|

|

市場調査レポート

商品コード

1161448

四輪車の世界市場:推進方式別(電動、ICE)、用途別(家庭、商業)、タイプ別(小型、大型)、エンドユーザー別(リゾート・博物館、産業施設、パーソナルモビリティ)、価格帯別(エコノミー、中、プレミアム)、地域別 - 2032年までの予測Quadricycle Market by Propulsion (Electric, ICE), Application (Household & Commercial), Type (Light, Heavy), End Use (Resorts & Museums, Industrial Facilities, Personal Mobility), Price Range (Economy, Mid, Premium) and Region - Global Forecast to 2032 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 四輪車の世界市場:推進方式別(電動、ICE)、用途別(家庭、商業)、タイプ別(小型、大型)、エンドユーザー別(リゾート・博物館、産業施設、パーソナルモビリティ)、価格帯別(エコノミー、中、プレミアム)、地域別 - 2032年までの予測 |

|

出版日: 2022年11月22日

発行: MarketsandMarkets

ページ情報: 英文 213 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の四輪車の市場規模は、2032年までに191億米ドルから356億米ドルへ、予測期間中にCAGR6.4%で成長すると予測されます。

排気ガス規制の緩和と運用コストの低減により、電気四輪車の採用が進み、予測期間中に電気四輪車の需要が増加します。

予測期間中、電気四輪車が最も成長すると予測されます。

今後の排ガス規制における炭素排出量の低下と燃料価格の上昇により、世界のOEMの焦点はグリーンでクリーンな車両へと移行しています。中国、米国、欧州諸国では、EVの普及が急速に進んでおり、四輪バイクについても同様の傾向が見られます。中国汽車工業協会(EV)によると、中国では2017年に約175万台のマイクロEVが販売されました。武陵紅光ミニはマイクロEVの中で最も売れており、2021年の販売台数は約50,561台、前年比成長率は約42.9%です。国際クリーン交通協議会(ICCT)によると、BEVの販売台数の約68%が軽自動車です。

一方、電気四輪車のシェアは、日本、欧州、北米の各国では比較的低い水準にあります。しかし、ICエンジン車に比べて製造コストが低く複雑で、予備部品やコンポーネントも少なくて済むことから、今後の成長が期待されています。さらに、生産台数の増加に伴い、電気四輪車のコストは低下すると予想され、充電ステーションの整備により、従来の燃料四輪車の需要が減少し、電気四輪車の普及が進むと思われます。

"エコノミー四輪車は予測期間中に最大の市場になると予測される"

エコノミー四輪車は、主に中国のローカルプレイヤーが低価格のマイクロカーを提供することにより、四輪車の最大市場を保持しています。400社以上の中国現地メーカーが1,000米ドルから4輪車を提供しています。これらは、鉛電池を搭載し、最低限の安全機能を備えたベーシックな四輪車です。原材料の入手が容易で、人件費が安く、大量生産が可能なため、中国メーカーは低価格の四輪バイクで利幅を確保することができます。これらの手頃な価格の四輪バイクは、燃費が良く、メンテナンスが少なくて済み、ICEと電気自動車の両方があり、毎日の通勤に好まれています。以上のことから、アジア太平洋地域と中国が経済的な四輪バイクのリーダーであり続けると予想されます。

"南北アメリカは、2032年までに2番目に大きな市場になると予想されています。

MarketsandMarketsの分析によると、南北アメリカはCOVID-19の発生後、2020-2021年にクアドリサイクルの売上が増加するのを示しました。米国市場の四輪車は一般的に中価格帯で、8,000~12,000米ドルからとなっています。北米では、米国とカナダの電気インフラ整備に伴い、電気四輪車の採用が進んでいます。米国では内燃機関車や近隣電気自動車(NEV)とも呼ばれ、都市部での短距離通勤に使用され、ここ数年で人気が高まっています。高齢者による電気四輪車(マイクロカー)の利用、マイクロモビリティサービスの増加、都市部の交通密度の増加が、この地域の四輪車市場の成長を支えています。これとは別に、eコマース産業の成長による小包配達や、都市部でのカーシェアリングサービスにクワドリシクルが使われることも増えています。例えば、Free2MoveはワシントンDCにシトロエンアミを配備し、カーシェアリングに参加させることを発表しています。これらの要因により、予測期間中、南北アメリカにおける四輪バイクの需要は増加すると思われます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- シナリオ - 四輪車市場

- 顧客ビジネスに影響を与える動向/ディスラプション

- サプライチェーン分析

- 四輪車市場のエコシステム

- 技術動向

- 平均販売価格(ASP)分析

- 貿易分析

- 特許分析

- 規制状況

- ケーススタディ分析

- 主要販売モデル

第6章 四輪車市場:推進方式別

- イントロダクション

- 電気

- 内燃機関(ICE)

第7章 四輪車市場:用途別

- イントロダクション

- 家庭

- 商業

第8章 四輪車市場:タイプ別

- イントロダクション

- 大型四輪車

- 小型四輪車

第9章 四輪車市場:最終用途別

- イントロダクション

- リゾート・博物館

- 産業施設

- パーソナルモビリティ

- その他の最終用途

第10章 四輪車市場:価格帯別

- イントロダクション

- エコノミー価格帯

- 中価格帯

- プレミアム価格帯

第11章 四輪車市場:地域別

- イントロダクション

- アジア太平洋地域

- 用途別市場

- 価格帯別市場

- 中国

- 日本

- インド

- 韓国

- 欧州

- 用途別市場

- 価格帯別市場

- ドイツ

- フランス

- 英国

- スペイン

- イタリア

- その他欧州

- 南北アメリカ

- 用途別市場

- 価格帯別市場

- 米国

- カナダ

- ブラジル

第12章 競合情勢

- 概要

- 四輪車市場シェア分析、2021年

- 主要企業の収益分析

- 競合評価クアドラント

- 四輪車市場:企業フットプリント

- 競合ベンチマーキング

- 競合シナリオ

- 主要企業の採用戦略

第13章 企業プロファイル

- 主要企業

- AIXAM

- LIGIER GROUP

- ITALCAR INDUSTRIAL S.R.L

- ALKE

- CASALINI

- BELLIER AUTOMOBILES

- CITROEN

- RENAULT GROUP

- TOYOTA MOTOR CORPORATION

- TAZZARI GL IMOLA SPA

- その他の企業

- HONDA MOTOR CO., LTD.

- SUZUKI MOTOR CORPORATION

- GLOBAL ELECTRIC MOTORCARS(GEM)

- GOUPIL

- ESTRIMA S.P.A

- AUTOMOBILES CHATENET

- TRIGGO

- PAXSTER

- ZHIDOU ELECTRIC VEHICLE CO., LTD.

- WEI YUN ELECTRIC VEHICLE

- BAJAJ AUTO LTD.

- ALBAMOBILITY S.R.L.

第14章 付録

The quadricycle market is projected to grow from USD 19.1 billion to USD 35.6 billion by 2032, at a CAGR of 6.4% during the forecast period. Decreased emission limits and lower operational costs lead to increased adoption of electric variants, thus driving the demand for electric quadricycles over the forecast period.

."Electric quadricycles are predicted to be the fastest growing during the forecast period."

Lowering carbon emissions in upcoming emission regulations and increasing fuel prices have shifted the focus of global OEMs focus toward green and cleaner vehicles. China, the US, and European countries are grooming faster in the EV space, and the same trend is noticed for quadricycles. In China, around 1.75 million units of Micro-EVs were sold in 2017, according to the China Association of Automobile Manufacturers (EV). Wuling Hongguang Mini is the best-selling micro-EV, with nearly 50,561 units sold in 2021 and Y-o-Y growth of approximately 42.9%. According to the International Council of Clean Transportation (ICCT), approximately 68% of BEV sales were microcars.

On the other hand, the share of electric quadricycles is comparatively lower in Japan, Europe, and North America countries. However, it is expected to grow in the future considering the lower cost and complexity of manufacturing and requires fewer spare parts and components than IC engine vehicles. Further, with increased production volume, the costs of electric quadricycles are expected to decline, and the development of charging stations will reduce the demand for conventional fuel quadricycles and promote electric quadricycles.

."Economic Quadricycles are projected to be the largest market during the forecast period."

The economy quadricycles hold the largest market for quadricycles, majorly due to local Chinese players offering low-cost microcars. More than 400 local Chinese manufacturers provide quadricycles starting from the price range of USD 1,000. These are basic quadricycles installed with lead-acid batteries and minimal safety features. The easy availability of raw materials, low labor cost, and benefit of bulk manufacturing enable Chinese manufacturers to maintain profit margins with lower-priced quadricycles. These affordable quadricycles are fuel-efficient, have lower maintenance, and are available in both ICE & electric variants, preferred for daily commute Consumers. With all the points discussed above, Asia Pacific and China would remain the leader of economic range quadricycles during the forecast period.

"Americas is anticipated to be the second largest market for quadricycles by 2032."

According to MarketsandMarkets analysis, the Americas witnessed a boost in quadricycle sales in 2020-2021 after the outbreak of COVID-19. Quadricycles in the US market are generally mid-priced, starting from USD 8,000-12,000. The adoption of electric quadricycles in North America is rising with the electric infrastructure development in the US and Canada. Quadricycles also called as Neighborhood ICE and neighborhood electric vehicle (NEV) in US, have gained traction in past few years which is used for short-distance commutes in urban areas. The use of electric quadricycles (microcars) by senior citizens, increase in micro-mobility services and increased traffic density in the cities support the growth of the quadricycle market in the region. Apart from this, Quadricycles are increasingly used for parcel deliveries due to growth in the e-commerce industry and car-sharing services in urban areas. For instance, Free2Move announced the deployment of Citroen Ami in Washington, DC, to join their carsharing fleet. These factors would increase the demand for quadricycles in the Americas during the forecast period.

In-depth interviews were conducted with CXOs, VPs, directors from business development, marketing, product development/innovation teams, independent consultants, and executives from various key organizations operating in this market.

- By Stakeholder: Supply Side - 95%, Demand Side- 5%

- By Designation: C-level executives - 10%, Directors/Vice-Presidents - 30%, Others - 60%

- By Region: Asia Pacific - 50%, Europe - 40%, and North America - 10%

The quadricycle market comprises prominent players such as Suzuki Motor Corporation (Japan), Honda Motor Co., Ltd. (Japan), Toyota Motor Corporation (Japan), Aixam (France), Ligier Group (France), and Citroen (France).

Research Coverage:

The study segments the quadricycle market and forecasts the market size based on Propulsion (Electric & Internal Combustion Engine (ICE)), Application (Household & Commercial), Type (Light Quadricycles & Heavy Quadricycles), End Use (Resorts & Museums, Industrial Facilities, Personal Mobility & Other End Uses), Price-Range (Economy, Mid-range & Premium) and Region (Asia Pacific, Europe, and Americas).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall quadricycle market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 MARKET SEGMENTATION: QUADRICYCLE MARKET

- 1.4.1 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 CURRENCY EXCHANGE RATES (WRT PER USD)

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 QUADRICYCLE MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources for quadricycle sales

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.1.2.1 Sampling techniques and data collection methods

- 2.1.2.2 Primary participants

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 6 QUADRICYCLE MARKET: BOTTOM-UP APPROACH (BY PRICE RANGE AND REGION)

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 7 QUADRICYCLE MARKET: TOP-DOWN APPROACH (BY PROPULSION)

- 2.2.3 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND- AND SUPPLY-SIDE

- 2.3 FACTOR ANALYSIS

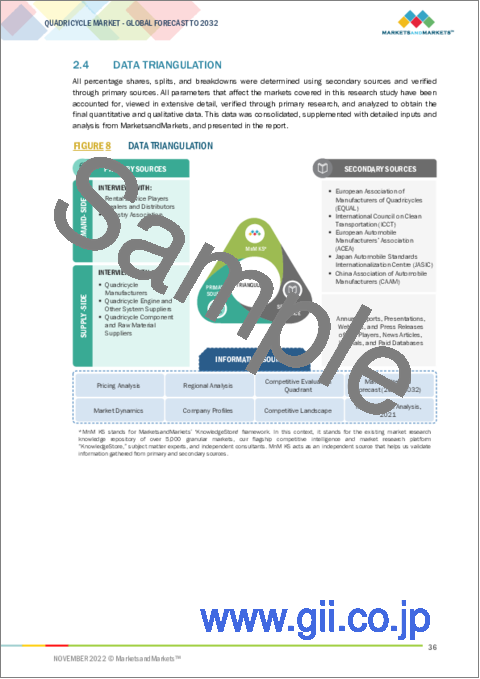

- 2.4 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.5 ASSUMPTIONS

- 2.5.1 GLOBAL ASSUMPTIONS

- 2.5.2 MARKET ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- 3.1 REPORT SUMMARY

- FIGURE 9 QUADRICYCLE MARKET OUTLOOK

- FIGURE 10 QUADRICYCLE MARKET, BY REGION, 2022 VS. 2032 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN QUADRICYCLE MARKET

- FIGURE 11 RISING DEMAND FOR COMPACT PERSONAL MOBILITY SOLUTIONS

- 4.2 QUADRICYCLE MARKET, BY APPLICATION

- FIGURE 12 HOUSEHOLD APPLICATION TO ACQUIRE MAXIMUM SHARE DURING FORECAST PERIOD

- 4.3 QUADRICYCLE MARKET, BY PROPULSION

- FIGURE 13 ELECTRIC PROPULSION TO SURPASS ICE DURING FORECAST PERIOD

- 4.4 QUADRICYCLE MARKET, BY TYPE

- FIGURE 14 LIGHT QUADRICYCLES TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.5 QUADRICYCLE MARKET, BY END USE

- FIGURE 15 PERSONAL MOBILITY TO LEAD MARKET DURING FORECAST PERIOD

- 4.6 QUADRICYCLE MARKET, BY PRICE RANGE

- FIGURE 16 ECONOMY-PRICED QUADRICYCLES COMMANDED HIGHEST DEMAND IN 2022

- 4.7 QUADRICYCLE MARKET, BY REGION

- FIGURE 17 ASIA PACIFIC TO DOMINATE QUADRICYCLE MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 QUADRICYCLE MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising geriatric population

- FIGURE 19 MEDIAN AGE OF TOTAL POPULATION, 2015-2050

- 5.2.1.2 Growing traffic congestion in urban areas

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of vehicles

- TABLE 2 MAJOR QUADRICYCLE OEMS AND THEIR ASP

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of electric vehicle charging infrastructure

- FIGURE 20 NUMBER OF CHARGING STATIONS IN TOP 10 EUROPEAN COUNTRIES, 2020

- FIGURE 21 NUMBER OF EV CHARGING STATIONS AND EVSE PORTS IN US, 2021

- 5.2.3.2 Advances in autonomous and connected car technology

- 5.2.3.3 Increased demand for last-mile delivery options

- 5.2.4 CHALLENGES

- 5.2.4.1 Reduced cost and improved energy density of EV batteries

- 5.2.4.2 Lack of safety standards

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 PORTER'S FIVE FORCES

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 SCENARIOS - QUADRICYCLE MARKET

- FIGURE 23 QUADRICYCLE MARKET SCENARIO, 2018-2032 (USD MILLION)

- 5.4.1 REALISTIC SCENARIO

- TABLE 4 QUADRICYCLE MARKET (REALISTIC SCENARIO), BY REGION, 2018-2032 (USD MILLION)

- 5.4.2 PESSIMISTIC SCENARIO

- TABLE 5 QUADRICYCLE MARKET (PESSIMISTIC SCENARIO), BY REGION, 2018-2032 (USD MILLION)

- 5.4.3 OPTIMISTIC SCENARIO

- TABLE 6 QUADRICYCLE MARKET (OPTIMISTIC SCENARIO), BY REGION, 2018-2032 (USD MILLION)

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 REVENUE SHIFT DRIVING MARKET GROWTH

- 5.6 SUPPLY CHAIN ANALYSIS

- FIGURE 25 SUPPLY CHAIN ANALYSIS: QUADRICYCLE MARKET

- 5.7 QUADRICYCLE MARKET ECOSYSTEM

- 5.7.1 ECOSYSTEM: QUADRICYCLE MARKET

- FIGURE 26 QUADRICYCLE MARKET: ECOSYSTEM

- TABLE 7 ROLE OF COMPANIES IN QUADRICYCLE MARKET ECOSYSTEM

- 5.8 TECHNOLOGY TREND

- 5.8.1 FUTURE OF AUTONOMOUS VEHICLE TECHNOLOGY

- 5.8.2 RISING INSTALLATION OF ADVANCED SAFETY AND COMFORT FEATURES

- 5.9 AVERAGE SELLING PRICE (ASP) ANALYSIS

- 5.9.1 BY TYPE AND REGION

- TABLE 8 AVERAGE SELLING PRICE (ASP), BY TYPE AND REGION

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO

- 5.10.1.1 France

- TABLE 9 FRANCE: QUADRICYCLE IMPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.1.2 Italy

- TABLE 10 ITALY: QUADRICYCLE IMPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.1.3 Spain

- TABLE 11 SPAIN: QUADRICYCLE IMPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.1.4 India

- TABLE 12 INDIA: QUADRICYCLE IMPORTS SHARE, BY COUNTRY (VALUE %)

- 5.10.2 EXPORT SCENARIO

- 5.10.2.1 France

- TABLE 13 FRANCE: QUADRICYCLE EXPORTS SHARE, BY COUNTRY (VALUE%)

- 5.10.2.2 Italy

- TABLE 14 ITALY: QUADRICYCLE EXPORTS SHARE, BY COUNTRY (VALUE%)

- 5.10.2.3 Spain

- TABLE 15 SPAIN: QUADRICYCLE EXPORTS SHARE, BY COUNTRY (VALUE%)

- 5.10.2.4 India

- TABLE 16 INDIA: QUADRICYCLE EXPORTS SHARE, BY COUNTRY (VALUE%)

- 5.10.1 IMPORT SCENARIO

- 5.11 PATENT ANALYSIS

- 5.12 REGULATORY LANDSCAPE

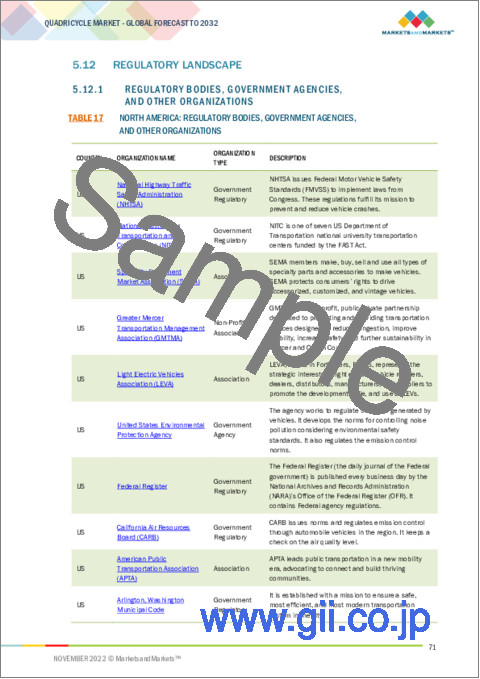

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA-PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATORY ANALYSIS FOR QUADRICYCLE MARKET, BY REGION/COUNTRY

- 5.12.2.1 Europe

- TABLE 21 EUROPE: QUADRICYCLE REGULATIONS

- 5.12.2.2 India

- TABLE 22 INDIA: QUADRICYCLE REGULATIONS

- 5.12.2.3 US

- TABLE 23 US: QUADRICYCLE REGULATIONS

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 USE CASE 1: PAXSTER OFFERS VEHICLES FOR LAST-MILE DELIVERY

- 5.13.2 USE CASE 2: LIGHT MICRO COMMERCIAL VEHICLES FOR URBAN USE

- 5.14 TOP SELLING MODELS

- TABLE 24 TOP-SELLING MODELS BY OEM (2021)

6 QUADRICYCLE MARKET, BY PROPULSION

- 6.1 INTRODUCTION

- 6.1.1 RESEARCH METHODOLOGY

- 6.1.2 ASSUMPTIONS

- 6.1.3 INDUSTRY INSIGHTS

- FIGURE 27 QUADRICYCLE MARKET, BY PROPULSION, 2022 VS. 2032 (USD MILLION)

- TABLE 25 QUADRICYCLE MARKET, BY PROPULSION, 2018-2021 (UNITS)

- TABLE 26 QUADRICYCLE MARKET, BY PROPULSION, 2022-2032 (UNITS)

- TABLE 27 QUADRICYCLE MARKET, BY PROPULSION, 2018-2021 (USD MILLION)

- TABLE 28 QUADRICYCLE MARKET, BY PROPULSION, 2022-2032 (USD MILLION)

- 6.2 ELECTRIC

- 6.2.1 INCREASED ADOPTION OF ELECTRIC VEHICLES

- TABLE 29 ELECTRIC: QUADRICYCLE MARKET, BY REGION, 2018-2021 (UNITS)

- TABLE 30 ELECTRIC: QUADRICYCLE MARKET, BY REGION, 2022-2032 (UNITS)

- TABLE 31 ELECTRIC: QUADRICYCLE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 32 ELECTRIC: QUADRICYCLE MARKET, BY REGION, 2022-2032 (USD MILLION)

- 6.3 INTERNAL COMBUSTION ENGINE (ICE)

- 6.3.1 RANGE ANXIETY REGARDING ELECTRIC VEHICLES

- TABLE 33 ICE: QUADRICYCLE MARKET, BY REGION, 2018-2021 (UNITS)

- TABLE 34 ICE: QUADRICYCLE MARKET, BY REGION, 2022-2032 (UNITS)

- TABLE 35 ICE: QUADRICYCLE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 36 ICE: QUADRICYCLE MARKET, BY REGION, 2022-2032 (USD MILLION)

7 QUADRICYCLE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.1.1 RESEARCH METHODOLOGY

- 7.1.2 ASSUMPTIONS

- 7.1.3 INDUSTRY INSIGHTS

- FIGURE 28 QUADRICYCLE MARKET, BY APPLICATION, 2022 VS. 2032 (USD MILLION)

- TABLE 37 QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (UNITS)

- TABLE 38 QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (UNITS)

- TABLE 39 QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 40 QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- 7.2 HOUSEHOLD

- 7.2.1 INCREASED USE BY GERIATRIC POPULATION

- TABLE 41 HOUSEHOLD: QUADRICYCLE MARKET, BY REGION, 2018-2021 (UNITS)

- TABLE 42 HOUSEHOLD: QUADRICYCLE MARKET, BY REGION, 2022-2032 (UNITS)

- TABLE 43 HOUSEHOLD: QUADRICYCLE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 44 HOUSEHOLD: QUADRICYCLE MARKET, BY REGION, 2022-2032 (USD MILLION)

- 7.3 COMMERCIAL

- 7.3.1 HIGH DEMAND FOR LAST-MILE DELIVERY

- TABLE 45 COMMERCIAL: QUADRICYCLE MARKET, BY REGION, 2018-2021 (UNITS)

- TABLE 46 COMMERCIAL: QUADRICYCLE MARKET, BY REGION, 2022-2032 (UNITS)

- TABLE 47 COMMERCIAL: QUADRICYCLE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 48 COMMERCIAL: QUADRICYCLE MARKET, BY REGION, 2022-2032 (USD MILLION)

8 QUADRICYCLE MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.1.1 RESEARCH METHODOLOGY

- 8.1.2 ASSUMPTIONS

- 8.1.3 INDUSTRY INSIGHTS

- FIGURE 29 QUADRICYCLE MARKET, BY TYPE, 2022 VS. 2032 (USD MILLION)

- TABLE 49 QUADRICYCLE MARKET, BY TYPE, 2018-2021 (UNITS)

- TABLE 50 QUADRICYCLE MARKET, BY TYPE, 2022-2032 (UNITS)

- TABLE 51 QUADRICYCLE MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 52 QUADRICYCLE MARKET, BY TYPE, 2022-2032 (USD MILLION)

- 8.2 HEAVY QUADRICYCLES

- 8.2.1 INCREASING USE IN PASSENGER AND CARGO TRANSPORT

- TABLE 53 HEAVY QUADRICYCLE MARKET, BY REGION, 2018-2021 (UNITS)

- TABLE 54 HEAVY QUADRICYCLE MARKET, BY REGION, 2022-2032 (UNITS)

- TABLE 55 HEAVY QUADRICYCLE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 56 HEAVY QUADRICYCLE MARKET, BY REGION, 2022-2032 (USD MILLION)

- 8.3 LIGHT QUADRICYCLES

- 8.3.1 IMPROVED AWARENESS OF ZERO-CARBON EMISSIONS

- TABLE 57 LIGHT QUADRICYCLE MARKET, BY REGION, 2018-2021 (UNITS)

- TABLE 58 LIGHT QUADRICYCLE MARKET, BY REGION, 2022-2032 (UNITS)

- TABLE 59 LIGHT QUADRICYCLE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 60 LIGHT QUADRICYCLE MARKET, BY REGION, 2022-2032 (USD MILLION)

9 QUADRICYCLE MARKET, BY END USE

- 9.1 INTRODUCTION

- 9.1.1 RESEARCH METHODOLOGY

- 9.1.2 ASSUMPTIONS

- 9.1.3 INDUSTRY INSIGHTS

- FIGURE 30 QUADRICYCLE MARKET, BY END USE, 2022 VS. 2032 (USD MILLION)

- TABLE 61 QUADRICYCLE MARKET, BY END USE, 2018-2021 (UNITS)

- TABLE 62 QUADRICYCLE MARKET, BY END USE, 2022-2032 (UNITS)

- TABLE 63 QUADRICYCLE MARKET, BY END USE, 2018-2021 (USD MILLION)

- TABLE 64 QUADRICYCLE MARKET, BY END USE, 2022-2032 (USD MILLION)

- 9.2 RESORTS AND MUSEUMS

- 9.2.1 INVESTMENTS IN HOSPITALITY SECTOR

- TABLE 65 RESORTS AND MUSEUMS: QUADRICYCLE MARKET, BY REGION, 2018-2021 (UNITS)

- TABLE 66 RESORTS AND MUSEUMS: QUADRICYCLE MARKET, BY REGION, 2022-2032 (UNITS)

- TABLE 67 RESORTS AND MUSEUMS: QUADRICYCLE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 68 RESORTS AND MUSEUMS: QUADRICYCLE MARKET, BY REGION, 2022-2032 (USD MILLION)

- 9.3 INDUSTRIAL FACILITIES

- 9.3.1 DEVELOPMENT OF MANUFACTURING SECTOR

- TABLE 69 INDUSTRIAL FACILITIES: QUADRICYCLE MARKET, BY REGION, 2018-2021 (UNITS)

- TABLE 70 INDUSTRIAL FACILITIES: QUADRICYCLE MARKET, BY REGION, 2022-2032 (UNITS)

- TABLE 71 INDUSTRIAL FACILITIES: QUADRICYCLE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 72 INDUSTRIAL FACILITIES: QUADRICYCLE MARKET, BY REGION, 2022-2032 (USD MILLION)

- 9.4 PERSONAL MOBILITY

- 9.4.1 LOW MAINTENANCE AND IMPROVED SAFETY

- TABLE 73 PERSONAL MOBILITY: QUADRICYCLE MARKET, BY REGION, 2018-2021 (UNITS)

- TABLE 74 PERSONAL MOBILITY: QUADRICYCLE MARKET, BY REGION, 2022-2032 (UNITS)

- TABLE 75 PERSONAL MOBILITY: QUADRICYCLE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 76 PERSONAL MOBILITY: QUADRICYCLE MARKET, BY REGION, 2022-2032 (USD MILLION)

- 9.5 OTHER END USES

- 9.5.1 INCREASE IN AIRPORT OPERATIONS

- TABLE 77 OTHER END USES: QUADRICYCLE MARKET, BY REGION, 2018-2021 (UNITS)

- TABLE 78 OTHER END USES: QUADRICYCLE MARKET, BY REGION, 2022-2032 (UNITS)

- TABLE 79 OTHER END USES: QUADRICYCLE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 80 OTHER END USES: QUADRICYCLE MARKET, BY REGION, 2022-2032 (USD MILLION)

10 QUADRICYCLE MARKET, BY PRICE RANGE

- 10.1 INTRODUCTION

- 10.1.1 RESEARCH METHODOLOGY

- 10.1.2 ASSUMPTIONS

- 10.1.3 INDUSTRY INSIGHTS

- FIGURE 31 QUADRICYCLE MARKET, BY PRICE RANGE, 2022 VS. 2032 (USD MILLION)

- TABLE 81 QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (UNITS)

- TABLE 82 QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (UNITS)

- TABLE 83 QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (USD MILLION)

- TABLE 84 QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (USD MILLION)

- 10.2 ECONOMY

- 10.2.1 ASIA PACIFIC TO HAVE LARGEST MARKET FOR ECONOMIC MODELS

- TABLE 85 ECONOMY: QUADRICYCLE MARKET, BY REGION, 2018-2021 (UNITS)

- TABLE 86 ECONOMY: QUADRICYCLE MARKET, BY REGION, 2022-2032 (UNITS)

- TABLE 87 ECONOMY: QUADRICYCLE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 88 ECONOMY: QUADRICYCLE MARKET, BY REGION, 2022-2032 (USD MILLION)

- 10.3 MID-RANGE

- 10.3.1 USE OF ELECTRIC MODELS TO PROMOTE MID-RANGE QUADRICYCLES

- TABLE 89 MID-RANGE: QUADRICYCLE MARKET, BY REGION, 2018-2021 (UNITS)

- TABLE 90 MID-RANGE: QUADRICYCLE MARKET, BY REGION, 2022-2032 (UNITS)

- TABLE 91 MID-RANGE: QUADRICYCLE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 92 MID-RANGE: QUADRICYCLE MARKET, BY REGION, 2022-2032 (USD MILLION)

- 10.4 PREMIUM

- 10.4.1 USE OF QUADRICYCLES AS A STATUS SYMBOL

- TABLE 93 PREMIUM: QUADRICYCLE MARKET, BY REGION, 2018-2021 (UNITS)

- TABLE 94 PREMIUM: QUADRICYCLE MARKET, BY REGION, 2022-2032 (UNITS)

- TABLE 95 PREMIUM: QUADRICYCLE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 96 PREMIUM: QUADRICYCLE MARKET, BY REGION, 2022-2032 (USD MILLION)

11 QUADRICYCLE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.1.1 RESEARCH METHODOLOGY

- 11.1.2 ASSUMPTIONS

- 11.1.3 INDUSTRY INSIGHTS

- FIGURE 32 QUADRICYCLE MARKET, BY REGION, 2022 VS. 2032 (USD MILLION)

- TABLE 97 QUADRICYCLE MARKET, BY REGION, 2018-2021 (UNITS)

- TABLE 98 QUADRICYCLE MARKET, BY REGION, 2022-2032 (UNITS)

- TABLE 99 QUADRICYCLE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 100 QUADRICYCLE MARKET, BY REGION, 2022-2032 (USD MILLION)

- 11.2 ASIA PACIFIC

- FIGURE 33 ASIA PACIFIC: QUADRICYCLE MARKET SNAPSHOT

- TABLE 101 ASIA PACIFIC: QUADRICYCLE MARKET, BY COUNTRY, 2018-2021 (UNITS)

- TABLE 102 ASIA PACIFIC: QUADRICYCLE MARKET, BY COUNTRY, 2022-2032 (UNITS)

- TABLE 103 ASIA PACIFIC: QUADRICYCLE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 104 ASIA PACIFIC: QUADRICYCLE MARKET, BY COUNTRY, 2022-2032 (USD MILLION)

- 11.2.1 ASIA PACIFIC QUADRICYCLE MARKET, BY APPLICATION

- TABLE 105 ASIA PACIFIC: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (UNITS)

- TABLE 106 ASIA PACIFIC: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (UNITS)

- TABLE 107 ASIA PACIFIC: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 108 ASIA PACIFIC: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- 11.2.2 ASIA PACIFIC QUADRICYCLE MARKET, BY PRICE RANGE

- TABLE 109 ASIA PACIFIC: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (UNITS)

- TABLE 110 ASIA PACIFIC: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (UNITS)

- TABLE 111 ASIA PACIFIC: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (USD MILLION)

- TABLE 112 ASIA PACIFIC: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (USD MILLION)

- 11.2.3 CHINA

- 11.2.3.1 Growing industrial sector

- TABLE 113 CHINA: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (UNITS)

- TABLE 114 CHINA: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (UNITS)

- TABLE 115 CHINA: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 116 CHINA: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 117 CHINA: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (UNITS)

- TABLE 118 CHINA: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (UNITS)

- TABLE 119 CHINA: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (USD MILLION)

- TABLE 120 CHINA: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (USD MILLION)

- 11.2.4 JAPAN

- 11.2.4.1 Awareness of safe commute post COVID-19

- TABLE 121 JAPAN: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (UNITS)

- TABLE 122 JAPAN: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (UNITS)

- TABLE 123 JAPAN: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 124 JAPAN: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 125 JAPAN: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (UNITS)

- TABLE 126 JAPAN: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (UNITS)

- TABLE 127 JAPAN: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (USD MILLION)

- TABLE 128 JAPAN: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (USD MILLION)

- 11.2.5 INDIA

- 11.2.5.1 Widescale commercial applications

- TABLE 129 INDIA: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (UNITS)

- TABLE 130 INDIA: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (UNITS)

- TABLE 131 INDIA: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 132 INDIA: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 133 INDIA: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (UNITS)

- TABLE 134 INDIA: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (UNITS)

- TABLE 135 INDIA: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (USD MILLION)

- TABLE 136 INDIA: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (USD MILLION)

- 11.2.6 SOUTH KOREA

- 11.2.6.1 Prevalence of ride-sharing and last-mile delivery services

- TABLE 137 SOUTH KOREA: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (UNITS)

- TABLE 138 SOUTH KOREA: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (UNITS)

- TABLE 139 SOUTH KOREA: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 140 SOUTH KOREA: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 141 SOUTH KOREA: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (UNITS)

- TABLE 142 SOUTH KOREA: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (UNITS)

- TABLE 143 SOUTH KOREA: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (USD MILLION)

- TABLE 144 SOUTH KOREA: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (USD MILLION)

- 11.3 EUROPE

- FIGURE 34 EUROPE: QUADRICYCLE MARKET, BY REGION, 2022 VS. 2032 (USD MILLION)

- TABLE 145 EUROPE: QUADRICYCLE MARKET, BY COUNTRY, 2018-2021 (UNITS)

- TABLE 146 EUROPE: QUADRICYCLE MARKET, BY COUNTRY, 2022-2032 (UNITS)

- TABLE 147 EUROPE: QUADRICYCLE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 148 EUROPE: QUADRICYCLE MARKET, BY COUNTRY, 2022-2032 (USD MILLION)

- 11.3.1 EUROPE QUADRICYCLE MARKET, BY APPLICATION

- TABLE 149 EUROPE: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (UNITS)

- TABLE 150 EUROPE: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (UNITS)

- TABLE 151 EUROPE: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 152 EUROPE: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- 11.3.2 EUROPE QUADRICYCLE MARKET, BY PRICE RANGE

- TABLE 153 EUROPE: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (UNITS)

- TABLE 154 EUROPE: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (UNITS)

- TABLE 155 EUROPE: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (USD MILLION)

- TABLE 156 EUROPE: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (USD MILLION)

- 11.3.3 GERMANY

- 11.3.3.1 Focus on cutting carbon emissions

- TABLE 157 GERMANY: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (UNITS)

- TABLE 158 GERMANY: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (UNITS)

- TABLE 159 GERMANY: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 160 GERMANY: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 161 GERMANY: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (UNITS)

- TABLE 162 GERMANY: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (UNITS)

- TABLE 163 GERMANY: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (USD MILLION)

- TABLE 164 GERMANY: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (USD MILLION)

- 11.3.4 FRANCE

- 11.3.4.1 Compact and sleek design

- TABLE 165 FRANCE: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (UNITS)

- TABLE 166 FRANCE: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (UNITS)

- TABLE 167 FRANCE: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 168 FRANCE: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 169 FRANCE: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (UNITS)

- TABLE 170 FRANCE: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (UNITS)

- TABLE 171 FRANCE: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (USD MILLION)

- TABLE 172 FRANCE: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (USD MILLION)

- 11.3.5 UK

- 11.3.5.1 Use of quadricycles by older people

- TABLE 173 UK: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (UNITS)

- TABLE 174 UK: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (UNITS)

- TABLE 175 UK: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 176 UK: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 177 UK: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (UNITS)

- TABLE 178 UK: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (UNITS)

- TABLE 179 UK: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (USD MILLION)

- TABLE 180 UK: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (USD MILLION)

- 11.3.6 SPAIN

- 11.3.6.1 Demand for sustainable mobility solutions

- TABLE 181 SPAIN: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (UNITS)

- TABLE 182 SPAIN: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (UNITS)

- TABLE 183 SPAIN: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 184 SPAIN: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 185 SPAIN: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (UNITS)

- TABLE 186 SPAIN: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (UNITS)

- TABLE 187 SPAIN: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (USD MILLION)

- TABLE 188 SPAIN: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (USD MILLION)

- 11.3.7 ITALY

- 11.3.7.1 Growing trend of ride-sharing

- TABLE 189 ITALY: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (UNITS)

- TABLE 190 ITALY: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (UNITS)

- TABLE 191 ITALY: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 192 ITALY: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 193 ITALY: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (UNITS)

- TABLE 194 ITALY: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (UNITS)

- TABLE 195 ITALY: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (USD MILLION)

- TABLE 196 ITALY: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (USD MILLION)

- 11.3.8 REST OF EUROPE

- 11.3.8.1 Preference for safe commute options

- TABLE 197 REST OF EUROPE: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (UNITS)

- TABLE 198 REST OF EUROPE: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (UNITS)

- TABLE 199 REST OF EUROPE: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 200 REST OF EUROPE: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 201 REST OF EUROPE: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (UNITS)

- TABLE 202 REST OF EUROPE: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (UNITS)

- TABLE 203 REST OF EUROPE: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (USD MILLION)

- TABLE 204 REST OF EUROPE: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (USD MILLION)

- 11.4 AMERICAS

- FIGURE 35 AMERICAS: QUADRICYCLE MARKET, BY REGION, 2022 VS. 2032 (USD MILLION)

- TABLE 205 AMERICAS: QUADRICYCLE MARKET, BY COUNTRY, 2018-2021 (UNITS)

- TABLE 206 AMERICAS: QUADRICYCLE MARKET, BY COUNTRY, 2022-2032 (UNITS)

- TABLE 207 AMERICAS: QUADRICYCLE MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 208 AMERICAS: QUADRICYCLE MARKET, BY COUNTRY, 2022-2032 (USD MILLION)

- 11.4.1 AMERICAS QUADRICYCLE MARKET, BY APPLICATION

- TABLE 209 AMERICAS: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (UNITS)

- TABLE 210 AMERICAS: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (UNITS)

- TABLE 211 AMERICAS: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 212 AMERICAS: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- 11.4.2 AMERICAS QUADRICYCLE MARKET, BY PRICE RANGE

- TABLE 213 AMERICAS: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (UNITS)

- TABLE 214 AMERICAS: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (UNITS)

- TABLE 215 AMERICAS: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (USD MILLION)

- TABLE 216 AMERICAS: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (USD MILLION)

- 11.4.3 US

- 11.4.3.1 Popularity of quadricycles for personal mobility

- TABLE 217 US: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (UNITS)

- TABLE 218 US: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (UNITS)

- TABLE 219 US: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 220 US: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 221 US: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (UNITS)

- TABLE 222 US: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (UNITS)

- TABLE 223 US: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (USD MILLION)

- TABLE 224 US: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (USD MILLION)

- 11.4.4 CANADA

- 11.4.4.1 Shift toward electrification

- TABLE 225 CANADA: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (UNITS)

- TABLE 226 CANADA: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (UNITS)

- TABLE 227 CANADA: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 228 CANADA: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 229 CANADA: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (UNITS)

- TABLE 230 CANADA: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (UNITS)

- TABLE 231 CANADA: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (USD MILLION)

- TABLE 232 CANADA: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (USD MILLION)

- 11.4.5 BRAZIL

- 11.4.5.1 Affordable running costs and ease of use

- TABLE 233 BRAZIL: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (UNITS)

- TABLE 234 BRAZIL: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (UNITS)

- TABLE 235 BRAZIL: QUADRICYCLE MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 236 BRAZIL: QUADRICYCLE MARKET, BY APPLICATION, 2022-2032 (USD MILLION)

- TABLE 237 BRAZIL: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (UNITS)

- TABLE 238 BRAZIL: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (UNITS)

- TABLE 239 BRAZIL: QUADRICYCLE MARKET, BY PRICE RANGE, 2018-2021 (USD MILLION)

- TABLE 240 BRAZIL: QUADRICYCLE MARKET, BY PRICE RANGE, 2022-2032 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 QUADRICYCLE MARKET SHARE ANALYSIS, 2021

- FIGURE 36 QUADRICYCLE MARKET SHARE, 2021

- 12.3 REVENUE ANALYSIS OF TOP PLAYERS

- FIGURE 37 REVENUE ANALYSIS, 2019-2021

- 12.4 COMPETITIVE EVALUATION QUADRANT

- 12.4.1 TERMINOLOGY

- 12.4.2 STARS

- 12.4.3 PERVASIVE PLAYERS

- 12.4.4 EMERGING LEADERS

- 12.4.5 PARTICIPANTS

- FIGURE 38 QUADRICYCLE MARKET MANUFACTURERS: COMPETITIVE EVALUATION MATRIX, 2021

- 12.5 QUADRICYCLE MARKET: COMPANY FOOTPRINT

- TABLE 241 QUADRICYCLE MARKET: COMPANY FOOTPRINT, 2021

- TABLE 242 QUADRICYCLE MARKET: COMPANY PRODUCT CATEGORY FOOTPRINT, 2021

- TABLE 243 QUADRICYCLE MARKET: COMPANY REGION FOOTPRINT, 2021

- 12.6 COMPETITIVE BENCHMARKING

- TABLE 244 QUADRICYCLE MARKET: KEY PLAYERS

- TABLE 245 QUADRICYCLE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PRODUCT LAUNCHES

- TABLE 246 PRODUCT LAUNCHES, 2018-2022

- 12.7.2 DEALS

- TABLE 247 DEALS, 2018-2022

- 12.8 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 248 OVERVIEW OF STRATEGIES DEPLOYED BY KEY QUADRICYCLE MARKET OEMS

13 COMPANY PROFILES

- (Business overview, Products offered, Recent developments & MnM View)**

- 13.1 KEY PLAYERS

- 13.1.1 AIXAM

- TABLE 249 AIXAM: BUSINESS OVERVIEW

- TABLE 250 AIXAM: PRODUCTS OFFERED

- TABLE 251 AIXAM: PRODUCT LAUNCHES

- TABLE 252 AIXAM: DEALS

- 13.1.2 LIGIER GROUP

- TABLE 253 LIGIER GROUP: BUSINESS OVERVIEW

- TABLE 254 LIGIER GROUP: PRODUCT LAUNCHES

- 13.1.3 ITALCAR INDUSTRIAL S.R.L

- TABLE 255 ITALCAR INDUSTRIAL S.R.L: BUSINESS OVERVIEW

- 13.1.4 ALKE

- TABLE 256 ALKE: BUSINESS OVERVIEW

- TABLE 257 ALKE: PRODUCT LAUNCHES

- 13.1.5 CASALINI

- TABLE 258 CASALINI: BUSINESS OVERVIEW

- 13.1.6 BELLIER AUTOMOBILES

- TABLE 259 BELLIER AUTOMOBILES: BUSINESS OVERVIEW

- 13.1.7 CITROEN

- TABLE 260 CITROEN: BUSINESS OVERVIEW

- TABLE 261 CITROEN: PRODUCT LAUNCHES

- TABLE 262 CITROEN: DEALS

- 13.1.8 RENAULT GROUP

- TABLE 263 RENAULT GROUP: BUSINESS OVERVIEW

- FIGURE 39 RENAULT GROUP: COMPANY SNAPSHOT

- 13.1.9 TOYOTA MOTOR CORPORATION

- TABLE 264 TOYOTA MOTOR CORPORATION: BUSINESS OVERVIEW

- FIGURE 40 TOYOTA MOTOR CORPORATION: COMPANY SNAPSHOT

- TABLE 265 TOYOTA MOTOR CORPORATION: PRODUCT LAUNCHES

- 13.1.10 TAZZARI GL IMOLA SPA

- TABLE 266 TAZZARI GL IMOLA SPA: BUSINESS OVERVIEW

- TABLE 267 TAZZARI GL IMOLA SPA: DEALS

- *Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 13.2 OTHER PLAYERS

- 13.2.1 HONDA MOTOR CO., LTD.

- TABLE 268 HONDA MOTOR CO., LTD.: COMPANY OVERVIEW

- 13.2.2 SUZUKI MOTOR CORPORATION

- TABLE 269 SUZUKI MOTOR CORPORATION: COMPANY OVERVIEW

- 13.2.3 GLOBAL ELECTRIC MOTORCARS (GEM)

- TABLE 270 GLOBAL ELECTRIC MOTORCARS: COMPANY OVERVIEW

- 13.2.4 GOUPIL

- TABLE 271 GOUPIL: COMPANY OVERVIEW

- 13.2.5 ESTRIMA S.P.A

- TABLE 272 ESTRIMA S.P.A: COMPANY OVERVIEW

- 13.2.6 AUTOMOBILES CHATENET

- TABLE 273 AUTOMOBILES CHATENET: COMPANY OVERVIEW

- 13.2.7 TRIGGO

- TABLE 274 TRIGGO: COMPANY OVERVIEW

- 13.2.8 PAXSTER

- TABLE 275 PAXSTER: COMPANY OVERVIEW

- 13.2.9 ZHIDOU ELECTRIC VEHICLE CO., LTD.

- TABLE 276 ZHIDOU ELECTRIC VEHICLE CO., LTD.: COMPANY OVERVIEW

- 13.2.10 WEI YUN ELECTRIC VEHICLE

- TABLE 277 WEI YUN ELECTRIC VEHICLE: COMPANY OVERVIEW

- 13.2.11 BAJAJ AUTO LTD.

- TABLE 278 BAJAJ AUTO LTD.: COMPANY OVERVIEW

- 13.2.12 ALBAMOBILITY S.R.L.

- TABLE 279 ALBAMOBILITY S.R.L.: COMPANY OVERVIEW

14 APPENDIX

- 14.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.4.1 QUADRICYCLE MARKET, BY PROPULSION

- 14.4.1.1 ELECTRIC

- 14.4.1.2 ICE

- 14.4.1 QUADRICYCLE MARKET, BY PROPULSION

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS