|

|

市場調査レポート

商品コード

1274196

ステアリン酸金属塩の世界市場:タイプ別、最終用途産業別、地域別 - 2028年までの予測Metallic Stearates Market by Type, End-Use Industry, & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| ステアリン酸金属塩の世界市場:タイプ別、最終用途産業別、地域別 - 2028年までの予測 |

|

出版日: 2023年05月09日

発行: MarketsandMarkets

ページ情報: 英文 184 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のステアリン酸金属塩の市場規模は、2023年の37億米ドルから、2028年までに49億米ドルに達し、CAGRで5.4%の成長が予測されています。

5種類のステアリン酸金属塩(ステアリン酸亜鉛、ステアリン酸カルシウム、ステアリン酸マグネシウム、ステアリン酸アルミニウム、その他)があります。ステアリン酸亜鉛が最大のシェアを有するのは、ステアリン酸亜鉛が優れた離型性があり、ゴムやプラスチックの製造時に金型の固着や汚れを防止する効果が高いからです。このため、ステアリン酸亜鉛はゴム・プラスチック産業において、離型剤として広く使用されています。さらに、ステアリン酸亜鉛は潤滑性に優れているため、化粧品、医薬品、食品など様々な用途で使用されています。また、ステアリン酸亜鉛は無毒で反応性がないため、多くの用途で安全に使用することができます。

タイプ別では、ステアリン酸カルシウムが予測期間中に最も高いCAGRを占める

ステアリン酸カルシウムは、プラスチック、ゴム、紙の製造における潤滑剤および離型剤として非常に有効です。これらの材料の流動特性や離型性などの加工特性を改善し、効率の向上と最終製品の高品質化につながります。また、ステアリン酸カルシウムは無毒・無反応であるため、食品包装や医療機器など多くの用途で安全に使用することができます。さらに、ステアリン酸カルシウムは熱安定性に優れているため、PVC加工のような高温の用途に適しています。最後に、環境に優しく持続可能な製品に対する需要の高まりが、ステアリン酸カルシウム市場の成長を促進しています。メーカーが再生可能な資源からバイオベースのステアリン酸カルシウムを開発しているからです。したがって、このことも予測期間中のステアリン酸金属塩の市場を促進するのに役立ちます。

最終用途産業別では、ポリマー・ゴムセグメントが予測期間中に2番目に高いCAGRを占める

ステアリン酸金属塩は、ポリマーまたはゴムと金型の間のバリアとして機能し、金型の固着や汚れを防ぐことで、効率の向上と最終製品の高品質化につながります。ステアリン酸金属塩は、潤滑剤や離型剤として使用されるほか、ポリ塩化ビニル(PVC)製品の製造において安定剤としても使用されています。ステアリン酸金属塩は、ゴム・ポリマー製品の引張強度、伸び、耐衝撃性などの機械的特性を向上させ、耐久性や耐摩耗性を高める効果があります。ポリマー・ゴムの最終用途産業におけるステアリン酸金属塩の使用は、自動車、建設、包装産業など様々な用途の厳しい要求を満たす高性能・高品質の製品を製造するために不可欠であり、予測期間中にポリマー・ゴム産業におけるステアリン酸金属塩の需要を増大させる可能性があります。

予測期間中、アジア太平洋地域がステアリン酸金属塩市場の急成長を占めると予測される

ステアリン酸金属塩の市場が最も成長するのは、アジア太平洋地域と予想されます。この地域の市場は、中国やインドなどの国々における急速な工業化によって牽引されています。この地域の建設産業は急速に成長しており、コンクリートやその他の建設材料に添加するステアリン酸金属塩の需要を後押ししています。さらに、包装や自動車産業におけるプラスチックやゴムの需要の増加も、この地域のステアリン酸金属塩の市場を牽引しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- ポーターのファイブフォース分析

- 顧客のビジネスに影響を与える動向/混乱

- 規制機関、政府機関、その他の組織

- バリューチェーン分析

- 有力企業

- 技術分析

- 価格分析

- 特許分析

- 貿易分析

- エコシステムマップ

- 不況の影響

- 主要な会議とイベント(2023年~2024年)

第7章 ステアリン酸金属塩市場:タイプ別

- イントロダクション

- ステアリン酸亜鉛

- ステアリン酸カルシウム

- ステアリン酸マグネシウム

- ステアリン酸アルミニウム

- その他

第8章 ステアリン酸金属塩市場:形態別(定性)

- イントロダクション

- 粉末

- 顆粒

- その他

第9章 ステアリン酸金属塩市場:最終用途産業別

- イントロダクション

- ポリマー・ゴム

- 医薬品・化粧品・食品

- 建築・建設

- 塗料・コーティング

- その他

第10章 ステアリン酸金属塩市場:地域別

- イントロダクション

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他のアジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 中東・アフリカ

- サウジアラビア

- エジプト

- 南アフリカ

- その他の中東・アフリカ

第11章 競合情勢

- イントロダクション

- 市場シェア分析

- 主要企業が採用した戦略

- 市場企業上位5社の収益分析

- 企業の評価象限

- スタートアップ・中小企業の評価象限

- 競合ベンチマーキング

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- DOVER CHEMICAL CORPORATION

- BAERLOCHER GMBH

- FACI S.P.A

- PETER GREVEN GMBH & CO. KG

- VALTRIS SPECIALTY CHEMICALS

- NORAC ADDITIVES(PETER GREVEN GROUP)

- NITIKA PHARMACEUTICAL SPECIALITIES PVT. LTD.

- MALLINCKRODT PHARMACEUTICALS

- SUN ACE KAKOH(PTE.)LIMITED

- PMC BIOGENIX, INC.

- JAMES M. BROWN LTD.

- NIMBASIA STABILIZERS

- その他の企業

- MARATHWADA CHEMICAL INDUSTRIES PVT. LTD.

- LUMEGA INDUSTRIES

- SEOUL FINE CHEMICALS IND

- IRRH SPECIALTY CHEMICALS

- HALLSTAR COMPANY

- SYNERGY ADDITIVES

- SHIVKRUPA INDUSTRIES

- MITTAL DHATU RASHAYAN UDYOG LIMITED

- SNG MICRONS PRIVATE LIMITED

第13章 北米のステアリン酸市場

- イントロダクション

- 北米のステアリン酸市場の市場シェアと企業ランキング

第14章 隣接市場

- イントロダクション

- 制限事項

- バイオプラスチック・バイオポリマー市場

- バイオプラスチック・バイオポリマー市場:地域別

第15章 付録

The Metallic Stearates market size is estimated to be USD 3.7 billion in 2023, and it is projected to reach USD 4.9 billion by 2028 at a CAGR of 5.4%. Out of five types of Metallic Stearates (Zinc Stearates, Calcium Stearates, Magnesium Stearates, Aluminium Stearates, and Others). Zinc Stearates has the largest market share because zinc stearates have excellent release properties and are highly effective in preventing sticking and fouling of molds during the production of rubber and plastics. This has led to widespread use of zinc stearates as a release agent in the rubber and plastics industries. Additionally, zinc stearates have good lubricating properties, which make them useful in a range of applications, including cosmetics, pharmaceuticals, and food. Zinc stearates are also non-toxic and non-reactive, making them safe for use in many applications.

By Type, Calcium Stearates accounted for the one of the highest CAGR during the forecast period.

calcium stearates are highly effective as lubricants and release agents in the production of plastics, rubber, and paper. They improve the processing characteristics of these materials, such as flow properties and mold release, which leads to improved efficiency and higher-quality end products. Secondly, calcium stearates are non-toxic and non-reactive, making them safe for use in many applications, such as food packaging and medical devices. Additionally, calcium stearates have good thermal stability, which makes them suitable for high-temperature applications, such as PVC processing. Finally, the increasing demand for eco-friendly and sustainable products is driving the growth of the calcium stearates market, as manufacturers are developing bio-based calcium stearates from renewable sources. Hence this also helps in driving the market of Metallic Stearates during the forecast period.

By End-Use Industry, polymer & rubber segment accounted for the second-highest CAGR during the forecast period

Metallic stearates act as a barrier between the polymer or rubber and the mold, which prevents sticking and fouling of the molds, leading to improved efficiency and higher-quality end products. In addition to being used as lubricants and release agents, metallic stearates are also used as stabilizers in the production of polyvinyl chloride (PVC) products. Metallic stearates improve the mechanical properties of rubber and polymer products, such as tensile strength, elongation, and impact resistance, which makes them more durable and resistant to wear and tear. The use of metallic stearates in polymer and rubber end-use industries is essential for producing high-performance and high-quality products that meet the demanding requirements of various applications, such as automotive, construction, and packaging industries., which may rises the demand for Metallic Stearates in the polymer & rubber industry during the forecast period.

Asia Pacific is projected to account for the fastest-growing in the Metallic Stearates market during the forecast period

The fastest-growing Metallic Stearates market is expected to occur in the Asia Pacific region. The market in the region is driven by the rapid industrialization in countries like china and India. The construction industry in the region is growing rapidly, which is fueling the demand for the metallic stearates as additives in concrete and other construction materials. Furthermore the increasing demand for plastics and rubber in the packaging and automotive industries is also driving the market for metallic stearates in the region.

Pharmaceuticals & cosmetics is another key industry in the region, which is the major consumer of the metallic stearates in the region.

Further in-depth interviews were conducted with the Chief Experience Officer (CXO), Managers, Marketing Officers, Production Officers, and other related key executives from various key companies and organizations operating in the Metallic Stearates market.

By Company Type: Tier 1: 11.1%, Tier 2: 33.3% and Tier 3: 55.6%

By Designation: C-level: 20%, Director: 10%, and Others: 70%

By Region: North America: 25%, Europe: 33.3%, Asia Pacific: 25%, and Rest of the world: 16.7%.

Companies Covered: Baerlocher GmbH (Germany), Faci Spa (Italy), Peter Greven GmbH & Co. KG (Germany), Valtris Specialty Chemicals (US), Sun Ace Kakoh (Japan), Dover Chemical Corporation (US), IRRH Specialty Chemicals (US), and others.

Research Coverage

The market study covers the Metallic Stearates market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on type, end-use, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the Metallic Stearates market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall Metallic Stearates market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims at helping stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities. Moreover, the report provides insights on the following pointers:

- Analysis of key drivers (Rising demand of polymer in various end-use industries, Growth of rubber manufacturing sector)

- Product Development/Innovation: Detailed insights on current technologies, research & development activities, and new product & service launches in the Metallic Stearates market.

- Market Development: The report analyses the Metallic Stearates market across varied regions

- Market Diversification: Exhaustive information about new products & services, recent developments, and investments in the Metallic Stearates market.

- Competitive Assessment: In-depth assessment of market rankings, growth strategies, and product offerings of leading players like Baerlocher GmbH (Germany), Faci Spa (Italy), Peter Greven GmbH & Co. KG (Germany), Valtris Specialty Chemicals (US), Sun Ace Kakoh (Japan), Dover Chemical Corporation (US), IRRH Specialty Chemicals (US), among others in the Metallic Stearates market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 METALLIC STEARATES MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 LIMITATIONS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 METALLIC STEARATES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 6 METALLIC STEARATES MARKET: DATA TRIANGULATION

- 2.4 ASSUMPTIONS

- 2.4.1 LIMITATIONS

- 2.4.2 GROWTH RATE ASSUMPTIONS

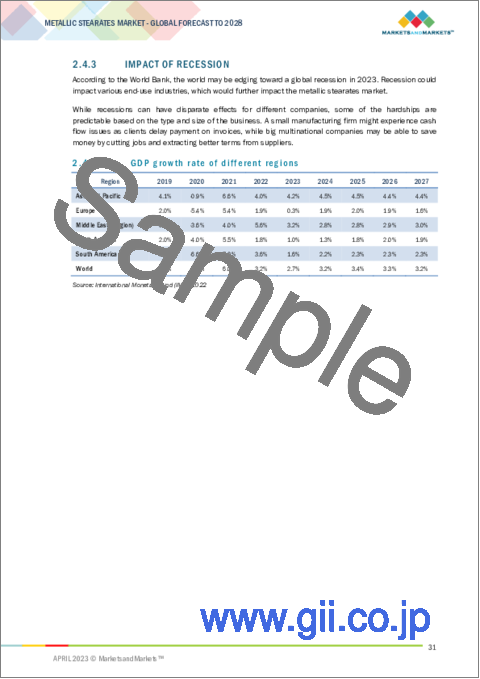

- 2.4.3 IMPACT OF RECESSION

- 2.4.3.1 GDP growth rate of different regions

3 EXECUTIVE SUMMARY

- FIGURE 7 ZINC STEARATES TO LEAD METALLIC STEARATES MARKET DURING FORECAST PERIOD

- FIGURE 8 ASIA PACIFIC LED METALLIC STEARATES MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN METALLIC STEARATES MARKET

- FIGURE 9 DEVELOPING COUNTRIES OFFER ATTRACTIVE OPPORTUNITIES IN METALLIC STEARATES MARKET

- 4.2 ASIA PACIFIC: METALLIC STEARATES MARKET, BY END-USE INDUSTRY & COUNTRY

- FIGURE 10 CHINA ACCOUNTED FOR LARGEST SHARE OF METALLIC STEARATES MARKET IN 2022

- 4.3 METALLIC STEARATES MARKET, BY TYPE

- FIGURE 11 ZINC STEARATES SEGMENT TO LEAD METALLIC STEARATES MARKET DURING FORECAST PERIOD

- 4.4 METALLIC STEARATES MARKET, BY APPLICATION

- FIGURE 12 POLYMER & RUBBER TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- 4.5 METALLIC STEARATES MARKET, BY COUNTRY

- FIGURE 13 CHINA TO RECORD HIGHEST CAGR FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN METALLIC STEARATES MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for polymers in various end-use industries

- 5.2.1.2 Growth of rubber manufacturing sector

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent environmental regulations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for PVC and other polymers in various applications

- 5.2.3.2 Adoption of sustainable measure

- 5.2.4 CHALLENGES

- 5.2.4.1 Price volatility

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 15 PORTER'S FIVE FORCES ANALYSIS: METALLIC STEARATES MARKET

- 6.1.1 BARGAINING POWER OF SUPPLIERS

- 6.1.2 THREAT OF NEW ENTRANTS

- 6.1.3 THREAT OF SUBSTITUTES

- 6.1.4 BARGAINING POWER OF BUYERS

- 6.1.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 1 METALLIC STEARATES MARKET: PORTER'S FIVE FORCE ANALYSIS

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 16 REVENUE SHIFT FOR METALLIC STEARATE MANUFACTURERS

- 6.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.4 VALUE CHAIN ANALYSIS

- FIGURE 17 PRODUCTION PROCESS CONTRIBUTES SIGNIFICANT VALUE ADDITION TO METALLIC STEARATES

- 6.5 PROMINENT COMPANIES

- 6.5.1 SMALL AND MEDIUM-SIZED ENTERPRISES

- TABLE 2 METALLIC STEARATES MARKET: STAKEHOLDERS IN VALUE CHAIN

- 6.6 TECHNOLOGY ANALYSIS

- 6.7 PRICING ANALYSIS

- FIGURE 18 AVERAGE SELLING PRICE (2022)

- 6.8 PATENT ANALYSIS

- 6.8.1 INTRODUCTION

- 6.8.2 METHODOLOGY

- 6.8.3 DOCUMENT TYPE

- FIGURE 19 GRANTED PATENTS ACCOUNT FOR 36% OF ALL PATENTS

- 6.8.4 PUBLICATION TRENDS (2013-2022)

- FIGURE 20 NUMBER OF PATENTS REGISTERED IN LAST TEN YEARS

- 6.8.5 INSIGHTS

- 6.8.6 JURISDICTION ANALYSIS

- FIGURE 21 TOP JURISDICTION, BY DOCUMENT

- 6.9 TRADE ANALYSIS

- TABLE 3 METALLIC STEARATES EXPORT DATA, 2022

- TABLE 4 METALLIC STEARATES IMPORT DATA, 2022

- 6.10 ECOSYSTEM MAP

- 6.10.1 BUYING CRITERIA

- FIGURE 22 KEY BUYING CRITERIA FOR MAJOR END-USE INDUSTRIES

- TABLE 5 KEY BUYING CRITERIA FOR MAJOR END-USE INDUSTRIES

- 6.11 IMPACT OF RECESSION

- 6.12 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 6 METALLIC STEARATES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

7 METALLIC STEARATES MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 23 MAGNESIUM STEARATES SEGMENT TO DRIVE OVERALL METALLIC STEARATES MARKET

- TABLE 7 METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 8 METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 7.2 ZINC STEARATES

- 7.2.1 ASIA PACIFIC TO BE DOMINANT MARKET FOR ZINC STEARATES

- 7.2.2 POLYMER & RUBBER

- 7.2.3 PHARMACEUTICALS & COSMETICS

- TABLE 9 ZINC STEARATES MARKET, BY REGION, 2022-2028 (KILOTON)

- TABLE 10 ZINC STEARATES MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.3 CALCIUM STEARATES

- 7.3.1 HIGH DEMAND FOR CALCIUM STEARATES IN POLYMER & RUBBER AND PHARMACEUTICALS

- 7.3.2 POLYMER & RUBBER

- 7.3.3 PHARMACEUTICALS & COSMETICS

- TABLE 11 CALCIUM STEARATES MARKET, BY REGION, 2022-2028 (KILOTON)

- TABLE 12 CALCIUM STEARATES MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.4 MAGNESIUM STEARATES

- 7.4.1 INCREASING USE OF MAGNESIUM STEARATES IN COSMETICS & PHARMACEUTICALS

- 7.4.2 POLYMER & RUBBER

- 7.4.3 PHARMACEUTICALS & COSMETICS

- TABLE 13 MAGNESIUM STEARATES MARKET, BY REGION, 2022-2028 (KILOTON)

- TABLE 14 MAGNESIUM STEARATES MARKET, BY REGION, 2022-2028 (USD MILLION)

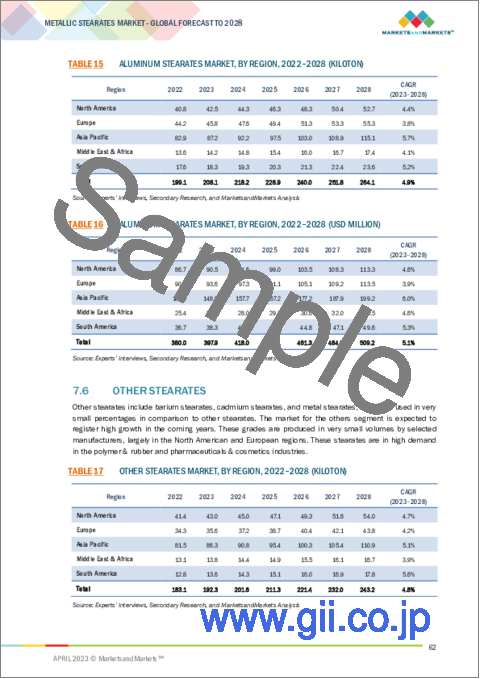

- 7.5 ALUMINUM STEARATES

- 7.5.1 POLYMER & RUBBER

- 7.5.2 PHARMACEUTICALS & COSMETICS

- 7.5.3 PAINTS & COATINGS

- TABLE 15 ALUMINUM STEARATES MARKET, BY REGION, 2022-2028 (KILOTON)

- TABLE 16 ALUMINUM STEARATES MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.6 OTHER STEARATES

- TABLE 17 OTHER STEARATES MARKET, BY REGION, 2022-2028 (KILOTON)

- TABLE 18 OTHER STEARATES MARKET, BY REGION, 2022-2028 (USD MILLION)

8 METALLIC STEARATES MARKET, BY FORM (QUALITATIVE)

- 8.1 INTRODUCTION

- 8.2 POWDER

- 8.3 GRANULES

- 8.4 OTHERS

9 METALLIC STEARATES MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 24 POLYMER & RUBBER SEGMENT TO DRIVE METALLIC STEARATES MARKET FROM 2023 TO 2028

- TABLE 19 METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 20 METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 9.2 POLYMER & RUBBER

- 9.2.1 ASIA PACIFIC TO DRIVE MARKET IN POLYMER & RUBBER SEGMENT

- 9.2.2 POLYMER

- 9.2.3 RUBBER

- TABLE 21 METALLIC STEARATES MARKET IN POLYMER & RUBBER, BY REGION, 2022-2028 (KILOTON)

- TABLE 22 METALLIC STEARATES MARKET IN POLYMER & RUBBER, BY REGION, 2022-2028 (USD MILLION)

- 9.3 PHARMACEUTICALS & COSMETICS AND FOOD

- 9.3.1 INCREASING DEMAND FOR PHARMACEUTICALS & COSMETICS AND FOOD TO FUEL MARKET GROWTH

- 9.3.2 PHARMACEUTICALS

- 9.3.3 COSMETICS

- 9.3.4 FOOD SUPPLEMENTS

- 9.3.5 FOOD

- TABLE 23 METALLIC STEARATES MARKET IN PHARMACEUTICALS & COSMETICS AND FOOD, BY REGION, 2022-2028 (KILOTON)

- TABLE 24 METALLIC STEARATES MARKET IN PHARMACEUTICALS & COSMETICS AND FOOD, BY REGION, 2022-2028 (USD MILLION)

- 9.4 BUILDING & CONSTRUCTION

- 9.4.1 ASIA PACIFIC TO DOMINATE MARKET IN BUILDING & CONSTRUCTION SEGMENT

- 9.4.2 HYDROPHOBIC AGENTS

- 9.4.3 WATERPROOFING AND EFFLORESCENCE CONTROL

- TABLE 25 METALLIC STEARATES MARKET IN BUILDING & CONSTRUCTION, BY REGION, 2022-2028 (KILOTON)

- TABLE 26 METALLIC STEARATES MARKET IN BUILDING & CONSTRUCTION, BY REGION, 2022-2028 (USD MILLION)

- 9.5 PAINTS & COATINGS

- 9.5.1 SOUTH AMERICA TO BE FASTEST-GROWING MARKET FOR METALLIC STEARATES IN PAINTS & COATINGS SEGMENT

- TABLE 27 METALLIC STEARATES MARKET IN PAINTS & COATINGS, BY REGION, 2022-2028 (KILOTON)

- TABLE 28 METALLIC STEARATES MARKET IN PAINTS & COATINGS, BY REGION, 2022-2028 (USD MILLION)

- 9.6 OTHER END-USE INDUSTRIES

- TABLE 29 METALLIC STEARATES MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2022-2028 (KILOTON)

- TABLE 30 METALLIC STEARATES MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2022-2028 (USD MILLION)

10 METALLIC STEARATES MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 25 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- TABLE 31 METALLIC STEARATES MARKET, BY REGION, 2022-2028 (KILOTON)

- TABLE 32 METALLIC STEARATES MARKET, BY REGION, 2022-2028 (USD MILLION)

- 10.2 ASIA PACIFIC

- 10.2.1 RECESSION IMPACT

- FIGURE 26 ASIA PACIFIC: METALLIC STEARATES MARKET SNAPSHOT

- TABLE 33 ASIA PACIFIC: METALLIC STEARATES MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- TABLE 34 ASIA PACIFIC: METALLIC STEARATES MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 36 ASIA PACIFIC: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 38 ASIA PACIFIC: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.2.2 CHINA

- 10.2.2.1 China to be largest producer and consumer of metallic stearates in Asia Pacific

- TABLE 39 CHINA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 40 CHINA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 41 CHINA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 42 CHINA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.2.3 JAPAN

- 10.2.3.1 Presence of strong manufacturing base to promote market growth

- TABLE 43 JAPAN: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 44 JAPAN: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 45 JAPAN: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 46 JAPAN: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.2.4 INDIA

- 10.2.4.1 Increasing number of pharmaceuticals manufacturers to drive market

- TABLE 47 INDIA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 48 INDIA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 49 INDIA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 50 INDIA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.2.5 SOUTH KOREA

- 10.2.5.1 Growth of end-use industries to fuel demand for metallic stearates

- TABLE 51 SOUTH KOREA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 52 SOUTH KOREA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 53 SOUTH KOREA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 54 SOUTH KOREA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.2.6 REST OF ASIA PACIFIC

- TABLE 55 REST OF ASIA PACIFIC: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 56 REST OF ASIA PACIFIC: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 57 REST OF ASIA PACIFIC: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 58 REST OF ASIA PACIFIC: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.3 NORTH AMERICA

- 10.3.1 RECESSION IMPACT

- TABLE 59 NORTH AMERICA: METALLIC STEARATES MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- TABLE 60 NORTH AMERICA: METALLIC STEARATES MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 62 NORTH AMERICA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 64 NORTH AMERICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.3.2 US

- 10.3.2.1 Increasing use in pharmaceutical and cosmetics sectors to boost market

- TABLE 65 US: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 66 US: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 67 US: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 68 US: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.3.3 CANADA

- 10.3.3.1 Growth in pharmaceutical and cosmetics sectors to boost market

- TABLE 69 CANADA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 70 CANADA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 71 CANADA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 72 CANADA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.3.4 MEXICO

- 10.3.4.1 Government policies to promote industrial growth to fuel demand

- TABLE 73 MEXICO: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 74 MEXICO: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 75 MEXICO: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 76 MEXICO: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.4 EUROPE

- 10.4.1 RECESSION IMPACT

- TABLE 77 EUROPE: METALLIC STEARATES MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- TABLE 78 EUROPE: METALLIC STEARATES MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 79 EUROPE: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 80 EUROPE: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 81 EUROPE: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 82 EUROPE: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.4.2 GERMANY

- 10.4.2.1 Germany to lead metallic stearates market in Europe

- TABLE 83 GERMANY: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 84 GERMANY: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 85 GERMANY: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 86 GERMANY: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.4.3 FRANCE

- 10.4.3.1 Increase in production of cosmetics to support market growth

- TABLE 87 FRANCE: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 88 FRANCE: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 89 FRANCE: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 90 FRANCE: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.4.4 ITALY

- 10.4.4.1 Calcium stearates to be largest and fastest-growing segment

- TABLE 91 ITALY: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 92 ITALY: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 93 ITALY: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 94 ITALY: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.4.5 UK

- 10.4.5.1 Pharmaceuticals & cosmetics and food industry to be fastest-growing segment

- TABLE 95 UK: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 96 UK: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 97 UK: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 98 UK: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.4.6 REST OF EUROPE

- TABLE 99 REST OF EUROPE: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 100 REST OF EUROPE: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 101 REST OF EUROPE: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 102 REST OF EUROPE: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.5 SOUTH AMERICA

- 10.5.1 RECESSION IMPACT

- TABLE 103 SOUTH AMERICA: METALLIC STEARATES MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- TABLE 104 SOUTH AMERICA: METALLIC STEARATES MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 105 SOUTH AMERICA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 106 SOUTH AMERICA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 107 SOUTH AMERICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 108 SOUTH AMERICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.5.2 BRAZIL

- 10.5.2.1 Growing end-use industries to fuel consumption of metallic stearates

- TABLE 109 BRAZIL: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 110 BRAZIL: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 111 BRAZIL: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 112 BRAZIL: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.5.3 ARGENTINA

- 10.5.3.1 Polymer & rubber industry to be major consumer of metallic stearates

- TABLE 113 ARGENTINA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 114 ARGENTINA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 115 ARGENTINA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 116 ARGENTINA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.5.4 REST OF SOUTH AMERICA

- TABLE 117 REST OF SOUTH AMERICA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 118 REST OF SOUTH AMERICA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 119 REST OF SOUTH AMERICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 120 REST OF SOUTH AMERICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 RECESSION IMPACT

- TABLE 121 MIDDLE EAST & AFRICA: METALLIC STEARATES MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- TABLE 122 MIDDLE EAST & AFRICA: METALLIC STEARATES MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 123 MIDDLES EAST & AFRICA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 124 MIDDLES EAST & AFRICA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 125 MIDDLES EAST & AFRICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 126 MIDDLES EAST & AFRICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.6.2 SAUDI ARABIA

- 10.6.2.1 Dominant market for metallic stearates in Middle East & Africa

- TABLE 127 SAUDI ARABIA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 128 SAUDI ARABIA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 129 SAUDI ARABIA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 130 SAUDI ARABIA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.6.3 EGYPT

- 10.6.3.1 Building & construction to be fastest-growing end-industry

- TABLE 131 EGYPT: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 132 EGYPT: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 133 EGYPT: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 134 EGYPT: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.6.4 SOUTH AFRICA

- 10.6.4.1 Increasing construction and manufacturing activities to drive market

- TABLE 135 SOUTH AFRICA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 136 SOUTH AFRICA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 137 SOUTH AFRICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 138 SOUTH AFRICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

- 10.6.5 REST OF MIDDLE EAST & AFRICA

- TABLE 139 REST OF MIDDLE EAST & AFRICA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 140 REST OF MIDDLE EAST & AFRICA: METALLIC STEARATES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 141 REST OF MIDDLE EAST & AFRICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (KILOTON)

- TABLE 142 REST OF MIDDLE EAST & AFRICA: METALLIC STEARATES MARKET, BY END-USE INDUSTRY, 2022-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- FIGURE 27 COMPANIES ADOPTED EXPANSION AS KEY GROWTH STRATEGY BETWEEN 2019 AND 2023

- 11.2 MARKET SHARE ANALYSIS

- FIGURE 28 RANKING OF KEY PLAYERS IN METALLIC STEARATES MARKET, 2022

- TABLE 143 METALLIC STEARATES MARKET: DEGREE OF COMPETITION

- 11.3 STRATEGIES ADOPTED BY KEY PLAYER

- 11.3.1 STRATEGIC POSITIONING OF KEY PLAYERS

- 11.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

- FIGURE 29 TOP FIVE PLAYERS DOMINATED MARKET IN LAST FIVE YEARS

- 11.5 COMPANY EVALUATION QUADRANT

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 30 COMPETITIVE LEADERSHIP MAPPING: METALLIC STEARATES MARKET, 2022

- 11.6 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 31 SME MATRIX: METALLIC STEARATES MARKET, 2022

- 11.7 COMPETITIVE BENCHMARKING

- TABLE 144 METALLIC STEARATES MARKET: DETAILED LIST OF KEY PLAYERS

- TABLE 145 METALLIC STEARATES MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 11.8 COMPETITIVE SCENARIO AND TRENDS

- 11.8.1 PRODUCT LAUNCH

- TABLE 146 PRODUCT LAUNCH, 2019-2023

- 11.8.2 DEALS

- TABLE 147 MERGER & ACQUISITION, 2019-2023

- 11.8.3 OTHER DEVELOPMENTS

- TABLE 148 OTHER DEVELOPMENTS, 2019-2023

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 12.1.1 DOVER CHEMICAL CORPORATION

- TABLE 149 DOVER CHEMICAL CORPORATION: BUSINESS OVERVIEW

- 12.1.2 BAERLOCHER GMBH

- TABLE 150 BAERLOCHER GMBH: BUSINESS OVERVIEW

- TABLE 151 BAERLOCHER GMBH: OTHERS

- 12.1.3 FACI S.P.A

- TABLE 152 FACI S.P.A: BUSINESS OVERVIEW

- 12.1.4 PETER GREVEN GMBH & CO. KG

- TABLE 153 PETER GREVEN GMBH & CO. KG.: BUSINESS OVERVIEW

- TABLE 154 PETER GREVEN GMBH & CO. KG.: DEALS

- TABLE 155 PETER GREVEN GMBH & CO. KG.: PRODUCT LAUNCH

- TABLE 156 PETER GREVEN GMBH & CO. KG.: OTHERS

- 12.1.5 VALTRIS SPECIALTY CHEMICALS

- TABLE 157 VALTRIS SPECIALTY CHEMICALS: BUSINESS OVERVIEW

- TABLE 158 VALTRIS SPECIALTY CHEMICALS: DEALS

- TABLE 159 VALTRIS SPECIALTY CHEMICALS: OTHERS

- 12.1.6 NORAC ADDITIVES (PETER GREVEN GROUP)

- TABLE 160 NORAC ADDITIVES: BUSINESS OVERVIEW

- 12.1.7 NITIKA PHARMACEUTICAL SPECIALITIES PVT. LTD.

- TABLE 161 NITIKA PHARMACEUTICALS SPECIALTIES PVT. LTD.: BUSINESS OVERVIEW

- 12.1.8 MALLINCKRODT PHARMACEUTICALS

- TABLE 162 MALLINCKRODT PHARMACEUTICALS: BUSINESS OVERVIEW

- FIGURE 32 MALLINCKRODT PHARMACEUTICALS: COMPANY SNAPSHOT

- 12.1.9 SUN ACE KAKOH (PTE.) LIMITED

- TABLE 163 SUN ACE KAKOH (PTE.) LIMITED: BUSINESS OVERVIEW

- 12.1.10 PMC BIOGENIX, INC.

- TABLE 164 PMC BIOGENIX, INC.: BUSINESS OVERVIEW

- TABLE 165 PMC BIOGENIX, INC.: OTHERS

- 12.1.11 JAMES M. BROWN LTD.

- TABLE 166 JAMES M. BROWN LTD.: BUSINESS OVERVIEW

- TABLE 167 JAMES M. BROWN LTD.: OTHERS

- 12.1.12 NIMBASIA STABILIZERS

- TABLE 168 NIMBASIA STABILIZERS: BUSINESS OVERVIEW

- 12.2 OTHER PLAYERS

- 12.2.1 MARATHWADA CHEMICAL INDUSTRIES PVT. LTD.

- TABLE 169 MARATHWADA CHEMICAL INDUSTRIES PVT. LTD.: COMPANY OVERVIEW

- 12.2.2 LUMEGA INDUSTRIES

- TABLE 170 LUMEGA INDUSTRIES: COMPANY OVERVIEW

- 12.2.3 SEOUL FINE CHEMICALS IND

- TABLE 171 SEOUL FINE CHEMICALS IND: COMPANY OVERVIEW

- 12.2.4 IRRH SPECIALTY CHEMICALS

- TABLE 172 IRRH SPECIALTY CHEMICALS: COMPANY OVERVIEW

- 12.2.5 HALLSTAR COMPANY

- TABLE 173 HALLSTAR COMPANY: COMPANY OVERVIEW

- 12.2.6 SYNERGY ADDITIVES

- TABLE 174 SYNERGY ADDITIVES: COMPANY OVERVIEW

- 12.2.7 SHIVKRUPA INDUSTRIES

- TABLE 175 SHIVKRUPA INDUSTRIES: COMPANY OVERVIEW

- 12.2.8 MITTAL DHATU RASHAYAN UDYOG LIMITED

- TABLE 176 MITTAL DHATU RASHAYAN UDYOG LIMITED: COMPANY OVERVIEW

- 12.2.9 SNG MICRONS PRIVATE LIMITED

- TABLE 177 SNG MICRONS PRIVATE LIMITED: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

13 NORTH AMERICA STEARIC ACID MARKET

- 13.1 INTRODUCTION

- TABLE 178 NORTH AMERICA: STEARIC ACID MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- TABLE 179 NORTH AMERICA: STEARIC ACID MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 180 NORTH AMERICA: STEARIC ACID MARKET, BY FEEDSTOCK, 2022-2028 (KILOTON)

- TABLE 181 NORTH AMERICA: STEARIC ACID MARKET, BY FEEDSTOCK, 2022-2028 (USD MILLION)

- TABLE 182 NORTH AMERICA: STEARIC ACID MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 183 NORTH AMERICA: STEARIC ACID MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 13.1.1 MARKET SHARE AND RANKING OF COMPANIES IN NORTH AMERICA STEARIC ACID MARKET

14 ADJACENT MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.2.1 BIOPLASTICS & BIOPOLYMERS MARKET

- FIGURE 33 BIODEGRADABLE SEGMENT TO LEAD BIOPLASTICS & BIOPOLYMERS MARKET DURING FORECAST PERIOD

- FIGURE 34 PLA TO LEAD BIODEGRADABLE PLASTICS MARKET DURING FORECAST PERIOD

- FIGURE 35 SUGARCANE/SUGAR BEET SEGMENT TO DOMINATE OVERALL MARKET DURING FORECAST PERIOD

- FIGURE 36 PACKAGING TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

- 14.2.2 BIOPLASTICS & BIOPOLYMERS MARKET, BY REGION

- TABLE 184 BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY REGION, 2018-2021 (KILOTON)

- TABLE 185 BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY REGION, 2022-2027 (KILOTON)

- TABLE 186 BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 187 BIOPLASTICS & BIOPOLYMERS MARKET SIZE, BY REGION, 2022-2027 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS