|

|

市場調査レポート

商品コード

1919588

グリーン水素の世界市場 (~2032年):技術 (アルカリ電解・PEM電解)・再生可能エネルギー源 (風力・太陽光)・エンドユーザー産業 (モビリティ・電力・化学・産業・電力系統注入)・地域別Green Hydrogen Market By Technology (Alkaline, PEM), Renewable Source (Wind, Solar), End-use Industry (Mobility, Power, Chemical, Industrial, Grid Injection), and Region (North America, Europe, APAC, MEA, and Latin America) - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| グリーン水素の世界市場 (~2032年):技術 (アルカリ電解・PEM電解)・再生可能エネルギー源 (風力・太陽光)・エンドユーザー産業 (モビリティ・電力・化学・産業・電力系統注入)・地域別 |

|

出版日: 2025年12月09日

発行: MarketsandMarkets

ページ情報: 英文 375 Pages

納期: 即納可能

|

概要

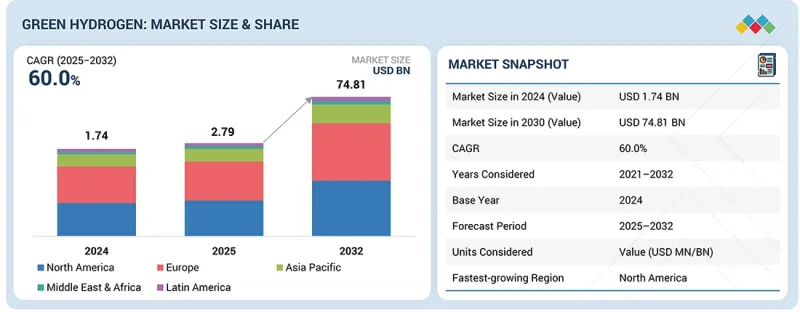

グリーン水素の市場規模は、2025年の27億9,000万米ドルから、予測期間中はCAGR 60.0%で成長し、2032年には748億1,000万米ドルに達すると見込まれています。

市場を牽引する主な要因として、あらゆる再生可能エネルギー源における製造コストの低下、電解技術の進歩、電力業界および燃料電池電気自動車からの需要増加が挙げられます。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 単位 | 金額 (米ドル) |

| セグメント | 再生可能エネルギー源、技術、エンドユーザー産業、流通チャネル、製造規模、純度レベル、貯蔵、地域 |

| 対象地域 | アジア太平洋、欧州、北米、中東・アフリカ、南米 |

グリーン水素は、化学、モビリティ、系統連系、電力産業など、様々な産業分野で応用されています。ゼロエミッションの製造プロセスにより、従来のグレー水素、ブラウン水素、ブルー水素に代わるものとして、ますます注目されています。技術進歩により、グリーン水素のコスト競争力も向上しています。この持続可能な燃料源は、様々なエンドユーザー産業において、化石燃料に代わる現実的な選択肢として台頭しています。

"技術別では、予測期間中、アルカリ電解ベースのセグメントが金額ベースで最大のシェアを占める見通し"

アルカリ電解のグリーン水素セグメントは、その信頼性、拡張性、低コスト性により、最大の市場シェアを占めると予想されます。この技術では、水酸化カリウムなどのアルカリ電解質を用いて水を分解し、水素イオンが電解質中にゆっくりと拡散するためガス交差が最小限に抑えられ、高純度の水素を製造します。セル設計と一般的な非貴金属材料の使用により、新規電解法と比較して設備投資コストと維持管理コストの両方を低く抑えられます。同時に、確立された製造プロセスにより大規模な迅速な展開が可能です。アルカリ電解装置は様々な電力条件下で効率的に稼働するため、風力や太陽光などの再生可能エネルギー源との互換性があります。スタックの長い寿命、運転安定性、連続的な工業製造との互換性といった利点により、アルカリ電解は成長するグリーン水素市場において最も実用的で商業的に魅力的な技術の一つとなっています。

"エンドユーザー産業別では、モビリティ分野が予測期間中に最も急速に成長する見込み"

鉄道、道路、航空、船舶など様々な輸送モードにおいて、電池技術の性能要件を満たすことがますます困難になっています。グリーン水素はエネルギー密度が高いため、航続距離が大幅に延長されると同時に燃料補給時間も短縮され、燃料電池電気自動車 (FCEV) は大型トラック、バス、列車、航空機、船舶にとって自然な選択肢となります。これにより事業者は最小限のダウンタイムで車両を運用でき、物流、公共交通、産業環境におけるモビリティの優先選択肢となります。グリーン水素製造技術の急速な進歩、燃料補給インフラの拡充、自動車メーカー・エネルギー供給者・フリート事業者間の連携が、多様な輸送モードにおけるグリーン水素導入を加速させています。加えて、政府の優遇政策や国家脱炭素化戦略が早期導入を後押ししています。

"欧州市場が予測期間中に金額と量の両面で最大の地域市場となる見込み"

欧州は世界最大の地域としてグリーン水素市場をリードしています。強固な産業基盤、先進的な技術力、深い脱炭素化への非常に明確なコミットメントが促進要因です。同地域で設定された野心的な気候目標は、再生可能エネルギー容量とグリーン水素製造への大規模投資を加速させています。欧州はまた、成熟した製造エコシステムを有しており、複数の確立された電解装置メーカー、エンジニアリング企業、技術開発企業が確固たる地位を築いています。これらはそれぞれのバリューチェーンにおいて、イノベーションの推進、効率性の向上、コスト削減の達成に貢献しています。水素インフラの拡充、大規模実証プロジェクトの開発、グリーン水素の産業プロセス・電力システム・モビリティへの統合に向け、公的・民間双方の多額の投資が注がれています。これらの要素が相まって、欧州はグリーン水素の開発・普及における世界のハブの中心に位置づけられています。

当レポートでは、世界のグリーン水素の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 重要考察

第4章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- アンメットニーズとホワイトスペース

- 関連市場・異業種との分野横断的機会

- ティア1/2/3企業の戦略的動き

第5章 業界動向

- ポーターのファイブフォース分析

- マクロ経済見通し

- バリューチェーン分析

- グリーン水素市場のためのエコシステム

- 価格分析

- 貿易分析

- 2025~2026年の主な会議とイベント

- 動向/混乱の影響

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 2025年の米国関税の影響- グリーン水素市場

- 主要な関税率

第6章 技術、特許、デジタル、AIの導入による戦略的ディスラプション

- 主要な新興技術

- PEM (プロトン交換膜) 電解装置

- アルカリ電解装置

- 補完的技術

- SOEC (固体酸化物形電解セル) 電解装置

- AEM (陰イオン交換膜) 電解装置

- 技術/製品ロードマップ

- 特許分析

- 将来の応用

- グリーン水素市場におけるAIの影響

- 成功事例と実世界への応用

第7章 持続可能性と規制状況

- 地域の規制とコンプライアンス

- 持続可能性への取り組み

- 持続可能性への影響と規制政策の取り組み

- 認証、ラベル、環境基準

第8章 顧客情勢と購買行動

- 意思決定プロセス

- 主要なステークホルダーと購入基準

- 採用障壁と内部課題

- さまざまなエンドユーザーの満たされていないニーズ

- 市場収益性

第9章 グリーン水素市場:流通チャネル別

- パイプライン

- 貨物

第10章 グリーン水素市場:製造規模別

- 小規模 (1 MW未満)

- 中規模 (1~10MW)

- 大規模 (10 MW超)

第11章 グリーン水素市場:純度別

- 超高純度

- 高純度

- 標準純度

第12章 グリーン水素市場:貯蔵別

- 圧縮ガス貯蔵

- 液体水素貯蔵

- 金属水素化物貯蔵

- その他の貯蔵オプション (化学水素化物貯蔵、極低温圧縮水素貯蔵)

第13章 グリーン水素市場:再生可能エネルギー源別

- 風力エネルギー

- 太陽エネルギー

- その他

第14章 グリーン水素市場:技術別

- アルカリ電解

- PEM電解

第15章 グリーン水素市場:エンドユーザー産業別

- モビリティ

- 化学

- 電力

- 電力系統注入

- 産業

- その他

第16章 グリーン水素市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- アジア太平洋

- 中国

- 日本

- オーストラリア

- その他

- 欧州

- ドイツ

- オーストリア

- デンマーク

- 英国

- フランス

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- 中東・アフリカ

- GCC諸国

- その他

第17章 競合情勢

- 主要企業の戦略/有力企業

- 収益分析

- 市場シェア分析

- ブランド/製品比較

- SIEMENS ENERGY

- AIR LIQUIDE

- AIR PRODUCTS

- ENGIE

- UNIPER

- 企業評価と財務指標

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合ベンチマーキング:スタートアップ/中小企業

- 競合シナリオ

第18章 企業プロファイル

- 主要企業

- AIR LIQUIDE

- LINDE PLC

- AIR PRODUCTS AND CHEMICALS, INC.

- ENGIE

- TOSHIBA ENERGY SYSTEMS & SOLUTIONS CORPORATION

- UNIPER SE

- SIEMENS ENERGY

- LHYFE

- NEL

- ORSTED

- BLOOM ENERGY

- CUMMINS INC.

- H&R GROUP

- W2E TECHNOLOGY, LLC

- SINOSYNERGY

- その他の企業

- ABO ENERGY KGAA

- GREEN HYDROGEN SYSTEMS

- SALZGITTER AG

- RWE

- ADANI GROUP

- HYDROGENEA GMBH

- WAAREE ENERGIES LTD

- IBERDROLA, S.A.

- ENEL S.P.A

- ENVISION GROUP

- HYNAMICS GROUPE (EDF)

- ACWA POWER

- THE STATE ATOMIC ENERGY CORPORATION ROSATOM

- ENEGIX ENERGY

- ACME GROUP

- GEOPURA LTD.

- IWATANI CORPORATION

- IVYS ENERGY SOLUTIONS

- ENAPTER S.R.L

- ATAWEY

- HIRINGA ENERGY LIMITED

- PLUG POWER, INC.

- ITM POWER PLC.