|

|

市場調査レポート

商品コード

1452522

アジア太平洋のグリーン水素市場(2030年までの予測)- 地域別分析- 技術別、再生可能エネルギー源別、最終用途産業別Asia Pacific Green Hydrogen Market Forecast to 2030 - Regional Analysis - by Technology, Renewable Source, and End-Use Industry |

||||||

| アジア太平洋のグリーン水素市場(2030年までの予測)- 地域別分析- 技術別、再生可能エネルギー源別、最終用途産業別 |

|

出版日: 2023年12月22日

発行: The Insight Partners

ページ情報: 英文 110 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

アジア太平洋のグリーン水素市場は、2022年の10億9,291万米ドルから2030年には259億7,641万米ドルに成長すると予測されています。2022年から2030年までのCAGRは48.6%と推定されます。

大規模グリーン水素プラントの設立がアジア太平洋のグリーン水素市場を後押し

大規模なグリーン水素プラントは、水素製造施設、貯蔵システム、輸送ネットワークなどの専用インフラを必要とします。このようなプラントの設立は、グリーン水素の流通と利用をサポートする強固なインフラへの要求を後押しします。例えば、ラーセン&トウブロ社は2023年6月、NEOMグリーン水素社(NGHC)がサウジアラビアに建設する世界最大のグリーン水素プラントのインフラ整備計画を発表しました。このように、インフラ開発の活発化により、さまざまな分野でのグリーン水素の採用に有利な環境が整うことが予想され、予測期間中に市場プレーヤーに成長機会を提供する可能性が予測されます。

アジア太平洋のグリーン水素市場の概要

アジア太平洋地域では、次世代電源としての水素の可能性を認識し、グリーン水素製造拠点の設立を目指す企業間の競合が激しくなっています。先陣を切っているのは、大規模プロジェクトで提携する欧米企業と地域企業です。デンマークの多国籍企業で洋上風力発電大手のOrsted社は、グリーン水素市場への参入を模索しています。同社は2021年5月、韓国の鉄鋼メーカーPOSCOと洋上風力発電プロジェクトで提携しました。同社はグリーン水素製造の実現可能性を研究しています。欧米の石油会社もこの地域で大規模な投資を行っています。例えば、BPは2022年6月、オーストラリアのアジア再生可能エネルギー・ハブ(AREH)プロジェクトの筆頭株主となり、年間最大1.6トンのグリーン水素を生産し、世界市場の10%シェアを確保することを目指しています。

アジア太平洋のグリーン水素市場の収益と2030年までの予測(金額)

アジア太平洋のグリーン水素市場のセグメンテーション

アジア太平洋のグリーン水素市場は、技術、再生可能エネルギー源、最終用途産業、国別に区分されます。

技術別に見ると、アジア太平洋のグリーン水素市場はアルカリ電解とPEM電解に二分されます。2022年のアジア太平洋のグリーン水素市場では、アルカリ電解分野が大きなシェアを占めています。

再生可能エネルギー源別では、アジア太平洋のグリーン水素市場は風力エネルギーと太陽エネルギーに分けられます。2022年のアジア太平洋のグリーン水素市場では、太陽エネルギー部門がより大きなシェアを占めています。

最終用途別では、アジア太平洋のグリーン水素市場は化学、電力、飲食品、医療、石油化学、その他に区分されます。2022年には、電力分野がアジア太平洋のグリーン水素市場で最大のシェアを占めています。

国別に見ると、アジア太平洋のグリーン水素市場はオーストラリア、中国、インド、日本、韓国、その他アジア太平洋地域に区分されます。2022年のアジア太平洋のグリーン水素市場は中国が支配的でした。

Air Products &Chemicals Inc、Cummins Inc、Engie SA、L'Air Liquide SA、Linde Plc、Nel ASA、Siemens Energy AG、Toshiba Energy Systems &Solutions Corpは、アジア太平洋のグリーン水素市場に参入している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

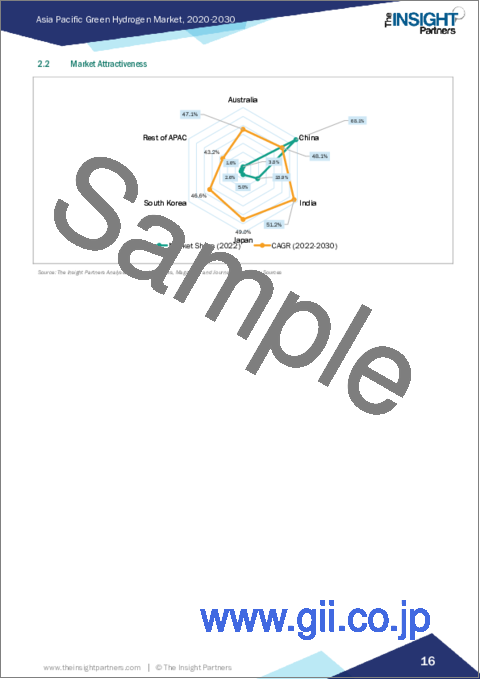

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 アジア太平洋のグリーン水素市場情勢

- 概観

- PEST分析

- エコシステム分析

- 再生可能エネルギー源

- グリーン水素生産者

- グリーン水素の流通業者

- エンドユーザーまたは消費者

第5章 アジア太平洋のグリーン水素市場:主要産業力学

- 主な市場促進要因

- 2050年までにネットゼロエミッションを目指す世界の計画の高まり

- 再生可能エネルギーへの投資拡大

- FCEV需要の増加

- 主な市場抑制要因

- グリーン水素と関連製品の高コスト

- インフラの不足

- 主な市場機会

- グリーン水素プロジェクトへの投資の増加

- 大規模グリーン水素プラントの設立増加

- 今後の動向

- グリーン水素の技術進歩

- 促進要因と抑制要因の影響

第6章 グリーン水素市場:アジア太平洋市場分析

- アジア太平洋地域のグリーン水素市場シェア(地域別)、2020年および2030年

- アジア太平洋地域のグリーン水素市場売上実績:2020年~2030年

第7章 アジア太平洋のグリーン水素市場分析-最終用途産業

- アジア太平洋のグリーン水素市場収入シェア:最終用途産業別(2022年、2030年)

- 化学

- 化学品の概要アジア太平洋のグリーン水素市場の収益と2030年までの予測

- 電力

- 電力:アジア太平洋地域のグリーン水素市場の収益と2030年までの予測

- 飲食品

- 飲食品:アジア太平洋地域のグリーン水素市場の収益と2030年までの予測

- 医療

- 医療アジア太平洋地域のグリーン水素市場の収益と2030年までの予測

- 石油化学

- 石油化学アジア太平洋地域のグリーン水素市場の収益と2030年までの予測

- その他

- その他アジア太平洋地域のグリーン水素市場の収益と2030年までの予測

第8章 アジア太平洋地域のグリーン水素市場分析:再生可能資源

- アジア太平洋のグリーン水素市場:再生可能エネルギー別売上シェア(2022年および2030年)

- 風力エネルギー

- 風力エネルギー:アジア太平洋のグリーン水素市場の収益と2030年までの予測

- 太陽エネルギー

- 太陽エネルギー:アジア太平洋のグリーン水素市場の収益と2030年までの予測

第9章 アジア太平洋のグリーン水素市場分析:テクノロジー

- アジア太平洋のグリーン水素市場:売上高シェア、技術別(2022年および2030年)

- アルカリ電解

- 技術概要

- アルカリ電解:アジア太平洋のグリーン水素市場の収益と2030年までの予測

- PEM電解

- PEM電解:アジア太平洋のグリーン水素市場の収益と2030年までの予測

第10章 アジア太平洋のグリーン水素市場:国別分析

- オーストラリア

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

第11章 競合情勢

- 企業のポジショニングと集中度

第12章 業界情勢

- 市場イニシアティブ

第13章 企業プロファイル

- L'Air Liquide SA

- Siemens Energy AG

- Cummins Inc

- Linde Plc

- Nel ASA

- Orsted AS

- Toshiba Energy Systems & Solutions Corp

- Uniper SE

- Engie SA

- Air Products & Chemicals Inc

第14章 付録

List Of Tables

- Table 1. Asia Pacific Green Hydrogen Market Segmentation

- Table 2. Asia Pacific Green Hydrogen Market Revenue And Forecasts To 2030 (US$ Mn)

- Table 3. Asia Pacific Green Hydrogen Market, By End-Use Industry - Revenue and Forecast to 2030 (US$ Million)

- Table 4. Asia Pacific Green Hydrogen Market, By Renewable Source - Revenue and Forecast to 2030 (US$ Million)

- Table 5. Asia Pacific Green Hydrogen Market, By Technology - Revenue and Forecast to 2030 (US$ Million)

- Table 6. Australia: Asia Pacific Green Hydrogen Market, By End-Use Industry - Revenue and Forecast to 2030 (US$ Million)

- Table 7. Australia: Asia Pacific Green Hydrogen Market, By Renewable Source - Revenue and Forecast to 2030 (US$ Million)

- Table 8. Australia: Asia Pacific Green Hydrogen Market, By Technology - Revenue and Forecast to 2030 (US$ Million)

- Table 9. China: Asia Pacific Green Hydrogen Market, By End-Use Industry - Revenue and Forecast to 2030 (US$ Million)

- Table 10. China: Asia Pacific Green Hydrogen Market, By Renewable Source - Revenue and Forecast to 2030 (US$ Million)

- Table 11. China: Asia Pacific Green Hydrogen Market, By Technology - Revenue and Forecast to 2030 (US$ Million)

- Table 12. India: Asia Pacific Green Hydrogen Market, By End-Use Industry - Revenue and Forecast to 2030 (US$ Million)

- Table 13. India: Asia Pacific Green Hydrogen Market, By Renewable Source - Revenue and Forecast to 2030 (US$ Million)

- Table 14. India: Asia Pacific Green Hydrogen Market, By Technology - Revenue and Forecast to 2030 (US$ Million)

- Table 15. Japan: Asia Pacific Green Hydrogen Market, By End-Use Industry - Revenue and Forecast to 2030 (US$ Million)

- Table 16. Japan: Asia Pacific Green Hydrogen Market, By Renewable Source - Revenue and Forecast to 2030 (US$ Million)

- Table 17. Japan: Asia Pacific Green Hydrogen Market, By Technology - Revenue and Forecast to 2030 (US$ Million)

- Table 18. South Korea: Asia Pacific Green Hydrogen Market, By End-Use Industry - Revenue and Forecast to 2030 (US$ Million)

- Table 19. South Korea: Asia Pacific Green Hydrogen Market, By Renewable Source - Revenue and Forecast to 2030 (US$ Million)

- Table 20. South Korea: Asia Pacific Green Hydrogen Market, By Technology - Revenue and Forecast to 2030 (US$ Million)

- Table 21. Rest of Asia Pacific: Asia Pacific Green Hydrogen Market, By End-Use Industry - Revenue and Forecast to 2030 (US$ Million)

- Table 22. Rest of Asia Pacific: Asia Pacific Green Hydrogen Market, By Renewable Source - Revenue and Forecast to 2030 (US$ Million)

- Table 23. Rest of Asia Pacific: Asia Pacific Green Hydrogen Market, By Technology - Revenue and Forecast to 2030 (US$ Million)

List Of Figures

- Figure 1. Asia Pacific Green Hydrogen Market Segmentation, By Country

- Figure 2. Asia Pacific Green Hydrogen Market - PEST Analysis

- Figure 3. Asia Pacific Green Hydrogen Market - Ecosystem Analysis

- Figure 4. Asia Pacific Green Hydrogen Market - Key Industry Dynamics

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. Asia Pacific Green Hydrogen Market Share, By Region (%), 2020 and 2030

- Figure 7. Asia Pacific Green Hydrogen Market Revenue (US$ Mn), 2020 - 2030

- Figure 8. Asia Pacific Green Hydrogen Market Revenue Share, By End-Use Industry (2022 and 2030)

- Figure 9. Chemicals: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Power: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Food and Beverages: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Medical: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Petrochemicals: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Others: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Asia Pacific Green Hydrogen Market Revenue Share, By Renewable Source (2022 and 2030)

- Figure 16. Wind Energy: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Solar Energy: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Asia Pacific Green Hydrogen Market Revenue Share, By Technology (2022 and 2030)

- Figure 19. Alkaline Electrolysis: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

- Figure 20. PEM Electrolysis: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Asia Pacific Green Hydrogen Market, by Key Country- Revenue (2022) (US$ Million)

- Figure 22. Asia Pacific Green Hydrogen Market Revenue Share, By Key Country (2022 and 2030)

- Figure 23. Australia: Asia Pacific Green Hydrogen Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 24. China: Asia Pacific Green Hydrogen Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 25. India: Asia Pacific Green Hydrogen Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 26. Japan: Asia Pacific Green Hydrogen Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 27. South Korea: Asia Pacific Green Hydrogen Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 28. Rest of Asia Pacific: Asia Pacific Green Hydrogen Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 29. Company Positioning & Concentration

The Asia Pacific green hydrogen market is expected to grow from US$ 1,092.91 million in 2022 to US$ 25,976.41 by 2030. It is estimated to grow at a CAGR of 48.6% from 2022 to 2030.

Growing Establishment of Large Green Hydrogen Plants Fuels Asia Pacific Green Hydrogen Market

The establishment of large-scale green hydrogen plants attracts significant investments from both the public and private sectors. In June 2023, a group of companies announced their plan to invest US$ 79.75 in a project for the development of a hydrogen production facility and a hydrogen liquefaction facility in Queensland, Australia. The group of companies includes Iwatani Corporation (Japan), Kansai Electric Power Company (Japan), Marubeni Corporation (Japan), Keppel Infrastructure (Singapore), and Stanwell Corporation (Australia).

Large-sized green hydrogen plants require dedicated infrastructure, including hydrogen production facilities, storage systems, and transportation networks. The establishment of such plants drives the requirement for a robust infrastructure that supports the distribution and utilization of green hydrogen. For instance, in June 2023, Larsen & Toubro announced its plan to set up infrastructure for the world's largest green hydrogen plant in Saudi Arabia, which is being built by NEOM Green Hydrogen Company (NGHC). Thus, a rise in infrastructure development is expected to create a favorable environment for the adoption of green hydrogen in different sectors, which is likely to offer growth opportunities to the market players during the forecast period.

Asia Pacific Green Hydrogen Market Overview

Asia Pacific is witnessing intense competition among companies aiming to establish green hydrogen production bases, recognizing its potential as a next-generation power source. Leading the charge are Western and regional companies teaming up for massive projects. Danish multinational Orsted, a major offshore wind power company, is exploring entry into the green hydrogen market. The company partnered with South Korean steelmaker POSCO for an offshore wind power project in May 2021. It is studying the feasibility of green hydrogen production. Western oil companies are also making significant investments in the region. For instance, in June 2022, BP became the largest shareholder in the Asian Renewable Energy Hub (AREH) project in Australia, aiming to produce up to 1.6 metric ton of green hydrogen annually and secure a 10% share of the global market.

Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Green Hydrogen Market Segmentation

The Asia Pacific green hydrogen market is segmented into technology, renewable source, end-use industry, and country.

Based o n technology, the Asia Pacific green hydrogen market is bifurcated into alkaline electrolysis and PEM electrolysis. The alkaline electrolysis segment accounted a larger share of the Asia Pacific green hydrogen market in 2022.

By renewable source, the Asia Pacific green hydrogen market is divided into wind energy and solar energy. The solar energy segment held a larger share of the Asia Pacific green hydrogen market in 2022.

By end use, the Asia Pacific green hydrogen market is segmented into chemical, power, food & beverages, medical, petrochemicals, and others. In 2022, the power segment held a largest share of the Asia Pacific green hydrogen market.

Based on country, the Asia Pacific green hydrogen market is segmented int o Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific green hydrogen market in 2022.

Air Products & Chemicals Inc, Cummins Inc, Engie SA, L'Air Liquide SA, Linde Plc, Nel ASA, Siemens Energy AG, and Toshiba Energy Systems & Solutions Corp are some of the leading companies operating in the Asia Pacific green hydrogen market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Asia Pacific Green Hydrogen Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 Renewable Energy Sources:

- 4.3.2 Green Hydrogen Producers:

- 4.3.3 Green Hydrogen Distributors:

- 4.3.4 End Users or Consumers:

5. Asia Pacific Green Hydrogen Market - Key Industry Dynamics

- 5.1 Key Market Drivers:

- 5.1.1 Rising Global Plans for Net-zero Emission by 2050

- 5.1.2 Growing Investment in Renewable Energy

- 5.1.3 Increasing Demand for FCEV

- 5.2 Key Market Restraints:

- 5.2.1 High Cost of Green Hydrogen and Associated Products

- 5.2.2 Lack of Infrastructure

- 5.3 Key Market Opportunities:

- 5.3.1 Increasing Investment in Green Hydrogen Projects

- 5.3.2 Growing Establishment of Large Green Hydrogen Plants

- 5.4 Future Trend:

- 5.4.1 Technological Advancements in Green Hydrogen

- 5.5 Impact of Drivers and Restraints:

6. Green Hydrogen Market - Asia Pacific Market Analysis

- 6.1 Asia Pacific Green Hydrogen Market Share, By Region (%), 2020 and 2030

- 6.2 Asia Pacific Green Hydrogen Market Revenue (US$ Mn), 2020 - 2030

7. Asia Pacific Green Hydrogen Market Analysis - End-Use Industry

- 7.1 Overview

- 7.2 Asia Pacific Green Hydrogen Market Revenue Share, By End-Use Industry (2022 and 2030)

- 7.3 Chemicals

- 7.3.1 Overview

- 7.3.2 Chemicals: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

- 7.4 Power

- 7.4.1 Overview

- 7.4.2 Power: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

- 7.5 Food and Beverages

- 7.5.1 Overview

- 7.5.2 Food and Beverages: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

- 7.6 Medical

- 7.6.1 Overview

- 7.6.2 Medical: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

- 7.7 Petrochemicals

- 7.7.1 Overview

- 7.7.2 Petrochemicals: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

- 7.8 Others

- 7.8.1 Overview

- 7.8.2 Others: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

8. Asia Pacific Green Hydrogen Market Analysis - Renewable Source

- 8.1 Overview

- 8.2 Asia Pacific Green Hydrogen Market Revenue Share, By Renewable Source (2022 and 2030)

- 8.3 Wind Energy

- 8.3.1 Overview

- 8.3.2 Wind Energy: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

- 8.4 Solar Energy

- 8.4.1 Overview

- 8.4.2 Solar Energy: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

9. Asia Pacific Green Hydrogen Market Analysis - Technology

- 9.1 Overview

- 9.2 Asia Pacific Green Hydrogen Market Revenue Share, By Technology (2022 and 2030)

- 9.3 Alkaline Electrolysis

- 9.3.1 Overview

- 9.3.2 Alkaline Electrolysis: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

- 9.4 PEM Electrolysis

- 9.4.1 Overview

- 9.4.2 PEM Electrolysis: Asia Pacific Green Hydrogen Market Revenue and Forecast to 2030 (US$ Million)

10. Asia Pacific Green Hydrogen Market - Country Analysis

- 10.1 Overview

- 10.1.1 Asia Pacific Green Hydrogen Market, by Key Country

- 10.1.1.1 Australia: Asia Pacific Green Hydrogen Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.1.1 Australia: Asia Pacific Green Hydrogen Market, By End-Use Industry

- 10.1.1.1.2 Australia: Asia Pacific Green Hydrogen Market, By Renewable Source

- 10.1.1.1.3 Australia: Asia Pacific Green Hydrogen Market, By Technology

- 10.1.1.2 China: Asia Pacific Green Hydrogen Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.2.1 China: Asia Pacific Green Hydrogen Market, By End-Use Industry

- 10.1.1.2.2 China: Asia Pacific Green Hydrogen Market, By Renewable Source

- 10.1.1.2.3 China: Asia Pacific Green Hydrogen Market, By Technology

- 10.1.1.3 India: Asia Pacific Green Hydrogen Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.3.1 India: Asia Pacific Green Hydrogen Market, By End-Use Industry

- 10.1.1.3.2 India: Asia Pacific Green Hydrogen Market, By Renewable Source

- 10.1.1.3.3 India: Asia Pacific Green Hydrogen Market, By Technology

- 10.1.1.4 Japan: Asia Pacific Green Hydrogen Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.4.1 Japan: Asia Pacific Green Hydrogen Market, By End-Use Industry

- 10.1.1.4.2 Japan: Asia Pacific Green Hydrogen Market, By Renewable Source

- 10.1.1.4.3 Japan: Asia Pacific Green Hydrogen Market, By Technology

- 10.1.1.5 South Korea: Asia Pacific Green Hydrogen Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.5.1 South Korea: Asia Pacific Green Hydrogen Market, By End-Use Industry

- 10.1.1.5.2 South Korea: Asia Pacific Green Hydrogen Market, By Renewable Source

- 10.1.1.5.3 South Korea: Asia Pacific Green Hydrogen Market, By Technology

- 10.1.1.6 Rest of Asia Pacific: Asia Pacific Green Hydrogen Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.6.1 Rest of Asia Pacific: Asia Pacific Green Hydrogen Market, By End-Use Industry

- 10.1.1.6.2 Rest of Asia Pacific: Asia Pacific Green Hydrogen Market, By Renewable Source

- 10.1.1.6.3 Rest of Asia Pacific: Asia Pacific Green Hydrogen Market, By Technology

- 10.1.1.1 Australia: Asia Pacific Green Hydrogen Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1 Asia Pacific Green Hydrogen Market, by Key Country

11. Competitive Landscape

- 11.1 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

13. Company Profiles

- 13.1 L'Air Liquide SA

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Siemens Energy AG

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Cummins Inc

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Linde Plc

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Nel ASA

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Orsted AS

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Toshiba Energy Systems & Solutions Corp

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Uniper SE

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Engie SA

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Air Products & Chemicals Inc

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

14. Appendix

- 14.1 Appendix