|

|

市場調査レポート

商品コード

1280003

製油所・石油化学向け濾過の世界市場:フィルターの種類別 (コアレッサーフィルター (液液コアレッサー、気液コアレッサー)、カートリッジフィルター (プリーツカートリッジ、ハイフローカートリッジ))・用途別・エンドユーザー別・地域別の将来予測 (2028年まで)Refinery and Petrochemical Filtration Market by Filter Type (Coalescer Filter (Liquid-liquid Coalescer, Liquid-gas Coalescer), Cartridge Filter (Pleated Cartridge, High Flow Cartridge), Application, End User & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 製油所・石油化学向け濾過の世界市場:フィルターの種類別 (コアレッサーフィルター (液液コアレッサー、気液コアレッサー)、カートリッジフィルター (プリーツカートリッジ、ハイフローカートリッジ))・用途別・エンドユーザー別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年05月22日

発行: MarketsandMarkets

ページ情報: 英文 217 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の製油所・石油化学向け濾過の市場規模は、2023年の46億米ドルから、2028年には61億米ドルに達し、予測期間中に6.0%のCAGRで成長する予想されています。

エネルギー需要の増加は、下流への投資の増加につながり、製油所・石油化学向け濾過市場を牽引しています。

"フィルタープレス":フィルターの種類別では2番目に速いセグメント"

フィルタープレスは、液体から固形物や不純物を除去する効率が高いため、製油所や石油化学産業で採用が進んでいます。フィルタープレスは、圧力とフィルターメディアの組み合わせで液体から固体を分離するため、脱水、清澄化、スラッジ処理などの用途で高い効果を発揮します。また、大量の液体を扱うことができるため、製油所や石油化学産業で必要とされる大量処理に適しています。

"用途別では、液液分離が2番目に大きなセグメントとして浮上する"

液液分離は、石油・ガスの下流工程で必要とされるため、第2位の市場規模になると予想されます。ガソリン・ディーゼル・灯油・ジェット燃料からの水分除去、触媒や吸着剤の水分汚染からの保護、苛性処理工程での残留苛性の除去、液化石油ガス (LPG) からの残留アミンの除去、アミンからの炭化水素の除去、塩乾燥機や粘土塔の保護に使用されます。

"エンドユーザー別では、石油化学産業が最速のセグメントとして浮上する"

石油化学産業におけるインフラ投資の増加は、石油化学用ろ過の需要を促進すると予想されます。石油化学プラントへの投資の増加は、経済発展や人口増加に伴うプラスチック・合成繊維・肥料・化学品などの製品需要の増加を背景としています。石油化学プラントのオペレーターは、原料や最終製品から不純物、汚染物質、粒子を取り除くために、バグフィルター、カートリッジフィルター、メンブレンフィルター、コアレッサーを使用しています。

"アジア太平洋地が2番目に大きな地域になる"

アジア太平洋は、2023年から2028年の間に、北米に次いでで2番目に大きな地域になると予想されます。同地域では、石油化学製品の需要増に伴い、下流部門の拡大が進んでいます。また、この地域の国々は製油所の戦略的立地を有しており、中東をはじめとする地域からの原油供給が可能になっています。さらに、これらの国の政府は、川下分野への外国投資を誘致するための政策やインセンティブを実施しています。それらが、アジア太平洋における製油所・石油化学向け濾過市場の成長を促進する主要因となっています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- マーケットマップ

- バリューチェーン分析

- 平均販売価格 (ASP) 分析

- 交換率

- 技術分析

- 関税・法規・規制

- 特許分析

- 貿易分析

- 主要な会議とイベント (2023年~2024年)

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

第6章 製油所・石油化学向け濾過市場:フィルターの種類別

- イントロダクション

- コアレッサーフィルター

- カートリッジフィルター

- 電気集塵機

- フィルタープレス

- バグフィルター

- その他

第7章 製油所・石油化学向け濾過市場:用途別

- イントロダクション

- 液液分離

- 気液分離

- その他

第8章 製油所・石油化学向け濾過市場:エンドユーザー別

- イントロダクション

- 製油所

- 石油化学産業

第9章 製油所・石油化学向け濾過市場:地域別

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- 南米

- 中東・アフリカ

第10章 競合情勢

- 主要な市場参入企業が採用した主要戦略

- 上位5社の市場シェア分析

- 上位5社の収益分析

- 企業評価クアドラント

- スタートアップ/中小企業 (SME) の評価クアドラント (2021年)

- 世界の製油所・石油化学向け濾過市場:企業のフットプリント

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- 3M

- EATON

- PARKER HANIFFIN CORP.

- PENTAIR FILTRATION SOLUTION, LLC

- CAMFILAB

- W. L. GORE & ASSOCIATES, INC

- PALL CORPORATION

- FILTRATION GROUOP

- FILTCARE TECHNOLOGY PVT. LTD.

- FILTCRATION TECHNOLOGY CORPORATION

- PORVAIR FILTRATION GROUP

- LENNTECH B. V.

- AMAZON FILTERS INC.

- NORMAN FILTER COMPANY

- SUNGOV ENGINEERING

- その他の主要企業

- FILSON FILTER

- BROTHER FILTRATION

- COMPOSITECH PRODUCTS MANUFACTURING, INC.

- KEL INDIA FILTERS

- HUADING SEPARATOR

第12章 付録

The global refinery and petrochemical filtration market is estimated to grow from USD 4.6 Billion in 2023 to USD 6.1 Billion by 2028; it is expected to record a CAGR of 6.0% during the forecast period. Increasing energy demand leads to an increase in downstream investment which drives the refinery and petrochemical filtration market.

"Filter press: The second-fastest segment of the refinery and petrochemical filtration market, by filter type"

Based on filter type, the refinery and petrochemical filtration market has been split into six types: coalescer filter, cartridge filter, electrostatic precipitator, filter press, bag filter, and others. The adoption of filter press is growing in the refinery and petrochemical industry due to their high efficiency in removing solids and impurities from liquids. Filter presses use a combination of pressure and filter media to separate solids from liquids, making them highly effective in applications such as dewatering, clarification, and sludge handling. They can also handle large volumes of liquids, making them suitable for use in the high-volume processing required in the refinery and petrochemical industry.

"Liquid-Liquid segment is expected to emerge as the second-largest segment based on application"

Based on application, the refinery and petrochemical filtration market has been segmented into liquid-liquid separation, liquid-gas separation, and others. The liquid-liquid separation segment is expected to be the second-largest segment owing to its requirement in the downstream oil and gas sector. This is used for removal of water from gasoline, diesel, kerosene, and jet fuel, protection of catalysts and adsorbents from water contamination, removal of carried-over caustic from caustic treating processes, removal of carried-over amine from liquified petroleum gas (LPG), removal of hydrocarbons from amine, and protection of salt driers and clay towers..

"Petrochemical Industry is expected to emerge as fastest segment based on end user"

By end user, the refinery and petrochemical filtration market has been segmented into refineries and petrochemical industry. Increasing infrastructure investments in the petrochemical industry are anticipated to drive the demand for petrochemical filtration. The rising investment in petrochemical plants is driven by increasing demand for products such as plastics, synthetic fibers, fertilizers, and chemicals as economies develop and populations grow. Petrochemical plant operators use bag filters, cartridge filters, membrane filters, and coalescers to remove impurities, contaminants, and particles from feedstocks and final products.

Asia Pacific is expected to be the second-largest region in the refinery and petrochemical filtration market

Asia Pacific is expected to be the second-largest region in the refinery and petrochemical filtration market between 2023-2028, preceded by North America. The downstream sector is growing in the region due to the increasing demand for petrochemical products, which has prompted the expansion of the downstream sector to meet the growing demand. Moreover, countries in this region have strategic locations for refineries, which enable them to access crude oil supplies from the Middle East and other regions. Additionally, the governments of these countries have implemented policies and incentives to attract foreign investments in the downstream sector. These are the key factors fostering the growth of the refinery and petrochemical filtration market in the Asia Pacific.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 45%, Tier 2- 30%, and Tier 3- 25%

By Designation: C-Level- 35%, Director Levels- 25%, and Others- 40%

By Region: North America- 27%, Asia Pacific- 33%, Europe- 20%, the Middle East & Africa- 12%, and South America- 8%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2021. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The refinery and petrochemical filtration market is dominated by a few major players that have a wide regional presence. The leading players in the refinery and petrochemical filtration market are 3M (US), Pall Corporation (US), Parker Hannifin Corporation (US), Eaton (Ireland), and Pentair Filtration Solutions, LLC (US).

Research Coverage:

The report defines, describes, and forecasts the global refinery and petrochemical filtration market, by component, power source, application, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the refinery and petrochemical filtration market.

Key Benefits of Buying the Report

- Focus of oil and gas giants on downstream expansion, increase of energy demand, and growing focus on environmental mandates drive the demand. Factors such as reduced adoption of refinery and petrochemical filtration due to increasing adoption of renewable energy, and availability of low-cost and inferior-quality filtration products hinder market growth. Huge investments in shale refining, along with increasing fuel requirement for transportation sector offer lucrative opportunities in this market. High replacement rate of filters and supply-chain constraints are major challenges faced by countries in this market.

- Product Development/ Innovation: The trends such as innovative filter media materials, designs, and processes have led to more efficient, reliable, compact, and longer-lasting filters. The focus on sustainability and reducing carbon footprints has also led to the expectation that filter media will contribute to lower energy consumption.

- Market Development: The global scenario of refinery and petrochemical filtration in refineries and petrochemical industry is evolving rapidly, with trends toward the material innovation is, with advances in new forms of media, such as fine fibres, being explored to produce filters at mass production scale and make them more chemistry compatible with caustic environments.

- Market Diversification: Eaton introduced a high-volume flow rate system to its IFPM series of fully automated, PLC-controlled, mobile, offline fluid purifiers. The system quickly and efficiently removes free and dissolved water, gases, and particulate contamination down to 3 µm from light transformer oils to heavy lubricating oils.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like 3M (US), Pall Corporation (US), Parker Hannifin Corporation (US), Eaton (Ireland), and Pentair Filtration Solutions, LLC (US), among others in the refinery and petrochemical filtration market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.1.1 Refinery and petrochemical filtration market, by filter type

- 1.2.1.2 Refinery and petrochemical filtration market, by application

- 1.2.1.3 Refinery and petrochemical filtration market, by end user

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 REFINERY AND PETROCHEMICAL FILTRATION MARKET SEGMENTATION

- 1.3.1 REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 REFINERY AND PETROCHEMICAL FILTRATION MARKET: RESEARCH DESIGN

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 3 DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Breakdown of primaries

- FIGURE 4 BREAKDOWN OF PRIMARIES

- 2.3 SCOPE

- FIGURE 5 MAIN METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR REFINERY AND PETROCHEMICAL FILTRATION SYSTEMS

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4.3 DEMAND-SIDE ANALYSIS

- 2.4.3.1 Regional analysis

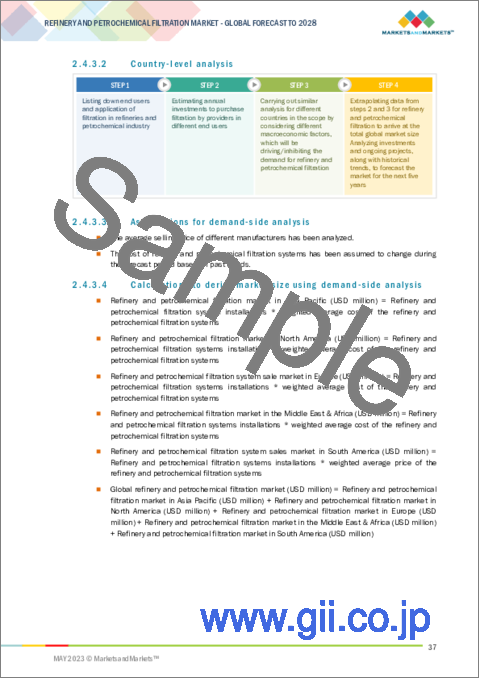

- 2.4.3.2 Country-level analysis

- 2.4.3.3 Assumptions for demand-side analysis

- 2.4.3.4 Calculations to derive market size using demand-side analysis

- 2.4.4 SUPPLY-SIDE ANALYSIS

- FIGURE 8 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF REFINERY AND PETROCHEMICAL FILTRATION SYSTEMS

- FIGURE 9 REFINERY AND PETROCHEMICAL FILTRATION MARKET: SUPPLY-SIDE ANALYSIS

- 2.4.4.1 Calculations to derive market size using supply-side analysis

- 2.4.4.2 Assumptions for supply-side analysis

- FIGURE 10 COMPANY REVENUE ANALYSIS, 2022

- 2.4.5 FORECAST

- 2.5 RISK ASSESSMENT

- 2.6 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- TABLE 1 REFINERY AND PETROCHEMICAL FILTRATION MARKET SNAPSHOT

- FIGURE 11 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN REFINERY AND PETROCHEMICAL FILTRATION MARKET FROM 2023 TO 2028

- FIGURE 12 COALESCER FILTER SEGMENT TO LEAD REFINERY AND PETROCHEMICAL FILTRATION MARKET DURING FORECAST PERIOD

- FIGURE 13 OTHERS SEGMENT TO LEAD REFINERY AND PETROCHEMICAL FILTRATION MARKET DURING FORECAST PERIOD

- FIGURE 14 REFINERIES SEGMENT TO LEAD REFINERY AND PETROCHEMICAL FILTRATION MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN REFINERY AND PETROCHEMICAL FILTRATION MARKET

- FIGURE 15 RISING FUEL CONSUMPTION

- 4.2 REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY REGION

- FIGURE 16 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 NORTH AMERICAN REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY APPLICATION AND COUNTRY

- FIGURE 17 REFINERIES SEGMENT AND US HELD LARGEST SHARES OF NORTH AMERICAN REFINERY AND PETROCHEMICAL FILTRATION MARKET IN 2022

- 4.4 REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY FILTER TYPE

- FIGURE 18 COALESCER FILTER SEGMENT TO DOMINATE REFINERY AND PETROCHEMICAL FILTRATION MARKET IN 2028

- 4.5 REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY APPLICATION

- FIGURE 19 OTHERS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF REFINERY AND PETROCHEMICAL FILTRATION MARKET IN 2028

- 4.6 REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER

- FIGURE 20 REFINERIES SEGMENT TO ACCOUNT FOR LARGER SHARE OF REFINERY AND PETROCHEMICAL FILTRATION MARKET IN 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 REFINERY AND PETROCHEMICAL FILTRATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Implementation of government mandates and policies for environmental protection

- TABLE 2 ENVIRONMENTAL PROTECTION MANDATES AND POLICIES

- 5.2.1.2 Increasing expenditure on refinery and petrochemical infrastructure development

- TABLE 3 LIST OF REFINERY AND PETROCHEMICAL INFRASTRUCTURE PROJECTS

- FIGURE 22 DISTILLATION CAPACITY ADDITIONS FROM EXISTING PROJECTS, BY REGION, 2022-2027

- 5.2.2 RESTRAINTS

- 5.2.2.1 Availability of low-cost and inferior-quality filtration products

- 5.2.2.2 Increasing focus on use of renewable energy

- FIGURE 23 INCREASE IN RENEWABLE GENERATION CAPACITY, 2002-2022

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising shale development activities to enhance shale refining potential

- FIGURE 24 RECOVERABLE SHALE OIL AND GAS RESERVES ACROSS MAJOR COUNTRIES

- 5.2.3.2 Expanding transportation sector

- FIGURE 25 GLOBAL VEHICLE SALES, 2019-2022

- FIGURE 26 PROJECTED GLOBAL OIL DEMAND FOR TRANSPORTATION, 2021-2045

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain constraints

- 5.2.4.2 Frequent replacement and disposal of filters

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.3.1 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR REFINERY AND PETROCHEMICAL FILTRATION SYSTEM MANUFACTURERS

- FIGURE 27 REVENUE SHIFTS FOR REFINERY AND PETROCHEMICAL FILTRATION SYSTEM MANUFACTURERS

- 5.4 MARKET MAP

- TABLE 4 REFINERY AND PETROCHEMICAL FILTRATION MARKET: ECOSYSTEM ANALYSIS

- FIGURE 28 REFINERY AND PETROCHEMICAL FILTRATION MARKET: MARKET MAP/ ECOSYSTEM ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 29 REFINERY AND PETROCHEMICAL FILTRATION MARKET: VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL PROVIDERS/SUPPLIERS

- FIGURE 30 NICKEL PRODUCTION, BY COUNTRY, 2021 AND 2022E

- 5.5.2 REFINERY AND PETROCHEMICAL FILTRATION SYSTEM MANUFACTURERS

- 5.5.3 DISTRIBUTORS AND END USERS

- 5.5.4 POST-SALES SERVICE PROVIDERS

- 5.6 AVERAGE SELLING PRICE (ASP) ANALYSIS

- FIGURE 31 AVERAGE SELLING PRICE OF REFINERY AND PETROCHEMICAL FILTRATION UNITS, BY FILTER TYPE

- TABLE 5 AVERAGE SELLING PRICE OF REFINERY AND PETROCHEMICAL FILTRATION UNITS, BY FILTER TYPE (USD)

- TABLE 6 AVERAGE SELLING PRICE ANALYSIS, BY REGION (USD), 2021 AND 2028

- FIGURE 32 AVERAGE SELLING PRICE ANALYSIS, BY REGION (USD), 2021 AND 2028

- 5.7 REPLACEMENT RATE

- TABLE 7 AVERAGE REPLACEMENT RATE OF REFINERY AND PETROCHEMICAL FILTRATION UNITS, BY END USER (NUMBER OF MONTHS)

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 TECHNOLOGY TRENDS RELATED TO REFINERY AND PETROCHEMICAL FILTRATION SYSTEMS

- 5.9 TARIFFS, CODES, AND REGULATIONS

- 5.9.1 TARIFFS RELATED TO REFINERY AND PETROCHEMICAL FILTRATION UNITS

- 5.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS FOR REFINERY AND PETROCHEMICAL FILTRATION

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.3 CODES AND REGULATIONS RELATED TO REFINERY AND PETROCHEMICAL FILTRATION

- TABLE 12 NORTH AMERICA: CODES AND REGULATIONS

- TABLE 13 ASIA PACIFIC: CODES AND REGULATIONS

- TABLE 14 GLOBAL: CODES AND REGULATIONS

- 5.10 PATENT ANALYSIS

- TABLE 15 REFINERY AND PETROCHEMICAL FILTRATION MARKET: INNOVATIONS AND PATENT REGISTRATIONS

- 5.11 TRADE ANALYSIS

- 5.11.1 EXPORT SCENARIO

- TABLE 16 EXPORT SCENARIO FOR HS CODE: 842199, BY COUNTRY, 2020-2022 (USD THOUSAND)

- 5.11.2 IMPORT SCENARIO

- TABLE 17 IMPORT SCENARIO FOR HS CODE: 842199, BY COUNTRY, 2020-2022 (USD THOUSAND)

- FIGURE 33 IMPORT AND EXPORT SCENARIO FOR HS CODE: 842199, 2018-2021 (USD THOUSAND)

- TABLE 18 TRADE DATA FOR HS CODE: 854419, 2016-2021 (USD THOUSAND)

- 5.12 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 19 REFINERY AND PETROCHEMICAL FILTRATION MARKET: CONFERENCES AND EVENTS

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 JONELL SYSTEMS REDUCED COALESCING COSTS IN EUROPEAN REFINERY

- 5.13.2 JONELL SYSTEMS' REFINERY PRE-FILTRATION SOLUTION SAVED USD 2 MILLION FOR US REFINERY

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- TABLE 20 REFINERY AND PETROCHEMICAL FILTRATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 REFINERY AND PETROCHEMICAL FILTRATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF SUBSTITUTES

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF NEW ENTRANTS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- 5.15.2 BUYING CRITERIA

- FIGURE 36 KEY BUYING CRITERIA, BY END USER

- TABLE 22 KEY BUYING CRITERIA, BY END USER

6 REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY FILTER TYPE

- 6.1 INTRODUCTION

- FIGURE 37 REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY FILTER TYPE, 2022

- TABLE 23 REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY FILTER TYPE, 2021-2028 (USD MILLION)

- TABLE 24 COALESCER FILTER: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY FILTER TYPE, 2021-2028 (USD MILLION)

- TABLE 25 CARTRIDGE FILTER: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY FILTER TYPE, 2021-2028 (USD MILLION)

- 6.2 COALESCER FILTER

- 6.2.1 HIGHLY EFFECTIVE AT SEPARATING LIQUIDS FROM LIQUIDS AND GASES

- 6.2.1.1 Liquid-liquid coalescer

- 6.2.1.1.1 Cost-effective solution for separating liquids from liquids

- 6.2.1.2 Liquid-gas coalescer

- 6.2.1.2.1 Helps enhance quality of end products

- 6.2.1.1 Liquid-liquid coalescer

- TABLE 26 COALESCER FILTER: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 27 COALESCER FILTER: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY FILTER TYPE, 2021-2028 (USD MILLION)

- TABLE 28 LIQUID-LIQUID COALESCER: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 29 LIQUID-GAS COALESCER: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 30 COALESCER FILTER: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 6.2.1 HIGHLY EFFECTIVE AT SEPARATING LIQUIDS FROM LIQUIDS AND GASES

- 6.3 CARTRIDGE FILTER

- 6.3.1 OFFERS HIGH VERSATILITY AND REQUIRES LESS MAINTENANCE

- 6.3.1.1 Pleated cartridge filter

- 6.3.1.1.1 Features high surface area

- 6.3.1.2 Depth cartridge filter

- 6.3.1.2.1 Long service life and effectiveness against different contaminants

- 6.3.1.3 High flow cartridge filter

- 6.3.1.3.1 Used in high flow processes

- 6.3.1.1 Pleated cartridge filter

- TABLE 31 CARTRIDGE FILTER: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 32 CARTRIDGE FILTER: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY FILTER TYPE, 2021-2028 (USD MILLION)

- TABLE 33 PLEATED CARTRIDGE FILTER: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 34 DEPTH CARTRIDGE FILTER: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 35 HIGH FLOW CARTRIDGE FILTER: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 36 CARTRIDGE FILTER: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 6.3.1 OFFERS HIGH VERSATILITY AND REQUIRES LESS MAINTENANCE

- 6.4 ELECTROSTATIC PRECIPITATOR

- 6.4.1 HIGHLY EFFICIENT IN REMOVING PARTICULATE MATTER AND POLLUTANTS FROM EXHAUST GASES

- TABLE 37 ELECTROSTATIC PRECIPITATOR: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 38 ELECTROSTATIC PRECIPITATOR: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 6.5 FILTER PRESS

- 6.5.1 USED TO REMOVE SOLIDS AND IMPURITIES FROM LIQUIDS IN DEWATERING, CLARIFICATION, AND SLUDGE HANDLING APPLICATIONS

- TABLE 39 FILTER PRESS: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 40 FILTER PRESS: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 6.6 BAG FILTER

- 6.6.1 EXHIBITS HIGH DIRT-HOLDING CAPACITY AND LONG SERVICE LIFE

- TABLE 41 BAG FILTER: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 42 BAG FILTER: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 6.7 OTHERS

- TABLE 43 OTHERS: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY FILTER TYPE, BY REGION, 2021-2028 (USD MILLION)

- TABLE 44 OTHERS: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

7 REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 38 REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY APPLICATION, 2022

- TABLE 45 REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 7.2 LIQUID-LIQUID SEPARATION

- 7.2.1 NEED TO PREVENT COMPONENT FAILURES ATTRIBUTED TO PRESENCE OF WATER-IN-CRUDE OIL EMULSIONS

- TABLE 46 LIQUID-LIQUID SEPARATION: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3 LIQUID-GAS SEPARATION

- 7.3.1 NEED TO ENSURE COMPONENT PROTECTION

- TABLE 47 LIQUID-GAS SEPARATION: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.4 OTHERS

- TABLE 48 OTHERS: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY APPLICATION, BY REGION, 2021-2028 (USD MILLION)

8 REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER

- 8.1 INTRODUCTION

- FIGURE 39 REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2022

- TABLE 49 REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.2 REFINERIES

- 8.2.1 RISING INVESTMENTS IN REFINERIES ATTRIBUTED TO GROWING GLOBAL DEMAND AND INCREASING CRUDE OIL PRICES

- TABLE 50 REFINERIES: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.3 PETROCHEMICAL INDUSTRY

- 8.3.1 NEED TO ENSURE COMPONENT PROTECTION

- TABLE 51 PETROCHEMICAL INDUSTRY: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

9 REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 40 ASIA PACIFIC REFINERY AND PETROCHEMICAL FILTRATION MARKET TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 41 REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY REGION, 2022 (%)

- TABLE 52 REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 53 REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY REGION, 2021-2028 (MILLION UNITS)

- 9.2 ASIA PACIFIC

- FIGURE 42 ASIA PACIFIC: SNAPSHOT OF REFINERY AND PETROCHEMICAL FILTRATION MARKET

- 9.2.1 RECESSION IMPACT: ASIA PACIFIC

- 9.2.2 BY FILTER TYPE

- TABLE 54 ASIA PACIFIC: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY FILTER TYPE, 2021-2028 (USD MILLION)

- TABLE 55 ASIA PACIFIC: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR COALESCER FILTER, BY FILTER TYPE, 2021-2028 (USD MILLION)

- TABLE 56 ASIA PACIFIC: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR CARTRIDGE FILTER, BY FILTER TYPE, 2021-2028 (USD MILLION)

- TABLE 57 ASIA PACIFIC: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR COALESCER FILTER, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 58 ASIA PACIFIC: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR CARTRIDGE FILTER, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 59 ASIA PACIFIC: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR ELECTROSTATIC PRECIPITATOR, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 60 ASIA PACIFIC: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR FILTER PRESS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 61 ASIA PACIFIC: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR BAG FILTER, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 62 ASIA PACIFIC: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR OTHERS, BY APPLICATION, 2021-2028 (USD MILLION)

- 9.2.3 BY APPLICATION

- TABLE 63 ASIA PACIFIC: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 9.2.4 BY END USER

- TABLE 64 ASIA PACIFIC: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.5 BY COUNTRY

- TABLE 65 ASIA PACIFIC: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.2.5.1 China

- 9.2.5.1.1 Rising investments in refinery and petrochemical infrastructure development

- 9.2.5.1 China

- TABLE 66 CHINA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.5.2 India

- 9.2.5.2.1 Increasing investments in refineries and petrochemical plants

- 9.2.5.2 India

- TABLE 67 INDIA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.5.3 Japan

- 9.2.5.3.1 Presence of favorable government policies

- 9.2.5.3 Japan

- TABLE 68 JAPAN: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.5.4 Australia

- 9.2.5.4.1 Government-led initiatives to enhance fuel quality

- 9.2.5.4 Australia

- TABLE 69 AUSTRALIA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.5.5 South Korea

- 9.2.5.5.1 High refining capacity

- 9.2.5.5 South Korea

- TABLE 70 SOUTH KOREA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.5.6 Rest of Asia Pacific

- TABLE 71 REST OF ASIA PACIFIC: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3 EUROPE

- FIGURE 43 EUROPE: SNAPSHOT OF REFINERY AND PETROCHEMICAL FILTRATION MARKET

- 9.3.1 RECESSION IMPACT: EUROPE

- 9.3.2 BY FILTER TYPE

- TABLE 72 EUROPE: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY FILTER TYPE, 2021-2028 (USD MILLION)

- TABLE 73 EUROPE: REFINERY AND PETROCHEMICAL FILTRATION MARKET, FOR COALESCER FILTER, BY FILTER TYPE, 2021-2028 (USD MILLION)

- TABLE 74 EUROPE: REFINERY AND PETROCHEMICAL FILTRATION MARKET, FOR CARTRIDGE FILTER, BY FILTER TYPE, 2021-2028 (USD MILLION)

- TABLE 75 EUROPE: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR COALESCER FILTER, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 76 EUROPE: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR CARTRIDGE FILTER, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 77 EUROPE: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR ELECTROSTATIC PRECIPITATOR, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 78 EUROPE: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR FILTER PRESS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 79 EUROPE: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR BAG FILTER, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 80 EUROPE: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR OTHERS, BY APPLICATION, 2021-2028 (USD MILLION)

- 9.3.3 BY APPLICATION

- TABLE 81 EUROPE: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 9.3.4 BY END USER

- TABLE 82 EUROPE: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.5 BY COUNTRY

- TABLE 83 EUROPE: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.3.5.1 Russia

- 9.3.5.1.1 High crude production to boost downstream investment

- 9.3.5.1 Russia

- TABLE 84 RUSSIA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.5.2 Germany

- 9.3.5.2.1 High energy requirement

- 9.3.5.2 Germany

- TABLE 85 GERMANY: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.5.3 UK

- 9.3.5.3.1 Favorable government policies related to industrial waste management

- 9.3.5.3 UK

- TABLE 86 UK: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.5.4 France

- 9.3.5.4.1 Technological advancements in refineries

- 9.3.5.4 France

- TABLE 87 FRANCE: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.5.5 Italy

- 9.3.5.5.1 High refining potential and presence of strict environmental regulations

- 9.3.5.5 Italy

- TABLE 88 ITALY: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.5.6 Rest of Europe

- TABLE 89 REST OF EUROPE: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4 NORTH AMERICA

- FIGURE 44 NORTH AMERICA: SNAPSHOT OF REFINERY AND PETROCHEMICAL FILTRATION MARKET

- 9.4.1 RECESSION IMPACT: NORTH AMERICA

- 9.4.2 BY FILTER TYPE

- TABLE 90 NORTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY FILTER TYPE, 2021-2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR COALESCER FILTER, BY FILTER TYPE, 2021-2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR CARTRIDGE FILTER, BY FILTER TYPE, 2021-2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR COALESCER FILTER, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR CARTRIDGE FILTER, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR ELECTROSTATIC PRECIPITATOR, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR FILTER PRESS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR BAG FILTER, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR OTHERS, BY APPLICATION, 2021-2028 (USD MILLION)

- 9.4.3 BY APPLICATION

- TABLE 99 NORTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 9.4.4 BY END USER

- TABLE 100 NORTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.5 BY COUNTRY

- TABLE 101 NORTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.4.5.1 US

- 9.4.5.1.1 Government policies and funding for development of downstream oil & gas industry

- 9.4.5.1 US

- TABLE 102 US: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.5.2 Canada

- 9.4.5.2.1 Environmental initiatives to reduce greenhouse gas emissions

- 9.4.5.2 Canada

- TABLE 103 CANADA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.5.3 Mexico

- 9.4.5.3.1 Investments in downstream infrastructure

- 9.4.5.3 Mexico

- TABLE 104 MEXICO: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5 SOUTH AMERICA

- 9.5.1 RECESSION IMPACT: SOUTH AMERICA

- 9.5.2 BY FILTER TYPE

- TABLE 105 SOUTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY FILTER TYPE, 2021-2028 (USD MILLION)

- TABLE 106 SOUTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR COALESCER FILTER, BY FILTER TYPE, 2021-2028 (USD MILLION)

- TABLE 107 SOUTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR CARTRIDGE FILTER, BY FILTER TYPE, 2021-2028 (USD MILLION)

- TABLE 108 SOUTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR COALESCER FILTER, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 109 SOUTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR CARTRIDGE FILTER, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 110 SOUTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR ELECTROSTATIC PRECIPITATOR, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 111 SOUTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR FILTER PRESS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 112 SOUTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR BAG FILTER, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 113 SOUTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR OTHERS, BY APPLICATION, 2021-2028 (USD MILLION)

- 9.5.3 BY APPLICATION

- TABLE 114 SOUTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 9.5.4 BY END USER

- TABLE 115 SOUTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.5 BY COUNTRY

- TABLE 116 SOUTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.5.5.1 Brazil

- 9.5.5.1.1 Rising investments in infrastructure development in refineries and petrochemical industry

- 9.5.5.1 Brazil

- TABLE 117 BRAZIL: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.5.2 Argentina

- 9.5.5.2.1 Increasing new infrastructure development investments

- 9.5.5.2 Argentina

- TABLE 118 ARGENTINA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.5.3 Rest of South America

- TABLE 119 REST OF SOUTH AMERICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 RECESSION IMPACT: MIDDLE EAST & AFRICA

- 9.6.2 BY FILTER TYPE

- TABLE 120 MIDDLE EAST & AFRICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY FILTER TYPE, 2021-2028 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR COALESCER FILTER, BY FILTER TYPE, 2021-2028 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR CARTRIDGE FILTER, BY FILTER TYPE, 2021-2028 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR COALESCER FILTER, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR CARTRIDGE FILTER, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR ELECTROSTATIC PRECIPITATOR, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR FILTER PRESS, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR BAG FILTER, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET FOR OTHERS, BY APPLICATION, 2021-2028 (USD MILLION)

- 9.6.3 BY APPLICATION

- TABLE 129 MIDDLE EAST & AFRICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 9.6.4 BY END USER

- TABLE 130 MIDDLE EAST & AFRICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER 2021-2028 (USD MILLION)

- 9.6.5 BY COUNTRY

- TABLE 131 MIDDLE EAST & AFRICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.6.5.1 Saudi Arabia

- 9.6.5.1.1 Rising infrastructure development investments

- 9.6.5.1 Saudi Arabia

- TABLE 132 SAUDI ARABIA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.6.5.2 UAE

- 9.6.5.2.1 Favorable government policies and partnerships with international companies to develop new technologies and solutions

- 9.6.5.2 UAE

- TABLE 133 UAE: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.6.5.3 South Africa

- 9.6.5.3.1 Government initiatives to support petrochemical industry by developing new technologies and expanding existing facilities

- 9.6.5.3 South Africa

- TABLE 134 SOUTH AFRICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.6.5.4 Rest of Middle East & Africa

- TABLE 135 REST OF MIDDLE EAST & AFRICA: REFINERY AND PETROCHEMICAL FILTRATION MARKET, BY END USER, 2021-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 KEY STRATEGIES ADOPTED BY MAJOR MARKET PLAYERS

- TABLE 136 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018-2022

- 10.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

- TABLE 137 REFINERY AND PETROCHEMICAL FILTRATION MARKET: DEGREE OF COMPETITION

- FIGURE 45 REFINERY AND PETROCHEMICAL FILTRATION MARKET SHARE ANALYSIS, 2022

- 10.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

- FIGURE 46 TOP PLAYERS IN REFINERY AND PETROCHEMICAL FILTRATION MARKET FROM 2018 TO 2022

- 10.4 COMPANY EVALUATION QUADRANT

- 10.4.1 STARS

- 10.4.2 PERVASIVE PLAYERS

- 10.4.3 EMERGING LEADERS

- 10.4.4 PARTICIPANTS

- FIGURE 47 REFINERY AND PETROCHEMICAL FILTRATION MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2022

- 10.5 STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISE (SME) EVALUATION QUADRANT, 2021

- 10.5.1 PROGRESSIVE COMPANIES

- 10.5.2 RESPONSIVE COMPANIES

- 10.5.3 DYNAMIC COMPANIES

- 10.5.4 STARTING BLOCKS

- FIGURE 48 REFINERY AND PETROCHEMICAL FILTRATION MARKET: STARTUP/SME EVALUATION QUADRANT, 2022

- 10.5.5 COMPETITIVE BENCHMARKING

- TABLE 138 REFINERY AND PETROCHEMICAL FILTRATION MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 139 REFINERY AND PETROCHEMICAL FILTRATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 140 REFINERY AND PETROCHEMICAL FILTRATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (END USER)

- 10.6 GLOBAL REFINERY AND PETROCHEMICAL FILTRATION MARKET: COMPANY FOOTPRINT

- TABLE 141 FILTER TYPE: COMPANY FOOTPRINT

- TABLE 142 END USER: COMPANY FOOTPRINT

- TABLE 143 APPLICATION: COMPANY FOOTPRINT

- TABLE 144 REGION: COMPANY FOOTPRINT

- TABLE 145 COMPANY FOOTPRINT

- 10.7 COMPETITIVE SCENARIO AND TRENDS

- TABLE 146 REFINERY AND PETROCHEMICAL FILTRATION MARKET: PRODUCT LAUNCHES, JANUARY 2019-JANUARY 2023

- TABLE 147 REFINERY AND PETROCHEMICAL FILTRATION MARKET: DEALS, JANUARY 2019-JANUARY 2023

- TABLE 148 REFINERY AND PETROCHEMICAL FILTRATION MARKET: OTHERS, JANUARY 2019-JANUARY 2023