13.4 WEB APPLICATION FIREWALL MARKET

- 13.4.1 ADJACENT MARKET: WEB APPLICATION FIREWALL MARKET, BY ORGANIZATION SIZE

- TABLE 276 WEB APPLICATION FIREWALL MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 277 WEB APPLICATION FIREWALL MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 278 SMALL AND MEDIUM-SIZED ENTERPRISES: WEB APPLICATION FIREWALL MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 279 SMALL AND MEDIUM-SIZED ENTERPRISES: WEB APPLICATION FIREWALL MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 280 LARGE ENTERPRISES: WEB APPLICATION FIREWALL MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 281 LARGE ENTERPRISES: WEB APPLICATION FIREWALL MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.5 API MANAGEMENT MARKET

- 13.5.1 ADJACENT MARKET: API MANAGEMENT MARKET, BY ORGANIZATION SIZE

- TABLE 282 API MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 283 API MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2027 (USD MILLION)

- TABLE 284 SMALL AND MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 285 SMALL AND MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2021-2027 (USD MILLION)

- TABLE 286 LARGE ENTERPRISES MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 287 LARGE ENTERPRISES MARKET, BY REGION, 2021-2027 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS