|

|

市場調査レポート

商品コード

1500646

マネージドディテクション&レスポンス(MDR)の世界市場:サービスタイプ別、セキュリティタイプ別、導入形態別、組織規模別、業界別、地域別 - 2029年までの予測Managed Detection and Response (MDR) Market by Security Type (Network, Endpoint, Cloud), Deployment Mode (On-Premises and Cloud), Organization Size (SMEs and Large Enterprises), Vertical and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| マネージドディテクション&レスポンス(MDR)の世界市場:サービスタイプ別、セキュリティタイプ別、導入形態別、組織規模別、業界別、地域別 - 2029年までの予測 |

|

出版日: 2024年06月11日

発行: MarketsandMarkets

ページ情報: 英文 287 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のマネージドディテクション&レスポンス(MDR)の市場規模は、2024年に41億米ドルと予測され、予測期間中のCAGRは23.5%となり、2029年には118億米ドルに達すると予測されています。

企業は、高度なマルウェア、ランサムウェア、従来のセキュリティ対策を迂回する標的型攻撃などを特徴とする、進化し続ける脅威の状況に直面しています。このような課題に対応するため、サイバーセキュリティ能力を強化するMDRサービスを利用する企業が増えています。MDRソリューションは、継続的な監視、脅威の検知、迅速な対応能力を提供し、サイバー脅威にリアルタイムで効果的に対抗するために必要な俊敏性と回復力を企業に提供します。熟練したサイバーセキュリティ専門家の不足とセキュリティインフラ管理の複雑さは、企業が進化する脅威に対する防御を強化するためにアウトソーシングされた専門知識を求め、MDRサービスの採用をさらに後押ししています。このような要因が重なることで、組織がサイバー敵の先手を打ち、デジタル資産を保護する上で、MDRが重要な役割を担っていることが浮き彫りになっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 米ドル(10億米ドル) |

| セグメント別 | サービスタイプ別、セキュリティタイプ別、導入形態別、組織規模別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

企業は、拡張性、柔軟性、費用対効果など、クラウド導入の数々のメリットを認識しています。クラウド経由で提供されるMDRソリューションは、デジタル資産を効果的に保護するために必要な俊敏性とアクセシビリティを組織に提供します。クラウドベースのMDRサービスは、迅速な展開、シームレスな更新、一元管理を提供するため、企業は変化する脅威環境に迅速に対応し、必要に応じてセキュリティインフラを拡張することができます。クラウド固有の回復力と冗長性は、MDRサービスの信頼性と可用性を高め、進化するサイバー脅威からの継続的な保護を保証します。企業がイノベーションと効率化を推進するためにクラウド技術を採用し続けていることから、クラウド分野は予測期間中、MDR市場におけるリーダー的地位を維持する見通しです。

BFSIセグメントの市場シェアが拡大する見込みであることは、この業界におけるサイバーセキュリティへの関心の高まりを裏付けています。BFSI組織は膨大な量の機密金融データを扱っており、データ漏洩、詐欺、ランサムウェアなどのサイバー攻撃の格好の標的となっています。金銭取引がますますデジタル・プラットフォームに移行するにつれ、リスクの状況はより複雑になり、強固なセキュリティ対策が必要となっています。マネージドディテクション&レスポンス(MDR)ソリューションは、BFSI機関に高度な脅威検知、継続的モニタリング、迅速なインシデントレスポンス機能を提供し、高度なサイバー脅威から保護します。PCI DSSやGDPRなどの厳しい規制要件により、BFSI機関はコンプライアンスを確保し、顧客データを保護するための包括的なサイバーセキュリティ対策の実施を余儀なくされています。BFSI企業にとってサイバーセキュリティは信頼と完全性を維持するための最優先事項であり続けるため、この分野特有の課題に合わせたMDRソリューションに対する需要が、予測期間中の市場の大幅な成長を促進すると予想されます。

当レポートでは、世界のマネージドディテクション&レスポンス(MDR)市場について調査し、サービスタイプ別、セキュリティタイプ別、導入形態別、組織規模別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- ケーススタディ分析

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 価格分析

- 技術分析

- 特許分析

- 購入者に影響を与える動向/混乱

- 規制状況

- 主な利害関係者と購入基準

- 2024年~2025年の主な会議とイベント

- ビジネスモデル分析

- 投資と資金調達のシナリオ

第6章 マネージドディテクション&レスポンス市場、サービスタイプ別

- イントロダクション

- 保護監視

- 脅威とアラートの優先順位付け

- 脅威ハンティング

- マネージド調査サービス

- ガイド付き応答

- マネージド修復

第7章 マネージドディテクション&レスポンス市場、セキュリティタイプ別

- イントロダクション

- エンドポイントセキュリティ

- ネットワークセキュリティ

- クラウドセキュリティ

- その他

第8章 マネージドディテクション&レスポンス市場、導入形態別

- イントロダクション

- オンプレミス

- クラウド

第9章 マネージドディテクション&レスポンス市場、組織規模別

- イントロダクション

- 大企業

- 中小企業

第10章 マネージドディテクション&レスポンス市場、業界別

- イントロダクション

- BFSI

- IT・ITES

- 政府

- エネルギー・ユーティリティ

- 製造

- ヘルスケア

- 小売

- その他

第11章 マネージドディテクション&レスポンス市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第12章 競合情勢

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- ブランド比較

- 企業価値評価と財務指標

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- CROWDSTRIKE

- RAPID7

- RED CANARY

- ARCTIC WOLF

- KUDELSKI SECURITY

- SENTINELONE

- PROFICIO

- EXPEL

- SECUREWORKS

- ALERT LOGIC

- その他の企業

- TRUSTWAVE

- MANDIANT

- BINARY DEFENSE

- SOPHOS

- ESENTIRE

- DEEPWATCH

- NETSURION

- GOSECURE

- LMNTRIX

- UNDERDEFENSE

- ACKCENT

- CYBEREASON

- CRITICAL START

- CYSIV

- CRITICAL INSIGHT

第14章 隣接市場

第15章 付録

The global Managed Detection and Response (MDR) is estimated to be worth USD 4.1 billion in 2024 and is projected to reach USD 11.8 billion by 2029, at a CAGR of 23.5% during the forecast period. Businesses are facing an ever-evolving threat landscape characterized by advanced malware, ransomware, and targeted attacks that can bypass traditional security measures. Organizations increasingly turn to MDR services to augment their cybersecurity capabilities in response to these challenges. MDR solutions offer continuous monitoring, threat detection, and rapid response capabilities, providing businesses with the agility and resilience needed to effectively combat cyber threats in real-time. The shortage of skilled cybersecurity professionals and the complexity of managing security infrastructure further drive the adoption of MDR services as businesses seek outsourced expertise to bolster their defenses against evolving threats. This convergence of factors underscores MDR's critical role in helping organizations stay ahead of cyber adversaries and protect their digital assets.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | USD (Billion) |

| Segments | By security type, deployment mode, organization size, vertical and region |

| Regions covered | North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

"By deployment mode, the cloud segment is expected to achieve a larger market share during the forecast period."

Businesses recognize cloud deployment's numerous benefits, including scalability, flexibility, and cost-effectiveness. Managed Detection and Response (MDR) solutions delivered via the cloud provide organizations with the agility and accessibility needed to protect their digital assets effectively. Cloud-based MDR services offer rapid deployment, seamless updates, and centralized management, enabling businesses to quickly adapt to changing threat landscapes and scale their security infrastructure as needed. The cloud's inherent resilience and redundancy enhance the reliability and availability of MDR services, ensuring continuous protection against evolving cyber threats. As organizations continue to embrace cloud technologies to drive innovation and efficiency, the cloud segment is poised to maintain its leadership position in the MDR market during the forecast period.

"By vertical, the BFSI segment is expected to achieve a larger market share during the forecast period."

The anticipated larger market share for the BFSI segment underscores the heightened cybersecurity concerns within this industry vertical. BFSI organizations handle vast amounts of sensitive financial data and are prime targets for cyber attacks such as data breaches, fraud, and ransomware. As monetary transactions increasingly migrate to digital platforms, the risk landscape becomes more complex, necessitating robust security measures. Managed Detection and Response (MDR) solutions offer BFSI institutions advanced threat detection, continuous monitoring, and rapid incident response capabilities to protect against sophisticated cyber threats. Stringent regulatory requirements, such as PCI DSS and GDPR, compel BFSI organizations to implement comprehensive cybersecurity measures to ensure compliance and safeguard customer data. As cybersecurity remains a top priority for BFSI firms to maintain trust and integrity, the demand for MDR solutions tailored to the unique challenges of this sector is expected to drive significant market growth during the forecast period.

"The North America region will dominate the market during the forecast period."

The forecasted dominance of the North American region underscores the region's strong focus on cybersecurity and technological innovation. North America is home to many leading cybersecurity firms and technology hubs, driving advancements in Managed Detection and Response (MDR) solutions. The region's robust regulatory framework, including regulations like GDPR and HIPAA, mandates stringent data protection measures, further fueling the demand for comprehensive security services. The prevalence of high-profile cyber-attacks and data breaches in North America has heightened awareness among organizations about the importance of proactive threat detection and response. As businesses prioritize cybersecurity investments to protect their digital assets and customer data, North America is poised to maintain its leadership position in the MDR market during the forecast period.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The breakdown of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level - 40%, Managers and Others - 60%

- By Region: North America - 20%, Europe - 35%, Asia Pacific - 45%.

The major players in the Managed Detection and Response (MDR) market are CrowdStrike (US), Rapid7 (US), Red Canary (US), Arctic Wolf (US), Kudelski Security (Switzerland), SentinelOne (US), Proficio (US), Expel (US), Secureworks (US), Alert Logic (US), Trustwave (US), Mandiant (US), Binary Defense (US), Sophos (UK), eSentire (Canada), Deepwatch (US), Netsurion (US), GoSecure (Canada), LMNTRIX (Australia), UnderDefense (US), Ackcent (Spain), Cybereason (US), Critical Start (US), Forescout (US), and Critical Insight (US). The study includes an in-depth competitive analysis of these key players in the managed detection and response market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The research encompasses the size of the managed detection and response market across various segments. It seeks to gauge its market size and growth potential within different categories by offering sub-types, organization sizes, deployment modes, verticals, and regions. Additionally, the study provides a comprehensive competitive analysis of major market players, delving into their company profiles, significant observations regarding product and business offerings, recent advancements, and key market strategies.

Reasons to buy this report

The report aims to assist market leaders and new entrants by providing near-accurate revenue estimates for the managed detection and response market and its subsegments. It offers insights into the competitive landscape, enabling stakeholders to gain a deeper understanding and better position their businesses while also aiding in developing appropriate go-to-market strategies. Furthermore, the report aids stakeholders in grasping the market dynamics, offering information on significant market drivers, constraints, challenges, and opportunities.

The report provides insights on the following pointers:

- The report offers insights into various aspects: As businesses increasingly recognize the critical importance of managed detection and response, there is a growing demand for comprehensive solutions and services. These encompass a range of tools that enable organizations to achieve secure and authentic connectivity. While challenges such as the need for alignment and technology integration are acknowledged, the report emphasizes the dynamic nature of managed detection and response technologies and evolving market trends. Additionally, it provides valuable insights into the future direction of the managed detection and response market.

- Product Development/Innovation: The report provides detailed insights into emerging technologies, research and development activities, and product and solution launches within the managed detection and response market.

- Market Development: The report offers extensive details regarding profitable markets, analyzing the managed detection and response market across diverse regions.

- Market Diversification: The report provides thorough information on newly developed products and solutions, unexplored geographical areas, recent advancements, and investments in the managed detection and response market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like CrowdStrike (US), Rapid7 (US), Red Canary (US), Arctic Wolf (US), Kudelski Security (Switzerland), SentinelOne (US), Proficio (US), Expel (US), Secureworks (US), Alert Logic (US), Trustwave (US), Mandiant (US), Binary Defense (US), Sophos (UK), eSentire (Canada), Deepwatch (US), Netsurion (US), GoSecure (Canada), LMNTRIX (Australia), UnderDefense (US), Ackcent (Spain), Cybereason (US), Critical Start (US), Forescout (US), and Critical Insight (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- FIGURE 1 MANAGED DETECTION AND RESPONSE MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- FIGURE 2 MANAGED DETECTION AND RESPONSE MARKET SEGMENTATION, BY REGION

- 1.4 YEARS CONSIDERED

- FIGURE 3 STUDY YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2023

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 4 MANAGED DETECTION AND RESPONSE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primary interviews

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.2 Key industry insights

- FIGURE 6 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 2.2 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- FIGURE 8 APPROACH 1: TOP-DOWN (SUPPLY SIDE): REVENUE FROM SOLUTIONS AND SERVICES

- FIGURE 9 APPROACH 1: TOP-DOWN (SUPPLY-SIDE) ANALYSIS

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 10 APPROACH 2 (BOTTOM-UP; DEMAND SIDE): SEGMENTAL REVENUE BASED ON REGIONAL FACTORS

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 STUDY LIMITATIONS

- FIGURE 11 LIMITATIONS AND RISK ASSESSMENT

- 2.7 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 12 MANAGED DETECTION AND RESPONSE MARKET SIZE, 2022-2029 (USD MILLION)

- FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE MARKET OPPORTUNITIES FOR MANAGED DETECTION AND RESPONSE MARKET PLAYERS

- FIGURE 14 MANAGED SERVICES TO ADDRESS SHORTAGE OF SKILLED CYBERSECURITY PROFESSIONALS

- 4.2 MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE

- FIGURE 15 ENDPOINT SECURITY TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.3 MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL

- FIGURE 16 BFSI SEGMENT TO BE LARGEST VERTICAL IN 2024 AND 2029

- 4.4 MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE

- FIGURE 17 CLOUD DEPLOYMENT TO ACCOUNT FOR LARGER MODE DURING FORECAST PERIOD

- 4.5 MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE

- FIGURE 18 SMALL & MEDIUM-SIZED ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.6 MANAGED DETECTION AND RESPONSE MARKET INVESTMENT SCENARIO, BY REGION

- FIGURE 19 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- FIGURE 20 BENEFITS GAINED BY ORGANIZATION USING MANAGED DETECTION AND RESPONSE SERVICES

- 5.2 MARKET DYNAMICS

- FIGURE 21 MANAGED DETECTION AND RESPONSE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in incidents of business email compromise, ransomware, and crypto-jacking threats

- 5.2.1.2 Addressing gaps in cybersecurity skills and overwhelming alert volumes

- 5.2.1.3 Government regulations and need for compliance to drive adoption of MDR services

- 5.2.1.4 Technological proliferation and increasing penetration of IoT

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of trust in third-party applications

- 5.2.2.2 Cost of MDR services to be inhibitor for organizations

- 5.2.2.3 False positives hinder effectiveness of MDR services

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Introduction of ML/AI-powered MDR services

- 5.2.3.2 Increase in adoption of MDR across SMEs

- 5.2.3.3 Benefits of scalability for MDR services

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of modern IT infrastructure

- 5.2.4.2 Potential cyberattacks on MDR service provider's infrastructure

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 VENERABLE HOLDINGS BENEFITED FROM ESENTIRE'S 24/7 THREAT DETECTION, RESPONSE, AND CLOUD SECURITY POSTURE MANAGEMENT

- 5.3.2 CANADIAN FINANCIAL SERVICES FIRM USED ARCTIC WOLF'S MANAGED DETECTION AND RESPONSE SERVICES TO MONITOR IT ENVIRONMENT

- 5.3.3 ALERT LOGIC HELPED IODINE SOFTWARE SECURE IN-PATIENT HEALTHCARE DATA AND MEET COMPLIANCE MANDATES

- 5.3.4 SECUREWORKS SUPPORTED STRENGTHENING CYBERSECURITY FOR GKN WHEELS AND STRUCTURES

- 5.3.5 GLOBAL INVESTMENT FIRM USED MANAGED DETECTION AND RESPONSE SERVICES TO PROTECT PROPRIETARY INFORMATION AND PRIVATE DATA

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 22 MANAGED DETECTION AND RESPONSE MARKET: VALUE CHAIN

- 5.4.1 OFFERINGS

- 5.4.2 PLANNING AND DESIGNING

- 5.4.3 DEPLOYMENT (IF APPLICABLE)

- 5.4.4 SYSTEM INTEGRATION

- 5.4.5 CONSULTATION

- 5.4.6 ONSITE SUPPORT (IF REQUIRED)

- 5.4.7 END-USER GROUPS

- 5.5 ECOSYSTEM ANALYSIS

- FIGURE 23 MANAGED DETECTION AND RESPONSE MARKET: ECOSYSTEM

- TABLE 3 MANAGED DETECTION AND RESPONSE MARKET: ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 MANAGED DETECTION AND RESPONSE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 PORTER'S FIVE FORCES IMPACT ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 BARGAINING POWER OF SUPPLIERS

- 5.6.3 BARGAINING POWER OF BUYERS

- 5.6.4 THREAT OF SUBSTITUTES

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 PRICING ANALYSIS

- 5.7.1 INDICATIVE PRICING ANALYSIS, BY OFFERING

- FIGURE 25 INDICATIVE PRICING TREND OF KEY VENDORS, BY OFFERING (USD)

- TABLE 5 INDICATIVE PRICING TREND OF KEY PLAYERS, BY OFFERING (USD/MONTH)

- 5.7.2 INDICATIVE PRICING ANALYSIS, BY VENDOR

- TABLE 6 INDICATIVE PRICING LEVELS OF MANAGED DETECTION AND RESPONSE SOLUTIONS, BY VENDOR

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Artificial intelligence (AI) and machine learning (ML)

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Big data analytics

- 5.8.2.2 Biometric authentication

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Endpoint security

- 5.8.3.2 Cloud security

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- FIGURE 26 MANAGED DETECTION AND RESPONSE MARKET: PATENT ANALYSIS, 2013-2023

- FIGURE 27 REGIONAL ANALYSIS OF PATENTS GRANTED, 2013-2023

- 5.9.1 KEY PATENTS

- TABLE 7 LIST OF KEY PATENTS

- 5.10 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 28 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES IN MANAGED DETECTION AND RESPONSE MARKET

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1.1 Payment Card Industry-Data Security Standard (PCI-DSS)

- 5.11.1.2 Health Insurance Portability and Accountability Act (HIPAA)

- 5.11.1.3 Federal Information Security Management Act (FISMA)

- 5.11.1.4 Gramm-Leach-Bliley Act (GLBA)

- 5.11.1.5 Sarbanes-Oxley Act (SOX)

- 5.11.1.6 International Organization for Standardization (ISO) standard 27001

- 5.11.1.7 European Union General Data Protection Regulation (EU GDPR)

- 5.11.1.8 FFIEC Cybersecurity Assessment Tool

- 5.11.1.9 NIST Cybersecurity Framework

- 5.11.1.10 Defense Federal Acquisition Regulation Supplement (DFARS)

- 5.11.1.11 Information Technology Infrastructure Library (ITIL)

- 5.11.1.12 CSA STAR

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- 5.12.2 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 14 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.13 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 15 MANAGED DETECTION AND RESPONSE MARKET: LIST OF CONFERENCES AND EVENTS, 2024-2025

- 5.14 BUSINESS MODEL ANALYSIS

- TABLE 16 BUSINESS MODEL ANALYSIS OF MANAGED DETECTION AND RESPONSE MARKET

- 5.15 INVESTMENT & FUNDING SCENARIO

- FIGURE 31 LEADING GLOBAL MANAGED DETECTION AND RESPONSE STARTUPS/SMES, BY NUMBER OF INVESTORS AND FUNDING ROUNDS

- TABLE 17 LEADING GLOBAL MANAGED DETECTION AND RESPONSE STARTUPS/SMES, BY TOTAL FUNDING AND LATEST FUNDING ROUNDS

6 MANAGED DETECTION AND RESPONSE MARKET, BY SERVICE TYPE

- 6.1 INTRODUCTION

- 6.1.1 SERVICE TYPE: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- 6.2 PROTECTIVE MONITORING

- 6.2.1 PROACTIVE CYBERSECURITY AND COMPLIANCE ENSURED THROUGH PROTECTIVE MONITORING

- 6.3 PRIORITIZATION OF THREATS & ALERTS

- 6.3.1 STRATEGIC THREAT AND ALERT PRIORITIZATION NEEDED FOR ROBUST CYBERSECURITY

- 6.4 THREAT HUNTING

- 6.4.1 INCREASE IN CYBERSECURITY RESILIENCE WITH REDUCED DWELL TIME ON THREATS

- 6.5 MANAGED INVESTIGATION SERVICES

- 6.5.1 LEVERAGED ADVANCED THREAT DETECTION AND RESPONSE CAPABILITIES FOR ORGANIZATIONS WITHOUT MAINTAINING DEDICATED SECURITY TEAMS

- 6.6 GUIDED RESPONSE

- 6.6.1 EXPERT-LED GUIDED RESPONSE TO ENHANCE INCIDENT MANAGEMENT

- 6.7 MANAGED REMEDIATION

- 6.7.1 COMPREHENSIVE CYBERSECURITY THAT GOES BEYOND DETECTION

7 MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE

- 7.1 INTRODUCTION

- 7.1.1 SECURITY TYPE: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- FIGURE 32 CLOUD SECURITY TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

- TABLE 18 MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 19 MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- 7.2 ENDPOINT SECURITY

- 7.2.1 RAPID GLOBAL GROWTH IN NUMBER OF MOBILE DEVICES

- 7.2.2 ENDPOINT SECURITY: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- TABLE 20 MANAGED DETECTION AND RESPONSE MARKET FOR ENDPOINT SECURITY, BY REGION, 2018-2023 (USD MILLION)

- TABLE 21 MANAGED DETECTION AND RESPONSE MARKET FOR ENDPOINT SECURITY, BY REGION, 2024-2029 (USD MILLION)

- 7.3 NETWORK SECURITY

- 7.3.1 INCREASE IN BYOD TREND TO GENERATE GREATER DEMAND FOR CYBERSECURITY SOLUTIONS

- 7.3.2 NETWORK SECURITY: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- TABLE 22 MANAGED DETECTION AND RESPONSE MARKET FOR NETWORK SECURITY, BY REGION, 2018-2023 (USD MILLION)

- TABLE 23 MANAGED DETECTION AND RESPONSE MARKET FOR NETWORK SECURITY, BY REGION, 2024-2029 (USD MILLION)

- 7.4 CLOUD SECURITY

- 7.4.1 RISE IN DEMAND FROM SMES FOR CLOUD-BASED HEALTHCARE SOLUTIONS

- 7.4.2 CLOUD SECURITY: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

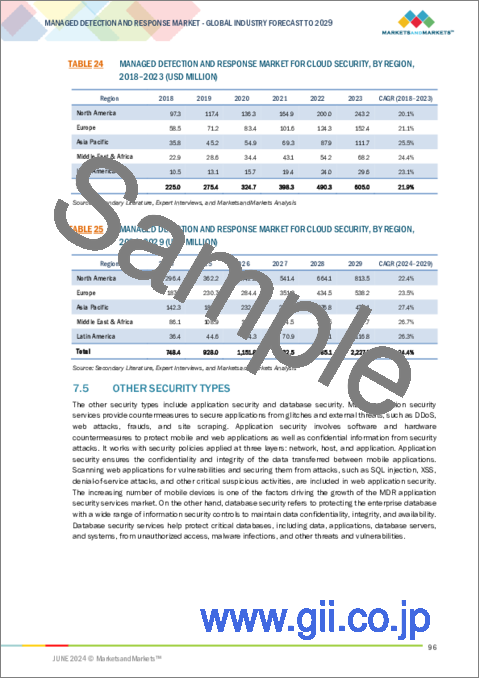

- TABLE 24 MANAGED DETECTION AND RESPONSE MARKET FOR CLOUD SECURITY, BY REGION, 2018-2023 (USD MILLION)

- TABLE 25 MANAGED DETECTION AND RESPONSE MARKET FOR CLOUD SECURITY, BY REGION, 2024-2029 (USD MILLION)

- 7.5 OTHER SECURITY TYPES

- TABLE 26 MANAGED DETECTION AND RESPONSE MARKET FOR OTHER SECURITY TYPES, BY REGION, 2018-2023 (USD MILLION)

- TABLE 27 MANAGED DETECTION AND RESPONSE MARKET FOR OTHER SECURITY TYPES, BY REGION, 2024-2029 (USD MILLION)

8 MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE

- 8.1 INTRODUCTION

- 8.1.1 DEPLOYMENT MODE: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- FIGURE 33 CLOUD DEPLOYMENT OF MANAGED DETECTION AND RESPONSE SOLUTIONS AND SERVICES TO ACCOUNT FOR LARGER MARKET DURING FORECAST PERIOD

- TABLE 28 MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 29 MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- 8.2 ON-PREMISES

- 8.2.1 CUSTOMIZATION OF ON-PREMISE SOLUTION DEPLOYMENT TO GAIN CONTROL OVER SYSTEMS

- 8.2.2 ON-PREMISES: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- TABLE 30 ON-PREMISE MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 31 ON-PREMISE MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 8.3 CLOUD

- 8.3.1 COST OPTIMIZATION, SCALABILITY, AND FLEXIBILITY OF CLOUD DEPLOYMENT

- 8.3.2 CLOUD: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- TABLE 32 CLOUD-BASED MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 33 CLOUD-BASED MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2024-2029 (USD MILLION)

9 MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE

- 9.1 INTRODUCTION

- 9.1.1 ORGANIZATION SIZE: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- FIGURE 34 SMALL AND MEDIUM-SIZED ENTERPRISES TO ACCOUNT FOR LARGER MARKET DURING FORECAST PERIOD

- TABLE 34 MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 35 MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- 9.2 LARGE ENTERPRISES

- 9.2.1 RISE IN CONCERNS ABOUT REGULATORY COMPLIANCE TO FUEL ADOPTION OF MDR SERVICES

- 9.2.2 LARGE ENTERPRISES: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- TABLE 36 MANAGED DETECTION AND RESPONSE MARKET FOR LARGE ENTERPRISES, BY REGION, 2018-2023 (USD MILLION)

- TABLE 37 MANAGED DETECTION AND RESPONSE MARKET FOR LARGE ENTERPRISES, BY REGION, 2024-2029 (USD MILLION)

- 9.3 SMALL & MEDIUM-SIZED ENTERPRISES

- 9.3.1 INCREASED SOPHISTICATION OF CYBERATTACKS TO ENCOURAGE IMPLEMENTATION OF MORE THAN TRADITIONAL SERVICE MODELS

- 9.3.2 SMALL & MEDIUM-SIZED ENTERPRISES: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- TABLE 38 MANAGED DETECTION AND RESPONSE MARKET FOR SMES, BY REGION, 2018-2023 (USD MILLION)

- TABLE 39 MANAGED DETECTION AND RESPONSE MARKET FOR SMES, BY REGION, 2024-2029 (USD MILLION)

10 MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- 10.1.1 VERTICAL: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- FIGURE 35 BFSI TO ACCOUNT FOR LARGEST VERTICAL MARKET DURING FORECAST PERIOD

- TABLE 40 MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 41 MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 10.2 BFSI

- 10.2.1 HIGH SUSCEPTIBILITY OF BANKS AND OTHER FINANCIAL INSTITUTIONS TO FRAUD

- 10.2.2 BFSI: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- TABLE 42 MANAGED DETECTION AND RESPONSE MARKET IN BFSI, BY REGION, 2018-2023 (USD MILLION)

- TABLE 43 MANAGED DETECTION AND RESPONSE MARKET IN BFSI, BY REGION, 2024-2029 (USD MILLION)

- 10.3 IT & ITES

- 10.3.1 GROWTH COMPLIANCE CONCERNS AND VULNERABILITY TO MALICIOUS CODES VIA SPAM

- 10.3.2 IT & ITES: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- TABLE 44 MANAGED DETECTION AND RESPONSE MARKET IN IT & ITES, BY REGION, 2018-2023 (USD MILLION)

- TABLE 45 MANAGED DETECTION AND RESPONSE MARKET IN IT & ITES, BY REGION, 2024-2029 (USD MILLION)

- 10.4 GOVERNMENT

- 10.4.1 RISE IN CONCERNS ABOUT IDENTITY THEFT AND NEED TO MITIGATE DATA LOSS

- 10.4.2 GOVERNMENT: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- TABLE 46 MANAGED DETECTION AND RESPONSE MARKET IN GOVERNMENT, BY REGION, 2018-2023 (USD MILLION)

- TABLE 47 MANAGED DETECTION AND RESPONSE MARKET IN GOVERNMENT, BY REGION, 2024-2029 (USD MILLION)

- 10.5 ENERGY & UTILITIES

- 10.5.1 INCREASE IN INTEGRATED THREAT INTELLIGENCE SOLUTIONS AMONG ENERGY & UTILITY ENTERPRISES AND NEED TO SECURE CRITICAL INFRASTRUCTURE

- 10.5.2 ENERGY & UTILITIES: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- TABLE 48 MANAGED DETECTION AND RESPONSE MARKET IN ENERGY & UTILITIES, BY REGION, 2018-2023 (USD MILLION)

- TABLE 49 MANAGED DETECTION AND RESPONSE MARKET IN ENERGY & UTILITIES, BY REGION, 2024-2029 (USD MILLION)

- 10.6 MANUFACTURING

- 10.6.1 ADOPTION OF THREAT INTELLIGENCE TO PREPARE FOR SURGE IN PRODUCTION AS VERTICAL TO GROW ACROSS REGIONS

- 10.6.2 MANUFACTURING: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- TABLE 50 MANAGED DETECTION AND RESPONSE MARKET IN MANUFACTURING, BY REGION, 2018-2023 (USD MILLION)

- TABLE 51 MANAGED DETECTION AND RESPONSE MARKET IN MANUFACTURING, BY REGION, 2024-2029 (USD MILLION)

- 10.7 HEALTHCARE

- 10.7.1 NEED TO SECURE CRITICAL PATIENT DATA ACROSS CLOUD ENVIRONMENT

- 10.7.2 HEALTHCARE: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- TABLE 52 MANAGED DETECTION AND RESPONSE MARKET IN HEALTHCARE, BY REGION, 2018-2023 (USD MILLION)

- TABLE 53 MANAGED DETECTION AND RESPONSE MARKET IN HEALTHCARE, BY REGION, 2024-2029 (USD MILLION)

- 10.8 RETAIL

- 10.8.1 AUTOMATION ACROSS RETAIL CHANNELS FOR CURBING DATA THEFT

- 10.8.2 RETAIL: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- TABLE 54 MANAGED DETECTION AND RESPONSE MARKET IN RETAIL, BY REGION, 2018-2023 (USD MILLION)

- TABLE 55 MANAGED DETECTION AND RESPONSE MARKET IN RETAIL, BY REGION, 2024-2029 (USD MILLION)

- 10.9 OTHER VERTICALS

- TABLE 56 MANAGED DETECTION AND RESPONSE MARKET IN OTHER VERTICALS, BY REGION, 2018-2023 (USD MILLION)

- TABLE 57 MANAGED DETECTION AND RESPONSE MARKET IN OTHER VERTICALS, BY REGION, 2024-2029 (USD MILLION)

11 MANAGED DETECTION AND RESPONSE MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 36 ASIA PACIFIC MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 58 MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2018-2023 (USD MILLION)

- TABLE 59 MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2024-2029 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- 11.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 37 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET SNAPSHOT

- TABLE 60 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 61 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 62 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 63 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 64 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 65 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 66 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 67 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 68 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 69 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.2.3 US

- 11.2.3.1 Increase in ransomware and phishing attacks, along with government initiatives and technological advancements

- TABLE 70 US: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 71 US: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 72 US: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 73 US: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 74 US: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 75 US: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 76 US: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 77 US: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.2.4 CANADA

- 11.2.4.1 Increase in adoption of cloud-based services and private sector initiatives to curb cyberattacks

- TABLE 78 CANADA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 79 CANADA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 80 CANADA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 81 CANADA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 82 CANADA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 83 CANADA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 84 CANADA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 85 CANADA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 EUROPE: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- 11.3.2 EUROPE: RECESSION IMPACT

- TABLE 86 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 87 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 88 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 89 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 90 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 91 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 92 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 93 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 94 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 95 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.3.3 UK

- 11.3.3.1 Substantial technical expertise, government investment in cybersecurity training programs, and strong IT budgets

- TABLE 96 UK: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 97 UK: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 98 UK: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 99 UK: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 100 UK: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 101 UK: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 102 UK: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 103 UK: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.3.4 GERMANY

- 11.3.4.1 Need to combat massive hit on mid-sized and critical infrastructures with focus on healthcare cybersecurity

- TABLE 104 GERMANY: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 105 GERMANY: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 106 GERMANY: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 107 GERMANY: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 108 GERMANY: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 109 GERMANY: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 110 GERMANY: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 111 GERMANY: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.3.5 FRANCE

- 11.3.5.1 Growing threat of nation-state cyberattacks on government infrastructure

- TABLE 112 FRANCE: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 113 FRANCE: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 114 FRANCE: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 115 FRANCE: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 116 FRANCE: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 117 FRANCE: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 118 FRANCE: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 119 FRANCE: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.3.6 REST OF EUROPE

- TABLE 120 REST OF EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 121 REST OF EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 122 REST OF EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 123 REST OF EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 124 REST OF EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 125 REST OF EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 126 REST OF EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 127 REST OF EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 38 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET SNAPSHOT

- TABLE 128 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 129 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 130 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 131 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 132 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 133 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 134 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 135 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 136 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY/REGION, 2018-2023 (USD MILLION)

- TABLE 137 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY/REGION, 2024-2029 (USD MILLION)

- 11.4.3 CHINA

- 11.4.3.1 Evolving digital landscape, strict regulations, and high adoption in BFSI sector

- TABLE 138 CHINA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 139 CHINA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 140 CHINA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 141 CHINA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 142 CHINA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 143 CHINA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 144 CHINA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 145 CHINA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.4.4 JAPAN

- 11.4.4.1 Rise in demand for robust cybersecurity solutions across verticals, specifically finance, healthcare, manufacturing, and government

- TABLE 146 JAPAN: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 147 JAPAN: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 148 JAPAN: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 149 JAPAN: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 150 JAPAN: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 151 JAPAN: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 152 JAPAN: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 153 JAPAN: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.4.5 AUSTRALIA & NEW ZEALAND

- 11.4.5.1 Significant growth of web application attacks and increase in demand for threat intelligent solutions and services

- TABLE 154 AUSTRALIA & NEW ZEALAND: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 155 AUSTRALIA & NEW ZEALAND: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 156 AUSTRALIA & NEW ZEALAND: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 157 AUSTRALIA & NEW ZEALAND: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 158 AUSTRALIA & NEW ZEALAND: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 159 AUSTRALIA & NEW ZEALAND: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 160 AUSTRALIA & NEW ZEALAND: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 161 AUSTRALIA & NEW ZEALAND: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.4.6 INDIA

- 11.4.6.1 Increased cases of cyberattacks and continuous adoption of cloud services

- TABLE 162 INDIA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 163 INDIA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 164 INDIA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 165 INDIA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 166 INDIA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 167 INDIA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 168 INDIA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 169 INDIA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.4.7 REST OF ASIA PACIFIC

- TABLE 170 REST OF ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 177 REST OF ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 178 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.5.3 GULF COOPERATION COUNCIL (GCC)

- 11.5.3.1 Escalating need for cybersecurity solutions, digital transformation, and integration of advanced technologies in MDR services

- TABLE 188 GCC: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 189 GCC: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 190 GCC: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 191 GCC: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 192 GCC: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 193 GCC: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 194 GCC: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 195 GCC: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 196 GCC: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 197 GCC: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.5.3.2 KSA

- 11.5.3.2.1 High investments in cybersecurity and continuous training on implementing best cyber hygiene practices

- 11.5.3.2 KSA

- TABLE 198 KSA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 199 KSA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 200 KSA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 201 KSA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 202 KSA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 203 KSA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 204 KSA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 205 KSA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.5.3.3 UAE

- 11.5.3.3.1 Highly prone to security threats and looming danger on region's vital infrastructures

- 11.5.3.3 UAE

- TABLE 206 UAE: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 207 UAE: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 208 UAE: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 209 UAE: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 210 UAE: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 211 UAE: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 212 UAE: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 213 UAE: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.5.3.4 Rest of GCC countries

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Rise in sophisticated cyberattacks, such as APT and ransomware, and public-private collaborations

- TABLE 214 SOUTH AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 215 SOUTH AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 216 SOUTH AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 217 SOUTH AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 218 SOUTH AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 219 SOUTH AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 220 SOUTH AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 221 SOUTH AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.5.5 REST OF MIDDLE EAST & AFRICA

- TABLE 222 REST OF MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 223 REST OF MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 224 REST OF MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 225 REST OF MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 226 REST OF MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 227 REST OF MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 228 REST OF MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 229 REST OF MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- 11.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 230 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 231 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 232 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 233 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 234 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 235 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 236 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 237 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 238 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2018-2023 (USD MILLION)

- TABLE 239 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 11.6.3 BRAZIL

- 11.6.3.1 Growth in awareness to protect critical infrastructures and sensitive data

- TABLE 240 BRAZIL: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 241 BRAZIL: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 242 BRAZIL: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 243 BRAZIL: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 244 BRAZIL: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 245 BRAZIL: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 246 BRAZIL: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 247 BRAZIL: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.6.4 MEXICO

- 11.6.4.1 Highly targeted country for cyberattacks and regulatory gap to increase vulnerability of organizations

- TABLE 248 MEXICO: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 249 MEXICO: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 250 MEXICO: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 251 MEXICO: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 252 MEXICO: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 253 MEXICO: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 254 MEXICO: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 255 MEXICO: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 11.6.5 REST OF LATIN AMERICA

- TABLE 256 REST OF LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2018-2023 (USD MILLION)

- TABLE 257 REST OF LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2024-2029 (USD MILLION)

- TABLE 258 REST OF LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2018-2023 (USD MILLION)

- TABLE 259 REST OF LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 260 REST OF LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2018-2023 (USD MILLION)

- TABLE 261 REST OF LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 262 REST OF LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2018-2023 (USD MILLION)

- TABLE 263 REST OF LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 264 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANAGED DETECTION AND RESPONSE VENDORS

- 12.2 REVENUE ANALYSIS

- FIGURE 39 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2019-2023 (USD MILLION)

- 12.3 MARKET SHARE ANALYSIS

- FIGURE 40 SHARE OF LEADING COMPANIES IN MANAGED DETECTION AND RESPONSE MARKET, 2023

- TABLE 265 MANAGED DETECTION AND RESPONSE MARKET: DEGREE OF COMPETITION

- 12.4 BRAND COMPARISON

- FIGURE 41 MANAGED DETECTION AND RESPONSE MARKET: COMPARISON OF VENDORS' BRANDS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.5.1 COMPANY VALUATION

- FIGURE 42 COMPANY VALUATION OF KEY VENDORS (USD BILLION)

- 12.5.2 FINANCIAL METRICS USING EV/EBIDTA

- FIGURE 43 EV/EBIDTA, 2024

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- FIGURE 44 MANAGED DETECTION AND RESPONSE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.6.5.1 Company footprint

- FIGURE 45 COMPANY FOOTPRINT, 2023

- 12.6.5.2 Solution footprint

- TABLE 266 SOLUTION FOOTPRINT, 2023

- 12.6.5.3 Vertical footprint

- TABLE 267 VERTICAL FOOTPRINT, 2023

- 12.6.5.4 Regional footprint

- TABLE 268 REGIONAL FOOTPRINT, 2023

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 46 MANAGED DETECTION AND RESPONSE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 12.7.5.1 Detailed list of key startups/SMEs

- TABLE 269 MANAGED DETECTION AND RESPONSE MARKET: KEY STARTUPS/SMES

- 12.7.5.2 Competitive benchmarking of key startups/SMEs

- TABLE 270 MANAGED DETECTION AND RESPONSE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY SOLUTION

- TABLE 271 MANAGED DETECTION AND RESPONSE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY VERTICAL

- TABLE 272 MANAGED DETECTION AND RESPONSE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY REGION

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 PRODUCT LAUNCHES

- TABLE 273 MANAGED DETECTION AND RESPONSE MARKET: PRODUCT LAUNCHES, FEBRUARY 2021-APRIL 2024

- 12.8.2 DEALS

- TABLE 274 MANAGED DETECTION AND RESPONSE MARKET: DEALS, FEBRUARY 2021-APRIL 2024

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and Competitive threats)**

- 13.1.1 CROWDSTRIKE

- TABLE 275 CROWDSTRIKE: BUSINESS OVERVIEW

- FIGURE 47 CROWDSTRIKE: COMPANY SNAPSHOT

- TABLE 276 CROWDSTRIKE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 CROWDSTRIKE: PRODUCT LAUNCHES

- TABLE 278 CROWDSTRIKE: DEALS

- 13.1.2 RAPID7

- TABLE 279 RAPID7: BUSINESS OVERVIEW

- FIGURE 48 RAPID7: COMPANY SNAPSHOT

- TABLE 280 RAPID7: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 RAPID7: PRODUCT LAUNCHES

- TABLE 282 RAPID7: DEALS

- 13.1.3 RED CANARY

- TABLE 283 RED CANARY: BUSINESS OVERVIEW

- TABLE 284 RED CANARY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 RED CANARY: PRODUCT LAUNCHES

- TABLE 286 RED CANARY: DEALS

- 13.1.4 ARCTIC WOLF

- TABLE 287 ARCTIC WOLF: BUSINESS OVERVIEW

- TABLE 288 ARCTIC WOLF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 ARCTIC WOLF: PRODUCT LAUNCHES

- TABLE 290 ARCTIC WOLF: DEALS

- TABLE 291 ARCTIC WOLF: EXPANSIONS

- 13.1.5 KUDELSKI SECURITY

- TABLE 292 KUDELSKI SECURITY: BUSINESS OVERVIEW

- TABLE 293 KUDELSKI SECURITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 294 KUDELSKI SECURITY: PRODUCT LAUNCHES

- TABLE 295 KUDELSKI SECURITY: DEALS

- TABLE 296 KUDELSKI SECURITY: EXPANSIONS

- 13.1.6 SENTINELONE

- TABLE 297 SENTINELONE: BUSINESS OVERVIEW

- FIGURE 49 SENTINELONE: COMPANY SNAPSHOT

- TABLE 298 SENTINELONE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 SENTINELONE: DEALS

- 13.1.7 PROFICIO

- TABLE 300 PROFICIO: BUSINESS OVERVIEW

- TABLE 301 PROFICIO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 PROFICIO: PRODUCT LAUNCHES

- TABLE 303 PROFICIO: DEALS

- 13.1.8 EXPEL

- TABLE 304 EXPEL: BUSINESS OVERVIEW

- TABLE 305 EXPEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 EXPEL: PRODUCT LAUNCHES

- 13.1.9 SECUREWORKS

- TABLE 307 SECUREWORKS: BUSINESS OVERVIEW

- FIGURE 50 SECUREWORKS: COMPANY SNAPSHOT

- TABLE 308 SECUREWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 309 SECUREWORKS: PRODUCT LAUNCHES

- TABLE 310 SECUREWORKS: DEALS

- TABLE 311 SECUREWORKS: EXPANSIONS

- 13.1.10 ALERT LOGIC

- TABLE 312 ALERT LOGIC: BUSINESS OVERVIEW

- TABLE 313 ALERT LOGIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 314 ALERT LOGIC: PRODUCT LAUNCHES

- TABLE 315 ALERT LOGIC: DEALS

- 13.2 OTHER PLAYERS

- 13.2.1 TRUSTWAVE

- 13.2.2 MANDIANT

- 13.2.3 BINARY DEFENSE

- 13.2.4 SOPHOS

- 13.2.5 ESENTIRE

- 13.2.6 DEEPWATCH

- 13.2.7 NETSURION

- 13.2.8 GOSECURE

- 13.2.9 LMNTRIX

- 13.2.10 UNDERDEFENSE

- 13.2.11 ACKCENT

- 13.2.12 CYBEREASON

- 13.2.13 CRITICAL START

- 13.2.14 CYSIV

- 13.2.15 CRITICAL INSIGHT

- *Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and Competitive threats might not be captured in case of unlisted companies

14 ADJACENT MARKETS

- 14.1 INTRODUCTION

- TABLE 316 ADJACENT MARKETS

- 14.2 LIMITATIONS

- 14.3 MANAGED DETECTION AND RESPONSE ECOSYSTEM AND ADJACENT MARKETS

- 14.4 MANAGED SECURITY SERVICES MARKET

- 14.4.1 MANAGED SECURITY SERVICES MARKET, BY ORGANIZATION SIZE

- TABLE 317 MANAGED SECURITY SERVICES MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 318 MANAGED SECURITY SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 319 SMALL AND MEDIUM-SIZED ENTERPRISES: MANAGED SECURITY SERVICES MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 320 SMALL AND MEDIUM-SIZED ENTERPRISES: MANAGED SECURITY SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 321 LARGE ENTERPRISES: MANAGED SECURITY SERVICES MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 322 LARGE ENTERPRISES: MANAGED SECURITY SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 14.5 CYBERSECURITY MARKET

- 14.5.1 CYBERSECURITY MARKET, BY ORGANIZATION SIZE

- TABLE 323 CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2016-2021 (USD MILLION)

- TABLE 324 CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 325 SMALL AND MEDIUM-SIZED ENTERPRISES: CYBERSECURITY MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 326 SMALL AND MEDIUM-SIZED ENTERPRISES: CYBERSECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 327 LARGE ENTERPRISES: CYBERSECURITY MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 328 LARGE ENTERPRISES: CYBERSECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATIONS OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS