|

|

市場調査レポート

商品コード

1295440

センサーフュージョン市場:アルゴリズム(カルマンフィルター、ベイズフィルター、中心極限定理、畳み込みニューラルネットワーク)、技術(MEMS、非MEMS)、提供(ハードウェア、ソフトウェア)、最終用途、地域別-2028年までの世界予測Sensor Fusion Market by Algorithms (Kalman Filter, Bayesian Filter, Central Limit Theorem, Convolutional Neural Networks), Technology (MEMS, Non-MEMS), Offering (Hardware, Software), End-Use Application and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| センサーフュージョン市場:アルゴリズム(カルマンフィルター、ベイズフィルター、中心極限定理、畳み込みニューラルネットワーク)、技術(MEMS、非MEMS)、提供(ハードウェア、ソフトウェア)、最終用途、地域別-2028年までの世界予測 |

|

出版日: 2023年06月12日

発行: MarketsandMarkets

ページ情報: 英文 228 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のセンサーフュージョンの市場規模は、2023年の80億米ドルから2028年には180億米ドルに成長し、予測期間中に17.8%のCARで成長すると予測されています。

センサーフュージョン市場の成長を促進する主な要因としては、スマートウォッチ、フィットネストラッカー、その他のウェアラブル技術などのウェアラブルデバイスの需要拡大、エレクトロニクスの小型化の動向などが挙げられます。しかし、複数のセンサーにまたがるキャリブレーションは、今後の市場の課題となると思われます。市場プレイヤーの主な成長機会は、ADAS (先進運転支援システム) と自律走行車に対する需要の拡大です。

"非MEMS技術の市場が、予測期間中により高いCAGRで成長"

センサフュージョン市場の非MEMSセグメントは、予測期間中に最も高いCAGRで成長すると予測されています。レーダー・LiDAR・画像などの非MEMSベースのセンサーは、衝突回避システムや電子安定制御などの自動車安全システムで広く使用され、車両周囲の完全な視野を提供します。これらの技術はサイズが大きくなる傾向があり、異なる材料や製造技術を使用する場合があります。非MEMS技術の活用領域は、通信・エネルギー・医療・輸送など、多くの分野で見られます。これらの技術は、現代文化のいくつかの側面を劇的に変える可能性を秘めており、独自の材料、生産技術、コンピュータアルゴリズムの創造を往々にして伴っています。

"自動車向け最終用途が、予測期間中最大のCAGRを維持"

センサーフュージョン市場を最終用途別に見ると、予測期間中は自動車がより速いペースで成長すると予想されています。自動車に使用されるセンサーの数が増加しています。自動車で使用されるセンサーは、安全性・快適性・環境保護・運転支援といった、輸送における性能向上の重要な要素を形成しています。センサーフュージョン技術は、安全性、運転支援、エンターテインメント・システムなどの自動車で広く使用され、複数のセンサーやデータを抽出・結合します。さらに、インテリジェントな自動車とADAS (先進運転支援システム) の急速な発展に伴い、新しい動向として、ドライバーが交通システムに関与するレベルが混在するようになり、市場促進要因となっています。

"アジア太平洋が予測期間中、地域別で最も高い成長を達成する"

予測期間中、アジア太平洋がセンサーフュージョンの重要市場であり、世界市場を独占すると予想されています。この地域は、センサーフュージョン製品とソリューションに対する需要が最も高いです。特に、センサーフュージョンシステムの主な活用領域である家電・自動車・医療製品の主要市場となっています。センサーフュージョン技術は、スマートフォン・タブレット・ゲーム機・ウェアラブル機器などの民生用電子機器で、モーションセンシング、ナビゲーション、ジェスチャー認識などの用途に主に使用されています。同地域は、Samsung Group (韓国)、Huawei (中国) Xiaomi (中国) など、世界的に大きな市場を持つ主要なスマートフォン製造企業の拠点であり、同地域の市場成長を牽引しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- 技術分析

- ケーススタディ分析

- 特許分析

- 貿易分析

- 主要な利害関係者と購入基準

- ポーターのファイブフォース分析

- 主要な会議とイベント (2023年~2024年)

- 規制状況

第6章 センサーフュージョンのアルゴリズム

- イントロダクション

- カルマンフィルター

- ベイジアンフィルター

- 中心極限定理

- 畳み込みニューラルネットワーク

第7章 センサーフュージョン市場:技術別

- イントロダクション

- MEMS

- 非MEMS

第8章 センサーフュージョン市場:提供別

- イントロダクション

- ハードウェア

- 慣性コンボセンサー

- レーダー+画像センサー+LiDAR

- 環境センサー (温度+圧力+湿度/光/ガスセンサー)

- IMU+GPS

- その他

- ソフトウェア

- AIベース

- 非AIベース

第9章 センサーフュージョン市場:最終用途別

- イントロダクション

- 家電

- スマートフォン

- タブレット・ノートブック

- テレビゲーム機

- ウェアラブル

- スマートテレビ

- 自動車

- 先進運転支援システム (ADAS)

- 横滑り防止システム (ESC)

- 衝突回避システム (CAS)

- 駐車支援システム (PAS)

- ホームオートメーション

- 遠隔制御システム

- 環境制御システム

- その他

- 医療

- ウェアラブル健康機器

- 非ウェアラブル健康機器

- 軍隊

- 適応型ナビゲーションシステム (ANS)

- 無人航空機 (UAV)

- 工業

- その他の用途

第10章 地域分析

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋

- その他の地域 (ROW)

- 中東・アフリカ

- 南米

第11章 競合情勢

- 概要

- 主要企業が採用した戦略

- 市場シェア分析 (2022年)

- センサーフュージョン市場:上位企業の収益分析

- 企業評価クアドラント

- スタートアップ/中小企業の評価クアドラント

- 企業のフットプリント

- 競争シナリオと動向

第12章 企業プロファイル

- 主要企業

- STMICROELECTRONICS

- INVENSENSE INC.

- INFINEON TECHNOLOGIES AG

- BOSCH SENSORTEC GMBH

- ANALOG DEVICES, INC.

- NXP SEMICONDUCTORS

- RENESAS ELECTRONICS CORPORATION

- AMPHENOL CORPORATION

- TEXAS INSTRUMENTS INC.

- QUALCOMM TECHNOLOGIES, INC.

- その他の企業

- MEMSIC SEMICONDUCTOR CO., LTD.

- CEVA, INC.

- KIONIX, INC.

- ASAHI KASEI MICRODEVICES CORPORATION

- INTEL CORPORATION

- TE CONNECTIVITY

- BASELABS

- CONTINENTAL AG

- PLUSAI, INC.

- REIVR FUSION

- ALTERIA AUTOMATION

- APTIV

- QUICKLOGIC

- PNI SENSOR

- SBG SYSTEMS

第13章 付録

The sensor fusion market is projected to grow from USD 8.0 billion in 2023 to USD 18.0 billion by 2028, registering a CAGR of 17.8% during the forecast period. Some of the major factors driving the growth of the sensor fusion market include the growing demand for wearable devices, such as smartwatches, fitness trackers, and other wearable technology, and the growing trend of miniaturization in electronics. However, calibration across multiple sensors will be a challenge for the market in the future. The major growth opportunities for the market players are growing demand for advanced driver assistance systems (ADAS) and f autonomous vehicles.

"Market for Non-MEMS technology to grow at higher CAGR during forecast period"

The non-MEMS segment of the sensor fusion market is expected to account for the highest CAGR in the forecast period. Non-MEMS-based sensors such as radar, LiDAR, and image are extensively used in automotive safety systems, such as collision avoidance systems and electronic stability controls, to provide a complete view of the vehicle's surroundings. These technologies tend to be larger in size and may use different materials and production techniques. Applications for non-MEMS technology can be found in a number of sectors, including telecommunications, energy, healthcare, and transportation. These technologies, which have the potential to drastically alter several aspects of modern culture, frequently involve the creation of unique materials, production techniques, and computer algorithms.

"Automotive end-use application holds the largest CAGR in sensor fusion market during forecast period"

The automotive application is expected to grow at faster pace by end-use application for sensor fusion during the forecast period. There is increase in the number of sensors used in automobiles. The sensor used in automobiles form a vital component of performance enhancement in safety, comfort, environment protection, driver assistance, and other features in transportation. The sensor fusion technology is used widely in automobiles for safety, driver assistance, entertainment system, and so on to extract and combine multiple sensor data. Further, with the rapid development of intelligent vehicles and Advanced Driver-Assistance Systems (ADAS), a new trend is that mixed levels of human driver engagements will be involved in the transportation system and are driving the market growth.

"Asia Pacific to witness the highest growth among other regions during forecast period"

Asia Pacific is expected to dominate the sensor fusion market during the forecast period Asia Pacific is one of the emerging markets for sensor fusion. The APAC region continues to be a significant market for sensor fusion. This region has the highest demand for sensor fusion products and solutions. Asia-Pacific is the major market for consumer electronics, automobiles, and healthcare products where sensor fusion systems are mostly used. Sensor fusion technology is being used in consumer electronic devices such as smartphones, tablets, gaming consoles, and wearable devices mostly for applications such as motion sensing, navigation, gesture recognition, and so on. The region is a hub for major smartphone manufacturing companies, which hold a substantial market in the world, such as Samsung Group (South Korea), Huawei (China) and Xiaomi (China), thereby leading to the growth of the market in this region.

In determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key industry experts in the sensor fusion market. The break-up of primary participants for the report has been shown below:

- By company type: Tier 1 - 35 %, Tier 2 - 45%, and Tier 3 - 20%

- By designation: C-Level Executives - 35%, Managers - 25%, and Others - 40%

- By region: North America - 45%, Europe - 20%, Asia Pacific - 30%, and RoW - 5%

The report profiles key players in the sensor fusion market with their respective market ranking analyses. Prominent players profiled in this report include STMicroelectronics (Switzerland), InvenSense, Inc. (US), NXP Semiconductors N.V. (Netherlands), Infineon Technologies (Germany), Bosch Sensortec GmbH (Germany), Analog Devices, Inc. (US), Renesas Electronics Corporation. (Japan), Amphenol Corporation (US), Texas Instruments (US), and Qualcomm Technologies, Inc. (US), among others.

Research coverage

This research report categorizes the sensor fusion market on the basis of component, product, application, vertical, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the sensor fusion market and forecasts the same till 2028. The report also consists of leadership mapping and analysis of companies in the sensor fusion ecosystem.

Key benefits of buying report

The report will help market leaders/new entrants with information on the closest approximations of the revenue numbers for the sensor fusion market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 SENSOR FUSION MARKET SEGMENT

- 1.3.2 YEARS CONSIDERED

- 1.3.3 GEOGRAPHIC SCOPE

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 INTRODUCTION

- FIGURE 2 SENSOR FUSION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.3.1 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using supply-side analysis

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

- 2.6.1 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- 3.1 RECESSION ANALYSIS

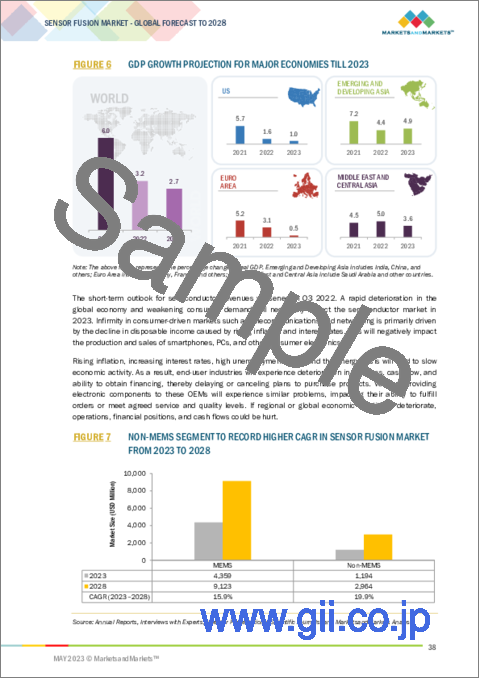

- FIGURE 6 GDP GROWTH PROJECTION FOR MAJOR ECONOMIES TILL 2023

- FIGURE 7 NON-MEMS SEGMENT TO RECORD HIGHER CAGR IN SENSOR FUSION MARKET FROM 2023 TO 2028

- FIGURE 8 HARDWARE SEGMENT TO EXHIBIT HIGHER CAGR BETWEEN 2023 AND 2028

- FIGURE 9 AUTOMOTIVE APPLICATION TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 10 SENSOR FUSION MARKET, BY REGION, 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SENSOR FUSION MARKET

- FIGURE 11 INCREASING DEMAND FROM AUTOMOTIVE AND CONSUMER ELECTRONICS APPLICATIONS TO FUEL MARKET

- 4.2 SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE

- FIGURE 12 MARKET FOR IMU + GPS TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- 4.3 SENSOR FUSION MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

- FIGURE 13 CONSUMER ELECTRONICS APPLICATIONS AND CHINA HELD LARGEST SHARE OF ASIA PACIFIC MARKET IN 2022

- 4.4 SENSOR FUSION MARKET, BY COUNTRY

- FIGURE 14 INDIA TO DOMINATE SENSOR FUSION MARKET GLOBALLY THROUGHOUT FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 SENSOR FUSION MARKET: DYNAMICS

- 5.2.1 DRIVERS

- FIGURE 16 SENSOR FUSION MARKET DRIVERS: IMPACT ANALYSIS

- 5.2.1.1 Increasing use of integrated sensors in smartphones

- 5.2.1.2 Growing trend of miniaturization in electronics

- 5.2.1.3 Rising demand for home automation solutions

- 5.2.2 RESTRAINTS

- FIGURE 17 SENSOR FUSION MARKET RESTRAINTS: IMPACT ANALYSIS

- 5.2.2.1 Lack of standardization in MEMS and sensor fusion products

- 5.2.2.2 Calibration-related issues across multiple sensors

- 5.2.3 OPPORTUNITIES

- FIGURE 18 SENSOR FUSION MARKET OPPORTUNITIES: IMPACT ANALYSIS

- 5.2.3.1 Growing deployment of advanced driver-assistance systems (ADAS), coupled with rising demand for autonomous vehicles

- 5.2.3.2 Increasing use of wearable devices

- 5.2.4 CHALLENGES

- FIGURE 19 SENSOR FUSION MARKET CHALLENGES: IMPACT ANALYSIS

- 5.2.4.1 Security and safety concerns

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 20 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED BY COMPONENT MANUFACTURERS AND ASSEMBLERS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 21 REVENUE SHIFTS IN SENSOR FUSION MARKET

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE (ASP) OF SENSOR FUSION COMPONENTS, BY APPLICATION

- TABLE 1 AVERAGE SELLING PRICE OF VARIOUS SENSOR FUSION COMPONENTS, BY APPLICATION

- FIGURE 22 AVERAGE SELLING PRICE OF INERTIAL MEASUREMENT UNITS OFFERED BY KEY PLAYERS

- TABLE 2 AVERAGE SELLING PRICE OF INERTIAL MEASUREMENT UNITS OFFERED BY KEY PLAYERS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TRENDS IN SENSOR FUSION MARKET

- 5.7.1.1 Sensor fusion to transform future of automated driving

- 5.7.1.2 Sensor fusion to advance next-generation wearable devices

- 5.7.1 KEY TRENDS IN SENSOR FUSION MARKET

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 RENESAS' CASE STUDY FOR AUTONOMOUS DRIVING AND ADAS

- 5.8.2 WIREFLOW HELPED CLIENT DEVELOP MULTI-SENSORY DEVICE WITH SENSOR FUSION CAPABILITY FOR MARITIME APPLICATIONS

- 5.9 PATENT ANALYSIS

- FIGURE 23 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 3 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- FIGURE 24 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2022

- 5.9.1 LIST OF MAJOR PATENTS

- TABLE 4 LIST OF MAJOR PATENTS IN SENSOR FUSION MARKET

- 5.10 TRADE ANALYSIS

- FIGURE 25 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 902690, BY COUNTRY, 2019-2022 (USD THOUSAND)

- FIGURE 26 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 902690, BY COUNTRY, 2019-2022 (USD THOUSAND)

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE APPLICATIONS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE APPLICATIONS

- 5.11.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 END-USE APPLICATIONS

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 END-USE APPLICATIONS

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 PORTER'S FIVE FORCES ANALYSIS, 2022

- TABLE 7 SENSOR FUSION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF BUYERS

- 5.12.4 BARGAINING POWER OF SUPPLIERS

- 5.12.5 THREAT OF NEW ENTRANTS

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 8 SENSOR FUSION MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS RELATED TO SENSOR FUSION

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS AND REGULATIONS RELATED TO SENSOR FUSION

- TABLE 13 NORTH AMERICA: SAFETY STANDARDS FOR SENSOR FUSION MARKET

- TABLE 14 EUROPE: SAFETY STANDARDS FOR SENSOR FUSION MARKET

- TABLE 15 ASIA PACIFIC: SAFETY STANDARDS FOR SENSOR FUSION MARKET

6 SENSOR FUSION ALGORITHMS

- 6.1 INTRODUCTION

- FIGURE 30 ALGORITHMS USED IN SENSOR FUSION TECHNIQUES

- 6.2 KALMAN FILTER

- 6.3 BAYESIAN FILTER

- 6.4 CENTRAL LIMIT THEOREM

- 6.5 CONVOLUTIONAL NEURAL NETWORKS

7 SENSOR FUSION MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 31 SENSOR FUSION MARKET, BY TECHNOLOGY

- FIGURE 32 NON-MEMS TECHNOLOGY TO REGISTER HIGHER CAGR IN SENSOR FUSION MARKET DURING FORECAST PERIOD

- TABLE 16 SENSOR FUSION MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 17 SENSOR FUSION MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 7.2 MEMS

- 7.2.1 RISING USE OF MEMS TECHNOLOGY-BASED SENSORS IN MOTION-SENSING DEVICES TO PROPEL MARKET

- TABLE 18 MEMS: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 19 MEMS: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- FIGURE 33 MEMS TECHNOLOGY-ENABLED 9-AXIS INERTIAL COMBO SENSORS TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 20 MEMS: SENSOR FUSION MARKET, BY INERTIAL COMBO PRODUCT, 2019-2022 (USD MILLION)

- TABLE 21 MEMS: SENSOR FUSION MARKET, BY INERTIAL COMBO PRODUCT, 2023-2028 (USD MILLION)

- TABLE 22 MEMS: SENSOR FUSION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 23 MEMS: SENSOR FUSION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 NON-MEMS

- 7.3.1 TELECOMMUNICATIONS, ENERGY, HEALTHCARE, AND TRANSPORTATION SECTORS TO CONTRIBUTE TO MARKET GROWTH

- TABLE 24 NON-MEMS: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 25 NON-MEMS: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 26 NON-MEMS: SENSOR FUSION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 27 NON-MEMS: SENSOR FUSION MARKET, BY REGION, 2023-2028 (USD MILLION)

8 SENSOR FUSION MARKET, BY OFFERING

- 8.1 INTRODUCTION

- FIGURE 34 SENSOR FUSION MARKET, BY OFFERING

- FIGURE 35 HARDWARE SEGMENT TO HOLD MAJORITY OF SENSOR FUSION MARKET SHARE IN 2023

- TABLE 28 SENSOR FUSION MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 29 SENSOR FUSION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 30 OFFERING: SENSOR FUSION MARKET, BY END-USE APPLICATION, 2019-2022 (USD MILLION)

- TABLE 31 OFFERING: SENSOR FUSION MARKET, BY END-USE APPLICATION, 2023-2028 (USD MILLION)

- 8.2 HARDWARE

- 8.2.1 HIGH ADOPTION OF INERTIAL COMBO SENSORS IN VARIOUS APPLICATIONS TO SUPPORT SEGMENTAL GROWTH

- FIGURE 36 SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE

- FIGURE 37 INERTIAL COMBO SENSORS TO ACCOUNT FOR LARGEST SHARE OF SENSOR FUSION MARKET IN 2023

- TABLE 32 HARDWARE: SENSOR FUSION MARKET, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 33 HARDWARE: SENSOR FUSION MARKET, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 34 HARDWARE: SENSOR FUSION MARKET, BY END-USE APPLICATION, 2019-2022 (USD MILLION)

- TABLE 35 HARDWARE: SENSOR FUSION MARKET, BY END-USE APPLICATION, 2023-2028 (USD MILLION)

- TABLE 36 HARDWARE: SENSOR FUSION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 37 HARDWARE: SENSOR FUSION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.2 INERTIAL COMBO SENSORS

- 8.2.2.1 High adoption of IMUs in automobiles, aircraft, gaming consoles, navigation systems, and robotics to fuel market

- TABLE 38 INERTIAL COMBO SENSORS: SENSOR FUSION MARKET, BY END-USE APPLICATION, 2019-2022 (USD MILLION)

- TABLE 39 INERTIAL COMBO SENSORS: SENSOR FUSION MARKET, BY END-USE APPLICATION, 2023-2028 (USD MILLION)

- FIGURE 38 WEARABLES SEGMENT TO RECORD HIGHEST CAGR IN MARKET FOR INERTIAL COMBO SENSORS THROUGHOUT FORECAST PERIOD

- TABLE 40 INERTIAL COMBO SENSORS: SENSOR FUSION MARKET, BY CONSUMER ELECTRONICS APPLICATION, 2019-2022 (USD MILLION)

- TABLE 41 INERTIAL COMBO SENSORS: SENSOR FUSION MARKET, BY CONSUMER ELECTRONICS APPLICATION, 2023-2028 (USD MILLION)

- 8.2.2.2 Accelerometers + gyroscopes

- 8.2.2.2.1 Increasing adoption of sensor fusion from aircraft, automobiles, and gaming consoles to boost segmental growth

- 8.2.2.3 Accelerometers + magnetometers

- 8.2.2.3.1 Increasing use of combination sensors in Smart TV and home automation applications to drive market

- 8.2.2.4 9-axis (3-axis gyroscope, 3-axis accelerometer, & 3-axis magnetometer)

- 8.2.2.4.1 Presence of major market players offering 9-axis sensor fusion software and solutions to contribute to market growth

- 8.2.2.5 12-axis (3-axis gyroscope, 3-axis accelerometer, 3-axis magnetometer, light sensor, temperature sensor, and pressure sensor)

- 8.2.2.5.1 Increasing demand for smart portable devices, such as smartphones and tablets, to accelerate segmental growth

- 8.2.2.2 Accelerometers + gyroscopes

- 8.2.3 RADAR + IMAGE SENSORS + LIDAR

- 8.2.3.1 Rising demand for advanced driver-assistance systems, collision detection systems, and automatic cruising systems to boost segmental growth

- TABLE 42 RADAR + IMAGE SENSORS + LIDAR: SENSOR FUSION MARKET, BY END-USE APPLICATION, 2019-2022 (USD MILLION)

- TABLE 43 RADAR + IMAGE SENSORS + LIDAR: SENSOR FUSION MARKET, BY END-USE APPLICATION, 2023-2028 (USD MILLION)

- 8.2.4 ENVIRONMENTAL SENSORS (TEMPERATURE + PRESSURE + HUMIDITY/LIGHT/GAS SENSORS)

- 8.2.4.1 Growing penetration of intelligent weather forecasting systems to drive segmental growth

- TABLE 44 ENVIRONMENTAL SENSORS: SENSOR FUSION MARKET, BY END-USE APPLICATION, 2019-2022 (USD MILLION)

- TABLE 45 ENVIRONMENTAL SENSORS: SENSOR FUSION MARKET, BY END-USE APPLICATION, 2023-2028 (USD MILLION)

- TABLE 46 ENVIRONMENTAL SENSORS: SENSOR FUSION MARKET, BY CONSUMER ELECTRONICS APPLICATION, 2019-2022 (USD MILLION)

- TABLE 47 ENVIRONMENTAL SENSORS: SENSOR FUSION MARKET, BY CONSUMER ELECTRONICS APPLICATION, 2023-2028 (USD MILLION)

- 8.2.5 IMU + GPS

- 8.2.5.1 Increasing use of navigation systems in automotive, consumer electronics, and military applications to drive segmental growth

- TABLE 48 IMU + GPS: SENSOR FUSION MARKET, BY END-USE APPLICATION, 2019-2022 (USD MILLION)

- TABLE 49 IMU + GPS: SENSOR FUSION MARKET, BY END-USE APPLICATION, 2023-2028 (USD MILLION)

- TABLE 50 IMU + GPS: SENSOR FUSION MARKET, BY CONSUMER ELECTRONICS APPLICATION, 2019-2022 (USD MILLION)

- TABLE 51 IMU + GPS: SENSOR FUSION MARKET, BY CONSUMER ELECTRONICS APPLICATION, 2023-2028 (USD MILLION)

- 8.2.6 OTHERS

- TABLE 52 OTHERS: SENSOR FUSION MARKET, BY END-USE APPLICATION, 2019-2022 (USD MILLION)

- TABLE 53 OTHERS: SENSOR FUSION MARKET, BY END-USE APPLICATION, 2023-2028 (USD MILLION)

- TABLE 54 OTHERS: SENSOR FUSION MARKET, BY CONSUMER ELECTRONICS APPLICATION, 2019-2022 (USD MILLION)

- TABLE 55 OTHERS: SENSOR FUSION MARKET, BY CONSUMER ELECTRONICS APPLICATION, 2023-2028 (USD MILLION)

- 8.3 SOFTWARE

- 8.3.1 INTEGRATION OF SENSOR FUSION PRODUCTS IN ROBOTICS, AUTONOMOUS VEHICLES, AND VIRTUAL REALITY APPLICATIONS TO BOOST DEMAND FOR SOFTWARE

- FIGURE 39 SOFTWARE SENSOR FUSION MARKET, BY TYPE

- FIGURE 40 NON-AI-BASED SOFTWARE TO HOLD LARGER SHARE OF SENSOR FUSION MARKET IN 2023

- TABLE 56 SOFTWARE: SENSOR FUSION MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 57 SOFTWARE: SENSOR FUSION MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 58 SOFTWARE: SENSOR FUSION MARKET, BY END-USE APPLICATION, 2019-2022 (USD MILLION)

- TABLE 59 SOFTWARE: SENSOR FUSION MARKET, BY END-USE APPLICATION, 2023-2028 (USD MILLION)

- TABLE 60 SOFTWARE: SENSOR FUSION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 61 SOFTWARE: SENSOR FUSION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.2 AI-BASED

- 8.3.2.1 Increasing penetration of deep learning and machine learning technologies to drive market

- TABLE 62 AI-BASED: SENSOR FUSION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 63 AI-BASED: SENSOR FUSION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.3 NON-AI-BASED

- 8.3.3.1 High adoption of non-AI-based sensor fusion products in Asia Pacific to fuel segmental growth

- TABLE 64 NON-AI-BASED: SENSOR FUSION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 65 NON-AI-BASED: SENSOR FUSION MARKET, BY REGION, 2023-2028 (USD MILLION)

9 SENSOR FUSION MARKET, BY END-USE APPLICATION

- 9.1 INTRODUCTION

- FIGURE 41 SENSOR FUSION MARKET, BY END-USE APPLICATION

- FIGURE 42 CONSUMER ELECTRONICS TO CAPTURE LARGEST SHARE OF SENSOR FUSION MARKET IN 2023

- TABLE 66 SENSOR FUSION MARKET, BY END-USE APPLICATION, 2019-2022 (USD MILLION)

- TABLE 67 SENSOR FUSION MARKET, BY END-USE APPLICATION, 2023-2028 (USD MILLION)

- TABLE 68 SENSOR FUSION MARKET FOR HARDWARE, BY CONSUMER ELECTRONICS APPLICATION, 2019-2022 (USD MILLION)

- TABLE 69 SENSOR FUSION MARKET FOR HARDWARE, BY CONSUMER ELECTRONICS APPLICATION, 2023-2028 (USD MILLION)

- 9.2 CONSUMER ELECTRONICS

- TABLE 70 CONSUMER ELECTRONICS: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 71 CONSUMER ELECTRONICS: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 72 CONSUMER ELECTRONICS: SENSOR FUSION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 73 CONSUMER ELECTRONICS: SENSOR FUSION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2.1 SMARTPHONES

- 9.2.1.1 Increasing users of smartphones to propel market

- TABLE 74 SMARTPHONES: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 75 SMARTPHONES: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- 9.2.2 TABLETS AND NOTEBOOKS

- 9.2.2.1 Growing focus on manufacturing power-saving tablets to drive market

- TABLE 76 TABLETS AND NOTEBOOKS: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 77 TABLETS AND NOTEBOOKS: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- 9.2.3 VIDEO GAME CONSOLES

- 9.2.3.1 Booming gaming industry to create opportunities for market players

- TABLE 78 VIDEO GAME CONSOLES: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 79 VIDEO GAME CONSOLES: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- 9.2.4 WEARABLES

- 9.2.4.1 Rising demand for fitness and sports applications that monitor health to fuel market

- TABLE 80 WEARABLES: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 81 WEARABLES: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- 9.2.5 SMART TVS

- 9.2.5.1 Constant developments in smart TVs to drive demand for sensor fusion

- TABLE 82 SMART TVS: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 83 SMART TVS: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- 9.3 AUTOMOTIVE

- 9.3.1 RISING USE OF SENSORS IN AUTOMOBILES TO OFFER ENHANCED SAFETY TO FUEL MARKET

- FIGURE 43 RADAR + IMAGE SENSORS + LIDAR SEGMENT TO DOMINATE SENSOR FUSION MARKET FOR AUTOMOTIVE APPLICATIONS

- TABLE 84 AUTOMOTIVE: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 85 AUTOMOTIVE: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 86 AUTOMOTIVE: SENSOR FUSION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 87 AUTOMOTIVE: SENSOR FUSION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3.2 ADVANCED DRIVER-ASSISTANCE SYSTEM

- 9.3.2.1 Growing need for intelligent and automated driving systems to boost demand for sensor fusion

- 9.3.3 ELECTRONIC STABILITY CONTROL SYSTEM

- 9.3.3.1 Increasing concerns for safety measures in automated vehicles to drive market

- 9.3.4 COLLISION AVOIDANCE SYSTEM

- 9.3.4.1 Growing penetration of hybrid and autonomous vehicles to fuel market

- 9.3.5 PARKING ASSIST SYSTEM

- 9.3.5.1 Rising adoption of sensor fusion technology while manufacturing automotive vehicles to drive market

- 9.4 HOME AUTOMATION

- 9.4.1 GROWING USE OF HOME AUTOMATION PRODUCTS TO SPUR DEMAND FOR SENSOR FUSION

- TABLE 88 HOME AUTOMATION: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 89 HOME AUTOMATION: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 90 HOME AUTOMATION: SENSOR FUSION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 91 HOME AUTOMATION: SENSOR FUSION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4.2 REMOTE CONTROL SYSTEM

- 9.4.2.1 Inclination of consumers toward home automation to boost market

- 9.4.3 ENVIRONMENT CONTROL SYSTEM

- 9.4.3.1 Increasing demand for HVAC systems to support market growth

- 9.4.4 OTHERS

- 9.5 MEDICAL

- 9.5.1 EMERGING NEED FOR INTELLIGENT SENSOR TECHNOLOGIES AND MONITORING DEVICES TO DRIVE MARKET

- TABLE 92 MEDICAL: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 93 MEDICAL: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 94 MEDICAL: SENSOR FUSION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 95 MEDICAL: SENSOR FUSION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5.2 WEARABLE HEALTH DEVICES

- 9.5.2.1 Rapid advancements in healthcare services and wireless communication technologies to boost market

- 9.5.3 NON-WEARABLE HEALTH DEVICES

- 9.5.3.1 Increasing demand for telemedicine solutions for elderly care to foster market

- 9.6 MILITARY

- 9.6.1 INCREASING USE OF MACHINE LEARNING TO MEET MISSION-CRITICAL OBJECTIVES TO DRIVE MARKET

- TABLE 96 MILITARY: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 97 MILITARY: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 98 MILITARY: SENSOR FUSION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 99 MILITARY: SENSOR FUSION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6.2 ADAPTABLE NAVIGATION SYSTEM (ANS)

- 9.6.2.1 Growing need to restructure navigation applications by combining advanced and traditional sensor data to propel market

- 9.6.3 UNMANNED AERIAL VEHICLE (UAV)

- 9.6.3.1 Increasing deployment of UAVs in military applications to spur demand for sensor fusion

- 9.7 INDUSTRIAL

- 9.7.1 GROWING PENETRATION OF INDUSTRIAL ROBOTS TO DRIVE MARKET

- TABLE 100 INDUSTRIAL: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 101 INDUSTRIAL: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 102 INDUSTRIAL: SENSOR FUSION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 103 INDUSTRIAL: SENSOR FUSION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.8 OTHER APPLICATIONS

- TABLE 104 OTHER APPLICATIONS: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 105 OTHER APPLICATIONS: SENSOR FUSION MARKET FOR HARDWARE, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- TABLE 106 OTHER APPLICATIONS: SENSOR FUSION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 107 OTHER APPLICATIONS: SENSOR FUSION MARKET, BY REGION, 2023-2028 (USD MILLION)

10 GEOGRAPHIC ANALYSIS

- 10.1 INTRODUCTION

- FIGURE 44 SENSOR FUSION MARKET, BY REGION

- FIGURE 45 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN SENSOR FUSION MARKET DURING FORECAST PERIOD

- TABLE 108 SENSOR FUSION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 109 SENSOR FUSION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 46 NORTH AMERICA: SENSOR FUSION MARKET SNAPSHOT

- TABLE 110 NORTH AMERICA: SENSOR FUSION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 111 NORTH AMERICA: SENSOR FUSION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 112 NORTH AMERICA: SENSOR FUSION MARKET, BY END-USE APPLICATION, 2019-2022 (USD MILLION)

- TABLE 113 NORTH AMERICA: SENSOR FUSION MARKET, BY END-USE APPLICATION, 2023-2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: SENSOR FUSION MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 115 NORTH AMERICA: SENSOR FUSION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 116 NORTH AMERICA: SENSOR FUSION MARKET FOR HARDWARE, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 117 NORTH AMERICA: SENSOR FUSION MARKET FOR HARDWARE, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 118 NORTH AMERICA: SENSOR FUSION MARKET FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 119 NORTH AMERICA: SENSOR FUSION MARKET FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Automotive and consumer electronics to contribute significantly to market growth

- 10.2.2 CANADA

- 10.2.2.1 Growing use of sensor fusion technology in automotive applications to boost growth

- 10.2.3 MEXICO

- 10.2.3.1 Presence of manufacturing plants of giant automobile companies to support market growth

- 10.3 EUROPE

- FIGURE 47 EUROPE: SENSOR FUSION MARKET SNAPSHOT

- TABLE 120 EUROPE: SENSOR FUSION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 121 EUROPE: SENSOR FUSION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 122 EUROPE: SENSOR FUSION MARKET, END-USE APPLICATION, 2019-2022 (USD MILLION)

- TABLE 123 EUROPE: SENSOR FUSION MARKET, END-USE APPLICATION, 2023-2028 (USD MILLION)

- TABLE 124 EUROPE: SENSOR FUSION MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 125 EUROPE: SENSOR FUSION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 126 EUROPE: SENSOR FUSION MARKET FOR HARDWARE, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 127 EUROPE: SENSOR FUSION MARKET FOR HARDWARE, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 128 EUROPE: SENSOR FUSION MARKET FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 129 EUROPE: SENSOR FUSION MARKET FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.1 UK

- 10.3.1.1 Significant presence of aerospace companies to support market growth

- 10.3.2 GERMANY

- 10.3.2.1 Rising use of technology in industrial automation and robotics to boost market

- 10.3.3 FRANCE

- 10.3.3.1 Presence of strong automobile companies to fuel market

- 10.3.4 REST OF EUROPE

- 10.4 ASIA PACIFIC

- FIGURE 48 ASIA PACIFIC: SENSOR FUSION MARKET SNAPSHOT

- TABLE 130 ASIA PACIFIC: SENSOR FUSION MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: SENSOR FUSION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: SENSOR FUSION MARKET, END-USE APPLICATION, 2019-2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: SENSOR FUSION MARKET, END-USE APPLICATION, 2023-2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: SENSOR FUSION MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: SENSOR FUSION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 136 ASIA PACIFIC: SENSOR FUSION MARKET FOR HARDWARE, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 137 ASIA PACIFIC: SENSOR FUSION MARKET FOR HARDWARE, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 138 ASIA PACIFIC: SENSOR FUSION MARKET FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 139 ASIA PACIFIC: SENSOR FUSION MARKET FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 Increasing use of sensor fusion in consumer electronics to drive market

- 10.4.2 JAPAN

- 10.4.2.1 Increasing adoption of multi-sensor fusion technology in intelligent industrial robots to propel market

- 10.4.3 INDIA

- 10.4.3.1 Increased demand for embedded monitoring devices in healthcare sector to provide growth opportunities

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Growing demand from consumer electronics and automotive applications to support market growth

- 10.4.5 REST OF ASIA PACIFIC

- 10.5 REST OF THE WORLD (ROW)

- FIGURE 49 ROW: SENSOR FUSION MARKET SNAPSHOT

- TABLE 140 ROW: SENSOR FUSION MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 141 ROW: SENSOR FUSION MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 142 ROW: SENSOR FUSION MARKET, END-USE APPLICATION, 2019-2022 (USD MILLION)

- TABLE 143 ROW: SENSOR FUSION MARKET, END-USE APPLICATION, 2023-2028 (USD MILLION)

- TABLE 144 ROW: SENSOR FUSION MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 145 ROW: SENSOR FUSION MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 146 ROW: SENSOR FUSION MARKET FOR HARDWARE, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 147 ROW: SENSOR FUSION MARKET FOR HARDWARE, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 148 ROW: SENSOR FUSION MARKET FOR SOFTWARE, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 149 ROW: SENSOR FUSION MARKET FOR SOFTWARE, BY TYPE, 2023-2028 (USD MILLION)

- 10.5.1 MIDDLE EAST & AFRICA

- 10.5.1.1 Rising adoption of self-driving vehicles to contribute to market growth

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Growing demand for multi-cameras and high-megapixel cameras to boost market

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 150 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN SENSOR FUSION MARKET

- 11.2.1 PRODUCT PORTFOLIO

- 11.2.2 REGIONAL FOCUS

- 11.2.3 ORGANIC/INORGANIC GROWTH STRATEGIES

- 11.3 MARKET SHARE ANALYSIS, 2022

- TABLE 151 SENSOR FUSION MARKET: DEGREE OF COMPETITION

- 11.4 REVENUE ANALYSIS OF TOP PLAYERS IN SENSOR FUSION MARKET

- FIGURE 50 THREE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN SENSOR FUSION MARKET

- 11.5 COMPANY EVALUATION QUADRANT

- 11.5.1 STARS

- 11.5.2 PERVASIVE PLAYERS

- 11.5.3 EMERGING LEADERS

- 11.5.4 PARTICIPANTS

- FIGURE 51 SENSOR FUSION MARKET: COMPANY EVALUATION QUADRANT, 2022

- 11.6 STARTUPS/SMES EVALUATION QUADRANT

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 52 SENSOR FUSION MARKET: STARTUPS/SMES EVALUATION QUADRANT, 2022

- 11.7 COMPANY FOOTPRINT

- TABLE 152 COMPANY FOOTPRINT

- TABLE 153 COMPANY FOOTPRINT, BY PRODUCT TYPE

- TABLE 154 COMPANY FOOTPRINT, BY END-USE APPLICATION

- TABLE 155 COMPANY FOOTPRINT, BY REGION

- TABLE 156 SENSOR FUSION MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 157 SENSOR FUSION MARKET BY PRODUCT TYPE: LIST OF KEY STARTUPS/SMES

- TABLE 158 SENSOR FUSION MARKET BY APPLICATION: LIST OF KEY STARTUPS/SMES

- TABLE 159 SENSOR FUSION MARKET BY REGION: LIST OF KEY STARTUPS/SMES

- 11.8 COMPETITIVE SCENARIOS AND TRENDS

- 11.8.1 PRODUCT LAUNCHES AND DEVELOPMENTS

- TABLE 160 SENSOR FUSION MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS, JANUARY 2019-JANUARY 2023

- 11.8.2 DEALS

- TABLE 161 SENSOR FUSION MARKET: DEALS, JANUARY 2019-JANUARY 2023

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 12.1.1 STMICROELECTRONICS

- TABLE 162 STMICROELECTRONICS: COMPANY OVERVIEW

- FIGURE 53 STMICROELECTRONICS: COMPANY SNAPSHOT

- TABLE 163 STMICROELECTRONICS: PRODUCT LAUNCHES

- TABLE 164 STMICROELECTRONICS: DEALS

- 12.1.2 INVENSENSE INC.

- TABLE 165 INVENSENSE INC.: COMPANY OVERVIEW

- TABLE 166 INVENSENSE INC.: PRODUCT LAUNCHES

- 12.1.3 INFINEON TECHNOLOGIES AG

- TABLE 167 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- FIGURE 54 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- TABLE 168 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- 12.1.4 BOSCH SENSORTEC GMBH

- TABLE 169 BOSCH SENSORTEC GMBH: COMPANY OVERVIEW

- TABLE 170 BOSCH SENSORTECH GMBH: PRODUCT LAUNCHES

- TABLE 171 BOSCH SENSORTEC GMBH: DEALS

- 12.1.5 ANALOG DEVICES, INC.

- TABLE 172 ANALOG DEVICES, INC.: COMPANY OVERVIEW

- FIGURE 55 ANALOG DEVICES, INC.: COMPANY SNAPSHOT

- TABLE 173 ANALOG DEVICES, INC.: DEALS

- 12.1.6 NXP SEMICONDUCTORS

- TABLE 174 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- FIGURE 56 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- TABLE 175 NXP SEMICONDUCTORS: PRODUCT LAUNCHES

- 12.1.7 RENESAS ELECTRONICS CORPORATION

- TABLE 176 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- FIGURE 57 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- TABLE 177 RENESAS ELECTRONICS CORPORATION: DEALS

- 12.1.8 AMPHENOL CORPORATION

- TABLE 178 AMPHENOL CORPORATION: COMPANY OVERVIEW

- FIGURE 58 AMPHENOL CORPORATION: COMPANY SNAPSHOT

- TABLE 179 AMPHENOL CORPORATION: DEALS

- 12.1.9 TEXAS INSTRUMENTS INC.

- TABLE 180 TEXAS INSTRUMENTS INC.: COMPANY OVERVIEW

- FIGURE 59 TEXAS INSTRUMENTS INC.: COMPANY SNAPSHOT

- 12.1.10 QUALCOMM TECHNOLOGIES, INC.

- TABLE 181 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- FIGURE 60 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 182 QUALCOMM TECHNOLOGIES, INC.: DEALS

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 MEMSIC SEMICONDUCTOR CO., LTD.

- 12.2.2 CEVA, INC.

- 12.2.3 KIONIX, INC.

- 12.2.4 ASAHI KASEI MICRODEVICES CORPORATION

- 12.2.5 INTEL CORPORATION

- 12.2.6 TE CONNECTIVITY

- 12.2.7 BASELABS

- 12.2.8 CONTINENTAL AG

- 12.2.9 PLUSAI, INC.

- 12.2.10 REIVR FUSION

- 12.2.11 ALTERIA AUTOMATION

- 12.2.12 APTIV

- 12.2.13 QUICKLOGIC

- 12.2.14 PNI SENSOR

- 12.2.15 SBG SYSTEMS

13 APPENDIX

- 13.1 INSIGHTS OF INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 AVAILABLE CUSTOMIZATIONS

- 13.5 RELATED REPORTS