|

|

市場調査レポート

商品コード

1476610

腫瘍溶解性ウイルス免疫療法の世界市場:市場の機会と臨床試験動向(2030年)Global Oncolytic Virus Immunotherapy Market Opportunity & Clinical Trials Insight 2030 |

||||||

|

|||||||

| 腫瘍溶解性ウイルス免疫療法の世界市場:市場の機会と臨床試験動向(2030年) |

|

出版日: 2024年05月01日

発行: KuicK Research

ページ情報: 英文 420 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

世界の腫瘍溶解性ウイルス免疫療法の市場規模は、2030年までに15億米ドル以上になると予測されています。

がんは容赦ない敵であり、世界中の患者と医療界の双方に課題を突きつけています。この多面的な疾患と闘うための革新的で的を絞った治療法の探求は、がん治療の分野で目覚ましい進歩をもたらしました。多くの新たな戦略の中で、腫瘍溶解性ウイルス免疫療法は近年、がん治療の有望な手段として研究者や臨床医の注目を集めています。腫瘍溶解性ウイルス免疫療法の領域は、ウイルスの自然な特性を利用してがん細胞を選択的に標的とし破壊するもので、ユニークで精密志向の治療アプローチを提供します。この治療パラダイムが科学的発見の領域から商業的可能性へと進展するにつれ、商業市場のダイナミクスを形成する多くの機会と課題がもたらされます。

これまで、頭頸部がん、悪性黒色腫、悪性神経膠腫などさまざまなタイプのがんの治療薬として、オンコリン(H101)、イムリック(Talimogene laherparepvec)、テセルパチュレフ(G47-Delta;Delytact)の3つの腫瘍溶解性ウイルス免疫療法が過去10年間に承認されています。しかし、Oncos 102、CAN-2409、Pelareorep、CG070、VG161といった最先端の腫瘍溶解性ウイルス免疫療法が、FDAやEMAといった規制当局からファストトラック、希少疾病用医薬品、PRIMEといった指定を受けていることから、この領域では今後数年間でさらに多くの承認が得られると予想されます。

臨床分野では、がん細胞溶解ウイルスは革新的研究と治療開発の最前線にあります。これらのウイルスは、生得的な腫瘍溶解特性を持つように注意深く操作または選択され、がん細胞に浸潤し、がん細胞内で複製し、がん細胞の破壊を誘導すると同時に免疫反応を刺激するように設計されています。さらに、腫瘍溶解性ウイルス免疫療法の領域が研究室や臨床試験の枠を超え、商業的な領域へと移行する過程で、製薬会社の関与が特徴的であり、世界のがん治療の状況においてその軌跡を形成する一助となるとみられています。

チェックポイント阻害剤やCAR-T細胞療法といった他の免疫療法の勝利は、がんと闘うために免疫系を利用することに大きな関心を呼んでいます。腫瘍溶解性ウイルス免疫療法は、ウイルスを利用してがん細胞に対する免疫反応を刺激することにより、これらのアプローチを補完するものです。これらの免疫療法による良好な結果は、がんと闘うために免疫系を活用することへの関心を煽り、補完的かつ相乗的なアプローチとして、腫瘍溶解性ウイルス免疫療法の研究が活発化することにつながっています。

そのため、膵臓がん、消化器がん、乳がんなど、さまざまながんサブタイプに罹患している患者を治療するために、delolimogene mupadenorepvecとatezolizumab、OH2注射とイリノテカン、HX008、ADV/HSV-tkとPembrolizumabなど、免疫チェックポイント受容体を標的とするさまざまな種類の抗体と腫瘍溶解性ウイルスの組み合わせからなる臨床パイプラインで複数の研究が進行中です。

がん細胞溶解性ウイルス免疫療法の市場は、製薬セクターにおける投資、提携、パートナーシップの雪だるま式に増加する規制当局の承認と結合して、今後数年間でさらに拡大し、増殖すると予測されています。2024年5月現在、がん治療のためのデリバリーやパフォーマンスを最適化するために、単純ヘルペス-1型ウイルス(HSV-1)やアデノウイルスのような様々なタイプのがん溶解ウイルスと化学療法、PD-1やPD-L1受容体に対するモノクローナル抗体、治療用ペプチドワクチンやナノ粒子の併用が混雑しています。

当レポートは、世界の腫瘍溶解性ウイルス免疫療法市場について調査し、市場の概要とともに、薬剤動向、臨床試験動向、地域別動向、および市場に参入する企業の競合情勢などを提供しています。

目次

第1章 腫瘍溶解性ウイルス免疫療法のイントロダクション

- 概要

- 腫瘍溶解性ウイルス免疫療法の必要性

第2章 世界的に承認されている腫瘍溶解性ウイルス免疫療法

- 商業的に承認された治療法

- FDAおよびEMA指定:画期的治療薬、ファストトラック、オーファン、PRIME

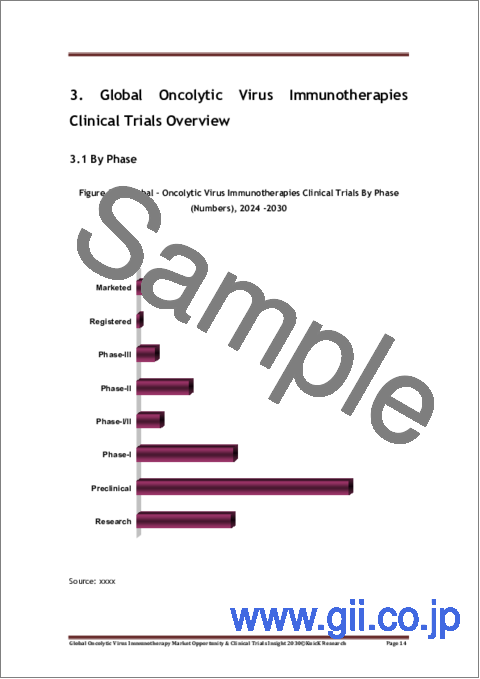

第3章 世界の腫瘍溶解性ウイルス免疫療法の臨床試験の概要

- 相別

- 国別

- 企業別

- 適応症別

- 優先度別

- 患者セグメント

第4章 世界の腫瘍溶解性ウイルス免疫療法市場の動向と発展

- 現在の市場の概略

- 今後の市場予測

第5章 世界の腫瘍溶解性ウイルス免疫療法市場の動向、地域別

- 韓国

- 日本

- 米国

- 欧州

- 英国

- 中国

- オーストラリア

第6章 腫瘍溶解性ウイルス免疫療法の市場動向(適応症別)

- 悪性黒色腫

- 頭頸部がん

- 神経膠腫

- 膵臓がん

- 卵巣がん

- リンパ腫

- 肺がん

- 乳がん

- 前立腺がん

- 肝細胞がん

第7章 腫瘍溶解性ウイルス免疫療法の臨床試験(企業別、適応症別、相別)

- 研究

- 前臨床

- 第I相

- 第I/II相

- 第II相

- 第III相

- 登録済み

第8章 上市済みの腫瘍溶解性ウイルス免疫療法の臨床的洞察

第9章 世界の腫瘍溶解性ウイルス免疫療法- 可用性、投与量、価格分析

- イムリジック

- オンコリン(H101)

- デリタクト

第10章 先進的な腫瘍溶解性ウイルス免疫療法の開発に使用されるプラットフォーム

第11章 腫瘍溶解性ウイルス免疫療法と他の治療薬との併用

- ナノ材料を用いた腫瘍溶解性ウイルス免疫療法

- 化学療法薬を用いた腫瘍溶解性ウイルス免疫療法

- ペプチドを用いた腫瘍溶解性ウイルス免疫療法

- 標的免疫療法別腫瘍溶解性ウイルス免疫療法

第12章 世界の腫瘍溶解性ウイルス免疫療法市場力学

- 市場の促進要因

- 市場の課題

第13章 競合情勢

- AdCure Bio

- Beijing SyngenTech

- BioVex Inc. (Amgen)

- Calidi Biotherapeutics

- Genelux Corporation

- Immvira Pharma

- Jennerex Biotherapeutics

- KaliVir

- Lokon Pharma

- Oncolys BioPharma

- PsiOxus Therapeutics (Akamis Bio)

- Seneca Therapeutics

- Shanghai Sunway Biotech

- Takara Bio

- TILT Biotherapeutics

- Transgene

- Virogin Biotech

List of Figures

- Figure 1-1: Demonstration of Categorization of Oncolytic Viruses

- Figure 1-2: Illustration of Major Events in Clinical Virotherapy

- Figure 1-3: Comparison of Conventional Therapies v/s Oncolytic Virus Immunotherapy

- Figure 1-4: Oncolytic Virus Immunotherapy - Advantages

- Figure 3-1: Global - Oncolytic Virus Immunotherapies Clinical Trials By Phase (Numbers), 2024 -2030

- Figure 3-2: Global - Oncolytic Virus Immunotherapies Clinical Trials By Country (Numbers), 2024 - 2030

- Figure 3-3: Global - Oncolytic Virus Immunotherapies Clinical Trials By Company (Numbers), 2024 - 2030

- Figure 3-4: Global - Oncolytic Virus Immunotherapies Clinical Trials By Indication (Numbers), 2024 - 2030

- Figure 3-5: Global - Oncolytic Virus Immunotherapies Clinical Trials By Priority Status (Numbers), 2024 - 2030

- Figure 3-6: Global - Oncolytic Virus Immunotherapies Clinical Trials By Patient Segment (Numbers), 2024 -2030

- Figure 4-1: Global - Oncolytic Virus Immunotherapy Market Opportunity (US$ Million), 2023 -2030

- Figure 4-2: Approved Oncolytic Virus Immunotherapy

- Figure 4-3: Global Oncolytic Virus Immunotherapy Market - Key Players

- Figure 4-4: Aspects Determining the Future of Oncolytic Virus Therapy Market

- Figure 5-1: Barinthus Biotherapeutics - ChAdOx1-HBV & MVA-HBV Clinical Trials

- Figure 5-2: GeneMedicine - Oncolytic Virus Pipeline

- Figure 5-3: TBI-1401(HF10) Phase I Study - Initiation & Completion Year

- Figure 5-4: Astellas Pharma - ASP1012

- Figure 5-5: ASP1012 & Pembrolizumab Phase I Study - Initiation & Completion Year

- Figure 5-6: CF33-hNIS-antiPDL Phase I Study - Initiation & Completion Year

- Figure 5-7: Cretostimogene Grenadenorepvec Phase III Study - Initiation & Completion Year

- Figure 5-8: Cretostimogene Grenadenorepvec FDA Designations to treat unresponsive Non-Muscle Invasive Bladder Cancer (NMIBC)

- Figure 5-9: AdAPT-001 Phase I Study - Initiation & Completion Year

- Figure 5-10: Pelareorep with INCMGA00012 Phase II Study - Initiation & Completion Year

- Figure 5-11: Oncolytic Virus Immunotherapy Market Trend in the US

- Figure 5-12: Aspects Influencing Oncolytic Virus Market in Europe

- Figure 5-13: TILT-123 with Pembrolizumab Phase I Study - Initiation & Completion Year

- Figure 5-14: BT-001 & Pembrolizumab Phase I Study - Initiation & Completion Year

- Figure 5-15: Transgene - Oncolytic Virus Candidates

- Figure 5-16: 21325-2-02 Phase IV Study - Initiation & Completion Year

- Figure 5-17: OH2 - Combinations with Other Therapeutic Agents

- Figure 5-18: VAXINIA - FDA Fast Track Designation

- Figure 6-1: MQ710 & Pembrolizumab Phase I Study - Initiation & Completion Year

- Figure 6-2: Combination of GALV-GP-R protein with PD1 antibody to Treat Melanoma

- Figure 6-3: Replimune - Oncolytic Virus Candidates

- Figure 6-4: Oncorine - Approved Oncolytic Virus Immunotherapy for Head & Neck Cancer

- Figure 6-5: YSCH-01 Phase I Study - Initiation & Completion Year

- Figure 6-6: Head & Neck Cancer - Clinical Pipeline of Oncolytic Viruses

- Figure 6-7: Calidi Biotherapeutics - NSC.CRAd-S-pk7 for Glioblastoma

- Figure 6-8: CRAd-S-pk7 Phase I Study - Initiation & Completion Year

- Figure 6-9: CAN-3110 Phase I Study - Initiation & Completion Year

- Figure 6-10: Pancreatic Cancer - Influencing Factors in Oncolytic Virus Immunotherapy Market

- Figure 6-11: STI-1386 Phase I Study - Initiation & Completion Year

- Figure 6-12: TBI-1401 (HF10) Phase I Study - Initiation & Completion Year

- Figure 6-13: RenovoRx & Imugene - Collaboration

- Figure 6-14: TILT-123 - Mode of Action

- Figure 6-15: TILT-T563 Phase I Study - Initiation & Completion Year

- Figure 6-16: Combinations of Oncolytic Virus with Other Therapies

- Figure 6-17: Comparison of Olvi-Vec with Chemotherapy

- Figure 6-18: RT-01 Phase I Study - Initiation & Completion Year

- Figure 6-19: Advantages of Oncolytic Virus Immunotherapy to Treat Lymphoma

- Figure 6-20: Lung Cancer - Commercial Market Landscape of Oncolytic Virus Immunotherapy

- Figure 6-21: Pro2020000268 Phase II Study - Initiation & Completion Year

- Figure 6-22: Combination of Radio Chemotherapeutic Drug with Oncolytic Virus

- Figure 6-23: Prostate Cancer - Benefits of Oncology Virus Immunotherapy

- Figure 6-24: HB-302/HB-301 Phase I/II Study - Initiation & Completion Year

- Figure 6-25: CAN-2409 Phase III Study - Initiation & Completion Year

- Figure 6-26: Reasons for Candel Therapeutics Decided to Reduce Staff

- Figure 6-27: Pexavec - Mode of Action

- Figure 6-28: OPTIONS-04 Phase III Study - Initiation & Completion Year

- Figure 6-29: Replimune RP3 Oncolytic Virus Immunotherapy for Hepatocellular Carcinoma Treatment

- Figure 9 -1: US - Cost of Supply of Imlygic 1 mpfu/mL & 100 mpfu/mL (US$), May'2024

- Figure 9 -2: Imlygic - Dose for Initial Treatment Cycle & Subsequent Treatment Cycle (Million PFU/ml), September'2020

- Figure 9 -3: Imlygic - Duration of Initial & Subsequent Treatment Cycle (weeks), September'2020

- Figure 9 -4: Imlygic - Average Price of Initial Treatment Cycle & Each Subsequent Treatment Cycle (US$), September'2022

- Figure 9 -5: Imlygic - Maximum Volume Administered by Size of Lesion (ml), September'2020

- Figure 10-1: KaliVir Immunotherapeutics - VET Backbone Technology

- Figure 10-2: Calidi Biotherapeutics Platform

- Figure 10-3: ValoTx - PeptiCRAd

- Figure 10-4: ValoTx - PeptiVAX / PeptiENV / PeptiBAC

- Figure 10-5: Transgene - myvac

- Figure 10-6: Genelux - Choice Discovery platform

- Figure 11-1: Combination of Oncolytic Virus with Other Therapies

- Figure 11-2: Combination of Oncolytic Virus Immunotherapy with Nano materials

- Figure 11-3: Oncolytic Virus Immunotherapy & Nano materials - Mode of Action

- Figure 11-4: Combination of Oncolytic Virus Immunotherapy with Peptides

- Figure 12-1: Global Oncolytic Virus Immunotherapy - Market Drivers

- Figure 12-2: Global Oncolytic Virus Immunotherapy - Market Challenges

List of Tables

- Table 2-1: Approved Oncolytic Virus Immunotherapies

- Table 5-1: US - Ongoing Clinical Trials for Oncolytic Virus Immunotherapy

- Table 5-2: Europe - Ongoing Clinical Trials for Oncolytic Virus Immunotherapy

- Table 6-1: Melanoma - Ongoing Clinical Trials for Oncolytic Virus Immunotherapy

- Table 6-2: Head & Neck Cancer - Ongoing Clinical Trials for Oncolytic Virus Immunotherapy

- Table 6-3: Glioma - Ongoing Clinical Trials for Oncolytic Virus Immunotherapy

- Table 6-4: Pancreatic Cancer - Ongoing Clinical Trials for Oncolytic Virus Immunotherapy

- Table 6-5: Ovarian Cancer - Ongoing Clinical Trials for Oncolytic Virus Immunotherapy

- Table 6-6: Lung Cancer - Ongoing Clinical Trials for Oncolytic Virus Immunotherapy

- Table 6-7: Breast Cancer - Ongoing Clinical Trials for Oncolytic Virus Immunotherapy

- Table 9-1: Imlygic - Recommended Dose & Schedule

Global Oncolytic Virus Immunotherapy Market Opportunity & Clinical Trials Insight 2030 Report Highlights:

- Global Oncolytic Virus Immunotherapy Therapy Market Opportunity: > USD 1.50 Billion By 2030

- Oncolytic Viruses Immunotherapies Clinical Trials By Company, Indication & Phase

- Comprehensive Insight On Oncolytic Virus Immunotherapies In Clinical Trials: > 180 Therapies

- FDA & EMA Designations: Breakthrough Therapy, Fast Track, Orphan, PRIME

- Patent Analysis Therapies in Clinical Trials

- IMLYGIC, Oncorine, Delytact: Availability, Dosage and Price Analysis

- Platforms Used For Developing Advanced Oncolytic Virus Immunotherapy

Cancer endures to be a relentless adversary, challenging both patients and the medical community across the world. The quest of innovative and targeted therapies to battle against this multifaceted disease has led to remarkable advancements in the field of cancer therapy. Amidst the many emerging strategies, oncolytic virus immunotherapy has captured the attention of researchers and clinicians as a promising avenue for cancer treatment in the recent years. The realm of oncolytic virus immunotherapy harnesses the natural characteristics of viruses to selectively target and destroy cancer cells, offering a unique and precision oriented approach to treatment. As this therapeutic paradigm progresses from the realm of scientific discovery to commercial viability, it brings forth a multitudinous of opportunities and challenges that shape the dynamics of the commercial market.

Hitherto, 3 oncolytic virus immunotherapies, namely Oncorine (H101), Imlygic (Talimogene laherparepvec), and teserpaturev (G47-Delta; Delytact), have been approved over the preceding decennium for the treatment of different types of cancer like head and neck cancer, melanoma and malignant glioma. However, it is expected that the domain will observe many more approvals in the upcoming years because of that fact that a handful of advanced oncolytic virus immunotherapies such as Oncos 102, CAN-2409, Pelareorep, CG070, VG161 have received designations like Fast Track, Orphan Drug, PRIME from regulatory agencies, FDA and EMA.

In the clinical field, oncolytic viruses are at the forefront of innovative research and therapeutic development. These viruses, carefully engineered or selected for their innate oncolytic properties, are designed to infiltrate cancer cells, replicate within them, and induce their destruction while simultaneously stimulating an immune response. Moreover, as the sphere of oncolytic virus immunotherapy surpasses the confines of laboratories and clinical trials, its journey into the commercial arena is characterized by an involvement of pharma companies that will aid to shape its trajectory in the global cancer treatment landscape.

The triumph of other immunotherapies, such as checkpoint inhibitors and CAR-T cell therapies, has generated considerable interest in harnessing the immune system to fight cancer. Oncolytic virus immunotherapy complements these approaches by utilizing viruses to stimulate an immune response against cancer cells. The positive outcomes from these immunotherapies have fueled interest in leveraging the immune system to combat cancer, leading to increased exploration of oncolytic virus immunotherapy as a complementary and synergistic approach.

On that account, multiple studies are ongoing in the clinical pipeline which comprise the combinations of oncolytic viruses with different types of antibodies targeting immune checkpoint receptors such as delolimogene mupadenorepvec with atezolizumab, OH2 injection, with or without irinotecan or HX008, ADV/HSV-tk with Pembrolizumab, for the treatment of patients suffering from wide array of cancer subtypes such as pancreatic cancer, Gastrointestinal Cancer, breast cancer etc.

Competition from the involvement of multitudinous pharmaceutical companies such as Merck, Bristol-Myers Squibb, Astellas Pharma, Roche, Lokon Pharma, NRG oncology, CG oncology, Genemedicine, Binhui Biopharmaceutical Barinthus Biotherapeutics, TILT Biotherapeutics, Genelux Corporation, Replimune, and Candel Therapeutics have created wave in the commercial market of oncolytic virus immunotherapy. As a result, the clinical development landscape will observed several pharmaceuticals companies commencing research in order to understand the oncolytic virus mode of actions which will aid to develop advanced and innovative oncolytic virus immunotherapy with least possible side effects.

It is projected that the market of oncolytic virus immunotherapy is poised to expand and multiply further in the forthcoming years due to the augmenting government regulatory approvals in conjugation with snow balling investments, collaborations and partnerships in the pharmaceutical sector. As of May 2024, the oncolytic virus is crowded by usage of different types of oncolytic virus like herpes simplex type-1 virus (HSV-1) or adenoviruses with or without chemotherapy, monoclonal antibodies directing against PD-1 and PD-L1 receptors, therapeutic peptide vaccines or nanoparticles in order to optimize delivery and performance for cancer treatments.

Currently, the US remains the market leader of the market as evident from rising collaborations, advancement and government bestow. The synergy between these clinical and commercial aspects propels the field forward, offering new expectation to cancer patients and shaping the future of cancer treatment. Continuous research, innovation, and collaboration are essential to sustaining this growth and realizing the full potential of oncolytic virus immunotherapy. As research further delves deeper into understanding the complexities of this innovative approach, there is optimism that oncolytic viruses will emerge as a valuable addition for cancer treatments, offering new avenues for improved outcomes and enhanced quality of life for patients.

Table of Contents

1. Introduction to Oncolytic Virus Therapy

- 1.1 Overview

- 1.2 Need of Oncolytic Virus Immunotherapy

2. Globally Approved Oncolytic Virus Immunotherapies

- 2.1 Commercially Approved Therapies

- 2.2 FDA & EMA Designations: Breakthrough Therapy, Fast Track, Orphan, PRIME

3. Global Oncolytic Virus Immunotherapies Clinical Trials Overview

- 3.1 By Phase

- 3.2 By Country

- 3.3 By Company

- 3.4 By Indication

- 3.5 By Priority Status

- 3.6 Patient Segment

4. Global Oncolytic Virus Immunotherapy Market Trend & Developments

- 4.1 Current Market Outline

- 4.2 Future Market Forecast

5. Global Oncolytic Virus Immunotherapy Market Trends By Region

- 5.1 South Korea

- 5.2 Japan

- 5.3 US

- 5.4 Europe

- 5.5 UK

- 5.6 China

- 5.7 Australia

6. Global Oncolytic Virus Immunotherapy Market Trends By Indications

- 6.1 Melanoma

- 6.2 Head & Neck Cancer

- 6.3 Glioma

- 6.4 Pancreatic Cancer

- 6.5 Ovarian Cancer

- 6.6 Lymphoma

- 6.7 Lung Cancer

- 6.8 Breast Cancer

- 6.9 Prostate Cancer

- 6.10 Hepatocellular carcinoma

7. Global Oncolytic Viruses Immunotherapies Clinical Trials By Company, Indication & Phase

- 7.1 Research

- 7.2 Preclinical

- 7.3 Phase-I

- 7.4 Phase-I/II

- 7.5 Phase-II

- 7.6 Phase-III

- 7.7 Registered

8. Marketed Oncolytic Viruses Immunotherapies Clinical Insight

9. Global Oncolytic Virus Immunotherapy - Availability, Dosage & Price Analysis

- 9.1 Imlygic

- 9.1.1 Overview & Patent Insights

- 9.1.2 Pricing & Dosage

- 9.2 Oncorine (H101)

- 9.2.1 Overview

- 9.2.2 Pricing & Dosage

- 9.3 Delytact

- 9.3.1 Overview

- 9.3.2 Pricing & Dosage

10. Platforms used for Developing Advanced Oncolytic Virus Immunotherapy

- 10.1 KaliVir VET Backbone Technology

- 10.2 Calidi's Platform Technology

- 10.3 RenovoRx TAMP Platform

- 10.4 ValoTx PeptiCRAd

- 10.5 ValoTx PeptiVAX / PeptiENV / PeptiBAC

- 10.6 Transgene's Invir.IO Platform

- 10.7 Transgene's myvac Platform

- 10.8 Imugene's CF33 Technology

- 10.9 EpicentRx AdAPT Platform

- 10.10 Genelux's Choice Discovery Platform

11. Oncolytic Virus Immunotherapy Combinations with Other Therapeutic Agents

- 11.1 Oncolytic Virus Immunotherapy with Nano materials

- 11.2 Oncolytic Virus Immunotherapy with Chemotherapeutic Drugs

- 11.3 Oncolytic Virus Immunotherapy with Peptides

- 11.4 Oncolytic Virus Immunotherapy with Targeted Immunotherapies

12. Global Oncolytic Virus Immunotherapy Market Dynamics

- 12.1 Market Drivers

- 12.2 Market Challenges

13. Competitive Landscape

- 13.1 AdCure Bio

- 13.2 Beijing SyngenTech

- 13.3 BioVex Inc. (Amgen)

- 13.4 Calidi Biotherapeutics

- 13.5 Genelux Corporation

- 13.6 Immvira Pharma

- 13.7 Jennerex Biotherapeutics

- 13.8 KaliVir

- 13.9 Lokon Pharma

- 13.10 Oncolys BioPharma

- 13.11 PsiOxus Therapeutics (Akamis Bio)

- 13.12 Seneca Therapeutics

- 13.13 Shanghai Sunway Biotech

- 13.14 Takara Bio

- 13.15 TILT Biotherapeutics

- 13.16 Transgene

- 13.17 Virogin Biotech