|

|

市場調査レポート

商品コード

1290721

コネクテッドタイヤの世界市場:車種別・コンポーネント別・リムサイズ別 (12~17インチ、18~22インチ、22インチ以上)・販売チャネル別 (OEM、アフターマーケット)・推進方式別 (電動、ICE)・提供別 (ハードウェア、ソフトウェア)・地域別の将来予測 (2028年まで)Connected Tires Market by Vehicle Type, Component, Rim Size (12-17 Inches, 18-22 Inches, More than 22 Inches), Sales Channel (OEM, Aftermarket), Propulsion (Electric, ICE), Offering (Hardware, Software) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| コネクテッドタイヤの世界市場:車種別・コンポーネント別・リムサイズ別 (12~17インチ、18~22インチ、22インチ以上)・販売チャネル別 (OEM、アフターマーケット)・推進方式別 (電動、ICE)・提供別 (ハードウェア、ソフトウェア)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年06月05日

発行: MarketsandMarkets

ページ情報: 英文 218 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のコネクテッドタイヤの市場規模は、2023年の400万米ドルから、2028年には5,400万米ドルに達し、CAGRは67.1%になると予測されています。

安全性に対する要求の高まりと、車両コネクティビティのトレンドの普及が、コネクテッドタイヤ市場に大きな影響を与えるものと思われます。これらの要因が融合することで、業界に大きな変化がもたらされると予想されます。安全性重視の高まりは、タイヤ空気圧、温度、トレッド摩耗などのリアルタイム監視機能を備えたコネクテッドタイヤの需要に拍車をかけると思われます。この情報は、車両の車載システムにシームレスに送信され、 促進要因にタイムリーな警告を与え、事故を未然に防ぐ対策を可能にします。このような要因により、コネクテッドタイヤの需要は今後数年間で増加すると思われます。さらに、コネクテッドカーや自律走行車 (CAV) の台頭により、コネクテッドモビリティ・エコシステムの需要が増加します。コネクテッドタイヤは、フリートオペレーター、ライドシェアプラットフォーム、スマートシティインフラを含む様々な利害関係者が活用できる貴重なデータを提供することで、これらのエコシステムにおいて重要な役割を果たします。

"予測期間中、12~17インチのセグメントが市場をリードする"

12~17インチの市場では、タイヤ監視システムをはじめとする自動車の先進安全機能に対する需要の高まりが市場を牽引すると予測されます。電気自動車の成長も、より精密で効率的な監視システムを必要とするため、コネクテッドタイヤの需要を促進すると予想されます。コネクテッドカーの動向は、リアルタイム車両データの分析・監視の必要性を生み出し、成長の大きな原動力となっています。GoodyearのTPMSやContinentalのContiConnectなどのコネクテッドタイヤシステムは、タイヤの空気圧や温度などのパラメーターをリアルタイムで監視し、安全性と性能を向上させる。シェアードモビリティサービスやライドシェアプラットフォームの台頭は、高度なタイヤ管理ソリューションの需要を促進すると予想されます。

"予測期間中、EVセグメントがより速い成長を遂げる"

コネクテッドタイヤ市場の電気推進サブセグメントは、電気自動車の採用増加により、今後数年間で大きな成長が見込まれます。電気自動車はバッテリーが重く、より大きなトルクを発生する傾向があるため、タイヤへの負担が大きくなります。そのため、タイヤの空気圧・温度の監視は、最適な性能と安全性を確保するために不可欠です。いくつかのタイヤメーカーは、電気自動車に特化したコネクテッドタイヤ・ソリューションを開発しています。例えば、Michelinのコネクテッドロード・コンセプトは、路面に埋め込まれたセンサーを利用して、道路状況、交通状況、天候に関する情報をドライバーにリアルタイムで提供し、ドライバーがより適切な判断を下し、エネルギー消費を抑えることができます。より多くの消費者が持続可能な交通手段へとシフトするにつれ、車両の性能、安全性、効率を向上させることができる高度なタイヤ監視とメンテナンスのソリューションに対する需要が高まると予想されます。スマートシティとコネクテッドインフラの動向も、電気自動車セグメントにおける先進タイヤ監視システムの需要を促進すると予想されます。

"北米がコネクテッドタイヤ市場を短期的にリードする"

安全性に対する需要の高まりと、消費者の新技術導入意欲の高まりが、北米のコネクテッドタイヤ市場の成長を牽引すると予想されます。先進的なタイヤ技術の採用が進み、リアルタイムタイヤ監視ソリューションの需要が高まっていることから、同市場は今後数年間で大きな成長が見込まれます。また、高級車の採用が増加しており、高級車特有のニーズに最適化された専用タイヤが必要とされていることも、市場の成長を牽引すると予想されます。全体として、北米のコネクテッドタイヤ市場は、技術進歩、政府による義務付け、安全性と利便性に対する消費者の要求の高まりなどを背景に、今後数年間で大きく成長する見通しです。

消費者は、安全性を向上させるために、自動車に新技術を採用することを望むようになってきています。この動向は、タイヤに埋め込まれたセンサーによってタイヤの性能と安全性をリアルタイムで監視できるコネクテッドタイヤの人気の高まりに反映されています。Michelinは、Michelin Connected Technologiesプラットフォームでこの分野をリードする企業のひとつであり、タイヤ性能のリアルタイムデータと分析をドライバーと車両管理者に提供しています。さらに、米国におけるコネクテッドタイヤ市場の最近動向には、RFIDチップなどの新技術の導入が含まれ、従来のTPMSに比べて精度と安全性が向上しています。Bridgestone・Goodyear・Michelin・Pirelliは、米国のコネクテッドタイヤ市場の大手企業であり、顧客のニーズの変化に対応した革新的なソリューションを提供するため、研究開発に多額の投資を行っています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- コネクテッドタイヤ市場のエコシステム

- サプライチェーン分析

- 価格分析

- 特許分析

- ケーススタディ

- 技術分析

- 貿易分析

- 規制の枠組み

- 動向と混乱

- ソリューションの比較:主要企業別

- マクロ経済指標

- 主要な利害関係者と購入基準

- 主要な会議とイベント (2023年・2024年)

- コネクテッドタイヤ市場のシナリオ (2023年~2028年)

第6章 コネクテッドタイヤ市場:リムサイズ別

- イントロダクション

- 12~17インチ

- 18~22インチ

- 22インチ以上

- 主要な洞察

第7章 コネクテッドタイヤ市場:推進方式別

- イントロダクション

- 電動

- ICE (内燃機関)

- 主要な洞察

第8章 コネクテッドタイヤ市場:販売チャネル別

- イントロダクション

- OEM

- アフターマーケット

第9章 コネクテッドタイヤ市場:車種別

- イントロダクション

- 乗用車

- 商用車

- 業界の主要な洞察

第10章 コネクテッドタイヤ市場:提供別

- イントロダクション

- ソフトウェア

- ハードウェア

- 主要な洞察

第11章 コネクテッドタイヤ市場:コンポーネント別

- イントロダクション

- 加速度計センサー

- ひずみゲージセンサー

- RFIDチップ

- TPMS (タイヤ空気圧監視システム)

- その他のセンサー

- 主要な洞察

第12章 コネクテッドタイヤ市場:地域別

- イントロダクション

- 北米

- カナダ

- 米国

- メキシコ

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- タイ

- その他のアジア太平洋

- 欧州

- フランス

- ドイツ

- ロシア

- イタリア

- 英国

- トルコ

- スペイン

- その他の欧州

- その他の地域

- ブラジル

- 南アフリカ

- その他の国々

第13章 競合情勢

- 概要

- コネクテッドタイヤ市場:市場ランキング分析

- 主な上場企業の収益分析

- 競合シナリオ

- コネクテッドタイヤ市場:企業評価クアドラント

- スタートアップ/中小企業の評価クアドラント

- 競合ベンチマーキング

第14章 企業プロファイル

- 主要企業

- GOODYEAR

- MICHELIN

- PIRELLI

- BRIDGESTONE

- CONTINENTAL AG

- NOKIAN TYRES

- YOKOHAMA RUBBER CO.

- SUMITOMO RUBBER INDUSTRIES LTD.

- TOYO TIRES

- JK TYRE

- MRF

- HANKOOK TIRES

- その他の企業

- KUMHO

- BF GOODRICH

- MAXXIS

- FALKEN

- GENERAL TIRE

- UNIROYAL

- COOPER TIRE & RUBBER COMPANY

- FIRESTONE TIRE AND RUBBER COMPANY

- NITTO TIRE

- SMART TIRE COMPANY

- SAILUN TIRES

第15章 MarketsandMarketsの提言

第16章 付録

The global connected tires market size is projected to grow from USD 4 million in 2023 to USD 54 million by 2028, at a CAGR of 67.1%. Increasing demand for safety and the growing vehicle connectivity trend are poised to impact the connected tire market profoundly. The convergence of these factors is expected to drive significant changes in the industry. Growing emphasis on safety will fuel the demand for connected tires equipped with real-time monitoring capabilities, including tire pressure, temperature, and tread wear. This information would be seamlessly transmitted to the vehicle's onboard systems, empowering drivers with timely alerts and enabling proactive measures to prevent accidents. Such factors will lead to an increase in demand for connected tyres in the coming years. Further, the rise of connected and autonomous vehicles (CAVs) will increase the demand of connected mobility ecosystems. Connected tires play a vital role within these ecosystems by offering valuable data that various stakeholders, including fleet operators, ride-sharing platforms, and smart city infrastructure, can harness.

"The 12-17 Inches segment will lead the market during forecast period"

The market for the 12-17 inches segment is expected to be driven by the increasing demand for advanced safety features in vehicles, including tire monitoring systems. The growth of electric vehicles is also expected to fuel demand for connected tires, as they require more precise and efficient monitoring systems. The trend of connected cars is a significant driver of growth, creating a need for real-time vehicle data analysis and monitoring. Connected tire systems, such as the Goodyear TPMS and Continental's ContiConnect, offer real-time monitoring of tire pressure, temperature, and other parameters, improving safety and performance. The rise of shared mobility services and ride-sharing platforms is expected to drive demand for advanced tire management solutions.

"EV segment to witness a faster growth during the forecast period"

The electric propulsion subsegment of the connected tires market is expected to witness significant growth in the coming years due to the increasing adoption of electric vehicles. Electric vehicles tend to have heavier batteries and generate more torque, which can strain the tires more. As a result, tire pressure and temperature monitoring are critical for ensuring optimal performance and safety. Several tire manufacturers have developed connected tire solutions specifically for electric vehicles. For example, Michelin's Connected Road concept uses sensors embedded in the road surface to provide real-time information to drivers about road conditions, traffic, and weather, enabling them to make better decisions and reduce energy consumption. As more consumers shift toward sustainable modes of transportation, demand for advanced tire monitoring and maintenance solutions that can improve vehicle performance, safety, and efficiency is expected to rise. The trend of smart cities and connected infrastructure is also expected to fuel demand for advanced tire monitoring systems in the electric vehicle segment.

"North America will lead the connected tyre market in the short future"

The growing demand for safety and the increasing willingness of consumers to adopt new technologies is expected to drive the growth of the connected tires market in North America. The market is expected to witness significant growth in the coming years due to the increasing adoption of advanced tire technologies and the increasing demand for real-time tire monitoring solutions. The growth of the market is expected to be driven by the increasing adoption of luxury vehicles, which require specialized tires optimized for their unique needs. Overall, the connected tires market in North America is poised for significant growth in the coming years, driven by technological advancements, government mandates, and increasing consumer demand for safety and convenience.

Consumers are becoming increasingly willing to adopt new technologies in their vehicles to improve safety. This trend is reflected in the growing popularity of connected tires, which allow for real-time monitoring of tire performance and safety through sensors embedded in the tire. Michelin is one of the companies leading the way in this space with its Michelin Connected Technologies platform, which provides real-time data and analysis of tire performance to drivers and fleet managers. Moreover, recent developments in the connected tires market in the US include the introduction of new technologies, such as RFID chips, which offer improved accuracy and security compared to traditional TPMS. Bridgestone, Goodyear, Michelin, and Pirelli are some of the leading players in the connected tires market in US, investing heavily in research and development to offer innovative solutions for the changing needs of customers.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Tier I - 67%, Others - 9%, and OEMs - 24%

- By Designation: C Level Executives - 33%, Directors - 52%, and Others - 15%

- By Region: North America - 28%, Europe - 38%, Asia Pacific - 32%, Rest of the World - 2%

The Connected tyre market is dominated by major charging providers including Bridgestone (Japan), Michelin (France), Goodyear (US), Continental (Germany), and Pirelli (Italy) among others in the Connected tyre market.

Research Coverage:

This research report categorizes Connected tyre market by Vehicle Type (Passenger Cars, Commercial Vehicles), Component (TPMS, Accelerometer, Strain Gauge Sensor, RFID Chips, Other Sensors), Rim Size (12-17 Inches, 18-22 Inches, More than 22 Inches), Sales Channel (OEM, Aftermarket), Propulsion (ICE, Electric), Offering (Hardware, Software) and Region (Asia Pacific, Europe, North America and Rest of the World).

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the Connected tyre market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. new product & service launches, mergers and acquisitions, and recent developments associated with the Connected tyre market. Competitive analysis of upcoming startups in the Connected tyre market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Connected tyre market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increased demand for vehicle safety, Technological advancements Regulations for TPMS and safety monitoring), restraints (High cost of connected tire technology, Data privacy and cybersecurity, concerns), opportunities (Increased acceptance of connected mobility, Increased efficiency, Increased investment for autonomous vehicles), and challenges (Lack of standardization, Limited acceptance by consumers) influencing the growth of the Connected tyre market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Connected tyre market

- Market Development: Comprehensive information about lucrative markets - the report analyses the Connected tyre market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Connected tyre market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Bridgestone (Japan), Michelin (France), Goodyear (US), Continental (Germany), and Pirelli (Italy) among others in the Connected tyre market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 CONNECTED TIRES MARKET DEFINITION, BY SALES CHANNEL

- TABLE 2 CONNECTED TIRES MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 3 CONNECTED TIRES MARKET DEFINITION, BY RIM SIZE

- TABLE 4 CONNECTED TIRES MARKET DEFINITION, BY COMPONENT

- TABLE 5 CONNECTED TIRES MARKET DEFINITION BY PROPULSION TYPE

- TABLE 6 CONNECTED TIRES MARKET DEFINITION, BY OFFERING

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 7 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 MARKETS COVERED

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 8 CURRENCY EXCHANGE RATES

- 1.5 STAKEHOLDERS

- 1.6 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 CONNECTED TIRES MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources for connected tires market

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews - demand and supply sides

- 2.1.2.2 Key industry insights and breakdown of primary interviews

- FIGURE 4 KEY INDUSTRY INSIGHTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.1.2.3 List of primary participants

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 6 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 7 CONNECTED TIRES MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 8 TOP-DOWN APPROACH: CONNECTED TIRES MARKET

- FIGURE 9 CONNECTED TIRES: MARKET ESTIMATION NOTES

- 2.3 RECESSION IMPACT ANALYSIS

- FIGURE 10 CONNECTED TIRES MARKET: RESEARCH DESIGN AND METHODOLOGY - DEMAND SIDE

- 2.4 DATA TRIANGULATION

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- 2.5 FACTOR ANALYSIS

- FIGURE 12 FACTOR ANALYSIS: CONNECTED TIRES MARKET

- 2.5.1 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 13 CONNECTED TIRES MARKET: MARKET OVERVIEW

- FIGURE 14 CONNECTED TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- FIGURE 15 HARDWARE SEGMENT ESTIMATED TO LEAD CONNECTED TIRES MARKET IN 2023

- FIGURE 16 KEY PLAYERS IN CONNECTED TIRES MARKET

- FIGURE 17 PASSENGER CARS SEGMENT TO HAVE HIGHEST MARKET SHARE IN CONNECTED TIRES MARKET IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN CONNECTED TIRES MARKET

- FIGURE 18 INCREASING DEMAND FOR SMART AND CONNECTED VEHICLES TO BOOST MARKET

- 4.2 CONNECTED TIRES MARKET, BY PROPULSION

- FIGURE 19 ELECTRIC SEGMENT EXPECTED TO HAVE FASTEST CAGR DURING FORECAST PERIOD

- 4.3 CONNECTED TIRES MARKET, BY VEHICLE TYPE

- FIGURE 20 PASSENGER CARS TO LEAD MARKET DURING FORECAST PERIOD

- 4.4 CONNECTED TIRES MARKET, BY RIM SIZE

- FIGURE 21 12-17 INCHES RIM SIZE TO HAVE HIGHEST GROWTH DURING FORECAST PERIOD

- 4.5 CONNECTED TIRES MARKET, BY OFFERING

- FIGURE 22 SOFTWARE SEGMENT TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- 4.6 CONNECTED TIRES MARKET, BY COMPONENT

- FIGURE 23 TPMS AND RFID CHIPS TO REGISTER FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.7 CONNECTED TIRES MARKET, BY REGION

- FIGURE 24 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 25 CONNECTED TIRES MARKET: MARKET DYNAMICS

- 5.2.1 DRIVERS

- FIGURE 26 DRIVING FACTORS OF CONNECTED TIRES MARKET

- 5.2.2 RESTRAINTS

- FIGURE 27 RESTRAINING FACTORS OF CONNECTED TIRES MARKET

- 5.2.3 OPPORTUNITIES

- FIGURE 28 OPPORTUNITIES IN CONNECTED TIRES MARKET

- 5.2.4 CHALLENGES

- FIGURE 29 CHALLENGING FACTORS OF CONNECTED TIRES MARKET

- TABLE 9 CONNECTED TIRES MARKET: IMPACT OF MARKET DYNAMICS

- 5.3 CONNECTED TIRES MARKET ECOSYSTEM

- FIGURE 30 CONNECTED TIRES MARKET: ECOSYSTEM ANALYSIS

- 5.3.1 TIRE MANUFACTURERS

- 5.3.2 TECHNOLOGY PROVIDERS

- 5.3.3 IOT PLATFORM PROVIDERS

- 5.3.4 AUTOMOTIVE OEMS

- 5.3.5 CONNECTIVITY PROVIDERS

- TABLE 10 CONNECTED TIRES MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 31 SUPPLY CHAIN ANALYSIS OF CONNECTED TIRES MARKET

- 5.5 PRICING ANALYSIS

- TABLE 11 CONNECTED TIRES COST SUMMARY

- TABLE 12 CONNECTED TIRES COST, BY VEHICLE TYPE

- 5.6 PATENT ANALYSIS

- FIGURE 32 NUMBER OF PUBLISHED PATENTS (2012-2022)

- 5.6.1 LEGAL STATUS OF PATENTS

- FIGURE 33 LEGAL STATUS OF PATENTS FILED FOR CONNECTED TIRES

- TABLE 13 IMPORTANT PATENT REGISTRATIONS RELATED TO CONNECTED TIRES MARKET

- 5.7 CASE STUDIES

- 5.7.1 CASE STUDY 1: SMART TIRES IOT PRODUCT DEVELOPMENT

- 5.7.2 CASE STUDY 2: BUILDING BETTER TIRES WITH AI

- 5.7.3 CASE STUDY 3: TIREMATICS CLOUD SYSTEM

- 5.7.4 CASE STUDY 4: CONTINENTAL AND HEWLETT PACKARD ENTERPRISE (HPE)

- 5.7.5 CASE STUDY 5: PIRELLI AND ERICSSON

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 5G CONNECTIVITY

- 5.8.2 IOT INTEGRATION

- FIGURE 34 MICROSOFT TIRE MONITORING SYSTEM

- 5.8.3 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- FIGURE 35 AUTOMATED TIRE INFORMATION GATHERING SYSTEM FOR BUSES AND TRUCKS

- 5.8.4 AUGMENTED REALITY

- FIGURE 36 FALKEN TIRES AUGMENTED REALITY

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT DATA

- TABLE 14 US: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 15 MEXICO: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 16 CHINA: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

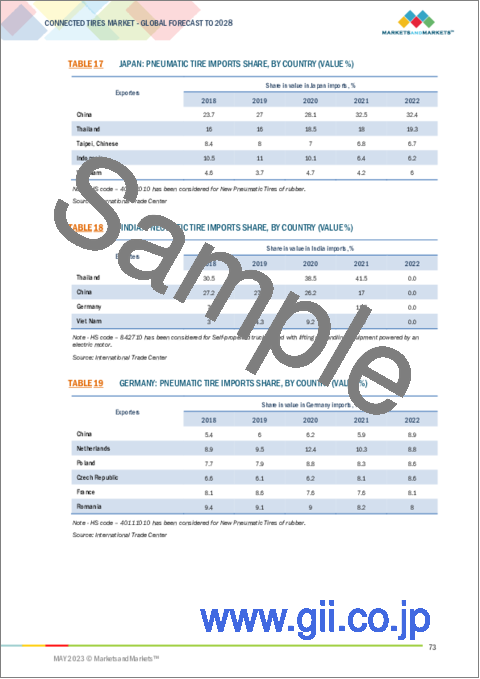

- TABLE 17 JAPAN: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 18 INDIA: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 19 GERMANY: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 20 FRANCE: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 21 SPAIN: PNEUMATIC TIRE IMPORTS SHARE, BY COUNTRY (VALUE %)

- 5.9.2 EXPORT DATA

- TABLE 22 US: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 23 CHINA: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 24 JAPAN: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 25 INDIA: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 26 GERMANY: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 27 FRANCE: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- TABLE 28 SPAIN: PNEUMATIC TIRE EXPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10 REGULATORY FRAMEWORK

