|

|

市場調査レポート

商品コード

1318148

決済処理ソリューションの世界市場 (~2028年):決済手段 (デビットカード・クレジットカード・ACH・eWallet)・産業 (BFSI・小売・ヘルスケア・通信・旅行&ホスピタリティ・不動産)・地域別Payment Processing Solutions Market by Payment Method (Debit Card, Credit Card, ACH, eWallet), Vertical (BFSI, Retail, Healthcare, Telecom, Travel & Hospitality, Real Estate), and Region(North America, Europe, APAC, RoW) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 決済処理ソリューションの世界市場 (~2028年):決済手段 (デビットカード・クレジットカード・ACH・eWallet)・産業 (BFSI・小売・ヘルスケア・通信・旅行&ホスピタリティ・不動産)・地域別 |

|

出版日: 2023年07月24日

発行: MarketsandMarkets

ページ情報: 英文 257 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

決済処理ソリューションの市場規模は、2023年の1,032億米ドルから9.2%のCAGRで推移し、2028年には1,600億米ドルの規模に成長すると予測されています。

AI、ML、ブロックチェーン、生体認証などの先進技術の統合により、セキュリティ、不正検知、取引スピードが強化され、企業や消費者にとってより魅力的なソリューションとなっています。

産業別では、小売部門が予測期間中に最大の成長を示すと予測されています。小売業界は大きな変革期を迎えており、小売業者は収益を上げ、カスタマーエクスペリエンスを向上させるために、実店舗を更新し、オンラインプラットフォームを確立しています。また、クラウドコンピューティング、ビッグデータアナリティクス、デジタル店頭、ソーシャルネットワークなどの革新的な技術を採用し、知名度と市場での存在感を高めています。さらに、小売業者は取引時間の短縮、収益の増加、業務効率の改善、コストの削減など、デジタル決済がもたらす数々のメリットを認識しています。モバイル決済は、取引の合理化や小売店での行列の減少に極めて重要な役割を果たしています。現在、多くのeコマース企業がスマートフォンアプリを提供しており、従来の決済手段への依存を減らし、ユニークで便利な顧客体験を提供しています。

地域別では、アジア太平洋地域がもっとも高い成長率を示すと予測されています。アジア太平洋地域は、シームレスで安全なデジタル決済取引に対する消費者の強い嗜好を示しています。このため、高度な決済処理ソリューションにとって有利な市場が形成されています。

当レポートでは、世界の決済処理ソリューションの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、関連法規制、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要・産業動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 規制状況

- 産業動向

- 利用事例

- ベストプラクティス

- バリューチェーン分析

- 決済処理ソリューションの簡単な歴史

- エコシステム

- 特許分析

- 価格分析

- 決済処理ソリューションが隣接技術に与える影響

- 購入者に影響を与える動向とディスラプション

- ポーターのファイブフォース分析

- 主な会議とイベント

- 主なステークホルダーと購入基準

- 市場の今後の方向性

第6章 決済処理ソリューション市場:決済手段別

- Eウォレット

- クレジットカード

- デビットカード

- ACH

- その他

第7章 決済処理ソリューション市場:産業別

- 銀行・金融サービス・保険

- 政府・ユーティリティ

- 通信

- ヘルスケア

- 不動産

- 小売

- メディア&エンターテイメント

- 旅行・ホスピタリティ

- その他

第8章 決済処理ソリューション市場:地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第9章 競合情勢

- 概要

- 主要企業の採用戦略

- 競合シナリオ

- 市場シェア分析

- 過去の収益分析

- 主要企業ランキング

- 企業評価クアドラント:調査手法

- スタートアップ/中小企業の評価手法・定義

- 競合ベンチマーキング

- 競合シナリオ

- 主要な決済処理ソリューションベンダーの評価・財務指標

第10章 企業プロファイル

- 主要企業

- PAYPAL

- FISERV

- FIS

- GLOBAL PAYMENTS

- ACI WORLDWIDE

- SQUARE

- MASTERCARD

- VISA

- ADYEN

- STRIPE

- PAYU

- JACK HENRY & ASSOCIATES

- PAYSAFE

- PHONEPE

- RAZORPAY

- その他の企業・スタートアップ

- SECURE PAYMENT SYSTEMS

- WORLDLINE

- SPREEDLY

- FATTMERCHANT

- NORTH AMERICAN BANCARD

- DWOLLA

- CCBILL

- AUTHORIZE.NET

- ALIPAY

- PAYPROTEC

- SIGNAPAY

- KLIKNPAY

- FINIX PAYMENTS

- DUE

- PINEAPPLE PAYMENTS

- MODULR

- MUCHBETTER

- PAYKICKSTART

- AEROPAY

- SILA

第11章 隣接/関連市場

第12章 付録

The Payment processing solutions market is estimated at USD 103.2 billion in 2023 to USD 160.0 billion by 2028, at a CAGR of 9.2%. Integrating advanced technologies like AI, ML, blockchain, and biometrics into payment processing solutions enhances security, fraud detection, and transaction speed, making them more appealing to businesses and consumers.

Based on vertical, the retail segment is expected to register the fastest growth rate during the forecast period.

The retail industry is undergoing a significant transformation, with retailers updating their brick-and-mortar stores and establishing online platforms to drive revenue and enhance customer experiences. Retailers are embracing innovative technologies such as cloud computing, Big Data analytics, digital storefronts, and social networks to increase their visibility and market presence. They recognize the numerous benefits of digital payments, including faster transaction times, increased revenue, improved operational efficiency, and reduced costs. Mobile payments have played a pivotal role in streamlining transactions and reducing queues at retail stores. Many e-commerce companies now offer smartphone apps that reduce reliance on traditional payment methods and deliver unique and convenient customer experiences.

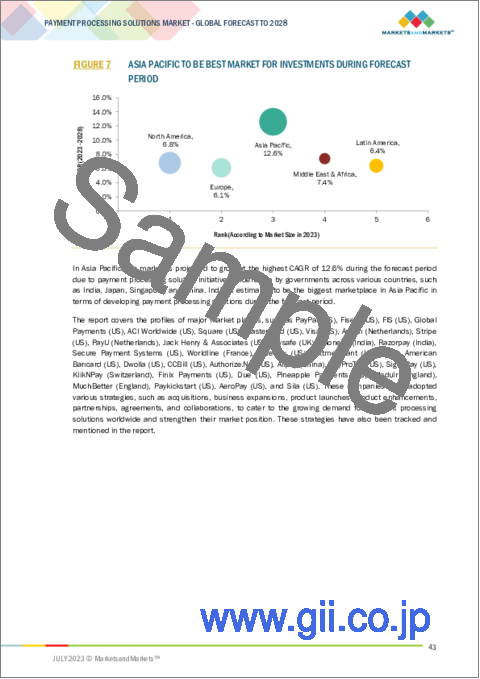

"Asia Pacific to register the highest growth rate during the forecast period."

Asia Pacific region exhibits a strong preference among consumers for both seamless and secure digital payment transactions. This has created a favorable market for advanced payment processing solutions. Global providers in this sector are capitalizing on the region's growing retail market and are increasingly targeting Asia Pacific to deliver sophisticated payment solutions. Notably, countries such as China, India, Indonesia, and Malaysia have experienced a surge in mobile transactions, prompting their governments to prioritize user-friendly payment methods. The GSMA's "The Mobile Economy 2021" report reveals that Asia Pacific boasts a 42% mobile internet penetration, with 1.2 billion individuals connected to mobile internet by the end of 2020, representing an addition of 200 million new subscribers compared to the previous year.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Stakeholder: Payment Processors - 67%, Card Issuers - 25%, and Network Providers - 8%

- By Designation: C-level -25%, D-level - 58.3%, and Others - 16.7%

- By Region: North America - 50%, Europe - 16.7%, Asia Pacific - 25%, Rest of the World- 8.3%.

The major players in the Payment processing solutions market are The major vendors covered in the payment processing solutions market include PayPal (US), Fiserv (US), FIS (US), Global Payments (US), ACI Worldwide (US), Square (US), Mastercard (US), Visa (US), Adyen (Netherland), Stripe (US), PayU (Netherland), Jack Henry & Associates (US), Paysafe (UK), PhonePe (India), Razorpay (India), Secure Payment Systems (US), Worldline (France), Spreedly (US), Fattmerchant (US), North American Bancard (US), Dwolla (US), CCBill (US), Authorize.Net (US), Alipay (China), PayProTec (US), SignaPay (US), Klik & Pay (Switzerland), Finix Payments (US), Due (US), Pineapple Payments (US), Modulr (UK), MuchBetter (UK), Paykickstart (US), AeroPay (US), and Sila (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, product enhancements, and acquisitions to expand their footprint in the Payment processing solutions market.

Research Coverage

The market study covers the Payment processing solutions market size across different segments. It aims at estimating the market size and the growth potential across different segments, including payment method, vertical, and region. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the global Payment processing solutions market and its subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Increasing eCommerce sales along with growing internet penetration, Embracing contactless payments globally, Evolving customer expectations, Rising use of mCommerce in the transportation industry, and Increasing focus on security and fraud prevention), restraints (Absence of a global standard for cross-border transactions Lack of digital literacy in emerging countries, and Technical limitations and resistance to change), opportunities (Rising financial inclusion across the globe, Rising government and private initiatives to promote digital transactions and Global e-commerce growth), and challenges (Threat of increasing cyberattacks on digital payment solutions, and Regulatory compliance) influencing the growth of the Payment processing solutions market. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Payment processing solutions market. Market Development: Comprehensive information about lucrative markets - the report analyses the Payment processing solutions market across various regions. Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Payment processing solutions market. Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as major vendors covered in the payment processing solutions market include PayPal (US), Fiserv (US), FIS (US), Global Payments (US), ACI Worldwide (US), Square (US), Mastercard (US), Visa (US), Adyen (Netherland), Stripe (US), PayU (Netherland), Jack Henry & Associates (US), Paysafe (UK), PhonePe (India), Razorpay (India), Secure Payment Systems (US), Worldline (France), Spreedly (US), Fattmerchant (US), North American Bancard (US), Dwolla (US), CCBill (US), Authorize.Net (US), Alipay (China), PayProTec (US), SignaPay (US), Klik & Pay (Switzerland), Finix Payments (US), Due (US), Pineapple Payments (US), Modulr (UK), MuchBetter (UK), Paykickstart (US), AeroPay (US), and Sila (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- TABLE 1 PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD: INCLUSIONS & EXCLUSIONS

- TABLE 2 PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL: INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 3 USD EXCHANGE RATES, 2020-2022

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 PAYMENT PROCESSING SOLUTIONS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakdown of primary profiles

- 2.1.2.4 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 2 PAYMENT PROCESSING SOLUTIONS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 3 PAYMENT PROCESSING SOLUTIONS MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 4 PAYMENT PROCESSING SOLUTIONS MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

- 2.4 MARKET FORECAST

- TABLE 4 FACTOR ANALYSIS

- 2.5 ASSUMPTIONS

- TABLE 5 STUDY ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 IMPLICATION OF RECESSION

3 EXECUTIVE SUMMARY

- FIGURE 5 PAYMENT PROCESSING SOLUTIONS MARKET, 2021-2028 (USD MILLION)

- FIGURE 6 PAYMENT PROCESSING SOLUTIONS MARKET: REGIONAL SHARE, 2023

- FIGURE 7 ASIA PACIFIC TO BE BEST MARKET FOR INVESTMENTS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF PAYMENT PROCESSING SOLUTIONS MARKET

- FIGURE 8 RISING GOVERNMENT INITIATIVES FOR DIGITAL PAYMENTS TO ACT AS OPPORTUNITY IN PAYMENT PROCESSING SOLUTIONS MARKET

- 4.2 NORTH AMERICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY TOP 3 PAYMENT METHODS AND VERTICALS

- FIGURE 9 CREDIT CARD SEGMENT AND BFSI TO ACCOUNT FOR LARGE SHARES IN NORTH AMERICA

- 4.3 ASIA PACIFIC: PAYMENT PROCESSING SOLUTIONS MARKET, BY TOP 3 PAYMENT METHODS AND COUNTRIES

- FIGURE 10 CREDIT CARD SEGMENT AND CHINA TO ACCOUNT FOR LARGE SHARES IN ASIA PACIFIC

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: PAYMENT PROCESSING SOLUTIONS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing eCommerce sales along with growing internet penetration

- 5.2.1.2 Embracing contactless payments globally

- 5.2.1.3 Evolving customer expectations

- 5.2.1.4 Rising use of mCommerce in transportation industry

- 5.2.1.5 Increasing focus on security and fraud prevention

- 5.2.2 RESTRAINTS

- 5.2.2.1 Absence of global standards for cross-border transactions

- 5.2.2.2 Lack of digital literacy in emerging countries

- 5.2.2.3 Technical limitations and resistance to change

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising financial inclusion globally

- 5.2.3.2 Rising government and private initiatives to promote digital transactions

- 5.2.3.3 Global growth of eCommerce

- 5.2.4 CHALLENGES

- 5.2.4.1 Threat of increasing cyberattacks on digital payment solutions

- 5.2.4.2 Regulatory compliance

- 5.3 REGULATORY LANDSCAPE

- 5.4 INDUSTRY TRENDS

- 5.4.1 USE CASES

- 5.4.1.1 Use case 1: PayPal

- 5.4.1.2 Use case 2: FIS

- 5.4.1.3 Use case 3: PayU

- 5.4.1.4 Use case 4: Stripe

- 5.4.1.5 Use case 5: Square

- 5.4.2 BEST PRACTICES IN PAYMENT PROCESSING SOLUTIONS MARKET

- 5.4.3 VALUE CHAIN ANALYSIS

- FIGURE 12 PAYMENT PROCESSING SOLUTIONS MARKET: VALUE CHAIN ANALYSIS

- 5.4.4 BRIEF HISTORY OF PAYMENT PROCESSING SOLUTIONS

- FIGURE 13 EVOLUTION OF PAYMENT PROCESSING SOLUTIONS

- 5.4.4.1 2000-2010

- 5.4.4.2 2010-2020

- 5.4.4.3 2020-Present

- 5.4.5 ECOSYSTEM

- FIGURE 14 PAYMENT PROCESSING SOLUTIONS ECOSYSTEM

- TABLE 6 PAYMENT PROCESSING SOLUTIONS MARKET: ECOSYSTEM

- 5.4.6 PATENT ANALYSIS

- 5.4.6.1 Methodology

- 5.4.6.2 Document type

- TABLE 7 PATENTS FILED, 2020-2023

- 5.4.6.3 Innovation and patent applications

- FIGURE 15 TOTAL NUMBER OF PATENTS GRANTED, 2020-2023

- 5.4.6.4 Top applicants

- FIGURE 16 TOP TEN PATENT APPLICANTS, 2020-2023

- 5.4.7 PRICING ANALYSIS

- 5.4.7.1 Average selling price of key players

- TABLE 8 AVERAGE SELLING PRICE OF KEY PLAYERS

- 5.4.7.2 Average selling price trend

- 5.4.8 IMPACT OF PAYMENT PROCESSING SOLUTIONS ON ADJACENT TECHNOLOGIES

- 5.4.8.1 Technology Analysis

- 5.4.8.1.1 Adjacent Technologies

- 5.4.8.1.1.1 Encryption and Tokenization

- 5.4.8.1.1.2 Point-of-Sale (POS) Technologies

- 5.4.8.1.1.3 Near Field Communication (NFC)

- 5.4.8.1.1.4 Mobile Wallets and Payment Apps

- 5.4.8.1.1.5 Biometric Authentication

- 5.4.8.1.1.6 Analytics and Business Intelligence

- 5.4.8.1.1.7 Internet of Things (IoT)

- 5.4.8.1.1.8 Blockchain and Cryptocurrency Technologies

- 5.4.8.1.2 Related Technologies

- 5.4.8.1.2.1 Payment Gateways

- 5.4.8.1.2.2 Application Programming Interfaces (APIs)

- 5.4.8.1.2.3 Cloud Computing

- 5.4.8.1.1 Adjacent Technologies

- 5.4.8.1 Technology Analysis

- TABLE 9 DIGITAL TECHNOLOGY ENABLERS, THEIR BENEFITS, AND EXAMPLES IN PAYMENT PROCESSING SOLUTIONS MARKET

- 5.4.9 TRENDS AND DISRUPTIONS IMPACTING BUYERS

- FIGURE 17 PAYMENT PROCESSING SOLUTIONS MARKET

- 5.4.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 PAYMENT PROCESSING SOLUTIONS MARKET: PORTER'S FIVE FORCES MODEL

- 5.4.10.1 Threat of new entrants

- 5.4.10.2 Threat of substitutes

- 5.4.10.3 Bargaining power of buyers

- 5.4.10.4 Bargaining power of suppliers

- 5.4.10.5 Intensity of competitive rivalry

- 5.4.11 KEY CONFERENCES & EVENTS IN 2023-24

- TABLE 11 PAYMENT PROCESSING SOLUTIONS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.4.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.4.12.1 Key stakeholders in buying process

- FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- 5.4.12.2 Buying criteria

- FIGURE 19 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.4.13 FUTURE DIRECTION OF PAYMENT PROCESSING SOLUTIONS MARKET

- 5.4.1 USE CASES

6 PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD

- 6.1 INTRODUCTION

- FIGURE 20 EWALLET SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 6.1.1 PAYMENT METHOD: PAYMENT PROCESSING SOLUTIONS MARKET DRIVERS

- TABLE 14 PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 15 PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- 6.2 EWALLET

- 6.2.1 INCREASING PAYMENTS BY MOBILE DEVICES TO DRIVE PAYMENT SOLUTIONS MARKET GROWTH

- TABLE 16 EWALLET: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 17 EWALLET: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 CREDIT CARD

- 6.3.1 GROWING CREDIT CARD USERS TO BOOST MARKET GROWTH

- TABLE 18 CREDIT CARD: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 19 CREDIT CARD: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 DEBIT CARD

- 6.4.1 EXCLUSIVE USE OF SOME DEBIT CARDS ON INTERNET TO DRIVE PAYMENT PROCESSING SOLUTIONS MARKET GROWTH

- TABLE 20 DEBIT CARD: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 21 DEBIT CARD: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.5 AUTOMATIC CLEARING HOUSE

- 6.5.1 DEVELOPING ACH TRANSFERS WITH INCREASING SECURITY TO FUEL DEMAND FOR PAYMENT PROCESSING SOLUTIONS

- TABLE 22 AUTOMATIC CLEARING HOUSE: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 23 AUTOMATIC CLEARING HOUSE: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.6 OTHER PAYMENT METHODS

- TABLE 24 OTHER PAYMENT METHODS: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 25 OTHER PAYMENT METHODS: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

7 PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL

- 7.1 INTRODUCTION

- FIGURE 21 RETAIL VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 7.1.1 VERTICAL: PAYMENT PROCESSING SOLUTIONS MARKET DRIVERS

- TABLE 26 PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 27 PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 7.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 7.2.1 INCREASING ADOPTION OF ADVANCED TECHNOLOGIES IN BFSI SECTOR TO DRIVE MARKET GROWTH

- TABLE 28 BFSI: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 29 BFSI: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.2 USE CASE

- 7.2.2.1 To bring powerful payment optimization tools and multiple payment methods for better customer checkout experience

- 7.2.2.2 FIS helped River City Bank to strengthen business continuity, regulatory compliance, and resiliency

- 7.3 GOVERNMENT AND UTILITIES

- 7.3.1 GROWING SUPPORT FOR PAYMENT SOLUTIONS IN GOVERNMENT AND UTILITIES TO DRIVE MARKET

- TABLE 30 GOVERNMENT AND UTILITIES: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 31 GOVERNMENT AND UTILITIES: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.2 USE CASE

- 7.3.2.1 Need to look for new ways to engage attendees and increase sales at events

- 7.3.2.2 Baxter Credit Union made collection process more efficient and accessible

- 7.4 TELECOM

- 7.4.1 GROWING ADOPTION OF DIGITALIZATION AND INCREASING USE OF SMARTPHONES TO DRIVE MARKET GROWTH

- TABLE 32 TELECOM: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 33 TELECOM: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4.2 USE CASE

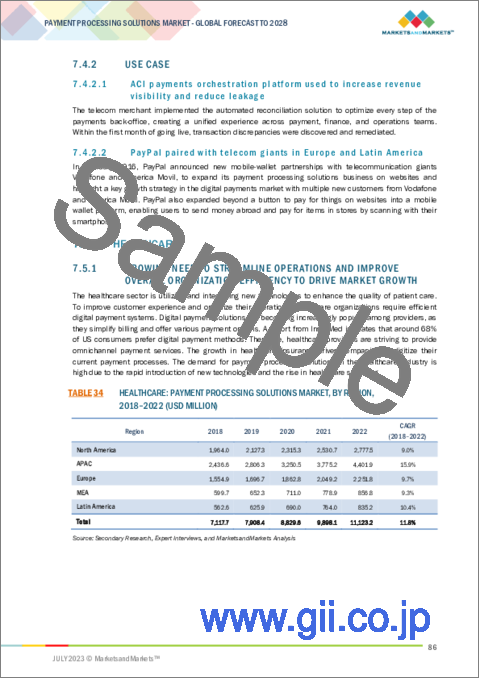

- 7.4.2.1 ACI payments orchestration platform used to increase revenue visibility and reduce leakage

- 7.4.2.2 PayPal paired with telecom giants in Europe and Latin America

- 7.5 HEALTHCARE

- 7.5.1 GROWING NEED TO STREAMLINE OPERATIONS AND IMPROVE OVERALL ORGANIZATION EFFICIENCY TO DRIVE MARKET GROWTH

- TABLE 34 HEALTHCARE: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 35 HEALTHCARE: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5.2 USE CASE

- 7.5.2.1 Need to help practitioners be more efficient, better collaborate with peers, and improve patient experience

- 7.5.2.2 Electronic payments enabled dynamic growth for leading healthcare services company

- 7.6 REAL ESTATE

- 7.6.1 GROWING NEED TO MAKE TRANSACTIONS SAFE AND SECURE DIGITALLY TO LEAD TO SIGNIFICANT MARKET GROWTH

- TABLE 36 REAL ESTATE: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 37 REAL ESTATE: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6.2 USE CASE

- 7.6.2.1 Developing unified API solutions to support payment processing solutions market

- 7.6.2.2 Need to improve payment methods and operational efficiency to drive market growth

- 7.7 RETAIL

- 7.7.1 INCREASING NEED TO PROVIDE BETTER CUSTOMER EXPERIENCE AND REDUCE TRANSACTION TIME TO DRIVE MARKET GROWTH

- TABLE 38 RETAIL: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 39 RETAIL: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.7.2 USE CASE

- 7.7.2.1 Enhancing customer security with more verification systems

- 7.7.2.2 Enhancing customer experience with better payment solutions

- 7.7.2.3 To simplify cross-border payments, Amazon used Stripe

- 7.7.2.4 Decathlon collaborated with Stripe to support payments for new coaches and sports classes

- 7.8 MEDIA AND ENTERTAINMENT

- 7.8.1 INCREASING PENETRATION OF SMARTPHONES AND OTHER PAYMENT DEVICES TO DRIVE MARKET GROWTH

- TABLE 40 MEDIA AND ENTERTAINMENT: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 41 MEDIA AND ENTERTAINMENT: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.8.2 USE CASE

- 7.8.2.1 Need to make it easy for customers to offer omnichannel experience

- 7.8.2.2 Agua Bendita expanded internationally with payment processing solutions from Stripe and VTEX

- 7.9 TRAVEL AND HOSPITALITY

- 7.9.1 INCREASING NEED FOR DIGITAL PAYMENT TECHNOLOGIES IN TRAVEL AND HOSPITALITY INDUSTRY TO DRIVE MARKET

- TABLE 42 TRAVEL AND HOSPITALITY: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 43 TRAVEL AND HOSPITALITY: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.9.2 USE CASE

- 7.9.2.1 Ireland's Mount Errigal hotel switched to Worldpay to make seamless payment improvements

- 7.9.2.2 Aegean Airlines used ACI Worldwide fraud prevention solution to increase efficiency and payment management

- 7.10 OTHER VERTICALS

- TABLE 44 OTHER VERTICALS: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 45 OTHER VERTICALS: PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 22 PAYMENT PROCESSING SOLUTIONS MARKET: REGIONAL SNAPSHOT

- FIGURE 23 PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- TABLE 46 PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 47 PAYMENT PROCESSING SOLUTIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2 NORTH AMERICA

- 8.2.1 NORTH AMERICA: PAYMENT PROCESSING SOLUTIONS MARKET DRIVERS

- 8.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 24 NORTH AMERICA: PAYMENT PROCESSING SOLUTIONS MARKET SNAPSHOT

- TABLE 48 NORTH AMERICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 49 NORTH AMERICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 51 NORTH AMERICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 53 NORTH AMERICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.2.3 US

- 8.2.3.1 Presence of key payment processing solutions players in US to drive market growth

- TABLE 54 US: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 55 US: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 56 US: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 57 US: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.2.4 CANADA

- 8.2.4.1 Increasing technological advancements for payment solutions to drive market growth

- TABLE 58 CANADA: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 59 CANADA: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 60 CANADA: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 61 CANADA: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.3 EUROPE

- 8.3.1 EUROPE: PAYMENT PROCESSING SOLUTIONS MARKET DRIVERS

- 8.3.2 EUROPE: RECESSION IMPACT

- TABLE 62 EUROPE: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 63 EUROPE: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 64 EUROPE: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 65 EUROPE: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 66 EUROPE: PAYMENT PROCESSING SOLUTIONS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 67 EUROPE: PAYMENT PROCESSING SOLUTIONS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.3.3 UK

- 8.3.3.1 Major investments by public and private sectors to drive market

- TABLE 68 UK: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 69 UK: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 70 UK: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 71 UK: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.3.4 GERMANY

- 8.3.4.1 Multiple organizations stepping up in payment processing industry to drive market growth

- TABLE 72 GERMANY: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 73 GERMANY: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 74 GERMANY: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 75 GERMANY: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.3.5 FRANCE

- 8.3.5.1 Significant investments by government to drive market growth

- TABLE 76 FRANCE: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 77 FRANCE: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 78 FRANCE: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 79 FRANCE: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.3.6 ITALY

- 8.3.6.1 Major opportunities for payment processing solution vendors in Italy to drive market growth

- TABLE 80 ITALY: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 81 ITALY: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 82 ITALY: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 83 ITALY: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.3.7 NORDIC COUNTRIES

- TABLE 84 NORDIC COUNTRIES: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 85 NORDIC COUNTRIES: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 86 NORDIC COUNTRIES: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 87 NORDIC COUNTRIES: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.3.8 REST OF EUROPE

- 8.4 ASIA PACIFIC

- 8.4.1 ASIA PACIFIC: PAYMENT PROCESSING SOLUTIONS MARKET DRIVERS

- 8.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 25 ASIA PACIFIC: PAYMENT PROCESSING SOLUTIONS MARKET SNAPSHOT

- TABLE 88 ASIA PACIFIC: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 89 ASIA PACIFIC: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 91 ASIA PACIFIC: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: PAYMENT PROCESSING SOLUTIONS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 93 ASIA PACIFIC: PAYMENT PROCESSING SOLUTIONS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.4.3 CHINA

- 8.4.3.1 Increasing payment transactions to boost market growth in China

- TABLE 94 CHINA: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 95 CHINA: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 96 CHINA: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 97 CHINA: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.4.4 INDIA

- 8.4.4.1 Digitalization across business verticals to drive market in India

- TABLE 98 INDIA: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 99 INDIA: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 100 INDIA: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 101 INDIA: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.4.5 JAPAN

- 8.4.5.1 Better customer experience in payment processing to drive market growth

- TABLE 102 JAPAN: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 103 JAPAN: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 104 JAPAN: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 105 JAPAN: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.4.6 ANZ

- 8.4.6.1 Increasing advancements in payment technologies to drive market growth

- TABLE 106 ANZ: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 107 ANZ: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 108 ANZ: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 109 ANZ: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.4.7 REST OF ASIA PACIFIC

- 8.5 MIDDLE EAST & AFRICA

- 8.5.1 MIDDLE EAST & AFRICA: PAYMENT PROCESSING SOLUTIONS MARKET DRIVERS

- 8.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 110 MIDDLE EAST & AFRICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.5.3 UAE

- 8.5.3.1 Growing need for innovations to drive market in UAE

- TABLE 116 UAE: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 117 UAE: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 118 UAE: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 119 UAE: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.5.4 KSA

- 8.5.4.1 Government initiatives to develop advanced logistics and transportation systems to fuel market growth

- TABLE 120 KSA: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 121 KSA: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 122 KSA: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 123 KSA: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.5.5 SOUTH AFRICA

- 8.5.5.1 Need to modernize payment methods leading to significant market growth

- TABLE 124 SOUTH AFRICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 125 SOUTH AFRICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 126 SOUTH AFRICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 127 SOUTH AFRICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.5.6 REST OF MIDDLE EAST & AFRICA

- 8.6 LATIN AMERICA

- 8.6.1 LATIN AMERICA: PAYMENT PROCESSING SOLUTIONS MARKET DRIVERS

- 8.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 128 LATIN AMERICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 129 LATIN AMERICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 130 LATIN AMERICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 131 LATIN AMERICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 132 LATIN AMERICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 133 LATIN AMERICA: PAYMENT PROCESSING SOLUTIONS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.6.3 BRAZIL

- 8.6.3.1 Increasing penetration of mobiles and other payment devices in Brazil to drive market growth

- TABLE 134 BRAZIL: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 135 BRAZIL: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 136 BRAZIL: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 137 BRAZIL: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.6.4 MEXICO

- 8.6.4.1 Growing digital innovations and technological advancements to drive market

- TABLE 138 MEXICO: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2018-2022 (USD MILLION)

- TABLE 139 MEXICO: PAYMENT PROCESSING SOLUTIONS MARKET, BY PAYMENT METHOD, 2023-2028 (USD MILLION)

- TABLE 140 MEXICO: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 141 MEXICO: PAYMENT PROCESSING SOLUTIONS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.6.5 REST OF LATIN AMERICA

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 142 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN PAYMENT PROCESSING SOLUTIONS MARKET

- 9.3 COMPETITIVE SCENARIO

- 9.4 MARKET SHARE ANALYSIS

- TABLE 143 PAYMENT PROCESSING SOLUTIONS MARKET: DEGREE OF COMPETITION

- 9.5 HISTORICAL REVENUE ANALYSIS

- FIGURE 26 HISTORICAL THREE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2020-2022 (USD MILLION)

- 9.6 RANKING OF KEY PLAYERS IN PAYMENT PROCESSING SOLUTIONS MARKET, 2023

- FIGURE 27 MARKET RANKING OF KEY PLAYERS, 2023

- 9.7 COMPANY EVALUATION QUADRANT METHODOLOGY

- FIGURE 28 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 9.7.1 STARS

- 9.7.2 EMERGING LEADERS

- 9.7.3 PERVASIVE PLAYERS

- 9.7.4 PARTICIPANTS

- FIGURE 29 PAYMENT PROCESSING SOLUTIONS MARKET: COMPANY EVALUATION MATRIX, 2023

- 9.8 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

- FIGURE 30 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 9.8.1 PROGRESSIVE COMPANIES

- 9.8.2 RESPONSIVE COMPANIES

- 9.8.3 DYNAMIC COMPANIES

- 9.8.4 STARTING BLOCKS

- FIGURE 31 PAYMENT PROCESSING SOLUTIONS MARKET, STARTUP/SME EVALUATION MATRIX

- 9.9 COMPETITIVE BENCHMARKING

- TABLE 144 PRODUCT FOOTPRINT WEIGHTAGE

- TABLE 145 COMPANY FOOTPRINT ANALYSIS: PAYMENT PROCESSING SOLUTIONS MARKET

- TABLE 146 COMPANY VERTICAL FOOTPRINT: PAYMENT PROCESSING SOLUTIONS MARKET

- TABLE 147 COMPANY REGION FOOTPRINT: PAYMENT PROCESSING SOLUTIONS MARKET

- TABLE 148 PAYMENT PROCESSING SOLUTIONS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 149 PAYMENT PROCESSING SOLUTIONS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY VERTICAL

- TABLE 150 PAYMENT PROCESSING SOLUTIONS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY REGION

- 9.10 COMPETITIVE SCENARIO

- 9.10.1 PRODUCT LAUNCHES

- TABLE 151 PAYMENT PROCESSING SOLUTIONS MARKET: PRODUCT LAUNCHES, 2017-2023

- 9.10.2 DEALS

- TABLE 152 PAYMENT PROCESSING SOLUTIONS MARKET: DEALS, 2017-2023

- 9.11 VALUATION AND FINANCIAL METRICS OF KEY PAYMENT PROCESSING SOLUTIONS VENDORS

- FIGURE 32 VALUATION AND FINANCIAL METRICS OF PAYMENT PROCESSING SOLUTIONS VENDORS

10 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent developments & MnM View)**

- 10.1 MAJOR PLAYERS

- 10.1.1 PAYPAL

- TABLE 153 PAYPAL: BUSINESS OVERVIEW

- FIGURE 33 PAYPAL: COMPANY SNAPSHOT

- TABLE 154 PAYPAL: SOLUTIONS OFFERED

- TABLE 155 PAYPAL: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 156 PAYPAL: DEALS

- 10.1.2 FISERV

- TABLE 157 FISERV: BUSINESS OVERVIEW

- FIGURE 34 FISERV: COMPANY SNAPSHOT

- TABLE 158 FISERV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 FISERV: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 160 FISERV: DEALS

- 10.1.3 FIS

- TABLE 161 FIS: BUSINESS OVERVIEW

- FIGURE 35 FIS: COMPANY SNAPSHOT

- TABLE 162 FIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 FIS: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 164 FIS: DEALS

- 10.1.4 GLOBAL PAYMENTS

- TABLE 165 GLOBAL PAYMENTS: BUSINESS OVERVIEW

- FIGURE 36 GLOBAL PAYMENTS: COMPANY SNAPSHOT

- TABLE 166 GLOBAL PAYMENTS: SOLUTIONS OFFERED

- TABLE 167 GLOBAL PAYMENTS: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 168 GLOBAL PAYMENTS: DEALS

- 10.1.5 ACI WORLDWIDE

- TABLE 169 ACI WORLDWIDE: BUSINESS OVERVIEW

- FIGURE 37 ACI WORLDWIDE: COMPANY SNAPSHOT

- TABLE 170 ACI WORLDWIDE: SOLUTIONS OFFERED

- TABLE 171 ACI WORLDWIDE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 172 ACI WORLDWIDE: DEALS

- 10.1.6 SQUARE

- TABLE 173 SQUARE: BUSINESS OVERVIEW

- FIGURE 38 SQUARE: COMPANY SNAPSHOT

- TABLE 174 SQUARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 SQUARE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 176 SQUARE: DEALS

- 10.1.7 MASTERCARD

- TABLE 177 MASTERCARD: BUSINESS OVERVIEW

- FIGURE 39 MASTERCARD: COMPANY SNAPSHOT

- TABLE 178 MASTERCARD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 MASTERCARD: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 180 MASTERCARD: DEALS

- 10.1.8 VISA

- TABLE 181 VISA: BUSINESS OVERVIEW

- FIGURE 40 VISA: COMPANY SNAPSHOT

- TABLE 182 VISA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 VISA: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 184 VISA: DEALS

- 10.1.9 ADYEN

- TABLE 185 ADYEN: BUSINESS OVERVIEW

- FIGURE 41 ADYEN: COMPANY SNAPSHOT

- TABLE 186 ADYEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 ADYEN: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 188 ADYEN: DEALS

- 10.1.10 STRIPE

- TABLE 189 STRIPE: BUSINESS OVERVIEW

- TABLE 190 STRIPE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 STRIPE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 192 STRIPE: DEALS

- 10.1.11 PAYU

- TABLE 193 PAYU: BUSINESS OVERVIEW

- TABLE 194 PAYU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 PAYU: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 196 PAYU: DEALS

- 10.1.12 JACK HENRY & ASSOCIATES

- 10.1.13 PAYSAFE

- 10.1.14 PHONEPE

- 10.1.15 RAZORPAY

- *Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 10.2 OTHER PLAYERS/STARTUPS

- 10.2.1 SECURE PAYMENT SYSTEMS

- 10.2.2 WORLDLINE

- 10.2.3 SPREEDLY

- 10.2.4 FATTMERCHANT

- 10.2.5 NORTH AMERICAN BANCARD

- 10.2.6 DWOLLA

- 10.2.7 CCBILL

- 10.2.8 AUTHORIZE.NET

- 10.2.9 ALIPAY

- 10.2.10 PAYPROTEC

- 10.2.11 SIGNAPAY

- 10.2.12 KLIKNPAY

- 10.2.13 FINIX PAYMENTS

- 10.2.14 DUE

- 10.2.15 PINEAPPLE PAYMENTS

- 10.2.16 MODULR

- 10.2.17 MUCHBETTER

- 10.2.18 PAYKICKSTART

- 10.2.19 AEROPAY

- 10.2.20 SILA

11 ADJACENT/RELATED MARKETS

- 11.1 INTRODUCTION TO ADJACENT MARKETS

- TABLE 197 ADJACENT MARKETS AND FORECASTS

- 11.2 LIMITATIONS

- 11.3 DIGITAL PAYMENT MARKET

- TABLE 198 DIGITAL PAYMENT MARKET IN BFSI, BY REGION, 2016-2020 (USD MILLION)

- TABLE 199 DIGITAL PAYMENT MARKET IN BFSI, BY REGION, 2021-2026 (USD MILLION)

- TABLE 200 DIGITAL PAYMENT MARKET IN RETAIL AND ECOMMERCE, BY REGION, 2016-2020 (USD MILLION)

- TABLE 201 DIGITAL PAYMENT MARKET IN RETAIL AND ECOMMERCE, BY REGION, 2021-2026 (USD MILLION)

- TABLE 202 DIGITAL PAYMENT MARKET IN HEALTHCARE, BY REGION, 2016-2020 (USD MILLION)

- TABLE 203 DIGITAL PAYMENT MARKET IN HEALTHCARE, BY REGION, 2021-2026 (USD MILLION)

- TABLE 204 DIGITAL PAYMENT MARKET IN TRAVEL AND HOSPITALITY, BY REGION, 2016-2020 (USD MILLION)

- TABLE 205 DIGITAL PAYMENT MARKET IN TRAVEL AND HOSPITALITY, BY REGION, 2021-2026 (USD MILLION)

- TABLE 206 DIGITAL PAYMENT MARKET IN TRANSPORTATION AND LOGISTICS, BY REGION, 2016-2020 (USD MILLION)

- TABLE 207 DIGITAL PAYMENT MARKET IN TRANSPORTATION AND LOGISTICS, BY REGION, 2021-2026 (USD MILLION)

- TABLE 208 DIGITAL PAYMENT MARKET IN MEDIA AND ENTERTAINMENT, BY REGION, 2016-2020 (USD MILLION)

- TABLE 209 DIGITAL PAYMENT MARKET IN MEDIA AND ENTERTAINMENT, BY REGION, 2021-2026 (USD MILLION)

- TABLE 210 DIGITAL PAYMENT MARKET IN OTHER VERTICALS, BY REGION, 2016-2020 (USD MILLION)

- TABLE 211 DIGITAL PAYMENT MARKET IN OTHER VERTICALS, BY REGION, 2021-2026 (USD MILLION)

- 11.4 FINTECH AS A SERVICE MARKET

- TABLE 212 FINTECH AS A SERVICE MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 213 FINTECH AS A SERVICE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 214 FINTECH AS A SERVICE MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 215 FINTECH AS A SERVICE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 216 FINTECH AS A SERVICE MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 217 FINTECH AS A SERVICE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 218 FINTECH AS A SERVICE MARKET, BY END USER, 2017-2022 (USD MILLION)

- TABLE 219 FINTECH AS A SERVICE MARKET, BY END USER, 2023-2028 (USD MILLION)

- TABLE 220 FINTECH AS A SERVICE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 221 FINTECH AS A SERVICE MARKET, BY REGION, 2023-2028 (USD MILLION)

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS