|

|

市場調査レポート

商品コード

1807080

医薬品受託製造の世界市場 (~2030年):サービス (医薬品開発・医薬品 (原薬・FDF-非経口剤・錠剤・カプセル剤)・生物製剤 (原薬・FDF)・包装&ラベリング・充填仕上げ)・分子 (小・大 (ADC・CGT) 別Pharmaceutical Contract Manufacturing Market by Service (Drug Development, Pharmaceutical (API, FDF - Parenteral, Tablet, Capsule), Biologics (API, FDF), Packaging & Labelling, Fill-finish), Molecule (Small, Large (ADC, CGT)) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 医薬品受託製造の世界市場 (~2030年):サービス (医薬品開発・医薬品 (原薬・FDF-非経口剤・錠剤・カプセル剤)・生物製剤 (原薬・FDF)・包装&ラベリング・充填仕上げ)・分子 (小・大 (ADC・CGT) 別 |

|

出版日: 2025年08月29日

発行: MarketsandMarkets

ページ情報: 英文 522 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

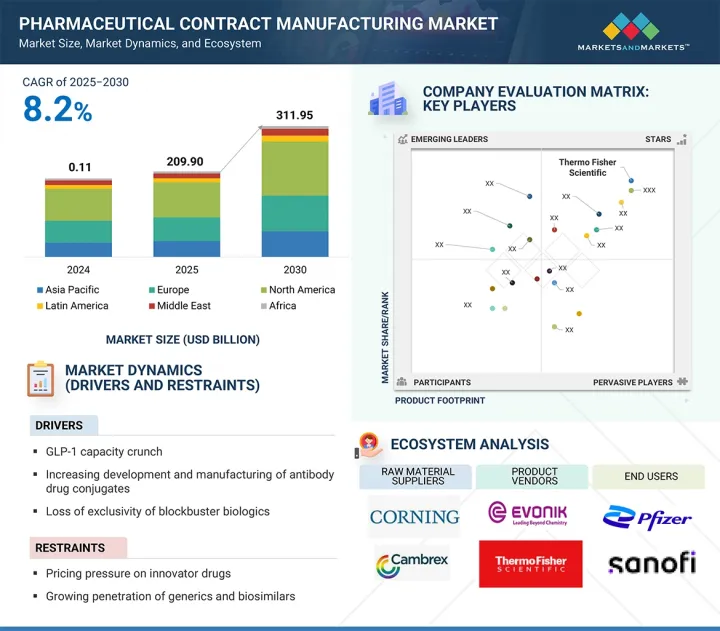

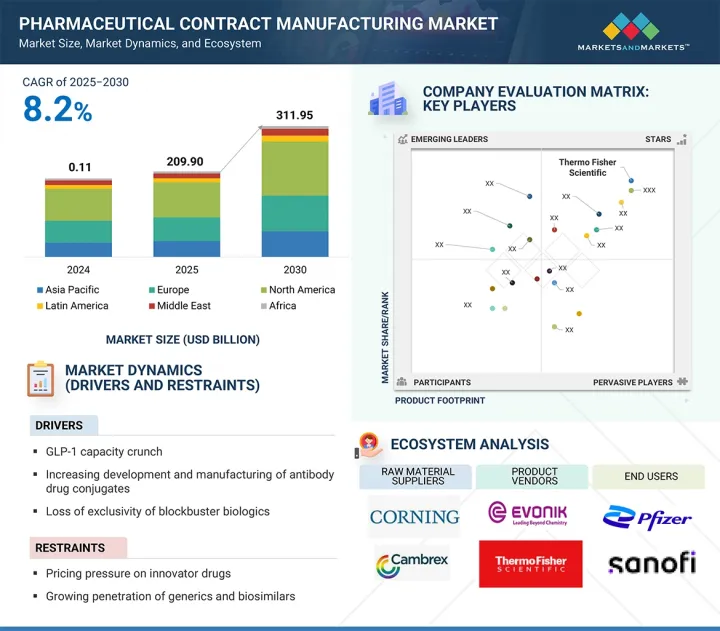

世界の医薬品受託製造の市場規模は、2025年の2,099億米ドルから、2025年から2030年までの予測期間中はCAGR 8.2%で推移し、2030年には3,119億5,000万米ドルに達すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額 (米ドル) |

| セグメント | サービス、分子、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

医薬品受託製造市場の拡大は、主にGLP-1の製造・開発におけるアウトソーシング、ADC (抗体薬物複合体) の承認およびプログラム、ブロックバスター生物製剤の独占権喪失によって牽引されてきました。しかし、製薬企業による社内製造能力の拡大や、米国および欧州における価格圧力が、市場成長を抑制する要因になると予測されています。

サービス別では、生物製剤FDF製造サービスの部門が2024年に最大のCAGRを記録

生物製剤FDF製造サービスは、2025年から2030年の予測期間において最も速い成長率を示すと予測されています。この強い成長見通しは、モノクローナル抗体、組換えタンパク質、細胞・遺伝子治療、ワクチンといった複雑かつ高付加価値の製品を含む生物製剤需要の急増によって主に牽引されています。従来の治療と比較して、より高い有効性と副作用の低減を提供する標的型薬理療法への注目の高まりが、特殊な製造能力への需要をさらに押し上げています。

加えて、特に細胞・遺伝子治療における研究開発活動の増加も市場拡大に大きく寄与しています。これら先端的治療分野におけるパイプライン候補数の増加は、高度に専門的な製造プロセスを必要とし、製薬企業に必要な専門知識、インフラ、規制遵守能力を備えたCDMOとの提携を促しています。この傾向により、CDMOにおける先進的な生物製剤生産技術、能力拡大、品質システムへの投資が増加すると予想されます。その結果、FDF製造サービス部門は今後数年間で大幅な成長を遂げ、医薬品アウトソーシング分野においてますます重要な役割を果たすことが期待されています。

分子別では、低分子の部門が2024年の市場で支配的位置付け

2024年においては、高活性低分子、オリゴヌクレオチドおよび合成ペプチド、放射性医薬品などの低分子の部門が市場で最大のシェアを占めました。高活性低分子、特にがん領域は、特殊な封じ込め設備と専門知識を必要とするため、高度な施設を有するCDMOへの需要を牽引しています。オリゴヌクレオチドおよび合成ペプチドは、精密医療や標的治療における役割から勢いを増しており、新たなアウトソーシングの機会を提供しています。

放射性医薬品は、診断および治療における応用とともに、核医学の拡大に伴い関心が高まっています。その他の低分子も、心血管疾患から感染症に至る多数の治療分野で依然として重要です。低分子は、その安定性、経口バイオアベイラビリティ、コスト効率の高い大量生産性から、革新的医薬品およびジェネリック医薬品パイプラインの双方において魅力的とされています。慢性疾患の有病率の増加に加え、合成化学や連続生産における継続的なイノベーションが市場での地位を強化しています。これらサブカテゴリーに特化した専門知識を有するCDMOは、スピード、柔軟性、コスト効率を求める製薬企業からの強い需要を活用でき、低分子がCDMO産業成長の中核的な推進力であり続けることを保証します。

地域別では、北米が最大のシェアを示す

北米は、強固な規制枠組み、先進的な製造インフラ、主要CDMOの高い集中度に支えられ、2024年に市場を支配しました。この地域は、確立された製薬産業、広範な研究開発能力、コスト最適化と市場投入スピード向上のために開発・製造をアウトソーシングする大手製薬企業の強い存在感の恩恵を受けています。特に米国FDAを中心とする支援的な規制当局は、明確なガイドラインや迅速な承認を通じてイノベーションを促進し、連続生産や高活性API製造といった先進的な製造技術への投資を奨励しています。北米はまた、細胞・遺伝子治療に対応する専門的なCDMO施設に支えられ、生物製剤や先進治療の製造でも主導的地位を占めています。戦略的提携、合併・買収は、サービスのポートフォリオと能力をさらに強化しています。この地域の強固なベンチャーキャピタル・エコシステムや産学連携はイノベーションを促進し、品質、コンプライアンス、拡張性に対する重視は、世界中の顧客を惹きつけています。

当レポートでは、世界の医薬品受託製造の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客の事業に影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 技術分析

- 特許分析

- 2025-2026年の主な会議とイベント

- 規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- エンドユーザーのアンメットニーズ

- 簡略化された新薬申請 (ANDA) の承認

- AI/生成AIが医薬品受託製造市場に与える影響

- 2025年の米国関税が医薬品受託製造市場に与える影響

第6章 医薬品受託製造市場:サービス別

- 医薬品製造サービス

- 医薬品API製造サービス

- 医薬品FDF製造サービス

- 医薬品開発サービス

- 生物製剤製造サービス

- 生物製剤API製造サービス

- 生物製剤FDF製造サービス

- 包装・ラベルサービス

- 充填仕上げサービス

- その他

第7章 医薬品受託製造市場:分子別

- 低分子

- 高効力低分子

- オリゴヌクレオチドおよび合成ペプチド

- 放射性医薬品分子

- その他

- 高分子

- モノクローナル抗体

- 細胞・遺伝子治療

- 抗体薬物複合体

- ワクチン

- 治療用ペプチドとタンパク質

- その他

第8章 医薬品受託製造市場:エンドユーザー別

- 大手医薬品企業

- 中小規模医薬品企業

- ジェネリック医薬品企業

- その他

第9章 医薬品受託製造市場:地域別

- 北米

- マクロ経済見通し

- 米国

- カナダ

- 欧州

- マクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スイス

- ポーランド

- スペイン

- その他

- アジア太平洋

- マクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- その他

- ラテンアメリカ

- マクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東

- マクロ経済見通し

- GCC諸国

- その他

- アフリカ

- マクロ経済見通し

第10章 競合情勢

- 主要参入企業の戦略/強み

- 収益シェア分析

- 市場シェア分析

- 企業評価と財務指標

- ブランド/サービス比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- THERMO FISHER SCIENTIFIC INC.

- LONZA

- CATALENT, INC.

- WUXI APPTEC

- WUXI BIOLOGICS

- SAMSUNG BIOLOGICS

- BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- EVONIK

- FUJIFILM HOLDINGS CORPORATION

- ABBVIE INC.

- SIEGFRIED HOLDING AG

- MERCK KGAA

- ALMAC GROUP

- CHARLES RIVER LABORATORIES

- ASYMCHEM INC.

- VETTER

- ALCAMI CORPORATION

- EUROFINS SCIENTIFIC

- その他の企業

- PIRAMAL PHARMA SOLUTIONS

- SYNGENE INTERNATIONAL LIMITED

- CAMBREX CORPORATION

- JUBILANT PHARMANOVA LIMITED

- YUHAN CORPORATION

- PIERRE FABRE LABORATORIES

- PFIZER CENTREONE

- DELPHARM

- FRONTAGE LABS

- SHARP SERVICES, LLC

- GRAND RIVER ASEPTIC MANUFACTURING

- RECIPHARM AB

- PCI PHARMA SERVICES

- CURIA GLOBAL, INC.

- SIMTRA BIOPHARMA SOLUTIONS

- PORTON

- MABPLEX INTERNATIONAL CO. LTD.

- CELLARES

第12章 付録

List of Tables

- TABLE 1 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 IMPACT ANALYSIS OF SUPPLY-SIDE AND DEMAND-SIDE FACTORS

- TABLE 3 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: RISK ANALYSIS

- TABLE 4 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 5 GLP-1 PIPELINE, EXPECTED LAUNCH BY 2030

- TABLE 6 ADC PIPELINE, EXPECTED LAUNCH BY 2030

- TABLE 7 IMPENDING AND ONGOING PATENT EXPIRIES OF BLOCKBUSTER BIOLOGICS, 2023-2035

- TABLE 8 LIST OF RECENTLY APPROVED INJECTABLES, 2022-2024

- TABLE 9 CELL & GENE THERAPY-SPECIFIC CDMO EXPANSIONS, 2023-2025

- TABLE 10 CELL & GENE THERAPY PIPELINE, EXPECTED LAUNCH BY 2030

- TABLE 11 INDICATIVE PRICING ANALYSIS, BY SERVICE

- TABLE 12 INDICATIVE PRICING ANALYSIS, BY REGION

- TABLE 13 PRICING MODELS FOR CDMO SERVICES

- TABLE 14 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: ROLE OF COMPANIES IN SUPPLY CHAIN

- TABLE 15 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 16 MANUFACTURING SITES OF KEY CDMOS

- TABLE 17 LIST OF SITE EXPANSIONS FOR KEY CDMOS, 2023-2025

- TABLE 18 CAPEX FOR SELECTED PUBLICLY LISTED KEY CDMOS, 2021-2024 (USD MILLION)

- TABLE 19 NUMBER OF PATENTS FILED IN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, 2014-2024

- TABLE 20 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 21 REGULATORY SCENARIO, BY COUNTRY

- TABLE 22 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 27 AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 28 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF PHARMACEUTICAL CONTRACT MANUFACTURING SERVICES (%)

- TABLE 30 BUYING CRITERIA FOR PHARMACEUTICAL CONTRACT MANUFACTURING, BY END USER

- TABLE 31 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 32 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 33 PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 34 PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 35 NORTH AMERICA: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 36 EUROPE: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 37 ASIA PACIFIC: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 38 LATIN AMERICA: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 39 MIDDLE EAST: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 40 GCC COUNTRIES: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 41 PHARMACEUTICAL API MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030(USD BILLION)

- TABLE 42 NORTH AMERICA: PHARMACEUTICAL API MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 43 EUROPE: PHARMACEUTICAL API MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 44 ASIA PACIFIC: PHARMACEUTICAL API MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 45 LATIN AMERICA: PHARMACEUTICAL API MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 46 MIDDLE EAST: PHARMACEUTICAL API MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030(USD BILLION)

- TABLE 47 GCC COUNTRIES: PHARMACEUTICAL API MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 48 PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030(USD BILLION)

- TABLE 49 PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030(USD BILLION)

- TABLE 50 NORTH AMERICA: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 51 EUROPE: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 52 ASIA PACIFIC: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 53 LATIN AMERICA: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 54 MIDDLE EAST: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030(USD BILLION)

- TABLE 55 GCC COUNTRIES: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030(USD BILLION)

- TABLE 56 PARENTERAL MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 57 NORTH AMERICA: PARENTERAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 58 EUROPE: PARENTERAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 59 ASIA PACIFIC: PARENTERAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 60 LATIN AMERICA: PARENTERAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 61 MIDDLE EAST: PARENTERAL MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 62 GCC COUNTRIES: PARENTERAL MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 63 TABLET MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 64 NORTH AMERICA: TABLET MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 65 EUROPE: TABLET MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 66 ASIA PACIFIC: TABLET MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 67 LATIN AMERICA: TABLET MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 68 MIDDLE EAST: TABLET MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 69 GCC COUNTRIES: TABLET MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 70 CAPSULE MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 71 NORTH AMERICA: CAPSULE MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 72 EUROPE: CAPSULE MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 73 ASIA PACIFIC: CAPSULE MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 74 LATIN AMERICA: CAPSULE MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 75 MIDDLE EAST: CAPSULE MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 76 GCC COUNTRIES: CAPSULE MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 77 ORAL LIQUID MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 78 NORTH AMERICA: ORAL LIQUID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 79 EUROPE: ORAL LIQUID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 80 ASIA PACIFIC: ORAL LIQUID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 81 LATIN AMERICA: ORAL LIQUID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 82 MIDDLE EAST: ORAL LIQUID MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 83 GCC COUNTRIES: ORAL LIQUID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 84 SEMI-SOLID MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 85 NORTH AMERICA: SEMI-SOLID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 86 EUROPE: SEMI-SOLID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 87 ASIA PACIFIC: SEMI-SOLID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 88 LATIN AMERICA: SEMI-SOLID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 89 MIDDLE EAST: SEMI-SOLID MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 90 GCC COUNTRIES: SEMI-SOLID MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 91 OTHER FDF MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 92 NORTH AMERICA: OTHER FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 93 EUROPE: OTHER FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 94 ASIA PACIFIC: OTHER FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 95 LATIN AMERICA: OTHER FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 96 MIDDLE EAST: OTHER FDF MANUFACTURING SERVICES MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 97 GCC COUNTRIES: OTHER FDF MANUFACTURING SERVICES MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 98 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR DRUG DEVELOPMENT SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 99 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR DRUG DEVELOPMENT SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 100 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR DRUG DEVELOPMENT SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 101 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR DRUG DEVELOPMENT SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 102 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR DRUG DEVELOPMENT SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 103 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR DRUG DEVELOPMENT SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 104 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR DRUG DEVELOPMENT SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 105 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 106 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 107 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 108 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 109 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 110 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 111 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 112 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 113 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS API MANUFACTURING SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 114 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS API MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 115 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS API MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 116 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS API MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 117 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS API MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 118 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS API MANUFACTURING SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 119 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS API MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 120 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS FDF MANUFACTURING SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 121 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS FDF MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 122 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS FDF MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 123 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS FDF MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 124 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS FDF MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 125 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS FDF MANUFACTURING SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 126 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS FDF MANUFACTURING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

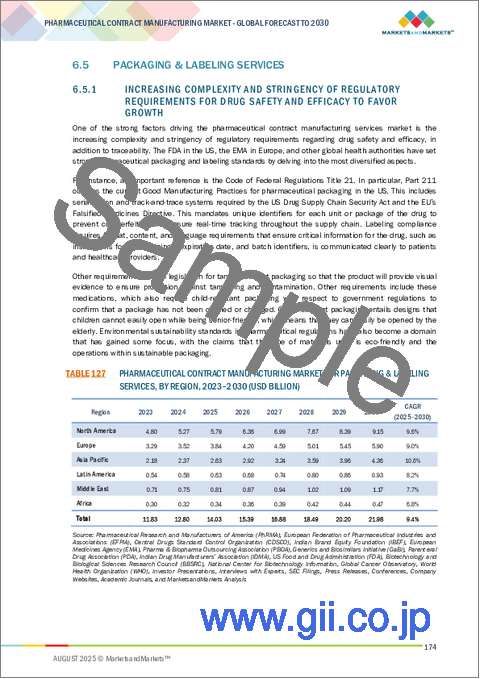

- TABLE 127 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 128 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 129 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 130 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 131 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 132 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 133 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR PACKAGING & LABELING SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 134 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FILL-FINISH SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 135 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FILL-FINISH SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 136 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FILL-FINISH SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 137 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FILL-FINISH SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 138 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FILL-FINISH SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 139 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FILL- FINISH SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 140 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR FILL-FINISH SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 141 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 142 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 143 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 144 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 145 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 146 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 147 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SERVICES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 148 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 149 PHARMACEUTICAL MANUFACTURING SERVICES MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 150 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 151 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 152 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 153 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 154 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 155 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 156 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 157 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR HIGH-POTENCY SMALL MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 158 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR HIGH-POTENCY SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 159 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR HIGH-POTENCY SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 160 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR HIGH-POTENCY SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 161 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR HIGH-POTENCY SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 162 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR HIGH-POTENCY SMALL MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 163 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR HIGH POTENCY SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 164 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OLIGONUCLEOTIDES AND SYNTHETIC PEPTIDES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 165 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OLIGONUCLEOTIDES AND SYNTHETIC PEPTIDES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 166 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OLIGONUCLEOTIDES AND SYNTHETIC PEPTIDES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 167 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OLIGONUCLEOTIDES AND SYNTHETIC PEPTIDES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 168 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OLIGONUCLEOTIDES AND SYNTHETIC PEPTIDES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 169 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OLIGONUCLEOTIDES AND SYNTHETIC PEPTIDES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 170 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OLIGONUCLEOTIDES AND SYNTHETIC PEPTIDES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 171 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR RADIOPHARMACEUTICAL MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 172 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR RADIOPHARMACEUTICAL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 173 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR RADIOPHARMACEUTICAL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 174 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR RADIOPHARMACEUTICAL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 175 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR RADIOPHARMACEUTICAL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 176 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR RADIOPHARMACEUTICAL MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 177 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR RADIOPHARMACEUTICAL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 178 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SMALL MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 179 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 180 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 181 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 182 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 183 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SMALL MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 184 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER SMALL MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 185 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 186 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 187 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 188 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 189 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 190 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 191 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 192 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 193 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 194 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 195 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 196 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 197 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 198 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 199 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR MONOCLONAL ANTIBODIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 200 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 201 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 202 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 203 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 204 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 205 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 206 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR CELL & GENE THERAPIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 207 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY DRUG CONJUGATES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 208 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY DRUG CONJUGATES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 209 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY DRUG CONJUGATES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 210 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY DRUG CONJUGATES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 211 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY DRUG CONJUGATES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 212 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY DRUG CONJUGATES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 213 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR ANTIBODY DRUG CONJUGATES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 214 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 215 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 216 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 217 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 218 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 219 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 220 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR VACCINES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 221 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 222 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 223 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 224 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 225 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 226 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 227 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR THERAPEUTIC PEPTIDES & PROTEINS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 228 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER LARGE MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 229 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 230 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 231 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 232 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 233 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER LARGE MOLECULES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 234 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER LARGE MOLECULES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 235 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 236 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIG PHARMACEUTICAL COMPANIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 237 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIG PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 238 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIG PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 239 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIG PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 240 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIG PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 241 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIG PHARMACEUTICAL COMPANIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 242 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIG PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 243 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL & MEDIUM-SIZED PHARMACEUTICAL COMPANIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 244 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL & MEDIUM-SIZED PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 245 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL & MEDIUM-SIZED PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 246 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL & MEDIUM-SIZED PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 247 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL & MEDIUM-SIZED PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 248 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL & MEDIUM-SIZED PHARMACEUTICAL COMPANIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 249 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL & MEDIUM-SIZED PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 250 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR GENERIC PHARMACEUTICAL COMPANIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 251 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR GENERIC PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 252 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR GENERIC PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 253 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR GENERIC PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 254 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR GENERIC PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 255 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR GENERIC PHARMACEUTICAL COMPANIES, BY REGION, 2023-2030 (USD BILLION)

- TABLE 256 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR GENERIC PHARMACEUTICAL COMPANIES, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 257 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 258 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 259 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 260 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 261 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 262 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD BILLION)

- TABLE 263 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR OTHER END USERS, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 264 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 265 NORTH AMERICA: KEY MACROECONOMIC INDICATORS

- TABLE 266 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 267 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 268 NORTH AMERICA: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 269 NORTH AMERICA: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 270 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 271 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 272 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 273 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 274 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 275 US: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 276 US: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 277 US: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 278 US: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 279 US: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 280 US: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 281 US: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 282 US: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 283 CANADA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 284 CANADA: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 285 CANADA: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 286 CANADA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 287 CANADA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 288 CANADA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 289 CANADA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 290 CANADA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 291 EUROPE: KEY MACROECONOMIC INDICATORS

- TABLE 292 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 293 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 294 EUROPE: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 295 EUROPE: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 296 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 297 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 298 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 299 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 300 EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 301 GERMANY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 302 GERMANY: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 303 GERMANY: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 304 GERMANY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 305 GERMANY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 306 GERMANY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 307 GERMANY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 308 GERMANY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 309 UK: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 310 UK: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 311 UK: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 312 UK: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 313 UK: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 314 UK: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 315 UK: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 316 UK: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 317 FRANCE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 318 FRANCE: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 319 FRANCE: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 320 FRANCE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 321 FRANCE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 322 FRANCE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 323 FRANCE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 324 FRANCE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 325 ITALY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 326 ITALY: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 327 ITALY: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 328 ITALY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 329 ITALY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 330 ITALY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 331 ITALY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 332 ITALY: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 333 SWITZERLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 334 SWITZERLAND: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 335 SWITZERLAND: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 336 SWITZERLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 337 SWITZERLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 338 SWITZERLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 339 SWITZERLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 340 SWITZERLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 341 POLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 342 POLAND: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 343 POLAND: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 344 POLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 345 POLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 346 POLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 347 POLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 348 POLAND: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 349 SPAIN: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 350 SPAIN: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 351 SPAIN: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 352 SPAIN: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 353 SPAIN: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 354 SPAIN: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 355 SPAIN: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 356 SPAIN: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 357 REST OF EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 358 REST OF EUROPE: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 359 REST OF EUROPE: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 360 REST OF EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 361 REST OF EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 362 REST OF EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 363 REST OF EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 364 REST OF EUROPE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 365 ASIA PACIFIC: KEY MACROECONOMIC INDICATORS

- TABLE 366 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 367 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 368 ASIA PACIFIC: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 369 ASIA PACIFIC: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 370 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 371 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 372 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 373 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 374 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 375 CHINA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 376 CHINA: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 377 CHINA: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 378 CHINA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 379 CHINA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 380 CHINA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 381 CHINA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 382 CHINA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 383 JAPAN: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 384 JAPAN: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 385 JAPAN: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 386 JAPAN: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 387 JAPAN: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 388 JAPAN: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 389 JAPAN: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 390 JAPAN: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 391 SOUTH KOREA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 392 SOUTH KOREA: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 393 SOUTH KOREA: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 394 SOUTH KOREA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 395 SOUTH KOREA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 396 SOUTH KOREA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 397 SOUTH KOREA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 398 SOUTH KOREA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 399 INDIA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 400 INDIA: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 401 INDIA: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 402 INDIA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 403 INDIA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 404 INDIA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 405 INDIA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 406 INDIA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 407 AUSTRALIA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 408 AUSTRALIA: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 409 AUSTRALIA: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 410 AUSTRALIA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 411 AUSTRALIA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 412 AUSTRALIA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 413 AUSTRALIA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 414 AUSTRALIA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 415 REST OF ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 416 REST OF ASIA PACIFIC: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 417 REST OF ASIA PACIFIC: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 418 REST OF ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 419 REST OF ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 420 REST OF ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 421 REST OF ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 422 REST OF ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 423 LATIN AMERICA: KEY MACROECONOMIC INDICATORS

- TABLE 424 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 425 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 426 LATIN AMERICA: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 427 LATIN AMERICA: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 428 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 429 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 430 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 431 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 432 LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 433 BRAZIL: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 434 BRAZIL: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 435 BRAZIL: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 436 BRAZIL: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 437 BRAZIL: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 438 BRAZIL: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 439 BRAZIL: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 440 BRAZIL: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 441 MEXICO: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 442 MEXICO: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 443 MEXICO: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 444 MEXICO: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 445 MEXICO: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 446 MEXICO: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 447 MEXICO: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 448 MEXICO: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 449 REST OF LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 450 REST OF LATIN AMERICA: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 451 REST OF LATIN AMERICA: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 452 REST OF LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 453 REST OF LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 454 REST OF LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 455 REST OF LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 456 REST OF LATIN AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 457 MIDDLE EAST: KEY MACROECONOMIC INDICATORS

- TABLE 458 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY REGION, 2023-2030 (USD BILLION)

- TABLE 459 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 460 MIDDLE EAST: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 461 MIDDLE EAST: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 462 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 463 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 464 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 465 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 466 MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 467 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2023-2030 (USD BILLION)

- TABLE 468 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 469 GCC COUNTRIES: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 470 GCC COUNTRIES: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 471 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 472 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 473 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 474 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 475 GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 476 KINGDOM OF SAUDI ARABIA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 477 KINGDOM OF SAUDI ARABIA: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 478 KINGDOM OF SAUDI ARABIA: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 479 KINGDOM OF SAUDI ARABIA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 480 KINGDOM OF SAUDI ARABIA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 481 KINGDOM OF SAUDI ARABIA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 482 KINGDOM OF SAUDI ARABIA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 483 KINGDOM OF SAUDI ARABIA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 484 UAE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 485 UAE: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 486 UAE: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 487 UAE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 488 UAE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 489 UAE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 490 UAE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 491 UAE: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 492 REST OF GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 493 REST OF GCC COUNTRIES: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 494 REST OF GCC COUNTRIES: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 495 REST OF GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 496 REST OF GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 497 REST OF GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 498 REST OF GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 499 REST OF GCC COUNTRIES: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 500 REST OF MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 501 REST OF MIDDLE EAST: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 502 REST OF MIDDLE EAST: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 503 REST OF MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 504 REST OF MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 505 REST OF MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 506 REST OF MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 507 REST OF MIDDLE EAST: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION)

- TABLE 508 AFRICA: KEY MACROECONOMIC INDICATORS

- TABLE 509 AFRICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2023-2030 (USD BILLION)

- TABLE 510 AFRICA: PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 511 AFRICA: PHARMACEUTICAL FDF MANUFACTURING SERVICES MARKET, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 512 AFRICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR BIOLOGICS MANUFACTURING SERVICES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 513 AFRICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2023-2030 (USD BILLION)

- TABLE 514 AFRICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR SMALL MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 515 AFRICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET FOR LARGE MOLECULES, BY TYPE, 2023-2030 (USD BILLION)

- TABLE 516 AFRICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2023-2030 (USD BILLION) S

- TABLE 517 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, JANUARY 2022-AUGUST 2025

- TABLE 518 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: DEGREE OF COMPETITION

- TABLE 519 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: REGION FOOTPRINT

- TABLE 520 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: SERVICE FOOTPRINT

- TABLE 521 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: MOLECULE FOOTPRINT

- TABLE 522 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 523 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 524 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: SERVICE LAUNCHES, JANUARY 2022-JULY 2025

- TABLE 525 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: DEALS, JANUARY 2022-JULY 2025

- TABLE 526 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 527 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 528 THERMO FISHER SCIENTIFIC INC.: SERVICES OFFERED

- TABLE 529 THERMO FISHER SCIENTIFIC INC.: SERVICE LAUNCHES, JANUARY 2022-JULY 2025

- TABLE 530 THERMO FISHER SCIENTIFIC INC.: DEALS, JANUARY 2022-JULY 2025

- TABLE 531 LONZA: COMPANY OVERVIEW

- TABLE 532 LONZA: SERVICES OFFERED

- TABLE 533 LONZA: DEALS, JANUARY 2022-JULY 2025

- TABLE 534 LONZA: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 535 CATALENT, INC.: COMPANY OVERVIEW

- TABLE 536 CATALENT, INC.: SERVICES OFFERED

- TABLE 537 CATALENT, INC.: SERVICE LAUNCHES, JANUARY 2022-JULY 2025

- TABLE 538 CATALENT, INC.: DEALS, JANUARY 2022-JULY 2025

- TABLE 539 CATALENT, INC.: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 540 WUXI APPTEC: COMPANY OVERVIEW

- TABLE 541 WUXI APPTEC: SERVICES OFFERED

- TABLE 542 WUXI APPTEC: DEALS, JANUARY 2022-JULY 2025

- TABLE 543 WUXI APPTEC: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 544 WUXI BIOLOGICS: COMPANY OVERVIEW

- TABLE 545 WUXI BIOLOGICS: SERVICES OFFERED

- TABLE 546 WUXI BIOLOGICS: SERVICE LAUNCHES, JANUARY 2022-JULY 2025

- TABLE 547 WUXI BIOLOGICS: DEALS, JANUARY 2022-JULY 2025

- TABLE 548 WUXI BIOLOGICS: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 549 WUXI BIOLOGICS: OTHER DEVELOPMENTS, JANUARY 2022-JULY 2025

- TABLE 550 SAMSUNG BIOLOGICS: COMPANY OVERVIEW

- TABLE 551 SAMSUNG BIOLOGICS: SERVICES OFFERED

- TABLE 552 SAMSUNG BIOLOGICS: SERVICE LAUNCHES, JANUARY 2022-JUNE 2025

- TABLE 553 SAMSUNG BIOLOGICS: DEALS, JANUARY 2022-JULY 2025

- TABLE 554 SAMSUNG BIOLOGICS: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 555 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: COMPANY OVERVIEW

- TABLE 556 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: SERVICES OFFERED

- TABLE 557 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: DEALS, JANUARY 2022-JULY 2025

- TABLE 558 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 559 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: OTHER DEVELOPMENTS, JANUARY 2022-JULY 2025

- TABLE 560 EVONIK: COMPANY OVERVIEW

- TABLE 561 EVONIK: SERVICES OFFERED

- TABLE 562 EVONIK: DEALS, JANUARY 2022-JULY 2025

- TABLE 563 EVONIK: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 564 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 565 FUJIFILM HOLDINGS CORPORATION: SERVICES OFFERED

- TABLE 566 FUJIFILM HOLDINGS CORPORATION: DEALS, JANUARY 2022-JULY 2025

- TABLE 567 FUJIFILM HOLDINGS CORPORATION: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 568 ABBVIE INC.: COMPANY OVERVIEW

- TABLE 569 ABBVIE INC.: SERVICES OFFERED

- TABLE 570 ABBVIE INC.: DEALS, JANUARY 2022-JULY 2025

- TABLE 571 ABBVIE INC.: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 572 SIEGFRIED HOLDING AG: COMPANY OVERVIEW

- TABLE 573 SIEGFRIED HOLDING AG: SERVICES OFFERED

- TABLE 574 SIEGFRIED HOLDING AG: DEALS, JANUARY 2022-JULY 2025

- TABLE 575 SIEGFRIED HOLDING AG: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 576 MERCK KGAA: COMPANY OVERVIEW

- TABLE 577 MERCK KGAA: SERVICES OFFERED

- TABLE 578 MERCK KGAA: DEALS, JANUARY 2022-JULY 2025

- TABLE 579 MERCK KGAA: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 580 ALMAC GROUP: COMPANY OVERVIEW

- TABLE 581 ALMAC GROUP: SERVICES OFFERED

- TABLE 582 ALMAC GROUP: DEALS, JANUARY 2022-JULY 2025

- TABLE 583 ALMAC GROUP: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 584 CHARLES RIVER LABORATORIES: COMPANY OVERVIEW

- TABLE 585 CHARLES RIVER LABORATORIES: SERVICES OFFERED

- TABLE 586 CHARLES RIVER LABORATORIES: DEALS, JANUARY 2022-JULY 2025

- TABLE 587 CHARLES RIVER LABORATORIES: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 588 ASYMCHEM INC.: COMPANY OVERVIEW

- TABLE 589 ASYMCHEM INC.: SERVICES OFFERED

- TABLE 590 ASYMCHEM INC.: DEALS, JANUARY 2022-JULY 2025

- TABLE 591 ASYMCHEM INC.: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 592 VETTER: COMPANY OVERVIEW

- TABLE 593 VETTER: SERVICES OFFERED

- TABLE 594 VETTER: SERVICE LAUNCHES, JANUARY 2022-JULY 2025

- TABLE 595 VETTER: DEALS, JANUARY 2022-JULY 2025

- TABLE 596 VETTER: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 597 ALCAMI CORPORATION: COMPANY OVERVIEW

- TABLE 598 ALCAMI CORPORATION: SERVICES OFFERED

- TABLE 599 ALCAMI CORPORATION: DEALS, JANUARY 2022-JULY 2025

- TABLE 600 ALCAMI CORPORATION: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 601 EUROFINS SCIENTIFIC: COMPANY OVERVIEW

- TABLE 602 EUROFINS SCIENTIFIC: SERVICES OFFERED

- TABLE 603 EUROFINS SCIENTIFIC: EXPANSIONS, JANUARY 2022-JUNE 2025

- TABLE 604 PIRAMAL PHARMA SOLUTIONS: COMPANY OVERVIEW

- TABLE 605 SYNGENE INTERNATIONAL LIMITED: COMPANY OVERVIEW

- TABLE 606 CAMBREX CORPORATION: COMPANY OVERVIEW

- TABLE 607 JUBILANT PHARMANOVA LIMITED: COMPANY OVERVIEW

- TABLE 608 YUHAN CORPORATION: COMPANY OVERVIEW

- TABLE 609 PIERRE FABRE LABORATORIES: COMPANY OVERVIEW

- TABLE 610 PFIZER CENTREONE: COMPANY OVERVIEW

- TABLE 611 DELPHARM: COMPANY OVERVIEW

- TABLE 612 FRONTAGE LABS: COMPANY OVERVIEW

- TABLE 613 SHARP SERVICES, LLC: COMPANY OVERVIEW

- TABLE 614 GRAND RIVER ASEPTIC MANUFACTURING: COMPANY OVERVIEW

- TABLE 615 RECIPHARM AB: COMPANY OVERVIEW

- TABLE 616 PCI PHARMA SERVICES: COMPANY OVERVIEW

- TABLE 617 CURIA GLOBAL, INC.: COMPANY OVERVIEW

- TABLE 618 SIMTRA BIOPHARMA SOLUTIONS: COMPANY OVERVIEW

- TABLE 619 PORTON: COMPANY OVERVIEW

- TABLE 620 MABPLEX INTERNATIONAL CO. LTD.: COMPANY OVERVIEW

- TABLE 621 CELLARES: COMPANY OVERVIEW

List of Figures

- FIGURE 1 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: YEARS CONSIDERED

- FIGURE 3 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: RESEARCH DESIGN

- FIGURE 4 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 6 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE ESTIMATION (SUPPLY-SIDE ANALYSIS), 2024

- FIGURE 7 COMPANY REVENUE ANALYSIS-BASED ESTIMATION: BOTTOM-UP APPROACH, 2024

- FIGURE 8 REVENUE SHARE ANALYSIS OF THERMO FISHER SCIENTIFIC INC., 2024

- FIGURE 9 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SIZE VALIDATION FROM PRIMARY SOURCES

- FIGURE 10 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: TOP-DOWN APPROACH

- FIGURE 11 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: CAGR PROJECTIONS

- FIGURE 12 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: DATA TRIANGULATION

- FIGURE 13 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY SERVICE, 2025 VS. 2030 (USD BILLION)

- FIGURE 14 PHARMACEUTICAL MANUFACTURING SERVICES MARKET, BY TYPE, 2025 VS. 2030 (USD BILLION)

- FIGURE 15 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY MOLECULE, 2025 VS. 2030 (USD BILLION)

- FIGURE 16 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY END USER, 2025 VS. 2030 (USD BILLION)

- FIGURE 17 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET, BY REGION, 2025-2030

- FIGURE 18 RISING INVESTMENTS IN PHARMACEUTICAL R&D TO DRIVE MARKET

- FIGURE 19 PHARMACEUTICAL MANUFACTURING SERVICES AND US TO LEAD NORTH AMERICAN MARKET IN 2025

- FIGURE 20 SMALL MOLECULES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 21 BIG PHARMACEUTICAL COMPANIES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 22 CHINA TO HAVE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 23 EMERGING MARKETS TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 24 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 NEW REVENUE POCKETS FOR PLAYERS IN PHARMACEUTICAL CONTRACT MANUFACTURING MARKET

- FIGURE 26 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 INVESTMENT AND FUNDING SCENARIO, 2023-2024

- FIGURE 30 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: PATENT ANALYSIS, JANUARY 2014-DECEMBER 2024

- FIGURE 31 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY SERVICE

- FIGURE 33 KEY BUYING CRITERIA FOR END USERS

- FIGURE 34 ABBREVIATED NEW DRUG APPLICATION (ANDA) APPROVALS, 2020-2025

- FIGURE 35 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: AI USE CASES

- FIGURE 36 NORTH AMERICA: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SNAPSHOT

- FIGURE 39 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 40 EV/EBITDA OF KEY VENDORS

- FIGURE 41 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 42 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: BRAND/SERVICE COMPARISON

- FIGURE 43 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 44 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: COMPANY FOOTPRINT

- FIGURE 45 PHARMACEUTICAL CONTRACT MANUFACTURING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 46 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2024)

- FIGURE 47 LONZA: COMPANY SNAPSHOT (2024)

- FIGURE 48 CATALENT, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 49 WUXI APPTEC: COMPANY SNAPSHOT (2024)

- FIGURE 50 WUXI BIOLOGICS: COMPANY SNAPSHOT (2024)

- FIGURE 51 SAMSUNG BIOLOGICS: COMPANY SNAPSHOT (2024)

- FIGURE 52 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: COMPANY SNAPSHOT (2024)

- FIGURE 53 EVONIK: COMPANY SNAPSHOT (2024)

- FIGURE 54 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 55 ABBVIE INC.: COMPANY SNAPSHOT (2024)

- FIGURE 56 SIEGFRIED HOLDING AG: COMPANY SNAPSHOT (2024)

- FIGURE 57 MERCK KGAA: COMPANY SNAPSHOT (2024)

- FIGURE 58 ALMAC GROUP: COMPANY SNAPSHOT (2024)