|

|

市場調査レポート

商品コード

1136308

醸造設備の世界市場:設備タイプ別、醸造所タイプ別(マクロブルワリー、クラフトブルワリー)、操作モード別(手動、自動、半自動)、地域別(北米、アジア太平洋、欧州、RoW) - 2027年までの予測Brewery Equipment Market by Equipment Type, Brewery Type (Macrobrewery, Craft brewery), Mode of Application (Manual, Automatic and Semi-automatic), and Region (North America, Asia Pacific, Europe and RoW) - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 醸造設備の世界市場:設備タイプ別、醸造所タイプ別(マクロブルワリー、クラフトブルワリー)、操作モード別(手動、自動、半自動)、地域別(北米、アジア太平洋、欧州、RoW) - 2027年までの予測 |

|

出版日: 2022年10月05日

発行: MarketsandMarkets

ページ情報: 英文 279 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

MarketsandMarketsによると、世界のビール製造装置市場規模は、2022年に192億米ドルとなり、2027年には256億米ドルに達し、金額ベースで5.9%のCAGRを記録すると予測されています。

所得の増加、低アルコール飲料の人気、社会的受容性の拡大により、ビール市場の重要性は高まっています。先進国、発展途上国を問わず、プレミアム低アルコールビールへの需要が高まっています。研究開発費、競合の増加、新技術が市場を新しい方向へと導いています。醸造設備に加え、より付加価値の高いエンジニアリング、デザイン、その他のサービスが提供されています。大手企業は研究開発への投資を増やし、市場にさらに浸透させるために新たな機会を探っています。技術革新の進歩に伴い、醸造機器の広い範囲は、醸造所からの需要に応じて適切な変更と付加価値と一緒に利用できるようになります。

醸造設備とは、ビールを製造するための容器や道具を指し、一般的には糖化、発酵、冷蔵、クリーンインプレイスシステムなどが含まれます。醸造設備には、製粉設備、醸造所設備、マッシュケトル、ロータータン、ワートケトル、ワールプーラー、蒸気発生器、エアレーション装置、熱水タンク、冷水タンク、実験装置、冷却装置、発酵装置、ろ過・充填装置、洗浄装置、穀物サイロ、発電機、パイプなどが含まれます。貯蔵装置、コンプレッサー、発酵装置、冷却装置、ポンプ、フィルター、セパレーターも醸造所で使用されます。各機器はあらかじめ決められた機能を持っています。例えば、穀物を粉砕するために使用される最初の機器はミリング機器であり、その後麦汁は醸造所に送られ、発酵のために準備されます。その後、エアレーション、発酵、酵母の分離、熟成、パッケージングと続きます。醸造の全工程は、穀物のでんぷんを糖に変え、その糖を水で抽出し、酵母で発酵させてアルコール度数の高い微炭酸飲料を作ることを目的としています。

"操作モード別では、自動醸造装置の利用増加が、醸造装置市場の成長を牽引"

ビール業界では、効率性&生産性向上のため、生産時間やコストを削減する自動ビール加工機器の導入が進んでいます。複雑なビール生産工程では、継続的な監視、制御、評価が必要ですが、自動醸造設備によって容易に実現することができます。自動化設備には高い初期投資が必要ですが、長い目で見れば大きなリターンが得られます。さらに、手作業にかかるコストを削減し、ビールの安全な取り扱いと製品の品質劣化を抑えることができます。

"醸造所タイプ別では、醸造所業界におけるブルーパブの人気が高まりが、醸造機器市場の成長を牽引"

最近の動向では、米国全土でブルーパブの数が増加していることが分かっています。米国の醸造所市場の3分の1以上をブルーパブが占めています。醸造所ビジネスにとって、ブルーパブは収益源を多様化し、より多くの顧客を引き付けることができる魅力的な方法です。ブリューパブは、マイクロブルワリーやテイスティングルームなどの他のクラフトビール醸造所と比較して、ビールブランドを広める良い機会を提供します。若者の社会文化の変化や、クラフトビールやノンアルコール・低アルコールビールへの需要の高まりが、世界のブルーパブ数の伸びを後押ししています。

"予測期間中、北米地域が最も高いCAGRで成長すると予測"

北米地域はビールの消費量が最も多い地域の一つであり、そのため世界のビール機器市場において重要な役割を果たすと予想されています。米国ではクラフトビールからラガービールまで、ビールの消費量が増え続けているため、この地域はビール製造装置の主要市場の1つとなっています。また、メキシコが世界最大のビール輸出国として台頭してきたことも、この地域のビール製造装置市場を牽引しています。メキシコでは、大手ビールメーカーがビール製造工場を建設中であり、市場にとって大きなチャンスとなっています。これらの動向はさらに、世界中の醸造設備メーカーからの投資を呼び込み、醸造設備市場を牽引すると予測されます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界の動向

- イントロダクション

- バリューチェーン

- サプライチェーン分析

- 醸造設備市場のマーケットマップとエコシステム

- 顧客のビジネスに影響を与える動向/ディスラプション

- 技術分析

- 価格分析

- 醸造設備市場:特許分析

- 貿易分析

- 主な会議とイベント

- ケーススタディ

- 関税と規制の状況

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

第7章 醸造設備市場:設備タイプ別

- イントロダクション

- マクロブルワリー設備

- フライス盤

- 醸造設備

- 発酵設備

- 冷却装置

- ろ過および充填装置

- その他

- クラフトブルワリー設備

- マッシング装置

- 保管設備

- コンプレッサー

- 発酵設備

- 冷却装置

- その他

第8章 醸造設備市場:操作モード別

- イントロダクション

- 手動

- 自動

- 半自動

第9章 醸造設備市場:醸造タイプ別

- イントロダクション

- マクロブルワリー

- クラフトブルワリー

- マイクロブルワリー

- ブリューパブ

- その他

第10章 醸造設備市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スイス

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- ニュージーランド

- その他アジア太平洋

- その他地域

- 南米

- 中東

- アフリカ

第11章 競合情勢

- 概要

- 市場シェア分析

- 主要企業のセグメント収益分析

- 主要企業の戦略

- 企業評価クアドラント(主要企業)

- 製品フットプリント

- 評価クアドラント(スタートアップ/中小企業)

- 競合シナリオ

第12章 企業プロファイル

- イントロダクション

- 主要企業

- ALFA LAVAL

- GEA GROUP AKTIENGESELLSCHAFT

- KRONES AG

- PAUL MUELLER COMPANY

- PRAJ INDUSTRIES

- MEURA

- CRIVELLER GROUP

- SHANGHAI HENGCHENG BEVERAGE EQUIPMENT CO, LTD

- LEHUI

- INTERPUMP GROUP S.P.A(INOXPA)

- DELLA TOFFOLA SPA

- KASPAR SCHULZ BRAUEREIMASCHINENFABRIK & APPARATEBAUANSTALT GMBH

- HYPRO

- HG MACHINERY

- ABE EQUIPMENT

- その他企業(SMES/スタートアップ)

- CEDARSTONE INDUSTRY

- ALPHA BREWING OPERATIONS

- BRAUKON GMBH

- CANADIAN CRYSTALLINE WATER INDIA LTD

- SPECIFIC MECHANICAL SYSTEM LTD

- BREWBILT MANUFACTURING INC

- SCHULZ BREWERY

- SHANDONG ZUNHUANG BREWING EQUIPMENT CO., LTD.

- CASPARY GMBH AND CO.KG

- BREW-TEK AUSTRALIA

第13章 隣接および関連市場

- イントロダクション

- 制限事項

- 飲料加工機器市場

- 食品・飲料産業用ポンプ市場

第14章 付録

According to MarketsandMarkets, the global brewery equipment market size is estimated to be valued at USD 19.2 billion in 2022 and is projected to reach USD 25.6 billion by 2027, recording a CAGR of 5.9% in terms of value. Due to rising incomes, the popularity of low-alcohol beverages, and expanding social acceptance, the beer market is becoming more significant. Both in developed and developing nations, there is a rising demand for premium low-alcohol beer. Research & development spending, increasing competition, and new technologies are steering the market in a new direction. The brewery equipment is supplemented with higher value-added engineering, design, and other services. Bigger firms are increasingly investing in R&D and exploring new opportunities to penetrate further into the market. With the advancement in innovation, a wide range of brewery equipment is made available along with value-addition with the right modification as per demand from the brewery.

Brewing equipment refers to the vessels and tools used to make beer, which typically includes saccharification, fermentation, refrigeration, and clean-in-place systems. The brewery equipment includes milling equipment, brewhouse equipment, mash kettles, lauter tun, wort kettles, whirlpoolers, steam generators, aeration devices, hot liquor tanks, cold-water tanks, and laboratory equipment, cooling equipment, fermentation equipment, filtration & filling equipment, cleaning systems, grain silos, generators, and pipes. Storage equipment, compressors, fermentation equipment, cooling equipment, pumps, filters, and separators are also used in a brewery. Each piece of equipment has pre-determined functions, like, milling equipment is the first equipment that is used for the crushing of grains then the wort is sent to the brewhouse, where the wort is prepared for fermentation. The entire process is followed by aeration, fermentation, yeast separation from young beer, aging, maturing, and packaging. The complete brewing process is intended to turn grain starches into sugar, extract the sugar with water, and then ferment the sugar with yeast to create the alcoholic, lightly carbonated beverage.

"By mode of operation, there is an increased use of automatic brewery equipment, driving the growth of brewery equipment market"

The beer industry has shown increased adoption of automated beer processing equipment to reduce the time and cost of production for greater efficiency & productivity. The complex beer production process needs continuous monitoring, controlling, and evaluation which can be easily achieved through an automated brewery setup. Although Automatic equipment requires a high initial investment it offers fast returns in the long run. It further reduces the cost involved in manual labor and is helpful for the safe handling of beer and reducing product quality damage.

"By brewery type, increase in the popularity of brewpubs in the brewery industry drives the growth of brewery equipment market"

The recent trends have shown a rise in the number of brewpubs across the US. The brewpubs account for more than one-third of the US brewery market. Brewpubs are an attractive way for brewery businesses to diversify their revenue streams and attract more customers. Brewpubs provide a good branding opportunity to promote the beer brand as compared to other craft breweries such as microbreweries and tasting rooms. The changing social culture among the youth and growing demand for craft beers and no and low alcohol beer is driving the growth in the number of brewpubs globally.

"The North America region is projected to grow at the highest CAGR during the forecast period"

The North American region has one of the highest consumptions of beer and hence is expected to play an important role in the global beer equipment market. The region is one of the major markets for brewery equipment due to the continued increase in beer consumption in the US ranging from craft beer to lager beer. The rise of Mexico as the biggest exporter of beer globally also drives the market for brewery equipment in this region. Major large-scale breweries are setting up beer manufacturing plants in Mexico which serves as a great opportunity for the market. These trends are further projected to attract investments from brewery equipment manufacturers across the globe, driving the brewery equipment market.

The break-up of Primaries:

By Value Chain Side: Demand Side-41%, Supply Side-59%

By Designation: CXOs-31%, Managers - 24%, and Executives- 45%

By Region: Europe - 25%, Asia Pacific - 15%, North America - 45%, RoW - 5%, South America-10%

Leading players profiled in this report:

- Alfa Laval (Sweden)

- GEA Group Aktiengesellschaft (Germany)

- Krones AG (Germany)

- Paul Mueller Company (US)

- Praj Industries (India)

- Meura (Belgium)

- Della Toffola SpA (Italy)

- Criveller Group (US)

- KASPAR SCHULZ Brauereimaschinenfabrik & Apparatebauanstalt GmbH (Germany)

- LEHUI (China)

- Hypro (India)

- HG Machinery (China)

- Interpump Group S.p.A (INOXPA) (Spain)

- ABE Equipment (US)

Research Coverage:

The report segments the brewery equipment market on the basis of equipment type, mode of application, brewery type, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global brewery equipment, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

- To get a comprehensive overview of the brewery equipment market

- To gain wide-ranging information about the top players in this industry, their product portfolios, and key strategies adopted by them

- To gain insights into the major countries/regions in which the brewery equipment market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2017-2021

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 BREWERY EQUIPMENT MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 BREWERY EQUIPMENT MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

- FIGURE 5 BREWERY EQUIPMENT MARKET SIZE ESTIMATION (DEMAND SIDE)

- 2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 BREWERY EQUIPMENT MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 BREWERY EQUIPMENT MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.4 ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- TABLE 2 BREWERY EQUIPMENT MARKET SHARE SNAPSHOT, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 MACROBREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022 VS. 2027 (USD MILLION)

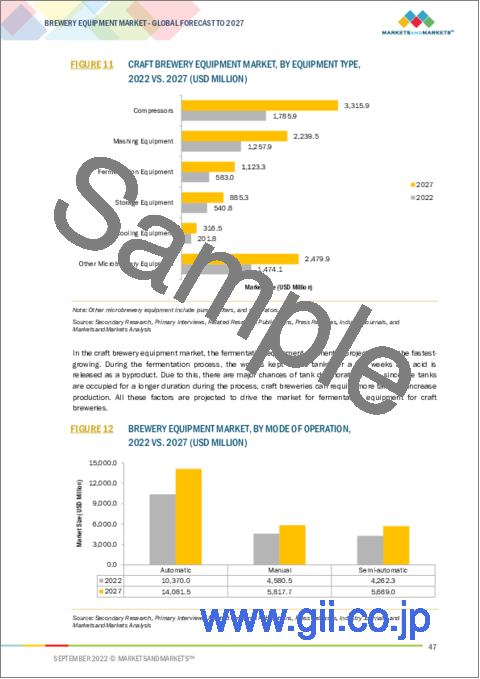

- FIGURE 11 CRAFT BREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 BREWERY EQUIPMENT MARKET, BY MODE OF OPERATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 13 BREWERY EQUIPMENT MARKET SHARE AND GROWTH RATE (VALUE), BY REGION, 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN BREWERY EQUIPMENT MARKET

- FIGURE 14 GROWTH IN NUMBER OF MICROBREWERIES & BREWPUBS AND CONTINUOUS INNOVATION TO DRIVE GLOBAL MARKET

- 4.2 BREWERY EQUIPMENT MARKET: MAJOR REGIONAL SUBMARKETS

- FIGURE 15 EUROPE WAS LARGEST MARKET GLOBALLY IN 2021

- 4.3 EUROPE: BREWERY EQUIPMENT MARKET, BY MODE OF OPERATION & COUNTRY

- FIGURE 16 GERMANY TO ACCOUNT FOR LARGEST SHARE IN EUROPEAN MARKET IN 2021

- 4.4 BREWERY EQUIPMENT MARKET, BY BREWERY TYPE

- FIGURE 17 MACROBREWERIES PROJECTED TO BE LARGER BREWERY TYPE MARKET DURING FORECAST PERIOD

- 4.5 BREWERY EQUIPMENT MARKET, BY MODE OF OPERATION

- FIGURE 18 AUTOMATIC EQUIPMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

- 4.6 BREWERY EQUIPMENT MARKET, BY BREWERY TYPE & REGION

- FIGURE 19 EUROPE TO DOMINATE MARKET FOR BREWERY EQUIPMENT DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 CULTIVATION OF CROPS ASSOCIATED WITH BEER PRODUCTION

- FIGURE 20 WORLD BARLEY PRODUCTION, 2016-2022 (MILLION TONS)

- FIGURE 21 US: HOPS HARVESTED, BY KEY STATE, 2021-2022 (ACRE)

- 5.2.2 BEER MARKET BENEFITS FROM LARGE YOUNG DEMOGRAPHIC

- FIGURE 22 NIGERIA: POPULATION, BY AGE GROUP, 2003-2021 (MILLION)

- 5.3 MARKET DYNAMICS

- FIGURE 23 BREWERY EQUIPMENT MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Mushrooming Craft Breweries drive Brewery Equipment Demand

- FIGURE 24 US: INCREASING NUMBER OF CRAFT BREWERIES, 2015-2021

- FIGURE 25 US: GROWTH IN TAPROOMS AND BREWPUBS, 2018-2021

- 5.3.1.2 Rise in consumption of beer, predominantly in developing countries

- FIGURE 26 BEER CONSUMPTION GROWTH, 2020 (KILOLITER)

- 5.3.1.3 Filling equipment gains demand by increased preference for canned beer

- 5.3.2 RESTRAINTS

- 5.3.2.1 Increase in Energy and Power Costs

- 5.3.2.2 Advertising Restrictions for Alcoholic Beverages

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 High Demand for Energy-efficient Technology

- 5.3.3.2 Beer manufacturers' demand for after-sales service to enhance operational efficiencies

- 5.3.3.3 Process Automation: Key to Modern Brewing

- 5.3.4 CHALLENGES

- 5.3.4.1 Rise in demand for Non-alcoholic and Functional Beverages

- 5.3.4.2 High equipment maintenance & startup cost

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN

- 6.2.1 RESEARCH & DEVELOPMENT

- 6.2.2 RAW MATERIAL SOURCING

- 6.2.3 MANUFACTURING

- 6.2.4 DISTRIBUTION

- 6.2.5 END USERS

- 6.2.6 POST-SALES SERVICES

- FIGURE 27 BREWERY EQUIPMENT MARKET: VALUE CHAIN

- 6.3 SUPPLY CHAIN ANALYSIS

- FIGURE 28 BREWERY EQUIPMENT MARKET: SUPPLY CHAIN

- 6.4 MARKET MAP AND ECOSYSTEM OF BREWERY EQUIPMENT MARKET

- 6.4.1 DEMAND SIDE

- 6.4.2 SUPPLY SIDE

- FIGURE 29 BREWERY EQUIPMENT MARKET: ECOSYSTEM MAP

- 6.4.3 ECOSYSTEM MAP

- TABLE 3 BREWERY EQUIPMENT MARKET: ECOSYSTEM

- 6.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 6.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN BREWERY EQUIPMENT MARKET

- FIGURE 30 REVENUE SHIFT IMPACTING TRENDS/DISRUPTIONS IN BREWERY EQUIPMENT MARKET

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 AUTOMATION

- 6.6.2 WORT OXYGENATOR

- 6.6.3 HYBRID MASH FILTER

- 6.7 PRICING ANALYSIS

- 6.7.1 SELLING PRICES CHARGED BY KEY PLAYERS IN TERMS OF BREWERY TYPE

- FIGURE 31 SELLING PRICES OF KEY PLAYERS FOR BREWERY TYPE (USD/UNIT/L)

- TABLE 4 SELLING PRICE OF KEY PLAYERS FOR EQUIPMENT TYPE, 2021 (USD/UNIT)

- 6.7.2 AVERAGE SELLING PRICE TRENDS

- FIGURE 32 AVERAGE SELLING PRICE TRENDS FOR MACROBREWERIES, 2019-2021 (USD/UNIT)

- FIGURE 33 AVERAGE SELLING PRICE TRENDS FOR CRAFT BREWERIES, 2019-2021 (USD/UNIT)

- 6.8 BREWERY EQUIPMENT MARKET: PATENT ANALYSIS

- FIGURE 34 NUMBER OF PATENTS GRANTED FOR BREWERY EQUIPMENT, 2011-2021

- FIGURE 35 REGIONAL ANALYSIS OF PATENTS GRANTED FOR BREWERY EQUIPMENT, 2019-2022

- 6.8.1 LIST OF MAJOR PATENTS

- TABLE 5 LIST OF PATENTS RELATED TO BREWERY EQUIPMENT, 2019-2022

- 6.9 TRADE ANALYSIS

- 6.9.1 EXPORT SCENARIO

- FIGURE 36 BREWERY EQUIPMENT EXPORTS, BY KEY COUNTRY, 2017-2021 (USD THOUSAND)

- TABLE 6 EXPORT DATA OF BREWERY EQUIPMENT FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- 6.9.2 IMPORT SCENARIO

- FIGURE 37 BREWERY EQUIPMENT IMPORTS, BY KEY COUNTRY, 2017-2021 (USD THOUSAND)

- TABLE 7 IMPORT DATA OF BREWERY EQUIPMENT FOR KEY COUNTRIES, 2021 (USD THOUSAND)

- 6.10 KEY CONFERENCES AND EVENTS

- TABLE 8 KEY CONFERENCES AND EVENTS IN BREWERY EQUIPMENT, 2022-2023

- 6.11 CASE STUDIES

- 6.11.1 MEURA: INCREASED ENERGY EFFICIENCY & PRODUCTION

- 6.11.2 SMART MACHINE TECHNOLOGIES, INC. (SMT): ADOPTED AUTOMATION

- 6.12 TARIFF AND REGULATORY LANDSCAPE

- 6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.2 REGULATORY FRAMEWORK

- 6.12.2.1 International Organization for Standardization (ISO)

- 6.12.2.2 North America

- 6.12.2.2.1 USFDA

- 6.12.2.3 Europe

- 6.12.2.4 Asia Pacific

- 6.12.2.4.1 India

- 6.13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 BREWERY EQUIPMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.13.1 DEGREE OF COMPETITION

- 6.13.2 BARGAINING POWER OF SUPPLIERS

- 6.13.3 BARGAINING POWER OF BUYERS

- 6.13.4 THREAT FROM SUBSTITUTES

- 6.13.5 THREAT FROM NEW ENTRANTS

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

- 6.14.2 BUYING CRITERIA

- FIGURE 39 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 15 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

7 BREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE

- 7.1 INTRODUCTION

- FIGURE 40 BASIC BREWING PROCESS

- TABLE 16 BREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017-2021 (USD MILLION)

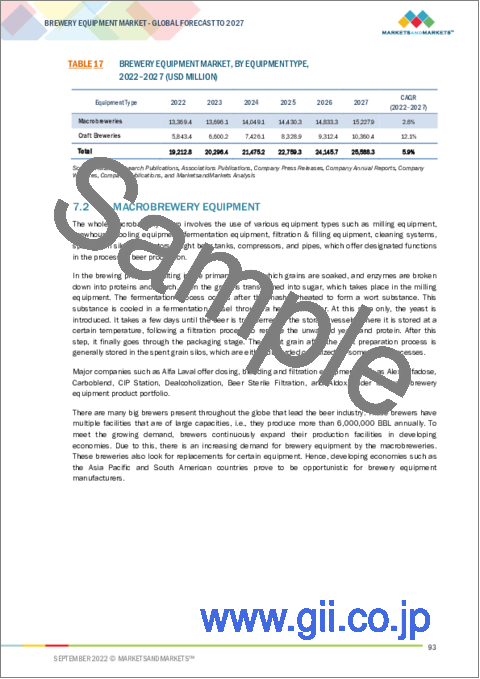

- TABLE 17 BREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- 7.2 MACROBREWERY EQUIPMENT

- TABLE 18 MACROBREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017-2021 (USD MILLION)

- TABLE 19 MACROBREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- 7.2.1 MILLING EQUIPMENT

- 7.2.1.1 Increased usage of dry milling to increase efficiency

- TABLE 20 MILLING EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 21 MILLING EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.2 BREWHOUSE EQUIPMENT

- 7.2.2.1 Economical advantage of single unit brewhouse equipment to drive growth

- TABLE 22 BREWHOUSE EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017-2021 (USD MILLION)

- TABLE 23 BREWHOUSE EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 24 BREWHOUSE EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 25 BREWHOUSE EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.2.2 Mash kettles

- TABLE 26 MASH KETTLES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 27 MASH KETTLES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.2.3 Lauter tuns

- TABLE 28 LAUTER TUNS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 29 LAUTER TUNS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.2.4 Wort kettles

- TABLE 30 WORT KETTLES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 31 WORT KETTLES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.2.5 Whirlpoolers

- TABLE 32 WHIRLPOOLERS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 33 WHIRLPOOLERS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.2.6 Steam generators

- TABLE 34 STEAM GENERATORS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 35 STEAM GENERATORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.2.7 Aeration devices

- TABLE 36 AERATION DEVICES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 37 AERATION DEVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.2.8 Other brewhouse equipment

- TABLE 38 OTHER BREWHOUSE EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 39 OTHER BREWHOUSE EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.3 FERMENTATION EQUIPMENT

- 7.2.3.1 Rise in demand for low- and high-ABV beer positively impact segment

- TABLE 40 FERMENTATION EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 41 FERMENTATION EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.4 COOLING EQUIPMENT

- 7.2.4.1 Demand for new beer flavors to enhance segment

- TABLE 42 COOLING EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 43 COOLING EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.5 FILTRATION & FILLING EQUIPMENT

- 7.2.5.1 Effective removal of external effluents through filtration for producing top-quality beer to drive market

- TABLE 44 FILTRATION & FILLING EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 45 FILTRATION & FILLING EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.2.6 OTHER MACROBREWERY EQUIPMENT

- 7.2.6.1 Cleaning systems

- 7.2.6.2 Grain silos

- 7.2.6.3 Generators

- 7.2.6.4 Pipes

- TABLE 46 OTHER MACROBREWERY EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 47 OTHER MACROBREWERY EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 CRAFT BREWERY EQUIPMENT

- TABLE 48 CRAFT BREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017-2021 (USD MILLION)

- TABLE 49 CRAFT BREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- 7.3.1 MASHING EQUIPMENT

- 7.3.1.1 Enhanced saccharification due to consistent mashing increases production efficiency

- TABLE 50 MASHING EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 51 MASHING EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3.2 STORAGE EQUIPMENT

- 7.3.2.1 Increased shelf life of beer with storage equipment to increase demand in breweries

- TABLE 52 STORAGE EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 53 STORAGE EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3.3 COMPRESSORS

- 7.3.3.1 Multiutility of rotary air compressors to drive demand in craft breweries

- TABLE 54 COMPRESSORS MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 55 COMPRESSORS MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3.4 FERMENTATION EQUIPMENT

- 7.3.4.1 Increase in demand for low- and no-alcohol craft beer to drive segment in craft breweries

- TABLE 56 CRAFT BREWERY FERMENTATION EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 57 CRAFT BREWERY FERMENTATION EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3.5 COOLING EQUIPMENT

- 7.3.5.1 Increase in brewing efficiency due to constantly maintained ideal temperature to drive segment

- TABLE 58 CRAFT BREWERY COOLING EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 59 CRAFT BREWERY COOLING EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3.6 OTHER CRAFT BREWERY EQUIPMENT

- TABLE 60 OTHER CRAFT BREWERY EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 61 OTHER CRAFT BREWERY EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

8 BREWERY EQUIPMENT MARKET, BY MODE OF OPERATION

- 8.1 INTRODUCTION

- FIGURE 41 BREWERY EQUIPMENT MARKET, BY MODE OF OPERATION, 2022 VS. 2027 (USD MILLION)

- TABLE 62 BREWERY EQUIPMENT MARKET, BY MODE OF OPERATION, 2017-2021 (USD MILLION)

- TABLE 63 BREWERY EQUIPMENT MARKET, BY MODE OF OPERATION, 2022-2027 (USD MILLION)

- 8.2 MANUAL

- 8.2.1 HIGHER DEMAND FOR TRADITIONAL HANDCRAFTED BEER TO DRIVE MANUAL PROCESSING

- TABLE 64 MANUAL BREWERY EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 65 MANUAL BREWERY EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 AUTOMATIC

- 8.3.1 QUALITY, CONSISTENCY, AND FAST PRODUCTION OF BEER THROUGH AUTOMATION TO DRIVE MARKET

- TABLE 66 AUTOMATIC BREWERY EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 67 AUTOMATIC BREWERY EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.4 SEMI-AUTOMATIC

- 8.4.1 COST-EFFECTIVENESS OF SEMI-AUTOMATIC BREWERY PROCESSING SYSTEMS AID SMALL- AND MEDIUM-SCALE BREWERIES

- TABLE 68 SEMI-AUTOMATIC BREWERY EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 69 SEMI-AUTOMATIC BREWERY EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

9 BREWERY EQUIPMENT MARKET, BY BREWERY TYPE

- 9.1 INTRODUCTION

- FIGURE 42 BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 70 BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 71 BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 72 CRAFT BREWERY EQUIPMENT MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 73 CRAFT BREWERY EQUIPMENT MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 9.2 MACROBREWERIES

- 9.2.1 EXPANSION PLANS OF LARGE BEER MANUFACTURERS DRIVE DEMAND FOR MACROBREWERY EQUIPMENT

- TABLE 74 MACROBREWERY EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 75 MACROBREWERY EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 CRAFT BREWERIES

- 9.3.1 EMERGENCE OF PREMIUM CRAFT BEER TO DRIVE DEMAND FOR CRAFT EQUIPMENT

- TABLE 76 CRAFT BREWERY EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 77 CRAFT BREWERY EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3.2 MICROBREWERIES

- 9.3.2.1 Rise in experimentation with beer flavors to drive microbrewery equipment

- TABLE 78 MICROBREWERY EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 79 MICROBREWERY EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3.3 BREWPUBS

- 9.3.3.1 Change in socio-cultural dynamics to enhance brewpub equipment market

- TABLE 80 BREWPUB EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 81 BREWPUB EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3.4 OTHER CRAFT BREWERIES

- TABLE 82 OTHER CRAFT BREWERIES EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 83 OTHER CRAFT BREWERIES EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

10 BREWERY EQUIPMENT MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 43 BREWERY EQUIPMENT MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

- FIGURE 44 REGIONAL SNAPSHOT OF BREWERY EQUIPMENT MARKET SHARE (VALUE), 2021

- 10.2 NORTH AMERICA

- TABLE 84 NORTH AMERICA: BREWERY EQUIPMENT MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 85 NORTH AMERICA: BREWERY EQUIPMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 86 NORTH AMERICA: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 87 NORTH AMERICA: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 88 NORTH AMERICA: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 89 NORTH AMERICA: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 90 NORTH AMERICA: MACROBREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017-2021 (USD MILLION)

- TABLE 91 NORTH AMERICA: MACROBREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 92 NORTH AMERICA: CRAFT BREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017-2021 (USD MILLION)

- TABLE 93 NORTH AMERICA: CRAFT BREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 94 NORTH AMERICA: BREWHOUSE EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017-2021 (USD MILLION)

- TABLE 95 NORTH AMERICA: BREWHOUSE EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 96 NORTH AMERICA: BREWERY EQUIPMENT MARKET, BY MODE OF OPERATION, 2017-2021 (USD MILLION)

- TABLE 97 NORTH AMERICA: BREWERY EQUIPMENT MARKET, BY MODE OF OPERATION, 2022-2027 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Growth of craft breweries and craft beer exports to be major driving force

- TABLE 98 US: BEER SALES VOLUME, BY BEER TYPE, 2021 (BBL)

- TABLE 99 US BREWERY COUNT FROM 2019-2021 (UNITS)

- TABLE 100 US: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 101 US: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 102 US: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 103 US: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- 10.2.2 CANADA

- 10.2.2.1 Growth in microbreweries and importance of automation for consistent product quality to drive market

- TABLE 104 CANADA: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 105 CANADA: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 106 CANADA: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 107 CANADA: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- 10.2.3 MEXICO

- 10.2.3.1 Higher export demand for beer from US to drive adoption of brewery equipment in Mexico

- TABLE 108 MEXICO: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 109 MEXICO: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 110 MEXICO: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 111 MEXICO: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- 10.3 EUROPE

- FIGURE 45 EUROPE: BREWERY EQUIPMENT MARKET SNAPSHOT

- TABLE 112 EUROPE: BREWERY EQUIPMENT MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 113 EUROPE: BREWERY EQUIPMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 114 EUROPE: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 115 EUROPE: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 116 EUROPE: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 117 EUROPE: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 118 EUROPE: MACROBREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017-2021 (USD MILLION)

- TABLE 119 EUROPE: MACROBREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 120 BREWHOUSE EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017-2021 (USD MILLION)

- TABLE 121 EUROPE: BREWHOUSE EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 122 EUROPE: CRAFT BREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017-2021 (USD MILLION)

- TABLE 123 EUROPE: CRAFT BREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 124 EUROPE: BREWERY EQUIPMENT MARKET, BY MODE OF OPERATION, 2017-2021 (USD MILLION)

- TABLE 125 EUROPE: BREWERY EQUIPMENT MARKET, BY MODE OF OPERATION, 2022-2027 (USD MILLION)

- 10.3.1 GERMANY

- 10.3.1.1 High export demand for locally manufactured brewery equipment to lead to growth

- FIGURE 46 GERMANY: NUMBER OF ACTIVE BREWERIES, 2016-2020

- TABLE 126 GERMANY: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 127 GERMANY: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 128 GERMANY: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 129 GERMANY: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Demand for premium beer to drive craft brewery equipment market

- FIGURE 47 UK: NUMBER OF ACTIVE BREWERIES, 2016-2020

- TABLE 130 UK: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 131 UK: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 132 UK: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 133 UK: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Change in consumption patterns from wine to beer to fuel demand for brewery equipment

- FIGURE 48 FRANCE: BEER CONSUMPTION, 2016-2020 ('000 HECTOLITERS)

- FIGURE 49 FRANCE: NUMBER OF MICROBREWERIES, 2016-2020

- TABLE 134 FRANCE: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 135 FRANCE: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 136 FRANCE: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 137 FRANCE: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- 10.3.4 ITALY

- 10.3.4.1 Growing per capita consumption of artisanal beer to raise demand for craft brewery equipment

- FIGURE 50 ITALY: BEER CONSUMPTION, 2016-2020 ('000 HECTOLITERS)

- TABLE 138 ITALY: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 139 ITALY: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 140 ITALY: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 141 ITALY: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- 10.3.5 SWITZERLAND

- 10.3.5.1 Rise in demand for premium and artisanal beer to account for highest growth rate of craft brewery equipment

- FIGURE 51 SWITZERLAND: NUMBER OF ACTIVE BREWERIES AND MICROBREWERIES, 2016-2020

- TABLE 142 SWITZERLAND: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 143 SWITZERLAND: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 144 SWITZERLAND: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 145 SWITZERLAND: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- 10.3.6 REST OF EUROPE

- FIGURE 52 REST OF EUROPE: NUMBER OF ACTIVE BREWERIES, 2016-2020

- TABLE 146 REST OF EUROPE: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 147 REST OF EUROPE: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 148 REST OF EUROPE: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 149 REST OF EUROPE: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- 10.4 ASIA PACIFIC

- FIGURE 53 ASIA PACIFIC: BREWERY EQUIPMENT MARKET SNAPSHOT

- TABLE 150 ASIA PACIFIC: BREWERY EQUIPMENT MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 151 ASIA PACIFIC: BREWERY EQUIPMENT MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 152 ASIA PACIFIC: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 153 ASIA PACIFIC: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 154 ASIA PACIFIC: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 155 ASIA PACIFIC: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 156 ASIA PACIFIC: MACROBREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017-2021 (USD MILLION)

- TABLE 157 ASIA PACIFIC: MACROBREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 158 ASIA PACIFIC: CRAFT BREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017-2021 (USD MILLION)

- TABLE 159 ASIA PACIFIC: CRAFT BREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 160 ASIA PACIFIC: BREWHOUSE BREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017-2021 (USD MILLION)

- TABLE 161 ASIA PACIFIC: BREWHOUSE EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 162 ASIA PACIFIC: BREWERY EQUIPMENT MARKET, BY MODE OF OPERATION, 2017-2021 (USD MILLION)

- TABLE 163 ASIA PACIFIC: BREWERY EQUIPMENT MARKET, BY MODE OF OPERATION, 2022-2027 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 Investments by leading breweries and adoption of 'mini-drinks production line' to drive market

- TABLE 164 CHINA: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 165 CHINA: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 166 CHINA: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 167 CHINA: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- 10.4.2 INDIA

- 10.4.2.1 Presence of large beer manufacturers led the market for brewery equipment

- TABLE 168 INDIA: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 169 INDIA: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 170 INDIA: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 171 INDIA: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- 10.4.3 JAPAN

- 10.4.3.1 Government intervention by tax revisions for increased sales to drive overall brewery industry

- TABLE 172 JAPAN: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 173 JAPAN: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 174 JAPAN: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 175 JAPAN: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- 10.4.4 AUSTRALIA

- 10.4.4.1 Innovations in production process and quality ingredients to enhance taste to drive market

- TABLE 176 AUSTRALIA: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 177 AUSTRALIA: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 178 AUSTRALIA: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 179 AUSTRALIA: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- 10.4.5 NEW ZEALAND

- 10.4.5.1 Tourism and innovations in low-alcohol and low-carb beer to drive market for craft brewery equipment

- FIGURE 54 ALCOHOL AVAILABLE FOR CONSUMPTION, 2021

- TABLE 180 NEW ZEALAND: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 181 NEW ZEALAND: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 182 NEW ZEALAND: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 183 NEW ZEALAND: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 184 REST OF ASIA PACIFIC: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 185 REST OF ASIA PACIFIC: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 186 REST OF ASIA PACIFIC: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 187 REST OF ASIA PACIFIC: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- 10.5 REST OF THE WORLD (ROW)

- TABLE 188 ROW: BREWERY EQUIPMENT MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 189 ROW: BREWERY EQUIPMENT MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 190 ROW: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 191 ROW: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 192 ROW: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 193 ROW: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 194 ROW: MACROBREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017-2021 (USD MILLION)

- TABLE 195 ROW: MACROBREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 196 ROW: CRAFT BREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017-2021 (USD MILLION)

- TABLE 197 ROW: CRAFT BREWERY EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 198 ROW: BREWHOUSE EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2017-2021 (USD MILLION)

- TABLE 199 ROW: BREWHOUSE EQUIPMENT MARKET, BY EQUIPMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 200 ROW: BREWERY EQUIPMENT MARKET EQUIPMENT MARKET, BY MODE OF OPERATION, 2017-2021 (USD MILLION)

- TABLE 201 ROW: BREWERY EQUIPMENT MARKET EQUIPMENT MARKET, BY MODE OF OPERATION, 2022-2027 (USD MILLION)

- 10.5.1 SOUTH AMERICA

- 10.5.1.1 Establishment of large breweries and demand for premium and super premium beers to steer growth

- TABLE 202 SOUTH AMERICA: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 203 SOUTH AMERICA: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 204 SOUTH AMERICA: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 205 SOUTH AMERICA: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Tourism industry and relaxation in alcohol laws lead to surge in market growth

- TABLE 206 MIDDLE EAST: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 207 MIDDLE EAST: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 208 MIDDLE EAST: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 209 MIDDLE EAST: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- 10.5.3 AFRICA

- 10.5.3.1 Major investments for establishment of microbreweries in African countries to fuel growth

- TABLE 210 AFRICA: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 211 AFRICA: BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

- TABLE 212 AFRICA: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2017-2021 (USD MILLION)

- TABLE 213 AFRICA: CRAFT BREWERY EQUIPMENT MARKET, BY BREWERY TYPE, 2022-2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS

- TABLE 214 BREWERY EQUIPMENT MARKET: DEGREE OF COMPETITION (FRAGMENTED)

- 11.3 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 55 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2017-2021 (USD MILLION)

- 11.4 KEY PLAYER STRATEGIES

- TABLE 215 STRATEGIES ADOPTED BY KEY BREWERY EQUIPMENT MANUFACTURERS

- 11.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 56 BREWERY EQUIPMENT MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- 11.6 PRODUCT FOOTPRINT

- TABLE 216 COMPANY FOOTPRINT, BY BREWERY TYPE

- TABLE 217 COMPANY FOOTPRINT, BY EQUIPMENT TYPE

- TABLE 218 COMPANY FOOTPRINT, BY REGION

- TABLE 219 OVERALL COMPANY FOOTPRINT

- 11.7 EVALUATION QUADRANT (STARTUPS/SMES)

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 STARTING BLOCKS

- 11.7.3 RESPONSIVE COMPANIES

- 11.7.4 DYNAMIC COMPANIES

- FIGURE 57 BREWERY EQUIPMENT MARKET: COMPANY EVALUATION QUADRANT, 2021 (STARTUPS/SMES)

- 11.7.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 220 BREWERY EQUIPMENT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 221 BREWERY EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 PRODUCT LAUNCHES

- TABLE 222 BREWERY EQUIPMENT MARKET: NEW PRODUCT LAUNCHES, 2021-2022

- 11.8.2 DEALS

- TABLE 223 BREWERY EQUIPMENT MARKET: DEALS, 2019-2022

12 COMPANY PROFILES

- 12.1 INTRODUCTION

(Business overview, Products/Solutions/Services offered, Recent developments & MnM View)**

- 12.2 KEY PLAYERS

- 12.2.1 ALFA LAVAL

- TABLE 224 ALFA LAVAL: BUSINESS OVERVIEW

- FIGURE 58 ALFA LAVAL: COMPANY SNAPSHOT

- TABLE 225 ALFA LAVAL: PRODUCTS OFFERED

- TABLE 226 ALFA LAVAL: NEW PRODUCT LAUNCHES

- TABLE 227 ALFA LAVAL: DEALS

- 12.2.2 GEA GROUP AKTIENGESELLSCHAFT

- TABLE 228 GEA GROUP AKTIENGESELLSCHAFT: BUSINESS OVERVIEW

- FIGURE 59 GEA GROUP AKTIENGESELLSCHAFT: COMPANY SNAPSHOT

- TABLE 229 GEA GROUP AKTIENGESELLSCHAFT: PRODUCTS OFFERED

- TABLE 230 GEA GROUP AKTIENGESELLSCHAFT: NEW PRODUCT LAUNCHES

- 12.2.3 KRONES AG

- TABLE 231 KRONES AG: BUSINESS OVERVIEW

- FIGURE 60 KRONES AG: COMPANY SNAPSHOT

- TABLE 232 KRONES AG: PRODUCTS OFFERED

- TABLE 233 KRONES AG: NEW PRODUCT LAUNCHES

- 12.2.4 PAUL MUELLER COMPANY

- TABLE 234 PAUL MUELLER COMPANY: BUSINESS OVERVIEW

- FIGURE 61 PAUL MUELLER COMPANY: COMPANY SNAPSHOT

- TABLE 235 PAUL MUELLER COMPANY: PRODUCTS OFFERED

- 12.2.5 PRAJ INDUSTRIES

- TABLE 236 PRAJ INDUSTRIES: BUSINESS OVERVIEW

- FIGURE 62 PRAJ INDUSTRIES: COMPANY SNAPSHOT

- TABLE 237 PRAJ INDUSTRIES: PRODUCTS OFFERED

- 12.2.6 MEURA

- TABLE 238 MEURA: BUSINESS OVERVIEW

- TABLE 239 MEURA: PRODUCTS OFFERED

- TABLE 240 MEURA: NEW PRODUCT LAUNCHES

- 12.2.7 CRIVELLER GROUP

- TABLE 241 CRIVELLER GROUP: BUSINESS OVERVIEW

- TABLE 242 CRIVELLER GROUP: PRODUCTS OFFERED

- 12.2.8 SHANGHAI HENGCHENG BEVERAGE EQUIPMENT CO, LTD

- TABLE 243 SHANGHAI HENGCHENG BEVERAGE EQUIPMENT CO, LTD: BUSINESS OVERVIEW

- TABLE 244 SHANGHAI HENGCHENG BEVERAGE EQUIPMENT CO, LTD: PRODUCTS OFFERED

- TABLE 245 SHANGHAI HENGCHENG BEVERAGE EQUIPMENT CO, LTD: NEW PRODUCT LAUNCHES

- 12.2.9 LEHUI

- TABLE 246 LEHUI: BUSINESS OVERVIEW

- TABLE 247 LEHUI: PRODUCTS OFFERED

- 12.2.10 INTERPUMP GROUP S.P.A (INOXPA)

- TABLE 248 INTERPUMP GROUP S.P.A (INOXPA): BUSINESS OVERVIEW

- TABLE 249 INTERPUMP INOXPA (INOXPA): PRODUCTS OFFERED

- 12.2.11 DELLA TOFFOLA SPA

- TABLE 250 DELLA TOFFOLA SPA: BUSINESS OVERVIEW

- TABLE 251 DELLA TOFFOLA SPA: PRODUCTS OFFERED

- TABLE 252 DELLA TOFFOLA SPA: DEALS

- 12.2.12 KASPAR SCHULZ BRAUEREIMASCHINENFABRIK & APPARATEBAUANSTALT GMBH

- TABLE 253 KASPAR SCHULZ BRAUEREIMASCHINENFABRIK & APPARATEBAUANSTALT GMBH: BUSINESS OVERVIEW

- TABLE 254 KASPAR SCHULZ BRAUEREIMASCHINENFABRIK & APPARATEBAUANSTALT GMBH: PRODUCTS OFFERED

- TABLE 255 KASPAR SCHULZ BRAUEREIMASCHINENFABRIK & APPARATEBAUANSTALT GMBH: DEALS

- 12.2.13 HYPRO

- TABLE 256 HYPRO: BUSINESS OVERVIEW

- TABLE 257 HYPRO: PRODUCTS OFFERED

- 12.2.14 HG MACHINERY

- TABLE 258 HG MACHINERY: BUSINESS OVERVIEW

- TABLE 259 HG MACHINERY: PRODUCTS OFFERED

- 12.2.15 ABE EQUIPMENT

- TABLE 260 ABE EQUIPMENT: BUSINESS OVERVIEW

- TABLE 261 ABE EQUIPMENT: PRODUCTS OFFERED

- 12.3 OTHER PLAYERS (SMES/STARTUPS)

- 12.3.1 CEDARSTONE INDUSTRY

- 12.3.1.1 Business overview

- TABLE 262 CEDARSTONE INDUSTRY: BUSINESS OVERVIEW

- TABLE 263 CEDARSTONE INDUSTRY: PRODUCTS OFFERED

- 12.3.2 ALPHA BREWING OPERATIONS

- TABLE 264 ALPHA BREWING OPERATIONS: BUSINESS OVERVIEW

- TABLE 265 ALPHA BREWING OPERATIONS: PRODUCTS OFFERED

- 12.3.3 BRAUKON GMBH

- TABLE 266 BRAUKON GMBH: BUSINESS OVERVIEW

- TABLE 267 BRAUKON GMBH: PRODUCTS OFFERED

- TABLE 268 BRAUKON GMBH: DEALS

- 12.3.4 CANADIAN CRYSTALLINE WATER INDIA LTD

- TABLE 269 CANADIAN CRYSTALLINE WATER INDIA LTD: BUSINESS OVERVIEW

- TABLE 270 CANADIAN CRYSTALLINE WATER INDIA LTD: PRODUCTS OFFERED

- 12.3.5 SPECIFIC MECHANICAL SYSTEM LTD

- TABLE 271 SPECIFIC MECHANICAL SYSTEM LTD: BUSINESS OVERVIEW

- TABLE 272 SPECIFIC MECHANICAL SYSTEM LTD: PRODUCTS OFFERED

- 12.3.6 BREWBILT MANUFACTURING INC

- TABLE 273 BREWBILT MANUFACTURING INC: BUSINESS OVERVIEW

- TABLE 274 BREWBILT MANUFACTURING INC: PRODUCTS OFFERED

- 12.3.7 SCHULZ BREWERY

- 12.3.8 SHANDONG ZUNHUANG BREWING EQUIPMENT CO., LTD.

- 12.3.9 CASPARY GMBH AND CO.KG

- 12.3.10 BREW-TEK AUSTRALIA

- 12.3.1 CEDARSTONE INDUSTRY

- *Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- TABLE 275 MARKETS ADJACENT TO BREWERY EQUIPMENT

- 13.2 LIMITATIONS

- 13.3 BEVERAGE PROCESSING EQUIPMENT MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.3 BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE

- TABLE 276 BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 277 BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2021-2026 (USD MILLION)

- 13.3.4 BEVERAGE PROCESSING EQUIPMENT MARKET, BY REGION

- 13.3.4.1 North America

- TABLE 278 NORTH AMERICA: BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 279 NORTH AMERICA: BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2021-2026 (USD MILLION)

- 13.3.4.2 Europe

- TABLE 280 EUROPE: BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 281 EUROPE: BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2021-2026 (USD MILLION)

- 13.3.4.3 Asia Pacific

- TABLE 282 ASIA PACIFIC: BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 283 ASIA PACIFIC: BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2021-2026 (USD MILLION)

- 13.3.4.4 Rest of the World (RoW)

- TABLE 284 ROW: BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2017-2020 (USD MILLION)

- TABLE 285 ROW: BEVERAGE PROCESSING EQUIPMENT MARKET, BY TYPE, 2021-2026 (USD MILLION)

- 13.4 FOOD & BEVERAGE INDUSTRY PUMPS MARKET

- 13.4.1 MARKET DEFINITION

- 13.4.2 MARKET OVERVIEW

- 13.4.3 FOOD & BEVERAGES INDUSTRY PUMPS, BY TYPE

- 13.4.3.1 Introduction

- TABLE 286 FOOD & BEVERAGE INDUSTRY PUMPS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 287 FOOD & BEVERAGE INDUSTRY PUMPS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 13.4.4 FOOD & BEVERAGES INDUSTRY PUMPS, BY REGION

- 13.4.4.1 Introduction

- TABLE 288 FOOD & BEVERAGES INDUSTRY PUMPS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 289 FOOD & BEVERAGES INDUSTRY PUMPS MARKET, BY REGION, 2022-2027 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS