|

|

市場調査レポート

商品コード

1374292

ポリオールの世界市場規模、シェア、産業動向分析レポート:最終用途別、製品別、用途別、地域別展望と予測、2023年~2030年Global Polyols Market Size, Share & Industry Trends Analysis Report By End-use, By Product, By Application (Flexible Foam, Rigid Foam, Coatings, Adhesives & Sealants, Elastomers), By Regional Outlook and Forecast, 2023 - 2030 |

||||||

|

|||||||

| ポリオールの世界市場規模、シェア、産業動向分析レポート:最終用途別、製品別、用途別、地域別展望と予測、2023年~2030年 |

|

出版日: 2023年09月30日

発行: KBV Research

ページ情報: 英文 378 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

ポリオール市場規模は、予測期間中にCAGR 6.8%で成長し、2030年には585億米ドルに達すると予測されます。2022年の市場規模は15,881.2キロトンに達し、成長率は5.4%である(2019-2022年)。

しかし、特に北米と欧州では、ポリウレタンフォームの生産に厳しい規制を設けています。これらの有害汚染物質に過度にさらされると、人の皮膚、目、鼻、喉、肺に害を及ぼす可能性があります。そのため、ジイソシアネートの空気中濃度にさらされる可能性がある場所では、機械的制御(局所排気)、適切な個人保護具(呼吸保護具)、その他の職場手順(適切な取り扱いと保管)の使用など、いくつかの予防策が実施されています。廃棄物処理規制を遵守することで、作業コストや複雑さが増す場合があります。環境規制は、エネルギー効率の高い製造工程を奨励または要求する場合があります。これらの要件は追加コストとなり、生産者の利益率を低下させるため、市場成長の主な抑制要因となります。

製品の展望

製品別では、市場はポリエーテルとポリエステルに区分されます。2022年の市場では、ポリエステル・セグメントが大きな収益シェアを獲得しました。ポリエステルポリオールは高い引張強度と応力吸収特性を持ち、そのため振動減衰用途に広く採用されています。ポリウレタン、ウレタン、ポリイソシアヌレートは、ポリエステルとポリエーテルポリオールの両方を利用しています。自動車、繊維、断熱包装、包装、電子機器、ガジェットなど、複数の最終用途産業からPUベースのフォームやコーティング、接着剤、シーリング剤、エラストマーに対する需要が伸びていることが、予測期間中の同分野の成長に寄与しています。

用途別展望

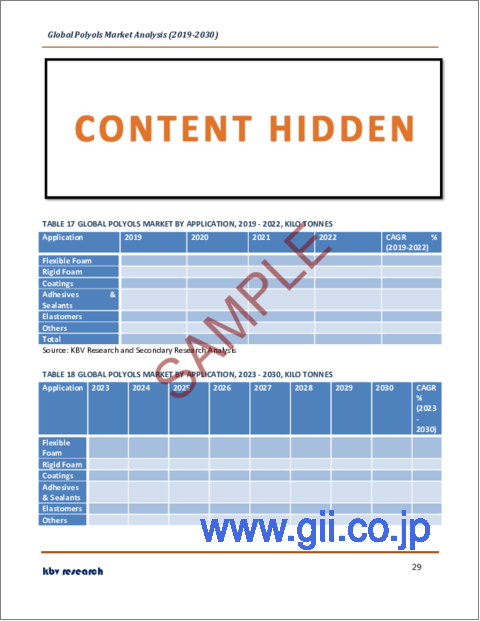

用途に基づき、市場は硬質フォーム、軟質フォーム、コーティング、接着剤・シーリング剤、エラストマー、その他に細分化されます。2022年には、軟質フォーム分野が市場で最も高い収益シェアを占めました。軟質フォームは、家具・マットレス、自動車、手荷物・荷物、履物・繊維製品、家電製品、エンジニアリング、パッケージングなど様々な最終用途産業において、家具、寝具・ベッド、座席、その他の軟質製品のクッション材として一般的に使用されています。ポリエーテルとポリエステル・ポリオールはどちらも軟質フォームの製造に利用されます。これらの発泡体の平均密度は1.5~3 lb/ft3です。ポリオールをベースとするフレキシブル・フォームの高い耐久性、弾力性、エネルギー吸収性、ハンドリング強度、断熱性の強化、優れた機械的特性は、予測期間を通じて様々な産業からの需要に貢献すると思われます。

最終用途の展望

市場は最終用途別に、建築・建設、家具、自動車、包装、エレクトロニクス、その他に分けられます。2022年の市場では、建築・建設セクターが最も高い収益シェアを獲得しました。ポリオールは、特にイソシアネートと併用される場合、ポリウレタンをベースとする建築材料の生産において重要な役割を果たしています。これらの材料は汎用性、耐久性、性能で知られ、さまざまな建設用途で一般的な選択肢となっています。ポリオールはコンクリートミックスに配合することで、その特性を向上させることができます。ポリオールはコンクリートの作業性を向上させ、含水量を減らし、凍結融解サイクルに対する耐性を高めます。ポリオールは、流動特性を改善するためにセルフレベリングコンクリートにも使用できます。ポリオールは、防水膜や防水材の配合にも使用されます。これらの材料は、特に地下室や屋根のような場所での水の浸入から建物を保護するために不可欠です。

地域別展望

地域別に見ると、市場は北米、欧州、アジア太平洋、LAMEAで分析されます。2022年には、アジア太平洋地域が市場で最も高い収益シェアを記録しました。自動車産業の拡大とポリマー消費の増加が、同地域の主要な市場促進要因になると予想されます。建設活動の増加と自動車産業やその他の製造業への投資が、この地域の市場を牽引しています。また、都市化の加速、インフラの高成長、ライフスタイルの変化など、同地域の家具やeコマース産業の需要が市場開拓に寄与しています。

目次

第1章 市場範囲と調査手法

- 市場の定義

- 目的

- 市場範囲

- セグメンテーション

- 調査手法

第2章 市場の概要

- 主なハイライト

第3章 市場概要

- イントロダクション

- 概要

- 市場構成とシナリオ

- 概要

- 市場に影響を与える主な要因

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

第4章 世界のポリオール市場:最終用途別

- 世界の建築・建設市場:地域別

- 世界の家具市場:地域別

- 世界の自動車市場:地域別

- 世界の包装市場:地域別

- 世界のエレクトロニクス市場:地域別

- 世界のその他の市場:地域別

第5章 世界のポリオール市場:製品別

- 世界のポリエーテル市場:地域別

- 世界のポリエステル市場:地域別

第6章 世界のポリオール市場:用途別

- 世界の軟質フォーム市場:地域別

- 世界の硬質フォーム市場:地域別

- 世界のコーティング市場:地域別

- 世界の接着剤およびシーラント市場:地域別

- 世界のエラストマー市場:地域別

- 世界のその他の市場:地域別

第7章 世界のポリオール市場:地域別

- 北米

- 北米の市場:国別

- 米国

- カナダ

- メキシコ

- その他北米地域

- 北米の市場:国別

- 欧州

- 欧州の市場:国別

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- その他欧州地域

- 欧州の市場:国別

- アジア太平洋

- アジア太平洋の市場:国別

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- マレーシア

- その他アジア太平洋地域

- アジア太平洋の市場:国別

- ラテンアメリカ・中東・アフリカ

- ラテンアメリカ・中東・アフリカの市場:国別

- ブラジル

- アルゼンチン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他ラテンアメリカ・中東・アフリカ地域

- ラテンアメリカ・中東・アフリカの市場:国別

第8章 企業プロファイル

- The Dow Chemical Company(Dow Corning Ltd)

- BASF SE

- Vertellus

- Huntsman Corporation

- Lanxess AG

- Mitsui Chemicals, Inc

- Stepan Company

- Koch Industries, Inc(Invista BV)

- Tosoh Corporation

- Shell plc

第9章 ポリオール市場での勝利の必須条件

LIST OF TABLES

- TABLE 1 Global Polyols Market, 2019 - 2022, USD Million

- TABLE 2 Global Polyols Market, 2023 - 2030, USD Million

- TABLE 3 Global Polyols Market, 2019 - 2022, Kilo Tonnes

- TABLE 4 Global Polyols Market, 2023 - 2030, Kilo Tonnes

- TABLE 5 Global Polyols Market by End-use, 2019 - 2022, USD Million

- TABLE 6 Global Polyols Market by End-use, 2023 - 2030, USD Million

- TABLE 7 Global Polyols Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 8 Global Polyols Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 9 Global Building & Construction Market by Region, 2019 - 2022, USD Million

- TABLE 10 Global Building & Construction Market by Region, 2023 - 2030, USD Million

- TABLE 11 Global Building & Construction Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 12 Global Building & Construction Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 13 Global Furnishings Market by Region, 2019 - 2022, USD Million

- TABLE 14 Global Furnishings Market by Region, 2023 - 2030, USD Million

- TABLE 15 Global Furnishings Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 16 Global Furnishings Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 17 Global Automotive Market by Region, 2019 - 2022, USD Million

- TABLE 18 Global Automotive Market by Region, 2023 - 2030, USD Million

- TABLE 19 Global Automotive Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 20 Global Automotive Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 21 Global Packaging Market by Region, 2019 - 2022, USD Million

- TABLE 22 Global Packaging Market by Region, 2023 - 2030, USD Million

- TABLE 23 Global Packaging Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 24 Global Packaging Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 25 Global Electronics Market by Region, 2019 - 2022, USD Million

- TABLE 26 Global Electronics Market by Region, 2023 - 2030, USD Million

- TABLE 27 Global Electronics Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 28 Global Electronics Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 29 Global Others Market by Region, 2019 - 2022, USD Million

- TABLE 30 Global Others Market by Region, 2023 - 2030, USD Million

- TABLE 31 Global Others Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 32 Global Others Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 33 Global Polyols Market by Product, 2019 - 2022, USD Million

- TABLE 34 Global Polyols Market by Product, 2023 - 2030, USD Million

- TABLE 35 Global Polyether Market by Region, 2019 - 2022, USD Million

- TABLE 36 Global Polyether Market by Region, 2023 - 2030, USD Million

- TABLE 37 Global Polyester Market by Region, 2019 - 2022, USD Million

- TABLE 38 Global Polyester Market by Region, 2023 - 2030, USD Million

- TABLE 39 Global Polyols Market by Application, 2019 - 2022, USD Million

- TABLE 40 Global Polyols Market by Application, 2023 - 2030, USD Million

- TABLE 41 Global Polyols Market by Application, 2019 - 2022, Kilo Tonnes

- TABLE 42 Global Polyols Market by Application, 2023 - 2030, Kilo Tonnes

- TABLE 43 Global Flexible Foam Market by Region, 2019 - 2022, USD Million

- TABLE 44 Global Flexible Foam Market by Region, 2023 - 2030, USD Million

- TABLE 45 Global Flexible Foam Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 46 Global Flexible Foam Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 47 Global Rigid Foam Market by Region, 2019 - 2022, USD Million

- TABLE 48 Global Rigid Foam Market by Region, 2023 - 2030, USD Million

- TABLE 49 Global Rigid Foam Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 50 Global Rigid Foam Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 51 Global Coatings Market by Region, 2019 - 2022, USD Million

- TABLE 52 Global Coatings Market by Region, 2023 - 2030, USD Million

- TABLE 53 Global Coatings Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 54 Global Coatings Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 55 Global Adhesives & Sealants Market by Region, 2019 - 2022, USD Million

- TABLE 56 Global Adhesives & Sealants Market by Region, 2023 - 2030, USD Million

- TABLE 57 Global Adhesives & Sealants Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 58 Global Adhesives & Sealants Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 59 Global Elastomers Market by Region, 2019 - 2022, USD Million

- TABLE 60 Global Elastomers Market by Region, 2023 - 2030, USD Million

- TABLE 61 Global Elastomers Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 62 Global Elastomers Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 63 Global Others Market by Region, 2019 - 2022, USD Million

- TABLE 64 Global Others Market by Region, 2023 - 2030, USD Million

- TABLE 65 Global Others Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 66 Global Others Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 67 Global Polyols Market by Region, 2019 - 2022, USD Million

- TABLE 68 Global Polyols Market by Region, 2023 - 2030, USD Million

- TABLE 69 Global Polyols Market by Region, 2019 - 2022, Kilo Tonnes

- TABLE 70 Global Polyols Market by Region, 2023 - 2030, Kilo Tonnes

- TABLE 71 North America Polyols Market, 2019 - 2022, USD Million

- TABLE 72 North America Polyols Market, 2023 - 2030, USD Million

- TABLE 73 North America Polyols Market, 2019 - 2022, Kilo Tonnes

- TABLE 74 North America Polyols Market, 2023 - 2030, Kilo Tonnes

- TABLE 75 North America Polyols Market by End-use, 2019 - 2022, USD Million

- TABLE 76 North America Polyols Market by End-use, 2023 - 2030, USD Million

- TABLE 77 North America Polyols Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 78 North America Polyols Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 79 North America Building & Construction Market by Country, 2019 - 2022, USD Million

- TABLE 80 North America Building & Construction Market by Country, 2023 - 2030, USD Million

- TABLE 81 North America Building & Construction Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 82 North America Building & Construction Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 83 North America Furnishings Market by Country, 2019 - 2022, USD Million

- TABLE 84 North America Furnishings Market by Country, 2023 - 2030, USD Million

- TABLE 85 North America Furnishings Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 86 North America Furnishings Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 87 North America Automotive Market by Country, 2019 - 2022, USD Million

- TABLE 88 North America Automotive Market by Country, 2023 - 2030, USD Million

- TABLE 89 North America Automotive Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 90 North America Automotive Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 91 North America Packaging Market by Country, 2019 - 2022, USD Million

- TABLE 92 North America Packaging Market by Country, 2023 - 2030, USD Million

- TABLE 93 North America Packaging Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 94 North America Packaging Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 95 North America Electronics Market by Country, 2019 - 2022, USD Million

- TABLE 96 North America Electronics Market by Country, 2023 - 2030, USD Million

- TABLE 97 North America Electronics Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 98 North America Electronics Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 99 North America Others Market by Country, 2019 - 2022, USD Million

- TABLE 100 North America Others Market by Country, 2023 - 2030, USD Million

- TABLE 101 North America Others Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 102 North America Others Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 103 North America Polyols Market by Product, 2019 - 2022, USD Million

- TABLE 104 North America Polyols Market by Product, 2023 - 2030, USD Million

- TABLE 105 North America Polyether Market by Country, 2019 - 2022, USD Million

- TABLE 106 North America Polyether Market by Country, 2023 - 2030, USD Million

- TABLE 107 North America Polyester Market by Country, 2019 - 2022, USD Million

- TABLE 108 North America Polyester Market by Country, 2023 - 2030, USD Million

- TABLE 109 North America Polyols Market by Application, 2019 - 2022, USD Million

- TABLE 110 North America Polyols Market by Application, 2023 - 2030, USD Million

- TABLE 111 North America Polyols Market by Application, 2019 - 2022, Kilo Tonnes

- TABLE 112 North America Polyols Market by Application, 2023 - 2030, Kilo Tonnes

- TABLE 113 North America Flexible Foam Market by Country, 2019 - 2022, USD Million

- TABLE 114 North America Flexible Foam Market by Country, 2023 - 2030, USD Million

- TABLE 115 North America Flexible Foam Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 116 North America Flexible Foam Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 117 North America Rigid Foam Market by Country, 2019 - 2022, USD Million

- TABLE 118 North America Rigid Foam Market by Country, 2023 - 2030, USD Million

- TABLE 119 North America Rigid Foam Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 120 North America Rigid Foam Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 121 North America Coatings Market by Country, 2019 - 2022, USD Million

- TABLE 122 North America Coatings Market by Country, 2023 - 2030, USD Million

- TABLE 123 North America Coatings Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 124 North America Coatings Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 125 North America Adhesives & Sealants Market by Country, 2019 - 2022, USD Million

- TABLE 126 North America Adhesives & Sealants Market by Country, 2023 - 2030, USD Million

- TABLE 127 North America Adhesives & Sealants Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 128 North America Adhesives & Sealants Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 129 North America Elastomers Market by Country, 2019 - 2022, USD Million

- TABLE 130 North America Elastomers Market by Country, 2023 - 2030, USD Million

- TABLE 131 North America Elastomers Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 132 North America Elastomers Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 133 North America Others Market by Country, 2019 - 2022, USD Million

- TABLE 134 North America Others Market by Country, 2023 - 2030, USD Million

- TABLE 135 North America Others Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 136 North America Others Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 137 North America Polyols Market by Country, 2019 - 2022, USD Million

- TABLE 138 North America Polyols Market by Country, 2023 - 2030, USD Million

- TABLE 139 North America Polyols Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 140 North America Polyols Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 141 US Polyols Market, 2019 - 2022, USD Million

- TABLE 142 US Polyols Market, 2023 - 2030, USD Million

- TABLE 143 US Polyols Market, 2019 - 2022, Kilo Tonnes

- TABLE 144 US Polyols Market, 2023 - 2030, Kilo Tonnes

- TABLE 145 US Polyols Market by End-use, 2019 - 2022, USD Million

- TABLE 146 US Polyols Market by End-use, 2023 - 2030, USD Million

- TABLE 147 US Polyols Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 148 US Polyols Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 149 US Polyols Market by Product, 2019 - 2022, USD Million

- TABLE 150 US Polyols Market by Product, 2023 - 2030, USD Million

- TABLE 151 US Polyols Market by Application, 2019 - 2022, USD Million

- TABLE 152 US Polyols Market by Application, 2023 - 2030, USD Million

- TABLE 153 US Polyols Market by Application, 2019 - 2022, Kilo Tonnes

- TABLE 154 US Polyols Market by Application, 2023 - 2030, Kilo Tonnes

- TABLE 155 Canada Polyols Market, 2019 - 2022, USD Million

- TABLE 156 Canada Polyols Market, 2023 - 2030, USD Million

- TABLE 157 Canada Polyols Market, 2019 - 2022, Kilo Tonnes

- TABLE 158 Canada Polyols Market, 2023 - 2030, Kilo Tonnes

- TABLE 159 Canada Polyols Market by End-use, 2019 - 2022, USD Million

- TABLE 160 Canada Polyols Market by End-use, 2023 - 2030, USD Million

- TABLE 161 Canada Polyols Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 162 Canada Polyols Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 163 Canada Polyols Market by Product, 2019 - 2022, USD Million

- TABLE 164 Canada Polyols Market by Product, 2023 - 2030, USD Million

- TABLE 165 Canada Polyols Market by Application, 2019 - 2022, USD Million

- TABLE 166 Canada Polyols Market by Application, 2023 - 2030, USD Million

- TABLE 167 Canada Polyols Market by Application, 2019 - 2022, Kilo Tonnes

- TABLE 168 Canada Polyols Market by Application, 2023 - 2030, Kilo Tonnes

- TABLE 169 Mexico Polyols Market, 2019 - 2022, USD Million

- TABLE 170 Mexico Polyols Market, 2023 - 2030, USD Million

- TABLE 171 Mexico Polyols Market, 2019 - 2022, Kilo Tonnes

- TABLE 172 Mexico Polyols Market, 2023 - 2030, Kilo Tonnes

- TABLE 173 Mexico Polyols Market by End-use, 2019 - 2022, USD Million

- TABLE 174 Mexico Polyols Market by End-use, 2023 - 2030, USD Million

- TABLE 175 Mexico Polyols Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 176 Mexico Polyols Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 177 Mexico Polyols Market by Product, 2019 - 2022, USD Million

- TABLE 178 Mexico Polyols Market by Product, 2023 - 2030, USD Million

- TABLE 179 Mexico Polyols Market by Application, 2019 - 2022, USD Million

- TABLE 180 Mexico Polyols Market by Application, 2023 - 2030, USD Million

- TABLE 181 Mexico Polyols Market by Application, 2019 - 2022, Kilo Tonnes

- TABLE 182 Mexico Polyols Market by Application, 2023 - 2030, Kilo Tonnes

- TABLE 183 Rest of North America Polyols Market, 2019 - 2022, USD Million

- TABLE 184 Rest of North America Polyols Market, 2023 - 2030, USD Million

- TABLE 185 Rest of North America Polyols Market, 2019 - 2022, Kilo Tonnes

- TABLE 186 Rest of North America Polyols Market, 2023 - 2030, Kilo Tonnes

- TABLE 187 Rest of North America Polyols Market by End-use, 2019 - 2022, USD Million

- TABLE 188 Rest of North America Polyols Market by End-use, 2023 - 2030, USD Million

- TABLE 189 Rest of North America Polyols Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 190 Rest of North America Polyols Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 191 Rest of North America Polyols Market by Product, 2019 - 2022, USD Million

- TABLE 192 Rest of North America Polyols Market by Product, 2023 - 2030, USD Million

- TABLE 193 Rest of North America Polyols Market by Application, 2019 - 2022, USD Million

- TABLE 194 Rest of North America Polyols Market by Application, 2023 - 2030, USD Million

- TABLE 195 Rest of North America Polyols Market by Application, 2019 - 2022, Kilo Tonnes

- TABLE 196 Rest of North America Polyols Market by Application, 2023 - 2030, Kilo Tonnes

- TABLE 197 Europe Polyols Market, 2019 - 2022, USD Million

- TABLE 198 Europe Polyols Market, 2023 - 2030, USD Million

- TABLE 199 Europe Polyols Market, 2019 - 2022, Kilo Tonnes

- TABLE 200 Europe Polyols Market, 2023 - 2030, Kilo Tonnes

- TABLE 201 Europe Polyols Market by End-use, 2019 - 2022, USD Million

- TABLE 202 Europe Polyols Market by End-use, 2023 - 2030, USD Million

- TABLE 203 Europe Polyols Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 204 Europe Polyols Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 205 Europe Building & Construction Market by Country, 2019 - 2022, USD Million

- TABLE 206 Europe Building & Construction Market by Country, 2023 - 2030, USD Million

- TABLE 207 Europe Building & Construction Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 208 Europe Building & Construction Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 209 Europe Furnishings Market by Country, 2019 - 2022, USD Million

- TABLE 210 Europe Furnishings Market by Country, 2023 - 2030, USD Million

- TABLE 211 Europe Furnishings Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 212 Europe Furnishings Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 213 Europe Automotive Market by Country, 2019 - 2022, USD Million

- TABLE 214 Europe Automotive Market by Country, 2023 - 2030, USD Million

- TABLE 215 Europe Automotive Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 216 Europe Automotive Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 217 Europe Packaging Market by Country, 2019 - 2022, USD Million

- TABLE 218 Europe Packaging Market by Country, 2023 - 2030, USD Million

- TABLE 219 Europe Packaging Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 220 Europe Packaging Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 221 Europe Electronics Market by Country, 2019 - 2022, USD Million

- TABLE 222 Europe Electronics Market by Country, 2023 - 2030, USD Million

- TABLE 223 Europe Electronics Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 224 Europe Electronics Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 225 Europe Others Market by Country, 2019 - 2022, USD Million

- TABLE 226 Europe Others Market by Country, 2023 - 2030, USD Million

- TABLE 227 Europe Others Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 228 Europe Others Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 229 Europe Polyols Market by Product, 2019 - 2022, USD Million

- TABLE 230 Europe Polyols Market by Product, 2023 - 2030, USD Million

- TABLE 231 Europe Polyether Market by Country, 2019 - 2022, USD Million

- TABLE 232 Europe Polyether Market by Country, 2023 - 2030, USD Million

- TABLE 233 Europe Polyester Market by Country, 2019 - 2022, USD Million

- TABLE 234 Europe Polyester Market by Country, 2023 - 2030, USD Million

- TABLE 235 Europe Polyols Market by Application, 2019 - 2022, USD Million

- TABLE 236 Europe Polyols Market by Application, 2023 - 2030, USD Million

- TABLE 237 Europe Polyols Market by Application, 2019 - 2022, Kilo Tonnes

- TABLE 238 Europe Polyols Market by Application, 2023 - 2030, Kilo Tonnes

- TABLE 239 Europe Flexible Foam Market by Country, 2019 - 2022, USD Million

- TABLE 240 Europe Flexible Foam Market by Country, 2023 - 2030, USD Million

- TABLE 241 Europe Flexible Foam Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 242 Europe Flexible Foam Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 243 Europe Rigid Foam Market by Country, 2019 - 2022, USD Million

- TABLE 244 Europe Rigid Foam Market by Country, 2023 - 2030, USD Million

- TABLE 245 Europe Rigid Foam Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 246 Europe Rigid Foam Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 247 Europe Coatings Market by Country, 2019 - 2022, USD Million

- TABLE 248 Europe Coatings Market by Country, 2023 - 2030, USD Million

- TABLE 249 Europe Coatings Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 250 Europe Coatings Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 251 Europe Adhesives & Sealants Market by Country, 2019 - 2022, USD Million

- TABLE 252 Europe Adhesives & Sealants Market by Country, 2023 - 2030, USD Million

- TABLE 253 Europe Adhesives & Sealants Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 254 Europe Adhesives & Sealants Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 255 Europe Elastomers Market by Country, 2019 - 2022, USD Million

- TABLE 256 Europe Elastomers Market by Country, 2023 - 2030, USD Million

- TABLE 257 Europe Elastomers Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 258 Europe Elastomers Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 259 Europe Others Market by Country, 2019 - 2022, USD Million

- TABLE 260 Europe Others Market by Country, 2023 - 2030, USD Million

- TABLE 261 Europe Others Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 262 Europe Others Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 263 Europe Polyols Market by Country, 2019 - 2022, USD Million

- TABLE 264 Europe Polyols Market by Country, 2023 - 2030, USD Million

- TABLE 265 Europe Polyols Market by Country, 2019 - 2022, Kilo Tonnes

- TABLE 266 Europe Polyols Market by Country, 2023 - 2030, Kilo Tonnes

- TABLE 267 Germany Polyols Market, 2019 - 2022, USD Million

- TABLE 268 Germany Polyols Market, 2023 - 2030, USD Million

- TABLE 269 Germany Polyols Market, 2019 - 2022, Kilo Tonnes

- TABLE 270 Germany Polyols Market, 2023 - 2030, Kilo Tonnes

- TABLE 271 Germany Polyols Market by End-use, 2019 - 2022, USD Million

- TABLE 272 Germany Polyols Market by End-use, 2023 - 2030, USD Million

- TABLE 273 Germany Polyols Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 274 Germany Polyols Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 275 Germany Polyols Market by Product, 2019 - 2022, USD Million

- TABLE 276 Germany Polyols Market by Product, 2023 - 2030, USD Million

- TABLE 277 Germany Polyols Market by Application, 2019 - 2022, USD Million

- TABLE 278 Germany Polyols Market by Application, 2023 - 2030, USD Million

- TABLE 279 Germany Polyols Market by Application, 2019 - 2022, Kilo Tonnes

- TABLE 280 Germany Polyols Market by Application, 2023 - 2030, Kilo Tonnes

- TABLE 281 UK Polyols Market, 2019 - 2022, USD Million

- TABLE 282 UK Polyols Market, 2023 - 2030, USD Million

- TABLE 283 UK Polyols Market, 2019 - 2022, Kilo Tonnes

- TABLE 284 UK Polyols Market, 2023 - 2030, Kilo Tonnes

- TABLE 285 UK Polyols Market by End-use, 2019 - 2022, USD Million

- TABLE 286 UK Polyols Market by End-use, 2023 - 2030, USD Million

- TABLE 287 UK Polyols Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 288 UK Polyols Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 289 UK Polyols Market by Product, 2019 - 2022, USD Million

- TABLE 290 UK Polyols Market by Product, 2023 - 2030, USD Million

- TABLE 291 UK Polyols Market by Application, 2019 - 2022, USD Million

- TABLE 292 UK Polyols Market by Application, 2023 - 2030, USD Million

- TABLE 293 UK Polyols Market by Application, 2019 - 2022, Kilo Tonnes

- TABLE 294 UK Polyols Market by Application, 2023 - 2030, Kilo Tonnes

- TABLE 295 France Polyols Market, 2019 - 2022, USD Million

- TABLE 296 France Polyols Market, 2023 - 2030, USD Million

- TABLE 297 France Polyols Market, 2019 - 2022, Kilo Tonnes

- TABLE 298 France Polyols Market, 2023 - 2030, Kilo Tonnes

- TABLE 299 France Polyols Market by End-use, 2019 - 2022, USD Million

- TABLE 300 France Polyols Market by End-use, 2023 - 2030, USD Million

- TABLE 301 France Polyols Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 302 France Polyols Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 303 France Polyols Market by Product, 2019 - 2022, USD Million

- TABLE 304 France Polyols Market by Product, 2023 - 2030, USD Million

- TABLE 305 France Polyols Market by Application, 2019 - 2022, USD Million

- TABLE 306 France Polyols Market by Application, 2023 - 2030, USD Million

- TABLE 307 France Polyols Market by Application, 2019 - 2022, Kilo Tonnes

- TABLE 308 France Polyols Market by Application, 2023 - 2030, Kilo Tonnes

- TABLE 309 Russia Polyols Market, 2019 - 2022, USD Million

- TABLE 310 Russia Polyols Market, 2023 - 2030, USD Million

- TABLE 311 Russia Polyols Market, 2019 - 2022, Kilo Tonnes

- TABLE 312 Russia Polyols Market, 2023 - 2030, Kilo Tonnes

- TABLE 313 Russia Polyols Market by End-use, 2019 - 2022, USD Million

- TABLE 314 Russia Polyols Market by End-use, 2023 - 2030, USD Million

- TABLE 315 Russia Polyols Market by End-use, 2019 - 2022, Kilo Tonnes

- TABLE 316 Russia Polyols Market by End-use, 2023 - 2030, Kilo Tonnes

- TABLE 317 Russia Polyols Market by Product, 2019 - 2022, USD Million

- TABLE 318 Russia Polyols Market by Product, 2023 - 2030, USD Million

- TABLE 319 Russia Polyols Market by Application, 2019 - 2022, USD Million

- TABLE 320 Russia Polyols Market by Application, 2023 - 2030, USD Million

- TABLE 321 Russia Polyols Market by Application, 2019 - 2022, Kilo Tonnes

- TABLE 322 Russia Polyols Market by Application, 2023 - 2030, Kilo Tonnes

The Global Polyols Market size is expected to reach $58.5 billion by 2030, rising at a market growth of 6.8% CAGR during the forecast period. In the year 2022, the market attained a volume of 15,881.2 Kilo Tonnes, experiencing a growth of 5.4% (2019-2022).

Elastomer polyols are essential in formulating high-performance elastomers with a wide range of properties Thus, Elastomers segment acquired $6,618.0 million revenue in the market in 2022. Elastomers are polymers that combine plastic's rigidity with rubber's flexibility. Due to their superior mechanical and chemical effects, low cost, and high durability, polyol-based elastomers are utilized in molded rubber components in numerous industries, including construction and building materials, clothing and footwear, automotive, packaging, furnishings, appliances, marine, medical, and electronics. The choice of the specific elastomer polyol depends on the desired characteristics of the final product, including its flexibility, durability, resistance to environmental factors, and temperature tolerance. These materials are crucial in industries where elastomers are used for their unique mechanical properties. Some of the factors impacting the market are growing application of polyurethane in the automotive industry, expansion of the packaging industry, and stringent environmental regulations for polyurethane foam production.

The automotive industry continuously strives to reduce vehicle weight to improve fuel efficiency and meet emission standards. Polyurethane materials are valued for their lightweight properties and are used in various parts to reduce vehicle weight. This trend has driven the adoption of polyurethane and polyols in automotive applications. Polyurethane produces safety components like energy-absorbing foam in bumpers and side-impact protection systems. Enhanced safety requirements have led to the increased use of polyurethane in automotive safety applications. There is a growing focus on sustainable materials in the automotive industry. Bio-based polyols derived from renewable sources are being developed as alternatives to petroleum-based polyols. These bio-based polyols align with the automotive industry's sustainability goals. Additionally, the packaging industry is increasingly concentrated on sustainability and reducing its environmental impact. Bio-based polyols, derived from renewable sources, are being used to produce more eco-friendly polyurethane packaging materials. These sustainable materials align with consumer preferences and regulatory requirements for eco-conscious packaging. Polyurethane foam, formulated with specific polyols, is used in temperature-sensitive packaging applications. This insulation helps maintain the desired temperature for products such as fresh produce, pharmaceuticals, and chemicals during transit. The growth of industries requiring temperature-controlled packaging has boosted the market.

However, several regulatory agencies, especially in North America and Europe, have strict restrictions governing polyurethane foam production. Overexposure to these hazardous pollutants could harm a person's skin, eyes, nose, throat, and lungs. As a result, several preventative measures are implemented in locations where there is a chance of exposure to diisocyanate airborne concentrations, including the use of mechanical controls (local exhaust ventilation), suitable personal protective gear (respiratory protection), and other workplace procedures (proper handling and storage). Compliance with waste disposal regulations can add to operational costs and complexity. Environmental regulations may encourage or require energy-efficient manufacturing processes. These requirements result in additional costs, therefore reducing the producers' profit margins, and thus being a major restraint for the market's growth.

Product Outlook

On the basis of product, the market is segmented into polyether and polyester. The polyester segment acquired a substantial revenue share in the market in 2022. Polyester polyols have high tensile strength and stress-absorbing properties, owing to which they are widely employed in vibration-dampening applications. Polyurethane, urethane, and polyisocyanurate use utilize both polyester and polyether polyols. Growing demand for PU-based foams and coatings, glues, sealants, and elastomers from multiple end-use industries, such as automobiles, textiles, insulation, packaging, electronics, and gadgets, will contribute to the sector's growth over the forecast period.

Application Outlook

Based on application, the market is fragmented into rigid foam, flexible foam, coatings, adhesives & sealants, elastomers, and others. In 2022, the flexible foam segment held the highest revenue share in the market. Flexible foams are commonly used as cushioning materials for furniture, bedding and beds, seating, and other soft products in various end-use industries, including furniture and mattresses, automotive, baggage and luggage, footwear and textiles, household appliances, engineering, and packaging. Polyether and polyester polyols are both utilized in the production of flexible foams. The average density of these foams is between 1.5 and 3 lb/ft3. The high durability, resilience, energy absorption, handling strength, enhanced thermal insulation, and superior mechanical properties of polyol-based flexible foam will likely contribute to its demand from various industries over the forecast period.

End-use Outlook

By end-use, the market is divided into building & construction, furnishings, automotive, packaging, electronics, and others. The building and construction sector acquired the highest revenue share in the market in 2022. Polyols, particularly when used in conjunction with isocyanates, play a crucial role in the production of polyurethane-based construction materials. These materials are known for their versatility, durability, and performance, making them a common choice in various construction applications. Polyol can be incorporated into concrete mixes to improve its properties. They can enhance the workability of concrete, reduce water content, and increase its resistance to freeze-thaw cycles. Polyols can also be used in self-leveling concrete to improve flow characteristics. These are used in the formulation of waterproofing membranes and materials. These materials are essential for protecting buildings from water ingress, particularly in areas like basements and roofs.

Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region registered the highest revenue share in the market. The expanding automotive industry and rising polymer consumption are expected to be major market drivers in the region. Rising construction activities and investments in the automotive and other manufacturing industries drive the region's market. In addition, accelerated urbanization, high infrastructure growth, and changing lifestyles, all of which are attributable to the demand for the furnishings and e-commerce industries in the region, have contributed to the development of the market.

The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include The Dow Chemical Company, BASF SE, Vertellus, Huntsman Corporation, Lanxess AG, Mitsui Chemicals, Inc., Stepan Company, Koch Industries, Inc. (Invista BV), Tosoh Corporation, and Shell plc.

Scope of the Study

Market Segments covered in the Report:

By End-use (Volume, Kilo Tonnes, USD Million, 2019-2030)

- Building & Construction

- Furnishings

- Automotive

- Packaging

- Electronics

- Others

By Product

- Polyether

- Polyester

By Application (Volume, Kilo Tonnes, USD Million, 2019-2030)

- Flexible Foam

- Rigid Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

By Geography (Volume, Kilo Tonnes, USD Million, 2019-2030)

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Companies Profiled

- The Dow Chemical Company

- BASF SE

- Vertellus

- Huntsman Corporation

- Lanxess AG

- Mitsui Chemicals, Inc.

- Stepan Company

- Koch Industries, Inc. (Invista BV)

- Tosoh Corporation

- Shell plc

Unique Offerings from KBV Research

- Exhaustive coverage

- Highest number of market tables and figures

- Subscription based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Chapter 1. Market Scope & Methodology

- 1.1 Market Definition

- 1.2 Objectives

- 1.3 Market Scope

- 1.4 Segmentation

- 1.4.1 Global Polyols Market, by End-use

- 1.4.2 Global Polyols Market, by Product

- 1.4.3 Global Polyols Market, by Application

- 1.4.4 Global Polyols Market, by Geography

- 1.5 Methodology for the research

Chapter 2. Market At a Glance

- 2.1 Key Highlights

Chapter 3. Market Overview

- 3.1 Introduction

- 3.1.1 Overview

- 3.1.1.1 Market Composition and Scenario

- 3.1.1 Overview

- 3.2 Key Factors Impacting the Market

- 3.2.1 Market Drivers

- 3.2.2 Market Restraints

- 3.3 Porter's Five Forces Analysis

Chapter 4. Global Polyols Market by End-use

- 4.1 Global Building & Construction Market by Region

- 4.2 Global Furnishings Market by Region

- 4.3 Global Automotive Market by Region

- 4.4 Global Packaging Market by Region

- 4.5 Global Electronics Market by Region

- 4.6 Global Others Market by Region

Chapter 5. Global Polyols Market by Product

- 5.1 Global Polyether Market by Region

- 5.2 Global Polyester Market by Region

Chapter 6. Global Polyols Market by Application

- 6.1 Global Flexible Foam Market by Region

- 6.2 Global Rigid Foam Market by Region

- 6.3 Global Coatings Market by Region

- 6.4 Global Adhesives & Sealants Market by Region

- 6.5 Global Elastomers Market by Region

- 6.6 Global Others Market by Region

Chapter 7. Global Polyols Market by Region

- 7.1 North America Polyols Market

- 7.1.1 North America Polyols Market by End-use

- 7.1.1.1 North America Building & Construction Market by Country

- 7.1.1.2 North America Furnishings Market by Country

- 7.1.1.3 North America Automotive Market by Country

- 7.1.1.4 North America Packaging Market by Country

- 7.1.1.5 North America Electronics Market by Country

- 7.1.1.6 North America Others Market by Country

- 7.1.2 North America Polyols Market by Product

- 7.1.2.1 North America Polyether Market by Country

- 7.1.2.2 North America Polyester Market by Country

- 7.1.3 North America Polyols Market by Application

- 7.1.3.1 North America Flexible Foam Market by Country

- 7.1.3.2 North America Rigid Foam Market by Country

- 7.1.3.3 North America Coatings Market by Country

- 7.1.3.4 North America Adhesives & Sealants Market by Country

- 7.1.3.5 North America Elastomers Market by Country

- 7.1.3.6 North America Others Market by Country

- 7.1.4 North America Polyols Market by Country

- 7.1.4.1 US Polyols Market

- 7.1.4.1.1 US Polyols Market by End-use

- 7.1.4.1.2 US Polyols Market by Product

- 7.1.4.1.3 US Polyols Market by Application

- 7.1.4.2 Canada Polyols Market

- 7.1.4.2.1 Canada Polyols Market by End-use

- 7.1.4.2.2 Canada Polyols Market by Product

- 7.1.4.2.3 Canada Polyols Market by Application

- 7.1.4.3 Mexico Polyols Market

- 7.1.4.3.1 Mexico Polyols Market by End-use

- 7.1.4.3.2 Mexico Polyols Market by Product

- 7.1.4.3.3 Mexico Polyols Market by Application

- 7.1.4.4 Rest of North America Polyols Market

- 7.1.4.4.1 Rest of North America Polyols Market by End-use

- 7.1.4.4.2 Rest of North America Polyols Market by Product

- 7.1.4.4.3 Rest of North America Polyols Market by Application

- 7.1.4.1 US Polyols Market

- 7.1.1 North America Polyols Market by End-use

- 7.2 Europe Polyols Market

- 7.2.1 Europe Polyols Market by End-use

- 7.2.1.1 Europe Building & Construction Market by Country

- 7.2.1.2 Europe Furnishings Market by Country

- 7.2.1.3 Europe Automotive Market by Country

- 7.2.1.4 Europe Packaging Market by Country

- 7.2.1.5 Europe Electronics Market by Country

- 7.2.1.6 Europe Others Market by Country

- 7.2.2 Europe Polyols Market by Product

- 7.2.2.1 Europe Polyether Market by Country

- 7.2.2.2 Europe Polyester Market by Country

- 7.2.3 Europe Polyols Market by Application

- 7.2.3.1 Europe Flexible Foam Market by Country

- 7.2.3.2 Europe Rigid Foam Market by Country

- 7.2.3.3 Europe Coatings Market by Country

- 7.2.3.4 Europe Adhesives & Sealants Market by Country

- 7.2.3.5 Europe Elastomers Market by Country

- 7.2.3.6 Europe Others Market by Country

- 7.2.4 Europe Polyols Market by Country

- 7.2.4.1 Germany Polyols Market

- 7.2.4.1.1 Germany Polyols Market by End-use

- 7.2.4.1.2 Germany Polyols Market by Product

- 7.2.4.1.3 Germany Polyols Market by Application

- 7.2.4.2 UK Polyols Market

- 7.2.4.2.1 UK Polyols Market by End-use

- 7.2.4.2.2 UK Polyols Market by Product

- 7.2.4.2.3 UK Polyols Market by Application

- 7.2.4.3 France Polyols Market

- 7.2.4.3.1 France Polyols Market by End-use

- 7.2.4.3.2 France Polyols Market by Product

- 7.2.4.3.3 France Polyols Market by Application

- 7.2.4.4 Russia Polyols Market

- 7.2.4.4.1 Russia Polyols Market by End-use

- 7.2.4.4.2 Russia Polyols Market by Product

- 7.2.4.4.3 Russia Polyols Market by Application

- 7.2.4.5 Spain Polyols Market

- 7.2.4.5.1 Spain Polyols Market by End-use

- 7.2.4.5.2 Spain Polyols Market by Product

- 7.2.4.5.3 Spain Polyols Market by Application

- 7.2.4.6 Italy Polyols Market

- 7.2.4.6.1 Italy Polyols Market by End-use

- 7.2.4.6.2 Italy Polyols Market by Product

- 7.2.4.6.3 Italy Polyols Market by Application

- 7.2.4.7 Rest of Europe Polyols Market

- 7.2.4.7.1 Rest of Europe Polyols Market by End-use

- 7.2.4.7.2 Rest of Europe Polyols Market by Product

- 7.2.4.7.3 Rest of Europe Polyols Market by Application

- 7.2.4.1 Germany Polyols Market

- 7.2.1 Europe Polyols Market by End-use

- 7.3 Asia Pacific Polyols Market

- 7.3.1 Asia Pacific Polyols Market by End-use

- 7.3.1.1 Asia Pacific Building & Construction Market by Country

- 7.3.1.2 Asia Pacific Furnishings Market by Country

- 7.3.1.3 Asia Pacific Automotive Market by Country

- 7.3.1.4 Asia Pacific Packaging Market by Country

- 7.3.1.5 Asia Pacific Electronics Market by Country

- 7.3.1.6 Asia Pacific Others Market by Country

- 7.3.2 Asia Pacific Polyols Market by Product

- 7.3.2.1 Asia Pacific Polyether Market by Country

- 7.3.2.2 Asia Pacific Polyester Market by Country

- 7.3.3 Asia Pacific Polyols Market by Application

- 7.3.3.1 Asia Pacific Flexible Foam Market by Country

- 7.3.3.2 Asia Pacific Rigid Foam Market by Country

- 7.3.3.3 Asia Pacific Coatings Market by Country

- 7.3.3.4 Asia Pacific Adhesives & Sealants Market by Country

- 7.3.3.5 Asia Pacific Elastomers Market by Country

- 7.3.3.6 Asia Pacific Others Market by Country

- 7.3.4 Asia Pacific Polyols Market by Country

- 7.3.4.1 China Polyols Market

- 7.3.4.1.1 China Polyols Market by End-use

- 7.3.4.1.2 China Polyols Market by Product

- 7.3.4.1.3 China Polyols Market by Application

- 7.3.4.2 Japan Polyols Market

- 7.3.4.2.1 Japan Polyols Market by End-use

- 7.3.4.2.2 Japan Polyols Market by Product

- 7.3.4.2.3 Japan Polyols Market by Application

- 7.3.4.3 India Polyols Market

- 7.3.4.3.1 India Polyols Market by End-use

- 7.3.4.3.2 India Polyols Market by Product

- 7.3.4.3.3 India Polyols Market by Application

- 7.3.4.4 South Korea Polyols Market

- 7.3.4.4.1 South Korea Polyols Market by End-use

- 7.3.4.4.2 South Korea Polyols Market by Product

- 7.3.4.4.3 South Korea Polyols Market by Application

- 7.3.4.5 Australia Polyols Market

- 7.3.4.5.1 Australia Polyols Market by End-use

- 7.3.4.5.2 Australia Polyols Market by Product

- 7.3.4.5.3 Australia Polyols Market by Application

- 7.3.4.6 Malaysia Polyols Market

- 7.3.4.6.1 Malaysia Polyols Market by End-use

- 7.3.4.6.2 Malaysia Polyols Market by Product

- 7.3.4.6.3 Malaysia Polyols Market by Application

- 7.3.4.7 Rest of Asia Pacific Polyols Market

- 7.3.4.7.1 Rest of Asia Pacific Polyols Market by End-use

- 7.3.4.7.2 Rest of Asia Pacific Polyols Market by Product

- 7.3.4.7.3 Rest of Asia Pacific Polyols Market by Application

- 7.3.4.1 China Polyols Market

- 7.3.1 Asia Pacific Polyols Market by End-use

- 7.4 LAMEA Polyols Market

- 7.4.1 LAMEA Polyols Market by End-use

- 7.4.1.1 LAMEA Building & Construction Market by Country

- 7.4.1.2 LAMEA Furnishings Market by Country

- 7.4.1.3 LAMEA Automotive Market by Country

- 7.4.1.4 LAMEA Packaging Market by Country

- 7.4.1.5 LAMEA Electronics Market by Country

- 7.4.1.6 LAMEA Others Market by Country

- 7.4.2 LAMEA Polyols Market by Product

- 7.4.2.1 LAMEA Polyether Market by Country

- 7.4.2.2 LAMEA Polyester Market by Country

- 7.4.3 LAMEA Polyols Market by Application

- 7.4.3.1 LAMEA Flexible Foam Market by Country

- 7.4.3.2 LAMEA Rigid Foam Market by Country

- 7.4.3.3 LAMEA Coatings Market by Country

- 7.4.3.4 LAMEA Adhesives & Sealants Market by Country

- 7.4.3.5 LAMEA Elastomers Market by Country

- 7.4.3.6 LAMEA Others Market by Country

- 7.4.4 LAMEA Polyols Market by Country

- 7.4.4.1 Brazil Polyols Market

- 7.4.4.1.1 Brazil Polyols Market by End-use

- 7.4.4.1.2 Brazil Polyols Market by Product

- 7.4.4.1.3 Brazil Polyols Market by Application

- 7.4.4.2 Argentina Polyols Market

- 7.4.4.2.1 Argentina Polyols Market by End-use

- 7.4.4.2.2 Argentina Polyols Market by Product

- 7.4.4.2.3 Argentina Polyols Market by Application

- 7.4.4.3 UAE Polyols Market

- 7.4.4.3.1 UAE Polyols Market by End-use

- 7.4.4.3.2 UAE Polyols Market by Product

- 7.4.4.3.3 UAE Polyols Market by Application

- 7.4.4.4 Saudi Arabia Polyols Market

- 7.4.4.4.1 Saudi Arabia Polyols Market by End-use

- 7.4.4.4.2 Saudi Arabia Polyols Market by Product

- 7.4.4.4.3 Saudi Arabia Polyols Market by Application

- 7.4.4.5 South Africa Polyols Market

- 7.4.4.5.1 South Africa Polyols Market by End-use

- 7.4.4.5.2 South Africa Polyols Market by Product

- 7.4.4.5.3 South Africa Polyols Market by Application

- 7.4.4.6 Nigeria Polyols Market

- 7.4.4.6.1 Nigeria Polyols Market by End-use

- 7.4.4.6.2 Nigeria Polyols Market by Product

- 7.4.4.6.3 Nigeria Polyols Market by Application

- 7.4.4.7 Rest of LAMEA Polyols Market

- 7.4.4.7.1 Rest of LAMEA Polyols Market by End-use

- 7.4.4.7.2 Rest of LAMEA Polyols Market by Product

- 7.4.4.7.3 Rest of LAMEA Polyols Market by Application

- 7.4.4.1 Brazil Polyols Market

- 7.4.1 LAMEA Polyols Market by End-use

Chapter 8. Company Profiles

- 8.1 The Dow Chemical Company (Dow Corning Ltd.)

- 8.1.1 Company Overview

- 8.1.2 Financial Analysis

- 8.1.3 Segmental and Regional Analysis

- 8.1.4 SWOT Analysis

- 8.2 BASF SE

- 8.2.1 Company Overview

- 8.2.2 Financial Analysis

- 8.2.3 Segmental and Regional Analysis

- 8.2.4 Research & Development Expense

- 8.2.5 Recent strategies and developments:

- 8.2.5.1 Geographical Expansions:

- 8.2.6 SWOT Analysis

- 8.3 Vertellus

- 8.3.1 Company Overview

- 8.3.2 Recent strategies and developments:

- 8.3.2.1 Acquisition and Mergers:

- 8.3.3 SWOT Analysis

- 8.4 Huntsman Corporation

- 8.4.1 Company Overview

- 8.4.2 Financial Analysis

- 8.4.3 Segment and Regional Analysis

- 8.4.4 Research & Development Expense

- 8.4.5 Recent strategies and developments:

- 8.4.5.1 Acquisition and Mergers:

- 8.4.6 SWOT Analysis

- 8.5 Lanxess AG

- 8.5.1 Company Overview

- 8.5.2 Financial Analysis

- 8.5.3 Segmental and Regional Analysis

- 8.5.4 Research & Development Expenses

- 8.5.5 SWOT Analysis

- 8.6 Mitsui Chemicals, Inc.

- 8.6.1 Company Overview

- 8.6.2 Financial Analysis

- 8.6.3 Segmental and Regional Analysis

- 8.6.4 Research & Development Expense

- 8.6.5 SWOT Analysis

- 8.7 Stepan Company

- 8.7.1 Company Overview

- 8.7.2 Financial Analysis

- 8.7.3 Segmental and Regional Analysis

- 8.7.4 Research & Development Expenses

- 8.7.5 Recent strategies and developments:

- 8.7.5.1 Acquisition and Mergers:

- 8.7.6 SWOT Analysis

- 8.8 Koch Industries, Inc. (Invista BV)

- 8.8.1 Company Overview

- 8.8.2 SWOT Analysis

- 8.9 Tosoh Corporation

- 8.9.1 Company Overview

- 8.9.2 Financial Analysis

- 8.9.3 Segmental and Regional Analysis

- 8.9.4 Research & Development Expenses

- 8.9.5 SWOT Analysis

- 8.10. Shell plc

- 8.10.1 Company Overview

- 8.10.2 Financial Analysis

- 8.10.3 Segmental and Regional Analysis

- 8.10.4 Research & Development Expenses

- 8.10.5 SWOT Analysis