|

|

市場調査レポート

商品コード

1282758

DataOpsプラットフォームの世界市場:提供別 (プラットフォーム、サービス)・種類別 (アジャイル開発、DevOps、リーン生産方式)・展開方式別・業種別 (BFSI、通信、医療・ライフサイエンス)・地域別の将来予測 (2028年まで)DataOps Platform Market by Offering (Platform and Services), Type (Agile Development, DevOps, and Lean Manufacturing), Deployment Mode, Vertical (BFSI, Telecommunications, and Healthcare & Life Sciences) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| DataOpsプラットフォームの世界市場:提供別 (プラットフォーム、サービス)・種類別 (アジャイル開発、DevOps、リーン生産方式)・展開方式別・業種別 (BFSI、通信、医療・ライフサイエンス)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年05月24日

発行: MarketsandMarkets

ページ情報: 英文 325 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のDataOpsプラットフォームの市場規模は、2023年の39億米ドルから2028年には109億米ドルに成長し、予測期間中のCAGRは23.0%と予測されています。

DataOpsプラットフォームは、データパイプライン、ワークフロー、プロセスを管理・運営するための集中型ハブとして重要な役割を担っています。データエンジニア、データサイエンティスト、アナリストなど、機能横断的なチーム間のコラボレーションを促進します。さまざまなツールや機能を提供することで、このプラットフォームは、エンドツーエンドのデータライフサイクルの自動化、監視、制御を可能にします。この一元的なアプローチにより、合理的な運用と効率的なコラボレーションが実現し、企業はデータ資産を効果的に活用し、価値を引き出すことができるようになります。

"アジャイル開発部門が予測期間中に、種類別で最大の市場シェアを占める"

DataOpsプラットフォームにおけるアジャイル開発は、組織が変化するビジネスニーズへの対応能力を高め、プロジェクトの可視性と透明性を向上させ、コラボレーションとイノベーションを促進し、データイニシアチブの価値実現までの時間を短縮することを支援します。また、データ運用の効率的な管理、データプロセスの最適化、実用的なインサイトを動的かつ反復的に提供することが可能になります。予測期間中、アジャイル開発が最大の市場シェアを占めると予想されます。

"提供別では、サービス分野が予測期間中に最も高いCAGRで成長する"

DataOpsプラットフォームのサービスは、効率的かつ効果的なデータ運用と管理を促進するために設計された幅広い機能性と能力を包含しています。これらのサービスは、データのライフサイクル全体を通じてデータを取り扱う際の課題や要件に対応するよう特別に調整されています。DataOpsプラットフォームのサービスは、効率的なAI機能、リアルタイム分析、インサイト配信をアプリケーションに統合することで、企業の意思決定を促進します。予測期間中、サービス分野は最も高いCAGRで成長すると予測されています。

"北米が予測期間中に最大の市場規模を占める"

予測期間中、地域別では北米は最大の市場規模を占めると予測されます。この地域は、DataOpsプラットフォームの採用を促進するテクノロジー産業が盛んです。世界有数のテクノロジー企業の多くは北米に拠点を置いており、これらの企業はデータインフラと分析機能に多額の投資を行っています。データの管理と分析を容易にする新しいテクノロジーの出現が、北米におけるDataOpsプラットフォームの採用を促進しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- DataOpsプラットフォームの略史

- DataOpsプラットフォーム市場:エコシステム

- DataOpsプラットフォームのアーキテクチャ

- DataOpsのプロセス構造

- サプライチェーン分析

- 価格モデルの分析

- 特許分析

- 技術分析

- ポーターのファイブフォース分析

- 主要な会議とイベント

- 規制状況

- 主要な利害関係者と購入基準

- DataOpsプラットフォーム市場のバイヤー/クライアントに影響を与える混乱

- DataOpsプラットフォームの技術ロードマップ

- DataOpsプラットフォームのビジネスモデル

- DataOpsとDevOpsの主な違い

- DataOpsプラットフォームの機能

- DataOpsプラットフォーム市場のベストプラクティス

第6章 DataOpsプラットフォーム市場:提供別

- イントロダクション

- プラットホーム

- データ統合

- データ品質

- データガバナンス

- マスターデータ管理

- データ分析

- オートメーション

- コラボレーション

- データ視覚化

- その他

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 DataOpsプラットフォーム市場:種類別

- イントロダクション

- アジャイル開発

- DevOps

- リーン生産方式

第8章 DataOpsプラットフォーム市場:展開方式別

- イントロダクション

- クラウド

- パブリッククラウド

- プライベートクラウド

- ハイブリッドクラウド

- オンプレミス

第9章 DataOpsプラットフォーム市場:業種別

- イントロダクション

- BFSI

- 財務データ最適化

- 不正取引の特定

- クレジットスコアリング

- 投資分析

- その他のBFSI用途

- 医療・ライフサイエンス

- 治験管理

- 電子カルテ

- 精密医療

- 創薬

- その他の医療・ライフサイエンス用途

- 小売業・eコマース

- 価格最適化

- 個別化製品の推奨

- 在庫管理

- 需要予測

- その他の小売業・eコマース用途

- 製造業

- 予知保全

- サプライチェーン最適化

- 製品品質管理

- 製品計画・スケジュール設定

- その他の製造業用途

- 政府・防衛

- 公安

- 情報収集・分析

- 緊急対応

- 地理空間分析

- その他の政府・防衛用途

- 通信

- ネットワークセキュリティー

- ネットワーク性能

- リアルタイム分析

- ネットワーク容量計画

- その他の通信用途

- 輸送・物流

- ルート最適化

- リアルタイム追跡

- フリート管理

- その他の輸送・物流用途

- IT/ITeS

- ソフトウェア開発

- ITインフラ管理

- アプリケーション性能管理

- インシデント管理

- その他のIT/ITeS用途

- メディア・エンターテインメント

- コンテンツ推奨

- 広告ターゲティング

- コンテンツ最適化

- 視聴者分類

- その他のメディア・エンターテイメント用途

- その他の業種

第10章 DataOpsプラットフォーム市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- インド

- 日本

- 中国

- オーストラリア・ニュージーランド

- 韓国

- ASEAN諸国

- その他のアジア太平洋

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- イスラエル

- その他の中東・アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- その他のラテンアメリカ

第11章 競合情勢

- 概要

- 主要企業が採用した戦略

- 収益分析

- 市場シェア分析

- 企業評価クアドラント

- スタートアップ/中小企業の評価クアドラント

- DataOpsプラットフォームの製品情勢

- 競合シナリオと動向

- 主要なDataOpsプラットフォームベンダーの評価と財務指標

- 主要なDataOpsプラットフォームベンダー:年初来 (YTD) の総収益と株価変動幅

第12章 企業プロファイル

- イントロダクション

- 主要企業

- IBM

- MICROSOFT

- ORACLE

- AWS

- INFORMATICA

- TERADATA

- WIPRO

- ACCENTURE

- SAS INSTITUTE

- HITACHI VANTARA

- DATAKITCHEN

- ATLAN

- DATAIKU

- FOSFOR

- DATABRICKS

- その他の企業

- BMC SOFTWARE

- STREAMSETS

- TALEND

- COLLIBRA

- CELONIS

- SAAGIE

- COMPOSABLE ANALYTICS

- TENGU.IO

- UNRAVEL DATA

- MONTE CARLO DATA

- CENSUS

- RIGHTDATA

- ZALONI

- DATAFOLD

- DATAOPS.LIVE

- K2VIEW

第13章 隣接・関連市場

- イントロダクション

- アドバンストアナリティクス市場:世界予測 (2026年まで)

- データカタログ市場:世界予測 (2027年まで)

第14章 付録

The market for DataOps platform is projected to grow from USD 3.9 billion in 2023 to USD 10.9 billion by 2028, at a CAGR of 23.0% during the forecast period. The DataOps platform plays a crucial role as a centralized hub for managing and governing data pipelines, workflows, and processes. It fosters collaboration among diverse teams to facilitate collaboration among cross-functional teams, including data engineers, data scientists, and analysts. By providing a range of tools and capabilities, the platform enables automation, monitoring, and control of the end-to-end data lifecycle. This centralized approach ensures streamlined operations and efficient collaboration, empowering organizations to effectively utilize and derive value from their data assets.

The agile development segment is projected to hold the largest market share during the forecast period

By type, the market is divided into agile development, DevOps, Lean Manufacturing. Agile Development in the DataOps platform helps organizations to enhance their ability to respond to changing business needs, improve project visibility and transparency, foster collaboration and innovation, and achieve faster time-to-value for their data initiatives. It empowers teams to efficiently manage data operations, optimize data processes, and deliver actionable insights dynamically and iteratively. During the forecast period, the agile development is anticipated to hold the largest market share.

Among offerings, the services segment is anticipated to grow at a highest CAGR during the forecast period

Services in a DataOps platform encompass a wide range of functionalities and capabilities designed to facilitate efficient and effective data operations and management. These services are specifically tailored to address the challenges and requirements of handling data throughout its lifecycle. Services in the DataOps platform facilitate decision-making for businesses by integrating efficient AI capabilities, real-time analytics, and insight delivery into the applications. During the forecast period, the services segment is anticipated to grow at the highest CAGR.

North America to account for the largest market size during the forecast period

During the forecast period, North America is estimated to account for the largest size of the market for DataOps platform. The region has a thriving technology industry that is driving the adoption of DataOps platforms. Many of the world's leading technology companies are based in North America, and these companies are investing heavily in data infrastructure and analytics capabilities. The emergence of new technologies that make it easier to manage and analyze data is driving the adoption of DataOps platforms in North America.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the DataOps platform market.

- By Company: Tier I: 35%, Tier II: 45%, and Tier III: 20%

- By Designation: C-Level Executives: 35%, Directors: 25%, and Others: 40%

- By Region: APAC: 30%, Europe: 20%, North America: 45%, Rest of World: 5%

The report includes the study of key players offering DataOps platform solutions and services. It profiles major vendors in the global market. The major vendors Microsoft (US), IBM (US), Oracle (US), AWS (US), Informatica (US), Teradata (US), Wipro (India), Accenture (Ireland), SAS Institute (US), Hitachi Vantara (US), DataKitchen (US), Atlan (Singapore), Dataiku (US), Fosfor (India), Databricks (US), StreamSets (US), Talend (US), Collibra (US), Celonis (US), BMC Software (US), Saagie (France), Composable Analytics (US), Tengu.io (Belgium), Unravel Data (US), Monte Carlo Data (US), Census (US), RightData (US), Zaloni (US), Datafold (US), DataOps.live (UK), K2view (Israel).

Research Coverage

The market study covers DataOps platform across segments. It aims at estimating the market size and the growth potential across different segments, such as offering, type, deployment mode, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market for DataOps platform and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (increased data complexity and data volumes, rise in need to gain real-time insights, increased demand for cloud solutions, and extensive focus on data-driven insights), restraints (data privacy and security concerns, budget constrain due to high investment), opportunities (need to bridge gap between data engineers and data analysts, need for data teams to keep pace with rapidly changing requirements), and challenges (lack of awareness and understanding of DataOps, need to mitigate the challenges of skilled talent shortage) influencing the growth of the DataOps platform market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the DataOps platform market

- Market Development: Comprehensive information about lucrative markets - the report analyses DataOps platform market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in DataOps platform market strategies; the report also helps stakeholders understand the pulse of the DataOps platform market and provides them with information on key market drivers, restraints, challenges, and opportunities.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as IBM (US), Microsoft (US), Oracle (US), AWS (US) among others in the DataOps platform market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2019-2022

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 DATAOPS PLATFORM MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- TABLE 2 PRIMARY INTERVIEWS

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 2 DATAOPS PLATFORM MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 3 APPROACH 1 (SUPPLY SIDE): REVENUE FROM OFFERINGS OF DATAOPS PLATFORM MARKET

- FIGURE 4 APPROACH 2-BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM OFFERINGS OF DATAOPS PLATFORM PLAYERS

- FIGURE 5 APPROACH 3-BOTTOM-UP (SUPPLY SIDE): REVENUE AND SUBSEQUENT MARKET ESTIMATION FROM OFFERINGS OF DATAOPS PLATFORMS

- FIGURE 6 APPROACH 4-BOTTOM-UP (DEMAND SIDE): SHARE OF DATAOPS PLATFORM OFFERINGS THROUGH OVERALL DATAOPS PLATFORM SPENDING

- 2.4 MARKET FORECAST

- TABLE 3 FACTOR ANALYSIS

- 2.5 ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 IMPLICATIONS OF RECESSION ON GLOBAL DATAOPS PLATFORM MARKET

- TABLE 4 IMPACT OF RECESSION ON THE GLOBAL DATAOPS PLATFORM MARKET

3 EXECUTIVE SUMMARY

- TABLE 5 GLOBAL DATAOPS PLATFORM MARKET SIZE AND GROWTH RATE, 2019-2022 (USD MILLION, Y-O-Y %)

- TABLE 6 GLOBAL DATAOPS PLATFORM MARKET SIZE AND GROWTH RATE, 2023-2028 (USD MILLION, Y-O-Y %)

- FIGURE 7 PLATFORM SEGMENT TO DOMINATE MARKET IN 2023

- FIGURE 8 PROFESSIONAL SERVICES TO BE LARGEST SERVICES SEGMENT IN 2023

- FIGURE 9 CONSULTING SERVICES TO BE LARGEST PROFESSIONAL SERVICES SEGMENT IN MARKET IN 2023

- FIGURE 10 CLOUD SEGMENT TO DOMINATE DATAOPS PLATFORM MARKET IN 2023

- FIGURE 11 PUBLIC CLOUD ESTIMATED TO BE LARGEST SEGMENT IN 2023

- FIGURE 12 AGILE DEVELOPMENT ESTIMATED TO BE LARGEST TYPE SEGMENT IN 2023

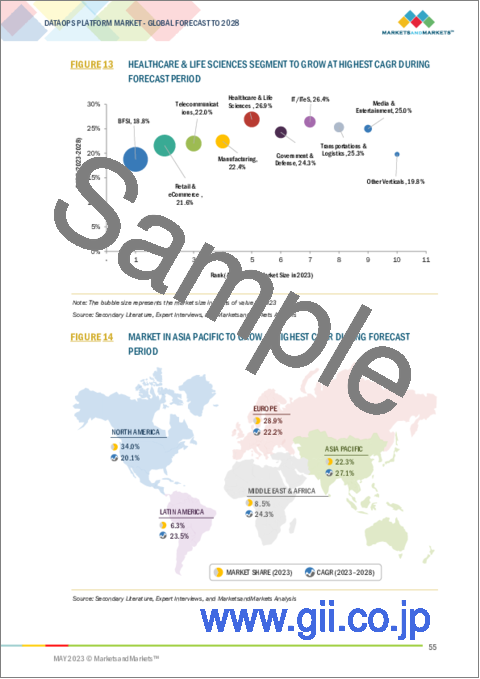

- FIGURE 13 HEALTHCARE & LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

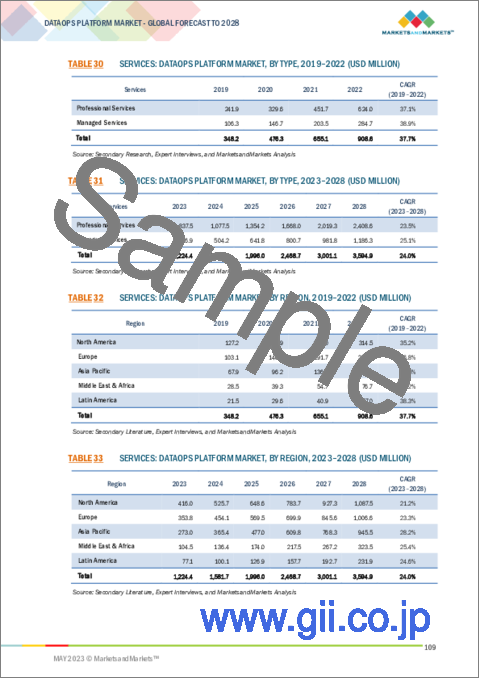

- FIGURE 14 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN DATAOPS PLATFORM MARKET

- FIGURE 15 RISING NEED TO GAIN REAL-TIME INSIGHTS FROM DATA TO DRIVE MARKET GROWTH

- 4.2 DATAOPS PLATFORM MARKET: BY TYPE

- FIGURE 16 AGILE DEVELOPMENT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY OFFERING AND TOP THREE VERTICALS

- FIGURE 17 PLATFORM SEGMENT AND BFSI SEGMENT TO HOLD LARGEST MARKET SHARES IN NORTH AMERICA IN 2023

- 4.4 DATAOPS PLATFORM MARKET: BY REGION

- FIGURE 18 NORTH AMERICA TO HOLD THE LARGEST MARKET SHARE IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 DATAOPS PLATFORM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increased data complexity and data volume

- 5.2.1.2 Rise in need to gain real-time insights

- 5.2.1.3 Increased demand for cloud solutions

- 5.2.1.4 Extensive focus on data-driven insights

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data privacy and security concerns

- 5.2.2.2 Budget constraints due to high investment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Need to bridge gap between data engineers and data analysts

- 5.2.3.2 Need for data teams to keep pace with rapidly changing requirements

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of awareness and understanding of DataOps

- 5.2.4.2 Shortage of skilled talent

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 HEALTHCARE AND LIFE SCIENCES

- 5.3.1.1 Large pharmaceutical business selected DataKitchen to offer timely analytical insights

- 5.3.1.2 Roche Diagnostic used DataOps.live platform to become a more agile data-driven business

- 5.3.2 BFSI

- 5.3.2.1 StreamSets enabled Aon to hold its position as a leader in the financial services sector

- 5.3.2.2 Fannie Mae selected Hitachi Vantara to deliver game-changing value to their business

- 5.3.3 RETAIL AND ECOMMERCE

- 5.3.3.1 Unravel Data enabled 84.51° to enhance operational efficiency

- 5.3.4 TELECOM

- 5.3.4.1 DataOps.live enables OneWeb to deliver great service through complete visibility of operations

- 5.3.5 MANUFACTURING

- 5.3.5.1 Clarios leverages Spectra and Snowflake to create next-gen data and analytics ecosystem

- 5.3.5.2 Hitachi Vantara helped metals industry manufacturers reduce equipment downtime

- 5.3.6 EDUCATION

- 5.3.6.1 Ad Astra selected StreamSets to tackle their data ingestion challenges

- 5.3.1 HEALTHCARE AND LIFE SCIENCES

- 5.4 BRIEF HISTORY OF DATAOPS PLATFORMS

- 5.5 DATAOPS PLATFORM MARKET: ECOSYSTEM

- TABLE 7 DATAOPS PLATFORM MARKET: CLOUD PROVIDERS

- TABLE 8 DATAOPS PLATFORM MARKET: PLATFORM PROVIDERS

- TABLE 9 DATAOPS PLATFORM MARKET: SERVICE PROVIDERS

- TABLE 10 DATAOPS PLATFORM MARKET: REGULATORY BODIES

- FIGURE 20 DATAOPS PLATFORM ECOSYSTEM

- 5.6 DATAOPS PLATFORM ARCHITECTURE

- FIGURE 21 DATAOPS PLATFORM ARCHITECTURE

- 5.7 DATAOPS PROCESS STRUCTURE

- FIGURE 22 DATAOPS PROCESS STRUCTURE

- 5.7.1 DATA ANALYTICS PIPELINES

- 5.7.2 CI/CD FOR DATA OPERATIONS

- 5.8 SUPPLY CHAIN ANALYSIS

- FIGURE 23 SUPPLY CHAIN ANALYSIS: DATAOPS PLATFORM MARKET

- 5.9 PRICING MODEL ANALYSIS

- TABLE 11 AVERAGE SELLING PRICE ANALYSIS, 2023

- 5.10 PATENT ANALYSIS

- 5.10.1 METHODOLOGY

- 5.10.2 DOCUMENT TYPE

- TABLE 12 PATENTS FILED, 2013-2023

- 5.10.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 24 TOTAL NUMBER OF PATENTS GRANTED, 2013-2023

- 5.10.3.1 Top applicants

- FIGURE 25 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS, 2013-2023

- FIGURE 26 REGIONAL ANALYSIS OF PATENTS GRANTED, 2013-2023

- TABLE 13 TOP 12 PATENT OWNERS IN THE DATAOPS PLATFORM MARKET, 2013-2023

- TABLE 14 LIST OF PATENTS IN DATAOPS PLATFORM MARKET, 2021-2023

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 RELATED TECHNOLOGY

- 5.11.1.1 Artificial intelligence

- 5.11.1.2 Machine learning

- 5.11.1.3 Big data

- 5.11.2 ALLIED TECHNOLOGY

- 5.11.2.1 DevOps

- 5.11.2.2 IoT

- 5.11.1 RELATED TECHNOLOGY

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 PORTER'S FIVE FORCES ANALYSIS

- TABLE 15 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY CONFERENCES & EVENTS

- TABLE 16 DATAOPS PLATFORM MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023-2024

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 REGULATIONS, BY REGION

- 5.14.2.1 North America

- 5.14.2.2 Europe

- 5.14.2.3 Asia Pacific

- 5.14.2.4 Middle East & Africa

- 5.14.2.5 Latin America

- 5.14.3 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

- 5.14.3.1 General Data Protection Regulation

- 5.14.3.2 Securities and Exchange Commission Rule 17a-4

- 5.14.3.3 International Organization for Standardization/International Electrotechnical Commission 27001

- 5.14.3.4 System and Organization Controls 2 Type II Compliance

- 5.14.3.5 Financial Industry Regulatory Authority

- 5.14.3.6 Freedom of Information Act

- 5.14.3.7 Health Insurance Portability and Accountability Act

- 5.15 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.15.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.16 DISRUPTIONS IMPACTING BUYERS/CLIENTS IN DATAOPS PLATFORM MARKET

- FIGURE 30 DATAOPS PLATFORM MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

- 5.17 TECHNOLOGY ROADMAP OF DATAOPS PLATFORM

- TABLE 23 SHORT-TERM ROADMAP, 2023-2025

- TABLE 24 MID-TERM ROADMAP, 2026-2028

- TABLE 25 LONG-TERM ROADMAP, 2029-2030

- 5.18 BUSINESS MODEL OF DATAOPS PLATFORM

- 5.18.1 API-BASED

- 5.18.2 CLOUD-BASED

- 5.19 KEY DIFFERENCES BETWEEN DATAOPS AND DEVOPS

- 5.20 FEATURES OF A DATAOPS PLATFORM

- 5.20.1 DATA PIPELINE ORCHESTRATION

- 5.20.2 TESTING AND PRODUCTION QUALITY

- 5.20.3 DEPLOYMENT AUTOMATION

- 5.20.4 DATA SCIENCE MODEL DEPLOYMENT/SANDBOX MANAGEMENT

- 5.21 BEST PRACTICES FOR DATAOPS PLATFORM MARKET

- 5.21.1 CATALOG DATA ASSETS AND PIPELINE

- 5.21.2 APPLY DATA GOVERNANCE FRAMEWORK

- 5.21.3 MONITOR, DOCUMENT, AND REMEDIATE DATA QUALITY

- 5.21.4 AUTOMATE DATA SOURCE AND PIPELINE DEPLOYMENT

- 5.21.5 MONITOR AND OPTIMIZE DATA SOURCE AND PIPELINE PERFORMANCE

6 DATAOPS PLATFORM MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: DATAOPS PLATFORM MARKET DRIVERS

- FIGURE 31 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 26 DATAOPS PLATFORM MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 27 DATAOPS PLATFORM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 PLATFORM

- TABLE 28 PLATFORM: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 29 PLATFORM: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.1 DATA INTEGRATION

- 6.2.1.1 Ability to offer unified view of data and extract meaningful insights to drive demand

- 6.2.2 DATA QUALITY

- 6.2.2.1 Data quality features that help streamline data management processes to drive growth

- 6.2.3 DATA GOVERNANCE

- 6.2.3.1 Implementation of data governance to maintain data quality and security to spur adoption

- 6.2.4 MASTER DATA MANAGEMENT

- 6.2.4.1 Incorporation of master data management capabilities to ensure data accuracy and enhance data agility to boost growth

- 6.2.5 DATA ANALYTICS

- 6.2.5.1 Implementation of data analytics to make more strategically guided decisions to propel demand

- 6.2.6 AUTOMATION

- 6.2.6.1 Automation of repetitive and time-consuming tasks to reduce risk of errors to boost demand

- 6.2.7 COLLABORATION

- 6.2.7.1 Use of collaboration features to optimize DataOps processes to spur demand

- 6.2.8 DATA VISUALIZATION

- 6.2.8.1 Ability to drill down into specific data points and offer more detailed view of data to fuel adoption

- 6.2.9 OTHERS

- 6.2.9.1 Extensive use in gaining complete view of journey of data from source to destination to propel demand

- 6.3 SERVICES

- FIGURE 32 TRAINING, SUPPORT, & MAINTENANCE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 30 SERVICES: DATAOPS PLATFORM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 31 SERVICES: DATAOPS PLATFORM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 32 SERVICES: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 33 SERVICES: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1 PROFESSIONAL SERVICES

- TABLE 34 PROFESSIONAL SERVICES: DATAOPS PLATFORM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 35 PROFESSIONAL SERVICES: DATAOPS PLATFORM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 36 PROFESSIONAL SERVICES: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 37 PROFESSIONAL SERVICES: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1.1 Consulting services

- 6.3.1.1.1 Rise in need to comply with various labor laws and regulations to drive demand

- 6.3.1.1 Consulting services

- TABLE 38 CONSULTING SERVICES: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 39 CONSULTING SERVICES: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1.2 Deployment & integration

- 6.3.1.2.1 Increased adoption to reduce implementation time to propel demand

- 6.3.1.2 Deployment & integration

- TABLE 40 DEPLOYMENT & INTEGRATION: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 41 DEPLOYMENT & INTEGRATION: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1.3 Training, support, & maintenance

- 6.3.1.3.1 Increased need for training, support, & maintenance services due to rise in adoption to support growth

- 6.3.1.3 Training, support, & maintenance

- TABLE 42 TRAINING, SUPPORT, & MAINTENANCE: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 43 TRAINING, SUPPORT, & MAINTENANCE: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Ability to ensure system availability and minimize downtime to propel demand

- TABLE 44 MANAGED SERVICES: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 45 MANAGED SERVICES: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

7 DATAOPS PLATFORM MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.1.1 TYPE: DATAOPS PLATFORM MARKET DRIVERS

- FIGURE 33 AGILE DEVELOPMENT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 46 DATAOPS PLATFORM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 47 DATAOPS PLATFORM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2 AGILE DEVELOPMENT

- 7.2.1 NEED TO OFFER EFFICIENT WORKFLOWS AND FASTER TIME-TO-MARKET FOR DATA ANALYTICS TO DRIVE GROWTH

- TABLE 48 AGILE DEVELOPMENT: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 49 AGILE DEVELOPMENT: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 DEVOPS

- 7.3.1 USE IN EFFICIENT DATAOPS PLATFORM DEVELOPMENT AND DELIVERY TO DRIVE DEMAND

- TABLE 50 DEVOPS: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 51 DEVOPS: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 LEAN MANUFACTURING

- 7.4.1 ABILITY TO ELIMINATE INEFFICIENCIES AND STREAMLINE DATA WORKFLOWS TO BOOST ADOPTION

- TABLE 52 LEAN MANUFACTURING DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 53 LEAN MANUFACTURING: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

8 DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE

- 8.1 INTRODUCTION

- 8.1.1 DEPLOYMENT MODE: DATAOPS PLATFORM MARKET DRIVERS

- FIGURE 34 CLOUD SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 54 DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2019-2022 (USD MILLION)

- TABLE 55 DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- 8.2 CLOUD

- TABLE 56 CLOUD: DATAOPS PLATFORM MARKET, BY TYPE 2019-2022 (USD MILLION)

- TABLE 57 CLOUD: DATAOPS PLATFORM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 58 CLOUD: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 59 CLOUD: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.1 PUBLIC CLOUD

- 8.2.1.1 Ability to eliminate expensive resources to drive demand

- TABLE 60 PUBLIC CLOUD: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 61 PUBLIC CLOUD: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.2 PRIVATE CLOUD

- 8.2.2.1 Ability to ensure compliance with data privacy regulations to support demand

- TABLE 62 PRIVATE CLOUD: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 63 PRIVATE CLOUD: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.3 HYBRID CLOUD

- 8.2.3.1 Ability to maintain control over critical data to propel demand

- TABLE 64 HYBRID CLOUD: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 65 HYBRID CLOUD: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 ON-PREMISES

- 8.3.1 BENEFITS SUCH AS HIGH PERFORMANCE AND GREATER CONTROL TO BOOST ADOPTION

- TABLE 66 ON-PREMISES: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 67 ON-PREMISES: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

9 DATAOPS PLATFORM MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.1.1 VERTICAL: DATAOPS PLATFORM MARKET DRIVERS

- FIGURE 35 HEALTHCARE & LIFE SCIENCES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 68 DATAOPS PLATFORM MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 69 DATAOPS PLATFORM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.2 BFSI

- TABLE 70 BFSI: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 71 BFSI: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2.1 FINANCIAL DATA OPTIMIZATION

- 9.2.1.1 Increased need to optimize data management and analytics capabilities to drive demand

- 9.2.2 FRAUDULENT TRANSACTIONS IDENTIFICATION

- 9.2.2.1 Rise in volume of financial transactions to spur adoption

- 9.2.3 CREDIT SCORING

- 9.2.3.1 Increased demand for fast and accurate credit decisions to boost demand

- 9.2.4 INVESTMENT ANALYSIS

- 9.2.4.1 Ability to offer wide range of tools and services to analyze large volume of data to drive demand

- 9.2.5 OTHER BFSI APPLICATIONS

- 9.2.5.1 Need to comply with regulations to protect financial stability of organizations to drive demand

- 9.3 HEALTHCARE & LIFE SCIENCES

- TABLE 72 HEALTHCARE & LIFE SCIENCES: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 73 HEALTHCARE & LIFE SCIENCES: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3.1 CLINICAL TRIAL MANAGEMENT

- 9.3.1.1 Efficient clinical trial management to propel adoption

- 9.3.2 ELECTRONIC HEALTH RECORD

- 9.3.2.1 Ability to gain insights from patient data to drive demand

- 9.3.3 PRECISION MEDICINE

- 9.3.3.1 Ability to process large-scale data sets to drive adoption

- 9.3.4 DRUG DISCOVERY

- 9.3.4.1 Accelerated drug discovery through use of advanced technologies to fuel demand

- 9.3.5 OTHER HEALTHCARE & LIFE SCIENCES APPLICATIONS

- 9.3.5.1 Analyzing large volumes of data from patient populations to identify patterns in patient health to propel demand

- 9.4 RETAIL & ECOMMERCE

- TABLE 74 RETAIL & ECOMMERCE: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 75 RETAIL & ECOMMERCE: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4.1 PRICING OPTIMIZATION

- 9.4.1.1 Use in identifying anomalies and irregularities to optimize pricing to drive adoption

- 9.4.2 PERSONALIZED PRODUCT RECOMMENDATION

- 9.4.2.1 Ability to process data from various sources in real-time for personalized product recommendations to propel demand

- 9.4.3 INVENTORY MANAGEMENT

- 9.4.3.1 Ability to offer real-time visibility into inventory levels to fuel adoption

- 9.4.4 DEMAND FORECASTING

- 9.4.4.1 Use in analyzing historical sales data and external factors to accurately forecast demand to drive demand

- 9.4.5 OTHER RETAIL & ECOMMERCE APPLICATIONS

- 9.4.5.1 Ability to proactively address return-related challenges and optimize operations to drive demand

- 9.5 MANUFACTURING

- TABLE 76 MANUFACTURING: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 77 MANUFACTURING: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5.1 PREDICTIVE MAINTENANCE

- 9.5.1.1 Use in identifying potential issues to avoid equipment downtime to spur adoption

- 9.5.2 SUPPLY CHAIN OPTIMIZATION

- 9.5.2.1 Need to adopt data-driven strategies to effectively manage supply chains to propel demand

- 9.5.3 PRODUCT QUALITY CONTROL

- 9.5.3.1 Ability to gain real-time insights into manufacturing processes to identify quality issues to fuel adoption

- 9.5.4 PRODUCT PLANNING AND SCHEDULING

- 9.5.4.1 Leveraging advanced analytics and automation to optimize production schedules to drive demand

- 9.5.5 OTHER MANUFACTURING APPLICATIONS

- 9.5.5.1 Wide range of capabilities to enhance asset tracking and supplier management to boost adoption

- 9.6 GOVERNMENT & DEFENSE

- TABLE 78 GOVERNMENT & DEFENSE: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 79 GOVERNMENT & DEFENSE: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6.1 PUBLIC SAFETY

- 9.6.1.1 Efficiently identifying and responding to potential threats to drive demand

- 9.6.2 INTELLIGENCE GATHERING AND ANALYSIS

- 9.6.2.1 Increased demand to share intelligence data across multiple agencies to propel demand

- 9.6.3 EMERGENCY RESPONSE

- 9.6.3.1 Ability to offer quick decision-making during emergencies to spur demand

- 9.6.4 GEOSPATIAL ANALYSIS

- 9.6.4.1 Use of advance analytics tools to efficiently analyze large volumes to propel adoption

- 9.6.5 OTHER GOVERNMENT & DEFENSE APPLICATIONS

- 9.6.5.1 Implementation in processing large volumes of data in real-time to respond to security breaches to drive demand

- 9.7 TELECOMMUNICATIONS

- TABLE 80 TELECOMMUNICATIONS: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 81 TELECOMMUNICATIONS: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.7.1 NETWORK SECURITY

- 9.7.1.1 Enhancing network security by providing real-time monitoring and management of network resources to drive demand

- 9.7.2 NETWORK PERFORMANCE

- 9.7.2.1 Automation of routine tasks to manage network performance to boost adoption

- 9.7.3 REAL-TIME ANALYTICS

- 9.7.3.1 Use of real-time analytics for quick response to network outages to propel adoption

- 9.7.4 NETWORK CAPACITY PLANNING

- 9.7.4.1 Collecting real-time data to make informed decisions to manage network capacity to boost adoption

- 9.7.5 OTHER TELECOMMUNICATIONS APPLICATIONS

- 9.7.5.1 Optimization of service delivery and call delivery to enhance customer satisfaction to fuel adoption

- 9.8 TRANSPORTATION & LOGISTICS

- TABLE 82 TRANSPORTATION & LOGISTICS: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 83 TRANSPORTATION &LOGISTICS: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.8.1 ROUTE OPTIMIZATION

- 9.8.1.1 Gathering real-time data on traffic conditions to create more accurate routes to boost adoption

- 9.8.2 REAL-TIME TRACKING

- 9.8.2.1 Ability to respond quickly to traffic congestion to drive adoption

- 9.8.3 FLEET MANAGEMENT

- 9.8.3.1 Increased need to optimize fleet management operations to enhance customer satisfaction to drive adoption

- 9.8.4 OTHER TRANSPORTATION & LOGISTICS APPLICATIONS

- 9.8.4.1 Ability to improve overall safety for both drivers and the public to spur demand

- 9.9 IT/ITES

- TABLE 84 IT/ITES: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 85 IT/ITES: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.9.1 SOFTWARE DEVELOPMENT

- 9.9.1.1 Need to boost development process while ensuring higher accuracy and quality of code to drive adoption

- 9.9.2 IT INFRASTRUCTURE MANAGEMENT

- 9.9.2.1 Need for real-time visibility into the performance of IT systems to optimize IT resources to boost adoption

- 9.9.3 APPLICATION PERFORMANCE MANAGEMENT

- 9.9.3.1 Ability to optimize the performance of applications to propel demand

- 9.9.4 INCIDENT MANAGEMENT

- 9.9.4.1 Increased need to respond quickly and effectively to incidents to drive demand

- 9.9.5 OTHER IT/ITES APPLICATIONS

- 9.9.5.1 Ability to streamline DevOps processes and enhance security posture to fuel adoption

- 9.10 MEDIA & ENTERTAINMENT

- TABLE 86 MEDIA & ENTERTAINMENT: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 87 MEDIA & ENTERTAINMENT: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.10.1 CONTENT RECOMMENDATION

- 9.10.1.1 Rise in demand for analyzing user data to predict viewer preferences and recommend content to boost adoption

- 9.10.2 AD TARGETING

- 9.10.2.1 Use in analyzing massive volumes of data in real-time to adjust ad targeting strategies to propel demand

- 9.10.3 CONTENT OPTIMIZATION

- 9.10.3.1 Leveraging power of data to optimize content for specific channels to drive demand

- 9.10.4 AUDIENCE SEGMENTATION

- 9.10.4.1 Use in processing large amounts of data to personalize content to fuel adoption

- 9.10.5 OTHER MEDIA & ENTERTAINMENT APPLICATIONS

- 9.10.5.1 Use in analyzing data on audience engagement to optimize content distribution strategies to drive demand

- 9.11 OTHER VERTICALS

- 9.11.1 LEVERAGING THE POWER OF DATA AND ANALYTICS TO STREAMLINE OPERATIONS AND IMPROVE SERVICES TO SPUR DEMAND

- TABLE 88 OTHER VERTICALS: DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 89 OTHER VERTICALS: DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

10 DATAOPS PLATFORM MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 36 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 90 DATAOPS PLATFORM MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 91 DATAOPS PLATFORM MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: DATAOPS PLATFORM MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 92 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY SERVICES, 2019-2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2019-2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2023-2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2019-2022 (USD MILLION)

- TABLE 99 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 100 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2019-2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2023-2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 103 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 104 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 107 NORTH AMERICA: DATAOPS PLATFORM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 Increased emphasis on data-driven decision-making to fuel growth of market

- 10.2.4 CANADA

- 10.2.4.1 Rise in need to gain valuable insights to enhance operational efficiency to propel market growth

- 10.3 EUROPE

- 10.3.1 EUROPE: DATAOPS PLATFORM MARKET DRIVERS

- 10.3.2 EUROPE: RECESSION IMPACT

- TABLE 108 EUROPE: DATAOPS PLATFORM MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 109 EUROPE: DATAOPS PLATFORM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 110 EUROPE: DATAOPS PLATFORM MARKET, BY SERVICES, 2019-2022 (USD MILLION)

- TABLE 111 EUROPE: DATAOPS PLATFORM MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 112 EUROPE: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2019-2022 (USD MILLION)

- TABLE 113 EUROPE: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2023-2028 (USD MILLION)

- TABLE 114 EUROPE: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2019-2022 (USD MILLION)

- TABLE 115 EUROPE: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 116 EUROPE: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2019-2022 (USD MILLION)

- TABLE 117 EUROPE: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2023-2028 (USD MILLION)

- TABLE 118 EUROPE: DATAOPS PLATFORM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 119 EUROPE: DATAOPS PLATFORM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 120 EUROPE: DATAOPS PLATFORM MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 121 EUROPE: DATAOPS PLATFORM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 122 EUROPE: DATAOPS PLATFORM MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 123 EUROPE: DATAOPS PLATFORM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Rise in volume of data generated in companies across several verticals to spur market growth

- 10.3.4 GERMANY

- 10.3.4.1 Increased need to manage data effectively to fuel market growth

- 10.3.5 FRANCE

- 10.3.5.1 Increased application across several business verticals to drive market growth

- 10.3.6 ITALY

- 10.3.6.1 Presence of supportive business ecosystem to drive market growth

- 10.3.7 SPAIN

- 10.3.7.1 Rise in investments in technology and favorable government policies to propel market growth

- 10.3.8 REST OF EUROPE

- 10.3.8.1 Rise in need to analyze large volumes of data generated to spur market growth

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: DATAOPS PLATFORM MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: IMPACT OF RECESSION

- FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 124 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY SERVICES, 2019-2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2019-2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2023-2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2019-2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2019-2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2023-2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 136 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 137 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 138 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 139 ASIA PACIFIC: DATAOPS PLATFORM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.3 INDIA

- 10.4.3.1 Rise in adoption of advanced technologies for automated approach to data management to fuel market growth

- 10.4.4 JAPAN

- 10.4.4.1 Increased demand to improve efficiency and agility of data operations to propel market growth

- 10.4.5 CHINA

- 10.4.5.1 Increased willingness to foster technological developments and provide policy support to propel market growth

- 10.4.6 AUSTRALIA AND NEW ZEALAND

- 10.4.6.1 Rise in need to gain competitive advantage through data-driven insights to propel market growth

- 10.4.7 SOUTH KOREA

- 10.4.7.1 Increased focus on innovation and adoption of advanced technologies to drive market growth

- 10.4.8 ASEAN

- 10.4.8.1 Increased use in automating data analytics processes to speed up decision-making process to propel market growth

- 10.4.9 REST OF ASIA PACIFIC

- 10.4.9.1 Rise in competition from global players to drive market growth

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: IMPACT OF RECESSION

- TABLE 140 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY SERVICES, 2019-2022 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2019-2022 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2023-2028 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2019-2022 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2019-2022 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2023-2028 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: DATAOPS PLATFORM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.3 SAUDI ARABIA

- 10.5.3.1 Initiatives taken by government to support digital technologies to propel market growth

- 10.5.4 UAE

- 10.5.4.1 Rise in awareness of advanced data analytics capabilities to drive adoption

- 10.5.5 SOUTH AFRICA

- 10.5.5.1 Rise in demand for data assets to gain competitive advantage to boost adoption

- 10.5.6 ISRAEL

- 10.5.6.1 Extracting valuable insights from extensive data sets to drive adoption

- 10.5.7 REST OF MIDDLE EAST & AFRICA

- 10.5.7.1 Increased investments in infrastructure to support digital transformation and support market growth

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: DATAOPS PLATFORM MARKET DRIVERS

- 10.6.2 LATIN AMERICA: IMPACT OF RECESSION

- TABLE 156 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 157 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 158 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY SERVICES, 2019-2022 (USD MILLION)

- TABLE 159 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY SERVICES, 2023-2028 (USD MILLION)

- TABLE 160 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2019-2022 (USD MILLION)

- TABLE 161 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY PROFESSIONAL SERVICES, 2023-2028 (USD MILLION)

- TABLE 162 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2019-2022 (USD MILLION)

- TABLE 163 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 164 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2019-2022 (USD MILLION)

- TABLE 165 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY CLOUD TYPE, 2023-2028 (USD MILLION)

- TABLE 166 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 167 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 168 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 169 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 170 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 171 LATIN AMERICA: DATAOPS PLATFORM MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.6.3 BRAZIL

- 10.6.3.1 Rise in need for effective data management and analysis to drive market

- 10.6.4 MEXICO

- 10.6.4.1 Increased demand for real-time insights and streamlined workflows to fuel market growth

- 10.6.5 ARGENTINA

- 10.6.5.1 Rise in need for businesses to manage and analyze data effectively to boost market growth

- 10.6.6 REST OF LATIN AMERICA

- 10.6.6.1 Increased adoption of cutting-edge technologies to stay competitive in market to boost demand

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 172 OVERVIEW OF STRATEGIES ADOPTED BY KEY DATAOPS PLATFORM VENDORS

- 11.3 REVENUE ANALYSIS

- 11.3.1 HISTORICAL REVENUE ANALYSIS

- FIGURE 40 HISTORICAL REVENUE ANALYSIS OF TOP PLAYERS, 2020-2022 (USD MILLION)

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 41 MARKET SHARE ANALYSIS FOR KEY COMPANIES, 2022

- TABLE 173 DATAOPS PLATFORM MARKET: DEGREE OF COMPETITION

- 11.5 COMPANY EVALUATION QUADRANT

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 42 KEY DATAOPS PLATFORM MARKET PLAYERS, COMPANY EVALUATION QUADRANT, 2022

- 11.5.5 COMPETITIVE BENCHMARKING

- TABLE 174 DATAOPS PLATFORM MARKET: PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS, 2022

- 11.6 STARTUPS/SMES EVALUATION QUADRANT

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 43 STARTUPS/SMES DATAOPS PLATFORM PLAYERS, COMPANY EVALUATION QUADRANT, 2022

- 11.6.5 STARTUPS/SMES COMPETITIVE BENCHMARKING

- TABLE 175 DATAOPS PLATFORM MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 176 DATAOPS PLATFORM MARKET: PRODUCT FOOTPRINT ANALYSIS OF STARTUPS/SMES, 2023

- 11.7 DATAOPS PLATFORM PRODUCT LANDSCAPE

- TABLE 177 COMPARATIVE ANALYSIS OF DATA INTEGRATION PRODUCTS

- TABLE 178 COMPARATIVE ANALYSIS OF DATA PREPARATION PRODUCTS

- TABLE 179 COMPARATIVE ANALYSIS OF DATA CATALOG PRODUCTS

- 11.8 COMPETITIVE SCENARIO AND TRENDS

- 11.8.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 180 SERVICE/PRODUCT LAUNCHES AND ENHANCEMENTS, 2019-2023

- 11.8.2 DEALS

- TABLE 181 DEALS, 2019-2023

- 11.9 VALUATION AND FINANCIAL METRICS OF KEY DATAOPS PLATFORM VENDORS

- FIGURE 44 VALUATION AND FINANCIAL METRICS OF KEY DATAOPS PLATFORM VENDORS

- 11.10 YEAR TO-DATE (YTD) PRICE TOTAL RETURN AND STOCK BETA OF KEY DATAOPS PLATFORM VENDORS

- FIGURE 45 YTD PRICE TOTAL RETURN AND STOCK BETA OF KEY DATAOPS PLATFORM VENDORS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 MAJOR PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 12.2.1 IBM

- TABLE 182 IBM: BUSINESS OVERVIEW

- FIGURE 46 IBM: COMPANY SNAPSHOT

- TABLE 183 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 185 IBM: DEALS

- 12.2.2 MICROSOFT

- TABLE 186 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 47 MICROSOFT: COMPANY SNAPSHOT

- TABLE 187 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 189 MICROSOFT: DEALS

- 12.2.3 ORACLE

- TABLE 190 ORACLE: BUSINESS OVERVIEW

- FIGURE 48 ORACLE: COMPANY SNAPSHOT

- TABLE 191 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 192 ORACLE: DEALS

- 12.2.4 AWS

- TABLE 193 AWS: BUSINESS OVERVIEW

- FIGURE 49 AWS: COMPANY SNAPSHOT

- TABLE 194 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 196 AWS: DEALS

- 12.2.5 INFORMATICA

- TABLE 197 INFORMATICA: BUSINESS OVERVIEW

- FIGURE 50 INFORMATICA: COMPANY SNAPSHOT

- TABLE 198 INFORMATICA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 INFORMATICA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 200 INFORMATICA: DEALS

- TABLE 201 INFORMATICA: OTHERS

- 12.2.6 TERADATA

- TABLE 202 TERADATA: BUSINESS OVERVIEW

- FIGURE 51 TERADATA: COMPANY SNAPSHOT

- TABLE 203 TERADATA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 TERADATA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 205 TERADATA: DEALS

- TABLE 206 TERADATA: OTHERS

- 12.2.7 WIPRO

- TABLE 207 WIPRO: BUSINESS OVERVIEW

- FIGURE 52 WIPRO: COMPANY SNAPSHOT

- TABLE 208 WIPRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 WIPRO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 210 WIPRO: DEALS

- 12.2.8 ACCENTURE

- TABLE 211 ACCENTURE: BUSINESS OVERVIEW

- FIGURE 53 ACCENTURE: COMPANY SNAPSHOT

- TABLE 212 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 ACCENTURE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 214 ACCENTURE: DEALS

- 12.2.9 SAS INSTITUTE

- TABLE 215 SAS INSTITUTE: BUSINESS OVERVIEW

- TABLE 216 SAS INSTITUTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 SAS INSTITUTE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 218 SAS INSTITUTE: DEALS

- 12.2.10 HITACHI VANTARA

- TABLE 219 HITACHI VANTARA: BUSINESS OVERVIEW

- TABLE 220 HITACHI VANTARA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 HITACHI VANTARA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 222 HITACHI VANTARA: DEALS

- 12.2.11 DATAKITCHEN

- TABLE 223 DATAKITCHEN: BUSINESS OVERVIEW

- TABLE 224 DATAKITCHEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 DATAKITCHEN: PRODUCT LAUNCHES AND ENHANCEMENTS

- 12.2.12 ATLAN

- TABLE 226 ATLAN: BUSINESS OVERVIEW

- TABLE 227 ATLAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 ATLAN: DEALS

- 12.2.13 DATAIKU

- TABLE 229 DATAIKU: BUSINESS OVERVIEW

- TABLE 230 DATAIKU: PRODUCTS/SOLUTION/SERVICES OFFERED

- TABLE 231 DATAIKU: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 232 DATAIKU: DEALS

- TABLE 233 DATAIKU: OTHERS

- 12.2.14 FOSFOR

- TABLE 234 FOSFOR: BUSINESS OVERVIEW

- TABLE 235 FOSFOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 FOSFOR: DEALS

- 12.2.15 DATABRICKS

- TABLE 237 DATABRICKS: BUSINESS OVERVIEW

- TABLE 238 DATABRICKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 DATABRICKS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 240 DATABRICKS: DEALS

- TABLE 241 DATABRICKS: OTHERS

- 12.3 OTHER PLAYERS

- 12.3.1 BMC SOFTWARE

- TABLE 242 BMC SOFTWARE: BUSINESS OVERVIEW

- TABLE 243 BMC SOFTWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 BMC SOFTWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 245 BMC SOFTWARE: DEALS

- 12.3.2 STREAMSETS

- TABLE 246 STREAMSETS: BUSINESS OVERVIEW

- TABLE 247 STREAMSETS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 STREAMSETS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 249 STREAMSETS: DEALS

- 12.3.3 TALEND

- TABLE 250 TALEND: BUSINESS OVERVIEW

- TABLE 251 TALEND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 TALEND: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 253 TALEND: DEALS

- 12.3.4 COLLIBRA

- TABLE 254 COLLIBRA: BUSINESS OVERVIEW

- TABLE 255 COLLIBRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 COLLIBRA: PRODUCT LAUNCHES

- TABLE 257 COLLIBRA: DEALS

- TABLE 258 COLLIBRA: OTHERS

- 12.3.5 CELONIS

- 12.3.6 SAAGIE

- 12.3.7 COMPOSABLE ANALYTICS

- 12.3.8 TENGU.IO

- 12.3.9 UNRAVEL DATA

- 12.3.10 MONTE CARLO DATA

- 12.3.11 CENSUS

- 12.3.12 RIGHTDATA

- 12.3.13 ZALONI

- 12.3.14 DATAFOLD

- 12.3.15 DATAOPS.LIVE

- 12.3.16 K2VIEW

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 ADVANCED ANALYTICS MARKET-GLOBAL FORECAST TO 2026

- 13.2.1 MARKET DEFINITION

- 13.2.2 MARKET OVERVIEW

- 13.2.3 ADVANCED ANALYTICS MARKET, BY COMPONENT

- TABLE 259 ADVANCED ANALYTICS MARKET SIZE, BY COMPONENT, 2016-2020 (USD MILLION)

- TABLE 260 ADVANCED ANALYTICS MARKET SIZE, BY COMPONENT, 2021-2026 (USD MILLION)

- 13.2.4 ADVANCED ANALYTICS MARKET, BY BUSINESS FUNCTION

- TABLE 261 ADVANCED ANALYTICS MARKET SIZE, BY BUSINESS FUNCTION, 2016-2020 (USD MILLION)

- TABLE 262 ADVANCED ANALYTICS MARKET SIZE, BY BUSINESS FUNCTION, 2021-2026 (USD MILLION)

- 13.2.5 ADVANCED ANALYTICS MARKET, BY TYPE

- TABLE 263 ADVANCED ANALYTICS MARKET SIZE, BY TYPE, 2016-2020 (USD MILLION)

- TABLE 264 ADVANCED ANALYTICS MARKET SIZE, BY TYPE, 2021-2026 (USD MILLION)

- 13.2.6 ADVANCED ANALYTICS MARKET, BY DEPLOYMENT MODE

- TABLE 265 ADVANCED ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2016-2020 (USD MILLION)

- TABLE 266 ADVANCED ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2021-2026 (USD MILLION)

- 13.2.7 ADVANCED ANALYTICS MARKET, BY ORGANIZATION SIZE

- TABLE 267 ADVANCED ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 268 ADVANCED ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- 13.2.8 ADVANCED ANALYTICS MARKET, BY VERTICAL

- TABLE 269 ADVANCED ANALYTICS MARKET SIZE, BY VERTICAL, 2016-2020 (USD MILLION)

- TABLE 270 ADVANCED ANALYTICS MARKET SIZE, BY VERTICAL, 2021-2026 (USD MILLION)

- 13.2.9 ADVANCED ANALYTICS MARKET, BY REGION

- TABLE 271 ADVANCED ANALYTICS MARKET SIZE, BY REGION, 2016-2020 (USD MILLION)

- TABLE 272 ADVANCED ANALYTICS MARKET SIZE, BY REGION, 2021-2026 (USD MILLION)

- 13.3 DATA CATALOG MARKET-GLOBAL FORECAST TO 2027

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.3 DATA CATALOG MARKET, BY COMPONENT

- TABLE 273 DATA CATALOG MARKET, BY COMPONENT, 2017-2021 (USD MILLION)

- TABLE 274 DATA CATALOG MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 13.3.4 DATA CATALOG MARKET, BY SERVICE

- TABLE 275 SERVICES: DATA CATALOG MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 276 SERVICES: DATA CATALOG MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 13.3.5 DATA CATALOG MARKET, BY DEPLOYMENT MODE

- TABLE 277 DATA CATALOG MARKET, BY DEPLOYMENT MODE, 2017-2021 (USD MILLION)

- TABLE 278 DATA CATALOG MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- 13.3.6 DATA CATALOG MARKET, BY DATA CONSUMER

- TABLE 279 DATA CATALOG MARKET, BY DATA CONSUMER, 2017-2021 (USD MILLION)

- TABLE 280 DATA CATALOG MARKET, BY DATA CONSUMER, 2022-2027 (USD MILLION)

- 13.3.7 DATA CATALOG MARKET, BY METADATA TYPE

- TABLE 281 DATA CATALOG MARKET, BY METADATA TYPE, 2017-2021 (USD MILLION)

- TABLE 282 DATA CATALOG MARKET, BY METADATA TYPE, 2022-2027 (USD MILLION)

- 13.3.8 DATA CATALOG MARKET, BY ORGANIZATION SIZE

- TABLE 283 DATA CATALOG MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 284 DATA CATALOG MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 13.3.9 DATA CATALOG MARKET, BY VERTICAL

- TABLE 285 DATA CATALOG MARKET, BY VERTICAL, 2017-2021 (USD MILLION)

- TABLE 286 DATA CATALOG MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 13.3.10 DATA CATALOG MARKET, BY REGION

- TABLE 287 DATA CATALOG MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 288 DATA CATALOG MARKET, BY REGION, 2022-2027 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATIONS OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS