|

|

市場調査レポート

商品コード

1327316

光学コーティングの世界市場:技術別(真空蒸着、電子ビーム蒸着、スパッタリングプロセス、イオンアシスト蒸着(IAD))、タイプ別、最終用途産業別、地域別(アジア太平洋、北米、欧州、その他の地域)-2028年までの予測Optical Coatings Market by Technology (Vacuum Deposition, E-Beam Evaporation, Sputtering Process, and Ion Assisted Deposition (IAD)), Type, End-Use Industry, and Region (APAC, North America, Europe, and Rest of World) - Global Forecasts to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 光学コーティングの世界市場:技術別(真空蒸着、電子ビーム蒸着、スパッタリングプロセス、イオンアシスト蒸着(IAD))、タイプ別、最終用途産業別、地域別(アジア太平洋、北米、欧州、その他の地域)-2028年までの予測 |

|

出版日: 2023年08月02日

発行: MarketsandMarkets

ページ情報: 英文 241 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の光学コーティングの市場規模は、予測期間中にCAGR 8.2%で拡大し、2023年の132億米ドルから2028年には196億米ドルに成長すると予測されています。

光学コーティング市場は、アジア太平洋と欧州の新興経済圏からの産業用途における光学コーティングの需要増加により、大きく成長しており、これが光学コーティング市場成長の主な促進要因となっています。

光学コーティング市場は、様々な産業における高品質光学システムに対する需要の増加により、一貫した成長を遂げてきました。拡張現実(AR)、仮想現実(VR)、自律走行車、高解像度ディスプレイなどの技術の進歩が、光学コーティングの需要を大きく牽引しています。

電子ビーム蒸着は、薄膜や光学コーティングの製造に利用される蒸着技術です。電子ビームを固体材料に集束させることで、その材料は気化し、基板上に蒸着されます。この凝縮プロセスにより、薄膜層が形成され、その厚みと組成が綿密に制御されます。電子ビーム蒸着は、金属、酸化物、半導体を含む多様な材料の蒸着を可能にします。エレクトロニクス、光学、半導体製造などの産業で、特定の特性を持つ精密で高品質な薄膜を製造するために広く応用されています。

高反射コーティングはミラーコーティングとしても知られ、特定の波長または波長範囲での反射率を最大化するように特別に設計されています。これらのコーティングは複数の層で構成され、与えられたレーザー光線の波長と入射角(0~45°)に対して可能な限り高い反射率を達成するように最適化されています。高反射コーティングは、高い透過率を維持しながら、優れた性能、耐久性、長寿命を提供します。レーザー光学、反射望遠鏡、共振器ミラー、様々な宇宙関連用途に使用されています。

2022年、アジア太平洋は光学コーティング市場において第2位のシェアを占めました。中国、日本、韓国、インドなどの新興国は、電子・半導体産業や軍事・防衛産業の成長により需要を牽引すると予測されています。急速な経済成長と持続可能な製造ソリューションを推進する政府の取り組みにより、市場はさらに拡大すると予想されます。アジア太平洋は経済的にも人口的にも最も急成長している地域です。過去10年間では、世界のGDPとGDP成長率のかなりの部分を占めています。同地域の人口の多さは、自動車、工業、電気、建設などの最終用途部門にとって大きな顧客基盤となり、光学コーティング市場の成長を牽引しています。

当レポートでは、世界の光学コーティング市場について調査し、技術別、タイプ別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- 関税と規制状況分析

- 規制機関および政府機関

- サプライチェーン分析

- 生態系

- 主要な利害関係者と購入基準

- 2023年~2024年の主な会議とイベント

- 貿易分析

- 特許分析

- ケーススタディ

- マクロ経済の概要

- 価格分析

- 景気後退の影響:現実的、楽観的、悲観的シナリオ

第6章 光学コーティング市場、技術別

- イントロダクション

- 真空蒸着技術

- 電子ビーム蒸着技術

- スパッタリングプロセス

- イオンアシスト蒸着(IAD)技術

第7章 光学コーティング市場、タイプ別

- イントロダクション

- ARコーティング

- 高反射コーティング

- 透明導電性コーティング

- フィルターコーティング

- ビームスプリッターコーティング

- ECコーティング

- その他

第8章 光学コーティング市場、最終用途産業別

- イントロダクション

- エレクトロニクス・半導体

- 軍事・防衛

- 輸送

- 通信/光通信

- インフラ

- 太陽光発電

- 医療

- その他

第9章 光学コーティング市場、地域別

- イントロダクション

- 北米

- アジア太平洋

- 欧州

- その他の地域

第10章 競合情勢

- 概要

- 市場シェア分析

- 主要企業の5年間の収益分析

- 企業評価マトリックス(市場全体)、2022年

- 市場全体の競合ベンチマーキング

- 新興企業/中小企業の評価マトリックス、2022年

- 主要な新興企業/中小企業の詳細リスト

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- DUPONT

- PPG

- NIPPON SHEET GLASS CO., LTD.

- ZEISS GROUP

- NEWPORT CORPORATION

- INRAD OPTICS, INC.

- ARTEMIS OPTICAL LIMITED

- ABRISA TECHNOLOGIES

- REYNARD CORPORATION

- COHERENT CORP.

- その他の企業

- CASCADE OPTICAL CORPORATION

- BENEQ

- MATERION CORPORATION

- DEPOSITION SCIENCES, INC.(DSI)

- LAMBDA RESEARCH OPTICS INC.

- MLD TECHNOLOGIES

- EVAPORATED COATINGS, INC.

- ANDOVER CORPORATION

- VISIMAX TECHNOLOGIES INC.

- OPHIR OPTRONICS SOLUTIONS LTD.

- JANOS TECHNOLOGY LLC

- DENTON VACUUM

- NANO QUARZ WAFER

- ALLUXA

- ASML BERLIN(BERLINER GLAS)

第12章 隣接市場および関連市場

第13章 付録

The global optical coatings market is projected to grow from USD 13.2 billion in 2023 to USD 19.6 billion by 2028, at a CAGR of 8.2% during the forecast period. The optical coatings market is witnessing high growth owing to the growing demand for optical coatings in industrial applications from emerging economies of APAC and Europe is the major drivers for the growth of the optical coatings market.

The market for optical coatings had been experiencing consistent growth due to increasing demand for high-quality optical systems in various industries. Advancements in technology, such as augmented reality (AR), virtual reality (VR), autonomous vehicles, and high-resolution displays, have been significant drivers for the demand for optical coatings.

"E-Beam evaporation technology is the second largest growing technology during the forecast period"

E-beam evaporation is a deposition technique utilized in the manufacturing of thin films and optical coatings. By focusing an electron beam on a solid material, it is vaporized and deposited onto a substrate. This condensation process results in the formation of a thin film layer with meticulous control over its thickness and composition. E-beam evaporation enables the deposition of diverse materials, including metals, oxides, and semiconductors. It finds widespread application in industries such as electronics, optics, and semiconductor manufacturing to produce precise and high-quality thin films with specific properties.

"High reflective coatings type is projected to be the second largest growing type in Optical Coatings Market"

High reflective coatings, also known as mirror coatings, are specifically designed to maximize reflectance at a particular wavelength or range of wavelengths. These coatings consist of multiple layers and are optimized to achieve the highest possible reflectivity for a given laser line wavelength and angle of incidence (0 to 45°). High reflective coatings offer excellent performance, durability, and long lifespan while maintaining high transmission levels. They find applications in laser optics, reflecting telescopes, cavity mirrors, and various space-related uses.

There are two types of high reflective coatings: dielectric high reflective (DHR) coatings and metallic high reflective (MHR) coatings. DHR coatings exhibit exceptionally high reflectivity and are ideal for single-wavelength laser cavities where minimizing cavity loss at a specific center wavelength is crucial. On the other hand, MHR coatings provide reflection over a broad spectral range spanning from near-UV to near-IR. They are employed in applications requiring consistent high reflectivity across a wide range of wavelengths.

"APAC accounts for the second largest share in Optical coatings Market by region"

In 2022, APAC held the second-largest market share in the Optical coatings Market. Emerging economies like China, Japan, South Korea, and India, are projected to drive demand due to the growth of the electronics & semiconductor and military & defense industries. The market is expected to expand further due to rapid economic growth and government initiatives promoting sustainable manufacturing solutions. APAC is the fastest-growing region economically and in terms of population. It accounted for a significant portion of global GDP and GDP growth in the past decade. The region's large population creates a substantial customer base for automotive, industrial, electrical, and construction end-use sectors, driving the growth of the optical coatings market.

Extensive primary interviews were conducted to determine and verify the market size for several segments and sub-segments and information was gathered through secondary research.

The break-up of primary interviews is given below:

- By Company Type - Tier 1 - 30%, Tier 2 - 50%, and Tier 3 - 20%

- By Designation - C level Executives - 30%, Director level - 25%, and Others - 45%

- By Region - North America - 40%, Asia Pacific - 25%, Europe - 25%, and Rest of the World - 10%.

Notes: Others include sales, marketing, and product managers.

Notes: Tier 1: >USD 5 Billion; Tier 2: USD 1 Billion- USD 5 Billion; and Tier 3: <USD 1 Billion

Companies Covered: The companies profiled in this market research report include DuPont (US), PPG Industries Ohio, Inc. (US), Nippon Sheet Glass Co., Ltd. (Japan), ZEISS Group (Germany), Newport Corporation (US), Inrad Optics, Inc. (US), Artemis Optical Limited (England), Abrisa Technologies (US), Reynard Corporation (US), Coherent Corp. (US) and others.

Research Coverage:

The market study covers the optical coatings market across various segments. It aims at estimating the market size and the growth potential of this market across different segments based on technology, type, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the optical coatings market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall optical coatings Market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims at helping stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Cost-effectiveness, excellent physical properties and increased product shelf life, Growing population and increasing urbanization, Increasing demand form end-use industries, and Expansion of e-commerce industry), restraints (Volatile prices of raw materials, Easy availability of substitutes) opportunities (Upcoming regulations and government support), and challenges (Recyclability of aluminum foils) influencing the growth of the optical coatings market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the optical coatings market

- Market Development: Comprehensive information about lucrative markets - the report analyses the optical coatings market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the optical coatings market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like DuPont (US), PPG Industries Ohio, Inc. (US), Nippon Sheet Glass Co., Ltd. (Japan), ZEISS Group (Germany), Newport Corporation (US), Inrad Optics, Inc. (US), Artemis Optical Limited (England), Abrisa Technologies (US), Reynard Corporation (US), Coherent Corp. (US) among others in the optical coatings market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 OPTICAL COATINGS MARKET SEGMENTATION

- 1.3.1 REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 OPTICAL COATINGS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE APPROACH - 1

- FIGURE 3 OPTICAL COATINGS MARKET: SUPPLY-SIDE APPROACH - 1

- 2.2.2 SUPPLY-SIDE APPROACH - 2

- FIGURE 4 OPTICAL COATINGS MARKET: SUPPLY-SIDE APPROACH - 2

- 2.2.3 SUPPLY-SIDE APPROACH - 3

- FIGURE 5 OPTICAL COATINGS MARKET: SUPPLY-SIDE APPROACH - 3

- 2.3 FACTOR ANALYSIS

- 2.3.1 INTRODUCTION

- 2.3.2 DEMAND-SIDE ANALYSIS

- 2.3.3 SUPPLY-SIDE ANALYSIS

- 2.4 MARKET SIZE ESTIMATION

- FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- 2.6 ASSUMPTIONS

- 2.7 IMPACT OF RECESSION

3 EXECUTIVE SUMMARY

- FIGURE 9 VACUUM DEPOSITION TECHNOLOGY TO LEAD OPTICAL COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 10 AR COATINGS SEGMENT TO DOMINATE OPTICAL COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 11 ELECTRONICS & SEMICONDUCTOR END USE INDUSTRY TO LEAD OPTICAL COATINGS MARKET DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA LED OPTICAL COATINGS MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN OPTICAL COATINGS MARKET

- FIGURE 13 OPTICAL COATINGS MARKET IN NORTH AMERICA TO OFFER ATTRACTIVE OPPORTUNITIES DURING FORECAST PERIOD

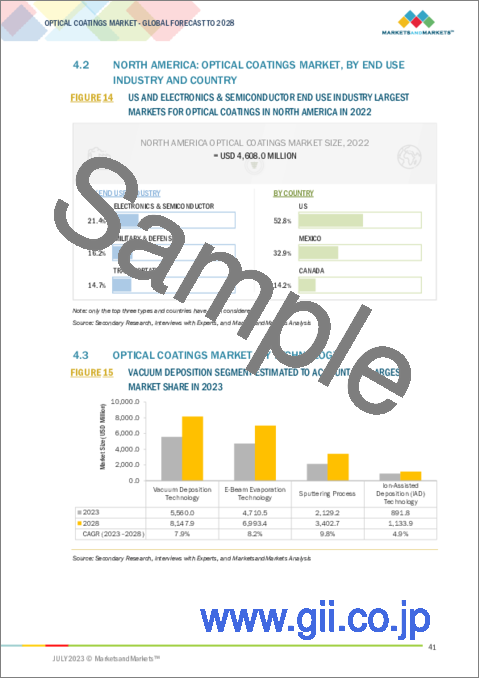

- 4.2 NORTH AMERICA: OPTICAL COATINGS MARKET, BY END USE INDUSTRY AND COUNTRY

- FIGURE 14 US AND ELECTRONICS & SEMICONDUCTOR END USE INDUSTRY LARGEST MARKETS FOR OPTICAL COATINGS IN NORTH AMERICA IN 2022

- 4.3 OPTICAL COATINGS MARKET, BY TECHNOLOGY

- FIGURE 15 VACUUM DEPOSITION SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- 4.4 OPTICAL COATINGS MARKET, BY TYPE

- FIGURE 16 FILTER COATINGS SEGMENT TO GROW AT HIGHEST CAGR IN OPTICAL COATINGS MARKET DURING FORECAST PERIOD

- 4.5 OPTICAL COATINGS MARKET, BY END USE INDUSTRY

- FIGURE 17 SOLAR POWER SEGMENT TO BE FASTEST-GROWING END USE INDUSTRY DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN OPTICAL COATINGS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in demand for optical coatings from electronics & semiconductor industry

- 5.2.1.2 Growing solar power industry to drive market

- 5.2.1.3 Technological advancements in optical equipment and fabrication processes

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatility in raw material prices

- 5.2.2.2 High R&D and equipment cost

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing adoption of advanced automotive electronics

- 5.2.3.2 Growing demand for high-speed communication networks

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent government regulations

- 5.2.4.2 Maintaining environmental durability of optical coatings

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 OPTICAL COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 1 OPTICAL COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 20 PRODUCTION PROCESS CONTRIBUTES MOST VALUE TO OVERALL PRICE OF OPTICAL COATINGS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5.1 REVENUE SHIFT & NEW REVENUE POCKETS FOR OPTICAL COATING MANUFACTURERS

- FIGURE 21 REVENUE SHIFT FOR OPTICAL COATING MANUFACTURERS

- 5.5.2 REVENUE SHIFT FOR OPTICAL COATINGS PLAYERS

- 5.6 TARIFF AND REGULATORY LANDSCAPE ANALYSIS

- 5.6.1 THE AMERICAN ASSOCIATION OF PHYSICISTS IN MEDICINE (AAPM)

- 5.7 REGULATORY BODIES AND GOVERNMENT AGENCIES

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER ORGANIZATIONS

- 5.7.1.1 International Traffic in Arms Regulations (ITAR)

- 5.7.1.2 The American Precision Optics Manufacturers Association (APOMA)

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER ORGANIZATIONS

- 5.8 SUPPLY CHAIN ANALYSIS

- FIGURE 22 SUPPLY CHAIN OF OPTICAL COATINGS INDUSTRY

- 5.8.1 RAW MATERIAL SUPPLIERS

- 5.8.2 OPTICAL COATINGS MANUFACTURERS

- 5.8.3 DISTRIBUTORS AND SUPPLIERS

- 5.8.4 END USERS

- TABLE 2 OPTICAL COATINGS MARKET: SUPPLY CHAIN

- 5.9 ECOSYSTEM

- FIGURE 23 OPTICAL COATINGS MARKET: ECOSYSTEM

- TABLE 3 ECOSYSTEM OF OPTICAL COATINGS MARKET

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY END USE INDUSTRIES

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS (%)

- 5.10.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR KEY END USE INDUSTRIES

- TABLE 5 KEY BUYING CRITERIA FOR KEY END USE INDUSTRIES

- 5.11 KEY CONFERENCES & EVENTS IN 2023-2024

- TABLE 6 OPTICAL COATINGS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.12 TRADE ANALYSIS

- TABLE 7 OPTICAL FIBERS AND OPTICAL FIBER BUNDLES, IMPORT DATA, HS CODE: 9001, 2022 (USD MILLION)

- TABLE 8 OPTICAL FIBERS AND OPTICAL FIBER BUNDLES, EXPORT DATA, HS CODE: 9001, 2022 (USD MILLION)

- 5.13 PATENT ANALYSIS

- 5.13.1 DOCUMENT ANALYSIS

- FIGURE 26 GRANTED PATENTS ACCOUNT FOR 4% OF TOTAL COUNT BETWEEN 2013 AND 2022

- FIGURE 27 NUMBER OF PATENTS BETWEEN 2013 AND 2022

- 5.13.2 JURISDICTION ANALYSIS

- FIGURE 28 NUMBER OF PATENTS, BY JURISDICTION

- 5.13.3 TOP COMPANIES/APPLICANTS

- FIGURE 29 TOP TEN COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- TABLE 9 LIST OF PATENTS BY SEMICONDUCTOR ENERGY LABORATORY

- TABLE 10 LIST OF PATENTS BY 3M INNOVATIVE PROPERTIES CO

- TABLE 11 LIST OF PATENTS BY SAMSUNG DISPLAY SOLUTIONS

- TABLE 12 US: PATENT OWNERS BETWEEN 2013 AND 2022

- 5.14 CASE STUDY

- 5.14.1 OPTICAL COATINGS FOR ACHIEVING HIGH-EFFICIENCY LED LIGHTING

- 5.14.1.1 Introduction

- 5.14.1.2 Background

- 5.14.1.3 Challenge

- 5.14.1.4 Optical coating solutions

- 5.14.1.5 Case study example: Office lighting upgrade

- 5.14.1.6 Benefits and results

- 5.14.1.7 Manufacturing processes

- 5.14.1.8 Future developments and trends

- 5.14.1.9 Conclusion

- 5.14.1 OPTICAL COATINGS FOR ACHIEVING HIGH-EFFICIENCY LED LIGHTING

- 5.15 MACROECONOMIC OVERVIEW

- 5.15.1 GLOBAL GDP OUTLOOK

- TABLE 13 WORLD GDP GROWTH PROJECTION, 2021-2028 (USD TRILLION)

- 5.16 PRICING ANALYSIS

- 5.17 IMPACT OF RECESSION: REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

6 OPTICAL COATINGS MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- FIGURE 30 VACUUM DEPOSITION TECHNOLOGY TO DRIVE OPTICAL COATINGS MARKET DURING FORECAST PERIOD

- TABLE 14 OPTICAL COATINGS MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 15 OPTICAL COATINGS MARKET, BY TECHNOLOGY, 2022-2028 (USD MILLION)

- 6.2 VACUUM DEPOSITION TECHNOLOGY

- 6.2.1 PRECISE CONTROL OVER COATING THICKNESS, OPTICAL PROPERTIES, AND LAYER COMPOSITION TO DRIVE MARKET

- TABLE 16 OPTICAL COATINGS MARKET IN VACUUM DEPOSITION TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 17 OPTICAL COATINGS MARKET IN VACUUM DEPOSITION TECHNOLOGY, BY REGION, 2022-2028 (USD MILLION)

- 6.3 E-BEAM EVAPORATION TECHNOLOGY

- 6.3.1 EXCELLENT COATING UNIFORMITY AND HIGH PURITY PROPERTIES TO DRIVE MARKET

- TABLE 18 OPTICAL COATINGS MARKET IN E-BEAM EVAPORATION TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 19 OPTICAL COATINGS MARKET IN E-BEAM EVAPORATION TECHNOLOGY, BY REGION, 2022-2028 (USD MILLION)

- 6.4 SPUTTERING PROCESS

- 6.4.1 VERSATILITY IN DEPOSITION OF WIDE RANGE OF MATERIALS ONTO VARIOUS SUBSTRATES TO DRIVE MARKET

- TABLE 20 OPTICAL COATINGS MARKET IN SPUTTERING PROCESS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 21 OPTICAL COATINGS MARKET IN SPUTTERING PROCESS, BY REGION, 2022-2028 (USD MILLION)

- 6.5 ION-ASSISTED DEPOSITION (IAD) TECHNOLOGY

- 6.5.1 ENHANCEMENT OF ADHESION BETWEEN COATING AND SUBSTRATE, FILM DENSITY, AND RESISTANCE TO ENVIRONMENTAL FACTORS TO DRIVE MARKET

- TABLE 22 OPTICAL COATINGS MARKET IN ION-ASSISTED (IAD) DEPOSITION TECHNOLOGY, BY REGION, 2018-2021 (USD MILLION)

- TABLE 23 OPTICAL COATINGS MARKET IN ION-ASSISTED (IAD) DEPOSITION TECHNOLOGY, BY REGION, 2022-2028 (USD MILLION)

7 OPTICAL COATINGS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 31 AR COATINGS SEGMENT TO DOMINATE OVERALL COATINGS MARKET DURING FORECAST PERIOD

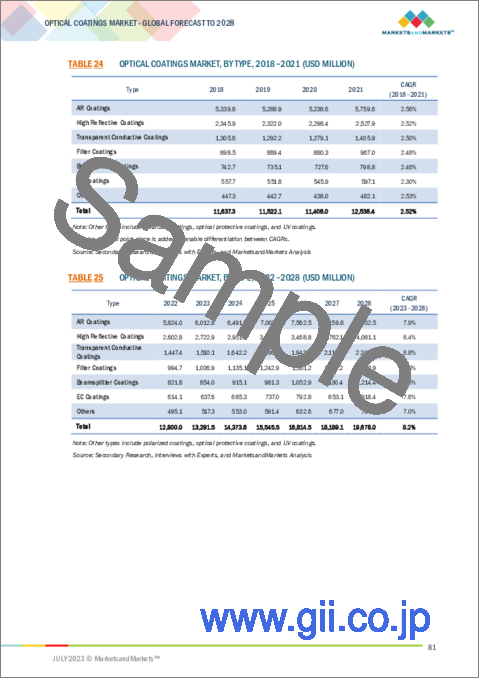

- TABLE 24 OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 25 OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 7.2 AR COATINGS

- 7.2.1 EXPANDING ELECTRONICS & SEMICONDUCTOR, SOLAR POWER, AND TRANSPORTATION SECTORS TO DRIVE MARKET

- TABLE 26 AR COATINGS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 27 AR COATINGS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.3 HIGH REFLECTIVE COATINGS

- 7.3.1 LASER OPTICS, REFLECTING TELESCOPES, CAVITY MIRRORS, AND SPACE-RELATED USES TO DRIVE MARKET

- TABLE 28 HIGH REFLECTIVE COATINGS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 29 HIGH REFLECTIVE COATINGS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.4 TRANSPARENT CONDUCTIVE COATINGS

- 7.4.1 DEMAND FOR LCD FABRICATIONS, TOUCH PANELS, DISPLAY WINDOWS, LAMINATED DISPLAY PACKAGES, HEATERS, AND SOLAR CELLS TO DRIVE MARKET

- TABLE 30 TRANSPARENT CONDUCTIVE COATINGS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 31 TRANSPARENT CONDUCTIVE COATINGS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.5 FILTER COATINGS

- 7.5.1 APPLICATIONS SUCH AS GAS DETECTION, FLAME DETECTION, AND MOTION SENSORS TO DRIVE MARKET

- TABLE 32 FILTER COATINGS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 33 FILTER COATINGS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.6 BEAMSPLITTER COATINGS

- 7.6.1 TELECOMMUNICATION/OPTICAL COMMUNICATION, ELECTRONICS & SEMICONDUCTOR, AND GREEN ENERGY SECTORS TO DRIVE MARKET

- TABLE 34 BEAMSPLITTER COATINGS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 35 BEAMSPLITTER COATINGS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.7 EC COATINGS

- 7.7.1 DEMAND FOR ENERGY SAVING AND REDUCTION OF CO2 EMISSIONS TO DRIVE MARKET

- TABLE 36 EC COATINGS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 37 EC COATINGS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.8 OTHERS

- TABLE 38 OTHER TYPE OPTICAL COATINGS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 39 OTHER TYPE OPTICAL COATINGS MARKET, BY REGION, 2022-2028 (USD MILLION)

8 OPTICAL COATINGS MARKET, BY END USE INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 32 ELECTRONICS & SEMICONDUCTOR END USE INDUSTRY TO DRIVE OPTICAL COATINGS MARKET DURING FORECAST PERIOD

- TABLE 40 OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 41 OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- 8.2 ELECTRONICS & SEMICONDUCTOR

- 8.2.1 ABILITY TO WITHSTAND CHALLENGING ENVIRONMENTAL CONDITIONS TO DRIVE MARKET

- TABLE 42 OPTICAL COATINGS MARKET IN ELECTRONICS & SEMICONDUCTOR, BY REGION, 2018-2021 (USD MILLION)

- TABLE 43 OPTICAL COATINGS MARKET IN ELECTRONICS & SEMICONDUCTOR, BY REGION, 2022-2028 (USD MILLION)

- 8.3 MILITARY & DEFENSE

- 8.3.1 ENHANCEMENT OF SAFETY AND PROTECTION OF MILITARY PERSONNEL TO DRIVE MARKET

- TABLE 44 OPTICAL COATINGS MARKET IN MILITARY & DEFENSE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 45 OPTICAL COATINGS MARKET IN MILITARY & DEFENSE, BY REGION, 2022-2028 (USD MILLION)

- 8.4 TRANSPORTATION

- 8.4.1 RISING DEMAND FOR HIGH-QUALITY, HIGH-EFFICIENCY, AND ABRASION-RESISTANT COMPONENTS TO DRIVE MARKET

- TABLE 46 OPTICAL COATINGS MARKET IN TRANSPORTATION, BY REGION, 2018-2021 (USD MILLION)

- TABLE 47 OPTICAL COATINGS MARKET IN TRANSPORTATION, BY REGION, 2022-2028 (USD MILLION)

- 8.5 TELECOMMUNICATION/OPTICAL COMMUNICATION

- 8.5.1 EFFICIENCY AND PERFORMANCE OF OPTICAL COMMUNICATION INFRASTRUCTURE TO DRIVE MARKET

- TABLE 48 OPTICAL COATINGS MARKET IN TELECOMMUNICATION/OPTICAL COMMUNICATION, BY REGION, 2018-2021 (USD MILLION)

- TABLE 49 OPTICAL COATINGS MARKET IN TELECOMMUNICATION/OPTICAL COMMUNICATION, BY REGION, 2022-2028 (USD MILLION)

- 8.6 INFRASTRUCTURE

- 8.6.1 DEMAND FOR SUSTAINABLE AND ENERGY-EFFICIENT INFRASTRUCTURE TO DRIVE MARKET

- TABLE 50 OPTICAL COATINGS MARKET IN INFRASTRUCTURE, BY REGION, 2018-2021 (USD MILLION)

- TABLE 51 OPTICAL COATINGS MARKET IN INFRASTRUCTURE, BY REGION, 2022-2028 (USD MILLION)

- 8.7 SOLAR POWER

- 8.7.1 GOVERNMENT INITIATIVES TO PROMOTE RENEWABLE ENERGY USAGE TO DRIVE MARKET

- TABLE 52 OPTICAL COATINGS MARKET IN SOLAR POWER, BY REGION, 2018-2021 (USD MILLION)

- TABLE 53 OPTICAL COATINGS MARKET IN SOLAR POWER, BY REGION, 2022-2028 (USD MILLION)

- 8.8 MEDICAL

- 8.8.1 OPTIMAL PERFORMANCE AND RELIABILITY OF COMPONENTS IN HEALTHCARE TO DRIVE MARKET

- TABLE 54 OPTICAL COATINGS MARKET IN MEDICAL, BY REGION, 2018-2021 (USD MILLION)

- TABLE 55 OPTICAL COATINGS MARKET IN MEDICAL, BY REGION, 2022-2028 (USD MILLION)

- 8.9 OTHERS

- TABLE 56 OPTICAL COATINGS MARKET IN OTHER END USE INDUSTRIES, BY REGION, 2018-2021 (USD MILLION)

- TABLE 57 OPTICAL COATINGS MARKET IN OTHER END USE INDUSTRIES, BY REGION, 2022-2028 (USD MILLION)

9 OPTICAL COATINGS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 33 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR OPTICAL COATINGS DURING FORECAST PERIOD

- TABLE 58 OPTICAL COATINGS MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 59 OPTICAL COATINGS MARKET, BY REGION, 2022-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 IMPACT OF RECESSION ON NORTH AMERICA

- FIGURE 34 NORTH AMERICA: OPTICAL COATINGS MARKET SNAPSHOT

- TABLE 60 NORTH AMERICA: OPTICAL COATINGS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 61 NORTH AMERICA: OPTICAL COATINGS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 63 NORTH AMERICA: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 65 NORTH AMERICA: OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: OPTICAL COATINGS MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 67 NORTH AMERICA: OPTICAL COATINGS MARKET, BY TECHNOLOGY, 2022-2028 (USD MILLION)

- 9.2.2 US

- 9.2.2.1 Government incentives to promote adoption of energy-efficient technologies to boost market

- TABLE 68 US: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 69 US: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 70 US: OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 71 US: OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 9.2.3 CANADA

- 9.2.3.1 Well-established automotive sector and sizable consumer base to drive market

- TABLE 72 CANADA: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 73 CANADA: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 74 CANADA: OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 75 CANADA: OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 9.2.4 MEXICO

- 9.2.4.1 Consumer electronics, automotive, and solar energy sectors to drive market

- TABLE 76 MEXICO: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 77 MEXICO: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 78 MEXICO: OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 79 MEXICO: OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 9.3 ASIA PACIFIC

- 9.3.1 IMPACT OF RECESSION ON ASIA PACIFIC

- FIGURE 35 ASIA PACIFIC: OPTICAL COATINGS MARKET SNAPSHOT

- TABLE 80 ASIA PACIFIC: OPTICAL COATINGS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 81 ASIA PACIFIC: OPTICAL COATINGS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 83 ASIA PACIFIC: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 85 ASIA PACIFIC: OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 86 ASIA PACIFIC: OPTICAL COATINGS MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 87 ASIA PACIFIC: OPTICAL COATINGS MARKET, BY TECHNOLOGY, 2022-2028 (USD MILLION)

- 9.3.2 CHINA

- 9.3.2.1 Industrial growth, focus on electric vehicles, and supportive government policies to drive market

- TABLE 88 CHINA: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 89 CHINA: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 90 CHINA: OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 91 CHINA: OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 9.3.3 INDIA

- 9.3.3.1 Expanding technology, industrial sector, and consumer electronics to drive market

- TABLE 92 INDIA: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 93 INDIA: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 94 INDIA: OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 95 INDIA: OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 9.3.4 JAPAN

- 9.3.4.1 Technological advancements in construction and automotive sectors to drive market

- TABLE 96 JAPAN: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 97 JAPAN: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 98 JAPAN: OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 99 JAPAN: OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 9.3.5 SOUTH KOREA

- 9.3.5.1 Emphasis on innovation and strong industrial foundation to drive market

- TABLE 100 SOUTH KOREA: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 101 SOUTH KOREA: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 102 SOUTH KOREA: OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 103 SOUTH KOREA: OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 9.3.6 REST OF ASIA PACIFIC

- TABLE 104 REST OF ASIA PACIFIC: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 105 REST OF ASIA PACIFIC: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 9.4 EUROPE

- 9.4.1 IMPACT OF RECESSION ON EUROPE

- TABLE 108 EUROPE: OPTICAL COATINGS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 109 EUROPE: OPTICAL COATINGS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 110 EUROPE: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 111 EUROPE: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 112 EUROPE: OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 113 EUROPE: OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 114 EUROPE: OPTICAL COATINGS MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 115 EUROPE: OPTICAL COATINGS MARKETS, BY TECHNOLOGY, 2022-2028 (USD MILLION)

- 9.4.2 GERMANY

- 9.4.2.1 Strong industries, advanced technology, and focus on precision engineering to boost market

- TABLE 116 GERMANY: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 117 GERMANY: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 118 GERMANY: OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 119 GERMANY: OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 9.4.3 UK

- 9.4.3.1 Consumer electronics, aerospace, and automotive industries to drive market

- TABLE 120 UK: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 121 UK: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 122 UK: OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 123 UK: OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 9.4.4 RUSSIA

- 9.4.4.1 Military & defense end use industry to drive market

- TABLE 124 RUSSIA: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 125 RUSSIA: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 126 RUSSIA: OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 127 RUSSIA: OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 9.4.5 FRANCE

- 9.4.5.1 Electronics sector to offer attractive opportunities for market growth

- TABLE 128 FRANCE: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 129 FRANCE: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 130 FRANCE: OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 131 FRANCE: OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 9.4.6 REST OF EUROPE

- TABLE 132 REST OF EUROPE: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 133 REST OF EUROPE: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 134 REST OF EUROPE: OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 135 REST OF EUROPE: OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 9.5 REST OF THE WORLD

- 9.5.1 IMPACT OF RECESSION ON THE REST OF THE WORLD (ROW)

- TABLE 136 REST OF THE WORLD: OPTICAL COATINGS MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 137 REST OF THE WORLD: OPTICAL COATINGS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 138 REST OF THE WORLD: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 139 REST OF THE WORLD: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 140 REST OF THE WORLD: OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 141 REST OF THE WORLD: OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 142 REST OF THE WORLD: OPTICAL COATINGS MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 143 REST OF THE WORLD: OPTICAL COATINGS MARKET, BY TECHNOLOGY, 2022-2028 (USD MILLION)

- 9.5.2 BRAZIL

- 9.5.2.1 Expanding industrial and technological sectors to drive market

- TABLE 144 BRAZIL: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 145 BRAZIL: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 146 BRAZIL: OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 147 BRAZIL: OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 9.5.3 OTHERS

- TABLE 148 OTHER COUNTRIES: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2018-2021 (USD MILLION)

- TABLE 149 OTHER COUNTRIES: OPTICAL COATINGS MARKET, BY END USE INDUSTRY, 2022-2028 (USD MILLION)

- TABLE 150 OTHER COUNTRIES: OPTICAL COATINGS MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 151 OTHER COUNTRIES: OPTICAL COATINGS MARKET, BY TYPE, 2022-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- TABLE 152 COMPANIES ADOPTED INVESTMENTS & EXPANSIONS AND MERGERS & ACQUISITIONS AS KEY GROWTH STRATEGIES BETWEEN 2020 AND 2023

- 10.2 MARKET SHARE ANALYSIS

- FIGURE 36 MARKET SHARE, BY KEY PLAYER (2022)

- TABLE 153 OPTICAL COATINGS MARKET: DEGREE OF COMPETITION

- 10.2.1 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

- FIGURE 37 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2022

- 10.3 KEY COMPANIES' FIVE-YEAR REVENUE ANALYSIS

- FIGURE 38 REVENUE ANALYSIS OF KEY COMPANIES, 2018-2022

- 10.4 COMPANY EVALUATION MATRIX (OVERALL MARKET), 2022

- 10.4.1 STARS

- 10.4.2 PERVASIVE LEADERS

- 10.4.3 PARTICIPANTS

- 10.4.4 EMERGING LEADERS

- FIGURE 39 COMPANY EVALUATION MATRIX, 2022

- 10.5 COMPETITIVE BENCHMARKING OF OVERALL MARKET

- TABLE 154 DETAILED LIST OF KEY PLAYERS

- 10.6 START-UPS/SMES EVALUATION MATRIX, 2022

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 40 START-UPS AND SMES EVALUATION MATRIX, 2022

- 10.7 DETAILED LIST OF KEY START-UPS/SMES

- 10.7.1 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 RECENT DEVELOPMENTS

- TABLE 155 PRODUCT LAUNCHES, 2019-2023

- 10.8.2 DEALS

- TABLE 156 DEALS, 2019-2023

- 10.8.3 OTHER DEVELOPMENTS

- TABLE 157 OTHER DEVELOPMENTS, 2019-2023

11 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services offered, Recent Developments, Deals, MnM view, Key strengths, Strategic choices, Weakness and competitive threats) **

- 11.1 MAJOR PLAYERS

- 11.1.1 DUPONT

- TABLE 158 DUPONT: COMPANY OVERVIEW

- FIGURE 41 DUPONT: COMPANY SNAPSHOT

- TABLE 159 DUPONT: PRODUCT LAUNCHES

- TABLE 160 DUPONT: DEALS

- TABLE 161 DUPONT: OTHERS

- 11.1.2 PPG

- TABLE 162 PPG: COMPANY OVERVIEW

- FIGURE 42 PPG: COMPANY SNAPSHOT

- TABLE 163 PPG: DEALS

- TABLE 164 PPG: OTHERS

- 11.1.3 NIPPON SHEET GLASS CO., LTD.

- TABLE 165 NIPPON SHEET GLASS CO., LTD.: COMPANY OVERVIEW

- FIGURE 43 NIPPON SHEET GLASS CO., LTD.: COMPANY SNAPSHOT

- TABLE 166 NIPPON SHEET GLASS CO., LTD.: PRODUCT LAUNCHES

- TABLE 167 NIPPON SHEET GLASS CO., LTD.: DEALS

- TABLE 168 NIPPON SHEET GLASS CO., LTD.: OTHERS

- 11.1.4 ZEISS GROUP

- TABLE 169 ZEISS GROUP: COMPANY OVERVIEW

- FIGURE 44 ZEISS GROUP: COMPANY SNAPSHOT

- TABLE 170 ZEISS GROUP: PRODUCT LAUNCHES

- TABLE 171 ZEISS GROUP: DEALS

- TABLE 172 ZEISS GROUP: OTHERS

- 11.1.5 NEWPORT CORPORATION

- TABLE 173 NEWPORT CORPORATION: COMPANY OVERVIEW

- TABLE 174 NEWPORT CORPORATION: DEALS

- 11.1.6 INRAD OPTICS, INC.

- TABLE 175 INRAD OPTICS, INC.: COMPANY OVERVIEW

- FIGURE 45 INRAD OPTICS, INC.: COMPANY SNAPSHOT

- TABLE 176 INRAD OPTICS, INC.: PRODUCT LAUNCHES

- 11.1.7 ARTEMIS OPTICAL LIMITED

- TABLE 177 ARTEMIS OPTICAL LIMITED: COMPANY OVERVIEW

- TABLE 178 ARTEMIS OPTICAL LIMITED: DEALS

- TABLE 179 ARTEMIS OPTICAL LIMITED: OTHERS

- 11.1.8 ABRISA TECHNOLOGIES

- TABLE 180 ABRISA TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 181 ABRISA TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 182 ABRISA TECHNOLOGIES: DEALS

- TABLE 183 ABRISA TECHNOLOGIES: OTHERS

- 11.1.9 REYNARD CORPORATION

- TABLE 184 REYNARD CORPORATION: COMPANY OVERVIEW

- TABLE 185 REYNARD CORPORATION: PRODUCT LAUNCHES

- TABLE 186 REYNARD CORPORATION: OTHERS

- 11.1.10 COHERENT CORP.

- TABLE 187 COHERENT CORP.: COMPANY OVERVIEW

- FIGURE 46 COHERENT CORP: COMPANY SNAPSHOT

- TABLE 188 COHERENT CORP.: PRODUCT LAUNCHES

- TABLE 189 COHERENT CORP.: DEALS

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, Deals, MnM view, Right to win, Strategic choices, Weakness and competitive threats might not be captured in case of unlisted companies.

- 11.2 ADDITIONAL PLAYERS

- 11.2.1 CASCADE OPTICAL CORPORATION

- TABLE 190 CASCADE OPTICAL CORPORATION: COMPANY OVERVIEW

- 11.2.2 BENEQ

- TABLE 191 BENEQ: COMPANY OVERVIEW

- 11.2.3 MATERION CORPORATION

- TABLE 192 MATERION CORPORATION: COMPANY OVERVIEW

- 11.2.4 DEPOSITION SCIENCES, INC. (DSI)

- TABLE 193 DEPOSITION SCIENCES, INC. (DSI): COMPANY OVERVIEW

- 11.2.5 LAMBDA RESEARCH OPTICS INC.

- TABLE 194 LAMBDA RESEARCH OPTICS INC.: COMPANY OVERVIEW

- 11.2.6 MLD TECHNOLOGIES

- TABLE 195 MLD TECHNOLOGIES: COMPANY OVERVIEW

- 11.2.7 EVAPORATED COATINGS, INC.

- TABLE 196 EVAPORATED COATINGS, INC.: COMPANY OVERVIEW

- 11.2.8 ANDOVER CORPORATION

- TABLE 197 ANDOVER CORPORATION: COMPANY OVERVIEW

- 11.2.9 VISIMAX TECHNOLOGIES INC.

- TABLE 198 VISIMAX TECHNOLOGIES INC.: COMPANY OVERVIEW

- 11.2.10 OPHIR OPTRONICS SOLUTIONS LTD.

- TABLE 199 OPHIR OPTRONICS SOLUTIONS LTD.: COMPANY OVERVIEW

- 11.2.11 JANOS TECHNOLOGY LLC

- TABLE 200 JANOS TECHNOLOGY LLC: COMPANY OVERVIEW

- 11.2.12 DENTON VACUUM

- TABLE 201 DENTON VACUUM: COMPANY OVERVIEW

- 11.2.13 NANO QUARZ WAFER

- TABLE 202 NANO QUARZ WAFER: COMPANY OVERVIEW

- 11.2.14 ALLUXA

- TABLE 203 ALLUXA: COMPANY OVERVIEW

- 11.2.15 ASML BERLIN (BERLINER GLAS)

- TABLE 204 ASML BERLIN (BERLINER GLAS): COMPANY OVERVIEW

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 CONFORMAL COATINGS MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 CONFORMAL COATINGS MARKET, BY TYPE

- TABLE 205 CONFORMAL COATINGS MARKET, BY TYPE, 2018-2025 (TON)

- TABLE 206 CONFORMAL COATINGS MARKET, BY TYPE, 2018-2025 (USD THOUSAND)

- 12.3.3 CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY

- TABLE 207 CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2025 (TON)

- TABLE 208 CONFORMAL COATINGS MARKET, BY END-USE INDUSTRY, 2018-2025 (USD THOUSAND)

- 12.3.4 CONFORMAL COATINGS MARKET, BY REGION

- TABLE 209 CONFORMAL COATINGS MARKET, BY REGION, 2018-2025 (TON)

- TABLE 210 CONFORMAL COATINGS MARKET, BY REGION, 2018-2025 (USD THOUSAND)

- 12.4 VAPOR DEPOSITION MARKET

- 12.4.1 MARKET DEFINITION

- 12.4.2 CVD & PVD, BY TECHNOLOGY

- TABLE 211 CVD TECHNOLOGY MARKET, BY EQUIPMENT & MATERIAL, 2012-2019 (USD MILLION)

- TABLE 212 PVD TECHNOLOGY MARKET, EQUIPMENT & MATERIAL, 2012-2019 (USD MILLION)

- 12.4.3 CVD & PVD EQUIPMENT MARKET, BY END-USE INDUSTRY

- TABLE 213 CVD EQUIPMENT MARKET, BY END-USE INDUSTRY, 2012-2019 (USD MILLION)

- TABLE 214 PVD EQUIPMENT MARKET, BY END-USE INDUSTRY, 2012-2019 (USD MILLION)

- 12.4.4 CVD & PVD, BY REGION

- TABLE 215 CVD TECHNOLOGY MARKET, BY REGION, 2012-2019 (USD MILLION)

- TABLE 216 PVD TECHNOLOGY MARKET, BY REGION, 2012-2019 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS