|

|

市場調査レポート

商品コード

1247342

ポテトプロテインの世界市場:種類別 (分離物、濃縮物)・特性別 (オーガニック、従来型)・用途別 (食品・飲料、飼料)・地域別 (北米、欧州、アジア太平洋、その他) の将来予測 (2028年まで)Potato Protein Market by Type (Isolates and Concentrates), Nature (Organic and Conventional), Application (Food & Beverages and Feed), and Region (North America, Europe, Asia Pacific and Rest of the World) - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ポテトプロテインの世界市場:種類別 (分離物、濃縮物)・特性別 (オーガニック、従来型)・用途別 (食品・飲料、飼料)・地域別 (北米、欧州、アジア太平洋、その他) の将来予測 (2028年まで) |

|

出版日: 2023年03月17日

発行: MarketsandMarkets

ページ情報: 英文 252 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のポテトプロテインの市場規模は、2022年の1億500万米ドルから、2028年には1億4,400万米ドルに達し、予測期間中に5.4%のCAGR (金額ベース) で成長すると予想されています。

ポテトプロテインは、ポテトジュースや工業用ポテト廃棄物から抽出されます。ポテトプロテインの栄養価や機能性は、他の野菜や穀物のタンパク質よりも重要であることが判明しています。そのため食品・飲料メーカーでは、タンパク質が豊富な商品を作るためにポテトプロテインを採用するようになってきています。

"種類別に見ると、ポテトプロテイン分離物が食品産業で広く活用されている"

加工されたポテトプロテイン分離物は、食品のタンパク質レベルを高めるために食品に添加され、商業的に使用されています。穏やかな分離技術を用いたポテトプロテイン分離物は、栄養価・代謝・汚染物質に大きな変化をもたらすことはありません。ポテトプロテイン分離物は、高い消化性とブレンド能力を持つため、これを用いて新しいクラスのデザイン食品が開発されています。ポテトプロテイン分離物は、タンパク質濃度が高く、色、風味、機能性において優れているため、他のポテトプロテインと比較して優位に立つことができます。

"用途別では、ベーカリー製品・菓子類で予測期間中に高い需要が見込まれる"

ポテトプロテインは、ベーカリー用途において、通常タンパク質がかなり少ないパン製品のタンパク質強化に使用されています。また、ポテトプロテインを使用したベーカリー製品は、グルテンフリーであるため、小麦タンパク質製品の代替品として使用することができます。パンやケーキなどのグルテンフリーベーカリー製品の需要が高まっていることが、この市場にチャンスをもたらしています。さらに、菓子類やベーカリー製品では、ポテトプロテインは焼き菓子の粘性・風味・構造を向上させる成分として頻繁に使用されています。こうした用途の需要に応えるため、継続的なイノベーションと新製品が市場で形成されています

"地域別に見ると、欧州ではドイツが、顧客の関心増大や植物性製品の需要拡大により、ポテトプロテイン市場を牽引する"

植物性タンパク質の需要は世界的に増加しており、ドイツも例外ではありません。その背景には、健康への関心、環境意識、動物愛護の問題など、いくつかの要因があります。ポテトプロテインは、低脂肪でコレステロールを含まない高品質のタンパク質源であるため、健康やウェルネスに人気のある素材です。また、肉や乳製品などの動物性タンパク質源と比較して、環境への負荷が小さいという特徴もあります。さらに、ポテトプロテインは必須アミノ酸をすべて含む高品質のタンパク質源であり、またグルテンフリー・非GM・アレルゲンフリーといった魅力があります。ドイツ政府は、さまざまな規制や取り組みを通じて、ポテトプロテイン産業の成長を支援してきました。

当レポートでは、世界のポテトプロテイン (ジャガイモタンパク質) の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別・特性別・用途別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 植物性食品の消費の増加

- グルテンフリー食品の需要の増加

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界動向

- イントロダクション

- バリューチェーン分析

- サプライチェーン分析

- ポテトプロテイン市場:マーケットマップとエコシステム

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- 価格分析

- ポテトプロテイン市場:特許分析

- 貿易分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 規制の枠組み

- ケーススタディ

- 主な会議とイベント

第7章 ポテトプロテイン市場:種類別

- イントロダクション

- 分離物

- 濃縮物

第8章 ポテトプロテイン市場:特性別

- イントロダクション

- オーガニック

- 従来型

第9章 ポテトプロテイン市場:用途別

- イントロダクション

- 食品・飲料

- ベーカリー製品・菓子類

- 飲料

- 加工食品

- 乳製品の代替品

- 肉製品

- スポーツ栄養

- 乳児栄養

- 代替肉

- その他の食品・飲料用途

- 飼料

第10章 ポテトプロテイン市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- イントロダクション

- 南米

- 中東・アフリカ

第11章 競合情勢

- 概要

- 市場シェア分析

- 主要企業の収益分析:セグメント別

- 主要企業が採用した戦略

- 企業評価クアドラント (主要企業)

- 企業評価クアドラント (スタートアップ/中小企業)

- 競合シナリオ

- 資本取引

- その他の動向

第12章 企業プロファイル

- 主要企業

- AVEBE

- TEREOS

- KERRY GROUP PLC

- SUDZUCKER AG

- ROQUETTE FRERES

- EMSLAND GROUP

- KMC INGREDIENTS

- PEPEES GROUP

- AKV LANGHOLT

- PPZ NIECHLOW

- THE SCOULAR COMPANY

- FINNAMYL

- KEMIN INDUSTRIES

- BIORIGINAL

- DUYNIE

- その他の企業

- AMINOLA B.V.

- GAOYUAN

- HEALTHMARQUE

- HJHERB

- KINGS DEHYDRATED FOODS PRIVATE LIMITED

- ZETPEZET

- SUDSTARKE

- ROYAL INGREDIENTS GROUP

- MEELUNIE

- EQUISTRO

第13章 隣接・関連市場

- イントロダクション

- 制限事項

- テクスチャード植物性タンパク質市場

- 植物性タンパク質市場

第14章 付録

The global the potato protein market is projected to reach USD 144 million by 2028 from USD 105 million by 2022, at a CAGR of 5.4% during the forecast period in terms of value. Protein has acknowledged superiority due to awareness and demand for healthy food. Potato protein is extracted from potato juice and industrial potato waste, and the nutritional and functional values of potato protein have been found to be more significant than other vegetables and cereal proteins. Hence, manufacturers are adopting potato protein to create protein-rich commodities in the food & beverage industry.

"By type, Potato protein Isolate is widely used in food industry."

Potato protein isolates largely finds application in the food industry when compared to the feed industry. Processed potato protein isolates are therefore used commercially for adding to food products to boost their protein level. Potato protein isolates using mild separation techniques do not lead to a significant change in the nutritional value, metabolism or contaminants. Potato protein isolates have high digestibility and blending abilities; hence, a new class of designed foods is developed using it. It has increased protein concentration & advantages in color, flavor and functional qualities, thus giving other varieties of potato protein a competitive edge.

"By application, Bakery & Confectionery is projected in high demand during the forecast period."

Potato protein is used for the protein enrichment of bread products that are usually quite low in protein in bakery application. Further, bakery products with potato protein can be used as a replacement for wheat protein products as it is gluten-free; this provides this market with an opportunity as there is a growing demand for gluten-free bakery goods such as bread and cakes. In confectionery and baking, potato protein is frequently used as an ingredient to enhance the consistency, flavor, and structure of baked goods. Protein from potatoes is high in amino acids but low in fat and carbs. Potato protein improves the texture of baked goods and has a high water-binding capacity which helps keep baked goods moist and prevent them from drying out. Potato protein is also a good choice for those with gluten intolerances or allergies due to its lack of gluten. The production of gluten-free baked goods is possible by substituting potato protein for wheat flour. Continuous innovation and new products are formed in the market to meet the demand for this application. KMC ingredients (Denmark) offers Protafy 130 potato protein products which are ideal for protein fortification of products based on dough systems, such as bakery, pasta or extruded snacks and pellets.

"By Region, Germany in Europe is driving the market in potato protein market due to increase in customer awareness and growing demand for plant-based products."

The demand for plant-based proteins is increasing globally, and Germany is no exception. It is driven by several factors, including health concerns, environmental awareness, and animal welfare issues. Potato protein being a high-quality protein source that is low in fat and is cholesterol-free, makes it popular ingredient in health and wellness. Moreover, potato protein has a smaller environmental footprint compared to animal-based protein sources such as meat and dairy. Additionally, potato protein is a high-quality protein source that contains all essential amino acids, making it an attractive option for health-conscious consumers. In addition, potato protein is gluten-free, non-GMO, and allergen-free, which adds to its appeal. The German government has been supporting the growth of the potato protein industry through various regulations and initiatives. In 2019, the German Ministry of Food and Agriculture included the promotion of plant-based protein sources in its "National Action Plan for Sustainable Consumption." This kind of support is expected to help drive demand for potato protein in the country.

Break-up of Primaries:

By Value Chain Side: Demand Side-41%, Supply Side-59%

By Designation: CXOs-31%, Managers - 24%, and Executives- 45%

By Region: Europe - 40%, Asia Pacific - 20%, North America - 30%, RoW - 10%

Leading players profiled in this report:

- Avebe (Netherlands)

- Tereos (France)

- Kerry Group PLC (Ireland)

- Sudzucker AG (US)

- Roquette Freres (France)

- Emsland Group (Germany)

- KMC Ingredients (Denmark)

- Pepees Group (Poland)

- AKV Langholt (Denmark)

- PPZ Niechlow (Poland)

- The Scoular Company (US)

- Finnamyl (Finland)

- Kemin Industries (USA)

- Bioriginal (Canada)

- Duynie (Netherlands)

Research Coverage:

The report segments the potato protein market on the basis on type, nature, application and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global potato protein market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the potato protein market.

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them.

- To gain insights about the major countries/regions in which the potato protein market is flourishing.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.4 INCLUSIONS AND EXCLUSIONS

- FIGURE 2 POTATO PROTEIN: GEOGRAPHIC SEGMENTATION

- 1.5 YEARS CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.6.1 CURRENCY/VALUE UNIT

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017-2022

- 1.6.2 VOLUME UNIT

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 RECESSION IMPACT ANALYSIS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 POTATO PROTEIN MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 POTATO PROTEIN MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 POTATO PROTEIN MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 POTATO PROTEIN MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 8 POTATO PROTEIN MARKET SIZE ESTIMATION (SUPPLY SIDE)

- 2.3 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.4 GROWTH RATE FORECAST ASSUMPTIONS

- 2.5 ASSUMPTIONS OF STUDY

- FIGURE 10 ASSUMPTIONS OF STUDY

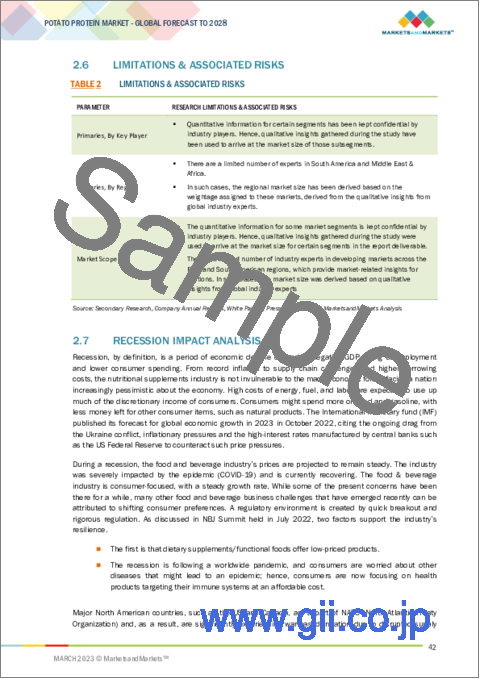

- 2.6 LIMITATIONS & ASSOCIATED RISKS

- TABLE 2 LIMITATIONS & ASSOCIATED RISKS

- 2.7 RECESSION IMPACT ANALYSIS

- 2.7.1 RECESSION IMPACT ON POTATO PROTEIN MARKET

- 2.7.1.1 Macroeconomic indicators of recession

- FIGURE 11 INDICATORS OF RECESSION

- FIGURE 12 GLOBAL INFLATION RATE, 2011-2021

- FIGURE 13 GLOBAL GDP, 2011-2021 (USD TRILLION)

- FIGURE 14 RECESSION INDICATORS AND THEIR IMPACT ON POTATO PROTEIN MARKET

- FIGURE 15 POTATO PROTEIN MARKET: PREVIOUS FORECAST VS. RECESSION FORECAST (USD MILLION)

- 2.7.1 RECESSION IMPACT ON POTATO PROTEIN MARKET

3 EXECUTIVE SUMMARY

- TABLE 3 POTATO PROTEIN MARKET SNAPSHOT (VALUE)

- FIGURE 16 POTATO PROTEIN MARKET, BY APPLICATION, 2023 VS. 2028 (USD THOUSAND)

- FIGURE 17 POTATO PROTEIN MARKET, BY TYPE, 2023 VS. 2028 (USD THOUSAND)

- FIGURE 18 POTATO PROTEIN MARKET, BY REGION, 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR POTATO PROTEIN MARKET PLAYERS

- FIGURE 19 DEMAND FOR FAST FOOD AND PLANT-BASED FOOD FOR POTATO PROTEIN MARKET

- 4.2 POTATO PROTEIN MARKET: MAJOR REGIONAL SUBMARKETS

- FIGURE 20 US WAS LARGEST MARKET GLOBALLY IN 2022

- 4.3 ASIA PACIFIC: POTATO PROTEIN MARKET, BY APPLICATION & COUNTRY

- FIGURE 21 GERMANY AND FEED WERE LARGEST POTATO PROTEIN MARKET SEGMENTS IN EUROPE IN 2022

- 4.4 POTATO PROTEIN MARKET, BY TYPE

- FIGURE 22 POTATO PROTEIN CONCENTRATES PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 POTATO PROTEIN MARKET, BY NATURE

- FIGURE 23 CONVENTIONAL POTATO PROTEIN TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.6 POTATO PROTEIN MARKET, BY APPLICATION

- FIGURE 24 FEED APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.7 POTATO PROTEIN MARKET, BY TYPE & REGION

- FIGURE 25 EUROPE TO DOMINATE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 RISE IN CONSUMPTION OF PLANT-BASED DIETS

- FIGURE 26 US: PLANT-BASED FOOD MARKET SALES, 2017 VS. 2019 (USD BILLION)

- 5.2.2 INCREASE IN DEMAND FOR GLUTEN-FREE FOOD PRODUCTS

- FIGURE 27 US: SALES OF GLUTEN-FREE PRODUCTS, 2020 VS. 2026 (USD BILLION)

- 5.3 MARKET DYNAMICS

- FIGURE 28 POTATO PROTEIN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.3.1 DRIVERS

- 5.3.1.1 Increase in vegan population

- TABLE 4 NUMBER OF VEGAN RESTAURANTS IN TOP FIVE VEGAN COUNTRIES

- 5.3.1.2 Consumer concerns regarding food allergens in products

- 5.3.1.3 Nutritional benefits of potato protein

- FIGURE 29 PROTEIN FRACTIONS OF POTATO PROTEIN

- 5.3.1.4 Increased demand for fast-food chains

- 5.3.2 RESTRAINTS

- 5.3.2.1 High production cost of potato protein

- TABLE 5 CHINA: COST AND PROFIT ANALYSIS OF POTATO STARCH PRODUCTION LINE, 2019

- 5.3.2.2 Potential fear of replacement of potato protein in food and feed industries

- TABLE 6 APPLICATION OF POTATO PROTEIN VS. OTHER PROTEIN SOURCES

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Growth in investments in new production facilities

- 5.3.3.2 Adoption of new technologies in potato protein industry

- 5.3.4 CHALLENGES

- 5.3.4.1 Low global production and distribution of potato protein

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH & DEVELOPMENT

- 6.2.2 SOURCING OF RAW MATERIALS

- 6.2.3 PRODUCTION & PROCESSING

- 6.2.4 DISTRIBUTION, MARKETING, AND SALES

- FIGURE 30 POTATO PROTEIN MARKET: VALUE CHAIN ANALYSIS

- 6.3 SUPPLY CHAIN ANALYSIS

- FIGURE 31 POTATO PROTEIN MARKET: SUPPLY CHAIN ANALYSIS

- 6.4 MARKET MAP AND ECOSYSTEM OF POTATO PROTEIN MARKET

- 6.4.1 POTATO PROTEIN: DEMAND SIDE

- 6.4.2 POTATO PROTEIN: SUPPLY SIDE

- FIGURE 32 POTATO PROTEIN MARKET: MARKET MAP

- 6.4.3 ECOSYSTEM MAP

- TABLE 7 POTATO PROTEIN MARKET: ECOSYSTEM

- 6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN POTATO PROTEIN MARKET

- FIGURE 33 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 SPRAY DRYING

- 6.6.1.1 Atomization

- 6.6.1.2 Dehydration

- 6.6.1.3 Powder collection

- 6.6.2 SEPARATION AND COAGULATION

- 6.6.1 SPRAY DRYING

- 6.7 PRICING ANALYSIS

- 6.7.1 AVERAGE SELLING PRICE, BY TYPE

- 6.7.2 SELLING PRICE CHARGED BY KEY PLAYERS IN TERMS OF TYPES

- FIGURE 34 SELLING PRICE OF KEY PLAYERS FOR POTATO PROTEIN TYPE, 2022 (USD/KG)

- TABLE 8 AVERAGE SELLING PRICE FOR TYPE, 2022 (USD/KG)

- 6.7.3 AVERAGE SELLING PRICE, BY TYPE

- FIGURE 35 AVERAGE SELLING PRICE, BY TYPE, 2018-2022 (USD/TON)

- TABLE 9 POTATO PROTEIN ISOLATES: AVERAGE SELLING PRICE, BY REGION, 2018-2022 (USD/TON)

- TABLE 10 POTATO PROTEIN CONCENTRATES: AVERAGE SELLING PRICE, BY REGION, 2018-2022 (USD/TON)

- 6.8 POTATO PROTEIN MARKET: PATENT ANALYSIS

- FIGURE 36 NUMBER OF PATENTS GRANTED BETWEEN 2013 AND 2022

- FIGURE 37 REGIONAL ANALYSIS OF PATENTS GRANTED FOR POTATO PROTEIN, 2013-2022

- TABLE 11 LIST OF KEY PATENTS PERTAINING TO POTATO PROTEIN, 2013-2022

- 6.9 TRADE ANALYSIS

- 6.9.1 IMPORT SCENARIO

- FIGURE 38 IMPORT VALUE OF POTATO STARCH FOR KEY COUNTRIES, 2017-2021 (USD THOUSAND)

- TABLE 12 TOP 10 IMPORTERS OF POTATO STARCH, 2021 (USD THOUSAND)

- 6.9.2 EXPORT SCENARIO

- FIGURE 39 EXPORT VALUE OF POTATO STARCH FOR KEY COUNTRIES, 2017-2021 (USD THOUSAND)

- TABLE 13 TOP 10 EXPORTERS OF POTATO STARCH, 2021 (USD THOUSAND)

- 6.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 POTATO PROTEIN MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.10.1 THREAT OF NEW ENTRANTS

- 6.10.2 THREAT OF SUBSTITUTES

- 6.10.3 BARGAINING POWER OF SUPPLIERS

- 6.10.4 BARGAINING POWER OF BUYERS

- 6.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 40 INFLUENCE OF STAKEHOLDERS ON BUYING FOR TOP APPLICATIONS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS

- 6.11.2 BUYING CRITERIA

- FIGURE 41 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- TABLE 16 KEY BUYING CRITERIA FOR POTATO PROTEIN APPLICATIONS

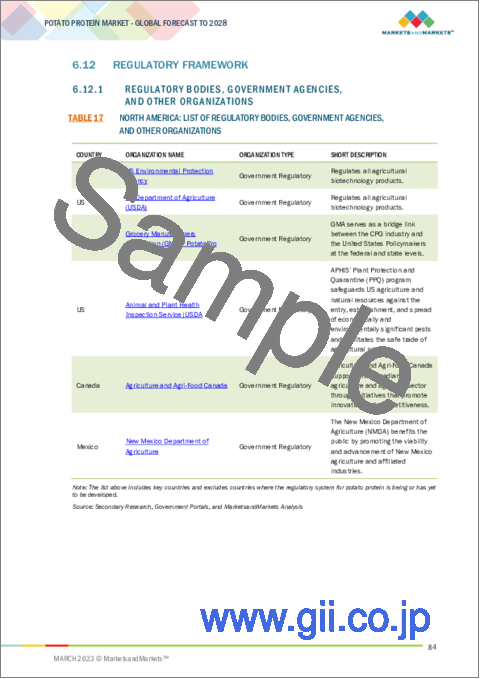

- 6.12 REGULATORY FRAMEWORK

- 6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 MIDDLE EAST: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.1.1 North America

- 6.12.1.2 Europe

- 6.12.1.3 Asia Pacific

- 6.12.1.4 Rest of the World

- 6.13 CASE STUDIES

- 6.13.1 KMC INGREDIENTS: DEVELOPMENT OF POTATO PROTEIN FOR INCORPORATION IN NUTRITIOUS SNACKS AND BEVERAGES

- TABLE 23 AVEBE: SOLANIC100 POTATO PROTEIN

- 6.13.2 KERRY GROUP PLC: DEVELOPMENT OF POTATO PROTEIN FOR CHEESE-FLAVORED SNACKS

- TABLE 24 KERRY GROUP PLC: CHEESE-FLAVORED SNACKS

- 6.14 KEY CONFERENCES & EVENTS

- TABLE 25 POTATO PROTEIN MARKET: LIST OF CONFERENCES & EVENTS, 2023-2024

7 POTATO PROTEIN MARKET, BY TYPE

- 7.1 INTRODUCTION

- TABLE 26 POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 27 POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 28 POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (TON)

- TABLE 29 POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (TON)

- 7.2 ISOLATES

- 7.2.1 MULTIFUNCTIONAL USE IN FOOD & BEVERAGE INDUSTRY

- TABLE 30 POTATO PROTEIN ISOLATES MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 31 POTATO PROTEIN ISOLATES MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- TABLE 32 POTATO PROTEIN ISOLATES MARKET, BY REGION, 2017-2022 (TON)

- TABLE 33 POTATO PROTEIN ISOLATES MARKET, BY REGION, 2023-2028 (TON)

- 7.3 CONCENTRATES

- 7.3.1 HIGH PROTEIN CONTENT PREFERRED IN FEED APPLICATIONS AND VEGAN OPTIONS

- TABLE 34 POTATO PROTEIN CONCENTRATES MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 35 POTATO PROTEIN CONCENTRATES MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- TABLE 36 POTATO PROTEIN CONCENTRATES MARKET, BY REGION, 2017-2022 (TON)

- TABLE 37 POTATO PROTEIN CONCENTRATES MARKET, BY REGION, 2023-2028 (TON)

8 POTATO PROTEIN MARKET, BY NATURE

- 8.1 INTRODUCTION

- TABLE 38 POTATO PROTEIN MARKET, BY NATURE, 2017-2022 (USD THOUSAND)

- TABLE 39 POTATO PROTEIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- 8.2 ORGANIC

- 8.2.1 GROWTH IN CUSTOMER AWARENESS REGARDING SAFETY ASSURANCE

- TABLE 40 ORGANIC POTATO PROTEIN MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 41 ORGANIC POTATO PROTEIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 8.3 CONVENTIONAL

- 8.3.1 COST EFFICIENCY OF CONVENTIONAL PROTEINS

- TABLE 42 CONVENTIONAL POTATO PROTEIN MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 43 CONVENTIONAL POTATO PROTEIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

9 POTATO PROTEIN MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- TABLE 44 POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 45 POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 9.2 FOOD & BEVERAGES

- 9.2.1 GROWTH IN DEMAND FOR ALLERGEN-FREE FOOD & BEVERAGE PRODUCTS

- TABLE 46 FOOD & BEVERAGES APPLICATION MARKET, BY SUBAPPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 47 FOOD & BEVERAGES APPLICATION MARKET, BY SUBAPPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 48 FOOD & BEVERAGES APPLICATION MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 49 FOOD & BEVERAGES APPLICATION MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 9.2.2 BAKERY & CONFECTIONERY

- 9.2.2.1 Increase in demand for gluten-free bakery items

- TABLE 50 BAKERY & CONFECTIONERY APPLICATION MARKET, BY SUBAPPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 51 BAKERY & CONFECTIONERY APPLICATION MARKET, BY SUBAPPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 52 BAKERY & CONFECTIONERY APPLICATION MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 53 BAKERY & CONFECTIONERY APPLICATION MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 9.2.2.2 Breads

- 9.2.2.2.1 Appropriate texture provided by potato flour in breads

- 9.2.2.2 Breads

- TABLE 54 BREAD APPLICATIONS MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 55 BREAD APPLICATIONS MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 9.2.2.3 Pastries

- 9.2.2.3.1 Increase in demand for potato protein as substitute for egg whites

- 9.2.2.3 Pastries

- TABLE 56 PASTRY APPLICATIONS MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 57 PASTRY APPLICATIONS MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 9.2.2.4 Cookies & Crackers

- 9.2.2.4.1 Crisp texture preferred in cookies and crackers

- 9.2.2.4 Cookies & Crackers

- TABLE 58 COOKIE & CRACKER APPLICATIONS MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 59 COOKIE & CRACKER APPLICATIONS MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 9.2.2.5 Other Bakery & Confectionery Applications

- TABLE 60 OTHER BAKERY & CONFECTIONERY APPLICATIONS MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 61 OTHER BAKERY & CONFECTIONERY APPLICATIONS MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 9.2.3 BEVERAGES

- 9.2.3.1 Increase in working population in need of ready-to-drink beverages

- TABLE 62 BEVERAGE APPLICATIONS MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 63 BEVERAGE APPLICATIONS MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 9.2.4 PROCESSED FOOD

- 9.2.4.1 Demand for healthy and gluten-free snack items among young individuals

- TABLE 64 PROCESSED FOOD APPLICATIONS MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 65 PROCESSED FOOD APPLICATIONS MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 9.2.5 DAIRY ALTERNATIVES

- 9.2.5.1 Consumer awareness toward health benefits associated with dairy alternatives

- TABLE 66 DAIRY ALTERNATIVE APPLICATIONS MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 67 DAIRY ALTERNATIVE APPLICATIONS MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 9.2.6 MEAT PRODUCTS

- 9.2.6.1 High biological value with high amino acid score of potato protein

- TABLE 68 MEAT PRODUCT APPLICATIONS MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 69 MEAT PRODUCT APPLICATIONS MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 9.2.7 SPORTS NUTRITION

- 9.2.7.1 Demand for higher body metabolism and lower blood pressure levels in sports

- TABLE 70 SPORTS NUTRITION APPLICATIONS MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 71 SPORTS NUTRITION APPLICATIONS MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 9.2.8 INFANT NUTRITION

- 9.2.8.1 Rise in awareness of lactose intolerance and milk allergies

- TABLE 72 INFANT NUTRITION APPLICATIONS MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 73 INFANT NUTRITION APPLICATIONS MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 9.2.9 MEAT ALTERNATIVES

- 9.2.9.1 Preference for frying crust texture and binding ingredients

- TABLE 74 MEAT ALTERNATIVE APPLICATIONS MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 75 MEAT ALTERNATIVE APPLICATIONS MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 9.2.10 OTHER FOOD & BEVERAGE APPLICATIONS

- TABLE 76 OTHER FOOD APPLICATIONS MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 77 OTHER FOOD APPLICATIONS MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- 9.3 FEED

- 9.3.1 HIGH PROTEIN DIGESTIBILITY OFFERED BY POTATO PROTEIN IN FEED

- TABLE 78 FEED APPLICATIONS MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 79 FEED APPLICATIONS MARKET, BY REGION, 2023-2028 (USD THOUSAND)

10 POTATO PROTEIN MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 42 US ACCOUNTED FOR LARGEST SHARE OF POTATO PROTEIN MARKET IN 2022

- FIGURE 43 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR OF POTATO PROTEIN MARKET

- TABLE 80 POTATO PROTEIN MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 81 POTATO PROTEIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- TABLE 82 POTATO PROTEIN MARKET, BY REGION, 2017-2022 (TON)

- TABLE 83 POTATO PROTEIN MARKET, BY REGION, 2023-2028 (TON)

- 10.2 NORTH AMERICA

- 10.2.1 INTRODUCTION

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 44 NORTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017-2021

- FIGURE 45 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2023

- TABLE 84 NORTH AMERICA: POTATO PROTEIN MARKET, BY COUNTRY, 2017-2022 (USD THOUSAND)

- TABLE 85 NORTH AMERICA: POTATO PROTEIN MARKET, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 86 NORTH AMERICA: POTATO PROTEIN MARKET, BY COUNTRY, 2017-2022 (TON)

- TABLE 87 NORTH AMERICA: POTATO PROTEIN MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 88 NORTH AMERICA: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 89 NORTH AMERICA: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 90 NORTH AMERICA: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (TON)

- TABLE 91 NORTH AMERICA: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (TON)

- TABLE 92 NORTH AMERICA: POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 93 NORTH AMERICA: POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 94 NORTH AMERICA: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 95 NORTH AMERICA: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 96 NORTH AMERICA: POTATO PROTEIN MARKET, BY NATURE, 2017-2022 (USD THOUSAND)

- TABLE 97 NORTH AMERICA POTATO PROTEIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- 10.2.3 US

- 10.2.3.1 Government investments and increase in exports

- TABLE 98 US: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 99 US: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 100 US: POTATO PROTEIN MARKET, BY NATURE, 2017-2022 (USD THOUSAND)

- TABLE 101 US: POTATO PROTEIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- TABLE 102 US: POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 103 US: POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 10.2.4 CANADA

- 10.2.4.1 Increase in demand for plant-based protein sources and sustainable food options

- TABLE 104 CANADA: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 105 CANADA: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 106 CANADA: NORTH AMERICAN POTATO PROTEIN MARKET, BY NATURE, 2017-2022 (USD THOUSAND)

- TABLE 107 CANADA: POTATO PROTEIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- TABLE 108 CANADA: POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 109 CANADA: POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 10.2.5 MEXICO

- 10.2.5.1 Government initiatives and rise in use of potato protein in food & beverage industry

- TABLE 110 MEXICO: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 111 MEXICO: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 112 MEXICO: POTATO PROTEIN MARKET, BY NATURE, 2017-2022 (USD THOUSAND)

- TABLE 113 MEXICO: POTATO PROTEIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- TABLE 114 MEXICO: POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 115 MEXICO: POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 10.3 EUROPE

- 10.3.1 INTRODUCTION

- 10.3.2 EUROPE: RECESSION IMPACT

- FIGURE 46 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2017-2021

- FIGURE 47 EUROPE: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 48 EUROPE: POTATO PROTEIN MARKET SNAPSHOT

- TABLE 116 EUROPE: POTATO PROTEIN MARKET, BY COUNTRY, 2017-2022 (USD THOUSAND)

- TABLE 117 EUROPE: POTATO PROTEIN MARKET, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 118 EUROPE: POTATO PROTEIN MARKET, BY COUNTRY, 2017-2022 (TON)

- TABLE 119 EUROPE: POTATO PROTEIN MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 120 EUROPE: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 121 EUROPE: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 122 EUROPE: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (TON)

- TABLE 123 EUROPE: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (TON)

- TABLE 124 EUROPE: POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 125 EUROPE: POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 126 EUROPE: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 127 EUROPE: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD THOUSAND)

- 10.3.3 GERMANY

- 10.3.3.1 Technological advancements

- TABLE 128 GERMANY: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 129 GERMANY: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 130 GERMANY: POTATO PROTEIN MARKET, BY NATURE, 2017-2022 (USD THOUSAND)

- TABLE 131 GERMANY: POTATO PROTEIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- TABLE 132 GERMANY: POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 133 GERMANY: POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 10.3.4 FRANCE

- 10.3.4.1 Active promotion of plant-based proteins by government

- TABLE 134 FRANCE: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 135 FRANCE: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 136 FRANCE: POTATO PROTEIN MARKET, BY NATURE, 2017-2022 (USD THOUSAND)

- TABLE 137 FRANCE: POTATO PROTEIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- TABLE 138 FRANCE: POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 139 FRANCE: POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 10.3.5 UK

- 10.3.5.1 Versatility in food & beverage applications

- TABLE 140 UK: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 141 UK: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 142 UK: POTATO PROTEIN MARKET, BY NATURE, 2017-2022 (USD THOUSAND)

- TABLE 143 UK: POTATO PROTEIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- TABLE 144 UK: POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 145 UK: POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 10.3.6 ITALY

- 10.3.6.1 High prevalence of celiac disease

- TABLE 146 ITALY: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 147 ITALY: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 148 ITALY: POTATO PROTEIN MARKET, BY NATURE, 2017-2022 (USD THOUSAND)

- TABLE 149 ITALY: POTATO PROTEIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- TABLE 150 ITALY: POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 151 ITALY: POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 10.3.7 REST OF EUROPE

- TABLE 152 REST OF EUROPE: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 153 REST OF EUROPE: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 154 REST OF EUROPE: POTATO PROTEIN MARKET, BY NATURE, 2017-2022 (USD THOUSAND)

- TABLE 155 REST OF EUROPE: POTATO PROTEIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- TABLE 156 REST OF EUROPE: POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 157 REST OF EUROPE: POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 10.4 ASIA PACIFIC

- 10.4.1 INTRODUCTION

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 49 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017-2021

- FIGURE 50 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2023

- FIGURE 51 ASIA PACIFIC: POTATO PROTEIN MARKET SNAPSHOT

- TABLE 158 ASIA PACIFIC: POTATO PROTEIN MARKET, BY COUNTRY, 2017-2022 (USD THOUSAND)

- TABLE 159 ASIA PACIFIC: POTATO PROTEIN MARKET, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 160 ASIA PACIFIC: POTATO PROTEIN MARKET, BY COUNTRY, 2017-2022 (TON)

- TABLE 161 ASIA PACIFIC: POTATO PROTEIN MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 162 ASIA PACIFIC: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 163 ASIA PACIFIC: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 164 ASIA PACIFIC: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (TON)

- TABLE 165 ASIA PACIFIC: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (TON)

- TABLE 166 ASIA PACIFIC: POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 167 ASIA PACIFIC: POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 168 ASIA PACIFIC: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 169 ASIA PACIFIC: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 170 ASIA PACIFIC: POTATO PROTEIN MARKET, BY NATURE, 2017-2022 (USD THOUSAND)

- TABLE 171 ASIA PACIFIC: POTATO PROTEIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- 10.4.3 CHINA

- 10.4.3.1 Rise in application of potato protein in feed sector

- TABLE 172 CHINA: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 173 CHINA: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 174 CHINA: POTATO PROTEIN MARKET, BY NATURE, 2017-2022 (USD THOUSAND)

- TABLE 175 CHINA: POTATO PROTEIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- TABLE 176 CHINA POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 177 CHINA POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 10.4.4 JAPAN

- 10.4.4.1 Rise in trend of plant-based and vegan diets

- TABLE 178 JAPAN: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 179 JAPAN: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 180 JAPAN POTATO PROTEIN MARKET, BY NATURE, 2017-2022 (USD THOUSAND)

- TABLE 181 JAPAN: POTATO PROTEIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- TABLE 182 JAPAN: POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 183 JAPAN: POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 10.4.5 INDIA

- 10.4.5.1 Rise in popularity of vegetarian and vegan diets

- TABLE 184 INDIA: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 185 INDIA: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 186 INDIA: POTATO PROTEIN MARKET, BY NATURE, 2017-2022 (USD THOUSAND)

- TABLE 187 INDIA: POTATO PROTEIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- TABLE 188 INDIA: POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 189 INDIA: POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 10.4.6 AUSTRALIA

- 10.4.6.1 Increase in popularity of health and functional foods

- TABLE 190 AUSTRALIA: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 191 AUSTRALIA: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 192 AUSTRALIA: POTATO PROTEIN MARKET, BY NATURE, 2017-2022 (USD THOUSAND)

- TABLE 193 AUSTRALIA: POTATO PROTEIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- TABLE 194 AUSTRALIA: POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 195 AUSTRALIA: POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 10.4.7 REST OF ASIA PACIFIC

- TABLE 196 REST OF ASIA PACIFIC: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 197 REST OF ASIA PACIFIC: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 198 REST OF ASIA PACIFIC: POTATO PROTEIN MARKET, BY NATURE, 2017-2022 (USD THOUSAND)

- TABLE 199 REST OF ASIA PACIFIC: POTATO PROTEIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- TABLE 200 REST OF ASIA PACIFIC: POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 201 REST OF ASIA PACIFIC: POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- 10.5 REST OF THE WORLD (ROW)

- 10.5.1 INTRODUCTION

- 10.5.2 ROW: RECESSION IMPACT

- FIGURE 52 AFRICA: INFLATION RATES, 2017-2021

- FIGURE 53 ROW: RECESSION IMPACT ANALYSIS, 2023

- TABLE 202 ROW: POTATO PROTEIN MARKET, BY REGION, 2017-2022 (USD THOUSAND)

- TABLE 203 ROW: POTATO PROTEIN MARKET, BY REGION, 2023-2028 (USD THOUSAND)

- TABLE 204 ROW: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 205 ROW: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- TABLE 206 ROW: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (TON)

- TABLE 207 ROW: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (TON)

- TABLE 208 ROW: POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 209 ROW: POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 210 ROW: POTATO PROTEIN MARKET, BY NATURE, 2017-2022 (USD THOUSAND)

- TABLE 211 ROW: POTATO PROTEIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- TABLE 212 ROW: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 213 ROW: FOOD & BEVERAGE APPLICATIONS MARKET, BY SUBAPPLICATION, 2023-2028 (USD THOUSAND)

- 10.5.3 SOUTH AMERICA

- 10.5.3.1 Large-scale production of potatoes

- TABLE 214 SOUTH AMERICA: POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 215 SOUTH AMERICA: POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 216 SOUTH AMERICA: POTATO PROTEIN MARKET, BY NATURE, 2017-2022 (USD THOUSAND)

- TABLE 217 SOUTH AMERICA: POTATO PROTEIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- TABLE 218 SOUTH AMERICA: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 219 SOUTH AMERICA: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

- 10.5.4 MIDDLE EAST & AFRICA

- 10.5.4.1 Increase in demand for plant-based foods

- TABLE 220 MIDDLE EAST & AFRICA: POTATO PROTEIN MARKET, BY APPLICATION, 2017-2022 (USD THOUSAND)

- TABLE 221 MIDDLE EAST & AFRICA: POTATO PROTEIN MARKET, BY APPLICATION, 2023-2028 (USD THOUSAND)

- TABLE 222 MIDDLE EAST & AFRICA: POTATO PROTEIN MARKET, BY NATURE, 2017-2022 (USD THOUSAND)

- TABLE 223 MIDDLE EAST & AFRICA: POTATO PROTEIN MARKET, BY NATURE, 2023-2028 (USD THOUSAND)

- TABLE 224 MIDDLE EAST & AFRICA: POTATO PROTEIN MARKET, BY TYPE, 2017-2022 (USD THOUSAND)

- TABLE 225 MIDDLE EAST & AFRICA: POTATO PROTEIN MARKET, BY TYPE, 2023-2028 (USD THOUSAND)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS

- TABLE 226 POTATO PROTEIN MARKET: DEGREE OF COMPETITION

- 11.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 54 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017-2021 (USD MILLION)

- 11.4 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 227 STRATEGIES ADOPTED BY KEY POTATO PROTEIN MANUFACTURERS

- 11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 55 POTATO PROTEIN MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- 11.5.5 PRODUCT FOOTPRINT

- TABLE 228 COMPANY FOOTPRINT, BY TYPE

- TABLE 229 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 230 COMPANY FOOTPRINT, BY REGION

- TABLE 231 OVERALL COMPANY FOOTPRINT

- 11.6 COMPANY EVALUATION QUADRANT (STARTUPS/SMES)

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 STARTING BLOCKS

- 11.6.3 RESPONSIVE COMPANIES

- 11.6.4 DYNAMIC COMPANIES

- FIGURE 56 POTATO PROTEIN MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- 11.6.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 232 POTATO PROTEIN MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 233 POTATO PROTEIN MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 DEALS

- TABLE 234 POTATO PROTEIN MARKET: DEALS, APRIL 2021-OCTOBER 2022

- 11.7.2 OTHER DEVELOPMENTS

- TABLE 235 POTATO PROTEIN MARKET: OTHER DEVELOPMENTS, MARCH 2019-JANUARY 2023

12 COMPANY PROFILES

(Business overview, Products offered, Recent developments & MnM View)*

- 12.1 KEY COMPANIES

- 12.1.1 AVEBE

- TABLE 236 AVEBE: COMPANY OVERVIEW

- FIGURE 57 AVEBE: COMPANY SNAPSHOT

- TABLE 237 AVEBE: PRODUCTS OFFERED

- TABLE 238 AVEBE: DEALS

- TABLE 239 AVEBE: OTHER DEVELOPMENTS

- 12.1.2 TEREOS

- TABLE 240 TEREOS: BUSINESS OVERVIEW

- FIGURE 58 TEREOS: COMPANY SNAPSHOT

- TABLE 241 TEREOS: PRODUCTS OFFERED

- TABLE 242 TEREOS: DEALS

- 12.1.3 KERRY GROUP PLC

- TABLE 243 KERRY GROUP PLC: BUSINESS OVERVIEW

- FIGURE 59 KERRY GROUP PLC: COMPANY SNAPSHOT

- TABLE 244 KERRY GROUP PLC: PRODUCTS OFFERED

- TABLE 245 KERRY GROUP PLC: DEALS

- TABLE 246 KERRY GROUP PLC: OTHER DEVELOPMENTS

- 12.1.4 SUDZUCKER AG

- TABLE 247 SUDZUCKER AG: BUSINESS OVERVIEW

- FIGURE 60 SUDZUCKER AG: COMPANY SNAPSHOT

- FIGURE 61 AGRANA GROUP: COMPANY SNAPSHOT

- TABLE 248 SUDZUCKER AG: PRODUCTS OFFERED

- 12.1.5 ROQUETTE FRERES

- TABLE 249 ROQUETTE FRERES: BUSINESS OVERVIEW

- TABLE 250 ROQUETTE FRERES: PRODUCTS OFFERED

- TABLE 251 ROQUETTE FRERES: DEALS

- 12.1.6 EMSLAND GROUP

- TABLE 252 EMSLAND GROUP: BUSINESS OVERVIEW

- TABLE 253 EMSLAND GROUP: PRODUCTS OFFERED

- TABLE 254 EMSLAND GROUP: DEALS

- 12.1.7 KMC INGREDIENTS

- TABLE 255 KMC INGREDIENTS: BUSINESS OVERVIEW

- TABLE 256 KMC INGREDIENTS: PRODUCTS OFFERED

- TABLE 257 KMC INGREDIENTS: OTHER DEVELOPMENTS

- 12.1.8 PEPEES GROUP

- TABLE 258 PEPEES GROUP: BUSINESS OVERVIEW

- TABLE 259 PEPEES GROUP: PRODUCTS OFFERED

- 12.1.9 AKV LANGHOLT

- TABLE 260 AKV LANGHOLT: BUSINESS OVERVIEW

- TABLE 261 AKV LANGHOLT: PRODUCTS OFFERED

- TABLE 262 AKV LANGHOLT: DEALS

- 12.1.10 PPZ NIECHLOW

- TABLE 263 PPZ NIECHLOW: BUSINESS OVERVIEW

- TABLE 264 PPZ NIECHLOW: PRODUCTS OFFERED

- 12.1.11 THE SCOULAR COMPANY

- TABLE 265 THE SCOULAR COMPANY: BUSINESS OVERVIEW

- TABLE 266 THE SCOULAR COMPANY: PRODUCTS OFFERED

- TABLE 267 THE SCOULAR COMPANY: OTHER DEVELOPMENTS

- 12.1.12 FINNAMYL

- TABLE 268 FINNAMYL: BUSINESS OVERVIEW

- TABLE 269 FINNAMYL: PRODUCTS OFFERED

- 12.1.13 KEMIN INDUSTRIES

- TABLE 270 KEMIN INDUSTRIES: BUSINESS OVERVIEW

- TABLE 271 KEMIN INDUSTRIES: PRODUCTS OFFERED

- TABLE 272 KEMIN INDUSTRIES: DEALS

- TABLE 273 KEMIN INDUSTRIES: OTHER DEVELOPMENTS

- 12.1.14 BIORIGINAL

- TABLE 274 BIORIGINAL: BUSINESS OVERVIEW

- 12.1.15 DUYNIE

- TABLE 275 DUYNIE: BUSINESS OVERVIEW

- TABLE 276 DUYNIE: PRODUCTS OFFERED

- 12.2 OTHER PLAYERS

- 12.2.1 AMINOLA B.V.

- TABLE 277 AMINOLA B.V.: BUSINESS OVERVIEW

- TABLE 278 AMINOLA B.V.: PRODUCTS OFFERED

- 12.2.2 GAOYUAN

- TABLE 279 GAOYUAN: BUSINESS OVERVIEW

- TABLE 280 GAOYUAN: PRODUCTS OFFERED

- 12.2.3 HEALTHMARQUE

- TABLE 281 HEALTHMARQUE: BUSINESS OVERVIEW

- TABLE 282 HEALTHMARQUE: PRODUCTS OFFERED

- 12.2.4 HJHERB

- TABLE 283 HJHERB: BUSINESS OVERVIEW

- TABLE 284 HJHERB: PRODUCTS OFFERED

- 12.2.5 KINGS DEHYDRATED FOODS PRIVATE LIMITED

- TABLE 285 KINGS DEHYDRATED FOODS PRIVATE LIMITED: BUSINESS OVERVIEW

- TABLE 286 KINGS DEHYDRATED FOOD PRIVATE LIMITED: PRODUCTS OFFERED

- 12.2.6 ZETPEZET

- 12.2.7 SUDSTARKE

- 12.2.8 ROYAL INGREDIENTS GROUP

- 12.2.9 MEELUNIE

- 12.2.10 EQUISTRO

Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- TABLE 287 MARKETS ADJACENT TO POTATO PROTEIN

- 13.2 LIMITATIONS

- 13.3 TEXTURED VEGETABLE PROTEIN MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.3 TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE

- TABLE 288 TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 289 TEXTURED VEGETABLE PROTEIN MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 13.3.4 TEXTURED VEGETABLE PROTEIN MARKET, BY REGION

- TABLE 290 TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 291 TEXTURED VEGETABLE PROTEIN MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.4 PLANT-BASED PROTEIN MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

- 13.4.3 PLANT-BASED PROTEIN MARKET, BY TYPE

- TABLE 292 PLANT-BASED PROTEIN MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 293 PLANT-BASED PROTEIN MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 13.4.4 PLANT-BASED PROTEIN MARKET, BY REGION

- TABLE 294 PLANT-BASED PROTEIN MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 295 PLANT-BASED PROTEIN MARKET, BY REGION, 2022-2027 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS