|

|

市場調査レポート

商品コード

1264802

インサイトエンジンの世界市場:提供別 (ソリューション、サービス)・用途別 (検索・発見、ナレッジマネジメント、リスク・コンプライアンス管理)・技術別・展開方式別・組織規模別・業種別・地域別の将来予測 (2028年まで)Insight Engines Market by Offering (Solutions and Services), Application (Search and Discovery, Knowledge Management, and Risk and Compliance Management), Technology, Deployment Mode, Organization Size, Vertical and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| インサイトエンジンの世界市場:提供別 (ソリューション、サービス)・用途別 (検索・発見、ナレッジマネジメント、リスク・コンプライアンス管理)・技術別・展開方式別・組織規模別・業種別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年04月21日

発行: MarketsandMarkets

ページ情報: 英文 281 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

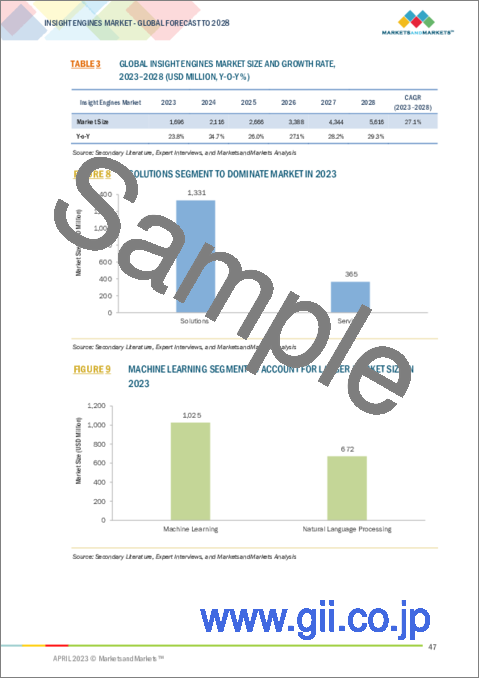

世界のインサイトエンジンの市場規模は、2023年の17億米ドルから2028年には56億米ドルに達し、予測期間中に27.1%のCAGRで成長すると予測されています。

インサイトエンジンは、自然言語処理 (NLP) を採用した認知システムと連携し、文書・ブログ・エンジニアリングレポート・市場調査・動画などのリッチメディアを含むソースからの非構造化データを解釈します。これらのデータセットから発見された考察と関連性は、機械学習技術によってさらに洗練されます。

予測期間中、大企業向けセグメントが最大の市場シェアを占める

大企業は生産性と効率性を高めるために、先端技術に多額の投資を行っています。データ量の増加に伴い、正確な情報を抽出することは、企業にとって困難な課題となっています。インサイトエンジンは、あらゆる組織に存在するデータから貴重な考察を抽出するのに役立つ、インテリジェントな検索機能を提供します。予測期間中、大企業が最大の市場シェアを占めると予測されています。

予測期間中、検索・発見のセグメントが最大の市場シェアを占める

インサイトエンジンは、セマンティック技術や機械学習技術を駆使して、プロアクティブかつオンデマンドな知識発見・探索を提供する検索技術の進化形です。幅広い情報を簡単に発見できるようにするため、社内外のデータソースや整理されたコンテンツ、非構造化コンテンツをクロール・インデックス・マイニングし、新しいインデックスを開発することがよくあります。予測期間中、検索・発見分野が最も大きなシェアを占めると予想されます。

技術の中では、機械学習のセグメントが予測期間中に最も高いCAGRで成長する

より直感的で個別化された適切なデジタル体験を提供するために、インサイトエンジンは機械学習・リッチ利用状況分析・AI搭載型の検索機能を統合しています。機械学習技術は、ユーザーの行動を分析し、データ・コンテンツ・ユーザー活動の発展や変化に合わせて自動的に学習・進歩する関連性モデルを作成するために、広く使用されています。この技術は、検索エンジンの一般的な機能を強化し、ユーザーが検索クエリに基づいて適切な結果を表示できるようにする方法と、ユーザーの検索クエリの背後にある意図を理解する方法の2つで役立ちます。予測期間中、機械学習分野は最も高いCAGRで成長すると予測されています。

予測期間中、北米が最大の市場規模を占める

予測期間中、インサイトエンジンの市場規模は北米が最も大きいと推定されます。この地域は、新しく革新的な技術の採用に対して非常にオープンであり、インサイトエンジンベンダーに市場成長の機会を提供すると期待されています。この地域には、先進技術への戦略的投資に支えられた強固なイノベーションエコシステムが存在し、市場の成長を後押ししています。様々な世界企業の存在と、様々なビジネス分野でのインサイトエンジンの応用の高まりが、この地域におけるインサイトエンジンソリューションの採用を後押ししています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界の動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- インサイトエンジン技術の略史

- インサイトエンジン市場:エコシステム

- サプライチェーン分析

- ケーススタディ分析

- 技術分析

- ポーターのファイブフォース分析

- 規制状況

- 価格モデル分析

- 特許分析

- 関税・規制状況

- インサイトエンジン市場のバイヤーに影響を与える動向/混乱

- インサイトエンジンの種類

- インサイトエンジンの利点

- 主な会議とイベント (2023年~2024年)

- インサイトエンジンの変数別の評価

- インサイトの種類別の評価

- 既存・新規のビジネスモデル

- 将来の方向性:インサイトエンジンの市場情勢

- 主な利害関係者と購入基準

- 検索の種類別の評価

第6章 インサイトエンジン市場:提供別

- イントロダクション

- ソリューション

- サービス

- コンサルティング・トレーニング

- 展開・インテグレーション

- サポート・保守

第7章 インサイトエンジン市場:用途別

- イントロダクション

- リスク・コンプライアンス管理

- 検索・発見

- 顧客管理

- ナレッジマネジメント

- その他の用途

第8章 インサイトエンジン市場:技術別

- イントロダクション

- 自然言語処理 (NLP)

- 機械学習 (ML)

第9章 インサイトエンジン市場:展開方式別

- イントロダクション

- オンプレミス

- クラウド

第10章 インサイトエンジン市場:組織規模別

- イントロダクション

- 中小企業

- 大企業

第11章 インサイトエンジン市場:業種別

- イントロダクション

- 銀行・金融サービス・保険 (BFSI)

- IT・ITES

- 小売業・eコマース

- 医療・ライフサイエンス

- 通信

- 製造業

- 政府

- その他の業種

第12章 インサイトエンジン市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- インド

- 日本

- 中国

- 韓国

- その他アジア太平洋

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- イスラエル

- その他中東・アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- その他ラテンアメリカ

第13章 競合情勢

- 概要

- 主要企業が採用した戦略

- 収益分析

- 市場シェア分析

- 製品比較

- 企業評価クアドラント

- スタートアップ/中小企業の評価クアドラント

- 競合シナリオと動向

第14章 企業プロファイル

- イントロダクション

- 主要企業

- MICROSOFT

- IBM

- ORACLE

- SAP

- OPENTEXT

- ELASTIC

- EXPERT.AI

- ALMAWAVE

- MINDBREEZE

- SQUIRRO

- SINEQUA

- COVEO

- LUCIDWORKS

- SEARCHBLOX

- ATTIVIO

- その他の主な企業

- O9 SOLUTIONS

- CELONIS

- SQUIZ

- INTRAFIND

- FLETCH

- VERITONE

- PROGRESS

- UPLAND SOFTWARE

- FORWARDLANE

- TECNOTREE

- COMINTELLI

- ACTIVEVIAM

- DUN & BRADSTREET

- PREVEDERE

- STRAVITO

- XFIND

- TURING LABS

- RAMPFY

- RAFFLE.AI

- PECAN AI

- OMNISEARCH

- FOSFOR

第15章 隣接・関連市場

- イントロダクション

- 高度分析市場:世界市場予測 (2026年まで)

- データディスカバリー市場:世界市場の予測 (2025年まで)

第16章 付録

The market for insight engines is projected to grow from USD 1.7 billion in 2023 to USD 5.6 billion by 2028, at a CAGR of 27.1% during the forecast period. The insight engine works with cognitive systems that employ NLP to interpret unstructured data from sources including documents, blogs, engineering reports, market research, and rich media such as videos. The insights and relevance discovered from these data sets are further refined by machine learning techniques.

The large enterprises' segment is projected to hold the largest market share during the forecast period

By organization size, the market is divided into large enterprises and small & medium enterprises. Large Enterprises invest heavily in advance technologies with an intent to enhance their productivity and efficiency. With the rising volume of data extracting exact information is a challenging task for businesses. The insight engines offers intelligent search that assists in extracting valuable insights from the data that is present across all organizations. During the forecast period, the large enterprises is anticipated to hold the largest market share.

The search and discovery segment is projected to hold the largest market share during the forecast period

Insight engines are an evolution of search technologies that offer proactive and on-demand knowledge discovery and exploration with the use of semantic and machine learning technologies. To make sure that a wide range of information is easily discoverable, they often develop a new index by crawling, indexing, and mining both internal and external data sources as well as organised and unstructured content. During the forecast period the search and discovery segment in anticipated to hold the largest share.

Among technologies, the machine learning segment is anticiapated to grow at a highest CAGR during the forecast period

For more intuitive, personalized, and pertinent digital experiences, insight engines integrate machine learning, rich usage analystics, and AI-powered search capabilities. Machine Learning technology is extensively use to analysis the user behaviour and creation of relevance models that automatically learn and advance as the data, content, and user activities develop and change. The technology helps in two ways: by enhancing the search engine's general capabilities, ensuring that the user sees appropriate results based on their search queries, and by understanding the intent behind the user's search queries. During the forecast period the machine learning segment is anticipated to grow at a highest CAGR.

North America to account for the largest market size during the forecast period

During the forecast period, North America is estimated to account for the largest size of the market for insight engines. The region has been extremely open toward adopting new and innovative technologies and is expected to provide market growth opportunities to insight engine vendors. The presence of a robust innovation ecosystem that is supported by strategic investments in advanced technologies across the region drives the growth of the market. The presence of various global players and rising application of insight engines across various business verticals are fueling the adoption of insight engines solution in this region.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the insight engines market.

- By Company: Tier I: 35%, Tier II: 45%, and Tier III: 20%

- By Designation: C-Level Executives: 35%, Directors: 25%, and Others: 40%

- By Region: APAC: 30%, Europe: 20%, North America: 40%, MEA: 5%, Latin America: 5%

The report includes the study of key players offering insight engines solutions and services. It profiles major vendors in the global market. The major vendors Microsoft (US), IBM (US), OpenText (Canada), SAP (Germany), Oracle (US), Elastic (US), Expert.ai (Italy), Almawave (Italy), Mindbreeze (Austria), Squirro (Switzerland), Sinequa (France), Coveo (Canada), Lucidworks (US), SearchBlox (US), Attivio (US), o9 Solutions (US), Celonis (US), Squiz (Australia), IntraFind (Germany), Fletch (US), Veritone (US), Progress (US), Upland Software (US), ForwardLane (US), Tecnotree (Finland), Comintelli (Sweden), Activeviam (US), Dun & Bradstreet (US), Prevedere (US), Stravito (Sweden), xFind (Israel), Turing Labs (US), Rampfy (Brazil), Raffle.ai (Denmark), Pecan AI (Israel), Omnisearch (Canada), and Fosfor (India).

Research Coverage

The market study covers insight engines across segments. It aims at estimating the market size and the growth potential across different segments, such as offering, application, technology, deployment mode, organization size, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market for insight engines and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (incresing use of unstructured data, growing adoption of insight engines solutions in BFSI sector, demand for enhanced and more effective strategic risk management, and growing demand for advanced search and natural access to in-depth analysis), restraints (data quality and source validation issues), opportunities (growing data volumes and sophisticated algorithms raising adoption of AI technologies for data inisghts, growing adoption of cutting edge technologies to offer predictive insights for businesses, and rising adoption of data driven decision making to enhance customer experience), and challenges (data security and privacy concerns, and lack of trained and skill personnel) influencing the growth of the insight engines market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the insight engines market

- Market Development: Comprehensive information about lucrative markets - the report analyses insight engines market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in insight engines market strategies; the report also helps stakeholders understand the pulse of the insight engines market and provides them with information on key market drivers, restraints, challenges, and opportunities.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as IBM (US), Microsoft (US), Elastic (US), and Coveo (Canada), among others in the insight engines market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.7 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 INSIGHT ENGINES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key primary interview participants

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 INSIGHT ENGINES MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF INSIGHT ENGINES MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF INSIGHT ENGINES MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF INSIGHT ENGINES MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF INSIGHT ENGINES THROUGH OVERALL SPENDING

- 2.4 MARKET FORECAST

- TABLE 1 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- TABLE 2 GLOBAL INSIGHT ENGINES MARKET SIZE AND GROWTH RATE, 2018-2022 (USD MILLION, Y-O-Y %)

- TABLE 3 GLOBAL INSIGHT ENGINES MARKET SIZE AND GROWTH RATE, 2023-2028 (USD MILLION, Y-O-Y %)

- FIGURE 8 SOLUTIONS SEGMENT TO DOMINATE MARKET IN 2023

- FIGURE 9 MACHINE LEARNING SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2023

- FIGURE 10 SEARCH AND DISCOVERY SEGMENT TO HOLD LARGEST MARKET SIZE IN 2023

- FIGURE 11 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SHARE IN 2023

- FIGURE 12 CLOUD SEGMENT TO HOLD LARGER MARKET SIZE IN 2023

- FIGURE 13 IT AND ITES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN INSIGHT ENGINES MARKET

- FIGURE 15 RISING DEMAND TO EMBRACE AI-POWERED SEARCH EXPERIENCE ACROSS BFSI AND RETAIL AND ECOMMERCE SECTORS TO DRIVE MARKET GROWTH

- 4.2 OVERVIEW OF RECESSION IN GLOBAL INSIGHT ENGINES MARKET

- FIGURE 16 INSIGHT ENGINES MARKET TO WITNESS MINOR DECLINE IN Y-O-Y GROWTH IN 2023

- 4.3 INSIGHT ENGINES MARKET: TOP THREE APPLICATIONS

- FIGURE 17 SEARCH AND DISCOVERY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.4 NORTH AMERICA: INSIGHT ENGINES MARKET, BY TECHNOLOGY AND TOP THREE VERTICALS

- FIGURE 18 MACHINE LEARNING AND IT AND ITES SEGMENTS TO HOLD LARGEST MARKET SHARES IN NORTH AMERICA IN 2023

- 4.5 INSIGHT ENGINES MARKET: BY REGION

- FIGURE 19 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: INSIGHT ENGINES MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing use of structured data

- 5.2.1.2 Growing adoption of insight engines solutions in BFSI sector

- 5.2.1.3 Demand for enhanced and more effective strategic risk management

- 5.2.1.4 Growing demand for advanced search and natural access to in-depth analysis

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data quality and source validation issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing data volumes and sophisticated algorithms raising adoption of AI technologies for data insights

- 5.2.3.2 Growing adoption of cutting-edge technologies to offer predictive insights for businesses

- 5.2.3.3 Rising adoption of data-driven decision-making to enhance customer experience

- 5.2.4 CHALLENGES

- 5.2.4.1 Data security and privacy concerns

- 5.2.4.2 Lack of trained and skilled personnel

- 5.3 BRIEF HISTORY OF INSIGHT ENGINES TECHNOLOGY

- FIGURE 21 HISTORY: INSIGHT ENGINES MARKET

- 5.4 INSIGHT ENGINES MARKET: ECOSYSTEM

- TABLE 4 INSIGHT ENGINES MARKET: ECOSYSTEM

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 22 SUPPLY CHAIN ANALYSIS: INSIGHT ENGINES MARKET

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 HEALTHCARE AND LIFE SCIENCES

- 5.6.1.1 Coveo enabled Life Extension to provide relevant and personalized experience to customers

- 5.6.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 5.6.2.1 Bank of England intended to drive innovation with Squirro Cognitive Search

- 5.6.2.2 Plexus Law selected Expert.ai to deliver better user experience with improved accuracy

- 5.6.3 RETAIL AND ECOMMERCE

- 5.6.3.1 Lucidworks enabled Goop to streamline its merchandising control over its search engine

- 5.6.4 TELECOM

- 5.6.4.1 Comintelli provided VodafoneZiggo central place where knowledge and insights can be shared easily across departments

- 5.6.5 ENERGY & UTILITY

- 5.6.5.1 Mindbreeze helped leading energy companies reduce ticket processing time and save countless hours

- 5.6.6 EDUCATION

- 5.6.6.1 Squiz enabled University of North Dakota to deliver relevant information for each query

- 5.6.1 HEALTHCARE AND LIFE SCIENCES

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 INSIGHT ENGINES AND ARTIFICIAL INTELLIGENCE

- 5.7.2 INSIGHT ENGINES AND NATURAL LANGUAGE PROCESSING

- 5.7.3 INSIGHT ENGINES AND MACHINE LEARNING

- 5.7.4 INSIGHT ENGINES AND DATA INTEGRATION

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 INSIGHT ENGINES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 INSIGHT ENGINES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

- 5.9.2 GENERAL DATA PROTECTION REGULATION

- 5.9.3 GRAMM-LEACH-BLILEY ACT

- 5.9.4 THE INTERNATIONAL ORGANIZATION FOR STANDARDIZATION STANDARD 27001

- 5.9.5 HEALTH LEVEL SEVEN INTERNATIONAL

- 5.9.6 COMMUNICATIONS DECENCY ACT

- 5.10 PRICING MODEL ANALYSIS

- 5.10.1 INDICATIVE PRICING ANALYSIS BY VARIOUS PRICING MODELS

- TABLE 6 AVERAGE SELLING PRICING ANALYSIS, 2023

- 5.11 PATENT ANALYSIS

- 5.11.1 METHODOLOGY

- 5.11.2 DOCUMENT TYPE

- TABLE 7 PATENTS FILED, 2013-2022

- 5.11.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 24 TOTAL NUMBER OF PATENTS GRANTED, 2013-2022

- 5.11.4 TOP APPLICANTS

- FIGURE 25 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST TEN YEARS, 2013-2022

- TABLE 8 TOP TWENTY PATENT OWNERS IN INSIGHT ENGINES MARKET, 2013-2022

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 TRENDS/DISRUPTIONS IMPACTING BUYERS OF INSIGHT ENGINES MARKET

- FIGURE 26 INSIGHT ENGINES MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- 5.14 TYPES OF INSIGHT ENGINES

- 5.15 BENEFITS OF INSIGHT ENGINES

- 5.16 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 14 INSIGHT ENGINES MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023-2024

- 5.17 ASSESSMENT BY INSIGHT ENGINES' VARIABLES

- 5.17.1 ARCHITECTURE

- 5.17.2 CONNECTIVITY

- 5.17.3 INTELLIGENCE

- 5.17.4 SECURITY

- 5.17.5 CONTENT PROCESSING

- 5.17.6 CUSTOMIZATION

- 5.18 ASSESSMENT BY INSIGHT TYPE

- 5.18.1 DESCRIPTIVE

- 5.18.2 PREDICTIVE

- 5.18.3 PRESCRIPTIVE

- 5.19 CURRENT & EMERGING BUSINESS MODELS

- 5.20 FUTURE DIRECTION INSIGHT ENGINES MARKET LANDSCAPE

- 5.21 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.21.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- 5.21.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 16 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.22 ASSESSMENT BY SEARCH TYPE

- 5.22.1 INTERNAL SEARCH

- 5.22.2 EXTERNAL SEARCH

6 INSIGHT ENGINES MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: INSIGHT ENGINES MARKET DRIVERS

- FIGURE 29 SOLUTIONS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 17 INSIGHT ENGINES MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 18 INSIGHT ENGINES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 SOLUTIONS

- 6.2.1 ENHANCED BUSINESS OPERATIONS AND OPERATIONAL EFFECTIVENESS TO DRIVE DEMAND FOR SOLUTIONS

- TABLE 19 SOLUTIONS: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 20 SOLUTIONS: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SERVICES

- FIGURE 30 SUPPORT AND MAINTENANCE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 21 SERVICES: INSIGHT ENGINES MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 22 SERVICES: INSIGHT ENGINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 23 SERVICES: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 24 SERVICES: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1 CONSULTING AND TRAINING

- 6.3.1.1 Growing need from organizations to comply with various labor laws and regulations to drive demand

- TABLE 25 CONSULTING AND TRAINING: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 26 CONSULTING AND TRAINING: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 DEPLOYMENT AND INTEGRATION

- 6.3.2.1 Lack of integral requirements to implement insight engines and need for proficient solutions to drive demand

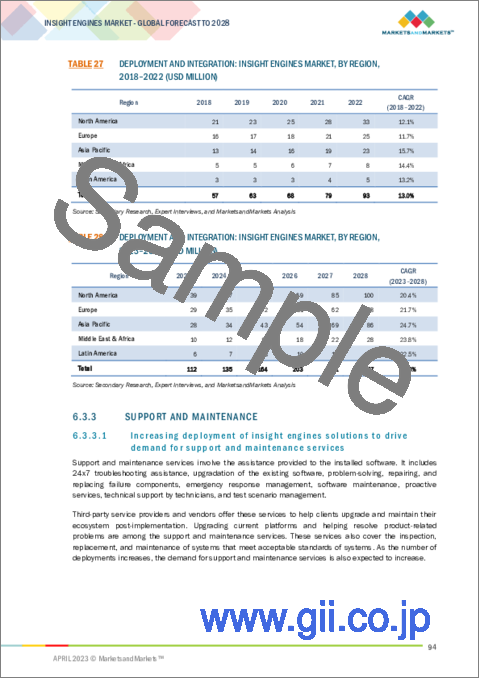

- TABLE 27 DEPLOYMENT AND INTEGRATION: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 28 DEPLOYMENT AND INTEGRATION: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.3 SUPPORT AND MAINTENANCE

- 6.3.3.1 Increasing deployment of insight engines solutions to drive demand for support and maintenance services

- TABLE 29 SUPPORT AND MAINTENANCE: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 30 SUPPORT AND MAINTENANCE: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

7 INSIGHT ENGINES MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.1.1 APPLICATION: INSIGHT ENGINES MARKET DRIVERS

- FIGURE 31 SEARCH AND DISCOVERY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 31 INSIGHT ENGINES MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 32 INSIGHT ENGINES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 7.2 RISK AND COMPLIANCE MANAGEMENT

- 7.2.1 NEED TO ENHANCE BUSINESS PERFORMANCE, MANAGE RISKS, AND MEET REGULATORY COMPLIANCE CHALLENGES TO DRIVE DEMAND

- TABLE 33 RISK AND COMPLIANCE MANAGEMENT: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 34 RISK AND COMPLIANCE MANAGEMENT: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 SEARCH AND DISCOVERY

- 7.3.1 RISING NEED FOR ADVANCED SEARCH AND ACCESS TO IN-DEPTH INSIGHTS TO DRIVE DEMAND FOR INSIGHT ENGINE SOLUTIONS

- TABLE 35 SEARCH AND DISCOVERY: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 36 SEARCH AND DISCOVERY: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 CUSTOMER MANAGEMENT

- 7.4.1 INCREASED NEED FOR UNDERSTANDING CUSTOMER BEHAVIOR AND SMART CUSTOMER SUPPORT TO DRIVE DEMAND

- TABLE 37 CUSTOMER MANAGEMENT: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 38 CUSTOMER MANAGEMENT: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 KNOWLEDGE MANAGEMENT

- 7.5.1 RISING NEED TO GAIN INSIGHTS TO MAKE SMART AND INFORMED DECISIONS TO BOOST MARKET

- TABLE 39 KNOWLEDGE MANAGEMENT: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 40 KNOWLEDGE MANAGEMENT: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 OTHER APPLICATIONS

- TABLE 41 OTHER APPLICATIONS: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 42 OTHER APPLICATIONS: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

8 INSIGHT ENGINES MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 TECHNOLOGY: INSIGHT ENGINES MARKET DRIVERS

- FIGURE 32 MACHINE LEARNING SEGMENT TO HOLD HIGHER GROWTH RATE DURING FORECAST PERIOD

- TABLE 43 INSIGHT ENGINES MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 44 INSIGHT ENGINES MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 8.3 NATURAL LANGUAGE PROCESSING

- 8.3.1 NEED TO COMPREHEND HUMAN VOICES AND EVALUATE LANGUAGES AND DATA SETS TO DRIVE DEMAND

- TABLE 45 NATURAL LANGUAGE PROCESSING: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 46 NATURAL LANGUAGE PROCESSING: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.1.1 Semantic analysis

- 8.3.1.2 Syntactic analysis

- 8.4 MACHINE LEARNING

- 8.4.1 RISING NEED TO ANALYZE USER BEHAVIOR AND IDENTIFY RELEVANCE IN SEARCH RESULTS TO DRIVE DEMAND

- TABLE 47 MACHINE LEARNING: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 48 MACHINE LEARNING: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4.1.1 Graph database

- 8.4.1.2 Collaborative filtering

- 8.4.1.3 Clustering

9 INSIGHT ENGINES MARKET, BY DEPLOYMENT MODE

- 9.1 INTRODUCTION

- 9.1.1 DEPLOYMENT MODE: INSIGHT ENGINES MARKET DRIVERS

- FIGURE 33 CLOUD DEPLOYMENT MODE TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- TABLE 49 INSIGHT ENGINES MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 50 INSIGHT ENGINES MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- 9.2 ON-PREMISES

- 9.2.1 RELIABILITY FOR HIGH-LEVEL CONTROL AND SECURITY, DATA PROTECTION, AND ANALYSIS IMPROVEMENT TO BOOST DEMAND

- TABLE 51 ON-PREMISES: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 52 ON-PREMISES: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 CLOUD

- 9.3.1 LOW DEPLOYMENT COST AND EASY UPGRADABILITY AND ACCESSIBILITY TO DRIVE DEMAND

- TABLE 53 CLOUD: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 54 CLOUD: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

10 INSIGHT ENGINES MARKET, BY ORGANIZATION SIZE

- 10.1 INTRODUCTION

- 10.1.1 ORGANIZATION SIZE: INSIGHT ENGINES MARKET DRIVERS

- FIGURE 34 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- TABLE 55 INSIGHT ENGINES MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 56 INSIGHT ENGINES MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 10.2.1 INTENSE COMPETITION TO IMPROVE STRATEGIC BUSINESS DECISIONS TO DRIVE DEMAND FOR INSIGHT ENGINES SOLUTIONS

- TABLE 57 SMALL AND MEDIUM-SIZED ENTERPRISES: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 58 SMALL AND MEDIUM-SIZED ENTERPRISES: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 LARGE ENTERPRISES

- 10.3.1 INTELLIGENT SEARCH FOR EXTRACTING VALUABLE INSIGHTS TO DRIVE DEMAND FOR INSIGHT ENGINES SOLUTIONS

- TABLE 59 LARGE ENTERPRISES: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 60 LARGE ENTERPRISES: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

11 INSIGHT ENGINES MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- 11.1.1 VERTICAL: INSIGHT ENGINES MARKET DRIVERS

- FIGURE 35 IT AND ITES VERTICAL TO GROW AT HIGHEST GROWTH RATE DURING FORECAST PERIOD

- TABLE 61 INSIGHT ENGINES MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 62 INSIGHT ENGINES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 11.2.1 NEED TO OPTIMIZE FINANCIAL DATA REPORTING, RISK ASSESSMENTS, AND FRAUD DETECTION TO DRIVE MARKET

- TABLE 63 BANKING, FINANCIAL SERVICES, AND INSURANCE: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 64 BANKING, FINANCIAL SERVICES, AND INSURANCE: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 IT AND ITES

- 11.3.1 REQUIREMENTS TO IMPROVE EFFICIENCY, FACILITATE INNOVATION, AND MAINTAIN REGULATORY COMPLIANCE TO DRIVE MARKET

- TABLE 65 IT AND ITES: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 66 IT AND ITES: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.4 RETAIL AND ECOMMERCE

- 11.4.1 NEED TO UNDERSTAND TARGET MARKETS, DETECT FRAUD AND THEFT, AND ENHANCE CUSTOMER EXPERIENCE TO BOOST MARKET

- TABLE 67 RETAIL AND ECOMMERCE: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 68 RETAIL AND ECOMMERCE: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.5 HEALTHCARE AND LIFE SCIENCES

- 11.5.1 RISING FOCUS ON IMPROVING PATIENT MANAGEMENT AND EXPERIENCE TO DRIVE DEMAND FOR INSIGHT ENGINE SOLUTIONS

- TABLE 69 HEALTHCARE AND LIFE SCIENCES: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 70 HEALTHCARE AND LIFE SCIENCES: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.6 TELECOM

- 11.6.1 NEED TO AUTOMATE NETWORK OPERATIONS AND MAXIMIZE NETWORK PROFITABILITY TO PROPEL MARKET

- TABLE 71 TELECOM: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 72 TELECOM: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.7 MANUFACTURING

- 11.7.1 ABILITY TO PREDICT GLOBAL SUPPLY CHAIN COSTS AND CONSUMER DEMAND TO DRIVE MARKET

- TABLE 73 MANUFACTURING: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 74 MANUFACTURING: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.8 GOVERNMENT

- 11.8.1 REQUIREMENT FOR UNDERSTANDING CONSTITUENT NEEDS AND IMPROVING CUSTOMER SERVICE TO BOOST MARKET

- TABLE 75 GOVERNMENT: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 76 GOVERNMENT: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.9 OTHER VERTICALS

- TABLE 77 OTHER VERTICALS: INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 78 OTHER VERTICALS: INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

12 INSIGHT ENGINES MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 36 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 79 INSIGHT ENGINES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 80 INSIGHT ENGINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: INSIGHT ENGINES MARKET DRIVERS

- 12.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 81 NORTH AMERICA: INSIGHT ENGINES MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: INSIGHT ENGINES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: INSIGHT ENGINES MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: INSIGHT ENGINES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: INSIGHT ENGINES MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: INSIGHT ENGINES MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: INSIGHT ENGINES MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: INSIGHT ENGINES MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: INSIGHT ENGINES MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: INSIGHT ENGINES MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: INSIGHT ENGINES MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: INSIGHT ENGINES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: INSIGHT ENGINES MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: INSIGHT ENGINES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: INSIGHT ENGINES MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: INSIGHT ENGINES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.2.3 US

- 12.2.3.1 Need for fast access to documents and data to drive demand for insight engines solutions and services

- 12.2.4 CANADA

- 12.2.4.1 Strong startup ecosystem and focus of businesses on data-driven decision-making to drive market

- 12.3 EUROPE

- 12.3.1 EUROPE: INSIGHT ENGINES MARKET DRIVERS

- 12.3.2 EUROPE: RECESSION IMPACT

- TABLE 97 EUROPE: INSIGHT ENGINES MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 98 EUROPE: INSIGHT ENGINES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 99 EUROPE: INSIGHT ENGINES MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 100 EUROPE: INSIGHT ENGINES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 101 EUROPE: INSIGHT ENGINES MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 102 EUROPE: INSIGHT ENGINES MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 103 EUROPE: INSIGHT ENGINES MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 104 EUROPE: INSIGHT ENGINES MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 105 EUROPE: INSIGHT ENGINES MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 106 EUROPE: INSIGHT ENGINES MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 107 EUROPE: INSIGHT ENGINES MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 108 EUROPE: INSIGHT ENGINES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 109 EUROPE: INSIGHT ENGINES MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 110 EUROPE: INSIGHT ENGINES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 111 EUROPE: INSIGHT ENGINES MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 112 EUROPE: INSIGHT ENGINES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.3.3 UK

- 12.3.3.1 Continued transition toward online services due to relative ease and speedy growth to boost market

- 12.3.4 GERMANY

- 12.3.4.1 Rapid adoption of cutting-edge solutions for maintaining competitive business environment to propel market

- 12.3.5 FRANCE

- 12.3.5.1 Significant potential for Al and increasing funding to drive adoption of insight engines solutions

- 12.3.6 ITALY

- 12.3.6.1 Growing adoption of insight engine solutions in healthcare and life sciences to boost market

- 12.3.7 SPAIN

- 12.3.7.1 Need for growing volume of data from various sources and more personalized experience to drive market

- 12.3.8 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: INSIGHT ENGINES MARKET DRIVERS

- 12.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 113 ASIA PACIFIC: INSIGHT ENGINES MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: INSIGHT ENGINES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: INSIGHT ENGINES MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: INSIGHT ENGINES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: INSIGHT ENGINES MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: INSIGHT ENGINES MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: INSIGHT ENGINES MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 120 ASIA PACIFIC: INSIGHT ENGINES MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: INSIGHT ENGINES MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 122 ASIA PACIFIC: INSIGHT ENGINES MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 123 ASIA PACIFIC: INSIGHT ENGINES MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 124 ASIA PACIFIC: INSIGHT ENGINES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 125 ASIA PACIFIC: INSIGHT ENGINES MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 126 ASIA PACIFIC: INSIGHT ENGINES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: INSIGHT ENGINES MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 128 ASIA PACIFIC: INSIGHT ENGINES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.4.3 INDIA

- 12.4.3.1 Growing adoption of technologies and expanding economy to drive demand for insight engines solutions

- 12.4.4 JAPAN

- 12.4.4.1 Ability to generate insights from large volumes of data through various sources to drive market growth

- 12.4.5 CHINA

- 12.4.5.1 Government's efforts for R&D activities and investments from foreign enterprises to drive market

- 12.4.6 SOUTH KOREA

- 12.4.6.1 Government initiatives to facilitate digital economy to drive market

- 12.4.7 REST OF ASIA PACIFIC

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 MIDDLE EAST & AFRICA: INSIGHT ENGINES MARKET DRIVERS

- 12.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 129 MIDDLE EAST & AFRICA: INSIGHT ENGINES MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: INSIGHT ENGINES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: INSIGHT ENGINES MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: INSIGHT ENGINES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: INSIGHT ENGINES MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: INSIGHT ENGINES MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: INSIGHT ENGINES MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: INSIGHT ENGINES MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: INSIGHT ENGINES MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: INSIGHT ENGINES MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: INSIGHT ENGINES MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: INSIGHT ENGINES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: INSIGHT ENGINES MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: INSIGHT ENGINES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: INSIGHT ENGINES MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: INSIGHT ENGINES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.5.3 SAUDI ARABIA

- 12.5.3.1 Government initiatives to build country's digital capabilities and infrastructure to drive demand for insight engines solutions

- 12.5.4 UAE

- 12.5.4.1 Ability to embrace cutting-edge technologies to drive adoption of insight engines solutions

- 12.5.5 SOUTH AFRICA

- 12.5.5.1 Extraction of insights for identifying patterns from massive data sets to drive adoption of insight engines solutions

- 12.5.6 ISRAEL

- 12.5.6.1 Ability to create valuable customer experience to drive demand for insight engines solutions

- 12.5.7 REST OF MIDDLE EAST & AFRICA

- 12.6 LATIN AMERICA

- 12.6.1 LATIN AMERICA: INSIGHT ENGINES MARKET DRIVERS

- 12.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 145 LATIN AMERICA: INSIGHT ENGINES MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 146 LATIN AMERICA: INSIGHT ENGINES MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 147 LATIN AMERICA: INSIGHT ENGINES MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 148 LATIN AMERICA: INSIGHT ENGINES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 149 LATIN AMERICA: INSIGHT ENGINES MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 150 LATIN AMERICA: INSIGHT ENGINES MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 151 LATIN AMERICA: INSIGHT ENGINES MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 152 LATIN AMERICA: INSIGHT ENGINES MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 153 LATIN AMERICA: INSIGHT ENGINES MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 154 LATIN AMERICA: INSIGHT ENGINES MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 155 LATIN AMERICA: INSIGHT ENGINES MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 156 LATIN AMERICA: INSIGHT ENGINES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 157 LATIN AMERICA: INSIGHT ENGINES MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 158 LATIN AMERICA: INSIGHT ENGINES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 159 LATIN AMERICA: INSIGHT ENGINES MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 160 LATIN AMERICA: INSIGHT ENGINES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.6.3 BRAZIL

- 12.6.3.1 Investments by startups in cutting-edge technologies to fuel demand for insight engines solutions

- 12.6.4 MEXICO

- 12.6.4.1 Rising support for implementing high-performance insight engines and analytics technologies to drive market

- 12.6.5 ARGENTINA

- 12.6.5.1 Increasing application of insight engines solutions in various industry verticals to spur market growth

- 12.6.6 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 161 OVERVIEW OF STRATEGIES ADOPTED BY KEY INSIGHT ENGINES VENDORS

- 13.3 REVENUE ANALYSIS

- 13.3.1 HISTORICAL REVENUE ANALYSIS

- FIGURE 40 HISTORICAL REVENUE ANALYSIS OF TOP PLAYERS, 2020-2022 (USD MILLION)

- 13.4 MARKET SHARE ANALYSIS

- FIGURE 41 MARKET SHARE ANALYSIS FOR KEY COMPANIES, 2022

- TABLE 162 INSIGHT ENGINES MARKET: DEGREE OF COMPETITION

- 13.5 PRODUCT COMPARISON

- TABLE 163 COMPARATIVE ANALYSIS OF INSIGHT ENGINES PRODUCTS

- 13.5.1 SAP ANALYTICS CLOUD

- 13.5.2 ELASTICSEARCH

- 13.5.3 LUCIDWORKS FUSION

- 13.5.4 SQUIRRO INSIGHT ENGINES

- 13.5.5 MINDBREEZE INSPIRE

- 13.6 COMPANY EVALUATION QUADRANT

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- FIGURE 42 KEY INSIGHT ENGINES MARKET PLAYERS, COMPANY EVALUATION QUADRANT, 2022

- 13.6.5 COMPETITIVE BENCHMARKING

- TABLE 164 INSIGHT ENGINES MARKET: PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS, 2022

- 13.7 STARTUP/SME EVALUATION QUADRANT

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- FIGURE 43 STARTUPS/SMES INSIGHT ENGINES PLAYERS, COMPANY EVALUATION QUADRANT, 2022

- 13.7.5 STARTUPS/SMES COMPETITIVE BENCHMARKING

- TABLE 165 INSIGHT ENGINES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 166 INSIGHT ENGINES MARKET: PRODUCT FOOTPRINT ANALYSIS OF STARTUPS/ SMES PLAYERS, 2023

- 13.8 COMPETITIVE SCENARIO AND TRENDS

- 13.8.1 PRODUCT LAUNCHES

- TABLE 167 SERVICE/PRODUCT LAUNCHES, 2020-2023

- 13.8.2 DEALS

- TABLE 168 DEALS, 2020-2023

14 COMPANY PROFILES

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 14.1 INTRODUCTION

- 14.2 MAJOR PLAYERS

- 14.2.1 MICROSOFT

- TABLE 169 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 44 MICROSOFT: COMPANY SNAPSHOT

- TABLE 170 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 172 MICROSOFT: DEALS

- 14.2.2 IBM

- TABLE 173 IBM: BUSINESS OVERVIEW

- FIGURE 45 IBM: COMPANY SNAPSHOT

- TABLE 174 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 176 IBM: DEALS

- 14.2.3 ORACLE

- TABLE 177 ORACLE: BUSINESS OVERVIEW

- FIGURE 46 ORACLE: COMPANY SNAPSHOT

- TABLE 178 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.4 SAP

- TABLE 179 SAP: BUSINESS OVERVIEW

- FIGURE 47 SAP: COMPANY SNAPSHOT

- TABLE 180 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 182 SAP: DEALS

- 14.2.5 OPENTEXT

- TABLE 183 OPENTEXT: BUSINESS OVERVIEW

- FIGURE 48 OPENTEXT: COMPANY SNAPSHOT

- TABLE 184 OPENTEXT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 OPENTEXT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 186 OPENTEXT: DEALS

- 14.2.6 ELASTIC

- TABLE 187 ELASTIC: BUSINESS OVERVIEW

- FIGURE 49 ELASTIC: COMPANY SNAPSHOT

- TABLE 188 ELASTIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 ELASTIC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 190 ELASTIC: DEALS

- 14.2.7 EXPERT.AI

- TABLE 191 EXPERT.AI: BUSINESS OVERVIEW

- FIGURE 50 EXPERT.AI: COMPANY SNAPSHOT

- TABLE 192 EXPERT.AI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 EXPERT.AI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 194 EXPERT.AI: DEALS

- 14.2.8 ALMAWAVE

- TABLE 195 ALMAWAVE: BUSINESS OVERVIEW

- FIGURE 51 ALMAWAVE: COMPANY SNAPSHOT

- TABLE 196 ALMAWAVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 ALMAWAVE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 198 ALMAWAVE: DEALS

- 14.2.9 MINDBREEZE

- TABLE 199 MINDBREEZE: BUSINESS OVERVIEW

- TABLE 200 MINDBREEZE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 MINDBREEZE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 202 MINDBREEZE: DEALS

- 14.2.10 SQUIRRO

- TABLE 203 SQUIRRO: BUSINESS OVERVIEW

- TABLE 204 SQUIRRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 SQUIRRO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 206 SQUIRRO: DEALS

- 14.2.11 SINEQUA

- TABLE 207 SINEQUA: BUSINESS OVERVIEW

- TABLE 208 SINEQUA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 SINEQUA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 210 SINEQUA: DEALS

- 14.2.12 COVEO

- TABLE 211 COVEO: BUSINESS OVERVIEW

- FIGURE 52 COVEO: COMPANY SNAPSHOT

- TABLE 212 COVEO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 COVEO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 214 COVEO: DEALS

- 14.2.13 LUCIDWORKS

- TABLE 215 LUCIDWORKS: BUSINESS OVERVIEW

- TABLE 216 LUCIDWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 LUCIDWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 218 LUCIDWORKS: DEALS

- 14.2.14 SEARCHBLOX

- TABLE 219 SEARCHBLOX: BUSINESS OVERVIEW

- TABLE 220 SEARCHBLOX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 SEARCHBLOX: PRODUCT LAUNCHES AND ENHANCEMENTS

- 14.2.15 ATTIVIO

- TABLE 222 ATTIVIO: BUSINESS OVERVIEW

- TABLE 223 ATTIVIO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 ATTIVIO: DEALS

- 14.3 OTHER KEY PLAYERS

- 14.3.1 O9 SOLUTIONS

- 14.3.2 CELONIS

- 14.3.3 SQUIZ

- 14.3.4 INTRAFIND

- 14.3.5 FLETCH

- 14.3.6 VERITONE

- 14.3.7 PROGRESS

- 14.3.8 UPLAND SOFTWARE

- 14.3.9 FORWARDLANE

- 14.3.10 TECNOTREE

- 14.3.11 COMINTELLI

- 14.3.12 ACTIVEVIAM

- 14.3.13 DUN & BRADSTREET

- 14.3.14 PREVEDERE

- 14.3.15 STRAVITO

- 14.3.16 XFIND

- 14.3.17 TURING LABS

- 14.3.18 RAMPFY

- 14.3.19 RAFFLE.AI

- 14.3.20 PECAN AI

- 14.3.21 OMNISEARCH

- 14.3.22 FOSFOR

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 ADVANCED ANALYTICS MARKET - GLOBAL FORECAST TO 2026

- 15.2.1 MARKET DEFINITION

- 15.2.2 MARKET OVERVIEW

- 15.2.3 ADVANCED ANALYTICS MARKET, BY COMPONENT

- TABLE 225 ADVANCED ANALYTICS MARKET, BY COMPONENT, 2016-2020 (USD MILLION)

- TABLE 226 ADVANCED ANALYTICS MARKET, BY COMPONENT, 2021-2026 (USD MILLION)

- 15.2.4 ADVANCED ANALYTICS MARKET, BY BUSINESS FUNCTION

- TABLE 227 ADVANCED ANALYTICS MARKET, BY BUSINESS FUNCTION, 2016-2020 (USD MILLION)

- TABLE 228 ADVANCED ANALYTICS MARKET, BY BUSINESS FUNCTION, 2021-2026 (USD MILLION)

- 15.2.5 ADVANCED ANALYTICS MARKET, BY TYPE

- TABLE 229 ADVANCED ANALYTICS MARKET, BY TYPE, 2016-2020 (USD MILLION)

- TABLE 230 ADVANCED ANALYTICS MARKET, BY TYPE, 2021-2026 (USD MILLION)

- 15.2.6 ADVANCED ANALYTICS MARKET, BY DEPLOYMENT MODE

- TABLE 231 ADVANCED ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016-2020 (USD MILLION)

- TABLE 232 ADVANCED ANALYTICS MARKET, BY DEPLOYMENT MODE, 2021-2026 (USD MILLION)

- 15.2.7 ADVANCED ANALYTICS MARKET, BY ORGANIZATION SIZE

- TABLE 233 ADVANCED ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 234 ADVANCED ANALYTICS MARKET, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- 15.2.8 ADVANCED ANALYTICS MARKET, BY VERTICAL

- TABLE 235 ADVANCED ANALYTICS MARKET, BY VERTICAL, 2016-2020 (USD MILLION)

- TABLE 236 ADVANCED ANALYTICS MARKET, BY VERTICAL, 2021-2026 (USD MILLION)

- 15.2.9 ADVANCED ANALYTICS MARKET, BY REGION

- TABLE 237 ADVANCED ANALYTICS MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 238 ADVANCED ANALYTICS MARKET, BY REGION, 2021-2026 (USD MILLION)

- 15.3 DATA DISCOVERY MARKET - GLOBAL FORECAST TO 2025

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.3.3 DATA DISCOVERY MARKET, BY COMPONENT

- TABLE 239 DATA DISCOVERY MARKET, BY COMPONENT, 2014-2019 (USD MILLION)

- TABLE 240 DATA DISCOVERY MARKET, BY COMPONENT, 2019-2025 (USD MILLION)

- TABLE 241 DATA DISCOVERY MARKET, BY SERVICE, 2014-2019 (USD MILLION)

- TABLE 242 DATA DISCOVERY MARKET, BY SERVICE, 2019-2025 (USD MILLION)

- TABLE 243 PROFESSIONAL SERVICES: DATA DISCOVERY MARKET, BY TYPE, 2014-2019 (USD MILLION)

- TABLE 244 PROFESSIONAL SERVICES: DATA DISCOVERY MARKET, BY TYPE, 2019-2025 (USD MILLION)

- 15.3.4 DATA DISCOVERY MARKET, BY ORGANIZATION SIZE

- TABLE 245 DATA DISCOVERY MARKET, BY ORGANIZATION SIZE, 2014-2019 (USD MILLION)

- TABLE 246 DATA DISCOVERY MARKET, BY ORGANIZATION SIZE, 2019-2025 (USD MILLION)

- 15.3.5 DATA DISCOVERY MARKET, BY DEPLOYMENT MODE

- TABLE 247 DATA DISCOVERY MARKET, BY DEPLOYMENT MODE, 2014-2019 (USD MILLION)

- TABLE 248 DATA DISCOVERY MARKET, BY DEPLOYMENT MODE, 2019-2025 (USD MILLION)

- TABLE 249 CLOUD: DATA DISCOVERY MARKET, BY TYPE, 2014-2019 (USD MILLION)

- TABLE 250 CLOUD: DATA DISCOVERY MARKET, BY TYPE, 2019-2025 (USD MILLION)

- 15.3.6 DATA DISCOVERY MARKET, BY FUNCTIONALITY

- TABLE 251 DATA DISCOVERY MARKET, BY FUNCTIONALITY, 2014-2019 (USD MILLION)

- TABLE 252 DATA DISCOVERY MARKET, BY FUNCTIONALITY, 2019-2025 (USD MILLION)

- 15.3.7 DATA DISCOVERY MARKET, BY APPLICATION

- TABLE 253 DATA DISCOVERY MARKET, BY APPLICATION, 2014-2019 (USD MILLION)

- TABLE 254 DATA DISCOVERY MARKET, BY APPLICATION, 2019-2025 (USD MILLION)

- 15.3.8 DATA DISCOVERY MARKET, BY VERTICAL

- TABLE 255 DATA DISCOVERY MARKET, BY VERTICAL, 2014-2019 (USD MILLION)

- TABLE 256 DATA DISCOVERY MARKET, BY VERTICAL, 2019-2025 (USD MILLION)

- 15.3.9 DATA DISCOVERY MARKET, BY REGION

- TABLE 257 DATA DISCOVERY MARKET, BY REGION, 2014-2019 (USD MILLION)

- TABLE 258 DATA DISCOVERY MARKET, BY REGION, 2019-2025 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS