|

|

市場調査レポート

商品コード

1711157

中古車の世界市場レポート 2025年Pre-owned Vehicles Global Market Report 2025 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 中古車の世界市場レポート 2025年 |

|

出版日: 2025年04月03日

発行: The Business Research Company

ページ情報: 英文 200 Pages

納期: 2~10営業日

|

全表示

- 概要

- 目次

中古車市場規模は、今後数年間で力強い成長が見込まれます。2029年には3,992億8,000万米ドルに成長し、CAGRは5.0%となります。予測期間における成長は、サステイナブル目標の上昇、オンラインプラットフォームの改善、インフレ率の上昇、中古車の保険料の低下などに起因すると考えられます。予測期間における主要動向としては、自動車サブスクリプションサービスへのシフト、車検用仮想現実ツールの改善、正確な価格設定モデルのためのAIとビッグデータの利用、詳細な車両履歴レポートへのアクセス強化、CPO車の需要増加などが挙げられます。

パーソナルモビリティに対する需要の高まりは、中古車市場の成長を促進すると予想されます。パーソナルモビリティとは、ある場所からによる場所へ自分の移動手段を使って独立して移動できる個人の能力を指します。リモートワークや軟質なスケジュールへのシフトにより、従来型通勤の必要性は減少しており、パーソナルモビリティソリューションはより魅力的なものとなっています。中古車は、人々が自立して効率的に移動できる手頃な輸送手段を提供することで、パーソナルモビリティを支援します。例えば、インフラ運輸・地域開発・通信・芸術省が2024年2月に発表したところによると、2022年1月31日現在、オーストラリアの登録自動車台数は2,070万台で、2021年1月から2%増加しました。さらに、自動車製造業者・貿易業者協会(Society of Motor Manufacturers and Traders)は2024年2月、英国の中古車市場が2024年第1四半期に6.5%増の約200万台に達したと発表しました。このような個人の移動手段に対する需要の高まりが、中古車市場の成長に拍車をかけています。

中古車市場の主要企業は、売買プロセスを簡素化する統合プラットフォームを構築しています。これらのプラットフォームは、包括的な車両履歴、融資オプション、査定と比較のためのデジタルツールを提供することで、顧客体験を向上させています。例えば、2024年5月、インドを拠点とする中古車専門のフィンテック企業Nxcarは、インドで中古車取引のための包括的なプラットフォームを立ち上げました。このプラットフォームは、個人出品者、ディーラー、クラシファイド・リスティングのいずれから購入する場合でも、顧客にローン、車検、査定、保険、RC譲渡サービスへのアクセスを記載しています。Nxcarは20以上の銀行や非銀行金融会社(NBFC)と提携し、全国をカバーし、エンドツーエンドの中古車ローンサービスを促進しています。

目次

第1章 エグゼクティブサマリー

第2章 市場の特徴

第3章 市場動向と戦略

第4章 市場-金利、インフレ、地政学、新型コロナウイルス感染症、景気回復が市場に与える影響を含むマクロ経済シナリオ

第5章 世界の成長分析と戦略分析フレームワーク

- 世界の中古車PESTEL分析(政治、社会、技術、環境、法的要因、促進要因と抑制要因)

- 最終用途産業の分析

- 世界の中古車市場:成長率分析

- 世界の中古車市場の実績:規模と成長、2019~2024年

- 世界の中古車市場の予測:規模と成長、2024~2029年、2034年

- 世界の中古車総アドレス可能市場(TAM)

第6章 市場セグメンテーション

- 世界の中古車市場:車種別、実績と予測、2019~2024年、2024~2029年、2034年

- 二輪車

- 三輪車

- 乗用車

- 小型商用車

- 大型トラック

- バスと長距離バス

- オフロード車

- 世界の中古車市場:推進力別、実績と予測、2019~2024年、2024~2029年、2034年

- ガソリン

- ディーゼル

- 電気

- 世界の中古車市場認定ステータス別、実績と予測、2019~2024年、2024~2029年、2034年

- 認定中古車(CPO)

- 非認定車両

- 世界の中古車市場販売形態別、実績と予測、2019~2024年、2024~2029年、2034年

- オンライン

- ディーラーウォークイン

- 世界の中古車市場:流通チャネル別、実績と予測、2019~2024年、2024~2029年、2034年

- 組織型ディーラー

- マルチブランド小売業者

- 直接販売代理店

- 非組織型ディーラー

- その他

- 世界の中古車市場、二輪車のサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2024~2029年、2034年

- 二輪車

- 原付

- 電動二輪車

- 世界の中古車市場、三輪車のサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2024~2029年、2034年

- オートリキシャ

- 電動三輪車

- 貨物三輪車

- 世界の中古車市場、乗用車のサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2024~2029年、2034年

- セダン

- ハッチバック

- SUV

- 世界の中古車市場、小型商用車のサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2024~2029年、2034年

- バン

- ピックアップトラック

- ミニトラック

- 世界の中古車市場、大型トラックのサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2024~2029年、2034年

- トラクタトラック

- ダンプトラック

- 貨物トラック

- 世界の中古車市場、バスと長距離バスのサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2024~2029年、2034年

- 市バス

- 都市間バス

- スクールバス

- 世界の中古車市場、オフロード車のサブセグメンテーション、タイプ別、実績と予測、2019~2024年、2024~2029年、2034年

- 全地形対応車(ATV)

- ユーティリティタスクビークル(UTV)

- ダート二輪車

第7章 地域別・国別分析

- 世界の中古車市場:地域別、実績と予測、2019~2024年、2024~2029年、2034年

- 世界の中古車市場:国別、実績と予測、2019~2024年、2024~2029年、2034年

第8章 アジア太平洋市場

第9章 中国市場

第10章 インド市場

第11章 日本市場

第12章 オーストラリア市場

第13章 インドネシア市場

第14章 韓国市場

第15章 西欧市場

第16章 英国市場

第17章 ドイツ市場

第18章 フランス市場

第19章 イタリア市場

第20章 スペイン市場

第21章 東欧市場

第22章 ロシア市場

第23章 北米市場

第24章 米国市場

第25章 カナダ市場

第26章 南米市場

第27章 ブラジル市場

第28章 中東市場

第29章 アフリカ市場

第30章 競合情勢と企業プロファイル

- 中古車市場:競合情勢

- 中古車市場:企業プロファイル

- CarMax Inc.

- Lithia Motors Inc.

- Penske Automotive Group

- AutoNation

- Cox Automotive Inc.

第31章 その他の大手企業と革新的企業

- Group 1 Automotive Inc.

- Asbury Automotive Group

- Sonic Automotive Inc.

- Carvana Co.

- Manheim Inc.

- Adesa Inc.

- VroomWheel

- CarGurus Inc.

- DriveTime Automotive Group Inc.

- Cars.com Inc.

- ACV Auctions Inc.

- Edmunds.com Inc.

- Craigslist Inc.

- TrueCar Inc.

- CarsDirect.com Inc.

第32章 世界の市場競合ベンチマーキングとダッシュボード

第33章 主要な合併と買収

第34章 最近の市場動向

第35章 市場の潜在力が高い国、戦略

- 中古車市場、2029年:新たな機会を提供する国

- 中古車市場、2029年:新たな機会を提供するセグメント

- 中古車市場、2029年:成長戦略

- 市場動向による戦略

- 競合の戦略

第36章 付録

Pre-owned vehicles are cars that have been previously owned and used by one or more individuals before being resold. They are typically more affordable than new cars, making them an attractive choice for buyers seeking cost-effective transportation. Pre-owned vehicles provide a flexible, budget-friendly alternative to new cars, with a broad selection available.

The pre-owned vehicle market includes various types, such as two-wheelers, three-wheelers, passenger vehicles, light commercial vehicles, heavy-duty trucks, buses and coaches, and off-road vehicles. Pre-owned two-wheelers specifically refer to used motorcycles or scooters available for resale. These vehicles come with different propulsion options, including gasoline, diesel, and electric, and can be certified pre-owned (CPO) or non-certified. Sales occur through online platforms and physical dealerships, with distribution channels involving organized dealers, multi-brand retailers, direct dealership sales agents, and unorganized dealers.

The pre-owned vehicles market research report is one of a series of new reports from The Business Research Company that provides pre-owned vehicles market statistics, including the pre-owned vehicles industry global market size, regional shares, competitors with pre-owned vehicles market share, detailed pre-owned vehicles market segments, market trends, and opportunities, and any further data you may need to thrive in the pre-owned vehicles industry. These pre-owned vehicles market research reports deliver a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The pre-owned vehicles market size has grown strongly in recent years. It will grow from $311.96 $ billion in 2024 to $328.29 $ billion in 2025 at a compound annual growth rate (CAGR) of 5.2%. The growth in the historic period can be attributed to demand for cost-effectiveness, improvements in vehicle durability, competitive financing options for used cars, and rise in digital platforms for used car sales.

The pre-owned vehicles market size is expected to see strong growth in the next few years. It will grow to $399.28 $ billion in 2029 at a compound annual growth rate (CAGR) of 5.0%. The growth in the forecast period can be attributed to rising sustainable goals, improved online platforms, rising inflation, and lower insurance premiums for used cars. Major trends in the forecast period include shift towards car subscription services, improved virtual reality tools for car inspections, use of AI and big data for accurate pricing models, enhanced access to detailed vehicle history reports, and increased demand for CPO vehicles.

The rising demand for personal mobility is expected to drive the growth of the pre-owned vehicle market. Personal mobility refers to an individual's ability to move independently from one location to another using their own transportation. The shift towards remote work and flexible schedules has decreased the need for traditional commuting, making personal mobility solutions more appealing. Pre-owned vehicles support personal mobility by offering affordable transportation options that allow people to travel independently and efficiently. For example, the Department of Infrastructure, Transport, Regional Development, Communications, and the Arts reported in February 2024 that, as of January 31, 2022, there were 20.7 million registered motor vehicles in Australia, reflecting a 2% increase from January 2021. Additionally, the Society of Motor Manufacturers and Traders noted in February 2024 that the UK used car market grew by 6.5% to nearly 2 million units in Q1 2024. This increasing demand for personal mobility is fueling the growth of the pre-owned vehicle market.

Leading companies in the pre-owned vehicle market are creating integrated platforms to simplify the buying and selling process. These platforms improve customer experience by offering comprehensive vehicle histories, financing options, and digital tools for valuation and comparison. For instance, in May 2024, Nxcar, an India-based fintech company specializing in pre-owned cars, launched a comprehensive platform for pre-owned car transactions in India. This platform provides customers with access to loans, vehicle inspections, valuations, insurance, and RC transfer services, whether buying from individual sellers, dealers, or classified listings. Nxcar has partnered with over 20 banks and non-banking financial companies (NBFCs) to offer nationwide coverage and facilitate end-to-end used car loan services.

In June 2024, MOTORS, a UK-based retailer of used vehicles, acquired Cazoo Group Ltd. for an undisclosed amount. This acquisition is a significant step for MOTORS, which plans to transform Cazoo Group Ltd. into a mobile-first digital marketplace for used cars. Cazoo Group Ltd. is a UK-based online retailer that specializes in the sale and purchase of used cars.

Major companies operating in the pre-owned vehicles market are CarMax Inc., Lithia Motors Inc., Penske Automotive Group, AutoNation, Cox Automotive Inc., Group 1 Automotive Inc., Asbury Automotive Group, Sonic Automotive Inc., Carvana Co., Manheim Inc., Adesa Inc., VroomWheel, CarGurus Inc., DriveTime Automotive Group Inc., Cars.com Inc., ACV Auctions Inc., Edmunds.com Inc., Craigslist Inc., TrueCar Inc., CarsDirect.com Inc., Hemmings, Autoweb.co.uk Ltd., Hertz Car Sales LLC, Enterprise Car Sales

Asia-Pacific was the largest region in the pre-owned vehicles market in 2023. The regions covered in the pre-owned vehicles market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The countries covered in the pre-owned vehicles market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The pre-owned vehicles market consists of sales of used cars, trucks, and sport utility vehicles. Values in this market are 'factory gate' values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

Pre-owned Vehicles Global Market Report 2025 from The Business Research Company provides strategists, marketers and senior management with the critical information they need to assess the market.

This report focuses on pre-owned vehicles market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you within 2-3 working days of order along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Where is the largest and fastest growing market for pre-owned vehicles ? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The pre-owned vehicles market global report from the Business Research Company answers all these questions and many more.

The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market's historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

- Markets Covered:1) By Vehicle Type: Two Wheelers; Three Wheelers; Passenger Vehicles; Light Commercial Vehicles; Heavy Duty Trucks; Buses And Coaches; Off-Road Vehicles

- 2) By Propulsion: Gasoline; Diesel; Electric

- 3) By Certification Status: Certified Pre-Owned (CPO); Non-certified Vehicles

- 4) By Mode of Selling: Online; Dealership Walk-Ins

- 5) By Distribution Channel: Organized Dealers; Multi Brand Retailers; Direct Dealership Sales Agents; Unorganized Dealers; Other Distribution Channels

- Subsegments:

- 1) Two Wheelers: Motorcycles; Scooters; Electric Two Wheelers

- 2) Three Wheelers: Auto Rickshaws; Electric Three Wheelers; Cargo Three Wheelers

- 3) Passenger Vehicles: Sedans; Hatchbacks; SUVs

- 4) Light Commercial Vehicles: Vans; Pickup Trucks; Mini Trucks

- 5) Heavy Duty Trucks: Tractor Trucks; Dump Trucks; Cargo Trucks

- 6) Buses And Coaches: City Buses; Intercity Buses; School Buses

- 7) Off-Road Vehicles: All-Terrain Vehicles (ATVs); Utility Task Vehicles (UTVs); Dirt Bikes

- Companies Mentioned: CarMax Inc.; Lithia Motors Inc.; Penske Automotive Group; AutoNation; Cox Automotive Inc.

- Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

- Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

- Time series: Five years historic and ten years forecast.

- Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita,

- Data segmentations: country and regional historic and forecast data, market share of competitors, market segments.

- Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

- Delivery format: PDF, Word and Excel Data Dashboard.

Table of Contents

1. Executive Summary

2. Pre-owned Vehicles Market Characteristics

3. Pre-owned Vehicles Market Trends And Strategies

4. Pre-owned Vehicles Market - Macro Economic Scenario Including The Impact Of Interest Rates, Inflation, Geopolitics, Covid And Recovery On The Market

5. Global Pre-owned Vehicles Growth Analysis And Strategic Analysis Framework

- 5.1. Global Pre-owned Vehicles PESTEL Analysis (Political, Social, Technological, Environmental and Legal Factors, Drivers and Restraints)

- 5.2. Analysis Of End Use Industries

- 5.3. Global Pre-owned Vehicles Market Growth Rate Analysis

- 5.4. Global Pre-owned Vehicles Historic Market Size and Growth, 2019 - 2024, Value ($ Billion)

- 5.5. Global Pre-owned Vehicles Forecast Market Size and Growth, 2024 - 2029, 2034F, Value ($ Billion)

- 5.6. Global Pre-owned Vehicles Total Addressable Market (TAM)

6. Pre-owned Vehicles Market Segmentation

- 6.1. Global Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Two Wheelers

- Three Wheelers

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Duty Trucks

- Buses And Coaches

- Off-Road Vehicles

- 6.2. Global Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Gasoline

- Diesel

- Electric

- 6.3. Global Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Certified Pre-Owned (CPO)

- Non-certified Vehicles

- 6.4. Global Pre-owned Vehicles Market, Segmentation By Mode of Selling, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Online

- Dealership Walk-Ins

- 6.5. Global Pre-owned Vehicles Market, Segmentation By Distribution Channel, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Organized Dealers

- Multi Brand Retailers

- Direct Dealership Sales Agents

- Unorganized Dealers

- Other Distribution Channels

- 6.6. Global Pre-owned Vehicles Market, Sub-Segmentation Of Two Wheelers, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Motorcycles

- Scooters

- Electric Two Wheelers

- 6.7. Global Pre-owned Vehicles Market, Sub-Segmentation Of Three Wheelers, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Auto Rickshaws

- Electric Three Wheelers

- Cargo Three Wheelers

- 6.8. Global Pre-owned Vehicles Market, Sub-Segmentation Of Passenger Vehicles, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Sedans

- Hatchbacks

- SUVs

- 6.9. Global Pre-owned Vehicles Market, Sub-Segmentation Of Light Commercial Vehicles, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Vans

- Pickup Trucks

- Mini Trucks

- 6.10. Global Pre-owned Vehicles Market, Sub-Segmentation Of Heavy Duty Trucks, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- Tractor Trucks

- Dump Trucks

- Cargo Trucks

- 6.11. Global Pre-owned Vehicles Market, Sub-Segmentation Of Buses And Coaches, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- City Buses

- Intercity Buses

- School Buses

- 6.12. Global Pre-owned Vehicles Market, Sub-Segmentation Of Off-Road Vehicles, By Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- All-Terrain Vehicles (ATVs)

- Utility Task Vehicles (UTVs)

- Dirt Bikes

7. Pre-owned Vehicles Market Regional And Country Analysis

- 7.1. Global Pre-owned Vehicles Market, Split By Region, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 7.2. Global Pre-owned Vehicles Market, Split By Country, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

8. Asia-Pacific Pre-owned Vehicles Market

- 8.1. Asia-Pacific Pre-owned Vehicles Market Overview

- Region Information, Market Information, Background Information, Government Initiatives, Regulations, Regulatory Bodies, Major Associations, Taxes Levied, Corporate Tax Structure, Investments, Major Companies

- 8.2. Asia-Pacific Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 8.3. Asia-Pacific Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 8.4. Asia-Pacific Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

9. China Pre-owned Vehicles Market

- 9.1. China Pre-owned Vehicles Market Overview

- 9.2. China Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F,$ Billion

- 9.3. China Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F,$ Billion

- 9.4. China Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F,$ Billion

10. India Pre-owned Vehicles Market

- 10.1. India Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 10.2. India Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 10.3. India Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

11. Japan Pre-owned Vehicles Market

- 11.1. Japan Pre-owned Vehicles Market Overview

- 11.2. Japan Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 11.3. Japan Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 11.4. Japan Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

12. Australia Pre-owned Vehicles Market

- 12.1. Australia Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 12.2. Australia Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 12.3. Australia Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

13. Indonesia Pre-owned Vehicles Market

- 13.1. Indonesia Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 13.2. Indonesia Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 13.3. Indonesia Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

14. South Korea Pre-owned Vehicles Market

- 14.1. South Korea Pre-owned Vehicles Market Overview

- 14.2. South Korea Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 14.3. South Korea Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 14.4. South Korea Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

15. Western Europe Pre-owned Vehicles Market

- 15.1. Western Europe Pre-owned Vehicles Market Overview

- 15.2. Western Europe Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 15.3. Western Europe Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 15.4. Western Europe Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

16. UK Pre-owned Vehicles Market

- 16.1. UK Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 16.2. UK Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 16.3. UK Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

17. Germany Pre-owned Vehicles Market

- 17.1. Germany Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 17.2. Germany Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 17.3. Germany Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

18. France Pre-owned Vehicles Market

- 18.1. France Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 18.2. France Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 18.3. France Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

19. Italy Pre-owned Vehicles Market

- 19.1. Italy Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 19.2. Italy Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 19.3. Italy Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

20. Spain Pre-owned Vehicles Market

- 20.1. Spain Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 20.2. Spain Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 20.3. Spain Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

21. Eastern Europe Pre-owned Vehicles Market

- 21.1. Eastern Europe Pre-owned Vehicles Market Overview

- 21.2. Eastern Europe Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 21.3. Eastern Europe Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 21.4. Eastern Europe Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

22. Russia Pre-owned Vehicles Market

- 22.1. Russia Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 22.2. Russia Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 22.3. Russia Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

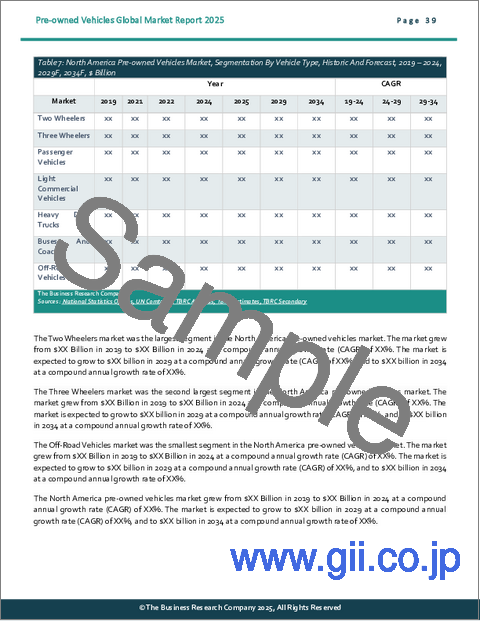

23. North America Pre-owned Vehicles Market

- 23.1. North America Pre-owned Vehicles Market Overview

- 23.2. North America Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 23.3. North America Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 23.4. North America Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

24. USA Pre-owned Vehicles Market

- 24.1. USA Pre-owned Vehicles Market Overview

- 24.2. USA Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 24.3. USA Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 24.4. USA Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

25. Canada Pre-owned Vehicles Market

- 25.1. Canada Pre-owned Vehicles Market Overview

- 25.2. Canada Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 25.3. Canada Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 25.4. Canada Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

26. South America Pre-owned Vehicles Market

- 26.1. South America Pre-owned Vehicles Market Overview

- 26.2. South America Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 26.3. South America Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 26.4. South America Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

27. Brazil Pre-owned Vehicles Market

- 27.1. Brazil Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 27.2. Brazil Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 27.3. Brazil Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

28. Middle East Pre-owned Vehicles Market

- 28.1. Middle East Pre-owned Vehicles Market Overview

- 28.2. Middle East Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 28.3. Middle East Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 28.4. Middle East Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

29. Africa Pre-owned Vehicles Market

- 29.1. Africa Pre-owned Vehicles Market Overview

- 29.2. Africa Pre-owned Vehicles Market, Segmentation By Vehicle Type, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 29.3. Africa Pre-owned Vehicles Market, Segmentation By Propulsion, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

- 29.4. Africa Pre-owned Vehicles Market, Segmentation By Certification Status, Historic and Forecast, 2019-2024, 2024-2029F, 2034F, $ Billion

30. Pre-owned Vehicles Market Competitive Landscape And Company Profiles

- 30.1. Pre-owned Vehicles Market Competitive Landscape

- 30.2. Pre-owned Vehicles Market Company Profiles

- 30.2.1. CarMax Inc. Overview, Products and Services, Strategy and Financial Analysis

- 30.2.2. Lithia Motors Inc. Overview, Products and Services, Strategy and Financial Analysis

- 30.2.3. Penske Automotive Group Overview, Products and Services, Strategy and Financial Analysis

- 30.2.4. AutoNation Overview, Products and Services, Strategy and Financial Analysis

- 30.2.5. Cox Automotive Inc. Overview, Products and Services, Strategy and Financial Analysis

31. Pre-owned Vehicles Market Other Major And Innovative Companies

- 31.1. Group 1 Automotive Inc.

- 31.2. Asbury Automotive Group

- 31.3. Sonic Automotive Inc.

- 31.4. Carvana Co.

- 31.5. Manheim Inc.

- 31.6. Adesa Inc.

- 31.7. VroomWheel

- 31.8. CarGurus Inc.

- 31.9. DriveTime Automotive Group Inc.

- 31.10. Cars.com Inc.

- 31.11. ACV Auctions Inc.

- 31.12. Edmunds.com Inc.

- 31.13. Craigslist Inc.

- 31.14. TrueCar Inc.

- 31.15. CarsDirect.com Inc.

32. Global Pre-owned Vehicles Market Competitive Benchmarking And Dashboard

33. Key Mergers And Acquisitions In The Pre-owned Vehicles Market

34. Recent Developments In The Pre-owned Vehicles Market

35. Pre-owned Vehicles Market High Potential Countries, Segments and Strategies

- 35.1 Pre-owned Vehicles Market In 2029 - Countries Offering Most New Opportunities

- 35.2 Pre-owned Vehicles Market In 2029 - Segments Offering Most New Opportunities

- 35.3 Pre-owned Vehicles Market In 2029 - Growth Strategies

- 35.3.1 Market Trend Based Strategies

- 35.3.2 Competitor Strategies

36. Appendix

- 36.1. Abbreviations

- 36.2. Currencies

- 36.3. Historic And Forecast Inflation Rates

- 36.4. Research Inquiries

- 36.5. The Business Research Company

- 36.6. Copyright And Disclaimer