|

|

市場調査レポート

商品コード

1290724

量子フォトニクスの世界市場:提供別 (システム、サービス)・用途別 (量子通信、量子コンピューティング、量子センシング・計測)・業種別 (銀行・金融、農業・環境)・地域別の将来予測 (2030年まで)Quantum Photonics Market Size by Offering (Systems, and Services), Application (Quantum Communications, Quantum Computing, and Quantum Sensing & Metrology), Vertical (Banking & Finance, Agriculture & Environment) and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 量子フォトニクスの世界市場:提供別 (システム、サービス)・用途別 (量子通信、量子コンピューティング、量子センシング・計測)・業種別 (銀行・金融、農業・環境)・地域別の将来予測 (2030年まで) |

|

出版日: 2023年06月07日

発行: MarketsandMarkets

ページ情報: 英文 217 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の量子フォトニクスの市場規模は、2023年に4億米ドルと評価され、2023年から2030年にかけて32.2%のCAGRで成長し、2030年には33億米ドルに達すると予測されています。

セキュア通信の需要増大や量子フォトニクスコンピューティングへの投資拡大などの要因が、予測期間中の市場成長を後押ししています。

"量子フォトニクスへの投資拡大"

近年、複数の企業や学術機関が量子フォトニクスに大規模な投資を行っています。量子フォトニクスへの投資拡大は、量子フォトニクスの進歩と採用の主要な促進要因です。企業や組織は、量子フォトニクス技術がコンピューティング・通信・センシングを含む様々な産業に革命を起こす計り知れない可能性を認識しています。投資増加は研究開発に拍車をかけ、ハードウェア・アルゴリズム・アプリケーションのブレークスルーにつながっています。政府・ベンチャーキャピタル・テクノロジー大手からの資金提供は、量子フォトニクスの進歩を加速させるために必要なリソースを提供しています。量子フォトニクスへの投資の増加はイノベーションを促進し、高度なスキルを持つ専門家を引き付け、エコシステムを拡大します。このような資金提供の急増は、量子フォトニクスの成長を促進し、様々な産業における変革的ソリューションの機会を生み出しています。

カリフォルニア州を拠点とするPsiQuantum社は、フォトニック量子ビットを利用した、実行可能で耐障害性に優れた量子コンピューターの開発に取り組んでいます。BlackRockが主導し、Baillie GiffordとM12 (マイクロソフトのスタートアップファンド) が参加した資金調達ラウンドで、この企業は2020年に2億1,500万米ドルを調達しました。この資金調達により、PsiQuantumは事業を拡大し、量子フォトニクス技術の開発を加速させることができます。

2021年の資金調達ラウンドで1億米ドルを調達したカナダの量子コンピューティング新興企業Xanaduと、複数の産業パートナーと協力してフォトニックベースの量子コンピュータの開発に取り組んでいるオランダの研究機関QuTechは、PsiQuantumの他にも量子フォトニクス市場で注目すべき企業です。

"量子覇権の可能性"

量子フォトニクスは、高度な計算を行うために光子のユニークな特徴を利用することで、コンピューティングを一変させる可能性を秘めた刺激的な技術です。量子コンピュータが古典的なコンピュータの能力を超えるタスクを実行する能力は、量子至上主義と呼ばれています。超伝導量子ビットによる量子最高性能の実証にはかなりの成功例があるが、光子量子ビットによる量子最高性能はまだ実証されていないです。しかし、フォトニック量子コンピューティングの分野では大規模な調査が行われており、将来的には量子フォトニクス・コンピューティングが量子最高性能を達成する可能性があります。

2022年6月、Xanaduは同社の最新量子コンピューター「Borealis」をクラウドを通じて一般利用向けに発表しました。Borealisはこれまで開発された中で最大のフォトニック量子コンピューターで、216個のスクイーズドステート量子ビットを搭載し、一般に利用可能になったのはこれが初めてです。

"アジア太平洋地域が量子フォトニクス市場で急成長"

アジア太平洋、特に日本・韓国・中国には量子フォトニクス市場があります。アジア太平洋の量子フォトニクス市場が急成長しているのは、中国や日本などの新興国が、宇宙・防衛、医療・製薬、エネルギー・電力産業などの様々な用途で、量子フォトニクスシステムやサービスの需要を今後数年で高めていくためです。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 価格分析

- ケーススタディ分析

- 貿易分析

- 料金分析

- 規則

- 技術分析

- 特許分析

- 主要な会議とイベント (2023年~2024年)

- 収益の変化と顧客のビジネスのための新たな収益源

- 主要な利害関係者と購入プロセス

第6章 量子フォトニクス市場:提供別

- イントロダクション

- システム

- サービス

- QCaaS (Quantum Computing as a Service)

- コンサルティングサービス

第7章 量子フォトニクス市場:用途別

- イントロダクション

- 量子通信

- 量子ランダム発生器

- 量子鍵の配布

- 量子センシング・計測

- 原子時計

- 量子ドット光検出器

- PAR (光合成活性放射線) 量子センサー

- 量子LiDAR

- 量子コンピューティング

- オンプレミス

- クラウド

第8章 量子フォトニクス市場:業種別

- イントロダクション

- 宇宙・防衛

- 銀行・金融

- 医療・製薬

- 輸送・物流

- 政府

- 農業・環境

- その他

第9章 量子フォトニクス市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- オランダ

- その他の欧州

- アジア太平洋

- 中国

- 日本

- 韓国

- その他のアジア太平洋

- その他の地域

- 南米

- 中東・アフリカ

第10章 競合情勢

- イントロダクション

- 大手企業が採用した主要戦略

- 収益分析

- 市場シェア分析 (2022年)

- 企業評価クアドラント (2022年)

- 競合ベンチマーキング

- スタートアップ/中小企業の評価クアドラント (2022年)

- 競合状況・動向

第11章 企業プロファイル

- 主要企業

- XANADU

- PSI QUANTUM

- QUANDELA

- ID QUANTIQUE

- TOSHIBA

- ORCA COMPUTING

- QUIX QUANTUM

- TUNDRASYSTEMS GLOBAL

- NORDIC QUANTUM COMPUTING GROUP (NQCG)

- NU QUANTUM

- その他の主な企業

- SINGLE QUANTUM

- AMAZON WEB SERVICES

- NTT TECHNOLOGIES

- M SQUARED

- AOSENSE

- NEC CORPORATION

- QUANTUM XCHANGE

- CRYPTA LABS

- MICROCHIP TECHNOLOGY

- MENLO SYSTEMS

- THORLABS

- QUINTESSENCE LABS

- QUANTUM DICE

- QUSIDE

- QUBITEKK

第12章 付録

The quantum photonics market is valued at USD 0.4 billion in 2023 and is anticipated to be USD 3.3 billion by 2030, growing at a CAGR of 32.2% from 2023 to 2030. Factors such as rising demand for secure communication and growing investment in quantum photonics computing are driving the growth of the market during the forecast period.

Growing investment in quantum photonics

In recent years, several businesses and academic organizations have made large investments in quantum photonics. Growing investment in quantum photonics is a major driver for its advancement and adoption. Companies and organizations are recognizing the immense potential of quantum photonics technology in revolutionizing various industries, including computing, communications, and sensing. The increasing investment is fueling research and development efforts, leading to hardware, algorithms, and applications breakthroughs. Funding from governments, venture capitalists, and technology giants areproviding the necessary resources to accelerate the progress of quantum photonics. The increased investment in quantum photonics fosters innovation, attracts highly skilled professionals, and expands the ecosystem. This surge in funding is propelling the growth of quantum photonics and creating opportunities for transformative solutions in various industries.

PsiQuantum, a California-based firm, is working to create a viable, fault-tolerant quantum computer utilizing photonic qubits quantum computer. In a fundraising round that was headed by BlackRock and included Baillie Gifford and M12 (Microsoft's startup fund), the business raised USD 215 million in 2020. With this funding, PsiQuantum will be able to expand its business and quicken the development of its quantum photonics technology.

Xanadu, a Canadian quantum computing startup that raised USD 100 million in a funding round in 2021, and QuTech, a Dutch research institute that is working to develop a photonic-based quantum computer in cooperation with several industrial partners, are two other notable players in the quantum photonics market in addition to PsiQuantum.

Potential for quantum supremacy

Quantum photonics is an exciting technology that has the potential to transform computing by utilizing photons' unique features to conduct sophisticated computations. The capacity of quantum computers to do tasks that are beyond the capability of classical computers is referred to as quantum supremacy. While there has been considerable success in showing quantum supremacy with superconducting qubits, quantum supremacy with photonic qubits has yet to be shown. However, major research is being conducted in the field of photonic quantum computing, and quantum photonics computing may attain quantum supremacy in the future.

In June 2022, Xanadu announced the launch of Borealis, the company's newest quantum computer, for public use through the cloud. Borealis is the biggest photonic quantum computer ever developed and the first to be made available to the public, with 216 squeezed-state qubits.

Asia Pacific is the fastest-growing region in the quantum photonics market

There is an significant market for quantum photonics in Asia Pacific, specifically in countries like Japan, South Korea, and China. The significant growth of the Asia Pacific quantum photonics market can be attributed to the increasing demand for quantum photonics systems and services from emerging economies such as China and Japan for use in different applications in the space & defense, healthcare & pharmaceutical, and energy & power industries in the coming years.

The breakup of primaries conducted during the study is depicted below:

- By Company Type: Tier 1 - 18 %, Tier 2 - 22%, and Tier 3 -60%

- By Designation: C-Level Executives - 21%, Directors - 35%, and Others - 44%

- By Region: North America- 45%, Europe - 38%, Asia Pacific - 12%, Rest of world- 5%

Research Coverage

The report segments the quantum photonics market and forecasts its size, by value, based on region (North America, Europe, Asia Pacific, and RoW), offering (systems, and services), application (quantum communication, quantum computing, quantum sensing & metrology), and vertical (Space & Defense, Banking & Finance, Healthcare & Pharmaceutical, Transportation & Logistics, Government, Agriculture & Environment, Others(include academia, retail, telecom, media, energy & power, chemical, industrial, and oil & gas sectors). The report also provides a comprehensive review of market drivers, restraints, opportunities, and challenges in the quantum photonics market. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Reason to buy Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall quantum photonics market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rising demand for secure communication ,growing investment in quantum photonics, and potential for quantum supremacy), restraints (lack of standardization in quantum photonics, and regulatory challenges can hinder quantum photonics adoption and commercialization), opportunities (Advancements in quantum communications, Growing R&D and investments in quantum photonics computing), and challenges (Experimental constraints in quantum photonics computing) influencing the growth of the quantum photonics market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the quantum photonics market

- Market Development: Comprehensive information about lucrative markets - the report analyses the quantum photonics market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the quantum photonics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Toshiba (Japan), Xanadu (Canada), Quandela (France), ID Quantique (Switzerland), and PsiQuantum (US), among others in the quantum photonics market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 QUANTUM PHOTONICS MARKET: SEGMENTATION

- 1.4.2 REGIONAL SCOPE

- 1.4.3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 CURRENCY CONVERSION RATES

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 QUANTUM PHOTONICS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- FIGURE 3 QUANTUM PHOTONICS MARKET: RESEARCH APPROACH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of key primary interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Breakdown of primaries

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 RESEARCH FLOW FOR MARKET SIZE ESTIMATION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: REVENUES OF COMPANIES

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- TABLE 2 QUANTUM PHOTONICS MARKET: RESEARCH ASSUMPTIONS

- 2.5 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON QUANTUM PHOTONICS MARKET

- TABLE 3 QUANTUM PHOTONICS MARKET: RECESSION IMPACT APPROACH

- 2.6 RESEARCH LIMITATIONS

- FIGURE 9 QUANTUM PHOTONICS MARKET: RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

- TABLE 4 QUANTUM PHOTONICS MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 10 SYSTEMS SEGMENT TO ACCOUNT FOR LARGER SHARE OF QUANTUM COMPUTING MARKET DURING FORECAST PERIOD

- FIGURE 11 QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023 VS. 2030

- FIGURE 12 BANKING & FINANCE SEGMENT TO DOMINATE QUANTUM PHOTONICS MARKET IN 2030

- FIGURE 13 ASIA PACIFIC QUANTUM PHOTONICS MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN QUANTUM PHOTONICS MARKET

- FIGURE 14 RISING INVESTMENTS IN QUANTUM PHOTONICS TECHNOLOGY TO CREATE OPPORTUNITIES FOR MARKET PLAYERS

- 4.2 QUANTUM PHOTONICS MARKET, BY OFFERING

- FIGURE 15 SYSTEMS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- 4.3 QUANTUM PHOTONICS MARKET, BY APPLICATION

- FIGURE 16 QUANTUM COMMUNICATIONS TO ACCOUNT FOR LARGEST SHARE OF MARKET DURING FORECAST PERIOD

- 4.4 NORTH AMERICA QUANTUM PHOTONICS MARKET, BY APPLICATION AND COUNTRY

- FIGURE 17 QUANTUM COMMUNICATIONS TO HOLD LARGEST SHARE OF NORTH AMERICAN MARKET IN 2023

- 4.5 QUANTUM PHOTONICS MARKET, BY VERTICAL

- FIGURE 18 BANKING & FINANCE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.6 QUANTUM PHOTONICS MARKET, BY REGION

- FIGURE 19 SOUTH KOREA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 QUANTUM PHOTONICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- FIGURE 21 ANALYSIS OF IMPACT OF DRIVERS ON QUANTUM PHOTONICS MARKET

- 5.2.1.1 Rising demand for secure communication

- 5.2.1.2 Potential for quantum supremacy

- 5.2.1.3 Growing investment in quantum photonics

- 5.2.1.4 Integration with existing technologies

- 5.2.2 RESTRAINTS

- FIGURE 22 ANALYSIS OF IMPACT OF RESTRAINTS ON QUANTUM PHOTONICS MARKET

- 5.2.2.1 Lack of standardization in quantum photonics

- 5.2.2.2 Regulatory challenges hinder quantum photonics adoption and commercialization

- 5.2.2.3 Difficulty in quantum photonics scaling

- 5.2.3 OPPORTUNITIES

- FIGURE 23 ANALYSIS OF IMPACT OF OPPORTUNITIES ON QUANTUM PHOTONICS MARKET

- 5.2.3.1 Advancements in quantum communications

- 5.2.3.2 Growing R&D and investments in quantum photonics computing

- 5.2.3.3 Opportunities for hardware and software in quantum photonics computing market

- 5.2.4 CHALLENGES

- FIGURE 24 ANALYSIS OF IMPACT OF CHALLENGES ON QUANTUM PHOTONICS MARKET

- 5.2.4.1 Experimental constraints in quantum photonics computing

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 25 QUANTUM PHOTONICS MARKET: VALUE CHAIN ANALYSIS

- 5.3.1 RESEARCH, DESIGN, AND DEVELOPMENT

- 5.3.2 MANUFACTURERS

- 5.3.3 SOFTWARE PROVIDERS

- 5.3.4 SYSTEM INTEGRATORS

- 5.3.5 END-USER INDUSTRIES

- 5.4 ECOSYSTEM ANALYSIS

- TABLE 5 QUANTUM PHOTONICS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 QUANTUM PHOTONICS MARKET: ECOSYSTEM ANALYSIS

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 QUANTUM PHOTONICS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 BARGAINING POWER OF SUPPLIERS

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 THREAT OF SUBSTITUTES

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.6 PRICING ANALYSIS

- FIGURE 28 AVERAGE SELLING PRICE OF PHOTONIC QUANTUM COMPUTER OFFERED BY XANADU, BY APPLICATION

- 5.7 CASE STUDY ANALYSIS

- TABLE 6 IDQ & SK BROADBAND EXPAND USE OF QKD TO PROTECT CRITICAL DATA IN SOUTH KOREA

- TABLE 7 CHARACTERIZING AND ENTANGLEMENT OF PHOTON-PAIR SOURCES

- TABLE 8 ROLLS-ROYCE PARTNERS WITH XANADU TO CO-DEVELOP QUANTUM ALGORITHM TO ACCELERATE AEROSPACE RESEARCH

- TABLE 9 QUANDELA AND CRYPTONEXT SECURITY PARTNERED TO OFFER FULLY INTEGRATED QUANTUM-SAFE SOLUTION

- TABLE 10 ORCA COMPUTING PARTNERED WITH UK MINISTRY OF DEFENCE (MOD) TO DEVELOP QUANTUM COMPUTING FOR FUTURE DATA PROCESSING CAPABILITIES

- 5.8 TRADE ANALYSIS

- TABLE 11 IMPORT DATA FOR ELECTRONIC INTEGRATED CIRCUITS, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 12 EXPORT DATA FOR ELECTRONIC INTEGRATED CIRCUITS, BY COUNTRY, 2017-2021 (USD MILLION)

- 5.9 TARIFF ANALYSIS

- TABLE 13 TARIFFS IMPOSED BY US ON IMPORTS OF ELECTRONIC INTEGRATED CIRCUITS; PARTS THEREOF, 2021

- TABLE 14 TARIFFS IMPOSED BY CHINA ON IMPORTS OF ELECTRONIC INTEGRATED CIRCUITS; PARTS THEREOF, 2021

- TABLE 15 TARIFFS IMPOSED BY GERMANY ON IMPORTS OF ELECTRONIC INTEGRATED CIRCUITS; PARTS THEREOF, 2021

- 5.10 REGULATIONS

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATORY STANDARDS

- 5.10.2.1 P1913 - Software-defined quantum communication

- 5.10.2.2 P7130 - Standard for quantum technologies definitions

- 5.10.2.3 P7131 - Standard for quantum computing performance metrics and benchmarking

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 QUANTUM IMAGING

- 5.11.2 QUANTUM CRYPTOGRAPHY

- 5.11.3 QUANTUM SIMULATION

- 5.11.4 QUANTUM NANOPHOTONICS

- 5.11.5 QUANTUM ERROR CORRECTION

- 5.11.6 PROCESSORS & CHIPS

- 5.11.7 DEVELOPMENT TOOLS

- 5.11.8 MACHINE LEARNING

- 5.12 PATENT ANALYSIS

- TABLE 20 PATENT REGISTRATIONS, 2019-2022

- FIGURE 29 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICANTS IN LAST 10 YEARS, 2013-2022

- FIGURE 30 NUMBER OF PATENTS GRANTED OVER LAST 10 YEARS, 2013-2022

- TABLE 21 TOP 20 PATENT OWNERS IN LAST 10 YEARS, 2013-2022

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 22 QUANTUM PHOTONICS MARKET: KEY CONFERENCES AND EVENTS, 2023-2024

- 5.14 REVENUE SHIFT AND NEW REVENUE POCKETS FOR CUSTOMERS' BUSINESSES

- FIGURE 31 REVENUE SHIFT IN QUANTUM PHOTONICS MARKET

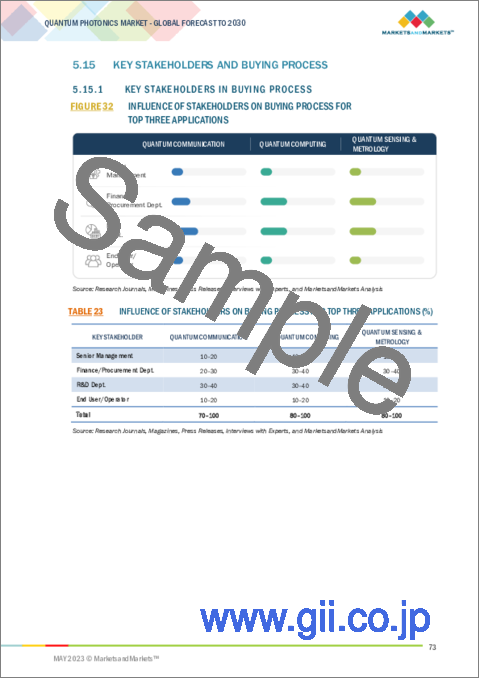

- 5.15 KEY STAKEHOLDERS AND BUYING PROCESS

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 5.15.2 BUYING CRITERIA

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 24 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

6 QUANTUM PHOTONICS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 34 SYSTEMS SEGMENT TO ACCOUNT FOR LARGER SHARE OF MARKET DURING FORECAST PERIOD

- TABLE 25 QUANTUM PHOTONICS MARKET, BY OFFERING, 2020-2022 (USD MILLION)

- TABLE 26 QUANTUM PHOTONICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- 6.2 SYSTEMS

- 6.2.1 INCREASING DEVELOPMENT OF QUANTUM PHOTONICS COMPUTING SYSTEMS TO DRIVE MARKET

- TABLE 27 SYSTEMS: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 28 SYSTEMS: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 29 SYSTEMS: QUANTUM PHOTONICS MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 30 SYSTEMS: QUANTUM PHOTONICS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 6.3 SERVICES

- TABLE 31 QUANTUM PHOTONICS MARKET, BY SERVICES, 2020-2022 (USD MILLION)

- TABLE 32 QUANTUM PHOTONICS MARKET, BY SERVICES, 2023-2030 (USD MILLION)

- TABLE 33 SERVICES: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 34 SERVICES: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 35 SERVICES: QUANTUM PHOTONICS MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 36 SERVICES: QUANTUM PHOTONICS MARKET, BY REGION, 2023-2030 (USD MILLION)

- FIGURE 35 SERVICES SEGMENT: ASIA PACIFIC TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- 6.3.1 QUANTUM COMPUTING AS A SERVICE (QCAAS)

- 6.3.1.1 Accessing power of quantum photonics through cloud-based platforms to fuel market

- 6.3.2 CONSULTING SERVICES

- 6.3.2.1 Increase in awareness of advantages of quantum photonics to drive market

7 QUANTUM PHOTONICS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 36 QUANTUM COMMUNICATIONS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 37 QUANTUM PHOTONICS MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 38 QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- 7.2 QUANTUM COMMUNICATIONS

- FIGURE 37 QUANTUM COMMUNICATIONS SEGMENT: ASIA PACIFIC TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- TABLE 39 QUANTUM COMMUNICATIONS: QUANTUM PHOTONICS MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 40 QUANTUM COMMUNICATIONS: QUANTUM PHOTONICS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 41 QUANTUM COMMUNICATIONS: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 42 QUANTUM COMMUNICATIONS: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 43 QUANTUM COMMUNICATIONS: QUANTUM PHOTONICS MARKET, BY OFFERING, 2020-2022 (USD MILLION)

- TABLE 44 QUANTUM COMMUNICATIONS: QUANTUM PHOTONICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 45 QUANTUM COMMUNICATIONS: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2020-2022 (USD MILLION)

- TABLE 46 QUANTUM COMMUNICATIONS: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2023-2030 (USD MILLION)

- 7.2.1 QUANTUM RANDOM GENERATORS

- 7.2.1.1 Generation of random numbers for advanced level of security to boost market

- 7.2.2 QUANTUM KEY DISTRIBUTION

- 7.2.2.1 Secure data transfer provided by quantum key distribution to drive market

- 7.3 QUANTUM SENSING & METROLOGY

- 7.3.1 ATOMIC CLOCKS

- 7.3.1.1 Precise measurement of time provided by atomic clocks to fuel market growth

- 7.3.2 QUANTUM DOT PHOTODETECTORS

- 7.3.2.1 Ability of quantum dot photodetectors to make precise measurements to fuel market growth

- 7.3.3 PAR (PHOTOSYNTHETICALLY ACTIVE RADIATION) QUANTUM SENSORS

- 7.3.3.1 Use of PAR to monitor plant growth to drive market

- 7.3.4 QUANTUM LIDAR

- 7.3.4.1 Precise and detailed images even in challenging conditions to drive market

- TABLE 47 QUANTUM SENSING & METROLOGY: QUANTUM PHOTONICS MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 48 QUANTUM SENSING & METROLOGY: QUANTUM PHOTONICS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 49 QUANTUM SENSING & METROLOGY: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 50 QUANTUM SENSING & METROLOGY: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 51 QUANTUM SENSING & METROLOGY: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2020-2022 (USD MILLION)

- TABLE 52 QUANTUM SENSING & METROLOGY: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2023-2030 (USD MILLION)

- 7.3.1 ATOMIC CLOCKS

- 7.4 QUANTUM COMPUTING

- 7.4.1 ON-PREMISES

- 7.4.1.1 On-premises photonic quantum computer to offer enhanced security and low latency

- 7.4.2 CLOUD

- 7.4.2.1 Growing adoption of cloud-based quantum computing for research and development

- TABLE 53 QUANTUM COMPUTING: QUANTUM PHOTONICS MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 54 QUANTUM COMPUTING: QUANTUM PHOTONICS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 55 QUANTUM PHOTONICS MARKET, BY SERVICES, 2020-2022 (USD MILLION)

- TABLE 56 QUANTUM PHOTONICS MARKET, BY SERVICES, 2023-2030 (USD MILLION)

- TABLE 57 QUANTUM COMPUTING: QUANTUM PHOTONICS MARKET, BY DEPLOYMENT MODE, 2020-2022 (USD MILLION)

- TABLE 58 QUANTUM COMPUTING: QUANTUM PHOTONICS MARKET, BY DEPLOYMENT MODE, 2023-2030 (USD MILLION)

- TABLE 59 QUANTUM COMPUTING: QUANTUM PHOTONICS MARKET, BY OFFERING, 2020-2022 (USD MILLION)

- TABLE 60 QUANTUM COMPUTING: QUANTUM PHOTONICS MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 61 QUANTUM COMPUTING: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2020-2022 (USD MILLION)

- TABLE 62 QUANTUM COMPUTING: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2023-2030 (USD MILLION)

- 7.4.1 ON-PREMISES

8 QUANTUM PHOTONICS MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- FIGURE 38 BANKING & FINANCE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 63 QUANTUM PHOTONICS MARKET, BY VERTICAL, 2020-2022 (USD MILLION)

- TABLE 64 QUANTUM PHOTONICS MARKET, BY VERTICAL, 2023-2030 (USD MILLION)

- 8.2 SPACE & DEFENSE

- 8.2.1 RISE IN USE OF QUANTUM PHOTONICS FOR CONCURRENT EXECUTION OF PROCESSES TO BOOST MARKET

- FIGURE 39 NORTH AMERICA SEGMENT TO DOMINATE QUANTUM PHOTONICS MARKET FOR SPACE & DEFENSE DURING FORECAST PERIOD

- TABLE 65 SPACE & DEFENSE: QUANTUM PHOTONICS MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 66 SPACE & DEFENSE: QUANTUM PHOTONICS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.3 BANKING & FINANCE

- 8.3.1 INCREASE IN USE OF QUANTUM PHOTONICS IN BANKING & FINANCE SECTORS TO FUEL MARKET

- FIGURE 40 ASIA PACIFIC TO RECORD HIGHEST CAGR FOR BANKING & FINANCE DURING FORECAST PERIOD

- TABLE 67 BANKING & FINANCE: QUANTUM PHOTONICS MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 68 BANKING & FINANCE: QUANTUM PHOTONICS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.4 HEALTHCARE & PHARMACEUTICAL

- 8.4.1 RISE IN REQUIREMENT FOR PERSONALIZED DIAGNOSTIC TOOLS AND TAILORED THERAPIES TO BOOST MARKET

- FIGURE 41 ASIA PACIFIC SEGMENT TO DOMINATE MARKET FOR HEALTHCARE & PHARMACEUTICAL DURING FORECAST PERIOD

- TABLE 69 HEALTHCARE & PHARMACEUTICAL: QUANTUM PHOTONICS MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 70 HEALTHCARE & PHARMACEUTICAL: QUANTUM PHOTONICS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.5 TRANSPORTATION & LOGISTICS

- 8.5.1 INCREASE IN USE OF QUANTUM-BASED METHODS TO IMPROVE TRAFFIC FLOW TO DRIVE MARKET

- FIGURE 42 ASIA PACIFIC SEGMENT TO GROW AT HIGHEST CAGR IN QUANTUM PHOTONICS MARKET FOR TRANSPORTATION & LOGISTICS DURING FORECAST PERIOD

- TABLE 71 TRANSPORTATION & LOGISTICS: QUANTUM PHOTONICS MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 72 TRANSPORTATION & LOGISTICS: QUANTUM PHOTONICS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.6 GOVERNMENT

- 8.6.1 SPIKE IN INVESTMENTS FOR DEVELOPMENT OF QUANTUM PHOTONICS TECHNOLOGY TO DRIVE MARKET

- FIGURE 43 ASIA PACIFIC SEGMENT TO DOMINATE MARKET FOR GOVERNMENT SECTOR DURING FORECAST PERIOD

- TABLE 73 GOVERNMENT: QUANTUM PHOTONICS MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 74 GOVERNMENT: QUANTUM PHOTONICS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.7 AGRICULTURE & ENVIRONMENT

- 8.7.1 PRECISE DETECTION CAPABILITIES FOR MONITORING CRUCIAL PARAMETERS TO BOOST MARKET

- FIGURE 44 NORTH AMERICA SEGMENT TO GROW AT HIGHEST CAGR FOR AGRICULTURE & ENVIRONMENT MARKET DURING FORECAST PERIOD

- TABLE 75 AGRICULTURE & ENVIRONMENT: QUANTUM PHOTONICS MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 76 AGRICULTURE & ENVIRONMENT: QUANTUM PHOTONICS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 8.8 OTHERS

- FIGURE 45 ASIA PACIFIC SEGMENT TO LEAD MARKET FOR OTHERS SEGMENT DURING FORECAST PERIOD

- TABLE 77 OTHERS: QUANTUM PHOTONICS MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 78 OTHERS: QUANTUM PHOTONICS MARKET, BY REGION, 2023-2030 (USD MILLION)

9 QUANTUM PHOTONICS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 46 SOUTH KOREA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 79 QUANTUM PHOTONICS MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 80 QUANTUM PHOTONICS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 47 NORTH AMERICA: SNAPSHOT OF QUANTUM PHOTONICS MARKET

- TABLE 81 NORTH AMERICA: QUANTUM PHOTONICS MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: QUANTUM PHOTONICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 85 NORTH AMERICA: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2020-2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2023-2030 (USD MILLION)

- 9.2.2 US

- 9.2.2.1 Extensive investments in quantum photonics research & development to drive market

- 9.2.3 CANADA

- 9.2.3.1 Spike in government-led investments for development of new technologies to fuel market

- 9.2.4 MEXICO

- 9.2.4.1 Rise in quantum photonics developmental initiatives to boost market

- 9.3 EUROPE

- 9.3.1 EUROPE: RECESSION IMPACT

- FIGURE 48 EUROPE: SNAPSHOT OF QUANTUM PHOTONICS MARKET

- TABLE 87 EUROPE: QUANTUM PHOTONICS MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 88 EUROPE: QUANTUM PHOTONICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 89 EUROPE: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 90 EUROPE: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 91 EUROPE: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2020-2022 (USD MILLION)

- TABLE 92 EUROPE: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2023-2030 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 Industrial developments and increase in adoption of quantum photonics to fuel market

- 9.3.3 GERMANY

- 9.3.3.1 Strong industrial and research presence in Germany to drive quantum photonics market

- 9.3.4 FRANCE

- 9.3.4.1 Surge in demand for advanced technologies for secure communications to fuel market

- 9.3.5 NETHERLANDS

- 9.3.5.1 Rise in initiatives to develop quantum photonics technology to drive market

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 49 ASIA PACIFIC: SNAPSHOT OF QUANTUM PHOTONICS MARKET

- TABLE 93 ASIA PACIFIC: QUANTUM PHOTONICS MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: QUANTUM PHOTONICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 95 ASIA PACIFIC: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 97 ASIA PACIFIC: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2020-2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2023-2030 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Government-led initiatives and spike in funding for development of quantum computers to fuel market

- 9.4.3 JAPAN

- 9.4.3.1 Rise in focus on deployment of emerging technologies to boost market

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Growing adoption of quantum photonics technology by key consumer electronics manufacturers to drive market

- 9.4.5 REST OF ASIA PACIFIC

- 9.5 REST OF THE WORLD

- TABLE 99 ROW: QUANTUM PHOTONICS MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 100 ROW: QUANTUM PHOTONICS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 101 ROW: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 102 ROW: QUANTUM PHOTONICS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 103 ROW: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2020-2022 (USD MILLION)

- TABLE 104 ROW: QUANTUM PHOTONICS MARKET, BY VERTICAL, 2023-2030 (USD MILLION)

- 9.5.1 SOUTH AMERICA

- 9.5.1.1 Establishment of quantum communities to drive market

- 9.5.2 MIDDLE EAST & AFRICA

- 9.5.2.1 Rise in initiatives to increase awareness regarding quantum photonics to boost market

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY STRATEGIES ADOPTED BY MAJOR COMPANIES

- TABLE 105 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN QUANTUM PHOTONICS MARKET

- 10.3 REVENUE ANALYSIS

- FIGURE 50 REVENUE ANALYSIS OF KEY PLAYERS IN QUANTUM PHOTONICS MARKET, 2020-2022

- 10.4 MARKET SHARE ANALYSIS, 2022

- FIGURE 51 QUANTUM PHOTONICS MARKET: SHARE OF KEY PLAYERS, 2022

- TABLE 106 QUANTUM PHOTONICS MARKET: DEGREE OF COMPETITION

- 10.5 COMPANY EVALUATION QUADRANT, 2022

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 52 QUANTUM PHOTONICS MARKET: COMPANY EVALUATION QUADRANT, 2022

- 10.6 COMPETITIVE BENCHMARKING

- 10.6.1 COMPANY FOOTPRINT: OFFERING

- 10.6.2 COMPANY FOOTPRINT: REGION

- 10.6.3 COMPANY FOOTPRINT: APPLICATION

- 10.6.4 OVERALL COMPANY FOOTPRINT

- 10.7 STARTUP/SME EVALUATION QUADRANT, 2022

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- FIGURE 53 QUANTUM PHOTONICS MARKET: STARTUP/SME EVALUATION QUADRANT, 2022

- TABLE 107 QUANTUM PHOTONICS MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 108 QUANTUM PHOTONICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.8 COMPETITIVE SITUATIONS AND TRENDS

- TABLE 109 QUANTUM PHOTONICS MARKET: PRODUCT LAUNCHES, 2020-2023

- TABLE 110 QUANTUM PHOTONICS MARKET: DEALS, 2020-2023

- TABLE 111 QUANTUM PHOTONICS MARKET: OTHERS, 2020-2023

11 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 11.1 KEY PLAYERS

- 11.1.1 XANADU

- TABLE 112 XANADU: COMPANY OVERVIEW

- TABLE 113 XANADU: PRODUCTS OFFERED

- TABLE 114 XANADU: PRODUCT LAUNCHES

- TABLE 115 XANADU: DEALS

- 11.1.2 PSI QUANTUM

- TABLE 116 PSIQUANTUM: COMPANY OVERVIEW

- TABLE 117 PSIQUANTUM: PRODUCTS OFFERED

- TABLE 118 PSIQUANTUM: DEALS

- 11.1.3 QUANDELA

- TABLE 119 QUANDELA: COMPANY OVERVIEW

- TABLE 120 QUANDELA: PRODUCTS OFFERED

- TABLE 121 QUANDELA: PRODUCT LAUNCHES

- TABLE 122 QUANDELA: DEALS

- 11.1.4 ID QUANTIQUE

- TABLE 123 ID QUANTIQUE: COMPANY OVERVIEW

- TABLE 124 ID QUANTIQUE: PRODUCTS OFFERED

- TABLE 125 ID QUANTIQUE: PRODUCT LAUNCHES

- TABLE 126 ID QUANTIQUE: DEALS

- 11.1.5 TOSHIBA

- TABLE 127 TOSHIBA: COMPANY OVERVIEW

- FIGURE 54 TOSHIBA: COMPANY SNAPSHOT

- TABLE 128 TOSHIBA: PRODUCT LAUNCHES

- TABLE 129 TOSHIBA: DEALS

- 11.1.6 ORCA COMPUTING

- TABLE 130 ORCA COMPUTING: COMPANY OVERVIEW

- TABLE 131 ORCA COMPUTING: PRODUCTS OFFERED

- TABLE 132 ORCA COMPUTING: DEALS

- 11.1.7 QUIX QUANTUM

- TABLE 133 QUIX QUANTUM: COMPANY OVERVIEW

- TABLE 134 QUIX QUANTUM: PRODUCTS OFFERED

- TABLE 135 QUIX QUANTUM: PRODUCT LAUNCHES

- TABLE 136 QUIX QUANTUM: DEALS

- 11.1.8 TUNDRASYSTEMS GLOBAL

- TABLE 137 TUNDRASYSTEMS GLOBAL: COMPANY OVERVIEW

- TABLE 138 TUNDRASYSTEMS GLOBAL: PRODUCTS OFFERED

- 11.1.9 NORDIC QUANTUM COMPUTING GROUP (NQCG)

- TABLE 139 NORDIC QUANTUM COMPUTING GROUP: COMPANY OVERVIEW

- TABLE 140 NORDIC QUANTUM COMPUTING GROUP: PRODUCTS OFFERED

- TABLE 141 NORDIC QUANTUM COMPUTING GROUP: DEALS

- 11.1.10 NU QUANTUM

- TABLE 142 NU QUANTUM: COMPANY OVERVIEW

- TABLE 143 NU QUANTUM: PRODUCTS OFFERED

- TABLE 144 NU QUANTUM: DEALS

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 11.2 OTHER KEY PLAYERS

- 11.2.1 SINGLE QUANTUM

- 11.2.2 AMAZON WEB SERVICES

- 11.2.3 NTT TECHNOLOGIES

- 11.2.4 M SQUARED

- 11.2.5 AOSENSE

- 11.2.6 NEC CORPORATION

- 11.2.7 QUANTUM XCHANGE

- 11.2.8 CRYPTA LABS

- 11.2.9 MICROCHIP TECHNOLOGY

- 11.2.10 MENLO SYSTEMS

- 11.2.11 THORLABS

- 11.2.12 QUINTESSENCE LABS

- 11.2.13 QUANTUM DICE

- 11.2.14 QUSIDE

- 11.2.15 QUBITEKK

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS