|

|

市場調査レポート

商品コード

1280719

多量二次要素の世界市場:栄養素別 (カルシウム、マグネシウム、硫黄)・作物の種類別 (穀物、油糧種子・豆類、果物・野菜)・適用方法別 (固体、液体)・形状別・地域別の将来予測 (2028年まで)Secondary Macronutrients Market by Nutrient (Calcium, Magnesium, and Sulfur), Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables), Mode of Application (Solid and Liquid), Form and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 多量二次要素の世界市場:栄養素別 (カルシウム、マグネシウム、硫黄)・作物の種類別 (穀物、油糧種子・豆類、果物・野菜)・適用方法別 (固体、液体)・形状別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年05月18日

発行: MarketsandMarkets

ページ情報: 英文 278 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

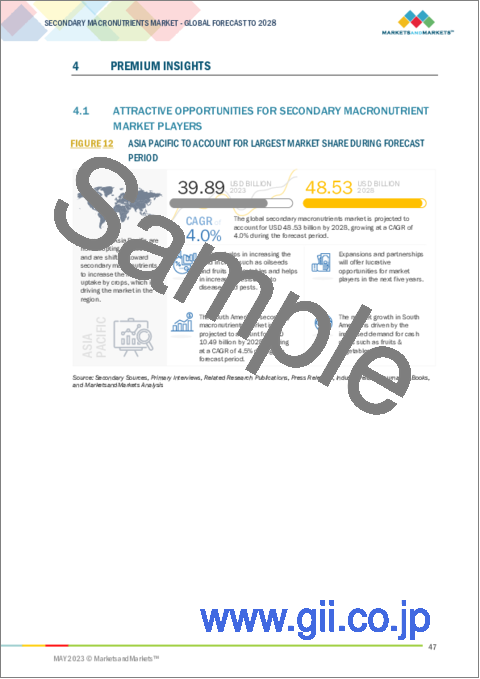

世界の多量二次要素の市場規模は、2022年に386億米ドル、2028年までに485億米ドルに達し、予測期間中に4.0%のCAGRで成長すると予想されています。

多量二次要素とは、植物の成長と発達に比較的大量に必要とされる3つの必須栄養素のことを指します。これらの栄養素には、カルシウム (Ca)、マグネシウム (Mg)、硫黄 (S) が含まれます。それらは作物の品質を向上させ、収穫量を増やし、土壌の肥沃化と生産性を促進します。また、多量二次要素の恩恵は植物にとどまらず、病気や害虫に対する抵抗力の向上にもつながります。

"硫黄は、2022年に2番目に大きな市場シェアを獲得する"

硫黄は植物の成長と発達に不可欠な栄養素であり、作物生産において重要な役割を担っています。アミノ酸、タンパク質、酵素など、いくつかの重要な植物化合物の一部を構成しています。また、植物の全体的な健康状態や活力を向上させるのに役立ちます。光合成に必要なクロロフィルの形成に必要です。硫黄は、窒素、リン、カリウムなどの他の重要な植物栄養素を取り込むのに重要です。そのため、栄養素の取り込みと利用の効率を向上させ、機能を高めることができます。

"果物・野菜分野は2番目に大きく、2022年に最大の市場シェアを占める"

果物・野菜の主要な生産・輸出地域で多量二次要素の使用を促進する主な要因として、果物の生産量の増加、果物の品質の良さ、生産コストの低減、生産量の拡大などが挙げられます。世界貿易の拡大により、世界各地の果物や野菜が入手しやすくなり、消費者にとってさらに身近な存在となったことが、市場をさらに押し上げるでしょう。

"2022年には、乾燥状態分野が最大の市場シェアを占めると予測されます。"

乾燥状態の多量二次要素は、取り扱いや輸送が容易であるため、農家にとって便利な選択肢となります。乾燥状態の多量二次要素は、通常、液体よりも安価です。この費用対効果は、これらの栄養素を大量に必要とする農家にとって特に有益です。乾燥状態の多量二次要素は、液体状態よりも保存期間が長いです。つまり、腐敗のリスクなしに長期間保存できるため、食糧の安定供給を必要とする農家にとって信頼できる選択肢となります。

"アジア太平洋市場が予測期間中に最大の市場シェアを獲得する"

アジア太平洋は、地域別で最大の多量二次要素市場です。これは、同地域の果物や野菜の生産量が多いことに起因しています。アジア太平洋地域では、小麦、大麦、トウモロコシ、トマト、ブドウ、種子、核果が最も多く栽培されています。また、これらの作物は世界のさまざまな地域に大量に輸出されています。アジア太平洋地域の多くの国にとって、食料安全保障は重要な目標であり、多量二次要素を含む肥料の使用は、収穫量を増やし、作物の栄養価を向上させることによって、この目標の達成に一役買うことができます。アジア太平洋の農家は、土壌の健全性と栄養の利用可能性を改善するのに役立つ輪作を採用することが増えています。多量二次要素を含む肥料の使用は、これらの実践を補完し、作物生産をサポートすることができます。このため、多量二次要素市場の利用が増加し、同地域の多量二次要素市場の成長を刺激しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 多量二次要素市場に影響を与えるマクロ経済指標

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- バリューチェーン分析

- サプライチェーン分析

- 技術分析

- 価格動向分析

- 市場マッピングとエコシステム分析

- 顧客のビジネスに影響を与える動向/混乱

- 貿易分析

- 特許分析

- ポーターのファイブフォース分析

- ケーススタディ

- 主要な会議とイベント (2023年~2024年)

- 関税・規制状況

- 規制の枠組み

- 主要な利害関係者と購入基準

第7章 多量二次要素市場:栄養素別

- イントロダクション

- カルシウム

- 硫黄

- マグネシウム

第8章 多量二次要素市場:形状別

- イントロダクション

- 乾燥状態

- 液体状態

第9章 多量二次要素市場:適用方法別

- イントロダクション

- 液体塗布

- 施肥

- 葉面

- その他の液体塗布方法

- 固形適用

- 散布

- 深耕

- 局所適用

第10章 多量二次要素市場:作物の種類別

- イントロダクション

- 穀物

- トウモロコシ

- 小麦

- 米

- その他の穀物

- 油糧種子・豆類

- 大豆

- ひまわり

- その他の油糧種子・豆類

- 果物・野菜

- 根菜類と塊茎野菜

- 葉物野菜

- 仁果類

- ベリー類

- 柑橘類

- その他の果物・野菜

- その他の作物の種類

第11章 多量二次要素市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- インド

- 日本

- 中国

- オーストラリア・ニュージーランド

- その他のアジア太平洋

- 欧州

- ドイツ

- フランス

- イタリア

- スペイン

- 英国

- ロシア

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- その他の地域

- アフリカ

- 中東

第12章 競合情勢

- 概要

- 主要企業が採用した戦略

- 市場シェア分析

- 企業収益分析 (2020年~2022年)

- 企業評価クアドラント (主要企業)

- スタートアップ/中小企業の評価クアドラント (その他の企業)

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- NUTRIEN LTD.

- YARA

- THE MOSAIC COMPANY

- ISRAEL CHEMICALS LTD.

- K+S AKTIENGESELLSCHAFT

- NUFARM

- SPIC

- KOCH INDUSTRIES, INC.

- COROMANDEL INTERNATIONAL LTD

- DEEPAK FERTILISERS AND PETROCHEMICALS CORPORATION LTD.

- HAIFA NEGEV TECHNOLOGIES LTD

- KUGLER COMPANY

- IFFCO

- WESTERN NUTRIENTS CORPORATION

- ARIES AGRO LIMITED

- その他の企業

- BMS MICRO-NUTRIENTS

- BAICOR, LLC

- PLANT FOOD COMPANY, INC.

- AGROLIQUID

- TERRALINK HORTICULTURE INC.

- STOLLER ENTERPRISES

- NACHURS

- MORRAL COMPANIES LLC

- ADITYA MICRODYNAMICS

- MYTHREYI AGRI INPUTS

第14章 隣接・関連市場

- イントロダクション

- 調査の限界

- 農薬市場

- 農業用生物製剤市場

第15章 付録

The secondary macronutrients market is expected to be valued USD 38.6 billion in 2022 and USD 48.5 billion by 2028, with a CAGR of 4.0% over the forecast period. Secondary macronutrients refer to three essential plant nutrients that are required in relatively large quantities for plant growth and development. These nutrients include calcium (Ca), magnesium (Mg), and sulfur (S). They improve the quality of crops, enhance yield, and promote soil fertility and productivity. The benefits of secondary macronutrients extend beyond the plant to include improved resistance to diseases and pests.

"sulfur is the second largest segment which is expected to be gain second largest market share in 2022."

Sulfur is an essential nutrient for plant growth and development and plays a key role in crop production. It is part of several important plant compounds, including amino acids, proteins and enzymes. It also help to improve overall plant health and vigor. It is necessary for the formation of chlorophyll, which is necessary for photosynthesis. Sulfur is important for the uptake of other important plant nutrients such as nitrogen, phosphorus and potassium. This helps improve the efficiency of nutrient uptake and utilization, which can increase performance.

"The fruits and vegetables segment is the second largest, projected to accounted for the largest market share in 2022"

The main factors driving the use of secondary macronutrients in major fruit and vegetable production and export regions are increased fruit production, good quality fruit and lower production costs. Increase in production of fruits such as strawberries, apples, grapes, pomegranates, oranges, chilies, peppers, tomatoes, chilies, among others. The expansion of world trade has increased the availability of fruits and vegetables from various parts of the world, making them even more accessible to consumers, will further boost the market.

"The dry form segment is forecasted to occupy for the largest market share in 2022."

Dry forms of secondary macronutrients are easy to handle and transport, making them a convenient choice for farmers. Dry forms of secondary macronutrients are usually less expensive than their liquid counterparts. This cost-effectiveness is particularly beneficial to farmers who require large quantities of these nutrients. Dry forms of secondary macronutrients have a longer shelf life than liquid forms. This means they can be stored for longer periods of time without the risk of spoilage, making them a reliable choice for farmers who need to ensure a constant supply of food.

"Asia Pacific market is projected to gain largest market share during the forecast period."

The Asia Pacific market is the largest market for secondary macronutrients. This is due to the higher production of fruits and vegetables in the region. In the Asia-Pacific region, wheat, barley, corn, tomatoes, grapes, seeds and stone fruits grow the most. These crops are also exported in large quantities to different parts of the world. Food security is an important goal for many countries in the Asia-Pacific region, and the use of fertilizers containing secondary macronutrients can play a role in achieving this goal by increasing yield and improving the nutritional value of crops. Farmers in Asia and the Pacific are increasingly adopting crop rotation practices that can help improve soil health and nutrient availability. The use of fertilizers containing secondary macronutrients can complement these practices and support crop production. This has led to increased utilization of the secondary macronutrients market and stimulated the growth of the secondary macronutrients market in the region.

Break-up of Primaries:

- By Company type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C level - 35%, Director level - 25%, Others - 40%

- By Geography: North America- 40%, Asia Pacific - 30%, Europe -20%, South America- 5% and RoW 5%

Some Leading players profiled in this report:

- Nutrien Ltd. (Canada)

- Yara (Norway)

- The Mosaic Company (US)

- Israel Chemicals Ltd. (Israel)

- K+S Aktiengesellschaft (Germany)

- IFFCO (India)

- Deepak Fertilisers and Petrochemicals Corporation Ltd. (India)

- Coromandel International Ltd (India)

Research Coverage:

This research report categorizes the secondary macronutrients market by nutrient (calcium, sulfur and magnesium), by crop type (cereals & grains, oilseeds & pulses, fruits & vegetables, and other crop types), by mode of application (liquid application and solid application), by form (dry form and liquid form), and region (North America, Europe, Asia Pacific, South America, and RoW). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the secondary macronutrient market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions; key strategies; partnerships, agreements; new product launches, mergers and acquisitions, and recent developments associated with the secondary macronutrient market. Competitive analysis of upcoming startups in the secondary macronutrients market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall secondary macronutrients market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Need for increasing crop production, Increased demand for high-value crops like fruits & vegetables, Increased demand for high-value crops like fruits & vegetables, Advancements in agricultural research and technology, Crop quality and market demand), restraints (Price volatility and fluctuations in the global market, Rising instances of counterfeit goods), opportunities (Precision agriculture for nutrient control on a site-by-site basis, Precision agriculture for nutrient control on a site-by-site basis, Integrated nutrient management (INM)), and challenges (Utilization of agricultural biologicals in farming, Lack of regulatory standards) influencing the growth of the secondary macronutrients market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the secondary macronutrient market

- Market Development: Comprehensive information about lucrative markets - the report analyses the secondary macronutrients market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the secondary macronutrients market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like Nutrien Ltd. (Canada), Yara (Norway), The Mosaic Company (US), Israel Chemicals Ltd. (Israel), K+S Aktiengesellschaft (Germany), IFFCO (India), Deepak Fertilisers and Petrochemicals Corporation Ltd. (India), Coromandel International Ltd (India), Koch Industries, INC. (US) and Nufarm (Australia) among others in the secondary macronutrients market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 SECONDARY MACRONUTRIENTS: MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.4 REGIONS COVERED

- 1.5 YEARS CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.6.1 CURRENCY

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018-2022

- 1.6.2 VOLUME

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 SECONDARY MACRONUTRIENTS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 SECONDARY MACRONUTRIENTS MARKET SIZE ESTIMATION - SUPPLY SIDE

- 2.2.2 SECONDARY MACRONUTRIENTS MARKET SIZE ESTIMATION - DEMAND SIDE

- FIGURE 4 SECONDARY MACRONUTRIENTS MARKET: BOTTOM-UP APPROACH

- 2.2.3 TOP-DOWN APPROACH

- FIGURE 5 SECONDARY MACRONUTRIENTS MARKET: TOP-DOWN APPROACH

- 2.3 GROWTH RATE FORECAST ASSUMPTION

- 2.4 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.5 RECESSION IMPACT ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- TABLE 2 SECONDARY MACRONUTRIENTS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 7 SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023 VS. 2028 (USD BILLION)

- FIGURE 8 SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2023 VS. 2028 (USD BILLION)

- FIGURE 9 SECONDARY MACRONUTRIENTS MARKET, BY CROP TYPE, 2023 VS. 2028 (USD BILLION)

- FIGURE 10 SECONDARY MACRONUTRIENTS MARKET, BY FORM, 2023 VS. 2028 (USD BILLION)

- FIGURE 11 SECONDARY MACRONUTRIENTS MARKET SHARE AND GROWTH RATE (VALUE), BY REGION

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR SECONDARY MACRONUTRIENT MARKET PLAYERS

- FIGURE 12 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.2 EUROPE: SECONDARY MACRONUTRIENTS MARKET, BY KEY CROP TYPE AND COUNTRY

- FIGURE 13 RUSSIA AND CEREALS & GRAINS ACCOUNTED FOR LARGEST SHARES IN 2022

- 4.3 SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2023 VS. 2028

- FIGURE 14 CALCIUM TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 SECONDARY MACRONUTRIENTS MARKET, BY CROP TYPE, 2023 VS. 2028

- FIGURE 15 CEREALS & GRAINS TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023 VS. 2028

- FIGURE 16 LIQUID APPLICATION TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.6 SECONDARY MACRONUTRIENTS MARKET, BY FORM, 2023 VS. 2028

- FIGURE 17 DRY FORM TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.7 SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT AND REGION, 2023 AND 2028

- FIGURE 18 ASIA PACIFIC AND CALCIUM TO DOMINATE DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS INFLUENCING SECONDARY MACRONUTRIENTS MARKET

- 5.2.1 POPULATION GROWTH AND DEMAND FOR DIVERSE FOOD PRODUCTS

- FIGURE 19 POPULATION GROWTH TREND, 1950-2050 (MILLION)

- 5.2.2 ARABLE LAND CONSTRAINTS

- 5.3 MARKET DYNAMICS

- FIGURE 20 MARKET DYNAMICS: SECONDARY MACRONUTRIENTS MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 Need to increase crop production

- FIGURE 21 US: CEREAL PRODUCTION, 2017-2021 (MILLION METRIC TONS)

- 5.3.1.2 Increased demand for high-value crops like fruits & vegetables

- FIGURE 22 WORLD FRUIT PRODUCTION, BY COUNTRY, 2017-2020 (HECTARES)

- 5.3.1.3 Soil degradation and deficiencies due to absence of secondary nutrients

- 5.3.1.4 Advancements in agricultural research and technology

- 5.3.1.5 Crop quality and market demand

- 5.3.2 RESTRAINTS

- 5.3.2.1 Price volatility and fluctuations in global market

- 5.3.2.2 Rising instances of counterfeit goods

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Precision agriculture for nutrient control on site-by-site basis

- 5.3.3.2 Rising investments in agricultural enterprises from emerging economies

- 5.3.3.3 Integrated nutrient management (INM)

- 5.3.4 CHALLENGES

- 5.3.4.1 Utilization of agricultural biologicals in farming

- 5.3.4.2 Lack of regulatory standards

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH AND PRODUCT DEVELOPMENT

- 6.2.2 SOURCING

- 6.2.3 MANUFACTURING

- 6.2.4 SALES & DISTRIBUTION

- 6.2.5 END CONSUMERS

- FIGURE 23 VALUE CHAIN ANALYSIS OF SECONDARY MACRONUTRIENTS MARKET

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.3.1 PROMINENT COMPANIES

- 6.3.2 SMALL AND MEDIUM ENTERPRISES (SMES)

- 6.3.3 END USERS

- 6.3.4 KEY INFLUENCERS

- FIGURE 24 SECONDARY MACRONUTRIENTS MARKET: SUPPLY CHAIN

- 6.4 TECHNOLOGY ANALYSIS

- 6.4.1 NANOFERTILIZERS

- 6.4.2 PRECISION FERTILIZATION OF SECONDARY MACRONUTRIENTS

- 6.5 PRICE TREND ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE, BY NUTRIENT

- FIGURE 25 GLOBAL AVERAGE SELLING PRICE, BY NUTRIENT

- TABLE 3 SECONDARY MACRONUTRIENTS: AVERAGE SELLING PRICE (ASP), BY REGION, 2020-2022 (USD/TON)

- TABLE 4 SECONDARY MACRONUTRIENTS: AVERAGE SELLING PRICE (ASP), BY NUTRIENT, 2020-2022 (USD/TON)

- TABLE 5 AVERAGE SELLING PRICE OF KEY MARKET PLAYERS, BY NUTRIENT, 2022 (USD/TON)

- 6.6 MARKET MAPPING AND ECOSYSTEM ANALYSIS

- 6.6.1 SUPPLY-SIDE ANALYSIS

- 6.6.2 DEMAND-SIDE ANALYSIS

- FIGURE 26 SECONDARY MACRONUTRIENTS MARKET MAPPING

- TABLE 6 SECONDARY MACRONUTRIENTS MARKET: SUPPLY CHAIN ECOSYSTEM

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.8 TRADE ANALYSIS

- TABLE 7 EXPORT VALUE OF MINERAL OR CHEMICAL NITROGENOUS FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 8 IMPORT VALUE OF MINERAL OR CHEMICAL NITROGENOUS FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 9 EXPORT VALUE OF MINERAL OR CHEMICAL NITROGENOUS FERTILIZERS, BY KEY COUNTRY, 2020

- TABLE 10 IMPORT VALUE OF MINERAL OR CHEMICAL NITROGENOUS FERTILIZERS, BY KEY COUNTRY, 2020

- TABLE 11 EXPORT VALUE OF MINERAL OR CHEMICAL PHOSPHATIC FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 12 IMPORT VALUE OF MINERAL OR CHEMICAL PHOSPHATIC FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 13 EXPORT VALUE OF MINERAL OR CHEMICAL PHOSPHATIC FERTILIZERS, BY KEY COUNTRY, 2020

- TABLE 14 IMPORT VALUE OF MINERAL OR CHEMICAL PHOSPHATIC FERTILIZERS, BY KEY COUNTRY, 2020

- TABLE 15 EXPORT VALUE OF MINERAL OR CHEMICAL POTASSIC FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 16 IMPORT VALUE OF MINERAL OR CHEMICAL POTASSIC FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 17 EXPORT VALUE OF MINERAL OR CHEMICAL POTASSIC FERTILIZERS, BY KEY COUNTRY, 2020

- TABLE 18 IMPORT VALUE OF MINERAL OR CHEMICAL POTASSIC FERTILIZERS, BY KEY COUNTRY, 2020

- TABLE 19 EXPORT VALUE OF MINERAL OR CHEMICAL FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 20 IMPORT VALUE OF MINERAL OR CHEMICAL FERTILIZERS, BY KEY COUNTRY, 2021

- TABLE 21 EXPORT VALUE OF MINERAL OR CHEMICAL FERTILIZERS, BY KEY COUNTRY, 2020

- TABLE 22 IMPORT VALUE OF MINERAL OR CHEMICAL FERTILIZERS, BY KEY COUNTRY, 2020

- 6.9 PATENT ANALYSIS

- FIGURE 28 PATENTS GRANTED FOR SECONDARY MACRONUTRIENTS MARKET, 2013-2022

- FIGURE 29 REGIONAL ANALYSIS OF PATENTS GRANTED FOR SECONDARY MACRONUTRIENTS, 2013-2022

- TABLE 23 PATENTS PERTAINING TO SECONDARY MACRONUTRIENTS, 2013-2022

- 6.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 24 SECONDARY MACRONUTRIENTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.10.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.10.2 BARGAINING POWER OF SUPPLIERS

- 6.10.3 BARGAINING POWER OF BUYERS

- 6.10.4 THREAT OF SUBSTITUTES

- 6.10.5 THREAT OF NEW ENTRANTS

- 6.11 CASE STUDIES

- TABLE 25 NUTRIEN LTD. LAUNCHED MAP+MST HOMOGENOUS FERTILIZER

- TABLE 26 INTRODUCTION OF CRF COATING BY ISRAEL CHEMICALS LIMITED

- 6.12 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 27 KEY CONFERENCES AND EVENTS IN SECONDARY MACRONUTRIENTS MARKET, 2023-2024

- 6.13 TARIFF AND REGULATORY LANDSCAPE

- TABLE 28 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 29 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 30 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 31 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.14 REGULATORY FRAMEWORK

- 6.14.1 NORTH AMERICA

- 6.14.1.1 US

- 6.14.1.2 Canada

- 6.14.2 EUROPE

- 6.14.2.1 Germany

- 6.14.2.2 Italy

- 6.14.3 ASIA PACIFIC

- 6.14.3.1 China

- 6.14.3.2 Australia

- 6.14.3.3 India

- 6.14.4 SOUTH AMERICA

- 6.14.4.1 Brazil

- 6.14.1 NORTH AMERICA

- 6.15 KEY STAKEHOLDERS AND BUYING CRITERIA

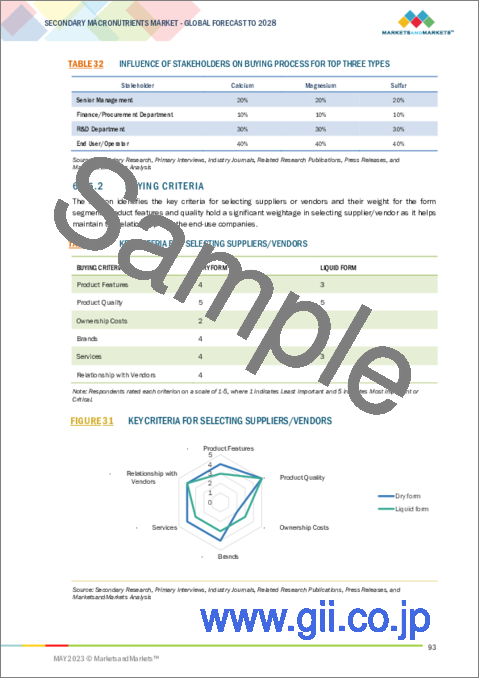

- 6.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY TYPES

- TABLE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TYPES

- 6.15.2 BUYING CRITERIA

- TABLE 33 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 31 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

7 SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT

- 7.1 INTRODUCTION

- FIGURE 32 CALCIUM TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- TABLE 34 SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2018-2022 (USD BILLION)

- TABLE 35 SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2023-2028 (USD BILLION)

- TABLE 36 SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2018-2022 (KT)

- TABLE 37 SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2023-2028 (KT)

- 7.2 CALCIUM

- 7.2.1 INCREASED USAGE OF CALCIUM ON WIDE RANGE OF CROPS TO FUEL GROWTH

- TABLE 38 CALCIUM: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 39 CALCIUM: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 40 CALCIUM: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 41 CALCIUM: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2023-2028 (KT)

- 7.3 SULFUR

- 7.3.1 SULFUR'S IMPACT ON CROP YIELD AND QUALITY TO DRIVE GROWTH

- TABLE 42 SULFUR: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 43 SULFUR: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 44 SULFUR: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 45 SULFUR: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2023-2028 (KT)

- 7.4 MAGNESIUM

- 7.4.1 MAGNESIUM'S ROLE IN PLANT RESILIENCE TO ENVIRONMENTAL STRESSES TO CONTRIBUTE TO GROWTH

- TABLE 46 MAGNESIUM: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 47 MAGNESIUM: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 48 MAGNESIUM: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 49 MAGNESIUM: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2023-2028 (KT)

8 SECONDARY MACRONUTRIENTS MARKET, BY FORM

- 8.1 INTRODUCTION

- FIGURE 33 DRY FORM TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- TABLE 50 SECONDARY MACRONUTRIENTS MARKET, BY FORM, 2018-2022 (USD BILLION)

- TABLE 51 SECONDARY MACRONUTRIENTS MARKET, BY FORM, 2023-2028 (USD BILLION)

- 8.2 DRY FORM

- 8.2.1 EASE OF STORAGE AND LONGER SHELF LIFE TO BOOST GROWTH

- TABLE 52 DRY FORM: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 53 DRY FORM: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 8.3 LIQUID FORM

- 8.3.1 QUICK NUTRIENT SUPPLY TO CROPS TO DRIVE MARKET GROWTH

- TABLE 54 LIQUID FORM: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 55 LIQUID FORM: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

9 SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION

- 9.1 INTRODUCTION

- FIGURE 34 LIQUID APPLICATION PROJECTED TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- TABLE 56 SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 57 SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 9.2 LIQUID APPLICATION

- TABLE 58 LIQUID APPLICATION: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 59 LIQUID APPLICATION: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 60 LIQUID APPLICATION: SECONDARY MACRONUTRIENTS MARKET, BY SUBTYPE, 2018-2022 (USD BILLION)

- TABLE 61 LIQUID APPLICATION: SECONDARY MACRONUTRIENTS MARKET, BY SUBTYPE, 2023-2028 (USD BILLION)

- 9.2.1 FERTIGATION

- 9.2.1.1 Improved efficiency and customizable nutrient application to lead to increased crop yield and quality

- 9.2.2 FOLIAR

- 9.2.2.1 Targeted nutrient delivery with foliar method to lead to improved plant health

- TABLE 62 FOLIAR: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2018-2022 (USD BILLION)

- TABLE 63 FOLIAR: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2023-2028 (USD BILLION)

- 9.2.3 OTHER LIQUID MODES OF APPLICATION

- 9.2.3.1 Targeting of nutrients and reduced risk of nutrient loss to drive growth

- 9.3 SOLID APPLICATION

- TABLE 64 SOLID APPLICATION: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 65 SOLID APPLICATION: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 66 SOLID APPLICATION: SECONDARY MACRONUTRIENTS MARKET, BY SUBTYPE, 2018-2022 (USD BILLION)

- TABLE 67 SOLID APPLICATION: SECONDARY MACRONUTRIENTS MARKET, BY SUBTYPE, 2023-2028 (USD BILLION)

- 9.3.1 BROADCASTING

- 9.3.1.1 Easy adoption and ability to provide nutrients in wide areas to drive growth

- 9.3.2 DEEP TILLAGE

- 9.3.2.1 Deep tillage to Improve fertility and texture of soil

- 9.3.3 LOCALIZED PLACEMENT

- 9.3.3.1 Localized placement to provide nutrients to crops in optimum amount

10 SECONDARY MACRONUTRIENTS MARKET, BY CROP TYPE

- 10.1 INTRODUCTION

- FIGURE 35 CEREALS & GRAINS PROJECTED TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- TABLE 68 SECONDARY MACRONUTRIENTS MARKET, BY CROP TYPE, 2018-2022 (USD BILLION)

- TABLE 69 SECONDARY MACRONUTRIENTS MARKET, BY CROP TYPE, 2023-2028 (USD BILLION)

- 10.2 CEREALS & GRAINS

- TABLE 70 CEREALS & GRAINS: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 71 CEREALS & GRAINS: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 72 CEREALS & GRAINS: SECONDARY MACRONUTRIENTS MARKET, BY SUBTYPE, 2018-2022 (USD BILLION)

- TABLE 73 CEREALS & GRAINS: SECONDARY MACRONUTRIENTS MARKET, BY SUBTYPE, 2023-2028 (USD BILLION)

- 10.2.1 CORN

- 10.2.1.1 Abundance of secondary macronutrients to drive production of corn

- 10.2.2 WHEAT

- 10.2.2.1 Reputation of wheat as major staple food to drive demand for secondary macronutrients

- 10.2.3 RICE

- 10.2.3.1 Versatility of rice to drive usage of secondary macronutrients

- 10.2.4 OTHER CEREALS & GRAINS

- 10.2.4.1 Industrial uses of sorghum, barley, and oats to fuel demand for secondary macronutrients

- 10.3 OILSEEDS & PULSES

- TABLE 74 OILSEEDS & PULSES: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 75 OILSEEDS & PULSES: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 76 OILSEEDS & PULSES: SECONDARY MACRONUTRIENTS MARKET, BY SUBTYPE, 2018-2022 (USD BILLION)

- TABLE 77 OILSEEDS & PULSES: SECONDARY MACRONUTRIENTS MARKET, BY SUBTYPE, 2023-2028 (USD BILLION)

- 10.3.1 SOYBEAN

- 10.3.1.1 Increased demand for soybean due to nutritional properties to drive growth of secondary macronutrients

- 10.3.2 SUNFLOWER

- 10.3.2.1 Economic importance and ornamental value of sunflower to drive demand for secondary macronutrients

- 10.3.3 OTHER OILSEEDS & PULSES

- 10.3.3.1 High nutritional value and drought resistance of these subtypes to contribute to market growth

- 10.4 FRUITS & VEGETABLES

- TABLE 78 FRUITS & VEGETABLES: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 79 FRUITS & VEGETABLES: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 80 FRUITS & VEGETABLES: SECONDARY MACRONUTRIENTS MARKET, BY SUBTYPE, 2018-2022 (USD BILLION)

- TABLE 81 FRUITS & VEGETABLES: SECONDARY MACRONUTRIENTS MARKET, BY SUBTYPE, 2023-2028 (USD BILLION)

- 10.4.1 ROOT & TUBER VEGETABLES

- 10.4.1.1 Secondary macronutrients to add value to root & tuber crops

- 10.4.2 LEAFY VEGETABLES

- 10.4.2.1 Versatility of leafy vegetables in culinary applications to drive demand for secondary macronutrients

- 10.4.3 POME FRUITS

- 10.4.3.1 Convenience of pome fruits due to shelf life to fuel growth of secondary macronutrients

- 10.4.4 BERRIES

- 10.4.4.1 Increased yield and profitability in berry cultivation to drive market growth

- 10.4.5 CITRUS FRUITS

- 10.4.5.1 Meeting export demand with high-quality citrus fruits to fuel growth

- 10.4.6 OTHER FRUITS & VEGETABLES

- 10.4.6.1 Suitability for cultivation in diverse climates and soil types to drive growth

- 10.5 OTHER CROP TYPES

- 10.5.1 ORNAMENTALS, TURF, AND FORAGE CROPS FOR AESTHETICS, LIVESTOCK FEED, AND ENVIRONMENTAL BENEFITS TO DRIVE MARKET

- TABLE 82 OTHER CROP TYPES: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 83 OTHER CROP TYPES: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

11 SECONDARY MACRONUTRIENTS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 36 BRAZIL TO WITNESS HIGHEST GROWTH RATE AMONG COUNTRY-LEVEL MARKETS

- TABLE 84 SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 85 SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 86 SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 87 SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2023-2028 (KT)

- 11.2 NORTH AMERICA

- 11.2.1 RECESSION IMPACT ANALYSIS

- FIGURE 37 NORTH AMERICA: RECESSION IMPACT ANALYSIS SNAPSHOT

- TABLE 88 NORTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 89 NORTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- TABLE 90 NORTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2018-2022 (USD BILLION)

- TABLE 91 NORTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2023-2028 (USD BILLION)

- TABLE 92 NORTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2018-2022 (KT)

- TABLE 93 NORTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2023-2028 (KT)

- TABLE 94 NORTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 95 NORTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- TABLE 96 NORTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY FORM, 2018-2022 (USD BILLION)

- TABLE 97 NORTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY FORM, 2023-2028 (USD BILLION)

- TABLE 98 NORTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY CROP TYPE, 2018-2022 (USD BILLION)

- TABLE 99 NORTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY CROP TYPE, 2023-2028 (USD BILLION)

- 11.2.2 US

- 11.2.2.1 Increasing consumer demand for food to lead to higher usage of secondary macronutrients in US agriculture

- TABLE 100 US: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 101 US: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 11.2.3 CANADA

- 11.2.3.1 Strong trading relationships and increasing crop exports to present opportunities in Canada

- TABLE 102 CANADA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 103 CANADA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 11.2.4 MEXICO

- 11.2.4.1 Rising cultivation of major crops in Mexico to drive market for secondary macronutrients

- TABLE 104 MEXICO: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 105 MEXICO: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 11.3 ASIA PACIFIC

- FIGURE 38 APAC: SECONDARY MACRONUTRIENTS MARKET SNAPSHOT

- 11.3.1 RECESSION IMPACT ANALYSIS

- FIGURE 39 APAC: RECESSION IMPACT ANALYSIS SNAPSHOT

- TABLE 106 APAC: SECONDARY MACRONUTRIENTS MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 107 APAC: SECONDARY MACRONUTRIENTS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- TABLE 108 APAC: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2018-2022 (USD BILLION)

- TABLE 109 APAC: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2023-2028 (USD BILLION)

- TABLE 110 APAC: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2018-2022 (KT)

- TABLE 111 APAC: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2023-2028 (KT)

- TABLE 112 APAC: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 113 APAC: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- TABLE 114 APAC: SECONDARY MACRONUTRIENTS MARKET, BY FORM, 2018-2022 (USD BILLION)

- TABLE 115 APAC: SECONDARY MACRONUTRIENTS MARKET, BY FORM, 2023-2028 (USD BILLION)

- TABLE 116 APAC: SECONDARY MACRONUTRIENTS MARKET, BY CROP TYPE, 2018-2022 (USD BILLION)

- TABLE 117 APAC: SECONDARY MACRONUTRIENTS MARKET, BY CROP TYPE, 2023-2028 (USD BILLION)

- 11.3.2 INDIA

- 11.3.2.1 Changing cropping pattern and stress to drive market growth

- TABLE 118 INDIA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 119 INDIA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 11.3.3 JAPAN

- 11.3.3.1 Increased efficiency and effectiveness of fertilizers containing secondary macronutrients to drive growth

- TABLE 120 JAPAN: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 121 JAPAN: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 11.3.4 CHINA

- 11.3.4.1 Population growth and income increase to drive demand for nutrient-rich foods

- TABLE 122 CHINA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 123 CHINA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 11.3.5 AUSTRALIA & NEW ZEALAND

- 11.3.5.1 Improved crop quality and export opportunities to fuel market for secondary macronutrients

- TABLE 124 AUSTRALIA & NEW ZEALAND: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 125 AUSTRALIA & NEW ZEALAND: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 11.3.6 REST OF ASIA PACIFIC

- 11.3.6.1 Rising demand for premium food to drive market for secondary macronutrients

- TABLE 126 REST OF ASIA PACIFIC: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 127 REST OF ASIA PACIFIC: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 11.4 EUROPE

- 11.4.1 RECESSION IMPACT ANALYSIS

- FIGURE 40 EUROPE: SECONDARY MACRONUTRIENTS MARKET RECESSION IMPACT ANALYSIS SNAPSHOT

- TABLE 128 EUROPE: SECONDARY MACRONUTRIENTS MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 129 EUROPE: SECONDARY MACRONUTRIENTS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- TABLE 130 EUROPE: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2018-2022 (USD BILLION)

- TABLE 131 EUROPE: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2023-2028 (USD BILLION)

- TABLE 132 EUROPE: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2018-2022 (KT)

- TABLE 133 EUROPE: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2023-2028 (KT)

- TABLE 134 EUROPE: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 135 EUROPE: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- TABLE 136 EUROPE: SECONDARY MACRONUTRIENTS MARKET, BY FORM, 2018-2022 (USD BILLION)

- TABLE 137 EUROPE: SECONDARY MACRONUTRIENTS MARKET, BY FORM, 2023-2028 (USD BILLION)

- TABLE 138 EUROPE: SECONDARY MACRONUTRIENTS MARKET, BY CROP TYPE, 2018-2022 (USD BILLION)

- TABLE 139 EUROPE: SECONDARY MACRONUTRIENTS MARKET, BY CROP TYPE, 2023-2028 (USD BILLION)

- 11.4.2 GERMANY

- 11.4.2.1 Diverse crop production and rising demand for different commodities to drive demand for secondary macronutrients

- TABLE 140 GERMANY: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 141 GERMANY: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 11.4.3 FRANCE

- 11.4.3.1 Greater demand for better agricultural production to propel growth of secondary macronutrients

- TABLE 142 FRANCE: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 143 FRANCE: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 11.4.4 ITALY

- 11.4.4.1 Diverse cultivation of crops and different climate conditions to encourage farmers to use secondary macronutrients

- TABLE 144 ITALY: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 145 ITALY: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 11.4.5 SPAIN

- 11.4.5.1 Need for fruit production and food security to lead to secondary macronutrient usage

- TABLE 146 SPAIN: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 147 SPAIN: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 11.4.6 UK

- 11.4.6.1 Increased production and expansion in acreage for crops to drive demand for secondary macronutrients

- TABLE 148 UK: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 149 UK: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 11.4.7 RUSSIA

- 11.4.7.1 Significance of cereals, wheat, and barley production in Russian agriculture to drive market growth

- TABLE 150 RUSSIA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 151 RUSSIA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 11.4.8 REST OF EUROPE

- 11.4.8.1 Regional specialization in crop production to drive market for secondary macronutrients

- TABLE 152 REST OF EUROPE: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 153 REST OF EUROPE: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 11.5 SOUTH AMERICA

- FIGURE 41 SOUTH AMERICA: SNAPSHOT

- 11.5.1 RECESSION IMPACT ANALYSIS

- FIGURE 42 SOUTH AMERICA: SECONDARY MACRONUTRIENTS MARKET RECESSION IMPACT ANALYSIS SNAPSHOT

- TABLE 154 SOUTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY COUNTRY, 2018-2022 (USD BILLION)

- TABLE 155 SOUTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- TABLE 156 SOUTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2018-2022 (USD BILLION)

- TABLE 157 SOUTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2023-2028 (USD BILLION)

- TABLE 158 SOUTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2018-2022 (KT)

- TABLE 159 SOUTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2023-2028 (KT)

- TABLE 160 SOUTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 161 SOUTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- TABLE 162 SOUTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY FORM, 2018-2022 (USD BILLION)

- TABLE 163 SOUTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY FORM, 2023-2028 (USD BILLION)

- TABLE 164 SOUTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY CROP TYPE, 2018-2022 (USD BILLION)

- TABLE 165 SOUTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY CROP TYPE, 2023-2028 (USD BILLION)

- 11.5.2 BRAZIL

- 11.5.2.1 Opportunities for innovation and technological advancements to fuel demand for secondary macronutrients

- TABLE 166 BRAZIL: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 167 BRAZIL: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 11.5.3 ARGENTINA

- 11.5.3.1 High market penetration with help of local companies to contribute to market growth

- TABLE 168 ARGENTINA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 169 ARGENTINA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 11.5.4 REST OF SOUTH AMERICA

- 11.5.4.1 Use of secondary macronutrients to enhance crop productivity to boost growth

- TABLE 170 REST OF SOUTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 171 REST OF SOUTH AMERICA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 11.6 REST OF THE WORLD

- 11.6.1 RECESSION IMPACT ANALYSIS

- FIGURE 43 ROW: SECONDARY MACRONUTRIENTS MARKET RECESSION IMPACT ANALYSIS SNAPSHOT

- TABLE 172 ROW: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2018-2022 (USD BILLION)

- TABLE 173 ROW: SECONDARY MACRONUTRIENTS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 174 ROW: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2018-2022 (USD BILLION)

- TABLE 175 ROW: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2023-2028 (USD BILLION)

- TABLE 176 ROW: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2018-2022 (KT)

- TABLE 177 ROW: SECONDARY MACRONUTRIENTS MARKET, BY NUTRIENT, 2023-2028 (KT)

- TABLE 178 ROW: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 179 ROW: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- TABLE 180 ROW: SECONDARY MACRONUTRIENTS MARKET, BY FORM, 2018-2022 (USD BILLION)

- TABLE 181 ROW: SECONDARY MACRONUTRIENTS MARKET, BY FORM, 2023-2028 (USD BILLION)

- TABLE 182 ROW: SECONDARY MACRONUTRIENTS MARKET, BY CROP TYPE, 2018-2022 (USD BILLION)

- TABLE 183 ROW: SECONDARY MACRONUTRIENTS MARKET, BY CROP TYPE, 2023-2028 (USD BILLION)

- 11.6.2 AFRICA

- 11.6.2.1 Increasing demand for agricultural goods to drive secondary macronutrients market in Africa

- TABLE 184 AFRICA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 185 AFRICA: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

- 11.6.3 MIDDLE EAST

- 11.6.3.1 Variations in usage of secondary macronutrients to propel market growth

- TABLE 186 MIDDLE EAST: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2018-2022 (USD BILLION)

- TABLE 187 MIDDLE EAST: SECONDARY MACRONUTRIENTS MARKET, BY MODE OF APPLICATION, 2023-2028 (USD BILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 MARKET SHARE ANALYSIS

- TABLE 188 SECONDARY MACRONUTRIENTS MARKET: DEGREE OF COMPETITION

- 12.4 COMPANY REVENUE ANALYSIS OF KEY PLAYERS, 2020-2022

- FIGURE 44 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2022 (USD BILLION)

- 12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 45 SECONDARY MACRONUTRIENTS MARKET, COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- 12.5.5 NUTRIENT FOOTPRINT

- TABLE 189 SECONDARY MACRONUTRIENTS: NUTRIENT FOOTPRINT OF KEY PLAYERS

- TABLE 190 SECONDARY MACRONUTRIENTS: FORM FOOTPRINT OF KEY PLAYERS

- TABLE 191 SECONDARY MACRONUTRIENTS: CROP TYPE FOOTPRINT OF KEY PLAYERS

- TABLE 192 SECONDARY MACRONUTRIENTS: REGIONAL FOOTPRINT OF KEY PLAYERS

- TABLE 193 SECONDARY MACRONUTRIENTS: OVERALL FOOTPRINT OF KEY PLAYERS

- 12.6 STARTUP/SME EVALUATION QUADRANT (OTHER PLAYERS)

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 STARTING BLOCKS

- 12.6.3 RESPONSIVE COMPANIES

- 12.6.4 DYNAMIC COMPANIES

- FIGURE 46 SECONDARY MACRONUTRIENTS MARKET: COMPANY EVALUATION QUADRANT, 2022 (OTHER PLAYERS)

- 12.6.5 COMPETITIVE BENCHMARKING OF OTHER PLAYERS

- TABLE 194 DETAILED LIST OF OTHER PLAYERS

- TABLE 195 COMPETITIVE BENCHMARKING (OTHER PLAYERS), 2021

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PRODUCT LAUNCHES

- TABLE 196 SECONDARY MACRONUTRIENTS MARKET: PRODUCT LAUNCHES, 2018-2022

- 12.7.2 DEALS

- TABLE 197 SECONDARY MACRONUTRIENTS MARKET: DEALS, 2018- 2022

- 12.7.3 OTHERS

- TABLE 198 SECONDARY MACRONUTRIENTS MARKET: OTHERS, 2018-2022

13 COMPANY PROFILES

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 13.1 KEY PLAYERS

- 13.1.1 NUTRIEN LTD.

- TABLE 199 NUTRIEN LTD.: BUSINESS OVERVIEW

- FIGURE 47 NUTRIEN LTD.: COMPANY SNAPSHOT

- TABLE 200 NUTRIEN LTD.: PRODUCT LAUNCHES

- TABLE 201 NUTRIEN LTD.: DEALS

- TABLE 202 NUTRIEN LTD.: DEALS

- 13.1.2 YARA

- TABLE 203 YARA: BUSINESS OVERVIEW

- FIGURE 48 YARA: COMPANY SNAPSHOT

- TABLE 204 YARA: DEALS

- 13.1.3 THE MOSAIC COMPANY

- TABLE 205 THE MOSAIC COMPANY: BUSINESS OVERVIEW

- FIGURE 49 THE MOSAIC COMPANY: COMPANY SNAPSHOT

- TABLE 206 THE MOSAIC COMPANY: DEALS

- 13.1.4 ISRAEL CHEMICALS LTD.

- TABLE 207 ISRAEL CHEMICAL LTD.: BUSINESS OVERVIEW

- FIGURE 50 ISRAEL CHEMICALS LTD.: COMPANY SNAPSHOT

- TABLE 208 ISRAEL CHEMICALS LTD.: PRODUCT LAUNCHES

- TABLE 209 ISRAEL CHEMICALS LTD.: DEALS

- 13.1.5 K+S AKTIENGESELLSCHAFT

- TABLE 210 K+S AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

- FIGURE 51 K+S AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- TABLE 211 K+S AKTIENGESELLSCHAFT: DEALS

- 13.1.6 NUFARM

- TABLE 212 NUFARM: BUSINESS OVERVIEW

- FIGURE 52 NUFARM: COMPANY SNAPSHOT

- 13.1.7 SPIC

- TABLE 213 SPIC: BUSINESS OVERVIEW

- FIGURE 53 SPIC: COMPANY SNAPSHOT

- 13.1.8 KOCH INDUSTRIES, INC.

- TABLE 214 KOCH INDUSTRIES, INC.: BUSINESS OVERVIEW

- TABLE 215 KOCH INDUSTRIES, INC.: DEALS

- TABLE 216 KOCH INDUSTRIES, INC.: OTHERS

- 13.1.9 COROMANDEL INTERNATIONAL LTD

- TABLE 217 COROMANDEL INTERNATIONAL LTD: BUSINESS OVERVIEW

- FIGURE 54 COROMANDEL INTERNATIONAL LTD: COMPANY SNAPSHOT

- TABLE 218 COROMANDEL INTERNATIONAL LTD: OTHERS

- 13.1.10 DEEPAK FERTILISERS AND PETROCHEMICALS CORPORATION LTD.

- TABLE 219 DEEPAK FERTILISERS AND PETROCHEMICALS CORPORATION LTD.: BUSINESS OVERVIEW

- FIGURE 55 DEEPAK FERTILISERS AND PETROCHEMICALS CORPORATION LTD.: COMPANY SNAPSHOT

- 13.1.11 HAIFA NEGEV TECHNOLOGIES LTD

- TABLE 220 HAIFA NEGEV TECHNOLOGIES LTD: BUSINESS OVERVIEW

- TABLE 221 HAIFA NEGEV TECHNOLOGIES LTD: DEALS

- 13.1.12 KUGLER COMPANY

- TABLE 222 KUGLER COMPANY: BUSINESS OVERVIEW

- 13.1.13 IFFCO

- TABLE 223 IFFCO: BUSINESS OVERVIEW

- FIGURE 56 IFFCO: COMPANY SNAPSHOT

- 13.1.14 WESTERN NUTRIENTS CORPORATION

- TABLE 224 WESTERN NUTRIENT CORPORATION: BUSINESS OVERVIEW

- 13.1.15 ARIES AGRO LIMITED

- TABLE 225 ARIES AGRO LIMITED: BUSINESS OVERVIEW

- FIGURE 57 ARIES AGRO LIMITED: COMPANY SNAPSHOT

- 13.2 OTHER PLAYERS

- 13.2.1 BMS MICRO-NUTRIENTS

- TABLE 226 BMS MICRO-NUTRIENTS: BUSINESS OVERVIEW

- 13.2.2 BAICOR, LLC

- TABLE 227 BAICOR, LLC: BUSINESS OVERVIEW

- 13.2.3 PLANT FOOD COMPANY, INC.

- TABLE 228 PLANT FOOD COMPANY, INC.: BUSINESS OVERVIEW

- 13.2.4 AGROLIQUID

- TABLE 229 AGROLIQUID: BUSINESS OVERVIEW

- 13.2.5 TERRALINK HORTICULTURE INC.

- TABLE 230 TERRALINK HORTICULTURE INC.: BUSINESS OVERVIEW

- 13.2.6 STOLLER ENTERPRISES

- 13.2.7 NACHURS

- 13.2.8 MORRAL COMPANIES LLC

- 13.2.9 ADITYA MICRODYNAMICS

- 13.2.10 MYTHREYI AGRI INPUTS

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- TABLE 231 ADJACENT MARKETS

- 14.2 RESEARCH LIMITATIONS

- 14.3 AGROCHEMICALS MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- TABLE 232 AGROCHEMICALS MARKET, BY CROP TYPE, 2023-2028 (USD MILLION)

- 14.4 AGRICULTURAL BIOLOGICALS MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- TABLE 233 AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2022-2027 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS