|

|

市場調査レポート

商品コード

1172586

ポリオールの世界市場:種類別 (ポリエーテルポリオール、ポリエステルポリオール)・用途別 (軟質ポリウレタンフォーム、硬質ポリウレタンフォーム、CASE)・エンドユース産業別 (建築・建設、自動車、エレクトロニクス)・地域別の将来予測 (2027年まで)Polyols Market by Type (Polyether polyols and Polyester polyols), Application (Flexible Polyurethane Foam, Rigid Polyurethane Foam, CASE), End-Use Industry (Building & Construction, Automotive, Electronics), and Region- Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ポリオールの世界市場:種類別 (ポリエーテルポリオール、ポリエステルポリオール)・用途別 (軟質ポリウレタンフォーム、硬質ポリウレタンフォーム、CASE)・エンドユース産業別 (建築・建設、自動車、エレクトロニクス)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年12月07日

発行: MarketsandMarkets

ページ情報: 英文 236 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のポリオールの市場規模は、2022年に367億米ドル、2027年には493億米ドルに達し、6.1%のCAGRで成長すると予測されています。

自動車・建築・建設などいくつかのエンドユース産業がCOVID-19の大流行から回復し、世界中で包装の需要が増加しているため、予測期間中にポリオールの需要が増加すると予測されています。

種類別に見ると、ポリエーテルポリオールが予測期間中に最大の市場シェアを占めると予想されます。ポリエーテルポリオールは、家具・マットレス・自動車用シート・ステアリングパッドなどに使われるクッションや軟質フォームの製造に主に使用されています。また、エラストマーや接着剤・シーラント、ポリウレタン繊維、コーティング剤などにも使用されています。

用途別に見ると、軟質ポリウレタンフォームが最大のシェアを占め、また予測期間中 (2022年~2027年) にかけて最も急速に成長するセグメントの1つでもあります。家具・自動車分野の成長により、クッション用途の需要が増加しています。

エンドユース産業別では、建築・建設分野が最大の市場であると推定されます。建築・建設分野は、COVID-19以降の需要増に加え、建築に使用される断熱材やシーリング材の需要増が主な要因で成長しています。また、住宅改修の急増がポリウレタン硬質フォーム需要の主な推進材料となっています。

地域別に見ると、アジア太平洋 (インド・中国・日本・インドネシアなど) がポリオールの最速成長市場になると予測されます。市場成長の主な要因として、中国やインドといった国々の経済成長や、域内の主要なエンドユース産業からの需要の増大などが挙げられます。

当レポートでは、世界のポリオールの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別・用途別・エンドユース産業別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- マクロ経済指標

- 世界人口の増加動向

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- 技術分析

- 自動車内装コーティング用のバイオベースポリウレタンの開発

- 主な会議とイベント (2022年~2023年)

- ケーススタディ分析

- 特許分析

- エコシステム

第6章 ポリオール市場:種類別

- イントロダクション

- ポリエーテルポリオール

- ポリエステルポリオール

第7章 ポリオール市場:用途別

- イントロダクション

- 軟質ポリウレタンフォーム

- 硬質ポリウレタンフォーム

- CASE (コーティング、接着剤、シーラント、エラストマー)

第8章 ポリオール市場:エンドユース産業別

- イントロダクション

- 建築・建設

- 自動車

- 家具

- 包装

- エレクトロニクス

- その他

第9章 ポリオール市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- タイ

- インドネシア

- 他のアジア太平洋諸国

- 欧州

- ドイツ

- イタリア

- 英国

- ロシア

- フランス

- トルコ

- 他の欧州諸国

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 他の中東・アフリカ諸国

- 南米

- ブラジル

- アルゼンチン

- 他の南米諸国

第10章 競合情勢

- イントロダクション

- 市場シェア分析

- 主要企業が採用した戦略

- 企業評価クアドラント

- 新興企業・中小企業の評価クアドラント

- 大手企業の収益分析

- 競合ベンチマーキング

- 競合シナリオと動向

- 製品の発売

- 資本取引

- その他の動向

第11章 企業プロファイル

- THE DOW CHEMICAL COMPANY

- COVESTRO AG

- SHELL CHEMICALS

- BASF SE

- HUNTSMAN CORPORATION

- STEPAN COMPANY

- WANHUA CHEMICAL GROUP

- REPSOL SA

- PCC GROUP

- LANXESS AG

- その他の企業

- ZIBO DEXIN LIANBANG CHEMICAL INDUSTRY CO., LTD.

- SHANDONG LONGHUA NEW MATERIAL CO., LTD

- HUAFENG (ZHEJIANG HUAFON NEW MATERIALS CORP., LTD)

- SHAKUN INDUSTRIES

- INTERPUR CHEMICALS

- MANALI PETROCHEMICALS

- POLYGREEN CHEMICALS

- BAYER

- VINTEK CHEMICAL PRODUCTS PVT. LTD

- POLYOLS AND POLYMERS PVT. LIMITED

- KURARAY CO., LTD.

- SUMITOMO BAKELITE HIGH PERFORMANCE PLASTICS (SBHPP)

- INVISTA

- ERCA ADVANCED POLYMER SOLUTIONS SRL

- SINOPEC CORP

- DAICEL CORPORATION

- EMERY OLEOCHEMICALS

- SOLVAY

- PERSTORP POLYOLS INC.

- SAUDI ARAMCO

- TOSOH CORPORATION

- DIC CORPORATION

- ARKEMA

第12章 付録

The Polyol market size is estimated to be USD 36.7 Billion in 2022 and is projected to reach USD 49.3 Billion by 2027, at a CAGR of 6.1%. The polyols are segmented into two types i.e., polyether polyols and polyester polyols. Polyether polyols are majorly used in cushioning for furniture, bedding, and automotive seats as flexible foam. Polyether-based rigid foams are used in packaging, refrigeration, and insulation materials. Owing to the recovery of several end-use industries such as automotive, building and construction, from the COVID-19 pandemic, and the increasing demand for packaging worldwide is projected to increase the demand for polyols in the forecast period.

By Type, Polyether polyols segment accounted for the largest share of the global polyol market during the forecast period

Polyether polyols are estimated to have the largest market share during the forecast period. They are more commonly used polyols. The major types of polyether polyols are polyethylene glycol, polypropylene glycol, and polytetramethylene glycol. Polyether polyols are largely used for making cushions and flexible foams used in furniture, mattresses, automobile seats, steering pads etc. Polyester-based rigid foams are used in packaging materials and as insulation materials used for refrigeration. Polyether polyols are also used in elastomers, adhesives & sealants, polyurethane fibers, and coatings.

By Application, Flexible polyurethane foams accounted for the highest market share during the forecast period

The market is segmented by application as flexible polyurethane foams, rigid polyurethane foams and CASE (coatings, adhesives, sealants, and elastomers). The largest application of polyols is flexible polyurethane foam. Flexible polyurethane foam is also one of the fastest-growing applications of polyols between 2022 and 2027. The growth in furniture and automobile sector is the major reason for increase in demand of cushioning applications.

By End Use Industry, Building and construction sector accounted for the largest market share during the forecast period

Building and construction sector is estimated to be the largest market for polyol market. The building and construction sector is growing, owing to rising post covid demand, and majorly due to the increase in demand of insulating and sealant materials used in construction. The polyols are used in decorative paints, flooring systems, coatings for exteriors & roof elements, and blinds & doors. The rapidly growing home refurbishment activities is the main drivers of polyurethane rigid foams in this sector.

APAC is projected to account for the biggest market share and highest CAGR in the polyol market during the forecast period

APAC is estimated to be the fastest growing market for polyol during the forecast period. Polyol markets are estimated to register significant growth in India, China, Indonesia, and Japan, due to their strong demand from end-use industries such as automotive, building and construction, electronics, packaging, and others. The growth of the Asia Pacific polyol market is driven by the economic growth of countries such as China and India. Moreover, the growing demand from major end-use industries in the region which further boosts the growth of the polyol market.

The polyol market includes major manufacturers such as The DOW Chemical Company (US), Covestro AG (Germany), Shell chemicals (US), BASF SE (Germany) and Huntsman (US) are the key players operating in polyol market. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies selected by these key players to boost their positions in the polyol market.

By Company Type: Tier 1: 45%, Tier 2: 22%, and Tier 3: 33%

By Designation: C-level Executives: 50%, Directors: 25%, and Others: 25%

By Region: North America: 50%, Europe: 20%, Asia Pacific: 20%, South America: 10%

Research Coverage

The market study covers the polyol market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on types, application, end use industries, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the polyol market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall polyol market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses and plan suitable go-to-market strategies. The report also aims at helping stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 POLYOLS MARKET SEGMENTATION

- 1.4.2 REGIONS COVERED

- 1.4.3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 POLYOLS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.2.2 APPROACH 2: BASED ON DEMAND FOR POLYETHER POLYOLS IN CHINA

- FIGURE 2 MARKET SIZE ESTIMATION: BASED ON DEMAND FOR POLYETHER POLYOLS IN CHINA (2021)

- 2.3 DATA TRIANGULATION

- FIGURE 3 POLYOLS MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 4 POLYETHER TYPE DOMINATED POLYOLS MARKET IN 2021

- FIGURE 5 FLEXIBLE POLYURETHANE FOAM APPLICATION LED POLYOLS MARKET IN 2021

- FIGURE 6 BUILDING & CONSTRUCTION WAS LARGEST END-USE INDUSTRY OF POLYOLS IN 2021

- FIGURE 7 ASIA PACIFIC TO BE FASTEST-GROWING POLYOLS MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POLYOLS MARKET

- FIGURE 8 GROWING CONSTRUCTION, AUTOMOTIVE, AND ELECTRONICS INDUSTRIES TO DRIVE MARKET BETWEEN 2022 AND 2027

- 4.2 POLYOLS MARKET IN ASIA PACIFIC, BY COUNTRY AND TYPE (2021)

- FIGURE 9 CHINA AND POLYETHER POLYOLS SEGMENT ACCOUNTED FOR LARGEST SHARES

- 4.3 POLYOLS MARKET, BY KEY COUNTRIES

- FIGURE 10 POLYOLS MARKET TO REGISTER HIGH GROWTH IN INDIA AND CHINA

5 MARKET OVERVIEW

- 5.1 OVERVIEW

- 5.2 MARKET DYNAMICS

- FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN POLYOLS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growth of packaging industry

- 5.2.1.2 Growing industrial sector

- 5.2.1.3 Growth of automotive and construction industries

- FIGURE 12 GLOBAL AUTOMOBILE PRODUCTION (UNITS)

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent environmental regulations for polyurethane foam production

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for bio-based polyols

- 5.2.4 CHALLENGES

- 5.2.4.1 Eco-friendly alternatives

- 5.2.4.2 Fluctuations in raw material prices

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 13 PORTER'S FIVE FORCES ANALYSIS OF POLYOLS MARKET

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 1 IMPACT OF PORTER'S FIVE FORCES ON POLYOLS MARKET

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 GLOBAL POPULATION GROWTH TRENDS

- TABLE 2 WORLD POPULATION, BY COUNTRY, 2022 (LIVE)

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 14 VALUE CHAIN ANALYSIS OF POLYOLS MARKET

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.7 PRICING ANALYSIS

- TABLE 3 AVERAGE SELLING PRICE OF POLYOLS, BY REGION (USD/KILOGRAM)

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 DEVELOPMENT OF BIO-BASED POLYURETHANE FOR AUTOMOTIVE INTERIOR COATINGS

- 5.9 KEY CONFERENCES AND EVENTS IN 2022-2023

- TABLE 4 KEY CONFERENCES AND EVENTS, 2022-2023

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 DEVELOPMENT OF BIO-BASED PREPOLYMERS TO ALLOW PU PROCESSORS TO PRODUCE COMPONENTS WITH LOWER CO2 FOOTPRINT

- 5.11 PATENT ANALYSIS

- 5.11.1 INTRODUCTION

- 5.11.2 METHODOLOGY

- 5.11.3 DOCUMENT TYPE

- TABLE 5 TOTAL NUMBER OF PATENTS, 2012-2021

- FIGURE 15 GRANTED PATENTS, LIMITED PATENTS, AND PATENT APPLICATIONS

- FIGURE 16 PATENT PUBLICATION TRENDS (2012-2021)

- 5.11.4 INSIGHTS

- 5.11.5 LEGAL STATUS OF PATENTS

- FIGURE 17 LEGAL STATUS OF PATENTS

- FIGURE 18 JURISDICTION ANALYSIS

- 5.11.6 ANALYSIS OF TOP PATENT APPLICANTS

- FIGURE 19 TOP 10 PATENT APPLICANTS

- TABLE 6 LIST OF PATENTS BY COVESTRO DEUTSCHLAND AG

- TABLE 7 LIST OF PATENTS BY DOW GLOBAL TECHNOLOGIES LLC

- TABLE 8 LIST OF PATENTS BY BASF SE

- TABLE 9 TOP 10 PATENT OWNERS IN LAST 10 YEARS

- 5.12 ECOSYSTEM

6 POLYOLS MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 20 POLYETHER POLYOLS TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 10 POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 11 POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 12 POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 13 POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- 6.2 POLYETHER POLYOLS

- 6.2.1 FLEXIBLE FOAM APPLICATION IN AUTOMOTIVE INDUSTRY TO DRIVE DEMAND FOR POLYETHER POLYOLS

- TABLE 14 POLYETHER POLYOLS MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 15 POLYETHER POLYOLS MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 16 POLYETHER POLYOLS MARKET SIZE, BY REGION, 2017-2020 (KILOTON)

- TABLE 17 POLYETHER POLYOLS MARKET SIZE, BY REGION, 2021-2027 (KILOTON)

- 6.3 POLYESTER POLYOLS

- 6.3.1 CASE APPLICATION TO FUEL DEMAND FOR POLYESTER POLYOLS

- TABLE 18 POLYESTER POLYOLS MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 19 POLYESTER POLYOLS MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 20 POLYESTER POLYOLS MARKET SIZE, BY REGION, 2017-2020 (KILOTON)

- TABLE 21 POLYESTER POLYOLS MARKET SIZE, BY REGION, 2021-2027 (KILOTON)

7 POLYOLS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 21 FLEXIBLE POLYURETHANE FOAM TO BE DOMINANT APPLICATION OF POLYOLS BETWEEN 2022 AND 2027

- TABLE 22 POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 23 POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 24 POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 25 POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 7.2 FLEXIBLE POLYURETHANE FOAM

- 7.2.1 GROWING AUTOMOTIVE AND FURNITURE INDUSTRIES TO BOOST MARKET

- TABLE 26 POLYOLS MARKET SIZE FOR FLEXIBLE POLYURETHANE FOAM, BY REGION, 2017-2020 (USD MILLION)

- TABLE 27 POLYOLS MARKET SIZE FOR FLEXIBLE POLYURETHANE FOAM, BY REGION, 2021-2027 (USD MILLION)

- TABLE 28 POLYOLS MARKET SIZE FOR FLEXIBLE POLYURETHANE FOAM, BY REGION, 2017-2020 (KILOTON)

- TABLE 29 POLYOLS MARKET SIZE FOR FLEXIBLE POLYURETHANE FOAM, BY REGION, 2021-2027 (KILOTON)

- 7.3 RIGID POLYURETHANE FOAM

- 7.3.1 GROWING REFRIGERATION INDUSTRY AND INCREASING ENERGY-SAVING STANDARDS TO DRIVE MARKET

- TABLE 30 POLYOLS MARKET SIZE FOR RIGID POLYURETHANE FOAM, BY REGION, 2017-2020 (USD MILLION)

- TABLE 31 POLYOLS MARKET SIZE FOR RIGID POLYURETHANE FOAM, BY REGION, 2021-2027 (USD MILLION)

- TABLE 32 POLYOLS MARKET SIZE FOR RIGID POLYURETHANE FOAM, BY REGION, 2017-2020 (KILOTON)

- TABLE 33 POLYOLS MARKET SIZE FOR RIGID POLYURETHANE FOAM, BY REGION, 2021-2027 (KILOTON)

- 7.4 CASE (COATINGS, ADHESIVES, SEALANTS, AND ELASTOMERS)

- 7.4.1 INCREASING DEMAND FOR ELASTOMERS FOR MANUFACTURING LIGHTWEIGHT AUTOMOTIVE PARTS TO PROPEL MARKET

- TABLE 34 POLYOLS MARKET SIZE FOR CASE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 35 POLYOLS MARKET SIZE FOR CASE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 36 POLYOLS MARKET SIZE FOR CASE, BY REGION, 2017-2020 (KILOTON)

- TABLE 37 POLYOLS MARKET SIZE FOR CASE, BY REGION, 2021-2027 (KILOTON)

8 POLYOLS MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 22 BUILDING & CONSTRUCTION END-USE INDUSTRY TO LEAD POLYOLS MARKET

- TABLE 38 POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 39 POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 40 POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 41 POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 8.2 BUILDING & CONSTRUCTION

- 8.2.1 USE OF EFFICIENT SEALING AND INSULATING SYSTEMS TO BOOST DEMAND FOR POLYOLS

- TABLE 42 POLYOLS MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2017-2020 (USD MILLION)

- TABLE 43 POLYOLS MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2021-2027 (USD MILLION)

- TABLE 44 POLYOLS MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2017-2020 (KILOTON)

- TABLE 45 POLYOLS MARKET SIZE IN BUILDING & CONSTRUCTION END-USE INDUSTRY, BY REGION, 2021-2027 (KILOTON)

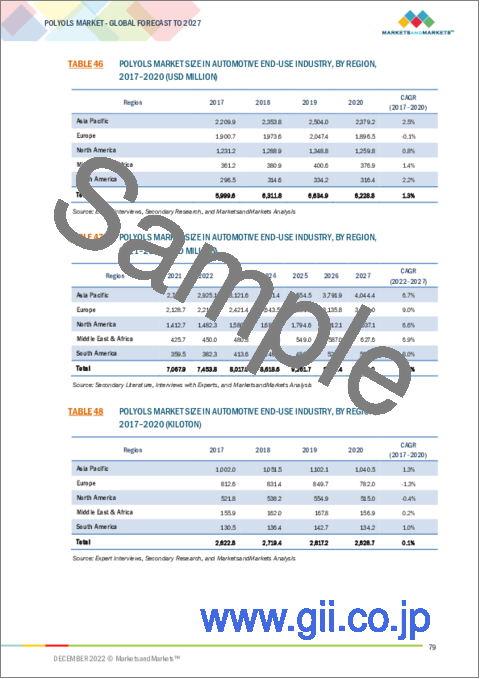

- 8.3 AUTOMOTIVE

- 8.3.1 USE OF POLYOLS IN SEATS, CUSHIONS, AND BACKRESTS TO DRIVE MARKET

- TABLE 46 POLYOLS MARKET SIZE IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2017-2020 (USD MILLION)

- TABLE 47 POLYOLS MARKET SIZE IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2021-2027 (USD MILLION)

- TABLE 48 POLYOLS MARKET SIZE IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2017-2020 (KILOTON)

- TABLE 49 POLYOLS MARKET SIZE IN AUTOMOTIVE END-USE INDUSTRY, BY REGION, 2021-2027 (KILOTON)

- 8.4 FURNISHING

- 8.4.1 CHANGING LIFESTYLES AND INCREASING DISPOSABLE INCOME TO DRIVE MARKET

- TABLE 50 POLYOLS MARKET SIZE IN FURNISHING END-USE INDUSTRY, BY REGION, 2017-2020 (USD MILLION)

- TABLE 51 POLYOLS MARKET SIZE IN FURNISHING END-USE INDUSTRY, BY REGION, 2021-2027 (USD MILLION)

- TABLE 52 POLYOLS MARKET SIZE IN FURNISHING END-USE INDUSTRY, BY REGION, 2017-2020 (KILOTON)

- TABLE 53 POLYOLS MARKET SIZE IN FURNISHING END-USE INDUSTRY, BY REGION, 2021-2027 (KILOTON)

- 8.5 PACKAGING

- 8.5.1 DEMAND FROM HEALTHCARE AND REFRIGERATION INDUSTRIES TO SUPPORT MARKET GROWTH

- TABLE 54 POLYOLS MARKET SIZE IN PACKAGING END-USE INDUSTRY, BY REGION, 2017-2020 (USD MILLION)

- TABLE 55 POLYOLS MARKET SIZE IN PACKAGING END-USE INDUSTRY, BY REGION, 2021-2027 (USD MILLION)

- TABLE 56 POLYOLS MARKET SIZE IN PACKAGING END-USE INDUSTRY, BY REGION, 2017-2020 (KILOTON)

- TABLE 57 POLYOLS MARKET SIZE IN PACKAGING END-USE INDUSTRY, BY REGION, 2021-2027 (KILOTON)

- 8.6 ELECTRONICS

- 8.6.1 INCREASING USE OF POLYOLS-BASED RIGID AND FLEXIBLE POLYURETHANE FOAMS AS INSULATORS TO FAVOR MARKET GROWTH

- TABLE 58 POLYOLS MARKET SIZE IN ELECTRONICS END-USE INDUSTRY, BY REGION, 2017-2020 (USD MILLION)

- TABLE 59 POLYOLS MARKET SIZE IN ELECTRONICS END-USE INDUSTRY, BY REGION, 2021-2027 (USD MILLION)

- TABLE 60 POLYOLS MARKET SIZE IN ELECTRONICS END-USE INDUSTRY, BY REGION, 2017-2020 (KILOTON)

- TABLE 61 POLYOLS MARKET SIZE IN ELECTRONICS END-USE INDUSTRY, BY REGION, 2021-2027 (KILOTON)

- 8.7 OTHERS

- TABLE 62 POLYOLS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2017-2020 (USD MILLION)

- TABLE 63 POLYOLS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2021-2027 (USD MILLION)

- TABLE 64 POLYOLS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2017-2020 (KILOTON)

- TABLE 65 POLYOLS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2021-2027 (KILOTON)

9 POLYOLS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 23 ASIA PACIFIC TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 66 POLYOLS MARKET SIZE, BY REGION, 2017-2020 (USD MILLION)

- TABLE 67 POLYOLS MARKET SIZE, BY REGION, 2021-2027 (USD MILLION)

- TABLE 68 POLYOLS MARKET SIZE, BY REGION, 2017-2020 (KILOTON)

- TABLE 69 POLYOLS MARKET SIZE, BY REGION, 2021-2027 (KILOTON)

- 9.2 ASIA PACIFIC

- FIGURE 24 ASIA PACIFIC: POLYOLS MARKET SNAPSHOT

- TABLE 70 ASIA PACIFIC: POLYOLS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 71 ASIA PACIFIC: POLYOLS MARKET SIZE, BY COUNTRY, 2021-2027(USD MILLION)

- TABLE 72 ASIA PACIFIC: POLYOLS MARKET SIZE, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 73 ASIA PACIFIC: POLYOLS MARKET SIZE, BY COUNTRY, 2021-2027 (KILOTON)

- TABLE 74 ASIA PACIFIC: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 75 ASIA PACIFIC: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 76 ASIA PACIFIC: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 77 ASIA PACIFIC: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 78 ASIA PACIFIC: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 79 ASIA PACIFIC: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 80 ASIA PACIFIC: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 81 ASIA PACIFIC: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- TABLE 82 ASIA PACIFIC: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 83 ASIA PACIFIC: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 84 ASIA PACIFIC: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 85 ASIA PACIFIC: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 9.2.1 CHINA

- 9.2.1.1 Growing construction and automotive industries to boost demand for polyols

- TABLE 86 CHINA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 87 CHINA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 88 CHINA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 89 CHINA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 90 CHINA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 91 CHINA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 92 CHINA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 93 CHINA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.2.2 JAPAN

- 9.2.2.1 Huge automobile manufacturing base to drive market

- TABLE 94 JAPAN: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 95 JAPAN: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 96 JAPAN: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 97 JAPAN: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 98 JAPAN: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 99 JAPAN: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 100 JAPAN: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 101 JAPAN: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.2.3 SOUTH KOREA

- 9.2.3.1 Automotive industry to generate demand for polyols

- TABLE 102 SOUTH KOREA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 103 SOUTH KOREA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 104 SOUTH KOREA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 105 SOUTH KOREA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 106 SOUTH KOREA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 107 SOUTH KOREA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 108 SOUTH KOREA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 109 SOUTH KOREA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.2.4 INDIA

- 9.2.4.1 Rapidly growing manufacturing and construction industries to fuel market

- TABLE 110 INDIA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 111 INDIA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 112 INDIA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 113 INDIA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 114 INDIA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 115 INDIA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 116 INDIA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 117 INDIA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.2.5 THAILAND

- 9.2.5.1 Growing automotive and furniture industries to boost demand for polyols

- TABLE 118 THAILAND: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 119 THAILAND: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 120 THAILAND: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 121 THAILAND: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 122 THAILAND: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 123 THAILAND: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 124 THAILAND: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 125 THAILAND: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.2.6 INDONESIA

- 9.2.6.1 Automotive and construction industries to propel market

- TABLE 126 INDONESIA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 127 INDONESIA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 128 INDONESIA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 129 INDONESIA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 130 INDONESIA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 131 INDONESIA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 132 INDONESIA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 133 INDONESIA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.2.7 REST OF ASIA PACIFIC

- TABLE 134 REST OF ASIA PACIFIC: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 135 REST OF ASIA PACIFIC: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 137 REST OF ASIA PACIFIC: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 138 REST OF ASIA PACIFIC: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 141 REST OF ASIA PACIFIC: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.3 EUROPE

- TABLE 142 EUROPE: POLYOLS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 143 EUROPE: POLYOLS MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 144 EUROPE: POLYOLS MARKET SIZE, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 145 EUROPE: POLYOLS MARKET SIZE, BY COUNTRY, 2021-2027 (KILOTON)

- TABLE 146 EUROPE: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 147 EUROPE: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 148 EUROPE: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 149 EUROPE: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 150 EUROPE: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 151 EUROPE: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 152 EUROPE: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 153 EUROPE: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- TABLE 154 EUROPE: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 155 EUROPE: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 156 EUROPE: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 157 EUROPE: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 9.3.1 GERMANY

- 9.3.1.1 Automotive industry to boost demand for polyols in flexible foam and CASE applications

- TABLE 158 GERMANY: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 159 GERMANY: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 160 GERMANY: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 161 GERMANY: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 162 GERMANY: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 163 GERMANY: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 164 GERMANY: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 165 GERMANY: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.3.2 ITALY

- 9.3.2.1 Government initiatives to boost construction sector to be favorable for market growth

- TABLE 166 ITALY: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 167 ITALY: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 168 ITALY: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 169 ITALY: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 170 ITALY: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 171 ITALY: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 172 ITALY: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 173 ITALY: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.3.3 UK

- 9.3.3.1 Government initiatives in construction sector to propel market

- TABLE 174 UK: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 175 UK: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 176 UK: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 177 UK: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 178 UK: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 179 UK: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 180 UK: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 181 UK: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.3.4 RUSSIA

- 9.3.4.1 Revival of construction and automotive industries to fuel demand for polyols

- TABLE 182 RUSSIA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 183 RUSSIA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 184 RUSSIA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 185 RUSSIA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 186 RUSSIA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 187 RUSSIA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 188 RUSSIA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 189 RUSSIA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.3.5 FRANCE

- 9.3.5.1 Strong manufacturing sectors and high investments to drive demand for polyols

- TABLE 190 FRANCE: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 191 FRANCE: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 192 FRANCE: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 193 FRANCE: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 194 FRANCE: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 195 FRANCE: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 196 FRANCE: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 197 FRANCE: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.3.6 TURKEY

- 9.3.6.1 Growing construction sector to drive market

- TABLE 198 TURKEY: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 199 TURKEY: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 200 TURKEY: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 201 TURKEY: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 202 TURKEY: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 203 TURKEY: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 204 TURKEY: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 205 TURKEY: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.3.7 REST OF EUROPE

- TABLE 206 REST OF EUROPE: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 207 REST OF EUROPE: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 208 REST OF EUROPE: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 209 REST OF EUROPE: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 210 REST OF EUROPE: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 211 REST OF EUROPE: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 212 REST OF EUROPE: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 213 REST OF EUROPE: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.4 NORTH AMERICA

- FIGURE 25 NORTH AMERICA: POLYOLS MARKET SNAPSHOT

- TABLE 214 NORTH AMERICA: POLYOLS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 215 NORTH AMERICA: POLYOLS MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 216 NORTH AMERICA: POLYOLS MARKET SIZE, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 217 NORTH AMERICA: POLYOLS MARKET SIZE, BY COUNTRY, 2021-2027 (KILOTON)

- TABLE 218 NORTH AMERICA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 219 NORTH AMERICA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 220 NORTH AMERICA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 221 NORTH AMERICA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 222 NORTH AMERICA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 223 NORTH AMERICA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 224 NORTH AMERICA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 225 NORTH AMERICA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- TABLE 226 NORTH AMERICA: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 227 NORTH AMERICA: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 228 NORTH AMERICA: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 229 NORTH AMERICA: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 9.4.1 US

- 9.4.1.1 Presence of major polyurethane manufacturing companies to drive market

- FIGURE 26 VEHICLE PRODUCTION IN US, 2000-2021 (MILLION UNITS)

- TABLE 230 US: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 231 US: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 232 US: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 233 US: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 234 US: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 235 US: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 236 US: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 237 US: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.4.2 CANADA

- 9.4.2.1 Growing housing construction activities to be market driver

- TABLE 238 CANADA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 239 CANADA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 240 CANADA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 241 CANADA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 242 CANADA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 243 CANADA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 244 CANADA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 245 CANADA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.4.3 MEXICO

- 9.4.3.1 Increasing investment in automotive and housing industries to boost market

- TABLE 246 MEXICO: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 247 MEXICO: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 248 MEXICO: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 249 MEXICO: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 250 MEXICO: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 251 MEXICO: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 252 MEXICO: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 253 MEXICO: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.5 MIDDLE EAST & AFRICA

- TABLE 254 MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 256 MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 257 MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY COUNTRY, 2021-2027 (KILOTON)

- TABLE 258 MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 259 MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 260 MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 261 MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 262 MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 263 MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 264 MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 265 MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- TABLE 266 MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 267 MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 268 MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 269 MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 9.5.1 SAUDI ARABIA

- 9.5.1.1 Government initiatives to expand construction sector to support market growth

- TABLE 270 SAUDI ARABIA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 271 SAUDI ARABIA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 272 SAUDI ARABIA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 273 SAUDI ARABIA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 274 SAUDI ARABIA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 275 SAUDI ARABIA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 276 SAUDI ARABIA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 277 SAUDI ARABIA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.5.2 UAE

- 9.5.2.1 Growing polyurethane demand for flexible foam and coating applications to drive market

- TABLE 278 UAE: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 279 UAE: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 280 UAE: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 281 UAE: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 282 UAE: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 283 UAE: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 284 UAE: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 285 UAE: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.5.3 REST OF MIDDLE EAST & AFRICA

- TABLE 286 REST OF MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 287 REST OF MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 288 REST OF MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 289 REST OF MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 290 REST OF MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 291 REST OF MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 292 REST OF MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 293 REST OF MIDDLE EAST & AFRICA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.6 SOUTH AMERICA

- TABLE 294 SOUTH AMERICA: POLYOLS MARKET SIZE, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 295 SOUTH AMERICA: POLYOLS MARKET SIZE, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 296 SOUTH AMERICA: POLYOLS MARKET SIZE, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 297 SOUTH AMERICA: POLYOLS MARKET SIZE, BY COUNTRY, 2021-2027 (KILOTON)

- TABLE 298 SOUTH AMERICA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 299 SOUTH AMERICA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 300 SOUTH AMERICA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 301 SOUTH AMERICA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 302 SOUTH AMERICA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 303 SOUTH AMERICA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 304 SOUTH AMERICA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 305 SOUTH AMERICA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- TABLE 306 SOUTH AMERICA: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 307 SOUTH AMERICA: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 308 SOUTH AMERICA: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 309 SOUTH AMERICA: POLYOLS MARKET SIZE, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 9.6.1 BRAZIL

- 9.6.1.1 Growing automobile production to drive demand for polyols

- TABLE 310 BRAZIL: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 311 BRAZIL: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 312 BRAZIL: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 313 BRAZIL: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 314 BRAZIL: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 315 BRAZIL: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 316 BRAZIL: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 317 BRAZIL: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.6.2 ARGENTINA

- 9.6.2.1 Expansion of automotive industry to boost market

- TABLE 318 ARGENTINA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 319 ARGENTINA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 320 ARGENTINA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 321 ARGENTINA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 322 ARGENTINA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 323 ARGENTINA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 324 ARGENTINA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 325 ARGENTINA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

- 9.6.3 REST OF SOUTH AMERICA

- TABLE 326 REST OF SOUTH AMERICA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 327 REST OF SOUTH AMERICA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (USD MILLION)

- TABLE 328 REST OF SOUTH AMERICA: POLYOLS MARKET SIZE, BY TYPE, 2017-2020 (KILOTON)

- TABLE 329 REST OF SOUTH AMERICA: POLYOLS MARKET SIZE, BY TYPE, 2021-2027 (KILOTON)

- TABLE 330 REST OF SOUTH AMERICA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 331 REST OF SOUTH AMERICA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (USD MILLION)

- TABLE 332 REST OF SOUTH AMERICA: POLYOLS MARKET SIZE, BY APPLICATION, 2017-2020 (KILOTON)

- TABLE 333 REST OF SOUTH AMERICA: POLYOLS MARKET SIZE, BY APPLICATION, 2021-2027 (KILOTON)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- TABLE 334 MARKET PLAYERS ADOPTED EXPANSION AS KEY STRATEGY BETWEEN 2018 AND 2022

- 10.2 MARKET SHARE ANALYSIS

- FIGURE 27 MARKET SHARE OF KEY PLAYERS, 2021

- TABLE 335 POLYOLS MARKET: DEGREE OF COMPETITION

- 10.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.4 COMPANY EVALUATION QUADRANT

- 10.4.1 STARS

- 10.4.2 PERVASIVE PLAYERS

- 10.4.3 PARTICIPANTS

- 10.4.4 EMERGING LEADERS

- FIGURE 28 GLOBAL POLYOLS MARKET: COMPANY EVALUATION MATRIX, 2021

- 10.5 START-UP AND SMALL AND MEDIUM-SIZED ENTERPRISE (SME) EVALUATION QUADRANT

- 10.5.1 RESPONSIVE COMPANIES

- 10.5.2 DYNAMIC COMPANIES

- 10.5.3 STARTING BLOCKS

- 10.5.4 PROGRESSIVE COMPANIES

- FIGURE 29 START-UPS AND SMES EVALUATION MATRIX, 2021

- 10.6 REVENUE ANALYSIS OF TOP PLAYERS

- FIGURE 30 REVENUE ANALYSIS OF KEY COMPANIES, 2018-2021

- 10.7 COMPETITIVE BENCHMARKING

- TABLE 337 POLYOLS MARKET: DETAILED LIST OF KEY PLAYERS

- TABLE 338 POLYOLS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 10.8 COMPETITIVE SCENARIO AND TRENDS

- 10.8.1 PRODUCT LAUNCHES

- TABLE 339 POLYOLS MARKET: PRODUCT LAUNCHES, 2018-2022

- 10.8.2 DEALS

- TABLE 340 POLYOLS MARKET: DEALS, 2018-2022

- 10.8.3 OTHER DEVELOPMENTS

- TABLE 341 POLYOLS MARKET: OTHER DEVELOPMENTS, 2018-2022

11 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 11.1 THE DOW CHEMICAL COMPANY

- TABLE 342 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

- FIGURE 31 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

- TABLE 343 THE DOW CHEMICAL COMPANY: PRODUCT LAUNCHES

- TABLE 344 THE DOW CHEMICAL COMPANY: OTHERS

- 11.2 COVESTRO AG

- TABLE 345 COVESTRO AG: COMPANY OVERVIEW

- FIGURE 32 COVESTRO AG: COMPANY SNAPSHOT

- TABLE 346 COVESTRO AG: PRODUCT LAUNCHES

- TABLE 347 COVESTRO AG: DEALS

- 11.3 SHELL CHEMICALS

- TABLE 348 SHELL CHEMICALS: COMPANY OVERVIEW

- FIGURE 33 SHELL CHEMICALS: COMPANY SNAPSHOT

- TABLE 349 SHELL CHEMICALS: OTHERS

- 11.4 BASF SE

- TABLE 350 BASF SE: COMPANY OVERVIEW

- FIGURE 34 BASF SE: COMPANY SNAPSHOT

- TABLE 351 BASF SE: DEALS

- TABLE 352 BASF SE: OTHERS

- 11.5 HUNTSMAN CORPORATION

- TABLE 353 HUNTSMAN CORPORATION: COMPANY OVERVIEW

- FIGURE 35 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

- TABLE 354 HUNTSMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 355 HUNTSMAN CORPORATION: OTHERS

- 11.6 STEPAN COMPANY

- TABLE 356 STEPAN COMPANY: COMPANY OVERVIEW

- FIGURE 36 STEPAN COMPANY: COMPANY SNAPSHOT

- TABLE 357 STEPAN COMPANY: PRODUCT LAUNCHES

- TABLE 358 STEPAN COMPANY: DEALS

- TABLE 359 STEPAN COMPANY: OTHERS

- 11.7 WANHUA CHEMICAL GROUP

- TABLE 360 WANHUA CHEMICAL GROUP: COMPANY OVERVIEW

- FIGURE 37 WANHUA CHEMICAL GROUP: COMPANY SNAPSHOT

- TABLE 361 WANHUA CHEMICAL GROUP: PRODUCT LAUNCHES

- TABLE 362 WANHUA CHEMICAL GROUP: DEALS

- 11.8 REPSOL SA

- TABLE 363 REPSOL SA: COMPANY OVERVIEW

- FIGURE 38 REPSOL SA: COMPANY SNAPSHOT

- TABLE 364 REPSOL SA: DEALS

- TABLE 365 REPSOL SA: OTHERS

- 11.9 PCC GROUP

- TABLE 366 PCC GROUP: COMPANY OVERVIEW

- TABLE 367 PCC GROUP: DEALS

- TABLE 368 PCC GROUP: OTHERS

- 11.10 LANXESS AG

- TABLE 369 LANXESS AG: COMPANY OVERVIEW

- FIGURE 39 LANXESS AG: COMPANY SNAPSHOT

- TABLE 370 LANXESS AG: PRODUCT LAUNCHES

- 11.11 ADDITIONAL PLAYERS

- 11.11.1 ZIBO DEXIN LIANBANG CHEMICAL INDUSTRY CO., LTD.

- TABLE 371 ZIBO DEXIN LIANBANG CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- 11.11.2 SHANDONG LONGHUA NEW MATERIAL CO., LTD

- TABLE 372 SHANDONG LONGHUA NEW MATERIAL CO., LTD: COMPANY OVERVIEW

- 11.11.3 HUAFENG (ZHEJIANG HUAFON NEW MATERIALS CORP., LTD)

- TABLE 373 HUAFENG (ZHEJIANG HUAFON NEW MATERIALS CORP., LTD): COMPANY OVERVIEW

- 11.11.4 SHAKUN INDUSTRIES

- TABLE 374 SHAKUN INDUSTRIES: COMPANY OVERVIEW

- 11.11.5 INTERPUR CHEMICALS

- TABLE 375 INTERPUR CHEMICALS: COMPANY OVERVIEW

- 11.11.6 MANALI PETROCHEMICALS

- TABLE 376 MANALI PETROCHEMICALS: COMPANY OVERVIEW

- 11.11.7 POLYGREEN CHEMICALS

- TABLE 377 POLYGREEN CHEMICALS: COMPANY OVERVIEW

- 11.11.8 BAYER

- TABLE 378 BAYER: COMPANY OVERVIEW

- 11.11.9 VINTEK CHEMICAL PRODUCTS PVT. LTD

- TABLE 379 VINTEK CHEMICAL PRODUCTS PVT. LTD: COMPANY OVERVIEW

- 11.11.10 POLYOLS AND POLYMERS PVT. LIMITED

- TABLE 380 POLYOLS AND POLYMERS PVT. LIMITED: COMPANY OVERVIEW

- 11.11.11 KURARAY CO., LTD.

- TABLE 381 KURARAY CO., LTD.: COMPANY OVERVIEW

- 11.11.12 SUMITOMO BAKELITE HIGH PERFORMANCE PLASTICS (SBHPP)

- TABLE 382 SUMITOMO BAKELITE HIGH PERFORMANCE PLASTICS (SBHPP): COMPANY OVERVIEW

- 11.11.13 INVISTA

- TABLE 383 INVISTA: COMPANY OVERVIEW

- 11.11.14 ERCA ADVANCED POLYMER SOLUTIONS SRL

- TABLE 384 ERCA ADVANCED POLYMER SOLUTIONS SRL: COMPANY OVERVIEW

- 11.11.15 SINOPEC CORP

- TABLE 385 SINOPEC CORP: COMPANY OVERVIEW

- 11.11.16 DAICEL CORPORATION

- TABLE 386 DAICEL CORPORATION: COMPANY OVERVIEW

- 11.11.17 EMERY OLEOCHEMICALS

- TABLE 387 EMERY OLEOCHEMICALS: COMPANY OVERVIEW

- 11.11.18 SOLVAY

- TABLE 388 SOLVAY: COMPANY OVERVIEW

- 11.11.19 PERSTORP POLYOLS INC.

- TABLE 389 PERSTORP POLYOLS INC.: COMPANY OVERVIEW

- 11.11.20 SAUDI ARAMCO

- TABLE 390 SAUDI ARAMCO: COMPANY OVERVIEW

- 11.11.21 TOSOH CORPORATION

- TABLE 391 TOSOH CORPORATION: COMPANY OVERVIEW

- 11.11.22 DIC CORPORATION

- TABLE 392 DIC CORPORATION: COMPANY OVERVIEW

- 11.11.23 ARKEMA

- TABLE 393 ARKEMA: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS