|

|

市場調査レポート

商品コード

1128166

EaaS (Energy as a Service) の世界市場:種類別 (エネルギー供給サービス、運用・保守サービス、エネルギー効率化・最適化サービス)・エンドユーザー別 (商業、産業)・地域別の将来予測 (2027年まで)Energy as a Service Market by Type (Energy Supply Services, Operational and Maintenance Services, and Energy Efficiency and Optimization Services) End-User (Commercial and Industrial) and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| EaaS (Energy as a Service) の世界市場:種類別 (エネルギー供給サービス、運用・保守サービス、エネルギー効率化・最適化サービス)・エンドユーザー別 (商業、産業)・地域別の将来予測 (2027年まで) |

|

出版日: 2022年09月14日

発行: MarketsandMarkets

ページ情報: 英文 189 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

EaaS (Energy as a Service) 市場は、2022年の647億米ドルから、2027年には1,056億米ドルに達すると予測され、予測期間中のCAGRは10.3%となる見込みです。

各種の技術進歩により、各種の自然エネルギー・貯蔵システムのコストがここ最近で大幅に低下しています。再生可能エネルギーと蓄電ソリューションの価格低下は、EaaSの利用を促進し、電力会社がエネルギーコストを削減するのに役立っています。また、今日の化石燃料市場は価格変動が激しく、予測不可能な価格により、政府は低コストの代替エネルギーよりも大きなコスト負担を強いられています。したがって、あらゆる要因がこれらの選択肢をより現実的で手頃なものにしています。

"2022年から2027年にかけて、種類別ではエネルギー供給サービス分野が最も成長する市場になる"

エネルギー供給サービスとは、建物のエネルギー需要を外部の企業(通常は電力会社やサービスプロバイダー)が引き受けるというものです。エネルギー供給サービスでは、従来型送電網に接続された商業施設や産業施設を、運営を脅かすような送電網の停電や異常気象から保護することができます。

"エンドユーザー別では、商業セグメントが最大の市場になる (2022年~2027年)"

商業分野 (医療、教育機関、空港、データセンター、レジャーセンター、倉庫、ホテルなど) の電気料金は、工業分野よりも高いため、顧客は、資本支出なしでエネルギー効率化プロジェクトを実施し、省エネを検証するためのソリューションを求めています。したがって、エネルギー消費需要の増加と商業用エネルギー価格の上昇が、この分野を牽引すると予想されます。

"北米":EaaS市場で最大かつ最速で成長している地域"

北米は、世界のEaaS市場を独占し、2022年~2027年の間に最も高いCAGRで成長すると予測されています。域内の主要な成長推進要因の1つに、エンドユーザー向けに技術・解析・個別化サービスを提供できることにあります。一方、北米の送電インフラは今日の脅威や自然災害に対して更新されていません。EaaSを活用すれば、脅威や危険の影響を受けることなく、地域全体で電力利用が可能な信頼性・柔軟性を提供できます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- COVID-19の影響

- マーケットマップ

- バリューチェーン分析

- ポーターのファイブフォース分析

第6章 EaaS (Energy as a Service) 市場:種類別

- イントロダクション

- エネルギー供給サービス

- 運用・保守サービス

- 省エネ・最適化サービス

第7章 EaaS (Energy as a Service) 市場:エンドユーザー別

- イントロダクション

- 商業

- 工業

第8章 EaaS (Energy as a Service) 市場:地域別

- イントロダクション

- 北米

- 種類別

- エンドユーザー別

- 国別

- アジア太平洋

- 欧州

- 中東・アフリカ

- 南米

第9章 競合情勢

- 主要企業の戦略

- 上位5社の市場シェア分析

- 主要企業の評価クアドラント

- EaaS (Energy as a Service) 市場:企業のフットプリント

- 競合シナリオ

第10章 企業プロファイル

- イントロダクション

- 主要企業

- ENGIE

- ENEL X

- SCHNEIDER ELECTRIC

- AMERESCO

- SIEMENS

- GENERAL ELECTRIC

- HONEYWELL

- JOHNSON CONTROLS

- EDF RENEWABLE ENERGY

- EDISON

- ALPIQ

- VEOLIA

- ORSTED

- CENTRICA

- WGL ENERGY

- その他の企業

- BERNHARD ENERGY SOLUTIONS

- ENTEGRITY

- SMARTWATT

- ENERTIKA

- NORSECO

- WENDEL ENERGY SERVICE

第11章 付録

The energy as a service market is projected to reach USD 105.6 billion by 2027 from an estimated USD 64.7 billion in 2022, at a CAGR of 10.3% during the forecast period. Due to the manufacturing advances and various technological improvements, the costs of various renewables and storage systems such as solar PVs, fuel cells, grid-based energy storage, especially batteries, and combined heat and power declined significantly in the recent times. The decreasing costs of solar PV are encouraging users to install these resources for generating electricity. These decreasing prices of the renewables and storage solutions have positively promoted the energy as a service approach as it is helping the utilities implement the same and helping various end-users reduce their energy costs. Also, with the price volatility found in today's fossil fuels markets, unpredictable prices are costing the government substantially more than lower cost alternatives. For instance, solar power can be generated and used during peak times to offset the costly high-demand electricity mentioned above. The use of solar power can not only reduce the overall electricity usage but also helps avoid demand charges. Hence, all factors are making these options more viable and affordable.

The deployment of various renewable energy sources has its own technical and feasibility considerations. They also have some capacity constraints such as restricted supplies of basic raw material inputs, limitations on manufacturing capacity, competition for larger construction project management and equipment, and limited trained workforce. Environment clearances and land acquisition have been the major issues for the delay in project execution. For instance, if a customer has already deployed smart lighting, an energy as a service provider could face trouble integrating the same with their platform for analyzing and automating the same using their proprietary platform. Hence, there is a need for a streamlined business process, effective controls, and transparency. In addition, several diverse and emerging technologies, such as connected devices and monitoring platforms, need to communicate . seamlessly with each other to achieve energy cost savings through constant monitoring and automation.

"The energy supply services segment, by type, is expected to be the fastest growing market from 2022 to 2027"

There are three types of services are considered in the report energy supply services, operational and maintenance services and energy efficiency and optimization services. Energy supply services refer to the idea where a building's energy requirements are taken care of by an outside company, typically utilities or service providers. Energy supply services protect end-users from grid blackouts and weather extremes that would threaten the operations of a traditional grid connected commercial and industrial entities. In energy as a service operation, energy supply services are increasingly delivered through Energy Services Agreements (ESAs) that are performance-based contracts through which a service provider agrees to finance, develop, and deploy renewable energy projects for clients without any upfront capital expenditures. In addition to this, consumers do not have any responsibility to maintain and upgrade the equipment.

"The commercial segment, by end-user, is expected to be the largest market from 2022 to 2027"

The end-user segment have two types includes commercial and industrial end-users. The commercial segment includes establishments such as healthcare, educational institutions, airports, data centers, leisure centers, warehouses, hotels, and others. Electricity prices for the commercial sector are higher than the industrial sector. Hence, customers are looking for a solution that helps them implement energy-efficiency projects with no capital expenditure and validate energy savings. Therefore, increase in the energy consumption demand and commercial energy prices is expected to drive the segment.

"North America: The largest and the fastest growing region in the energy as a service market"

North America is expected to dominate the global energy as a service market and is expected to grow at the highest CAGR between 2022-2027. One of the major drivers for the energy as a service business model in the region is the ability to incorporate technology, analytics, and personalized services for end users. North America's electrical transmission infrastructure is not upgraded for modern threats and natural hazards. Energy as a service would provide the reliability and flexibility that would enable expanded use of electricity across the region without getting affected by threats and hazards.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

- By Company Type: Tier 1- 40%, Tier 2- 35%, and Tier 3- 25%

- By Designation: C-Level- 30%, D-Level- 20%, and Others- 50%

- By Region: Asia Pacific- 60%, North America - 10%, Europe - 18%, Middle East & Africa - 8%, and South America- 4%

Note: "Others" include sales managers, engineers, and regional managers

The tiers of the companies are defined based on their total revenue as of 2021: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: <USD 500 million

The energy as a service market is dominated by major globally established players. The leading players in the energy as a service market are ENGIE (France), Enel X (Italy), Schneider Electric (France), Ameresco (US), Siemens (France), General Electric (US), Veolia (France), Honeywell (US), Centrica (Netherlands), Alpiq (Switzerland), WGL Energy (US), Orsted (Denmark), Bernhard Energy Solutions (US) and others.

Study Coverage:

The report defines, describes, and forecasts the energy as a service market, by type (energy supply services, operational and maintenance services and energy efficiency and optimization services), end-user (commercial and industrial) and region (Asia Pacific, North America, Europe, Middle East & Africa, and South America). It also offers a detailed qualitative and quantitative analysis of the market.

The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market, which include the analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the energy as a service market.

Key Benefits of Buying the Report

- 1. The report identifies and addresses the key markets for energy as a service, which would help end-users to grow the demand.

- 2. The report helps system providers understand the pulse of the market and provides insights into drivers, restraints, opportunities, and challenges.

- 3. The report will help key players understand the strategies of their competitors better and help them in making better strategic decisions.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.3.1 ENERGY AS A SERVICE MARKET, BY TYPE

- 1.3.2 ENERGY AS A SERVICE MARKET, BY END USER

- 1.3.3 ENERGY AS A SERVICE MARKET, BY REGION

- 1.4 MARKET SCOPE

- 1.4.1 ENERGY AS A SERVICE MARKET SEGMENTATION

- 1.4.2 REGIONAL SCOPE

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- 1.7 LIMITATIONS

- 1.8 STAKEHOLDERS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 ENERGY AS A SERVICE MARKET: RESEARCH DESIGN

- 2.2 DATA TRIANGULATION

- 2.2.1 ENERGY AS A SERVICE MARKET ANALYSIS THROUGH PRIMARY INTERVIEWS

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

- 2.2.2 SECONDARY DATA

- 2.2.2.1 Key data from secondary sources

- 2.2.3 PRIMARY DATA

- 2.2.3.1 Key data from primary sources

- 2.2.3.2 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE METRICS

- FIGURE 6 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR ENERGY AS A SERVICE

- 2.3.4 CALCULATION FOR DEMAND-SIDE METRICS

- 2.3.5 RESEARCH ASSUMPTIONS FOR DEMAND-SIDE METRICS

- 2.3.6 SUPPLY-SIDE ANALYSIS

- FIGURE 7 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY-SIDE OF ENERGY AS A SERVICE MARKET

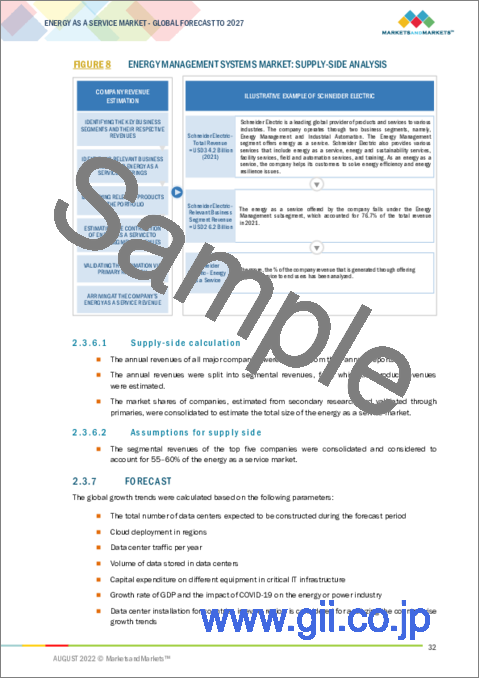

- FIGURE 8 ENERGY MANAGEMENT SYSTEMS MARKET: SUPPLY-SIDE ANALYSIS

- 2.3.6.1 Supply-side calculation

- 2.3.6.2 Assumptions for supply side

- 2.3.7 FORECAST

- 2.4 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 1 ENERGY AS A SERVICE MARKET SNAPSHOT

- FIGURE 9 NORTH AMERICA DOMINATED ENERGY AS A SERVICE MARKET IN 2021

- FIGURE 10 ENERGY SUPPLY SERVICES EXPECTED TO HOLD LARGER MARKET SHARE BETWEEN 2022 AND 2027

- FIGURE 11 COMMERCIAL SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR MARKET PLAYERS IN ENERGY AS A SERVICE MARKET

- 4.1.1 DECREASING COST OF RENEWABLE POWER GENERATION AND STORAGE SOLUTIONS TO DRIVE MARKET FROM 2022 TO 2027

- 4.2 ENERGY AS A SERVICE MARKET, BY REGION

- FIGURE 12 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 NORTH AMERICA: ENERGY AS A SERVICE MARKET, BY TYPE AND COUNTRY, 2021

- FIGURE 13 ENERGY SUPPLY SERVICES AND US HELD LARGEST MARKET SHARES IN NORTH AMERICA

- 4.4 ENERGY AS A SERVICE MARKET, BY TYPE

- FIGURE 14 ENERGY SUPPLY SERVICES EXPECTED TO ACCOUNT FOR LARGER MARKET SHARE IN 2027

- 4.5 ENERGY AS A SERVICE MARKET, BY END USER

- FIGURE 15 COMMERCIAL SEGMENT PROJECTED TO DOMINATE MARKET IN 2027

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 ENERGY AS A SERVICE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 New revenue generation streams for utilities

- 5.2.1.2 Increasing distributed energy resources

- FIGURE 17 GLOBAL ANNUAL INSTALLED SOLAR CAPACITY FROM 2011 TO 2021 (GW)

- 5.2.1.3 Decreasing cost of renewable power generation and storage solutions

- FIGURE 18 GLOBAL AVERAGE INSTALLED COST FOR SOLAR PV, 2010-2020 (USD PER KILOWATT)

- 5.2.1.4 Availability of federal and state tax benefits for energy-efficient projects

- 5.2.2 RESTRAINTS

- 5.2.2.1 Integration and deployment challenges

- 5.2.2.2 Dominance of existing centralized utility models

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Deeper operational and maintenance savings

- TABLE 2 RECENT ILLUSTRATIONS OF OPERATIONS AND MAINTENANCE SERVICES BY MAJOR PLAYERS

- 5.2.3.2 Increasing use of energy-efficient technologies

- TABLE 3 POTENTIAL LIST OF EFFICIENCY MEASURES IN END-USE SECTORS

- 5.2.4 CHALLENGES

- 5.2.4.1 Uncertainty about agreement structure

- 5.2.4.2 Building ownership constraints

- 5.3 COVID-19 IMPACT

- 5.4 MARKET MAP

- FIGURE 19 MARKET MAP: ENERGY AS A SERVICE MARKET

- TABLE 4 ENERGY AS A SERVICE MARKET PLAYERS: ROLE IN ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 20 VALUE CHAIN ANALYSIS: ENERGY AS A SERVICE MARKET

- 5.5.1 ENERGY AS A SERVICE SOLUTIONS ARCHITECT & PROJECT DEVELOPERS

- 5.5.2 MARKET OPERATIONS

- 5.5.3 ONGOING MANAGEMENT

- 5.5.4 END USERS

- 5.5.5 POST-SALES SERVICES

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 PORTER'S FIVE FORCES ANALYSIS FOR ENERGY AS A SERVICE MARKET

- TABLE 5 ENERGY AS A SERVICE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF SUBSTITUTES

- 5.6.2 BARGAINING POWER OF SUPPLIERS

- 5.6.3 BARGAINING POWER OF BUYERS

- 5.6.4 THREAT OF NEW ENTRANTS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

6 ENERGY AS A SERVICE MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 22 ENERGY AS A SERVICE MARKET, BY TYPE, 2021

- TABLE 6 ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 6.2 ENERGY SUPPLY SERVICES

- 6.2.1 ENERGY RESILIENCY AND IMMUNITY FROM TRADITIONAL GRID CONSTRAINTS

- TABLE 7 ENERGY SUPPLY SERVICES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.3 OPERATIONAL AND MAINTENANCE SERVICES

- 6.3.1 ASSET LIFECYCLE ENHANCEMENT AND PREVENTION OF DOWNTIME

- TABLE 8 OPERATIONAL AND MAINTENANCE SERVICES MARKET, BY REGION, 2020-2027 (USD MILLION)

- 6.4 ENERGY-EFFICIENCY AND OPTIMIZATION SERVICES

- 6.4.1 INCENTIVES FOR ENERGY EFFICIENCY AND NEED TO REDUCE ENERGY CONSUMPTION

- TABLE 9 ENERGY-EFFICIENCY AND OPTIMIZATION SERVICES MARKET, BY REGION, 2020-2027 (USD MILLION)

7 ENERGY AS A SERVICE MARKET, BY END USER

- 7.1 INTRODUCTION

- FIGURE 23 COMMERCIAL SEGMENT DOMINATED ENERGY AS A SERVICE MARKET IN 2021

- TABLE 10 ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

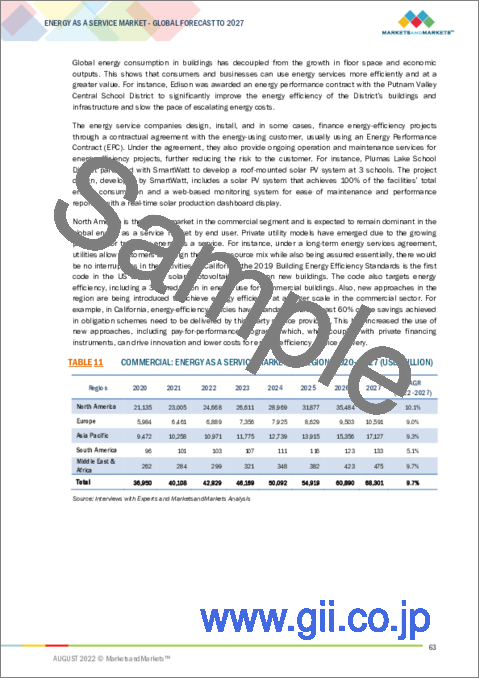

- 7.2 COMMERCIAL

- 7.2.1 INCREASING DEMAND FOR ENERGY AND RISING COMMERCIAL ENERGY PRICES

- TABLE 11 COMMERCIAL: ENERGY AS A SERVICE MARKET, BY REGION, 2020-2027 (USD MILLION)

- 7.3 INDUSTRIAL

- 7.3.1 INCREASE IN PRODUCTION ACROSS INDUSTRIES AND POTENTIAL ENERGY-EFFICIENCY IMPROVEMENTS

- FIGURE 24 ENERGY CONSUMPTION BY INDUSTRIAL SEGMENT FROM 2012-2025

- TABLE 12 INDUSTRIAL: ENERGY AS A SERVICE MARKET, BY REGION, 2020-2027 (USD MILLION)

8 ENERGY AS A SERVICE MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 25 ENERGY AS A SERVICE MARKET SHARE, BY REGION, 2021 (%)

- FIGURE 26 ASIA PACIFIC ENERGY AS A SERVICE MARKET TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

- TABLE 13 ENERGY AS A SERVICE MARKET, BY REGION, 2020-2027 (USD MILLION)

- 8.2 NORTH AMERICA

- FIGURE 27 NORTH AMERICA: ENERGY AS A SERVICE MARKET SNAPSHOT

- 8.2.1 BY TYPE

- TABLE 14 NORTH AMERICA: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.2.2 BY END USER

- TABLE 15 NORTH AMERICA: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.2.3 BY COUNTRY

- TABLE 16 NORTH AMERICA: ENERGY AS A SERVICE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.2.3.1 US

- 8.2.3.1.1 Need to reduce carbon footprint and increase energy efficiency

- 8.2.3.2 By type

- 8.2.3.1 US

- TABLE 17 US: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.2.3.3 By end user

- TABLE 18 US: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.2.3.4 Canada

- 8.2.3.4.1 Need for clean energy future and reduction of long-term energy demand

- 8.2.3.5 By type

- 8.2.3.4 Canada

- TABLE 19 CANADA: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.2.3.6 By end user

- TABLE 20 CANADA: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.2.3.7 Mexico

- 8.2.3.7.1 Rise in number of policies to support energy infrastructure growth and rising demand for renewable energy

- 8.2.3.8 By type

- 8.2.3.7 Mexico

- TABLE 21 MEXICO: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.2.3.9 By end user

- TABLE 22 MEXICO: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.3 ASIA PACIFIC

- FIGURE 28 ASIA PACIFIC: ENERGY AS A SERVICE MARKET SNAPSHOT

- 8.3.1 BY TYPE

- TABLE 23 ASIA PACIFIC: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.3.2 BY END USER

- TABLE 24 ASIA PACIFIC: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.3.3 BY COUNTRY

- TABLE 25 ASIA PACIFIC: ENERGY AS A SERVICE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.3.3.1 China

- 8.3.3.1.1 Extensive energy consumption in hard-to-abate sectors to drive market growth

- 8.3.3.2 By type

- 8.3.3.1 China

- TABLE 26 CHINA: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.3.3.3 By end user

- TABLE 27 CHINA: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.3.3.4 Japan

- 8.3.3.4.1 Increasing energy prices and need to reduce dependency on imported fuels

- 8.3.3.5 By type

- 8.3.3.4 Japan

- TABLE 28 JAPAN: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.3.3.6 By end user

- TABLE 29 JAPAN: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.3.3.7 Australia

- 8.3.3.7.1 Grid reliability and need for energy-efficiency projects

- 8.3.3.8 By type

- 8.3.3.7 Australia

- TABLE 30 AUSTRALIA: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.3.3.9 By end user

- TABLE 31 AUSTRALIA: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.3.3.10 Rest of Asia Pacific

- 8.3.3.11 By type

- TABLE 32 REST OF ASIA PACIFIC: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.3.3.12 By end user

- TABLE 33 REST OF ASIA PACIFIC: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.4 EUROPE

- 8.4.1 BY TYPE

- TABLE 34 EUROPE: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.4.2 BY END USER

- TABLE 35 EUROPE: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.4.3 BY COUNTRY

- TABLE 36 EUROPE: ENERGY AS A SERVICE MARKET SIZE, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.4.3.1 Germany

- 8.4.3.1.1 Need to adopt renewable energy sources and reduce carbon emissions

- 8.4.3.2 By type

- 8.4.3.1 Germany

- TABLE 37 GERMANY: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.4.3.3 By end user

- TABLE 38 GERMANY: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.4.3.4 Italy

- 8.4.3.4.1 Development of sustainable energy sector and need to reduce energy cost

- 8.4.3.5 By type

- 8.4.3.4 Italy

- TABLE 39 ITALY: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.4.3.6 By end user

- TABLE 40 ITALY: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.4.3.7 UK

- 8.4.3.7.1 Need for energy security and volatile energy prices

- 8.4.3.8 By type

- 8.4.3.7 UK

- TABLE 41 UK: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.4.3.9 By end user

- TABLE 42 UK: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.4.3.10 France

- 8.4.3.10.1 Investments in renewable technologies and growing demand for renewable power

- 8.4.3.11 By type

- 8.4.3.10 France

- TABLE 43 FRANCE: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.4.3.12 By end user

- TABLE 44 FRANCE: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.4.3.13 Spain

- 8.4.3.13.1 Growing need to maintain grid stability and increase energy efficiency

- 8.4.3.14 By type

- 8.4.3.13 Spain

- TABLE 45 SPAIN: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.4.3.15 By end user

- TABLE 46 SPAIN: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.4.3.16 Rest of Europe

- 8.4.3.17 By type

- TABLE 47 REST OF EUROPE: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.4.3.18 By end user

- TABLE 48 REST OF EUROPE: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.5 MIDDLE EAST & AFRICA

- 8.5.1 BY TYPE

- TABLE 49 MIDDLE EAST & AFRICA: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.5.2 BY END USER

- TABLE 50 MIDDLE EAST & AFRICA: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.5.3 BY COUNTRY

- TABLE 51 MIDDLE EAST & AFRICA: ENERGY AS A SERVICE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.5.3.1 Saudi Arabia

- 8.5.3.1.1 Shift to non-oil-based economy and need for renewable power generation

- 8.5.3.2 By type

- 8.5.3.1 Saudi Arabia

- TABLE 52 SAUDI ARABIA: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.5.3.3 By end user

- TABLE 53 SAUDI ARABIA: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.5.3.4 South Africa

- 8.5.3.4.1 Grid connectivity and policy support for energy-efficiency measures

- 8.5.3.5 By type

- 8.5.3.4 South Africa

- TABLE 54 SOUTH AFRICA: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.5.3.6 By end user

- TABLE 55 SOUTH AFRICA: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.6 SOUTH AMERICA

- 8.6.1 BY TYPE

- TABLE 56 SOUTH AMERICA: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.6.2 BY END USER

- TABLE 57 SOUTH AMERICA: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

- 8.6.3 BY COUNTRY

- TABLE 58 SOUTH AMERICA: ENERGY AS A SERVICE MARKET, BY COUNTRY, 2020-2027 (USD MILLION)

- 8.6.3.1 Brazil

- 8.6.3.1.1 Need to tackle power outages is driving market

- 8.6.3.2 By type

- 8.6.3.1 Brazil

- TABLE 59 BRAZIL: ENERGY AS A SERVICE MARKET, BY TYPE, 2020-2027 (USD MILLION)

- 8.6.3.3 By end user

- TABLE 60 BRAZIL: ENERGY AS A SERVICE MARKET, BY END USER, 2020-2027 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 KEY PLAYERS' STRATEGIES

- TABLE 61 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, JANUARY 2018 - JUNE 2022

- 9.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

- FIGURE 29 ENERGY AS A SERVICE MARKET SHARE ANALYSIS, 2021

- 9.3 KEY COMPANY EVALUATION QUADRANT

- 9.3.1 STARS

- 9.3.2 PERVASIVE PLAYERS

- 9.3.3 EMERGING LEADERS

- 9.3.4 PARTICIPANTS

- FIGURE 30 COMPETITIVE LEADERSHIP MAPPING: ENERGY AS A SERVICE MARKET, 2021

- 9.4 ENERGY AS A SERVICE MARKET: COMPANY FOOTPRINT

- TABLE 62 COMPANY FOOTPRINT: BY END USER

- TABLE 63 COMPANY FOOTPRINT: BY TYPE

- TABLE 64 COMPANY FOOTPRINT: BY REGION

- TABLE 65 OVERALL COMPANY FOOTPRINT

- 9.5 COMPETITIVE SCENARIO

- TABLE 66 ENERGY AS A SERVICE MARKET: PRODUCT LAUNCHES, FEBRUARY 2020-JULY 2022

- TABLE 67 ENERGY AS A SERVICE MARKET: DEALS, DECEMBER 2021-JULY 2022

- TABLE 68 ENERGY AS A SERVICE MARKET: OTHERS, MAY 2020-APRIL 2022

10 COMPANY PROFILES

- (Business overview, Products/services/solutions offered, Recent Developments, MNM view)**

- 10.1 INTRODUCTION

- 10.2 KEY PLAYERS

- 10.2.1 ENGIE

- TABLE 69 ENGIE: COMPANY OVERVIEW

- FIGURE 31 ENGIE: COMPANY SNAPSHOT

- TABLE 70 ENGIE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 71 ENGIE: DEALS

- 10.2.2 ENEL X

- TABLE 72 ENEL X: COMPANY OVERVIEW

- FIGURE 32 ENEL X: COMPANY SNAPSHOT

- TABLE 73 ENEL X: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 74 ENEL X: PRODUCT LAUNCHES

- TABLE 75 ENEL X: DEALS

- TABLE 76 ENEL X: OTHERS

- 10.2.3 SCHNEIDER ELECTRIC

- TABLE 77 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- FIGURE 33 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 78 SCHNEIDER ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 79 SCHNEIDER ELECTRIC: DEALS

- 10.2.4 AMERESCO

- TABLE 80 AMERESCO: COMPANY OVERVIEW

- FIGURE 34 AMERESCO: COMPANY SNAPSHOT

- TABLE 81 AMERESCO: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 82 AMERESCO: DEALS

- 10.2.5 SIEMENS

- TABLE 83 SIEMENS: COMPANY OVERVIEW

- FIGURE 35 SIEMENS: COMPANY SNAPSHOT

- TABLE 84 SIEMENS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 85 SIEMENS: DEALS

- 10.2.6 GENERAL ELECTRIC

- TABLE 86 GENERAL ELECTRIC: COMPANY OVERVIEW

- FIGURE 36 GENERAL ELECTRIC: COMPANY SNAPSHOT

- TABLE 87 GENERAL ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 88 GENERAL ELECTRIC: DEALS

- TABLE 89 GENERAL ELECTRIC: OTHERS

- 10.2.7 HONEYWELL

- TABLE 90 HONEYWELL: COMPANY OVERVIEW

- FIGURE 37 HONEYWELL: COMPANY SNAPSHOT

- TABLE 91 HONEYWELL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 92 HONEYWELL: PRODUCT LAUNCHES

- TABLE 93 HONEYWELL: DEALS

- 10.2.8 JOHNSON CONTROLS

- TABLE 94 JOHNSON CONTROLS: COMPANY OVERVIEW

- FIGURE 38 JOHNSON CONTROLS: COMPANY SNAPSHOT

- TABLE 95 JOHNSON CONTROLS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 96 JOHNSON CONTROL: PRODUCT LAUNCHES

- TABLE 97 JOHNSON CONTROLS: DEALS

- 10.2.9 EDF RENEWABLE ENERGY

- TABLE 98 EDF RENEWABLE ENERGY: COMPANY OVERVIEW

- FIGURE 39 EDF RENEWABLE ENERGY: COMPANY SNAPSHOT

- TABLE 99 EDF RENEWABLE ENERGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 100 EDF RENEWABLE ENERGY: PRODUCT LAUNCHES

- TABLE 101 EDF RENEWABLE ENERGY: DEALS

- 10.2.10 EDISON

- TABLE 102 EDISON: COMPANY OVERVIEW

- FIGURE 40 EDISON: COMPANY SNAPSHOT

- TABLE 103 EDISON: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 104 EDISON: DEALS

- 10.2.11 ALPIQ

- TABLE 105 ALPIQ: COMPANY OVERVIEW

- FIGURE 41 ALPIQ: COMPANY SNAPSHOT

- TABLE 106 ALPIQ: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 107 ALPIQ: DEALS

- 10.2.12 VEOLIA

- TABLE 108 VEOLIA: COMPANY OVERVIEW

- FIGURE 42 VEOLIA: COMPANY SNAPSHOT

- TABLE 109 VEOLIA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 110 VEOLIA: DEALS

- 10.2.13 ORSTED

- TABLE 111 ORSTED: COMPANY OVERVIEW

- FIGURE 43 ORSTED: COMPANY SNAPSHOT

- TABLE 112 ORSTED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 113 ORSTED: DEALS

- TABLE 114 ORSTED: OTHERS

- 10.2.14 CENTRICA

- TABLE 115 CENTRICA: COMPANY OVERVIEW

- FIGURE 44 CENTRICA: COMPANY SNAPSHOT

- TABLE 116 CENTRICA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 117 CENTRICA: DEALS

- 10.2.15 WGL ENERGY

- TABLE 118 WGL ENERGY: COMPANY OVERVIEW

- TABLE 119 WGL ENERGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 120 WGL ENERGY: PRODUCT LAUNCHES

- TABLE 121 WGL ENERGY: DEALS

- TABLE 122 WGL ENERGY: OTHERS

- 10.3 OTHER PLAYERS

- 10.3.1 BERNHARD ENERGY SOLUTIONS

- 10.3.2 ENTEGRITY

- 10.3.3 SMARTWATT

- 10.3.4 ENERTIKA

- 10.3.5 NORSECO

- 10.3.6 WENDEL ENERGY SERVICE

- *Details on Business overview, Products/services/solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 INSIGHTS FROM INDUSTRY EXPERTS

- 11.2 DISCUSSION GUIDE

- 11.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.4 CUSTOMIZATION OPTIONS

- 11.5 RELATED REPORTS

- 11.6 AUTHOR DETAILS