- 5.10.1 NORTH AMERICA

- 5.10.2 EUROPE

- 5.10.3 ASIA PACIFIC

- 5.10.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS, BY REGION

- TABLE 29 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 31 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 TRENDS AND DISRUPTIONS

- FIGURE 37 CONNECTED TIRES MARKET: TRENDS AND DISRUPTIONS

- 5.12 SOLUTION COMPARISON BY LEADING PLAYERS

- 5.13 MACROECONOMIC INDICATORS

- 5.13.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

- TABLE 32 GDP TRENDS AND FORECAST BY MAJOR ECONOMIES, 2019-2026 (USD BILLION)

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 PASSENGER CARS

- 5.14.2 COMMERCIAL VEHICLES

- 5.14.3 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP APPLICATIONS

- TABLE 33 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP APPLICATIONS (%)

- 5.14.4 BUYING CRITERIA

- FIGURE 39 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- TABLE 34 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- 5.14.5 ROI ANALYSIS

- TABLE 35 ASSUMPTIONS: YEAR 1

- TABLE 36 POTENTIAL BENEFITS: YEAR 1

- TABLE 37 ROI CALCULATION: YEAR 1

- 5.15 KEY CONFERENCES AND EVENTS IN 2023 AND 2024

- TABLE 38 CONNECTED TIRES MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.16 CONNECTED TIRES MARKET SCENARIO (2023-2028)

- FIGURE 40 CONNECTED TIRES MARKET - FUTURE TRENDS AND SCENARIOS, 2023-2028 (USD MILLION)

- 5.16.1 MOST LIKELY SCENARIO

- TABLE 39 MOST LIKELY SCENARIO, BY REGION, 2023-2028 (USD MILLION)

- 5.16.2 OPTIMISTIC SCENARIO

- TABLE 40 OPTIMISTIC SCENARIO, BY REGION, 2023-2028 (USD MILLION)

- 5.16.3 PESSIMISTIC SCENARIO

- TABLE 41 PESSIMISTIC SCENARIO, BY REGION, 2023-2028 (USD MILLION)

6 CONNECTED TIRES MARKET, BY RIM SIZE

- 6.1 INTRODUCTION

- TABLE 42 CONNECTED TIRES MARKET, BY RIM SIZE, 2019-2022 (THOUSAND UNITS)

- TABLE 43 CONNECTED TIRES MARKET BY RIM SIZE, 2023-2028 (THOUSAND UNITS)

- FIGURE 41 MORE THAN 22 INCHES SEGMENT TO DOMINATE RIM SIZE MARKET DURING FORECAST PERIOD

- 6.2 12-17 INCHES

- 6.2.1 INCORPORATION OF NEW TECHNOLOGIES FOR BETTER PRODUCTIVITY

- TABLE 44 12-17 INCHES: CONNECTED TIRES MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 45 12-17 INCHES: CONNECTED TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 6.3 18-22 INCHES

- 6.3.1 ENABLES BETTER PERFORMANCE AND HANDLING AT HIGHER SPEEDS FOR SUVS, SPORTS CARS, AND OTHERS

- TABLE 46 18-22 INCHES: CONNECTED TIRES MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 47 18-22 INCHES: CONNECTED TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 6.4 MORE THAN 22 INCHES

- 6.4.1 INCREASED USAGE IN COMMERCIAL AND HEAVY-DUTY VEHICLES

- TABLE 48 MORE THAN 22 INCHES: CONNECTED TIRES MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 49 MORE THAN 22 INCHES: CONNECTED TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 6.5 KEY PRIMARY INSIGHTS

7 CONNECTED TIRES MARKET, BY PROPULSION

- 7.1 INTRODUCTION

- TABLE 50 CONNECTED TIRES MARKET, BY PROPULSION TYPE, 2019-2022 (THOUSAND UNITS)

- TABLE 51 CONNECTED TIRES MARKET, BY PROPULSION TYPE, 2023-2028 (THOUSAND UNITS)

- FIGURE 42 ELECTRIC SEGMENT TO BE DOMINANT DURING FORECAST PERIOD (2023-2028)

- 7.2 ELECTRIC

- 7.2.1 SUSTAINABLE AND ECO-FRIENDLY SOLUTION

- TABLE 52 ELECTRIC: CONNECTED TIRES MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 53 ELECTRIC: CONNECTED TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 7.3 ICE

- 7.3.1 DEVELOPMENT OF NEW CONNECTED TIRE TECHNOLOGIES TO ENHANCE FUEL EFFICIENCY

- TABLE 54 ICE: CONNECTED TIRES MARKET BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 55 ICE: CONNECTED TIRES MARKET BY REGION, 2023-2028 (THOUSAND UNITS)

- 7.4 KEY PRIMARY INSIGHTS

8 CONNECTED TIRES MARKET, BY SALES CHANNEL

- 8.1 INTRODUCTION

- 8.2 OEM

- 8.3 AFTERMARKET

9 CONNECTED TIRES MARKET, BY VEHICLE TYPE

- 9.1 INTRODUCTION

- FIGURE 43 CONNECTED TIRES MARKET, BY VEHICLE TYPE, 2023-2028

- TABLE 56 CONNECTED TIRES MARKET, BY VEHICLE TYPE, 2019-2022 (THOUSAND UNITS)

- TABLE 57 CONNECTED TIRES MARKET, BY VEHICLE TYPE, 2023-2028 (THOUSAND UNITS)

- 9.2 PASSENGER CARS

- 9.2.1 INTEGRATION OF AI AND ML FOR BETTER RESULTS

- TABLE 58 PASSENGER CARS: CONNECTED TIRES MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 59 PASSENGER CARS: CONNECTED TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 9.3 COMMERCIAL VEHICLES

- 9.3.1 NEED FOR ENHANCED SAFETY AND EFFICIENCY

- TABLE 60 COMMERCIAL VEHICLES: CONNECTED TIRES MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 61 COMMERCIAL VEHICLES: CONNECTED TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 9.4 KEY INDUSTRY INSIGHTS

10 CONNECTED TIRES MARKET, BY OFFERING

- 10.1 INTRODUCTION

- TABLE 62 CONNECTED TIRES MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 63 CONNECTED TIRES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- FIGURE 44 SOFTWARE PROJECTED TO REGISTER HIGHER RATE DURING FORECAST PERIOD

- 10.2 SOFTWARE

- 10.2.1 INVESTMENTS IN CLOUD-BASED PLATFORMS FOR REAL-TIME DATA ANALYSIS AND TIRE MONITORING

- TABLE 64 SOFTWARE BY COMPANY NAMES

- TABLE 65 SOFTWARE CONNECTED TIRES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 66 SOFTWARE CONNECTED TIRES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 HARDWARE

- 10.3.1 R&D INVESTMENTS IN NEXT-GENERATION CONNECTED TIRES

- TABLE 67 HARDWARE CONNECTED TIRES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 68 HARDWARE CONNECTED TIRES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 KEY PRIMARY INSIGHTS

11 CONNECTED TIRES MARKET, BY COMPONENT

- 11.1 INTRODUCTION

- TABLE 69 CONNECTED TIRES MARKET, BY COMPONENT, 2019-2022 (THOUSAND UNITS)

- TABLE 70 CONNECTED TIRES MARKET, BY COMPONENT, 2023-2028 (THOUSAND UNITS)

- FIGURE 45 TPMS AND RFID CHIPS PROJECTED TO HAVE HIGH GROWTH RATE DURING FORECAST PERIOD (2023-2028)

- 11.2 ACCELEROMETER SENSORS

- 11.2.1 MEASURES TIRE PERFORMANCE METRICS

- TABLE 71 ACCELEROMETER SENSORS: CONNECTED TIRES MARKET, BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 72 ACCELEROMETER SENSORS: CONNECTED TIRES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 11.3 STRAIN GAUGE SENSORS

- 11.3.1 MORE RELIABLE AND COST-EFFECTIVE

- TABLE 73 STRAIN GAUGE SENSORS: CONNECTED TIRES MARKET BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 74 STRAIN GAUGE SENSORS: CONNECTED TIRES MARKET BY REGION, 2023-2028 (THOUSAND UNITS)

- 11.4 RFID CHIPS

- 11.4.1 ALLOWS QUICK AND EASY IDENTIFICATION AND TRACKING OF TIRES

- TABLE 75 RFID CHIPS: CONNECTED TIRES MARKET BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 76 RFID CHIPS: CONNECTED TIRES MARKET BY REGION, 2023-2028 (THOUSAND UNITS)

- 11.5 TPMS

- 11.5.1 MANDATED BY GOVERNMENTS WORLDWIDE TO IMPROVE ROAD SAFETY

- TABLE 77 TPMS: CONNECTED TIRES MARKET BY REGION, 2019-2022 (THOUSAND UNITS)

- TABLE 78 TPMS: CONNECTED TIRES MARKET BY REGION, 2023-2028 (THOUSAND UNITS)

- 11.6 OTHER SENSORS

- 11.7 KEY PRIMARY INSIGHTS

12 CONNECTED TIRES MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 46 CONNECTED TIRES MARKET, BY REGION (2023-2028)

- TABLE 79 CONNECTED TIRES MARKET, BY REGION, 2019-2022(USD MILLION)

- TABLE 80 CONNECTED TIRES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.2 NORTH AMERICA

- FIGURE 47 NORTH AMERICA: CONNECTED TIRES MARKET SNAPSHOT

- TABLE 81 NORTH AMERICA: CONNECTED TIRES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: CONNECTED TIRES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.2.1 CANADA

- 12.2.1.1 Increased demand for technologies to optimize performance and efficiency of electric vehicles

- TABLE 83 CANADA: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 Strong government support and presence of leading providers

- TABLE 84 US: CONNECTED TIRES MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 85 US: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 12.2.3 MEXICO

- 12.2.3.1 Implementation of several initiatives by government to promote connected technologies

- TABLE 86 MEXICO: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 12.3 ASIA PACIFIC

- FIGURE 48 ASIA PACIFIC: CONNECTED TIRES MARKET SNAPSHOT

- TABLE 87 ASIA PACIFIC: CONNECTED TIRES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 88 ASIA PACIFIC: CONNECTED TIRES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.3.1 CHINA

- 12.3.1.1 Government initiatives to promote technological advancements

- TABLE 89 CHINA: CONNECTED TIRES MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 90 CHINA: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 12.3.2 INDIA

- 12.3.2.1 Increased investment by government in connected mobility market

- TABLE 91 INDIA: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 12.3.3 JAPAN

- 12.3.3.1 High R&D investments

- TABLE 92 JAPAN: CONNECTED TIRES MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 93 JAPAN: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 12.3.4 SOUTH KOREA

- 12.3.4.1 Partnerships to develop next-generation tires for premium electric vehicles

- TABLE 94 SOUTH KOREA: CONNECTED TIRES MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 95 SOUTH KOREA: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 12.3.5 THAILAND

- 12.3.5.1 Low awareness among consumers of connected tires

- TABLE 96 THAILAND: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028(USD MILLION)

- 12.3.6 REST OF ASIA PACIFIC

- TABLE 97 REST OF ASIA PACIFIC: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 12.4 EUROPE

- FIGURE 49 CONNECTED TIRES IN EUROPE, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 98 EUROPE: CONNECTED TIRES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 99 EUROPE: CONNECTED TIRES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.4.1 FRANCE

- 12.4.1.1 Investment by manufacturers to develop new and innovative connected tire technologies

- TABLE 100 FRANCE: CONNECTED TIRES MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 101 FRANCE: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 12.4.2 GERMANY

- 12.4.2.1 Ideal market for adoption of connected tires

- TABLE 102 GERMANY: CONNECTED TIRES MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 103 GERMANY: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 12.4.3 RUSSIA

- 12.4.3.1 Automotive demand set to recover

- TABLE 104 RUSSIA: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 12.4.4 ITALY

- 12.4.4.1 Need for efficient and safe transportation

- TABLE 105 ITALY: CONNECTED TIRES MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 106 ITALY: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 12.4.5 UK

- 12.4.5.1 Higher growth in fleet management sector

- TABLE 107 UK: CONNECTED TIRES MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 108 UK: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 12.4.6 TURKEY

- 12.4.6.1 Market to grow at slow rate

- TABLE 109 TURKEY: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 12.4.7 SPAIN

- 12.4.7.1 Presence of major automotive manufacturers

- TABLE 110 SPAIN: CONNECTED TIRES MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 111 SPAIN: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 12.4.8 REST OF EUROPE

- TABLE 112 REST OF EUROPE: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 12.5 REST OF THE WORLD

- FIGURE 50 REST OF THE WORLD: CONNECTED TIRES MARKET SNAPSHOT

- TABLE 113 REST OF THE WORLD: CONNECTED TIRES MARKET, BY COUNTRY, 2023-2028(USD MILLION)

- 12.5.1 BRAZIL

- TABLE 114 BRAZIL: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028(USD MILLION)

- 12.5.2 SOUTH AFRICA

- TABLE 115 SOUTH AFRICA: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 12.5.3 OTHER COUNTRIES

- TABLE 116 OTHER COUNTRIES: CONNECTED TIRES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 MARKET RANKING ANALYSIS FOR CONNECTED TIRES MARKET

- FIGURE 51 MARKET RANKING ANALYSIS, 2022

- 13.3 REVENUE ANALYSIS OF TOP LISTED PLAYERS

- FIGURE 52 REVENUE ANALYSIS, 2017-2021

- 13.4 COMPETITIVE SCENARIO

- 13.4.1 DEALS

- TABLE 117 DEALS, 2020-2023

- 13.4.2 NEW PRODUCT LAUNCHES

- TABLE 118 PRODUCT LAUNCHES, 2020-2023

- 13.4.3 OTHERS, 2020-2023

- TABLE 119 OTHERS, 2020-2023

- 13.5 COMPANY EVALUATION QUADRANT FOR CONNECTED TIRES MARKET

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 53 CONNECTED TIRES MARKET: COMPANY EVALUATION QUADRANT, 2022

- TABLE 120 CONNECTED TIRES MARKET: COMPANY FOOTPRINT, 2022

- TABLE 121 CONNECTED TIRES MARKET: VEHICLE TYPE FOOTPRINT, 2022

- TABLE 122 CONNECTED TIRES MARKET: REGIONAL FOOTPRINT, 2022

- 13.6 STARTUP/SME EVALUATION QUADRANT

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- FIGURE 54 CONNECTED TIRES MARKET: SME EVALUATION QUADRANT, 2022

- 13.7 COMPETITIVE BENCHMARKING

- TABLE 123 CONNECTED TIRES MARKET: DETAILED LIST OF KEY STARTUPS

- TABLE 124 CONNECTED TIRES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS]

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 14.1.1 GOODYEAR

- TABLE 125 GOODYEAR: BUSINESS OVERVIEW

- FIGURE 55 GOODYEAR: COMPANY SNAPSHOT

- FIGURE 56 GOODYEAR REMOTE TIRE MONITORING

- TABLE 126 GOODYEAR: PRODUCTS OFFERED

- TABLE 127 GOODYEAR: PRODUCT LAUNCHES

- 14.1.2 MICHELIN

- TABLE 128 MICHELIN: BUSINESS OVERVIEW

- FIGURE 57 MICHELIN: COMPANY SNAPSHOT

- FIGURE 58 MICHELIN CONNECTED TECHNOLOGIES

- TABLE 129 MICHELIN: PRODUCTS OFFERED

- TABLE 130 MICHELIN: PRODUCT LAUNCHES

- TABLE 131 MICHELIN: DEALS

- 14.1.3 PIRELLI

- TABLE 132 PIRELLI: BUSINESS OVERVIEW

- FIGURE 59 PIRELLI: COMPANY SNAPSHOT

- FIGURE 60 PIRELLI MOBILITY OF FUTURE

- TABLE 133 PIRELLI: PRODUCTS OFFERED

- TABLE 134 PIRELLI: PRODUCT LAUNCHES

- TABLE 135 PIRELLI: DEALS

- TABLE 136 PIRELLI: OTHERS

- 14.1.4 BRIDGESTONE

- TABLE 137 BRIDGESTONE: BUSINESS OVERVIEW

- FIGURE 61 BRIDGESTONE: COMPANY SNAPSHOT

- FIGURE 62 BRIDGESTONE ACQUIRES TOMTOM TELEMATICS

- TABLE 138 BRIDGESTONE: PRODUCTS OFFERED

- TABLE 139 BRIDGESTONE: PRODUCT LAUNCHES

- TABLE 140 BRIDGESTONE: DEALS

- TABLE 141 BRIDGESTONE: OTHERS

- 14.1.5 CONTINENTAL AG

- TABLE 142 CONTINENTAL AG: BUSINESS OVERVIEW

- FIGURE 63 CONTINENTAL AG: COMPANY SNAPSHOT

- FIGURE 64 CONTINENTAL AG DIGITAL TIRE MONITORING

- TABLE 143 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 144 CONTINENTAL AG: PRODUCT LAUNCHES

- TABLE 145 CONTINENTAL AG: DEALS

- 14.1.6 NOKIAN TYRES

- TABLE 146 NOKIAN TYRES: BUSINESS OVERVIEW

- FIGURE 65 NOKIAN TYRES: COMPANY SNAPSHOT

- TABLE 147 NOKIAN TYRES: PRODUCTS OFFERED

- TABLE 148 NOKIAN TYRES: PRODUCT LAUNCHES

- 14.1.7 YOKOHAMA RUBBER CO.

- TABLE 149 YOKOHAMA RUBBER CO.: BUSINESS OVERVIEW

- FIGURE 66 YOKOHAMA RUBBER CO.: COMPANY SNAPSHOT

- TABLE 150 YOKOHAMA RUBBER CO.: PRODUCTS OFFERED

- TABLE 151 YOKOHAMA RUBBER CO.: DEALS

- 14.1.8 SUMITOMO RUBBER INDUSTRIES LTD.

- TABLE 152 SUMITOMO RUBBER INDUSTRIES LTD.: BUSINESS OVERVIEW

- FIGURE 67 SUMITOMO RUBBER INDUSTRIES LTD.: COMPANY SNAPSHOT

- TABLE 153 SUMITOMO RUBBER INDUSTRIES LTD.: PRODUCTS OFFERED

- TABLE 154 SUMITOMO RUBBER INDUSTRIES LTD.: PRODUCT LAUNCHES

- 14.1.9 TOYO TIRES

- TABLE 155 TOYO TIRES: BUSINESS OVERVIEW

- FIGURE 68 TOYO TIRES: COMPANY SNAPSHOT

- TABLE 156 TOYO TIRES: PRODUCTS OFFERED

- TABLE 157 TOYO TIRES: DEALS

- 14.1.10 JK TYRE

- TABLE 158 JK TYRE: BUSINESS OVERVIEW

- FIGURE 69 JK TYRE: COMPANY SNAPSHOT

- TABLE 159 JK TYRE: PRODUCTS OFFERED

- TABLE 160 JK TYRE: PRODUCT LAUNCHES

- 14.1.11 MRF

- TABLE 161 MRF: BUSINESS OVERVIEW

- FIGURE 70 MRF: COMPANY SNAPSHOT

- TABLE 162 MRF: PRODUCTS OFFERED

- 14.1.12 HANKOOK TIRES

- TABLE 163 HANKOOK TIRES: BUSINESS OVERVIEW

- FIGURE 71 HANKOOK TIRES: COMPANY SNAPSHOT

- TABLE 164 HANKOOK TIRES: PRODUCTS OFFERED

- TABLE 165 HANKOOK TIRES: DEALS

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 14.2 OTHER PLAYERS

- 14.2.1 KUMHO

- TABLE 166 KUMHO TIRE: BUSINESS OVERVIEW

- 14.2.2 BF GOODRICH

- TABLE 167 BF GOODRICH: BUSINESS OVERVIEW

- 14.2.3 MAXXIS

- TABLE 168 MAXXIS: BUSINESS OVERVIEW

- 14.2.4 FALKEN

- TABLE 169 FALKEN: BUSINESS OVERVIEW

- 14.2.5 GENERAL TIRE

- TABLE 170 GENERAL TIRE: BUSINESS OVERVIEW

- 14.2.6 UNIROYAL

- TABLE 171 UNIROYAL: BUSINESS OVERVIEW

- 14.2.7 COOPER TIRE & RUBBER COMPANY

- TABLE 172 COOPER TIRE & RUBBER COMPANY: BUSINESS OVERVIEW

- 14.2.8 FIRESTONE TIRE AND RUBBER COMPANY

- TABLE 173 FIRESTONE TIRE AND RUBBER COMPANY: BUSINESS OVERVIEW

- 14.2.9 NITTO TIRE

- TABLE 174 NITTO TIRE: BUSINESS OVERVIEW

- 14.2.10 SMART TIRE COMPANY

- TABLE 175 SMART TIRE COMPANY: BUSINESS OVERVIEW

- 14.2.11 SAILUN TIRES

- TABLE 176 SAILUN TIRES: BUSINESS OVERVIEW

15 RECOMMENDATIONS BY MARKETSANDMARKETS

- 15.1 ASIA PACIFIC TO OFFER MOST LUCRATIVE OPPORTUNITIES IN CONNECTED TIRES MARKET

- 15.2 TECHNOLOGICAL ADVANCEMENTS TO BE CRUCIAL FOR MARKET GROWTH

- 15.3 SOFTWARE SOLUTIONS TO BE INTEGRAL PART OF CONNECTED TIRES AND ADVANCED IOT-ENABLED APPLICATIONS

- 15.4 CONCLUSION

16 APPENDIX

- 16.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS