|

|

市場調査レポート

商品コード

1463247

産業用車両の世界市場:車両タイプ別、駆動タイプ別、用途別、能力別、自律性レベル別、タイプ別、地域別 - 2030年までの予測Industrial Vehicles Market by Vehicle Type (Forklifts, Aisle Trucks, Tow Tractors, Container Handlers), Drive Type (ICE, Battery-operated, Gas-powered), Application, Capacity, Level of Autonomy, & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 産業用車両の世界市場:車両タイプ別、駆動タイプ別、用途別、能力別、自律性レベル別、タイプ別、地域別 - 2030年までの予測 |

|

出版日: 2024年04月10日

発行: MarketsandMarkets

ページ情報: 英文 354 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の産業用車両の市場規模は、2024年の492億米ドルから2030年には643億米ドルに成長し、CAGRは4.6%と予測されています。

サプライチェーン業務の複雑化と自動化技術の採用により、産業用車両市場は世界的に拡大しています。このシフトにより、AGVや自律型フォークリフトなどの高度な産業用車両が効率を高めるために必要となっています。さらに、IoT統合やAI駆動型分析などのスマート倉庫技術の統合は、リアルタイムの在庫追跡や最適化されたルート計画を可能にすることで、市場の成長をさらに加速させます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 車両タイプ別、駆動タイプ別、用途別、能力別、自律性レベル別、タイプ別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米、その他の地域 |

内燃機関機関車はその効率性で有名であり、多くの産業で好まれています。頻繁な充電を必要とする電気自動車とは異なり、内燃機関車は長時間運転が可能です。さらに、重い荷物の持ち上げや運搬に優れており、倉庫や工場、配送センターでの積み下ろし作業の効率を高めています。高い出力、素早い加速、優れた最高速度は、輸送やマテリアルハンドリング作業における有効性をさらに高めています。初期コストの低さ、運転速度の速さ、燃料補給の容易さ、ヘビーデューティー用途への適合性といった要因が、内燃機関産業車の需要を促進すると予想されます。予測期間中、内燃機関フォークリフトの大幅な収益成長が見込まれるが、これは主に産業用車両メーカーが提供する強固な製品ポートフォリオに起因します。

金属・重機械産業の世界的成長は、インフラ開発、建設活動、自動車生産の増加によって推進されています。大型で重い部品や組立部品の反復的な取り扱いと輸送がこの産業の特徴です。このような重量のある金属板や機械を手作業で取り扱うことは、作業員の負傷や製品への潜在的な損傷のリスクをもたらします。このような懸念に対処するため、工場のオペレーターは、製造および倉庫施設内での重機のスムーズな移動を確保し、作業効率を高める傾向にあります。産業用車両は、このような大きな製品を扱う上で非常に重要であり、重量物の安全かつ効率的な物流内移動を保証します。重い積載量を持つ産業用車両を利用することで、施設の所有者は、大きな部品やコンポーネントを、より高いスピード、正確さ、効率で持ち上げ、取り扱うことができ、それによって労働者の怪我や潜在的な損害を防ぐことができます。これらの産業用車両は、あらかじめ決められたルートに沿ってパレット化された荷物を移動させることに長けています。

当レポートでは、世界の産業用車両市場について調査し、車両タイプ別、駆動タイプ別、用途別、能力別、自律性レベル別、タイプ別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 価格分析

- 電動フォークリフトと氷上フォークリフトの総所有コストの比較

- 氷上フォークリフトと電動フォークリフトの部品表の比較

- エコシステム分析

- バリューチェーン分析

- ケーススタディ

- 投資と資金調達のシナリオ

- 特許分析

- 技術分析

- 主要企業が提供する産業車両

- 貿易分析

- 規制状況

- 主な会議とイベント

- 主な利害関係者と購入基準

- 顧客ビジネスに影響を与える動向と混乱

第6章 産業用車両市場(車両タイプ別・容量別)

- イントロダクション

- フォークリフト

- トラック

- 牽引トラクター

- コンテナハンドラー

- 自動誘導車両

- 人員輸送車

- 主な洞察

第7章 産業用車両市場(駆動タイプ別)

- イントロダクション

- 氷上産業用車両

- バッテリー駆動型産業用車両

- ガソリン駆動産業用車両

- 主な洞察

第8章 産業用車両市場(用途別)

- イントロダクション

- 製造

- 倉庫保管

- 貨物輸送と物流

- その他

- 主な洞察

第9章 産業用車両市場(自律性レベル別)

- イントロダクション

- 非自律型/半自律型

- 自律型

- 主な洞察

第10章 高所作業車市場(タイプ別)

- イントロダクション

- ブームリフト

- シザーリフト

- 主な洞察

第11章 産業用車両市場(地域別)

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- その他の地域

第12章 競合情勢

- イントロダクション

- 市場シェア分析、2022年

- 収益分析、2018年~2022年

- 企業価値評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 高所作業車市場における企業評価マトリックス

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業(産業用車両)

- TOYOTA INDUSTRIES CORPORATION

- KION GROUP AG

- MITSUBISHI LOGISNEXT CO., LTD.

- JUNGHEINRICH AG

- CROWN EQUIPMENT CORPORATION

- HYSTER-YALE MATERIALS HANDLING, INC.

- HANGCHA GROUP CO., LTD.

- CLARK

- ANHUI HELI CO., LTD.

- KONECRANES

- EP EQUIPMENT

- その他の企業(産業用車両)

- KOMATSU LTD.

- DOOSAN INDUSTRIAL VEHICLE

- MANITOU GROUP

- CARGOTEC CORPORATION

- ACTION CONSTRUCTION EQUIPMENT LTD.

- HYUNDAI CONSTRUCTION EQUIPMENT INDIA PVT. LTD.

- V. MARIOTTI SRL

- COMBILIFT

- DAIFUKU

- JBT

- LONKING MACHINERY CO., LTD.

- HUBTEX MASCHINENBAU GMBH & CO. KG

- GODREJ & BOYCE MFG. CO. LTD.

- SVETRUCK AB

- STOCKLIN LOGISTIK AG

- O.M.G. SRL

- PALETRANS FORKLIFTS

- GENKINGER GMBH

- FLEXI TRUCKS

- AGILOX SERVICES GMBH

- 主要参入企業(リフトプラットフォーム)

- JLG INDUSTRIES, INC.

- TADANO LTD.

- TEREX CORPORATION

- LINAMAR CORPORATION

- MAGNI TELESCOPIC HANDLERS SRL

- その他の企業(リフトプラットフォーム)

- HAULOTTE GROUP

- AICHI CORPORATION

- PALFINGER AG

- IMER INTERNATIONAL S.P.A.

- SINOBOOM INTELLIGENT EQUIPMENT CO., LTD.

- ALTEC INDUSTRIES

- J C BAMFORD EXCAVATORS LTD.

- NOBLELIFT INTELLIGENT EQUIPMENT CO., LTD.

- BRONTO SKYLIFT

- SNORKEL

- DINOLIFT OY

第14章 市場への提言

第15章 付録

The global industrial vehicles market size is projected to grow from USD 49.2 Billion in 2024 to USD 64.3 Billion by 2030, at a CAGR of 4.6%. The industrial vehicles market is expanding globally due to the growing complexity of supply chain operations and the adoption of automation technologies. This shift necessitates advanced industrial vehicles such as AGVs and autonomous forklifts to enhance efficiency. Additionally, the integration of smart warehousing technologies, such as IoT integration and AI-driven analytics, further accelerates market growth by enabling real-time inventory tracking and optimized route planning.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | Vehicle Type, Drive Type, Application, Capacity, Level of Autonomy, & Region |

| Regions covered | Asia Pacific, Europe, North America, and Rest of the World |

"The Internal Combustion Engine Industrial vehicles segment is expected to grow substantially during the forecast period."

ICE-operated industrial vehicles are renowned for their efficiency, making them a preferred choice across numerous industries. Unlike electric counterparts that require frequent recharging, ICE vehicles can operate for extended periods. Moreover, they excel in lifting and transporting heavy loads, enhancing the efficiency of loading and unloading tasks in warehouses, factories, and distribution centers. Their high-power output, swift acceleration, and superior top speeds further contribute to their effectiveness in transportation and material handling operations. Factors such as lower initial costs, high operational speeds, ease of refueling, and suitability for heavy-duty applications are anticipated to propel the demand for ICE industrial vehicles. Substantial revenue growth is expected for ICE forklifts over the forecast period, primarily attributed to the robust product portfolios offered by industrial vehicle manufacturers. Companies such as Toyota Industries Corporation (Japan), Jungheinrich AG (Germany), KION Group AG (Germany), Hyster-Yale Materials Handling, Inc. (US), Crown Equipment Corporation (US), and Mitsubishi Logisnext Co., Ltd. (Japan) provide ICE forklifts to end-users. Toyota's IC counterbalance lift truck "8FG/D Series". Cat DP20- 35N3 compact diesel-powered forklifts, and Cat DP60-100N3 diesel forklifts are some of the models of ICE forklifts. In May 2021, Mitsubishi Logisnext Co., Ltd. launched new heavy-duty ICE forklift trucks with a 22,000 - 40,000 lbs capacity. These attributes are anticipated to propel the growth of the ICE segment within the global industrial vehicles market over the forecast period.

"Metals & Heavy Machinery application segment to have notable opportunities during the forecast period."

The global growth of the metals and heavy machinery industry is propelled by increased infrastructural development, construction activities, and automotive production. The repetitive handling and transportation of large and heavy components or assembly parts characterizes this industry. Manual handling of such weighty metal sheets and machinery poses risks of worker injuries and potential damage to products. To address these concerns, plant operators are inclined to enhance operational efficiency, ensuring the smooth movement of heavy equipment within manufacturing and warehousing facilities. Industrial vehicles are crucial in handling these substantial products, ensuring the safe and efficient intralogistic movement of heavy loads. Utilizing industrial vehicles with heavy payload capacity enables facility owners to lift and handle large parts and components with heightened speed, accuracy, and efficiency, thereby preventing injuries to the workforce and potential damages. These industrial vehicles are adept at moving palletized loads along predetermined routes.

The anticipated growth in production capacity within the metals and heavy machinery industry is poised to drive the industrial vehicles market during the forecast period. Companies such as Cargotec Corporation (Finland), Hubtex Maschinenbau GmbH & Co. KG (Germany), Linamar Corporation (Canada), Mitsubishi Logisnext Co., Ltd. (Japan), Crown Equipment Corporation (US), Hangcha Group Co., Ltd. (China), Anhui Heli Co., Ltd. (China), Hyundai Construction Equipment India Pvt. Ltd. (India), and Svetruck AB (Sweden) offer a range of industrial vehicles tailored for the metal and heavy machinery industry.

"China poised for considerable growth in the Asia Pacific industrial vehicles market."

China is expected to be the largest market in terms of value and volume in the Asia Pacific industrial vehicles market during the forecast period. The industrial vehicles market is anticipated to experience significant growth in China due to government incentives for industrial infrastructure development, positioning China as the fastest-growing market for material handling equipment. Additionally, major manufacturers are expanding their product portfolio in the country to capitalize on its burgeoning industrial sector. For instance, in May 2023, Hangcha Group Co., Ltd. released the XE series of electric forklifts. These forklifts will have a load-carrying capacity of 1.5-3.8 tons. The availability of a diverse range of electric forklift models from leading manufacturers is expected to fuel the growth of the industrial vehicles market, catering to the evolving needs of industries across China.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in the industrial vehicles market. The break-up of the primaries is as follows:

- By Company Type: OEMs - 75%, Tier 1 -10% and Others - 15%,

- By Designation: CXO's - 50%, Managers - 30%, and Executives - 20%

- By Region: North America - 40%, Europe - 25%, Asia Pacific - 30%, and Rest of the World - 5%

The industrial vehicles market comprises major manufacturers such as Toyota Industries Corporation (Japan), KION Group AG (Germany), Mitsubishi Logisnext Co., Ltd. (Japan), Jungheinrich AG (Germany), Crown Equipment Corporation (US), and Hyster-Yale Materials Handling, Inc. (US), etc.

Research Coverage:

The study covers the industrial vehicles market across various segments. It aims to estimate the market size and future growth potential across different segments such as vehicle type & capacity, drive type, application, level of autonomy, aerial work platform market by type, and region. The study also includes an in-depth competitive analysis of key market players, their company profiles, key observations related to product and business offerings, recent developments, and acquisitions.

This research report categorizes the industrial vehicles market by Vehicle Type & Capacity (Forklifts (<5ton, 5-10 ton, 11-36 ton, >36 ton), Aisle trucks (<1ton, 1-2 ton, >2 ton), Tow tractors (<5ton, 5-10 ton, 11-30 ton, >30 ton), Container handlers (<30ton, 30-40 ton, >40 ton), Automated Guided Vehicles, and Personnel Carriers), Drive Type (Internal Combustion Engine Industrial Vehicles, Battery-operated Industrial Vehicles, and Gas-powered Industrial Vehicles), Application (Manufacturing (Chemical, Food & Beverages, Mining, Automotive, Metals & Heavy Machinery, and Others), Warehousing, Freight & Logistics, and Others), Level of Autonomy (Non/Semi-autonomous and Autonomous), Aerial Work Platforms market based on type (Scissor Lifts (Scissor Lifts by Drive Type), Boom Lifts (Articulating AWP, Telescopic AWP), and Boom Lifts by Drive Type) and Region (Asia Pacific, Europe, North America, and Rest of the World).

The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the industrial vehicles market. A detailed analysis of the key industry players provides insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers and acquisitions; and recent developments associated with the industrial vehicles market. This report covers a competitive analysis of SMEs/startups in the industrial vehicles market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall industrial vehicles market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (E-commerce expansion and warehousing dynamics, Impact of warehouse automation and industry 4.0, Role of JIT inventory management in industrial logistics, Growing infrastructure developments, Industrial vehicles as catalysts for enhancing workplace safety), restraints (Financial implications of automation in forklifts & AGVs, High maintenance and repair costs for industrial vehicles), opportunities (Emergence of rental and leasing in industrial vehicles sector, Rise of battery-powered industrial vehicles, Emerging applications in non-traditional industries, Technological advancements in autonomous industrial vehicles), and challenges (Workplace safety concerns and government regulations, Cost-competitive workforce in emerging markets) influencing the growth of the industrial vehicles market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the industrial vehicles market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the industrial vehicles market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the industrial vehicles market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Toyota Industries Corporation (Japan), KION Group AG (Germany), Mitsubishi Logisnext Co., Ltd. (Japan), Jungheinrich AG (Germany), Crown Equipment Corporation (US), and Hyster-Yale Materials Handling, Inc. (US) among others in the industrial vehicles market.

- Strategies: The report also helps stakeholders understand the pulse of the industrial vehicles market and provides them with information on key market drivers, restraints, challenges, and opportunities

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 INDUSTRIAL VEHICLES MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 2 INDUSTRIAL VEHICLES MARKET DEFINITION, BY DRIVE TYPE

- TABLE 3 AERIAL WORK PLATFORM MARKET DEFINITION, BY TYPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 4 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 INDUSTRIAL VEHICLES MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 5 CURRENCY EXCHANGE RATES

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources for industrial vehicles

- 2.1.1.2 Secondary sources for lifting platforms

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.1.2.1 Primary participants

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 6 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 MARKET ESTIMATION NOTES

- FIGURE 9 RESEARCH DESIGN AND METHODOLOGY (DEMAND-SIDE)

- FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP (SUPPLY-SIDE) - COLLECTIVE MARKET SHARE OF MAJOR PLAYERS

- 2.3 RECESSION IMPACT ANALYSIS

- 2.4 DATA TRIANGULATION

- FIGURE 11 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- FIGURE 12 FACTORS IMPACTING INDUSTRIAL VEHICLES MARKET

- 2.5.1 REGIONAL ECONOMY IMPACT ANALYSIS

- FIGURE 13 DEMAND- AND SUPPLY-SIDE FACTOR ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 14 INDUSTRIAL VEHICLES MARKET OVERVIEW

- FIGURE 15 INDUSTRIAL VEHICLES MARKET, BY REGION, 2024-2030

- FIGURE 16 INDUSTRIAL VEHICLES MARKET, BY DRIVE TYPE, 2024-2030

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL VEHICLES MARKET

- FIGURE 17 RISING EMPHASIS ON OPTIMIZING LOGISTICS AND WAREHOUSING TO DRIVE MARKET

- 4.2 INDUSTRIAL VEHICLES MARKET, BY REGION

- FIGURE 18 ASIA PACIFIC TO BE LARGEST MARKET FOR INDUSTRIAL VEHICLES DURING FORECAST PERIOD

- 4.3 INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE

- FIGURE 19 AISLE TRUCKS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- 4.4 INDUSTRIAL VEHICLES MARKET, BY DRIVE TYPE

- FIGURE 20 BATTERY-OPERATED SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.5 INDUSTRIAL VEHICLES MARKET, BY APPLICATION

- FIGURE 21 WAREHOUSING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.6 AERIAL WORK PLATFORM MARKET, BY TYPE

- FIGURE 22 BOOM LIFTS SEGMENT TO SECURE LEADING MARKET POSITION DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 23 INDUSTRIAL VEHICLES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 E-commerce expansion and warehousing dynamics

- FIGURE 24 US: QUARTERLY E-COMMERCE RETAIL SALES, 2022-2023

- FIGURE 25 TOP 10 WAREHOUSING SOLUTION PROVIDERS IN US, BASED ON LAND AREA, 2023

- 5.2.1.2 Impact of warehouse automation and Industry 4.0

- FIGURE 26 KEY TECHNOLOGIES OF WAREHOUSE AUTOMATION

- FIGURE 27 AGV AND AMR CHARACTERISTICS IN WAREHOUSE OPERATIONS

- 5.2.1.3 Role of JIT inventory management in industrial logistics

- FIGURE 28 BENEFITS OF JIT LOGISTICS

- 5.2.1.4 Growing infrastructure developments

- 5.2.1.5 Industrial vehicles as catalysts for enhancing workplace safety

- 5.2.2 RESTRAINTS

- 5.2.2.1 Financial implications of automation in forklifts and AGVs

- TABLE 6 AVERAGE SELLING PRICE OF MANUALLY-OPERATED MATERIAL LIFTS AND AUTONOMOUS FORKLIFTS

- TABLE 7 AVERAGE SELLING PRICE OF FORKLIFTS VS. AGVS

- 5.2.2.2 High maintenance and repair costs of industrial vehicles

- TABLE 8 FORKLIFT MAINTENANCE CHECKLISTS RECOMMENDED BY OSHA

- TABLE 9 AVERAGE COST OF IC FORKLIFT REPLACEMENT AND REPAIRS

- FIGURE 29 AVERAGE FORKLIFT PART COSTS PER SERVICE INTERVAL

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of rental and leasing in industrial vehicles sector

- TABLE 10 AVERAGE COST OF FORKLIFT RENTALS IN US

- 5.2.3.2 Rise of battery-powered industrial vehicles

- TABLE 11 OEMS AND THEIR KEY ELECTRIC INDUSTRIAL VEHICLE MODELS

- 5.2.3.3 Emerging applications in non-traditional industries

- 5.2.3.4 Technological advancements in autonomous industrial vehicles

- FIGURE 30 VARIOUS SENSORS USED IN ADVANCED FORKLIFTS

- 5.2.4 CHALLENGES

- 5.2.4.1 Workplace safety concerns and government regulations

- FIGURE 31 FORKLIFT FATALITIES, BY INDUSTRY

- FIGURE 32 FORKLIFT ACCIDENT STATISTICS

- FIGURE 33 EMISSION TIER SLABS FOR OFF-ROAD MOBILE MACHINERY AND FORKLIFTS

- 5.2.4.2 Cost-competitive workforce in emerging markets

- TABLE 12 IMPACT ANALYSIS OF MARKET DYNAMICS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE TRENDS, BY VEHICLE TYPE, 2021-2023

- TABLE 13 AVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY VEHICLE TYPE, 2021-2023 (USD)

- FIGURE 34 AVERAGE SELLING PRICE TRENDS, BY VEHICLE TYPE, 2021-2023 (USD)

- 5.3.2 AVERAGE SELLING PRICE TRENDS, BY REGION, 2023

- TABLE 14 AVERAGE SELLING PRICE TRENDS, BY REGION, 2023 (USD)

- FIGURE 35 AVERAGE SELLING PRICE TRENDS, BY REGION, 2023 (USD)

- 5.4 TOTAL COST OF OWNERSHIP COMPARISON OF ELECTRIC AND ICE FORKLIFTS

- TABLE 15 PRICES OF EV AND ICE FORKLIFT MODELS IN US (2023)

- FIGURE 36 5-YEAR TOTAL COST OF OWNERSHIP BREAKDOWN

- 5.5 BILL OF MATERIALS COMPARISON OF ICE AND ELECTRIC FORKLIFTS

- 5.6 ECOSYSTEM ANALYSIS

- FIGURE 37 INDUSTRIAL VEHICLES MARKET: ECOSYSTEM ANALYSIS

- TABLE 16 INDUSTRIAL VEHICLES MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 38 INDUSTRIAL VEHICLES MARKET: VALUE CHAIN ANALYSIS

- 5.8 CASE STUDIES

- 5.8.1 MITSUBISHI FORKLIFT ENHANCES SAFETY AT KELLOGG'S MANCHESTER SITE

- 5.8.2 DEMATIC'S AUTONOMOUS FORKLIFT REDUCES DELIVERY TIME AT L'OREAL

- 5.8.3 THYSSENKRUPP EMPLOYS JUNGHEINRICH AG FOR FLEXIBLE AUTOMATION

- 5.8.4 JUNGHEINRICH AG AUTOMATES COKO-WERK GMBH & CO. KG WAREHOUSE

- 5.8.5 TOYOTA DELIVERS SUSTAINABLE AGV SOLUTIONS TO PANASONIC ENERGY

- 5.8.6 LARGE TOYOTA AGV FLEET HELPS FUTURE-PROOF ALBERT HEIJN'S DISTRIBUTION CENTERS

- 5.8.7 TOYOTA'S AUTOMATED FORKLIFTS SUPPORT ELM.LEBLANC'S INDUSTRY 4.0 JOURNEY

- 5.8.8 HUBTEX PARTNERS WITH INTIS FOR INDUCTIVE CHARGING SYSTEM FOR AGVS

- 5.8.9 PORTS AMERICA REPLACES OLDER CONTAINER HANDLERS WITH HYSTER-YALE'S LIFT TRUCKS

- 5.8.10 BEIJER BYGGMATERIAL AB TRANSFORMS ITS FLEET OF DIESEL FORKLIFT TRUCKS TO ELECTRIC FORKLIFT TRUCKS

- 5.9 INVESTMENT AND FUNDING SCENARIO

- FIGURE 39 INVESTMENT AND FUNDING, 2022-2024

- TABLE 17 LIST OF FUNDING, 2022-2024

- 5.10 PATENT ANALYSIS

- 5.10.1 INTRODUCTION

- FIGURE 40 PATENT PUBLICATION TRENDS, 2014-2023

- 5.10.2 LEGAL STATUS OF PATENTS

- FIGURE 41 LEGAL STATUS OF PATENTS FILED FOR INDUSTRIAL VEHICLES, 2014-2023

- 5.10.3 TOP PATENT APPLICANTS

- FIGURE 42 INDUSTRIAL VEHICLE PATENTS, BY OEM (2014-2023)

- TABLE 18 INDUSTRIAL VEHICLES MARKET: KEY PATENTS

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 IoT for automated material handling

- FIGURE 43 IOT-ENABLED WAREHOUSE AND LOGISTICS SYSTEMS

- 5.11.1.2 Smart braking technology for forklifts

- 5.11.2 COMPLIMENTARY TECHNOLOGIES

- 5.11.2.1 Collaborative robots

- FIGURE 44 FEATURES OF AUTONOMOUS MOBILE ROBOTS

- 5.11.2.2 Sustainable forklift technology

- FIGURE 45 HYDROGEN FUEL CELLS VS. LEAD-ACID BATTERIES

- FIGURE 46 ADVANTAGES OF HYDROGEN FUEL CELLS

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 5G connectivity for automated warehouses

- 5.11.3.2 AI

- FIGURE 47 BENEFITS OF AI FOR FORKLIFTS IN WAREHOUSES

- 5.11.1 KEY TECHNOLOGIES

- 5.12 INDUSTRIAL VEHICLE OFFERINGS BY KEY PLAYERS

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT/EXPORT SCENARIO (HS CODE 842710)

- TABLE 19 IMPORT DATA FOR HS CODE 842710, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 20 EXPORT DATA FOR HS CODE 842710, BY COUNTRY, 2020-2022 (USD MILLION)

- 5.13.2 IMPORT/EXPORT SCENARIO (HS CODE 8427)

- TABLE 21 IMPORT DATA FOR HS CODE 8427, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 22 EXPORT DATA FOR HS CODE 8427, BY COUNTRY, 2020-2022 (USD MILLION)

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 SAFETY STANDARDS FOR INDUSTRIAL VEHICLES

- TABLE 23 SAFETY STANDARDS FOR INDUSTRIAL VEHICLES

- TABLE 24 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15 KEY CONFERENCES AND EVENTS

- TABLE 25 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 48 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP FOUR VEHICLE TYPES

- TABLE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP FOUR VEHICLE TYPES (%)

- 5.16.2 BUYING CRITERIA

- FIGURE 49 KEY BUYING CRITERIA FOR TOP FOUR VEHICLE TYPES

- TABLE 27 KEY BUYING CRITERIA FOR TOP FOUR VEHICLE TYPES

- 5.17 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 50 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

6 INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE & CAPACITY

- 6.1 INTRODUCTION

- FIGURE 51 AISLE TRUCKS SEGMENT TO DOMINATE MARKET IN TERMS OF VALUE FROM 2024 TO 2030

- TABLE 28 INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 29 INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 30 INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 31 INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- 6.1.1 OPERATIONAL DATA

- TABLE 32 INDUSTRIAL VEHICLE MODELS OFFERED BY COMPANIES, BY VEHICLE TYPE

- 6.2 FORKLIFTS

- 6.2.1 GROWING ADOPTION OF HUB-AND-SPOKE MODEL TO DRIVE MARKET

- TABLE 33 FORKLIFTS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 34 FORKLIFTS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 35 FORKLIFTS MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 36 FORKLIFTS MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 6.2.2 FORKLIFTS MARKET, BY CAPACITY

- TABLE 37 FORKLIFTS MARKET, BY CAPACITY, 2019-2023 (USD MILLION)

- TABLE 38 FORKLIFTS MARKET, BY CAPACITY, 2024-2030 (USD MILLION)

- TABLE 39 FORKLIFTS MARKET, BY CAPACITY, 2019-2023 (THOUSAND UNITS)

- TABLE 40 FORKLIFTS MARKET, BY CAPACITY, 2024-2030 (THOUSAND UNITS)

- 6.2.3 <5 TONS

- 6.2.4 5-10 TONS

- 6.2.5 11-36 TONS

- 6.2.6 >36 TONS

- 6.3 AISLE TRUCKS

- 6.3.1 INCREASING DEMAND FOR SPACE OPTIMIZATION IN WAREHOUSES TO DRIVE MARKET

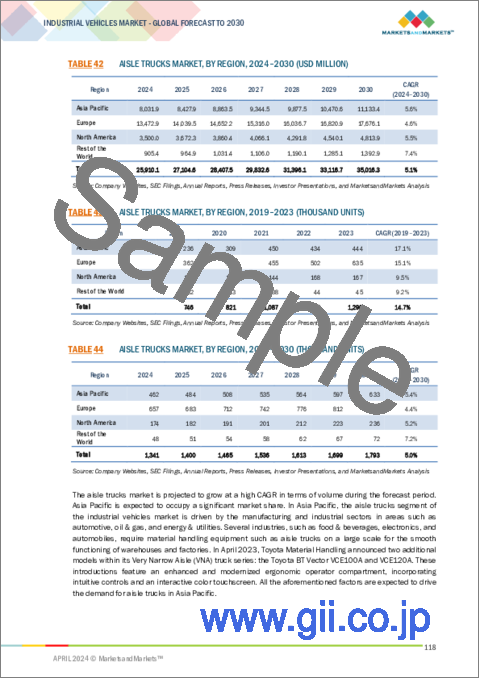

- TABLE 41 AISLE TRUCKS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 42 AISLE TRUCKS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 43 AISLE TRUCKS MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 44 AISLE TRUCKS MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 6.3.2 AISLE TRUCKS MARKET, BY CAPACITY

- TABLE 45 AISLE TRUCKS MARKET, BY CAPACITY, 2019-2023 (USD MILLION)

- TABLE 46 AISLE TRUCKS MARKET, BY CAPACITY, 2024-2030 (USD MILLION)

- TABLE 47 AISLE TRUCKS MARKET, BY CAPACITY, 2019-2023 (THOUSAND UNITS)

- TABLE 48 AISLE TRUCKS MARKET, BY CAPACITY, 2024-2030 (THOUSAND UNITS)

- 6.3.3 <1 TON

- 6.3.4 1-2 TONS

- 6.3.5 >2 TONS

- 6.4 TOW TRACTORS

- 6.4.1 RISING DEMAND FOR EFFICIENT MATERIAL HANDLING TO DRIVE MARKET

- TABLE 49 TOW TRACTORS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 50 TOW TRACTORS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 51 TOW TRACTORS MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 52 TOW TRACTORS MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 6.4.2 TOW TRACTORS MARKET, BY CAPACITY

- TABLE 53 TOW TRACTORS MARKET, BY CAPACITY, 2019-2023(USD MILLION)

- TABLE 54 TOW TRACTORS MARKET, BY CAPACITY, 2024-2030 (USD MILLION)

- TABLE 55 TOW TRACTORS MARKET, BY CAPACITY, 2019-2023 (THOUSAND UNITS)

- TABLE 56 TOW TRACTORS MARKET, BY CAPACITY, 2024-2030 (THOUSAND UNITS)

- 6.4.3 <5 TONS

- 6.4.4 5-10 TONS

- 6.4.5 11-30 TONS

- 6.4.6 >30 TONS

- 6.5 CONTAINER HANDLERS

- 6.5.1 INCREASING INFRASTRUCTURE PROJECTS AND STEADY GROWTH IN MARINE SECTOR TO DRIVE MARKET

- TABLE 57 CONTAINER HANDLERS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 58 CONTAINER HANDLERS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 59 CONTAINER HANDLERS MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 60 CONTAINER HANDLERS MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 6.5.2 CONTAINER HANDLERS MARKET, BY CAPACITY

- TABLE 61 CONTAINER HANDLERS MARKET, BY CAPACITY, 2019-2023 (USD MILLION)

- TABLE 62 CONTAINER HANDLERS MARKET, BY CAPACITY, 2024-2030 (USD MILLION)

- TABLE 63 CONTAINER HANDLERS MARKET, BY CAPACITY, 2019-2023 (THOUSAND UNITS)

- TABLE 64 CONTAINER HANDLERS MARKET, BY CAPACITY, 2024-2030 (THOUSAND UNITS)

- 6.5.3 <30 TONS

- 6.5.4 30-40 TONS

- 6.5.5 >40 TONS

- 6.6 AUTOMATED GUIDED VEHICLES

- 6.6.1 GROWING NEED FOR AUTOMATION IN MATERIAL HANDLING PROCESSES TO DRIVE MARKET

- 6.6.1.1 Availability of cost-effective labor restricting adoption of AGVs in emerging economies

- 6.6.1.2 Technical challenges related to sensing elements

- 6.6.1.3 High installation, maintenance, and switching costs associated with AGVs

- 6.6.1 GROWING NEED FOR AUTOMATION IN MATERIAL HANDLING PROCESSES TO DRIVE MARKET

- 6.7 PERSONNEL CARRIERS

- 6.7.1 RISING LEVELS OF INDUSTRIALIZATION WORLDWIDE TO DRIVE MARKET

- 6.8 KEY PRIMARY INSIGHTS

7 INDUSTRIAL VEHICLES MARKET, BY DRIVE TYPE

- 7.1 INTRODUCTION

- TABLE 65 LPG FORKLIFTS VS. BATTERY-OPERATED FORKLIFTS

- FIGURE 52 BATTERY-OPERATED SEGMENT TO REGISTER HIGHEST CAGR FROM 2024 TO 2030

- TABLE 66 INDUSTRIAL VEHICLES MARKET, BY DRIVE TYPE, 2019-2023 (USD MILLION)

- TABLE 67 INDUSTRIAL VEHICLES MARKET, BY DRIVE TYPE, 2024-2030 (USD MILLION)

- TABLE 68 INDUSTRIAL VEHICLES MARKET, BY DRIVE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 69 INDUSTRIAL VEHICLES MARKET, BY DRIVE TYPE, 2024-2030 (THOUSAND UNITS)

- 7.1.1 OPERATIONAL DATA

- TABLE 70 INDUSTRIAL VEHICLES OFFERED BY COMPANIES, BY DRIVE TYPE

- 7.2 ICE INDUSTRIAL VEHICLES

- 7.2.1 INCREASING DEMAND FROM WAREHOUSING AND TRANSPORTATION SECTORS TO DRIVE MARKET

- TABLE 71 EMISSION STANDARDS

- FIGURE 53 KEY DIFFERENCE BETWEEN ICE FORKLIFTS AND ELECTRIC FORKLIFTS

- TABLE 72 ICE INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 73 ICE INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 74 ICE INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 75 ICE INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- 7.3 BATTERY-OPERATED INDUSTRIAL VEHICLES

- 7.3.1 GROWING ENVIRONMENTAL AWARENESS TO DRIVE DEMAND

- FIGURE 54 CO2 EMISSION REDUCTION BY TOYOTA INDUSTRIES CORPORATION

- FIGURE 55 KEY BENEFITS OF ELECTRIC FORKLIFTS

- TABLE 76 LIFECYCLE COST COMPARISON: ELECTRIC LIFT TRUCKS VS. ICE LIFT TRUCKS

- TABLE 77 BATTERY-OPERATED INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 78 BATTERY-OPERATED INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 79 BATTERY-OPERATED INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 80 BATTERY-OPERATED INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- 7.4 GAS-POWERED INDUSTRIAL VEHICLES

- 7.4.1 ABILITY TO OPERATE IN DIVERSE ENVIRONMENTS INDEPENDENTLY OF CHARGING INFRASTRUCTURE TO BOOST DEMAND

- TABLE 81 GAS-POWERED INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 82 GAS-POWERED INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 83 GAS-POWERED INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 84 GAS-POWERED INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- 7.5 KEY PRIMARY INSIGHTS

8 INDUSTRIAL VEHICLES MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 56 MANUFACTURING SEGMENT TO LEAD MARKET FROM 2024 TO 2030

- TABLE 85 INDUSTRIAL VEHICLES MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 86 INDUSTRIAL VEHICLES MARKET, BY APPLICATION, 2024-2030 (USD MILLION)

- TABLE 87 INDUSTRIAL VEHICLES MARKET, BY APPLICATION, 2019-2023 (THOUSAND UNITS)

- TABLE 88 INDUSTRIAL VEHICLES MARKET, BY APPLICATION, 2024-2030 (THOUSAND UNITS)

- 8.1.1 OPERATIONAL DATA

- TABLE 89 INDUSTRIAL VEHICLES AND THEIR APPLICATIONS

- 8.2 MANUFACTURING

- 8.2.1 INCREASING ADOPTION OF INDUSTRIAL VEHICLES IN END-USE SECTORS TO DRIVE SEGMENT

- TABLE 90 MANUFACTURING: INDUSTRIAL VEHICLES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 91 MANUFACTURING: INDUSTRIAL VEHICLES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 92 MANUFACTURING: INDUSTRIAL VEHICLES MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 93 MANUFACTURING: INDUSTRIAL VEHICLES MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 8.2.2 AUTOMOTIVE

- 8.2.3 METALS & HEAVY MACHINERY

- 8.2.4 CHEMICAL

- 8.2.5 HEALTHCARE

- 8.2.6 FOOD & BEVERAGES

- 8.2.7 OTHERS

- 8.3 WAREHOUSING

- 8.3.1 EXPANSION OF E-COMMERCE SECTOR TO DRIVE SEGMENT

- FIGURE 57 CHINA: ONLINE RETAIL SALES (2019-2023)

- TABLE 94 WAREHOUSING: INDUSTRIAL VEHICLES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 95 WAREHOUSING: INDUSTRIAL VEHICLES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 96 WAREHOUSING: INDUSTRIAL VEHICLES MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 97 WAREHOUSING: INDUSTRIAL VEHICLES MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 8.4 FREIGHT & LOGISTICS

- 8.4.1 CONSUMER SHIFT TOWARD ONLINE SHOPPING TO DRIVE SEGMENT

- TABLE 98 FREIGHT & LOGISTICS: INDUSTRIAL VEHICLES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 99 FREIGHT & LOGISTICS: INDUSTRIAL VEHICLES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 100 FREIGHT & LOGISTICS: INDUSTRIAL VEHICLES MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 101 FREIGHT & LOGISTICS: INDUSTRIAL VEHICLES MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 8.5 OTHERS

- TABLE 102 OTHERS: INDUSTRIAL VEHICLES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 103 OTHERS: INDUSTRIAL VEHICLES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 104 OTHERS: INDUSTRIAL VEHICLES MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 105 OTHERS: INDUSTRIAL VEHICLES MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 8.6 KEY PRIMARY INSIGHTS

9 INDUSTRIAL VEHICLES MARKET, BY LEVEL OF AUTONOMY

- 9.1 INTRODUCTION

- 9.2 NON/SEMI-AUTONOMOUS

- 9.3 AUTONOMOUS

- FIGURE 58 COST BREAKDOWN OF NON-AUTONOMOUS VS. AUTONOMOUS FORKLIFTS

- 9.4 KEY PRIMARY INSIGHTS

10 AERIAL WORK PLATFORM MARKET, BY TYPE

- 10.1 INTRODUCTION

- FIGURE 59 BOOM LIFTS SEGMENT TO LEAD MARKET FROM 2024 TO 2030

- TABLE 106 AERIAL WORK PLATFORM MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 107 AERIAL WORK PLATFORM MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 108 AERIAL WORK PLATFORM MARKET, BY TYPE, 2019-2023 (UNITS)

- TABLE 109 AERIAL WORK PLATFORM MARKET, BY TYPE, 2024-2030 (UNITS)

- TABLE 110 AERIAL WORK PLATFORM MARKET, BY DRIVE TYPE, 2019-2023 (USD MILLION)

- TABLE 111 AERIAL WORK PLATFORM MARKET, BY DRIVE TYPE, 2024-2030 (USD MILLION)

- TABLE 112 AERIAL WORK PLATFORM MARKET, BY DRIVE TYPE, 2019-2023 (UNITS)

- TABLE 113 AERIAL WORK PLATFORM MARKET, BY DRIVE TYPE, 2024-2030 (UNITS)

- 10.1.1 OPERATIONAL DATA

- TABLE 114 AERIAL LIFT PLATFORMS OFFERED BY COMPANIES

- 10.2 BOOM LIFTS

- 10.2.1 GOVERNMENT SUPPORT AND FOREIGN INVESTMENTS TO DRIVE MARKET

- TABLE 115 BOOM LIFTS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 116 BOOM LIFTS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 117 BOOM LIFTS MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 118 BOOM LIFTS MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 119 BOOM LIFTS MARKET, BY DRIVE TYPE, 2019-2023 (USD MILLION)

- TABLE 120 BOOM LIFTS MARKET, BY DRIVE TYPE, 2024-2030 (USD MILLION)

- TABLE 121 BOOM LIFTS MARKET, BY DRIVE TYPE, 2019-2023 (UNITS)

- TABLE 122 BOOM LIFTS MARKET, BY DRIVE TYPE, 2024-2030 (UNITS)

- 10.3 SCISSOR LIFTS

- 10.3.1 GROWING LOGISTICS SECTOR TO DRIVE MARKET

- TABLE 123 SCISSOR LIFTS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 124 SCISSOR LIFTS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 125 SCISSOR LIFTS MARKET, BY REGION, 2019-2023 (UNITS)

- TABLE 126 SCISSOR LIFTS MARKET, BY REGION, 2024-2030 (UNITS)

- TABLE 127 SCISSOR LIFTS MARKET, BY DRIVE TYPE, 2019-2023 (USD MILLION)

- TABLE 128 SCISSOR LIFTS MARKET, BY DRIVE TYPE, 2024-2030 (USD MILLION)

- TABLE 129 SCISSOR LIFTS MARKET, BY DRIVE TYPE, 2019-2023 (UNITS)

- TABLE 130 SCISSOR LIFTS MARKET, BY DRIVE TYPE, 2024-2030 (UNITS)

- 10.4 KEY PRIMARY INSIGHTS

11 INDUSTRIAL VEHICLES MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 60 INDUSTRIAL VEHICLES MARKET, BY REGION, 2024 VS. 2030 (USD MILLION)

- TABLE 131 INDUSTRIAL VEHICLES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 132 INDUSTRIAL VEHICLES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 133 INDUSTRIAL VEHICLES MARKET, BY REGION, 2019-2023 (THOUSAND UNITS)

- TABLE 134 INDUSTRIAL VEHICLES MARKET, BY REGION, 2024-2030 (THOUSAND UNITS)

- 11.2 ASIA PACIFIC

- 11.2.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 61 ASIA PACIFIC: INDUSTRIAL VEHICLES MARKET SNAPSHOT

- TABLE 135 ASIA PACIFIC: INDUSTRIAL VEHICLES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 136 ASIA PACIFIC: INDUSTRIAL VEHICLES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: INDUSTRIAL VEHICLES MARKET, BY COUNTRY, 2019-2023 (THOUSAND UNITS)

- TABLE 138 ASIA PACIFIC: INDUSTRIAL VEHICLES MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- 11.2.2 CHINA

- 11.2.2.1 Increasing industrialization and infrastructure development to drive market

- TABLE 139 CHINA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 140 CHINA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 141 CHINA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 142 CHINA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- 11.2.3 INDIA

- 11.2.3.1 Persistent growth of e-commerce sector to drive market

- TABLE 143 INDIA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 144 INDIA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 145 INDIA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 146 INDIA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- 11.2.4 JAPAN

- 11.2.4.1 Advancements in electric and autonomous industrial vehicles to drive market

- TABLE 147 JAPAN: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 148 JAPAN: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 149 JAPAN: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 150 JAPAN: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- 11.2.5 SOUTH KOREA

- 11.2.5.1 Surging industrialization to drive market

- TABLE 151 SOUTH KOREA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 152 SOUTH KOREA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 153 SOUTH KOREA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 154 SOUTH KOREA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- 11.2.6 REST OF ASIA PACIFIC

- TABLE 155 REST OF ASIA PACIFIC: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 158 REST OF ASIA PACIFIC: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- 11.3 EUROPE

- 11.3.1 EUROPE: RECESSION IMPACT

- FIGURE 62 EUROPE: INDUSTRIAL VEHICLES MARKET SNAPSHOT

- TABLE 159 EUROPE: INDUSTRIAL VEHICLES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 160 EUROPE: INDUSTRIAL VEHICLES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 161 EUROPE: INDUSTRIAL VEHICLES MARKET, BY COUNTRY, 2019-2023 (THOUSAND UNITS)

- TABLE 162 EUROPE: INDUSTRIAL VEHICLES MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- 11.3.2 GERMANY

- 11.3.2.1 Expansion of e-commerce industry to drive market

- TABLE 163 GERMANY: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 164 GERMANY: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 165 GERMANY: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 166 GERMANY: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- 11.3.3 UK

- 11.3.3.1 Increasing innovation in material handling equipment to drive market

- TABLE 167 UK: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 168 UK: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 169 UK: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 170 UK: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- 11.3.4 FRANCE

- 11.3.4.1 Accelerating automation to drive market

- TABLE 171 FRANCE: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 172 FRANCE: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 173 FRANCE: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 174 FRANCE: INDUSTRIAL VEHICLES MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- 11.3.5 ITALY

- 11.3.5.1 Growing e-commerce sector to drive market

- TABLE 175 ITALY: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 176 ITALY: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 177 ITALY: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 178 ITALY: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- 11.3.6 SPAIN

- 11.3.6.1 Rising activities in logistics and warehousing sectors to drive market

- TABLE 179 SPAIN: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 180 SPAIN: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 181 SPAIN: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 182 SPAIN: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- 11.3.7 REST OF EUROPE

- TABLE 183 REST OF EUROPE: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 184 REST OF EUROPE: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 185 REST OF EUROPE: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 186 REST OF EUROPE: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- 11.4 NORTH AMERICA

- 11.4.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 63 NORTH AMERICA: INDUSTRIAL VEHICLES MARKET, BY COUNTRY, 2024 VS. 2030 (USD MILLION)

- TABLE 187 NORTH AMERICA: INDUSTRIAL VEHICLES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 188 NORTH AMERICA: INDUSTRIAL VEHICLES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 189 NORTH AMERICA: INDUSTRIAL VEHICLES MARKET, BY COUNTRY, 2019-2023 (THOUSAND UNITS)

- TABLE 190 NORTH AMERICA: INDUSTRIAL VEHICLES MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- 11.4.2 US

- 11.4.2.1 E-commerce dynamics and automation trends to drive market

- TABLE 191 US: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 192 US: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 193 US: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 194 US: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- 11.4.3 MEXICO

- 11.4.3.1 Growing e-commerce and manufacturing sectors to drive market

- TABLE 195 MEXICO: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 196 MEXICO: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 197 MEXICO: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 198 MEXICO: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- 11.4.4 CANADA

- 11.4.4.1 Government initiatives on infrastructure development to drive market

- TABLE 199 CANADA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 200 CANADA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 201 CANADA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 202 CANADA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- 11.5 REST OF THE WORLD

- 11.5.1 REST OF THE WORLD: RECESSION IMPACT

- FIGURE 64 REST OF THE WORLD: INDUSTRIAL VEHICLES MARKET, BY COUNTRY, 2024 VS. 2030 (USD MILLION)

- TABLE 203 REST OF THE WORLD: INDUSTRIAL VEHICLES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 204 REST OF THE WORLD: INDUSTRIAL VEHICLES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 205 REST OF THE WORLD: INDUSTRIAL VEHICLES MARKET, BY COUNTRY, 2019-2023 (THOUSAND UNITS)

- TABLE 206 REST OF THE WORLD: INDUSTRIAL VEHICLES MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- 11.5.2 BRAZIL

- 11.5.2.1 Expanding food & beverages manufacturing sector to drive market

- TABLE 207 BRAZIL: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 208 BRAZIL: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 209 BRAZIL: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 210 BRAZIL: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- 11.5.3 SOUTH AFRICA

- 11.5.3.1 Growing manufacturing sector to drive market

- TABLE 211 SOUTH AFRICA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 212 SOUTH AFRICA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 213 SOUTH AFRICA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 214 SOUTH AFRICA: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

- 11.5.4 OTHERS

- TABLE 215 OTHERS: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (USD MILLION)

- TABLE 216 OTHERS: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (USD MILLION)

- TABLE 217 OTHERS: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2019-2023 (THOUSAND UNITS)

- TABLE 218 OTHERS: INDUSTRIAL VEHICLES MARKET, BY VEHICLE TYPE, 2024-2030 (THOUSAND UNITS)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 MARKET SHARE ANALYSIS, 2022

- TABLE 219 MARKET SHARE ANALYSIS, 2022

- FIGURE 65 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- 12.3 REVENUE ANALYSIS, 2018-2022

- FIGURE 66 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018-2022

- 12.4 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 67 COMPANY VALUATION OF TOP FIVE PLAYERS

- FIGURE 68 FINANCIAL MATRIX OF TOP FIVE PLAYERS

- 12.5 BRAND/PRODUCT COMPARISON

- FIGURE 69 BRAND/PRODUCT COMPARISON OF TOP FIVE PLAYERS

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- FIGURE 70 INDUSTRIAL VEHICLES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- 12.6.5 COMPANY FOOTPRINT

- FIGURE 71 INDUSTRIAL VEHICLES MARKET: COMPANY FOOTPRINT, 2024

- TABLE 220 INDUSTRIAL VEHICLES MARKET: REGION FOOTPRINT, 2024

- TABLE 221 INDUSTRIAL VEHICLES MARKET: DRIVE TYPE FOOTPRINT, 2024

- TABLE 222 INDUSTRIAL VEHICLES MARKET: VEHICLE TYPE FOOTPRINT, 2024

- TABLE 223 INDUSTRIAL VEHICLES MARKET: APPLICATION FOOTPRINT, 2024

- 12.7 COMPANY EVALUATION MATRIX: START-UP/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 72 INDUSTRIAL VEHICLES MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- 12.7.5 COMPETITIVE BENCHMARKING

- TABLE 224 INDUSTRIAL VEHICLES MARKET: KEY START-UPS/SMES

- TABLE 225 INDUSTRIAL VEHICLES MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 12.8 COMPANY EVALUATION MATRIX FOR AERIAL WORK PLATFORMS MARKET

- 12.8.1 STARS

- 12.8.2 EMERGING LEADERS

- 12.8.3 PERVASIVE PLAYERS

- 12.8.4 PARTICIPANTS

- FIGURE 73 AERIAL WORK PLATFORMS MARKET: COMPANY EVALUATION MATRIX, 2024

- 12.8.5 COMPANY FOOTPRINT

- FIGURE 74 AERIAL WORK PLATFORMS MARKET: COMPANY FOOTPRINT, 2024

- TABLE 226 AERIAL WORK PLATFORMS MARKET: REGION FOOTPRINT, 2024

- TABLE 227 AERIAL WORK PLATFORMS MARKET: TYPE FOOTPRINT, 2024

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 228 INDUSTRIAL VEHICLES MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2022-2024

- 12.9.2 DEALS

- TABLE 229 INDUSTRIAL VEHICLES MARKET: DEALS, 2022-2024

- 12.9.3 EXPANSIONS

- TABLE 230 INDUSTRIAL VEHICLES MARKET: EXPANSIONS, 2022-2024

13 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 13.1 KEY PLAYERS (INDUSTRIAL VEHICLES)

- 13.1.1 TOYOTA INDUSTRIES CORPORATION

- TABLE 231 TOYOTA INDUSTRIES CORPORATION: COMPANY OVERVIEW

- FIGURE 75 TOYOTA INDUSTRIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 76 PERCENTAGE OF TOTAL SHARES FOR TOYOTA INDUSTRIES CORPORATION'S MAJOR SHAREHOLDERS (2023)

- FIGURE 77 KEY PRODUCTS OF TOYOTA INDUSTRIES CORPORATION

- TABLE 232 TOYOTA INDUSTRIES CORPORATION: PRODUCTS OFFERED

- TABLE 233 TOYOTA INDUSTRIES CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 234 TOYOTA INDUSTRIES CORPORATION: DEALS

- 13.1.2 KION GROUP AG

- TABLE 235 KION GROUP AG: COMPANY OVERVIEW

- FIGURE 78 KION GROUP AG: COMPANY SNAPSHOT

- FIGURE 79 KION GROUP AG: EMPLOYEE STRENGTH, BY REGION (2023)

- FIGURE 80 KION GROUP AG: PRODUCTION SITES (2023)

- TABLE 236 KION GROUP AG: PRODUCTS OFFERED

- TABLE 237 KION GROUP AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 238 KION GROUP AG: DEALS

- TABLE 239 KION GROUP AG: EXPANSIONS

- 13.1.3 MITSUBISHI LOGISNEXT CO., LTD.

- TABLE 240 MITSUBISHI LOGISNEXT CO., LTD.: COMPANY OVERVIEW

- FIGURE 81 MITSUBISHI LOGISNEXT CO., LTD.: COMPANY SNAPSHOT

- TABLE 241 MITSUBISHI LOGISNEXT CO., LTD.: MAJOR SHAREHOLDERS (COMMON STOCK)

- TABLE 242 MITSUBISHI LOGISNEXT CO., LTD.: PRODUCTS OFFERED

- TABLE 243 MITSUBISHI LOGISNEXT CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 244 MITSUBISHI LOGISNEXT CO., LTD.: DEALS

- TABLE 245 MITSUBISHI LOGISNEXT CO., LTD.: EXPANSIONS

- TABLE 246 MITSUBISHI LOGISNEXT CO., LTD.: OTHER DEVELOPMENTS

- 13.1.4 JUNGHEINRICH AG

- TABLE 247 JUNGHEINRICH AG: COMPANY OVERVIEW

- FIGURE 82 JUNGHEINRICH AG: COMPANY SNAPSHOT

- FIGURE 83 JUNGHEINRICH AG: GEOGRAPHIC PRESENCE

- TABLE 248 JUNGHEINRICH AG: PRODUCTS OFFERED

- TABLE 249 JUNGHEINRICH AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 250 JUNGHEINRICH AG: DEALS

- TABLE 251 JUNGHEINRICH AG: EXPANSIONS

- 13.1.5 CROWN EQUIPMENT CORPORATION

- TABLE 252 CROWN EQUIPMENT CORPORATION: COMPANY OVERVIEW

- TABLE 253 MAJOR BUYERS OF PRODUCTS & SERVICES FROM CROWN EQUIPMENT CORPORATION

- TABLE 254 CROWN EQUIPMENT CORPORATION: PRODUCTS OFFERED

- TABLE 255 CROWN EQUIPMENT CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 256 CROWN EQUIPMENT CORPORATION: EXPANSIONS

- 13.1.6 HYSTER-YALE MATERIALS HANDLING, INC.

- TABLE 257 HYSTER-YALE MATERIALS HANDLING, INC.: COMPANY OVERVIEW

- FIGURE 84 HYSTER-YALE MATERIALS HANDLING, INC.: COMPANY SNAPSHOT

- TABLE 258 HYSTER-YALE MATERIALS HANDLING, INC.: PRODUCTS OFFERED

- TABLE 259 HYSTER-YALE MATERIALS HANDLING, INC.: WORLDWIDE LIFT TRUCK SALES, BY PRODUCT (2023)

- TABLE 260 HYSTER-YALE MATERIALS HANDLING, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 261 HYSTER-YALE MATERIALS HANDLING, INC.: DEALS

- TABLE 262 HYSTER-YALE MATERIALS HANDLING, INC.: EXPANSIONS

- TABLE 263 HYSTER-YALE MATERIALS HANDLING, INC.: OTHER DEVELOPMENTS

- 13.1.7 HANGCHA GROUP CO., LTD.

- TABLE 264 HANGCHA GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 265 HANGCHA GROUP CO., LTD.: PRODUCTS OFFERED

- TABLE 266 HANGCHA GROUP CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 267 HANGCHA GROUP CO., LTD.: EXPANSIONS

- 13.1.8 CLARK

- TABLE 268 CLARK: COMPANY OVERVIEW

- FIGURE 85 CLARK: COMPANY SNAPSHOT

- TABLE 269 CLARK: PRODUCTS OFFERED

- TABLE 270 CLARK: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 271 CLARK: EXPANSIONS

- 13.1.9 ANHUI HELI CO., LTD.

- TABLE 272 ANHUI HELI CO., LTD.: COMPANY OVERVIEW

- FIGURE 86 ANHUI HELI CO., LTD.: COMPANY SNAPSHOT

- TABLE 273 ANHUI HELI CO., LTD.: PRODUCTS OFFERED

- TABLE 274 ANHUI HELI CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 275 ANHUI HELI CO., LTD.: DEALS

- TABLE 276 ANHUI HELI CO., LTD.: OTHER DEVELOPMENTS

- 13.1.10 KONECRANES

- TABLE 277 KONECRANES: COMPANY OVERVIEW

- FIGURE 87 KONECRANES: COMPANY SNAPSHOT

- TABLE 278 KONECRANES: PRODUCTS OFFERED

- TABLE 279 KONECRANES: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 280 KONECRANES: DEALS

- TABLE 281 KONECRANES: OTHER DEVELOPMENTS

- 13.1.11 EP EQUIPMENT

- TABLE 282 EP EQUIPMENT: COMPANY OVERVIEW

- FIGURE 88 EP EQUIPMENT: COMPANY SNAPSHOT

- TABLE 283 EP EQUIPMENT: PRODUCTS OFFERED

- TABLE 284 EP EQUIPMENT: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 285 EP EQUIPMENT: EXPANSIONS

- TABLE 286 EP EQUIPMENT: OTHER DEVELOPMENTS

- 13.2 OTHER PLAYERS (INDUSTRIAL VEHICLES)

- 13.2.1 KOMATSU LTD.

- TABLE 287 KOMATSU LTD.: COMPANY OVERVIEW

- 13.2.2 DOOSAN INDUSTRIAL VEHICLE

- TABLE 288 DOOSAN INDUSTRIAL VEHICLE: COMPANY OVERVIEW

- 13.2.3 MANITOU GROUP

- TABLE 289 MANITOU GROUP: COMPANY OVERVIEW

- 13.2.4 CARGOTEC CORPORATION

- TABLE 290 CARGOTEC CORPORATION: COMPANY OVERVIEW

- 13.2.5 ACTION CONSTRUCTION EQUIPMENT LTD.

- TABLE 291 ACTION CONSTRUCTION EQUIPMENT LTD.: COMPANY OVERVIEW

- 13.2.6 HYUNDAI CONSTRUCTION EQUIPMENT INDIA PVT. LTD.

- TABLE 292 HYUNDAI CONSTRUCTION EQUIPMENT INDIA PVT. LTD.: COMPANY OVERVIEW

- 13.2.7 V. MARIOTTI SRL

- TABLE 293 V. MARIOTTI SRL: COMPANY OVERVIEW

- 13.2.8 COMBILIFT

- TABLE 294 COMBILIFT: COMPANY OVERVIEW

- 13.2.9 DAIFUKU

- TABLE 295 DAIFUKU: COMPANY OVERVIEW

- 13.2.10 JBT

- TABLE 296 JBT: COMPANY OVERVIEW

- 13.2.11 LONKING MACHINERY CO., LTD.

- TABLE 297 LONKING MACHINERY CO., LTD.: COMPANY OVERVIEW

- 13.2.12 HUBTEX MASCHINENBAU GMBH & CO. KG

- TABLE 298 HUBTEX MASCHINENBAU GMBH & CO. KG: COMPANY OVERVIEW

- 13.2.13 GODREJ & BOYCE MFG. CO. LTD.

- TABLE 299 GODREJ & BOYCE MFG. CO. LTD.: COMPANY OVERVIEW

- 13.2.14 SVETRUCK AB

- TABLE 300 SVETRUCK AB: COMPANY OVERVIEW

- 13.2.15 STOCKLIN LOGISTIK AG

- TABLE 301 STOCKLIN LOGISTIK AG: COMPANY OVERVIEW

- 13.2.16 O.M.G. SRL

- TABLE 302 O.M.G. SRL: COMPANY OVERVIEW

- 13.2.17 PALETRANS FORKLIFTS

- TABLE 303 PALETRANS FORKLIFTS: COMPANY OVERVIEW

- 13.2.18 GENKINGER GMBH

- TABLE 304 GENKINGER GMBH: COMPANY OVERVIEW

- 13.2.19 FLEXI TRUCKS

- TABLE 305 FLEXI TRUCKS: COMPANY OVERVIEW

- 13.2.20 AGILOX SERVICES GMBH

- TABLE 306 AGILOX SERVICES GMBH: COMPANY OVERVIEW

- 13.3 KEY PLAYERS (LIFTING PLATFORMS)

- 13.3.1 JLG INDUSTRIES, INC.

- TABLE 307 JLG INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 89 JLG INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 308 JLG INDUSTRIES, INC.: MAJOR CENTERS

- TABLE 309 JLG INDUSTRIES, INC.: PRODUCTS OFFERED

- TABLE 310 JLG INDUSTRIES, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 311 JLG INDUSTRIES, INC.: DEALS

- TABLE 312 JLG INDUSTRIES, INC.: EXPANSIONS

- 13.3.2 TADANO LTD.

- TABLE 313 TADANO LTD.: COMPANY OVERVIEW

- FIGURE 90 TADANO LTD.: COMPANY SNAPSHOT

- TABLE 314 TADANO LTD.: PRODUCTS OFFERED

- TABLE 315 TADANO LTD.: DEALS

- TABLE 316 TADANO LTD.: EXPANSIONS

- TABLE 317 TADANO LTD.: OTHER DEVELOPMENTS

- 13.3.3 TEREX CORPORATION

- TABLE 318 TEREX CORPORATION: COMPANY OVERVIEW

- FIGURE 91 TEREX CORPORATION: COMPANY SNAPSHOT

- FIGURE 92 TEREX CORPORATION: BRANDS AND OFFERINGS

- TABLE 319 TEREX CORPORATION: PATENTS

- TABLE 320 TEREX CORPORATION: PRODUCTS OFFERED

- TABLE 321 TEREX CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 322 TEREX CORPORATION: EXPANSIONS

- 13.3.4 LINAMAR CORPORATION

- TABLE 323 LINAMAR CORPORATION: COMPANY OVERVIEW

- FIGURE 93 LINAMAR CORPORATION: COMPANY SNAPSHOT

- TABLE 324 LINAMAR CORPORATION: MANUFACTURING FACILITIES

- TABLE 325 LINAMAR CORPORATION: PRODUCTS OFFERED

- TABLE 326 LINAMAR CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 327 LINAMAR CORPORATION: DEALS

- TABLE 328 LINAMAR CORPORATION: EXPANSIONS

- 13.3.5 MAGNI TELESCOPIC HANDLERS SRL

- TABLE 329 MAGNI TELESCOPIC HANDLERS SRL: COMPANY OVERVIEW

- TABLE 330 MAGNI TELESCOPIC HANDLERS SRL: PRODUCTS OFFERED

- TABLE 331 MAGNI TELESCOPIC HANDLERS SRL: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 332 MAGNI TELESCOPIC HANDLERS SRL: DEALS

- TABLE 333 MAGNI TELESCOPIC HANDLERS SRL: EXPANSIONS

- 13.4 OTHER PLAYERS (LIFTING PLATFORMS)

- 13.4.1 HAULOTTE GROUP

- TABLE 334 HAULOTTE GROUP: COMPANY OVERVIEW

- 13.4.2 AICHI CORPORATION

- TABLE 335 AICHI CORPORATION: COMPANY OVERVIEW

- 13.4.3 PALFINGER AG

- TABLE 336 PALFINGER AG: COMPANY OVERVIEW

- 13.4.4 IMER INTERNATIONAL S.P.A.

- TABLE 337 IMER INTERNATIONAL S.P.A.: COMPANY OVERVIEW

- 13.4.5 SINOBOOM INTELLIGENT EQUIPMENT CO., LTD.

- TABLE 338 SINOBOOM INTELLIGENT EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- 13.4.6 ALTEC INDUSTRIES

- TABLE 339 ALTEC INDUSTRIES: COMPANY OVERVIEW

- 13.4.7 J C BAMFORD EXCAVATORS LTD.

- TABLE 340 JC BAMFORD EXCAVATORS LTD.: COMPANY OVERVIEW

- 13.4.8 NOBLELIFT INTELLIGENT EQUIPMENT CO., LTD.

- TABLE 341 NOBLELIFT INTELLIGENT EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- 13.4.9 BRONTO SKYLIFT

- TABLE 342 BRONTO SKYLIFT: COMPANY OVERVIEW

- 13.4.10 SNORKEL

- TABLE 343 SNORKEL: COMPANY OVERVIEW

- 13.4.11 DINOLIFT OY

- TABLE 344 DINOLIFT OY: COMPANY OVERVIEW

14 RECOMMENDATIONS BY MARKETSANDMARKETS

- 14.1 ASIA PACIFIC TO BE DOMINANT MARKET FOR INDUSTRIAL VEHICLES

- 14.2 GERMANY TO BE FASTEST-GROWING MARKET IN EUROPE

- 14.3 IMPACT OF E-COMMERCE ON INDUSTRIAL VEHICLES MARKET

- 14.4 AUTONOMOUS FORKLIFTS TO BE KEY FOCUS AREA FOR INDUSTRIAL VEHICLE MANUFACTURERS

- 14.5 CONCLUSION

15 APPENDIX

- 15.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.4.1 BY CAPACITY, AT REGIONAL LEVEL, FOR EACH VEHICLE TYPE

- 15.4.2 BY DRIVE TYPE, AT REGIONAL LEVEL, FOR EACH VEHICLE TYPE

- 15.4.3 BY APPLICATION, AT GLOBAL LEVEL, FOR EACH VEHICLE TYPE

- 15.4.4 COMPANY INFORMATION

- 15.4.4.1 Profiling of additional market players (up to five)

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS