|

|

市場調査レポート

商品コード

1235847

サプライチェーンアナリティクスの世界市場:エンドユーザー別 (ソフトウェア (サプライヤー業績分析、需要分析・予測、支出・調達分析)、サービス)・展開方式別・組織規模別・業種別・地域別の将来予測 (2027年まで)Supply Chain Analytics Market Component, Software (Supplier Performance Analytics, Demand Analysis & Forecasting, and Spend & Procurement Analytics), Service, Deployment Mode, Organization Size, Vertical and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| サプライチェーンアナリティクスの世界市場:エンドユーザー別 (ソフトウェア (サプライヤー業績分析、需要分析・予測、支出・調達分析)、サービス)・展開方式別・組織規模別・業種別・地域別の将来予測 (2027年まで) |

|

出版日: 2023年03月06日

発行: MarketsandMarkets

ページ情報: 英文 266 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のサプライチェーンアナリティクスの市場規模は、2022年の52億米ドルから2027年には135億米ドルへと、予測期間中に21.0%のCAGRで成長すると予想されています。

業界別では、自動車部門が予測期間中に最大の市場規模を獲得する見通しです。自動車メーカーはサプライチェーン・アナリティクスを利用して、自動変速機のような特定のオプションや特定の色へのシフトなど、新しい動向を早期に発見して、需要をより正確に見積もることができます。自動車メーカーやサプライヤーはこうした手法やツールを使って、これまで発見されなかったパターンや関係を特定することで、自社の業務やサプライチェーンをさらに深く理解することができます。

コンポーネント別では、サービス分野が予測期間中に最も高いCAGRで成長すると予測されています。主要な産業分野でサプライチェーンアナリティクス・ソリューションが普及するにつれ、サポートサービスへのニーズも企業の間で高まっています。

業界別では、製薬業界の分野が予測期間中に最も高いCAGRを記録すると予想されています。製薬企業が自社の治療薬や医薬品がどのくらい早く必要になるかを正確に予測できれば、サプライチェーンアナリティクスにより生産と需要の整合性を高めることができます。

地域別に見ると、北米市場が予測期間中に最大の市場規模を占める見通しです。域内の市場成長の主な要因として、ベンダー各社が戦略的ビジネス選択を行うための分析用ダッシュボードの提供に注力し、最先端の製品を供給していることなどが挙げられます。

当レポートでは、世界のサプライチェーンアナリティクスの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、コンポーネント別・サービス別・展開方式別・組織規模別・業種別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界の動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サプライチェーン分析市場:エコシステム

- 研究分析

- 技術分析

- サプライチェーン・バリューチェーン分析

- ポーターのファイブフォース分析

- 価格モデル分析

- 特許分析

- 主な会議とイベント (2023年~2024年)

- 関税と規制の状況

- 主な利害関係者と購入基準

- サプライチェーンの主要段階

第6章 サプライチェーン分析市場:コンポーネント別

- イントロダクション

- ソフトウェア

- 需要分析・予測

- 需要・供給計画

- S&OPプロセス管理

- サプライチェーンのリスク管理

- サプライチェーンイベント管理

- サプライヤー業績分析

- サプライヤー業績指標分析

- 供給実績分析

- 価格・利益率分析

- 支出・調達分析

- 支出・調達分析:種類別

- テールスペンド (非計画購買) 分析

- サプライヤー支出分析

- カテゴリー支出分析

- 契約費用分析

- 戦略的調達分析

- S2P (Source-to-Pay) 分析

- 在庫分析

- ABC分析

- HML分析

- VED分析

- SDE分析

- 安全在庫分析

- 流通分析

- 業績管理

- ルート最適化

- 出荷物流管理

第7章 サプライチェーンアナリティクス市場:サービス別

- イントロダクション

- マネージドサービス

- プロフェッショナルサービス

- コンサルティングサービス

- サポート・保守サービス

- 導入・インテグレーションサービス

第8章 サプライチェーンアナリティクス市場:展開方式別

- イントロダクション

- オンプレミス

- クラウド

第9章 サプライチェーンアナリティクス市場:組織規模別

- イントロダクション

- 中小企業

- 大企業

第10章 サプライチェーンアナリティクス市場:業種別

- イントロダクション

- 小売業・消費財

- 自動車

- 医薬品

- 食品・飲料製造

- 機械・産業機器製造

- エネルギー・ユーティリティ

- 政府

第11章 サプライチェーンアナリティクス市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- ASEAN諸国

- 他のアジア太平洋諸国

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア王国

- イスラエル

- トルコ

- カタール

- 南アフリカ

- 他の中東・アフリカ諸国

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- 他のラテンアメリカ諸国

第12章 競合情勢

- 概要

- 主要企業の戦略

- 収益分析

- 市場シェア分析

- 企業評価クアドラント

- スタートアップ/中小企業の評価マトリックス

- 競合ベンチマーキング

- 主要企業の割合 (2022年)

- 主要企業(スタートアップ/中小企業)のベンチマーク

- 競合シナリオ

- 製品の発売

- 資本取引

- その他

第13章 企業プロファイル

- 主要企業

- IBM

- ORACLE

- SAP

- SALESFORCE

- SOFTWARE AG

- MICROSTRATEGY

- CLOUDERA

- DOMO

- AXWAY

- ROSSLYN ANALYTICS

- 1010DATA

- QLIK

- LOGILITY

- INFOR

- VOXWARE

- その他の企業

- MANHATTAN ASSOCIATES

- DATAFACTZ

- DATAIKU

- RELEX SOLUTIONS

- AIMMS

- TARGIT

- TIBCO SOFTWARE

- ZEBRA TECHNOLOGIES

- THE ANYLOGIC COMPANY

- INTUGINE TECHNOLOGIES

- LUMACHAIN

- HUM INDUSTRIAL TECHNOLOGY

- PAFAXE

- SS SUPPLY CHAIN SOLUTIONS(3SC)

第14章 隣接・関連市場

- ブロックチェーン・サプライチェーン市場

- ビッグデータ市場

第15章 付録

The supply chain analytics market is expected to grow from USD 5.2 billion in 2022 to USD 13.5 billion by 2027, at a CAGR of 21.0% during the forecast period. Big data analytics has been used by a number of businesses in a variety of industries to improve tactical and real-time decision-making. As businesses want to use analytics to obtain a competitive advantage over rivals, the supply chain management sector has become one of the most popular places to use analytics solutions. The firms need assistance making decisions about crucial tactical and strategic supply chain operations, since the knowledge gained from these activities may help save costs and improve supply chains..

The automotive segment to have the largest market size during the forecast period

By vertical, the segments include automotive, retail and consumer goods, F&B manufacturing, machinery, and industrial equipment manufacturing, pharmaceutical, government, and energy and utilities. Automakers may use supply chain analytics to help them analyse ever-larger data sets. In essence, the capacity to mix various data sources and use effective big data approaches to help provide relevant insights has significantly improved in recent years. Automakers may estimate demand more precisely by using supply chain analytics to spot new developing trends early on, such as a shift to a certain option, like an automated transmission, or a particular colour. Automakers and their suppliers may get even greater understanding of their operations and the larger supply chain by using these methods and tools to identify patterns and relationships that may have previously gone unnoticed or undiscovered.

The service segment is registered to grow at the highest CAGR during the forecast period

With the growing acceptance of supply chain analytics solutions across key industrial verticals, the need for supporting services is also rising among businesses. The market for supply chain analytics offers managed and professional services. After the deployment of solutions, these services are crucial. Businesses are changing and looking for new methods to increase their Return on Investment (RoI) and enhance company optimization in the era of the digital economy. Enterprises are turning to services that are essential for simplifying corporate processes and maximising business resources in order to foster development and produce more income.

Among Vertical, pharmaceutical vertical is anticipated to register the highest CAGR during the forecast period

Due to intense rivalry from both local and foreign rivals, pharmaceutical companies are under enormous pressure to increase the efficiency of their supply chains and operations. Due to inadequate IT systems and infrastructure, it is difficult to see how the inventory and distribution operations are doing. To use supply chain analytics solutions to predict the growing demand and maintain appropriate inventory levels, top medical device firms are getting in touch with respected solution providers. If pharmaceutical companies can accurately predict how quickly their treatments and medications will be needed, supply chain analytics can help them better align production with demand. This data may be used by decision-makers to estimate how long a supply chain interruption will last and how long it will take to find a solution before there are significant shortages of medicines.

North America to account for the largest market size during the forecast period

North America is expected to have the largest market share in the supply chain analytics market. North America is one of the leading markers for supply chain analytics in terms of market share. The region's supply chain analytics market is expanding as a result of the fast-paced infrastructure development, widespread acceptance of digital technologies, and rise in real-time data in supply chain organisations. The expansion of the supply chain analytics market in the area is attributed to the cutting-edge products provided by different vendors that concentrate on supplying dashboards for analysis to make strategic business choices.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the supply chain analytics market.

- By Company: Tier I: 34%, Tier II: 43%, and Tier III: 23%

- By Designation: C-Level Executives: 50%, Directors: 30%, and Others: 20%

- By Region: APAC: 30%, Europe: 30%, North America: 25%, MEA: 10%, Latin America: 5%

The report includes the study of key players offering supply chain analytics and services. It profiles major vendors in the global supply chain analytics market. The major vendors in the global supply chain analytics market include SAP (Germany), Oracle (US), IBM (US), SAS Institute (US), Software AG (Germany), MicroStrategy (US), Tableau (US), Qlik (US), TIBCO (US), Cloudera (US), Logility (US), Savi Technology (US), Infor (US), RELEX Solutions (Finland), TARGIT(Denmark), Voxware (US), The AnyLogic Company (US), Antuit (US), Axway (US), AIMMS (Netherlands), BRIDGEi2i (India), Domo (US), Datameer (US), 1010data(US), Rosslyn Analytics(UK), Manhattan Associates (US), Salesforce (US), Zebra Technologies (US), Dataiku (US), Intugine Technologies (India), Lumachain (Australia), Hum Industrial Technology (US), Pafaxe, SS supply Chain Solutions (US), and DataFactZ (US).

Research Coverage

The market study covers the supply chain analytics market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such as components, service, deployment mode, organization size, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall supply chain analytics market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INDUSTRY DEFINITION

- 1.2.2 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2020-2022

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 SUPPLY CHAIN ANALYTICS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 2 SUPPLY CHAIN ANALYTICS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/SERVICES OF SUPPLY CHAIN ANALYTICS MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM SOFTWARE/SERVICES OF SUPPLY CHAIN ANALYTICS MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM SOFTWARE/SERVICES OF SUPPLY CHAIN ANALYTICS MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM-UP (DEMAND SIDE): SHARE OF SUPPLY CHAIN ANALYTICS THROUGH OVERALL SUPPLY CHAIN ANALYTICS SPENDING

- 2.4 MARKET FORECAST

- FIGURE 7 FACTOR ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 STUDY LIMITATIONS

- 2.7 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- TABLE 2 GLOBAL SUPPLY CHAIN ANALYTICS MARKET SIZE AND GROWTH RATE,

- 2016-2021 (USD MILLION, Y-O-Y%)

- TABLE 3 GLOBAL SUPPLY CHAIN ANALYTICS MARKET SIZE AND GROWTH RATE,

- 2022-2027 (USD MILLION, Y-O-Y%)

- FIGURE 8 SOFTWARE HELD LARGER MARKET SIZE IN 2022

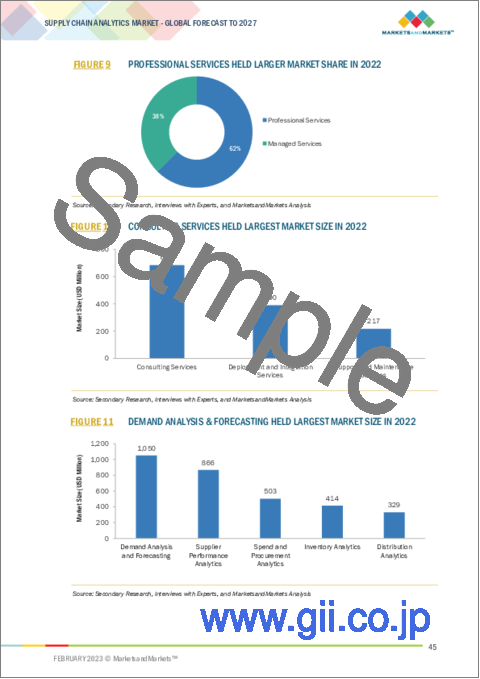

- FIGURE 9 PROFESSIONAL SERVICES HELD LARGER MARKET SHARE IN 2022

- FIGURE 10 CONSULTING SERVICES HELD LARGEST MARKET SIZE IN 2022

- FIGURE 11 DEMAND ANALYSIS & FORECASTING HELD LARGEST MARKET SIZE IN 2022

- FIGURE 12 CLOUD DEPLOYMENT MODE HELD LARGER MARKET SIZE IN 2022

- FIGURE 13 LARGE ENTERPRISES HELD LARGER MARKET SHARE IN 2022

- FIGURE 14 RETAIL AND CONSUMER GOODS VERTICAL HELD LARGEST MARKET SIZE IN 2022

- FIGURE 15 NORTH AMERICA HELD LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SUPPLY CHAIN ANALYTICS MARKET

- FIGURE 16 RISING NEED FOR DATA-DRIVEN DECISION-MAKING ACROSS SUPPLY CHAIN OPERATIONS TO DRIVE MARKET

- 4.2 SUPPLY CHAIN ANALYTICS MARKET, BY VERTICAL

- FIGURE 17 RETAIL AND CONSUMER GOODS VERTICAL TO CONTINUE TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- 4.3 SUPPLY CHAIN ANALYTICS MARKET, BY REGION

- FIGURE 18 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2027

- 4.4 SUPPLY CHAIN ANALYTICS MARKET, BY SOFTWARE AND VERTICAL

- FIGURE 19 DEMAND ANALYSIS & FORECASTING AND RETAIL AND CONSUMER GOODS TO BE LARGEST SHAREHOLDERS IN SUPPLY CHAIN ANALYTICS MARKET IN 2027

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 SUPPLY CHAIN ANALYTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing need for greater supply-chain and operational efficiency

- 5.2.1.2 Growing adoption of IoT in supply chains

- 5.2.1.3 Rising adoption of big data technologies

- 5.2.1.4 Growing use of analytics technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increasing concerns of businesses regarding data security

- 5.2.2.2 Rising cyber threats hindering adoption of SCA solutions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing use of supply chain analytics on cloud

- 5.2.3.2 Rising awareness of benefits of supply chain management

- 5.2.3.3 Increasing benefits of using supply chain analytics software

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of qualified employees

- 5.2.4.2 Reluctance to switch from manual methods to advanced reporting processes

- 5.2.4.3 Integration and analysis of all data

- 5.3 SUPPLY CHAIN ANALYTICS MARKET: ECOSYSTEM

- TABLE 4 SUPPLY CHAIN ANALYTICS MARKET: ECOSYSTEM

- 5.4 STUDY ANALYSIS

- 5.4.1 AUTOMOTIVE

- 5.4.1.1 Case study 1: Mazda Motor Logistics speeds visibility across supply chain

- 5.4.2 MANUFACTURING

- 5.4.2.1 Case study 1: Titan International's Journey with Oracle Cloud and Internet of Things

- 5.4.2.2 Case study 2: Electrolux improved customer service and reduced inventory management cost by using Demand planning & Optimization solution of SAS with Oracle Cloud and Internet of Things

- 5.4.3 BFSI

- 5.4.3.1 Case study 1: Improved distribution of products to target audiences

- 5.4.4 HEALTHCARE AND LIFE SCIENCES

- 5.4.4.1 Case study 1: EmblemHealth modernizes operations in Oracle Cloud

- 5.4.5 DISTRIBUTION ANALYTICS

- 5.4.5.1 Case study 1: Cloud automation helps FedEx respond to changes 2X faster

- 5.4.1 AUTOMOTIVE

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 ARTIFICIAL INTELLIGENCE

- 5.5.2 BIG DATA

- 5.5.3 IOT

- 5.5.4 BLOCKCHAIN

- 5.6 SUPPLY/VALUE CHAIN ANALYSIS

- FIGURE 21 SUPPLY/VALUE CHAIN ANALYSIS

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT FROM NEW ENTRANTS

- 5.7.2 THREAT FROM SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING MODEL ANALYSIS

- TABLE 6 SUPPLY CHAIN ANALYTICS MARKET: PRICING LEVELS

- 5.9 PATENT ANALYSIS

- 5.9.1 METHODOLOGY

- 5.9.2 DOCUMENT TYPE

- TABLE 7 PATENTS FILED, 2019-2022

- 5.9.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 23 TOTAL NUMBER OF PATENTS GRANTED, 2019-2022

- 5.9.3.1 Top applicants

- FIGURE 24 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2019-2022

- TABLE 8 TOP TEN PATENT OWNERS, 2019-2022

- 5.10 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 9 DETAILED LIST OF CONFERENCES AND EVENTS, 2023-2024

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST AND AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 NORTH AMERICA: REGULATIONS

- 5.11.2.1 Personal Information Protection and Electronic Documents Act (PIPEDA)

- 5.11.2.2 Gramm-Leach-Bliley (GLB) Act

- 5.11.2.3 Health Insurance Portability and Accountability Act (HIPAA) of 1996

- 5.11.2.4 Federal Information Security Management Act (FISMA)

- 5.11.2.5 Federal Information Processing Standards (FIPS)

- 5.11.2.6 California Consumer Privacy Act (CSPA)

- 5.11.3 EUROPE: TARIFFS AND REGULATIONS

- 5.11.3.1 GDPR 2016/679

- 5.11.3.2 General Data Protection Regulation

- 5.11.3.3 European Committee for Standardization (CEN)

- 5.11.3.4 European Technical Standards Institute (ETSI)

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- 5.12.2 BUYING CRITERIA

- TABLE 16 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.13 KEY STAGES IN SUPPLY CHAIN

- 5.13.1 PLANNING

- 5.13.2 MANAGEMENT AND CONTROL

- 5.13.3 EXECUTION

6 SUPPLY CHAIN ANALYTICS MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.1.1 COMPONENT: SUPPLY CHAIN ANALYTICS MARKET DRIVERS

- FIGURE 25 SERVICES TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- TABLE 17 SUPPLY CHAIN ANALYTICS MARKET, BY COMPONENT,

- 2016-2021 (USD MILLION)

- TABLE 18 SUPPLY CHAIN ANALYTICS MARKET, BY COMPONENT,

- 2022-2027 (USD MILLION)

- 6.2 SOFTWARE

- FIGURE 26 INVENTORY ANALYTICS SOFTWARE TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 19 SUPPLY CHAIN ANALYTICS MARKET, BY SOFTWARE,

- 2016-2021 (USD MILLION)

- TABLE 20 SUPPLY CHAIN ANALYTICS MARKET, BY SOFTWARE,

- 2022-2027 (USD MILLION)

- TABLE 21 SOFTWARE: SUPPLY CHAIN ANALYTICS MARKET, BY REGION,

- 2016-2021 (USD MILLION)

- TABLE 22 SOFTWARE: SUPPLY CHAIN ANALYTICS MARKET, BY REGION,

- 2022-2027 (USD MILLION)

- 6.3 DEMAND ANALYSIS AND FORECASTING

- 6.3.1 GROWING NEED FOR FORECASTING CUSTOMER DEMAND TO PROPEL MARKET

- 6.4 DEMAND AND SUPPLY PLANNING

- 6.4.1 S&OP PROCESS MANAGEMENT

- 6.4.2 SUPPLY CHAIN RISK MANAGEMENT

- 6.4.3 SUPPLY CHAIN EVENT MANAGEMENT

- TABLE 23 DEMAND ANALYSIS AND FORECASTING: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 24 DEMAND ANALYSIS AND FORECASTING: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.5 SUPPLIER PERFORMANCE ANALYTICS

- 6.5.1 RISING DEMAND FOR SUPPLIER PERFORMANCE ANALYTICS PLATFORMS TO MANAGE DELIVERY CONCERNS AND QUALITY CONTROL TO FUEL MARKET

- 6.6 SUPPLIER PERFORMANCE METRICS ANALYSIS

- 6.6.1 DELIVERY PERFORMANCE ANALYSIS

- 6.6.2 PRICE AND PROFIT MARGIN ANALYSIS

- TABLE 25 SUPPLIER PERFORMANCE ANALYTICS: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 26 SUPPLIER PERFORMANCE ANALYTICS: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.7 SPEND AND PROCUREMENT ANALYTICS

- 6.7.1 ABILITY TO MAKE DATA-DRIVEN DECISIONS TO REDUCE RISK AND DISCOVER COST-SAVING OPPORTUNITIES TO DRIVE MARKET

- 6.8 TYPES OF SPEND AND PROCUREMENT ANALYSIS

- 6.8.1 TAIL SPEND ANALYSIS

- 6.8.2 SUPPLIER SPEND ANALYSIS

- 6.8.3 CATEGORY SPEND ANALYSIS

- 6.8.4 CONTRACT SPEND ANALYSIS

- 6.8.5 STRATEGIC SOURCING ANALYSIS

- 6.8.6 SOURCE-TO-PAY ANALYSIS

- TABLE 27 SPEND AND PROCUREMENT ANALYTICS: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 28 SPEND AND PROCUREMENT ANALYTICS: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.9 INVENTORY ANALYTICS

- 6.9.1 INCREASING NEED FOR INVENTORY ANALYTICS TO FUEL MARKET

- 6.9.2 ABC ANALYSIS

- 6.9.3 HML ANALYSIS

- 6.9.4 VED ANALYSIS

- 6.9.5 SDE ANALYSIS

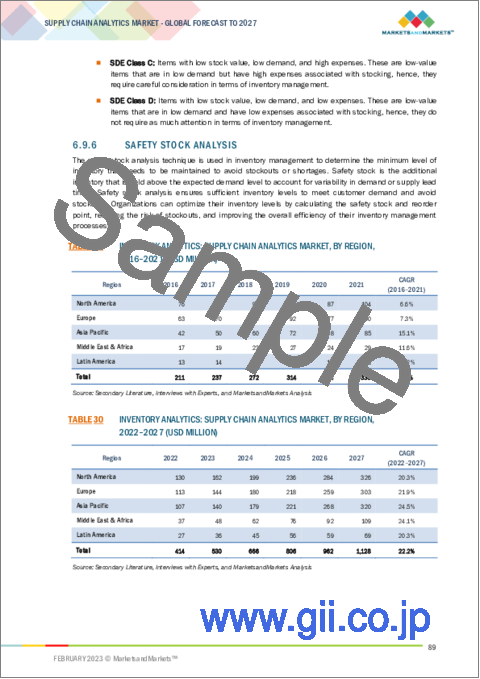

- 6.9.6 SAFETY STOCK ANALYSIS

- TABLE 29 INVENTORY ANALYTICS: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 30 INVENTORY ANALYTICS: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.10 DISTRIBUTION ANALYTICS

- 6.10.1 GROWING USE OF ANALYTICS IN DISTRIBUTION MANAGEMENT TO ACCELERATE MARKET GROWTH

- TABLE 31 DISTRIBUTION ANALYTICS: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 32 DISTRIBUTION AND LOGISTICS ANALYTICS: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.10.2 PERFORMANCE MANAGEMENT

- 6.10.3 ROUTE OPTIMIZATION

- 6.10.4 OUTBOUND LOGISTICS MANAGEMENT

7 SUPPLY CHAIN ANALYTICS MARKET, BY SERVICE

- 7.1 INTRODUCTION

- 7.1.1 SERVICES: SUPPLY CHAIN ANALYTICS MARKET DRIVERS

- FIGURE 27 MANAGED SERVICES TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- TABLE 33 SUPPLY CHAIN ANALYTICS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 34 SUPPLY CHAIN ANALYTICS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 35 SERVICES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 36 SERVICES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2 MANAGED SERVICES

- 7.2.1 GROWING DEMAND FOR ON-TIME DELIVERY BY CLIENTS TO PROPEL MARKET

- TABLE 37 MANAGED SERVICES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 38 MANAGED SERVICES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 PROFESSIONAL SERVICES

- FIGURE 28 CONSULTING SERVICES TO HOLD LARGEST MARKET SIZE IN 2027

- TABLE 39 SUPPLY CHAIN ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2016-2021 (USD MILLION)

- TABLE 40 SUPPLY CHAIN ANALYTICS MARKET, BY PROFESSIONAL SERVICE TYPE, 2022-2027 (USD MILLION)

- TABLE 41 PROFESSIONAL SERVICES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 42 PROFESSIONAL SERVICES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3.1 CONSULTING SERVICES

- 7.3.1.1 Rising demand for lowering risks, reducing complexities, and increasing RoI to drive market

- TABLE 43 CONSULTING SERVICES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 44 CONSULTING SERVICES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3.2 SUPPORT AND MAINTENANCE SERVICES

- 7.3.2.1 Increasing demand for data management to fuel market

- TABLE 45 SUPPORT AND MAINTENANCE SERVICES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 46 SUPPORT AND MAINTENANCE SERVICES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3.3 DEPLOYMENT AND INTEGRATION SERVICES

- 7.3.3.1 Growing need for integrating IoT devices and solutions with existing IT infrastructure to boost

- TABLE 47 DEPLOYMENT AND INTEGRATION SERVICES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 48 DEPLOYMENT AND INTEGRATION SERVICES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

8 SUPPLY CHAIN ANALYTICS MARKET, BY DEPLOYMENT MODE

- 8.1 INTRODUCTION

- 8.1.1 DEPLOYMENT MODE: SUPPLY CHAIN ANALYTICS MARKET DRIVERS

- FIGURE 29 CLOUD DEPLOYMENT MODE TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- TABLE 49 SUPPLY CHAIN ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016-2021 (USD MILLION)

- TABLE 50 SUPPLY CHAIN ANALYTICS MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- 8.2 ON-PREMISES

- 8.2.1 REDUCED COMPLEXITIES OVER AI APPLICATIONS TO PROPEL MARKET

- TABLE 51 ON-PREMISES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 52 ON-PREMISES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 CLOUD

- 8.3.1 GROWING NEED FOR ADOPTION OF DIGITAL SOLUTIONS FOR FLEXIBLE AND SCALED PRODUCTIVITY TO FUEL MARKET

- TABLE 53 CLOUD: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 54 CLOUD: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

9 SUPPLY CHAIN ANALYTICS MARKET, BY ORGANIZATION SIZE

- 9.1 INTRODUCTION

- 9.1.1 ORGANIZATION SIZE: SUPPLY CHAIN ANALYTICS MARKET DRIVERS

- FIGURE 30 SMALL AND MEDIUM-SIZED ENTERPRISES TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- TABLE 55 SUPPLY CHAIN ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 56 SUPPLY CHAIN ANALYTICS MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- 9.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 9.2.1 RISE IN INNOVATIVE BUSINESS APPROACH IN SUPPLY CHAIN MANAGEMENT TO DRIVE MARKET

- TABLE 57 SMALL AND MEDIUM-SIZED ENTERPRISES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 58 SMALL AND MEDIUM-SIZED ENTERPRISES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 LARGE ENTERPRISES

- 9.3.1 GROWING INVESTMENTS BY LARGE ENTERPRISES TO IMPLEMENT SUITABLE SUPPLY CHAIN ANALYTICS SOLUTIONS AND SERVICES TO FUEL MARKET

- TABLE 59 LARGE ENTERPRISES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 60 LARGE ENTERPRISES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

10 SUPPLY CHAIN ANALYTICS MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.1.1 VERTICAL: SUPPLY CHAIN ANALYTICS MARKET DRIVERS

- FIGURE 31 RETAIL AND CONSUMER GOODS VERTICAL TO HOLD LARGEST MARKET SIZE IN 2027

- TABLE 61 SUPPLY CHAIN ANALYTICS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 62 SUPPLY CHAIN ANALYTICS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.2 RETAIL AND CONSUMER GOODS

- 10.2.1 RISING DEMAND FOR BETTER CUSTOMER EXPERIENCE TO PROPEL MARKET

- TABLE 63 RETAIL AND CONSUMER GOODS: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 64 RETAIL AND CONSUMER GOODS: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3 AUTOMOTIVE

- 10.3.1 GROWING NEED TO IMPROVE BUSINESS PERFORMANCE, OPERATIONAL EFFICIENCY, AND BOOST VISIBILITY WITH SUPPLY CHAIN ANALYTICS SOLUTIONS TO DRIVE MARKET

- TABLE 65 AUTOMOTIVE: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 66 AUTOMOTIVE: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.4 PHARMACEUTICAL

- 10.4.1 INCREASING COMPETITION TO FORECAST LIFECYCLE OF SPECIFIC DRUGS TO FUEL MARKET

- TABLE 67 PHARMACEUTICAL: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 68 PHARMACEUTICAL: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.5 FOOD & BEVERAGE MANUFACTURING

- 10.5.1 INCREASING NEED TO MINIMIZE WASTE WITH BETTER UNDERSTANDING OF INVENTORY LEVELS TO BOOST MARKET

- TABLE 69 F&B MANUFACTURING: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 70 F&B MANUFACTURING: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.6 MACHINERY AND INDUSTRIAL EQUIPMENT MANUFACTURING

- 10.6.1 RISING DEMAND FOR CAPACITY PLANNING TO HELP BUSINESSES ADOPT SUPPLY CHAIN ANALYTICS SOLUTIONS

- TABLE 71 MACHINERY AND INDUSTRIAL EQUIPMENT MANUFACTURING: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 72 MACHINERY AND INDUSTRIAL EQUIPMENT MANUFACTURING: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.7 ENERGY AND UTILITIES

- 10.7.1 GROWING NEED FOR OPERATIONAL EXPENSES AND PROJECT DELAYS TO GENERATE DEMAND FOR SUPPLY CHAIN ANALYTICS

- TABLE 73 ENERGY AND UTILITIES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 74 ENERGY AND UTILITIES: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.8 GOVERNMENT

- 10.8.1 GROWING GOVERNMENT INITIATIVES TO DRIVE ADOPTION OF SUPPLY CHAIN ANALYTICS SOFTWARE

- TABLE 75 GOVERNMENT: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 76 GOVERNMENT: SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

11 SUPPLY CHAIN ANALYTICS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.1.1 SUPPLY CHAIN ANALYTICS MARKET: IMPACT OF RECESSION

- FIGURE 32 ASIA PACIFIC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 UNITED ARAB EMIRATES TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 77 SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 78 SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: SUPPLY CHAIN ANALYTICS MARKET DRIVERS

- FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 79 NORTH AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 80 NORTH AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 81 NORTH AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 82 NORTH AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 83 NORTH AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 84 NORTH AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 85 NORTH AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016-2021 (USD MILLION)

- TABLE 86 NORTH AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 87 NORTH AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 88 NORTH AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 89 NORTH AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 90 NORTH AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 91 NORTH AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 92 NORTH AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Advanced infrastructure, innovation, and initiatives to drive market

- 11.2.3 CANADA

- 11.2.3.1 Huge investment share of Canadian companies to strengthen supply chain operations

- 11.3 EUROPE

- 11.3.1 EUROPE: SUPPLY CHAIN ANALYTICS MARKET DRIVERS

- TABLE 93 EUROPE: SUPPLY CHAIN ANALYTICS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 94 EUROPE: SUPPLY CHAIN ANALYTICS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 95 EUROPE: SUPPLY CHAIN ANALYTICS MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 96 EUROPE: SUPPLY CHAIN ANALYTICS MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 97 EUROPE: SUPPLY CHAIN ANALYTICS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 98 EUROPE: SUPPLY CHAIN ANALYTICS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 99 EUROPE: SUPPLY CHAIN ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016-2021 (USD MILLION)

- TABLE 100 EUROPE: SUPPLY CHAIN ANALYTICS MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 101 EUROPE: SUPPLY CHAIN ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 102 EUROPE: SUPPLY CHAIN ANALYTICS MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 103 EUROPE: SUPPLY CHAIN ANALYTICS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 104 EUROPE: SUPPLY CHAIN ANALYTICS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 105 EUROPE: SUPPLY CHAIN ANALYTICS MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 106 EUROPE: SUPPLY CHAIN ANALYTICS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.3.2 UK

- 11.3.2.1 Disruptions in supply chain to drive market

- 11.3.3 GERMANY

- 11.3.3.1 Industrial developments and advancements to fuel market

- 11.3.4 FRANCE

- 11.3.4.1 Initiatives by government to position France as tech-giant to propel market

- 11.3.5 ITALY

- 11.3.5.1 Technological developments to boost market

- 11.3.6 SPAIN

- 11.3.6.1 Cloud adoption to drive investments in data centers

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: SUPPLY CHAIN ANALYTICS MARKET DRIVERS

- FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 107 ASIA PACIFIC: SUPPLY CHAIN ANALYTICS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 108 ASIA PACIFIC: SUPPLY CHAIN ANALYTICS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 109 ASIA PACIFIC: SUPPLY CHAIN ANALYTICS MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 110 ASIA PACIFIC: SUPPLY CHAIN ANALYTICS MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 111 ASIA PACIFIC: SUPPLY CHAIN ANALYTICS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 112 ASIA PACIFIC: SUPPLY CHAIN ANALYTICS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 113 ASIA PACIFIC: SUPPLY CHAIN ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016-2021 (USD MILLION)

- TABLE 114 ASIA PACIFIC: SUPPLY CHAIN ANALYTICS MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 115 ASIA PACIFIC: SUPPLY CHAIN ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 116 ASIA PACIFIC: SUPPLY CHAIN ANALYTICS MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 117 ASIA PACIFIC: SUPPLY CHAIN ANALYTICS MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 118 ASIA PACIFIC: SUPPLY CHAIN ANALYTICS MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 119 ASIA PACIFIC: SUPPLY CHAIN ANALYTICS MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 120 ASIA PACIFIC: SUPPLY CHAIN ANALYTICS MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Increasing adoption of AI and IoT to fuel supply chain analytics adoption

- 11.4.3 JAPAN

- 11.4.3.1 Rising demand for process automation among enterprises to drive market

- 11.4.4 INDIA

- 11.4.4.1 Growing adoption of supply chain 4.0 to boost market

- 11.4.5 ASEAN

- 11.4.5.1 Increasing adoption of digital tools and real-time data to propel market

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST AND AFRICA

- 11.5.1 MIDDLE EAST AND AFRICA: SUPPLY CHAIN ANALYTICS MARKET DRIVERS

- TABLE 121 MIDDLE EAST AND AFRICA: SUPPLY CHAIN ANALYTICS MARKET,

- BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 122 MIDDLE EAST AND AFRICA: SUPPLY CHAIN ANALYTICS MARKET,

- BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 123 MIDDLE EAST AND AFRICA: SUPPLY CHAIN ANALYTICS MARKET,

- BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 124 MIDDLE EAST AND AFRICA: SUPPLY CHAIN ANALYTICS MARKET,

- BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 125 MIDDLE EAST AND AFRICA: SUPPLY CHAIN ANALYTICS MARKET, BY SERVICE, 2016-2021 (USD MILLION)

- TABLE 126 MIDDLE EAST AND AFRICA: SUPPLY CHAIN ANALYTICS MARKET, BY SERVICE, 2022-2027 (USD MILLION)

- TABLE 127 MIDDLE EAST AND AFRICA: SUPPLY CHAIN ANALYTICS MARKET,

- BY DEPLOYMENT MODE, 2016-2021 (USD MILLION)

- TABLE 128 MIDDLE EAST AND AFRICA: SUPPLY CHAIN ANALYTICS MARKET,

- BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 129 MIDDLE EAST AND AFRICA: SUPPLY CHAIN ANALYTICS MARKET,

- BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 130 MIDDLE EAST AND AFRICA: SUPPLY CHAIN ANALYTICS MARKET,

- BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 131 MIDDLE EAST AND AFRICA: SUPPLY CHAIN ANALYTICS MARKET,

- BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 132 MIDDLE EAST AND AFRICA: SUPPLY CHAIN ANALYTICS MARKET,

- BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 133 MIDDLE EAST AND AFRICA: SUPPLY CHAIN ANALYTICS MARKET,

- BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 134 MIDDLE EAST AND AFRICA: SUPPLY CHAIN ANALYTICS MARKET,

- BY COUNTRY, 2022-2027 (USD MILLION)

- 11.5.2 UAE

- 11.5.2.1 Government's focus on adopting various strategies to drive market

- 11.5.3 KINGDOM OF SAUDI ARABIA

- 11.5.3.1 Rising digitization and growing partnership strategies in KSA to boost demand for supply chain analytics

- 11.5.4 ISRAEL

- 11.5.4.1 Increasing use of cutting-edge solutions to analyze and gain better insights from data to fuel market

- 11.5.5 TURKEY

- 11.5.5.1 Growing need for smart devices and analytics to fuel market growth

- 11.5.6 QATAR

- 11.5.6.1 Increasing focus of government on enhancing logistics infrastructure to drive market

- 11.5.7 SOUTH AFRICA

- 11.5.7.1 Rising number of initiatives to increase infrastructure expenditure to propel market

- 11.5.8 REST OF MIDDLE EAST AND AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: SUPPLY CHAIN ANALYTICS MARKET DRIVERS

- TABLE 135 LATIN AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 136 LATIN AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 137 LATIN AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY SERVICE,

- 2016-2021 (USD MILLION)

- TABLE 138 LATIN AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY SERVICE,

- 2022-2027 (USD MILLION)

- TABLE 139 LATIN AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY SOFTWARE,

- 2016-2021 (USD MILLION)

- TABLE 140 LATIN AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY SOFTWARE,

- 2022-2027 (USD MILLION)

- TABLE 141 LATIN AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016-2021 (USD MILLION)

- TABLE 142 LATIN AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 143 LATIN AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 144 LATIN AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 145 LATIN AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY VERTICAL,

- 2016-2021 (USD MILLION)

- TABLE 146 LATIN AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY VERTICAL,

- 2022-2027 (USD MILLION)

- TABLE 147 LATIN AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY COUNTRY,

- 2016-2021 (USD MILLION)

- TABLE 148 LATIN AMERICA: SUPPLY CHAIN ANALYTICS MARKET, BY COUNTRY,

- 2022-2027 (USD MILLION)

- 11.6.2 BRAZIL

- 11.6.2.1 Increasing sales and operational planning in Brazil owing to big data analytics to boost market

- 11.6.3 MEXICO

- 11.6.3.1 Growing digitalization of supply chain to drive market

- 11.6.4 ARGENTINA

- 11.6.4.1 Increasing use of cutting-edge technologies to fuel market

- 11.6.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES

- TABLE 149 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN SUPPLY CHAIN ANALYTICS MARKET

- 12.3 REVENUE ANALYSIS

- FIGURE 36 REVENUE ANALYSIS FOR KEY COMPANIES, 2017-2021 (USD MILLION)

- 12.4 MARKET SHARE ANALYSIS

- FIGURE 37 SUPPLY CHAIN ANALYTICS MARKET SHARE ANALYSIS FOR

KEY PLAYERS, 2021

- TABLE 150 SUPPLY CHAIN ANALYTICS MARKET: DEGREE OF COMPETITION

- 12.5 COMPANY EVALUATION QUADRANT

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 38 KEY SUPPLY CHAIN ANALYTICS MARKET PLAYERS,

COMPANY EVALUATION MATRIX, 2022

- 12.6 STARTUP/SME EVALUATION MATRIX

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 39 STARTUP/SME SUPPLY CHAIN ANALYTICS MARKET EVALUATION

MATRIX, 2022

- 12.7 COMPETITIVE BENCHMARKING

- TABLE 151 SUPPLY CHAIN ANALYTICS MARKET: COMPETITIVE BENCHMARKING

- OF KEY PLAYERS, 2022

- TABLE 152 SUPPLY CHAIN ANALYTICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 153 SUPPLY CHAIN ANALYTICS MARKET: COMPETITIVE

- BENCHMARKING OF KEY PLAYERS (STARTUPS/SMES)

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 PRODUCT LAUNCHES

- TABLE 154 PRODUCT LAUNCHES, 2021-2022

- 12.8.2 DEALS

- TABLE 155 DEALS, 2019-2022

- 12.8.3 OTHERS

- TABLE 156 OTHERS, 2019-2021

13 COMPANY PROFILES

- 13.1 MAJOR PLAYERS

- 13.1.1 IBM

- 13.1.2 ORACLE

- 13.1.3 SAP

- 13.1.4 SALESFORCE

- 13.1.5 SOFTWARE AG

- 13.1.6 MICROSTRATEGY

- 13.1.8 CLOUDERA

- 13.1.9 DOMO

- 13.1.10 AXWAY

- 13.1.11 ROSSLYN ANALYTICS

- 13.1.12 1010DATA

- 13.1.13 QLIK

- 13.1.14 LOGILITY

- 13.1.15 INFOR

- 13.1.16 VOXWARE

- 13.2 OTHER PLAYERS

- 13.2.1 MANHATTAN ASSOCIATES

- 13.2.2 DATAFACTZ

- 13.2.3 DATAIKU

- 13.2.4 RELEX SOLUTIONS

- 13.2.5 AIMMS

- 13.2.6 TARGIT

- 13.2.7 TIBCO SOFTWARE

- 13.2.8 ZEBRA TECHNOLOGIES

- 13.2.9 THE ANYLOGIC COMPANY

- 13.2.10 INTUGINE TECHNOLOGIES

- 13.2.11 LUMACHAIN

- 13.2.12 HUM INDUSTRIAL TECHNOLOGY

- 13.2.13 PAFAXE

- 13.2.14 SS SUPPLY CHAIN SOLUTIONS (3SC)

14 ADJACENT AND RELATED MARKETS

- 14.1 BLOCKCHAIN SUPPLY CHAIN MARKET

- 14.1.1 MARKET DEFINITION

- 14.1.2 MARKET OVERVIEW

- 14.1.3 BLOCKCHAIN SUPPLY CHAIN MARKET, BY OFFERING

- 14.1.4 BLOCKCHAIN SUPPLY CHAIN MARKET, BY TYPE

- 14.1.5 BLOCKCHAIN SUPPLY CHAIN MARKET, BY PROVIDER TYPE

- 14.1.6 BLOCKCHAIN SUPPLY CHAIN MARKET, BY APPLICATION

- 14.1.7 BLOCKCHAIN SUPPLY CHAIN MARKET, BY ORGANIZATION SIZE

- 14.1.8 BLOCKCHAIN SUPPLY CHAIN MARKET, BY END-USER

- 14.1.9 BLOCKCHAIN SUPPLY CHAIN MARKET, BY REGION

- 14.2 BIG DATA MARKET

- 14.2.1 MARKET DEFINITION

- 14.2.2 MARKET OVERVIEW

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS