|

|

市場調査レポート

商品コード

1527783

ゼラチンの世界市場:タイプ別、由来別、用途別、機能別、地域別 - 2029年までの予測Gelatin Market by Source (Animal, Plants), By Applications (Food & Beverages, Pharmaceuticals, Health & Nutrition, Cosmetics, Personal Care, Animal Feed), Type (Type A, Type B), Function (Thickener, Stabilizer, Gelling Agent) - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| ゼラチンの世界市場:タイプ別、由来別、用途別、機能別、地域別 - 2029年までの予測 |

|

出版日: 2024年08月02日

発行: MarketsandMarkets

ページ情報: 英文 238 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のゼラチンの市場規模は2024年に40億米ドルと推定されており、予測期間中のCAGRは6.9%と見込まれ、2029年には56億米ドルに達すると予測されています。

農業用途に次いで高いCAGRで急成長している用途は、アンチエイジング、抗酸化、抗シワの特性を持つ化粧品とパーソナルケア製品です。ゼラチンの継続的な需要は、ローション、化粧品、ウェーブセットローションのようなヘアケア製品のようなパーソナルケア製品のほとんどにあります。また、乾燥や色素沈着の緩和にも役立ちます。ゼラチンに多く含まれるタンパク質は、髪や爪に良いとされています。人間の皮膚に対する優れた生理活性を持つゼラチンは、ほとんどの化粧品に配合されています。また、化粧品としての安全性も報告されています。メーカー各社は、クリームやパウダーからリップカラーやシャンプーに至るまで、ほとんどすべての種類の美容・化粧品にゼラチンを使用しています。このように、時間の経過とともに、生活の変化やストレスの多いライフスタイルがもたらす老化の症状は、化粧品におけるゼラチンの高い需要を意味しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(米ドル)、数量(キロトン) |

| セグメント別 | タイプ別、由来別、用途別、機能別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、その他の地域 |

ゼラチンは動物の製品別から得られ、そのゲル化特性だけでなく、風味や食感を改善するために、世界中のほぼすべてのベーカリーや菓子類食品に使用されています。ゼラチンの代表的な用途としては、グミキャンディー、デザート、ケーキ、マシュマロ、アイスクリーム、ディップ、ソースなどがあり、ゲル化剤、乳化剤、安定化剤として働いています。粉末状のゼラチンは、通常ベーカリー製品に使用されます。

ゼラチンは、フルーツジュース、果実酒、シデン、ビールなど、アルコール飲料とノンアルコール飲料の両方に含まれています。ほとんどの飲料には不純物や不溶物が含まれており、ゼラチンは清澄化するために添加されます。ゼラチンはハイドロコロイドや他のタンパク質と結合して濁りや渋みを抑えるが、風味には影響しません。その上、ゼラチンは多くの飲料において砂糖の代用品として機能します。強化飲料、フルーツジュース、アルコール飲料の需要の増加は、この用途分野におけるゼラチンの世界需要を押し上げる可能性が高いとみられています。

増粘剤セグメントも予測期間中に市場の成長が見られます。ゼラチンは、無味、無臭、無色でありながら、食品の食感や味を向上させる機能性が評価されています。このため、ヨーグルト、チーズ、ケーキ、アイスクリームなどの製品にかなり応用できます。Lapi Gelatine S.p.A.(イタリア)やGelita AG(ドイツ)などの企業は、特に飲食品の増粘剤として使用されるゼラチンを製造しています。

当レポートでは、世界のゼラチン市場について調査し、タイプ別、由来別、用途別、機能別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

第6章 業界の動向

- イントロダクション

- サプライチェーン分析

- バリューチェーン分析

- 貿易分析

- 技術分析

- 価格分析

- エコシステム/市場マップ

- 顧客のビジネスに影響を与える動向/混乱

- 特許分析

- 2024年~2025年の主な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- ゼラチンに代わる新たな原料

- 投資と資金調達のシナリオ

第7章 ゼラチン市場(タイプ別)

- イントロダクション

- タイプA

- タイプB

第8章 ゼラチン市場(由来別)

- イントロダクション

- 豚

- 牛

- 家禽

- 海産物

- その他

第9章 ゼラチン市場(用途別)

- イントロダクション

- 食品・飲料

- 医薬品

- 健康・栄養製品

- 化粧品・パーソナルケア製品

- 飼料

第10章 ゼラチン市場(機能別)

- イントロダクション

- 増粘剤

- スタビライザー

- ゲル化剤

- その他

第11章 ゼラチン市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 南米

- その他の地域

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオと動向

第13章 企業プロファイル

- 主要参入企業

- DARLING INGREDIENTS

- TESSENDERLO GROUP

- GELITA AG

- NITTA GELATIN INC.

- LAPI GELATINE S.P.A.

- INDIA GELATINE & CHEMICALS LTD.

- NARMADA GELATINES LIMITED

- NIPPI, INC.

- WEISHARDT

- TROBAS GELATINE B.V.

- STERLING BIOTECH LTD.

- HEBEI CHENGDA MINGJIAO CO., LTD.

- NORLAND PRODUCTS INC.

- EWALD-GELATIN GMBH

- ITALGEL S.P.A.

- その他の企業

- GELKEN

- KENNEY & ROSS LIMITED

- JELLICE GELATIN & COLLAGEN

- ATHOS COLLAGEN PVT. LTD.

- GELTECH CO., LTD.

- FOODMATE CO., LTD.

- XUSHANG GELATIN CO., LTD.

- ELNASR4GELATIN

- BOOM GELATIN

- BAOTOU DONGBAO BIO-TECH CO., LTD.

第14章 隣接市場と関連市場

第15章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2023

- TABLE 2 GELATIN MARKET SHARE SNAPSHOT, 2024 VS. 2029 (USD MILLION)

- TABLE 3 GELATIN SPECIFICATION FOR PHARMACEUTICAL APPLICATIONS

- TABLE 4 IMPORT SCENARIO FOR HS CODE: 3503, BY COUNTRY, 2019-2023 (USD)

- TABLE 5 EXPORT SCENARIO FOR HS CODE: 1201, BY COUNTRY, 2019-2023 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND, BY REGION, 2020-2023 (USD/KG)

- TABLE 7 AVERAGE SELLING PRICE TREND, BY SOURCE, 2019-2023 (USD/TON)

- TABLE 8 GELATIN MARKET: ECOSYSTEM

- TABLE 9 LIST OF MAJOR PATENTS PERTAINING TO MARKET, 2014-2024

- TABLE 10 GELATIN MARKET: LIST OF KEY CONFERENCES & EVENTS, 2024-2025

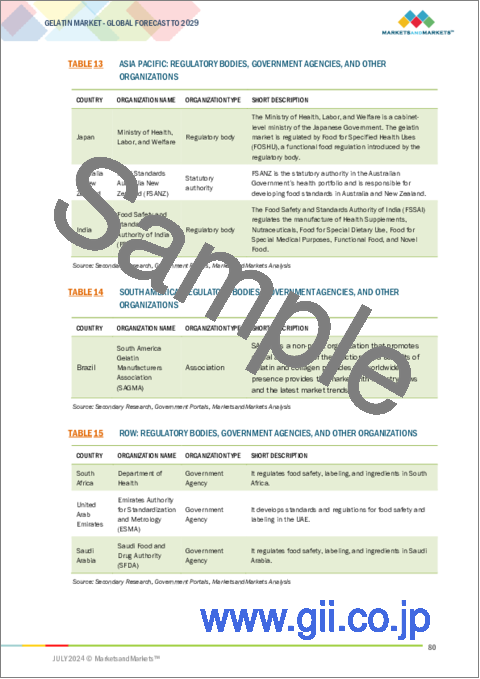

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 PORTER'S FIVE FORCES: IMPACT ON GELATIN MARKET

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS (%)

- TABLE 18 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 19 COMPARISION: GELATIN VS. AGAR AGAR

- TABLE 20 GELATIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 21 GELATIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 22 NUTRITIONAL COMPOSITION OF TYPE A GELATIN

- TABLE 23 TYPE A: GELATIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 24 TYPE A: GELATIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 25 NUTRITIONAL COMPOSITION OF TYPE B GELATIN

- TABLE 26 TYPE B: GELATIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 27 TYPE B: GELATIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 28 GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 29 GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 30 GELATIN MARKET, BY SOURCE, 2020-2023 (KT)

- TABLE 31 GELATIN MARKET, BY SOURCE, 2024-2029 (KT)

- TABLE 32 PORCINE: GELATIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 33 PORCINE: GELATIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 34 PORCINE: GELATIN MARKET, BY REGION, 2020-2023 (KT)

- TABLE 35 PORCINE: GELATIN MARKET, BY REGION, 2024-2029 (KT)

- TABLE 36 BOVINE: GELATIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 37 BOVINE: GELATIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 38 BOVINE: GELATIN MARKET, BY REGION, 2020-2023 (KT)

- TABLE 39 BOVINE: GELATIN MARKET, BY REGION, 2024-2029 (KT)

- TABLE 40 POULTRY: GELATIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 41 POULTRY: GELATIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 42 POULTRY: GELATIN MARKET, BY REGION, 2020-2023 (KT)

- TABLE 43 POULTRY: GELATIN MARKET, BY REGION, 2024-2029 (KT)

- TABLE 44 MARINE: GELATIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 45 MARINE: GELATIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 46 MARINE: GELATIN MARKET, BY REGION, 2020-2023 (KT)

- TABLE 47 MARINE: GELATIN MARKET, BY REGION, 2024-2029 (KT)

- TABLE 48 OTHER SOURCES: GELATIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 49 OTHER SOURCES: GELATIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 50 OTHER SOURCES: GELATIN MARKET, BY REGION, 2020-2023 (KT)

- TABLE 51 OTHER SOURCES: GELATIN MARKET, BY REGION, 2024-2029 (KT)

- TABLE 52 GELATIN MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 53 GELATIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 54 GELATIN AS FOOD INGREDIENT

- TABLE 55 FOOD & BEVERAGES: GELATIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 56 FOOD & BEVERAGES: GELATIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 57 FOOD & BEVERAGES: GELATIN MARKET, BY SUB-APPLICATION, 2020-2023

- TABLE 58 FOOD & BEVERAGES: GELATIN MARKET, BY SUB-APPLICATION, 2024-2029

- TABLE 59 GELATIN TYPES, FUNCTIONS, AND DOSAGES IN CONFECTIONERY & BAKERY APPLICATIONS

- TABLE 60 PHARMACEUTICALS: GELATIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 61 PHARMACEUTICALS: GELATIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 62 GELATIN: NUTRITIONAL INFORMATION

- TABLE 63 HEALTH & NUTRITION PRODUCTS: GELATIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 64 HEALTH & NUTRITION PRODUCTS: GELATIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 65 COSMETICS & PERSONAL CARE PRODUCTS: GELATIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 66 COSMETICS & PERSONAL CARE PRODUCTS: GELATIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 67 FEED: GELATIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 68 FEED: GELATIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 69 FUNCTIONAL PROPERTIES OF GELATIN IN FOOD

- TABLE 70 GELATIN MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 71 GELATIN MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 72 THICKENERS: GELATIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 73 THICKENERS: GELATIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 74 STABILIZERS: GELATIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 75 STABILIZERS: GELATIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 76 GELLING AGENTS: GELATIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 77 GELLING AGENTS: GELATIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 78 OTHER FUNCTIONS: GELATIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 79 OTHER FUNCTIONS: GELATIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 80 GELATIN MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 81 GELATIN MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 82 GELATIN MARKET, BY REGION, 2020-2023 (KT)

- TABLE 83 GELATIN MARKET, BY REGION, 2024-2029 (KT)

- TABLE 84 NORTH AMERICA: GELATIN MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 85 NORTH AMERICA: GELATIN MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 86 NORTH AMERICA: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 87 NORTH AMERICA: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 88 NORTH AMERICA: GELATIN MARKET, BY SOURCE, 2020-2023 (KT)

- TABLE 89 NORTH AMERICA: GELATIN MARKET, BY SOURCE, 2024-2029 (KT)

- TABLE 90 NORTH AMERICA: GELATIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 91 NORTH AMERICA: GELATIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 92 NORTH AMERICA: GELATIN MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 93 NORTH AMERICA: GELATIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 94 NORTH AMERICA: GELATIN MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 95 NORTH AMERICA: GELATIN MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 96 US: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 97 US: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 98 CANADA: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 99 CANADA: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 100 MEXICO: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 101 MEXICO: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 102 EUROPE: GELATIN MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 103 EUROPE: GELATIN MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 104 EUROPE: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 105 EUROPE: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 106 EUROPE: GELATIN MARKET, BY SOURCE, 2020-2023 (KT)

- TABLE 107 EUROPE: GELATIN MARKET, BY SOURCE, 2024-2029 (KT)

- TABLE 108 EUROPE: GELATIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 109 EUROPE: GELATIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 110 EUROPE: GELATIN MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 111 EUROPE: GELATIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 112 EUROPE: GELATIN MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 113 EUROPE: GELATIN MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 114 GERMANY: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 115 GERMANY: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 116 UK: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 117 UK: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 118 FRANCE: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 119 FRANCE: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 120 ITALY: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 121 ITALY: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 122 SPAIN: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 123 SPAIN: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 124 REST OF EUROPE: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 125 REST OF EUROPE: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 126 ASIA PACIFIC: GELATIN MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 127 ASIA PACIFIC: GELATIN MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 128 ASIA PACIFIC: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 129 ASIA PACIFIC: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 130 ASIA PACIFIC: GELATIN MARKET, BY SOURCE, 2020-2023 (KT)

- TABLE 131 ASIA PACIFIC: GELATIN MARKET, BY SOURCE, 2024-2029 (KT)

- TABLE 132 ASIA PACIFIC: GELATIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 133 ASIA PACIFIC: GELATIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 134 ASIA PACIFIC: GELATIN MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 135 ASIA PACIFIC: GELATIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 136 ASIA PACIFIC: GELATIN MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 137 ASIA PACIFIC: GELATIN MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 138 CHINA: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 139 CHINA: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 140 JAPAN: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 141 JAPAN: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 142 INDIA: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 143 INDIA: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 144 AUSTRALIA & NEW ZEALAND: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 145 AUSTRALIA & NEW ZEALAND: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 146 REST OF ASIA PACIFIC: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 148 SOUTH AMERICA: GELATIN MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 149 SOUTH AMERICA: GELATIN MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 150 SOUTH AMERICA: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 151 SOUTH AMERICA: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 152 SOUTH AMERICA: GELATIN MARKET, BY SOURCE, 2020-2023 (KT)

- TABLE 153 SOUTH AMERICA: GELATIN MARKET, BY SOURCE, 2024-2029 (KT)

- TABLE 154 SOUTH AMERICA: GELATIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 155 SOUTH AMERICA: GELATIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 156 SOUTH AMERICA: GELATIN MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 157 SOUTH AMERICA: GELATIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 158 SOUTH AMERICA: GELATIN MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 159 SOUTH AMERICA: GELATIN MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 160 BRAZIL: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 161 BRAZIL: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 162 ARGENTINA: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 163 ARGENTINA: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 164 REST OF SOUTH AMERICA: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 165 REST OF SOUTH AMERICA: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 166 REST OF THE WORLD: GELATIN MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 167 REST OF THE WORLD: GELATIN MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 168 REST OF THE WORLD: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 169 REST OF THE WORLD: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 170 REST OF THE WORLD: GELATIN MARKET, BY SOURCE, 2020-2023 (KT)

- TABLE 171 REST OF THE WORLD: GELATIN MARKET, BY SOURCE, 2024-2029 (KT)

- TABLE 172 REST OF THE WORLD: GELATIN MARKET, BY TYPE, 2020-2023 (USD MILLION)

- TABLE 173 REST OF THE WORLD: GELATIN MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 174 REST OF THE WORLD: GELATIN MARKET, BY APPLICATION, 2020-2023 (USD MILLION)

- TABLE 175 REST OF THE WORLD: GELATIN MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 176 REST OF THE WORLD: GELATIN MARKET, BY FUNCTION, 2020-2023 (USD MILLION)

- TABLE 177 REST OF THE WORLD: GELATIN MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 178 AFRICA: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 179 AFRICA: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 180 MIDDLE EAST: GELATIN MARKET, BY SOURCE, 2020-2023 (USD MILLION)

- TABLE 181 MIDDLE EAST: GELATIN MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 182 OVERVIEW OF STRATEGIES ADOPTED BY KEY GELATIN MARKET PLAYERS

- TABLE 183 GELATIN MARKET: DEGREE OF COMPETITION, 2023

- TABLE 184 GELATIN MARKET: REGION FOOTPRINT

- TABLE 185 GELATIN MARKET: SOURCE FOOTPRINT

- TABLE 186 GELATIN MARKET: APPLICATION FOOTPRINT

- TABLE 187 GELATIN MARKET: FUNCTION FOOTPRINT

- TABLE 188 GELATIN MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 189 GELATIN MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 190 GELATIN MARKET: PRODUCT LAUNCHES, SEPTEMBER 2020-NOVEMBER 2022

- TABLE 191 GELATIN MARKET: DEALS, JANUARY 2020-MAY 2023

- TABLE 192 DARLING INGREDIENTS: COMPANY OVERVIEW

- TABLE 193 DARLING INGREDIENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 DARLING INGREDIENTS: PRODUCT LAUNCHES

- TABLE 195 DARLING INGREDIENTS: DEALS

- TABLE 196 TESSENDERLO GROUP: COMPANY OVERVIEW

- TABLE 197 TESSENDERLO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 TESSENDERLO GROUP: PRODUCT LAUNCHES

- TABLE 199 GELITA AG: COMPANY OVERVIEW

- TABLE 200 GELITA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 GELITA AG: DEALS

- TABLE 202 NITTA GELATIN INC.: COMPANY OVERVIEW

- TABLE 203 NITTA GELATIN INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 204 LAPI GELATINE S.P.A.: COMPANY OVERVIEW

- TABLE 205 LAPI GELATINE S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 LAPI GELATINE S.P.A.: DEALS

- TABLE 207 INDIA GELATINE & CHEMICALS LTD.: COMPANY OVERVIEW

- TABLE 208 INDIA GELATINE & CHEMICALS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 NARMADA GELATINES LIMITED: COMPANY OVERVIEW

- TABLE 210 NARMADA GELATINES LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 211 NIPPI, INC.: COMPANY OVERVIEW

- TABLE 212 NIPPI, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 213 WEISHARDT: COMPANY OVERVIEW

- TABLE 214 WEISHARDT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 TROBAS GELATINE B.V.: COMPANY OVERVIEW

- TABLE 216 TROBAS GELATINE B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 STERLING BIOTECH LTD.: COMPANY OVERVIEW

- TABLE 218 STERLING BIOTECH LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 HEBEI CHENGDA MINGJIAO CO., LTD.: COMPANY OVERVIEW

- TABLE 220 HEBEI CHENGDA MINGJIAO CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 221 NORLAND PRODUCTS INC.: COMPANY OVERVIEW

- TABLE 222 NORLAND PRODUCTS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 223 EWALD-GELATIN GMBH: COMPANY OVERVIEW

- TABLE 224 EWALD-GELATIN GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 225 ITALGEL S.P.A.: COMPANY OVERVIEW

- TABLE 226 ITALGEL S.P.A.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 227 GELKEN: COMPANY OVERVIEW

- TABLE 228 GELKEN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 229 KENNEY & ROSS LIMITED: COMPANY OVERVIEW

- TABLE 230 KENNEY & ROSS LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 231 JELLICE GELATIN & COLLAGEN: COMPANY OVERVIEW

- TABLE 232 JELLICE GELATIN & COLLAGEN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 233 ATHOS COLLAGEN PVT. LTD.: COMPANY OVERVIEW

- TABLE 234 ATHOS COLLAGEN PVT. LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 235 GELTECH CO., LTD.: COMPANY OVERVIEW

- TABLE 236 GELTECH CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 237 FOODMATE CO., LTD.: COMPANY OVERVIEW

- TABLE 238 XUSHANG GELATIN CO., LTD.: COMPANY OVERVIEW

- TABLE 239 ELNASR4GELATIN: COMPANY OVERVIEW

- TABLE 240 BOOM GELATIN: COMPANY OVERVIEW

- TABLE 241 BAOTOU DONGBAO BIO-TECH CO., LTD.: COMPANY OVERVIEW

- TABLE 242 ADJACENT MARKETS

- TABLE 243 COLLAGEN MARKET, BY FORM, 2019-2022 (USD MILLION)

- TABLE 244 COLLAGEN MARKET, BY FORM, 2023-2030 (USD MILLION)

- TABLE 245 COLLAGEN PEPTIDES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 246 COLLAGEN PEPTIDES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 GELATIN MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 4 GELATIN MARKET SIZE CALCULATION: SUPPLY SIDE

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 DATA TRIANGULATION

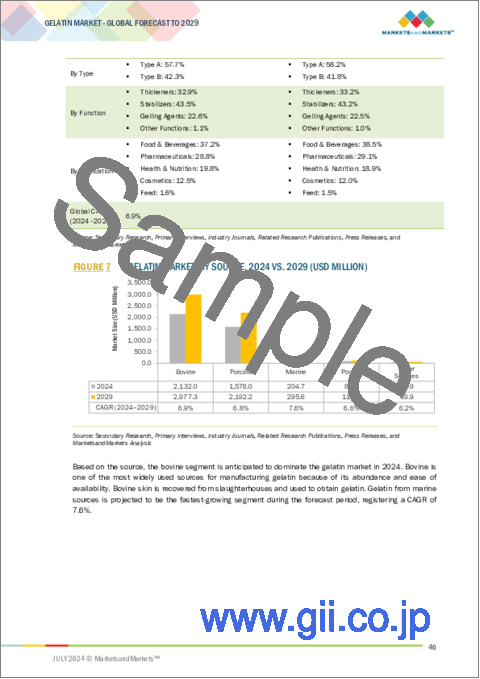

- FIGURE 7 GELATIN MARKET, BY SOURCE, 2024 VS. 2029 (USD MILLION)

- FIGURE 8 GELATIN MARKET, BY FUNCTION, 2024 VS. 2029 (USD MILLION)

- FIGURE 9 GELATIN MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 10 GELATIN MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 11 GELATIN MARKET SHARE AND GROWTH RATE, BY REGION, 2024 (BY VALUE)

- FIGURE 12 INCREASING DEMAND FOR FUNCTIONAL AND CONVENIENCE FOOD & BEVERAGES TO DRIVE MARKET

- FIGURE 13 GERMANY AND TYPE A SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARES IN 2024

- FIGURE 14 TYPE A SEGMENT TO ACCOUNT FOR LARGER MARKET DURING FORECAST PERIOD

- FIGURE 15 BOVINE SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 16 STABILIZERS SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 17 FOOD & BEVERAGES SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 18 TYPE A SEGMENT AND NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARES DURING FORECAST PERIOD

- FIGURE 19 US TO DOMINATE GELATIN MARKET IN 2024

- FIGURE 20 GLOBAL IMPORT AND EXPORT OF GELATIN, 2019-2023 (USD)

- FIGURE 21 GLOBAL POPULATION GROWTH, 1950-2050 (BILLION)

- FIGURE 22 GELATIN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 TOP TEN COUNTRIES IMPORTING CONFECTIONERY PRODUCTS FROM US IN 2022

- FIGURE 24 ADOPTION OF GEN AI IN FOOD & BEVERAGE PRODUCTION PROCESS

- FIGURE 25 GELATIN MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 GELATIN MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 IMPORT OF GELATIN, BY KEY COUNTRY, 2019-2023 (USD)

- FIGURE 28 EXPORT OF GELATIN, BY KEY COUNTRY, 2019-2023 (USD)

- FIGURE 29 GELATIN MARKET: AVERAGE SELLING PRICE TREND, BY REGION, 2020-2023 (USD/TON)

- FIGURE 30 AVERAGE SELLING PRICE TREND, BY SOURCE, 2019-2023 (USD/KG)

- FIGURE 31 KEY PLAYERS IN GELATIN MARKET

- FIGURE 32 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 33 NUMBER OF PATENTS GRANTED FOR GELATIN MARKET, 2014-2024

- FIGURE 34 REGIONAL ANALYSIS OF PATENTS GRANTED FOR GELATIN MARKET, 2023

- FIGURE 35 GELATIN MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS

- FIGURE 37 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 38 INVESTMENT AND FUNDING SCENARIO, 2020-2024 (USD BILLION)

- FIGURE 39 GELATIN MARKET, BY TYPE, 2024 VS. 2029

- FIGURE 40 GELATIN MARKET, BY SOURCE, 2024 VS. 2029 (USD MILLION)

- FIGURE 41 GLOBAL PORK PRODUCTION, 2020-2023 (MILLION METRIC TONS)

- FIGURE 42 GELATIN MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 43 GELATIN MARKET, BY FUNCTION, 2024 VS. 2029 (USD MILLION)

- FIGURE 44 GERMANY TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 45 EUROPE: GELATIN MARKET SNAPSHOT

- FIGURE 46 ASIA PACIFIC: GELATIN MARKET SNAPSHOT

- FIGURE 47 REVENUE ANALYSIS FOR KEY COMPANIES IN LAST 5 YEARS, 2021-2023 (USD BILLION)

- FIGURE 48 SHARE OF LEADING PLAYERS IN GELATIN MARKET, 2023

- FIGURE 49 RANKING OF TOP FIVE PLAYERS IN GELATIN MARKET

- FIGURE 50 GELATIN MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 51 GELATIN MARKET: COMPANY FOOTPRINT

- FIGURE 52 GELATIN MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 53 COMPANY VALUATION FOR FOUR MAJOR PLAYERS IN GELATIN MARKET

- FIGURE 54 EV/EBITDA OF MAJOR PLAYERS

- FIGURE 55 GELATIN MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 56 DARLING INGREDIENTS: COMPANY SNAPSHOT

- FIGURE 57 TESSENDERLO GROUP: COMPANY SNAPSHOT

- FIGURE 58 GELITA AG: COMPANY SNAPSHOT

- FIGURE 59 NITTA GELATIN INC.: COMPANY SNAPSHOT

- FIGURE 60 INDIA GELATINE & CHEMICALS LTD.: COMPANY SNAPSHOT

- FIGURE 61 NARMADA GELATINES LIMITED: COMPANY SNAPSHOT

- FIGURE 62 NIPPI, INC.: COMPANY SNAPSHOT

The global market for gelatin is estimated to be valued at USD 4.0 billion in 2024 and is projected to reach USD 5.6 billion by 2029, at a CAGR of 6.9% during the forecast period. The second-fastest growing application after agriculture applications, in terms of high CAGR, will be cosmetics and personal care products due to their anti-aging, antioxidant, and anti-wrinkle properties. A continued demand for gelatin lies in most of the personal care products, such as lotions, cosmetics, and hair care products like wave-set lotions. It also helps in relieving dryness and pigmentation. The high protein content in gelatin is considered good for hair and nails. With its outstanding bioactivity on human skin, gelatin finds a place in most of the cosmetic preparations. It also has been reported to be safe for a cosmeceutical application. The manufacturers use gelatin in almost every type of beauty and cosmetic preparation starting from creams and powders to lip colors and shampoos. Thus, over time, the symptoms of aging-brought about by altered living and stressful lifestyles-mean high demand for gelatin in cosmetic products.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD), Volume (KT) |

| Segments | By Source, By type, By Function, By Application, and By Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

"The food & beverages segment is projected to dominate the market in the application segment during the forecast period."

Gelatin is obtained from by-products of animals and used in almost all bakery and confectionery foodstuffs in the world, not only for its gelling properties but also to improve flavor and texture. Typical uses of gelatin include in gummy candies, desserts, cakes, marshmallows, ice cream, dips, and sauces-working therein as a gelling, emulsifying, and stabilizing agent. The powdered form of gelatin is usually applied in bakery products.

Gelatin finds a place in both alcoholic and non-alcoholic beverages, like fruit juices, fruit wine, ciden, and beer. Most of the drinks always contain impurities and insoluble matter; gelatin is added to clarify them through a process called fining. The gelatin joins with the hydrocolloids and other proteins to reduce turbidity and astringency but does not affect flavor. Besides, gelatin may act as a sugar substitute in many drinks. Growing demand for fortified beverages, fruit juices, and alcoholic drinks is likely to boost the global demand for gelatin in this application segment.

"The thickener sub-segment in the function segment is estimated to grow at a significant CAGR during the forecast period."

The thickener segment is also seeing growth in the market during the forecast period. Gelatin is valued on account of its functionality to enhance food texture and taste, while being itself tasteless, odorless, and colorless. This makes it quite applicable in products such as yogurt, cheese, cakes, and ice cream. Companies such as Lapi Gelatine S.p.A. (Italy) and Gelita AG (Germany) produce gelatin specifically used as a thickening agent in food and beverages.

"North America has consistently held a substantial market share within the gelatin sector during the study period."

The North American market for gelatin is thriving thanks to a strong biopharmaceutical industry, the wide acceptance of gelatin in pharma applications, easy access to raw materials, and the presence of major players. The large pig population in the region, the US, and, as per the latest number from the USDA in March 2022, it stands at 72.2 million provides the constant raw material requirement.

In addition, the increasing elderly population and the spiraling cases of chronic disorders and other infectious diseases are propelling pharmaceutical sales in North America. Demand is also witnessing a surge for gelatins specifically in the pharmaceutical space, and capsule manufacturers are one of the prime consumers. Furthermore, the utilization of gelatin in hemostats also augments with the increasing cases of traumatic bleeding.

However, the North American industry of pharmaceuticals is unable to optimize these positives as the government interferes in cost-cutting to lower the amount spent on healthcare, which has been one of the most significant moves. And so, pharma manufacturers geographically rebase to more cost-effective production locations like Brazil, India, and China.

Companies like Darling Ingredients, Inc., Great Lakes Gelatin, and Aspire Pharmaceuticals have a vast customer base, while the distribution network is well-established, serving the whole of North America.

The break-up of the profile of primary participants in the gelatin market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: CXO's - 20%, Managers - 50%, Executives- 30%

- By Region: North America - 25%, Europe - 20%, Asia Pacific - 30%, South America - 15% and Rest of the World -10%

Prominent companies in the market include Darling Ingredients (US), Tessenderlo Group (Belgium), GELITA AG (Germany), Nitta Gelatin Inc. (Japan), Lapi Gelatine S.p.a. (Italy), India Gelatine & Chemicals Ltd. (India), Narmada Gelatines Limited (India), Nippi. Inc. (Japan), Weishardt (France), Trobas Gelatine B.V. (Netherlands), Sterling Biotech Ltd (India), Roxlor (US), Suheung (South Korea), Ewald-Gelatin GmbH (Germany), Geltech Co., Ltd (Korea).

Other players include Gelken (China), Kenney & Ross Limited (Canada), Jellice Gelatin & Collagen (Netherlands), Athos Collagen Pvt. Ltd (India), ITALGEL S.p.a. (Italy), Foodmate Co., Ltd (China), Xushang Gelatin Co., Ltd (China), ElNasr4Gelatin (Saudi Arabia), Boom Gelatin (China), Baotou Dongbao Bio-Tech Co., Ltd. (China).

Research Coverage:

This research report categorizes the gelatin market by Source (animals, plants), by type (type A, type B), by applications (food & beverages, pharmaceuticals, cosmetics & personal care, health & nutrition, animal feed), by function (thickeners, stabilizers, gelling agents) and by region (North America, Europe, Asia Pacific, South America, RoW). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the gelatin market. A detailed analysis of the key industry players has been done to provide insights into their business overview, services, key strategies, contracts, partnerships, and agreements. New service launches, mergers and acquisitions, and recent developments associated with the gelatin market. Competitive analysis of upcoming startups in the gelatin market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall gelatin market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing use of gelatin in biomedical applications), restraints (cultural restrictions), opportunities (Changing lifestyles and food habits), and challenges (Animal-borne diseases) influencing the growth of the gelatin market.

- New product launch/Innovation: Detailed insights on research & development activities and new product launches in the gelatin market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the gelatin market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the gelatin market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Darling Ingredients (US), Tessenderlo Group (Belgium), GELITA AG (Germany), Nitta Gelatin Inc. (Japan), Lapi Gelatine S.p.a. (Italy), India Gelatine & Chemicals Ltd. (India) and others in the gelatin market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKET SEGMENTATION

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary profiles

- 2.1.2.3 Key insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 SUPPLY-SIDE ANALYSIS

- 2.2.3 BOTTOM-UP APPROACH (DEMAND SIDE)

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.4.1 STUDY ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN GELATIN MARKET

- 4.2 EUROPEAN GELATIN MARKET, BY TYPE AND COUNTRY

- 4.3 GELATIN MARKET, BY TYPE

- 4.4 GELATIN MARKET, BY SOURCE

- 4.5 GELATIN MARKET, BY FUNCTION

- 4.6 GELATIN MARKET, BY APPLICATION

- 4.7 GELATIN MARKET, BY TYPE AND REGION

- 4.8 GELATIN MARKET: REGIONAL SNAPSHOT

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 RISING TRADE OPPORTUNITIES FOR GELATIN

- 5.2.2 RISING APPETITE FOR GELATIN WITH GLOBAL INCREASE IN POPULATION

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Growing demand for functional and convenience food products

- 5.3.1.2 Increasing applications of gelatin in pharmaceutical industry

- 5.3.1.3 Rising use of gelatin in medical and biomedical applications

- 5.3.1.4 Increasing demand for naturally sourced ingredients

- 5.3.2 RESTRAINTS

- 5.3.2.1 Availability of alternative products

- 5.3.2.2 Limited acceptance due to cultural restrictions

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Use of gelatin in fortified confectionery and sports nutrition products

- 5.3.3.2 Changing lifestyles, food habits, and rapid industrialization in emerging economies

- 5.3.4 CHALLENGES

- 5.3.4.1 Insufficient technologies to extract and process gelatin

- 5.3.4.2 Rising incidence of animal-borne diseases

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON FOOD & BEVERAGE INGREDIENTS/ADDITIVES

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI IN FOOD & BEVERAGE INGREDIENTS/ADDITIVES

- 5.4.3 CASE STUDY ANALYSIS

- 5.4.3.1 Kerry Trendspotter enabled precise identification and prediction of emerging ingredients and flavor trends by analyzing real-time social media data

- 5.4.3.2 Givaudan (Switzerland) developed advanced digital tools to translate vast amounts of consumer data into actionable insights

- 5.4.3.3 International Flavors & Fragrances Inc. (US) partnered with Salus Optima (UK) to create personalized nutrition platform

- 5.4.3.4 AI and cloud technology to address challenges in food & beverage industry

- 5.4.4 IMPACT OF AI ON GELATIN MARKET

- 5.4.5 IMPACT OF GEN AI ON ADJACENT ECOSYSTEM

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RESEARCH & PRODUCT DEVELOPMENT

- 6.3.2 SOURCING

- 6.3.3 PRODUCTION & PROCESSING

- 6.3.4 PACKAGING & STORAGE

- 6.3.5 DISTRIBUTION, SALES, AND MARKETING

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT SCENARIO OF GELATIN, 2019-2023 (USD)

- 6.4.2 EXPORT SCENARIO OF GELATIN, 2019-2023 (USD)

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Application of green technology in gelatin extraction

- 6.5.1.2 Ultrasound-assisted extraction

- 6.5.2 COMPLEMENTARY TECHNOLOGY

- 6.5.2.1 Gelatin-based injectable hydrogels

- 6.5.3 ADJACENT TECHNOLOGY

- 6.5.3.1 Collagen-based injectable hydrogels

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND, BY REGION, 2020-2023

- 6.6.2 AVERAGE SELLING PRICE TREND, BY SOURCE, 2020-2023

- 6.6.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOURCE

- 6.7 ECOSYSTEM/MARKET MAP

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.8.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES & EVENTS DURING 2024-2025

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 REGULATORY FRAMEWORK

- 6.11.2.1 North America

- 6.11.2.1.1 US

- 6.11.2.2 Europe

- 6.11.2.3 Asia Pacific

- 6.11.2.1 North America

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 CASE STUDY ANALYSIS

- 6.14.1 NITTA GELATIN DEVELOPED XACTSET TO MEET RISING DEMAND FOR STARCHLESS GUMMY PRODUCTS

- 6.14.2 PERFECT DAY'S ACQUISITION OF STERLING BIOTECH LIMITED HELPED BROADEN ITS MARKET OFFERINGS

- 6.15 NEW SOURCES SUBSTITUTE TO GELATIN

- 6.15.1 AGAR-AGAR

- 6.15.2 CARRAGEENAN

- 6.15.3 LOCUST BEAN GUM

- 6.15.4 OTHER PLANT SOURCES

- 6.16 INVESTMENT AND FUNDING SCENARIO

7 GELATIN MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 TYPE A

- 7.2.1 HIGH NUTRITIONAL COMPOSITION TO DRIVE TYPE A GELATIN USAGE

- 7.3 TYPE B

- 7.3.1 AMPLE AVAILABILITY OF RAW MATERIALS TO DRIVE TYPE B GELATIN MANUFACTURING

8 GELATIN MARKET, BY SOURCE

- 8.1 INTRODUCTION

- 8.1.1 GELATIN: REGULATIONS SET BY DIFFERENT REGIONS/COUNTRIES

- 8.2 PORCINE

- 8.2.1 INCREASING PORK PRODUCTION TO DRIVE GELATIN MANUFACTURING INDUSTRY WORLDWIDE

- 8.3 BOVINE

- 8.3.1 ABUNDANT AVAILABILITY AND HEALTH BENEFITS OF GELATIN TO DRIVE BOVINE MARKET GROWTH

- 8.4 POULTRY

- 8.4.1 GROWING DEMAND FOR ALTERNATE GELATIN SOURCES TO DRIVE POULTRY GELATIN MARKET

- 8.5 MARINE

- 8.5.1 RISING KEY PLAYERS' INTEREST IN FISH GELATIN TO DRIVE DEMAND FOR MARINE GELATIN

- 8.6 OTHER SOURCES

9 GELATIN MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 FOOD & BEVERAGES

- 9.2.1 GROWING DEMAND FOR PROCESSED FOOD & BEVERAGES TO DRIVE GELATIN MARKET

- 9.2.2 CONFECTIONERY & BAKERY PRODUCTS

- 9.2.3 BEVERAGES

- 9.2.4 DAIRY PRODUCTS

- 9.2.5 MEAT PRODUCTS

- 9.2.6 OTHER FOOD PRODUCTS

- 9.3 PHARMACEUTICALS

- 9.3.1 MULTI-FUNCTIONALITY AND HEALTH BENEFITS OF GELATIN TO DRIVE PHARMACEUTICAL MARKET

- 9.4 HEALTH & NUTRITION PRODUCTS

- 9.4.1 INCREASE IN USE OF GELATIN IN NUTRACEUTICALS TO PUSH CONSUMERS TOWARD SPORTS NUTRITION

- 9.5 COSMETICS & PERSONAL CARE PRODUCTS

- 9.5.1 INCREASING CONSUMER DEMAND FOR USE OF GELATIN IN COSMETICS DUE TO ITS ANTI-AGING PROPERTIES

- 9.6 FEED

- 9.6.1 HIGH BENEFITS OF GELATIN AND GOVERNMENT SUPPORT TO DRIVE DEMAND

10 GELATIN MARKET, BY FUNCTION

- 10.1 INTRODUCTION

- 10.2 THICKENERS

- 10.2.1 INCREASING DEMAND FOR GELATIN AS THICKENING AGENT IN FOOD AND COSMETICS & PERSONAL CARE INDUSTRIES

- 10.3 STABILIZERS

- 10.3.1 GROWING DEMAND FOR GELATIN AS STABILIZER IN FOOD & BEVERAGE INDUSTRY DUE TO ITS FUNCTIONAL PROPERTIES

- 10.4 GELLING AGENTS

- 10.4.1 RISING DEMAND FOR GELATIN AS GELLING AGENT IN VARIOUS BIOMEDICAL APPLICATIONS

- 10.5 OTHER FUNCTIONS

11 GELATIN MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Growing concerns about arthritis and obesity to drive gelatin market

- 11.2.2 CANADA

- 11.2.2.1 Substantial growth of food & beverage and pharmaceutical sectors to drive gelatin market

- 11.2.3 MEXICO

- 11.2.3.1 Higher meat production and growing bakery industry to drive demand for gelatin

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Growth of pharmaceutical industry to drive demand

- 11.3.2 UK

- 11.3.2.1 Growth of food & beverage industry to be major driver for market

- 11.3.3 FRANCE

- 11.3.3.1 Rise in pharmaceutical industry and trade opportunities to drive gelatin market

- 11.3.4 ITALY

- 11.3.4.1 Growth of food and pharmaceutical industries to fuel demand for gelatin

- 11.3.5 SPAIN

- 11.3.5.1 Spain's pharmaceutical industry to drive market for gelatin

- 11.3.6 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Rapidly growing pharmaceutical industry in China to drive gelatin demand in medicines

- 11.4.2 JAPAN

- 11.4.2.1 Growing aging population to drive gelatin market

- 11.4.3 INDIA

- 11.4.3.1 Growth of confectionery industry to drive market

- 11.4.4 AUSTRALIA AND NEW ZEALAND

- 11.4.4.1 Australia's pharmaceutical industry and New Zealand's food & beverage industry to drive demand for gelatin

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.5.1.1 Key player strategies like acquisitions to drive market growth

- 11.5.2 ARGENTINA

- 11.5.2.1 Rising trade opportunities to drive market

- 11.5.3 REST OF SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.6 REST OF THE WORLD (ROW)

- 11.6.1 AFRICA

- 11.6.1.1 Availability of raw material to drive gelatin market

- 11.6.2 MIDDLE EAST

- 11.6.2.1 Rising investments in healthcare industry to drive market

- 11.6.1 AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.4.1 MARKET RANKING ANALYSIS

- 12.4.2 DARLING INGREDIENTS

- 12.4.3 GELITA AG

- 12.4.4 TESSENDERLO GROUP

- 12.4.5 NITTA GELATIN, INC.

- 12.4.6 NIPPI, INC.

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Source footprint

- 12.5.5.4 Application footprint

- 12.5.5.5 Function footprint

- 12.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING, START-UPS/SMES, 2023

- 12.6.5.1 Detailed list of key start-ups/SMEs

- 12.6.5.2 Competitive benchmarking of start-ups/SMEs

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 DARLING INGREDIENTS

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 TESSENDERLO GROUP

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 GELITA AG

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 NITTA GELATIN INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Services/Solutions offered

- 13.1.4.3 Recent developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 LAPI GELATINE S.P.A.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 INDIA GELATINE & CHEMICALS LTD.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.4 MnM view

- 13.1.7 NARMADA GELATINES LIMITED

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Services/Solutions offered

- 13.1.7.3 Recent developments

- 13.1.7.4 MnM view

- 13.1.8 NIPPI, INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Services/Solutions offered

- 13.1.8.3 Recent developments

- 13.1.8.4 MnM view

- 13.1.9 WEISHARDT

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.4 MnM view

- 13.1.10 TROBAS GELATINE B.V.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.4 MnM view

- 13.1.11 STERLING BIOTECH LTD.

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.4 MnM view

- 13.1.12 HEBEI CHENGDA MINGJIAO CO., LTD.

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Services/Solutions offered

- 13.1.12.3 Recent developments

- 13.1.12.4 MnM view

- 13.1.13 NORLAND PRODUCTS INC.

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Services/Solutions offered

- 13.1.13.3 Recent developments

- 13.1.13.4 MnM view

- 13.1.14 EWALD-GELATIN GMBH

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Services/Solutions offered

- 13.1.14.3 Recent developments

- 13.1.14.4 MnM view

- 13.1.15 ITALGEL S.P.A.

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Services/Solutions offered

- 13.1.15.3 Recent developments

- 13.1.15.4 MnM view

- 13.1.1 DARLING INGREDIENTS

- 13.2 OTHER PLAYERS

- 13.2.1 GELKEN

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Services/Solutions offered

- 13.2.1.3 Recent developments

- 13.2.1.4 MnM view

- 13.2.2 KENNEY & ROSS LIMITED

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Services/Solutions offered

- 13.2.2.3 Recent developments

- 13.2.2.4 MnM view

- 13.2.3 JELLICE GELATIN & COLLAGEN

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Services/Solutions offered

- 13.2.3.3 Recent developments

- 13.2.3.4 MnM view

- 13.2.4 ATHOS COLLAGEN PVT. LTD.

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Services/Solutions offered

- 13.2.4.3 Recent developments

- 13.2.4.4 MnM view

- 13.2.5 GELTECH CO., LTD.

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Services/Solutions offered

- 13.2.5.3 Recent developments

- 13.2.5.4 MnM view

- 13.2.6 FOODMATE CO., LTD.

- 13.2.7 XUSHANG GELATIN CO., LTD.

- 13.2.8 ELNASR4GELATIN

- 13.2.9 BOOM GELATIN

- 13.2.10 BAOTOU DONGBAO BIO-TECH CO., LTD.

- 13.2.1 GELKEN

14 ADJACENT & RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 STUDY LIMITATIONS

- 14.3 COLLAGEN MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.4 COLLAGEN PEPTIDES MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS