|

|

市場調査レポート

商品コード

1699607

KRAS阻害剤の世界市場:薬剤売上、特許、価格、臨床試験動向(2030年)Global KRAS Inhibitors Market, Drug Sales, Patent, Price & Clinical Trials Insight 2030 |

||||||

|

|||||||

| KRAS阻害剤の世界市場:薬剤売上、特許、価格、臨床試験動向(2030年) |

|

出版日: 2025年04月01日

発行: KuicK Research

ページ情報: 英文 240 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

世界のKRAS阻害剤の市場規模は、2030年までに20億米ドルを超える見込みです。

肺がん、大腸がん、膵臓がんなど、さまざまな固形がんにおいて、KRAS変異ががん開拓の重要な一因であるという認識が高まったことが主な原因です。細胞増殖を制御する必須遺伝子であるKRASは、その複雑な生物学的性質と腫瘍の生存を支える機能のために、歴史的に治療標的としての課題を突きつけられてきました。それにもかかわらず、分子生物学の進歩と標的治療薬の創製により、KRAS阻害剤は有望な薬物カテゴリーとして台頭してきました。

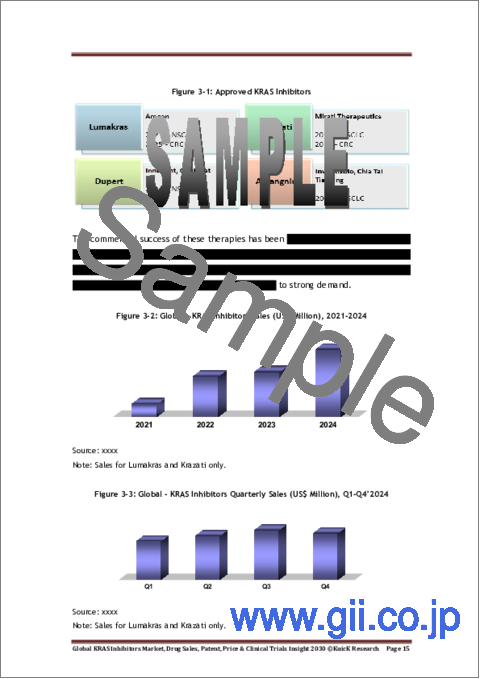

KRAS阻害剤市場において極めて重要な出来事は、2021年に非小細胞肺がん(NSCLC)の治療薬としてルマクラスが承認されたことです。この承認は、がん標的治療における新たな局面の到来を告げるものであり、次いで2022年にKrazatiが、2024年にはDupertとAnfangningがNSCLCに対して承認され、この特定の遺伝子変異を有する患者に対する治療の展望が広がっています。2024年と2025年には、クラザティとルマクラスの両剤が大腸がん(CRC)の追加承認を取得し、市場は拡大し続けました。

現在、80種類以上のKRAS阻害剤が様々な臨床試験段階にあり、その中には現在第3相試験中のRocheのディバラシブや、中国で登録試験中の Jacobio Pharmaのグレシラシブ(JAB-21822)も含まれています。これらの薬剤の開発が進行中であることは、KRAS阻害剤が様々な悪性腫瘍に対応できる広範な可能性を示しており、化学療法、免疫療法、標的治療など他のがん治療との併用が多くの臨床試験で検討されています。KRAS阻害剤が承認され、その利用が拡大していることは、腫瘍学、特に代替治療が少なく予後不良ながんに対する重要性を強調しています。

肺がん、特に非小細胞肺がん(NSCLC)は引き続きKRAS阻害剤の研究の1次調査対象であり、多くの臨床試験がKRAS G12C変異を調査しています。それにもかかわらず、大腸がんや膵臓がんもまた、KRAS変異がこれらのタイプのがんで一般的に観察されることから、重要な研究分野となっています。KRAS阻害剤の治療の可能性はこれらの悪性腫瘍以外にも広がっており、卵巣がん、脳腫瘍、子宮内膜がんなどの他のがんに対する有効性の研究が進行中です。その結果、KRAS阻害剤の世界市場は、多様な腫瘍型におけるこれらの治療法の有効性を裏付ける臨床エビデンスの増加に後押しされ、より多様ながん種を包含して拡大すると予想されます。

KRAS阻害剤は主にKRAS遺伝子の特定の変異を標的とし、G12C、G12V、G12Dが最も一般的です。これらの変異はKRASの発がん活性化に重要な役割を果たしており、治療戦略の重要な標的となっています。従来のKRAS阻害剤は、KRASタンパク質の活性状態または不活性状態のいずれかに焦点を当ててきたが、KRASの「ON」状態と「OFF」状態の両方を標的とできる次世代阻害剤の出現により、新たな治療の可能性が生まれています。そのような阻害剤の一例として、BridgeBio Oncology TherapeuticsのBBO-8520があります。BBO-8520は、KRAS G12Cの活性型と不活性型の両方に共有結合し、エフェクターの結合を効果的に阻止してKRASの機能を阻害します。前臨床試験において、BBO-8520は標準的なKRAS G12C阻害剤と比較して、より高い効力、より深い腫瘍反応、耐性の遅延を示すことが示されており、既存の治療法の限界を解決する有望な選択肢として位置づけられています。

今後、KRAS阻害剤の世界市場は、臨床試験を経て承認される阻害剤の増加に伴い、大きく成長するものと思われます。現在進行中の併用療法の研究は、様々なKRAS変異サブタイプを標的とし、非小細胞肺がん(NSCLC)以外のがんにも拡大することで、利用可能な治療選択肢の幅を広げることが期待されます。さらに、より多くの国際的な提携や協力関係の出現により、これらの重要な治療法への世界のアクセスが強化され、それによってより多くのがん患者層が恩恵を受けることになると思われます。とはいえ、高い治療費、アクセスに関する問題、長期的な有効性と安全性に関する継続研究の必要性といった課題は、市場の持続的開拓のために対処されなければなりません。

当レポートは、世界のKRAS阻害剤市場について調査し、市場の概要とともに、薬剤動向、臨床試験動向、地域別動向、および市場に参入する企業の競合情勢などを提供しています。

目次

第1章 KRAS阻害剤のイントロダクション

- KRAS阻害剤の開発

- 作用機序

第2章 がん治療におけるKRAS阻害剤の役割

第3章 世界のKRAS阻害剤市場の展望

- 現在の市場シナリオ

- KRAS阻害剤が画期的治療薬、ファストトラック、希少疾病用医薬品として承認

- 将来の市場機会

第4章 Lumakras-概要、価格、投与量、販売分析

- 概要と特許情報

- 投与量と価格分析

- 売上分析

第5章 Krazati-概要、価格、投与量、販売分析

- 概要と特許情報

- 投与量と価格分析

- 売上分析

第6章 Dupert - 臨床的洞察

第7章 臨床的洞察

第8章 KRAS阻害剤市場の地域分析- 商業および臨床開発の展望

- 米国

- 中国

- EU

- 英国

- 日本

- 韓国

- カナダ

- 台湾

- オーストラリア

第9章 適応症別のKRAS阻害剤開発動向

- 肺がん

- 大腸がん

- 膵臓がん

- その他

第10章 世界KRAS阻害剤の臨床パイプラインの概要

- 国別

- 相別

- 企業別

- 適応症別

- 優先ステータス別

第11章 世界KRAS阻害剤臨床試験の洞察、国、企業、適応症、相別

- 研究

- 前臨床

- 第I相

- 第I/II相

- 第II相

- 第III相

- 事前登録

- 登録済み

第12章 市販KRAS阻害剤の臨床試験の洞察

第13章 KRAS阻害剤の併用戦略

- 免疫療法

- 化学療法

- 標的療法

- 放射線

第14章 世界のKRAS阻害剤市場力学

- 市場の促進要因

- 市場の課題

第15章 競合情勢

- Applied Pharmaceutical Science

- Amgen

- AnBogen Therapeutics

- AstraZeneca

- Biond Biologics

- BridgeBio Oncology Therapeutics

- Bristol Myers Squibb

- Boehringer Ingelheim

- Eli Lilly

- Erasca

- Frontier Medicines

- GenFleet Therapeutics

- Innovent Bio

- Jacobio Pharmaceuticals

- Jiangsu Hansoh Pharmaceutical

- Jiangsu Hengrui Medicine Co.

- Quanta Therapeutics

- Revolution Medicines

- Roche

- Suzhou Zelgen Biopharmaceuticals

List of Figures

- Figure 1-1: RAS Mutation - Frequency of KRAS Mutation v/s HRAS & NRAS Mutations

- Figure 1-2: KRAS Inhibitors - Development Milestones

- Figure 1-3: KRAS Inhibitor - General Mechanism In Cancer

- Figure 1-4: KRAS Inhibitors - Targeting Approaches

- Figure 1-5: Direct Targeting of Mutant KRAS

- Figure 1-6: Targets for Modifying the KRAS Membrane Association

- Figure 2-1: KRAS Mutational Frequency By Organ (%)

- Figure 2-2: KRAS Inhibitor - Role In Cancer Treatment

- Figure 3-1: Approved KRAS Inhibitors

- Figure 3-2: Global - KRAS Inhibitors Sales (US$ Million), 2021-2024

- Figure 3-3: Global - KRAS Inhibitors Quarterly Sales (US$ Million), Q1-Q4'2024

- Figure 3-4: KRAS Inhibitor Market - Future Opportunities

- Figure 3-5: Global - KRAS Inhibitors Sales (US$ Million), 2025-2030

- Figure 4-1: Sotorasib - Approval Year By Indication

- Figure 4-2: Sotorasib - Patent Expiration Year

- Figure 4-3: US - Cost Per Unit & Supply Of Lumakras (US$), April'2025

- Figure 4-4: EU - Cost Per Unit & Supply Of Lumakras (US$), April'2025

- Figure 4-5: Lumakras - Recommended Dose Reduction Levels For Adverse Reaction

- Figure 4-6: Global - Lumakras/Lumykras Annual Sales (US$ Million), 2021-2024

- Figure 4-7: Global - Lumakras/Lumykras Sales (US$ Million), Q1-Q4'2024

- Figure 4-8: Regional - US v/s ROW Lumakras/Lumykras Sales (US$ Million), 2024

- Figure 4-9: Regional - US v/s ROW Lumakras/Lumykras Sales (%), 2024

- Figure 4-10: US - Lumakras Sales (US$ Million), 2021-2024

- Figure 4-11: US - Lumakras Sales (US$ Million), Q1-Q4'2024

- Figure 4-12: ROW - Lumakras/Lumykras Sales (US$ Million), 2021-2024

- Figure 4-13: ROW - Lumakras/Lumykras Sales (US$ Million), Q1-Q4'2024

- Figure 5-1: Krazati - Approval Year By Indication

- Figure 5-2: Krazati - Market Exclusivity Expiry By Region

- Figure 5-3: US - Cost Per Unit & Supply Of Krazati (US$), April'2025

- Figure 5-4: Krazati - Recommended Dosage Reduction for Adverse Reactions (mg/day)

- Figure 5-5: Global - Krazati Annual Sales (US$ Million), 2023-2024

- Figure 5-6: Global - Krazati Quarterly Sales (US$ Million), Q1-Q4'2024

- Figure 5-7: Regional - US v/s ROW Krazati Sales (US$ Million), 2024

- Figure 5-8: Regional - US v/s ROW Krazati Sales (%), 2024

- Figure 5-9: US - Krazati Sales (US$ Million), Q1-Q4'2024

- Figure 5-10: ROW - Krazati Sales (US$ Million), Q1-Q4'2024

- Figure 7-1: Garsorasib - NMPA Breakthrough Therapy Designation Year By Indication

- Figure 9-1: TBBO8520-101 Phase 1 Study (NCT06343402) - Initiation & Completion Year

- Figure 9-2: KRYSTAL-12 Phase 3 Study (NCT04685135) - Initiation & Completion Year

- Figure 9-3: RAMP203/VS-6766-203 Phase 1/2 Study (NCT05074810) - Initiation & Completion Year

- Figure 9-4: RASolve 301 Phase 3 (NCT06881784) Study - Initiation & Completion Year

- Figure 9-5: RMC-LUNG-101 Phase 1/2 (NCT06162221) Study - Initiation & Completion Year

- Figure 9-6: CodeBreaK 301 Phase 3 (NCT06252649) Study - Initiation & Completion Year

- Figure 9-7: CodeBreaK 101 Phase 3 (NCT04185883) Study - Initiation & Completion Year

- Figure 9-8: KRYSTAL-10 Phase 3 (NCT04793958) Study - Initiation & Completion Year

- Figure 9-9: RMC-6291-101 Phase 1 (NCT06128551) Study - Initiation & Completion Year

- Figure 9-10: RMC-6236-001 Phase 1 (NCT05379985) Study - Initiation & Completion Year

- Figure 9-11: RMC-9805-001 Phase 1 (NCT06040541) Study - Initiation & Completion Year

- Figure 9-12: BrainMet ADePPT Phase 1 (NCT06807619) Study - Initiation & Completion Year

- Figure 9-13: NCI-2023-09685 Phase 1 (NCT06130254) Study - Initiation & Completion Year

- Figure 10-1: Global - KRAS Protein Inhibitors Clinical Trials By Country, 2025 -2030

- Figure 10-2: Global - KRAS Protein Inhibitors Clinical Trials By Phase, 2025 -2030

- Figure 10-3: Global - KRAS Protein Inhibitors Clinical Trials By Company, 2025 -2030

- Figure 10-4: Global - KRAS Protein Inhibitors Clinical Trials By Indication, 2025 -2030

- Figure 10-5: Global - KRAS Protein Inhibitors Clinical Trials By Priority Status, 2025 -2030

- Figure 13-1: KRAS inhibitors & Immunotherapy Combinations

- Figure 14-1: KRAS Inhibitors Market - Drivers

- Figure 14-2: KRAS Inhibitors Market - Challenges

List of Tables

- Table 3-1: KRAS Inhibitors Breakthrough Therapy, Fast Track & Orphan Designation

- Table 4-1: Lumakras - Recommended Dosage Modifications For Adverse Reactions

- Table 5-1: Krazati - Recommended Dosage Modifications For Adverse Reactions

- Table 8-1: US - Ongoing KRAS Inhibitor Clinical Trials

- Table 8-2: China - Ongoing KRAS Inhibitor Clinical Trials

- Table 8-3: UK - Ongoing KRAS Inhibitor Clinical Trials

- Table 8-4: Japan - Ongoing KRAS Inhibitor Clinical Trials

- Table 8-5: South Korea - Ongoing KRAS Inhibitor Clinical Trials

- Table 8-6: Canada - Ongoing KRAS Inhibitor Clinical Trials

- Table 8-7: Taiwan - Ongoing KRAS Inhibitor Clinical Trials

- Table 8-8: Australia - Ongoing KRAS Inhibitor Clinical Trials

- Table 9-1: Lung Cancer - KRAS Inhibitors In Clinical Trials

- Table 9-2: Colorectal Cancer - KRAS Inhibitors In Clinical Trials

- Table 9-3: Colorectal Cancer - KRAS Inhibitors With Regulatory Designations

- Table 9-4: Pancreatic Cancer - KRAS Inhibitors in Clinical Trials

- Table 9-5: Pancreatic Cancer - KRAS Inhibitors with Regulatory Designations

- Table 13-1: KRAS Inhibitor & Immunotherapy Combinations In Clinical Trials

- Table 13-2: KRAS Inhibitor & Chemotherapy Combinations In Clinical Trials

- Table 13-3: KRAS Inhibitor & Targeted Therapy Combinations In Clinical Trials

- Table 13-4: KRAS Inhibitor & Radiotherapy Combinations In Clinical Trials

Global KRAS Inhibitors Market, Drug Sales, Patent, Price & Clinical Trials Insight 2030 Report Findings & Highlights:

- Research Methodology

- Global & Regional Market Trends Insight

- First KRAS Inhibitor Drug Approved In 2021

- Global KRAS Market Opportunity To Surpass US$ 2 Billion By 2030

- KRAS Inhibitors Market Absolute Growth: >400% Since First Drug Approval

- Approved KRAS Inhibitors Drugs: 4 Drugs

- Approved Drugs Dosage, Price & Sales Insight

- Insight On More Than 80 Drugs In Clinical Trials

- KRAS Inhibitor Clinical Trials Insight By Country, Company, Indication & Phase

The global market for KRAS inhibitors has seen substantial growth in recent years, largely due to the heightened awareness of KRAS mutations as significant contributors to cancer development in various solid tumors, including lung, colorectal, and pancreatic cancers. KRAS, an essential gene that regulates cell proliferation, has historically posed a challenge as a therapeutic target because of its intricate biology and its function in supporting tumor survival. Nevertheless, advancements in molecular biology and the creation of targeted therapies have led to the emergence of KRAS inhibitors as a promising category of medications.

A pivotal moment in the KRAS inhibitor market occurred in 2021 with the approval of Lumakras for the treatment of non-small cell lung cancer (NSCLC), representing a significant breakthrough for patients with KRAS G12C mutations. This approval heralded a new phase in targeted cancer therapies, followed by the authorization of Krazati in 2022, and Dupert and Anfangning in 2024 for NSCLC, thereby broadening the treatment landscape for patients with this particular genetic alteration. In 2024 and 2025, the market continued to expand, with both Krazati and Lumakras receiving additional approvals for colorectal cancer (CRC).

At present, more than 80 KRAS inhibitors are in various stages of clinical trials, including Roche's Divarasib, which is currently in Phase 3 trials, and Jacobio Pharma's Glecirasib (JAB-21822), which is undergoing registrational trials in China. The ongoing development of these agents highlights the extensive potential of KRAS inhibitors in addressing a range of malignancies, with numerous clinical trials exploring their use in combination with other cancer treatments, such as chemotherapy, immunotherapy, and targeted therapies. The approval and growing utilization of KRAS inhibitors emphasize their importance in oncology, especially for cancers that have few treatment alternatives and poor outcomes.

Lung cancer, especially non-small cell lung cancer (NSCLC), continues to be the primary focus of research on KRAS inhibitors, with many clinical trials investigating KRAS G12C mutations. Nonetheless, colorectal and pancreatic cancers are also critical areas of study, as KRAS mutations are commonly observed in these types of cancer. The therapeutic potential of KRAS inhibitors extends beyond these malignancies, with ongoing investigations into their effectiveness against other cancers, such as ovarian, brain, and endometrial cancers. Consequently, the global market for KRAS inhibitors is anticipated to broaden, encompassing a wider variety of cancer types, fueled by increasing clinical evidence that supports the efficacy of these treatments across diverse tumor types.

KRAS inhibitors primarily target specific mutations in the KRAS gene, with G12C, G12V, and G12D being the most prevalent. These mutations play a significant role in the oncogenic activation of KRAS, making it an important target for therapeutic strategies. While traditional KRAS inhibitors have focused on either the active or inactive states of the KRAS protein, the emergence of next-generation inhibitors capable of targeting both the "ON" and "OFF" states of KRAS has created new therapeutic possibilities. An example of such an inhibitor is BBO-8520 from BridgeBio Oncology Therapeutics, which covalently binds to both the active and inactive forms of KRAS G12C, effectively preventing effector binding and inhibiting KRAS function. Preclinical studies indicate that BBO-8520 demonstrates greater potency, more profound tumor responses, and a delay in resistance compared to standard KRAS G12C inhibitors, positioning it as a promising option to address the limitations of existing therapies.

Looking ahead, the global market for KRAS inhibitors is set for significant growth as an increasing number of inhibitors advance through clinical trials and receive regulatory approval. Ongoing investigations into combination therapies are expected to broaden the range of treatment options available, targeting various KRAS mutation subtypes and extending to other cancers beyond non-small cell lung cancer (NSCLC). Furthermore, the emergence of more international partnerships and collaborations will likely enhance global access to these vital treatments, thereby benefiting a larger segment of cancer patients. Nevertheless, challenges such as high treatment costs, issues related to accessibility, and the necessity for continued research into long-term efficacy and safety must be addressed to ensure the market's sustainable development.

Table of Contents

1. Introduction To KRAS Inhibitors

- 1.1 Development Of KRAS Inhibitors

- 1.2 Mechanism Of Action

2. Role Of KRAS Inhibitors In Cancer Therapy

3. Global KRAS Inhibitor Market Outlook

- 3.1 Current Market Scenario

- 3.2 KRAS Inhibitors Granted Breakthrough Therapy, Fast Track & Orphan

Designation

- 3.3 Future Market Opportunity

4. Lumakras - Overview, Pricing, Dosing & Sales Analysis

- 4.1 Overview & Patent Insight

- 4.2 Dosage & Price Analysis

- 4.3 Sales Analysis

5. Krazati - Overview, Pricing, Dosing & Sales Analysis

- 5.1 Overview & Patent Insight

- 5.2 Dosage & Price Analysis

- 5.3 Sales Analysis

6. Dupert - Clinical Insight

7. Anfangning - Clinical Insight

8. KRAS Inhibitor Market Regional Analysis - Commercial & Clinical Development Outlook

- 8.1 US

- 8.2 China

- 8.3 EU

- 8.4 UK

- 8.5 Japan

- 8.6 South Korea

- 8.7 Canada

- 8.8 Taiwan

- 8.9 Australia

9. KRAS Inhibitor Development Trends By Indications

- 9.1 Lung Cancer

- 9.2 Colorectal Cancer

- 9.3 Pancreatic Cancer

- 9.4 Other Indications

10. Global KRAS Inhibitors Clinical Pipeline Overview

- 10.1 By Country

- 10.2 By Phase

- 10.3 By Company

- 10.4 By Indication

- 10.5 By Priority Status

11. Global KRAS Inhibitor Clinical Trials Insight By Country, Company, Indication & Phase

- 11.1 Research

- 11.2 Preclinical

- 11.3 Phase I

- 11.4 Phase I/II

- 11.5 Phase II

- 11.6 Phase III

- 11.7 Preregistration

- 11.8 Registered

12. Marketed KRAS Inhibitor Clinical Trials Insight

13. KRAS Inhibitors Combination Strategies

- 13.1 Immunotherapy

- 13.2 Chemotherapy

- 13.3 Targeted Therapies

- 13.4 Radiation

14. Global KRAS Inhibitors Market Dynamics

- 14.1 Market Drivers

- 14.2 Market Challenges

15. Competitive Landscape

- 15.1 Applied Pharmaceutical Science

- 15.2 Amgen

- 15.3 AnBogen Therapeutics

- 15.4 AstraZeneca

- 15.5 Biond Biologics

- 15.6 BridgeBio Oncology Therapeutics

- 15.7 Bristol Myers Squibb

- 15.8 Boehringer Ingelheim

- 15.9 Eli Lilly

- 15.10 Erasca

- 15.11 Frontier Medicines

- 15.12 GenFleet Therapeutics

- 15.13 Innovent Bio

- 15.14 Jacobio Pharmaceuticals

- 15.15 Jiangsu Hansoh Pharmaceutical

- 15.16 Jiangsu Hengrui Medicine Co.

- 15.17 Quanta Therapeutics

- 15.18 Revolution Medicines

- 15.19 Roche

- 15.20 Suzhou Zelgen Biopharmaceuticals