|

|

市場調査レポート

商品コード

1288943

水素貯蔵の世界市場:貯蔵方式別 (物理的、物質ベース)・貯蔵の種類別 (シリンダー、マーチャント、オンサイト、搭載型)・用途別 (化学製品、石油精製、工業、自動車・輸送、金属加工)・地域別の将来予測 (2030年まで)Hydrogen Storage Market by Storage Form (Physical, Material-Based), Storage Type (Cylinder, Merchant, On-Site, On-board), Application (Chemicals, Oil Refineries, Industrial, Automotive & Transportation, Metalworking), Region - Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 水素貯蔵の世界市場:貯蔵方式別 (物理的、物質ベース)・貯蔵の種類別 (シリンダー、マーチャント、オンサイト、搭載型)・用途別 (化学製品、石油精製、工業、自動車・輸送、金属加工)・地域別の将来予測 (2030年まで) |

|

出版日: 2023年06月06日

発行: MarketsandMarkets

ページ情報: 英文 241 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の物理的水素貯蔵の市場規模は、2023年の15億米ドルから2030年には63億米ドルへと、予測期間中に21.5%のCAGRで成長すると予測されています。

代替エネルギーとして水素が広く受け入れられているため、水素貯蔵の利用は世界的に増加しています。このように広く受け入れられることで、化石燃料の使用に関連する環境問題、エネルギー需要のピーク、エネルギー安全保障が解決されます。水素貯蔵市場は大小様々な企業が存在する競合的市場であり、予測期間中に大きな成長が見込まれます。

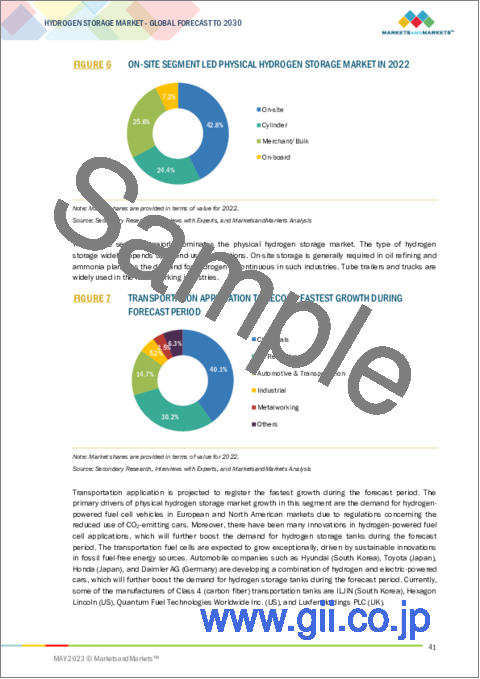

"2022年の水素貯蔵市場は、物理貯蔵形態が金額・数量ともに支配的となる"

物理的水素貯蔵市場は、2022年に13億米ドルと推定され、2030年にはCAGR21.8%で63億米ドルに達すると予想されています。主な市場促進要因の1つは、輸送用途で使用されるガソリンやディーゼルなどの燃料の脱硫のために製油所からの水素需要が増加していることです。さらに、自動車やバスに搭載される水素を動力源とする燃料電池が、予測期間中に市場を牽引すると期待されています。

"搭載型セグメントは、予測期間中、金額・数量の両方で最も高い成長を達成する"

搭載型貯蔵タンクは、新しいコンセプトの貯蔵の一種であり、自動車・バス・マテリアルハンドリング機器などの輸送業が活用領域となっています。搭載型物理的水素タンクの市場は、主に日本と韓国政府が水素を動力源とする燃料電池車の開発に提供する補助金によって牽引されています。

"化学製品用途が2022年の水素貯蔵市場をリードし、予測期間中もその支配的地位を維持する"

化学製品は2022年に最大の市場であり、予測期間中に18.8%のCAGR (金額ベース) で大きく成長すると予測されています。化学産業における水素貯蔵の用途として、アンモニア、メタノール、シクロヘキサン、過酸化水素などが挙げられます。2021年には、約1,000万トンの水素がEU域内の諸産業で使用され、主にアンモニアを製造するための原料として、精製産業で使用されました。ブルー水素とグリーン水素は、炭素集約型のグレー水素に代わる重要な低CO2代替品であり、現在の水素生産の95%を占めています。

化学産業における新たな水素経済は、欧州や各国の政策立案者のイニシアティブによって支えられており、2030年までに4,300億ユーロの投資が必要であると推定されています。さらに、化学産業で開始または発表される水素プロジェクトの数も増加しています。欧州以外の国でも、水素戦略やプロジェクトの正式化が進んでいます。中国における水素の需要は、2050年までに年間6,000万トンに達すると推定されています。

"北米は、水素貯蔵市場において、金額・数量ともに2番目に大きな支配的地域となる"

この地域における市場の成長は、燃料電池の用途の拡大、排ガス規制に関する厳しい規制、よりクリーンな燃料の使用への傾倒に起因していると考えられます。また、さまざまなエネルギー需要に対して水素などのクリーン燃料の使用を調査・奨励するための政策が組まれています。例えば、2023年3月、バイデン-ハリス政権は米国エネルギー省 (DOE) を通じて、クリーンな水素のコストを劇的に下げるための研究開発・実証活動のために7億5,000万米ドルを用意することを発表しました。このイニシアチブの主な目標は、2035年までに100%クリーンな電力網を実現し、2050年までに炭素排出量をゼロにすることです。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 業界の動向

- ポーターのファイブフォース分析

- テクノロジー分析

- エコシステムマッピング

- バリューチェーン分析

- サプライチェーン分析

- 価格分析

- 主要な利害関係者と購入基準

- 輸出入シナリオ

- 特許分析

- 関税と規制

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向と混乱

- 主要な会議とイベント (2023年~2024年)

第6章 水素貯蔵市場:方式別

- イントロダクション

- 物理的水素貯蔵

- 物理的水素貯蔵市場:地域別

- 物理的水素貯蔵市場、形状別

- 物質ベース水素貯蔵

第7章 物理的水素貯蔵市場:種類別

- イントロダクション

- シリンダー

- マーチャント (商用)/バルク

- オンサイト (現場用)

- 搭載型

第8章 水素貯蔵市場:用途別

- イントロダクション

- 化学製品

- 石油精製

- 工業

- 自動車・輸送

- 金属加工

- その他の用途

第9章 物理的水素貯蔵市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- アジア太平洋

- 韓国

- 中国

- インド

- 日本

- その他のアジア太平洋

- 欧州

- ドイツ

- イタリア

- 英国

- フランス

- オランダ

- その他の欧州

- 中東・アフリカ

- アラブ首長国連邦

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ

第10章 競合情勢

- イントロダクション

- 市場シェア分析

- 市場ランキング分析

- 大手企業の収益分析

- 企業評価マトリックス

- 競合情勢のマッピング

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- 市場評価の枠組み

- 競合ベンチマーキング

- 中小企業の評価マトリックス

第11章 企業プロファイル

- 主要企業

- AIR LIQUIDE

- LINDE PLC

- WORTHINGTON INDUSTRIES, INC.

- LUXFER HOLDINGS PLC

- PRAGMA INDUSTRIES

- HEXAGON COMPOSITES ASA

- HBANK TECHNOLOGIES INC.

- INOXCVA

- CHART INDUSTRIES, INC.

- CRYOLOR

- その他の企業

- CRYOFAB

- CALVERA HYDROGEN S.A.

- STEELHEAD COMPOSITES, INC.

- FIBA TECHNOLOGIES, INC.

- GARDNER CRYOGENICS

- AUGUSTE CRYOGENICS

- MACOMBER CRYOGENICS

- BNH GAS TANKS LLP

- MAHYTEC

- NPROXX

第12章 付録

The physical hydrogen storage market size is projected to grow from USD 1.5 billion in 2023 to USD 6.3 billion by 2030, at a CAGR of 21.5% during the forecast period. The use of hydrogen storage has increased globally due to the wide acceptability of hydrogen as an alternative energy carrier. This wide acceptance addresses environmental concerns, peak energy demand, and energy security related to the use of fossil fuels. The hydrogen storage market is competitive with many big and small players and is expected to grow at a significant rate during the forecast period.

"Physical form is the dominated segment in the hydrogen storage market in terms of both value and volume in 2022."

The physical hydrogen storage market was estimated to be USD 1.3 billion in 2022 and is expected to reach USD 6.3 billion by 2030, at a CAGR of 21.8%. One of the primary market drivers is the increase in hydrogen demand from refineries for the desulfurization of fuels such as gasoline and diesel used in transportation applications. Further, hydrogen-powered fuel cells for cars and buses are expected to drive the market during the forecast period.

"On-board segment is expected to register the highest growth in the hydrogen storage market in terms of both value and volume during the forecast period."

The on-board storage tank is a new concept and a type of storage, which finds application in the transportation industry in cars, buses, and material handling equipment. The market of on-board physical hydrogen tanks is primarily driven by subsidies offered by the governments of Japan and South Korea for developing hydrogen-powered fuel cell vehicles.

"Chemicals application led the hydrogen storage market in 2022 and expected to hold its dominant position during the forecast period."

Chemicals were the largest market in 2022 and are anticipated to grow significantly during the forecast period with a CAGR of 18.8% (in terms of value). Hydrogen storage applications in various chemical industries are ammonia, methanol, cyclohexane, hydrogen peroxide, etc. In 2021, approximately 10 million tons of hydrogen were used in the EU industry, mainly as a feedstock for producing ammonia and in the refining industry. Blue and green hydrogen are the key low-CO2 alternatives that could replace the carbon-intensive grey hydrogen, representing 95% of the current hydrogen production.

The emerging hydrogen economy in the chemical industry is supported by policymaker initiatives at the European and country level, estimating a required investment of € 430 billion by 2030. Moreover, there has been an increase in the number of hydrogen projects being initiated or announced in the chemical industry. Countries outside Europe are formalizing hydrogen strategies and projects. The demand for hydrogen in China is estimated to hit 60 million tons annually by 2050.

"North America is the second-highest dominating region in hydrogen storage market in terms of both value and volume."

The growth of the market in the region can be attributed to the rise in fuel cell applications, strict regulations regarding emission control, and the inclination to use cleaner fuels. Policies are also being framed to research and encourage the use of clean fuels such as hydrogen for various energy needs. For example, in March 2023, the Biden-Harris Administration, through the US Department of Energy (DOE), announced the availability of USD 750 million for research, development, and demonstration efforts to dramatically reduce the cost of clean hydrogen. The main goal of this initiative is to achieve a 100% clean electrical grid by 2035 and net-zero carbon emissions by 2050.*The US accounts for the highest share in the North American physical hydrogen storage market because of the growing usage of hydrogen in grid infrastructure and manufacturing fertilizers and chemicals.

This study has been validated through primary interviews conducted with various industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1- 37%, Tier 2- 33%, and Tier 3- 30%

- By Designation- C Level- 50%, Director Level- 20%, and Others- 30%

- By Region- Europe- 50%, Asia Pacific (APAC) - 20%, North America- 15%, Middle East & Africa (MEA)-10%, Latin America-5%,

The report provides a comprehensive analysis of company profiles :

Air Liquide (France), Worthington Industries, Inc. (US), Luxfer Holdings PLC (UK), Linde plc (Germany), Chart Industries (US), INOXCVA (India), Hexagon Composites ASA (Norway), HBank Technologies Inc. (Taiwan), Pragma Industries (France), Croyolor (France).

Research Coverage

This report covers the global hydrogen storage market and forecasts the market size until 2030. It includes the following market segmentation - by Form (Physical, Material-based), by Type (Cylinder, On-site, On-board, Merchant/Bulk), by Application (Automotive & Transportation, Chemicals, Oil Refineries, Industrial, Metalworking, and Others), and Region (North America, Europe, Asia Pacific, Middle East & Africa, Latin America). Porter's Five Forces Analysis, along with the drivers, restraints, opportunities, and challenges, have been discussed in the report. It also provides company profiles and competitive strategies adopted by the major players in the global hydrogen storage market market.

Key benefits of buying the report:

The report is expected to help market leaders/new entrants in this market in the following ways:

1. This report segments the global hydrogen storage market comprehensively. It provides the closest approximations of the revenues for the overall market and the sub-segments across different verticals and regions.

2. The report helps stakeholders understand the pulse of the hydrogen storage market and provides them with information on key market drivers, restraints, challenges, and opportunities.

3. This report will help stakeholders to understand competitors better and gain more insights to better their position in their businesses. The competitive landscape section includes the competitor ecosystem, new product development, agreement, contract, expansion, and acquisition.

Reasons to buy the report:

The report will help leaders/new entrants in this market by providing them with the closest approximations of the revenues for the overall hydrogen storage market and the sub-segments. This report will help stakeholders to understand the competitive landscape and gain more insights and position their businesses and market strategies in a better way.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising demand for low-emission fuels, increased hydrogen demand in other applications, use of hydrogen storage tanks for transportation, and government investments and initiatives to drive market), restraints (Limited availability of hydrogen refueling infrastructure in developed economies and less efficient in terms of power storage ), opportunities (Development of low-weight storage tank for transportation and new applications for hydrogen-powered fuel cells), and challenges (High competition from alternative fuel, high flammability, fluctuating oil prices ) influencing the growth of the hydrogen storage market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the hydrogen storage market

- Market Development: Comprehensive information about lucrative markets - the report analyses the hydrogen storage market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the hydrogen storage market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Air Liquide (France), Worthington Industries, Inc. (US), Luxfer Holdings PLC (UK), Linde plc (Germany), Chart Industries (US), INOXCVA (India),, among others in the hydrogen storage market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 HYDROGEN STORAGE MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 1 HYDROGEN STORAGE MARKET: RESEARCH DESIGN

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE APPROACH

- 2.2.2 DEMAND-SIDE APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 RESEARCH DATA

- 2.4.1 SECONDARY DATA

- 2.4.1.1 Key data from secondary sources

- 2.4.2 PRIMARY DATA

- 2.4.2.1 Key data from primary sources

- 2.4.2.2 Key primary participants

- 2.4.2.3 Breakdown of primary interviews

- 2.4.2.4 Key industry insights

- 2.4.1 SECONDARY DATA

- 2.5 MARKET SIZE ESTIMATION

- 2.5.1 BOTTOM-UP APPROACH

- FIGURE 2 HYDROGEN STORAGE MARKET: BOTTOM-UP APPROACH

- 2.5.2 TOP-DOWN APPROACH

- FIGURE 3 HYDROGEN STORAGE MARKET: TOP-DOWN APPROACH

- 2.6 DATA TRIANGULATION

- FIGURE 4 HYDROGEN STORAGE MARKET: DATA TRIANGULATION

- 2.7 FACTOR ANALYSIS

- 2.8 ASSUMPTIONS

- 2.9 GROWTH FORECAST

- 2.10 LIMITATIONS

- 2.11 RISK ANALYSIS

- 2.12 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 5 GAS FORM DOMINATED PHYSICAL HYDROGEN STORAGE MARKET IN 2022

- FIGURE 6 ON-SITE SEGMENT LED PHYSICAL HYDROGEN STORAGE MARKET IN 2022

- FIGURE 7 TRANSPORTATION APPLICATION TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 8 CHINA TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PHYSICAL HYDROGEN STORAGE MARKET

- FIGURE 10 HIGH DEMAND FOR HYDROGEN STORAGE FROM END-USE INDUSTRIES TO DRIVE MARKET

- 4.2 PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE

- FIGURE 11 CYLINDER STORAGE TYPE DOMINATED MARKET IN 2022

- 4.3 PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION

- FIGURE 12 CHEMICALS SEGMENT LED MARKET IN 2022

- 4.4 PHYSICAL HYDROGEN STORAGE MARKET, BY KEY COUNTRY

- FIGURE 13 CHINA MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN HYDROGEN STORAGE MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for low-emission fuels

- 5.2.1.2 Increased hydrogen demand from various applications

- 5.2.1.3 Use of hydrogen storage tanks for transportation

- 5.2.1.4 Development of hydrogen infrastructure across various countries

- 5.2.1.5 Government investments and initiatives

- TABLE 1 POLICIES BY MAJOR ECONOMIES TO STIMULATE HYDROGEN DEMAND

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited availability of hydrogen refueling infrastructure

- 5.2.2.2 Less efficient in terms of power storage

- 5.2.2.3 High cost of composite material-based tanks

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of low-weight storage tanks for transportation

- 5.2.3.2 New applications for hydrogen-powered fuel cells

- 5.2.3.3 Development of electric cars using hydrogen fuel

- 5.2.4 CHALLENGES

- 5.2.4.1 High competition from alternative fuels

- 5.2.4.2 High flammability

- 5.2.4.3 Fluctuating oil prices

- 5.3 INDUSTRY TRENDS

- 5.3.1 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 15 HYDROGEN STORAGE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1.1 Threat of new entrants

- 5.3.1.2 Threat of substitutes

- 5.3.1.3 Bargaining power of buyers

- 5.3.1.4 Bargaining power of suppliers

- 5.3.1.5 Intensity of competitive rivalry

- TABLE 2 HYDROGEN STORAGE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 TECHNOLOGY ANALYSIS

- TABLE 3 BASIC TYPES OF HYDROGEN STORAGE TANKS

- 5.5 ECOSYSTEM MAPPING

- FIGURE 16 HYDROGEN STORAGE MARKET: ECOSYSTEM MAP

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 17 HYDROGEN STORAGE MARKET: VALUE CHAIN ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE OF APPLICATIONS OFFERED BY KEY PLAYERS

- FIGURE 18 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP THREE APPLICATIONS (USD/KG)

- 5.8.2 AVERAGE SELLING PRICE, BY TYPE

- FIGURE 19 AVERAGE SELLING PRICE BASED ON TYPE (USD/KG)

- 5.8.3 AVERAGE SELLING PRICE, BY APPLICATION

- FIGURE 20 AVERAGE SELLING PRICE BASED ON APPLICATIONS (USD/KG)

- 5.8.4 AVERAGE SELLING PRICE, BY REGION

- TABLE 4 HYDROGEN STORAGE AVERAGE SELLING PRICE, BY REGION

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 5 IMPACT ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- 5.9.2 BUYING CRITERIA

- FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 6 KEY BUYING CRITERIA

- 5.10 IMPORT-EXPORT SCENARIO

- 5.10.1 US

- 5.10.2 FRANCE

- 5.10.3 GERMANY

- 5.10.4 INDIA

- 5.11 PATENT ANALYSIS

- 5.11.1 INTRODUCTION

- 5.11.2 METHODOLOGY

- 5.11.3 DOCUMENT TYPES

- TABLE 7 HYDROGEN STORAGE MARKET: GLOBAL PATENTS

- FIGURE 23 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 24 GLOBAL PATENT PUBLICATION TREND, 2012-2022

- 5.11.4 INSIGHTS

- 5.11.5 LEGAL STATUS

- FIGURE 25 HYDROGEN STORAGE MARKET: LEGAL STATUS OF PATENTS

- 5.11.6 JURISDICTION ANALYSIS

- FIGURE 26 GLOBAL JURISDICTION ANALYSIS

- 5.11.7 TOP APPLICANTS

- FIGURE 27 ZHEJIANG UNIVERSITY REGISTERED HIGHEST NUMBER OF PATENTS BETWEEN 2012 TO 2022

- 5.11.8 PATENTS BY ZHEJIANG UNIVERSITY

- 5.11.9 PATENTS BY HUANENG CLEAN ENERGY RESEARCH INSTITUTE

- 5.11.10 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.12 TARIFF AND REGULATIONS

- 5.12.1 REGULATIONS IN HYDROGEN STORAGE MARKET

- 5.12.1.1 US

- 5.12.1.2 Japan

- 5.12.1.3 Europe

- 5.12.1.4 China

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.3 HYDROGEN STORAGE MARKET: REGULATORY FRAMEWORK

- TABLE 12 REGULATORY FRAMEWORK: HYDROGEN STORAGE MARKET, BY REGION

- 5.12.4 STANDARDS IN HYDROGEN STORAGE MARKET

- TABLE 13 US: CURRENT STANDARD CODES FOR HYDROGEN CYLINDERS

- TABLE 14 EUROPE: CURRENT STANDARD CODES FOR HYDROGEN CYLINDERS

- TABLE 15 ASIA PACIFIC: CURRENT STANDARD CODES FOR HYDROGEN CYLINDERS

- 5.12.1 REGULATIONS IN HYDROGEN STORAGE MARKET

- 5.13 CASE STUDY ANALYSIS

- FIGURE 28 HYDROGEN STORAGE MARKET: CASE STUDY ANALYSIS

- 5.14 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 HYDROGEN STORAGE MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.15 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 16 HYDROGEN STORAGE MARKET: KEY CONFERENCES AND EVENTS

6 HYDROGEN STORAGE MARKET, BY FORM

- 6.1 INTRODUCTION

- FIGURE 30 PHYSICAL FORM TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 17 HYDROGEN STORAGE MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 18 HYDROGEN STORAGE MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- 6.2 PHYSICAL HYDROGEN STORAGE

- 6.2.1 INCREASING DEMAND FOR STATIONARY APPLICATIONS TO DRIVE MARKET

- 6.2.2 PHYSICAL HYDROGEN STORAGE MARKET, BY REGION

- FIGURE 31 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 19 PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 20 PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 21 PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 22 PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (USD THOUSAND)

- 6.2.3 PHYSICAL HYDROGEN STORAGE MARKET, BY FORM TYPE

- FIGURE 32 GAS FORM TO LEAD PHYSICAL HYDROGEN STORAGE MARKET DURING FORECAST PERIOD

- TABLE 23 PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2018-2022 (UNITS)

- TABLE 24 PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 25 PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2023-2030 (UNITS)

- TABLE 26 PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- 6.2.3.1 Gas form: Physical hydrogen storage market, by region

- FIGURE 33 ASIA PACIFIC TO LEAD GAS FORM SEGMENT DURING FORECAST PERIOD

- TABLE 27 GAS FORM: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 28 GAS FORM: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (USD THOUSAND)

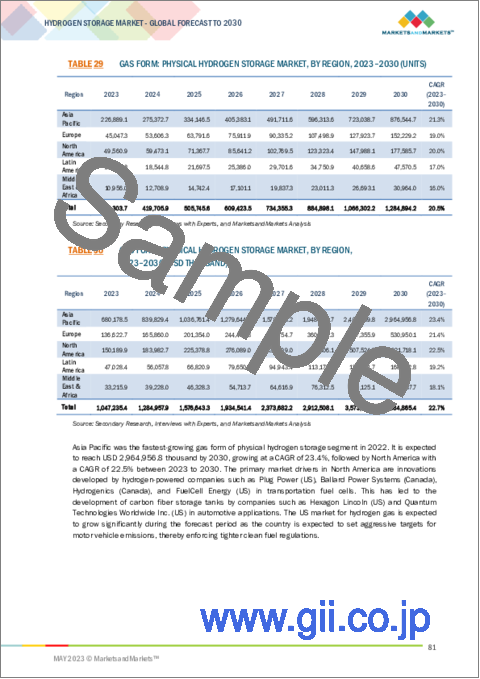

- TABLE 29 GAS FORM: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 30 GAS FORM: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (USD THOUSAND)

- 6.2.3.2 Liquid form: Physical hydrogen storage market, by region

- FIGURE 34 ASIA PACIFIC TO DOMINATE LIQUID FORM SEGMENT DURING FORECAST PERIOD

- TABLE 31 LIQUID FORM: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 32 LIQUID FORM: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 33 LIQUID FORM: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 34 LIQUID FORM: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (USD THOUSAND)

- 6.3 MATERIAL-BASED HYDROGEN STORAGE

- 6.3.1 INVOLVES ABSORPTION OR ADSORPTION MECHANISMS

7 PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 35 ON-SITE STORAGE SEGMENT TO DOMINATE DURING FORECAST PERIOD

- TABLE 35 PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2018-2022 (UNITS)

- TABLE 36 PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2018-2022 (USD THOUSAND)

- TABLE 37 PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2023-2030 (UNITS)

- TABLE 38 PHYSICAL HYDROGEN STORAGE MARKET, TYPE, 2023-2030 (USD THOUSAND)

- 7.2 CYLINDERS

- 7.2.1 USE OF HYDROGEN CYLINDERS IN END-USE INDUSTRIES TO DRIVE MARKET

- FIGURE 36 ASIA PACIFIC TO DOMINATE CYLINDER SEGMENT DURING FORECAST PERIOD

- TABLE 39 CYLINDER PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 40 CYLINDER PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 41 CYLINDER PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 42 CYLINDER PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (USD THOUSAND)

- 7.3 MERCHANT/BULK

- 7.3.1 HIGH DEMAND FOR MERCHANT HYDROGEN IN METALWORKING INDUSTRIES TO PROPEL MARKET

- TABLE 43 MERCHANT/BULK PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 44 MERCHANT/BULK PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 45 MERCHANT/BULK PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 46 MERCHANT/BULK PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (USD THOUSAND)

- 7.4 ON-SITE

- 7.4.1 REGULATORY STANDARDS FOR POLLUTION CONTROL TO FUEL DEMAND FOR ON-SITE HYDROGEN TANKS

- TABLE 47 ON-SITE PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 48 ON-SITE PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 49 ON-SITE PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 50 ON-SITE PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (USD THOUSAND)

- 7.5 ON-BOARD

- 7.5.1 USE OF FUEL CELLS IN AUTOMOTIVE & TRANSPORTATION SECTOR TO BOOST DEMAND FOR ON-BOARD HYDROGEN STORAGE

- TABLE 51 ON-BOARD PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 52 ON-BOARD PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 53 ON-BOARD PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 54 ON-BOARD PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (USD THOUSAND)

8 HYDROGEN STORAGE MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- TABLE 55 PHYSICAL HYDROGEN STORAGE: APPLICATIONS

- FIGURE 37 PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2030

- TABLE 56 PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 57 PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 58 PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 59 PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 8.2 CHEMICALS

- 8.2.1 INCREASING USE OF HYDROGEN IN CHEMICALS INDUSTRY TO DRIVE MARKET

- TABLE 60 CHEMICALS: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 61 CHEMICALS: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 62 CHEMICALS: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 63 CHEMICALS: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (USD THOUSAND)

- 8.3 OIL REFINERIES

- 8.3.1 DESULFURIZATION OF FUELS TO PROPEL MARKET

- TABLE 64 OIL REFINERIES: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 65 OIL REFINERIES: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 66 OIL REFINERIES: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 67 OIL REFINERIES: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (USD THOUSAND)

- 8.4 INDUSTRIAL

- 8.4.1 INCREASED USE IN INDUSTRIAL PROCESSES TO FUEL DEMAND FOR HYDROGEN

- TABLE 68 INDUSTRIAL: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 69 INDUSTRIAL: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 70 INDUSTRIAL: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 71 INDUSTRIAL: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (USD THOUSAND)

- 8.5 AUTOMOTIVE & TRANSPORTATION

- 8.5.1 RISING DEMAND FOR HYDROGEN-POWERED VEHICLES TO DRIVE MARKET

- TABLE 72 AUTOMOTIVE & TRANSPORTATION: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 73 AUTOMOTIVE & TRANSPORTATION: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 74 AUTOMOTIVE & TRANSPORTATION: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 75 AUTOMOTIVE & TRANSPORTATION: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (USD THOUSAND)

- 8.6 METALWORKING

- 8.6.1 USE OF HYDROGEN IN PLASMA TO CLEAN METAL SURFACES TO DRIVE MARKET

- TABLE 76 METALWORKING: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 77 METALWORKING: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 78 METALWORKING: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 79 METALWORKING: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (USD THOUSAND)

- 8.7 OTHER APPLICATIONS

- TABLE 80 OTHER APPLICATIONS: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 81 OTHER APPLICATIONS: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 82 OTHER APPLICATIONS: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 83 OTHER APPLICATIONS: PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (USD THOUSAND)

9 PHYSICAL HYDROGEN STORAGE MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 38 CHINA TO BE FASTEST-GROWING PHYSICAL HYDROGEN STORAGE MARKET DURING FORECAST PERIOD

- TABLE 84 PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (UNITS)

- TABLE 85 PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2018-2022 (USD THOUSAND)

- TABLE 86 PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (UNITS)

- TABLE 87 PHYSICAL HYDROGEN STORAGE MARKET, BY REGION, 2023-2030 (USD THOUSAND)

- 9.2 NORTH AMERICA

- 9.2.1 RECESSION IMPACT ON NORTH AMERICA

- FIGURE 39 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET SNAPSHOT

- 9.2.2 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM

- TABLE 88 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2018-2022 (UNITS)

- TABLE 89 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 90 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2023-2030 (UNITS)

- TABLE 91 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- 9.2.3 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE

- TABLE 92 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2018-2022 (UNITS)

- TABLE 93 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2018-2022 (USD THOUSAND)

- TABLE 94 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2023-2030 (UNITS)

- TABLE 95 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2023-2030 (USD THOUSAND)

- 9.2.4 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION

- TABLE 96 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 97 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 98 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 99 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.2.5 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY

- TABLE 100 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2022 (UNITS)

- TABLE 101 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 102 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2023-2030 (UNITS)

- TABLE 103 NORTH AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2023-2030 (USD THOUSAND)

- 9.2.6 US

- 9.2.6.1 Upcoming projects and investments to drive market

- TABLE 104 US: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 105 US: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 106 US: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 107 US: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION 2023-2030 (USD THOUSAND)

- 9.2.7 CANADA

- 9.2.7.1 Emission reduction plans to fuel demand for hydrogen storage

- TABLE 108 CANADA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 109 CANADA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 110 CANADA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 111 CANADA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.3 ASIA PACIFIC

- 9.3.1 RECESSION IMPACT ON ASIA PACIFIC

- FIGURE 40 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET SNAPSHOT

- 9.3.2 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM

- TABLE 112 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2018-2022 (UNITS)

- TABLE 113 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 114 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2023-2030 (UNITS)

- TABLE 115 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- 9.3.3 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE

- TABLE 116 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2018-2022 (UNITS)

- TABLE 117 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2018-2022 (USD THOUSAND)

- TABLE 118 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2023-2030 (UNITS)

- TABLE 119 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2023-2030 (USD THOUSAND)

- 9.3.4 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION

- TABLE 120 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 121 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 122 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 123 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.3.5 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY

- TABLE 124 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2022 (UNITS)

- TABLE 125 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 126 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2023-2030 (UNITS)

- TABLE 127 ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2023-2030 (USD THOUSAND)

- 9.3.6 SOUTH KOREA

- 9.3.6.1 High FCEV deployment to drive market

- TABLE 128 SOUTH KOREA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 129 SOUTH KOREA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 130 SOUTH KOREA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 131 SOUTH KOREA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.3.7 CHINA

- 9.3.7.1 Carbon neutrality targets to drive energy management systems

- TABLE 132 CHINA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 133 CHINA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 134 CHINA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 135 CHINA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.3.8 INDIA

- 9.3.8.1 Developments in industrial sector to drive market

- TABLE 136 INDIA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 137 INDIA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 138 INDIA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 139 INDIA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.3.9 JAPAN

- 9.3.9.1 National hydrogen strategies for emission reduction to boost market

- TABLE 140 JAPAN: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 141 JAPAN: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 142 JAPAN: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 143 JAPAN: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.3.10 REST OF ASIA PACIFIC

- TABLE 144 REST OF ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 145 REST OF ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 146 REST OF ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 147 REST OF ASIA PACIFIC: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.4 EUROPE

- 9.4.1 RECESSION IMPACT ON EUROPE

- FIGURE 41 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET SNAPSHOT

- 9.4.2 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM

- TABLE 148 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2018-2022 (UNITS)

- TABLE 149 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 150 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2023-2030 (UNITS)

- TABLE 151 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- 9.4.3 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE

- TABLE 152 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2018-2022 (UNITS)

- TABLE 153 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2018-2022 (USD THOUSAND)

- TABLE 154 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2023-2030 (UNITS)

- TABLE 155 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2023-2030 (USD THOUSAND)

- 9.4.4 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION

- TABLE 156 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 157 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 158 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 159 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.4.5 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY

- TABLE 160 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2022 (UNITS)

- TABLE 161 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 162 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2023-2030 (UNITS)

- TABLE 163 EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2023-2030 (USD THOUSAND)

- 9.4.6 GERMANY

- 9.4.6.1 Funding for R&D projects to drive market

- TABLE 164 GERMANY: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 165 GERMANY: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 166 GERMANY: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 167 GERMANY: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.4.7 ITALY

- 9.4.7.1 Efforts to achieve net zero emission target to boost market

- TABLE 168 ITALY: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 169 ITALY: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 170 ITALY: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 171 ITALY: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.4.8 UK

- 9.4.8.1 Increasing use of hydrogen-powered vehicles to propel market

- TABLE 172 UK: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 173 UK: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 174 UK: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 175 UK: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.4.9 FRANCE

- 9.4.9.1 Demand for hydrogen tanks at refueling stations to drive market

- TABLE 176 FRANCE: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 177 FRANCE: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 178 FRANCE: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 179 FRANCE: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.4.10 NETHERLANDS

- 9.4.10.1 Increasing requirement for transportation fuels and stringent emission regulations to propel market

- TABLE 180 NETHERLANDS: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 181 NETHERLANDS: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 182 NETHERLANDS: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION 2023-2030 (UNITS)

- TABLE 183 NETHERLANDS: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.4.11 REST OF EUROPE

- TABLE 184 REST OF EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 185 REST OF EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 186 REST OF EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 187 REST OF EUROPE: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 RECESSION IMPACT ON MIDDLE EAST & AFRICA

- 9.5.2 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM

- TABLE 188 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2018-2022 (UNITS)

- TABLE 189 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 190 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2023-2030 (UNITS)

- TABLE 191 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- 9.5.3 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE

- TABLE 192 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2018-2022 (UNITS)

- TABLE 193 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2018-2022 (USD THOUSAND)

- TABLE 194 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2023-2030 (UNITS)

- TABLE 195 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2023-2030 (USD THOUSAND)

- 9.5.4 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION

- TABLE 196 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 197 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 198 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 199 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.5.5 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY

- TABLE 200 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2022 (UNITS)

- TABLE 201 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 202 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2023-2030 (UNITS)

- TABLE 203 MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2023-2030 (USD THOUSAND)

- 9.5.6 UAE

- 9.5.6.1 Increasing R&D investment in hydrogen infrastructure to drive market

- TABLE 204 UAE: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 205 UAE: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 206 UAE: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 207 UAE: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.5.7 SOUTH AFRICA

- 9.5.7.1 Efforts for decarbonization to fuel demand for hydrogenated products

- TABLE 208 SOUTH AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 209 SOUTH AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 210 SOUTH AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 211 SOUTH AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.5.8 REST OF MIDDLE EAST & AFRICA

- TABLE 212 REST OF MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 213 REST OF MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 214 REST OF MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 215 REST OF MIDDLE EAST & AFRICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.6 LATIN AMERICA

- 9.6.1 RECESSION IMPACT ON LATIN AMERICA

- 9.6.2 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM

- TABLE 216 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2018-2022 (UNITS)

- TABLE 217 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2018-2022 (USD THOUSAND)

- TABLE 218 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2023-2030 (UNITS)

- TABLE 219 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- 9.6.3 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE

- TABLE 220 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2018-2022 (UNITS)

- TABLE 221 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2018-2022 (USD THOUSAND)

- TABLE 222 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2023-2030 (UNITS)

- TABLE 223 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY TYPE, 2023-2030 (USD THOUSAND)

- 9.6.4 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION

- TABLE 224 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 225 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 226 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 227 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.6.5 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY

- TABLE 228 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2022 (UNITS)

- TABLE 229 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 230 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2023-2030 (UNITS)

- TABLE 231 LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY COUNTRY, 2023-2030 (USD THOUSAND)

- 9.6.6 BRAZIL

- 9.6.6.1 Technological advancements to facilitate transition to low-carbon economy

- TABLE 232 BRAZIL: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 233 BRAZIL: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 234 BRAZIL: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 235 BRAZIL: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.6.7 MEXICO

- 9.6.7.1 Partnerships and collaborations with other economies to drive market

- TABLE 236 MEXICO: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 237 MEXICO: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 238 MEXICO: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 239 MEXICO: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

- 9.6.8 REST OF LATIN AMERICA

- TABLE 240 REST OF LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (UNITS)

- TABLE 241 REST OF LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2018-2022 (USD THOUSAND)

- TABLE 242 REST OF LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (UNITS)

- TABLE 243 REST OF LATIN AMERICA: PHYSICAL HYDROGEN STORAGE MARKET, BY APPLICATION, 2023-2030 (USD THOUSAND)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 MARKET SHARE ANALYSIS

- TABLE 244 DEGREE OF COMPETITION: HYDROGEN STORAGE MARKET

- 10.3 MARKET RANKING ANALYSIS

- FIGURE 42 RANKING OF TOP FIVE PLAYERS IN HYDROGEN STORAGE MARKET

- 10.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 43 REVENUE ANALYSIS OF KEY PLAYERS IN HYDROGEN STORAGE MARKET

- 10.5 COMPANY EVALUATION MATRIX

- TABLE 245 COMPANY PRODUCT FOOTPRINT

- TABLE 246 COMPANY APPLICATION FOOTPRINT

- TABLE 247 COMPANY REGION FOOTPRINT

- 10.6 COMPETITIVE LANDSCAPE MAPPING

- 10.6.1 STARS

- 10.6.2 PERVASIVE PLAYERS

- 10.6.3 PARTICIPANTS

- 10.6.4 EMERGING LEADERS

- FIGURE 44 HYDROGEN STORAGE MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2022

- 10.7 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 45 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN HYDROGEN STORAGE MARKET

- 10.8 BUSINESS STRATEGY EXCELLENCE

- FIGURE 46 BUSINESS STRATEGY OF TOP PLAYERS IN HYDROGEN STORAGE MARKET

- 10.9 MARKET EVALUATION FRAMEWORK

- TABLE 248 HYDROGEN STORAGE MARKET: NEW PRODUCT DEVELOPMENTS, 2018-2023

- TABLE 249 HYDROGEN STORAGE MARKET: DEALS, 2018-2023

- TABLE 250 HYDROGEN STORAGE MARKET: OTHER DEVELOPMENTS, 2018-2023

- 10.10 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 251 HYDROGEN STORAGE MARKET: KEY STARTUPS/SMES

- TABLE 252 HYDROGEN STORAGE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.11 SME EVALUATION MATRIX

- 10.11.1 PROGRESSIVE COMPANIES

- 10.11.2 RESPONSIVE COMPANIES

- 10.11.3 DYNAMIC COMPANIES

- 10.11.4 STARTING BLOCKS

- FIGURE 47 HYDROGEN STORAGE MARKET: SME MATRIX, 2022

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business overview, Products offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats)**

- 11.1.1 AIR LIQUIDE

- TABLE 253 AIR LIQUIDE: COMPANY OVERVIEW

- FIGURE 48 AIR LIQUIDE: COMPANY SNAPSHOT

- TABLE 254 AIR LIQUIDE: DEALS

- 11.1.2 LINDE PLC

- TABLE 255 LINDE PLC: COMPANY OVERVIEW

- FIGURE 49 LINDE PLC: COMPANY SNAPSHOT

- TABLE 256 LINDE PLC: DEALS

- 11.1.3 WORTHINGTON INDUSTRIES, INC.

- TABLE 257 WORTHINGTON INDUSTRIES INC.: COMPANY OVERVIEW

- FIGURE 50 WORTHINGTON INDUSTRIES INC.: COMPANY SNAPSHOT

- TABLE 258 WORTHINGTON INDUSTRIES INC.: DEALS

- TABLE 259 WORTHINGTON INDUSTRIES, INC.: OTHER DEVELOPMENTS

- 11.1.4 LUXFER HOLDINGS PLC

- TABLE 260 LUXFER HOLDINGS PLC: COMPANY OVERVIEW

- FIGURE 51 LUXFER HOLDINGS PLC: COMPANY SNAPSHOT

- TABLE 261 LUXFER HOLDINGS PLC: DEALS

- 11.1.5 PRAGMA INDUSTRIES

- TABLE 262 PRAGMA INDUSTRIES: COMPANY OVERVIEW

- 11.1.6 HEXAGON COMPOSITES ASA

- TABLE 263 HEXAGON COMPOSITES ASA: COMPANY OVERVIEW

- FIGURE 52 HEXAGON COMPOSITES ASA: COMPANY SNAPSHOT

- TABLE 264 HEXAGON COMPOSITES ASA: DEALS

- TABLE 265 HEXAGON COMPOSITES ASA: OTHER DEVELOPMENTS

- 11.1.7 HBANK TECHNOLOGIES INC.

- TABLE 266 HBANK TECHNOLOGIES INC.: COMPANY OVERVIEW

- 11.1.8 INOXCVA

- TABLE 267 INOXCVA: COMPANY OVERVIEW

- FIGURE 53 INOXCVA: COMPANY SNAPSHOT

- TABLE 268 INOXCVA: DEALS

- TABLE 269 INOXCVA: OTHER DEVELOPMENTS

- 11.1.9 CHART INDUSTRIES, INC.

- TABLE 270 CHART INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 54 CHART INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 271 CHART INDUSTRIES, INC.: DEALS

- 11.1.10 CRYOLOR

- TABLE 272 CRYOLOR: COMPANY OVERVIEW

- 11.2 OTHER PLAYERS

- 11.2.1 CRYOFAB

- TABLE 273 CRYOFAB: COMPANY OVERVIEW

- 11.2.2 CALVERA HYDROGEN S.A.

- TABLE 274 CALVERA HYDROGEN S.A.: COMPANY OVERVIEW

- 11.2.3 STEELHEAD COMPOSITES, INC.

- TABLE 275 STEELHEAD COMPOSITES, INC.: COMPANY OVERVIEW

- 11.2.4 FIBA TECHNOLOGIES, INC.

- TABLE 276 FIBA TECHNOLOGIES, INC.: COMPANY OVERVIEW

- 11.2.5 GARDNER CRYOGENICS

- TABLE 277 GARDNER CRYOGENICS: COMPANY OVERVIEW

- 11.2.6 AUGUSTE CRYOGENICS

- TABLE 278 AUGUSTE CRYOGENICS: COMPANY OVERVIEW

- 11.2.7 MACOMBER CRYOGENICS

- TABLE 279 MACOMBER CRYOGENICS: COMPANY OVERVIEW

- 11.2.8 BNH GAS TANKS LLP

- TABLE 280 BNH GAS TANKS LLP: COMPANY OVERVIEW

- 11.2.9 MAHYTEC

- TABLE 281 MAHYTEC: COMPANY OVERVIEW

- 11.2.10 NPROXX

- *Details on Business overview, Products offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS