|

|

市場調査レポート

商品コード

1596806

創薬における人工知能の世界市場:プロセス別、使用事例別、治療分野別、参入企業タイプ別、ツール別、展開別、エンドユーザー別、地域別 - 2029年までの予測Artificial Intelligence in Drug Discovery Market by Process, Use Case, Therapy, Tool (ML:DL ), End User & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 創薬における人工知能の世界市場:プロセス別、使用事例別、治療分野別、参入企業タイプ別、ツール別、展開別、エンドユーザー別、地域別 - 2029年までの予測 |

|

出版日: 2024年11月12日

発行: MarketsandMarkets

ページ情報: 英文 478 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の創薬における人工知能(AI)の市場規模は、2024年の18億6,000万米ドルから2029年には68億9,000万米ドルに達し、2024年から2029年までのCAGRは29.9%と予測されています。

創薬サプライチェーンのさまざまな側面から専門知識、リソース、技術を組み合わせることで、業界を超えたコラボレーションやパートナーシップが増加し、創薬における人工知能(AI)市場の成長を後押ししています。例えば、2024年3月、CognizantはBioNeMoプラットフォームを通じて生成AIを活用するためにNVIDIAと協業し、創薬に変革をもたらし、救命治療の開発を加速させることを目標としています。同様に、2024年8月、Exscientia RecursionとExscientia plcは、創薬を強化するために両社の技術を組み合わせることで合意したと発表しました。統合されたRecursion OSは、患者中心のターゲット探索、AI主導の設計、量子力学モデリング、自動化学合成などの機能を通じて創薬を強化します。統合会社は18ヶ月以内に10件の臨床試験を完了させる予定。Exscientiaの株主はRecursionの株式を受け取り、Recursionの株主は統合会社の74%を所有します。取引は現金8億5000万米ドル相当で、2025年初頭までに完了する予定です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 100万/10億(米ドル) |

| セグメント別 | プロセス別、使用事例別、治療分野別、参入企業タイプ別、ツール別、展開別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

治療分野別では、創薬における人工知能(AI)市場は、腫瘍学、感染症、神経学、代謝性疾患、心血管疾患、免疫学、メンタルヘルス、その他(呼吸器疾患、腎臓学、皮膚科疾患、遺伝性疾患、炎症性疾患、消化器)に区分されます。がんの高い有病率と腫瘍生物学の複雑な性質により、創薬における人工知能(AI)市場ではがん分野が最大の市場シェアを占めており、そのため創薬市場開拓には革新的なアプローチが必要とされています。2022年には、世界で約2,000万人の新規がん患者と970万人のがん関連死が発生しました。同様に2024年には、米国で新たに200万人のがん患者と611,720人のがん死亡者が発生すると予測されています。がん研究、患者記録、ゲノム研究、マルチオミクスデータセット(ゲノム、プロテオミクス、トランスクリプトミクス)、臨床試験から得られる生物医学データの利用可能性が高まっていることは、パターン認識や薬物相互作用の予測にAIを活用する機会を提供します。がん領域における個別化医療と標的治療への高い需要、大きな商業的リターン、免疫腫瘍学(特にチェックポイント阻害剤とT細胞療法)への新たな注目、網羅的なデータの利用可能性は、AI主導型ソリューションへの投資を促進し、AIを創薬ランドスケープの最前線に押し上げます。

使用事例別では、創薬における人工知能(AI)市場は、疾患理解、薬剤再利用、de novoドラッグデザイン、薬剤最適化、安全性と毒性に区分されます。疾病の解明は、予測期間中に最も急成長する使用事例になる見込みです。複雑な生物学的データを評価し、疾患メカニズムを特定するAIの能力は、初期段階の医薬品開発において極めて重要です。AIは研究者が疾患経路、遺伝的要因、バイオマーカーをよりよく理解するのに役立ち、これらはすべて標的療法の開発に必要なものです。疾患を理解することは、潜在的な創薬標的を特定するために必要であり、創薬設計や試験などの後続段階の効率を高める。表現型スクリーニング、画像解析、細胞や組織の形態に関する遺伝子異常の検出、バイオマーカーの同定、オミクスデータマイニングのためのAIの利用拡大が市場成長を促進すると予想されます。

当レポートでは、世界の創薬における人工知能市場について調査し、プロセス別、使用事例別、治療分野別、参入企業タイプ別、ツール別、展開別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

>目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- 業界動向

- エコシステム分析

- サプライチェーン分析

- 技術分析

- 規制状況

- 価格分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- 特許分析

- アンメットニーズと主な問題点

- 2024年~2025年の主な会議とイベント

- ケーススタディ分析

- ビジネスモデル分析

- 投資と資金調達のシナリオ

- AI/生成AIが創薬における人工知能市場に与える影響

- 人工知能から生まれた臨床資産

第6章 創薬における人工知能市場(プロセス別)

- イントロダクション

- 標的特定と選択

- 標的検証

- ヒットの識別と優先順位付け

- ヒットからリードへの識別/リード生成

- リード最適化

- 候補者の選定と検証

第7章 創薬における人工知能市場(使用事例別)

- イントロダクション

- 病気の理解

- 薬物の再利用

- 新規医薬品設計

- 薬剤最適化

- 安全性と毒性

第8章 創薬における人工知能市場(治療分野別)

- イントロダクション

- 腫瘍学

- 感染症

- 神経学

- 代謝性疾患

- 心臓血管疾患

- 免疫学

- 精神疾患

- その他

第9章 創薬における人工知能市場(参入企業タイプ別)

- イントロダクション

- エンドツーエンドソリューションプロバイダー

- ニッチ/ポイントソリューションプロバイダー

- AIテクノロジープロバイダー

- ビジネスプロセスサービスプロバイダー

第10章 創薬における人工知能市場(ツール別)

- イントロダクション

- 機械学習

- 自然言語処理

- コンテキスト認識処理とコンピューティング

- コンピュータービジョン

- 画像分析

第11章 創薬における人工知能市場(展開別)

- イントロダクション

- オンプレミス展開

- クラウドベースの展開

- SaaSベースの展開

第12章 創薬における人工知能市場(エンドユーザー別)

- イントロダクション

- 製薬・バイオテクノロジー企業

- CRO

- 研究センターおよび学術機関・政府機関

第13章 創薬における人工知能市場(地域別)

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第14章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析、2019年~2023年

- 市場シェア分析、2023年

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオ

第15章 企業プロファイル

- 主要参入企業

- NVIDIA CORPORATION

- EXSCIENTIA

- RECURSION

- INSILICO MEDICINE

- SCHRODINGER, INC.

- BENEVOLENTAI

- MICROSOFT CORPORATION

- ATOMWISE INC.

- ILLUMINA, INC.

- NUMEDII, INC.

- XTALPI INC.

- IKTOS

- TEMPUS

- DEEP GENOMICS

- VERGE GENOMICS

- BENCHSCI

- INSITRO

- VALO HEALTH

- BPGBIO, INC.

- MERCK KGAA

- その他の企業

- PREDICTIVE ONCOLOGY

- IQVIA INC.

- TENCENT HOLDINGS LIMITED

- CYTOREASON LTD.

- OWKIN, INC.

- CLOUD PHARMACEUTICALS

- EVAXION BIOTECH A/S

- STANDIGM INC.

- BIOAGE LABS

- ENVISAGENICS

- ABCELLERA

- CENTELLA

第16章 付録

List of Tables

- TABLE 1 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD, 2021-2023

- TABLE 3 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: FACTOR ANALYSIS

- TABLE 4 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: MARKET SIZING ASSUMPTIONS

- TABLE 5 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: RISK ASSESSMENT

- TABLE 6 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: IMPACT ANALYSIS

- TABLE 7 INDICATIVE LIST OF COLLABORATIONS AND PARTNERSHIPS, 2021-2023

- TABLE 8 INDICATIVE LIST OF DRUGS LOSING PATENTS IN 2023 AND 2024

- TABLE 9 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: ROLE IN ECOSYSTEM

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 NORTH AMERICA: REGULATORY FRAMEWORK

- TABLE 16 EUROPE: REGULATORY FRAMEWORK

- TABLE 17 ASIA PACIFIC: REGULATORY FRAMEWORK

- TABLE 18 MIDDLE EAST & AFRICA: REGULATORY FRAMEWORK

- TABLE 19 LATIN AMERICA: REGULATORY FRAMEWORK

- TABLE 20 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: INDICATIVE SELLING PRICE, BY REGION, 2021-2023

- TABLE 21 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: INDICATIVE PRICING, BY PROCESS, 2023

- TABLE 22 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP THREE END USERS (%)

- TABLE 24 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 25 JURISDICTION ANALYSIS OF TOP APPLICANT COUNTRIES FOR ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY

- TABLE 26 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: LIST OF PATENTS/PATENT APPLICATIONS

- TABLE 27 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: KEY CONFERENCES & EVENTS, JANUARY 2024-DECEMBER 2025

- TABLE 28 CASE STUDY 1: LEVERAGING AI-DRIVEN PRECISION MEDICINE TO IDENTIFY PATIENT SUBTYPES AND NOVEL TARGETS IN INFLAMMATORY BOWEL DISEASE

- TABLE 29 CASE STUDY 2: ARTIFICIAL INTELLIGENCE-DRIVEN DRUG DISCOVERY AND CO-DEVELOPMENT

- TABLE 30 CASE STUDY 3: ADVANCING GENE THERAPY FOR RARE NEUROLOGICAL DISEASES

- TABLE 31 CASE STUDY 4: ARTIFICIAL INTELLIGENCE DESIGN AND OPTIMIZATION OF EXS4318

- TABLE 32 CASE STUDY 5: ARTIFICIAL INTELLIGENCE-DRIVEN DESIGN AND CLINICAL EVALUATION OF GTAEXS617

- TABLE 33 KEY ARTIFICIAL INTELLIGENCE-DERIVED CLINICAL ASSETS, BY COMPANY

- TABLE 34 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS, 2022-2029 (USD MILLION)

- TABLE 35 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR TARGET IDENTIFICATION & SELECTION, BY REGION, 2022-2029 (USD MILLION)

- TABLE 36 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR TARGET VALIDATION, BY REGION, 2022-2029 (USD MILLION)

- TABLE 37 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR HIT IDENTIFICATION & PRIORITIZATION, BY REGION, 2022-2029 (USD MILLION)

- TABLE 38 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR HIT-TO-LEAD IDENTIFICATION/LEAD GENERATION, BY REGION, 2022-2029 (USD MILLION)

- TABLE 39 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR LEAD OPTIMIZATION, BY REGION, 2022-2029 (USD MILLION)

- TABLE 40 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR CANDIDATE SELECTION & VALIDATION, BY REGION, 2022-2029 (USD MILLION)

- TABLE 41 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 42 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR UNDERSTANDING DISEASES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 43 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG REPURPOSING, BY REGION, 2022-2029 (USD MILLION)

- TABLE 44 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 45 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY REGION, 2022-2029 (USD MILLION)

- TABLE 46 SMALL-MOLECULE DESIGN MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 47 VACCINE DESIGN MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 48 ANTIBODY & OTHER BIOLOGICS DESIGN MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 49 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 50 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY REGION, 2022-2029 (USD MILLION)

- TABLE 51 SMALL-MOLECULE OPTIMIZATION MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 52 VACCINE OPTIMIZATION MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 53 ANTIBODY & OTHER BIOLOGICS OPTIMIZATION MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 54 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR SAFETY & TOXICITY, BY REGION, 2022-2029 (USD MILLION)

- TABLE 55 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 56 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR ONCOLOGY, BY REGION, 2022-2029 (USD MILLION)

- TABLE 57 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR INFECTIOUS DISEASES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 58 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR NEUROLOGY, BY REGION, 2022-2029 (USD MILLION)

- TABLE 59 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR METABOLIC DISEASES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 60 INDICATIVE LIST OF DEVELOPMENTS IN CARDIOVASCULAR DRUG DEVELOPMENT

- TABLE 61 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR CARDIOVASCULAR DISEASES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 62 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR IMMUNOLOGY, BY REGION, 2022-2029 (USD MILLION)

- TABLE 63 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MENTAL HEALTH DISORDERS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 64 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR OTHER THERAPEUTIC AREAS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 65 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 66 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR END-TO-END SOLUTION PROVIDERS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 67 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR NICHE/POINT SOLUTION PROVIDERS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 68 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR AI TECHNOLOGY PROVIDERS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 69 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR BUSINESS PROCESS SERVICE PROVIDERS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 70 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 71 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 72 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY REGION, 2022-2029 (USD MILLION)

- TABLE 73 DEEP LEARNING MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 74 SUPERVISED LEARNING MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 75 REINFORCEMENT LEARNING MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 76 UNSUPERVISED LEARNING MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 77 OTHER MACHINE LEARNING TECHNOLOGIES MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 78 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR NATURAL LANGUAGE PROCESSING, BY REGION, 2022-2029 (USD MILLION)

- TABLE 79 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR CONTEXT-AWARE PROCESSING & COMPUTING, BY REGION, 2022-2029 (USD MILLION)

- TABLE 80 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR COMPUTER VISION, BY REGION, 2022-2029 (USD MILLION)

- TABLE 81 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR IMAGE ANALYSIS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 82 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 83 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR ON-PREMISES DEPLOYMENT, BY REGION, 2022-2029 (USD MILLION)

- TABLE 84 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR CLOUD-BASED DEPLOYMENT, BY REGION, 2022-2029 (USD MILLION)

- TABLE 85 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR SAAS-BASED DEPLOYMENT, BY REGION, 2022-2029 (USD MILLION)

- TABLE 86 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 87 INDICATIVE LIST OF DEVELOPMENTS RELATED TO ARTIFICIAL INTELLIGENCE IN PHARMACEUTICAL & BIOTECHNOLOGY INDUSTRY

- TABLE 88 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 89 INDICATIVE LIST OF COLLABORATIONS WITH CONTRACT RESEARCH ORGANIZATIONS

- TABLE 90 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2022-2029 (USD MILLION)

- TABLE 91 INDICATIVE LIST OF COLLABORATIONS IN RESEARCH CENTERS AND ACADEMIC & GOVERNMENT INSTITUTES

- TABLE 92 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR RESEARCH CENTERS AND ACADEMIC & GOVERNMENT INSTITUTES, BY REGION, 2022-2029 (USD MILLION)

- TABLE 93 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY REGION, 2022-2029 (USD MILLION)

- TABLE 94 NORTH AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 95 NORTH AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS 2022-2029 (USD MILLION)

- TABLE 96 NORTH AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 97 NORTH AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 98 NORTH AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 99 NORTH AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 100 NORTH AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 101 NORTH AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 102 NORTH AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 103 NORTH AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 104 NORTH AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 105 US: INDICATIVE LIST OF STRATEGIC DEVELOPMENTS

- TABLE 106 US: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS 2022-2029 (USD MILLION)

- TABLE 107 US: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 108 US: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 109 US: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 110 US: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 111 US: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 112 US: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 113 US: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 114 US: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 115 US: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 116 CANADA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS 2022-2029 (USD MILLION)

- TABLE 117 CANADA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 118 CANADA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 119 CANADA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 120 CANADA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 121 CANADA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 122 CANADA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 123 CANADA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 124 CANADA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 125 CANADA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 126 EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY COUNTRY 2022-2029 (USD MILLION)

- TABLE 127 EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS, 2022-2029 (USD MILLION)

- TABLE 128 EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 129 EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 130 EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 131 EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 132 EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 133 EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 134 EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 135 EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 136 EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 137 UK: INDICATIVE LIST OF STRATEGIC DEVELOPMENTS

- TABLE 138 UK: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS, 2022-2029 (USD MILLION)

- TABLE 139 UK: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 140 UK: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 141 UK: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 142 UK: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 143 UK: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 144 UK: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 145 UK: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 146 UK: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 147 UK: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 148 GERMANY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS, 2022-2029 (USD MILLION)

- TABLE 149 GERMANY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 150 GERMANY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 151 GERMANY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 152 GERMANY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 153 GERMANY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 154 GERMANY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 155 GERMANY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 156 GERMANY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 157 GERMANY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 158 FRANCE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS, 2022-2029 (USD MILLION)

- TABLE 159 FRANCE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 160 FRANCE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 161 FRANCE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 162 FRANCE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 163 FRANCE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 164 FRANCE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 165 FRANCE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 166 FRANCE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 167 FRANCE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 168 ITALY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS, 2022-2029 (USD MILLION)

- TABLE 169 ITALY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 170 ITALY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 171 ITALY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 172 ITALY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 173 ITALY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 174 ITALY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 175 ITALY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 176 ITALY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 177 ITALY: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 178 SPAIN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS, 2022-2029 (USD MILLION)

- TABLE 179 SPAIN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 180 SPAIN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 181 SPAIN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 182 SPAIN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 183 SPAIN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 184 SPAIN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 185 SPAIN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 186 SPAIN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 187 SPAIN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 188 REST OF EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS, 2022-2029 (USD MILLION)

- TABLE 189 REST OF EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 190 REST OF EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 191 REST OF EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 192 REST OF EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 193 REST OF EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 194 REST OF EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 195 REST OF EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 196 REST OF EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 197 REST OF EUROPE: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 198 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY COUNTRY 2022-2029 (USD MILLION)

- TABLE 199 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS, 2022-2029 (USD MILLION)

- TABLE 200 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 201 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 202 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 203 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 204 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 205 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 206 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 207 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 208 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 209 JAPAN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS, 2022-2029 (USD MILLION)

- TABLE 210 JAPAN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 211 JAPAN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 212 JAPAN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 213 JAPAN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 214 JAPAN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 215 JAPAN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 216 JAPAN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 217 JAPAN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 218 JAPAN: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 219 CHINA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS, 2022-2029 (USD MILLION)

- TABLE 220 CHINA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 221 CHINA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 222 CHINA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 223 CHINA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 224 CHINA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 225 CHINA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 226 CHINA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 227 CHINA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 228 CHINA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 229 INDIA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS, 2022-2029 (USD MILLION)

- TABLE 230 INDIA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 231 INDIA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 232 INDIA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 233 INDIA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 234 INDIA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 235 INDIA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 236 INDIA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 237 INDIA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 238 INDIA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 239 REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS, 2022-2029 (USD MILLION)

- TABLE 240 REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 241 REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 242 REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 243 REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 244 REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 245 REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 246 REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 247 REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 248 REST OF ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 249 LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY COUNTRY, 2022-2029 (USD MILLION)

- TABLE 250 LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS, 2022-2029 (USD MILLION)

- TABLE 251 LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 252 LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 253 LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 254 LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 255 LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 256 LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 257 LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 258 LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 259 LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 260 BRAZIL: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS, 2022-2029 (USD MILLION)

- TABLE 261 BRAZIL: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 262 BRAZIL: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 263 BRAZIL: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG DISCOVERY, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 264 BRAZIL: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 265 BRAZIL: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 266 BRAZIL: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 267 BRAZIL: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 268 BRAZIL: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 269 BRAZIL: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 270 MEXICO: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS, 2022-2029 (USD MILLION)

- TABLE 271 MEXICO: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 272 MEXICO: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 273 MEXICO: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 274 MEXICO: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 275 MEXICO: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 276 MEXICO: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 277 MEXICO: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 278 MEXICO: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 279 MEXICO: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

- TABLE 280 REST OF LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS, 2022-2029 (USD MILLION)

- TABLE 281 REST OF LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2022-2029 (USD MILLION)

- TABLE 282 REST OF LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DE NOVO DRUG DESIGN, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 283 REST OF LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR DRUG OPTIMIZATION, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 284 REST OF LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2022-2029 (USD MILLION)

- TABLE 285 REST OF LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2022-2029 (USD MILLION)

- TABLE 286 REST OF LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2022-2029 (USD MILLION)

- TABLE 287 REST OF LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET FOR MACHINE LEARNING, BY TYPE, 2022-2029 (USD MILLION)

- TABLE 288 REST OF LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2022-2029 (USD MILLION)

- TABLE 289 REST OF LATIN AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2022-2029 (USD MILLION)

List of Figures

- FIGURE 1 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: SEGMENTS AND REGIONS CONSIDERED

- FIGURE 2 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: YEARS CONSIDERED

- FIGURE 3 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: RESEARCH DESIGN

- FIGURE 4 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: KEY PRIMARY SOURCES

- FIGURE 6 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: KEY DATA FROM PRIMARY SOURCES

- FIGURE 7 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: KEY INDUSTRY INSIGHTS

- FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS: BY DEMAND SIDE, SUPPLY SIDE, DESIGNATION, AND REGION

- FIGURE 9 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 10 SUPPLY-SIDE MARKET ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 11 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: REVENUE SHARE ANALYSIS ILLUSTRATION

- FIGURE 12 BOTTOM-UP APPROACH: END-USER SPENDING ON ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY

- FIGURE 13 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2024-2029)

- FIGURE 14 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 15 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: TOP-DOWN APPROACH

- FIGURE 16 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: DATA TRIANGULATION

- FIGURE 17 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS, 2024 VS. 2029 (USD MILLION)

- FIGURE 18 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE, 2024 VS. 2029 (USD MILLION)

- FIGURE 19 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA, 2024 VS. 2029 (USD MILLION)

- FIGURE 20 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 21 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL, 2024 VS. 2029 (USD MILLION)

- FIGURE 22 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT, 2024 VS. 2029 (USD MILLION)

- FIGURE 23 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER, 2024 VS. 2029 (USD MILLION)

- FIGURE 24 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: REGIONAL SNAPSHOT

- FIGURE 25 INCREASING NUMBER OF CROSS-INDUSTRY COLLABORATIONS AND PARTNERSHIPS TO DRIVE MARKET

- FIGURE 26 US AND PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES COMMANDED LARGEST MARKET SHARE IN 2023

- FIGURE 27 INDIA TO REGISTER HIGHEST GROWTH RATE FROM 2024 TO 2029

- FIGURE 28 NORTH AMERICA TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 29 EMERGING MARKETS TO REGISTER HIGHER GROWTH RATES DURING STUDY PERIOD

- FIGURE 30 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 31 COST OF GENOME ANALYSIS VS. LEVELS OF RAW DATA GENERATED, 2003-2023

- FIGURE 32 APPROVAL OF PERSONALIZED MEDICINES BY US FDA, 2015-2023

- FIGURE 33 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 34 EVOLUTION OF AI IN DRUG DISCOVERY MARKET

- FIGURE 35 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: STRUCTURE-BASED DRUG DESIGNING

- FIGURE 36 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: ECOSYSTEM ANALYSIS

- FIGURE 37 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 38 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: TYPES OF SERVICE

- FIGURE 39 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 40 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- FIGURE 41 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 42 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR "AI IN DRUG DISCOVERY" PATENTS (JANUARY 2015-SEPTEMBER 2024)

- FIGURE 43 MAJOR PATENTS IN ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET (JANUARY 2015-SEPTEMBER 2024)

- FIGURE 44 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: BUSINESS MODELS

- FIGURE 45 BENEFITS OF HYBRID BUSINESS MODELS

- FIGURE 46 SPECIALIZATION OF ARTIFICIAL INTELLIGENCE-BASED COMPANIES OVER TIME

- FIGURE 47 FUNDING IN ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, 2013-2022 (USD MILLION)

- FIGURE 48 MARKET POTENTIAL OF AI/GENERATIVE AI IN ENHANCING LABORATORY INFORMATICS ACROSS INDUSTRIES

- FIGURE 49 IMPACT OF AI/GENERATIVE AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- FIGURE 50 HIT-TO-LEAD IDENTIFICATION/LEAD GENERATION SEGMENT HELD LARGEST MARKET SHARE IN 2023

- FIGURE 51 NORTH AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET SNAPSHOT

- FIGURE 52 DISTRIBUTION OF R&D COMPANIES, BY COUNTRY/REGION (2022 VS. 2023)

- FIGURE 53 ASIA PACIFIC: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET SNAPSHOT

- FIGURE 54 REVENUE ANALYSIS OF KEY PLAYERS IN ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET (2019-2023)

- FIGURE 55 MARKET SHARE ANALYSIS OF KEY PLAYERS IN ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET (2023)

- FIGURE 56 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: RANKING OF KEY MARKET PLAYERS (2023)

- FIGURE 57 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 58 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: COMPANY FOOTPRINT

- FIGURE 59 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 60 EV/EBITDA OF KEY VENDORS

- FIGURE 61 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 62 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 63 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 64 EXSCIENTIA: COMPANY SNAPSHOT

- FIGURE 65 GOOGLE: COMPANY SNAPSHOT

- FIGURE 66 RECURSION: COMPANY SNAPSHOT

- FIGURE 67 SCHRODINGER, INC.: COMPANY SNAPSHOT

- FIGURE 68 BENEVOLENTAI: COMPANY SNAPSHOT

- FIGURE 69 MICROSOFT CORPORATION: COMPANY SNAPSHOT

- FIGURE 70 ILLUMINA, INC.: COMPANY SNAPSHOT

- FIGURE 71 MERCK KGAA: COMPANY SNAPSHOT

The global artificial intelligence (AI) in drug discovery market is projected to reach 6.89 billion by 2029 from 1.86 billion in 2024, at a CAGR of 29.9% from 2024 to 2029. Increasing cross-industry collaborations and partnerships drive the growth of the artificial intelligence (AI) in drug discovery market by combining expertise, resources, and technology from various aspects of the drug discovery supply chain. For instance, in March 2024, Cognizant collaborated with NVIDIA to use generative AI through the BioNeMo platform, with the goal of transforming drug discovery and accelerating the development of life-saving therapies. Similarly, in August 2024, Exscientia Recursion and Exscientia plc announced a agreement, combining their technologies to enhance drug discovery. The integrated Recursion OS will enhance drug discovery through patient-centric target discovery, AI-driven design, quantum mechanics modeling, automated chemical synthesis, and other features. The combined company plans to complete 10 clinical trials within 18 months. Exscientia shareholders will receive Recursion stock, with Recursion shareholders owning 74% of the combined company. The deal is worth USD 850M in cash and is expected to close by early 2025.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Million/Billion (USD) |

| Segments | By Process, use case, therapeutic area, player type, AI tools, deployment, end user, and region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. |

"Oncology held the largest market share in the artificial intelligence (AI) in drug discovery market, by therapeutic area in 2023."

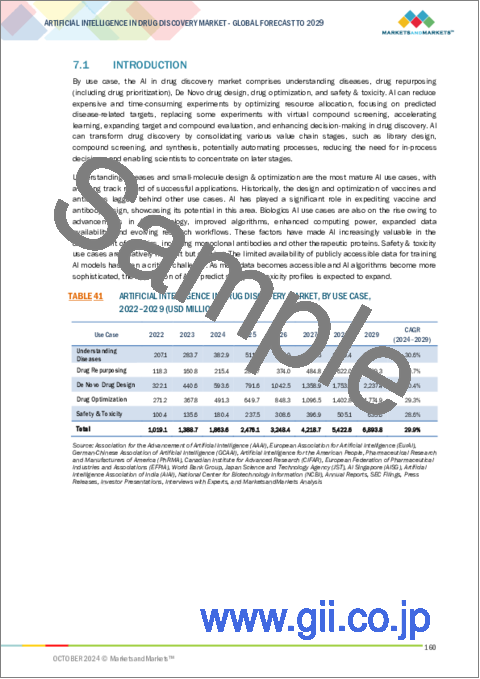

Based on therapeutic areas, the artificial intelligence (AI) in drug discovery market is segmented into oncology, infectious diseases, neurology, metabolic diseases, cardiovascular diseases, immunology, mental health, and others (respiratory diseases, nephrology, dermatological diseases, genetic disorders, inflammatory diseases, and gastrointestinal). The oncology segment held the largest market share in the artificial intelligence (AI) in drug discovery market due to high prevalence of cancer and the complex nature of tumor biology, which necessitates innovative approaches for drug development. There were approximately 20 million new cancer cases and 9.7 million cancer-related deaths worldwide in 2022. Similarly, in 2024, 2.0 million new cancer cases and 611,720 cancer deaths are projected to occur in the US. The growing availability of biomedical data from cancer research, patient records, genomic studies, multi-omics datasets (genomics, proteomics, transcriptomics), and clinical trials provides an opportunity to leverage AI for pattern recognition and predicting drug interactions. The high demand for personalized medicine and targeted therapies in oncology, large commercial returns, emerging focus on immuno-oncology (especially checkpoint inhibitors and T-cell therapies), and exhaustive data availability drive investment in AI-driven solutions, elevating it to the forefront of the drug discovery landscape.

"Understanding disease use case to witness the fastest growth during the forecast period."

Based on the use case, artificial intelligence (AI) in drug discovery market is segmented into understanding the disease, drug repurposing, de novo drug design, drug optimization, and safety & toxicity. The understanding disease is poised to be the fastest-growing use case over the forecast period. AI's capacity to assess complex biological data and identify disease mechanisms is critical in early-stage drug development. AI helps researchers better understand disease pathways, genetic factors, and biomarkers, all of which are necessary for developing targeted therapies. Understanding diseases is required to identify potential drug targets, which enhances the efficiency of subsequent stages such as drug design and testing. The growth use of AI for phenotypic screening, image analysis, detecting anomalies in genetic perturbations on cellular or tissue morphology, biomarker identification, (-omics) data mining is expected to fuel the market growth.

"North America to dominate the market over the forecast period."

Based on the region, the artificial intelligence (AI) in drug discovery market is segmented into five major regional segments: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. The North American region dominated the artificial intelligence (AI) in drug discovery market in 2023. Several factors contribute to this dominance, including significant investment in healthcare technology, strong cross-sector collaborations, the presence of large pharmaceutical and biotechnology companies, and a favorable regulatory environment. The total investments in AI in Drug Development companies are USD 60.2 billion as of March 2023. A large wave of proof-of-concept studies and substantial advances in democratizing AI technology are also propelling the growth of the market. For example, in January 2023, AbSci created and validated de novo antibodies in silico with generative AI. Furthermore, in February 2023, the FDA granted an Orphan Drug Designation to a drug discovered and designed with AI. Insilico Medicine and began a global Phase I trial for the drug.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the authentication and brand protection marketplace.

Breakdown of supply-side primary interviews by company type, designation, and region:

- By Company Type: Tier 1 (31%), Tier 2 (28%), and Tier 3 (41%)

- By Designation - Demand Side: Purchase Managers (45%), Heads of Artificial Intelligence, Machine Learning, Drug Discovery, and Computational Molecular Design (30%), and Research Scientists (25%)

- By Designation - Supply Side: C-level Excecutives & Director level (35%), Managers (40%), and Others (25%)

- By Region: North America (45%), Europe (30%), Asia Pacific (20%), and Rest of the world (5%)

List of Companies Profiled in the Report

- NVIDIA Corporation (US)

- Exscientia (UK)

- Google (US)

- BenevolentAI (UK)

- Recursion (US)

- Insilico Medicine (US)

- Schrodinger, Inc. (US)

- Microsoft (US)

- Atomwise Inc. (US)

- Illumina, Inc. (US)

- Numedii, Inc. (US)

- Xtalpi Inc. (US)

- Iktos (France)

- Tempus (US)

- DEEP GENOMICS (Canada)

- Verge Genomics (US)

- BenchSci (Canada)

- Insitro (US)

- Valo Health (US)

- BPGBio, Inc. (US)

- Merck KGaA (Germany)

- IQVIA (US)

- Tencent Holdings Limited (China)

- Predictive Oncology, Inc. (US)

- CytoReason (Israel)

- Owkin, Inc. (US)

- Cloud Pharmaceuticals (US)

- Evaxion Biotech (Denmark)

- Standigm (South Korea)

- BIOAGE (US)

- Envisagenics (US)

- Abcellera (US)

- Centella (India)

The study includes an in-depth competitive analysis of these key players in the artificial intelligence (AI) in drug discovery market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the artificial intelligence (AI) in drug discovery market by process (target identification & selection, target validation, hit identification & prioritization, hit-to-lead identification/lead generation, lead optimization, and candidate selection & validation), by use case (understanding disease, drug repurposing, de novo drug design [small molecule design, vaccines design, antibody & other biologics design], drug optimization [small molecule optimization, vaccines optimization, antibody & other biologics optimization], and safety and toxicity), by therapeutic area (oncology, infectious diseases, neurology, metabolic diseases, cardiovascular diseases, immunology, mental health, others), by player type (end-to-end solution providers, niche/point solutions providers, AI technology providers, business process service providers), by tools (machine learning, natural language processing, context-aware process and computing, computer vision, image analysis (including optical character recognition)), by deployment (on-premise, cloud-based, SaaS-based), by end user (pharmaceutical & biotechnology companies, contract research organizations (CROs), and research centers, academic institutes, & government organizations) and by region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the artificial intelligence (AI) in drug discovery market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services, key strategies such as product launches and enhancements, investments, partnerships, collaborations, agreements, joint ventures, funding, acquisitions, expansions, conferences, FDA clearances, sales contracts, alliances, and other recent developments associated with the artificial intelligence (AI) in drug discovery market. Competitive analysis of upcoming startups in the artificial intelligence (AI) in drug discovery market ecosystem is covered in this report.

Reasons to buy this report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the artificial intelligence (AI) in drug discovery market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (growing cross-industry collaborations and partnerships, growing need to reduce time and cost of drug discovery and development, patent expiry of several drugs, AI application in oncology areas, integration of multi-omics data, initiatives for research on rare diseases and orphan drugs), restraints (shortage of AI workforce and ambiguous regulatory guidelines for medical software, interpretability of AI), opportunities (growing biotechnology industry, increasing focus on emerging markets, focus on developing human-aware AI systems, increasing use of AI in single cell analysis, rapid expansion of biomarker, disease types, and subtypes identification, growing demand for precision and personalized medicine), and challenges (limited availability of data sets, lack of required tools and usability, computational limitations of advanced AI models, challenges regarding the accessibility of high-quality data) influencing the growth of the artificial intelligence (AI) in drug discovery market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the artificial intelligence (AI) in drug discovery market

- Market Development: Comprehensive information about lucrative markets - the report analyses the artificial intelligence (AI) in drug discovery market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the artificial intelligence (AI) in drug discovery market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as NVIDIA Corporation (US), Exscientia (UK), Google (US), BenevolentAI (UK), Recursion (US), Insilico Medicine (US), Schrodinger, Inc. (US), Microsoft (US), Atomwise Inc. (US), Illumina, Inc. (US), Numedii, Inc. (US), Xtalpi Inc. (US), Iktos (France), Valo Health (US), and Merck KGaA (Germany), among others in artificial intelligence (AI) in drug discovery market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 SEGMENTS AND REGIONS CONSIDERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 MARKET STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key objectives of primary research

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.2.5 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 RESEARCH DESIGN

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 SUPPLY-SIDE ANALYSIS (REVENUE SHARE ANALYSIS)

- 2.3.2 BOTTOM-UP APPROACH: END-USER ADOPTION

- 2.3.2.1 Top-down assessment of parent market

- 2.3.2.2 Company presentations and primary interviews

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.5.1 MARKET SIZING ASSUMPTIONS

- 2.5.2 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

- 2.7.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET OVERVIEW

- 4.2 NORTH AMERICA: ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER AND COUNTRY (2023)

- 4.3 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: REGIONAL MIX

- 4.5 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET: DEVELOPED VS. EMERGING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing number of cross-industry collaborations and partnerships

- 5.2.1.2 Rising need to reduce time and cost of drug discovery and development

- 5.2.1.3 Patent expiry of drugs and need for effective new leads

- 5.2.1.4 Growing utilization of AI to predict drug-target interactions for cancer therapy

- 5.2.1.5 Integration of AI-assisted multiomics in drug discovery

- 5.2.1.6 Growing focus on rare disease treatments for orphan drug development

- 5.2.2 RESTRAINTS

- 5.2.2.1 Shortage of AI workforce and ambiguous regulatory guidelines for medical software

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Leveraging AI for accelerated biotech drug discovery

- 5.2.3.2 Increased focus on drug discovery in emerging economies

- 5.2.3.3 Focus on developing human-aware AI systems

- 5.2.3.4 Growing use of AI in single-cell analysis

- 5.2.3.5 Easy identification of biomarker and disease subtypes from single-cell data

- 5.2.3.6 High demand for precision and personalized medicines

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited availability of quality data sets

- 5.2.4.2 Lack of advanced AI tools and training data sets

- 5.2.4.3 Computational constraints of advanced AI models

- 5.2.4.4 Lack of high-quality data sets for model training

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.4 INDUSTRY TRENDS

- 5.4.1 EVOLUTION OF AI IN DRUG DISCOVERY

- 5.4.2 COMPUTER-AIDED DRUG DESIGN AND ARTIFICIAL INTELLIGENCE

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Dry lab services

- 5.7.1.2 Wet lab services

- 5.7.1.2.1 Chemistry software and services

- 5.7.1.2.2 Biology software and services

- 5.7.1.2.2.1 Single-cell analysis

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 High-performance computing

- 5.7.2.2 Next-generation sequencing

- 5.7.2.3 Real-world evidence/Real-world data

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Cloud computing

- 5.7.3.2 Blockchain technologies

- 5.7.3.3 Internet of things

- 5.7.1 KEY TECHNOLOGIES

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.2 REGULATORY FRAMEWORK

- 5.9 PRICING ANALYSIS

- 5.9.1 INDICATIVE SELLING PRICE FOR DRUG DISCOVERY SOFTWARE AND SERVICES, BY REGION

- 5.9.2 INDICATIVE PRICING ANALYSIS, BY PROCESS

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.10.2 BARGAINING POWER OF BUYERS

- 5.10.3 THREAT OF SUBSTITUTES

- 5.10.4 THREAT OF NEW ENTRANTS

- 5.10.5 BARGAINING POWER OF SUPPLIERS

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 KEY BUYING CRITERIA

- 5.12 PATENT ANALYSIS

- 5.12.1 PATENT PUBLICATION TRENDS

- 5.12.2 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY

- 5.12.3 MAJOR PATENTS IN ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET

- 5.13 UNMET NEEDS AND KEY PAIN POINTS

- 5.13.1 UNMET NEEDS

- 5.13.2 SINGLE-CELL ANALYSIS LANDSCAPE: KEY CHALLENGES AND PAIN POINTS IN DRUG DISCOVERY

- 5.13.3 END-USER EXPECTATIONS

- 5.14 KEY CONFERENCES & EVENTS, 2024-2025

- 5.15 CASE STUDY ANALYSIS

- 5.16 BUSINESS MODEL ANALYSIS

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF AI/GENERATIVE AI ON ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET

- 5.18.1 TOP USE CASES AND MARKET POTENTIAL

- 5.18.1.1 Key use cases

- 5.18.2 CASE STUDIES OF AI/GENERATIVE AI IMPLEMENTATION

- 5.18.2.1 Case study 1: Accelerated drug discovery with generative AI and streamlined workflows

- 5.18.2.2 Case study 2: Accelerating small-molecule drug discovery with generative AI

- 5.18.3 IMPACT OF AI/GENERATIVE AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- 5.18.3.1 AI in drug discovery market

- 5.18.3.2 Genomics and bioinformatics market

- 5.18.3.3 Life science analytics market

- 5.18.4 USER READINESS AND IMPACT ASSESSMENT

- 5.18.4.1 User readiness

- 5.18.4.1.1 Pharmaceutical companies

- 5.18.4.1.2 Biotechnology companies

- 5.18.4.2 Impact assessment

- 5.18.4.2.1 User A: Pharmaceutical Companies

- 5.18.4.2.1.1 Implementation

- 5.18.4.2.1.2 Impact

- 5.18.4.2.2 User B: Biotechnology companies

- 5.18.4.2.2.1 Implementation

- 5.18.4.2.2.2 Impact

- 5.18.4.2.1 User A: Pharmaceutical Companies

- 5.18.4.1 User readiness

- 5.18.1 TOP USE CASES AND MARKET POTENTIAL

- 5.19 ARTIFICIAL INTELLIGENCE-DERIVED CLINICAL ASSETS

6 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PROCESS

- 6.1 INTRODUCTION

- 6.2 TARGET IDENTIFICATION & SELECTION

- 6.2.1 INCREASED DEMAND FOR PERSONALIZED MEDICINES AND HIGH INVESTMENT IN PHARMACEUTICAL R&D TO FUEL MARKET GROWTH

- 6.3 TARGET VALIDATION

- 6.3.1 RISING EMPHASIS ON AVOIDING LATE-STAGE FAILURE IN DRUG DISCOVERY TO BOOST MARKET GROWTH

- 6.4 HIT IDENTIFICATION & PRIORITIZATION

- 6.4.1 NEED FOR LARGE-SCALE DATA ANALYSIS TO DRIVE ADOPTION

- 6.5 HIT-TO-LEAD IDENTIFICATION/LEAD GENERATION

- 6.5.1 HIT-TO-LEAD IDENTIFICATION/LEAD GENERATION TO IMPROVE NEW DRUG POTENCY WITHOUT INCREASING LIPOPHILICITY

- 6.6 LEAD OPTIMIZATION

- 6.6.1 NEED FOR TRANSPARENT PRESENTATION AND ANALYSIS TO BOOST MARKET GROWTH

- 6.7 CANDIDATE SELECTION & VALIDATION

- 6.7.1 HIGH POSSIBILITY OF CLINICAL DRUG FAILURE TO SPUR ADOPTION OF CANDIDATE VALIDATION SERVICES

7 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY USE CASE

- 7.1 INTRODUCTION

- 7.2 UNDERSTANDING DISEASES

- 7.2.1 INCREASED FOCUS ON UNDERSTANDING DISEASES TO IMPROVE RESEARCH DATA QUALITY AND QUANTITY

- 7.3 DRUG REPURPOSING

- 7.3.1 INCREASING NEED FOR COST-EFFECTIVE TREATMENTS AND RISING AVAILABILITY OF BIOMEDICAL DATA TO AID MARKET GROWTH

- 7.4 DE NOVO DRUG DESIGN

- 7.4.1 SMALL-MOLECULE DESIGN

- 7.4.1.1 Increasing use of virtual screening and simulation techniques to drive growth

- 7.4.2 VACCINE DESIGN

- 7.4.2.1 Availability of well-validated AI tools to boost market growth

- 7.4.3 ANTIBODY & OTHER BIOLOGICS DESIGN

- 7.4.3.1 Advancements in protein modeling to propel segment growth

- 7.4.1 SMALL-MOLECULE DESIGN

- 7.5 DRUG OPTIMIZATION

- 7.5.1 SMALL-MOLECULE OPTIMIZATION

- 7.5.1.1 Leveraging generative models for identifying potential modifications in molecular structures to aid market growth

- 7.5.2 VACCINE OPTIMIZATION

- 7.5.2.1 Effectively predicting vaccine formulations and adjusting delivery vectors to drive growth

- 7.5.3 ANTIBODY & OTHER BIOLOGICS OPTIMIZATION

- 7.5.3.1 Increasing adoption of machine learning for predicting protein structures to augment segment growth

- 7.5.1 SMALL-MOLECULE OPTIMIZATION

- 7.6 SAFETY & TOXICITY

- 7.6.1 FOCUS ON ADVANCED OFF-TARGET EFFECT PREDICTION, PK/PD SIMULATION, AND QSP MODELING TO DRIVE MARKET

8 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY THERAPEUTIC AREA

- 8.1 INTRODUCTION

- 8.2 ONCOLOGY

- 8.2.1 HIGH PREVALENCE OF CANCER AND SHORTAGE OF EFFECTIVE ONCOLOGY DRUGS TO PROPEL MARKET GROWTH

- 8.3 INFECTIOUS DISEASES

- 8.3.1 RISING EPIDEMIC OUTBREAKS TO BOOST DRUG DISCOVERY ACTIVITY

- 8.4 NEUROLOGY

- 8.4.1 COMPLEX DISEASE DIAGNOSIS AND TREATMENT TO INCREASE ADOPTION OF ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY

- 8.5 METABOLIC DISEASES

- 8.5.1 ROLE OF ARTIFICIAL INTELLIGENCE IN UNCOVERING SMALL-MOLECULE THERAPIES TO DRIVE ADOPTION

- 8.6 CARDIOVASCULAR DISEASES

- 8.6.1 SEDENTARY LIFESTYLES AND HIGH PREVALENCE OF OBESITY TO INCREASE NOVEL DRUG DEVELOPMENT FOR CARDIAC DISEASES

- 8.7 IMMUNOLOGY

- 8.7.1 GROWING DRUG PIPELINE FOR IMMUNOLOGICAL DISORDERS TO FAVOR MARKET GROWTH

- 8.8 MENTAL HEALTH DISORDERS

- 8.8.1 INCREASED OCCURRENCE OF MENTAL HEALTH DISEASES IN DEVELOPED ECONOMIES TO SPUR MARKET GROWTH

- 8.9 OTHER THERAPEUTIC AREAS

9 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY PLAYER TYPE

- 9.1 INTRODUCTION

- 9.2 END-TO-END SOLUTION PROVIDERS

- 9.2.1 END-TO-END SOLUTION PROVIDERS TO REDUCE NEED FOR MULTIPLE VENDORS AND ACCELERATE WORKFLOWS

- 9.3 NICHE/POINT SOLUTION PROVIDERS

- 9.3.1 ACCURATE, COST-EFFECTIVE, AND LESS TIME CONSUMPTION TO PROPEL MARKET GROWTH

- 9.4 AI TECHNOLOGY PROVIDERS

- 9.4.1 SPECIALIZED AI CAPABILITIES WITH FULL-SERVICE MANAGEMENT TO SUPPORT MARKET GROWTH

- 9.5 BUSINESS PROCESS SERVICE PROVIDERS

- 9.5.1 BETTER ACCESSIBILITY OF HIGH-QUALITY TOOLS AND LOWER DRUG DEVELOPMENT COSTS TO AID MARKET GROWTH

10 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY AI TOOL

- 10.1 INTRODUCTION

- 10.2 MACHINE LEARNING

- 10.2.1 DEEP LEARNING

- 10.2.1.1 Reduced number of errors and consistent management of data to augment market growth

- 10.2.1.2 Convolutional neural networks

- 10.2.1.3 Recurrent neural networks

- 10.2.1.4 Generative adversarial networks

- 10.2.1.5 Graph neural networks

- 10.2.1.6 Other deep learning technologies

- 10.2.2 SUPERVISED LEARNING

- 10.2.2.1 Supervised learning to predict drug repositioning and manage high-dimensional datasets

- 10.2.3 REINFORCEMENT LEARNING

- 10.2.3.1 Need to accelerate new molecules and maximize performance to augment segment growth

- 10.2.4 UNSUPERVISED LEARNING

- 10.2.4.1 Unsupervised learning to perform complex tasks, uncover potential drug candidates, and optimize lead compounds

- 10.2.5 OTHER MACHINE LEARNING TECHNOLOGIES

- 10.2.1 DEEP LEARNING

- 10.3 NATURAL LANGUAGE PROCESSING

- 10.3.1 NATURAL LANGUAGE PROCESSING TO IDENTIFY INFORMATION WITHIN UNSTRUCTURED DATA AND ACCELERATE DRUG DISCOVERY

- 10.4 CONTEXT-AWARE PROCESSING & COMPUTING

- 10.4.1 CONTEXT-AWARE COMPUTING TO IMPROVE PREDICTIONS OF PATIENT-SPECIFIC DRUG RESPONSES AND OPTIMIZE THERAPEUTIC INTERVENTIONS

- 10.5 COMPUTER VISION

- 10.5.1 COMPUTER VISION TO ENHANCE DRUG DISCOVERY THROUGH ADVANCED IMAGE PROCESSING

- 10.6 IMAGE ANALYSIS

- 10.6.1 BETTER DRUG DISCOVERY THROUGH IMAGE PROCESSING TECHNIQUES TO SUPPORT MARKET GROWTH

11 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY DEPLOYMENT

- 11.1 INTRODUCTION

- 11.2 ON-PREMISES DEPLOYMENT

- 11.2.1 PROVISION OF MULTI-VENDOR ARCHITECTURE AND SECURITY BENEFITS TO DRIVE MARKET

- 11.3 CLOUD-BASED DEPLOYMENT

- 11.3.1 FOCUS ON RESEARCH COLLABORATIONS AND ELIMINATION OF SOFTWARE AND HARDWARE PURCHASING COSTS TO DRIVE MARKET

- 11.4 SAAS-BASED DEPLOYMENT

- 11.4.1 LOWER COSTS, BETTER SECURITY, AND EASIER ACCESS TO AUGMENT MARKET GROWTH

12 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY END USER

- 12.1 INTRODUCTION

- 12.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 12.2.1 RISING DEMAND FOR COST-EFFECTIVE DRUG DEVELOPMENT TO PROPEL MARKET GROWTH

- 12.3 CONTRACT RESEARCH ORGANIZATIONS

- 12.3.1 RISING NEED FOR OUTSOURCING IN PHARMACEUTICAL & BIOTECHNOLOGY INDUSTRIES TO AID MARKET GROWTH

- 12.4 RESEARCH CENTERS AND ACADEMIC & GOVERNMENT INSTITUTES

- 12.4.1 FOCUS ON DEVELOPING THERAPEUTIC STRATEGIES AND INNOVATIVE APPROACHES IN DRUG DISCOVERY TO AID MARKET GROWTH

13 ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 US to dominate North American market during study period

- 13.2.3 CANADA

- 13.2.3.1 Emergence of new AI-based startups and high health expenditure to support market growth

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 UK

- 13.3.2.1 Favorable government R&D funding to augment market growth

- 13.3.3 GERMANY

- 13.3.3.1 Presence of advanced medical infrastructure and high focus on personalized medicines to drive market

- 13.3.4 FRANCE

- 13.3.4.1 Strong government support and favorable strategies to propel market growth

- 13.3.5 ITALY

- 13.3.5.1 Advanced pharmaceutical industry and increased focus on life science R&D to fuel market growth

- 13.3.6 SPAIN

- 13.3.6.1 Favorable government initiatives and high investments by pharmaceutical companies to boost market growth

- 13.3.7 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 JAPAN

- 13.4.2.1 High geriatric population and advanced pharmaceutical research to boost market growth

- 13.4.3 CHINA

- 13.4.3.1 Increasing demand for generics and rising government investments to propel market growth

- 13.4.4 INDIA

- 13.4.4.1 Developed IT infrastructure and favorable government initiatives to spur market growth

- 13.4.5 REST OF ASIA PACIFIC

- 13.5 LATIN AMERICA

- 13.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 13.5.2 BRAZIL

- 13.5.2.1 Growing biotechnology sector and increasing governmental initiatives to boost market growth

- 13.5.3 MEXICO

- 13.5.3.1 Favorable government initiatives and high investments by pharmaceutical companies to support market growth

- 13.5.4 REST OF LATIN AMERICA

- 13.6 MIDDLE EAST & AFRICA

- 13.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 13.6.2 GCC COUNTRIES

- 13.6.2.1 Increasing emphasis on personalized medicines and developing healthcare infrastructure to drive market

- 13.6.3 REST OF MIDDLE EAST & AFRICA

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 14.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ARTIFICIAL INTELLIGENCE IN DRUG DISCOVERY MARKET

- 14.3 REVENUE ANALYSIS, 2019-2023

- 14.4 MARKET SHARE ANALYSIS, 2023

- 14.4.1 RANKING OF KEY MARKET PLAYERS

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 14.5.5.1 Company footprint

- 14.5.5.2 Use case footprint

- 14.5.5.3 Process footprint

- 14.5.5.4 Therapeutic area footprint

- 14.5.5.5 Player type footprint

- 14.5.5.6 Deployment mode footprint

- 14.5.5.7 Region footprint

- 14.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- 14.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 14.7 COMPANY VALUATION AND FINANCIAL METRICS

- 14.7.1 FINANCIAL METRICS

- 14.7.2 COMPANY VALUATION

- 14.8 BRAND/PRODUCT COMPARISON

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT AND SOLUTION LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

- 14.9.4 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 NVIDIA CORPORATION

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Services/Solutions offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product and service launches

- 15.1.1.3.2 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 EXSCIENTIA

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Services/Solutions offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Solution launches

- 15.1.2.3.2 Deals

- 15.1.2.3.3 Expansions

- 15.1.2.3.4 Other developments

- 15.1.2.4 MnM view

- 15.1.2.4.1 Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 GOOGLE

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Services/Solutions offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Solution launches

- 15.1.3.3.2 Deals

- 15.1.3.3.3 Expansions

- 15.1.3.4 MnM view

- 15.1.3.4.1 Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 RECURSION

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Services/Solutions offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Solution launches

- 15.1.4.3.2 Deals

- 15.1.4.3.3 Expansions

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices made

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 INSILICO MEDICINE

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Services/Solutions offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product and solution launches and developments

- 15.1.5.3.2 Deals

- 15.1.5.3.3 Other developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 SCHRODINGER, INC.

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Services/Solutions offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.6.3.2 Other developments

- 15.1.7 BENEVOLENTAI

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Services/Solutions offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Deals

- 15.1.8 MICROSOFT CORPORATION

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Services/Solutions offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Deals

- 15.1.9 ATOMWISE INC.

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Services/Solutions offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.10 ILLUMINA, INC.

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Services/Solutions offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Solution launches

- 15.1.10.3.2 Deals

- 15.1.11 NUMEDII, INC.

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Services/Solutions offered

- 15.1.12 XTALPI INC.

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Services/Solutions offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Deals

- 15.1.13 IKTOS

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Services/Solutions offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Deals

- 15.1.13.3.2 Other developments

- 15.1.14 TEMPUS

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Services/Solutions offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Solution launches

- 15.1.14.3.2 Deals

- 15.1.14.3.3 Expansions

- 15.1.14.3.4 Other developments

- 15.1.15 DEEP GENOMICS

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Services/Solutions offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Solution launches

- 15.1.15.3.2 Deals

- 15.1.15.3.3 Other developments

- 15.1.16 VERGE GENOMICS

- 15.1.16.1 Business overview

- 15.1.16.2 Products/Services/Solutions offered

- 15.1.16.3 Recent developments

- 15.1.16.3.1 Deals

- 15.1.17 BENCHSCI

- 15.1.17.1 Business overview

- 15.1.17.2 Products/Services/Solutions offered

- 15.1.17.3 Recent developments

- 15.1.17.3.1 Solution launches

- 15.1.17.3.2 Deals

- 15.1.17.3.3 Other developments

- 15.1.18 INSITRO

- 15.1.18.1 Business overview

- 15.1.18.2 Products/Services/Solutions offered

- 15.1.18.3 Recent developments

- 15.1.18.3.1 Deals

- 15.1.18.3.2 Other developments

- 15.1.19 VALO HEALTH

- 15.1.19.1 Business overview

- 15.1.19.2 Products/Services/Solutions offered

- 15.1.19.3 Recent developments

- 15.1.19.3.1 Deals

- 15.1.19.3.2 Other developments

- 15.1.20 BPGBIO, INC.

- 15.1.20.1 Business overview

- 15.1.20.2 Products/Services/Solutions offered

- 15.1.20.3 Recent developments

- 15.1.20.3.1 Deals

- 15.1.21 MERCK KGAA