|

|

市場調査レポート

商品コード

1266814

5Gデバイス試験の世界市場:装置の種類別 (オシロスコープ、信号発生器、スペクトラムアナライザー、ネットワークアナライザー)・エンドユーザー別 (IDM・ODM、通信機器メーカー)・地域別の将来予測 (2028年まで)5G Device Testing Market by Equipment Type (Oscilloscope, Signal Generator, Spectrum Analyzers, Network Analyzers), End User (IDMs & ODMs, Telecom Equipment Manufacturers) and Region - Global Forecast 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 5Gデバイス試験の世界市場:装置の種類別 (オシロスコープ、信号発生器、スペクトラムアナライザー、ネットワークアナライザー)・エンドユーザー別 (IDM・ODM、通信機器メーカー)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年04月14日

発行: MarketsandMarkets

ページ情報: 英文 201 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の5Gデバイス試験の市場規模は、2023年の12億米ドルから、2028年までに17億米ドルに達し、予測期間中に7.0%のCAGRで成長すると予想されます。

IoTや連携デバイスの利用が増加しているため、5Gアプリケーションは一定の成長を続けています。また、巨大なデータセンターへのアクセス性が向上しているため、5G技術の展開に5G試験装置を採用することが便利です。

"スペクトラムアナライザーは予測期間中、装置の種類別では最も速い速度で成長する"

スペクトラムアナライザーは、RF信号や無線通信を利用した回路・システムの試験・設計を行うことができます。スペクトラムアナライザーは、信号のスペクトル全体とスプリアス信号、ノイズ、変調信号の幅などのその他の要因を深く掘り下げて可視化します。信号のスナップショットを提供する機器とは異なり、周波数ドメインまたは変調ドメインの両方で詳細な信号を提供し、現代のRF信号の動的および過渡的な性質をさらに詳しく説明します。この点で、スペクトラムアナライザーが重要であることが証明されています。

"通信機器メーカーが、予測期間中に最も高い市場シェアを占める"

5Gの展開において、スモールセルは大きな役割を果たし、5GネットワークのO-RAN技術と組み合わせて使用されます。その機能を成功させるためには、試験が必要です。スモールセルの試験には、フロントエンド設計の検証後の、通信モジュールとシステム設計の試験が含まれています。ビームフォーミングの特性評価、ビームフォーミングの検証、RFのキャリブレーション、アンテナ測定は、さらに重要な試験です。基地局設備の試験に特化した市場で著名なTeradyne, Inc. (米国) は、世界各国でスモールセルの試験用に採用されているIQxstream-5G FR1 Sub-6 GHzセルラー・テスターを提供しています。

"欧州地域は予測期間中に健全なCAGRで成長する"

この地域における5G技術の成長と5Gインフラの継続的な開発と展開が、この地域における5Gデバイス試験の市場を促進すると予想されます。この地域は、インダストリー4.0、IoT、コネクテッドカーを高い割合で採用している、いくつかの主要国から構成されています。これらの技術の採用は主に接続性に依存しており、5Gネットワークは欧州市場の開拓に不可欠な役割を果たすと予測されています。同地域のエンドユーザー部門全体で5Gのアプリケーションが登場していることが、欧州における5Gネットワークの展開を促進しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステムマッピング

- 顧客ビジネスに影響を与える動向

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 価格分析

- ケーススタディ分析

- 技術分析

- 特許分析

- 主な会議とイベント (2023年~2024年)

- 規制状況

- 貿易分析

- 関税分析

第6章 5Gデバイス試験市場:装置の種類別

- イントロダクション

- オシロスコープ

- スペクトラムアナライザー

- 信号発生器

- ネットワークアナライザー

- その他

第7章 5Gデバイス試験市場:エンドユーザー別

- イントロダクション

- IDM・ODM

- 通信機器メーカー

第8章 5Gデバイス試験市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- その他欧州

- アジア太平洋

- 中国

- 日本

- 韓国

- その他アジア太平洋

- その他の地域 (RoW)

- 中東・アフリカ

- 南米

第9章 競合情勢

- 概要

- 5Gデバイス試験市場:収益分析

- 市場シェア分析 (2022年)

- 主要企業の評価クアドラント (2022年)

- 競合ベンチマーキング

- 中小企業 (SME) の評価クアドラント (2022年)

- 競合シナリオと動向

第10章 企業プロファイル

- 主要企業

- ANRITSU

- KEYSIGHT TECHNOLOGIES

- ROHDE & SCHWARZ

- TERADYNE INC.

- NATIONAL INSTRUMENTS CORP.

- TEKTRONIX INC.

- VIAVI SOLUTIONS INC.

- ARTIZA NETWORKS INC.

- EMITE

- EXFO INC.

- MACOM

- SPIRENT COMMUNICATIONS

- GL COMMUNICATIONS INC.

- その他の企業

- INNOWIRELESS CO., LTD.

- PCTEL, INC.

- MARVIN TEST SOLUTIONS, INC.

- GAO TEK & GAO GROUP INC.

- NETSCOUT

- CONSULTIX WIRELESS

- VALID8.COM INC.

- SIMNOVUS

- BUREAU VERITAS

- POLARIS NETWORKS

- ADVANTEST CORPORATION

- VERKOTAN

第11章 付録

The 5G device testing market is projected to grow from USD 1.2 billion in 2023 to reach USD 1.7 billion by 2028; it is expected to grow at a CAGR of 7.0% during the forecast period. Due to rising IoT and linked device usage, 5G applications are continuing to grow at a constant rate. Also, it is convenient to employ 5G testing equipment for the deployment of 5G technology due to the increased accessibility of huge data centres.

"Spectrum analyzers is expected to grow at fastest rate by equipment type during the forecast period"

Through spectrum analyzer, testing and designing of Radio Frequency (RF) signals and wireless communications-based circuits and systems can be performed. Spectrum analyzer dives deep into visualizing the entire signal spectrum and other factors such as spurious signals, noise, modulated signal width, etc. It provides a detailed signal in both the frequency or modulation domain, which further elaborates on the dynamic and the transient nature of modern RF signals, unlike devices that provide snapshots of signals. This is where spectrum analyzers are proven to be important.

"Telecom equipment manufacturer segment is expected have highest market share during the forecast period"

In 5G deployment, small cells play a huge role, and they are used in combination with O-RAN technology for the 5G network. Testing is required for their successful functioning. Small cell testing covers testing the communication module and the system design after front-end design verification. Beamforming characterization, beamforming verification, RF calibration, and antenna measurements are additional crucial tests. Teradyne, Inc. (US), a prominent player in the market specializing in base station equipment testing, offers the globally adopted IQxstream-5G FR1 Sub-6 GHz cellular tester for small cell testing.

"Europe region to grow at healthy CAGR during the forecast period"

The growth of 5G technology in the region and ongoing developments and deployments of 5G infrastructure are expected to drive the market for 5G device testing in the region. The region comprises some key countries adopting Industry 4.0, IoT, and connected cars at a higher rate. The adoption of these technologies is mainly dependent on connectivity, and the 5G network is anticipated to play an integral role in developing the European market. The emerging application of 5G across end-user sectors in the region is driving the deployment of 5G networks in Europe.

In the process of determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key officials in the 5G device testing market. Following is the breakup of the profiles of the primary participants for the report.

- By Company Type: Tier 1 - 10%, Tier 2 - 55%, and Tier 3 - 35%

- By Designation: C-level Executives - 45%, Managers - 25%, and Others - 30%

- By Region: North America - 55%, Europe - 20%, APAC - 15%, and RoW - 10%

The report profiles key players in the global 5G device testing market with their respective market share analysis. Prominent players profiled in this report are Anritsu (Japan), Rohde & Schwarz (Germany), Keysight Technologies (US), NATIONAL INSTRUMENTS CORP. (US), TEKTRONIX, INC. (US), Teradyne, Inc. (US), VIAVI Solutions Inc. (US), Artiza Networks, Inc. (US), EMITE (Spain), EXFO (Canada), MACOM (US), Innowireless Co., Ltd. (South Korea), PCTEL, Inc. (US), GAO Tek & GAO Group Inc. (US), NETSCOUT (US), Consultix Wireless (Egypt), Valid8.com Inc. (US), SIMNOVUS (US), Verkotan (Finland), Spirent Communications (UK), and GL COMMUNICATIONS (US) among others.

Research Coverage:

The report defines, describes, and forecasts the 5G device testing market based on equipment, end user and geography. It provides detailed information regarding factors such as drivers, restraints, opportunities, and challenges influencing the growth of the 5G device testing market. It also analyzes competitive developments such as product launches, acquisitions, expansions, contracts, partnerships, and developments carried out by the key players to grow in the market.

Reasons to Buy This Report

The report will help leaders/new entrants in the 5G device testing market in the following ways:

1. The report segments the 5G device testing market comprehensively and provides the closest market size estimation for all subsegments across regions.

2. The report will help stakeholders understand the pulse of the market and provide them with information on key drivers, restraints, challenges, and opportunities in the 5G device testing market.

3. The report will help stakeholders understand their competitors better and gain insights to improve their position in the 5G device testing market. The competitive landscape section describes the competitor ecosystem.

4. Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the 5G device testing market

5. In-depth assessment of market shares, growth strategies and product offerings of leading players like Anritsu (Japan), Rohde & Schwarz (Germany), Keysight Technologies (US), NATIONAL INSTRUMENTS CORP. (US), and Teradyne, Inc. (US) among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 5G DEVICE TESTING MARKET SEGMENTATION

- FIGURE 2 REGIONAL SCOPE

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 RECESSION ANALYSIS

- FIGURE 3 GDP GROWTH PROJECTIONS TILL 2023 FOR MAJOR ECONOMIES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 4 5G DEVICE TESTING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- FIGURE 5 RESEARCH APPROACH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Breakdown of primaries

- 2.1.3.2 Key data from secondary sources

- 2.1.3.3 Primary interviews

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis (demand side)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis (supply side)

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION: RESEARCH METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 10 ASSUMPTIONS

- 2.5 ASSUMPTIONS RELATED TO RECESSION

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

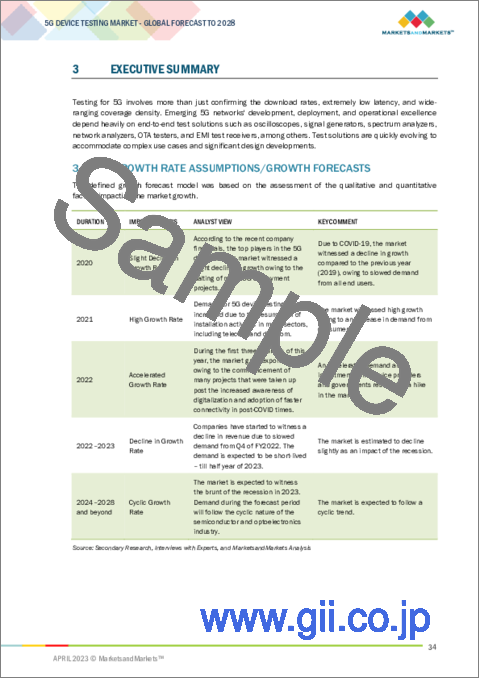

- 3.1 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

- FIGURE 11 5G DEVICE TESTING MARKET, 2019-2028 (USD MILLION)

- FIGURE 12 PROJECTIONS FOR 5G DEVICE TESTING MARKET, 2019-2028 (THOUSAND UNITS)

- FIGURE 13 TELECOM EQUIPMENT MANUFACTURERS SEGMENT HELD LARGEST SHARE OF 5G DEVICE TESTING MARKET, BY END USER, IN 2022

- FIGURE 14 SPECTRUM ANALYZERS SEGMENT TO HOLD LARGEST SHARE OF 5G DEVICE TESTING MARKET, BY EQUIPMENT TYPE, DURING FORECAST PERIOD

- FIGURE 15 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF 5G DEVICE TESTING MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN 5G DEVICE TESTING MARKET

- FIGURE 16 GROWING ADOPTION OF 5G DEVICE TESTING DUE TO HIGH INVESTMENTS

- 4.2 5G DEVICE TESTING MARKET, BY EQUIPMENT TYPE

- FIGURE 17 OSCILLOSCOPES TO HOLD SECOND-LARGEST MARKET SHARE IN 2023

- 4.3 5G DEVICE TESTING MARKET, BY END USER

- FIGURE 18 TELECOM EQUIPMENT MANUFACTURERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 5G DEVICE TESTING MARKET, BY REGION

- FIGURE 19 ASIA PACIFIC TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- 4.5 ASIA PACIFIC 5G DEVICE TESTING MARKET, BY EQUIPMENT TYPE AND COUNTRY

- FIGURE 20 SPECTRUM ANALYZERS AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC 5G DEVICE TESTING MARKET IN 2022

- 4.6 5G DEVICE TESTING MARKET, BY COUNTRY

- FIGURE 21 INDIA TO REGISTER HIGHEST CAGR IN 5G DEVICE TESTING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 5G DEVICE TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 5G DEVICE TESTING MARKET: IMPACT OF DRIVERS

- 5.2.1 DRIVERS

- 5.2.1.1 Requirement for EMI protection and EMC testing of 5G equipment

- 5.2.1.2 Increasing use cases of 5G across various sectors and compatible products

- 5.2.1.3 Increasing 5G adoption

- FIGURE 24 MOBILE 5G DATA TRAFFIC, 2018-2028 (EB PER MONTH)

- 5.2.1.4 High adoption of smartphones and mobile devices

- FIGURE 25 GLOBAL MOBILE SUBSCRIPTIONS PER 100 PEOPLE

- 5.2.2 RESTRAINTS

- FIGURE 26 5G DEVICE TESTING MARKET: IMPACT OF RESTRAINTS

- 5.2.2.1 Lack of global compliance and standardization in connectivity protocols

- 5.2.2.2 High cost of equipment and lack of skilled workforce

- 5.2.3 OPPORTUNITIES

- FIGURE 27 5G DEVICE TESTING MARKET: IMPACT OF OPPORTUNITIES

- 5.2.3.1 5G networks in IoT with emergence of cloud services

- 5.2.3.2 Rising demand for 5G network in automobiles, smart cities, and healthcare sector

- 5.2.4 CHALLENGES

- FIGURE 28 5G DEVICE TESTING MARKET: IMPACT OF CHALLENGES

- 5.2.4.1 Complexity in developing new 5G testing products

- 5.2.4.2 Long lead times for overseas qualification tests

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 29 5G DEVICE TESTING MARKET: VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM MAPPING

- FIGURE 30 5G DEVICE TESTING MARKET: ECOSYSTEM ANALYSIS

- TABLE 1 ROLE OF COMPANIES IN ECOSYSTEM

- 5.5 TRENDS IMPACTING CUSTOMER BUSINESS

- FIGURE 31 REVENUE SHIFT IN 5G DEVICE TESTING MARKET

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 5G DEVICE TESTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 5G DEVICE TESTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- 5.7.2 BUYING CRITERIA

- FIGURE 34 KEY BUYING CRITERIA, BY END USER

- TABLE 4 KEY BUYING CRITERIA, BY END USER

- 5.8 PRICING ANALYSIS

- FIGURE 35 GLOBAL AVERAGE PRICING TREND OF 5G DEVICE TESTING EQUIPMENT, 2019-2028 (USD)

- FIGURE 36 AVERAGE SELLING PRICE OF 5G DEVICE TESTING, BY EQUIPMENT TYPE

- TABLE 5 SELLING PRICE SAMPLES OF 5G DEVICE TESTING EQUIPMENT, BY COMPANY

- 5.9 CASE STUDY ANALYSIS

- TABLE 6 GERMAN FEDERAL NETWORK AGENCY ADOPTED ANRITSU'S BASE STATION SIMULATORS

- TABLE 7 NOKIA BELL LABS SELECTED KEYSIGHT TECHNOLOGIES FOR 5G USE CASE TESTING

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 COMPLEMENTARY TECHNOLOGY

- 5.10.1.1 5G FR2 testing

- 5.10.2 ADJACENT TECHNOLOGY

- 5.10.2.1 Internet of Things (IoT)

- 5.10.1 COMPLEMENTARY TECHNOLOGY

- 5.11 PATENT ANALYSIS

- FIGURE 37 5G DEVICE TESTING MARKET: PATENT ANALYSIS

- TABLE 8 PATENTS RELATED TO 5G DEVICE TESTING MARKET

- 5.12 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 9 5G DEVICE TESTING MARKET: LIST OF CONFERENCES AND EVENTS

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

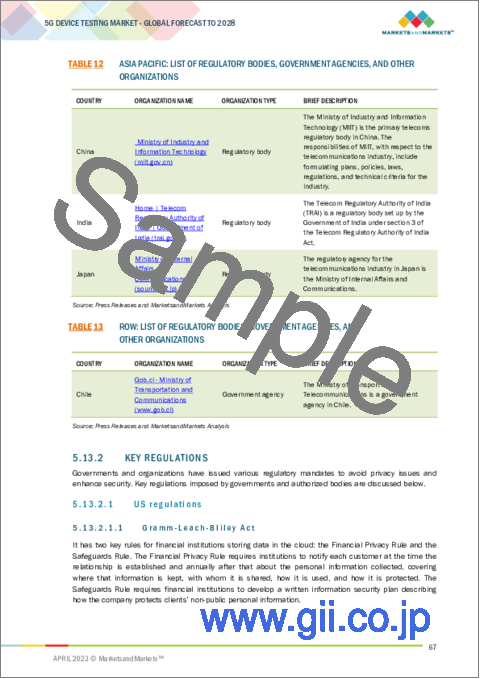

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 KEY REGULATIONS

- 5.13.2.1 US regulations

- 5.13.2.1.1 Gramm-Leach-Bliley Act

- 5.13.2.1.2 California Consumer Privacy Act

- 5.13.2.1.3 Anticybersquatting Consumer Protection Act

- 5.13.2.1.4 FTC's Fair Information Practice Principles

- 5.13.2.1.5 Export-Import regulations

- 5.13.2.2 EU regulations

- 5.13.2.2.1 General Data Protection Regulation

- 5.13.2.2.2 Restriction of Hazardous Substances (ROHS) and Waste Electrical and Electronic Equipment (WEEE)

- 5.13.2.2.3 Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH)

- 5.13.2.1 US regulations

- 5.13.3 STANDARDS

- 5.13.3.1 Distributed Management Task Force (DMTF) Standard

- 5.13.3.2 Standards in ITS/C-ITS

- TABLE 14 SECURITY AND PRIVACY STANDARDS DEVELOPED BY EUROPEAN TELECOMMUNICATION STANDARDS INSTITUTE (ETSI)

- 5.14 TRADE ANALYSIS

- TABLE 15 EXPORT DATA FOR HS CODE 903040, BY COUNTRY, 2018-2022 (USD MILLION)

- FIGURE 38 EXPORT DATA FOR HS CODE 903040, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 16 IMPORT DATA FOR HS CODE 903040, BY COUNTRY, 2018-2022 (USD MILLION)

- FIGURE 39 IMPORT DATA FOR HS CODE 903040, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.15 TARIFF ANALYSIS

- TABLE 17 MFN TARIFF IMPOSED BY US ON EXPORTS OF PRODUCTS WITH HS CODE 903040

- TABLE 18 MFN TARIFF IMPOSED BY CHINA ON EXPORTS OF PRODUCTS WITH HS CODE 903040

6 5G DEVICE TESTING MARKET, BY EQUIPMENT TYPE

- 6.1 INTRODUCTION

- FIGURE 40 5G DEVICE TESTING MARKET, BY EQUIPMENT TYPE, 2023-2028

- 6.2 OSCILLOSCOPES

- 6.2.1 DIGITAL OSCILLOSCOPES TO OFFER EASY HORIZONTAL AND VERTICAL SIGNAL ADJUSTMENTS

- 6.2.1.1 Case study: Rohde & Schwarz (Germany) and TEKTRONIX, INC. (US) extended their capabilities in 5G testing

- 6.2.1 DIGITAL OSCILLOSCOPES TO OFFER EASY HORIZONTAL AND VERTICAL SIGNAL ADJUSTMENTS

- 6.3 SPECTRUM ANALYZERS

- 6.3.1 SPECTRUM ANALYZERS EASILY CONNECT TO WIRELESS DEVICES AND ANALYZE ELECTROMAGNETIC SIGNALS

- 6.3.1.1 Case study: Anritsu extended its product offerings for 5G device testing

- 6.3.1 SPECTRUM ANALYZERS EASILY CONNECT TO WIRELESS DEVICES AND ANALYZE ELECTROMAGNETIC SIGNALS

- 6.4 SIGNAL GENERATORS

- 6.4.1 SIGNAL GENERATORS ALLOW TO OUTPUT SIGNALS WITH VARIOUS FREQUENCIES, AMPLITUDES, AND TIME DURATIONS

- 6.4.1.1 Case study: Anritsu launched test solutions supported by signal generators

- 6.4.1 SIGNAL GENERATORS ALLOW TO OUTPUT SIGNALS WITH VARIOUS FREQUENCIES, AMPLITUDES, AND TIME DURATIONS

- 6.5 NETWORK ANALYZERS

- 6.5.1 VNA IS MOST PROMINENT TYPE OF NETWORK ANALYZER

- 6.6 OTHERS

- 6.6.1 OTA TESTERS AND EMI TEST RECEIVERS ARE SOME OTHER FREQUENTLY USED EQUIPMENT

- 6.6.1.1 Case study: Keysight Technologies expanded its OTA testing product line

- TABLE 19 5G DEVICE TESTING MARKET, BY EQUIPMENT TYPE, 2019-2022 (USD MILLION)

- TABLE 20 5G DEVICE TESTING MARKET, BY EQUIPMENT TYPE, 2023-2028 (USD MILLION)

- 6.6.1 OTA TESTERS AND EMI TEST RECEIVERS ARE SOME OTHER FREQUENTLY USED EQUIPMENT

7 5G DEVICE TESTING MARKET, BY END USER

- 7.1 INTRODUCTION

- FIGURE 41 5G DEVICE TESTING MARKET, BY END USER, 2023-2028

- 7.2 IDMS & ODMS

- 7.2.1 INCREASING DEMAND AT END-OF-LINE

- 7.2.2 RISING CONSUMER ELECTRONICS DEMAND TO SUPPORT MARKET GROWTH

- 7.3 TELECOM EQUIPMENT MANUFACTURERS

- 7.3.1 INCREASING DEMAND FOR 5G USERS TO DRIVE TELECOM INFRASTRUCTURE DEPLOYMENT AND TESTING

- 7.3.2 TELECOM EQUIPMENT TESTING IS COMPETITIVE SEGMENT

- TABLE 21 5G DEVICE TESTING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 22 5G DEVICE TESTING MARKET, BY END USER, 2023-2028 (USD MILLION)

8 5G DEVICE TESTING MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 42 ASIA PACIFIC TO BE NEW HOTSPOT FOR 5G DEVICE TESTING MARKET DURING FORECAST PERIOD

- TABLE 23 5G DEVICE TESTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 24 5G DEVICE TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2 NORTH AMERICA

- FIGURE 43 NORTH AMERICA: 5G DEVICE TESTING MARKET SNAPSHOT

- 8.2.1 NORTH AMERICA: RECESSION IMPACT

- TABLE 25 NORTH AMERICA: 5G DEVICE TESTING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 26 NORTH AMERICA: 5G DEVICE TESTING MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 27 NORTH AMERICA: 5G DEVICE TESTING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 28 NORTH AMERICA: 5G DEVICE TESTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.2.2 US

- 8.2.2.1 5G-to-Next G initiative to create huge market scope for 5G testing

- TABLE 29 US: 5G DEVICE TESTING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 30 US: 5G DEVICE TESTING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.2.3 CANADA

- 8.2.3.1 Rising investments in smart city projects to fuel market

- TABLE 31 CANADA: 5G DEVICE TESTING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 32 CANADA: 5G DEVICE TESTING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.2.4 MEXICO

- 8.2.4.1 5G deployment initiatives to drive market

- TABLE 33 MEXICO: 5G DEVICE TESTING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 34 MEXICO: 5G DEVICE TESTING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.3 EUROPE

- FIGURE 44 EUROPE: 5G DEVICE TESTING MARKET SNAPSHOT

- 8.3.1 EUROPE: RECESSION IMPACT

- TABLE 35 5G ACTIVITIES IN EUROPE

- TABLE 36 EUROPE: 5G DEVICE TESTING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 37 EUROPE: 5G DEVICE TESTING MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 38 EUROPE: 5G DEVICE TESTING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 39 EUROPE: 5G DEVICE TESTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.3.2 UK

- 8.3.2.1 Increasing 5G deployment to drive device testing market

- 8.3.2.2 Case study: 5G Testbeds and Trials Programme (5GTT) by UK government

- TABLE 40 UK: 5G DEVICE TESTING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 41 UK: 5G DEVICE TESTING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.3.3 GERMANY

- 8.3.3.1 High adoption rate of 5G connectivity to drive market

- TABLE 42 GERMANY: 5G DEVICE TESTING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 43 GERMANY: 5G DEVICE TESTING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.3.4 FRANCE

- 8.3.4.1 Deployment of connected car technologies by renowned car manufacturers to drive market

- TABLE 44 FRANCE: 5G DEVICE TESTING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 45 FRANCE: 5G DEVICE TESTING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.3.5 REST OF EUROPE

- TABLE 46 REST OF EUROPE: 5G DEVICE TESTING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 47 REST OF EUROPE: 5G DEVICE TESTING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.4 ASIA PACIFIC

- FIGURE 45 ASIA PACIFIC: 5G DEVICE TESTING MARKET SNAPSHOT

- 8.4.1 ASIA PACIFIC: RECESSION IMPACT

- TABLE 48 ASIA PACIFIC: 5G DEVICE TESTING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 49 ASIA PACIFIC: 5G DEVICE TESTING MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: 5G DEVICE TESTING MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 51 ASIA PACIFIC: 5G DEVICE TESTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.4.2 CHINA

- 8.4.2.1 China is front runner in 5G network infrastructure with highest number of 5G connections

- TABLE 52 CHINA: 5G DEVICE TESTING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 53 CHINA: 5G DEVICE TESTING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.4.3 JAPAN

- 8.4.3.1 Thriving IT and telecom industries to create demand in market

- TABLE 54 JAPAN: 5G DEVICE TESTING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 55 JAPAN: 5G DEVICE TESTING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.4.4 SOUTH KOREA

- 8.4.4.1 Increasing PPP activities to launch 5G mobile networks to drive market

- TABLE 56 SOUTH KOREA: 5G DEVICE TESTING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 57 SOUTH KOREA: 5G DEVICE TESTING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.4.5 REST OF ASIA PACIFIC

- TABLE 58 REST OF ASIA PACIFIC: 5G DEVICE TESTING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 59 REST OF ASIA PACIFIC: 5G DEVICE TESTING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.5 ROW

- 8.5.1 ROW: RECESSION IMPACT

- TABLE 60 ROW: 5G DEVICE TESTING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 61 ROW: 5G DEVICE TESTING MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 62 ROW: 5G DEVICE TESTING MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 63 ROW: 5G DEVICE TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5.2 MIDDLE EAST & AFRICA

- 8.5.2.1 Adoption of 5G device testing equipment by network providers to drive market

- TABLE 64 MIDDLE EAST & AFRICA: 5G DEVICE TESTING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 65 MIDDLE EAST & AFRICA: 5G DEVICE TESTING MARKET, BY END USER, 2023-2028 (USD MILLION)

- 8.5.3 SOUTH AMERICA

- 8.5.3.1 Rising demand for 5G networks in Brazil, Mexico, Chile, and Argentina to drive 5G device testing market

- TABLE 66 SOUTH AMERICA: 5G DEVICE TESTING MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 67 SOUTH AMERICA: 5G DEVICE TESTING MARKET, BY END USER, 2023-2028 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.1.1 OVERVIEW OF KEY GROWTH STRATEGIES ADOPTED BY MAJOR COMPANIES

- TABLE 68 OVERVIEW OF KEY GROWTH STRATEGIES ADOPTED BY MAJOR COMPANIES

- 9.2 5G DEVICE TESTING MARKET: REVENUE ANALYSIS

- FIGURE 46 THREE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN 5G DEVICE TESTING MARKET

- 9.3 MARKET SHARE ANALYSIS (2022)

- FIGURE 47 MARKET SHARE ANALYSIS (2022)

- TABLE 69 5G DEVICE TESTING MARKET: MARKET SHARE ANALYSIS

- 9.4 KEY COMPANY EVALUATION QUADRANT, 2022

- 9.4.1 STARS

- 9.4.2 EMERGING LEADERS

- 9.4.3 PERVASIVE PLAYERS

- 9.4.4 PARTICIPANTS

- FIGURE 48 5G DEVICE TESTING MARKET (GLOBAL): KEY COMPANY EVALUATION QUADRANT, 2022

- 9.5 COMPETITIVE BENCHMARKING

- TABLE 70 5G DEVICE TESTING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 71 5G DEVICE TESTING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 9.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2022

- 9.6.1 PROGRESSIVE COMPANIES

- 9.6.2 RESPONSIVE COMPANIES

- 9.6.3 DYNAMIC COMPANIES

- 9.6.4 STARTING BLOCKS

- FIGURE 49 5G DEVICE TESTING MARKET (GLOBAL): SME EVALUATION QUADRANT, 2022

- TABLE 72 5G DEVICE TESTING MARKET: COMPANY FOOTPRINT

- TABLE 73 5G DEVICE TESTING MARKET: EQUIPMENT TYPE FOOTPRINT

- TABLE 74 5G DEVICE TESTING MARKET: END USER FOOTPRINT

- TABLE 75 5G DEVICE TESTING MARKET: REGION FOOTPRINT

- 9.7 COMPETITIVE SCENARIOS AND TRENDS

- 9.7.1 PRODUCT LAUNCHES

- TABLE 76 5G DEVICE TESTING MARKET: PRODUCT LAUNCHES, SEPTEMBER 2019-FEBRUARY 2023

- 9.7.2 DEALS

- TABLE 77 5G DEVICE TESTING MARKET: DEALS, FEBRUARY 2018-FEBRUARY 2023

- 9.7.3 OTHERS

- TABLE 78 5G DEVICE TESTING MARKET: OTHERS, APRIL 2022-FEBRUARY 2023

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 10.1.1 ANRITSU

- TABLE 79 ANRITSU: COMPANY OVERVIEW

- FIGURE 50 ANRITSU: COMPANY SNAPSHOT

- TABLE 80 ANRITSU: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 81 ANRITSU: PRODUCT LAUNCHES

- TABLE 82 ANRITSU: DEALS

- TABLE 83 ANRITSU: OTHERS

- 10.1.2 KEYSIGHT TECHNOLOGIES

- TABLE 84 KEYSIGHT TECHNOLOGIES: COMPANY OVERVIEW

- FIGURE 51 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 85 KEYSIGHT TECHNOLOGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 86 KEYSIGHT TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 87 KEYSIGHT TECHNOLOGIES: DEALS

- 10.1.3 ROHDE & SCHWARZ

- TABLE 88 ROHDE & SCHWARZ: COMPANY OVERVIEW

- TABLE 89 ROHDE & SCHWARZ: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 90 ROHDE & SCHWARZ: PRODUCT LAUNCHES

- TABLE 91 ROHDE & SCHWARZ: DEALS

- TABLE 92 ROHDE & SCHWARZ: OTHERS

- 10.1.4 TERADYNE INC.

- TABLE 93 TERADYNE, INC.: COMPANY OVERVIEW

- FIGURE 52 TERADYNE INC.: COMPANY SNAPSHOT

- TABLE 94 TERADYNE INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 10.1.5 NATIONAL INSTRUMENTS CORP.

- TABLE 95 NATIONAL INSTRUMENTS CORP.: COMPANY OVERVIEW

- FIGURE 53 NATIONAL INSTRUMENTS CORP.: COMPANY SNAPSHOT

- TABLE 96 NATIONAL INSTRUMENTS CORP.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 97 NATIONAL INSTRUMENTS CORP.: PRODUCT LAUNCHES

- TABLE 98 NATIONAL INSTRUMENTS CORP.: DEALS

- TABLE 99 NATIONAL INSTRUMENTS CORP.: OTHERS

- 10.1.6 TEKTRONIX INC.

- TABLE 100 TEKTRONIX, INC.: COMPANY OVERVIEW

- TABLE 101 TEKTRONIX INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 10.1.7 VIAVI SOLUTIONS INC.

- TABLE 102 VIAVI SOLUTIONS INC.: COMPANY OVERVIEW

- FIGURE 54 VIAVI SOLUTION INC.: COMPANY SNAPSHOT

- TABLE 103 VIAVI SOLUTIONS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 104 VIAVI SOLUTIONS INC.: PRODUCT LAUNCHES

- TABLE 105 VIAVI SOLUTIONS INC.: DEALS

- 10.1.8 ARTIZA NETWORKS INC.

- TABLE 106 ARTIZA NETWORKS INC.: COMPANY OVERVIEW

- TABLE 107 ARTIZA NETWORKS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 108 ARTIZA NETWORKS INC.: PRODUCT LAUNCHES

- TABLE 109 ARTIZA NETWORKS: DEALS

- 10.1.9 EMITE

- TABLE 110 EMITE: COMPANY OVERVIEW

- TABLE 111 EMITE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 112 EMITE: PRODUCT LAUNCHES

- TABLE 113 EMITE: DEALS

- 10.1.10 EXFO INC.

- TABLE 114 EXFO: COMPANY OVERVIEW

- TABLE 115 EXFO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 116 EXFO: PRODUCT LAUNCHES

- TABLE 117 EXFO: DEALS

- TABLE 118 EXFO: OTHERS

- 10.1.11 MACOM

- TABLE 119 MACOM: COMPANY OVERVIEW

- FIGURE 55 MACOM: COMPANY SNAPSHOT

- TABLE 120 MACOM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 121 MACOM: DEALS

- 10.1.12 SPIRENT COMMUNICATIONS

- TABLE 122 SPIRENT COMMUNICATIONS: COMPANY OVERVIEW

- FIGURE 56 SPIRENT COMMUNICATIONS: COMPANY SNAPSHOT

- TABLE 123 SPIRENT COMMUNICATIONS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 124 SPIRENT COMMUNICATIONS: PRODUCT LAUNCHES

- TABLE 125 SPIRENT COMMUNICATIONS: DEALS

- 10.1.13 GL COMMUNICATIONS INC.

- TABLE 126 GL COMMUNICATIONS: COMPANY OVERVIEW

- TABLE 127 GL COMMUNICATIONS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 128 GL COMMUNICATIONS: PRODUCT LAUNCHES

- 10.2 OTHER PLAYERS

- 10.2.1 INNOWIRELESS CO., LTD.

- 10.2.2 PCTEL, INC.

- 10.2.3 MARVIN TEST SOLUTIONS, INC.

- 10.2.4 GAO TEK & GAO GROUP INC.

- 10.2.5 NETSCOUT

- 10.2.6 CONSULTIX WIRELESS

- 10.2.7 VALID8.COM INC.

- 10.2.8 SIMNOVUS

- 10.2.9 BUREAU VERITAS

- 10.2.10 POLARIS NETWORKS

- 10.2.11 ADVANTEST CORPORATION

- 10.2.12 VERKOTAN

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS